#tax preparation services in new york

Text

Learn how to effectively manage a tax audit with expert guidance from Fortune Builder LLC. Our NYC tax preparation services offer comprehensive support to ensure compliance and ease.

0 notes

Text

#accounting firms in new york#bookkeeping services new york#tax and accounting services in new york#small business accounting services in new york#finalert llc#tax preparation services in new york

0 notes

Text

The Supreme Court ruled that the Defense of Marriage Act was unconstitutional on June 26, 2013.

In U.S. v Windsor, SCOTUS held that the federal government could not discriminate against same-sex couples.

Record Group 267: Records of the Supreme Court of the United States

Series: Appellate Jurisdiction Case Files

Transcription:

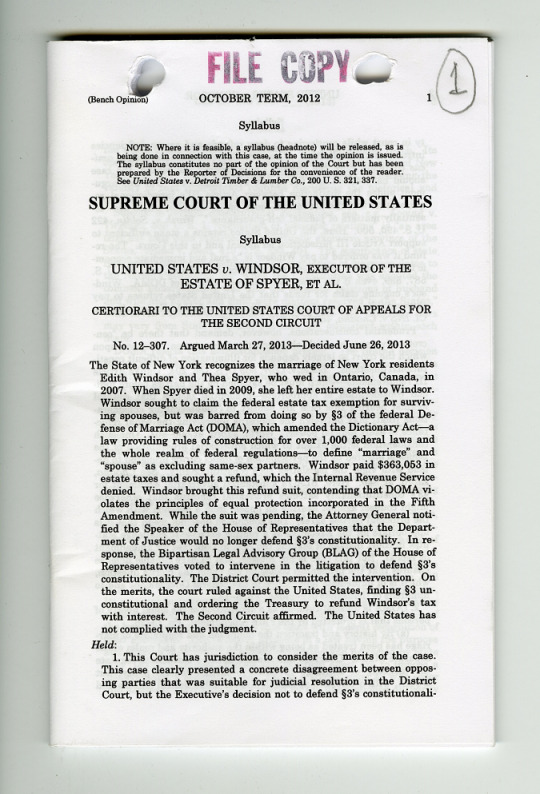

[Stamped: " FILE COPY "]

(Bench Opinion) OCTOBER TERM, 2012 1 [Handwritten and circled " 1" in upper right-hand corner]

Syllabus

NOTE: Where it is feasible, a syllabus (headnote) will be released, as is

being done in connection with this case, at the time the opinion is issued.

The syllabus constitutes no part of the opinion of the Court but has been

prepared by the Reporter of Decisions for the convenience of the reader.

See United States v. Detroit Timber & Lumber Co., 200 U.S. 321, 337.

SUPREME COURT OF THE UNITED STATES

Syllabus

UNITED STATES v. WINDSOR, EXECUTOR OF THE

ESTATE OF SPYER, ET AL.

CERTIORARI TO THE UNITED STATES COURT OF APPEALS FOR

THE SECOND CIRCUIT

No. 12-307. Argued March 27, 2013---Decided June 26, 2013

The State of New York recognizes the marriage of New York residents

Edith Windsor and Thea Spyer, who wed in Ontario, Canada, in

2007. When Spyer died in 2009, she left her entire estate to Windsor.

Windsor sought to claim the federal estate tax exemption for surviv-

ing spouses, but was barred from doing so by §3 of the federal Defense

of Marriage Act (DOMA), which amended the Dictionary Act---a

law providing rules of construction for over 1,000 federal laws and

the whole realm of federal regulations-to define "marriage" and

"spouse" as excluding same-sex partners. Windsor paid $363,053 in

estate taxes and sought a refund, which the Internal Revenue Service

denied. Windsor brought this refund suit, contending that DOMA vi-

olates the principles of equal protection incorporated in the Fifth

Amendment. While the suit was pending, the Attorney General notified

the Speaker of the House of Representatives that the Department

of Justice would no longer defend §3's constitutionality. In re-

sponse, the Bipartisan Legal Advisory Group (BLAG) of the House of

Representatives voted to intervene in the litigation to defend §3's

constitutionality. The District Court permitted the intervention. On

the merits, the court ruled against the United States, finding §3 un-

constitutional and ordering the Treasury to refund Windsor's tax

with interest. The Second Circuit affirmed. The United States has

not complied with the judgment.

Held:

1. This Court has jurisdiction to consider the merits of the case.

This case clearly presented a concrete disagreement between oppos-

ing parties that was suitable for judicial resolution in the District

Court, but the Executive's decision not to defend §3's constitutionali-

[page 2]

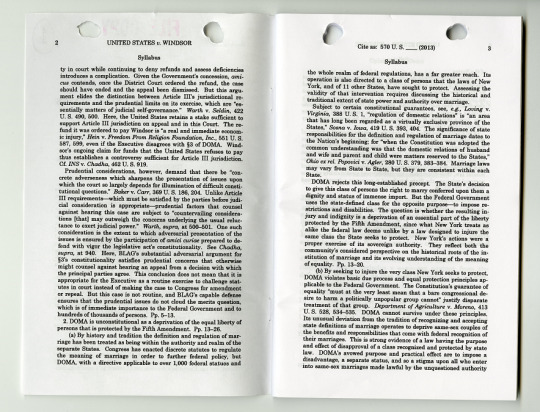

2 UNITED STATES v. WINDSOR

Syllabus

ty in court while continuing to deny refunds and assess deficiencies

introduces a complication. Given the Government's concession, ami-

cus contends, once the District Court ordered the refund, the case

should have ended and the appeal been dismissed. But this argu-

ment elides the distinction between Article Ill's jurisdictional re-

quirements and the prudential limits on its exercise, which are "es-

sentially matters of judicial self-governance." Warth v. Seldin, 422

U. S. 490, 500. Here, the United States retains a stake sufficient to

support Article III jurisdiction on appeal and in this Court. The re-

fund it was ordered to pay Windsor is "a real and immediate econom-

ic injury," Hein v. Freedom From Religion Foundation, Inc., 551 U. S.

587, 599, even if the Executive disagrees with §3 of DOMA. Wind-

sor's ongoing claim for funds that the United States refuses to pay

thus establishes a controversy sufficient for Article III jurisdiction.

Cf. INS v. Chadha, 462 U. S. 919.

Prudential considerations, however, demand that there be "con-

crete adverseness which sharpens the presentation of issues upon

which the court so largely depends for illumination of difficult consti-

tutional questions." Baker v. Carr, 369 U. S. 186, 204. Unlike Article

III requirements---which must be satisfied by the parties before judi-

cial consideration is appropriate---prudential factors that counsel

against hearing this case are subject to "countervailing considera-

tions [that] may outweigh the concerns underlying the usual reluc-

tance to exert judicial power." Warth, supra, at 500-501. One such

consideration is the extent to which adversarial presentation of the

issues is ensured by the participation of amici curiae prepared to de-

fend with vigor the legislative act's constitutionality. See Chadha,

supra, at 940. Here, BLAG's substantial adversarial argument for

§3's constitutionality satisfies prudential concerns that otherwise

might counsel against hearing an appeal from a decision with which

the principal parties agree. This conclusion does not mean that it is

appropriate for the Executive as a routine exercise to challenge stat-

utes in court instead of making the case to Congress for amendment

or repeal. But this case is not routine, and BLAG's capable defense

ensures that the prudential issues do not cloud the merits question,

which is of immediate importance to the Federal Government and to

hundreds of thousands of persons. Pp. 5-13.

2. DOMA is unconstitutional as a deprivation of the equal liberty of

persons that is protected by the Fifth Amendment. Pp. 13--26.

(a) By history and tradition the definition and regulation of mar-

riage has been treated as being within the authority and realm of the

separate States. Congress has enacted discrete statutes to regulate

the meaning of marriage in order to further federal policy, but

DOMA, with a directive applicable to over 1,000 federal statues and

[NEW PAGE]

Cite as: 570 U.S._ (2013) 3

Syllabus

the whole realm of federal regulations, has a far greater reach. Its

operation is also directed to a class of persons that the laws of New

York, and of 11 other States, have sought to protect. Assessing the

validity of that intervention requires discussing the historical and

traditional extent of state power and authority over marriage.

Subject to certain constitutional guarantees, see, e.g., Loving v.

Virginia, 388 U.S. 1, "regulation of domestic relations" is "an area

that has long been regarded as a virtually exclusive province of the

States," Sosna v. Iowa, 419 U. S. 393, 404. The significance of state

responsibilities for the definition and regulation of marriage dates to

the Nation's beginning; for "when the Constitution was adopted the

common understanding was that the domestic relations of husband

and wife and parent and child were matters reserved to the States,"

Ohio ex rel. Popovici v. Agler, 280 U. S. 379, 383-384. Marriage laws

may vary from State to State, but they are consistent within each

State.

DOMA rejects this long-established precept. The State's decision

to give this class of persons the right to marry conferred upon them a

dignity and status of immense import. But the Federal Government

uses the state-defined class for the opposite purpose---to impose re-

strictions and disabilities. The question is whether the resulting injury

and indignity is a deprivation of an essential part of the liberty

protected by the Fifth Amendment, since what New York treats as

alike the federal law deems unlike by a law designed to injure the

same class the State seeks to protect. New York's actions were a

proper exercise of its sovereign authority. They reflect both the

community's considered perspective on the historical roots of the in-

stitution of marriage and its evolving understanding of the meaning

of equality. Pp. 13--20.

(b) By seeking to injure the very class New York seeks to protect,

DOMA violates basic due process and equal protection principles ap-

plicable to the Federal Government. The Constitution's guarantee of

equality "must at the very least mean that a bare congressional de-

sire to harm a politically unpopular group cannot" justify disparate

treatment of that group. Department of Agriculture v. Moreno, 413

U. S. 528, 534-535. DOMA cannot survive under these principles.

Its unusual deviation from the tradition of recognizing and accepting

state definitions of marriage operates to deprive same-sex couples of

the benefits and responsibilities that come with federal recognition of

their marriages. This is strong evidence of a law having the purpose

and effect of disapproval of a class recognized and protected by state

law. DOMA's avowed purpose and practical effect are to impose a

disadvantage, a separate status, and so a stigma upon all who enter

into same-sex marriages made lawful by the unquestioned authority

[page 3]

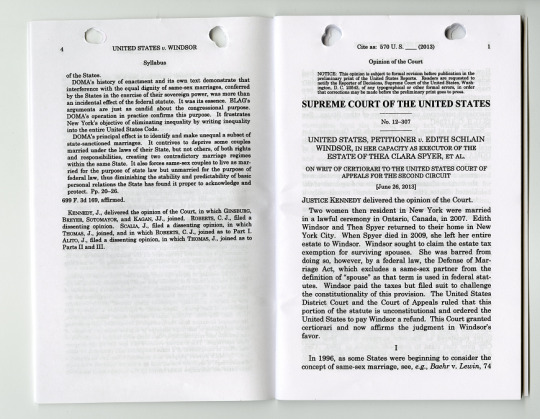

4 UNITED STATES v. WINDSOR

Syllabus

of the States.

DOMA's history of enactment and its own text demonstrate that

interference with the equal dignity of same-sex marriages, conferred

by the States in the exercise of their sovereign power, was more than

an incidental effect of the federal statute. It was its essence. BLAG's

arguments are just as candid about the congressional purpose.

DOMA's operation in practice confirms this purpose. It frustrates

New York's objective of eliminating inequality by writing inequality

into the entire United States Code.

DOMA's principal effect is to identify and make unequal a subset of

state-sanctioned marriages. It contrives to deprive some couples

married under the laws of their State, but not others, of both rights

and responsibilities, creating two contradictory marriage regimes

within the same State. It also forces same-sex couples to live as mar-

ried for the purpose of state law but unmarried for the purpose of

federal law, thus diminishing the stability and predictability of basic

personal relations the State has found it proper to acknowledge and

protect. Pp. 20-26.

699 F. 3d 169, affirmed.

KENNEDY, J., delivered the opinion of the Court, in which GINSBURG,

BREYER, SOTOMAYOR, and KAGAN, JJ., joined. ROBERTS, C. J., filed a

dissenting opinion. SCALIA, J., filed a dissenting opinion, in which

THOMAS, J., joined, and in which ROBERTS, C. J., joined as to Part I.

ALITO, J., filed a dissenting opinion, in which THOMAS, J., joined as to

Parts II and III.

[NEW PAGE]

Cite as: 570 U. S. _ (2013) 1

Opinion of the Court

NOTICE: This opinion is subject to formal revision before publication in the

preliminary print of the United States Reports. Readers are requested to

notify the Reporter of Decisions, Supreme Court of the United States, Washington,

D. C. 20543, of any typographical or other formal errors, in order

that corrections may be made before the preliminary print goes to press.

SUPREME COURT OF THE UNITED STATES

No. 12-307

UNITED STATES, PETITIONER v. EDITH SCHLAIN

WINDSOR, IN HER CAPACITY AS EXECUTOR OF THE

ESTATE OF THEA CLARA SPYER, ET AL.

ON WRIT OF CERTIORARI TO THE UNITED STATES COURT OF

APPEALS FOR THE SECOND CIRCUIT

[June 26, 2013]

JUSTICE KENNEDY delivered the opinion of the Court.

Two women then resident in New York were married

in a lawful ceremony in Ontario, Canada, in 2007. Edith

Windsor and Thea Spyer returned to their home in New

York City. When Spyer died in 2009, she left her entire

estate to Windsor. Windsor sought to claim the estate tax

exemption for surviving spouses. She was barred from

doing so, however, by a federal law, the Defense of Mar-

riage Act, which excludes a same-sex partner from the

definition of "spouse" as that term is used in federal stat-

utes. Windsor paid the taxes but filed suit to challenge

the constitutionality of this provision. The United States

District Court and the Court of Appeals ruled that this

portion of the statute is unconstitutional and ordered the

United States to pay Windsor a refund. This Court granted

certiorari and now affirms the judgment in Windsor's

favor.

I

In 1996, as some States were beginning to consider the

concept of same-sex marriage, see, e.g., Baehr v. Lewin, 74

#archivesgov#June 26#2013#2010s#Pride#LGBTQ+#LGBTQ+ history#U.S. v Windsor#Defense of Marriage Act#same-sex marriage#Supreme Court#SCOTUS

143 notes

·

View notes

Text

The Falling Star Incident

TW/CW: Acts of terrorism, plane crashes, swearing, mention of trauma, rape and death. Note: This is never a part of my HC, nor I ship RusAme, the tag is only there for views.

Project Personification Watchforce

Incident Date: 06/15/1986

Security Rating: Classifiied

Rated For: President of America and Russian President's eyes only

On June 15, 1986, an incident occurred with two personifications, PN-04 and PN-07, otherwise known as America and Russia respectively, within National Airlines Flight 2354 departing from New York to Seattle which resulted in a horrific loss of life incident.

*Boeing 747-135 of National Airlines similar to accident aircraft*

*The following is a recreation of the incident and measures being taken place to this current date as of 8/9/2024*

[A National 747-135 sits at the gate at Newark Airport, ready for it's flight to Seattle, inside the airport, passengers roam to their respective flights as announcements sound off for various flights, a flight attendant gets to the Gate Attendant as passengers board the jumbo jet]

Flight Attendant: I hope I'm not late!

Gate Attendant: Oh! Just 10 minutes before departure.

[The Gate Attendant checks her ticket, the Flight Attendant looks at the board and sees that National Airlines Flight 2354 is on time for departure]

Gate Attendant: Here you go. [He gives her his ticket] Same as your birthday?

Flight Attendant: What?

Gate Attendant: The departure time, it's the same as your birthday, September 25th.

Flight Attendant: Okay, I must go.

Gate Attendant: Have a nice flight!

Flight Attendant: You too!

[She goes off to board the jet, but after her, two men, one with blue eyes, blond hair and a cowlick and another who is taller, has platinum blond hair and violet eyes are surrounded by people from their governments, seemingly their handlers, guide them onboard the 747, on board, passengers stow away their luggage and take their seats, on the flight deck, the Captain, First Officer, and Flight Engineer prepare for departure]

Captain: Alright, it's almost time for us to depart, go through the checklist.

Flight Engineer: It's the first time I've been an engineer aboard a 747, I hope I don't mess this up.

[The Gate Attendants closes the doors to the gate, and onboard, the one of the Flight Attendants close the cabin doors, the Captain goes on the PA System]

Captain: Hello, ladies and gentlemen, we are now leaving the gate, flight attendants, please prepare for pushback.

[The tug then pushes the 747 out of the gate and onto the apron, the JT9D engines begin to spool up as they start up, on board, the lights in the cabin dim]

Flight Attendant 2: [On PA System] Please notice that the lights have been dimmed for this night takeoff.

[Back on the flight deck]

Captain: Turn on engines One and Two, activate the taxi lights.

[The tug gets the 747 onto the apron, it detaches and moves out of the way, and the 747 rolls towards the runway, after a while of taxing, it lines up on the runway, the Captain pushes the throttles towards takeoff thrust as the jumbo jet speeds down the runway]

Captain: V1, Rotate.

[The massive 747 then lifts off, on its way toward Seattle, however, during takeoff, the aircraft begins to shake and rattle during takeoff, but it then subsides]

Captain: Well, that just happened.

[33 minutes after takeoff, the 747 reached it's cruising altitude, on board, the fasten seatbelt sign turns off, and food service starts]

Passenger: Excuse me, I can I have a cup of water, just a water, you know.

Male Flight Attendant: Okay, I'll be right back.

[He then goes back to get a water bottle, to which he pours into his cup, back on the flight deck, a Flight Attendant goes to the flight deck to give the flight crew their meal]

Flight Attendant: Here's your meal!

Flight Engineer: Oh, thanks!

[In the top deck, there is some banter going on]

Passenger: You know, there's just something off about this.

Other Passenger: What do you mean?

Passenger: This food's like, I don't know, it's a bit bland. It's always like this on airlines. Like, what's the deal with it?

Other Passenger: They don't taste bad, I don't see that's the deal with it.

Passenger: Of course you don't, you just don't understand. Every food that I tasted whenever I'm on a plane, it always seems to taste really bad.

Other Passenger: [Groans] Whatever you say.

[The Flight Attendant is in the middle of the cabin checking on all the passengers, when the other Flight Attendant came through the curtains]

Flight Attendant 2: Hello, Alice!

Flight Attendant: Yeah?

Flight Attendant 2: What are you planning to do when you get to Seattle?

Flight Attendant: Oh, I'm going on a business trip after this flight, I'm looking forward to being promoted tomorrow.

[One of the flight attendants gets to the front of the cabin when she heard something]

???: Why am I sitting next to this sh!thead?

[She turns over to the blond man sitting next to the Russian]

Flight Attendant 3: Sir, is there something wrong?

???: You're d@mn right there's something wrong!

[The Russian spoke up]

Russian: Always hot heated are you, Америка?

America: Shut the f&ck up, Russia! Like the time you decapitated England in front of me and RAPED me!?!

[America goes for a punch, which is blocked by Russia, and he slams him against the cabin]

Flight Attendant 3: Sir, you need to calm down!

[The handers try to subdue America, but he shoves them off as he squares up Russia, who has a sadistic smile on his face]

America: You wanna f&cking go?

[Russia smiles as he undoes his coat, revealing a bomb, America does the same to his jacket, also revealing another bomb]

Flight Attendant 3: Sir! You need to stop!

America: Shut it, b!tch! I'm gonna take you down to hell!

Russia: Not if I take you down with me.

America: Commie B@stard!

Russia: [Smiles] Capitalist Pig.

[The entire cabin is filled with tension as scared passengers, Flight Attendants and handlers try to stop them, back to the rear of the cabin with Alice and the other Flight Attendant]

Alice: And after that I'm going back home, so what about you—

[Suddenly, everyone is knocked back by a massive explosion that tears a hole in the 747, the flight deck shakes from the explosion]

Captain: Woah!

Flight Engineer: What's happening?!

[It was chaos in the cabin as luggage flies everywhere, passengers are sucked out, and the port engines catch on fire]

Captain: Mayday, Mayday, Mayday, this is Flight 2354, we're declaring an emergency!

[The crew struggles to keep the 747 flying as hydraulic systems are burned up and the airframe begins to go past it's stress limits]

Captain: Right, now put the thrust back—

[Suddenly, the fuel tank explodes as the forward section of the fuselage breaks away and falls, the burning body then falls back to Earth, the tail section breaking up from aerodynamic stresses, on a dark road, a couple was sitting by a car, when suddenly the burning fuselage crashes onto the ground with a massive explosion]

Guy: What the f&ck was that?!

[They look in horror at the aftermath of the crash as it begins to start a fire]

*END RECREATION*

The cause of the accident was due to America being sat next to Russia, and because of their hatred, they tried to eliminate each other via a bomb, resulting in the deaths of all passengers and crew, they both fell 35,000 feet and survived, and continued to fight until being picked up by local police, we had to cover up the crash under the guise of an electrical failure which caused the crash, and as a result, America and Russia should never be aboard passenger aircraft, and must be put into containers aboard cargo aircraft to avoid the same mistake from happening, these containers should be marked secret, and the flight crew should never be told about the cargo, however, should this ever happen again, the subject of terminating all the Personifications will be taken into consideration.

*PN-04 and PN-07 being loaded onto a cargo aircraft*

Based off this video

youtube

#aph hetalia#hetalia#alfred f jones#hetalia america#aph#aph america#ivan braginsky#aph russia#hetalia russia#rusame#aph rusame#tw swearing#cw death#cw terrorism#tw terrorism#boeing 747#Not Rusame#Boeing 747-100#tw r4p3#cw mention of murder#Youtube

5 notes

·

View notes

Text

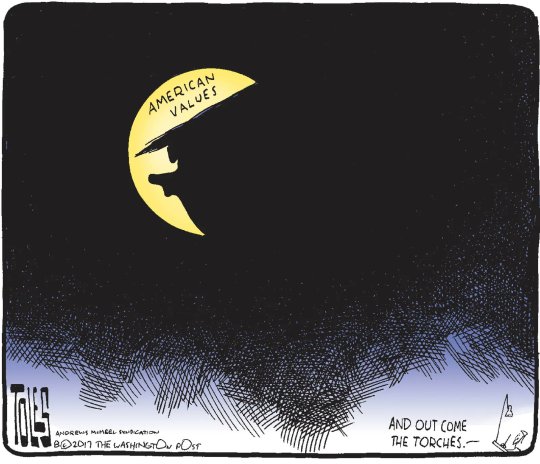

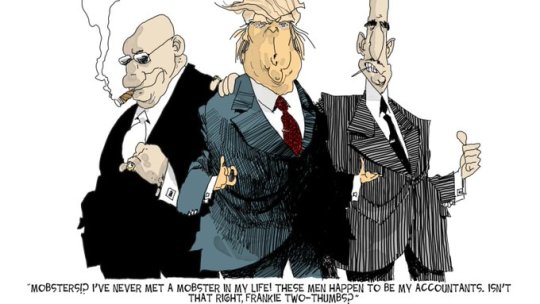

Tom Toles

* * * *

LETTERS FROM AN AMERICAN

April 26, 2024

HEATHER COX RICHARDSON

APR 27, 2024

Yesterday, in a long story about “the petty feud between the [New York Times] and the White House,” Eli Stokols of Politico suggested that the paper’s negative coverage of President Joe Biden came from the frustration of its publisher, A. G. Sulzberger, at Biden’s refusal to do an exclusive interview with the paper. Two people told Stokols that Sulzberger’s reasoning is that only an interview with an established paper like the New York Times “can verify that the 81-year-old Biden is still fit to hold the presidency.”

For his part, Stokols reported, Biden’s frustration with the New York Times reflects “the resentment of a president with a working-class sense of himself and his team toward a news organization catering to an elite audience,” and their conviction that the newspaper is not taking seriously the need to protect democracy.

A spokesperson for the New York Times responded to the story by saying the idea that it has skewed its coverage out of pique over an interview is “outrageous and untrue,” and that the paper will continue to cover the president “fully and fairly.”

Today, Biden sat for a live interview of more than an hour with SiriusXM shock jock Howard Stern. Writer Kurt Andersen described it as a “*Total* softball interview, mostly about his personal life—but lovely, sweet, human, and Biden was terrific, consistently clear, detailed, charming, moving. Which was the point. SO much better than his opponent could do.”

Also today, the Treasury Department announced that the pilot program of the Internal Revenue Service (IRS) that enabled taxpayers to file their tax returns directly with the IRS for free had more users than the program’s stated goal, got positive ratings, and saved users an estimated $5.6 million in fees for tax preparation. The government had hoped about 100,000 people would use the pilot program; 140,803 did.

Former deputy director of the National Economic Council Bharat Ramamurti wrote on social media, “Of all the things I was lucky enough to work on, this might be my favorite. You shouldn’t have to pay money to pay your taxes. As this program continues to grow, most people will get pre-populated forms and be able to file their taxes with a few clicks in a few minutes.” Such a system would look much like the system other countries already use.

Also today, the Federal Trade Commission announced that Williams-Sonoma will pay a record $3.17 million civil penalty for advertising a number of products as “Made in USA” when they were really made in China and other countries. This is the largest settlement ever for a case under the “Made in USA” rule. Williams-Sonoma will also be required to file annual compliance certifications.

FTC chair Lina Khan wrote on social media: “Made in USA fraud deceives customers and punishes honest businesses. FTC will continue holding to account businesses that misrepresent where their product[s] are manufactured.”

In another win for the United Auto Workers (UAW), the union negotiated a deal today with Daimler Trucks over contracts for 7,300 Daimler employees in four North Carolina factories. The new contracts provide raises of at least 25% over four years, cost of living increases, and profit sharing. This victory comes just a week after workers at a Volkswagen plant in Chattanooga, Tennessee, voted overwhelmingly to join the UAW.

Today was the eighth day of Trump’s criminal trial for his efforts to interfere with the 2016 election by paying to hide negative information about himself from voters and then falsifying records to hide the payments. David Pecker, who ran the company that published the National Enquirer tabloid, finished his testimony.

In four days on the stand, Pecker testified that he joined Michael Cohen and others in killing stories to protect Trump in the election. Trump’s longtime executive assistant Rhona Graff took the stand after Pecker, and testified that both Karen McDougal and Stormy Daniels were in Trump’s contacts. Next up was Gary Farro, a bank employee who verified banking information that showed how Michael Cohen had hidden payments to Daniels in 2016.

Once again, Trump appeared to be trying to explain away his lack of support at the trial, writing on his social media channel that the courthouse was heavily guarded. “Security is that of Fort Knox,” he wrote, “all so that MAGA will not be able to attend this trial….” But CNN’s Kaitlan Collins immediately responded: “Again, the courthouse is open [to] the public. The park outside, where a handful of his supporters have gathered on [trial] days, is easily accessible.”

Dispatch Politics noted today that when co-chairs Michael Whatley and Lara Trump and senior campaign adviser Chris LaCivita took over the Republican National Committee (RNC), they killed a plan to open 40 campaign offices in 10 crucial states and fired 60 members of the RNC staff. According to Dispatch Politics, Trump insisted to the former RNC chair that he did not need the RNC to work on turning out voters. He wanted the RNC to prioritize “election integrity” efforts.

The RNC under Trump has not yet developed much infrastructure or put staff into the states. It appears to have decided to focus only on those that are key to the presidential race, leaving down-ballot candidates on their own.

While Trump appears to be hoping to win the election through voter suppression or in the courts, following his blueprint from 2020, Biden’s campaign has opened 30 offices in Michigan alone and has established offices in Wisconsin, Pennsylvania, Nevada, Arizona, Georgia, North Carolina, New Hampshire, and Florida.

Finally today, news broke that in her forthcoming book, South Dakota governor Kristi Noem wrote about shooting her 14-month-old dog because it was “untrainable” and dangerous. “I hated that dog,” she wrote, and she recorded how after the dog ruined a hunting trip, she shot it in a gravel pit. Then she decided to kill a goat that she found to be “nasty and mean” as well as smelly and aggressive. She “dragged him to the gravel pit,” too, and “put him down.”

Noem has been seen as a leading contender for the Republican vice presidential nomination on a ticket with Trump, and it seems likely she was trying to demonstrate her ruthlessness—a trait Trump appears to value—as a political virtue. But across the political spectrum, people have expressed outrage and disgust. In The Guardian, Martin Pengelly said her statement, “I guess if I were a better politician I wouldn’t tell the story,” was “a contender for the greatest understatement of election year.”

—

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Tom Toles#American Values#political cartoons#Letters From An American#Heather Cox Richardson#election 2024#South Dakota governor Kristi Noem#Ugly American#A. G. Sulzberger#NYTimes#Biden's accomplishments

3 notes

·

View notes

Text

The Role of Accounting and Bookkeeping in Tax Industry

Accounting and bookkeeping are tedious and arduous but are necessary for the company to gain an advantage over competitors and to make decisions. Bookkeeping is the recording of financial details of the company in an orderly manner over some time. Bookkeepers are people who maintain the accounts. Ileadtax LLC is one of the best tax preparation and planning companies based in New York, India, and California. It offers accounting and bookkeeping services and are adviser for many companies. This article discloses the importance of accounting and bookkeeping in the tax industry and how it is useful to a company.

Accounting and bookkeeping are dependent on each other. Bookkeeping is a sub-branch of accounting that organizes and summarizes financial data and it has accurate financial data. Bookkeepers have access to all financial data of the company and can track their transactions. They ensure the data is up to date and is complete. Bookkeeping helps the company with decisions related to investing and operations. IleadTax LLC is a global company that consists of tax accounting experts in India, New York, and California. They provide their tax experts for all companies which are in need. The accounting and bookkeeping services provided contain detailed records of past transactions.

The first step in achieving flawless tax preparation is keeping accurate financial records. The foundation of this process is accounting and bookkeeping. These tasks entail the meticulous documentation of financial transactions, which results in an accurate depiction of earnings, outlays, assets, and liabilities. Having structured financial records is essential for tax season. Identification of deductible expenses is made possible for people and organizations through accounting and bookkeeping. Taxpayers can properly minimize their taxable income by accurately categorizing their costs and keeping track of the necessary supporting records. This may lead to significant cost savings and a better tax situation.

Beyond tax time, accounting and bookkeeping are important. They serve as the cornerstone for budgeting, investments, and future tax planning, enabling both individuals and corporations to make well-informed choices. It's advantageous to obtain professional advice when dealing with the complicated realm of tax preparation. CPAs (Certified Public Accountants) and seasoned bookkeepers may provide priceless insights, ensuring that you successfully navigate tax season.

A thorough and accurate bookkeeping procedure gives businesses a reliable way to assess their success. It also serves as a benchmark for its income and revenue targets and information for general strategic decision-making. A trustworthy source for businesses to gauge their financial performance is bookkeeping.

Accounting and bookkeeping are more than simply administrative duties; they are also effective instruments that can lessen the strain of tax season and enhance your financial security. A sound accounting and bookkeeping system can result in significant savings, compliance, and financial peace of mind whether you're a business owner or an individual taxpayer. So, as tax season draws near, keep in mind that having a solid financial foundation is the key to success. ILeadTax LLC attempts to deliver results that meet the expectations of the client.

#Accounting and bookkeeping#tax preparation#tax accounting experts in India#accounting and bookkeeping services

4 notes

·

View notes

Text

IRS Tax Preparer

We have a list of IRS-enrolled agents who can provide professional tax preparation for your needs. Find a tax office near you today by searching the IRS enrolled agent list.

For best information please visit our website - https://www.enrolledagent.com/

Address - 100 Church Street, 8th floor, New York, NY, United States, 10007

Phone - +1 8552224368

Email - [email protected]

#Enrolled Agent#Enrolled Agent Near Me#Tax Services#EA Tax Preparer#EA Tax Preparer Near Me#IRS Free Filing Program#Enrolled Agent Lookup#List of Enrolled Agents#find enrolled agent

2 notes

·

View notes

Text

Sunday, October 15, 2023

US colleges become flashpoints for protests on both sides of Israel-Hamas war

(Reuters) At Columbia University on Thursday, two groups of hundreds of students tensely faced each other in dueling pro-Israel and pro-Palestinian demonstrations, while university officials blocked public access to the New York City campus as a safety measure. Supporters of Palestinians, many of whom wore face masks to hide their identities, held signs in a grassy area near a library that read "Free Palestine" and "To Exist is to Resist." About 100 feet (30 meters) away, students backing Israel silently held up posters with the faces of Israeli hostages taken by Hamas. Amid the growing conflict, tensions between students on opposite sides of the issue have boiled over on some U.S. college campuses. Statements by student groups supporting Palestinians have prompted outrage and fear among Jews and, in some cases, wider rebuke from public officials and corporations. There have been reports of harassment and assaults of both pro-Israel and pro-Palestinian students, deepening grief and putting students of all political stripes on high alert.

Dominica’s Golden Passport

(Miami Herald) Dominica is a small country in the Caribbean with an increasingly desirable passport, especially for individuals who are willing to pay big bucks to get a citizenship toehold outside of their country for business, freedom of travel, or tax evasion reasons. A passport from Dominica gets you into most countries visa-free, and given an investment program where a passport can be had for $100,000, some of the country’s newest citizens may not be entirely on the level. An investigation found 7,700 people who purchased passports from Dominica, and they’re such a big business that golden passports alone accounted for 50 percent of Dominica’s government budget.

Ukraine hits Russian navy ships with sea drones

(Washington Post) “Experimental” naval drones damaged two Russian military vessels—the Buyan missile carrier and the Pavel Derzhavin patrol boat—over the past two days, Ukrainian intelligence officials said Friday, as Kyiv continued a series of strikes against Moscow’s Black Sea Fleet. The attacks on the Black Sea Fleet, which is based in occupied Crimea, have demonstrated Ukraine’s ability to operate in Kremlin-controlled waters but do not appear to have seriously reduced Moscow’s capabilities.

France is deploying 7,000 troops after a deadly school stabbing by a suspected Islamic radical

(AP) France will mobilize up to 7,000 soldiers to increase security around the country after a teacher was fatally stabbed and three other people wounded in a school attack by a former student suspected of Islamic radicalization, the president’s office said Saturday. Counterterrorism authorities are investigating the stabbing, and the suspected assailant and several others are in custody, prosecutors said. The suspect is a Chechen who had attended the school and had been under recent surveillance by intelligence services for radicalization. The government heightened the national threat alert, and President Emmanuel Macron ordered up to 7,000 soldiers deployed by Monday night and until further notice to bolster security and vigilance around France, his office said.

Poland prepares to hold a high-stakes national election

(Reuters) Poland holds its parliamentary election on Sunday, with the ruling nationalist Law and Justice party, called PiS, seeking an unprecedented third term in power. Critics say the government has politicized the judiciary, used public media as a propaganda tool and undermined the country's position in the EU. The party says it supports Ukraine in its war against Russia, but not at the expense of Poland’s own interests.

Turkey earthquake: Reconstruction promises and reality

(Reuters) Sheltering in a converted shipping container, Ismet Kaplan waits to hear if he's eligible for one of hundreds of thousands of homes President Tayyip Erdogan promised would replace those ruined by modern Turkey's deadliest earthquake in February. Days after the quake and with a national election looming, Erdogan made bold promises. While survivors were still emerging from rubble, he said half the disaster zone would be rebuilt within a year - a total of 319,000 homes. Eight months on, more than a dozen officials, builders and engineers told Reuters that rising construction costs and economic uncertainty have deterred companies from bidding for government reconstruction contracts, making that deadline look hard to reach, especially in the worst-hit areas. With work underway on a fraction of the planned new buildings in the devastated city of Adiyaman, Kaplan fears a long wait together with his disabled wife and other survivors. They are exposed to summer and winter temperatures in the lines of containers set up as temporary housing after the Feb. 6 disaster. "I believe it will take years to move," said Kaplan, whose apartment block collapsed in the quake. His daughter, daughter-in-law and four grandchildren died under falling buildings.

Israeli army to confront resilient foe in anticipated Gaza invasion

(Reuters) An Israeli invasion of Gaza will face an enemy that has built a formidable armoury with Iran’s help, dug a vast tunnel network to evade attackers and has shown in past ground wars it can exact a heavier toll on Israeli troops each time. Based on past experience, Israel’s bunker buster bombs and hi-tech Merkava tanks will be up against booby-trapped tunnels, fighters using the underground network to strike and vanish, and a range of Hamas weaponry that includes Russian-made Kornet anti-tank missiles that Israel first reported used in 2010. Hundreds of thousands of reservists are being mobilised by Israel for combat against fighters who one former official in Israel’s Shin Bet security service said could number 20,000. Saleh Al-Arouri, deputy chief of Hamas politburo, told Al Jazeera that before Hamas unleashed its assault on Israel it had a defence plan that was stronger than its attack plan.

Thousands Flee Northern Gaza as Israeli Evacuation Order Stirs Panic

(NYT) Panic and chaos gripped the northern Gaza Strip Friday as thousands of people fled south in vehicles piled high with blankets and mattresses along two main roads after the Israeli military ordered a mass evacuation of half of the besieged coastal strip. But rather than finding safety from a feared ground invasion, at least 70 people were killed along the way when Israeli airstrikes hit some of the vehicles fleeing south, according to the Gazan authorities. Some Gaza residents said they feared this could be the start of another permanent mass displacement like the one in 1948, when more than 700,000 Palestinians were expelled or fled their homes in present-day Israel during the war surrounding the nation’s establishment. The majority of Gaza’s population—some 1.7 million of the 2.1 million residents—are among those who were forced to leave their homes in 1948, or are their descendants. In 1948, Palestinians were told they would be allowed to return after a few days or weeks, and they took just a few belongings and the keys to their front doors. But they were never allowed back.

Trapped in Gaza, Palestinian Americans Say They Feel Abandoned

(NYT) Duaa Abufares, 24, a psychology student from Clifton, N.J., has been anxiously awaiting word from her father, Fares, each day this week. He had gone back to Gaza to visit relatives in early September. Now, Mr. Abufares, who is a U.S. citizen, is sheltering with relatives amid the sounds of nonstop bombing, and calling his five children back in New Jersey during brief periods when he can access electricity. During a video call with them on Thursday, Mr. Abufares, 50, described seeing the bodies of dozens of women and children killed in an airstrike blocks from his family home. The sudden Hamas attack on Saturday and the subsequent counteroffensive left American citizens stranded in both Israel and Gaza. To assist American citizens who want to leave Israel amid the spiraling security crisis, the Biden administration announced it would begin arranging charter flights to ferry Americans to destinations in Europe starting on Friday. But for American citizens stuck in Gaza, there is no such arrangement. “I feel like I’ve been abandoned by my country,” said Lena Beseiso, 57, who lives in Salt Lake City, Utah, and is caught in Gaza with her husband, two of her daughters and a 10-year-old grandson. “We’re American citizens and we’re not being treated as American citizens.” U.S. officials estimated that 500 to 600 American citizens were in Gaza.

With all eyes on Gaza war, violence is quietly mounting in the West Bank

(Washington Post) At least 11 Palestinians were killed by Israeli security forces and dozens injured across the West Bank on Friday, according to the Palestinian Ministry of Health, as fears rise over mounting violence and instability ahead of an expected Israeli land invasion of Gaza. In scenes rare for the West Bank, Palestinians raised Hamas flags in a solidarity march with Gaza, defying long-standing political divides between the Islamist militant group and the West Bank’s dominant Fatah party. Many in the occupied territory spent the day glued to the news as Israel ordered 1.1 million Gazans under bombardment to evacuate—fueling Palestinian fears of another mass displacement.

Rise in piracy

(gCaptain) The ICC International Marine Bureau is reporting a rise in piracy, with 99 incidents of piracy in the first nine months of this year, up from 90 incidents of piracy over the course of 2022. The pirates are pretty good at their jobs, too: The pirates successfully boarded 89 percent of the vessels they targeted, mostly at night. Of those incidents, 21 took place in the Gulf of Guinea, and 33 took place in the Singapore Straits. The latter waterway is a congested and difficult-to-navigate waterway, and obviously being lousy with pirates complicates things even further.

Your Face May Soon Be Your Ticket. Not Everyone Is Smiling.

(NYT) You may not have to fumble with your cellphone in the boarding area very much longer. As the travel industry embraces facial recognition technology, phones are beginning to go the way of paper tickets at airports, cruise terminals and theme parks, making checking in more convenient, but raising privacy and security concerns, too. “Before Covid it felt like a future thing,” said Hicham Jaddoud, a professor of hospitality and tourism at the University of Southern California, describing the way contactless transactions have become common since the pandemic. That includes facial recognition, which is “now making its way into daily operations” in the travel industry, Dr. Jaddoud said. Facial recognition systems are already being expanded at some airports. At Miami International, for example, cameras at 12 gates serving international flights match passengers’ faces to the passport photographs they have on file with the airlines, letting passengers at those gates board without showing physical passports or boarding passes. The company installing the systems, SITA, has been contracted to do the same for a number of international gates in 10 other U.S. airports, including Boston Logan International Airport and Philadelphia International Airport. (Passengers can opt out and still present physical documents instead, SITA says.)

2 notes

·

View notes

Text

Many parents suffered heartbreak after losing their children to the Moonies

Voices of parents of children lost to the moonies 8

February 16, 1976

Our son, [redacted], has been affiliated with one or another of Sun Myung Moon’s many “front ” groups for the past 3½ years, during which time we have had many personal experiences which convince us that Moon is engaged in personal aggrandizement and the accumulation of political power, rather than truly leading a religious movement.

Any questions we have put to responsible members of the groups, including our son, relative to the flow of cash, or group insurance, or group health plans for the members, have been met with evasions, generalizations, half-truths or lies. We have seen at first hand, serious exploitation of the rank and file group members selling flowers and the like on the streets of our cities, producing enormous money for the movement, but living at a below-subsistence level, jeopardizing their physical well-being.

Although Moon and his followers profess to aid the people of the world, we have seen no evidences of the usual charitable assistance or retraining functions. We have seen instead, the purchase of palatial estates and specially-built limousines. Other vast sums have been spent on high-cost media promotions and lecture tours nationwide by Mr. Moon.

We firmly believe Sun Myung Moon represents a serious threat, not only to the members and families of his groups, but potentially to our entire democratic society and institutions.

We urge strongly that Moon’s claim to religious tax status be thoroughly investigated by the proper government agencies and another investigation be mounted in the area of fiscal probity and responsibility.

[redacted] and I are prepared at any time to support the above through personal experiences at the Boonville, Oakland and Berkeley, California and New York, New York properties of Moon.

_____________________________________

February 13, 1976

[redacted] is the youngest of three children. She was born in 1957. She graduated from high school in June 1975 and three days later moved into the Unification Church Center at Southeast 39th & Hawthorne in Portland. She has since been transferred to the Center at [redacted]

She was a four year honor roll student with a G.P.A. for four years of 3.89. She was a member of the speech team, the honor math club, and was active in tennis, journalism, and track. During her senior year she dropped all activities and wanted to graduate early to join the MOON group. I refused to let her do this but after graduation she joined them.

The group travel around to different towns and are expected to be up sometimes twenty hours a day trying to get others to join them and to earn from $100 to $200 a day selling candy, flowers and homemade granariums. They have no service to people and all funds above their most urgent needs are sent to the MOON Headquarters.

Since last June I have seen very little of her. At Thanksgiving she came home for one day. Her father and I tried to talk to her but she withdrew and practically said nothing more to us. At Christmas she was home two nights and one day. During this time she was picked up three times by the group for a couple of hours and spent very little time with us. Christmas night her older brother asked three friends to the house to talk to her. One, a close girl friend, and the other two are bible students from an eastern bible college. One of the boys had written a college paper on Moon’s Divine Principle and could compare it to actual Bible Scriptures. They talked with her from 5:30 p.m. to 3:30 a.m. She left once and came back saying she did not wish to talk to them anymore. After family pressure they again talked to her. They were unable to penetrate the MOON brainwashing.

On January 27th, her older sister, father and I found she was in [redacted] and tried to take her out for breakfast and visit with her. She refused to leave the group and we could only see her inside the Center. After twenty minutes the group started singing “You Are My Sunshine” so loudly that we could no longer hear. She intends to spend the rest of her life there.

[redacted] has all the signs described in the many articles about the group. The exhausted glassy eyed, fixed facial smile. These remarks have been made to me by people at our home on Christmas Eve who know her well. She is not the same person.

Please help us in our endeavors for a Congressional Investigation.

_____________________________________

To all concerned,

This letter is to inform you of our son’s involvement in the Unification Church and our efforts to get him released through the organization of Citizens Engaged in Reuniting Families, Inc. (CERF)

Our son, [redacted] age 19 – honor graduate from North High School, June 1975 – recipient of two scholarships.... The youngest of our four children, member of the United Methodist Church, ex Boy Scout, member of DeMolay,....

Through the usual tactics, days at the [redacted] Center, working on their cars, weekends at “retreats”, three week “training” in Minneapolis (“to see if he really wanted to join”) – [redacted] was brainwashed and taken into the Unification Church. By using him they succeeding in getting his girl friend out of college at [redacted] in September. He then was sent off to Barrytown, New York for 40 days training. He was sure, when he left for Barrytown that he would be home for Christmas. He was not, the last day we saw him was October 16, 1975. We thank God that he does contact us occasionally. He says: “I want to come home, but can’t” — “The happiest day of my life will be when I can see all of you again” — “I miss home and all of you more than you can imagine” — “I would come home if I could, but I can’t”. Needless to say we will do anything to get him back .

We fear not only for the mental and physical well being of [redacted] but also for all the special youth who have been taken into such organizations in the world. Also, we feel such organizations are a great threat to our country and the world.

We pray daily that something can be done and we will help in any way we can.

More detailed information about our experiences with the Unification Church and [redacted] involvement in it will gladly be given upon request.

Sincerely,

[redacted]

_____________________________________

The sequence of events which occurred to my son in his involvement with the Unification Church

[redacted] was approached last summer on the steps of the New York Library, while studying for his Law Boards, by members of the Unification Church who induced him to go to their 43rd street headquarters. [redacted] visited there several times, unbeknownst to his mother and myself and later, instead of going back to school at [redacted] College, where he had two semesters to go, went to a seven day indoctrination program into the Moon Movement.

He emerged from this a totally changed person, disregarding his schoolwork to a great extent, alienating himself from his friends at school, as well as his family. He now spouted gibberish such as, “Six million Jews perished in Europe due to the fact that they were responsible for the death of Jesus Christ”. A few months ago, prior to his involvement with the Moon Movement, [redacted] would have been shocked at this association.

Upon his completion of his next to last semester at [redacted], he has quit school and entered full time into the movement. He has lost all contact with family and friends. He was kept physically from speaking to his mother when we went to Tarrytown to see him and, at present, his whereabouts are kept secret from us so that all communications have stopped.

He is a total stranger to his entire family, to his friends and to all his former beliefs and has totally withdrawn and been brainwashed by this insipid movement which is avowed to take over the U.S. as well as the rest of the world.

In Mr. Moon’s manifesto he states that his is the Messiah, that he must become the richest and most powerful man on earth, in order to control it, and can use any means whatsoever to obtain this end.

My son, we understand now, is “fund-raising” which means he is selling flowers or candy in the streets, being moved from town to town. The money he raises goes tax free to enrich Rev. Moon. All of [redacted] ambitions, hopes and aspirations for the future have been taken away from him and he is no longer master of his own destiny.

Name withheld

_____________________________________

Voices of parents of children lost to the moonies 1

Ken Sudo’s 120-day Training Manual and Moonie telephone fraud

Voices of parents of children lost to the moonies 2

Moon’s mass marriages are “a form of sex perversion”

Voices of parents of children lost to the moonies 3

Our son “seemed to be in a bizarre world of science fiction”

Voices of parents of children lost to the moonies 4

“only if she got rid of the baby and gave it up for adoption”

Voices of parents of children lost to the moonies 5

Moon is a man devoid of of human compassion

Voices of parents of children lost to the moonies 6

“One of your ancestors was a peeping Tom.”

Voices of parents of children lost to the moonies 7

Secret marriage, shaking and vomiting

Voices of parents of children lost to the moonies 9

3 notes

·

View notes

Text

Outsource Bookkeeping to India: NYC Compliance Made Easy

This article focuses on how firms may be able to obtain superior, cost-effective solutions that guarantee compliance with New York State requirements by outsourcing bookkeeping to India.

In today's fast-paced corporate environment, outsourcing has emerged as a key tactic for companies looking to streamline their processes and concentrate on expansion.

Managing bookkeeping in-house may be expensive, time-consuming, and burdensome for New York businesses, particularly when it comes to guaranteeing compliance with state regulations.

India provides a customized solution through bookkeeping outsourcing that not only satisfies regulatory standards but also saves time and money.

Let us begin with a few important queries.

Why Use an Indian Bookkeeping Service for NY Compliance?

The practice of outsourcing bookkeeping to India is becoming more and more popular among businesses in the US, especially those in New York.

Businesses can benefit from first-rate bookkeeping services at a significantly reduced cost because to India's highly skilled labour force and financial services expertise.

Businesses are free to focus on what matters most: growth and profitability because to the flexibility and scalability that can be outsourced.

Working with organizations that understand New York compliance also ensures that all local laws are obeyed without the requirement for internal process management.

What Can We Expect from This Article?

The advantages of outsourcing bookkeeping to India will be covered in-depth in this essay, along with the rationale that New York businesses find compelling.

We will examine topics like financial benefits, specialized compliance solutions, and selecting an outsourced partner.

Continue reading to find out how this tactic will make your business more successful while ensuring that you continue to abide by New York law.

Why Use India for Bookkeeping Outsourcing?

Outsourcing bookkeeping offers tailored solutions suitable for New York's complex regulatory environment, going beyond simple financial savings.

Businesses that choose to outsource bookkeeping to India can anticipate a host of benefits, such as flawless compliance, expert financial management, and access to a global talent pool, all while keeping operating costs under control.

Customized Approaches to NY Compliance

When outsourcing, compliance is a major concern, especially for businesses in New York.

NY compliance regulations are very complex, therefore it's critical to have a partner who understands these nuances.

Here are some advantages of outsourcing to India:

1. Knowledge of New York Tax Laws

India's bookkeeping companies offer specialized expertise in payroll and tax regulations in New York. Teams are instructed to ensure that the books adhere to state and municipal regulations.

When it comes to payroll or tax processing, outsourcing firms ensure that you stay in compliance, lowering the risk of fines or errors.

2. Skilled Full-Service Bookkeeping Services for Small Enterprises

By outsourcing full-service bookkeeping services to India, small businesses can benefit from having a dedicated team manage everything from regular operations to year-end tax preparation.

This personalized service ensures that all financial papers are accurate, timely, and compliant with New York State law.

Daily records of financial transactionsReconciliation and reporting every monthPayroll administration compliant with New York regulationscompliance with year-end tax filing

3. A flawless amalgamation with the American Accounting System

The majority of businesses that provide bookkeeping services in India are skilled users of popular American accounting software, such as Xero and QuickBooks.

Because of the assurance of perfect integration, openness and efficiency are maintained while data administration and sharing are made easy.

Now let's look at the cost-effective part and see how outsourcing bookkeeping to India may offer solutions that are both affordable and of the highest calibre.

High-quality and reasonably priced solutions

One of the main reasons companies choose to outsource bookkeeping to India is the cost benefit.

Outsourcing offers exceptional bookkeeping services at a significantly lower cost than hiring employees in-house, all without sacrificing quality.

1. Significant Operational Cost Savings

It could be expensive to hire and retain internal bookkeepers in New York. Outsourcing to India offers cost-effective solutions because it provides access to the greatest talent at a fraction of the expense. Businesses can save a lot of money on overhead, perks, and salaries by outsourcing.

2. Services that are Scalable and Affordable

Particularly startups and small businesses rely on cost minimization. Businesses that outsource bookkeeping to India might expand their services in response to market demand.

Small and growing businesses might benefit from the flexibility that comes with outsourced bookkeeping, as services can be easily adjusted as your firm expands.

Pay solely for the necessary services.Reasonable prices in contrast to employing local teamsSolutions that are scalable and expand with your company

3. Quick and Trusted Tax Filing Services for New Businesses

Indian bookkeeping companies offer prompt and reliable tax filing services in the U.S. for startups and businesses of all sizes.

Their expertise in U.S. tax laws ensures that you never overlook a filing deadline, helping you stay in compliance with all the requirements and stay out of trouble.

How to Select the Appropriate Outsourcing Affiliate

Because not all outsourcing firms are created equal, choosing the right partner is essential to success.

The following considerations should be examined when choosing an Indian bookkeeping company:

1. Verified Performance History

Seek out organizations that have a history of working with clients in the United States and that have experience offering small businesses full-service bookkeeping.

A strong portfolio demonstrates consistency and proficiency in handling various bookkeeping obligations.

2. Knowledge of New York State Law

Verify that the business is knowledgeable about all of the regulations unique to New York, such as those that deal with payroll and taxes. To ensure faultless operations, they ought to provide tailored services that align with New York State compliance.

3. Interaction and Time-Zone Coordination

Good communication is essential to outsourcing. Look for businesses that offer regular updates, easy access to your financial information, and the ability to solve problems or respond to inquiries quickly.

Additionally, some Indian businesses shift their working hours to align with US business hours, ensuring smooth collaboration.

4. Security and Technology

Choosing a business ensures data protection and leverages cutting edge technologies. Security should be prioritized due to the shared sensitive financial data.

Seek out companies with expertise in US accounting software.Verify the presence of robust security measures and data encryption.Make sure they understand cloud-based bookkeeping so you can easily retrieve your information.

Recall that outsourcing bookkeeping to India is a fantastic way to streamline your business, save costs, and ensure New York compliance.

Further examination of how outsourcing helps businesses expand without compromising complete financial transparency will be provided in the following section.

The Unspoken Advantages of Hiring a Bookkeeper

Beyond just financial management and compliance, outsourcing bookkeeping has additional benefits that enhance long-term business performance.

1. Pay attention to your core business operations

Businesses can focus on key initiatives and strategic development by delegating bookkeeping tasks to third parties.

Managers and business owners can devote more time to product development, customer support, and market expansion by outsourcing.

2. Entry to a Worldwide Talent Pool

Employing an Indian bookkeeper might give you access to a global network of qualified professionals. These experts offer innovative concepts and imaginative fixes, allowing your business to thrive in a constantly competitive landscape.

3. Increased Accessibility of Financial Data

Through comprehensive and transparent reporting, outsourced firms ensure that business owners have a clear understanding of their financial status. Having access to real-time data simplifies making smart business decisions.

Last Remarks

By outsourcing bookkeeping to India, businesses in New York can obtain affordable, customized solutions that ensure compliance with NY regulations while also boosting productivity.

For businesses looking to streamline operations and focus on growth, outsourcing offers scalable services, access to skilled professionals, and a strong emphasis on compliance.

Whether your business is small and needs full-service bookkeeping,

OR

Outsourcing offers the flexibility, experience, and cost-effectiveness that businesses need to succeed in today's competitive landscape. As the company grows, it need rapid and reliable tax filing services.

0 notes

Text

Facing a tax audit? Learn how to handle it effectively with expert tips from Fortune Builder LLC. Our NYC tax preparation services ensure compliance and peace of mind. Discover more here: How to Handle a Tax Audit: Tax Preparation Services in NYC

0 notes

Text

https://finalertnet.blogspot.com/2023/09/choosing-right-cpa-firm-your-guide-to.html

#finalert llc#cpa firm#accounting services in new york#bookkeeping services new york#tax and accounting services in new york#accounting firms in new york#small business accounting services in new york#cpa firm new york city#financial consulting services in new york#new york#tax preparation services in new york

0 notes

Text

Brooklyn Tax Preparers

"Brooklyn Tax Preparers" refers to experts or companies in Brooklyn, New York, that focus on preparing and submitting tax returns for both private citizens and commercial entities. In order to ensure compliance and maximise tax results, these tax preparers assist customers in navigating the complexity of local, state, and federal tax legislation. The services offered might include bookkeeping, tax planning, income tax preparation, and audit representation. Certifications like CPA (Certified Public Accountant), EA (Enrolled Agent), or other pertinent credentials are frequently held by Brooklyn Tax Preparers.

0 notes

Text

Accounting Firm in Brooklyn

Accounting Firm in Brooklyn refers to a professional service provider located in Brooklyn, New York, specializing in various accounting services. These firms offer a wide range of financial services, including bookkeeping, tax preparation, financial planning, auditing, payroll management, and consulting for businesses, individuals, and organizations. Accounting firms in Brooklyn are known for their deep understanding of local market dynamics and regulations, providing tailored advice and solutions to meet the unique needs of their clients in the area.

0 notes

Photo

LETTERS FROM AN AMERICAN

March 16, 2023

Heather Cox Richardson

Yesterday, Tamar Hallerman and Bill Rankin of the Atlanta Journal-Constitution reported that the special grand jury in Fulton County, Georgia, investigating the attempt to overturn the 2020 presidential election in that state, heard yet another recording of former president Trump pushing a key lawmaker—in this case, Georgia House speaker David Ralston—to convene a special session of the legislature to overturn Biden’s victory.

One juror recalled that Ralston “basically cut the president off. He said, ‘I will do everything in my power that I think is appropriate.’ … He just basically took the wind out of the sails.” Ralston, who died last November, did not call a special session.

This is the third such recorded call. One was with Georgia secretary of state Brad Raffensperger, and another was with the lead investigator in Raffensperger’s office. Ralston had reported the call, but it was not public knowledge that there was a recording of it.

Hallerman and Rankin interviewed five members of the grand jury, which met for 8 months and heard testimony from 75 witnesses. The jurors praised the elections system, and one said, “I tell my wife if every person in America knew every single word of information we knew, this country would not be divided as it is right now.” Another said: “A lot’s gonna come out sooner or later…. And it’s gonna be massive. It’s gonna be massive.”

The special grand jury recommended Fulton County district attorney Fani Willis indict people involved in the attempt to overturn the election. The cases are now in her hands.

Yesterday, prosecutors in New York met with Stormy Daniels, the adult film actress whom Trump allegedly paid $130,000 to keep their sexual liaison quiet. Also yesterday, Trump fixer Michael Cohen testified before a grand jury about the hush-money payment. Cohen’s testimony suggests that Manhattan district attorney Alvin L. Bragg is considering an indictment on a felony charge for misrepresenting the nature of that payment.

Trump has a new lawyer in that case, Joe Tacopina, who has been making the rounds on television shows to insist that Trump isn’t guilty. Tacopina’s job isn’t easy, and he is not necessarily helping, telling MSNBC’s Ari Melber that Trump didn’t actually lie about the hush payment when he lied about it because he was not under oath and he didn’t want to violate a confidentiality agreement.

Also in New York, Trump has asked a judge to delay the $250 million civil case against him, his three oldest children, and the Trump Organization, for manipulating asset valuations to get bank loans and avoid taxes. New York attorney general Letitia James, who brought the suit, said the defendants had had plenty of time to prepare and that Trump is trying to move the case into the election season, at which point he will insist it must be delayed again.

Katelyn Polantz, Paula Reid, Kristen Holmes, and Casey Gannon of CNN reported today that the federal grand jury investigating Trump’s handling of classified documents has interviewed dozens of Mar-a-Lago staff, from servers to attorneys. Special Counsel Jack Smith continues to try to get Trump lawyer Evan Corcoran to testify after prosecutors learned that on June 24, 2022, Trump and Corcoran spoke on the phone as Trump had been ordered to produce the missing documents and the surveillance tapes of the area.

Prosecutors want Corcoran to have to testify despite the attorney-client privilege he claims, using the “crime-fraud exception,” which means that discussions that aided a crime cannot be kept secret.

In the face of this mounting legal pressure, Trump took to video to demand: “The State Department, the defense bureaucracy, the intelligence services, and all of the rest need to be completely overhauled and reconstituted to fire the deep staters.” Then, he said, his people need to finish the process he began of “fundamentally revaluating [sic] NATO’s purpose and NATO’s mission.” “[T]he greatest threat to Western civilization today is not Russia,” he said, but “some of the horrible USA-hating people that represent us.”

This speech was not simply a defense of Russia and its unprovoked invasion of Ukraine. In his attempt to undermine the legal cases against him, Trump has endorsed the “post-liberal order” whose adherents reject the American institutions that defend democracy. In their formulation, American institutions they do not control—“the State Department, the defense bureaucracy, the intelligence services, and all of the rest,” for example—are corrupt because they defend the ideas of equality before the law, a free press, religious freedom, and so on. They must be torn down and taken over by true believers who will use the state to enforce their “Christian nationalism.”

In that formulation, the FBI and the Department of Justice are persecuting good Americans who were trying to protect the country on January 6, 2021. And yesterday, Zoe Tillman of Bloomberg reported that Matthew Graves, the U.S. attorney in Washington, D.C., sent a letter on October 28 last year to Chief Judge Beryl Howell warning that as many as 1,200 more people could still face charges in connection with the January 6 attack on the U.S. Capitol.

Today, the House Republicans announced an investigation, run by Representative Barry Loudermilk (R-GA), into the House Select Committee to Investigate the January 6th Attack on the U.S. Capitol. The January 6th committee asked Loudermilk to talk to it voluntarily to explain why he gave a tour of the Capitol complex on January 5, 2021, a time when the coronavirus had ended public tours. One of the people on that tour showed up on a video the next day threatening lawmakers.

Loudermilk told Scott MacFarlane and Rebecca Kaplan of CBS News that Americans have “very little confidence” in the report of the January 6th committee, “[a]nd there’s good reason. I mean, you even consider what they did to me, the false allegations that they made against me regarding the constituents that I had in my office in the office buildings—accusing me of giving reconnaissance tours.”

Loudermilk, who chairs the House Administration subcommittee on Oversight, says his committee will work “aggressively” to explain why Capitol security failed on January 6 and will seek interviews with people involved, including former House speaker Nancy Pelosi (D-CA). He says his panel will “be honest, show the truth, show both sides.” Representative Norma Torres (D-CA), the top Democrat on the panel, notes that Loudermilk has not informed the Democrats even of the dates on which the committee is supposed to meet.

Politico’s Heidi Przybyla today reported on a February 2023 “bootcamp” for Republican staffers to learn how to investigate the Biden administration. The camp was sponsored by right-wing organizations including the Conservative Partnership Institute, which is led by Trump’s former chief of staff Mark Meadows and other right-wing leaders and which raised $45 million in 2021 alone. Sessions included “Deposing/Interviewing a Witness” and “Managing the News Cycle.”

At one of those investigations yesterday, Representative Marjorie Taylor Greene (R-GA), who sits on the Homeland Security committee, said she intended to divulge classified information, saying: “I’m not gonna be confidential because I think people deserve to know.” She claimed that drug cartels had left an explosive device on the border; U.S. Border Patrol chief Raul Ortiz later posted a picture of the “device” and said it was “a duct-taped ball filled with sand that wasn’t deemed a threat to agents/public.”

Meanwhile, the Biden administration continues to administer.

Today, Sanofi, the third major producer of insulin in the United States, announced it will cap prices for insulin at $35 a month. Sanofi, Eli Lilly, and Novo Nordisk produce 90% of the insulin in the U.S. The producers have faced pressure after the Inflation Reduction Act lowered the monthly cost of insulin to $35 a month for those on Medicare.

—LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

[From comments :: “Wild how Putin just assumed Trump would win one way or another and Ukraine would have been an easy acquisition. NATO and our State Department would have been dismantled.Scary to think this evil is still so prevalent in our government with the help of Mark Meadows and Steve Bannon lurking around the back doors.”]

#Heather Cox Richardson#Letters From an American#TFG#Gangster Trump#Fulton Co. Ga.#House Republicans#Corrupt GOP#Criminal GOP#January 6 2021#January 6 Commission

4 notes

·

View notes

Text

Why You Need an Estate Attorney Near You: Richard Cary Spivack's Top Tips for Probate in NY

Finding the right estate planning attorney New York is crucial for navigating the complexities of probate regulation in New York. Richard Cary Spivack, an experienced probate legal professional in New York, offers valuable insights into why hiring an property legal professional close to you is crucial, in particular whilst dealing with probate matters. Below are key points to don't forget while looking for criminal help in property planning and probate.

Probate is the prison system that occurs after someone passes away, concerning the validation of the deceased's will, inventorying their property, paying money owed and taxes, and distributing the remaining belongings to beneficiaries. This method may be prolonged and complex, making it vital to have a knowledgeable probate legal professional in New York via your aspect.

Key Responsibilities of a Probate Attorney

1. Validating the Will: A queens probate lawyer ensures that the deceased's will is legally legitimate, which is an essential step earlier than any assets may be dispensed.

2. Asset Inventory: They assist in identifying and appraising the deceased's property, which is crucial for figuring out the estate's cost.

3. Debt Settlement: A probate lawyer enables management of the estate's debts, making sure that all duties are settled before distribution.

4. Distribution of Assets: They guide the executor in dispensing belongings in line with the need and New York state regulation, minimizing the chance of disputes amongst beneficiaries.

5. Court Representation: If any disputes rise up or if the need is contested, a probate attorney can represent the estate in court.

Why You Need an Estate Attorney Near You

Local Expertise

Hiring an estate attorney close to you presents the advantage of neighborhood expertise. They are acquainted with New York's probate laws and strategies, which could range considerably from country to nation. This nearby understanding can streamline the probate process and assist avoid criminal pitfalls.

Personalized Service

A property lawyer near you can provide a personalized provider tailored for your unique wishes. They can meet with you in individual, bearing in mind greater powerful communique and a better knowledge of your unique state of affairs.

Accessibility

Having a property lawyer close by way you could without difficulty access their offerings for consultations, file signings, and court docket appearances. This accessibility can be specifically useful for the duration of the emotionally taxing time following a loved one’s passing.

What to Expect from a Probate Attorney

When you have interaction a probate lawyer, here are a few matters you may assume:

1. Initial Consultation: Many queens probate attorneys provide an unfastened session to discuss your case. This meeting allows you to evaluate their know-how and decide if they're the proper health for your needs.

2. Transparent Pricing: A legitimate probate attorney in New York will provide clear facts about their costs, whether they rate hourly prices or flat prices for unique offerings.

3. Comprehensive Support: Your legal professional will guide you through each step of the probate technique, making sure that you recognize your duties and the timeline involved.

4. Conflict Resolution: Should disputes stand up amongst heirs or beneficiaries, your attorney will work to mediate and resolve these conflicts, protecting your interests and those of the property.

Estate Planning: A Proactive Approach

While probate is frequently visible as a reactive method, estate making plans are proactive. Engaging and property making plans legal professionals in New York assist you to prepare for the destiny, ensuring that your desires are commemorated after your demise.

Benefits of Estate Planning

1. Control Over Asset Distribution: With a solid property plan, you can dictate how your belongings will be dispensed, minimizing the probabilities of disputes.