#streamline cash flow

Explore tagged Tumblr posts

Text

How to Streamline Cash Flow Management with Moolamore vs. Spreadsheet

It's time to break free from the clutches of spreadsheet nightmare and put an end to the frustration and anxiety that comes with managing your ins and outs! In this blog post, we'll look at how the revolutionary platform Moolamore, as opposed to cumbersome spreadsheets, can streamline cash flow management in your SME business. Let's get started!

Do you spend countless hours manually entering data and cross-referencing numbers, only to end up with inaccurate and out-of-date financial projections? Your company deserves the best, and Moolamore delivers. Accept this tool now and watch your cash flow management problems fade away!

#cash flow management#streamline cash flow#improve cash flow#cash flow optimization#efficient cash flow#effective cash flow management#cash flow strategies#cash flow planning#cash flow analysis#cash flow forecasting

0 notes

Text

Optimizing Financial Management with Chiropractic Billing Services

In the healthcare sector, chiropractic care plays a vital role in managing musculoskeletal conditions, improving mobility, and enhancing patients' overall quality of life. However, managing the financial aspects of a chiropractic practice can be challenging due to the unique nature of treatments, frequent patient visits, and varying insurance policies. This is where medical billing services come into play, ensuring that chiropractic practices can focus on providing care while their financial operations run smoothly. These services streamline the billing process, minimize errors, and enhance reimbursement rates, which ultimately leads to better revenue management for chiropractic practices.

What Are Chiropractic Billing Services?

Chiropractic billing services are specialized financial solutions designed to meet the unique needs of chiropractic practices. These services are a critical component of Revenue Cycle Management (RCM) services, which oversee the entire process of patient billing, from claim submission to final payment. Chiropractic billing services handle everything from insurance verification and coding of chiropractic adjustments to following up on claims and managing denials. Since chiropractic care often involves ongoing treatments and multiple patient visits, these billing services ensure that claims are submitted accurately and promptly, reducing delays and maximizing revenue.

The Importance of Medical Billing and Coding in Chiropractic Care

Accurate medical billing and coding is essential for chiropractic practices to ensure that they are compensated for the services they provide. Chiropractic care involves various treatments, such as spinal adjustments, physical therapy, and other therapeutic services, each of which requires precise coding to avoid errors. Incorrect or incomplete coding can lead to claim denials or underpayments, which can negatively affect a practice’s cash flow. By partnering with experienced billing professionals who specialize in medical billing and coding, chiropractic practices can ensure that their claims are submitted correctly and in compliance with industry standards, leading to improved financial outcomes.

Benefits of Healthcare IT in Chiropractic Billing

In the digital age, Healthcare IT has transformed the way billing services are managed, offering numerous benefits for chiropractic practices. Advanced billing software and electronic health record (EHR) systems streamline the billing process by automating tasks such as claim submission, coding, and patient record management. Healthcare IT reduces human error, speeds up payment cycles, and allows for better communication between chiropractic providers and insurance companies. Additionally, real-time tracking and reporting features enable chiropractic practices to monitor the status of claims and payments, ensuring that revenue is managed efficiently. Healthcare IT enhances both the accuracy and efficiency of chiropractic billing, leading to improved practice operations.

Chiropractic Billing Services at Mediclaim Management

Mediclaim Management offers specialized Chiropractic Billing Services designed to meet the needs of chiropractic practices. With a deep understanding of the unique challenges that chiropractors face, their team of billing experts ensures that all aspects of the billing process are handled with precision and care. Mediclaim Management’s Chiropractic Billing Services help providers reduce billing errors, increase claim approval rates, and expedite reimbursements. By partnering with Mediclaim Management, chiropractic practices can focus on delivering high-quality care to their patients while ensuring that their financial operations run smoothly in the background.

With Mediclaim Management’s Chiropractic Billing Services, chiropractic providers can optimize their revenue cycle, reduce financial stress, and ensure that their practice remains financially healthy. This allows chiropractors to focus on what truly matters—improving the health and well-being of their patients.

#medical billing#Optimizing Financial Management with Chiropractic Billing Services#In the healthcare sector#chiropractic care plays a vital role in managing musculoskeletal conditions#improving mobility#and enhancing patients' overall quality of life. However#managing the financial aspects of a chiropractic practice can be challenging due to the unique nature of treatments#frequent patient visits#and varying insurance policies. This is where medical billing services come into play#ensuring that chiropractic practices can focus on providing care while their financial operations run smoothly. These services streamline t#minimize errors#and enhance reimbursement rates#which ultimately leads to better revenue management for chiropractic practices.#What Are Chiropractic Billing Services?#Chiropractic billing services are specialized financial solutions designed to meet the unique needs of chiropractic practices. These servic#which oversee the entire process of patient billing#from claim submission to final payment. Chiropractic billing services handle everything from insurance verification and coding of chiroprac#these billing services ensure that claims are submitted accurately and promptly#reducing delays and maximizing revenue.#The Importance of Medical Billing and Coding in Chiropractic Care#Accurate medical billing and coding is essential for chiropractic practices to ensure that they are compensated for the services they provi#such as spinal adjustments#physical therapy#and other therapeutic services#each of which requires precise coding to avoid errors. Incorrect or incomplete coding can lead to claim denials or underpayments#which can negatively affect a practice’s cash flow. By partnering with experienced billing professionals who specialize in medical billing#chiropractic practices can ensure that their claims are submitted correctly and in compliance with industry standards#leading to improved financial outcomes.#Benefits of Healthcare IT in Chiropractic Billing#In the digital age

0 notes

Text

Streamlining Trucking Finances with Digital Invoice Management

Let’s talk invoices. I know, it might not be the most exciting topic when you’re out on the road, but stick with me for a minute—it’s actually smart for your business. Tired of handling stacks of paper invoices? It’s like trying to navigate rush hour traffic with a broken GPS. Papers get lost, numbers get messed up, and chasing down payments can feel like an endless loop. But here’s some good…

View On WordPress

#AI for trucking operations#AI invoice processing#automated invoicing systems#blockchain in trucking#business#cash flow management#cloud computing in trucking#cloud-based invoicing#digital invoicing for truckers#digital solutions for trucking#factoring services for truckers#Freight#freight industry#Freight Revenue Consultants#invoice automation in trucking#invoice factoring for truckers#invoice management software for truckers#logistics#real-time invoice tracking#scalable invoicing solutions#secure invoicing for truckers#small carriers#streamline trucking operations#Transportation#Trucking#trucking business efficiency#trucking cash flow solutions#trucking data insights#Trucking Financial Management#trucking financial tools

0 notes

Text

Unlocking the Value of Your Veterinary Clinic Business: A Comprehensive Guide by Next Best Exit

In the dynamic landscape of the veterinary industry, understanding the true worth of your clinic is crucial for strategic decision-making and future planning. Next Best Exit, a leading authority in business valuation, is here to guide you through the process. In this article, we'll delve into the key factors that determine the value of your veterinary clinic and provide insights on how to optimize and assess "What is my Veterinary Clinic business worth."

Conclusion: In conclusion, unlocking the true worth of your veterinary clinic requires a holistic approach that considers various factors. Next Best Exit stands as your trusted partner, offering expert insights and customized solutions to answer the pivotal question, "What is my Veterinary Clinic business worth?" Contact us today to embark on the journey of m

#a leading authority in business valuation#is here to guide you through the process. In this article#Market Trends and Demand: To accurately gauge the value of your veterinary clinic#identifying growth opportunities#and assessing the demand for specialized veterinary services.#profit margins#and cash flow#providing actionable insights to enhance your clinic's overall financial health.#streamline workflows#Conclusion: In conclusion

0 notes

Text

★ financial guide for the rising signs [2nd, 6th, 10th] ★

★ aries rising ★

your financial success is built on consistency and long-term stability, not quick wins. with taurus ruling your 2nd house, money grows when you treat wealth like a garden, planting seeds that will pay off over time. you thrive financially when you own assets, build slow but steady income streams, and develop financial patience. stop chasing instant gratification—your wealth is strongest when it’s rooted in something tangible. luxury and financial comfort are meant for you, but you have to build them brick by brick.

your 6th house in virgo makes you a high-efficiency worker, someone who functions best when there’s structure, organization, and refinement. you make money by perfecting a craft, streamlining processes, and offering exceptional value. your best financial move is to create a system that allows you to scale your work efficiently. you’re at your worst when you’re working aimlessly without a clear financial plan.

your 10th house in capricorn means you were born to lead, build, and accumulate wealth over time. you’re meant for legacy careers, business ownership, and high-status roles. people respect you when you take charge, so stop underpricing yourself or playing small.

how to make money effectively:

develop long-term wealth strategies—real estate, investments, high-end services

charge premium rates for expertise and reputation

create a financial structure that supports stability

what to avoid:

chasing quick, unstable money

overworking without a strategy

switching careers before establishing mastery

★ taurus rising ★

your financial power is in communication, adaptability, and multiple income streams. with gemini ruling your 2nd house, money flows to you when you leverage your voice, ideas, and connections. financial success doesn’t come from routine—it comes from diversity in income sources. you are meant to write, teach, sell, or speak your way into wealth. the more financial channels you open, the more money circulates to you.

your 6th house in libra means you work best in aesthetic, harmonious, and collaborative environments. you aren’t built for chaotic, high-stress jobs. you thrive in team settings, networking-based careers, and industries that blend beauty with logic. financial stability comes when you learn to balance your workload instead of overextending yourself.

your 10th house in aquarius demands an unconventional, tech-forward career path. you are meant to break traditional job structures, innovate, and align with futuristic industries. you do best in digital entrepreneurship, social media, trend forecasting, or anything that involves forward-thinking ideas.

how to make money effectively:

monetize your ability to communicate and teach

build multiple income streams—investments, digital products, freelancing

work in tech, media, or networking-heavy industries

what to avoid:

relying on one static job

working in environments that lack creativity

ignoring opportunities in digital markets

★ gemini rising ★

your wealth is deeply emotional, tied to security, intuition, and financial comfort. with cancer in your 2nd house, money doesn’t just pay the bills—it makes you feel safe, nurtured, and at home. your income thrives when you create financial stability through consistent cash flow, savings, and emotional alignment. financial stress deeply affects you, so it’s essential to prioritize steady income rather than risky financial ventures.

your 6th house in scorpio makes you a deep, obsessive worker. you aren’t interested in shallow or meaningless tasks—you work best when you’re fully immersed in something that feels powerful. your financial strength comes from mastering hidden knowledge, psychology, finance, or investigative work.

your 10th house in pisces means your career should be intuitive, creative, or healing-based. you excel in spirituality, psychology, creative arts, or behind-the-scenes industries. your wealth is strongest when you trust your intuition in financial decisions and align with work that feels meaningful.

how to make money effectively:

build a secure financial base to reduce stress

monetize your intuition, creativity, or depth of knowledge

work in psychology, spirituality, creative arts, or research fields

what to avoid:

taking jobs that feel emotionally unfulfilling

working in environments that lack depth or purpose

ignoring financial planning and relying on instinct alone

★ cancer rising ★

your financial success is built on self-worth, confidence, and personal branding. with leo ruling your 2nd house, money flows when you own your value, embrace leadership, and position yourself as someone who deserves high earnings. you don’t attract wealth through small, quiet roles—you thrive when you command attention and make bold financial moves. underpricing yourself or working behind the scenes limits your wealth potential. financial success comes when you set premium rates, build a reputation, and confidently market yourself.

your 6th house in sagittarius means you work best in free-flowing, exploratory environments. you’re not designed for strict routines or micromanagement—you need variety, freedom, and adventure in your work. you thrive when you’re constantly learning, traveling, or expanding your knowledge.

your 10th house in aries makes you a self-made success. you aren’t meant to follow a traditional career path—you’re supposed to take risks, initiate projects, and carve your own way. your professional reputation grows when you move fast, innovate, and trust yourself to lead.

how to make money effectively:

charge higher prices and position yourself as an expert

monetize your personal brand, leadership skills, and visibility

choose work that offers freedom, travel, and expansion

what to avoid:

waiting for permission or validation before taking financial risks

settling for low-paying jobs that don’t challenge you

forcing yourself into structured, routine-based work

★ leo rising ★

your financial success is built on precision, planning, and efficiency. with virgo in your 2nd house, money comes when you treat your finances like a system—organized, methodical, and structured. you thrive when you budget carefully, invest in skill-building, and refine your financial strategy. spontaneous spending or reckless investments disrupt your natural wealth flow. success happens when you track income meticulously and build sustainable wealth through careful management.

your 6th house in capricorn makes you a relentless worker. you have an intense work ethic, but you need to ensure that your effort leads to long-term success rather than just grinding for survival. your wealth expands when you commit to one field and steadily rise through the ranks.

your 10th house in taurus means your career should be stable, luxurious, and built for long-term wealth. you are meant to own property, invest in high-end businesses, or work in industries that prioritize security and financial stability.

how to make money effectively:

build financial routines and long-term wealth strategies

focus on high-quality work that leads to reputation and authority

invest in tangible wealth like property, luxury markets, and stable industries

what to avoid:

working endlessly without a clear financial plan

undervaluing your expertise and meticulous skills

making impulsive financial choices instead of planning ahead

★ virgo rising ★

your financial success is tied to relationships, aesthetics, and social influence. with libra in your 2nd house, money flows when you use charm, partnerships, and artistic talents to generate wealth. your earning potential expands when you surround yourself with financially successful people and work in industries that blend beauty, balance, and intelligence.

your 6th house in aquarius means you work best in unconventional, flexible environments. you aren’t designed for traditional 9-to-5 jobs—you thrive when you can innovate, experiment, and work on your own terms. your wealth builds when you stay ahead of trends and tap into progressive industries.

your 10th house in gemini means your career should involve communication, education, and media. you excel when you’re writing, speaking, teaching, or sharing ideas with the public.

how to make money effectively:

leverage social connections, networking, and collaborations

work in aesthetic industries like fashion, branding, design, or public relations

monetize your voice, writing, or ability to share knowledge

what to avoid:

working in rigid, traditional jobs that limit your creativity

avoiding financial discussions or neglecting money management

sticking to one income source instead of diversifying

★ libra rising ★

your financial power is rooted in secrecy, transformation, and hidden wealth. with scorpio in your 2nd house, money isn’t just about earning—it’s about long-term accumulation, financial control, and strategic investments. you are meant to build private wealth, passive income, and financial independence through methods that aren’t obvious to others. your money grows when you invest wisely, keep your financial moves private, and create wealth that isn’t easily disrupted.

your 6th house in pisces makes you a fluid, intuitive worker. you function best when you can follow inspiration rather than rigid schedules. your work needs to feel meaningful, creative, or spiritually aligned.

your 10th house in cancer means your career should be emotionally connected, nurturing, and deeply fulfilling. you thrive in real estate, finance, healing professions, or work that allows you to support others.

how to make money effectively:

build passive income and long-term wealth strategies

work in finance, psychology, healing, or real estate

keep your financial success private—money grows best when protected from outside influence

what to avoid:

oversharing your financial plans before they manifest

choosing jobs that feel shallow or emotionally unfulfilling

avoiding money management out of fear of instability

★ scorpio rising ★

your financial success comes from expansion, risk-taking, and trusting your instincts. with sagittarius in your 2nd house, money doesn’t come through slow accumulation—it comes through big leaps, bold decisions, and aligned opportunities. financial growth happens when you invest in yourself, take strategic risks, and follow your gut on money matters.

your 6th house in aries makes you a fast-paced, action-driven worker. you work best when you can move quickly, make independent decisions, and avoid unnecessary bureaucracy.

your 10th house in leo means your career should be high-profile, leadership-based, and tied to personal recognition. you are meant to be seen, respected, and known for your achievements.

how to make money effectively:

take calculated financial risks—investments, entrepreneurship, or industry leadership

monetize your personal brand and leadership skills

position yourself in high-visibility roles where people trust your expertise

what to avoid:

playing small in low-status roles that don’t challenge you

waiting too long to take financial risks and expand

ignoring financial planning in favor of short-term wins

★ sagittarius rising ★

your financial success is built on discipline, long-term planning, and strategic wealth-building. with capricorn in your 2nd house, money doesn’t come from luck—it comes from calculated effort, financial responsibility, and structured income streams. you are meant to accumulate wealth slowly and steadily, focusing on stability over quick money. financial success happens when you treat money seriously, create structured goals, and build assets that appreciate over time.

your 6th house in taurus makes you a consistent, hardworking employee or business owner. you thrive in stable, predictable work environments where your effort compounds over time. financial success is strongest when you create a routine that guarantees steady progress toward your goals.

your 10th house in virgo means your career should be practical, analytical, and detail-oriented. you excel in careers that require precision, problem-solving, and a structured approach to success. your path to wealth involves mastering a craft, refining your skills, and gaining a reputation for reliability.

how to make money effectively:

build structured financial plans and investment portfolios

work in industries that reward consistency, expertise, and long-term strategy

create multiple revenue streams that grow over time

what to avoid:

relying on short-term gains instead of sustainable wealth-building

working in unstable jobs with no long-term potential

ignoring financial planning and delaying wealth accumulation

★ capricorn rising ★

your financial success is tied to innovation, technology, and unconventional wealth-building methods. with aquarius in your 2nd house, money flows when you break away from traditional financial structures and embrace modern, progressive income sources. your wealth isn’t built through slow accumulation—it’s built through disrupting old systems, networking, and staying ahead of trends. financial success happens when you embrace new industries, invest in digital business, and use social influence to expand your financial reach.

your 6th house in gemini makes you a multitasking, fast-paced worker. you thrive in careers that keep your mind engaged, allow for constant learning, and involve communication or technology. your best financial move is to build diverse income streams rather than relying on one job.

your 10th house in libra means your career should involve social connections, aesthetics, or partnership-based industries. you succeed when you leverage your ability to connect people, create beauty, or navigate business relationships effectively.

how to make money effectively:

invest in tech-driven businesses, digital markets, and networking opportunities

create flexible income streams that allow financial independence

work in industries that prioritize aesthetics, relationships, or innovation

what to avoid:

following outdated financial models instead of embracing new ones

working in rigid, creativity-stifling jobs

ignoring opportunities that involve social influence or technology

★ aquarius rising ★

your financial success is built on intuition, creativity, and fluid income streams. with pisces in your 2nd house, money flows to you when you trust your instincts, embrace imaginative work, and allow wealth to come to you rather than chasing it. you don’t follow traditional financial rules—you manifest wealth through subconscious alignment, creativity, and spiritual awareness. financial success happens when you remove limiting beliefs around money and let abundance flow naturally.

your 6th house in cancer makes you an emotionally driven worker. you function best when your job feels meaningful, nurturing, and deeply connected to your values. you can’t thrive in cold, impersonal workplaces—you need a work environment that feels supportive and emotionally fulfilling.

your 10th house in scorpio means your career should be deep, powerful, and transformative. you succeed in roles that involve research, healing, finance, or uncovering hidden knowledge.

how to make money effectively:

monetize your creativity, spirituality, or intuitive skills

create passive income streams that let money flow without constant effort

work in industries that involve healing, psychology, or artistic expression

what to avoid:

following strict financial plans that don’t align with your natural flow

working in emotionally draining jobs that don’t fulfill you

ignoring your natural ability to manifest wealth effortlessly

★ pisces rising ★

your financial success is built on bold action, independence, and high-energy decision-making. with aries in your 2nd house, money doesn’t come from waiting—it comes from taking risks, trusting your instincts, and constantly staying in motion. you don’t accumulate wealth through slow, careful planning—you build it by jumping on opportunities, acting fast, and believing in yourself. financial success happens when you take charge of your earnings and don’t hesitate to claim financial independence.

your 6th house in leo makes you a natural performer and leader in the workplace. you thrive in high-energy jobs where you can be recognized, admired, and rewarded for your hard work. your best financial move is to put yourself in visible positions where people trust and follow your expertise.

your 10th house in sagittarius means your career should involve travel, adventure, and continuous expansion. you succeed when you embrace new experiences, follow your passions, and take risks in your professional life.

how to make money effectively:

take bold financial risks that align with your instincts

build a personal brand that makes you stand out in your field

work in industries that offer freedom, independence, and high rewards

what to avoid:

hesitating too long before making financial decisions

staying in jobs that don’t allow you to be seen or recognized

ignoring your need for financial independence and self-driven success

★ book a reading ★ ★ masterlist 1 ★ ★ masterlist 2 ★

#astrology#astrology observations#astrology aspects#astro observations#2nd house#6th house#10th house

746 notes

·

View notes

Text

Axolt: Modern ERP and Inventory Software Built on Salesforce

Today’s businesses operate in a fast-paced, data-driven environment where efficiency, accuracy, and agility are key to staying competitive. Legacy systems and disconnected software tools can no longer meet the evolving demands of modern enterprises. That’s why companies across industries are turning to Axolt, a next-generation solution offering intelligent inventory software and a full-fledged ERP on Salesforce.

Axolt is a unified, cloud-based ERP system built natively on the Salesforce platform. It provides a modular, scalable framework that allows organizations to manage operations from inventory and logistics to finance, manufacturing, and compliance—all in one place.

Where most ERPs are either too rigid or require costly integrations, Axolt is designed for flexibility. It empowers teams with real-time data, reduces manual work, and improves cross-functional collaboration. With Salesforce as the foundation, users benefit from enterprise-grade security, automation, and mobile access without needing separate platforms for CRM and ERP.

Smarter Inventory Software Inventory is at the heart of operational performance. Poor inventory control can result in stockouts, over-purchasing, and missed opportunities. Axolt’s built-in inventory software addresses these issues by providing real-time visibility into stock levels, warehouse locations, and product movement.

Whether managing serialized products, batches, or kits, the system tracks every item with precision. It supports barcode scanning, lot and serial traceability, expiry tracking, and multi-warehouse inventory—all from a central dashboard.

Unlike traditional inventory tools, Axolt integrates directly with Salesforce CRM. This means your sales and service teams always have accurate availability information, enabling faster order processing and better customer communication.

A Complete Salesforce ERP Axolt isn’t just inventory software—it’s a full Salesforce ERP suite tailored for businesses that want more from their operations. Finance teams can automate billing cycles, reconcile payments, and manage cash flows with built-in modules for accounts receivable and payable. Manufacturing teams can plan production, allocate work orders, and track costs across every stage.

86 notes

·

View notes

Text

Typed out a long response to @blasphemyenjoyer's question and I also want it on my blog, this being my diary of my dragon age obsession I guess.

Largely positive about writing choices below the cut with some critical elements, largely about how the realities of the game production necessitate a lack of flow between games.

[As always, sorry for putting a somewhat critical post in main tags, I try to make sure my followers can filter stuff accurately.]

So here's the thing: a lot of the replayability enjoyment of these games [blogger's note: DA series and RPGs more widely] for me comes from crafting different story decisions to roleplay different characters. The first time playing inquisition, not knowing how the choices I was making would play out, was exciting and crazy and scary! And then the second time, I felt like the urgency was gone and I could actually explore every corner of the world, and that was kinda more fun. Going in with a character made to target a specific romance or have a backstory connection to certain elements of the game or whatever is super fun for me.

Knowing that Rook is always going to get the rug pulled out from under them by Solas and have to face the grief of Varric being dead all a long is a fun thing to play with when making different characters. And a lot of the origins specifically have different ideas about death: my warden Rook is going to have a different relationship to Varric sacrificing himself for the sake of the mission than, say, a mourn watch Rook will have with the idea of seeing and interacting with the spirit of a departed friend.

Given that they made the choice to sacrifice Varric in this game, I'm not super mad at how they did it. I enjoyed the twists and turns, the reveal even though I figured out it was coming, and the replayability of it for at least the second time is crazy. For example,

"Hey, let's not get stuck in our regrets, all right?" -sock puppet of a guy who is about to trap you in a literal prison made of regret voice

I don't necessarily think it's bad for the series as a whole to shift towards a more streamlined set of choices so they can focus on big beats and character moments like this. They've known since the development of DA2 that it's incredibly hard for them to cash in on the results of the world-altering choices you make in past games. Don't have one character be dead in 25% of saves and alive in 75% of saves, let them have their moment.

UNFORTUNATELY having bg3 come out a year before this game really kneecapped my enjoyment of it. Because that was such a good example of loving detail breathing life into every square foot in a game world, and your choices coming back to matter in a concrete way BEFORE THE END OF THE GAME

also if they wanted to kill Varric off they should have done it in DA2 or Inquisition. Sorry. Have Cassandra actually kill him during the interrogation to find Hawke and we the player not find out until we're already the figurehead of the organization in the next game. Have him sacrifice himself if Hawke gets left in the fade in Inquisition. Hell, make the inquisitor the protagonist of this game so he's sacrificing himself in front of his friend of 10 years and not his employee of 6 months. like, I think there were better ways to do this, but it's beginning to be clear that they're only ever thinking one release ahead with a huge turnover of writers in between projects.

So maybe when they wrote Inquisition they did have good ideas to follow up on who becomes divine, who rules Orlais, how they track down solas, whatever, because those were the things they were focusing on. But then 10 years go by and the writing staff largely turns over and they're focused on writing another AAA fantasy rpg that can stand alone, and trying to bow to the whims of the market in terms of what's popular (oh maybe they want online multiplayer and a move away from the hugely d&d inspired mechanics--AH FUCK OOPS THE GOTY IS WHAT) so then you lose any sense of broader arc or intention over the series as a whole.

So there I guess that's my thoughts

12 notes

·

View notes

Text

Benefits of Hiring a Professional Bookkeeper for Your Business

A bookkeeping consultant in Fort Mill can save you time, reduce stress, and improve financial accuracy. Get expert guidance for tax season, cash flow management, and business grow

16 notes

·

View notes

Text

Simplify Decentralized Payments with a Unified Cash Collection Application

In a world where financial accountability is non-negotiable, Atcuality provides tools that ensure your field collections are as reliable as your core banking or ERP systems. Designed for enterprises that operate across multiple regions or teams, our cash collection application empowers agents to accept, log, and report payments using just their mobile devices. With support for QR-based transactions, offline syncing, and instant reconciliation, it bridges the gap between field activities and central operations. Managers can monitor performance in real-time, automate reporting, and minimize fraud risks with tamper-proof digital records. Industries ranging from insurance to public sector utilities trust Atcuality to improve revenue assurance and accelerate their collection cycles. With API integrations, role-based access, and custom dashboards, our application becomes the single source of truth for your field finance workflows.

#ai applications#artificial intelligence#augmented and virtual reality market#augmented reality#website development#emailmarketing#information technology#web design#web development#digital marketing#cash collection application#custom software development#custom software services#custom software solutions#custom software company#custom software design#custom application development#custom app development#application development#applications#iot applications#application security#application services#app development#app developers#app developing company#app design#software development#software testing#software company

4 notes

·

View notes

Text

Jack in the Box to close up to 200 restaurants

https://fox5sandiego.com/news/business/jack-in-the-box-to-close-up-to-200-restaurants/

(KTLA) – Jack in the Box announced plans Tuesday to close 150 to 200 underperforming stores as part of an aggressive financial plan called “JACK on Track.”

The company’s CEO said that the fast-food chain, which is known for its Jumbo Jack and sarcastic mascot, is focused on accelerating cash flow and paying down debt.

Jack in the Box operates some 2,200 stores across 22 states, primarily on the West Coast, including many locations in Southern California.

Jack in the Box, Inc, also owns Del Taco, another fast-food chain headquartered in California. Jack in the Box’s plans to streamline finances could impact the future of the taco chain, which operates some 600 locations.

3 notes

·

View notes

Text

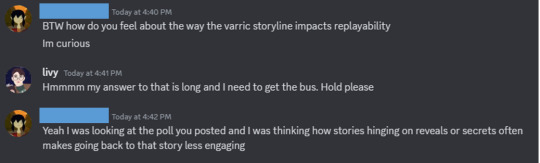

Backpack must-haves: College edition

Pens, laptop, notebooks, water, some cash and a charger with the odd mint or tictac chilling somewhere at the bottom of your bag.

Scrambling around, trying to find your ratty notebook, and then asking your impeccable, super organized neighbor for a pen 6 minutes after class has started only to be shushed by the person in front of you and having 10 heads swivel back and glare at you for interrupting their flow.

Sounds familiar? That was the state of my learning and my bag during my first week of uni, after which my itinerary was promptly overhauled and reorganized.

Question: If your backpack is messy and disorganized, how will that reflect on your studies in the long-run? Not great, so let's go through my back pack must-have's so that you have one less thing to stress about.

1. A pencil case with: 4x pens, 2x pencils, 1x sharpener, 1x eraser, 3x highlighters, 1x scissors, 1x small glue.

The amount and items vary, depending on your major and personal use, but an actual pencil case is a must have. It doesn't need to be flashy, or designer.

Even a plastic ziplock bag will do!

You just need a bag or a container to store your pens so that instead of scrambling at the bottom of your bag and hopelessly trying to find a working pen, you know exactly where everything is.

2. Electronics: 1x phone charger, 1x laptop with charger, headphones

One of the worst things that can happen is low batter, so come prepared! Bring along your phone and laptop charger (if you need your lapop that day) just in case.

3. Your beauty & health case

If you wear makeup regularly, you probably already have a small makeup bag with your products.

Other people, myself included should also have a smaller bag, but not just for makeup or makeup at all.

This case should have tampons, pads, a spare set of underwear and socks (you never know when the rain decides to go apocolyptic, and going back home in wet socks is unpleasant), gum, painkillers, any meds that you may need, deodorant, body spray, hand sanitizer, tissues, some emergency cash, lipbalm etc.

Once again, the actual contents may vary, but the point stands. Get a separate case or bag for your health products, so that instead of trying to juggle several items when going to the bathroom, you can just remove your case and go do your business quickly and easily.

When possible, streamline the process.

4. A full water bottle

Staying hydrated is a must, especially during the start of the school year. All the running around the campus, trying to remember in which buliding your classes are require enough liquids.

Early autumn tends to be quite hot in my region, and only starts to cool off in mid November, so my water bottle requires constant re-filling.

Your studies will thank you, as an over-heated, dehydrated student with a raging headache is rarely a productive student.

(Source: me and a few other uni students who chose coffee over water one time too many, and lived to tell the tale. Oh the regret. Anyway. Live and learn.)

5. Food

Who has time to wake up in the morning, cook a proper lunch, pack it neatly into your lunchbox, shower, get dressed, and make it in time for your morning class bright-eyed and energized?

Not many students, especially uni students commuting to class for 1-2hrs each day.

I should probably make a separate post about meal prep on a money and time budget (lmk if that'll be useful!), but the bottom line is this:

You need to eat, and the on campus cafe's usually charge an arm and a leg, so there are a few options available.

A. Cook overnight and bring leftovers and some snacks to tide you over with you. Snacks may include fruit, sandwiches, some chips etc. Small and light.

B. Live solely on pre-bought snacks. Works for some people, not so much for others. A good option, as long as the snacks have some substance (cheetos don't count! Think more like a fruit cup, or a chicken sandwhich).

C. Depending on your location, some campuses are located in a city, so a quick 10 min bus ride to a grocery store is likely to offer more variety and better lunch options. I

've certainly done that, and guess what? The daily bus ticket and my shawarma cost less than a fancy sandwhich so there's always that!

6. The stationary: Notebooks, textbooks, a planner

Your course may require you to use just one notebook, whereas you may go through 10 notebooks per term in a different class.

Look up the syllabus and email your lecturer in advance to know what material you will need.

Don't forget to include some extra notebooks for your own out-of-class studying. Using the same notebook can have varying results.

Personally, I don't need anyone else seeing my notebook filled with what appears to be incomprehensible scribblings and ramblings, when it's just me annotating my answers to practise questions.

You may like many people use an online planner, but nothing beats having an on paper entry. Besides, it's more convenient to use in those weak or no signal buildings, with wifi so weak that they shouldn't have bothered wiring the building.

7. The wallet

Campus ID, personal ID, card, cash, driver's license, health card, maybe a business card or two.

You never know when you might need any of these things, as things happen, especially on college campuses, so always carry around some cash and an ID of some sort.

#college life#student life#studyinspo#studyblr#study tips#china#aesthetic#college#slavic roots western mind#student#study in china#travel blog#study blog#studyspo#study motivation#studying#exams#study space#study aesthetic#langblr#study notes#light academia#current mood#vibes#booklr

54 notes

·

View notes

Text

Conclusion

Buying blinds in bulk isn’t just about getting a lower unit price—it’s a strategic decision that can transform your operations, improve cash flow, and elevate your product offerings. From cost savings and consistent quality to streamlined logistics and enhanced customization, bulk purchasing provides a suite of advantages for retailers, contractors, and designers alike. By partnering with a reliable supplier, forecasting demand accurately, and implementing robust inventory practices, you can unlock the full potential of bulk blinds and stay one step ahead in a competitive market.

2 notes

·

View notes

Text

The Future of Commercial Loan Brokering: Trends to Watch!

The commercial loan brokering industry is evolving rapidly, driven by technological advancements, changing market dynamics, and shifting borrower expectations. As businesses continue to seek financing solutions, brokers must stay ahead of emerging trends to remain competitive. Here are some key developments shaping the future of commercial loan brokering:

1. Rise of AI and Automation

Artificial intelligence (AI) and automation are revolutionizing loan processing. From AI-driven underwriting to automated document verification, these technologies are streamlining workflows, reducing manual effort, and speeding up loan approvals. Brokers who leverage AI-powered tools can offer faster and more efficient services.

2. Alternative Lending is Gaining Momentum

Traditional banks are no longer the only players in commercial lending. Alternative lenders, including fintech platforms and private lenders, are expanding options for businesses that may not qualify for conventional loans. As a result, brokers must build relationships with non-bank lenders to provide flexible financing solutions.

3. Data-Driven Decision Making

Big data and analytics are transforming how loans are assessed and approved. Lenders are increasingly using alternative data sources, such as cash flow analysis and digital transaction history, to evaluate creditworthiness. Brokers who understand and utilize data-driven insights can better match clients with the right lenders.

4. Regulatory Changes and Compliance Requirements

The commercial lending landscape is subject to evolving regulations. Compliance with federal and state laws is becoming more complex, requiring brokers to stay updated on industry guidelines. Implementing compliance-friendly processes will be essential for long-term success.

5. Digital Marketplaces and Online Lending Platforms

Online lending marketplaces are making it easier for businesses to compare loan offers from multiple lenders. These platforms provide transparency, efficiency, and better loan matching. Brokers who integrate digital platforms into their services can enhance customer experience and expand their reach.

6. Relationship-Based Lending Still Matters

Despite digital advancements, relationship-based lending remains crucial. Many businesses still prefer working with brokers who offer personalized service, industry expertise, and lender connections. Building trust and maintaining strong relationships with both clients and lenders will continue to be a key differentiator.

7. Increased Focus on ESG (Environmental, Social, and Governance) Lending

Sustainability-focused lending is gaining traction, with more lenders prioritizing ESG factors in their financing decisions. Brokers who understand green financing and social impact lending can tap into a growing market of businesses seeking sustainable funding options.

Final Thoughts

The commercial loan brokering industry is undergoing a transformation, with technology, alternative lending, and regulatory changes shaping the future. Brokers who embrace innovation, stay informed on market trends, and continue building strong relationships will thrive in this evolving landscape.

Are you a commercial loan broker? What trends are you seeing in the industry? Share your thoughts in the comments below!

#CommercialLoanBroker#BusinessFinancing#LoanBrokerTrends#AlternativeLending#Fintech#SmallBusinessLoans#AIinLending#DigitalLending#ESGLending#BusinessGrowth#LoanBrokerage#FinanceTrends#CommercialLending#BusinessFunding#FinancingSolutions#4o

3 notes

·

View notes

Text

The Strategic Advantage of Outsourcing Accounts Receivable

Photo by Tima Miroshnichenko on Pexels.com In today’s competitive business landscape, managing accounts receivable (AR) efficiently is crucial for maintaining healthy cash flow and ensuring business sustainability. Recognizing this, many companies, including industry leaders like Swift, Invensis, FedEx Corporation, United Parcel Service, Inc. (UPS), Penske Logistics LLC, and XPO Logistics, are…

View On WordPress

#access to AR expertise#accounts receivable management#accounts receivable outsourcing#AR collections#AR outsourcing benefits#AR process streamlining#AR technology solutions#business cash flow improvement#cost-saving strategies#FedEx Corporation#financial health enhancement#financial operations optimization#focus on core business#Freight#freight industry#Freight Revenue Consultants#future of AR outsourcing#improve cash flow#Invensis outsourcing#invoice processing efficiency#logistics#outsourcing case studies#outsourcing services#Penske Logistics LLC#reduce operational costs#small carriers#strategic business partnerships#Swift logistics#Transportation#UPS logistics

0 notes

Text

Chicago Real Estate Market: Trends, Opportunities, and What to Expect in 2025

Managing a business involves more than just delivering excellent products and services. Financial management plays a critical role in the success of any business. For many business owners in North Carolina, bookkeeping can become an overwhelming task that diverts attention from core operations. However, outsourcing bookkeeping services can streamline financial processes, save valuable time, and lead to significant cost savings.

Here's a closer look at how professional bookkeeping services can optimize financial management.

Time Savings: Focus on What Matters

Every business owner understands the importance of time, and bookkeeping tasks can quickly take up valuable hours that could be better spent on growing the business. Managing financial records, categorizing transactions, and reconciling accounts can be complicated and tedious. Outsourcing these tasks to experienced bookkeepers frees up time to focus on strategic goals, customer relations, and other business operations.

By trusting experts with financial duties, owners ensure that these tasks are handled efficiently and accurately. Bookkeepers use specialized tools to organize and maintain financial records, making the process faster and more reliable. As a result, businesses avoid spending time correcting mistakes and can rest assured that financial records are up to date.

Financial Clarity: Informed Decision-Making

Clear, accurate financial data is essential for making informed decisions. Without up-to-date reports, it can be challenging to understand the true state of a business's finances. Professional bookkeeping services provide valuable insights into cash flow, income, and expenses. Business owners gain a clear picture of financial health, which is vital for planning and budgeting.

Regular financial reports, including profit and loss statements, balance sheets, and cash flow summaries, help identify trends and highlight areas for improvement. With this knowledge, businesses can adjust strategies, identify opportunities for growth, and make smarter decisions that lead to success. Understanding the numbers simplifies the decision-making process and helps ensure long-term sustainability.

Reducing Costs: Avoiding Errors and Penalties

Handling bookkeeping independently often leads to mistakes—whether it's misclassifying an expense or missing a tax deduction. These errors can result in costly penalties, missed savings, or poor financial decisions. By working with professional bookkeepers in Chicago for real estate, businesses can reduce the risk of errors that could lead to economic setbacks.

Experienced bookkeepers ensure that taxes are filed correctly, transactions are properly recorded, and all necessary deductions are applied. This not only helps avoid penalties but also uncovers potential savings by identifying overlooked deductions or financial inefficiencies. Outsourcing bookkeeping services, therefore, saves money by preventing costly mistakes.

Streamlining Operations: Efficient Financial Management

Bookkeeping involves more than just tracking income and expenses. It also includes managing accounts payable, accounts receivable, payroll, and tax filings. Keeping up with these responsibilities can become overwhelming, especially as a business grows. Professional bookkeeping services automate many of these processes, ensuring they are completed efficiently and on time.

Timely payment of invoices and the smooth processing of payroll help businesses maintain strong relationships with vendors and employees. At the same time, timely billing and collections keep cash flow consistent. By handling these essential tasks, bookkeeping services allow business owners to focus on other aspects of their operations, while the financial side of the business remains in capable hands.

Scalability: Adapting to Business Growth

As businesses grow, so do their financial complexities. Whether it's increasing revenue, adding new employees, or expanding to new markets, the need for more detailed financial management arises. Professional bookkeeping services can scale with a business, providing tailored solutions as needs evolve.

Outsourcing bookkeeping allows businesses to avoid the cost and hassle of hiring additional in-house staff or purchasing expensive software. Bookkeepers can adjust their services to accommodate changing demands, whether it's managing more transactions or overseeing more complex accounting tasks. This scalability ensures that businesses are equipped to handle growth without compromising on financial accuracy.

Data Protection: Safeguarding Financial Information

When it comes to financial data, security is critical. Storing sensitive business information—such as revenue details, tax filings, and payroll records—requires a high level of protection. Professional bookkeeping services use secure systems to ensure that financial records are safely stored and only accessible to authorized personnel.

By employing encryption and secure cloud storage, bookkeepers safeguard against data breaches and fraud. Additionally, regular reconciliations and audits help detect any discrepancies or signs of fraudulent activity, providing an extra layer of protection for the business's financial assets.

Conclusion: Why Bookkeeping Services Are an Investment

Outsourcing bookkeeping may seem like an added expense, but it's an investment that yields significant returns. By entrusting financial management to experts, business owners save valuable time, reduce the risk of costly errors, and gain valuable insights into their financial health. From improving cash flow management to identifying areas for cost savings, professional bookkeeping services help businesses optimize operations and increase profitability.

For businesses in North Carolina, professional bookkeeping is not just a convenience—it's a strategic asset that ensures financial processes are efficient, accurate, and secure. By freeing up time and minimizing costs, bookkeeping services allow businesses to focus on what matters most: achieving long-term success and growth.

To know more about real estate services, visit the website now.

2 notes

·

View notes

Text

Medical Billing Services in Florida: 2024 Guide to Boost Revenue

Florida’s healthcare providers encounter a perfect storm of difficulties with the hurricane season, aging patients, and the intricate rules of Medicaid. Clinics lost over $4.7 million a year due to billing mistakes in 2023 alone, which is enough to hire more than 50 nurses throughout the state. This guide explores how medical billing services in Florida mitigate these issues through expert knowledge and advanced technology to stop revenue loss and streamline profits.

What Are Medical Billing Services? (And Ohio’s Reasons For The Need)

They are the financial lifeline of a clinic. Medical billing services in Florida manage the coding of the diagnosis and the appeals for denied claims. In Florida, it is more than just a contracting firm; it is a matter of survival.

Why Florida?

Medicare Mayhem: One of the most bizarre situations in America is that 32% of people living in Florida use Medicare Advantage plans, each with its own billing rules.

Hurricane Headaches: Correctly coding claims is a difficult task. After Hurricane Ian, clinics reported using ICD-10 code Z04.1 (disaster-related care) for more than 3000 claims.

Legal Landmines: The “Balance Billing” law in Florida means that a single coding mistake could incur a loss of more than $10,000 in fines.

5 Ways Florida Medical Billing Services Boost Revenue

Slash Denial Rates

AI software, like Claim Genius, is helping Miami clinics decrease denial rates. Denials due to discrepancies such as telehealth visit Cand PT code mismatches are flagged. These tools help reduce denials by 40%.

Speed Up Payments

If correctly coded, the Staywell program of Florida Medicaid processes case management claims (HCPCS code T1015) 15 days earlier than the stipulated payment period.

Ensure Compliance

By outsourcing coding to AAPC-certified specialists, Sunset Medical Group mitigated $250,000 in anticipated AHCA fines.

Cut Costs

HealthFirst Clinic of Orlando saves $67k a year by contracting billing out to Specialized-Billing.com.

Disaster-Proof Billing

Fort Myers clinics adopted cloud-based systems for billing and were able to submit 95% of claims on time after Hurricane Ian.

How to Choose the Best Medical Billing Partner in Florida

Ask These Questions:

“What is the ‘1115 Waiver’ rule and do your coders know Florida Medicaid's version?”

“Are claims manageable during the oncoming hurricane?”

Avoid These Pitfalls:

Companies with no local client references, like Jacksonville or Tallahassee clinics,

No HIPAA-compliant data centers are located in Florida.

Case Study: Tampa Clinic Recovered $220k in 6 Months

The Problem:

A primary care clinic in Tampa encountered a 45% denial rate because the practice used incorrect Medicaid codes for chronic care management (CPT 99490).

The Solution:

Engaged Specialized-Billing.com for:

In-house coding audits.

Training workshops on Florida Medicaid’s “Episodes of Care” program.

The Result:

Denials were reduced to 20% within three months.

Revenue of $220k recovered, funding two additional exam rooms.

Future Trends in Florida Medical Billing

RevCycleAI denial prediction tools forecast Medicaid denials for submission and AI-driven denial predictions are now possible.

Telehealth Boom: New modifiers like 95 for real-time telehealth are mandated by Florida’s Senate Bill 1606.

Blockchain Security: Unity Health of Miami hospital network securely shares patient data across more than 10 hospitals using blockchain technology.

Conclusion

Nothing illustrates the ever-changing Florida billing landscape better than an unpredictable summer storm. However, the chaos can be transformed into seamless cash flow with the right medical billing partner. Specialized-Billing.com utilizes AI-driven technology with on-the-ground knowledge to ensure Florida clinics flourish, even during hurricane season.

Suffering from costly billing errors? Claim your free Florida billing audit at Specialized-Billing.com today.

2 notes

·

View notes