#savinggoals

Explore tagged Tumblr posts

Text

Save Big by Starting Small: A Simple Guide to Setting Saving Goals

Want to build better money habits in 2025? It starts with one step: goal-based saving.

I've written a simple guide on how you can start saving — even if you earn very little. You’ll learn:

📝 How to choose a goal 📊 How to break it down into weekly steps 🔐 How to protect and track your savings

Start small. Stay strong. Save smart. 👉 Full article here: https://bit.ly/43iJLFi

SavingGoals #BudgetTips #NepaliFinance #SmartMoney #TumblrFinance

#Want to build better money habits in 2025? It starts with one step: goal-based saving.#I've written a simple guide on how you can start saving — even if you earn very little. You’ll learn:#📝 How to choose a goal#📊 How to break it down into weekly steps#🔐 How to protect and track your savings#Start small. Stay strong. Save smart.#👉 Full article here: [Your Blog Link]#SavingGoals#BudgetTips#NepaliFinance#SmartMoney#TumblrFinance

0 notes

Text

In today’s unpredictable economic landscape, having a robust emergency fund is more crucial than ever.��With rising inflation, potential job market fluctuations, and unforeseen expenses, a financial safety net can provide peace of mind and stability. Here’s a comprehensive guide to help you build an emergency fund in 2025.

#emergencyfund#emergencysafety#EmergencyLoan#medicalemergencies#savinggoals#payyourselffirst#hashtagjackets#Hashtag#reducespenfing#freelancer#fiverr#sidehustle#taxrefund#gift

0 notes

Photo

🏡 Dreaming of homeownership? Check out our top tips to make saving for your first home a reality. 🏦💰 https://cstu.io/3270c8

0 notes

Text

소득 증빙 걱정 끝! 청년도약계좌 필수 가이드

#YouthSavings#FinanceTips#FuturePlanning#FinancialIndependence#SavingGoals#청년도약계좌#소득요건해결#재테크#청년금융#미래설계

0 notes

Text

Top 5 Personal Finance Ideas and Inspiration

In today's fast-paced financial world, managing your personal finances effectively is more crucial than ever.

Whether you're looking to build wealth, secure your future, or simply gain better control over your money, having the right ideas and inspiration can make all the difference.

This comprehensive guide will explore the top 5 personal finance ideas and inspiration to help you achieve your financial goals and lead a more prosperous life.

1. Create a Solid Financial Foundation

The first step in mastering your personal finances is to build a strong foundation.

This involves several key components that will set you up for long-term success.

Develop a Comprehensive Budget

One of the most fundamental aspects of personal finance is creating and sticking to a budget.

A well-crafted budget helps you track your income and expenses, ensuring you live within your means and allocate your resources effectively.

To get started, try these steps:

Track all your income sources

List all your monthly expenses

Categorize your spending

Identify areas where you can cut back

Set realistic financial goals

Build an Emergency Fund

An emergency fund is a crucial component of your financial foundation. It provides a safety net for unexpected expenses or income disruptions, helping you avoid debt and financial stress.

Aim to save 3-6 months of living expenses in a easily accessible savings account. This fund will give you peace of mind and financial stability during challenging times.

Tackle High-Interest Debt

If you have high-interest debt, such as credit card balances, prioritize paying it off as quickly as possible.

High-interest debt can significantly hinder your financial progress and cost you thousands of dollars in interest over time.

Consider using the debt avalanche method, where you focus on paying off the debt with the highest interest rate first while making minimum payments on other debts.

This approach can save you money in the long run and help you become debt-free faster.

2. Invest in Your Future

One of the top 5 personal finance ideas and inspiration is to invest in your future. By making smart investment decisions, you can grow your wealth and secure your financial future.

Start Investing Early

The power of compound interest makes early investing one of the most effective ways to build wealth over time.

Even small contributions can grow significantly when given enough time to compound.

Consider these investment options:

Employer-sponsored retirement plans (e.g., 401(k))

Individual Retirement Accounts (IRAs)

Low-cost index funds

Exchange-traded funds (ETFs)

Real estate investments

Diversify Your Portfolio

Diversification is key to managing risk and maximizing returns in your investment portfolio.

By spreading your investments across different asset classes, sectors, and geographic regions, you can reduce the impact of market volatility on your overall portfolio.

Consider incorporating a mix of:

Stocks

Bonds

Real estate

Commodities

International investments

Stay Informed and Educated

The financial world is constantly evolving, and staying informed is crucial for making smart investment decisions.

Continuously educate yourself about personal finance and investing by reading books, attending seminars, and following reputable financial news sources.

3. Optimize Your Income Streams

Maximizing and diversifying your income streams is another key aspect of the top 5 personal finance ideas and inspiration.

By increasing your earning potential and creating multiple income sources, you can accelerate your financial growth and achieve your goals faster.

Develop Your Skills and Advance Your Career

Investing in your skills and education can lead to better job opportunities, promotions, and higher salaries. Consider these strategies:

Pursue advanced degrees or certifications in your field

Attend workshops and conferences to stay current in your industry

Take on challenging projects at work to showcase your abilities

Network with professionals in your field

Negotiate your salary and benefits regularly

Create Multiple Income Streams

Relying on a single income source can be risky. Diversifying your income streams can provide financial stability and accelerate your wealth-building efforts.

Consider these options:

Start a side hustle or freelance business

Invest in dividend-paying stocks

Create and monetize a blog or YouTube channel

Rent out a spare room or property

Sell digital products or online courses

Explore Passive Income Opportunities

Passive income can provide a steady stream of revenue with minimal ongoing effort. Some popular passive income ideas include:

Rental Properties

Peer-to-peer lending

Royalties from creative works

Affiliate marketing

Creating and selling digital products

4. Protect Your Financial Future

Safeguarding your financial future is an essential component of the top 5 personal finance ideas and inspiration.

By implementing proper protection strategies, you can ensure that your hard-earned wealth and assets are secure.

Obtain Adequate Insurance Coverage

Insurance plays a crucial role in protecting your finances from unexpected events. Consider these types of insurance:

Health insurance

Life insurance

Disability insurance

Homeowners or renters' insurance

Auto insurance

Create an Estate Plan

Estate planning ensures that your assets are distributed according to your wishes and minimizes potential conflicts among your heirs.

Key components of an estate plan include:

A will

Power of attorney

Healthcare directive

Beneficiary designations

Trust (if applicable)

Monitor and Protect Your Credit

Your credit score plays a significant role in your financial life, affecting everything from loan approvals to interest rates.

Take these steps to protect and improve your credit:

Regularly review your credit reports

Dispute any errors you find

Pay bills on time

Keep credit utilization low

Avoid opening too many new credit accounts

5. Cultivate a Wealth-Building Mindset

The final component of the top 5 personal finance ideas and inspiration is developing a wealth-building mindset.

Your attitudes and beliefs about money can significantly impact your financial success.

Practice Delayed Gratification

Developing the ability to delay gratification is crucial for long-term financial success.

By prioritizing future financial goals over immediate wants, you can make better spending decisions and accelerate your wealth-building efforts.

Continuously Educate Yourself

Financial education is an ongoing process. Stay curious and committed to learning about personal finance, investing, and wealth-building strategies.

Some ways to stay informed include:

Reading financial books and blogs

Listening to personal finance podcasts

Attending financial seminars or workshops

Following reputable financial experts on social media

Joining personal finance communities or forums

Learn more: usawisehub

#PersonalFinance#FinanceTips#MoneyManagement#FinancialFreedom#SavingMoney#InvestingTips#FinancialInspiration#WealthBuilding#FinancialGoals#MoneyMindset#DebtFreeJourney#FrugalLiving#BudgetingTips#FinanceAdvice#SmartMoney#FinancialWellness#MoneyGoals#FinancialPlanning#WealthInspiration#FinanceIdeas#FinancialSuccess#MoneyInspiration#SavingGoals#PersonalFinanceTips#MoneySavvy

0 notes

Text

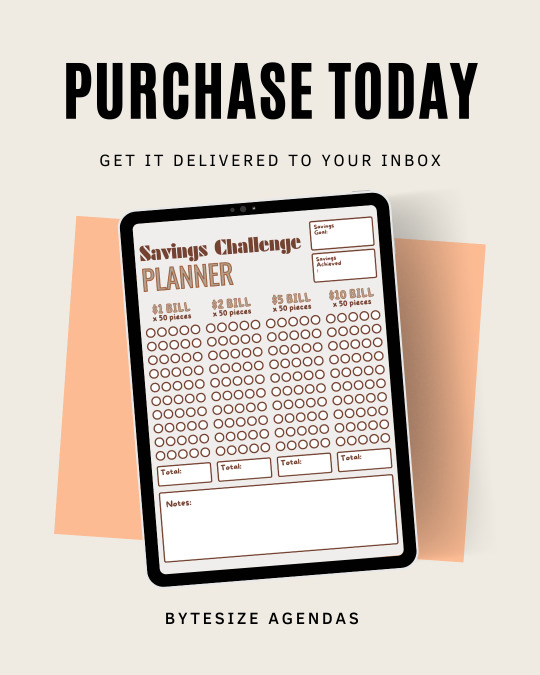

🎨💰 Unlock Your Financial Goals: Download Your Aesthetic Saving Planner Today! 📊✨

Dreaming of a brighter financial future? Let our aesthetic downloadable saving planner be your guiding light on the path to financial freedom and success!

Here's why it's a must-have:

✅ Visual Appeal: Say goodbye to boring spreadsheets and hello to a planner that's as beautiful as it is functional. 💰 Goal-Oriented: Set and track your savings goals with clarity and precision. 📲 Digital Convenience: Access your planner anytime, anywhere, right from your device. 🌟 Motivational Design: Stay inspired and focused on your financial journey with uplifting visuals and affirmations. 📈 Progress Tracking: Watch your savings grow and celebrate every milestone along the way.

Don't just dream about your financial goals—make them a reality with our aesthetic saving planner by your side!

Click the link in our bio to download yours today and embark on your journey to financial empowerment! 🚀💸 #SavingGoals #FinancialFreedom #AestheticPlanner

#financialpplanning#savinggoals#moneymanagement#budgetingtips#personalfinance#aestheticplanner#financegoals#digitalplanner#finanicalfreedom#visualplanning

0 notes

Text

Finding Zen in Money Mayhem.

There will always be ups and downs when planning for your future. Don't worry, it always turns around. Schedule a consultation with us today and let's work together to secure your financial future! Learn more at https://reps.modernwoodmen.org/slong

0 notes

Text

Thay vì xem nghỉ hưu như một điểm dừng, hãy định nghĩa lại nó như một khởi đầu mới. Nghỉ hưu sớm có thể được coi là cơ hội để bắt đầu một giai đoạn thứ hai trong cuộc sống, mang tính ý nghĩa và mục tiêu. Nó cho phép cá nhân theo đuổi niềm đam mê, khám phá sở thích mới và đóng góp cho xã hội theo cách khác.

#Quản Lý Tài ChínhCáNhân #Quản lý Tài chính Cá nhân #FinancialWellness #Tài ChínhCáNhân #FinancialFreedom #FinancialPlanning #Budgeting #SavingGoals #Mẹo đầu tư #DebtManagement #Financial Literacy

#QuảnLýTàiChínhCáNhân#PersonalFinanceManagement#FinancialWellness#TàiChínhCáNhân#FinancialFreedom#FinancialPlanning#Budgeting#SavingGoals#InvestingTips#DebtManagement#FinancialLiteracy#MoneyManagement#FinancialGoals#SmartSpending#WealthBuilding

1 note

·

View note

Text

Financial Wellness Strategies for Achieving

Financial Wellness Strategies Introduction:

In this article, we explore different budgeting strategies that can improve financial wellness and promote healthier spending habits. Undoubtedly, financial planning and budget management are essential to achieving personal finance goals, ensuring long-term stability, and building wealth. Consequently, we will discuss various budgeting methods, and our subheadings will delve into practical insights, tips, while also addressing potential challenges along the way. Monetary Well-being Techniques Body:

Understanding Financial Needs and Priorities

- Firstly, assess your financial goals (short-term, medium-term, and long-term) - Moreover,Financial Wellness Strategies evaluate your current spending habits - Above all, prioritize your financial obligations, such as debts, bills, and savings

The 50/30/20 Budget Method Monetary Well-being Techniques

Zero-Based Budgeting

- To clarify, we'll present an explanation of the zero-based budgeting concept - This means allocating income to specific budget categories until all income is accounted for - We'll discuss the advantages and challenges of zero-based budgeting

The Envelope System Monetary Well-being Techniques

- Next, we introduce the envelope system and its history - This includes using physical or digital envelopes for different expense categories - We'll examine the pros and cons of the envelope budgeting system

Implementing a Digital Budgeting Tool

- Now, let's look at an overview of digital budgeting tools and apps - Consider various factors when choosing a digital budgeting tool - For instance, we'll present examples of popular budgeting apps and their features

Adapting to Changing Financial Situations

- Furthermore, learn how to adjust your budget during financial fluctuations - Recognize the importance of revisiting and revising your budget regularly - Develop strategies to adapt your budget during Monetary Well-being Techniques emergencies or unexpected events

Now, let's look at an overview of digital budgeting tools and apps. Consider various factors when choosing a digital budgeting tool. For instance, we'll present examples of popular budgeting apps and their features. `Learn more about different budgeting strategies from this in-depth guide`

Conclusion: Monetary Well-being Techniques In summary, the article explores various budgeting strategies that can significantly impact individuals' financial wellness and personal finance habits. By understanding one's financial needs, priorities, and adapting to ever-changing financial situations, lasting financial stability can be achieved. Therefore, we encourage readers to explore different budgeting methods and choose the one that best aligns with their financial goals and habits. "Find useful tips on managing your personal finances here." Read the full article

0 notes

Text

La Jolla, Championing the art of saving today for a future full of possibilities. Every penny saved paves the path for brighter tomorrows!

Google Gilbert Gomez Realtor

#worldsavingsday #securefuture #pennypincher #financialwellness #moneymatters #savinggoals

0 notes

Text

#tatoolovers#tatooart#tatooine#tatoo ideas#tatoolife#tatoonie#inked all over#inked thoughts#inkedboy#inkedlife#inkedmag#inkedart#savinggoals

9 notes

·

View notes

Photo

The Question Girl Week 4 - Are you good with money? If so how? If not, why?

I LOVED! this weeks live, I felt there was so much discussion in the comments about this subject and that is exactly how I want The Question Girl lives to go. This is a space for mostly my viewers to be able to express their opinion and what they think to potentially help others and I felt that’s exactly what we did.

1 HOUR!?!? Let’s not forget the fact that it went on for a whole hour, I felt every time I went to end the live from being to long another conversation sparked up. This weeks question was picked because I feel that money isn’t spoken about often in a confident way, especially if you’re not very good with money. Money can be the root of all problems, and it’s one of the top contributors to bad mental health.

It was very clear during the live that it took the direction of our childhood influences and how they were with their money. It really does just depend on who you are and what you’ve experienced as a child growing up. We had also covered the topics of when is it the best time to allow children to learn about money management etc which I thought was really interesting! I didn't expect so many conversations to have come from this question!

Overall I was super happy with this live, especially the question as well! I wanted the live to also be quite educational for others to be able to learn from as well, so had included some tips. If you missed this weeks live don’t forget to go and give it a watch!! You can find it on my IGTV’s on Instagram @Ruby_khristinaadams! Don’t forget to give me a follow!

#money#money management#money manifestation#money money money#lets talk money#money talk#extra money#make money online#bad with money#good with money#saving money#savings account#online savings#savinggoals#savings#quesions#the question girl#question#discussion#discuss#conversation#join the conversation#opinions#opinion#judgement free#safe space#sharing experiences#experience#instagram#instagramlive

3 notes

·

View notes

Photo

Are you familiar with all of the ways I help women get on financial track?! If you need assistance with your finances, don't hesitate to do something about it. The longer you prolong your growth, the longer you prolong your success. Schedule your free consultation with me (@rayareaves) now via link in bio! https://citygirlsavings.com/consultation/ #savemoney #grindtime #moneymoves #moneygoals #budgeting #financialfreedom #dreamlife #savinggoals https://www.instagram.com/p/BxiruTHnsEC/?igshid=frtt0vo8qa66

1 note

·

View note

Photo

Use Step-up SIP - a flexible way to save and invest for your goals, by gradually increasing your investment amount each year to match your rising income. Kindly contact us to know more #investing #SIP #savinggoals https://www.instagram.com/p/CrLUYzOSoJS/?igshid=NGJjMDIxMWI=

0 notes

Photo

To have a savings plan for the future so that you have a constant source of income after retirement. To ensure that you have extra income when your earnings are reduced due to serious illness or accident. To provide for other financial contingencies and life style requirements.

Call us today: +91 98112 24550 or

Visit: http://pticindia.com/

#ptic#pticindia#insurance#home insurance#term insurance#lifeinsurance#health insurance tips#financial security#financial planning#travel insurance#tax benefits#savinggoals#investment#investmentplan#futureplanning

0 notes

Photo

How to set yourself up for a financially strong future

0 notes