#roadtax

Text

The Six Most Expensive Countries For Car Ownership

Buying a car is a costly endeavor, which explains why many people complain about the cost. Desired vehicles, in particular, are often quite expensive. The uncertain economic climate exacerbates the problem we're in right now. In Malaysia, motoring is not for the faint of heart - especially if you're into brand new cars. The further problem is that the country imposes some of the highest road taxes on automobiles globally. Recent car sales and parts sales for motor vehicles contribute the most to collecting import and excise duties. Then again, is Malaysia the most expensive country for buying and operating a car? Continue reading to find out.

Most Expensive Countries To Own a Car

Cuba

There have been many positive changes in Cuba, at least on paper. Before 2011, it was nearly impossible to buy or sell. The island has been opened up to car manufacturers due to a tentative deregulation plan. Many popular brands and cars are available today, making it theoretically possible to buy and own one. Cuba has, unfortunately, remained an expensive country for automobile ownership. The second-hand market remains unaffected by the liberation, so many drivers cannot afford to buy used cars. The high cost of most cars is due to centralized price-setting and various taxes.

Kitts and Nevis

No doubt that this is a beautiful paradise on earth. As far as cars are concerned, St. Kitts and Nevis are more like a private hell. The costs of taxes are staggeringly high, making buying a car here one of the most expensive options. Perhaps only one positive aspect of this situation is that the island is tiny. Motorbikes and bicycles may be sufficient for your purposes.

Brazil

Car prices are ridiculously high in Brazil because of high taxes, high labor costs, and limited raw material supplies. You might end up doing some window shopping for a Brazilian-made car, like a locally manufactured Volkswagen. Many people consider importing cars because the available selection is poor. However, importing a vehicle can result in you being charged up to 100 percent of its value! There is also a lot of paperwork needed with autos, and fuel is heavily taxed!

North Korea

It is unlikely that many will or plan to buy a car in North Korea, but we would certainly have our hands full if we did. It may be possible for some government officials to get their hands on a Merc-copied Pyongyang 4.10, but others may not be so lucky. The purchasers of older Russian Volgas might find themselves dismayed to discover that their parts have not been imported in more than 20 years. You may want to take precautions if you own an automobile made outside of the country. Kim Jong Il reportedly got stuck behind a Japanese car in a traffic jam and ordered all Japanese vehicles to be confiscated at the time.

Malaysia

In Malaysia, car import policies protect home-grown automakers, particularly Proton. It is considered luxurious to drive a Toyota Camry or Honda Accord in this country. Malaysia has a unique situation when it comes to car prices. Here, even the most standard models sell at luxury car prices, making Malaysia the second most expensive country for car buyers. Even the least affluent Malaysians can afford to drive a Proton, which is not prohibitively expensive to own.

Singapore

Almost everyone knows that Singapore leads the list of the most expensive countries to buy a car. The truth is: Only 15% of Singaporeans can afford a car. Some car prices here are insane, such as the $135,988.00 Toyota Corolla, almost identical to the price of a new Scion FR-S. Even a Volkswagen Golf costs around $90,000 here. Those vehicles sell for about a third of that price in the UK. Cars in Singapore are so expensive because of their small size and dense population. Several measures have been set by the government of Singapore to regulate car ownership and use due to fears that there will be traffic jams if there are too many vehicles.

The Land Transport Department also imposes a Certificate of Entitlement (COE), quotas for transport, road taxes, and electronic road charges, in addition to mandatory registration of vehicles. Despite Singapore's expensive car ownership, the country's public transportation system is among the world's best. The bottom line is that car ownership isn't always necessary, even for high-ranking executives.

Read the full article

0 notes

Text

The Importance of Filing Form 2290 for New Truckers

For new truckers, understanding the importance of Form 2290 is vital. Not only does filing this form ensure you remain compliant with federal laws, but it also plays a role in funding essential infrastructure. By paying your HVUT, you contribute to road maintenance and safety, which benefits all motorists.

#Form2290#TruckersTax#NewTruckers#HVUT#HeavyVehicleTax#RoadTax#TruckingBusiness#TruckersCompliance#IRSForm2290#TruckTaxFiling

0 notes

Text

Payment choices for Form 2290

Form 2290 Payment Options" provides various methods for remitting taxes associated with heavy highway vehicles. These options cater to diverse preferences, ensuring convenience and efficiency for filers. From electronic transfers to credit card payments, filers can select the most suitable method for their needs on Truck2290.com.

#Truck2290#HVUT#RoadTax#IRS#Truckers#TaxationInsights#TaxCompliance#HeavyVehicle#TruckingTax#taxdeadlines#onlinefiling2290#taxseason#heavyvehicletax

0 notes

Text

নতুন গাড়ি কিনলেই এবার থেকে দিতে হবে ১৫ বছরের রোড ট্যাক্স -Takapoysanews - TAKAPOYSANEWS

0 notes

Text

Problems just keep on coming doesn't it

#personal#just read a warning notice that theyre gonna cut off the power supply if we dont pay off the full amount in 2 weeks#my job needs to pay me soon bc i cant afford to pay that off#vent#theres so much to pay off this week my car needs repair and the roadtax is expiring tomorrow#why is life so hard to deal with

6 notes

·

View notes

Photo

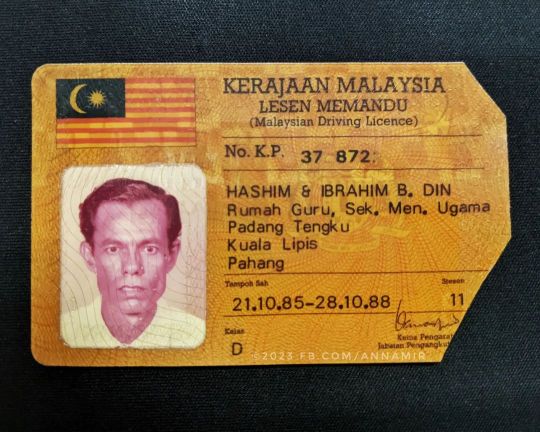

. Driving License | 1985 ~~~~~~~~~~~~~~~~~~~ Aboh koi punya ni. Kalau tengok belakang tu, bila hidupkan yg baru, dia cuma tampal kertas tempoh baharu, dan lekatkan dengan selotip aja. Katanya yg versi awal dari yang ni lagi la, tulis tangan dan bulatkan aja lesen kita kelas apa. Jaman now (2029), JPJ/Polis aja yg simpan data diri kita, scan anak mata kita jer kluaq smua info lesen, IC dan roadtax 🤭 p/s: No IC zaman tu ada 7 angka, koi edit tu buang sikit. #myJPJ #lesenmemandu#jpj #rarecollection #igersmalaysia #malaysiaigers #fyp #fypシ #fypage #ig_malaysiabest #instadaily #instaold #malaysiatrending #annamir #syukur #alhamdulillah #salamjumaat (at Padang Tengku) https://www.instagram.com/p/CowdRjbyX9x/?igshid=NGJjMDIxMWI=

#myjpj#lesenmemandu#jpj#rarecollection#igersmalaysia#malaysiaigers#fyp#fypシ#fypage#ig_malaysiabest#instadaily#instaold#malaysiatrending#annamir#syukur#alhamdulillah#salamjumaat

3 notes

·

View notes

Text

Car insurance is of most importance for various reasons, ensuring financial security and legal compliance. In Malaysia, where you are likely based, having car insurance is not just a choice but a legal requirement. Here are key points highlighting the importance of car insurance.

Legal Compliance: In Malaysia, it is mandatory to have at least third-party motor insurance to legally drive on the roads. Failure to comply with this requirement can lead to penalties, fines, and even legal consequences.

Financial Protection: Car insurance provides financial protection against unexpected events such as accidents, theft, or damage to your vehicle. Without insurance, you may have to bear the entire financial burden of repairing or replacing your car.

Personal Injury Coverage: Comprehensive car insurance often includes coverage for personal injuries, ensuring medical expenses are covered for you and your passengers in the event of an accident.

Third-Party Liability: Third-party insurance covers the costs of damage or injuries caused to other people or their property during an accident for which you are at fault. This protects you from potential legal actions and financial liabilities.

Vehicle Protection: Comprehensive car insurance offers coverage for a wide range of incidents, including natural disasters, fire, and vandalism. This safeguards your vehicle against various risks beyond just collisions.

Peace of Mind: Knowing that you are covered by insurance provides peace of mind while driving. Accidents can happen unexpectedly, and having insurance alleviates the stress associated with potential financial burdens.

Coverage for Uninsured Motorists: Some insurance policies offer protection in case you are involved in an accident with an uninsured or underinsured driver. This coverage ensures that you are not left with hefty expenses due to someone else's lack of insurance.

Loan or Lease Requirements: If you financed the purchase of your car through a loan or lease, the lender may require you to have comprehensive insurance to protect their investment until the loan is paid off.

Enhanced Security Features: Some insurance policies offer additional benefits, such as coverage for car accessories, roadside assistance, and even reimbursement for a rental car during repairs.

Promotes Responsible Driving: The awareness of being insured encourages responsible driving habits, as individuals are more likely to follow traffic rules and drive cautiously to avoid accidents.

Things you must know about Roadtax?

Understanding road tax is essential for vehicle owners in Malaysia, where compliance with road tax regulations is crucial. Here are key things you must know about road tax:

Legal Requirement: Road tax is a legal requirement for all vehicles in Malaysia. It is an annual fee that must be paid to the Road Transport Department (JPJ) to ensure the vehicle's legality on the road.

Renewal Frequency: Road tax needs to be renewed annually. The renewal process typically involves paying the required fee and providing necessary documentation to the JPJ.

Calculation of Road Tax: The road tax amount is determined based on various factors, including the vehicle's engine capacity (CC) and type. Different categories of vehicles have different road tax rates.

Engine Capacity Categories: Vehicles are categorized into engine capacity groups, and the road tax rates vary accordingly. It's important to know your vehicle's engine capacity to determine the correct road tax amount.

Payment Options: Road tax can be paid at JPJ offices, online through the MyEG portal, or at authorized banks. Online payments offer convenience and can save time compared to visiting physical locations.

Validity Period: Road tax is valid for one year from the date of issuance. It is crucial to renew it before the expiry date to avoid penalties and legal consequences.

Late Renewal Penalties: If road tax renewal is delayed, late penalties may be imposed.

These penalties can accumulate for each day of delay, so it's advisable to renew on time to avoid additional costs.

Required Documents: When renewing road tax, you may need to provide certain documents, including a valid insurance certificate, vehicle registration card, and the previous year's road tax receipt.

Enforcement and Fines: Authorities conduct regular checks to ensure vehicles have valid road tax. Driving without valid road tax can result in fines, and your vehicle may be impounded.

No-Fault Compensation Scheme (NFCS): A portion of the road tax goes towards the No-Fault Compensation Scheme, which provides financial compensation to individuals involved in road accidents, regardless of fault.

Vehicle Inspection: In some cases, a vehicle inspection may be required before road tax renewal, especially for older vehicles. This inspection ensures the vehicle's roadworthiness.

Changes in Vehicle Details: If there are changes in your vehicle details, such as engine capacity or vehicle type, it is important to update these with the JPJ to ensure accurate road tax calculation.

Types of Car Insurance Coverage

n Malaysia, various types of car insurance coverage are available to cater to different needs and preferences. Here are the main types of car insurance coverage.

Third-Party Insurance:

Coverage: This is the minimum legal requirement in Malaysia. It covers third-party bodily injuries, death, and property damage caused by your vehicle.

Exclusions: It does not cover damage to your own vehicle.

Comprehensive Insurance:

Coverage: Comprehensive insurance provides coverage for third-party liabilities and also covers damage to your own vehicle. It includes protection against accidents, theft, fire, and natural disasters.

Additional Benefits: Some comprehensive policies offer additional benefits like coverage for personal injuries, towing services, and car accessories.

Third-Party, Fire, and Theft Insurance:

Coverage: This type of insurance covers third-party liabilities and provides protection for your vehicle in case of fire or theft.

Exclusions: It does not cover damages from accidents or natural disasters.

Comprehensive Plus Insurance:

Coverage: An extended version of comprehensive insurance, this coverage often includes additional perks such as windshield coverage, flood damage protection, and more.

Benefits: It offers a higher level of protection and additional features compared to standard comprehensive insurance.

Named Driver Policy:

Coverage: Instead of covering any driver, this policy specifies named individuals who are allowed to drive the insured vehicle. It can be a cost-effective option for families with specific drivers.

Exclusions: Other drivers not named in the policy are not covered.

Auto Takaful:

Concept: Takaful is an Islamic insurance concept based on mutual cooperation. Auto Takaful operates on these principles, ensuring that risks are shared among participants.

Coverage: Similar to comprehensive insurance, it includes protection against various risks.

Special Perils Coverage:

Coverage: This type of coverage is an add-on to a comprehensive policy and provides protection against specific perils such as flood, landslide, and other natural disasters.

Exclusions: Standard comprehensive insurance may not cover certain natural disasters.

Personal Accident Coverage:

Coverage: This coverage provides financial compensation in case of accidental death or permanent disability resulting from a car accident.

Additional Benefits: Some policies include coverage for medical expenses and funeral expenses.

Windscreen Coverage:

Coverage: This add-on covers the repair or replacement costs of a damaged windshield.

Exclusions: Some policies may have limits on the number of claims allowed within a specific period.

Sum Insured of Car Insurance Coverage?

The sum insured in car insurance refers to the maximum amount that the insurance company will pay in the event of a covered loss or damage to the insured vehicle.

It's a crucial aspect of your insurance policy, and understanding it is essential for ensuring that you have adequate coverage. Here are key points related to the sum insured in car insurance:

Market Value:

The most common method of determining the sum insured is based on the market value of the vehicle. This is the current market value of the car at the time of the insurance application.

Market value is influenced by factors such as the car's age, make, model, condition, and depreciation.

Agreed Value:

In some cases, policyholders may opt for an agreed value, especially for newer or high-value vehicles. The agreed value is a predetermined amount agreed upon by the insurer and the policyholder at the time of purchasing the policy.

This fixed value is used in the event of a total loss or theft, providing more certainty to the policyholder regarding the payout amount.

Factors Influencing Sum Insured:

Vehicle Age: The older a vehicle, the lower its market value due to depreciation.

Make and Model: High-end or luxury cars may have a higher market value compared to standard models.

Modifications: Any modifications or enhancements to the vehicle can impact its market value.

Importance of Adequate Sum Insured:

It's crucial to ensure that the sum insured adequately covers the potential costs of repairing or replacing your vehicle in case of an accident, theft, or other covered events.

Underinsuring the vehicle may lead to out-of-pocket expenses, while overinsuring may result in higher premiums than necessary.

Review and Adjust Regularly:

The market value of a vehicle can change over time due to factors such as market conditions, depreciation, or enhancements. It's advisable to review and adjust the sum insured periodically to reflect the current value of the vehicle.

Depreciation and Insured Value:

Insurers often take into account the depreciation of the vehicle when determining the sum insured. This means that the payout for a claim may be based on the depreciated value of the vehicle at the time of the incident.

Insurance Declaration:

When purchasing or renewing car insurance, you will need to declare the sum insured or market value of your vehicle. Providing accurate information is crucial to ensure proper coverage.

Exclusions and Deductibles:

Be aware of any exclusions or deductibles associated with your policy. Some policies may have deductibles, and certain items or damages may not be covered, affecting the actual payout.

Car Insurance Additional Coverage?

Car insurance providers often offer additional coverage options, also known as add-ons or riders, to enhance the protection provided by standard policies. These optional coverages can be tailored to specific needs and circumstances. In Malaysia, where you are based, here are common additional coverage options available:

Windscreen Coverage:

Coverage: Repairs or replacement costs for a damaged windscreen are covered.

Benefits: Helps avoid out-of-pocket expenses for windscreen repairs, which may not be covered under a standard policy.

Special Perils Coverage:

Coverage: Protection against specific perils like flood, landslide, and other natural disasters.

Benefits: Useful in areas prone to natural disasters not covered by standard comprehensive insurance.

No-Claim Discount Protector:

Coverage: Preserves your no-claim discount (NCD) even if you make a claim.

Benefits: Helps maintain your premium discounts over consecutive claim-free years.

Additional Named Driver:

Coverage: Extends coverage to additional named drivers.

Benefits: Useful for families or households with multiple drivers sharing the same vehicle.

Compensation for Assessed Repair Time (CART):

Coverage: Provides compensation for the time your car is under repair, considering the loss of use.

Benefits: Helps cover expenses for alternative transportation during the repair period.

Special Perils Extension for Flood and Landslide:

Coverage: Extends coverage for damages caused by flood and landslide.

Benefits: Ideal for areas prone to flooding or landslides, offering additional protection beyond standard coverage.

Car Accessories Coverage:

Coverage: Protects non-factory fitted accessories and modifications in your car.

Benefits: Ensures coverage for customized features, audio systems, and other enhancements.

Key Replacement Coverage:

Coverage: Covers the cost of replacing lost or stolen car keys.

Benefits: Convenient for situations where replacing keys can be expensive.

Personal Accident Coverage (PA):

Coverage: Provides compensation for bodily injuries or death to the insured or passengers.

Benefits: Offers financial support for medical expenses, loss of income, or funeral expenses.

Agreed Value Coverage:

Coverage: Allows for an agreed-upon value for your vehicle, providing a fixed sum insured.

Benefits: Certainty of payout in the event of a total loss, especially for newer or high-value vehicles.

Legal Liability to Passengers (LLP):

Coverage: Covers legal liabilities for injury or death of passengers in your vehicle.

Benefits: Ensures financial protection in case of legal claims from passengers.

Special Perils Extension for Convulsion of Nature:

Coverage: Extends coverage for damages caused by earthquakes, volcanic eruptions, and other convulsions of nature.

Benefits: Additional protection in areas prone to such natural events.

Note: When considering additional coverage, it's important to assess your specific needs, driving habits, and the environment in which you use your vehicle. Consult with your insurance provider to understand the available options and tailor your coverage to provide comprehensive protection based on your requirements.

No Claim Discount (NCD)

The No Claim Discount (NCD), also known as No Claim Bonus (NCB) in some regions, is a crucial aspect of car insurance that rewards policyholders for not making any claims during the policy period. In Malaysia, where you are based, the NCD system is widely used, and it plays a significant role in determining the cost of insurance premiums. Here are key points about No Claim Discount:

Accumulating NCD:

Definition: NCD is a discount given by insurance companies for each claim-free year.

Accumulation: The discount accumulates for every consecutive year without making a claim.

NCD Scale:

Scale: NCD is typically applied on a scale, with increasing discounts for each claim-free year.

Example: The scale might start at 0% for the first year, increasing to 25% for the second year, and further increasing with each subsequent year without a claim.

Maximum NCD:

Limit: There is usually a maximum limit on the NCD percentage, often ranging from 50% to 55%.

Ceiling: Once the maximum NCD is reached, it remains constant for subsequent claim-free years.

Transferring NCD:

Transferability: NCD is transferable between insurance companies when you switch providers.

Proof: You can obtain a certificate of NCD from your current insurer and present it to the new insurer to continue enjoying the discount.

Forfeiture of NCD:

Claim Consequence: Making a claim during the policy period usually results in a loss of NCD.

Loss Percentage: The loss of NCD can vary, often resulting in a reduction of the discount percentage.

NCD Protector:

Coverage Option: Some policies offer an NCD Protector as an add-on.

Benefits: With an NCD Protector, you can make a certain number of claims without losing your NCD.

Time Limit for Claims:

Consideration Period: Some insurers have a specific time limit during which claims won't affect the NCD.

Example: Claims made within 30 days of policy renewal might not impact the NCD.

Impact on Premiums:

Premium Reduction: The NCD directly reduces the cost of your insurance premiums.

Significant Savings: Higher NCD percentages result in more significant savings on premiums.

NCD for Multiple Cars:

Individual Basis: NCD is usually applied on a per-vehicle basis.

Transferability: You can transfer NCD from one vehicle to another.

NCD for Named Drivers:

Named Driver NCD: Some insurers allow named drivers to earn their NCD, which they can use when they become the main policyholder.

Comprehensive Coverage of Car Insurance

Comprehensive car insurance is a robust coverage option that provides a wide range of protection beyond the basic third-party coverage. In Malaysia, where you are based, comprehensive insurance is a popular choice for those seeking extensive coverage for their vehicles. Here are the key features and benefits of comprehensive car insurance:

Allianz Private Car Insurance

FREE 24-hour Emergency Towing up to 150km

FREE 1 Additional Driver

FREE 24-hour Claim Assistance

Best Car Insurer 2018

Instant Cover Note approval

Suitable for E-hailing purpose

Pacific & Orient Private Car Insurance

FREE 24-hour Towing up to RM 350

FREE 24-hour Roadside Assistance

FREE Jumpstart or change of battery service

FREE Refuel empty tank service

FREE Replacement of tyre service

FREE 1 Additional Driver

FREE 24-hour Claim Assistance

Established Brand, 1994

Voted Best Value and Price

Insurance acceptance for Old Vehicles

RHB Private Car Insurance

FREE 24-hour Towing up to RM 300

FREE 24-hour Roadside Assistance

FREE Jumpstart or change of battery service

FREE Refuel empty tank service

FREE Replacement of tyre service

FREE 1 Additional Driver

FREE 24-hour Claim Assistance

Takaful Malaysia Private Car Takaful

FREE All Drivers Coverage

FREE 24-hour towing up to 50km every trip, no trip limit

FREE 24-hour roadside assistance program

FREE Jumpstart or change of battery service

FREE Refuel empty tank service

FREE Replacement of tyre service

1st Takaful Operator in Malaysia

Cash back for no claims up to 7.5%

Instant Cover Note approval

Easy and Fast Claims approval

Nationwide Panel Workshops

Suitable for non-Muslims too

Etiqa Takaful Private Car Insurance

FREE All Drivers Coverage

FREE Towing up to 200km

FREE 24-hour Claim Assistance

Islamic

Zurich Takaful Private Car Takaful

FREE 24-hour towing up to RM 200 per year

FREE All Additional Named Drivers

FREE 24-hour Claim Assistance

Easy and Fast Claims Approval

Islamic

Instant Cover Note approval

Suitable for E-hailing purpose

Liberty Private Car Insurance

FREE 24-hour Emergency Towing up to 150km

FREE 24-hour Roadside Assistance

FREE Jumpstart or change of battery service

FREE Refuel empty tank service

FREE Replacement of tyre service

FREE 1 Additional Driver

FREE 24-hour Claim Assistance

FREE Personal Accident (PA) coverage for Policy Holder (Up to RM10,000)

FREE Medical Expenses for Policy Holder (Up to RM1,500)

FREE Key Replacement

FREE Childseat Replacement

Suitable for E-hailing purpose

Lonpac Private Car Insurance

FREE 24-hour Towing up to RM 200

FREE All Drivers Coverage

FREE 24-hour Claim Assistance

Suitable for ehailing purpose

Takaful Ikhlas Private Car Takaful

FREE 24 hours Emergency towing up to 100km

FREE 24 hours Roadside Assistance - Bantuan Ikhlas

FREE Additional 10 Drivers

FREE Jump start and Battery replacement services

FREE Changing of Flat Tyre Services

FREE Petrol Assistance Services

FREE Locksmith Services

FREE Personal Accident Insurance for Car Owner (Covers RM10,000)

MSIG Private Car Insurance

FREE 24-hour Emergency towing up to RM 300

FREE 1 Additional Driver

FREE 24-hour roadside assistance program

FREE 24-hour claim assistance

Suitable for E-hailing purpose

Tokio Marine Private Car Insurance

FREE 24-hour Emergency towing up to RM 250

FREE 1 Additional Driver

FREE 24-hour roadside assistance program

FREE 24-hour claim assistance

Great Eastern Private Car Insurance

FREE 24-hour Emergency towing up to RM 300

FREE 1 Additional Driver

FREE 24-hour roadside assistance program

FREE 24-hour claim assistance

Chubb Private Car Insurance

FREE 24-hour Emergency towing up to RM 400

FREE 1 Additional Driver

FREE 24-hour roadside assistance program

FREE 24-hour claim assistance

Tune Private Car Insurance

FREE 24-hour Emergency towing up to RM 300/200KM

FREE 1 Additional Driver

FREE 24-hour roadside assistance program

FREE 24-hour claim assistance

Pacific Private Car Insurance

FREE 24-hour Emergency towing up to RM 300/50KM

FREE 1 Additional Driver

FREE 24-hour roadside assistance program

FREE 24-hour claim assistance

Suitable for E-hailing purpose

AIA Private Car Insurance

FREE 24-hour Emergency Road Assistance

FREE 1 Additional Named Driver

Total repair cost borne by AIA at all workshops

Affordable flood coverage

Berjaya Sompo Private Car Insurance

FREE 24-hour Emergency towing up to RM 300

FREE 1 Additional Driver

FREE 24-hour roadside assistance program

FREE 24-hour claim assistance

Your question car insurance malaysia?

What types of car insurance are available in Malaysia? In Malaysia, there are mainly two types of car insurance: Third-Party Insurance and Comprehensive Insurance. Third-Party Insurance covers liabilities to third parties, while Comprehensive Insurance provides broader coverage, including damages to your own vehicle. Is car insurance mandatory in Malaysia? Yes, it is a legal requirement to have at least Third-Party Insurance to drive on Malaysian roads. Comprehensive Insurance is optional but highly recommended for better protection. How is the premium for car insurance calculated? Car insurance premiums are calculated based on factors such as the vehicle's make and model, engine capacity, driver's age and experience, claims history, and coverage type. The No Claim Discount (NCD) also influences the premium. What is No Claim Discount (NCD)? NCD is a discount given by insurers for each claim-free year. It accumulates over time, leading to a reduction in the insurance premium. NCD is transferable between insurance providers. Can I transfer my NCD to another vehicle? Yes, you can transfer your NCD from one vehicle to another. You will need to obtain a certificate of NCD from your current insurer and provide it to the new insurer. What is Comprehensive Plus Insurance? Comprehensive Plus Insurance is an extended version of comprehensive coverage. It offers additional benefits such as windshield coverage, flood damage protection, and other enhanced features. Are flood and natural disaster damages covered in standard comprehensive insurance? While standard comprehensive insurance covers a wide range of risks, some policies may not automatically include protection against specific perils like floods. Special Perils Coverage can be added for such protection. How can I make a car insurance claim? In case of an accident or damage, contact your insurance provider as soon as possible. Follow their instructions for filing a claim, provide necessary documents such as the police report and photos of the damage, and cooperate with their assessment process. What is the importance of having windscreen coverage? Windscreen coverage protects you from the costs of repairing or replacing a damaged windscreen. It is especially valuable as damages to the windscreen are common and can be expensive to fix. Can I customize my car insurance coverage? Yes, many insurance providers offer additional coverage options or add-ons that you can customize based on your needs. These may include coverage for accessories, personal accident coverage, and more. Is car insurance coverage applicable to named drivers? Yes, insurance coverage can be extended to named drivers. However, the policy might specify the individuals covered, and coverage may vary based on the driver's age and driving history. How often should

I review my car insurance policy? It's advisable to review your car insurance policy annually, especially during the renewal period. Assess your coverage needs, check for any changes in your vehicle's value, and ensure that your policy aligns with your current circumstances.

0 notes

Link

Used NISSAN SERENA 2020 for sale, RM24,500 in Bidor, Perak, Malaysia. NISSAN SERENA 2. 0L CVT AUTO MPV NEW FACELIFT YEARS 2020 MONTHLY RM1450 X 6 YEARS++ NEW ROADTAX

0 notes

Text

legit believe i have no luck when it comes to finance. I'm suppose to fly off to visit my sis dec 25th, my salary was delayed a week after its supposed date so couldnt afford tickets at the time.

When my money did come, the ticket prices were unreasonably high that it sucked my whole 2 months worth salary and im left with 200$ only to spend in korea???? with my savings thats only 400$?

then i have a loan shark for a father, he knows of my financial situation yet insists that me and my sister pay up 180$ for roadtax. we've been saying how we will pay but are not in the situation to do so. and he just couldnt accept that. mind you, his salary is 3k to 4k. he has a nugget business with his wifes family, does forex, a car business, and a currency exchange business too. my income doesnt even pass 1k. hes freaking rich yet so selfish. we arent asking him to pay for us, we are just asking that he pay first then we'll pay him back. eventually i had to pay that $180 just to satisfy him. so how much am i left you ask? $20 for spendings this month

im so tired. i work 6 days a week. i teach kids who dont respect me, and have to do other sidework. yet all of my energy is being used and im not being paid enough for all this. im so stressed to the point that my period comes late every month. its so insane

0 notes

Text

The heart of the CBD. Every individual and business taxpayer plays a part in shaping the nation. We can be a smart city and eco-friendly by going car-lite. The biking initiative was a good idea but it died a natural death as many harried Singaporeans want everything fast. That's why Grab named itself precisely that, GRAB AND GO.. And PMDs which are more controversial have been accepted as a way of life.

1 note

·

View note

Link

It would help if you had a valid road tax in Malaysia before driving a car on public roads. But do you know how the government spends your road tax? Here, you will find information about how the Malaysian government spends road tax revenues and other information related to road taxes.

How Did The Malaysian Government Spend Your Road Tax Revenue?

The country of Malaysia has a vast network of roads that connect different cities in different states. You have to pay to drive your car on public roads because it is used to build and maintain public streets and provide safety and emergency services along these roads. In other words, road tax revenues are used to construct roads, retain them, and upgrade them.

Who Has To Pay Road Tax?

Individuals who purchase motorized vehicles must pay road taxes for commercial or personal use. The car can be a two-wheeler, a three-wheeler, a four-wheeler, or a commercial truck or trailer.

How To Renew Road Tax

Department Of Road Transport (JPJ)

Renewal of your road tax can be done at JPJ. To get it done, all you need to do is go to the nearest JPJ Office, queuing, and get it done. There is typically a long queue at JPJ offices because they are usually very crowded. It is also possible to renew your road tax at the post office, but you’ll need to make an appointment first.

Can Someone Help Me Renew My Road Tax?

Vehicle owners or their representatives can apply for a road tax renewal. If the vehicle owner is the one presenting to renew the road tax, he must submit his MyKad to be read and recorded in the MySikap system using the MyKad reader. When a representative is sent on your behalf, he does not need to bring the MyKad of the registered vehicle’s owner. Only his MyKad is required.

How To Renew Your Road Tax At JPJ

Ensure you have prepared all the necessary documents:

Identity card (IC)

A copy of the vehicle grant or certificate of ownership

A cover note insurance policy

Visit a JPJ office or branch or a UTC counter.

The complete list of JPJ offices is here.

UTC’s full list of offices is available here.

Find out what your queue number is.

You should wait in the waiting area until your number is called.

If your number is called, go to the counter and renew your road tax.

Pos Malaysia

With expired road, taxes come uneasy feelings and worries. Besides getting it done at JPJ, you can also renew road tax at Pos Malaysia. They are very similar steps to getting it done at JPJ.

Renewal Of Road Tax At Pos Malaysia

Be sure that you have prepared the following documents:

Identity card (IC)

A copy of the vehicle grant or certificate of ownership

A cover note insurance policy

Visit the nearest Pos Malaysia office.

Obtain the queue number.

Sit in the waiting area while you await your number.

When your number is called, go to the counter and renew your road tax.

Those who have lost their vehicle grant still have the option of renewing their road tax at the Post Office. You will need your IC or passport. It is unnecessary to have the owner’s IC if you are only a representative.

Renew Online With Fincrew!

Now, renew your auto insurance and road tax online and avoid the “I forgot, I was busy” excuse! To buy/renew your road tax, you no longer have to stand in line or hire a runner. Go online to Fincrew and have your road tax restored within minutes.

0 notes

Text

Try now with Truck2290 & Quick and Securely File Form 2290 Online

Truck2290 gives the highest priority to protecting the user’s privacy. We follow the best practices to keep your IRS 2290 Form filing information safe in the right hands.

0 notes

Photo

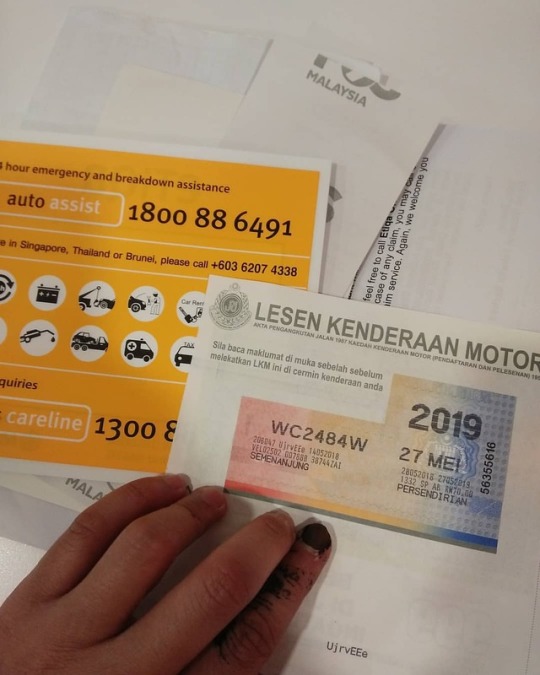

#renew #roadtax #insurance #call #wassup #amad #0166991009 (at Subang Jaya) https://www.instagram.com/p/CSVaJ4oJ3rU/?utm_medium=tumblr

0 notes

Photo

Saya sudah anda bila lg? #roadtax #jpj #sagaflxplus #etiqa #maybank #somewhereovertherainbow #bryandarwishironman #awesome

3 notes

·

View notes

Photo

Ok done tok hrni... nk deliver to da customers... ☺️ smuanye Online.... Quote pun online... pAyment pn Online... (COD pn bole)😊 rtax & Ins Sy by Hand :) Nak Renew Roadtax Insuran?? Nak Interchange Plate No Kenderaan Anda?? Nk tukar nama kenderaan tanpa ke JPJ? Segala urusan Puspakom??? Mai la Whatsapp2 ☺️☺️☺️ #renew #roadtax #insuran #murah #JPJ #Puspakom #tukarnamakenderaanonline #eauto #Inspection #ccris #ccrisptptn #ctos #fullloan #usedcarmurah #blacklist #belikeretatanpadokumen #salehidrisagency #peroduaprotonshowroom •PAKAR Jualan Kereta Baru&Terpakai. •PAKAR Urusan Pinjaman Kenderaan. •BLACKLIST Layak Memohon.(T&S) •Bekerja Tanpa Dokumen.(T&S) (Pengasuh Kanak2/Penjaja/ Dan Lain2) •CCRIS PTPTN Layak Memohon.(T&S) •KHIDMAT NASIHAT Percuma!!! Saleh Idris 📞 019-360 0171 Click Link >>> Wasap.My/60193600171 << 📠 03-3290 7113 SALEH IDRIS AGENCY NEW & USED CAR SALES CONSULTANT [email protected] www.facebook.com/peroduaprotonshowroom👍 (at Klang)

#tukarnamakenderaanonline#jpj#eauto#peroduaprotonshowroom#insuran#renew#roadtax#puspakom#usedcarmurah#murah#ccrisptptn#fullloan#ctos#belikeretatanpadokumen#ccris#salehidrisagency#blacklist#inspection

2 notes

·

View notes

Link

Used PROTON EXORA 2016 for sale, RM12,900 in Ampang, Kuala Lumpur, Malaysia. PROTON EXORA BOLD 1. 6 TURBO YEARS 2016 MONTHLY RM570 ONLY BALANCE 7 YEARS++ ROADTAX NOV 2022

0 notes