#startup business 2021

Text

youtube

Qualification Requirements

$5,000+ Monthly Bank Revenue

Business Checking Account

6 Months In Business

450+ Credit Score

All Industries Included

Breezy Online Process

View and Accept Offer

Link Online Banking

Review Approval Terms

Sign Agreement Online

Receive Funds

Simple and Fair Terms

No Hard Credit Inquiries

Transparent Terms

No Collateral Required

Industry Leading Early Pay Discounts

Get More When Needed

Payment History Earns You More

Receive Funding Again

Add-On Funds Available

Personalized Account Manager

GET STARTED

Need More Than $25k?

Funding of $25,000 - $2,000,000 In 2-5 Days

Requirements:

$25,000+ Monthly Bank Revenue

Business Checking Account

4 Months In Business

500+ Credit Score

All Industries Included

Learn More

Courtesy of ASB Capital Loan Funding

#Business Lenders#buisness lenders#world buisness lenders#world business lenders#worls buisness lenders#Worls business lenders#world business lenders review#sameday business loans#small business loans same day funding#business loans same day funding#start up business grants#start up business grants 2021#business loans for small business#cash advance business#cash advance credit line#startup business funding#cash business loans#instant business loan#instant business financing#Youtube#smallbusinessloans#BusinessLineofCredit#EquipmentFinancing#HybridgeSBALoan#PerformanceAdvance#CannaBusinessFinancingSolution#Cannabisbusinessloans#marijuanabusinessloans#AssetBasedLending#SBALoans

0 notes

Text

The 15 best Business Ideas 2023

Business ideas 2023- As you all know, without money we cannot do any work in our life. All the people in today’s time, they all work to earn money! If we do not have money in our pocket in today’s time, then we cannot do any work, but if we have money then we will be able to do our desired work!

Earning money is not an easy task because in today’s time unemployment has increased so much that it has become very difficult for any person to get a job, and very few people get government jobs who are very intelligent!

But you will be surprised to know that you can earn money even without working with anyone. That is to say, you can start a business sitting at your home!

But to do any business, you have to develop skills inside yourself!

If you want to start your own business? So today’s article is going to be very beneficial for you, because inside this article we will know “15 Poplar Greatest Business Ideas in 2023” through which you can earn a lot, and to do these business ideas, you will need someone. There is no need to invest any kind of money. You just need to turn around a little bit. Read More...

#business ideas#small business ideas#business ideas 2022#new business ideas#best business ideas#new business ideas 2022#profitable business ideas#profitable business ideas 2022#online business ideas 2023#business#business ideas in hindi#business ideas 2021#unique business ideas#online business ideas for beginner 2023#best business ideas 2022#best business ideas 2021#business ideas 2023#latest business ideas 2022#low investment business ideas#developers & startups#health & fitness#education#student

1 note

·

View note

Text

@oakfern replied to your post “it's going to be fun to watch the realization...”:

i feel like this is going to play out very similarly to voice assistants. there was a huge boom in ASR research, the products got a lot of hype, and they actually sold decently (at least alexa did). but 10 years on, they've been a massive failure, costing way more than they ever made back. even if ppl do think chatbot search engines are exciting and cool, it's not going to bring in more users or sell more products, and in the end it will just be a financial loss

(Responding to this a week late)

I don't know much about the history of voice assistants. Are there any articles you recommend on the topic? Sounds interesting.

ETA: Iater, I found and read this article from Nov 2022, which reports that Alexa and co. still can't turn a profit after many years of trying.

But anyway, yeah... this is why I don't have a strong sense of how widespread/popular these "generative AI" products will be a year or two from now. Or even five years from now.

(Ten years from now? Maybe we can trust the verdict will be in at that point... but the tech landscape of 2033 is going to be so different from ours that the question "did 'generative AI' take off or not?" will no doubt sound quaint and irrelevant.)

Remember when self-driving cars were supposed to be right around the corner? Lots of people took this imminent self-driving future seriously.

And I looked at it, and thought "I don't get it, this problem seems way harder than people are giving it credit for. And these companies show no signs of having discovered some clever proprietary way forward." If people asked me about it, that's what I would say.

But even if I was sure that self-driving cars wouldn't arrive on schedule, that didn't give me much insight into the fate of "self-driving cars," the tech sector meme. It wasn't like there was some specific deadline, and when we crossed it everyone was going to look up and say "oh, I guess that didn't work, time to stop investing."

The influx of capital -- and everything downstream from it, the trusting news stories, the prominence of the "self-driving car future" in the public mind, the seriousness which it was talked about -- these things went on, heedless of anything except their own mysterious internal logic.

They went on until . . . what? The pandemic, probably? I actually still don't know.

Something definitely happened:

In 2018 analysts put the market value of Waymo LLC, then a subsidiary of Alphabet Inc., at $175 billion. Its most recent funding round gave the company an estimated valuation of $30 billion, roughly the same as Cruise. Aurora Innovation Inc., a startup co-founded by Chris Urmson, Google’s former autonomous-vehicle chief, has lost more than 85% since last year [i.e. 2021] and is now worth less than $3 billion. This September a leaked memo from Urmson summed up Aurora’s cash-flow struggles and suggested it might have to sell out to a larger company. Many of the industry’s most promising efforts have met the same fate in recent years, including Drive.ai, Voyage, Zoox, and Uber’s self-driving division. “Long term, I think we will have autonomous vehicles that you and I can buy,” says Mike Ramsey, an analyst at market researcher Gartner Inc. “But we’re going to be old.”

Whatever killed the "self-driving car" meme, though, it wasn't some newly definitive article of proof that the underlying ideas were flawed. The ideas never made sense in the first place. The phenomenon was not really about the ideas making sense.

Some investors -- with enough capital, between them, to exert noticable distortionary effects on entire business sectors -- decided that "self-driving cars" were, like, A Thing now. And so they were, for a number of years. Huge numbers of people worked very hard trying to make "self-driving cars" into a viable product. They were paid very well to do. Talent was diverted away from other projects, en masse, into this effort. This went on as long as the investors felt like sustaining it, and they were in no danger of running out of money.

Often the "tech sector" feels less like a product of free-market incentives than it does like a massive, weird, and opaque public works product, orchestrated by eccentrics like Masayoshi Son, and ultimately organized according to the aesthetic proclivities and changing moods of its architects, not for the purpose of "doing business" in the conventional sense.

Gig economy delivery apps (Uber Eats, Doordash, etc.) have been ubiquitous for years, and have reported huge losses in every one of those years.

This entertaining post from 2020 about "pizza arbitrage" asks:

Which brings us to the question - what is the point of all this? These platforms are all losing money. Just think of all the meetings and lines of code and phone calls to make all of these nefarious things happen which just continue to bleed money. Why go through all this trouble?

Grubhub just lost $33 million on $360 million of revenue in Q1.

Doordash reportedly lost an insane $450 million off $900 million in revenue in 2019 (which does make me wonder if my dream of a decentralized network of pizza arbitrageurs does exist).

Uber Eats is Uber's "most profitable division” 😂😂. Uber Eats lost $461 million in Q4 2019 off of revenue of $734 million. Sometimes I need to write this out to remind myself. Uber Eats spent $1.2 billion to make $734 million. In one quarter.

And now, in February 2023?

DoorDash's total orders grew 27% to 467 million in the fourth quarter. That beat Wall Street’s forecast of 459 million, according to analysts polled by FactSet. Fourth quarter revenue jumped 40% to $1.82 billion, also ahead of analysts’ forecast of $1.77 billion.

But profits remain elusive for the 10-year-old company. DoorDash said its net loss widened to $640 million, or $1.65 per share, in the fourth quarter as it expanded into new categories and integrated Wolt into its operations.

Do their investors really believe these companies are going somewhere, and just taking their time to get there? Or is this more like a subsidy? The lost money (a predictable loss in the long term) merely the price paid for a desired good -- for an intoxicating exercise of godlike power, for the chance to reshape reality to one's whims on a large scale -- collapsing the usual boundary between self and outside, dream and reality? "The gig economy is A Thing, now," you say, and wave your hand -- and so it is.

Some people would pay a lot of money to be a god, I would think.

Anyway, "generative AI" is A Thing now. It wasn't A Thing a year ago, but now it is. How long will it remain one? The best I can say is: as long as the gods are feeling it.

449 notes

·

View notes

Text

When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off. [...] if some charismatic tech founder had come to you in 2021 and said “I am going to revolutionize the world via [artificial intelligence][robot taxis][flying taxis][space taxis][blockchain],” it might have felt unnatural to reply “nah but what if the Fed raises rates by 0.25%?” This was an industry with a radical vision for the future of humanity, not a bet on interest rates. Turns out it was a bet on interest rates though.

-Matt Levine

58 notes

·

View notes

Text

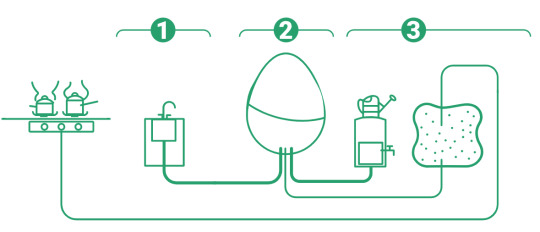

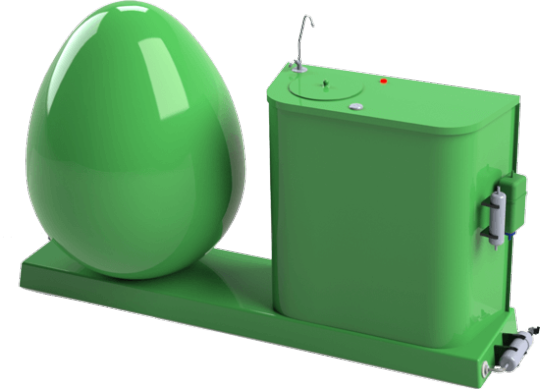

MyGug provides a technology that focuses on small food businesses that grow their own food, providing them with a food waste disposal system that turns waste into biogas energy for cooking that can be used in kitchens and gardens.

The egg-shaped MyGug units harness the power of a natural process called anaerobic digestion in which food waste is broken down to produce a natural gas suitable for cooking and liquid fertiliser for growing.

Headquartered in Clonakilty, Co Cork, MyGug was founded in 2021 by Fiona Kelleher and Kieran Coffey. The company works with the ambition to change the face of food waste.

#solarpunk#solarpunk business#solarpunk business models#solar punk#startup#reculture#farmers#renewable energy#biogas#food waste#ireland#solarpunk AF

9 notes

·

View notes

Text

SVB bailouts for everyone - except affordable housing projects

For the apologists, the SVB bailout was merely prudent: a bunch of innocent bystanders stood in harm’s way — from the rank-and-file employees at startups to the scholarship kids at elite private schools that trusted their endowment to Silicon Valley Bank — and so the government made an exception, improvising measures that made everyone whole without costing the public a dime. What’s not to like?

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/04/15/socialism-for-the-rich/#rugged-individualism-for-the-poor

But that account doesn’t hold up to even the most cursory scrutiny. Everything about it is untrue. Take the idea that this wasn’t a “bailout” because it was the depositors who got rescued, not the shareholders. That’s just factually untrue: guess where the shareholders kept their money? That’s right, SVB. The shareholders of SVB will get billions in public money thanks to the bailout. Billions:

https://pluralistic.net/2023/03/18/2-billion-here-2-billion-there/#socialism-for-the-rich

But is it really public money? After all, the FDIC payouts come from a pool of funds raised from all of America’s banks. The billions the public put into SVB will be recouped through hikes on the premiums paid by every bank. Well, sure — but who do you think the banks are going to gouge to cover those additional expenses? Hint: it’s not going to be the millionaires who get white-glove treatment and below-cost loans. It’ll be the working people whom the banks steal billions from every year in overdraft fees — 78% of these are paid by 9.2% of customers, the very poorest, and they amortize to a 3,500% loan:

https://pluralistic.net/2021/04/22/ihor-kolomoisky/#usurers

As Adam Levitin put it on Credit Slips:

They will pass those premiums through to customers because the market for banking services is less competitive than the market for capital. In particular, the higher costs for increased insurance premiums are likely to flow to the least price-sensitive and most “sticky” customers: less wealthy individuals. So average Joes are going to be facing things like higher account fees or lower APYs, without gaining any benefit. Instead, the benefit of removing the cap would flow entirely to wealthy individuals and businesses. This is one massive, regressive cross-subsidy. It’s not determinative of whether raising the cap is the right policy move in the end, but this is something that should be considered.

https://www.creditslips.org/creditslips/2023/03/the-regressive-cross-subsidy-of-uncapping-deposit-insurance.html

The SVB apologists display the most curious and bizarre imaginative leaps…and imaginative failings. For them, imagining that regulators will just wing it to the tune of hundreds of billions in public money is simplicity itself. Meanwhile, imagining that those same regulators would say, “Not one penny unless every shareholder agrees to sign away their deposits” is literally impossible.

This bizarrely inconstant imagination carries over into all of the claims used to justify the SVB bailout — like, say, the claim that if SVB wasn’t bailed out, everyone would pile into too big to fail banks like Jpmorgan. This is undoubtably true — unless (and hear me out here!), regulators were to use this failure as a launchpad for public banks, and breakups of Jpmorgan, Wells Fargo, Citi, et al.

This is a very weird imaginative failure. America operated public banks. It had broken up too big to fail banks. These weren’t the deeds of a fallen civilization whose techniques were lost to the mists of time. There are literally people alive today who were around when America operated nationwide public banks — a practice that only ended in 1966! We’re not talking about recovering the lost praxis of the druids who built Stonehenge without power-tools, here.

The most telling imaginative failure of SVB apologists, though, is this: they think that people are angry that the government saved the janitors at startups and the scholarship kids at private schools, and can’t imagine that people are angry that America didn’t save anyone else. If you’re a low-income student at an elite private school, there’s billions on hand to save you — but not because the government gives a damn about you — saving you is a side effect of saving all the rich kids you go to school with.

Likewise, the startup janitors aren’t the target of the bailout — they’re overspill from the billions mobilized to rescue the personal fortunes of tech billionaires who supply VCs’ investment capital. If there was a way to bail out the startups without bailing out the janitors, that’s exactly what would happen.

How do I know this? Well, first of all, the “investors” who demanded — and received — a bailout are on record as hating workers and wanting to fire as many of them as possible. As one of the loudest voices for the bailout said of Twitter employees, in a private message to Elon Musk following the takeover: “Day zero: Sharpen your blades boys 🔪”:

https://pluralistic.net/2023/03/21/tech-workers/#sharpen-your-blades-boys

But there’s even better evidence that the bailout’s intended target was wealthy, powerful people, and every chance to carve out working people was seized upon. When regulators engineered the sale of SVB to First Citizens Bank, they did not require First Citizens to honor SVB’s community development obligations, killing thousands of affordable housing units that had been previously greenlit:

https://calreinvest.org/wp-content/uploads/2021/05/Community-Benefits-Plan-SVB-CRC-GLI.pdf

Tens of thousands of people wrote to regulators, urging them to transfer SVB’s Community Benefits Plan obligation to First Citizens:

https://www.dailykos.com/campaigns/petitions/sign-the-petition-save-affordable-housing-keep-the-promises-silicon-valley-bank-made

As did Rep Maxine Waters, the ranking member of the House Financial Services Committee:

https://democrats-financialservices.house.gov/uploadedfiles/318_cwm_ltr_fdic.pdf

But First Citizens — a bank whose slot in America’s top-20 banks was secured through a string of exceptions, exemptions and waivers — was not required to take on SVB’s obligations to carry out loans to build thousands of affordable housing units in the Bay Area and Boston, including a 112-unit building for people with disabilities planned for a plum spot across from San Francisco City Hall:

https://www.levernews.com/regulators-stiffed-low-income-communities-in-silicon-valley-bank-bailout/

All those people who wanted SVB’s community development obligations to carry forward vastly outnumbered the people calling for billionaires portfolio companies to be saved — but they merely spoke on behalf of people who sought the most basic of human rights — shelter. No one listened to them. Instead, it was the hyperventilating all-caps “investors” who spent SVB’s no-good weekend shouting on Twitter about the fall of civilization who got what they wanted, with a bow on top, and a glass of publicly funded warm milk before bed.

The US finance sector is reckless to the point of being criminally negligent. It constitutes an existential risk to the nation. And yet, every time it gets into trouble, regulators are able to imagine anything and everything to shift their risks to the public’s shoulders.

Meanwhile, everyday people are frozen out. School lunches? Unaffordable. Student debt cancellation? Inconceivable. Help for the hundreds of thousands of NYC schoolchildren whose schools are facing a $469m hack-and-slash attack? That’s clearly impossible:

https://council.nyc.gov/joseph-borelli/2022/09/06/nyc-council-calls-for-mayor-adams-doe-to-fully-restore-469m-in-school-funding/

When it comes to helping everyday people, American elites and their captured champions in the US government have minds that are so rigid and inflexible that it’s a wonder they can even dress themselves. But when the fortunes and wellbeing of the wealthy and powerful are on the line, their minds are so open that some of their brains actually leak out of their ears and nostrils:

https://pluralistic.net/2023/03/15/mon-dieu-les-guillotines/#ceci-nes-pas-une-bailout

Every bank merger is supposed to come with a “public interest analysis.” But these analyses are “perfunctory.” They needn’t be:

https://openyls.law.yale.edu/bitstream/handle/20.500.13051/8305/Kress_Article._Publication__1_.pdf

First Citizens got a hell of a bargain: it paid zero dollars for SVB’s assets, its deposits and its loans. Any losses it incurs from its commercial loans over the next five years will be paid by the FDIC, no questions asked. The inability of regulators to convince First Citizens to assume SVB’s community obligations along with those billions in public largesse speaks volumes.

Meanwhile, SVB’s shareholders continue to claim that their headquarters are a relatively unimportant office in Manhattan, and not their glittering, massive corporate offices in San Jose, as part of their bid to shift their bankruptcy proceeding to the Southern District of New York, where corporate criminals like the Sackler opioid family have found such a warm reception that they were able to escape “bankruptcy” with billions in the bank, while their victims were left in the cold:

https://pluralistic.net/2023/03/18/2-billion-here-2-billion-there/#socialism-for-the-rich

Contrary to what SVB’s apologists think, the case against them isn’t driven by spite — it’s driven by fury. America’s “socialism for the rich, rugged individualism for the poor” has been with us for generations, but rarely is it so plain as it is in this case.

There’s only two days left in the Kickstarter campaign for the audiobook of my next novel, a post-cyberpunk anti-finance finance thriller about Silicon Valley scams called Red Team Blues. Amazon’s Audible refuses to carry my audiobooks because they’re DRM free, but crowdfunding makes them possible.

[Image ID: A glass-and-steel, high-tech office building. Atop it is a cartoon figure of Humpty Dumpty, whose fall has been arrested by masses of top-hatted financiers, who hold fast to a rope that keeps him in place. At the foot of the office tower is heaped rubble. On top of the rubble is another Humpty Dumpty figure, this one shattered and dripping yolk. Protruding from the rubble are modest multi-family housing units.]

Image:

Lydia (modified)

https://commons.wikimedia.org/wiki/File:Vicroft_Court_Starley_Housing_Co-operative_%282996695836%29.jpg

Oatsy40 (modified)

https://www.flickr.com/photos/oatsy40/21647688003

Håkan Dahlström (modified)

https://www.flickr.com/photos/93755244@N00/4140459965

CC BY 2.0

https://creativecommons.org/licenses/by/2.0/deed.en

#pluralistic#housing crisis#svb#silicon valley bank#plutocracy#bailouts#affording housing#socialism for the rich#rugged individualism for the poor#regional banking#community development banks#housing

89 notes

·

View notes

Text

California is facing a record $68 billion budget deficit.

This is largely attributed to a “severe revenue decline,” according to the state's Legislative Analyst's Office (LAO).

While it’s not the largest deficit the state has ever faced as a percentage of overall spending, it’s the largest in terms of real dollars — and could have a big impact on California taxpayers in the coming years.

Here’s what has eaten into the Golden State’s coffers.

Unprecedented drop in revenue

California is dealing with a revenue shortfall partly due to a delay in 2022-2023 tax collection. The IRS postponed 2022 tax payment deadlines for individuals and businesses in 55 of the 58 California counties to provide relief after a series of natural weather disasters, including severe winter storms, flooding, landslides and mudslides.

Tax payments were originally postponed until Oct. 16, 2023, but hours before the deadline they were further postponed until Nov. 16, 2023. In line with the federal action, California also extended its due date for state tax returns to the same date.

These delays meant California had to adopt its 2023-24 budget before collections began, “without a clear picture of the impact of recent economic weakness on state revenues,” according to the LAO.

Total income tax collections were down 25% in 2022-23, according to the LAO — a decline compared to those seen during the Great Recession and dot-com bust.

“Federal delays in tax collection forced California to pass a budget based on projections instead of actual tax receipts," Erin Mellon, communications director for California Gov. Gavin Newsom, told Fox News. "Now that we have a clearer picture of the state’s finances, we must now solve what would have been last year’s problem in this year’s budget.”

The exodus

California has also lost residents and businesses — and therefore, tax revenue — in recent years.

The Golden State’s population declined for the first time in 2021, as it lost around 281,000 residents, according to the Public Policy Institute of California (PPIC). In 2022, the population dropped again by around 211,000 residents — with many moving to other states like Texas, Oregon, Nevada, and Arizona.

Read more: 'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling inflation

“Housing costs loom large in this dynamic,” according to the PPIC, which found through a survey that 34% of Californians are considering moving out of the state due to housing costs.

Other factors such as the post-pandemic remote work trend — which has resulted in empty office towers in California’s downtown cores — have also played a role in migration out of the state.

Poor economic conditions

In an effort to tame inflation in the U.S., the Federal Reserve has hiked interest rates 11 times — from 0.25% to 5.5% — since March 2022. These actions have made borrowing more expensive and have reduced the amount of money available for investment.

This has cooled California’s economy in a number of ways. Home sales in the state are down by about 50%, according to the LAO, which it largely attributes to the surge in mortgage rates. The monthly mortgage to buy a typical California home has gone from $3,500 to $5,400 over the course of the Fed’s rate hikes the LAO says.

The Fed’s rate hikes have “hit segments of the economy that have an outsized importance to California,” according to the LAO, including startups and technology companies. Investment in the state’s tech economy has “dropped significantly” due to the financial conditions — evidenced by the number of California companies that went public in 2022 and 2023 being down by over 80% from 2021, the LAO says.

One result of this is that California businesses have had less funding to be able to expand their operations or hire new workers. The LAO pointed out that the number of unemployed workers in the Golden State has risen by nearly 200,000 people since the summer of 2022, lifting the percentage from 3.8% to 4.8%.

Fixing the budget crunch

The LAO suggests that California has various options to address its $68 billion budget deficit — including declaring a budget emergency and then withdrawing around $24 billion in cash reserves.

California also has the option to lower school spending to the constitutional minimum — a move that could save around $16.7 billion over three years. It could also cut back on at least $8 billion of temporary or one-time spending in 2024-25.

However, these are just short-term solutions and may not address the state’s longer term budget issues. In the past, the state has cut back on business tax credits and deductions and increased broad-based taxes to generate more revenue.

Mellon did not reveal any specifics behind the state’s recovery plan in her comments to Fox News. She simply said: “In January, the Governor will introduce a balanced budget proposal that addresses our challenges, protects vital services and public safety and brings increased focus on how the state’s investments are being implemented, while ensuring accountability and judicious use of taxpayer money.”

13 notes

·

View notes

Text

As a venture capitalist, JD Vance repeatedly touted his guiding principles for investing in a company: A business should not only turn a profit, it should also help American communities.

That’s why, he said, he invested in AppHarvest, a startup that promised a high-tech future for farming and for the workers of Eastern Kentucky. Over a four-year span, Vance was an early investor, board member and public pitchman for the indoor-agriculture company.

. . .

Last year, facing hundreds of millions of dollars in debt, AppHarvest declared bankruptcy.

. . .

AppHarvest employees said they were forced to work in grueling conditions inside the company’s greenhouse, where temperatures often soared into the triple digits. Complaints filed with the US Department of Labor and a Kentucky regulator between 2020 and 2023 show that workers alleged they were given insufficient water breaks and weren’t provided adequate safety gear. Some workers said they suffered heat exhaustion or injuries, though state inspectors did not find violations.

. . .

“A couple days a week, you’d have an ambulance show up and you seen people leaving on gurneys to go to the hospital.”

The conditions became intolerable, and employees began to leave the company in droves, several workers told CNN. Morgan helped organize an employee sit-in to demand fairer working conditions, and said that he was fired after he took time off for medical care for an injury he said he suffered on the job.

“It was a nightmare that should have never happened,” Morgan said of his experience overall

. . .

As workers left, AppHarvest replaced them with migrant workers, numerous former employees told CNN. By the early fall of 2021, Hester described a workforce that was made up of many workers from countries such as Mexico and Guatemala.

That juxtaposition with the company’s public messaging on jobs was on full display when Senate Minority Leader Mitch McConnell, a Kentucky Republican, toured the greenhouse that November.

“They brought Mitch McConnell into the greenhouse, and they sent every single Hispanic worker home before he got there,” Hester said. “He then proceeded to have a speech about how we were taking the jobs from the Mexicans.” At least five workers confirmed Hester’s account of McConnell’s visit to CNN.

3 notes

·

View notes

Text

Just days after people gleefully posted their Spotify Wrapped, bad news came for the music streaming giant. Spotify announced today that it would cut 17 percent of its workforce, a chunk that equates to an estimated 1,500 people. It’s the third time the world’s largest music streamer has cut jobs this year.

The news came after Spotify posted its first profitable quarter since 2021. In a memo to staff, CEO Daniel Ek said the company had expanded its workforce and offerings significantly throughout 2020 and 2021, thanks to lower-cost capital, but is now bumping up against the same problems startups across industries are facing, like high capital costs and slowed economic growth.

Ek said the cuts may seem “surprisingly large given the recent positive earnings report and our performance,” but due to “the gap between our financial goal state and our current operational costs,” Spotify would take “substantial action.”

Despite its popularity (Spotify held 30 percent of the music streaming market by late 2022), the company has long struggled to turn consistent profits. The layoffs wrap up a bad year: Spotify cut 6 percent of its workforce last January, followed by another 2 percent in June as it slimmed down its podcasting business. Even as the world’s most recognizable music streaming service, Spotify is plagued by an unreliable business model, one in which record companies sit back and rake in royalty payments while artists can struggle to bring in enough cash.

“Investors are increasingly impatient in 2023 for tech firms to start making money,” says Phil Bird, head of rights and royalties at the software development company Vistex. Spotify isn’t alone—tech companies have slashed jobs throughout the year, with more than 250,000 people losing jobs worldwide in 2023, according to layoffs.fyi, a site that tracks job cuts in tech.

Many major tech companies that overhired during the pandemic have taken steps to rightsize—and that’s what Ek says Spotify is doing now. But Spotify’s high cost to license music adds to its financial strain. “The cost of doing business is huge for streaming companies,” Bird says.

Spotify gained momentum in the third quarter of 2023, earning €32 million ($34.6 million) in operating income. It now has 226 million subscribers and 574 million monthly users. “On the surface, it looks great,” says Simon Dyson, senior principal analyst of music and digital audio at consultancy firm Omdia. “It’s [those] nagging costs that it can’t get on top of.”

Spotify and the recording industry have a deeply entwined and sticky relationship: Spotify is seen by some as a savior of the music industry, which flailed after Napster upended music downloading in 1999, but artists earn wildly different incomes based on how Spotify pays. According to a calculation from Billboard, Taylor Swift may have earned nearly $100 million from streaming on Spotify so far this year. Smaller artists earn far less, and music streaming models have long been accused of exploiting them.

Like Spotify, Apple Music and Amazon Music are each charging $10.99 per month for premium subscriptions, and each give access to 100 million songs. But unlike Spotify, Apple and Amazon have massive streams of revenue elsewhere to fall back on. So Spotify has spent the past few years looking for that standout content. It spent more than $1 billion building its podcast world and acquiring exclusive deals to shows like The Joe Rogan Experience. This fall, it began offering paying subscribers in the UK and Australia free audiobook access for 15 hours each month.

The music streaming fight isn’t like the streaming wars, where Max, Netflix, Hulu, and others can each lure in subscribers with a combination of classic and original movies and shows. If Spotify were to charge more for music (it already increased monthly prices from $9.99 to 10.99 in the US this summer), it would risk losing people to comparable services, where people can find the same songs. But unless it can convince people to pay more for music, it might continue to struggle.

“It’s too cheap,” says Dyson. “To have access to every single piece of music that’s ever been released—and ever will be released—for $10 a month is just astounding.” The same is true of Spotify today as was true when it was founded 17 years ago: It’s a business that’s good for listeners and labels but bad for both streamers and artists.

9 notes

·

View notes

Text

Does it feel like Texas is suddenly taking over the national entertainment industry?

Megaproducer Taylor Sheridan – Wind River, Hell or High Water, and now the blockbuster Yellowstone– raised in Fort Worth, is making Western culture popular again and filling rodeo arenas with city folks.

A new force in streaming and cable

Another Texas-based player may be an even more disruptive force in the U.S. entertainment industry.

Great American Media (GAM) is suddenly an overnight contender in the U.S. streaming and cable television space, winning regular coverage in industry flagships like Variety and The Hollywood Reporter, and it has the entertainment industry sitting up and taking notice for its success attracting audiences to faith and family content.

“We’re on our way to being America’s most uplifting and inspiring network,” says CEO Bill Abbott, who founded Great American Media in 2021.

Abbott follows a familiar playbook – his own — perfected over 35 years in family entertainment.

Abbott’s resume includes senior leadership roles at Fox Kids, Fox Family Channel, and ABC Family, plus more than 20 years as the architect of the Hallmark television brands. Now he has launched another TV brand in the burgeoning Dallas-Fort Worth metroplex, a big community with small-town sensibilities and a dedicated and talented populace, he says.

As the engineer of the next big thing, Abbott pulled on both experience and his friends, instantly creating a crew of iconic TV stars, including Mario Lopez, Danica McKellar, Cameron Mathison, Alexa and Carlos PenaVega, and, of course, Candace Cameron Bure.

These stars are making an appearance at iconic venues across the nation for spotlight events and movie production. Carlos and Alexa PenaVega spent the day at AT&T Stadium in Dallas – right down the road from the headquarters of Great America Media – filming their upcoming holiday premiere movie. Not only is the AT&T Stadium recognizable by many, but this production further solidifies Abbott’s dedication to creating uplifting, quality content.

Today, his startup boasts over 70 million viewers and subscribers to its cable television channels and streaming service, a remarkable feat in any environment. The last three years have been some of the most tumultuous in television and entertainment history, with a record decline in cable subscribers and increasing competition among streaming services. Yet Great American Media is on the rise.

The success is a testament to early mornings, continual conference calls, coast-to-coast travel, and non-stop team building. Every Friday, Abbott hosts a company-wide review of the market and a company performance where he answers employees’ questions nationwide. One staffer describes it as a master class in cable and streaming television.

Great American Media’s Fort Worth headquarters includes production and administrative offices, while its sales and executive offices are in New York. Its member services center, a call center supporting a committed fan base, is in Phoenix.

“One of the most rewarding parts of my jobs is to read viewer emails,” says Abbott, who regularly corresponds with a group of over 25,000 loyal Great American Media Insiders. “Our viewers know what they want and it’s our job to give them a great uplifting experience free of the stress and contentiousness of their already overly complex world.”

Great American Media’s portfolio of brands now includes Great American Family, Great American Pure Flix, Great American Faith & Living, Great American Adventures, and Pure Flix TV.

As the company’s flagship cable TV network, Great American Family, features quality original movies and classic series that are inspiring and emotionally connecting. The business strategy is to align the content and convert cable viewers to streaming subscribers, a riddle many in Hollywood are attempting to solve.

Great American Pure Flix is GAM’s leading subscription on-demand streaming service and the most successful faith-based content provider of its size. A recent Financial Times story described GAM as the Netflix of faith-based content, to which Abbott responds, “Not bad company to be in after only three years.”

Great American Faith & Living features mostly unscripted lifestyle programming that celebrates family-friendly traditions every day and every season.

Great American Media is also home to a FAST (free ad-supporting streaming TV) channel with Great American Adventures, which offers both scripted and unscripted content, including cooking and do-it-yourself programs, and Great American Community, a free direct-to-consumer streaming app featuring short-form original series hosted by well-known lifestyle experts and TV stars. There is also a Pure Flix FAST channel.

“We are creating an oasis in a cultural desert,” says Candace Cameron Bure, star of many Great American Media original programs, including hit My Christmas Hero. She joined Abbott at the film’s screening on Joint Base Lewis-McChord in Tacoma, Washington.

Abbott agrees, saying, “I think that the culture overall needs what we’re offering. And there is just so little content out there that serves family and faith and yet is done in a quality way. It is a very big part of what our mission is and what we do, and the demand is huge.”

Not His First Rodeo

Abbott founded Great American Media in June 2021 with backing from Dallas-based investors, including Dallas businessman Doug Deason. Abbott credits Deason with the company’s steady focus on strategy.

“After running companies that possess varying levels of leadership and judgment exercised at the board and ownership level, I know first-hand that these qualities can make or break a business, and Great American Media’s success starts with Doug in his role as Chairman of the Board,” says Abbott.

Deason, who most recently demonstrated political acumen by leading an initiative to get Texans to set aside $1 billion to expand Texas state parks and co-chaired the expansion of Dallas’ Centennial Parks.

“Without Doug’s unwavering support, vision, and courage, Great American Media would lack the ability to stand firmly behind the values conveyed in our faith and family content,” says Abbott, “and in fact, it’s quite likely the business would never have gotten off the ground.”

Deason credits Abbott, who he points out is unique among broadcasting executives, who more typically are finance types or lawyers and rarely schooled in stories, let alone moral tales. Abbott is an English and Literature graduate of the College of the Holy Cross, a private Jesuit liberal arts college in Worcester, Massachusetts, a foundation he puts to good use by reading every script and participating in creative development with his producers and stars.

GAM’s CEO is deeply respected in the industry and serves on the boards of the Parents Television & Media Council and the International Radio & Television Society Foundation. He was inducted into Broadcasting & Cable’s Hall of Fame in 2017.

Previously, Abbott served for two decades as a senior executive and then CEO of Crown Media Family Networks, the parent company of Hallmark Channel, Hallmark Mystery, Hallmark Drama, and Hallmark Movies Now.

“We had tremendous success with creating a destination that was family-friendly and themed around the holidays,” explains Abbott. He is credited with creating the Christmas television genre, expanding the network’s romantic comedies, and launching its mysteries channel.

After 20 years, Abbott left Hallmark and looked to Texas to build a new network: Great American Family.

“We’re proud to say we celebrate faith, family, and country,” explains Abbott, “and we have an investor group where we all believe in the mission of family-friendly and faith-based content.”

Equipped with funding and a vision, Abbott acquired Fort Worth’s independently owned equestrian and western channel Ride TV and a music video channel called Great American Country from Discovery. This gave his fledgling dream two traditional cable television linear channels. As the company sorted through its inherited programs and shows, Great American Media was quickly rebranded.

“Now we had something to work with, and we went to work,” he explained.

The entertainment world suddenly noticed when the new GAM network acquired Michael Landon Jr.’s When Calls the Heart spin-off, When Hope Calls,” and began hiring the most well-known talent in the genre to appear in its own slate of made-for-TV movies.

GAM also quickly established Great American Christmas premieres and seasonal rotation around Christmas, including 12 original movies in its first year. Now, they’re producing more than 20 original Christmas movies per year.

Dream Streaming

While building a traditional cable offering, Abbott heard from Sony Pictures Entertainment, one of the world’s largest entertainment conglomerates. They owned Pure Flix, a niche faith-based streaming video-on-demand service with a loyal fan base.

“Pure Flix had been sort of under the radar,” explained Abbott. Sony had only recently acquired the streaming service and began looking for a means of growing it. Sony executives saw the synergies between Abbott’s startup, the Great American Family channel, and their streamer and proposed a merger.

The merger enhanced both platforms’ content library and created synergies between cable and streaming services, meeting customer expectations for a fulfilling, uplifting, and inspiring entertainment experience. Since the merger, SVOD subscriptions have increased, and the customer experience has been enhanced through several platform upgrades, making the streaming service intuitive and user-friendly.

“Our brands and diversified content distribution capabilities have helped us reach substantially larger and broader audiences on each platform, creating a family- and faith-friendly streaming service unlike any other,” he added. “Our business strategy is becoming more and more clear to the industry.”

And they’re noticing. Great American Media ncluded 2023 as the fastest-growing channel on cable television, and its ad sales were up 25 percent. Under Abbott’s watchful eye, the economy balances with creative excellence, allowing the GAM channels to increasingly share the same programming vision, creating the brand synergies critical to growth.

Great American Media’s programming and development team steers all original scripts from concept through production with an eye toward brand integrity. Abbott and the leadership team ensure every frame it controls is on brand as promised.

Great American Media has made headlines for the stars it has drawn in its first few years, including Candace Cameron Bure, Danica McKellar, Trevor Donovan, Jill Wagner, Jen Lilley, Cameron Mathison, and Jen Lilley.

In February, Great American Media announced it signed Emmy Award–winning host and actor Mario Lopez to a multi-picture, multi-year deal to star in content across the company’s vast media portfolio. Lopez will be a major part of Great American Christmas 2024. His first film in the partnership will include a holiday film starring alongside his wife and Broadway star Courtney Lopez. Lopez will continue hosting NBC’s Access Hollywood and Access Daily.

Abbott cites the dedicated Fort Worth team and the talent across Texas as a critical aspect of GAM’s success, noting that programmers and production crews work around the clock and maintain a high commitment to the brand and its viewers.

As conglomerates continue to obliterate brands, Abbott is on a mission to maintain his company’s commitment to bringing high-quality family content with a faith focus to a new heyday.

“We are not replicating the past; we are creating a new bright future, diverse in genre and format, but all wrapped in high-quality family programming that features romantic comedies, Christmas, drama, faith-inspired lifestyles, and even drama series,” says Abbott. Mysteries are now a cornerstone of the broad programming, with Great American Mysteries’ inaugural launch, The Ainsley McGregor Mysteries: A Case for the Winemaker, starring Cameron Bure, premiering on July 25.

“We’re about faith, family, and country,” said Abbott, “and those values can be reflected in uplifting and inspiring ways across all genres, including mysteries.”

2 notes

·

View notes

Text

youtube

Incredibly fast alternative small business loans, funding working capital with low interest, same day funding available, equipment financing for the tools you need, and much more.

Your Competition Is Back to Growing. Are You? If Not Get Funding Now.

Our simple application connects you with our lender marketplace to get you the best rates, terms, and amounts.

Best Small Business Loans

Your opportunity is waiting, but not for long. Let ASB Capital Loan Funding help you seize it before it’s too late! Choose from a variety of financing options (based on your needs) to take your business to the next level.

We’re here to help your business grow! Our Business Financing Advisors fight every day to get you the funding you deserve, and have a great time doing it!

You Are Just Hours Away From The Money You Need!

1. Apply with a free, easy and frictionless digital application in less than 60 seconds.

2. Connect with your Business Financing Advisor, who will reach out to learn more about your goals, and answer any questions.

3. Match with one (or several) lenders available in our Lender Marketplace to find the best offers (lowest rates, highest amounts, and best terms).

4. Review offers tailored to help your business grow in real time, and choose the best one for your business with guidance from your Business Financing Advisor.

5. Get Funded in as little as a few hours, and get back to what’s most important: growing your business!

When your bank or SBA can't help, we can!

LEARN MORE

Courtesy of ASB Capital Loan Funding

#small business loans#business capital#grants for small business#grants for black business owners#grants for small business start up#black women entrepreneurs#grants for small business startup 2021#business loan#business loan 2021#business grants for small business#business grants for disabled veterans#business grants for startups#business loan requirements#business grants 2021#business loan interest rates#grants for startups 2021#black owned business grants#Youtube#smallbusinessloans#BusinessLineofCredit#EquipmentFinancing#HybridgeSBALoan#PerformanceAdvance#CannaBusinessFinancingSolution#Cannabisbusinessloans#marijuanabusinessloans#AssetBasedLending#SBALoans#AccountsReceivableFinancing#LoansforDoctors

0 notes

Text

Erik Ortiz and Daniel Arkin at NBC News:

In recent years, The Epoch Times has amassed a large audience as a publisher of right-wing news articles and peddler of baseless election conspiracies. This summer, the conservative media company is hoping to conquer new territory: Hollywood.

Epoch Studios, a branch of the wider Epoch Times Association, plans to release “The Firing Squad,” a drama starring Kevin Sorbo and Cuba Gooding Jr. as drug smugglers who find God behind bars.

“The Firing Squad” marks Epoch’s entry into the growing market of faith-based cinema, a genre that includes recent box-office successes such as “Sound of Freedom,” “Unsung Hero” and “Jesus Revolution.” The film’s Aug. 2 theatrical debut comes as other right-wing media companies are pushing into entertainment, releasing content that counters what conservatives view as Hollywood’s progressive and secular agenda.

The creation of Epoch Studios has caught the attention of those who have closely watched the New York-based media company’s ascent from a fringe print newspaper startup formed in 2000 by followers of Falun Gong, a religious group persecuted in China, into a prominent conservative outlet with content amplifying Donald Trump’s conspiracies and right-wing messaging.

[...]

In a news release announcing “The Firing Squad,” Epoch Studios described itself as a “platform for storytelling that fosters hope, healing, and growth.” The studio is overseen by executive director Sally Sun, who has supervised Epoch documentaries and streaming specials, some with religious themes, such as “Divine Messengers” and “Church & State.”

The Epoch Times Association did not respond to a request for comment on this article.

Tim Chey, who wrote and directed “The Firing Squad,” told NBC News he is grateful that Epoch Studios came aboard his passion project as a co-producer and distributor.

“I’m a huge fan of Epoch Times. I absolutely love these guys,” Chey said in a recent interview.

Chey’s film follows three Christians — played by actors Sorbo (TV’s “Hercules”), Gooding Jr. and James Barrington — who are set to be executed by firing squad in Indonesia. (Right-wing audiences may seek out the film in part because of Sorbo, a pro-Trump conservative activist who previously appeared in the Christian film “God’s Not Dead” and produces faith-based movies through his own production company.)

“The Firing Squad” is inspired by actual events in the country in 2015, when eight people convicted of drug smuggling were put to death. One of them, an Australian national, became a Christian pastor while on death row and led the singing of Christian songs while the smugglers were being executed. (The Southeast Asian nation is known for its strict drug laws.)

[...]

But whether Epoch Studios can attain the cultural prominence and commercial reach of other conservative and Christian-focused media companies remains to be seen. (“The Firing Squad” debuts in theaters the same weekend as the kid-friendly “Harold and the Purple Crayon” and a new psychological thriller from M. Night Shyamalan.)

The Daily Wire, which was founded by conservative political commentator Ben Shapiro and film director Jeremy Boreing, launched its own movie and TV studio in 2021. Fox Nation, the entertainment unit of Fox News, runs a streaming service that hosts various reality shows and historical documentaries. Great American Pure Flix, a production company with a streaming service, features Christian-themed movies that have found mainstream success, including the “God’s Not Dead” series.

Big corporate players have clearly seen a business opportunity, too. Sony Pictures owns the independent Christian studio Affirm Films, which has produced and distributed titles such as the Jennifer Garner vehicle “Miracles From Heaven” and last year’s “Big George Foreman.”

Right-wing propaganda outlet The Epoch Times has added a new market: faith-based films. The launch of Epoch Studios and their plan to release The Firing Squad in a similar manner to Sound Of Freedom.

#The Epoch Times#The Firing Squad#Conservative Media Apparatus#Epoch Studios#Kevin Sorbo#Tim Chey#James Barrington#Cuba Gooding Jr.#Film

2 notes

·

View notes

Text

FDI in India: Unleashing Growth Potential in 2024

Introduction

Foreign Direct Investment (FDI) has been a cornerstone of India's economic growth, driving industrial development, technological advancement, and job creation. As we move into 2024, the FDI landscape in India is poised for substantial growth, bolstered by a favorable policy environment, a burgeoning consumer market, and strategic government initiatives. This blog delves into the potential of FDI in India for 2024, examining the key sectors attracting investment, the regulatory framework, and the strategies investors can employ to navigate this dynamic market.

The Significance of FDI in India

FDI is crucial for India’s economic progress, providing the capital, technology, and expertise needed to enhance productivity and competitiveness. It facilitates the integration of India into the global economy, stimulates innovation, and creates employment opportunities. Over the past decade, India has emerged as one of the top destinations for FDI, reflecting its economic resilience and strategic importance.

Historical Context and Recent Trends

India's FDI inflows have shown a consistent upward trend, reaching record levels in recent years. According to the Department for Promotion of Industry and Internal Trade (DPIIT), India attracted FDI inflows worth $81.72 billion in 2021-22, highlighting its strong appeal among global investors. The sectors that have traditionally attracted significant FDI include services, telecommunications, computer software and hardware, trading, construction, and automobiles.

Key Factors Driving FDI in India

1. Economic Growth and Market Size

India's economy is one of the fastest-growing in the world, with a projected GDP growth rate of around 6-7% in 2024. The country’s large and youthful population offers a vast consumer base, making it an attractive market for foreign investors. The rising middle class and increasing disposable incomes further fuel demand across various sectors.

2. Strategic Government Initiatives

The Indian government has implemented several initiatives to make the country more investor-friendly. Programs like 'Make in India,' 'Digital India,' and 'Startup India' are designed to boost manufacturing, digital infrastructure, and entrepreneurial ventures. These initiatives, coupled with reforms in labor laws and ease of doing business, create a conducive environment for FDI.

3. Infrastructure Development

Significant investments in infrastructure development, including roads, railways, ports, and urban infrastructure, enhance connectivity and logistics efficiency. The development of industrial corridors and smart cities further improves the attractiveness of India as an investment destination.

4. Favorable Regulatory Environment

India has progressively liberalized its FDI policy, allowing 100% FDI in most sectors under the automatic route. This means that foreign investors do not require prior government approval, simplifying the investment process. The government has also streamlined regulatory procedures and improved transparency to facilitate ease of doing business.

Key Sectors Attracting FDI in 2024

1. Technology and Digital Economy

The technology sector continues to be a magnet for FDI, driven by India’s growing digital ecosystem, skilled workforce, and innovation capabilities. Investments in software development, IT services, and emerging technologies like artificial intelligence, blockchain, and cybersecurity are expected to surge.

2. Manufacturing and Industrial Production

The 'Make in India' initiative aims to transform India into a global manufacturing hub. Key sectors attracting FDI include electronics, automobiles, pharmaceuticals, and renewable energy. The Production-Linked Incentive (PLI) schemes introduced by the government provide financial incentives to boost manufacturing and attract foreign investment.

3. Healthcare and Biotechnology

The COVID-19 pandemic has underscored the importance of healthcare infrastructure and innovation. India’s pharmaceutical industry, known for its generic drug production, continues to attract substantial FDI. Additionally, biotechnology and medical devices are emerging as significant sectors for investment.

4. Infrastructure and Real Estate

Infrastructure development is critical for sustaining economic growth. Sectors like transportation, logistics, urban development, and real estate offer significant investment opportunities. The government's focus on developing smart cities and industrial corridors presents lucrative prospects for foreign investors.

5. Renewable Energy

With a commitment to achieving net-zero emissions by 2070, India is focusing on renewable energy sources. The solar, wind, and hydroelectric power sectors are witnessing substantial investments. The government's policies and incentives for green energy projects make this a promising area for FDI.

Regulatory Framework for FDI in India

Understanding the regulatory framework is essential for investors looking to enter the Indian market. The key aspects of India's FDI policy include:

1. FDI Policy and Routes

FDI in India can be routed through the automatic route or the government route. Under the automatic route, no prior approval is required, and investments can be made directly. Under the government route, prior approval from the concerned ministries or departments is necessary. The sectors open to 100% FDI under the automatic route include:

- Infrastructure

- E-commerce

- IT and BPM (Business Process Management)

- Renewable Energy

2. Sectoral Caps and Conditions

While many sectors allow 100% FDI, some have sectoral caps and conditions. For example:

- Defense: Up to 74% FDI under the automatic route, and beyond 74% under the government route in certain cases.

- Telecommunications: Up to 100% FDI allowed, with up to 49% under the automatic route and beyond that through the government route.

- Insurance: Up to 74% FDI under the automatic route.

3. Regulatory Authorities

Several regulatory authorities oversee FDI in India, ensuring compliance with laws and policies. These include:

- Reserve Bank of India (RBI): Oversees foreign exchange regulations.

- Securities and Exchange Board of India (SEBI): Regulates investments in capital markets.

- Department for Promotion of Industry and Internal Trade (DPIIT): Formulates and monitors FDI policies.

4. Compliance and Reporting Requirements

Investors must comply with various reporting requirements, including:

- Filing of FDI-related returns: Periodic filings to RBI and other regulatory bodies.

- Adherence to sector-specific regulations: Compliance with industry-specific norms and guidelines.

- Corporate Governance Standards: Ensuring adherence to governance standards as per the Companies Act, 2013.

Strategies for Navigating the FDI Landscape

1. Thorough Market Research

Conducting comprehensive market research is crucial for understanding the competitive landscape, consumer behavior, and regulatory environment. Investors should analyze market trends, identify potential risks, and evaluate the long-term viability of their investment.

2. Partnering with Local Entities

Collaborating with local businesses can provide valuable insights into the market and help navigate regulatory complexities. Joint ventures and strategic alliances with Indian companies can facilitate market entry and expansion.

3. Leveraging Government Initiatives

Tapping into government initiatives like 'Make in India' and PLI schemes can provide financial incentives and support for setting up manufacturing units and other projects. Staying updated on policy changes and leveraging these initiatives can enhance investment returns.

4. Ensuring Legal and Regulatory Compliance

Compliance with local laws and regulations is paramount. Engaging legal and financial advisors with expertise in Indian regulations can ensure that all legal requirements are met. This includes obtaining necessary approvals, adhering to reporting norms, and maintaining corporate governance standards.

5. Focusing on Sustainable Investments

Given the global emphasis on sustainability, investments in green technologies and sustainable practices can offer long-term benefits. The Indian government’s focus on renewable energy and sustainable development provides ample opportunities for environmentally conscious investments.

Conclusion

India's FDI landscape in 2024 is ripe with opportunities across various sectors, driven by robust economic growth, strategic government initiatives, and a favorable regulatory environment. However, navigating this dynamic market requires a deep understanding of the legal and regulatory framework, thorough market research, and strategic partnerships.

For investors looking to unleash the growth potential of their investments in India, staying informed about policy changes, leveraging government incentives, and ensuring compliance with local laws are critical. By adopting a strategic approach and focusing on sustainable investments, foreign investors can tap into the immense opportunities offered by the Indian market and contribute to its economic transformation.

In conclusion, FDI in India in 2024 presents a compelling opportunity for global investors. With the right strategies and guidance, investors can navigate the complexities of the Indian market and achieve significant growth and success.

This post was originally published on: Foxnangel

#fdi in india#fdi investment in india#foreign direct investment in india#economic growth#foreign investors#startup india#pli schemes#renewable energy#indian market#foxnangel

2 notes

·

View notes

Text

B.S.ers Are SOL in Copywriter Jeff Putnam's World

Professional Sales Tips you'll learn today on The Sales Podcast ...

Listen to Jeff Putnam’s first interview on The Sales Podcast, episode 510, back on June 23, 2021, and see the change he’s made

Deep down, he always wanted to be a writer

He did a project as a kid on Ernest Hemingway and saw a picture of him smoking a cigar and hunting a shark with a machine gun that lit a fire

In December 2018, he got the idea for Rugged Legacy and launched it in early 2019

He didn’t want to work for anyone else

He had to learn copywriting so his business wouldn’t die

Then, he started teaching people how to do it

Wrote two books, and he reads all the time

Related episodes and posts

Find The Best CRM For Your Team and Budget

Start Your Free 12 Weeks To Peak™

Working on a novel and is about 1/3rd complete

Most people suck at writing so they pay him to write

Now 99% of his income comes from writing for others

He focused on Twitter rather than building a “personal brand”

He got so busy with work that he didn’t have the time or interest in building a brand

He no longer promotes himself online

People know who he is

He has a great network now

He has some coaching clients

He wakes up at five am, takes his huskie for a walk, gets some coffee, reads for four hours, then starts his day writing for clients

Vince Flynn/Mitch Rapp series

Jack Reacher series by Lee Child

Loves Musashi by Eiji Yoshikawa

Will reference a business book but doesn’t sit and read them

Does not like the appeal of the “digital nomad” lifestyle

He doesn’t want to live out of seven suitcases

He spent nearly five years hustling and grinding and perfecting his writing craft

A customer of his asked him if he’d help with their website, and that became his first paying copywriting client, but he was visible and active online and on Twitter, so they knew him

He Googled typical prices for copywriting and added 20% to that

Then he raised his prices until people balked, and then he dropped his prices 5%

He’ll include three revisions, but the fourth is 50% of the original invoice

He doesn’t design websites, but he writes the copy

He loves writing long-form content like 80-page white papers

He’ll write 16k-20k words every ten days or so

Many people confuse niche and industry

He can research any industry and write about it

A Web 3 startup paid him $60k upfront ($5k/mo) to do all of their content, and he had no experience in that space

The Web 3 client saw an article Jeff wrote on marriage and reached out to him

If clients are jerks, he cuts them loose

He charges 6-7 cents per word

He just does words

He uses AI as a style guide by uploading something like a five-paragraph description the client provides

“Additionally…in a fast-paced world…”

He loves 3-piece suits

Anchoring…

He’ll sometimes wear his suit to write to anchor himself

“Okay”

Zuby

“I’m a serious Catholic”

Adoration and Holy Hours and Mass

He carries his rosary always

He has Catholic cigars, Incensum Cigars

He converted to Catholicism last year

There are only 450 TLM churches in the U.S.

His wife is Hispanic who grew up in New England and is Catholic

He spent 18 months writing a book on Catholic masculinity

He decided to go to Mass May 7, 2023, which was two months after he launched the book

His wife was a lapsed Catholic, but now they go weekly

He’s in RCIA and entering the Catholic Church fully this Easter

Sales Growth Tools Mentioned In The Sales Podcast

Have Me Take a Look at Your Business Processes

Get This $19 CRM

Get 10% The Best Beef You’ll Ever Put In Your Mouth

Send Drunk Emails: ...that get opened and get you paid!

Phone Burner: work the phone like a machine so you can be a human when you connect.

GUEST INFO:

Guest Twitter

PODCAST INFO:

Podcast website

Apple Podcasts

Spotify

YouTube

SUPPORT & CONNECT: Check out the sponsors above; it’s the best way to support this podcast

Support on Patreon: https://www.patreon.com/TheWes

Twitter: https://twitter.com/saleswhisperer

Instagram: https://instagram.com/saleswhisperer

LinkedIn: https://www.linkedin.com/in/thesaleswhisperer/

Facebook: https://www.facebook.com/thesaleswhisperer

YouTube: https://www.youtube.com/thesaleswhispererwes

Check out The Sales Podcast's latest episode

2 notes

·

View notes

Text

I posted 2,632 times in 2022

That's 1,578 more posts than 2021!

831 posts created (32%)

1,801 posts reblogged (68%)

Blogs I reblogged the most:

@sreegs

@kilgorezouzou

@red-mercer

@howling-techie

@iamoutofideas

I tagged 2,367 of my posts in 2022

Only 10% of my posts had no tags

#tumblr - 378 posts

#star trek - 132 posts

#hell - 106 posts

#meme - 75 posts

#world heritage post - 74 posts

#ds9 - 63 posts

#guy fieri - 58 posts

#tumblr ads - 54 posts

#feliz jueves - 54 posts

#ai - 51 posts

Longest Tag: 132 characters

#the memories april fools was kind of one of these things that made it through as a joke about features that every social network has

My Top Posts in 2022:

#5

35,469 notes - Posted June 6, 2022

#4

who's so busy they have to tag a two second video "watch later"?

38,396 notes - Posted March 18, 2022

#3

Years ago, when Tumblr was still owned by Yahoo, Yahoo wanted Tumblr to use their video player, rather than Tumblr's own video player. This was partially to unify analytics, but mostly because Yahoo planned to put pre-roll ads on Tumblr videos. You know those unskippable Youtube ads? That's what was going to happen to Tumblr videos.

The only reason it didn't happen out is because Tumblr staff pushed back on the idea, saying it was absolutely idiotic and would anger users beyond their breaking point.

The next time you're angry at staff for fucking up something a lil bit, or trying to make money in some optional way, keep this in mind.

84,463 notes - Posted February 25, 2022

#2

As the staff post about ad-free tumblr continues to get thousands of notes telling staff to fuck off in the tags, I wanna remind you that this website's days are numbered. Tumblr is still unprofitable and by some modern-day miracle none of its acquiring companies pulled the plug on this money pit. But it will happen if it continues its trajectory.

Whether you like it or not, Tumblr needs to make money off you somehow in order to stay up. It either serves ads or asks for money to use it. This has been a paradigm on the web longer than many of you have been alive. It's Tumblr's job to make money right now because it's well past its grace period of being a black hole for cash. This has actually always been Tumblr's job, since it is a corporation, but that's capitalism for ya.

If you want Tumblr to be here for free and you want to continue to use it, you do yourself a disservice by opposing any changes Tumblr makes in order to pay for its costs. When this site finally goes belly-up then you're gonna be Tumblr-less until whatever startup takes its place and the cycle repeats itself.

If you think it should just ask for donations Wikipedia-style, remember that if and when that happens, there will be users repeating the same tired bullshit about giving Tumblr any money.

105,961 notes - Posted February 24, 2022

My #1 post of 2022

ah you can't tip yourself

123,340 notes - Posted March 30, 2022

Get your Tumblr 2022 Year in Review →

#tumblr2022#year in review#my 2022 tumblr year in review#your tumblr year in review#oh did i manage to feliz every jueves??

21 notes

·

View notes

Text

Pricing Best Practices in the Fashion Industry

Written By: Gargi Sarma

Introduction:

The fashion industry's retail pricing landscape is a complex and ever-changing environment that is influenced by a wide range of factors, including customer demand, market trends, brand positioning, and production costs. Pricing strategies are crucial in defining a brand's competitiveness, profitability, and overall market placement in the dynamic world of fashion. Fashion merchants must make wise decisions to strike a delicate balance between providing value to customers and upholding a sustainable business strategy. This investigation explores the nuances of retail pricing in the fashion sector, illuminating the important factors, difficulties, and tactics that companies use to deal with this complicated environment. Understanding the factors at work is crucial for both industry insiders and consumers looking to get insight into the dynamics that drive the cost of style, from the impact of rapid fashion to the growth of e-commerce.

With a predicted cumulative annual growth rate (CAGR) of 3.8%, the worldwide fashion retail market, estimated at USD 1.9 trillion in 2022, is expected to reach USD 2.2 trillion by 2025 (Statista).

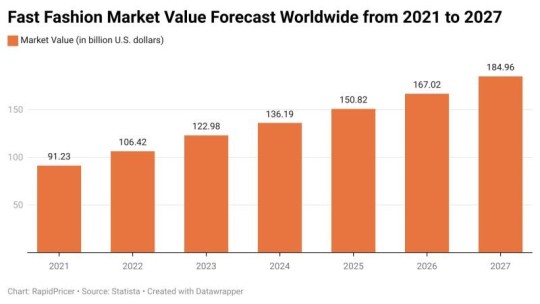

Figure 1: Fast Fashion Market Value Forecast Worldwide 2021 to 2027

In 2022, the global fast fashion market was projected to be valued at more than 106 billion dollars. It was predicted that this would increase significantly in the ensuing years. It was projected that the fast fashion industry would have a global market value of about 185 billion dollars by 2027.

Now let us explore the subtleties of fashion retail pricing and discover the strategies that fashion retailers can use to draw in customers, build brand loyalty, and stay afloat in the always-shifting global fashion industry.

Competitive Pricing in the Fashion Industry:

The fashion industry presents itself as a dazzling realm of short-lived fads and high-stakes trends, but retail pricing is really a battlefield of ruthlessness. Here, companies compete for consumers' attention and market share by using price tags as weapons in an unending battle for their part of their wallets. With a compound annual growth rate (CAGR) of 6.47%, the global fashion retailing market is projected to reach USD 122.6 billion by 2027 from USD 89.61 billion in 2022.

Merchants cannot reliably duplicate that performance over thousands of styles, not even when they precisely balance all the relevant criteria and evaluate them for a given style. For them to incorporate this level of rigor into their daily merchandising, they require at-scale analytical skills.

Successful clothing companies have figured out how to use a scalable, intelligent pricing discipline that responds to their customer's willingness to pay. These retailers are making more informed judgments by carefully considering their price and promotion expenditures and by utilizing insights from advanced analytics.

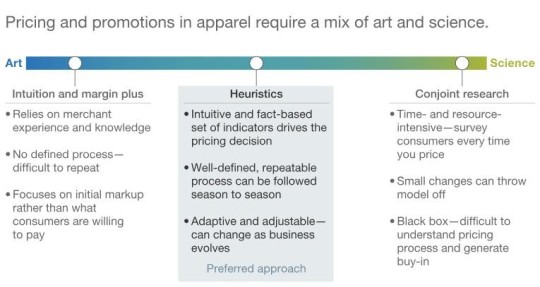

This does not imply that business owners should give up on setting prices. Fashion's seasonality and constantly shifting trends necessitate a pricing strategy that combines science and intuition, even if automated pricing solutions have been successful in several hardline categories (Figure 2).

Figure 2: Pricing and promotions in Fashion Industry (Source: McKinsey & Company)

Intensity of Competition:

High Saturation: There are a plethora of players in the fashion business, ranging from agile online startups to international behemoths. Because there are so many options available, customers are picky and brands are striving to distinguish out.

Rules of Transparency: Comparing prices is now quite easy thanks to the internet. Brands are continually forced to modify and improve their pricing tactics as a result of consumers' ability to instantaneously pit them against one another.

Quick Fashion Madness: Traditional fashion is under pressure as fast fashion's lightning-fast pace produces stylish items at ridiculously low costs. Strategic discounting is essential to the fast fashion industry, which is defined by its quick trend cycles and reasonably priced clothing. However, the discounting game becomes more difficult when there are several retail locations. It can be very difficult to strike a balance between local competitiveness, consumer behavior, and profitability across many geographies

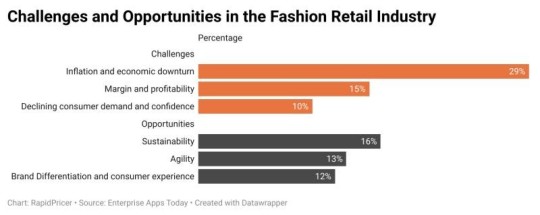

Figure 3: Challenges and Opportunities in the Fashion Retail Industry

Sustainability is regarded as the best opportunity for fashion retail firms, according to a 2022 study of fashion professionals globally (Enterprise Apps Today). Of those surveyed, about sixteen percent said that the biggest opportunity facing the fashion sector in 2023 is sustainability. In the same year, the industry was expected to face major challenges mostly from inflation and economic deterioration.

Data Highlights:

According to a McKinsey analysis from 2021, 70% of fashion executives consider pricing to be their most important strategic tool.

According to a 2022 Edited research, the average discount percentage in the US across all apparel categories was an astounding 54%. This demonstrates how common markdowns are and how constant demand to offer offers is.

The Environment of Competition:

Value vs. Premium: Brands with a tight budget, like as Zara and H&M, rely on providing fashionable looks at reasonable costs. In the meantime, high-end brands such as Chanel and Dior demand premium pricing due to their exclusivity and fine craftsmanship.

Niche vs. Mass: Independent, smaller firms frequently establish a niche by focusing on particular ideals or styles. They must, meanwhile, contend with bigger firms' extensive reach and powerful marketing campaigns.

Online vs. Offline: Traditional retail has been upended by e-commerce. There is more pricing competitiveness when brick-and-mortar stores are undercut by online sellers due to lower overhead costs.

New Approach in Fashion Retail Pricing:

A flurry of cutting-edge tactics that put data, personalization, and dynamic adjustments front and center are challenging the conventional, one-size-fits-all approach to clothing pricing. Let us examine some of the novel strategies that are transforming the fashion pricing landscape: