#regulatory compliance consultants

Text

Regulatory Compliance Consulting for SMBs: Trends & Expert Guidance

Discover key trends in regulatory compliance for SMBs in financial services, crypto, and tech sectors. Learn how consulting services and freelance experts can help your business thrive. Go here https://www.regulatoryrisks.com/blog-details/regulatory-compliance-consulting-smbs-trends-expert-guidance

#Regulatory Compliance Consulting#Regulatory Compliance Experts#Regulatory Compliance Consultants#Regulatory Compliance Services

0 notes

Text

https://dyrectory.com/listings/brand-maven-consulting

#Regulatory consulting#Regulatory consulting firms#Regulatory compliance firms#Regulatory compliance consulting firms#Regulatory consulting companies#Regulatory compliance agency#FDA regulatory consulting firms#Regulatory compliance consulting company#Compliance consulting firms#Compliance consulting services#Compliance experts#Regulatory compliance services#Registration services#Industry experts#Compliance management#Regulatory support#Streamline product submissions#Regulatory consulting firm

0 notes

Text

Freyr provides food regulatory consulting support for Food/Dietary supplements manufacturers that span across product registration, Classification and formula review/ingredient assessment for compliant market entry of products across the globe.

#Food regulatory compliance#Food regulatory requirements#Food regulatory Services#Food Supplement Classification#Food regulatory consulting#Food regulatory compliance consulting#Food Labelling Solutions#Food Product Compliance

0 notes

Text

#mca#mca rules#registered valuers#valuation#registered valuer#valuation services#financial consultant#regulatory compliance#indian economy#business#financial consulting services

0 notes

Text

The Cost of Ignoring Professional Advice in the Trucking Industry

Running a trucking business isn’t just about owning a bunch of trucks and hiring drivers. It’s a tough industry filled with rules, rising expenses, and new technologies popping up all the time. To keep up, you need more than just hard work—you need expert advice. Unfortunately, many trucking companies skip out on this, thinking they can handle it on their own. The truth is, that decision can cost…

View On WordPress

#avoid trucking penalties#business#cash flow management#driver retention#driver satisfaction#financial stability in trucking#fleet management#Freight#freight industry#Freight Revenue Consultants#logistics#professional advice#regulatory compliance#small carriers#Transportation#truck fleet optimization#Trucking#Trucking business#trucking business growth#trucking business strategy#trucking company success#trucking compliance#trucking consultancy#trucking consultant benefits#trucking consultants#trucking efficiency#Trucking Financial Management#trucking growth strategies#trucking industry#trucking industry challenges

0 notes

Text

Tax Compliance Solutions Essential Strategies for Every Business Owner

In a complex business world, tax compliance remains a key pillar to ensuring regulatory integrity and financial stability. Navigating the daunting tax code can be daunting, but with the right strategies, business owners can not only achieve compliance but give them the best financial results This comprehensive guide explores important tax compliance strategies, providing business owners with insights they can use to streamline their operations and maintain tax compliance.

Understanding Tax Compliance

What Is Tax Compliance?

Tax compliance refers to compliance with tax laws and regulations established by governing bodies. This includes timely and accurate reporting of income and expenses and other financial information, as well as properly calculating and paying income taxes

The Importance Of Tax Compliance

Maintaining tax compliance is important for several reasons:

Penalty Avoidance: Failure to comply can result in high fines, interest, and legal consequences.

Reputation: A compliant business builds trust among stakeholders, including customers, investors and regulatory agencies.

Financial Health: Good Tax Planning Leads To Smooth Cash Flow And Budgeting.

Special Methods Of Tax Compliance

1. They Are Informed About Tax Laws

Tax law is dynamic and can change frequently. It’s important to keep up to date with the latest legislation. Fill out tax return forms, join professional associations, and consider consulting with tax professionals about any changes.

2. Use a Robust Accounting System

Accurate and structured financial reporting is the backbone of tax compliance. Invest in reliable accounting software that can track revenue, expenses, payroll, and other financial activity. This will simplify the process of preparing tax returns and accounts.

3. Review Financial Statements Regularly

Review your financial statements regularly to ensure accuracy. Regular audits can help identify anomalies early and correct them before they become critical issues.

4. Understand Your Tax Obligations

Different businesses have different tax obligations. These may include:

Income Tax: A tax on the profits of a business.

Payroll Taxes: Taxes on salaries of employees.

Sales Tax: A tax on the sale of goods and services.

Value Added Tax (VAT): Similar to excise tax but applied at every step of manufacturing.

5. Separate Personal And Business Finances

Maintain clear boundaries between personal and business finances. This not only simplifies accounting, but also ensures that business expenses are reported accurately and that individual payments do not impact the business.

6. Take Advantage Of Tax Breaks And Credits

Identify and apply all available tax breaks and credits. This can significantly reduce the amount of tax payable. Common exclusions include business expenses such as office supplies, travel, and professional services.

7. Keep Complete Records

Keep detailed records of all financial transactions. This includes receipts, invoices, bank statements and contracts. Proper documentation is important when doing a tax audit and can prove the authenticity of your tax return.

8. Schedule Of Assessed Taxes

If your business is required to pay estimated taxes, make sure you have a plan. This includes expecting taxes and paying them periodically throughout the year to avoid penalties.

9. Contact a Tax Professional

Hiring a tax professional can provide valuable help. They can provide tailored advice, help with complex tax situations, and ensure all tax returns are accurate and up-to-date.

10. Do Periodic Tax Audits

Internal tax audits can detect potential compliance problems before they escalate. Regular audits help ensure your business stays compliant and can adapt to any changes in tax laws.

General Tax Compliance Challenges

Navigating The Complex Tax Code

Tax law can be complex and difficult to interpret. Professionals often struggle to understand and apply these rules effectively.

Multi-State Tax System

Navigating state tax laws can be particularly challenging for businesses that operate in multiple countries. Each country has its own tax laws, which can vary greatly.

International Tax Relations

Global businesses face another challenge: international taxation. Understanding foreign tax laws, double taxation treaties and compliance requirements is essential for multinational operations.

Verify The Data Is Correct

Accurate data entry and record keeping are important. Mistakes can result in incorrect tax returns and possible penalties.

They Are Updated With Changes

Tax laws can change, and keeping track of them can be time-consuming. Companies must constantly monitor innovation to stay compliant.

Benefits Of Tax Compliance

Savings Of Money

Better tax compliance can result in savings by avoiding deductions, fees, and penalties. Effective tax policy can improve the overall health of the economy.

Strengthened Employee List

A compliant business is viewed as reliable and trustworthy. This can enhance relationships with customers, investors and regulators.

Excellent Budget

Accurate tax reporting helps with better financial planning and decision making. It provides a clear picture of the financial position of the business, enabling informed strategic choices.

Avoiding Legal Issues

Failure to comply may result in legal disputes and penalties. Ensuring compliance mitigates these risks and improves business viability.

Conclusion

Tax compliance solutions is key to running a successful business. By understanding your tax obligations, maintaining accurate records, and staying abreast of tax laws, you can confidently navigate the complexities of tax law to navigate the options outlined in guidance taking advantage of this will not only help you comply but give you the best financial results. Remember to seek expert advice when in doubt to ensure your business stays on the right side of the law.

#tax compliance solutions#tax consulting solutions#tax regulatory compliance software#tax compliance expert#filing tax returns#financial compliance

0 notes

Text

Senior Managers and Certification Regime (SM&CR) | FCA Compliance | MEMA Consultants

The Financial Conduct Authority (FCA) introduced the Senior Managers and Certification Regime (SM&CR) in December 2019 to enhance accountability within FCA-regulated firms. This regime replaces the FCA's Approved Persons Regime, mandating firms to appoint Senior Management Functions (SMFs) and, if necessary, Certification Functions (CFs). SM&CR applies differently to Limited Scope, Core, and Enhanced firms, each with specific rules.

SMFs, typically the most senior individuals in a firm, must have Statements of Responsibility and meet fitness and propriety requirements, approved by the FCA. Certification Functions, assessed internally by firms, must be certified annually. All individuals within these roles must adhere to Conduct Rules, ensuring a high standard of individual behavior.

For more information, visit our page on the Senior Managers and Certification Regime.

#Senior Managers and Certification Regime#SM&CR#FCA compliance#Senior Management Functions#Certification Functions#Conduct Rules#FCA regulated firms#MEMA Consultants#accountability#regulatory compliance

0 notes

Text

Compliance and Regulatory Services | Business Advisory Consulting | Felix Advisory

Felix Advisory offers expert compliance advisory and regulatory compliance services to ensure your business adheres to all necessary regulations. Our comprehensive compliance and regulatory services are designed to support businesses in navigating complex regulatory environments. Partner with Felix Advisory for reliable business advisory consulting services to enhance your compliance and regulatory practices.

#compliance advisory#compliance and regulatory services#regulatory compliance service#business advisory consulting services

0 notes

Text

Compliance

Complete Healthcare Business Consulting (CHCB Consulting) offers comprehensive compliance services to healthcare practices, ensuring adherence to regulatory standards. Their services include comprehensive risk analysis, regulatory compliance and coding audits, HIPAA compliance and training, OSHA compliance, and quality measure enhancement. These services aim to help healthcare practices manage new guidelines, protect patient health information, and maintain safety standards. By providing expert advice and tailored solutions, CHCB Consulting assists practices in navigating the complexities of healthcare regulations and achieving compliance.

#Healthcare Practice and Regulatory Compliance Services#Healthcare Compliance Services#Complete Healthcare Business Consulting

0 notes

Text

#Letter of Credit Consultancy#FEMA & FEDAI Workshop#Trade Finance Solutions#Trade finance solutions#Capital account transactions#FEMA compliance#Export-import financing#Documentary collections#Trade finance instruments#FEMA regulatory updates#Trade finance trends

0 notes

Text

Empowering Pharmaceutical Excellence: Product Development & Licensing Services in India

Frontro Pharma leads the charge in empowering pharmaceutical excellence through its comprehensive Product Development & Licensing services in India. With a focus on pioneering innovation and securing success, we accelerate new product developments, ensuring quality control certifications that meet stringent regulatory standards. Our expertise extends to strategic expansion through loan licenses, facilitating seamless acquisition and compliance. Additionally, our third-party manufacturing services optimize efficiency through collaboration, while comprehensive plant audits instill confidence in regulatory compliance. Partner with Frontro Pharma to navigate the dynamic landscape of the Indian pharmaceutical industry and propel your company towards excellence.

#Product Development & Licensing in india#Regulatory Approvals and Compliance Associates#New Product Development & Licensing#Pharmaceutical Regulatory Affairs Consultants#Regulatory Services For New Product Development & Licensing

0 notes

Text

AI Regulatory Compliance: Revolutionizing SME Compliance Solutions

Discover how AI is transforming regulatory compliance for SMEs, streamlining processes, reducing risks, and offering cost-effective solutions with expert compliance consultants.

#Hire Compliance Consultants#Freelance Compliance Consultants#Regulatory Compliance Consultants#Regulatory Compliance Services

0 notes

Text

Freyr provides Cosmetic Regulatory Affairs/Compliance Services for cosmetic industry that span across Product Registration, ingredient review, label and claims review, toxicology assessment and product information file for compliant market entry of products across the globe.

#Cosmetic regulatory compliance#Cosmetic regulatory affairs#Cosmetics Regulatory Services#Cosmetic industry regulations#Regulatory affairs in cosmetic industry#Cosmetic regulatory consultant#Cosmetic safety regulations

0 notes

Text

#financial consultant#chit funds bill 2018#chit fund bill#unregulated deposite schemes#corporate governance#regulatory compliance#financial reporting#financial consulting services

0 notes

Text

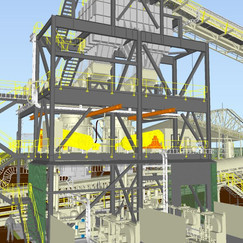

Comprehensive Engineering Solutions with Little P.Eng.: Catalyzing Innovation Across Engineering

Engineering challenges in contemporary industry demand sophisticated, multidisciplinary approaches. Little P.Eng., a rising name in the engineering sector, has positioned itself as a nexus for solutions spanning various specialized fields, including structural engineering, piping design, piping stress analysis, seismic bracing design, storage tank design, material handling engineering services, pressure vessel design, electrical design, and CRN registration services. This article delves into each of these areas, highlighting the complexities, methodologies, and cutting-edge strategies employed by Little P.Eng. to cater to the evolving needs of diverse sectors.

Engineering services are the cornerstone of modern industrial and infrastructural developments. From the conceptualization of a project to its final commissioning, various engineering disciplines come into play to ensure functionality, safety, compliance, and efficiency. Little P.Eng., with its array of engineering services, has etched its mark by offering comprehensive solutions under one roof. The company's commitment to technical excellence, precision, and continual innovation positions it at the forefront of engineering consultancy.

Structural Engineering: Structural engineering, a critical subset of civil engineering, involves the analysis, design, and planning of structural components and systems to achieve design goals and ensure the safety and comfort of users or occupants. The experts at Little P.Eng. undertake detailed analyses, considering factors such as geology of the site, environmental conditions, and materials to be used, ensuring structural soundness against static and dynamic loading, including human traffic and environmental stressors.

The service spectrum includes:

Building Design: Erection of residential, commercial, and industrial structures with considerations for material efficiency, safety regulations, and aesthetic aspects.

Structural Analysis and Inspection: Employing advanced tools to analyze stress, strain, and load distribution and conducting inspections to assure structural integrity and longevity.

Foundation Design: Creating robust foundations, including piles, rafts, and footings, customized to site conditions and building requirements.

Retrofitting and Rehabilitation: Strengthening existing structures through modernization techniques, enhancing our capacity to withstand additional or unanticipated loads.

Piping Design and Piping Stress Analysis: Piping systems are lifelines of process industries, influencing operational efficiency, safety, and economic feasibility. Little P.Eng. offers comprehensive solutions in piping design, ensuring optimal layout and functionality, accommodating project constraints, and adhering to international standards.

Key aspects include:

Piping Layout and 3D Modeling: Developing detailed piping system layouts, incorporating equipment placement, structural design, and safety compliance, facilitated through advanced 3D modeling for accuracy and visualization.

Stress Analysis: Utilizing software tools like CAESAR II for precise stress analysis, determining strain and stress levels within piping systems under various scenarios, including temperature changes, fluid dynamics, pressure variations, and external forces, thereby verifying system reliability and identifying necessary supports and reinforcements.

Seismic Bracing Design: In regions prone to seismic activity, designing structures with adequate bracing is crucial to prevent collapse and minimize damage during earthquakes. Little P.Eng.'s seismic bracing designs are tailored to enhance the resilience of structures, factoring in regional seismic activity, local regulations, and material specifications.

Services involve:

Seismic Risk Evaluations: Assessing seismic risks associated with specific locations, analyzing historical data, and geological conditions.

Bracing System Design: Engineering customized bracing systems, including base isolators, cross-bracing, and shear walls, to dissipate seismic forces and minimize structural vulnerability.

Post-Earthquake Assessments: Inspecting and evaluating structures post-seismic activity for damage assessment and further reinforcement recommendations.

Storage Tank Design: Storage tanks, essential for industries requiring liquid or gas storage, entail specialized design parameters. Little P.Eng. focuses on custom solutions, factoring in the stored substance's characteristics, environmental considerations, and industry regulations.

The design process encompasses:

Material Selection and Design: Choosing appropriate materials resistant to the stored contents and environmental conditions, and designing tanks based on capacity requirements, pressure ratings, and structural regulations.

Foundation and Settlement Analysis: Ensuring ground stability and accommodating potential settlement or shifts without compromising tank integrity.

Safety and Emission Controls: Integrating features to prevent leaks, limit emissions, and safeguard against potential hazards, including explosions or toxic releases.

Material Handling Engineering Services: Efficient material handling is pivotal to operational success in manufacturing, warehousing, and distribution facilities. Little P.Eng. offers engineering solutions optimizing the movement, storage, control, and protection of materials throughout the process.

These services include:

System Design and Integration: Developing comprehensive systems combining conveyors, automated storage and retrieval systems, and transfer equipment, ensuring seamless, efficient operations.

Equipment Selection and Procurement: Advising on the appropriate equipment tailored to specific operational needs and assisting with acquisition from reputable manufacturers.

Safety and Ergonomics: Designing systems prioritizing operator safety and ergonomics, reducing workplace hazards and potential for injury.

Pressure Vessel Design: Pressure vessels, used for holding gases or liquids at high pressures, require meticulous design to prevent failure and catastrophic results. Little P.Eng.'s expertise lies in crafting pressure vessels compliant with industry standards like the ASME Boiler and Pressure Vessel Code.

Specific services involve:

Design and Analysis: Performing detailed calculations for wall thickness, stress distribution, and overall vessel geometry, ensuring safety under various pressure conditions.

Material Specification and Fabrication Oversight: Specifying suitable materials able to withstand extreme pressures and overseeing the fabrication process for quality assurance.

Inspection and Certification: Conducting thorough inspections and facilitating necessary certifications, confirming adherence to safety and operational standards.

Electrical Design: Electrical design services encompass the planning and execution of electrical systems, vital for the operational integrity of residential, commercial, and industrial projects. Little P.Eng.'s electrical engineers are adept at crafting systems that meet energy efficiency, safety, and performance standards.

Critical offerings include:

System Layout and Design: Creating comprehensive electrical systems, including power distribution, lighting, and emergency backup systems, tailored to specific project requirements.

Compliance and Safety: Ensuring designs meet electrical codes and safety standards, incorporating protective measures to prevent system failures, electrical shocks, or fire hazards.

Energy Efficiency Solutions: Proposing energy-efficient technologies and methodologies, contributing to sustainable and cost-effective operations.

CRN Registration Services: The Canadian Registration Number (CRN) is a number issued by each province or territory of Canada for the design of a boiler, pressure vessel, or fitting. The CRN identifies that the design has been accepted and registered for use in that province or territory. Little P.Eng. assists with the complex process of obtaining CRN certifications, essential for legal and safe operation within Canada.

This process includes:

Design Evaluations: Reviewing pressure equipment designs to ensure they comply with pertinent regulations and standards.

Documentation Preparation: Compiling and preparing extensive documentation required for CRN applications, including drawings, calculations, and material test reports.

Liaison with Authorities: Acting as an intermediary between clients and regulatory bodies, facilitating communication and expediting the registration process.

Conclusion: Little P.Eng. has emerged as a one-stop solution for diverse engineering needs, driven by a team of experts dedicated to upholding the highest standards of engineering excellence. Our approach is not just about meeting the minimum regulatory requirements; it is about designing safe, efficient, and sustainable systems that stand the test of time. By embracing advanced technologies, up-to-date methodologies, and a customer-centric approach, Little P.Eng. is setting new benchmarks in the engineering domain, contributing significantly to industrial innovation and infrastructural advancement.

Tags:

CAESAR II

energy efficiency

structural engineering

material handling

3D modeling

safety standards

regulatory compliance

earthquake resilience

stress analysis

CRN registration

advanced technologies

engineering consultancy

fabrication oversight

rehabilitation

piping design

pressure vessel

project commissioning

retrofitting

electrical design

automated storage

operational excellence

system reliability

ASME compliance

seismic bracing

foundation design

storage tank

tank integrity

design evaluation

infrastructural advancement

industrial innovation

Engineering Services

Structural Engineering Consultancy

Pipe Stress Analysis Services

Located in Calgary, Alberta; Vancouver, BC; Toronto, Ontario; Edmonton, Alberta; Houston Texas; Torrance, California; El Segundo, CA; Manhattan Beach, CA; Concord, CA; We offer our engineering consultancy services across Canada and United States. Meena Rezkallah.

#CAESAR II#energy efficiency#structural engineering#material handling#3D modeling#safety standards#regulatory compliance#earthquake resilience#stress analysis#CRN registration#advanced technologies#engineering consultancy#fabrication oversight#rehabilitation#piping design#pressure vessel#project commissioning#retrofitting#electrical design#automated storage#operational excellence#system reliability#ASME compliance#seismic bracing#foundation design#storage tank#tank integrity#design evaluation#infrastructural advancement#industrial innovation

0 notes

Text

Professional Compliance Advisory Services | Bespoke Compliance Support | MEMA Consultants

Navigating regulatory compliance can be challenging, but MEMA Consultants' compliance advisory services are here to help. We offer bespoke support packages tailored to your firm's specific needs, ensuring you meet your compliance goals efficiently.

Our ongoing compliance advisory support keeps you updated on new regulations and helps you understand their impact on your business. We assist with drafting policies and procedures, creating robust compliance monitoring programs, reviewing and implementing financial crime controls, and designing and delivering training programs.

For more information, visit our compliance advisory services page.

#compliance advisory services#bespoke compliance support#regulatory compliance#compliance monitoring#policy drafting#financial crime controls#compliance training#MEMA Consultants#ongoing compliance support#compliance goals

0 notes