#remittance processing

Explore tagged Tumblr posts

Text

Understanding Invoices, Billing, and Payment Terms: A Simple Guide to Getting Paid Right

If you’ve ever sold a product or service, you already know how important it is to get paid on time. But when money is involved, there’s more than just sending a bill and hoping it gets paid. Behind every successful business transaction, there’s a system that keeps things organized, clear, and traceable. This system lives in a world full of terms like invoices, credit memos, remittance advice,…

#accounting terms#Accounts Receivable#accounts receivable management#applied payments#billing#billing process#business payments#cash application#credit memo#customer billing#customer payment#debit memo#financial documents#financial recordkeeping#invoice#invoice accuracy#invoice management#invoice matching#invoice processing#invoice terms#invoice tracking#Net 30#Net 60#payment collection#payment due#payment reconciliation#Payment Terms#remittance advice#remittance processing#unapplied cash

0 notes

Note

AITA for dismissing Motherhood?

🐣🚼👼

I (33f) work in a large financial institution, doing remittance processing. No customers are ever around us, and I sit with a group of 5-6 people every day. One of our cool supervisors came around greeting everyone and saying happy Mother's Day. He also asked my friend (29m) if he'd gotten his pregnant wife a gift yet. Friend replies that he's thinking about it. I say "well technically she's not a mother yet".

Here's where I might be TA. Everyone's reaction, erupting in a mix of laughter and gasps. (Gaspter, if you will) I am child free by choice and everyone knows that, as the conversation around kids comes up pretty often. And one of our coworkers (45f) who is pretty religious, was on break and everyone was saying how lucky I was that she didn't hear that.

Here's my thought process tho! WHICH I DID NOT SAY ALOUD. If someone is pregnant, even if they're up to 8.99999 months, horrible things can happen which lead to a stillborn baby. Someone who's had a miscarriage is definitely traumatized and in despair, but if they didn't have other kids, you wouldn't say "she's a mother/parent".

Maybe I'm wrong and it's some weird religion thing left behind in my child brain but until you breathe, you aren't born, and therefore become a Child.

Should I apologize for being insensitive? AITA?

163 notes

·

View notes

Text

Partially funded by Christy Walton. Walmart heiress.

Walmart has earned hundreds of billions from remittances the criminal illegal invaders send back home. They also help facilitate the property crimes committed by these criminals, via processing stolen credit cards, checks, etc., etc., and then selling gift cards to these criminals.

STOP SUPPORTING/SHOPPING AT WALMART!

34 notes

·

View notes

Text

MADISON, Wis. — A bombshell report this morning from Dan Bice of the Milwaukee Journal Sentinel revealed that Banco Azteca, a bank reportedly tied to the Mexican cartel flew $26 million of cash across the U.S.-Mexico Border to Eric Hovde’s bank in California.

As the Milwaukee Journal Sentinel detailed, Banco Azteca was cut off by several other U.S. banks over “risk and compliance concerns” after reporting linked it to cartel activity. An executive of the bank was recently implicated in a federal indictment detailing his attempts to bribe a member of the U.S. Congress to get U.S. banks to once again do business with the bank. Despite this, Eric Hovde’s bank flew $26 million of cash from Mexico City to Irvine, California as part of a deal with Banco Azteca last December.

This shocking revelation comes as Hovde has refused to disclose which foreign banks and governments his bank has done millions of dollars of business with. What else is Hovde hiding?

Read more below:

Milwaukee Journal Sentinel: Bice: Democrats question Eric Hovde over his bank’s $26M deal with a troubled Mexican bank

By: Dan Bice

Banco Azteca, the 10th largest financial institution in Mexico, has had its share of problems in recent years.

Accused in past news stories of having links to the Mexican drug cartel.

Dropped as a financial partner by some U.S. banks because of “risk and compliance concerns.”

And now caught up in a Texas bribery scheme with an American congressman.

But Sunwest Bank, the Utah-based financial institution run by Republican U.S. Senate candidate Eric Hovde, doesn’t mind doing business with it.

In December, Banco Azteca sent $26.2 million in cash to Sunwest on four airplane flights as part of a massive currency conversion called “repatriation,” records show. Hovde, who is running against Democratic U.S. Sen. Tammy Baldwin, is chairman and CEO of Sunwest.

Now Democrats are questioning the deal, saying it gives voters a window into how Hovde runs his businesses by putting personal financial stakes above other issues.

Arik Wolk, spokesman of the Democratic Party, said Sunwest’s transactions with Banco Azteca are “extraordinarily concerning,” especially given the alleged past ties between Azteca and the drug cartel. He added, however, that Democrats were not suggesting Hovde or Sunwest had done anything illegal.

“Hovde is willing to do anything to enrich himself, even flying cash across the border for a bank suspected of working for criminal groups that are pouring deadly fentanyl into our state,” Wolk claimed.

As recently as 2021, Banco Azteca had no correspondent banks in the U.S. with which it could transfer U.S. currency.

Over the past decade, several news accounts, including two by Reuters, have drawn links between Banco Azteca and Mexican gangs, which are the leading suppliers of cocaine, heroin, fentanyl and other illicit narcotics to the U.S.

In 2023, a Reuters reporter wrote that drug cartels are using remittances – money transfers favored by migrant workers – to send illicit earnings back to Mexico.

The Reuters reporter said he witnessed five individuals on motorcycles collecting cash from people leaving branch offices of three banks, including Banco Azteca. Locals said these were couriers for the Sinaloa Cartel picking up drug money sent as remittances.

In a 2014 story, Reuters quoted a prominent anti-kidnapping activist saying Mexican gangs involved in kidnapping migrants ask for the money to be sent to Banco Azteca. Also, the Yale Journal of International Affairs reported that Banco Azteca was one of four banks that the Mexican cartel was using to process extortion payments.

A little more than a decade ago, the U.S. Office of the Comptroller of the Currency investigated Banco Azteca’s ties with its then-correspondent bank in the U.S., Lone Star National Bank of Pharr, and turned up money-laundering concerns. Repeatedly cited and fined, Lone Star soon ended its relationship with Banco Azteca.

Other financial institutions, including Fifth Third Cincinnati and CBW Bank, soon followed.

According to a May story in the Wall Street Journal, Banco Azteca has struggled doing business with U.S. banks since regulators began enforcing rules cracking down on money laundering from drug trafficking, kidnapping and extortion. Many U.S. banks have cut ties with Banco Azteca because of “risk and compliance concerns.”

For years, that left Banco Azteca holding onto large sums of U.S. currency with no place to offload it.

25 notes

·

View notes

Text

Everything You Need to Know About UPB Token: The Future of Digital Transactions

The world of cryptocurrency is constantly evolving, with new tokens emerging to reshape the financial landscape. One such token making waves in the digital economy is UPB Token. Whether you're an investor, trader, or crypto enthusiast, understanding UPB Token can open up exciting opportunities. In this blog, we'll explore what UPB Token is, its features, use cases, and why it stands out in the competitive crypto market.

What is UPB Token?

UPB Token is a next-generation digital asset designed to facilitate fast, secure, and decentralized transactions. Built on a robust blockchain network, it offers users an efficient way to transfer value globally with low transaction fees and high scalability.

Key Features of UPB Token

✅ Decentralization: UPB Token operates on a decentralized blockchain, ensuring transparency and security without the need for intermediaries. ✅ Fast Transactions: The token is designed to process transactions within seconds, making it ideal for everyday use. ✅ Low Fees: Unlike traditional banking systems, UPB Token provides minimal transaction costs, allowing users to save money on transfers. ✅ Scalability: The network can handle a large number of transactions simultaneously, making it suitable for global adoption. ✅ Smart Contract Support: Developers can create decentralized applications (DApps) using UPB Token, enhancing its utility in the DeFi ecosystem.

Use Cases of UPB Token

1. Digital Payments

UPB Token can be used for online purchases, peer-to-peer transfers, and merchant payments, offering a seamless alternative to traditional payment systems.

2. Decentralized Finance (DeFi)

As part of the growing DeFi ecosystem, UPB Token enables staking, yield farming, and liquidity provision on various DeFi platforms.

3. NFT Marketplace

With the booming NFT industry, UPB Token can be used to buy, sell, and trade digital assets securely on NFT marketplaces.

4. Cross-Border Transactions

UPB Token eliminates the need for costly remittance services by allowing users to send and receive funds instantly across borders.

Why UPB Token Stands Out

Unlike many other tokens in the market, UPB Token is backed by a strong technological foundation, a growing community, and real-world applications. Its commitment to innovation and security makes it a promising digital asset for both investors and users.

Final Thoughts

As the cryptocurrency space continues to expand, UPB Token presents an exciting opportunity for those looking to invest in the future of digital finance. With its unique features, growing adoption, and strong use cases, it has the potential to become a major player in the blockchain ecosystem.

If you're interested in UPB Token, stay updated on its latest developments and explore how it can be integrated into your financial strategy!🚀 Join the UPB Token revolution today! 🚀

3 notes

·

View notes

Text

Representative Office in Thailand

A Representative Office (RO) serves as a non-revenue generating entity that allows foreign companies to establish a legal presence in Thailand without forming a full subsidiary. Governed by the Ministry of Commerce (MOC) and Foreign Business Act (FBA), ROs are ideal for:

Market research and business development

Coordination between headquarters and Thai partners

Quality control for regional suppliers

However, ROs face strict operational limitations—understanding these restrictions is critical before registration.

2. Legal Framework & Key Restrictions

Permissible Activities (Under MOC Notification No. 275)

An RO may only engage in:

Sourcing goods/services for its parent company

Inspecting/controlling quality of products ordered by HQ

Providing advisory support to HQ about Thai market

Disseminating information about new products/services

Reporting business trends to the parent company

Prohibited Activities (That Would Require a Full Company):

Direct sales, invoicing, or revenue generation

Signing contracts on behalf of the parent company

Providing services to third parties

Penalties: Violations can result in fines up to THB 1 million, imprisonment, or forced closure.

3. Registration Process: Step-by-Step Requirements

Phase 1: Pre-Registration Documentation

Parent Company Documents (notarized/apostilled):

Certificate of Incorporation

Memorandum & Articles of Association

Board Resolution authorizing RO establishment

Audited financial statements (last 3 years)

Thai Office Requirements:

Lease agreement (registered at Land Department)

List of intended expatriate staff

Phase 2: Ministry of Commerce Approval

Submit Application (Form Kor Tor 1) to MOC’s Business Development Department

Review Period: 30–60 days

Post-Approval: Register at DBD, Revenue Dept., and Social Security Office

Phase 3: Ongoing Compliance

Annual Audit Submission (even with no revenue)

Work Permits: Limited to 5 foreign employees

4. Tax & Financial Considerations

A. Tax Obligations

Corporate Income Tax: 0% (if compliant with RO restrictions)

Withholding Tax: 15% on remittances to HQ classified as "service fees"

VAT: Not applicable (no sales activity)

B. Capital Requirements

Minimum THB 5 million remitted to Thailand within first 3 years

Must maintain THB 2 million in a Thai bank account

C. Audit Requirements

Annual financial statements must be filed by a licensed Thai auditor

Transfer pricing documentation recommended for HQ transactions

5. Representative Office vs. Other Business Structures

CriteriaRepresentative OfficeRegional OfficeLimited CompanyAllowed RevenueNoYes (from affiliates)Yes (full operations)Tax LiabilityNone10% CIT (regional)20% CITCapital RequiredTHB 5MTHB 10MTHB 2M+Work PermitsMax 5No limitNo limit

Key Takeaway: An RO is not a substitute for a trading company—it’s a non-commercial liaison office.

6. Common Pitfalls & How to Avoid Them

A. Accidental Revenue Generation

Risk: Providing consultancy to local firms may be deemed as service income

Solution: Draft activity scope carefully in MOC application

B. Underestimating Compliance Costs

Hidden Fees: Auditor fees (~THB 50k/year), visa renewals, legal retainer

Budget: Minimum THB 1M/year for a compliant RO

C. Visa & Work Permit Issues

Expat Headcount: 5 is the absolute max—plan staffing accordingly

Local Hiring: Must have at least 1 Thai employee per foreign hire

7. When to Upgrade to a Regional/Branch Office

Consider transitioning if you need to: ✔ Generate revenue from affiliate companies ✔ Sign contracts locally ✔ Employ more than 5 foreigners

Upgrade Process: Requires new MOC approval and capital increase.

8. Expert Recommendations

For Market Entry:

Use an RO for 2–3 years to test the market before committing to a full subsidiary

Pair with a Thai distributor for actual sales

For Compliance:

Retain a Thai law firm to audit activities annually

Maintain separate bank accounts for HQ remittances

For Long-Term Strategy:

If scaling, convert to a BOI-promoted company for better incentives

Conclusion: Is a Representative Office Right for You?

A Thai RO offers low-risk market access but demands strict adherence to non-commercial activities. It’s ideal for:

Manufacturers vetting Thai suppliers

Tech firms exploring ASEAN expansion

Service companies needing a local liaison

Final Warning: Misuse can trigger FBA violations—always align activities with MOC approval. For complex cases, consult a Thai corporate lawyer before registration.

#thailand#corporate#thai#thailandcorporate#thaicorporate#representativeoffice#representativeofficeinthailand

2 notes

·

View notes

Text

Our Investors' Success Stories

💸 NRIs, planning to remit funds from your NRO account? Here's what you must know!

Managing your NRO (Non-Resident Ordinary) account remittances isn’t as simple as clicking “transfer.” There are specific RBI, FEMA, and income tax regulations to follow — and missing a step can lead to delays or penalties.

Here’s a quick guide to keep your remittances smooth and compliant:

✅ Understand the $1 million/year repatriation rule As per RBI guidelines, NRIs can repatriate up to USD 1 million per financial year from their NRO accounts. This includes income such as rent, dividends, or sale proceeds of assets acquired in India.

✅ Get your documentation in order You’ll need to furnish Form 15CA (self-declaration) and Form 15CB (CA certification) to confirm taxes have been paid. Without this, banks won’t process your transfer.

🚫 Avoid gifting from your NRO account FEMA regulations prohibit gifting funds from an NRO account to a resident Indian. Gifting via this route can lead to non-compliance and scrutiny.

🧠 Consult a financial expert Every remittance case is unique. An experienced advisor can guide you on tax implications, documentation, and best practices to ensure your transfer is hassle-free.

At Wealth Munshi, we help NRIs navigate the complex landscape of remittances, tax planning, and wealth management with confidence and clarity.

📲 Ready to remit the right way? Let’s talk. Visit wealthmunshi.com

Stay informed. Stay compliant. Stay ahead.

#NRIFinance#NROAccount#WealthPlanning#TaxCompliance#FEMA#NRIInsights#Wealthmunshi#Leading Wealth Management for NRIs & HNIs#Expert Financial Planning for HNIs and NRIs#Expert NRI & HNI Wealth Planning Services#financial consultant near me#wealth planning services for nri hyderabad

2 notes

·

View notes

Text

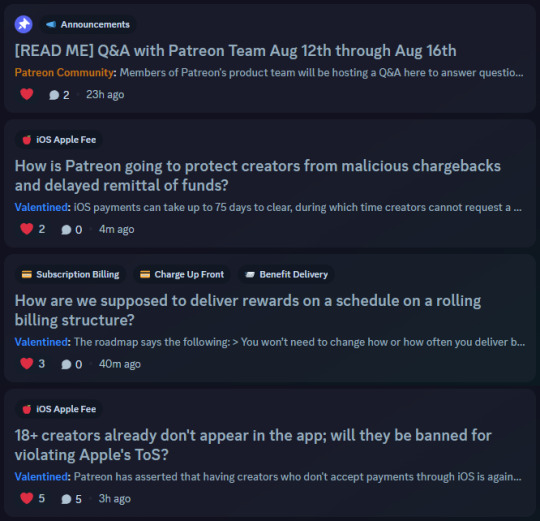

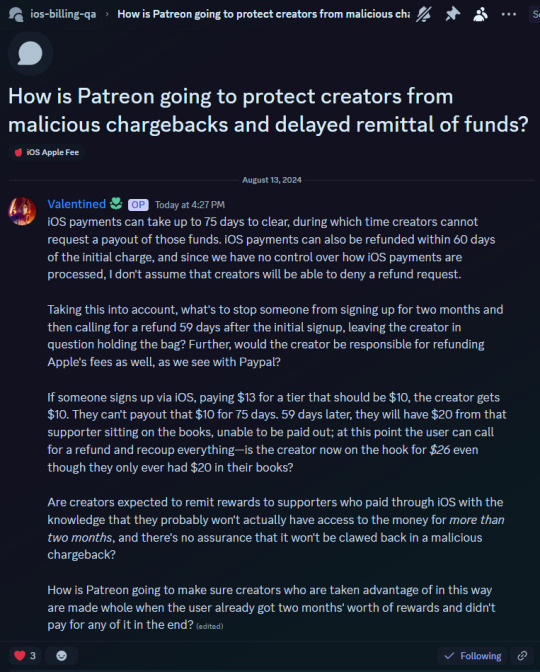

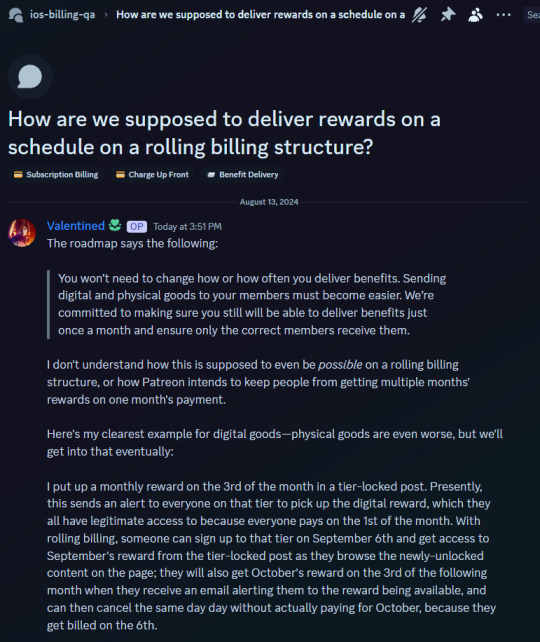

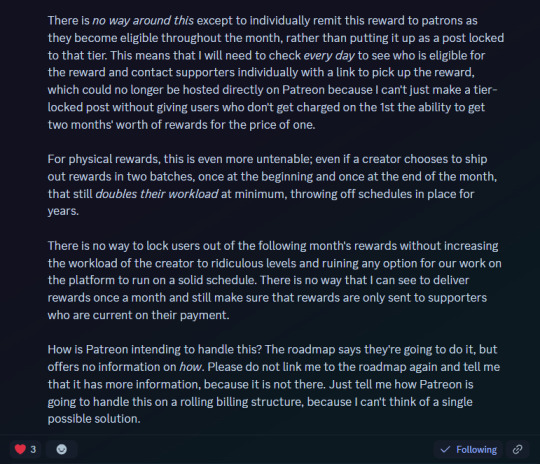

I have become the squeakiest wheel in the official Patreon server and NOBODY IS ANSWERING ME.

Screengrabs and full text of my questions under the cut, preserved in case of removal in the server.

How is Patreon going to protect creators from malicious chargebacks and delayed remittal of funds?

Valentined [OP] — Today at 4:27 PM iOS payments can take up to 75 days to clear, during which time creators cannot request a payout of those funds. iOS payments can also be refunded within 60 days of the initial charge, and since we have no control over how iOS payments are processed, I don't assume that creators will be able to deny a refund request. Taking this into account, what's to stop someone from signing up for two months and then calling for a refund 59 days after the initial signup, leaving the creator in question holding the bag? Further, would the creator be responsible for refunding Apple's fees as well, as we see with Paypal? If someone signs up via iOS, paying $13 for a tier that should be $10, the creator gets $10. They can't payout that $10 for 75 days. 59 days later, they will have $20 from that supporter sitting on the books, unable to be paid out; at this point the user can call for a refund and recoup everything—is the creator now on the hook for $26 even though they only ever had $20 in their books? Are creators expected to remit rewards to supporters who paid through iOS with the knowledge that they probably won't actually have access to the money for more than two months, and there's no assurance that it won't be clawed back in a malicious chargeback? How is Patreon going to make sure creators who are taken advantage of in this way are made whole when the user already got two months' worth of rewards and didn't pay for any of it in the end?

How are we supposed to deliver rewards on a schedule on a rolling billing structure?

Valentined [OP] — Today at 3:51 PM The roadmap says the following: You won’t need to change how or how often you deliver benefits. Sending digital and physical goods to your members must become easier. We’re committed to making sure you still will be able to deliver benefits just once a month and ensure only the correct members receive them. I don't understand how this is supposed to even be possible on a rolling billing structure, or how Patreon intends to keep people from getting multiple months' rewards on one month's payment. Here's my clearest example for digital goods—physical goods are even worse, but we'll get into that eventually: I put up a monthly reward on the 3rd of the month in a tier-locked post. Presently, this sends an alert to everyone on that tier to pick up the digital reward, which they all have legitimate access to because everyone pays on the 1st of the month. With rolling billing, someone can sign up to that tier on September 6th and get access to September's reward from the tier-locked post as they browse the newly-unlocked content on the page; they will also get October's reward on the 3rd of the following month when they receive an email alerting them to the reward being available, and can then cancel the same day day without actually paying for October, because they get billed on the 6th. There is no way around this except to individually remit this reward to patrons as they become eligible throughout the month, rather than putting it up as a post locked to that tier. This means that I will need to check every day to see who is eligible for the reward and contact supporters individually with a link to pick up the reward, which could no longer be hosted directly on Patreon because I can't just make a tier-locked post without giving users who don't get charged on the 1st the ability to get two months' worth of rewards for the price of one. For physical rewards, this is even more untenable; even if a creator chooses to ship out rewards in two batches, once at the beginning and once at the end of the month, that still doubles their workload at minimum, throwing off schedules in place for years. There is no way to lock users out of the following month's rewards without increasing the workload of the creator to ridiculous levels and ruining any option for our work on the platform to run on a solid schedule. There is no way that I can see to deliver rewards once a month and still make sure that rewards are only sent to supporters who are current on their payment. How is Patreon intending to handle this? The roadmap says they're going to do it, but offers no information on how. Please do not link me to the roadmap again and tell me that it has more information, because it is not there. Just tell me how Patreon is going to handle this on a rolling billing structure, because I can't think of a single possible solution.

18+ creators already don't appear in the app; will they be banned for violating Apple's ToS?

Valentined [OP] — Today at 12:11 PM Patreon has asserted that having creators who don't accept payments through iOS is against Apple's ToS for the App Store—but 18+ creators literally can't. Given that 18+ creator campaigns are not findable on the app, or even on Patreon's built-in search, there's no way to sign up to support them anywhere but via web. According to Patreon's claims about what Apple does not allow, this means that 18+ creators are against the ToS altogether, as they can't accept payments via the app, and therefore keeping us at all will result in the app being removed from the App Store. It wouldn't matter if we all switched to subscription billing right now, we can't accept payments through the app and that's against Apple's ToS. What is Patreon going to do about this, exactly? Are we going to spend the next year with official emails trying to cajole us to change to an all-ages campaign and then get banned all at once on November 1, 2025, so that Patreon can keep Apple happy?

7 notes

·

View notes

Text

Thailand LTR Visa

The Long-Term Resident (LTR) Visa, launched in 2022, is a major Thai government initiative to attract wealthy individuals, retirees, highly skilled professionals, and investors to Thailand by offering an extended stay with significant privileges. It forms part of Thailand's broader strategy to enhance economic growth through foreign direct investment and talent attraction.

Core Features of the LTR Visa

FeatureDescriptionDuration10 years (initial 5 years + automatic 5-year extension if conditions maintained).Work PermissionDigital Work Permit included for eligible applicants.Tax Benefits17% flat personal income tax rate (only for highly skilled professionals in targeted industries).Ease of ReportingOnly once-a-year immigration reporting (versus standard 90-day reporting).Fast Track at AirportsAccess to Premium Lane services.Dependent RightsSpouse and up to four dependents (children under 20) can also receive LTR Visas.

Who Is Eligible for the LTR Visa?

The program has five categories of eligible applicants:CategoryBasic CriteriaWealthy Global Citizens≥ USD 1 million in assets, USD 80,000/year income.Wealthy PensionersRetirees over 50 years old, ≥ USD 80,000/year pension income.Work-From-Thailand ProfessionalsRemote workers employed by established foreign companies; ≥ USD 80,000/year income.Highly Skilled ProfessionalsExperts in targeted industries like healthcare, robotics, fintech; employer certified.DependentsLegal spouse and children under 20 years old.

Important: Each category has nuanced financial and insurance requirements which must be fully documented.

Detailed Eligibility Requirements

Wealthy Global Citizens

USD 500,000 minimum investment in Thai government bonds, real estate, or direct investment.

Minimum USD 1 million in assets globally.

Health insurance with at least USD 50,000 coverage or social security benefits ensuring treatment in Thailand.

Wealthy Pensioners

Age ≥ 50.

Pension income of at least USD 80,000/year or, if lower, proof of at least USD 250,000 investment in Thai assets.

Health insurance or equivalent.

Work-From-Thailand Professionals

Employment by a foreign company listed on stock exchanges or with revenue ≥ USD 150 million in the last 3 years.

Minimum 5 years of work experience in fields relevant to their current role.

Highly Skilled Professionals

Employer operating in one of Thailand’s targeted sectors (e.g., biotechnology, automation, medical services).

Endorsement by a relevant Thai government agency.

Five years relevant experience unless holding a Master’s degree or higher.

Application Process

Document Preparation

Proof of employment, income, investments, insurance, academic degrees, professional certifications.

Submission

Apply through the Board of Investment (BOI) LTR Visa platform.

Qualification Endorsement

BOI evaluates the application within approximately 20 working days.

Visa Issuance

After approval, applicants collect the visa either inside Thailand or at a Thai consulate abroad.

Digital Work Permit Application (if applicable)

Apply through the BOI One Start One Stop Investment Center (OSOS) or EEC offices.

Costs and Fees

ItemFeeLTR Visa Issuance50,000 THB per personWork Permit IssuanceIncluded (no additional cost beyond visa fee)

Other costs (insurance premiums, investment costs) depend on the applicant's category.

Tax Implications

Highly Skilled Professionals can apply for a flat 17% personal income tax rate, compared to the standard progressive rates up to 35%.

Global income: In principle, Thailand taxes residents on worldwide income if remitted to Thailand in the same year, but practical taxation depends on tax treaty protections and remittance practices.

Note: Thailand has signed double taxation agreements (DTAs) with over 60 countries.

Common Pitfalls and Challenges

IssueRiskInsufficient documentationMissing proof of investments, income, insurance leads to rejection.Employer Certification DelayEspecially for highly skilled workers; may require negotiation with Thai government agencies.Insurance GapsPolicies must clearly show coverage of at least USD 50,000 without unacceptable exemptions.Changes in EmploymentHighly skilled visa holders must notify immigration if changing jobs.

Renewal and Revocation Conditions

Must continue to meet financial or employment conditions throughout the stay.

Changes in circumstances (e.g., income drop, investment sale) may trigger review and possible visa revocation.

Annual compliance checks may apply, particularly for taxation and insurance.

Conclusion: Strategic Planning Required

The LTR Visa represents a significant opportunity for foreigners seeking long-term stability in Thailand with attractive lifestyle and tax benefits. However, successful application requires meticulous preparation, strict legal compliance, and ongoing maintenance of eligibility standards.

Given the complexity, professional consultation with legal and financial advisors familiar with Thailand's immigration law is highly recommended.

#thailand#thai#immigration#visa#immigrationinthailand#immigrationlawyers#immigrationlawyersinthailand#thailandltrvisa#ltrvisa#ltrvisainthailand#thaivisa#visainthailand

2 notes

·

View notes

Text

Expatriate Tax Services in India, by Mercurius & Associates LLP

Comprehensive Expatriate Tax Services in India by Mercurius & Associates LLP

Navigating taxation as an expatriate in India can be complex without the right guidance. Whether you’re an individual expat working in India or a company managing foreign employees, staying compliant with Indian tax laws is critical. That’s where Mercurius & Associates LLP steps in with reliable and efficient Expatriate Tax Services in India tailored to your unique needs.

Understanding Expatriate Taxation in India Expatriates working in India are subject to Indian income tax based on their residential status, duration of stay, and nature of income earned in India. The Indian Income Tax Act classifies individuals into:

Resident and Ordinarily Resident (ROR)

Resident but Not Ordinarily Resident (RNOR)

Non-Resident (NR)

Each category has different tax implications, which makes proper planning essential to avoid double taxation and legal pitfalls.

Key Expat Tax Services Offered by Mercurius & Associates LLP Mercurius & Associates LLP provides end-to-end expat tax solutions to simplify compliance and enhance financial efficiency. Their services include:

✅ Tax Planning & Advisory Evaluation of residential status

Tax-efficient compensation structuring

Advisory on global income and double taxation avoidance

✅ Tax Return Preparation & Filing Income tax return filing for expatriates in India

Support with Form 67 for claiming foreign tax credit

✅ DTAA (Double Taxation Avoidance Agreement) Assistance Strategic application of DTAA between India and the expat’s home country

Legal compliance and claim optimization

✅ Payroll Structuring for Expat Employees Salary structuring in line with Indian laws

Perquisites and allowances optimization

Tax withholding guidance for employers

✅ Visa & Regulatory Compliance Support FRRO registration

PAN application and remittance advice

RBI and FEMA compliance for expat-related financial transactions

Why Choose Mercurius & Associates LLP? With deep experience in expatriate taxation, Mercurius & Associates LLP brings clarity, accuracy, and peace of mind to expats and multinational employers. Here's what sets them apart:

🌐 Strong understanding of Indian & international tax laws

👨💼 Personalized service for individuals & corporations

⚖️ Compliance-driven approach to minimize legal risk

📄 Assistance with global mobility, payroll, and documentation

🔍 Transparent and responsive consultation process

Who Can Benefit? Foreign nationals employed in India

Indian citizens returning from foreign assignments

Multinational companies hiring expatriates in India

Startups expanding with global teams

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#taxation#auditor#ap management services

5 notes

·

View notes

Text

Unapplied Cash: Why It Matters and How to Handle It

Behind the numbers and spreadsheets of everyday business, unapplied cash is a quiet disruptor that often goes unnoticed until it starts creating real problems. It’s not as visible as unpaid invoices or as flashy as revenue milestones, but it’s an area that deserves attention. Understanding unapplied cash and taking steps to reduce or clear it is essential for maintaining financial clarity, good…

#accounting issues#Accounts Receivable#cash application#cash flow#cash management#customer payments#double payment#finance operations#financial reporting#invoice matching#missing remittance advice#overpayment#payment disputes#payment processing#payment reconciliation#remittance errors#unapplied cash#unapplied payments#underpayment#wrong bank account

0 notes

Text

Blockchain Payments: The Game Changer in the Finance Industry

The finance industry has experienced a remarkable transformation over the past few years, with blockchain payments emerging as one of the most groundbreaking innovations. As businesses and individuals increasingly seek secure, transparent, and efficient transaction methods, blockchain technology has positioned itself as a powerful solution that challenges traditional payment systems.

Understanding Blockchain Payments

At its core, blockchain payments utilize decentralized ledger technology (DLT) to facilitate transactions without intermediaries such as banks. Unlike conventional payment systems, which rely on centralized institutions, blockchain operates through a distributed network of nodes that validate and record transactions in an immutable ledger. This decentralized approach ensures greater transparency, security, and efficiency in financial transactions.

Key Benefits of Blockchain Payments

1. Security and Transparency

Blockchain transactions are encrypted and recorded on an immutable ledger, making them highly secure and tamper-proof. The decentralized nature of blockchain ensures that no single entity can alter transaction records, increasing transparency and reducing the risk of fraud.

2. Lower Transaction Costs

Traditional payment methods often involve intermediaries such as banks and payment processors, which charge significant fees for transaction processing. Blockchain payments eliminate the need for intermediaries, resulting in lower transaction costs for businesses and consumers.

3. Faster Cross-Border Transactions

International transactions using traditional banking systems can take days to settle due to multiple intermediaries and regulatory approvals. Blockchain payments, on the other hand, enable near-instant cross-border transactions, enhancing financial inclusivity and reducing delays.

4. Enhanced Accessibility

Blockchain payments provide financial services to individuals and businesses without requiring a traditional bank account. This feature is particularly beneficial for underbanked populations, allowing them to participate in the global economy.

Real-World Applications of Blockchain Payments

E-Commerce and Retail: Merchants are integrating blockchain payment systems to accept cryptocurrencies, offering customers an alternative and secure payment method.

Remittances: Migrant workers can send money to their families without high remittance fees, ensuring more money reaches the recipients.

Supply Chain Management: Blockchain ensures secure and transparent payments between suppliers, manufacturers, and distributors.

Decentralized Finance (DeFi): DeFi platforms leverage blockchain payments for lending, borrowing, and yield farming, providing users with financial services without traditional banks.

How Resmic is Revolutionizing Blockchain Payments?

Resmic is at the forefront of enabling seamless cryptocurrency transactions, empowering businesses to embrace blockchain payments effortlessly. The platform provides a secure and user-friendly payment infrastructure, allowing businesses to accept multiple cryptocurrencies while ensuring compliance with regulatory requirements.

Key Features of Resmic:

Multi-Currency Support: Accepts various cryptocurrencies, enhancing customer flexibility.

Fast Settlements: Near-instant transactions for efficient cash flow management.

Secure Transactions: Robust encryption and decentralized validation for enhanced security.

Seamless Integration: Easy API integration with existing payment systems and e-commerce platforms.

Embracing the Future of Finance

Blockchain payments are reshaping the financial landscape, offering businesses and individuals a more efficient and secure way to transfer value globally. As adoption continues to grow, platforms like Resmic play a crucial role in facilitating this transition. By leveraging blockchain technology, businesses can stay ahead of the curve and unlock new opportunities in the digital economy.

3 notes

·

View notes

Text

Record-Breaking Remittances Showcase Resilience of Filipino Overseas Workers

The recent surge in Filipino remittances has defied global economic uncertainties, reaching unprecedented levels and showcasing the resilience of overseas workers and their families. In November 2024, personal remittances hit a record $3.12 billion, marking a 3.5% increase from the previous year. This remarkable achievement has contributed to the total remittances of $34.61 billion recorded from January to November 2024.

The United States, long-standing as the largest contributor, accounted for 40.9% of the total cash transfers processed through banks. Other major sources included Singapore and Saudi Arabia, reflecting the diverse global network of Filipino employment and the strong economic ties maintained by overseas workers.

Despite November marking a two-month low in inflows, the overall trajectory remains positive, supported by consistent contributions from land-based workers and expanding digital transfer options.

The economic benefits of these remittances extend far beyond individual households, serving as catalysts for community development and local business growth across the Philippines. As Festive Pinoy reports, the $34.61 billion in remittances have enabled families to invest in education, housing, and small enterprises, while also contributing to improved infrastructure and enhanced social services.

The digital transformation of money transfers has further strengthened the remittance landscape, with the increased adoption of mobile wallets and blockchain-powered systems. These innovations have improved accessibility, reduced transaction times, and enhanced the overall security of the remittance process.

Looking ahead, the Bangko Sentral ng Pilipinas projects a robust 3% growth in personal remittances for 2024, buoyed by steady overseas Filipino employment and improving labor conditions in key destination countries. This positive outlook is mirrored across various regional markets, with North America, the Middle East, and Asia Pacific all expected to experience continued growth.

The surge in Filipino remittances is a testament to the resilience and economic contributions of overseas workers. As Festive Pinoy continues to explore the vibrant culture, stunning destinations, and captivating experiences that the Philippines has to offer, we encourage our readers to immerse themselves in the rich tapestry of this dynamic nation. Visit FestivePinoy.com to discover the essence of the Philippines and uncover the remarkable stories that lie within.

2 notes

·

View notes

Text

What are the latest technological advancements shaping the future of fintech?

The financial technology (fintech) industry has witnessed an unprecedented wave of innovation over the past decade, reshaping how people and businesses manage money. As digital transformation accelerates, fintech new technologies are emerging, revolutionizing payments, lending, investments, and other financial services. These advancements, driven by fintech innovation, are not only enhancing user experience but also fostering greater financial inclusion and efficiency.

In this article, we will explore the most significant fintech trending technologies that are shaping the future of the industry. From blockchain to artificial intelligence, these innovations are redefining the boundaries of what fintech can achieve.

1. Blockchain and Cryptocurrencies

One of the most transformative advancements in fintech is the adoption of blockchain technology. Blockchain serves as the foundation for cryptocurrencies like Bitcoin, Ethereum, and stablecoins. Its decentralized, secure, and transparent nature has made it a game-changer in areas such as payments, remittances, and asset tokenization.

Key Impacts of Blockchain:

Decentralized Finance (DeFi): Blockchain is driving the rise of DeFi, which eliminates intermediaries like banks in financial transactions. DeFi platforms offer lending, borrowing, and trading services, accessible to anyone with an internet connection.

Cross-Border Payments: Blockchain simplifies and accelerates international transactions, reducing costs and increasing transparency.

Smart Contracts: These self-executing contracts are automating and securing financial agreements, streamlining operations across industries.

As blockchain adoption grows, businesses are exploring how to integrate this technology into their offerings to increase trust and efficiency.

2. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are at the core of fintech innovation, enabling smarter and more efficient financial services. These technologies are being used to analyze vast amounts of data, predict trends, and automate processes.

Applications of AI and ML:

Fraud Detection and Prevention: AI models detect anomalies and fraudulent transactions in real-time, enhancing security for both businesses and customers.

Personalized Financial Services: AI-driven chatbots and virtual assistants are offering tailored advice, improving customer engagement.

Credit Scoring: AI-powered algorithms provide more accurate and inclusive credit assessments, helping underserved populations gain access to loans.

AI and ML are enabling fintech companies to deliver faster, more reliable services while minimizing operational risks.

3. Open Banking

Open banking is one of the most significant fintech trending technologies, promoting collaboration between banks, fintechs, and third-party providers. It allows customers to share their financial data securely with authorized parties through APIs (Application Programming Interfaces).

Benefits of Open Banking:

Enhanced Financial Management: Aggregated data helps users better manage their finances across multiple accounts.

Increased Competition: Open banking fosters innovation, as fintech startups can create solutions tailored to specific customer needs.

Seamless Payments: Open banking APIs enable instant and direct payments, reducing reliance on traditional methods.

Open banking is paving the way for a more connected and customer-centric financial ecosystem.

4. Biometric Authentication

Security is paramount in the financial industry, and fintech innovation has led to the rise of biometric authentication. By using physical characteristics such as fingerprints, facial recognition, or voice patterns, biometric technologies enhance security while providing a seamless user experience.

Advantages of Biometric Authentication:

Improved Security: Biometrics significantly reduce the risk of fraud by making it difficult for unauthorized users to access accounts.

Faster Transactions: Users can authenticate themselves quickly, leading to smoother digital payment experiences.

Convenience: With no need to remember passwords, biometrics offer a more user-friendly approach to security.

As mobile banking and digital wallets gain popularity, biometric authentication is becoming a standard feature in fintech services.

5. Embedded Finance

Embedded finance involves integrating financial services into non-financial platforms, such as e-commerce websites or ride-hailing apps. This fintech new technology allows businesses to offer services like loans, insurance, or payment options directly within their applications.

Examples of Embedded Finance:

Buy Now, Pay Later (BNPL): E-commerce platforms enable customers to purchase products on credit, enhancing sales and customer satisfaction.

In-App Payments: Users can make seamless transactions without leaving the platform, improving convenience.

Insurance Integration: Platforms offer tailored insurance products at the point of sale.

Embedded finance is creating new revenue streams for businesses while simplifying the customer journey.

6. RegTech (Regulatory Technology)

As financial regulations evolve, fintech innovation is helping businesses stay compliant through RegTech solutions. These technologies automate compliance processes, reducing costs and minimizing errors.

Key Features of RegTech:

Automated Reporting: Streamlines regulatory reporting requirements, saving time and resources.

Risk Management: Identifies and mitigates potential risks through predictive analytics.

KYC and AML Compliance: Simplifies Know Your Customer (KYC) and Anti-Money Laundering (AML) processes.

RegTech ensures that fintech companies remain agile while adhering to complex regulatory frameworks.

7. Cloud Computing

Cloud computing has revolutionized the way fintech companies store and process data. By leveraging the cloud, businesses can scale rapidly and deliver services more efficiently.

Benefits of Cloud Computing:

Scalability: Enables businesses to handle large transaction volumes without investing in physical infrastructure.

Cost-Effectiveness: Reduces operational costs by eliminating the need for on-premise servers.

Data Security: Advanced cloud platforms offer robust security measures to protect sensitive financial data.

Cloud computing supports the rapid growth of fintech companies, ensuring reliability and flexibility.

The Role of Xettle Technologies in Fintech Innovation

Companies like Xettle Technologies are at the forefront of fintech new technologies, driving advancements that make financial services more accessible and efficient. With a focus on delivering cutting-edge solutions, Xettle Technologies helps businesses integrate the latest fintech trending technologies into their operations. From AI-powered analytics to secure cloud-based platforms, Xettle Technologies is empowering organizations to stay competitive in an ever-evolving industry.

Conclusion

The future of fintech is being shaped by transformative technologies that are redefining how financial services are delivered and consumed. From blockchain and AI to open banking and biometric authentication, these fintech new technologies are driving efficiency, security, and inclusivity. As companies like Xettle Technologies continue to innovate, the industry will unlock even greater opportunities for businesses and consumers alike. By embracing these fintech trending advancements, organizations can stay ahead of the curve and thrive in a dynamic financial landscape.

2 notes

·

View notes

Text

Money Transfers Why Expats Choose GCB Exchange for Money Transfers?

1. Competitive Exchange Rates for Maximum Savings

As an expat, every dollar counts when sending money back home. High exchange rates and hidden fees from traditional banks can reduce the value of your remittance.

GCB Exchange offers competitive rates and transparent pricing, ensuring you get the most value for your hard-earned money. For example, services like XE Currency can help you compare rates and see the benefits of using GCB Exchange.

2. Low Fees with No Hidden Costs

Many exchange services promise low rates but sneak in hidden fees that inflate the overall cost. GCB Exchange ensures complete transparency. What you see is what you pay — no surprises.

This commitment to fairness is why expats across the UAE, Egypt, Jordan, and beyond rely on GCB Exchange. Check out our transparent fee structure here.

3. Speedy Transfers to Anywhere in the World

When your family depends on timely remittances, every minute matters. GCB Exchange processes transfers quickly and efficiently, ensuring your money arrives when it’s needed.

Unlike traditional banking services, which may take days, GCB Exchange is designed for fast and reliable transfers. For example, compare with services like Wise and discover how GCB Exchange goes above and beyond for expats.

4. User-Friendly Platform for Hassle-Free Transactions

Managing finances as an expat is already complicated — your money transfer service shouldn’t add to the stress. GCB Exchange offers a straightforward platform that makes it easy to:

Send money to family members.

Pay international bills.

Exchange currencies for travel or investments.

Whether online or in-person, GCB Exchange ensures your experience is seamless and hassle-free.

5. Security You Can Trust

When it comes to your hard-earned money, security is a top priority. GCB Exchange employs advanced encryption technologies and adheres to strict financial regulations to keep your transactions safe.

You can compare security standards with trusted names like OANDA and see why expats put their faith in GCB Exchange.

6. Tailored Services for Expats

Expats have unique financial needs, from regular remittances to currency exchange for travel or investments. GCB Exchange offers personalized solutions to meet these requirements.

Real-life example: A user in the UAE shared how GCB Exchange saved them hundreds of dirhams by offering better rates and lower fees compared to their previous provider.

Why Expats Trust GCB Exchange

Here’s why expats consistently choose GCB Exchange for money transfers:

Transparent pricing with no hidden fees.

Fast and reliable transfers.

Competitive exchange rates to maximize savings.

Secure platform ensuring your money is protected.

User-friendly services tailored for expats.

Join thousands of satisfied customers and experience the GCB Exchange difference today.

Start Your Money Transfer Journey with GCB Exchange

Whether you’re sending money to family, paying international bills, or preparing for a big move, GCB Exchange is here to make the process simple, affordable, and stress-free.

Click here to get started!

2 notes

·

View notes

Text

Bitcoin: The Dawn of a New Digital Age

Throughout history, transformative technologies have reshaped society by dismantling barriers and expanding human potential. The printing press democratized knowledge during the Renaissance, while the internet revolutionized information sharing in our time. Bitcoin represents the next step in this evolution—a technology that could fundamentally transform our financial system, though not without important challenges to consider.

The Current Financial Landscape

Today's financial system faces significant challenges. In Venezuela, where inflation exceeded 200% in 2023, citizens watched their savings evaporate within months. In Lebanon, banks imposed strict withdrawal limits during the financial crisis, effectively trapping people's money. Meanwhile, approximately 1.4 billion adults remain unbanked globally, unable to access basic financial services due to geographical, economic, or political barriers.

Bitcoin's Practical Solutions

Bitcoin offers concrete solutions to these challenges. During Venezuela's hyperinflation, thousands of citizens converted their bolivars to Bitcoin, preserving their purchasing power despite the national currency's collapse. In Afghanistan, where women face restrictions on banking access, organizations like Code to Inspire have used Bitcoin to pay female programmers, circumventing traditional barriers.

The technology's core features enable these solutions:

Decentralization: No single entity can freeze accounts or block transactions.

Programmability: Smart contracts enable transparent, automated financial services.

Borderless nature: Transfers work the same whether sending money across the street or across continents.

Fixed supply: The 21 million coin limit provides a hedge against inflation.

Real-World Impact and Adoption

The adoption of Bitcoin as a practical tool is already showing promising results:

El Salvador's Bitcoin adoption has enabled faster, cheaper remittances for its citizens.

The Lightning Network processes millions of small Bitcoin transactions daily, with fees under a cent.

Companies like Strike are using Bitcoin's rails to enable instant, nearly free cross-border payments.

However, significant challenges remain:

Price volatility makes Bitcoin a risky store of value in the short term.

Energy consumption of Bitcoin mining raises environmental concerns.

Technical complexity creates adoption barriers for many users.

Regulatory uncertainty in many jurisdictions.

The Path Forward

Rather than an instant golden age, Bitcoin's impact will likely unfold gradually:

Near term (1-5 years):

Continued integration with traditional financial systems.

Improved user interfaces and education.

Development of clearer regulatory frameworks.

Growth of Lightning Network adoption for small payments.

Medium term (5-10 years):

Stabilization of price volatility as market matures.

Broader institutional adoption.

More energy-efficient mining through renewable energy.

Integration with Internet of Things and autonomous systems.

Long term (10+ years):

Potential emergence as a global neutral settlement layer.

Evolution of new economic models enabled by programmable money.

Reduction of financial inequality through broader access.

Development of currently unimagined applications.

A Balanced Revolution

Bitcoin represents not just a new form of money, but a fundamental upgrade to how value moves and is stored in our digital age. While it won't solve all financial problems or create utopia, it offers real solutions to pressing challenges in our current system.

The true revolution lies not in overnight transformation, but in Bitcoin's steady empowerment of individuals. From the Venezuelan preserving their savings to the Afghan woman accessing the global economy, Bitcoin is already changing lives in measurable ways.

As we move forward, success will require:

Thoughtful development of the technology.

Balanced regulation that protects while innovating.

Focus on real-world problems and solutions.

Recognition of both possibilities and limitations.

The dawn of this new digital age isn't about blind optimism—it's about building pragmatic solutions to real problems. Bitcoin may not create a perfect world, but it offers tools to build a better one, one block at a time.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#DigitalRevolution#FinancialFreedom#FutureOfMoney#Cryptocurrency#Decentralization#BlockchainTechnology#NewGoldenAge#EconomicEvolution#BitcoinAdoption#Unbanked#FinancialInclusion#DigitalAge#Empowerment#TechForGood#financial education#digitalcurrency#finance#globaleconomy#financial experts#financial empowerment#blockchain#unplugged financial

2 notes

·

View notes