#simulation software market

Explore tagged Tumblr posts

Text

The State of Simulation: Market Dynamics and Competitive Landscape 2025–2030

The global simulation software market is poised to expand significantly, with estimates projecting its value to reach USD 51.11 billion by 2030, fueled by a CAGR of 14.0% from 2025 to 2030. A primary driver of this growth is the increasing adoption of simulation tools for workforce training, which offer a cost-effective alternative to traditional, resource-intensive real-time training programs. By making a single, upfront investment in simulation platforms, organizations can deliver realistic, repeatable training scenarios without incurring ongoing facility, equipment, or instructor costs.

Beyond training, simulation software is revolutionizing product development cycles. Virtual prototyping enables engineers to identify and rectify design flaws before committing to physical builds, thereby drastically reducing the risk of production delays or costly failures. These tools also accelerate research and development by providing an immersive, data-rich environment in which to test processes under a wide array of conditions—shortening time to market and ensuring that final products meet stringent quality standards.

Despite these advantages, the need for specialized personnel to operate and interpret simulation systems has tempered adoption among some manufacturers. Hiring or upskilling staff to master complex modeling software represents an additional expense, causing hesitation among organizations with tight operational budgets. Moreover, the COVID-19 pandemic initially disrupted the market: border closures in manufacturing hubs such as China, Japan, and India created supply chain bottlenecks, while temporary factory shutdowns prompted some firms to defer or cancel software subscription renewals.

As global economies recover and manufacturing activities resume, the simulation software sector is expected to regain momentum. Companies across industries are reinvesting in digital solutions to optimize R&D expenditures, enhance product quality, and maintain competitive advantage through accelerated development lifecycles.

Simulation Software Market Report Highlights

By Component:

Software claimed 68.5% of market revenues in 2024 and is forecast to maintain its leadership position through 2030, driven by growing demand for comprehensive simulation suites.

By Deployment Mode:

The on-premise segment dominated in 2024, reflecting early adopters’ preference for locally hosted solutions that offer tight data control and customization.

By Application:

Cyber simulation tools are set to achieve a notable CAGR, as industries—particularly military, defense, and large enterprises—prioritize defenses against increasingly sophisticated cyber threats.

By End-Use Industry:

The automotive sector led the market in 2024, capitalizing on virtual crash testing, aerodynamic modeling, and assembly-line simulations to streamline vehicle development.

By Region:

North America emerged as the most lucrative market in 2024, buoyed by the concentration of major simulation software providers in the U.S. and Canada; the region is expected to preserve its dominance over the forecast period.

Get a preview of the latest developments in the Simulation Software Market? Download your FREE sample PDF copy today and explore key data and trends

Simulation Software Market Segmentation

Grand View Research has segmented the global simulation software market report based on component, deployment, application, end use, and region:

Simulation Software Component Outlook (Revenue, USD Million, 2018 - 2030)

Software

Services

Simulation Development Services

Training and Support & Maintenance

Simulation Software Deployment Outlook (Revenue, USD Million, 2018 - 2030)

On-premise

Cloud

Simulation Software Application Outlook (Revenue, USD Million, 2018 - 2030)

Engineering, Research, Modeling & Simulated Testing

High Fidelity Experiential 3D Training

Gaming and Immersive Experiences

Manufacturing Process Optimization

AI Training & Autonomous Systems

Planning and Logistics Management & Transportation

Cyber Simulation

Simulation Software End Use Outlook (Revenue, USD Million, 2018 - 2030)

Automotive

Aerospace & Defense

Industrial

Oil & Gas

Mining

Energy & Utilities

Others

Electronics and Semiconductor

Transportation & Logistics

Healthcare

Others

Simulation Software Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Mexico

Europe

Germany

UK

France

Asia Pacific

China

Japan

India

South Korea

Australia

Latin America

Brazil

Middle East and Africa (MEA)

KSA

UAE

South Africa

Key Players in Simulation Software Market

Altair Engineering, Inc.

Autodesk Inc.

Ansys, Inc.

Bentley Systems, Incorporated

Dassault Systèmes

The MathWorks, Inc.

Rockwell Automation, Inc.

Simulations Plus

ESI Group

GSE Systems

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

0 notes

Link

#simulation software market share#Simulation Software Market 2024#Simulation Software Market#Simulation Software Market Size

0 notes

Text

Simulation Software Market : A Comprehensive Overview

Simulation software has become an integral part of various industries, revolutionizing the way businesses operate and innovate. From manufacturing to healthcare, the applications are vast and diverse. In this article, we will delve into the evolution, key features, applications, and trends shaping the Simulation Software Market.

I. Introduction

A. Definition of Simulation Software

Simulation software refers to computer programs that replicate real-world processes or systems. These virtual models allow businesses to simulate scenarios, test hypotheses, and analyze data in a controlled environment.

B. Importance in Various Industries

The significance of simulation software extends across industries, offering valuable insights, reducing costs, and enhancing decision-making processes.

II. Evolution of Simulation Software

A. Early Days

Simulation software traces its roots back to the early days of computer programming. Initially used for scientific and mathematical simulations, it has evolved significantly over the years.

B. Technological Advancements

Advancements in computing power, graphics, and algorithms have propelled simulation software into a sophisticated tool used for complex simulations in various domains.

III. Key Features of Simulation Software

A. Realistic Modeling

One of the fundamental features of simulation software is its ability to create realistic models. These models replicate the behavior of real-world systems with a high degree of accuracy.

B. Customization Options

Simulation software offers customization options, allowing businesses to tailor simulations to their specific needs. This flexibility is crucial for addressing industry-specific challenges.

C. Data Analysis Capabilities

Modern simulation tools come equipped with robust data analysis capabilities. They can process large datasets, extract meaningful insights, and support data-driven decision-making.

IV. Applications Across Industries

A. Manufacturing

Simulation software is widely used in manufacturing for process optimization, production planning, and quality control.

B. Healthcare

In healthcare, simulation tools facilitate medical training, surgical simulations, and drug development, leading to improved patient outcomes.

C. Aerospace

The aerospace industry relies on simulation software for design validation, aircraft performance analysis, and safety assessments.

D. Education

Educational institutions use simulation software to create interactive learning experiences, enhancing understanding and retention.

V. Benefits of Simulation Software

A. Cost Savings

Simulation software allows businesses to identify inefficiencies and optimize processes, leading to significant cost savings.

B. Risk Mitigation

By simulating various scenarios, organizations can identify potential risks and develop strategies to mitigate them, reducing the likelihood of costly errors.

C. Training Advantages

In industries such as healthcare and aviation, simulation software provides realistic training environments, allowing practitioners to hone their skills without real-world consequences.

VI. Popular Simulation Software Tools

A. Ansys

Ansys is a widely used simulation tool known for its advanced engineering simulation capabilities across multiple industries.

B. Simulink

Simulink, developed by MathWorks, is popular for its modeling and simulation of multidomain dynamical systems.

C. AnyLogic

AnyLogic stands out for its versatility, offering simulation solutions for business, engineering, and healthcare applications.

VII. Simulation Software Market Trends

A. Growing Demand

The demand for simulation software is on the rise as businesses recognize its potential for innovation, efficiency, and risk management.

B. Integration with Artificial Intelligence

The integration of simulation software with artificial intelligence is a growing trend, enhancing predictive modeling and decision-making.

C. Cloud-Based Solutions

Cloud-based simulation solutions are gaining popularity, offering scalability, accessibility, and collaboration features.

VIII. Challenges in the Simulation Software Industry

A. Initial Costs

While the benefits are substantial, the initial costs of implementing simulation software can be a barrier for some businesses.

B. Complexity in Implementation

The complexity of implementing simulation software requires skilled professionals, posing a challenge for organizations without the necessary expertise.

IX. Future Prospects

A. Emerging Technologies

The future of simulation software is closely tied to emerging technologies such as virtual reality and augmented reality, opening new possibilities for immersive simulations.

B. Industry Collaboration

Collaboration between software developers and industry experts is crucial for addressing specific challenges and advancing the capabilities of simulation software.

X. Case Studies

A. Successful Implementations

Explore real-world case studies highlighting the successful implementation of simulation software and its impact on business outcomes.

B. Impact on Businesses

Understand how businesses have leveraged simulation software to streamline operations, improve efficiency, and stay ahead in competitive markets.

XI. How to Choose the Right Simulation Software

A. Assessing Business Needs

Identify your organization's specific needs and objectives before choosing a simulation software, ensuring it aligns with your goals.

B. Compatibility with Existing Systems

Consider the compatibility of the simulation software with your existing systems to ensure seamless integration and maximum efficiency.

XII. Tips for Effective Simulation Software Usage

A. Training Programs

Implement comprehensive training programs to familiarize your team with the simulation software, maximizing its benefits.

B. Regular Updates

Stay informed about updates and new features of your simulation software to take advantage of the latest advancements and improvements.

XIII. User Testimonials

A. Experiences with Simulation Software

Discover firsthand experiences from users who have benefited from simulation software, gaining valuable insights into its practical applications.

Buy the Full Report for Additional Insights on the Simulation Software Market Forecast, Download a Free Sample

0 notes

Text

Simulation Software Market Size is forecast to reach $20.3 billion by 2026, at a CAGR of 17.0% during 2021-2026. Adoption of simulation software in aerospace, defense and automobile industries with the development of modern aircraft, autonomous and electric vehicles boost the Simulation Software Market growth.

0 notes

Video

youtube

Stock-Market for the ZX81

#youtube#Stock-Market#ZX81#Simulation#Stock Market#Stockmarket#Stock Market Multiplayer#Multiplayer Stock Market#Multiplayer#Multiplayer Only#Video Software

3 notes

·

View notes

Text

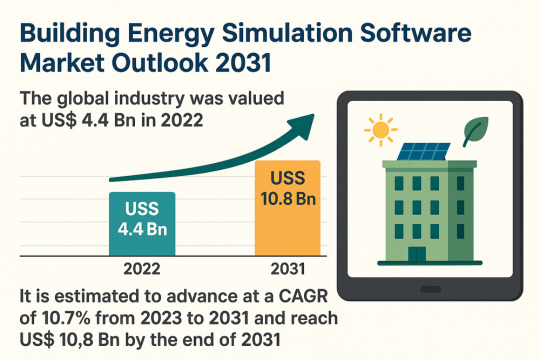

Sustainable Design Powers Building Energy Simulation Software Market Boom

The global building energy simulation software market is poised for significant growth, expanding from US$ 4.4 billion in 2022 to an estimated US$ 10.8 billion by 2031, at an impressive CAGR of 10.7%. This growth trajectory reflects the increasing demand for energy-efficient and sustainable building solutions driven by stricter environmental regulations, integration of smart technologies, and the adoption of AI and ML in building simulation tools.

Market Overview

Building energy simulation software enables stakeholders including architects, engineers, and energy consultants to model, simulate, and optimize the energy performance of buildings. These tools help reduce carbon emissions, lower operating costs, and ensure compliance with stringent energy codes and standards. They also support performance analysis for HVAC systems, lighting, plug loads, and water usage in residential, commercial, and institutional buildings.

The industry is experiencing strong momentum with the growing emphasis on green building certifications, retrofitting of existing infrastructure, and the integration of Internet of Things (IoT) technologies into construction and facilities management processes.

Market Drivers & Trends

The growth of the building energy simulation software market is primarily driven by:

Government regulations aimed at reducing building emissions

Increased adoption of smart building technologies and IoT

Rising demand for energy-efficient retrofitting of older structures

Technological advancements enabling real-time modeling and faster simulations

Financial incentives and tax benefits for energy-efficient construction

The increasing urgency to comply with frameworks such as the EU’s Energy Performance of Buildings Directive (EPBD), New York City’s Local Law 97 (LL97), and other national standards like Germany’s Buildings Energy Act and the Dubai Green Building Regulations, continues to create substantial demand for these tools.

Latest Market Trends

One of the most notable trends is the integration of Artificial Intelligence (AI) and Machine Learning (ML) into simulation software. These technologies improve modeling accuracy, reduce simulation time, and provide advanced predictive analytics. AI algorithms can automatically generate energy models based on design inputs, simulate future energy demand, and suggest optimal solutions for minimizing consumption and enhancing occupant comfort.

Another key trend is the availability of cloud-based platforms that enable collaboration and access to real-time simulation data, making energy modeling more accessible and scalable for small- to mid-sized firms.

Key Players and Industry Leaders

Major players in the global market include:

Autodesk, Inc.

4M S.A.

Integrated Environmental Solutions Ltd (IES)

DesignBuilder Software Ltd

Trimble Inc.

EQUA Simulation AB

Trane Technologies plc

StruSoft AB

BuildSimHub, Inc.

Environmental Design Solutions Ltd

Maalka Inc.

BRE Group

These companies are heavily investing in R&D to improve simulation speed, user interfaces, and integration with Building Information Modeling (BIM) tools, thus enhancing market competitiveness.

Access important conclusions and data points from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=77350

Recent Developments

Autodesk Inc., in November 2022, launched rapid operational energy analysis tools in Autodesk Spacemaker, allowing real-time visual feedback during early design phases—enabling energy-efficient decisions from the outset.

In February 2023, Glodon Company Limited, via its subsidiary MagiCAD Group, acquired a majority stake in EQUA Simulation AB. This strategic acquisition is expected to accelerate simulation technology development and expand global market reach.

These developments reflect the industry’s move toward comprehensive, real-time, and AI-integrated platforms.

Market Opportunities

Several untapped opportunities lie ahead for market players:

Emerging markets in Asia Pacific, the Middle East, and South America are expected to experience robust demand for simulation tools amid urbanization and green building initiatives.

AI-enabled automation can open new possibilities in design optimization and energy forecasting.

Partnerships with government bodies and educational institutions may drive innovation and training in simulation technologies.

Smart city projects and rising interest in Net-Zero Energy Buildings (NZEBs) present a fertile ground for software deployment.

Future Outlook

The future of the building energy simulation software market looks promising, with robust growth expected across all regions. The emphasis on data-driven architecture, zero-emission goals, and sustainable urban development will continue to influence market dynamics.

With continued advances in ML algorithms, simulation engines, and 3D visualization capabilities, energy simulation tools will become indispensable for building design, renovation, and facility management. Furthermore, integration with digital twins and BIM platforms will enhance their strategic role in urban planning and smart infrastructure development.

Market Segmentation

By Component:

Software / Platform

Services

Professional

Consulting & Integration

Support & Maintenance

Managed

By Deployment:

Cloud

On-premise

By End-user:

Residential

Commercial

Others

By Region:

North America

Europe

Asia Pacific

Middle East & Africa

South America

Regional Insights

North America leads the market due to a well-established ecosystem of universities, research labs (like NREL), and government-funded sustainability programs. The U.S., in particular, is witnessing widespread adoption of simulation software driven by regulations such as LL97 in New York.

Europe remains at the forefront of green construction regulations and energy performance mandates, making it a lucrative market for simulation software providers.

Asia Pacific is expected to record the fastest CAGR during the forecast period. Rapid urbanization, combined with rising environmental consciousness and increasing investments in green buildings across China, India, and Southeast Asia, is fueling demand in the region.

Why Buy This Report?

This comprehensive report offers:

In-depth analysis of market trends, drivers, and opportunities

Detailed segmentation and regional analysis

Competitive landscape with profiles of major players

Insights into government regulations and their impact on market dynamics

Forecasts up to 2031 with historic data and growth projections

Updates on key market developments and strategic movements

AI and ML integration trends reshaping the simulation software ecosystem

Whether you are a software developer, a building consultant, a policymaker, or an investor, this report offers invaluable insights into the future of energy-efficient construction technologies.

Explore Latest Research Reports by Transparency Market Research: Data Center Rack Market: https://www.transparencymarketresearch.com/data-center-rack-market.html

Virtual Reality in Gaming Market: https://www.transparencymarketresearch.com/virtual-reality-gaming-market.html

Retail Analytics Market: https://www.transparencymarketresearch.com/retail-analytics-market.html

3D Reconstruction Technology Market: https://www.transparencymarketresearch.com/3d-reconstruction-technology-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

Simulation Software Industry Size & Share | Statistics Report 2030

The global simulation software market size is estimated to reach USD 51.11 billion by 2030, registering a CAGR of 13.8% from 2024 to 2030, according to a new study by Grand View Research, Inc. Simulation software is being used for training personnel. It is replacing the traditional real-time training techniques, which incurred huge investments annually for companies. The use of simulation for training purposes helps reduce training costs as companies need to make a one-time investment for software implementation. The software also helps enterprises minimize production costs by enhancing the product development process.

The need for developing prototypes and the chances of product failure are considerably reduced through the use of simulators, as the product is virtually tested for all possible glitches before the commencement of production. Furthermore, simulation-based tools help product developers reduce the time spent on R&D processes as it enables them to obtain a realistic view of a product or process under study or review. Organizations across the globe are increasingly implementing the program and analyzing tools to enhance the entire product development cycle, reduce time to production, ensure delivery of high-quality products in minimal time, and reduce the overall cost to the company with respect to R&D.

Gather more insights about the market drivers, restrains and growth of the Global Simulation Software Market

It requires a skilled workforce or personnel with the required knowledge and understanding. This is leading to several manufacturers being reluctant to adopt this technology as the need for a skilled workforce incurs additional costs. The COVID-19 pandemic had an adverse impact on the global market. The closure of national and international borders in major countries, such as China, Japan, and India, has caused severe supply chain disruptions. In addition, the temporary shutdown of manufacturing operations has led manufacturing companies to face severe budgetary issues, resulting in delayed subscription renewal payments during the pandemic’s initial phase. However, recovering economies and opening businesses are expected to help the market grow at a rapid pace over the forecast period.

Simulation Software Market Report Highlights

The market is being driven by reduced training costs for personnel in various industries and sectors, such as automotive, defense, healthcare, and electrical

The service segment is expected to register a CAGR of 15.0% owing to the growing demand for customized simulation solutions, such as design and consulting

The cloud-based segment is expected to register the fastest CAGR of approximately 15.4% over the forecast period owing to benefits, such as easy and low-cost implementation

The automotive segment dominated the market in 2023 and is expected to hold a major share by 2030 owing to the early adoption of virtual testing tools in the automotive industry

North America is expected to account for the highest market share followed by Asia Pacific, by 2030 owing to the growing investments in R&D and defense in countries, such as the U.S.

Leading players are focusing on developing new simulation software solutions, to capture maximum share

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

Charging As A Service Market: The global charging as a service market size was estimated at USD 338.3 million in 2024 and is expected to grow at a CAGR of 25.0% from 2025 to 2030.

AI In Media & Entertainment Market: The global AI in media & entertainment market size was estimated at USD 25.98 billion in 2024 and is projected to grow at a CAGR of 24.2% from 2025 to 2030.

Simulation Software Market Segmentation

Grand View Research has segmented the global simulation software market on the basis of component, deployment, application, end-use, and region:

Simulation Software Component Outlook (Revenue, USD Million, 2017 - 2030)

Software

Services

Simulation Software Deployment Outlook (Revenue, USD Million, 2017 - 2030)

On-Premise

Cloud

Simulation Software Application Outlook (Revenue, USD Million, 2017 - 2030)

Engineering, Research, Modeling & Simulated Testing

High Fidelity Experiential 3D Training

Gaming & Immersive Experiences

Manufacturing Process Optimization

AI Training & Autonomous Systems

Planning And Logistics Management & Transportation

Cyber Simulation

Simulation Software End-use Outlook (Revenue, USD Million, 2017 - 2030)

Conventional Automotive

Electric Automotive and Autonomous Vehicles

Aerospace & Defense

Electrical, Electronics and Semiconductor

Healthcare

Robotics

Entertainment

Architectural Engineering and Construction

Others

Simulation Software Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

Europe

Asia Pacific

Latin America

Middle East & Africa (MEA)

Order a free sample PDF of the Simulation Software Market Intelligence Study, published by Grand View Research.

0 notes

Text

Simulation Software Industry Size, Trends, and Business Outlook Report 2030

The global simulation software market size is estimated to reach USD 51.11 billion by 2030, registering a CAGR of 13.8% from 2024 to 2030, according to a new study by Grand View Research, Inc. Simulation software is being used for training personnel. It is replacing the traditional real-time training techniques, which incurred huge investments annually for companies. The use of simulation for training purposes helps reduce training costs as companies need to make a one-time investment for software implementation. The software also helps enterprises minimize production costs by enhancing the product development process.

The need for developing prototypes and the chances of product failure are considerably reduced through the use of simulators, as the product is virtually tested for all possible glitches before the commencement of production. Furthermore, simulation-based tools help product developers reduce the time spent on R&D processes as it enables them to obtain a realistic view of a product or process under study or review. Organizations across the globe are increasingly implementing the program and analyzing tools to enhance the entire product development cycle, reduce time to production, ensure delivery of high-quality products in minimal time, and reduce the overall cost to the company with respect to R&D.

Gather more insights about the market drivers, restrains and growth of the Global Simulation Software Market

It requires a skilled workforce or personnel with the required knowledge and understanding. This is leading to several manufacturers being reluctant to adopt this technology as the need for a skilled workforce incurs additional costs. The COVID-19 pandemic had an adverse impact on the global market. The closure of national and international borders in major countries, such as China, Japan, and India, has caused severe supply chain disruptions. In addition, the temporary shutdown of manufacturing operations has led manufacturing companies to face severe budgetary issues, resulting in delayed subscription renewal payments during the pandemic’s initial phase. However, recovering economies and opening businesses are expected to help the market grow at a rapid pace over the forecast period.

Simulation Software Market Report Highlights

The market is being driven by reduced training costs for personnel in various industries and sectors, such as automotive, defense, healthcare, and electrical

The service segment is expected to register a CAGR of 15.0% owing to the growing demand for customized simulation solutions, such as design and consulting

The cloud-based segment is expected to register the fastest CAGR of approximately 15.4% over the forecast period owing to benefits, such as easy and low-cost implementation

The automotive segment dominated the market in 2023 and is expected to hold a major share by 2030 owing to the early adoption of virtual testing tools in the automotive industry

North America is expected to account for the highest market share followed by Asia Pacific, by 2030 owing to the growing investments in R&D and defense in countries, such as the U.S.

Leading players are focusing on developing new simulation software solutions, to capture maximum share

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

Charging As A Service Market: The global charging as a service market size was estimated at USD 338.3 million in 2024 and is expected to grow at a CAGR of 25.0% from 2025 to 2030.

AI In Media & Entertainment Market: The global AI in media & entertainment market size was estimated at USD 25.98 billion in 2024 and is projected to grow at a CAGR of 24.2% from 2025 to 2030.

Simulation Software Market Segmentation

Grand View Research has segmented the global simulation software market on the basis of component, deployment, application, end-use, and region:

Simulation Software Component Outlook (Revenue, USD Million, 2017 - 2030)

Software

Services

Simulation Software Deployment Outlook (Revenue, USD Million, 2017 - 2030)

On-Premise

Cloud

Simulation Software Application Outlook (Revenue, USD Million, 2017 - 2030)

Engineering, Research, Modeling & Simulated Testing

High Fidelity Experiential 3D Training

Gaming & Immersive Experiences

Manufacturing Process Optimization

AI Training & Autonomous Systems

Planning And Logistics Management & Transportation

Cyber Simulation

Simulation Software End-use Outlook (Revenue, USD Million, 2017 - 2030)

Conventional Automotive

Electric Automotive and Autonomous Vehicles

Aerospace & Defense

Electrical, Electronics and Semiconductor

Healthcare

Robotics

Entertainment

Architectural Engineering and Construction

Others

Simulation Software Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

Europe

Asia Pacific

Latin America

Middle East & Africa (MEA)

Order a free sample PDF of the Simulation Software Market Intelligence Study, published by Grand View Research.

0 notes

Text

The Building Energy Simulation Software Market size was USD 5.1 Billion in 2023 and is anticipated to reach USD 12.4 Billion in 2033, growing at a rate of 9.3% from 2024 to 2033.

0 notes

Text

https://introspectivemarketresearch.com/reports/factory-simulation-software-market/

#Factory Simulation Software Market Size#Factory Simulation Software Market Share#Factory Simulation Software Market Growth#Factory Simulation Software Market Trends#Factory Simulation Software Market Forecast Analysis#Factory Simulation Software Market Segmentation#Factory Simulation Software Market 2024#Factory Simulation Software Market CAGR#Factory Simulation Software Market Analyzer Industry

0 notes

Text

Exploring Dynamics of the Simulation Software Market: Key Opportunities & Challenges

The global simulation software market was valued at USD 20.96 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.8% from 2024 to 2030. Simulation software refers to a digital tool that enables the creation of a virtual environment to test the performance, efficiency, and applicability of various products and processes in real-time. This type of software is widely used across different industries due to its ability to help companies reduce costs, streamline production processes, and improve product development.

Market Drivers and Benefits

The primary factors driving the growth of the simulation software market are cost reduction and improved efficiency. Simulation tools significantly reduce production expenditures by minimizing the need for physical prototypes and extensive manual testing. Additionally, they help lower training costs, as employees can use simulated environments for hands-on practice without the financial burden of real-world resources.

Simulation software is also pivotal in several high-stakes applications, such as military and automotive industries. In the defense sector, simulation tools play a critical role in analyzing the effects of military weapons without the need for live testing, which can be costly and dangerous. For the automotive industry, simulation software helps in optimizing vehicle design, allowing manufacturers to create prototypes that meet environmental regulations, such as reducing CO2 emissions, before moving to the production stage.

Prototyping and Product Development

A significant challenge faced by many industries is the costs associated with physical prototypes and the risk of product failure during testing. In industries such as automotive, aerospace, and consumer electronics, the pre-production and post-production phases can incur substantial expenses due to the need to build and test numerous prototypes. Simulation software can greatly reduce these costs by enabling companies to conduct virtual testing of different design concepts, thereby reducing the number of physical prototypes required. This helps minimize the risk of product failures during manufacturing and testing stages, resulting in a more cost-effective and efficient product development process.

As businesses face a more Volatile, Uncertain, Complex, and Ambiguous (VUCA) world, there is growing investment in AI-driven simulation tools to help companies navigate challenges more effectively. For instance, artificial intelligence (AI) technologies are increasingly being integrated into simulation software, enabling the testing of AI-enabled devices under simulated real-world conditions. Virtual testing can observe and analyze how these AI-powered devices behave in various scenarios, helping businesses refine their designs and improve the performance of their products.

Gather more insights about the market drivers, restrains and growth of the Simulation Software Market

Deployment Segmentation Insights

The deployment mode is an essential factor influencing the growth of the simulation software market. Based on deployment, the global market is divided into on-premises and cloud-based segments. Both deployment models have distinct advantages that cater to different organizational needs and preferences.

On-Premises Deployment

In 2023, the on-premises deployment segment accounted for the largest share of the global simulation software market, with more than 71.4% of the total revenue. This dominance can be attributed to the early adoption of on-premises software, especially by larger companies that have the resources to manage on-site installations. On-premises deployment involves installing the software on the company's own servers, which gives the organization more control over data security and confidentiality.

Many organizations prefer this deployment method because it offers enhanced data security and privacy. Companies that deal with sensitive information, such as intellectual property or confidential client data, often prefer on-premises solutions to ensure that they maintain complete control over their systems and data storage. The need for data confidentiality and protection from cyber threats is a primary factor contributing to the continued growth of the on-premises segment. As a result, this segment is expected to retain a significant share of the market, with its dominance likely to continue through 2030.

Cloud-Based Deployment

On the other hand, the cloud-based deployment segment is projected to grow at the fastest CAGR over the forecast period. The cloud-based deployment model is gaining traction due to the ease of implementation and cost-effectiveness it offers compared to traditional on-premises solutions. With cloud-based simulation software, businesses do not need to invest in expensive on-site hardware or worry about software updates and maintenance. The software is hosted on external servers and accessed via the internet, making it easier to scale, upgrade, and customize based on the client’s specific needs.

One of the key advantages of cloud-based deployment is its flexibility. Cloud solutions allow users to access simulation software from anywhere, at any time, using any device with internet access. This makes it particularly useful for Research and Development (R&D) teams, as well as organizations in the training and education sectors, who can use the software remotely and collaborate more easily across different locations.

Additionally, cloud-based simulation software offers lower upfront costs since businesses typically pay for usage on a subscription basis, rather than making large, one-time purchases for on-premises installations. This subscription-based pricing model helps organizations save money in the short term while providing scalability for future growth. As more companies recognize these benefits, the cloud-based deployment segment is expected to register strong growth, particularly in industries where collaborative, remote access to simulation tools is crucial.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

0 notes

Text

Process Simulation Software in Oil and Gas Market size is projected to reach USD 2.21 Bn by end of 2030, at a CAGR of 4.3%.

0 notes

Text

As per the analysis of NCBI, every year around 250,000 deaths occur due to medical error. According to a study by The Johns Hopkins University, medical errors are predicted to be the third biggest cause of death, after cancer and cardiovascular disease. The demand for medical simulations to help doctors, nurses, surgeons, and other healthcare workers comprehend procedures has increased as a result of the need to reduce unnecessary deaths.

Data Bridge Market Research analyses that the health/medical simulation software market which was USD 1.7 billion in 2021, would rocket up to USD 5.16 billion by 2029, and is expected to undergo a CAGR of 14.90% during the forecast period 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

0 notes

Text

Data Bridge Market Research analyses that the health/medical simulation software market which was USD 1.7 billion in 2021, would rocket up to USD 5.16 billion by 2029, and is expected to undergo a CAGR of 14.90% during the forecast period 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

0 notes

Text

#Oil and Gas Process Simulation Software Market#Oil and Gas Process Simulation Software#consulting company#strategic advisory firm#best market reports#trending reports#market analysis reports#syndicated reports#IT & Telecom#IT & Telecom Industry

0 notes

Text

One of the most defining 16bit computers was introduced in June 1985.

ATARI ST 520

DESIGN HISTORY & STRATEGY

The Atari ST series was born in a turbulent time: Atari had just been acquired by Jack Tramiel, founder of Commodore, after leaving that company. Tramiel pushed for a quick-to-market product to compete with the Apple Macintosh and Commodore Amiga.

Development time: Less than one year — an aggressive schedule for a 16-bit GUI-based machine.

Initial models: The Atari 520ST was the first to ship, showcased at CES in 1985.

Innovative design: All-in-one casing (mainboard + keyboard), like the Amiga 500, but with better modularity (external floppy drive, monitor, etc.).

Former C=64 developer Shiraz Shivji led the design team. He tells a story about the Atari ST/Commodore Amiga history (source) "It is very interesting that the Warner Atari difficulties were due to Tramiel’s Commodore. The Commodore 64 was much more successful (I would say wildly successful) compared to the Atari Computers such as the 800 and the 400. We were also taking away sales from the video games division, the Atari 2600. Jay Miner was at Atari in the old days and was involved in the design of their products. He left Atari to design the Amiga. Atari had funded some of this effort and had an option to buy the Amiga. When we took over Atari in July 1984, the first order of business was to decide what to do with this option. The problem was that the Amiga was not quite ready and would need a lot of money to acquire. We decided to pass on Amiga, but this put enormous pressure on our own development team. Commodore, on the other hand, did not have an internally developed 32-bit graphics-oriented machine and did not have the confidence to develop the machine internally. They ended up buying Amiga for between $25-$30 million and spent a further $20 million or so and yet came out with a product a little after Atari. The roles were reversed, the Atari ST has a Commodore pedigree, while the Amiga has an Atari pedigree!"

MIDI AND MUSIC PRODUCTION

The 520ST included built-in MIDI ports — a revolutionary move. At the time, most other computers needed expensive third-party MIDI interfaces.

Key Software:

Steinberg Cubase – became the industry standard for MIDI sequencing.

Notator – early version of what later evolved into Logic Pro.

Pro 24, Dr. T's, and Hollis Trackman – widely used for composing, sequencing, and syncing synthesizers.

Used by Artists:

Fatboy Slim composed with the ST well into the 2000s.

Jean-Michel Jarre, Vangelis, The Chemical Brothers, and Underworld used it in studio setups.

Many studios kept an Atari ST just for MIDI due to its tight timing and reliability.

SOFTWARE ECOSYSTEM

TOS/GEM: A fast and responsive GUI OS that was very usable on 512KB of RAM.

Productivity apps:

Calamus DTP – high-quality desktop publishing

NeoDesk – an improved desktop GUI

GFA Basic – a powerful programming environment

Graphics tools:

Degas Elite, NeoChrome – pixel art, animation

Spectrum 512 – used clever tricks to display 512 colors

While the Amiga had better graphics and sound, many games were first developed for the ST, then ported to Amiga. Key games:

Dungeon Master – first-person RPG with real-time mechanics

Carrier Command, Starglider, Blood Money, Rick Dangerous

Flight simulators, strategy, and adventure games flourished

CULTURAL IMPACT

In Europe (especially the UK, Germany, France, and Hungary):

The ST became a cornerstone of bedroom coding, Demoscene, and music production.

Local software houses and users created a vibrant community around the machine.

The Atari ST was used in schools, small studios, and households well into the early '90s.

In education: The ST's affordability and easy-to-use software made it a favorite in European schools and computer labs.

DECLINE & LEGACY

By the early 1990s, the ST line was losing ground to IBM-compatible PCs and faster Amigas.

Later models like the STE, TT030, and Falcon 030 tried to revitalize the line, with limited success.

Atari shifted toward consoles (like the Jaguar) and left the computer market.

Long-term legacy:

The Atari ST's MIDI legacy lives on — it helped standardize digital music production workflows.

Many musicians and retrocomputing fans still collect and use STs today.

A vibrant retro software/demo scene remains active, especially in Europe.

#atari#atari st#anniversary#tech#technology#old tech#retrocomputing#retro computing#retro gaming#retrogaming#midi#cubase#calamus#notator#degas elite#16bit#Dungeon Master#Carrier Command#Starglider#Blood Money#Rick Dangerous#Flight simulators#80s#80s computer#fatboy slim#chemical brothers#jean michel jarre#vangelis

11 notes

·

View notes