#second son Prince Saud

Text

youtube

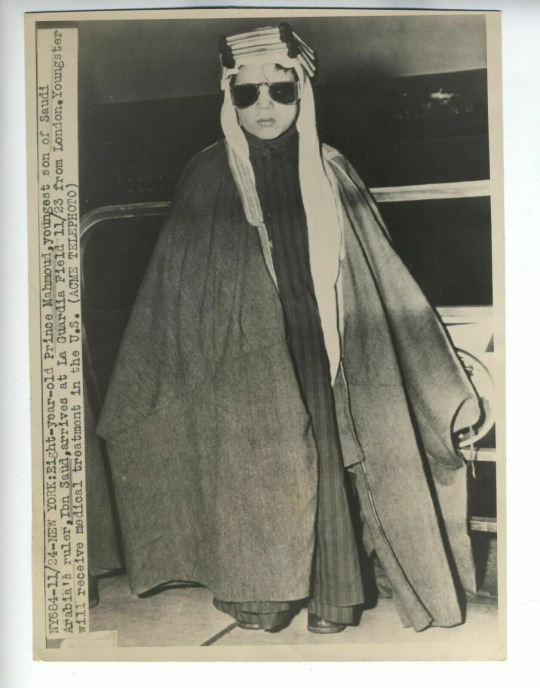

#second son Prince Saud#heir to the throne#saudi#throne#1933#prince mahmoud#eight years#in new york#many quarrels#with his elder brother#Muhammad bin Abdul Rahman#house saud#ruler#ibn saud#arrival#from london#to receive#medical treatment#good luck#Things fall into place#blancmange#living on the ceilimg#ceiling#up the tree#la guardia#Youtube

3 notes

·

View notes

Video

youtube

A Zionist delegation visits Saudi territory... after Bin Salman expelled them from the Paris conference and a Saudi-American deal against China

https://youtu.be/ETGs17K8nJo?si=7Ok7tjXiLdui6OFB

The latest news from Saudi Arabia today and the relationship between Saudi Arabia and the UAE after reports of disagreements between them and the reality of the start of Saudi-Israeli normalization

The latest news from Saudi Arabia and the Crown Prince of Saudi Arabia, Bin Salman, new Saudi affairs presented by this episode of Samri ChannelThis new episode of Samri Channel devotes its time to discussing developments in Saudi-Israeli normalization.

Starting with the report of the British newspaper the Financial Times, which confirmed the arrival of an Israeli delegation to Saudi territory to attend the UNESCO heritage conservation conference organized by the latter, two months after the report of the American website Axios, which confirmed Riyadh’s refusal to grant visas to the Israeli delegation. This Saudi statement comes approximately two days after the Kingdom of Saudi Arabia announced through Crown Prince Mohammed bin Salman Al Saud that his country had signed an agreement to establish an economic corridor linking India with Europe through a network linking ports and railway lines passing through the United Arab Emirates, Saudi Arabia, and then Israel, in A step that was considered the beginning of a certain upcoming Saudi-Israeli normalization between the Kingdom of Saudi Arabia and the Hebrew state.

On the other hand, well-known Republican Senator Lindsey Graham began a campaign within the corridors of his right-wing party to persuade the party's most powerful members, former President Donald Trump, to support Saudi-Israeli normalization, which is the same step that Trump's son-in-law, Jared Kushner, is currently taking.

The episode also refers to US-Saudi cooperation to counter expansion from China. After the economic corridor linking India and Europe as an alternative to the Chinese Belt and Road initiative, Washington intends to include Riyadh with it in the Libeto corridor project that links east and west southern regions of the African continent, and it will facilitate the transfer of precious metals, especially cobalt used in the manufacture of electric car batteries, to Europe, a step by which the United States will remove China from its monopoly over 90% of the cobalt trade in the world.

And we had already talked about the incident of Saudi Crown Prince Muhammad bin Salman expelling the Israeli delegation that traveled to Paris to support the Kingdom of Saudi Arabia's bid to organize Expo 2030 in the Saudi capital, Riyadh. A report broadcast by the Hebrew Walla Agency said that the Israeli delegation consisted of two members, one of whom was Haim Asraf, Ambassador of Tel Aviv to UNESCO, and the second, Eliezer Cohen, responsible for the Expo at the Israeli Ministry of Foreign Affairs.

#Saudi Arabia

#America

#Israel

0 notes

Note

I'm currently catching up on your fanfics (I really love your writing <3) and noticed that you tend to stay pretty in-universe so I wanted to ask about your general opinion on modern setting AU :) I like them because I can have all of the family related Russingon drama but with like less kinslaying/general death (I'm a little cry baby lmao). (also this is in no way a 'why aren't you writing this???' ask just wanted to talk about the topic)

first off, thank you!! I’m really glad you’re enjoying my writing and I hope it keeps staying fun!! I am so sorry because you’re about to get a whole wall of text.

second off, I have... complicated feelings on modern AUs, lol. though you’re not a crybaby! there’s nothing wrong with wanting Less Death. Eru knows our boys deserve it.

The problem that I run into consistently with a modern AU - as opposed to like, a postcanon modern setting like my fic set in Aspen Grove, where characters either come back East in the modern era or (in Maglor’s case) never left in the first place - is that I genuinely don’t know that any of the characters would be the same people in a modern AU. Their experiences would by definition be so different from what they went through in canon that I, personally, can’t find any basis for their characterization.

Like, Fëanáro won’t be the same kind of force of nature that he is in the book if he’s written as a corporate magnate or wealthy engineer of some kind, because a fundamental aspect of his character is his relationship to the crown and his desire for power and influence to secure his legacy. Maitimo can be a soldier and a POW and a survivor of grim conditions and torture, but he’s not going to have spent decades with a psychic sadistic demigod possessed of reality warping powers trying to break him down by pretending to be his family members or loved ones. Káno might be the best musician in the country but is that the same as an elvish bard? Does Tyelkormo still talk to animals? And these experiences - and the pressures of being nobility that operates under a very different idea of what that means than our postindustrial post-WWI society, and the fact that elvish psychology and linguistic development and approaches to the world are very different than human ones - are what shape the characters into the people we know and love from canon.

The biggest roadblock for me is that I get very stuck in the worldbuilding, in the details. I want to make every moment of one of my stories feel like it’s depicting a world that’s lived-in and full, and I want to make the characters make sense and tie their on-page actions into thought processes that make sense too, and that means I spend a shitton of time thinking about politics and elvish philosophy and sociological differences between the Quendi and the humans. It’s basically impossible for me to translate one to the other, lol. Even if I were to try and scale down to solely the Russingon drama of “you’re gay and marrying someone your father wouldn’t approve of” into a human modern AU (and I’m just gonna try and walk you through my process, how I’d approach this) -

okay, well, let’s assume Fëanáro is like eighteen years older than his younger siblings. Say Míriel and Finwë were fifteen and living in the US when they got pregnant and Míriel died in childbirth and Finwë had to single dad it for eighteen years, and his son’s now got a scholarship to MIT and he’s moving across the country for college, and Finwë is now thirty-three and dating again. He and Indis marry and have kids, except by the time Nolofinwë is old enough to marry and have children of his own, Fëanáro is well into his own career and independent from his father, because that’s how contemporary society works. he might have deep and lasting emotional issues, but he responds to them like a typical American man would rather than like he does in canon. Not to mention the ages - Maitimo would be closer in age to Nolofinwë than Findekáno, and there’s no guarantee they’d even meet except at the occasional awkward holiday dinner. Plus, even though marrying your first cousin is totally legal in many places in the US, it is still seen as sort of culturally weird and potentially worthy of a few mean-spirited jokes, so it probably wouldn’t happen at all. This plotline is nixed.

Try again - Fëanáro is an engineer serving as a senator, and Nolofinwë is a rival politician. They don’t get along, their families see one another relatively frequently, and then Findekáno and Maitimo meet and sparks fly. Except now a major part of the drama is gone - without Nolofinwë and Fëanáro’s intensely personal confrontations and especially without Nolofinwë’s biological relationship to Fëanáro, they’re just opponents in Congress, nothing more. And can we say that Fëanáro the polymath prodigy would want anything to do with politics if he’s not born into a royal family? Can we say that Nolofinwë would enter into public service and be successful when his platform is basically “I do what I must because the people demand it”?

Not to mention that a modern AU would have to deal with historical context that doesn’t exist in canon (if the Nolofinwëans are still black, for example, that carries with it a hell of a lot of history and culture and meaning that isn’t applicable at all to Beleriand, where they’re dark-skinned because elves are genetically diverse). And what about the people who work for them? We don’t view staff and hired help the way that canon elves would view their own staff and vassals. What about their social lives? Being extremely rich and powerful is different now than it was in the First Age, with different connotations and public perceptions. What about the fact that contemporary systems of government are vastly different than the quasi-early-medieval, feudalism-adjacent ones that the Noldor seem to have? What about homophobia? Russingon being gay isn’t really an on-page-confirmed issue in canon, so there’s no reason to assume elves have homophobia, but we humans certainly do. What about the history of LGBT+ rights, and the AIDS crisis, and the legalization of same-sex marriage? Does Ronald Reagan exist in this universe, and how did Finwë feel about him?

The only thing that I could really buy into is a contemporary secondary world fantasy with modern technology and amenities and culture but totally invented countries and systems of government. Make House Finwë something like the real-life House of Saud, where several royal princes all have blood ties to the throne and all are wealthy and politically influential but not everyone is actively vying for a place in the line of succession, and reintroduce the magic, and oh damn, I’m just back to canon again. Shit.

You see my problem. I’m standing at the bottom of a massive hole I dug myself, going “what now?” because I Overthink Everything.

#if it's an Absynthe original#I can promise you that I have thought Way Too Much#about Everything#whoops#tolkien#replies#anon replies#absynthe's fanfiction#all this being said though#I have a crackfic modern AU setting#for a hypothetical sitcom pitch#about Russingon#but it's not something I could ever write outside of a spec script

21 notes

·

View notes

Text

Nim and Ellena’s second child

It had been a few hours since the birth of their daughter, Nim was exhausted but oh so happy. They both sat in the bed while Nim fed there daughter from her breast, it had cause quite commotion when they came into the palace covered in hay and birthing fluids carrying their newborn.

The king cooed over the child from his sick bed, so happy to meet his first grandchild. He had worried he wouldn't live long enough to see her.

Ellena's older brother prince Ti was not as overjoyed that his return was overshadowed by an infant. He didn't belive that the ring had created this child, he believed Nim had been unfaithful.

For the next few days he would not be moved from his view, Nim and Ellena knew that it was time to return to the countryside. They agreed to one last dinner before heading out the next morning.

Conversation was flowing, many relatives had come to see the future king and the new princess. Nim and Ellena kept away from the future king, they didn't want to argue. But when they overherd Ti telling people that their daughter would not be welcome back to the palace, Ellena had herd enough.

"Dear brother she is my child, your niece. Please do not speak so ill of her. She was born as a product of true love, using this ring". Ellena gestured to the ring she had on a chain around her neck.

"Dear little sister how can you be so gullible, anyhow you say that if you wear the ring you become pregnant with child of your true love. Well you wear the ring round your neck, am I to believe you are currently in the early stages of pregnancy?" He said with a chuckle.

"Ellena isn't ready but once she us she just needs to put it on her finger. The ring harness true love, a powerful force. Myself being half witch I could slow the pregnancy, Ellena has practiced so we believe that she would be able to slow it but not to the length of an average pregnancy. Maybe over a few months" Nim explained.

"I call your bluff" said prince Ti, "put the ring on Ellena, and if you grow round with child I will offer you the crown".

"I don't desire it" said Ellena

"I then will offer it to your first born son"

"Offer it to our first born daughter" said Ellena

"Deal" said Ti

Nim held Ellena's hand "I believe in you, but remember the speed of the pregnancy is conected to your emotions and ours are certainly running high."

But Ellena took the ring off the chain, "I won't have rumors going around about our baby". With that she slide on the ring, at once her womb grew and bloomed with child. She was thankful this dress was without corset, but the dress strained and ripped at the seams. It stopped at around the 5 month mark, Ellena stepped forward. "Feel for yourself, it tis no trick" she said offering her freshly blossomed bump to her brother.

He shakily put his hands on his sisters abdomen, he could see it was real as the dress didn't hide much. There was the light flutterings of a child no mistake. "Remarkable" he said "I appolgise".

"I hope you will tell father yourself why his crown is going to his eldest grandchild" Ellena told her brother. But she knew now that they would no longer be having the quiet life in the countryside, they would have to stay to prepare there child too be queen. Chances are there eldest child would be queen in less then a few weeks with the kings ill health.

Ellena looked at Nim, she felt the child within her growing a few weeks with all the worry. But Nim gave her a forgiving look and she knew they would work it out, her heart soared with love for her amazing Nim.

The child within Ellena grew to it's 6th month at least, with that Nim took over the proceedings. "now if you excuse us we need to tend to our week old daughter upstairs".

As they entered there chamber both women felt themselves lactate at just the sight of their daughter. "She's due a feed may I?" asked Ellena her breasts feeling sore.

"We shall take turns" Nim agreed. While there child fed from Nim, Ellena found a dress more suitable for her condition. But after settling the baby, Ellena started to undress but Nim stopped her. "May I?" she asked and Ellena nodded.

Nim stroked Ellena's bump and started to enjoy her love's fertile form, shivers went down Nim's spine. "Would you like me to take care of those for you?" Nim whispered stroking Ellena's bosoms as Ellena stroked hers.

They drank from each other and the Nim explored Ellena's growing bump with her lips "careful, I can feel you growing slightly. You need too keep your emotions in check".

"I don't think I can, you know I've been growing all night. I am worried for the future, now that our daughter has the crown. Yet so so happy as I feel so full of life, do you think less of me?" Ellena asked.

Nim kissed her "not one bit, whst is done is done. We fell in love at this palace and we can still have a wonderful life her. As long as you don't mind our children have only a week between them in age" Nim said lovingly.

"I love you so much" Ellena said tears of joy in her eyes, and with that she felt her baby grow to term. She gasped at the speed of it all as she felt a small pop between her legs. Amniotic fluid trickled out of her and onto the sheets.

She held tight too the sheets as she felt the first contraction "uuuuuuuggggggg oh my goodness ooohh my goodness oooooohhhhhh" she moaned.

Nim jumped into action calling for the physician and calling for a maid to look after there first born.

“Uuuggghhhhh! The baby’s coming oooooohhhhh hhhuuunnngggghhhh” Ellena moaned spreading her legs as wide as she could on the bed. She thought her early labour wouldn't be so intense.

“You have to breath though it, take a deep breath" Nim instructed. "Remember what we did last week, come on lets breath together".

Nim went to the washing bowl and refreashed the sponge, she started dabbing Ellena's forehead.

Ellena was already sweating from the pain and strain she was under, she lay against the headboard as she breathed hard trying to get though the intense contractions. "Huff huff hufffffff huff huff huuuuuuuffff" she panted.

At the rate her contractions were hitting her, they both wondered if the child would shoot out and emerge under her dress at any moment. “Do you need to push?" Nim asked.

"I don't know" Ellena sobbed "should I try?"

But before Nim could answer the physician came bursting into the room, she was a short round women. She had overseen most the royal births the last 40 years. Not much phased her but she was surprised who was on the bed. It was not Nim who she had watched get heavier and heavier with child, but Nim's partner princess Ellena. She decided to not ask and focus on the birth, “how far apart are her contractions? How long has she been in labour?"

“They’re right on top of each other" said Nim

"Nooooooohhhhhh hufff huffff huuuuuffff" Ellena moaned and panted "I am having breaks of about miiiiiinate betweeeeen them".

“Has your water broke yet?” the physician asked coming closer.

"It broke a few minutes ago" answered Nim, and Ellena nodded keeping her breathing up.

“Let’s see how you are progressing” the physician said sliding up the skirt of Ellena's dress, so her orb like belly was on show. She ran her hands along the curve of Ellena's belly, she stopped at the bottom of her bump. "I can feel the head is down and ready to deliver. Let's see how much you have dilated next", she lowered Ellena's undergarments.

"Hhhhhhuuuuunnhhhhhh heeee heeee, hoooooooooooooo” Ellena breathed in pain, her body caught by another contraction. Nim held her hand while the physician continued to examine Ellena, they all hoped the baby was truely on it's way.

Ellena's hair was falling out of it's ushally neat bun to stick to her sweaty face. "The baby's head is a finger tip away and your fully dilated" the physician confirmed.

Ellena had both her hands on her massive belly clutching it, as if on cue she felt her contractions go up another level. “NNNNNUUGGGHHHHHH I FEEL PRESSURE, SOOOO MUCH PRESSURE UUUUUUGGGGGGHHHHHHH”

"I think it's time to push" suggested Nim squeezing her loves hand trying to comfort her.

Ellena nodded as the physician staying between her legs “give me a big push, that's it remember to breath.”

“NAAAAAAAHHHHHHHHH” she shouted as she continued too push.

“That’s great" Nim told her "our baby is almost here".

Ellena rested between contractions, she panted moaning slightly from the soreness her belly heaving. Nim kept using the sponge to cool Ellena's forehead, as they tried to pant though the pain together.

The physician told Nim "she needs to push harder, how many weeks is she?".

“We have no idea exactly, we used an enchanted ring. She was unable to slow the pregnancy like I was able to” Nim explained.

The physician didn't seem shaken as she put her hands on Ellena's belly feeling another contraction develop. “Ride this contraction and breath and push” she instructed.

"Huff huuufffff hhhmmmmffffff" groaned Ellena as she bore down again and again.

"I think you should change position, you're needing to push harder then you should. This baby isn't wanting to come out easily, let gravity help.”

They got Ellena up out the bed and helped her walk forward, Ellena started to moan clutching her low hanging belly. "Hooooo I can feel it moving down" she said between contractions.

"That's great" saud the physician "lets keep you like this for a bit longer".

Ellena kept pacing around the room stopping only to push, not once did Nim's hand leave her. The physician watched over Ellena as Nim helped her each time bear down, letting Ellena moan into her and squeeze her hands.

Though it was hard for Nim to watch as Ellena's body tensed with each passing contraction, but she knew the best she could do is be there. She knelt down and said soothing words to Ellena, each time dropped into a squat. "This feels right" said Ellena.

Nim moved behind Ellena sliding her arms around her, securing her while she sunk into a deeper squat. Ellena gave a long push while moaning "nnnnnggggghhhhhhhhh huuuuuffffff hhhhhuuuufffff hooooooo".

The physician got onto her hands and knees to look between Ellena's legs, “The baby’s head is crowning, a few more pushes like that and you'll be holding your baby in no time" encouraged the physician.

"Huff hufff I hope sooooo-naaaaahhhhh" moan Ellena as another contraction took over. Nim couldn't see the baby's head from where she was, but she kept up the encouragement. “You’re doing great, I'm so proud of you. Don't stop pushing.”

“Uuuuunnnggghhhhh” moaned Ellena as she pushed again. Her hands held her swollen belly, while Nim held her. The teardrop shape between her legs grew as the head emerged.

Again she gave a long push making the head drop lower. Though a series of breathing and bearing down she gave another huge push, and eventually the teardrop widened into a circle.

Ellena begged to lie back down, together the physician and Nim helped her. As soon as she was on the bed, she spread her legs trying to make room for the little one.

Ellena and Nim breathed though the contractions together, there was a lot if progress the head got half way out of Ellena. “I can see our youngest has lot of hair” Nim told Ellena.

Sweat made it's way down Ellena's face, as she strained to get the rest if the child out. Nim wipped away Ellena's sweat and held her hand, Nim told her "that's great, big hard pushes just like that, our baby's head is almost out".

“AAAAHHHHHGGGGAAAAA” Ellena moaned and screamed, it was too much she had been in pain for too long. She didn't know how most women could go for hours, she had hit her wall of pain.

“Come on Ellena" the physician said encouragingly "you didn’t grow a baby you couldn’t deliver”.

Ellena shook her head, she didn't grow her baby in a normal way.

“NNNNNAAAAGGGGGHHHH” Ellena moaned giving a huge push, but she felt her baby slip back in. It felt like her pushing was now becoming futile.

“It's okay, it happens all the time” the physician told Ellena. “Don't give up", but the physician could see it wasn't okay. The physician looked at both the ladies, she could see Ellena needed help. "We could try using forceps" she suggested.

“YES” Ellena shrieked "get it out of me, please I can't do this anymore”.

"This may hurt” the Physician said.

“I don’t care! Just get it out! GET IT OUT!”

Nim looked doubtful as the physician started to dig through her medical bag. But it wasn't her birthing the child this time, she knew the physician wouldn't hurt the baby. She also knew it was best to support Ellena as she was in agony.

The forceps looked a bit like a pair of tongs, Ellena suddenly went pale at the sight of the instrument. The physician carefully inserted the forceps on each side of the head that was wedged between Ellena’s legs. “If you push and I’ll pull, let's get this baby too it's mothers” said the physician.

Ellena leaned forward into a long hard push, “UUUUURRRRGGGHHHHHH” she moaned.

“Harder, come on Ellena don't stop” the physician said guiding the head as Ellena pushed. “Come on" she groaned as she pulled the head, sounding like she was in labour herself.

Nim looked between Ellena's legs, it was hard for her seeing the metallic instrument attached around her childs head. The baby was still deep in her partners vagina, she could see birthing fluid pooling on the bed beneath Ellena.

“AAAAAAAARRRRGGGGGGGGG” Ellena's scream filled the room, and the whole head fully emerging suddenly popping out of her body with another rush of fluid.

Nim let out a gasp “oh my Ellena the head is out” she said full of joy and wonder, "that’s it our baby is nearly here”. She was amazed at the sight of their child being born, she let a few tears of joy run down her face.

The physician cupped the head in her hands for a second before letting go. “That's right, you no longer need the forceps" said the physician encouraged her "it’s almost here, keep pushing”. Ellena grabbed the backs of her legs and pulled them towards her chest, then gave another push.

Her voice cracked with exhaustion as she begged “get this child out of me”.

“It’s coming, the baby's coming” she told her, and Ellena pushed her body shaking with effort.

She sucked in a deep breath "huff huuuuff huuuuuuuff" then leaned into a massive push with a deep moan "NNNNAAAGGGHHHH".

It seemed the intensity had gone up another level, Ellena was no longer shouting. She was exhausted but a new urge washed over her, she needed this baby out. "Uggghhh I need too push so bad, oh goodness I need too I need too" Ellena wimpered.

"Go ahead my darling, nothing is stopping you" Nim told her rubbing her back.

"The baby wants too come out" Ellena sobbed trying to push but no longer making progress.

"And they will" Nim told her "the head is already born, it's just the shoulders left".

“Uuuuugggghhhhh!” she moaned as the body stayed firmly where it was. After a few more tries the physician told her the baby needed help getting out, then asked Ellena to get on her hand and knees.

With help from Nim, Ellena got into position. She hoped that it wouldn't be the forceps again. The physician slipped her hand past the baby’s head, and then into the vagina.

Ellena squeezed Nims hand tight and groaned, every fiber in her wanted to get off the bed away from the physician. But she had to trust her, another contraction was unwelcome making her birth canal overcrowded with the royal doctors hand.

The physician unstuck the child so it was free to be born. Ellena felt the hand leave her and movement downwards from her child within her, and she knew whatever the physician had done worked. At first the shoulders fully showed themselfs, then an arm came flopping out.

“Our baby, one more push” Nim said.

“NNNNUUUUGGGHHHHH” her belly squeezed the second shoulder into the world, the arm and the rest of the body followed quickly. With a gush of fluid the child was born, Nim caught the baby smiling down at her little face. She let out a high pitched cry as Ellena slowly rolled onto her back.

Ellena looked down at her youngest child full of love, she knew that this wouldn't be the last child they had. But she looked up at Nim and knew she would be birthing any future ones.

42 notes

·

View notes

Video

أمير نجد الامام عبد الرحمن بن فيصل بن تركي آل سعود واخر حكام الدولة السعودية الثانية وولد الملك عبدالعزيز by Essam AL Jheme

Via Flickr:

The Prince of Najd, Imam Abdul Rahman bin Faisal bin Turki Al Saud, and the last ruler of the second Saudi state, and the son of King Abdulaziz ..................................................................... This image is in fact black and white and rare pictures Colors, it's clear in the image of my design

0 notes

Link

ABU DHABI: 15,SEPTEMBER,2019: Come Sept. 25, Hazza Al-Mansoori of the UAE will become the third Arab to travel into space.

On that day, at exactly 6.56pm, Al-Mansoori will blast off to the International Space Station (ISS) on board a Soyuz-MS 15 spacecraft.

With Al-Mansoori making the historic journey with two other astronauts, an American and a Russian, the hope is that he will be inaugurating a new era of Arab participation in space exploration.

The honor of being the first Arab in space goes to Saudi Arabia’s Prince Sultan bin Salman bin Abdul Aziz Al-Saud, who was one of the astronauts on board the space shuttle Discovery as part of a NASA mission 34 years ago.

Two years later, Muhammed Faris, a Syrian military aviator, became the second Arab to journey into space.

Al-Mansoori is currently in quarantine alongside the other two crew members — Russian commander Oleg Skripochka and Nasa astronaut Jessica Meir — at the Baikonur Cosmodrome in Kazakhstan.

In a statement, Yousuf Hamad Al-Shaibani, director general of the UAE’s Mohammad Bin Rashid Space Center (MBRSC), acknowledged the support of NASA, the European Space Agency and Roscosmos.

“The UAE’s first mission to the ISS is the result of extensive efforts by dedicated individuals and organizations in the UAE,” he said, “and also the result of important strategic partnerships with major global space agencies … who spared no effort in preparing our astronauts and providing them with all the support and training they need.”

On being handpicked, Al-Mansoori said “When I was told I was selected for the program, it was difficult to express how proud and honored I felt. I was euphoric.”

Before applying for the program, Al-Mansoori — who has amassed more than 14 years of experience in military aviation — was a pilot and flew the UAE air force’s F-16 Block 60, one of the world’s most advanced jet fighters.

He was also one of the first Arab and Emirati pilots to take part in the Dubai Air Show’s celebrations of the 50th anniversary of the UAE armed forces.

“A lot of things are happening in my mind from now till the launch,” Al-Mansoori was recently quoted as saying. “I’ve prepared for this mission but not only from here,” he said.

“It started from my childhood, from how my parents raised me, the confidence I gained from my life; thanks to our leadership for giving me this opportunity today to represent my country."

“I will try to remember each second of the launch because it will be really important for me to share with my country, with the world and the Arab region that experience.”

A similar sense of wonder and excitement gripped the Middle East when Prince Sultan became, at the age of 28, the first Arab astronaut.

Currently the chairman of the Saudi Space Agency, Prince Sultan, son of Saudi Arabia’s King Salman, was the first Arab, Muslim and royal to travel into space on June 17, 1985.

Discovery lifted off from the Kennedy Space Center in Florida for a seven-day mission during which Prince Sultan helped to deploy a satellite for the Arab Satellite Communications Organization (Arabsat).

During a special one-on-one interview with Arab News in the lead-up to the 50th anniversary of the moon landing, Prince Sultan, recalling his remarkable journey, said: “Brave people are people who feel fear but still go forward.”

American astronaut Neil Armstrong became the first person to walk on the Moon on July 20, 1969.

While Al-Mansoori will be the first Emirati to travel to space, he will not be the last.

Backup astronaut Al-Neyadi has been promised the next spot on a UAE mission to space.

The UAE also has plans to launch an exploration probe to Mars to mark the 50th anniversary of the country’s foundation in 2020.

The Emirates Mars Mission will launch its Al-Amal, or Hope, spacecraft from the Tanegashima Space Center in Japan.

Al-Amal is designed to orbit Mars, which has an area of contrasting brightness and darkness that was named Arabia Terra in 1979 for its resemblance to the Arabian Peninsula.

In Saudi Arabia, institutions such as the King Abdullah University of Science and Technology (KAUST) are playing their part in educating Arab space scientists of the future.

The Saudi Space Agency was set up by royal decree on Dec. 27, 2018.

In comments to Arab News in July, Salem Humaid Al-Marri, the MBRSC assistant director general for science and technology, said: “The UAE is working with the Saudi space program, as well as with others such as Algeria, Egypt, Kuwait and Bahrain, to boost Arab presence in the space industry. Space is bringing Arab nations together.”

For now, final preparations are underway for the UAE’s Sept. 25 voyage, after the Gagarin Cosmonaut Training Center (GCTC) in Star City, Russia officially gave the green light for the mission on Sept. 5.

Once Al-Mansoori reaches the ISS, he will present a tour of the station in Arabic and will conduct Earth observation and imaging experiences, interact with ground stations, share information, as well as documenting the daily lives of astronauts at the station.

Al-Mansoori will study the effect of microgravity compared with gravity on Earth.

It is the first time such research will be carried out on an astronaut from the Arab region.

He will not be missing traditional Emirati food as three dishes have been prepared for his journey — the madrooba, a salt-cured fish seasoned with spices; saloona, a traditional Emirati stew; and balaleet, a sweet Emirati breakfast dish of egg and vermicelli.

After completing his role as a second flight engineer, Al-Mansoori will return to Earth aboard a Soyuz-MS 12 spacecraft.

With just days remaining before he makes history, Al-Mansoori is taking the words of Sheikh Hamdan bin Mohammed Al-Maktoum, the crown prince of Dubai, with him: “A historic space flight, the ambition of the UAE and a new challenge. Keep your morale high and embrace the challenge. May Allah bless this landmark mission." (04)

0 notes

Text

Former Saudi King Established a School for Royals, Overlooking the Financial Conditions of Poor Citizens

Saudi Arabia inhabits around 33 million people, out of which maximum employed people work in oil and gas sector, leaving just 18 percent of the employed population working in labour force. As of last year, Saudi Arabia’s unemployment rate was 12.3 percent.

However, this year, the world’s largest oil exporter has been facing a dual crisis because of the pandemic, energy output cuts and lower crude prices, which have together derailed a fragile economic recovery from the last oil-price rout. This financial jerk sparked the unemployment rate to 15.4 percent in April to June.

Saudi Arabia has one of the largest GDPs among the GCC countries. Yet, the Gulf giant’s economy contracted by seven percent in the second quarter of 2020. Can it be blamed on the education inequality lurking around the region? A country’s economy, employment rate and education rate go hand in hand. All three factors are co-related to each other.

While educational attainment is expanding in Saudi, only 31 percent of 25-34 year-olds had attained less than upper secondary education in Saudi Arabia as per a 2017 data. 46 percent of 25-64 year-olds had below upper secondary education. Saudi Arabia reports the lowest rates of female participation in tertiary education alongside India, Mexico, Switzerland and Turkey.

Saudi Arabia is the land of the riches, where the Royals have all the power. The kingdom’s former King Ibn Saud founded the Princes’ School in 1937 for the members of House of Saud and other important Saudis. The goal was to make it easier for the sons of the Royal family and other foremost Saudis achieve quality higher education.

The school was only conducted in the Royal Court, thus, allowing only the members of the monarch to participate in the school activities. Saudi King Salman and his predecessor King Fahd bin Abdulaziz Al Saud have both been the prodigies of the royal school among other princes.

A school just for the royals and other prominent Saudis deeply reflects the power of money invested in the hands of the aristocrats. While the royals have always been on the receiving end of quality education, what about the common people? What is the Saudi government doing for the betterment of the poor people who cannot bear high costs of education?

1 note

·

View note

Text

2020 Prix Du Jockey Club Preview

Change.

It comes with many guises. Good, bad, forced and sometimes in coin form too. We can all recount a story for each with the ease of listing your families names or horses that have carried that coin form to victory.

With any positive change we must regretfully suffer the other pole of the spectrum; bad or forced. The latter is where we have stood for over 100 days now and the grand fête of Prix De Diane & Jockey Club day in a sun-kissed Chantilly will lack its colour, its glamour, its congregation but perhaps the most important. Its joie de vivre.

Fear not, as we endure this seemingly never ending campaign of terror upon the world, a change for good will come again. We will trade the facemasks for smiles, the waves replaced by hugs and the empty stands for the grand fêtes that have been confiscated. For now.

One thing that will forcibly change is the Prix Du Jockey Club winner. Sottsass bore the crown for a year and a new King must be crowned on Sunday. Let’s change the mood and get stuck into the runners eh.

VICTOR LUDORUM

As children we are told of fairytales. Dopey we may be at that young age we delighted in hearing of the stories in which you can swap a cow for magic beans or change your life for the better and be given a golden goose. Fairytales were then cast onto the big screen by Walt Disney. Crowds would flock to see them and leave not Grumpy or Bashful but Happy. The great animator himself would struggle to believe the fairytale that lies ahead of Victor Ludorum.

The royal blue of Godolphin has been carried only once to victory in this most historic of races. Frankie Dettori and Shamardal formed a fierce alliance in 2005, winning 6 of their 7 races together including 4 at the grandest of tables; Group 1s. A partnership as strong as that of the Brothers Grimm one may say. Twleve years later in 2017 the late champion sired Victor Ludorum.

Following in his fathers footsteps, Victor has lost just one of his 5 career races to date and formed a fierce alliance with Mickael Barzalona. The myth of him not training on and floundering at 3 as his siblings have done was firmly Snow White’d in the Poulains. Cruising past the 1000, 1100, 1200, 1300 and finally the 1400m pole he revved up and bound clear in the final 100m. Eight up for his princely trainer and the premier victory for his ally Mickael. Yet to race over 1600m+ we venture into the dark forest with the Jockey Club throne as our guiding light but what a story it would make.

If dreams do come true and fairytales become reality, the Brothers could not invent one any better than this. We will never know if Sheikh Mohammed himself is a fairytale follower but should his homebred heir return the riches of Chantilly to the Dubai ruler 15 years on from his maiden, well it would just be happily ever after.

OCEAN ATLANTIQUE

The dynasty of Coolmore has no equal. Their ability to breed talent, spot talent, cultivate talent and most importantly showcase talent is unrivalled. Their changes for good in the Racing world are based exactly where they should be, on four legs on the biggest and most grand pistes in the world.

They’ve had them all from homebred staying superpower Yeats to champion of champions Galileo, wondermares such as Found and the eagle eager eye of MV Magnier and his family have spotted talent from speedball Choisir to the history making American Pharoah.

It is the latter we look to with Ocean Atlantique, now even Coolmore will admit they didnt get much coin form change out of their €1,100,000 purchase but he could change their future immeasureably. Iron runs through the veins of the 3yo thanks to his dam’s sire Giant’s Causeway. A big strapping sort himself he has a way to go to emulate the palmares of his grandfather but he is sailing the right seas.

A record the “lads” will be happy to change for the better is of theirs in the French Derby. The famous tangerine Tabor silks have once been victorious with Montjeu but those of the Magnier family are yet to taste the celebratory Chantilly cuvee.

It took until a summery Saint Cloud september afternoon for Andre Fabre to unleash Ocean Atlantique and a second on debut is hardly to be scoffed at. Wrongs were changed to rights in an 8L demolition next time up and the maiden tag shed. The winter came and went as did the early spring. The gates of ParisLongchamp flung open on May 11th (for horses anyway..) and three days later Ocean Atlantique was back in business in the G3 La Force. Caught on the rail and in the pathway of a reversing Another Sky, second would have to do again behind Pao Alto. Wrongs righted once again on his next run in the Listed de Suresnes this time by a mere 5L demolition.

At home over 10f as was his father and grandfather, can Ocean Atlantique navigate his way to the Winners Enclosure at Chantilly and change his and Coolmore’s history for the better?

PAO ALTO

Change is frequent in Palo Alto. The place, not the horse whose name shares such resemblence. It is a true centre of excellence. Without this small corner of San Francisco we would not have life-changing spies companies such as (breathe): Google, Facebook, Apple, Paypal, HP, Dell, Xerox, Skype and Tesla. The final enterprise on that list is perhaps the most exciting, most forward thinking and most ludicrous. One fact remains however, horsepower is the name of the game for Tesla, the brainchild of lunatic maverick Elon Musk. Their desire to prove they are the best whilst maintaing all the style, glamour and substance is endering and these qualities are retained in the Christophe Ferland trained Pao Alto.

Pao Alto is visually one of the most beautiful chestnut colts you could possibly see with a flash of milky white on his left fore and an emblem-esque diamond between his eyes. Style. Owned by the uber elegant Wertheimer et frere he carries the famous sky blue and white silks that have bibles of Group wins to their name. Glamour. Beaten only once on his debut he has conquered a mile and graduated to ten furlongs too picking up the Group 3 La Force on the way. Substance.

He like the two before has champion blood racing through his veins. The son of 2013 winner Intello, he would take Gerard et Alain to two wins in the Jockey Club putting them ahead of their illustrious father Jacques and the patriarch of it all (their grandfather) Pierre. Pao is not a homebred as many of the brorthers horses are but heck, they cannot get much closer than having a son of their first Derby winner.

The La Force was a real triumph. The metal broke from the latch and he was out and away, relaxed for the first 400. Showing fine balance on the long downhill sweeping of ParisLongchamp he turned into the false straight tracking the rear end of Ocean Atlantique. A jolt of this head to the left told Guyon which way he wanted to go and when the air cleared he took off. One swipe of the foam was enough and a few bumps from Max saw him home comfortably ahead.

He will get to see, like Tesla, if he can be the best this Sunday where it matters most. On the turf at Chantilly.

MISHRIFF

What were we saying before about fairytales?

Believe in something and you can achieve it. Make Believe in something and anything is possible! A fourth entrant into the race with champion blood in his veins, Mishriff is the son of the 2015 Poulains winner and the pride and joy of Prince Faisal Al Saud. It would also provide a fairytale culmination for his trainer John Gosden. The master of Clarehaven has triumphed in almost all the Classics you could name. The (Epsom) Derby? Got two. The (Epsom) Oaks? Three of those. Irish Derby? Yep, tick. Irish Oaks? Of course, next. Hollywood Derby? Hell yes. Prix De Diane? Oui. Prix Du Jockey Club? Ah, erm...

The elsuive Prix Du Jockey Club remains the outstanding empty square in his sticker book of Classics. It has been lean pickings for the master trainer since 2000 with 4th being his highest placed finisher too.

In the five races in Mishriff’s career he has filled all the places, 4th on debut before 3rd next time up. Skipping a place to win by as far as he wanted at Nottingham to end his season he returned with a 2nd in the Saudi Derby.

His UK reappearance was a romp on the Rowley Mile. Posted on the flank by David Egan he had tremendous balance in the dip and despite having the whole of Newmarket to his right he kept his head down and his line almost straight to win by 4L. The form of his Newmarket Stakes win has twice been franked by Volkan Star and Al Aasy so tick that box as well.

What were we saying before about change?

It would be for the ultimate good should John Harry Martin Gosden complete his sticker book of Classics.

THE OTHERS

Port Guillaume - Jean Claude Rouget has been the man for the big occasion in this race winning three of the last five. His 2020 entrant whilst having a record of straight 1′s has to make the almighty leap from Class 1 to Group 1. A prominent front runner he will be the horse to watch and the gauge by which we measure the ferocity of the race. Not ruled out but it is a thankless task making the running in a race like this and questions remain over his quality at the level.

Ecrivain - The final orders bell is ringing in the Ecrivain Arms. A real talking horse coming into the season he finished 2nd in the Fontainebleau ahead of Victor Ludorum but was firmly put to the back of the class in the Poulains. Excuses have been graciously allowed given the virus rampaging around the Laffon Parias yard at the time but now its time to put up or shut up. Unfortunately the latter seems the more likely option.

Hurricane Dream - Those fairytales get everywhere! Jumps trainer Mickael Mescam would send shockwaves around the world should his colt be victorious. Team Valor were quick to swoop in after his win in the provinces and their judgement was justified as he swept aside a talented field over course and distance last time. Another making the leap from Class 1 to Group 1 he may have the class to challenge for places in this race and more should a few underperform.

The Summit - A real surprise package at 3 he has outperformed expectations time after time after time. His win in the Fontainebleau upcycled to 2nd in the Poulains and with a new set of emperors silks this could be his swansong in France. Alex Pantall has worked wonders with him and with Peslier in the plate anything is possible.

San Fabrizio - If you watch his last race you’ll be bamboozled as to the run he gets. Or well doesn’t get! PCB appeared to have boatfuls left in his hands but with nowhere to go he simply had to ride out at no more than a trot. He was behind Pao Alto on debut but that was a long time ago now. Soumi rides so he gets a boost but coming off the pace at Chantilly in the Jockey Club and having to be 4 or 5 wide? Tough ask.

VERDICT

First of all, expect a messy race. This event is rarely without a gripe from at least one participant and with only a thin strip of perfect ground at Chantilly everyone wants a piece that they cannot have. Second of all, stay away from the rail unless you are clear in front. It cannot be emphasised enough how important it is to treat that rail like an enemy if you are trying to come off the pace.

Victor Ludorum was mine and many many others guy for the Poulains and he will retain that with those many many others but not me. His win at Deauville was sensational but there was mitigating factors that day. His proximity to the rail from the start and the open runway he had to stroll down thanks to Alson being the main two. Fabre cannot hide his affection for this horse but is he better over the mile? We’ll see. Stall #1 isnt exactly super for him being a hold up horse, he could get a whack early on as they break and that may trap him in the group as they fall towards the rail. Pao Alto was superb when winning the La Force under Guyon. The doubt creeps into the mind about the state of the Fabre string during the opening period however. Did he catch his opponents on an off day? Maybe. Did he capitalise? Certainly. He appears to have the substance for the trip but will he be able to keep up now the pack have caught up too? Maybe not. He has not raced since that day and that too could be a concern. Stall #9 for him and that is about where you’d want to be.

OCEAN ATLANTIQUE will have the perfect man on board for this race. PCB is imperious around the undulations of Chantilly. He will devour the distance and he is more than quick enough to win despite posting a slow time LTO but he did win by 5L. The tactics employed in the Suresnes could work wonders given his pace and his jockeys ability to dictate a race but he is likely to have company upfront with Port Guillaume and The Summit in there too. The undoubted ability at staying the trip is hugely beneficial to him and will count hugely later on as they climb up the straight but it must be said that the red diamond on PC’s helmet could work as a real target. He was given a raw deal in stall #14 but the long run to the bend at Chantilly will give PC time to look at the pack and pick his best hand to play on a versatile horse. It would be a story told for years if Hurricane Dream could win for Mescam & Team Valor and he has a chance to finish in the top 4 without doubt. Eyquem has been given the steering wheel and stall #11 is prime real estate also.

In my opinion, the seas of change will blow the way of Ocean Atlantique and Coolmore team itheir first Prix Du Jockey Club in the colours of the Boss.

0 notes

Photo

Dears,This women name is Princes Basmah Bint Saud. For years,she was a rare princess from Saudi Arabia who spoke here mind to the world,criticizing the Kingdoms treatment of women,calling its religious teachings "extremely dangerous" and voicing support for a constitutional monarchy. And she got away with it _until she disappears in march 2019.This week,the princess ,Basmah bint Said,a doughter of Saudi Arabia's second king,confirmed what had been suspected . A statement on here Twitter feed said that she was being held in a prison in kingdom without charge, and that she was in urgent need of medical care."I was abducted without explanation together with one of my doughters and thrown into prison"she wrote .she begged Saudi Arabia's king and crown prince " to release me as I have done no wrong" By Friday that plea had been delated. The reason for here arrest was not clear,but it appeared to fit a patten of Saudi Arabia's government punishing prominent citizens who had publicity deviated from the governments line.Her detention was one of two new cases of Saudi royals locked up during the raise of the kingdom's De facto ruler,Crown prince Mohammed bin SALMAN.But the detentions of less prominent fingers like Basmah baffied some Saudi experts. Officers at the Saudi embassy in Washington declined to comment.And two associates of Basmah said she was being held with here daughter in A1 Ha it prison,a well_known lock up for criminal and militants near the capital,Riyadh,a move that appeared to have no president, said all_Rasheed ,the Saudi scholar.( Thanks for the report). De request &warning to Saudi kingdom and Criminal or human life killer Crown Prince SALMAN to today.Inncents women's joint criminal activities making ones are not men.this ones is "Basterd name call to world ,means ten father son. So Criminal Mohammed bin SALMAN life death penalty time is over,American begged Trump support is SALMAN life care,Inncents journalist Jamal Khasshogi life kill one,yeame peopls life harrash one,Inncents thousand of humans life murder...continued... (at ���ुंबई Mumbai) https://www.instagram.com/p/B_NdVtRl2HL/?igshid=d239l4kydb4i

0 notes

Text

The world’s most profitable company is about to go public

President and CEO of Saudi Aramco Amin Nasser (left) and Aramco’s chair Yasir al-Rumayyan attend a press conference in the eastern Saudi Arabian region of Dhahran on November 3, 2019. | AFP via Getty Images

The oil company that made Saudi Arabia rich is going public. Some say the timing couldn’t be worse.

Pop quiz: What’s the most profitable company in the world? Apple? Google?

Nope. Those two don’t even come close. The answer is Saudi Arabia’s state oil company, Aramco. In 2018, Saudi Aramco made $111 billion dollars in profit. The second-most profitable company, Apple, made $60 billion that year.

On November 3, Aramco officially announced its plan to go public for the first time in the company’s 86-year history. And on November 17, the oil giant announced the company could be valued at $1.7 trillion. Energy historian Ellen R. Wald joined Today, Explained to explain why Aramco’s initial public offering (IPO) is such a big deal.

As the most profitable company in the entire world, she says, the company’s IPO is going to set major records. And since it’s the largest oil company in the world, it’s likely that a lot of everyday things we use — from plastic to the energy fueling our cars — touches this company.

“In the United States,” Wald says as an example, “Aramco owns the largest refinery in the entire country. And it also owns Shell Gasoline Stations in the southeastern United States. So many Americans may be buying oil — or gasoline — that is made by Aramco, and they don’t even know it.”

But some say the timing for the Aramco IPO couldn’t be worse. One reason for that: Some people think that the world has or will soon reach peak oil demand. Another, Wald explains, is the “PR nightmare” that Saudi Arabia created with the killing of Saudi dissident journalist Jamal Khashoggi:

[The killing of Jamal Khashoggi] definitely soured investors and financiers on Saudi Arabia in general. The idea is that the money from this share sale would go to support the Saudi Arabian monarchy that has done and continues to do many horrible things, both in terms of human rights. ... And so there are a lot of people out there who look at that and say, “No, I’m not touching this because I don’t want to help these people.”

To understand the significance of Aramco’s upcoming IPO, you have to know the company’s history. If you want to learn all about it, here’s a lightly edited transcript of Wald’s conversation with Today, Explained host Sean Rameswaram.

Subscribe to Today, Explained wherever you get your podcasts, including: Apple Podcasts, Google Podcasts, Spotify, Stitcher, and ART19.

Sean Rameswaram

What exactly is it that takes Saudi Aramco from an extremely profitable oil company to the most profitable company in the world?

Ellen Ward

The really key year here is 1972. The United States could no longer pump more oil to meet rising demand. So instead of being able to accommodate America’s vast thirst for oil at the time, they had to import oil from elsewhere. And one of the big sources of that was Saudi Arabia. And Saudi Arabia was pumping and pumping more to meet that demand. All of those gas-guzzling cars, they were meeting that demand.

And the Saudis took note of this. The oil minister at the time, his name was Zaki Yamani, he and other oil-producing countries in the Middle East were already united in the cartel organization we know today as OPEC [the Organization of the Petroleum Exporting Countries].

And they got together and they said, essentially, “We know you’re in a difficult position, and we want to raise the price of oil because the price of oil is just too low.” And they negotiated with the representatives of big oil companies, including the American ones, and they could not reach an agreement. And they said, “You know what? We can’t reach an agreement. [So] we’re going to unilaterally raise the price of oil.”

They do this in conjunction with the Arab-Israeli War of 1973, along with an oil embargo. And the effect was very immediate. The price of oil skyrocketed, and in fact caused a recession in the United States.

But what it also did was help oil companies make a lot more money from this, including Aramco and including the Saudis. And what did the Saudis do with all this cash? Well, they put it into their own palaces and into their own country. But they also used it to buy the company from the Americans. And then in 1988, the Saudis eventually renamed it Saudi Aramco.

Sean Rameswaram

How has [the company] changed from what it was in the 1970s to now?

Ellen Ward

In the 1970s, Aramco was basically an oil-pumping machine. They pumped oil out of the ground, and most of that was sold as crude oil to the four American companies that owned it. Now, it’s much more like an international oil company like BP or Exxon or Royal Dutch Shell or Total in that they pump oil, they have crude oil assets, but they also have a range of what we call “downstream assets,” which are refineries, petrochemical companies. And they have these in Saudi Arabia, but also all over the world.

Sean Rameswaram

What’s the relationship between this company and the Saudi Arabian monarchy right now?

Ellen Ward

It’s much more difficult now than it was. Their first Saudi CEO at the time, a man named Ali al-Naimi, he negotiated with the king to keep Aramco separate from the Saudi government. Yes, they have a board of directors that is appointed by the government that kind of approves their plans. But, essentially, they get to decide how much money they want to spend on capital expenditures, what kind of projects they want to do, and what their strategy is. And that’s unique amongst national oil companies.

So Aramco is not quite a national oil company, but it’s not a private oil company either. It’s somewhere in between, and it has a high degree of independence. That is changing, though. And we’ve seen that change come about since the ascension of King Salman [bin Abdulaziz Al Saud] to the throne and also of his son, the young Crown Prince Mohammed bin Salman, and they are taking a much more active role in the larger strategy of the company.

They’re not trying to run it day to day, but they are saying things like, “We want you to buy this petrochemical company” or “we want to go public and this is how it’s going to be.” And that’s been a very different thing for Aramco to have to deal with after so much independence. And it has created some tension.

Sean Rameswaram

It sounds like you’re saying it’s hard to separate the Saudi monarchy from Aramco.

Ellen Ward

It’s hard to separate them from Aramco in terms of the big decisions. Aramco isn’t nearly as intertwined with the government as any other national oil company. But this is the real issue with this IPO. Normally when a company does an IPO, the money is going to go to the company to expand, to do new things, but that’s not the case here.

The monarchy wants to monetize Aramco shares and to take that money that they make from the share sale and put it into things that are not involving the company. So they want to put it into their sovereign wealth fund, which is designed to make investments both in companies in Saudi Arabia to help promote economic development and diversification, but also companies all over the world international companies. And use it to make investments in tech companies and in all sorts of crazy firms that they’ve been investing in, like Magic Leap virtual reality or a tech company or Uber or Tesla.

Sean Rameswaram

This is supposed to be one of the wealthiest countries in the world, right? How do they need the cash for some “sovereign wealth fund” that will finance startups?

Ellen Ward

Saudi Arabia has essentially a one-trick economy, which is selling oil. And they’ve done pretty well with that. But that doesn’t always go very well for the general economy at large, doesn’t necessarily employ everyone. It doesn’t foster small-business development. It doesn’t foster a vibrant economy.

What if oil prices tank and stay low for a long time? What if the oil runs out? At some point, the oil will run out. So the Saudi government has put together this plan that’s designed to diversify the economy so that they’re no longer wholly dependent on a single commodity.

Sean Rameswaram

Do we have any idea how this IPO will go in December?

Ellen Ward

One of the interesting things is that this company makes $111 billion dollars in profit. That’s what it made in profit in 2018. Apple I think is the next-most profitable company, [and] only made $60 billion in 2018.

And people are not going to just toss that aside, especially in a market today when so many of the IPOs that come up are companies that don’t even make a profit and have never made a profit and may never make a profit. So when an IPO comes along for a company that is immensely profitable, it’s very hard to turn away.

If the IPO doesn’t go very well — and there’s a distinct chance that it might not go very well — it could affect other oil companies’ earnings. Although I would say that if it doesn’t go well, that’s reflective more of the Saudi government than it is of Aramco itself.

If the IPO doesn’t go very well and politically the Saudi monarchy looks bad, that could be very far-ranging, particularly for the United States, which maintains strong diplomatic ties to Saudi Arabia. So it’s something that people definitely need to be on the lookout for; this could in some ways potentially fundamentally alter the balance of power in the Middle East.

from Vox - All https://ift.tt/341Wo6E

0 notes

Text

The world’s most profitable company is about to go public

President and CEO of Saudi Aramco Amin Nasser (left) and Aramco’s chair Yasir al-Rumayyan attend a press conference in the eastern Saudi Arabian region of Dhahran on November 3, 2019. | AFP via Getty Images

The oil company that made Saudi Arabia rich is going public. Some say the timing couldn’t be worse.

Pop quiz: What’s the most profitable company in the world? Apple? Google?

Nope. Those two don’t even come close. The answer is Saudi Arabia’s state oil company, Aramco. In 2018, Saudi Aramco made $111 billion dollars in profit. The second-most profitable company, Apple, made $60 billion that year.

On November 3, Aramco officially announced its plan to go public for the first time in the company’s 86-year history. And on November 17, the oil giant announced the company could be valued at $1.7 trillion. Energy historian Ellen R. Wald joined Today, Explained to explain why Aramco’s initial public offering (IPO) is such a big deal.

As the most profitable company in the entire world, she says, the company’s IPO is going to set major records. And since it’s the largest oil company in the world, it’s likely that a lot of everyday things we use — from plastic to the energy fueling our cars — touches this company.

“In the United States,” Wald says as an example, “Aramco owns the largest refinery in the entire country. And it also owns Shell Gasoline Stations in the southeastern United States. So many Americans may be buying oil — or gasoline — that is made by Aramco, and they don’t even know it.”

But some say the timing for the Aramco IPO couldn’t be worse. One reason for that: Some people think that the world has or will soon reach peak oil demand. Another, Wald explains, is the “PR nightmare” that Saudi Arabia created with the killing of Saudi dissident journalist Jamal Khashoggi:

[The killing of Jamal Khashoggi] definitely soured investors and financiers on Saudi Arabia in general. The idea is that the money from this share sale would go to support the Saudi Arabian monarchy that has done and continues to do many horrible things, both in terms of human rights. ... And so there are a lot of people out there who look at that and say, “No, I’m not touching this because I don’t want to help these people.”

To understand the significance of Aramco’s upcoming IPO, you have to know the company’s history. If you want to learn all about it, here’s a lightly edited transcript of Wald’s conversation with Today, Explained host Sean Rameswaram.

Subscribe to Today, Explained wherever you get your podcasts, including: Apple Podcasts, Google Podcasts, Spotify, Stitcher, and ART19.

Sean Rameswaram

What exactly is it that takes Saudi Aramco from an extremely profitable oil company to the most profitable company in the world?

Ellen Ward

The really key year here is 1972. The United States could no longer pump more oil to meet rising demand. So instead of being able to accommodate America’s vast thirst for oil at the time, they had to import oil from elsewhere. And one of the big sources of that was Saudi Arabia. And Saudi Arabia was pumping and pumping more to meet that demand. All of those gas-guzzling cars, they were meeting that demand.

And the Saudis took note of this. The oil minister at the time, his name was Zaki Yamani, he and other oil-producing countries in the Middle East were already united in the cartel organization we know today as OPEC [the Organization of the Petroleum Exporting Countries].

And they got together and they said, essentially, “We know you’re in a difficult position, and we want to raise the price of oil because the price of oil is just too low.” And they negotiated with the representatives of big oil companies, including the American ones, and they could not reach an agreement. And they said, “You know what? We can’t reach an agreement. [So] we’re going to unilaterally raise the price of oil.”

They do this in conjunction with the Arab-Israeli War of 1973, along with an oil embargo. And the effect was very immediate. The price of oil skyrocketed, and in fact caused a recession in the United States.

But what it also did was help oil companies make a lot more money from this, including Aramco and including the Saudis. And what did the Saudis do with all this cash? Well, they put it into their own palaces and into their own country. But they also used it to buy the company from the Americans. And then in 1988, the Saudis eventually renamed it Saudi Aramco.

Sean Rameswaram

How has [the company] changed from what it was in the 1970s to now?

Ellen Ward

In the 1970s, Aramco was basically an oil-pumping machine. They pumped oil out of the ground, and most of that was sold as crude oil to the four American companies that owned it. Now, it’s much more like an international oil company like BP or Exxon or Royal Dutch Shell or Total in that they pump oil, they have crude oil assets, but they also have a range of what we call “downstream assets,” which are refineries, petrochemical companies. And they have these in Saudi Arabia, but also all over the world.

Sean Rameswaram

What’s the relationship between this company and the Saudi Arabian monarchy right now?

Ellen Ward

It’s much more difficult now than it was. Their first Saudi CEO at the time, a man named Ali al-Naimi, he negotiated with the king to keep Aramco separate from the Saudi government. Yes, they have a board of directors that is appointed by the government that kind of approves their plans. But, essentially, they get to decide how much money they want to spend on capital expenditures, what kind of projects they want to do, and what their strategy is. And that’s unique amongst national oil companies.

So Aramco is not quite a national oil company, but it’s not a private oil company either. It’s somewhere in between, and it has a high degree of independence. That is changing, though. And we’ve seen that change come about since the ascension of King Salman [bin Abdulaziz Al Saud] to the throne and also of his son, the young Crown Prince Mohammed bin Salman, and they are taking a much more active role in the larger strategy of the company.

They’re not trying to run it day to day, but they are saying things like, “We want you to buy this petrochemical company” or “we want to go public and this is how it’s going to be.” And that’s been a very different thing for Aramco to have to deal with after so much independence. And it has created some tension.

Sean Rameswaram

It sounds like you’re saying it’s hard to separate the Saudi monarchy from Aramco.

Ellen Ward

It’s hard to separate them from Aramco in terms of the big decisions. Aramco isn’t nearly as intertwined with the government as any other national oil company. But this is the real issue with this IPO. Normally when a company does an IPO, the money is going to go to the company to expand, to do new things, but that’s not the case here.

The monarchy wants to monetize Aramco shares and to take that money that they make from the share sale and put it into things that are not involving the company. So they want to put it into their sovereign wealth fund, which is designed to make investments both in companies in Saudi Arabia to help promote economic development and diversification, but also companies all over the world international companies. And use it to make investments in tech companies and in all sorts of crazy firms that they’ve been investing in, like Magic Leap virtual reality or a tech company or Uber or Tesla.

Sean Rameswaram

This is supposed to be one of the wealthiest countries in the world, right? How do they need the cash for some “sovereign wealth fund” that will finance startups?

Ellen Ward

Saudi Arabia has essentially a one-trick economy, which is selling oil. And they’ve done pretty well with that. But that doesn’t always go very well for the general economy at large, doesn’t necessarily employ everyone. It doesn’t foster small-business development. It doesn’t foster a vibrant economy.

What if oil prices tank and stay low for a long time? What if the oil runs out? At some point, the oil will run out. So the Saudi government has put together this plan that’s designed to diversify the economy so that they’re no longer wholly dependent on a single commodity.

Sean Rameswaram

Do we have any idea how this IPO will go in December?

Ellen Ward

One of the interesting things is that this company makes $111 billion dollars in profit. That’s what it made in profit in 2018. Apple I think is the next-most profitable company, [and] only made $60 billion in 2018.

And people are not going to just toss that aside, especially in a market today when so many of the IPOs that come up are companies that don’t even make a profit and have never made a profit and may never make a profit. So when an IPO comes along for a company that is immensely profitable, it’s very hard to turn away.

If the IPO doesn’t go very well — and there’s a distinct chance that it might not go very well — it could affect other oil companies’ earnings. Although I would say that if it doesn’t go well, that’s reflective more of the Saudi government than it is of Aramco itself.

If the IPO doesn’t go very well and politically the Saudi monarchy looks bad, that could be very far-ranging, particularly for the United States, which maintains strong diplomatic ties to Saudi Arabia. So it’s something that people definitely need to be on the lookout for; this could in some ways potentially fundamentally alter the balance of power in the Middle East.

from Vox - All https://ift.tt/341Wo6E

0 notes

Text

The world’s most profitable company is about to go public

President and CEO of Saudi Aramco Amin Nasser (left) and Aramco’s chair Yasir al-Rumayyan attend a press conference in the eastern Saudi Arabian region of Dhahran on November 3, 2019. | AFP via Getty Images

The oil company that made Saudi Arabia rich is going public. Some say the timing couldn’t be worse.

Pop quiz: What’s the most profitable company in the world? Apple? Google?

Nope. Those two don’t even come close. The answer is Saudi Arabia’s state oil company, Aramco. In 2018, Saudi Aramco made $111 billion dollars in profit. The second-most profitable company, Apple, made $60 billion that year.

On November 3, Aramco officially announced its plan to go public for the first time in the company’s 86-year history. And on November 17, the oil giant announced the company could be valued at $1.7 trillion. Energy historian Ellen R. Wald joined Today, Explained to explain why Aramco’s initial public offering (IPO) is such a big deal.

As the most profitable company in the entire world, she says, the company’s IPO is going to set major records. And since it’s the largest oil company in the world, it’s likely that a lot of everyday things we use — from plastic to the energy fueling our cars — touches this company.

“In the United States,” Wald says as an example, “Aramco owns the largest refinery in the entire country. And it also owns Shell Gasoline Stations in the southeastern United States. So many Americans may be buying oil — or gasoline — that is made by Aramco, and they don’t even know it.”

But some say the timing for the Aramco IPO couldn’t be worse. One reason for that: Some people think that the world has or will soon reach peak oil demand. Another, Wald explains, is the “PR nightmare” that Saudi Arabia created with the killing of Saudi dissident journalist Jamal Khashoggi:

[The killing of Jamal Khashoggi] definitely soured investors and financiers on Saudi Arabia in general. The idea is that the money from this share sale would go to support the Saudi Arabian monarchy that has done and continues to do many horrible things, both in terms of human rights. ... And so there are a lot of people out there who look at that and say, “No, I’m not touching this because I don’t want to help these people.”

To understand the significance of Aramco’s upcoming IPO, you have to know the company’s history. If you want to learn all about it, here’s a lightly edited transcript of Wald’s conversation with Today, Explained host Sean Rameswaram.

Subscribe to Today, Explained wherever you get your podcasts, including: Apple Podcasts, Google Podcasts, Spotify, Stitcher, and ART19.

Sean Rameswaram

What exactly is it that takes Saudi Aramco from an extremely profitable oil company to the most profitable company in the world?

Ellen Ward

The really key year here is 1972. The United States could no longer pump more oil to meet rising demand. So instead of being able to accommodate America’s vast thirst for oil at the time, they had to import oil from elsewhere. And one of the big sources of that was Saudi Arabia. And Saudi Arabia was pumping and pumping more to meet that demand. All of those gas-guzzling cars, they were meeting that demand.

And the Saudis took note of this. The oil minister at the time, his name was Zaki Yamani, he and other oil-producing countries in the Middle East were already united in the cartel organization we know today as OPEC [the Organization of the Petroleum Exporting Countries].

And they got together and they said, essentially, “We know you’re in a difficult position, and we want to raise the price of oil because the price of oil is just too low.” And they negotiated with the representatives of big oil companies, including the American ones, and they could not reach an agreement. And they said, “You know what? We can’t reach an agreement. [So] we’re going to unilaterally raise the price of oil.”

They do this in conjunction with the Arab-Israeli War of 1973, along with an oil embargo. And the effect was very immediate. The price of oil skyrocketed, and in fact caused a recession in the United States.

But what it also did was help oil companies make a lot more money from this, including Aramco and including the Saudis. And what did the Saudis do with all this cash? Well, they put it into their own palaces and into their own country. But they also used it to buy the company from the Americans. And then in 1988, the Saudis eventually renamed it Saudi Aramco.

Sean Rameswaram

How has [the company] changed from what it was in the 1970s to now?

Ellen Ward

In the 1970s, Aramco was basically an oil-pumping machine. They pumped oil out of the ground, and most of that was sold as crude oil to the four American companies that owned it. Now, it’s much more like an international oil company like BP or Exxon or Royal Dutch Shell or Total in that they pump oil, they have crude oil assets, but they also have a range of what we call “downstream assets,” which are refineries, petrochemical companies. And they have these in Saudi Arabia, but also all over the world.

Sean Rameswaram

What’s the relationship between this company and the Saudi Arabian monarchy right now?

Ellen Ward

It’s much more difficult now than it was. Their first Saudi CEO at the time, a man named Ali al-Naimi, he negotiated with the king to keep Aramco separate from the Saudi government. Yes, they have a board of directors that is appointed by the government that kind of approves their plans. But, essentially, they get to decide how much money they want to spend on capital expenditures, what kind of projects they want to do, and what their strategy is. And that’s unique amongst national oil companies.

So Aramco is not quite a national oil company, but it’s not a private oil company either. It’s somewhere in between, and it has a high degree of independence. That is changing, though. And we’ve seen that change come about since the ascension of King Salman [bin Abdulaziz Al Saud] to the throne and also of his son, the young Crown Prince Mohammed bin Salman, and they are taking a much more active role in the larger strategy of the company.

They’re not trying to run it day to day, but they are saying things like, “We want you to buy this petrochemical company” or “we want to go public and this is how it’s going to be.” And that’s been a very different thing for Aramco to have to deal with after so much independence. And it has created some tension.

Sean Rameswaram

It sounds like you’re saying it’s hard to separate the Saudi monarchy from Aramco.

Ellen Ward

It’s hard to separate them from Aramco in terms of the big decisions. Aramco isn’t nearly as intertwined with the government as any other national oil company. But this is the real issue with this IPO. Normally when a company does an IPO, the money is going to go to the company to expand, to do new things, but that’s not the case here.