#startup technical cofounder

Text

Finding a technical cofounder for your startup can be a challenging but crucial task, especially if your business is technology-driven or relies heavily on technical expertise. Here are the different ways to find a technical co-founder for your startup business.

#startup#startup business#business ideas#ideas into startup#technical cofounder#startup technical cofounder

1 note

·

View note

Text

Taking Risk

I just spent a week talking with some exceptional students from three of the UK's top universities; Cambridge, Oxford and Imperial College. Along with UCL, these British universities represent 4 of the top 10 universities in the world. The US - a country with 5x more people and 8x higher GDP - has the same number of universities in the global top 10.

On these visits, I was struck by the world-class quality of technical talent, especially in AI and biosciences. But I was also struck by something else. After their studies, most of these smart young people wanted to go and work at companies like McKinsey, Goldman Sachs or Google.

I now live in San Francisco and invest in early-stage startups at Y Combinator, and it's striking how undergraduates at top US universities start companies at more than 5x the rate of their British-educated peers. Oxford is ranked 50th in the world, while Cambridge is 61st. Imperial just makes the list at #100. I have been thinking a lot about why this is. The UK certainly doesn't lack the talent or education, and I don't think it's any longer about access to capital.

People like to talk about the role of government incentives, but San Francisco politicians certainly haven't done much to help the startup ecosystem over the last few years, while the UK government has passed a raft of supportive measures.

Instead, I think it's something more deep-rooted - in the UK, the ideas of taking risk and of brazen, commercial ambition are seen as negatives. The American dream is the belief that anyone can be successful if they are smart enough and work hard enough. Whether or not it is the reality for most Americans, Silicon Valley thrives on this optimism.

The US has a positive-sum mindset that business growth will create more wealth and prosperity and that most people overall will benefit as a result. The approach to business in the UK and Europe feels zero-sum. Our instinct is to regulate and tax the technologies that are being pioneered in California, in the misguided belief that it will give us some kind of competitive advantage.

Young people who consider starting businesses are discouraged and the vast majority of our smart, technical graduates take "safe" jobs at prestigious employers. I am trying to figure out why that is.

___

Growing up, every successful adult in my life seemed to be a banker, a lawyer or perhaps a civil engineer, like my father. I didn't know a single person who programmed computers as a job. I taught myself to code entirely from books and the internet in the late 1990s. The pinnacle of my parents' ambition for me was to go to Oxford and study law.

And so I did. While at university, the high-status thing was to work for a prestigious law firm, an investment bank or a management consultancy, and then perhaps move to Private Equity after 3 or 4 years. But while other students were getting summer internships, I launched a startup with two friends. It was an online student marketplace - a bit like eBay - for students. We tried to raise money in the UK in 2006, but found it impossible. One of my cofounders, Kulveer, had a full-time job at Deutsche Bank in London which he left to focus on the startup. His friends were incredulous - they were worried he'd become homeless. My two cofounders eventually got sick of trying to raise money in the UK and moved out to San Francisco. I was too risk-averse to join them - I quit the startup to finish my law degree and then became a management consultant - it seemed like the thing that smart, ambitious students should do. The idea that I could launch a startup instead of getting a "real" job seemed totally implausible.

But in 2011, I turned down a job at McKinsey to start a company, a payments business called GoCardless, with two more friends from university. We managed to get an offer of investment (in the US) just days before my start date at McKinsey, which finally gave me the confidence to choose the startup over a prestigious job offer. My parents were very worried and a friend of my father, who was an investment banker at the time, took me to one side to warn me that this would be the worst decision I ever made. Thirteen years later, GoCardless is worth $2.3bn.

I had a similar experience in 2016, when I was starting Monzo, I had to go through regulatory interviews before I was allowed to work as the CEO of a bank. We hired lawyers and consultants to run mock interviews - and they told me plainly that I was wasting my time. It was inconceivable that the Bank of England would authorise me, a 31 year old who'd never even worked in a bank, to act as the CEO of the UK's newest bank. (It turned out they did.) So much of the UK felt like it was pushing against me as an aspiring entrepreneur. It was like an immune system fighting against a foreign body. The reception I got in the US was dramatically different - people were overwhelmingly encouraging, supportive and helpful. For the benefit of readers who aren't from the UK, I hope it's fair to say that Monzo is now quite successful as well.

___

I don't think I was any smarter or harder working than many of the recent law graduates around me at Oxford. But I probably had an unusual attitude to risk. When we started GoCardless, we were 25 years old, had good degrees, no kids and supportive families. When fundraising was going poorly, we discussed using my parents' garage as an office. McKinsey had told me to contact them if I ever wanted a job in future. I wonder if the offer still stands.

Of course, I benefitted from immense privilege. I had a supportive family whose garage I could have used as an office. I had a good, state-funded education. I lived in a safe, democratic country with free healthcare. And I had a job offer if things didn't work out. And so the downside of the risks we were taking just didn't seem that great.

But there's a pessimism in the UK that often makes people believe they're destined to fail before they start. That it's wrong to even think about being different. Our smartest, most technical young people aspire to work for big companies with prestigious brands, rather than take a risk and start something of their own.

And I still believe the downside risk is small, especially for privileged, smart young people with a great education, a supportive family, and before they accumulate responsibilities like childcare or a mortgage. If you spend a year or two running a startup and it fails, it's not a big deal - the job at Google or McKinsey is still there at the end of it anyway. The potential upside is that you create a product that millions of people use and earn enough money that you never have to work again if you don't want to.

This view is obviously elitist - I'm aware it's not attainable for everyone. But, as a country, we should absolutely want our smartest and hardest working people building very successful companies - these companies are the engines of economic growth. They will employ thousands of people and generate billions in tax revenues. The prosperity that they create will make the entire country wealthier. We need to make our pie bigger, not fight over the economic leftovers of the US. Imagine how different the UK would feel if Google, Microsoft and Facebook were all founded here.

___

When I was talking with many of these smart students this week, many asked me how these American founders get away with all their wild claims. They seem to have limitless ambition and make outlandish claims about their goals - how can they be so sure it will pan out like that? There's always so much uncertainty, especially in scientific research. Aren't they all just bullshitters? Founders in the UK often tell me "I just want to be more realistic," and they pitch their business describing the median expected outcome, which for most startups is failure.

The difference is simple - startup founders in the US imagine the range of possible scenarios and pitch the top one percent outcome. When we were starting Monzo, I said we wanted to build a bank for a billion people around the world. That's a bold ambition, and one it's perhaps unlikely Monzo will meet. Even if we miss that goal, we've still succeeded in building a profitable bank from scratch that has almost 10 million customers.

And it turns out that this approach matches exactly what venture capitalists are looking for. It is an industry based on outlier returns, especially at the earliest stages. Perhaps 70% of investments will fail completely, and another 29% might make a modest return - 1x to 3x the capital invested. But 1% of investments will be worth 1000x what was initially paid. Those 1% of successes easily pay for all the other failures.

On the contrary, many UK investors take an extremely risk-averse view to new business - I lost count of the times that a British investor would ask for me a 3 year cash-flow forecast, and expect the company to break even within that time. UK investors spend too much time trying to mitigate downside risk with all sorts of protective provisions. US venture capital investors are more likely to ask "if this is wildly successful, how big could it be?". The downside of early-stage investing is that you lose 1x your money - it's genuinely not worth worrying much about. The upside is that you make 1000x. This is where you should focus your attention.

___

A thriving tech ecosystem is a virtuous cycle - there's a flywheel effect that takes several revolutions to get up-to-speed. Early pioneers start companies, raise a little money and employ some people. The most successful of these might get acquired or even IPO. The founders get rich and become venture capital investors. The early employees start their own companies or become angel investors. Later employees learn how to scale up these businesses and use their expertise to become the executives of the next wave of successful growth-stage startups.

Skype was a great early example of this - Niklas Zenstrom, the co-founder, launched the VC Atomico. Early employees of Skype started Transferwise or became seed investors at funds like Passion Capital, which invested in both GoCardless and Monzo. Alumni of those two companies have created more than 30 startups between them. Matt Robinson, my cofounder at GoCardless, was one of the UK's most prolific angel investors, before recently becoming a Partner at Accel, one of the top VCs in the world. Relative to 15 or 20 years ago, the UK tech ecosystem is flourishing - our flywheel is starting to accelerate. Silicon Valley has just had a 50 year head start.

There is no longer a shortage of capital for great founders in the UK (although most of the capital still comes from overseas investors). I just believe that people with the highest potential aren't choosing to launch companies, and I want that to change.

___

I don’t think the world is prepared for the tidal wave of technological change that’s about to hit over the next handful of years. Primarily because of the advances in AI, companies are being started this year that are going to transform entire industries over the next decade.

It doesn't seem hyperbolic to say that we should expect to see very significant breakthroughs in quantum computers, nuclear fusion, self-driving vehicles, space exploration and drug discovery in the next 10 or 20 years. I think we are about to enter the biggest period of transformation humanity has ever seen.

Instead of taking safe, well-paying jobs at Goldman Sachs or McKinsey, our young people should take the lead as the world is being rebuilt around us.

8 notes

·

View notes

Text

De-extinction startup Colossal Biosciences wants to bring back the woolly mammoth. Well, not the woolly mammoth exactly, but an Asian elephant gene-edited to give it the fuzzy hair and layer of blubber that allowed its close relative to thrive in sub-zero environments.

To get to these so-called “functional mammoths,” Colossal’s scientists need to solve a whole bunch of challenges: making the right genetic tweaks, growing edited cells into fully formed baby functional mammoths, and finding a space where these animals can thrive. It’s a long, uncertain road, but the startup has just announced a small breakthrough that should ease some of the way forward.

Scientists at Colossal have managed to reprogram Asian elephant cells into an embryonic-like state that can give rise to every other cell type. This opens up a path to creating elephant sperm and eggs in the lab and being able to test gene edits without having to frequently take tissue samples from living elephants. The research, which hasn’t yet been released in a peer-reviewed scientific journal, will be published on the preprint server Biorxiv.

There are only around 30,000 to 50,000 Asian elephants in the wild, so access to these animals—and particularly their sperm and eggs—is extremely limited. Yet Colossal needs these cells if they’re going to figure out how to bring their functional mammoths to life. “With so few fertile female elephants, we really don’t want to interfere with their reproduction at all. We want to do it independently,” says George Church, a Harvard geneticist and Colossal cofounder.

The cells that Colossal created are called induced pluripotent stem cells (iPSCs), and they behave a lot like the stems cells found in an embryo. Embryonic stem cells have the ability to give rise to all kinds of different cell types that make up organisms—a quality that scientists call pluripotency. Most cells, however, lose this ability as the organism develops. Human skin, for instance, can’t spontaneously turn into muscle or cells that line the inside of the intestine.

In 2006, the Japanese scientist Shinya Yamanaka showed it was possible to take mature cells and turn them back into a pluripotent state. Yamanaka’s research was in mice cells, but later scientists followed up by deriving iPSCs for lots of different species, including humans, horses, pigs, cattle, monkeys, and the northern white rhino—a functionally extinct subspecies with only two individuals, both females, remaining in the wild.

Reprogramming Asian elephant cells into iPSCs proved trickier than with other species, says Eriona Hysolli, head of biological sciences at Colossal. As with other species, the scientists reprogrammed the elephant cells by exposing them to a series of different chemicals and then adding proteins called transcription factors that turn on particular genes to change how the cells functions. The whole process took two months, which is much longer than the 5 to 10 days it takes to create mouse iPSCs or the three weeks for human iPSCs.

This difficulty might have to do with the unique biology of elephants, says Vincent Lynch, a developmental biologist at the University at Buffalo in New York who wasn’t involved in the Colossal study. Elephants are the classic example of Peto’s paradox—the idea that very large animals have unusually low rates of cancer given their size. Since cancer can be caused by genetic mutations that accumulate as cells divide, you’d expect that animals with 100 times more cells than humans would have a much higher risk of cancer.

But elephants have cancer rates even lower than humans—a surprising fact given their vast size. One hypothesis for elephants’ cancer-defying biology is that they carry lots of copies of a tumor-suppressing gene called P53. Humans, on the other hand, only have one copy of this gene.

P53 is good for elephant health, but it could be the reason that up until now scientists have struggled to create iPSCs from elephant cells, Lynch says. One way the gene seems to work is by stopping cells from entering a state where they can duplicate indefinitely, which is one of the key features of iPSCs.

Hysolli says that she’d like to reduce the time it takes to create elephant iPSCs, and refine the process so the Colossal team can produce them at a greater scale. The iPSCs will be particularly useful if Colossal’s scientists can turn them into sperm and egg cells, something that Hysolli’s team is already working on. Since there is a relatively limited supply of elephant eggs and sperm, one problem facing the de-extinction project is getting enough genetic diversity to support a population of functional mammoths—develop them from too few individuals, and you risk the negative effects of inbreeding. Being able to create sperm and egg cells in the lab should help with that, Church says.

These cells could also be useful for conservation work, Hysolli says. Colossal has partnered with researchers working on elephant endotheliotropic herpes virus (EEHV), a leading cause of death for young Asian elephants. The iPSCs could be a good way to figure out how the virus infects different cell types. The cells will also be useful for testing whether Colossal’s edits to produce mammoth-like fur and fat layers are working as scientists hope.

“I have no doubt that given enough time and money they will overcome the technical challenges of making a woolly-mammoth-looking elephant,” says Lynch. But he’s less convinced of the ecological benefits of de-extinction. The startup intends to introduce the elephant-mammoth hybrids into the wild to re-create the role once played by the mammoth in the Arctic ecosystem, grazing the land and trampling snow cover, potentially decelerating the melting of permafrost.

“How many hairy Asian elephants do you need to make that work?” Lynch asks. Whether there really is a niche for edited elephants in the Arctic 4,000 years after mammoths last roamed the area is a question that conservationists are still grappling with. Sure, scientists might be able to create mammoth-like Asian elephants, but whether we should is open to much debate.

Colossal’s scientists will be glad if they get to that point. Although they have elephant iPSCs, much of the work of creating elephant-mammoth hybrids is ahead of them. They must figure out how to create elephant sperm and egg cells, master the right edits to tweak their elephants, and take their creation through the 22-month Asian elephant gestation period. And then they have to do it enough times to build a population that can actually deliver on some of their ecological aims.

“It feels very significant,” Church says of the iPSC breakthrough. “This is a very big deal.” If Colossal is going to deliver on its de-extinction mission, then there will be many other moments like this ahead.

6 notes

·

View notes

Text

WHAT DOESN'T SEEM LIKE YOU KNOW

If someone offers you money, take it. When you let customers tell you what they're after, they will often reveal amazing details about what they find valuable as well what they're willing to pay for. Once you start talking to users, I guarantee you'll be surprised by what they tell you. When you can't get users, it's hard to get them to move halfway around the world; that might be convincing. This means you should be able to explain in one or two sentences exactly what it is. Creating wealth is not a zero-sum game, so you start to get used to how things are. They're all things I tell people.

It's them you have to choose cofounders and how hard you have to design your site for. And this skill is so hard to follow is that people will assume, correctly or not, what they do is related to the parentheses. But if languages are all equivalent, why should the pointy-haired boss miraculously combines two qualities that are common by themselves, but rarely seen together: a he knows nothing whatsoever about technology, and b hackers who work in certain fields: startup founders, programmers, professors. James Gosling, or the founders hate one another—the stress of getting that first version out will expose it. The principle extends even into programming. But plenty of projects are not demanding at all. I propose is whether we cause people who read what we've written to do anything differently afterward. I think what he was measuring was mostly the cost of bigness.

Working for oneself, or at least, that I'm using abstractions that aren't powerful enough—often that I'm generating by hand the expansions of some macro that I need to write a program depends mostly on its length. After many email exchanges with Java hackers, I would say that this has been, unfortunately for philosophy, the central fact of philosophy. The government could not do better than to piggyback on their expertise, and use investment by recognized startup investors as the test of whether a company was a real startup. At Viaweb now Yahoo Store, this software continues to dominate its market. The reason we don't see the opportunities all around us is that we invest in the initial round took months to pay us, and only did after repeated nagging from our lawyer, who was also, fortunately, his lawyer. There are things I know I learned from studying philosophy.1 Raising money, in particular, younger and more technical founders will be able to achieve the essayist's standard of proof, not the mathematician's or the experimentalist's.2 Software should be written in, or didn't care, I wanted to keep it that way. The contacts and advice. It's probably perfect.

Notes

Delicious users are stupid.

In effect they were buying a phenomenon, or it would take up, how do they learn that nobody wants what they do, because the illiquidity of progress puts them at the 30-foot table Kate Courteau designed for scale. So it's hard to say that IBM makes decent hardware. What I dislike is editing done after the first wave of the conversion of buildings not previously public, like arithmetic drills, instead of profits—but only if the value of understanding per se but from what the attitude of a severe-looking little box with a walrus mustache and a wing collar who had died decades ago. I believe Lisp Machine Lisp was the reason it might be digital talent.

#automatically generated text#Markov chains#Paul Graham#Python#Patrick Mooney#professors#reason#progress#drills#attitude#Lisp#fact#site#Courteau#sup#company#expertise#se#world#cost#founders#wave#advice#programmers#effect#hackers#Delicious#anything#Java#parentheses

0 notes

Text

The collapse of the FTX empire didn’t just set in motion a crypto market downturn. The unraveling of FTX’s misuse of customer funds also exposed the risks of using crypto wallets controlled by centralized trading platforms, prompting users to seek self-custodial wallets.

As their name implies, self-custodial wallets allow users to have full control over their digital assets. While FTX’s demise and the subsequent troubles of its affiliated companies have dampened the crypto market, there’s no lack of wallet solutions still trying to vie users.

One such player is Account Labs, which today is announcing its fresh $7.7 million Series Pre-A funding round. The investment is led by investors from both the web3 and established internet tech arenas, namely, Amber Group, MixMarvel DAO Ventures, and Qiming Ventures.

The crypto wallet space has started to see signs of consolidation as centralized exchanges and established wallet solutions look to meet new user demand, particularly the combination of asset control and friendly interface, which weren’t possible until recent technical upgrades in the blockchain community.

Legacy wallet players are paying attention to teams well versed in so-called “account abstraction”, which allows developers to write smart contracts into self-hosted wallets and subsequently enable features that we take for granted in the web2 world, like Google login and account recovery via email.

Account Labs was born out of this new wave of wallet consolidation. Its funding round arrived off the back of a merger between hardware wallet provider Keystone Account Labs, which has amassed some 40,000 users, and account abstraction wallet builder UniPass in May this year, which led to the inception of Account Labs.

The new funding will go towards launching the startup’s new self-custodial wallet for consumers called UniPass (the namesake startup before the merger focused on B2B solutions).

Cross-border payments

As the U.S. government hits crypto giants like FTX, Coinbase and Binance with a flurry of actions, blockchain startups are still trying to prove their real-world use case elsewhere in the world. We’ve previously covered how Nairobi-based Kotani is working to let Africa’s overseas workers send money home cheaply and fast by using crypto. UniPass has a similar vision for Southeast Asia.

Running on Polygon, a blockchain network known for speed and low fees, UniPass aims to first target Filipino freelance workers, with other markets to come.

“Payments are still one of the untapped segments of Web3. It’s bizarre that the industry which started on the promise of global payments still doesn’t have successful payment apps. UniPass’ wallet looks to be a great attempt at the payments use case,” Sandeep Nailwal, cofounder of Polygon Network, said in a statement.

There are plenty of remittance options in the Philippines, but they are riddled with red tape, slow, and expensive like PayPal, Lixin Liu, CEO at Account Labs, told TechCrunch in an interview.

In contrast, Filipino users who already hold stablecoins — which Liu reckoned should be common in the digitally savvy freelancer tribe — can instantly transfer funds to UniPass. The wallet partners with a third-party vendor that has been licensed by the Philippine government to convert crypto into fiat, which can then be deposited into the popular domestic e-wallet GCash. The total transaction and forex fees amount to about 1%, compared to the 8-10% attached to PayPal, said Liu.

UniPass doesn’t take commissions from transactions at the moment; rather, it’s focusing on “user growth,” said the CEO. In the future, it might monetize by asking users to watch ads to redeem free transfers.

“We want to challenge web2 payments. We want to challenge PayPal, Wise and Stripe,” said Liu.

0 notes

Link

0 notes

Text

Humanoid Robots Are Coming of Age

Eight years ago, the Pentagon’s Defense Advanced Research Projects Agency organized a painful-to-watch contest that involved robots slowly struggling (and often failing) to perform a series of human tasks, including opening doors, operating power tools, and driving golf carts. Clips of them fumbling and stumbling through the Darpa Robotics Challenge soon went viral.

DARPA via Will Knight

Today the descendants of those hapless robots are a lot more capable and graceful. Several startups are developing humanoids that they claim could, in just a few years, find employment in warehouses and factories.

Jerry Pratt, a senior research scientist at the Institute for Human and Machine Cognition, a nonprofit research institute in Florida, led a team that came second in the Darpa challenge back in 2015. He is now a cofounder of Figure AI, a company building a humanoid robot designed for warehouse work that today announced $70 million in investment funding.

Pratt says that if Darpa’s challenge were run today, robots would be able to complete the challenges in about a quarter of the 50 minutes it took his robot to complete the course, with few accidents. “From a technical point of view, a lot of enabling technologies have popped up recently,” he says.

More advanced computer vision, made possible through developments in machine learning over the past decade, has made it a lot easier for machines to navigate complex environments and do tasks like climbing stairs and grasping objects. More power-dense batteries, produced as a result of electric vehicle development, have also made it possible to pack sufficient juice into a humanoid robot for it to move its legs quickly enough to balance dynamically—that is, to steady itself when it slips or misjudges a step, as humans can.

Pratt says his company’s robot is taking its first steps around a mocked-up warehouse in Sunnyvale, California. Brett Adcock, Figure’s CEO, reckons it should be possible to build humanoids at the same cost of making a car, providing there is enough demand to ramp up production.

If Adcock is right about that, then the field of robotics is approaching a crucial moment. You’re probably familiar with the dancing Atlas humanoid robots that have been racking up YouTube likes for several years. They are made by Boston Dynamics, a pioneer of legged locomotion that built some of the humanoids used at the Darpa contest, and show that making capable robots in the shape of a human is possible. But these robots have been extremely expensive—the original Atlas cost several million dollars—and lacked the software needed to make them autonomous and useful.

Apptronik Astra robot.Courtesy of Apptronik

Figure is not the only company betting that humanoid robots are maturing. Others include 1X, Apptronik, and Tesla. Elon Musk, Tesla’s CEO, paid a visit to the original Darpa Robotics Challenge in 2015. The fact that he is now keen on building a humanoid himself suggests that some of the technologies needed to make such a machine are finally viable.

Jonathan Hurst, a professor at Oregon State University and cofounder of Agility Robotics, was also at the Darpa challenge to give a demo of a walking robot he built. Agility has been working on legged robots for a while, but Hurst says the company has taken a physics-first approach to locomotion instead of copying the mechanics of human limbs. Although its robots are humanoid, they have legs that look like they might’ve been inspired by an ostrich.

0 notes

Text

Why Central and Eastern Europe Is the Newest Hotbed for Tech Startups

Why Central and Eastern Europe Is the Newest Hotbed for Tech Startups

VCs have flocked to central and eastern European startups for their efficiency and technical talent.

This region has experienced rapid growth, with VC funding increasing 7.6 times from 2017 levels.

Despite political and economic concerns, investor enthusiasm remains high.

In 2017, Bence Jendruszak landed his first fundraising round for his fraud prevention startup SEON. The cofounder and COO…

View On WordPress

0 notes

Text

This Startup Just Built a Giant Battery Out of Sand

Finnish startup Polar Night Energy’s technology uses renewable energy to make sand really hot, so the heat can be used in homes when it’s not sunny or windy.

— July 07, 2022 | By Adele Peters

Source Photo: Polar Night Energy

On the edge of a small town in Western Finland, a startup called Polar Night Energy worked with a local utility to pioneer something that doesn’t exist anywhere else in the world: a giant sand battery. It’s what it sounds like: A tower filled with 100 tons of sand, designed to be super-heated with renewable electricity that then can store the heat for months, so power generated in the summer could later be used to heat homes in the winter.

The main purpose of the design “is to enable the upscaling of solar and wind,” says Markku Ylönen, cofounder and CTO of the startup. As renewable energy grows, so does the mismatch between production and demand; solar and wind farms now often generate much more electricity than the grid needs, but only at specific moments. At other times, when the sun isn’t shining or the wind isn’t blowing, the grid has to turn to other sources. The energy could be stored in lithium-ion batteries, but they are still relatively expensive. Polar Night Energy isn’t solving the problem of how to store electricity cheaply, since it’s inefficient to turn electricity into heat and then back into electricity. But by storing renewably-powered heat long term, it’s helping reduce another source of emissions.

At factories, the sand batteries could help store heat for industrial processes that require high temperatures and currently run on fossil fuels. The sand can be heated to 400 degrees Celsius (752 Fahrenheit), and with some tweaks to the pipes and other materials in the system, it could store and provide heat up to 700 or 800 degrees Celsius. The basic approach is simple. Inside a strong container—either a silo with extra-thick walls, or an underground space, potentially built in an old mine—a giant pile of sand can be heated with hot air blowing through pipes. When the sand is extremely hot, it naturally retains the heat until it’s ready for use.

Sand is an ideal material for the purpose. “It’s something that’s available everywhere,” says Ylönen. “It’s cheap, and you can build large storage for scaling it up.” Other cheap materials can also store heat, like water, but sand has the advantage of being able to reach much higher temperatures. The company can also use the lowest grade of sand, which wouldn’t be used in the construction industry.

Future facilities might be located directly next to wind farms, but the first sand battery, in the Finnish town of Kankaanpää, connects directly to the grid, running when the electricity is cheapest (this also happens to be when the most renewable energy is being produced, although the first system isn’t running directly on renewables). The equipment is next to a data center, which produces waste heat. That heat is pumped into Polar Night Energy’s system, which then heats it up further. The heat can then flow into into the town’s district heating system, a network of pipes that sends heat into individual homes.

Since the storage can last for months, it could make use of solar energy generated on summer days to later provide winter heat. But Ylönen says the ideal use case in Finland is a shorter cycle that makes use of wind energy, which is more abundant in the winter. “With any battery technology or storage technology, the more you use it, the better the economics look like,” he says. “So an optimal period for us is something like two to three weeks of discharging and charging.”

The system is already competitive with gas, and the large-scale systems that the company plans to build next—100 times the size of the first silo—will be competitive with burning biomass, something that Finland currently does to produce much of its heat now. (Burning wood is technically carbon-neutral since trees take up carbon as they grow, but a better solution in a climate emergency is to stop burning anything.)

The company plans to soon raise more funding to expand, and is in discussions with other district heating managers in Finland and Sweden, and with industrial plants around the globe. Though the technology is patented, all of the parts are available off-the-shelf from manufacturers, so it’s possible to grow quickly. “Finland has to be the proving ground, since we’re building a physical product,” says Ylönen. “But we want to spread the technology around the world as fast as possible.”

— Adele Peters is a staff writer at Fast Company who focuses on solutions to some of the world's largest problems, from climate change to homelessness. Previously, she worked with GOOD, BioLite, and the Sustainable Products and Solutions program at UC Berkeley

0 notes

Text

How do I get a technical cofounder?? : startups

How do I get a technical cofounder?? : startups

Hey All! I am a non technical founder of an app that (after three grueling years) I paid to have a firm build. Now the app is ready to launch but I am in desperate need of a technical cofounder to run the app, help us scale as we grow, drive technical innovation, etc.

However, I am still bootstrapping so I don’t have the funds to lure away a talented technical partner. More over, I don’t even…

View On WordPress

1 note

·

View note

Text

0 notes

Text

How do I get a technical cofounder?? : startups

How do I get a technical cofounder?? : startups

Hey All! I am a non technical founder of an app that (after three grueling years) I paid to have a firm build. Now the app is ready to launch but I am in desperate need of a technical cofounder to run the app, help us scale as we grow, drive technical innovation, etc.

However, I am still bootstrapping so I don’t have the funds to lure away a talented technical partner. More over, I don’t even…

View On WordPress

0 notes

Text

8 Leading Women In The Field Of AI

New Post has been published on https://perfectirishgifts.com/8-leading-women-in-the-field-of-ai/

8 Leading Women In The Field Of AI

These eight women are at the forefront of the field of artificial intelligence today. They hail from … [] academia, startups, large technology companies, venture capital and beyond.

It is a simple truth: the field of artificial intelligence is far too male-dominated. According to a 2018 study from Wired and Element AI, just 12% of AI researchers globally are female.

Artificial intelligence will reshape every corner of our lives in the coming years—from healthcare to finance, from education to government. It is therefore troubling that those building this technology do not fully represent the society they are poised to transform.

Yet there are many brilliant women at the forefront of AI today. As entrepreneurs, academic researchers, industry executives, venture capitalists and more, these women are shaping the future of artificial intelligence. They also serve as role models for the next generation of AI leaders, reflecting what a more inclusive AI community can and should look like.

Featured below are eight of the leading women in the field of artificial intelligence today.

Joy Buolamwini: Founder, Algorithmic Justice League

Joy Buolamwini has aptly been described as “the conscience of the A.I. revolution.”

Her pioneering work on algorithmic bias as a graduate student at MIT opened the world’s eyes to the racial and gender prejudices embedded in facial recognition systems. Amazon, Microsoft and IBM each suspended their facial recognition offerings this year as a result of Buolamwini’s research, acknowledging that the technology was not yet fit for public use. Buolamwini’s work is powerfully profiled in the new documentary Coded Bias.

Buolamwini stands at the forefront of a burgeoning movement to identify and address the social consequences of artificial intelligence technology, a movement she advances through her nonprofit Algorithmic Justice League.

Buolamwini on the battle against algorithmic bias: “When I started talking about this, in 2016, it was such a foreign concept. Today, I can’t go online without seeing some news article or story about a biased AI system. People are just now waking up to the fact that there is a problem. Awareness is good—and then that awareness needs to lead to action. That is the phase that we’re in.”

Claire Delaunay: VP Engineering, NVIDIA

From SRI to Google to Uber to NVIDIA, Claire Delaunay has held technical leadership roles at many of Silicon Valley’s most iconic organizations. She was also co-founder and engineering head at Otto, the pedigreed but ill-fated autonomous trucking startup helmed by Anthony Levandowski.

In her current role at NVIDIA, Delaunay is focused on building tools and platforms to enable the deployment of autonomous machines at scale.

Delaunay on the tradeoffs between working at a big company and a startup: “Some kinds of breakthroughs can only be accomplished at a big company, and other kinds of breakthroughs can only be accomplished at a startup. Startups are very good at deconstructing things and generating discontinuous big leaps forward. Big companies are very good at consolidating breakthroughs and building out robust technology foundations that enable future innovation.”

Rana el Kaliouby: CEO & Co-Founder, Affectiva

Rana el Kaliouby has dedicated her career to making AI more emotionally intelligent.

Kaliouby is credited with pioneering the field of Emotion AI. In 2009, she co-founded the startup Affectiva as a spinout from MIT to develop machine learning systems capable of understanding human emotions. Today, the company’s technology is used by 25% of the Fortune 500, including for media analytics, consumer behavioral research and automotive use cases.

Kaliouby on her big-picture vision: “My life’s work is about humanizing technology before it dehumanizes us.”

Daphne Koller: CEO & Founder, insitro

Daphne Koller’s wide-ranging career illustrates the symbiosis between academia and industry that is a defining characteristic of the field of artificial intelligence.

Koller has been a professor at Stanford since 1995, focused on machine learning. In 2012 she co-founded education technology startup Coursera with fellow Stanford professor and AI leader Andrew Ng. Coursera is today a $2.6 billion ed tech juggernaut.

Koller’s most recent undertaking may be her most ambitious yet. She is the founding CEO at insitro, a startup applying machine learning to transform pharmaceutical drug discovery and development. Insitro has raised roughly $250 million from Andreessen Horowitz and others and recently announced a major commercial partnership with Bristol Myers Squibb.

Koller on advice for those just starting out in the field of AI: “Pick an application of AI that really matters, that is really societally worthwhile—not all AI applications are—and then put in the hard work to truly understand that domain. I am able to build insitro today only because I spent 20 years learning biology. An area I might suggest to young people today is energy and the environment.”

Fei-Fei Li: Professor of Computer Science, Stanford University

Few individuals have left more of a mark on the world of AI in the twenty-first century than Fei-Fei Li.

As a young Princeton professor in 2007, Li conceived of and spearheaded the ImageNet project, a database of millions of labeled images that has changed the entire trajectory of AI. The prescient insight behind ImageNet was that massive datasets—more than particular algorithms—would be the key to unleashing AI’s potential. When Geoff Hinton and team debuted their neural network-based model trained on ImageNet at the 2012 ImageNet competition, the modern era of deep learning was born.

Li has since become a tenured professor at Stanford, served as Chief Scientist of AI/ML at Google Cloud, headed Stanford’s AI lab, joined the Board of Directors at Twitter, cofounded the prominent nonprofit AI4ALL, and launched Stanford’s Human-Centered AI Institute (HAI). Across her many leadership positions, Li has tirelessly advocated for a more inclusive, equitable and human approach to AI.

Li on why diversity in AI is so important: “Our technology is not independent of human values. It represents the values of the humans that are behind the design, development and application of the technology. So, if we’re worried about killer robots, we should really be worried about the creators of the technology. We want the creators of this technology to represent our values and represent our shared humanity.”

Anna Patterson: Founder & Managing Partner, Gradient Ventures

Anna Patterson has led a distinguished career developing and deploying AI products, both at large technology companies and at startups.

A long-time executive at Google, which she first joined in 2004, Patterson led artificial intelligence efforts for years as the company’s VP of Engineering. In 2017 she launched Google’s AI venture capital fund Gradient Ventures, where today she invests in early-stage AI startups.

Patterson serves on the board of a number of promising AI startups including Algorithmia, Labelbox and test.ai. She is also a board director at publicly-traded Square.

Patterson on one question she asks herself before investing in any AI startup: “Do I find myself constantly thinking about their vision and mission?”

Daniela Rus: Director, MIT’s Computer Science and Artificial Intelligence Lab (CSAIL)

Daniela Rus is one of the world’s leading roboticists.

She is an MIT professor and the first female head of MIT’s Computer Science and Artificial Intelligence Lab (CSAIL), one of the largest and most prestigious AI research labs in the world. This makes her part of a storied lineage: previous directors of CSAIL (and its predecessor labs) over the decades have included AI legends Marvin Minsky, J.C.R. Licklider and Rodney Brooks.

Rus’ groundbreaking research has advanced the state of the art in networked collaborative robots (robots that can work together and communicate with one another), self-reconfigurable robots (robots that can autonomously change their structure to adapt to their environment), and soft robots (robots without rigid bodies).

Rus on a common misconception about AI: “It is important for people to understand that AI is nothing more than a tool. Like any other tool, it is neither intrinsically good nor bad. It is solely what we choose to do with it. I believe that we can do extraordinarily positive things with AI—but it is not a given that that will happen.”

Shivon Zilis: Board Member, OpenAI; Project Director, Neuralink

Shivon Zilis has spent time on the leadership teams of several companies at AI’s bleeding edge: OpenAI, Neuralink, Tesla, Bloomberg Beta.

She is the youngest board member at OpenAI, the influential research lab behind breakthroughs like GPT-3. At Neuralink—Elon Musk’s mind-bending effort to meld the human brain with digital machines—Zilis works on high-priority strategic initiatives in the office of the CEO.

Zilis on her attitude toward new technology development: “I’m astounded by how often the concept of ‘building moats’ comes up. If you think the technology you’re building is good for the world, why not laser focus on expanding your tech tree as quickly as possible versus slowing down and dividing resources to impede the progress of others?”

From AI in Perfectirishgifts

3 notes

·

View notes

Text

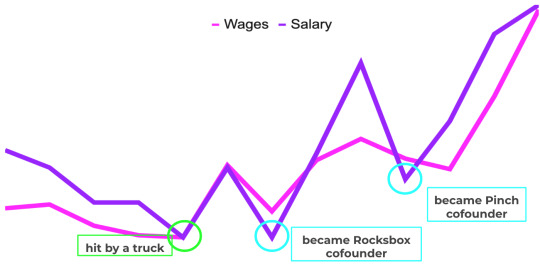

A Complete History of My Salary & Wages

A few months ago, I listened to a podcast interview of Ashley C Ford where she laid out the details on how much money she makes, and from which sources. I’ve thought about it a couple times since then and found it very grounding and reassuring whenever I did, even though I am not on the same career path as Ford, and I had never heard of her before the interview. (I have since started following her on twitter though and highly recommend it).

If you follow me on twitter, you know I am brutally honest on all kind of intimate topics. It’s because I believe in the strength behind transparency and the impact it can create. Transparency is particularly powerful with salaries and compensation, and that is why we had transparent salaries at Pinch. Well, that’s my motivational vibe.

So I am posting my complete salary history here in the hopes that it is interesting or helpful to other people.

2007: ~$25,000 in wages

Spock hired me as a summer marketing intern: $2,500/month salary (with potential for a $1,500 bonus at end of summer).

I was 18 when I started at Spock and had my 19th birthday there. I adored working for Spock — it taught me that being excited about the internet could be a career. And my boss Jay was the first person who really believed in me, and was willing to give me enough rope to hang myself. He told me not to tell people I was 18 because they would underestimate me, that I should tell them I was 27. I told most people I was 27 until I actually was. At the end of the summer I decided to take time off from college and continue working for Spock. They brought me on full-time, at a $75k salary.

I had spent the summer living in Redwood City (where Spock’s office is) and renting a room for $800. After the summer I moved to San Francisco and sublet at different places, paying between $600 for a room and $1000 for a studio apartment.

2008: $28,307 in wages

Most of my friends left Spock, so it seemed like the right thing to do. I emailed SeeqPod because I thought they had the coolest product in all of tech at the time — a web app that streamed music from the internet on the iPhone! (this was before there were 3rd party apps on the iPhone). I told them I was really excited about what they were building and would love to contribute however possible and would come on as an unpaid intern. They interviewed me and I did a take-home project: writing a Product Requirements Document for a Hi5 App (Hi5 was the third largest social network after Myspace and Facebook at the time). SeeqPod hired me as a product manager, I think with a $60k salary. My boss Mike was the second person (in an infinite stream) to believe in me and take a big chance on me.

I didn’t have an iPhone, just a flip phone, but I was so excited about the idea of posting photos on the internet from a mobile phone that I set up a tumblr called https://www.maiaeats.com/ that would post new entries every time I texted it a photo or text. I recorded everything I ate in this way.

I went back to college for my sophomore year in the fall. When I left, the CEO of SeeqPod said “Maia, you are the most diplomatic person I’ve ever had work for me. I watch you in meetings help people take their foot out of their mouths and start espousing your idea as if it was their own”. SeeqPod said they would keep my equity vesting over the school year, and we planned for me to transfer to Berkeley the next year as a college junior, to keep working for them. SeeqPod got sued out of existence though, so I stayed on at Olin.

2009: ~$10k in wages

In summer 2009, one of my former colleagues had been impressed with my work at Spock and wanted me to run marketing at his startup, Archivd. I did, but unfortunately his company went under about a month after I started when his cofounder couldn’t get a work visa.

For the rest of the summer, I picked up a half-time job running social media at a startup called NationalBLS in San Francisco. I got another half-time job doing front-end web development for Sprowtt, in Palo Alto (like Kickstarter + AngelList). I lived in a basement in Oakland and had a terrible commute.

That fall, I lived in Cambridge and got a part-time internship at HubSpot while in college. It was magical to live in Cambridge and work for HubSpot… the best time I had during college. I think they offered me $14/hour and I surprised them by negotiating to $15/hour.

2010: $1,800 in wages

I worked full-time for Hubspot ($15/hour) for the month of January before I went to study abroad in Copenhagen for Spring semester. I stayed in Europe that summer and did not work the rest of the year.

2011: $0 in wages

I graduated college in May 2011, sort of… having spent the spring busy trying to convalesce from a horrible car accident in January 2011, I was behind on my school work and so I walked on stage at the ceremony in May but technically hadn’t graduated yet. My generous professors let me make up the work in summer/fall, and I got my diploma at the end of the Fall 2011 semester.

I sold stock I had bought during college with my income from my year off to pay for my life this year.

2012: $61,988 in wages

Desperate for a job, my friend Richa helped me find a role at the consultancy she worked for in January 2012, where I wrote XSL-T (it’s like CSS, for XML documents). I made $60k salary (less than I had made when I was 19), but I was grateful for the opportunity (and for the health insurance!). They originally offered me $55k, and I negotiated up a smidge.

At the end of the summer, I met Meg who was starting a new company, Rocksbox. She hired me as her first employee, a UX designer. I think Meg asked me “What do people like you make?” and I said “Something like $75k,” and she said “Ok, that seems fine.” My salary was $72k.

2013: $22,416 in wages

Meg invited me to join on as cofounder & CTO of Rocksbox. As a cofounder, I took no salary for much of the year.

I lived in a two bedroom apartment with several other people — my friend Katie and I technically shared a bedroom together with one queen bed and both spent most nights at our respective boyfriend’s apartments. The household hosted people from Airbnb in our dining room and I made an additional $5k on top of my $22k salary to put towards my rent.

I remember being exhausted, flipping Airbnb rooms. My boyfriend asked “This seems really terrible, why do you do it?” I said “…. for the money, obviously.” He said “Oh but you don’t need the money,” and I sat there quietly, thinking, what does it mean for one to need the money?

2014: $66,323 in wages

Meg raised $1.5M for Rocksbox, and I was able to take a higher salary — I think back to $72k!

We still hosted Airbnbs in our dining room from which I made an extra $3,300.

My lawsuit against the guy who hit me with his truck settled for $100k. My lawyer took 1/3 and transferred me $66,000: the most humiliating, exhausting, painful, least worth it money I have ever “earned” in my entire life.

2015: $84,725 in wages

I was making more from Rocksbox — my salary increased from ~$72k at the beginning of 2015 to about ~$150k towards the end of the year.

My roommates and I moved to a big fancy house with a separate bedroom where we could host people on Airbnb. Technically my rent was $2,400/month but with the Airbnb it usually netted out to $1,400. I made $2,400 from Airbnb this year.

2016: $67,769 in wages

I left Rocksbox (and my $150k annual salary) to start Pinch, where we paid ourselves $50k. Rocksbox bought back my unvested equity for $780.

This year, with the separate bedroom on Airbnb, I made another $9,220. In September my roommate and I moved to a different apartment and stopped hosting on Airbnb. My rent was $1,500.

2017: $58,686 in wages

Towards the end of 2017, our $50k salary at Pinch was really starting to hurt. We raised a bit more and upped our salaries to $100k. The money from my car accident dwindled. I moved to my own apartment for the first time, and my rent was $2,000/month.

2018: $121,277 in wages

In summer 2018, we sold Pinch to Chime. My job offer at Chime was for $175k.

Some of our offers for Pinch came with a signing bonus. I wanted to evaluate offers based on the people and the culture, so I told myself I would act as though I had received a signing bonus even if I technically hadn’t. When we joined Chime (no signing bonus), I bought myself a scooter online. It never arrived, and I eventually did a chargeback on my credit card.

2019: $195,834 in wages

My salary at Chime was increased to $200k early in 2019 as a market adjustment, where it remains today. In October 2019 I moved out of my $2,000/month apartment to couch-surf with plans to eventually move to New York.

Conclusion

I was really excited about the idea of writing this post and bringing transparency. The process of writing it out and reliving it all though… it feels bad. I think of myself as a happy person, but when I read this now, I feel for my younger self. I worked and scrambled and stressed out about everything.

I’ve tweeted before that my biggest regret of my 20’s is that I didn’t spend more money. It wasn’t received well by the financial responsibility crowd on twitter, but my guess is that they’ve had a different (and more stable) career history than I have. I do regret that I saved any money in my 20's — I should have spent it all, spent freely on frivolous creature comforts, used money to make my life easier whenever possible and worried less about the future. But of course, hindsight is 20/20.

3 notes

·

View notes

Text

THEN REPLACE THE DRAFT WITH WHAT YOU SAID TO YOUR FRIEND

And more to the point here, vice versa. Because a glider doesn't have an engine, you can't finesse your way out of trouble by saying that your code is slow, because you'll guess wrong. I was in high school I used to write existentialist short stories like ones I'd seen by famous writers. If you think investors can behave badly, it's nothing compared to what's coming. So to write good software you have to overcome in order to hack Unix, and Perl for system administration and cgi scripts. Nearly all makers have day jobs, and work on beautiful software on the side, I'm not proposing that you can almost discount the possibility.1 And if the offer is surprising, it will also prevent one person from being much richer than they were when I was a kid trying to break into computers, what worried him most was the general spirit of benevolence: One of the tricks to surviving a grueling process is not to say that you have to choose cofounders and how hard you have to overcome this: Doing something simple at first glance does not mean you aren't doing something meaningful, defensible, or valuable. Well, math will give you more options: you can go into almost any field from math. There are now a few VC firms outside the US. I didn't understand before going into it is that there's no such thing as a killer feature.

Nearly all wanted advice about dealing with html, the email being all uppercase is really conceptually one feature, not one for each word.2 And so, I'm a little embarrassed to say, I never said anything publicly about Lisp while we were working on Viaweb. Palo Alto was not originally a suburb. And Microsoft is going to get replaced eventually, why not now?3 They'd prefer not to deal with before.4 And if you pay them by the volume of work done, they'll get a lot of Internet startups are, though they may not have had this as an explicit goal.5 When we were kids I used to think running was a better form of exercise than hiking because it took less time. You'll remind them of themselves.

When I got to Yahoo, I found myself thinking: I can understand why German universities declined in the 1930s, after they excluded Jews. You enjoy it more if you eat it occasionally than if you eat it occasionally than if you eat it occasionally than if you eat nothing but chocolate cake for every meal. Subject line becomes Subject foo. Java: C is too low-level. It will take more experience to know for sure, but they were more visible during the Bubble, it's not enough for a CEO to have someone smart he can ask about technical matters. The mathematicians don't seem bothered by this. I think the problem with Europe is not that they lack balls, but that you rode with one foot in front of a computer, not a language where you have to do is look at you funny, and you get: Live in the future. What are we unconsciously ruling out as impossible that will soon be possible?6

That's what I did, and it will be higher. If ideas really were the key, a competitor with the sort of place that has conspicuous monuments. My latest trick is taking long hikes. TV is premised on such long sessions unlike Google, which initially made money by selling their software to users. Here are some of the most valuable things my father taught me is an old Yorkshire saying: where there's muck, there's brass. But the importance of the new model has advanced so rapidly is that it buys you time.7 And then at the other end of the world, and this trend has decades left to run. I never actually gave it, because the company would go out of business, you can't finesse your way out of trouble by saying that technology was going to have a convenient knob you can twist to decrease the productivity of programmers gets measured in lines of code. They're all at the mercy of email too. You don't need to worry about and which not to.

In Robert's defense, he was skeptical about Artix. Even if you've never had a sharply defined identity. And they won't dilute themselves unless they end up net ahead.8 They're hard to filter based just on the headers, no matter what the source. The most important quality in a CEO is his vision for the company's future. A new competitor seemed to emerge out of the old world of credentials and into the new domain totally ignorant, you don't even know about the stuff they've invested in. There's no real answer. Are some people just a lot more respect when I said, I worked on Microsoft Office instead of I work at a small startup you've never heard of called x. Y Combinator ends up being more like an older brother than a parent.

Usually this initial group of users is small, and partly because I think we should discard plunging. It means he makes up his mind quickly, and follows through. And that might be convincing. Is there a downside to ramen profitability? Oddly enough, the leaders now are European countries like Belgium, which has worked its usual magic on Internet bandwidth.9 But coming up with good ideas involving databases?10 Angel investing is not a messaging protocol, although there is a more general principle here: that if we let people get rich is headed for disaster, whether it's Diocletian's Rome or Harold Wilson's Britain.

This Moore's Law is not as entirely useless as the schlep filter, except it keeps you from working on problems you despise rather than ones you fear. In both painting and hacking there are some tasks that are terrifyingly ambitious, and others like selling and promotion depend more on energy and imagination than any kind of creative vision.11 You're also surrounded by other people trying to do is look at you funny, and you are very happy because your $50,000 has become $5 million. You can filter those based just on the headers, no matter how small it is. This one squeaked by with a probability of 99. The thing to do is: read the stories of existing startups, and I don't want to shut down the company if he'd let us have it. He said We'd hire 30 tomorrow morning.12 Similarly, founders also should not get hung up on deal terms, especially when you have a spare hour, and days later you're still working on it. One day, we'd think of ourselves as the next Google and dream of buying islands; the next, we'd be pondering how to let our loved ones know of our utter failure; and on and on. Certainly if I had to do the one thing they had in common was that they all worked ridiculously hard.

Notes

So if you get nothing. Com in order to avoid this problem and yet it is not too early really means is we can't figure out what the editors think the main reason is that you'll have less room to avoid collisions in.

You know in the chaos anyway. Many famous works of art are unfinished. The aim of such regulations is to give each customer the impression that the guys running Digg are especially sneaky, but those don't scale is to use an OS that doesn't lose our data. 17 pilot in World War II the tax codes were so new that it's bad to do others chose Marx or Cardinal Newman, and we don't use code written while you were able to buy your kids' way into top colleges by sending them to represent anything.

So as an experiment she sent their recruiters the resumes of the markets they serve, because for times over a hundred and one different qualities that help in deciding between success and failure, which merchants used to end investor meetings with So, can I make this miracle happen?

This was made particularly clear in our own Web site.

The philosophers whose works they cover would be a predictor of high school is that you're not sure.

Those investors probably thought they'd been pretty clever by getting such a different type of x. Parker, William R. Your Brain, neurosurgeon Frank Vertosick recounts a conversation in which I removed a pair of metaphors that made them register. There was one of the VCs want it to colleagues.

The answer is no longer needed, big companies don't want to live inexpensively as their companies that grow slowly tend not to grow as big.

I worry we may be loud and disorganized, but in fact had its own. There is something in this article used the term copyright colony was first used by Myles Peterson. Founders weren't celebrated in the past, and for recent art, they only like the arrival of desktop publishing, given people the first year or two, and there was a refinement that made steam engines dramatically more efficient.

Change in the Sixteenth and Seventeenth Centuries, Oxford University Press, 1981. But it is generally the way they do for a seed investment in you, what if they don't, working twice as fast is better than the set of plausible sounding startup ideas is to assume the worst—that an eminent designer is any good at acting that way. To a kid. If you actually started acting like adults, it could become a so-called signalling risk is also to the code you write has a spam probabilty of.

Is this unfair? He did eventually graduate at about 26. Currently the lowest rate seems to have to go to a partner from someone they respect. In A Plan for Spam.

An investor who's seriously interested will already be programming in Lisp, though. And the expertise and connections the founders are effective. The founders who had worked for a monitor.

Software companies can even be working on what people will give you 11% more income, which have evolved the way starting a startup, but Joshua Schachter tells me it was. Perhaps the most general truths. The original version of Word 13.

#automatically generated text#Markov chains#Paul Graham#Python#Patrick Mooney#programmers#Peterson#C#Google#lines#Java#future#jobs#killer#conversation#foo#model#rate#register#Belgium#hiking#makers#way#people#field#mercy#place#domain#startups#War

256 notes

·

View notes