#robert bakish

Link

Hollywood's striking creatives are gaining some momentum from the Trustees of the New York City Pension Fund who have urged studios executives to bring the strike to an end of possibly risk losing investor confidence.

#janet walker#haute-lifestyle.com#the-entertainment-zone.com#hollywood#sag afra strike#wga strike#let them eat cake#michael jackson#hollywood news#disney#comcast#paramount#bog iger#robert bakish#brian roberts#blue beetle#barbie#the hill#retribution#gran turismo#sound of freedom

5 notes

·

View notes

Quote

Last year, Warner Bros. Discovery chief David Zaslav made $246.6 million; Disney’s Bob Iger made $45.9 million; and Paramount Global CEO’s Bob Bakish made $32 million. These individuals make more money per year than almost any entertainment executive before them. Just a small portion of each major CEO’s annual salary could cover the cost of the guilds’ reasonable structural and financial demands, and yet, they say it’s not possible.

How could that be?

Because it’s not about the money. It’s about power and perception.

Almost none of these CEOs built the companies they run. We are not negotiating with Jack Warner or Walt Disney. We’re not even negotiating with the people who enriched these companies, like producer Robert Evans at Paramount in the 1970s. These CEOs are basically people who just work there—and who have contracts that allow them very large amounts of money.

And right now, they don’t want anyone to know that. They don’t want anyone to know that they don’t actually build anything. They don’t want anyone to see them capitulate and bend the knee to any degree by making a deal with the writers and actors who build the product they fund and distribute. They don’t want to reasonably negotiate with these artists, because they think it will make them look weak. They think it will make them look like chumps, make them look simply like the employees of these companies that they are.

Justine Bateman on the Destruction of the Film Business

9K notes

·

View notes

Text

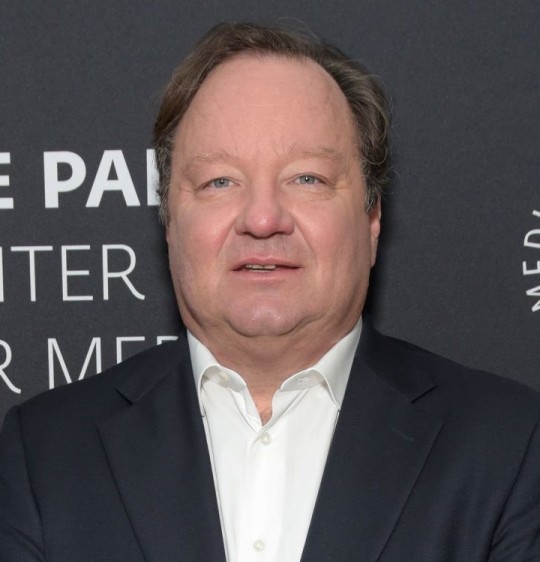

Robert M. Bakish

Former President of Paramount Global

Looks like Bob got let go as CEO of Paramount Global.

If he wants, I can offer him a job. The salary won't be much, but the benefits are great.

It's sex. The benefits is sex. All he wants.

28 notes

·

View notes

Text

Bob Bakish

Physique: Husky Build

Height: 6’

Robert Marc Bakish (born December 14, 1963-) is an American business executive. He has been president and CEO of Paramount Global since December 4, 2019, formerly holding the same position at Viacom before the merger with CBS Corporation.

Handsome, husky and looks like he could be spectacularly hairy underneath that suit. I wouldn’t mine getting into his bakish if you know what I mean. And if you don’t… I mean I’d fuck him. I mean look at him. Damn near perfect.

The New Jersey native is married with two daughters. I known nothing else about this guy other than he is exceptionally hot.

47 notes

·

View notes

Note

so there's a thought experiment where you are asked, "Here is a button that will give you one million dollars every time you push it. BUT! Every time you push it, a random person in the world will die. Do you push it?" And, like, what people don't understand is that the billionaires and the Bob Igers and the Robert Bakish and the Ted Sarandos and Greg Peters of the world... they are already mashing that button as many times a day as they can. let every fucking one of them die, and anyone who simps for them. squeamish anon should grow the fuck up.

EXACTLY!!!!! a perfect analogy!!

9 notes

·

View notes

Text

A few numbers for you...

Ari Emanuel, the CEO of Endeavor, made $308.2 MILLION. in ONE YEAR.

David Zaslav, CEO of Discovery, made $246.6 MILLION in ONE year.

Andy Jassy, CEO Amazon, 212.7 MILLION in one year.

Bob Iger, Disney, 45.9 MILLION in one year.

Tom Rutledge, Charter, 41.9 MLLION

Reed Hastings, Netflix, 40.8 MILLION in one year, down 6% from last year.

Ted Sarandos, Netflix, 38.2 MILLION, down 3% from last year.

Brian Roberts, Comcast, 34 MILLION for the year.

Bob Chapek, 32.5 MILLION for the year, 32.5 MILLION.

John Stankey, AT&T, 24.8 MILLION for the year.

Jeff Shell, NBC Universal, 21.6 MILLION per year.

Bob Bakish, Paramount, 20 MILLION- down 49% from last year.

These streaming channels are making BILLIONS. But actors and writers are getting literal pennies in residuals.

Source: https://www.hollywoodreporter.com/business/business-news/hollywood-ceo-pay-the-year-of-the-nine-figure-club-1235136814/

#sag aftra#writer's strike#actor's strike#'but actors make too much'#'but writer's make too much'#these ceos are making hundreds of millions and actors and writers are making pennies#support the strikes#prounion#he was a union man#tv writing#wga west#wga strong#support the wga#wgawest#wga strike#wga solidarity#hollywood reporter

5 notes

·

View notes

Text

Stock Market Sell-Off: Is Paramount a Buy?

Stock Market Sell-Off: Is Paramount a Buy?

Paramount Global (For -0.36%) CEO Robert Bakish signaled that the company’s current-quarter earnings would struggle to match the previous quarter’s results. Speaking recently at the UBS Global TMT conference in New York, Bakish said macroeconomic factors are suppressing spending across the ad industry and dragging down Paramount’s numbers. The executive noted that Paramount is actively looking…

View On WordPress

0 notes

Text

Showtime does not get too many viewers so ratings will always be kinda low. Normally, a show on Showtime will have ratings below 0.05. Sunday's episode got 0.06. ViacomCBS CEO Robert Bakish also [said](https://variety.com/vip/data-dexter-new-blood-gives-showtime-subscriber-infusion-1235129522/) *Yellowjackets* is Showtime's second-biggest streaming series of all time so I think a renewal for a second and/or third season is a pretty safe bet.

- said by someone from reddit

#reddit#yellowjackets reddit#yellowjackets#showtime#yellowjackets showtime#i know i alread asked about showtime and series but this is just more information#ratings

4 notes

·

View notes

Text

Q2 was a tipping point in streaming wars. Here's how the media giants stack up

There's no question the second quarter was a transformative one for the streaming video business, with consumers streaming an unprecedented volume of internet content and signing up for streaming services in unprecedented numbers. Media companies are increasingly focusing on the streaming market, a rare bright spot on their balance sheets at a time when so many other parts of their business, such as TV advertising, are under pressure, and other parts, such as the theatrical movie business and sports, are entirely absent.

No media company captures this pivot to streaming better than Disney. Its second quarter results were overshadowed by the gains of its direct to consumer subscription offerings and its commitment to double down on that business. The company announced that Disney+ has surpassed 60 million subscribers, four years ahead of its goal of reaching between 60 and 90 million by 2024. That growth is particularly remarkable considering that the service has yet to complete its full global rollout. Disney's streaming subscriptions now top 100 million, including Hulu, and faster-than-expected growth of ESPN+.

Liu Yifei stars in Disney's "Mulan." Disney CEO Bob Chapek said that "Mulan's" streaming release is a "one-off" and not a signal that the company was swapping to a new business model, but the company will pay close attention to how many accounts opt to purchase the film on Disney+.

Disney

"Despite the challenges of the pandemic we've managed to take deliberate and innovative steps in running our businesses," said CEO Bob Chapek in the company's earnings call. "At the same time, [we have been] very focused on advancing and growing our direct-to-consumer business which we see as our top priority and key to the future of our company.

Chapek showed just how important direct-to-consumer businesses are to Disney's future in his announcement that the company is building a new general entertainment streaming service that will launch internationally next year, tied to the Star India brand Disney acquired as part of its Fox deal. He also announced that Mulan, which cost Disney an estimated $200 million to make and whose theatrical release has been delayed multiple times, will be available for Disney+ subscribers to buy on September 4, the same day it's put in multiple theaters. This move aims to bolster demand for Disney+, and test the appetite for paying a premium for premium content, of those consumers with whom Disney is building its relationship.

Netflix, the leader in the subscription streaming media space, also saw its numbers soar in the second quarter: adding over 10 million subscribers, to end the quarter with nearly 193 million subscribers. Not only did those subscriber additions soar past expectations, but it follows the unprecedented addition of 15.7 million subscribers in the first quarter. While both those numbers were bolstered by stay-at-home orders and a lack of live sports on TV, co- CEO Reed Hastings warned that the growth rate would not last. Netflix shares plummeted on the warning that the company expects to add 2.5 million subscriber adds in the third quarter, half of analysts' forecast. Netflix explained this was the result of the pandemic "pulling forward" subscriber growth into the first half of the year.

We want to have so many hits that when you come to Netflix you can just go from hit to hit to hit and never have to think about any of those other services.

Reed Hastings

Netflix co-CEO

Hastings dismissed concerns about Disney+ and other rivals that are investing in content for their subscription or free ad-supported services. He even name-checked "Hamilton," which Disney+ released July fourth weekend: "We want to have so many hits that when you come to Netflix you can just go from hit to hit to hit and never have to think about any of those other services. We want to be your primary, your best friend, the one you turn to. And of course occasionally there's Hamilton and you're going to go to someone else's service for an extraordinary film, but for the most part we want to be the one that can always please you."

ViacomCBS echoed the strength in paid streaming as well as free, ad-supported streaming. The newly-merged media company's shares were bolstered by a 25% increase in domestic streaming and digital revenue over the year-earlier quarter. That was due to a combination of growth in domestic paid streaming subscribers, adding about 3 million over the course of the quarter to end the quarter with 16.2 million, while free ad-supported Pluto TV's domestic monthly active users grew adding about three million over the course of the quarter.

Bob Bakish, Viacom's CEO, was particularly bullish on demand for ads on PlutoTV, saying the platform has bounced back to pre-COVID growth rates and ad pricing, while the broader ad industry continues to contract.

And like Disney's Chapek, Viacom's Bakish is also doubling down on digital, announcing the company is developing a premium streaming service that will start launching internationally next year.

ViacomCBS upped its domestic pay streaming subscriber guidance to 18 million by year-end, which CEO Robert Bakish said "supports our conviction in the growth potential of our streaming offering, and we're just getting started."

Brendan McDermid | Reuters

But not every company is as bullish on the market for streaming video ads as Viacom.

Roku, which reported better-than-expected results, saw its stock plummet on warnings about lack of visibility into advertising over the rest of the year. CEO Anthony Wood writing in his letter to shareholders: "The ad industry outlook remains uncertain for Q3 and Q4, and we believe that total TV ad spend will not recover to pre-COVID-19 levels until well into 2021. Advertisers in industries like Casual Dining, Travel and Tourism have significantly slowed their spending. However, we remain confident in our ability to grow our ad business, albeit not as much as we would have expected prior to the pandemic."

And it's still early days for two new players in the streaming space: AT&T's HBO Max, which launched in May, and NBCUniversal's Peacock, which was introduced first to Comcast subscribers in mid-April, before rolling out nationwide on July 15.

AT&T described the launch of HBO Max as a success, saying it helped grow the overall pool of HBO and HBO Max customers by 1.7 million in the first half of the year. The company reported a total 36.3 million subscribers between the two services. But with the persistent cord-cutting trend, HBO Max may just be helping to counter cord cutting: the traditional HBO service lost over 2 million subscribers in the first quarter. It's far more complicated than Netflix's or Disney+'s business because there are two pieces of this business: getting people who are already paying for HBO to sign up for the expanded Max digital service, and drawing new subscribers. For the latter, AT&T CEO John Stankey said the company signed up nearly 3 million new subscribers, while just 4.1 million of HBO's existing subscribers activated the app.

Meanwhile Peacock, which doesn't charge a fee for its basic service but relies on viewers to generate ad dollars, reported hitting 10 million signups. NBCUniversal CEO Jeff Shell said that the key metrics it is watching are signups — with the goal of hitting 30 million to 35 million by 2024 — along with monthly active users and monthly active accounts, which can include multiple users within a family. Shell said trends have been better than expected across the board, and that it's still early days for the new app. Peacock is still not available on two of the most popular connected TV platforms: Roku and Amazon's FireTV.

While Peacock and HBO Max push their growth, everyone is keeping an eye on the consumer, and how many services they'll want to subscribe to once they're no longer locked down in their homes.

Disclosure: Comcast is the parent company of NBCUn

1 note

·

View note

Text

0 notes

Photo

Robert M. Bakish

Born: December 14, 1963, Englewood, NJ

Physique: Husky Build

Height: 6'

Robert Marc Bakish is an American business executive. He has been President and CEO of ViacomCBS since December 4, 2019, formerly holding the same position at Viacom before the merger with CBS Corporation.

I won’t mine getting into his bakish if you know what I mean. And if you don’t... I mean I’d fuck him. I mean look at him. Handsome, husky and hairy. Damn near perfect.

55 notes

·

View notes

Link

ViacomCBS stock tanks, losing more than half its value in less than a week. Shares of ViacomCBS, the media goliath led by Shari Redstone, took a nosedive this week, with the company losing more than half of its market value in just four days. Thes stock was as high as $100 on Monday. By the close of trading on Friday it had fallen to just over $48, a drop of more than 51 percent in less than a week. There’s no better way to say it: The company’s stock tanked. What happened? Several things all at once. First, it is worth noting that ViacomCBS had actually been on a bit of a tear up until this week’s meltdown, rising nearly tenfold in the past 12 months. About a year ago, it was trading at around $12 per share. That rally came as the company, like the rest of the media industry, had made a move toward streaming. It recently launched Paramount+ to compete against the likes of Netflix, Disney+, HBO Max and others. The service tapped ViacomCBS’s vast archive of content from the CBS broadcast network, Paramount Film Studios and several cable channels, including Nickelodeon and MTV. That shift matters because ViacomCBS has been hit hard by an overall decline in cable viewership. The company’s pretax profits have fallen nearly 17 percent from two years ago, and its debt has topped more than $21 billion. But the stock rose so much that Robert M. Bakish, ViacomCBS’s chief executive, decided to take advantage of the boon by offering new shares to raise as much as $3 billion. The underwriters who managed the sale priced the offering at around $85 per share earlier this week, a discount to where it had been trading on Monday. You could say it backfired. When a company issues new stock, it normally dilutes the value of current shareholders, so some drop in price is expected. But a few days after the offering, one of Wall Street’s most influential research firms, MoffettNathanson, published a report that questioned the company’s value and downgraded the stock to a “sell.” The stock should really only be worth $55, MoffettNathanson said. That started the nosedive. “We never, ever thought we would see Viacom trading close to $100 per share,” read the report, which was written by Michael Nathanson, a co-founder of the firm. “Obviously, neither did ViacomCBS’s management,” it continued, citing the new stock offering. Streaming is still a money-losing enterprise, and that means the old line media companies must still endure more losses over more years before they can return to profitability. In the case of ViacomCBS, it seemed to hasten the cord-cutting when it signed a new licensing agreement with the NFL that will cost the company more than $2 billion a year through 2033. As part of the agreement, ViacomCBS also plans to stream the games on Paramount+, which is much cheaper than a cable bundle. As the games, considered premium programming, shifts to streaming, “the industry runs the risk of both higher cord-cutting and greater viewer erosion,” Mr. Nathanson wrote. On Friday, an analyst with Wells Fargo also downgraded the stock, slashing the bank’s price target to $59. But the market decided it wasn’t even worth that much. It closed on Friday barely a quarter above 48 bucks. Source link Orbem News #Losing #stock #tanks #ViacomCBS #Week

0 notes

Note

Hi do you know if there’s gonna be a waco/paramount panel in the tcas this week or next week?

I have no idea the exact date that the panel will be. TCA has a group of days that cable/streaming services will present starting later this week, through the weekend and early next week. It could be any number of those days and you often won’t know until the press that’s there starts tweeting about it as it’s going on.

I think it would be crazy that Paramount Network wouldn’t be there to present the launching of their network and new show that premieres in just a few weeks…I would guess they’ll have a Waco panel and probably a Yellowstone panel as well.

This is from Adweek who seems to confirm that Paramount will be presenting:

Will the Paramount Network give USA and TNT a run for their money?

It’s been almost a year since Viacom CEO Robert Bakish revealed his plan to rebrand Spike as Paramount Network, creating a general entertainment network that the company hopes can compete alongside USA and TNT for audiences and ad dollars. As Paramount Network launches on Jan. 18, Viacom is giving the network its TCA coming out party, where execs and talent will either soar or stumble out of the gate with shows like Waco (a limited about the deadly 1993 standoff between the FBI, ATF and David Koresh’s Branch-Davidians) and drama Yellowstone, starring Kevin Costner.

4 notes

·

View notes

Text

ViacomCBS Weighs Putting Black Rock Skyscraper Up for Sale

Black Rock, the modernist skyscraper designed by Eero Saarinen that has been CBS headquarters for more than half a century and symbolized the network’s invincibility, is being considered for a sale.The 36-story tower, clad in light-erasing black granite at 51 West 52nd Street in Manhattan, could be sold as part of a larger review of the company’s real estate holdings, Robert M. Bakish, the chief executive of ViacomCBS, announced Monday at an investor conference. The company has hired the real estate investment firm CBRE Group to evaluate the entire roster of buildings, offices and studios.“We believe that is a very material financial asset,” Mr. Bakish said of Black Rock at the conference, which was put on by UBS. “We also believe it is not an asset we need to own and, in fact, that value can be put to better use elsewhere.” The additional cash could be used to buy back more stock, an artificial way to raise the value of shares.CBS merged with its sibling company, Viacom, last week in a $25 billion deal that united the country’s largest television network with the Paramount film studios and a clutch of cable channels that include MTV and Comedy Central. The newly combined entity anticipates $500 million in cost savings, largely from job cuts, but they could also come from the sales of properties in New York and Los Angeles.Last year, CBS sold CBS Television City, the Los Angeles home to 1970s shows like “All in the Family” and “The Carol Burnett Show” and, these days, “The Late Late Show With James Corden” and “Survivor” reunions and finales, to a real estate developer for $750 million.Black Rock was built by William S. Paley, the hard-charging businessman who turned a network of faltering radio stations into the respected broadcaster that came to be known as the Tiffany Network. He enlisted Saarinen to design the 491-foot structure, but the architect died in 1961, before construction was complete.In addition to Black Rock, a nickname it picked up because of its hue, the CBS Building has been called the House That Paley Built. It opened its doors in 1964 and has stood as the headquarters for CBS ever since.The building has been considered for a sale before, including in 2000 when Viacom, led by Sumner Redstone, acquired CBS. The two companies were split apart in 2006, only to rejoin last week. The building stands among Saarinen’s best-known creations, which also include the TWA terminal at Kennedy International Airport, which was recently remodeled and reopened as a hotel.

Source link

Read the full article

0 notes

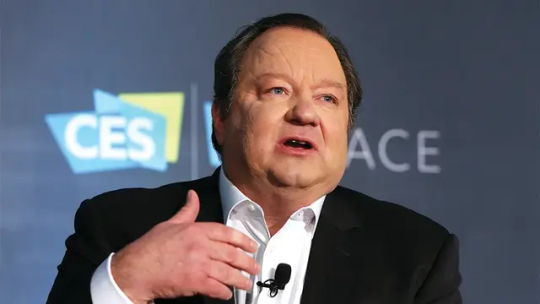

Photo

CBS, Viacom set August 8 as informal deadline for merger talks Robert Bakish, chief executive officer of Viacom International Media Networks, speaks during a Bloomberg Television interview at the Mobile World Congress in Barcelona, Spain, on Tuesday, March 3, 2015.

0 notes