#swiftbonds

Explore tagged Tumblr posts

Photo

2K notes

·

View notes

Text

tay taking a polaroid with adam instead of matty is amazing.

#taylor swift#taylors version#taylor swift 1989#the 1975#adam hann#ratty matty#matty healy#ross macdonald#george daniel#rockstar gf#rockstar#swiftbonds

144 notes

·

View notes

Text

Taylor Swift is beautiful🥰😍🤩😇😻💋💖💝

#taylor swift#taylorsnowlove#swifties#taylor swift 13#tswift13#tswiftnation#taylornation#swift wind#i love you taylor#taylor swift guitar#taytay#fearless taylor’s version#roger taylor#tswiftedit#tswiftlyrics#ts#lover taylor swift#taylor swift red#taylor swift for 15 year's#swiftbonds

16 notes

·

View notes

Text

9. Cornelia Street

Written by: Taylor Swift Produced by: Jack Antonoff & Taylor Swift Length: 4:47

~ listen along <3 ~

Fair warning, this is one is gonna be long.

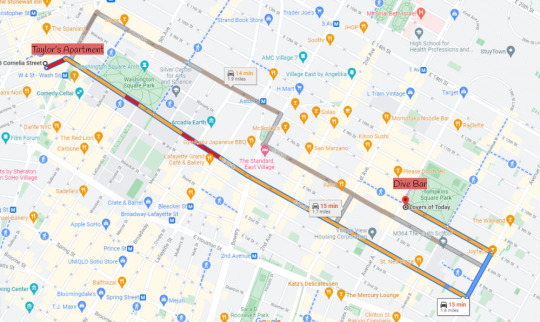

[Verse One] I think this first verse is about the night that he hit her up and told her to come to this bar, and sneak through the back. The same night she is talking about in 'Delicate', " dive bar on the east side, where you at, phone lights up my nightstand in the black, come here, you can meet me in the back". A lot of swifties think that the bar that she is singing about is called "Lovers of Today" in the East village. The entrance to the bar is in the back of a different bar, and it's a 15 minute car ride from there to Taylor's Cornelia Street apartment.

We were in the backseat Drunk off something stronger than the drinks in the bar Being "drunk off something stronger than the drinks" just means the lust and attraction they were feeling for each other, was much stronger than the actual drinks that they had. "I rent a place on Cornelia Street" I say casually in the car We were a fresh page on the desk Filling out the blanks as we go As if the street lights pointed in an arrow head Leading us home Here she is letting us know that the relationship is new. It's a fresh page, and they don't really have a plan. They are just filling it in as they go, but she is saying the traffic lights are leading them home, like that's where they are meant to be. [Chorus] And I hope I never lose you, hope it never ends I'd never walk Cornelia Street again That's the kind of heartbreak, time could never mend I'd never walk Cornelia Street again And baby I get mystified by how this city screams your name And baby, I'm so terrified of if you ever walk away I'd never walk Cornelia Street again At this part she is just telling Joe that if they ever broke up, she couldn't walk that street ever again. There's too many memories there and it would be way too painful. And I've seen a lot of people question why New York would scream Joe's name, but I think it's because that's the city where it all started for them. You know? There are memories every where she looks with him, that's why the city is screaming his name.

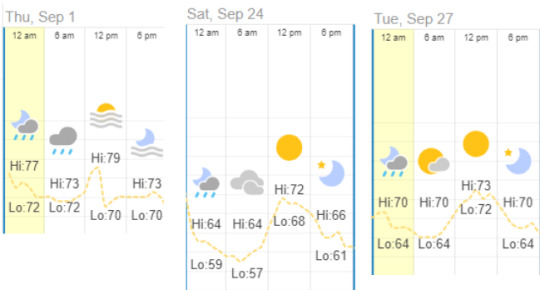

[Verse Two] Windows flung wide open, autumn air Jacket around my shoulders is yours We bless the rains on Cornelia Street We know it's raining, and it's autumn. We know her and Tom broke up late August or early September... Okay, please don't think I'm crazy... but I checked the weather report for New York. I really like research, okay?! I want to know what night this was.

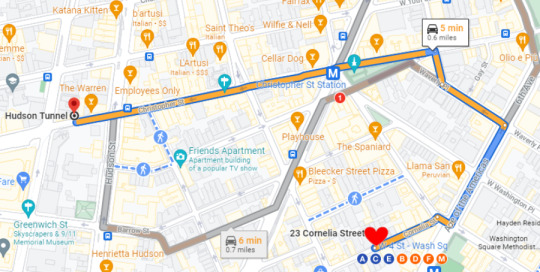

So we can see that it rained on three different nights in New York in September of '16. The only night where it looks cold enough to have his jacket on would be the 24th or even the 27th. And we know their anniversary is the 28th... So one of those days. Memorize the creaks in the floor Back when we were card sharks, playing games I thought you were leading me on I packed my bags, left Cornelia Street Before you even knew I was gone I guess she was kind of over the games and she didn't wanna be toyed with anymore. She dipped. She got in her car and left her own home. I'm not sure where she was headed, but there are a good bit of tunnels in the city. The Hudson Tunnel is the closest to her apartment. It's only a 5 minute ride.

[Pre-Chorus] But then you called, showed your hand I turned around before I hit the tunnel Sat on the roof, you and I

This is the roof of the Cornelia Street apartment. [Chorus] I hope I never lose you, hope it never ends I'd never walk Cornelia Street again That's the kind of heartbreak, time could never mend I'd never walk Cornelia Street again And baby I get mystified by how this city screams your name And baby, I'm so terrified of if you ever walk away I'd never walk Cornelia Street again I'd never walk Cornelia Street again

[Bridge] You hold my hand, on the street Walk me back to that apartment There are photos of Taylor and Joe holding hands with some friends walking through Greenwich village on December 30, 2018. They walked past the old property.

Years ago, we were just inside Barefoot in the kitchen Here's the kitchen that they were barefoot in!

Sacred new beginnings That became my religion, listen

[Chorus] I hope I never lose you I'd never walk Cornelia Street again Oh, never again And baby, I get mystified by how this city screams your name And baby, I'm so terrified of if you ever walk away I'd never walk Cornelia Street again I'd never walk Cornelia Street again

[Post Chorus] I don't wanna lose you (hope it never ends) I'd never walk Cornelia Street again I don't wanna lose you (yeah)

[Outro] "I rent a place on Cornelia Street" I say causally in the car

WOW This one was a lot of work! I really hope you enjoy it!

#taylornation#lover#musicians#taylor swift#writers#lyrics#taylor lyrics#taylorswift#swiftie#cornelia street#swifties#swifttok#taylor nation#taylurking#taylor#swiftbonds

7 notes

·

View notes

Text

Swifties waiting for the RED tv single

#taylor swift#cornelia street#taylornation#taylorstans#evermore#swifties#1989 era#red taylor swift#red taylor’s version#we love you taylor#swiftbonds#swift talks

11 notes

·

View notes

Text

AND WHEN WE MEAN INSANE, WE MEAN INSANE ! @taylorswift <3

cr pure.swift

7 notes

·

View notes

Text

Hello there tumbler swifties how are you today I'm new here 😊😊😊

4 notes

·

View notes

Text

PHOTO: Taylor Swift 'All Too Well' Performance on Saturday Night Live!

#taylorswiftupdates#taylor swift#autumn#autumleaves#all too well#art#performace#music#musicindustry#swifties#taylor swizzle#swiftbonds#blondie

5 notes

·

View notes

Text

sorry depression, you can't get me while peace is on repeat

3 notes

·

View notes

Text

cute ♥

1 note

·

View note

Video

youtube

according swiftbond

We provide fast, easy DMEPOS Medicare bonds at the best price. A DMEPOS bond is required to file claims or bill for medical equipment through Medicare.

0 notes

Text

Swiftbonds LLC

What are Department of Defense Performance Bonds? Department of Defense (DoD) bonds must be held by all freight carriers responsible for hauling military freight. The SDDC (Surface Deployment and Distribution Command) is the military branch that is in charge of them. Depending on how many states a company serves, the bond amount will vary. DoD Performance Bonds: What do they guarantee? Dedicated to ensuring the delivery of military freight, they ensure carrier performance and fulfillment. In addition to abandoned shipments and bankruptcy, the bond covers instances in which a carrier cannot or will not deliver military freight that they've been contracted to move. Damage to the cargo or late pickup from the shipper are not covered by the bond.

SDDC Performance Surety Bonds.

1 note

·

View note

Text

Saraland Electrical Contractor Bond

This is a web site that dedicates itself surety bond issues, especially those in the contractor world. We concentrate on performance bonds so that you can be ensured that you are getting the most as much as date strategies. We train thoroughly so that we can supply the exact right match for your wants and desires. We do not require everyone into a single mold. Instead, we try and make sure that everyone is treated with the most personalized option that best fulfills their needs.

See the below post for more good information. You can see the original article here: https://swiftbonds.com/license-permit-bonds/electrical-contractor-bond-saraland/

Saraland Electrical Contractor Bond

What is a Electrical Contractor Bond in Saraland?

A Electrical Contractor Bond is a type of license bond. The purpose of the bond is to protect the state or governmental entity for certain things, such as the payment of taxes.

To get this bond, please see our Electrical Contractor Bond Application Form. Fill this out and mail to [email protected]

You can also Apply On Line by clicking on this link.

How Much does a Electrical Contractor Bond Cost in Saraland?

Just fill out the form below and we’ll have you a quote in a few hours – at the absolute best possible rate.

How do I get a Electrical Contractor Bond?

We make it easy to get a Electrical Contractor Bond in Saraland. Fill out the form above and we’ll get right on this for you.

How Does this Process Work in Alabama?

Once we get the Electrical Contractor Bond application back from you, we process it right away. We typically have an answer within a few hours. Once you get approved, we’ll let you know the exact fee. Then:

You send us the fee

We send you the bond

For certain bonds, we may send you original forms to fill out (depends on the type of bond)

Then we’ll get the Electrical Contractor Bond right out to you. Easy.

Saraland Electrical Contractor Bond Application Form Fill this out and mail to [email protected]

Apply On Line

Find a Electrical Contractor Bond Near Me

We’ll work as hard as possible to get you the bond that you need in Alabama.

Find out more about our Permit and License Bonds

Tracking Down Where To Find Various Recommendations When Thinking Of Permit Surety Bonds

It’s highly essential to many professional services and construction corporations to obtain license and permit bonds. It is as the government typically requires permit bonds to all business functions involving a consumer. Having a surety bond is necessary in order to obtain a license or permit for your professional or business functions. The surety bond is a form of an insurance that guarantees the delivery of a service or infrastructure project to clientele. If a consumer files a complaint against your bond, you’ll face legal action. In this article, you’ll discover more about the essential facts on how to obtain a permit bond.

Figuring out License And Permit Bonds

The kind of license and permit surety bond that you will need for your business may vary based on the industry or category of your processes. The difference is the function, and how the bond protects the consumer.

Kinds of Surety Bonds

You will find several types of surety bonds, which include:

What is the purpose of license and permit bond? The key function of permit bonds is to ensure the clients and the government any projects entered into will be delivered accordingly. If a contractor was found non-compliant in the governing rules that cover their processes and failed to deliver the required service or project result for its consumer, he or she will eventually face legal action. Keep in mind that non-compliance may result in possible loss for your business simply since you have violated the regulations and rules that cover your business or professional functions. Never try to violate any laws.

Performance bonds, however, help the clients get insurance. Consumers will hire your services expecting that you’ll supply quality. Meeting all specifications requested by the consumer is portion of the quality services. In case of failure to comply, the client has the right to recover certain amount of the whole project cost through the help of the performance bond. This right and privilege is based on the argument that professional contractors have the skills, tools, and machineries to get the job done as prescribed, consequently there is no reason for the contractor to violate rules. In some cases, however, contractors fail to comply what is required. But because of the performance bond, there won’t be a substantial loss on the client’s part.

The Benefits Of License Bonds

These are the advantages of license and permit bonds to a customer.

License bonds restrict business processes, making sure they’re fair and legal. In order for a contractor or an expert business to function in a specific location, these laws has to be adhered to. The government in Kansas will require that each business has the license and permit bond. This allows the clients to secure their projects.

Permit bonds are designed to protect the clients that they are going to get quality service or result of projects. A specialist should not fail to deliver. If they do, the customer won’t suffer any loss. The surety bond serves as an insurance that guarantees the customer of quality service and secured project agreement.

Actions Involved In The Application

Applying for license and permit bond is simple if you follow the right actions. The following are the easy steps that you should follow when obtaining license and permit bond.

The Online Form

If you are applying online, the first thing you should do is to fill out the form. You can easily acquire this online application form by using the online platform of an approved forum. Before you decide to submit the online application, be sure that you have checked the data first so that you have verified its correctness and completeness. When you get the form, you have to only use the honest information when filling it.

Getting A Quote

The quote might help you understand any payments that you’ve got to make and the amount. Remember, the quote is dependent upon the amount of the project you indicated in the application form. So make sure that your figures are correct. You’ll not get a quote if you haven’t submitted the application form or if the application failed.

Payment

Finally, you need to pay the surety bond after acquiring a quote. When you make payments, you will get a license and permit bond.

While Filling The Form;

Don’t attempt to fabricate the info you will provide to the bond. It’s because doing so will only result in difficulties, such as legal action. Recognize that the government is skeptic with regards to legal documents. So even though you don’t have a good credit score, it is still essential that you provide the correct data to your surety bond.

Important Facts

You will need to understand the information about the license and permit bonds. To help you learn more about the license and permit bonds, here are a few important facts for you. When the government demands that you purchase a bond worth a particular amount, it doesn’t mean that you will pay the entire amount through the application of the bond. In fact, it might only charge a fee with about 1% of the whole rate if you purchase a bond worth a million dollars for example. Secondly, you must understand that a bond is not the same as a business license or permit. In fact, it protects the people that you serve. The bonds, consequently, improve the trust of your clients’ that you are going to deliver the best feasible result for the projects you involved with them.

When planning to engage in construction projects, it’s essential to know all the regulations of the government. Use the appropriate means to get what you will need for your company to thrive and obtain a license or permit.

See our Birmingham Electrician Bond page here.

Swiftbonds 4901 W. 136th Street #250 Leawood, KS 66224 (913) 214-8344

Bid bonds are really about assurance. What bid and performance bonds do is discovering the right devices to execute your basic needs. What that really means is that we utilize the most advanced surety documents to properly execute your needs. We personalize each and every plan so that you get exactly what you want. We do this using the most current tools so that we can prepare a customized strategy at the lowest possible cost. Kindly call us today with any questions.

https://swiftbonds.com/license-permit-bonds/electrical-contractor-bond-saraland/

1 note

·

View note

Text

Arizona Bid Bonds

The listed below short article is a good introduction to bid bonds. Quote bonds, as you are aware, are bonds used in the construction industry. These bonds guarantee that if someone quotes on a task, and is awarded the agreement, then they will move forward with carrying out under the terms of the contract.

See the below article for more excellent information. You can see the original post here:https://swiftbonds.com/bid-bond/arizona-2/

Arizona Bid Bonds

What is a Bid Bond in Arizona?

A bid bond is a type of surety bond, that guarantees that the bidder will accept the project and complete the contract according to its terms. The bid bond provides assurance to the project owner that the bidder has the expertise and wherewithal to finish the job once the bidder is selected after winning the bidding process. The basic reason is that you need one in order to get the work. However, the larger question is why are more owners/developers requiring a bid bond? The simply explanation is risk. Given the uncertainty of the marketplace, which includes experienced contractors closing their doors, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to complete the job. Thus, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our Arizona Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five or ten percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Arizona?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the P&P bond if you win the contract. The cost of a P&P bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges: 1) We do charge for Overnight fees 2) We will charge you if there is NOT going to be a bond on the contract if awarded.

How much do bonds cost in AZ?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Arizona. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

Bond Amount Needed Fee <$800,000 2-3% >$800,000<$1,500,00 1.5-3% >$1.500,000 1-3%

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in Arizona?

We make it easy to get a contract bid bond. Just click here to get our Arizona Bid Bond Application. Fill it out and then email it and the Arizona bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We thoroughly review each application for bid bonds and then submit it to the surety that we believe will provide the best surety bid bond for your company. We have a very high success rate in getting our clients bid and P&P bonds at the best rates possible.

What is an Arizona Bid Bond?

A bid bond is a bond that assures that you will accept the work if you win the contract. The bid fee (usually five or ten percent) is a forfeiture that is paid when you win the bid, but then refuse the work.

Find a Bid Bond near Me

Typically, a bid bond and P&P bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. This is risk security for the owner of the project.

Who Gets the Bond?

The general contractor is the corporation that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). However, it’s the general contractor that has to apply for the bond and be underwritten before it is issued by the surety. This is also known as bonding a business.

We provide bid bonds in each of the following counties:

Apache Cochise Coconino Gila Graham Greenlee La Paz Maricopa Mohave Navajo Pima Pinal Santa Cruz Yavapai Yuma

And Cities: Phoenix Tucson Scottsdale Mesa Tempe Sedona Chandler Flagstaff Glendale Gilbert Prescott Yuma

See our Arkansas bid bond page here.

More on Bid Bonds https://swiftbonds.com/bid-bond/.

Understanding Various Guidelines And Advice When Looking At Bid Bonds

You have to understand that a Surety Bid Bond is really important for anyone, however it is complex if you do not know anything about this. This is not regarded as an insurance claim because it’s a type of assurance that the principal will perform their job adequately. You have to understand that some folks will require you to obtain a certain bond before they actually go for your services as it will probably be a type of assurance to them. They require this type of thing from you so you should look for an insurance company that may offer this to you. If you really want to look at a license bond, permit bond, commercial bond and more, you have to understand what it means.

The Importance Of A Surety Bid Bond

Bid Bonds will almost always be in demand to protect the public as it is a form of guarantee that your obligations and duties will probably be complete. You will have to obtain a license Surety Bid Bond to make certain that the company will always follow the laws and you may obtain a contract bond to make sure that the public project will be completed. A Surety Bid Bond is certainly meant for the obliged since they are the ones which are being protected, but it may also benefit you as the clients will trust you in case you have this. There are a lot of bonds today and the kind of bond that you would like to look for will depend upon the specific situation.

How Does It Work

Bid Bonds can be regarded as a three-party agreement between a surety company, the principal and the obliged. The principal is actually the employer or company which will provide the services and the obliged is the project owner. If a construction company will work on a public project, they will likely be needed to get Bid Bonds. The government may also require the construction company to secure several bonds once they really want to go with the project.

The main function of the bond is actually for the sub-contractors and employees to make sure that they will likely be paid even when the contractor defaults. The contractor will handle any losses, but as soon as they reached their limit, the duty will fall to the surety company.

How Do You Apply For A Surety Bid Bond?

Bid Bonds are generally provided by insurance businesses, but you will have some standalone surety companies that will concentrate on these products. Surety businesses are licensed by a state Department of Insurance.

It will not be easy to apply for a bond because the applicants will have to proceed through a process that’s very comparable to applying for a loan. The bond underwriters would review the financial history of a candidate, credit profile and other important aspects.

It implies that there’s a chance that you will not be accepted for a Surety Bid Bond, specifically if the bond underwriters saw something from your credit history.

How Much Are You Going To Spend For This?

There is no fixed when you are thinking about a Bid Bond as it can still depend on various reasons like the bond type, bond amount, where the bond will be issued, contractual risk, credit score of the applicant and more. There are a lot of bonds available today and the cost will still depend upon the type that you will get. The amount of bond will probably be an issue because you can always get a $10,000 bond or a $25,000 bond. If you actually have a credit score that is above or near 700, you will qualify for the standard bonding market and you have to pay about 1 to 4 percent of the bid bond amount. If you may get $10,000 bond, it will only cost $100 to $400.

Is There A Chance Of Being Denied?

There is a possibility that your bond will be denied by the surety underwriter and it will always depend upon the background check that they did. If they think that it will be a big risk to provide a Surety Bid Bond, they will deny your application. Credit rating may also be a deciding factor because if you actually have a bad credit history, it’s going to be hard for you to obtain bonding because the underwriters are considering you as a risk. For those who have a bad credit score, you may still be approved, but you must pay an interest rate of 10 to 20 percent.

If you wish to get your Surety Bid Bond, you must be sure that you understand the process so you will not make a mistake. It will not be simple to apply, but if the requirements are met and you are eligible, you will get bonded.

A Deeper Take A Look At Bid Bonds in Building And Construction A Bid Bond is a type of surety bond utilized to make sure that a professional bidding on a task or job will participate in the contract with the obligee if granted.

A Bid Bond is released in the quantity of the contract bid, with the identical requirements as that of an Efficiency Bond.

Everything About Bid Bonds in Building And Construction The origins of our service was closely related to the provision of performance bonds to the contracting industry. Somewhat higher than one hundred years back, the federal authorities grew to end up being alarmed concerning the high failure charge amongst the personal firms it was using to perform public building and construction tasks. It discovered that the personal professional typically was insolvent when the job was awarded, or grew to end up being insolvent earlier than the difficulty was completed. Appropriately, the federal government was continuously entrusted to incomplete efforts, and the taxpayers had been required to cover the extra rates emerging from the specialist's default.

The standing of your surety company is very important, since it ensures you that when you have troubles or if even worse involves worst you'll have a trustworthy partner to turn to and get help from. We work just with A-rated and T-listed business, most likely the most reputable corporations in the market.

Normally no, they are separate. Nonetheless, quote bonds mechanically develop into efficiency bonds in case you are granted the agreement.

What Is A Building And Construction Surety Bond? The origins of our service was thoroughly related to the arrangement of performance bonds to the contracting market. Even if some tasks do not require cost and efficiency bonds, you will need to get bonded lastly due to the fact that the majority of public efforts do require the bonds. The longer a small professional waits to get bonded, the more resilient it will be given that there will not be a observe report of satisfying the compulsory requirements for bonding and performing bonded work.

The only limit is the biggest bond you might get for one specific job. The aggregate limit is the whole amount of bonded work readily available you possibly can have without hold-up.

The Value Of Quote Bonds near You Arms, generators, radio towers, tree elimination, computers, softward, smoke alarm, decorative work, scaffolding, water towers, lighting, and resurfacing of present roads/paved areas. Bid bonds in addition function an extra guarantee for project owners that a bidding professional or subcontractor is certified to perform the job they're bidding on. There are 2 causes for this.

https://swiftbonds.com/bid-bond/arizona-2/

1 note

·

View note

Text

Colorado Bid Bonds

The listed below short article is a great introduction to bid bonds. Bid bonds, as you understand, are bonds used in the building market. These bonds guarantee that if someone quotes on a job, and is granted the agreement, then they will move forward with carrying out under the regards to the arrangement.

See the below article for more excellent details. You can see the initial article here: https://swiftbonds.com/bid-bond/colorado-2/

Colorado Bid Bonds

What is a Bid Bond in Colorado?

A bid bond is a type of surety bond, that guarantees that the bidder will accept the project and complete the contract according to its terms. It provides assurance to the project owner that the bidder has the knowhow and wherewithal to complete the job once the bidder is selected after winning the bid. The simple reason is that you need one to get the job. But the bigger question is why are more owners/developers requiring a bid bond? The simply explanation is risk. Given the uncertainty of the marketplace, which includes experienced contractors going out of business, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable finish the work. Accordingly, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our Colorado Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five (5%) or ten (10%) percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Colorado?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the P&P bond if you get the job. The cost of a bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges: 1) We do charge for Overnight fees 2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in CO?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Colorado. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

Bond Amount Needed Fee <$800,000 2-3% >$800,000<$1,500,00 1.5-3% >$1.500,000 1-3%

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in Colorado?

We make it easy to get a contract bid bond. Just click here to get our Colorado Bid Bond Application. Fill it out and then email it and the Colorado bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review each application for bid bonds and then submit it to the surety that we believe will provide the best bid bond for your company. We have a great success rate in getting our clients bid bonds at the best rates possible.

What is a Colorado Bid Bond?

A bid bond is a bond that guarantees that you will accept the work if you win the contract. The bid fee (usually five (5%) or ten (10%) percent) is a damages calculation that is paid when you win the bid, but then back out of doing the work.

Find a Bid Bond near Me

Typically, a bid bond and P&P bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is security risk insurance for the benefit of the owner.

Who Gets the Bond?

The general contractor is the company that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). However, it’s the general contractor that has to apply for the bond and be underwritten before the contract bond is written by the surety. This is also known as bonding a business.

Conejos Costilla Crowley Custer Delta Denver Dolores Douglas Eagle Elbert El Paso Fremont Garfield Gilpin Grand Gunnison Hinsdale Huerfano Jackson Jefferson Kiowa Kit Carson Lake La Plata Larimer Las Animas Lincoln Logan Mesa Mineral Moffat Montezuma Montrose Morgan Otero Ouray Park Phillips Pitkin Prowers Pueblo Rio Blanco Rio Grande Routt Saguache San Juan San Miguel Sedgwick Summit Teller Washington Weld Yuma

And Cities: Denver Colorado Springs Boulder Aspen Fort Collins Aurora Steamboat Springs Littleton Grand Junction Pueblo Vail

See our Connecticut bid bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Key Specifics When Thinking Of Bid Bonds

It is not incorrect to say that Bid Bonds are very complicated, specially if you don’t have any idea how this works. Most individuals are thinking about this as an insurance, but this is a type of guarantee that the principal will perform their work correctly. Insurance providers usually provide a Surety Bid Bond, but you cannot call it insurance because its function is different. Most folks will surely require you to get a Surety Bid Bond before they consider your services as it’s a kind of guarantee to them.

If you want to get a license bond, permit bond, commercial bond and more, you have to know how they work. We are going to provide some good info on the significance of Bid Bonds and how they work.

A Basic Explanation On Bid Bonds

Bid Bonds will invariably be asked for by the public because it will secure them and it will guarantee that the principal will fulfill their responsibilities. You are the principal so you have to obtain a license Surety Bid Bond to guarantee that your company will invariably adhere to the laws and you must get a contract bond to guarantee that a public construction project will be completed. There are examples which will provide an idea on Surety Bid Bond.

This is made for the clients since they will likely be protected by the bond, but it can also provide advantages to you since they will trust you in case you have this.

How It Works

Bid Bonds are considered as a three-party agreement between a surety company, the obliged and the principal. The principal is actually the employer or company that will offer the services and the obliged is the project owner. Construction companies will invariably be required to purchase Bid Bonds as soon as they will work on a public project. If they want to work on the project, the government will need the construction company to secure a number of bonds.

The work of the bonds is aimed at the subcontractors and workers to guarantee that they will likely be paid even if the contractor defaults. The contractor will likely be covering the losses, but as soon as they reached the limit, the duty will definitely fall to the surety company.

How Do You Apply For A Surety Bid Bond?

Bid Bonds are generally given by insurance businesses, but you could look for some standalone surety businesses that focus on these unique products. A surety company should be licensed by a state Department of Insurance.

It’s hard to apply for a bond because the applicants will definitely experience a procedure that’s comparable to applying for a loan. The bond underwriters will evaluate the financial history of an applicant, credit profile, managerial team and other key factors.

There’s a chance that you will not be accepted for a Surety Bid Bond, particularly when the bond underwriters saw something from your credit history.

How Much Is A Surety Bid Bond?

It is hard to quote an exact cost for a bid bond because the cost might be affected by numerous factors like the bond type, bond amount, where it will likely be issued, contractual risk, credit history of the applicant and more. There are thousands of different bonds available right now and the cost will always depend on the bond that you could get. The amount of bound that you may avail may also be a big factor because you can select a $10,000 bond or a $25,000 bond or higher.

If you already have a credit history of 700 and above or very near this number, you could qualify for the standard bonding market and you only need to pay 1 to 4 percent of the Surety Bid Bond amount. This implies that if you may get a $10,000 bond, you only need to pay $100 to $400 for the interest.

The Approval Of Your Request

There is a chance that your bond request will be declined by the insurance businesses and it will depend on the background check that they carried out. If they believe that issuing you a bond will be a big risk, they won’t release a Surety Bid Bond for you.

Credit score is also an issue because if you have a bad credit rating, it will likely be extremely tough for you to get bonded as the companies consider you as a risk. If you have a poor credit score, you could be approved for the bond, but you must pay an interest rate of 10 to 20 percent.

There is a chance that your application would be declined so you must check the requirements before applying.

If you’re going to get a Surety Bid Bond, make sure that you know what is entailed before deciding. It won’t be easy to apply for one, but if you actually understand more about this, it will be easier to be approved.

A Deeper Look At Quote Bonds in Building A Quote Bond is a type of surety bond utilized to make sure that a contractor bidding on a task or job will get in into the agreement with the obligee if granted.

A Quote Bond is provided in the amount of the agreement quote, with the identical requirements as that of an Efficiency Bond.

All About Quote Bonds in Construction The origins of our company was closely related to the provision of efficiency bonds to the contracting market. A little greater than one a century earlier, the federal authorities grew to become alarmed concerning the high failure fee amongst the personal companies it was using to bring out public building tasks. It found that the private contractor usually was insolvent when the job was granted, or grew to end up being insolvent earlier than the challenge was finished. Appropriately, the federal government was continually entrusted unfinished initiatives, and the taxpayers had been forced to cover the additional costs arising from the professional's default.

The standing of your surety firm is necessary, due to the fact that it guarantees you that when you have difficulties or if worse includes worst you'll have a trusted partner to rely on and get aid from. We work just with T-listed and a-rated business, most likely the most dependable corporations in the industry.

Usually no, they are different. Nonetheless, quote bonds mechanically become efficiency bonds in case you are awarded the agreement.

What Is A Building Surety Bond? The origins of our company was thoroughly linked with the arrangement of performance bonds to the contracting industry. Even if some jobs do not need expense and performance bonds, you will require to get bonded finally because the majority of public initiatives do require the bonds. The longer a small contractor waits to get bonded, the more long lasting it will be given that there will not be a observe report of meeting the mandatory requirements for bonding and performing bonded work.

It's your pre-authorized bond limits. Bond pressures welcome single and combination limits. The only restrict is the biggest bond you may get for one particular job. The aggregate limitation is the entire amount of bonded work offered you possibly can have without delay.

The Value Of Bid Bonds near You Arms, generators, radio towers, tree elimination, computer systems, softward, emergency alarm, decorative work, scaffolding, water towers, lighting, and resurfacing of existing roads/paved locations. Bid bonds furthermore function an additional assurance for task owners that a bidding specialist or subcontractor is qualified to execute the job they're bidding on. There are two causes for this.

https://swiftbonds.com/bid-bond/colorado-2/

1 note

·

View note

Text

Dear @taylorswift,

Here it is.

My first letter.

I don’t really know where to start… except to say that I'm sorry for my english, french people are not very good in the language haha !

This first letter is not going to be long, I'm not going to talk and write for hours, but at least tell you that you are an amazing person. A life saver. Know that. You saved me, much more than you could imagine. You saved us all. That's all. I have nothing else to add for today, so it will be just a small 10-line letter, but believe me, the next ones will be much important !

Just take care of yourself please, and hug Meredith, Benjamin and Olivia <3

Love,

Diane

9 notes

·

View notes