#the pandemic and 10th was just a disaster and on my last day i had pretty much an anxiety attack in my 4th period bc my teacher was

Text

think i migght acactully drop out of school lmao i cannot do this shit anymore . i was fine a second ago but the thoughts got too strong and so now im Mad

#school doesnt start for another month and im already stressed and i just know that when school does start my mental health is just#going to rapidly decline and im gonna not have energy to do anything anymore n im sjut gonna fucking die#like if im being honest since i stopped going to school last year around like november/december my mental health has been Better#not good and not great but better than it is when im in school and i feel like that says a lot.#idc if dropping out means my entire family disowns me my moms already tired of me not going to school bc ive been struggling since#6th grade and its like. ok.#i might as well just not try#like ill be doing online school this year so not going back to public school but still dude i dont want to#i dont wanna do this shit for another 2 fucking eyars ive struggled enough already i cant Take It#i wanna fuckin move out so bad i dont wanna do this shit no more <3#evereyones like 'oh i could never drop out of school id ruin my relatinship with my mom' n its like#ok well for me theres no relationship to ruin between us in the first place. she hates me and i hate her n thats just how its gonna be#she already is like ignorant when it comes to school n me being in school so why even fuckin bother this year right#seriously just considering dropping out i really dont wanna do this becauuse doing school is just going to take such a tolll on me and like#i just . dont wanna go through it! im done! the american education system can suck my dick.#i dont even think im gonna graduate at 18. i dont think im gonna graduate ever. i didnt finish 6th grade and completely skipped 7th#i pretty much failed 8th bc my grades went down bc i didnt go to school bc of the whole covid thing n i manually passed but that#doesnt count bc i was already skipping school n didnt do the online classes. i didnt finish 9th bc that was also during like the height of#the pandemic and 10th was just a disaster and on my last day i had pretty much an anxiety attack in my 4th period bc my teacher was#a fucking loser.#so. im just done! im fucking done.#not gonna graduate. oh well.

5 notes

·

View notes

Text

The Specific Type of Grieving When You Lose Someone to Covid.

As this pandemic keeps going on I’ve felt a rage I’ve never felt before. I’m really not an angry person so for me to be filled with rage is unusual. So angry I unfollowed people I knew because I was sick of seeing reckless behavior.

When the pandemic started my family and I were super careful. Summer of 2020 I moved out of my childhood home but still went to hang and watch tv with my parents, mostly my dad. When Covid got bad again in the fall I even stopped going to the nail salon cause I didn’t want to get my parents sick. I started to use Instacart instead of going to grocery stores and the only three places I would go to were my house my parents house our cape house. Unfortunately as safe as we were my father still got Covid and died from it. He went into the hospital on January 10th and caught a pneumonia and was incubated the 11th. On the 12 he had a heart attack which he survived and was stabilized. On the 14th of January, the worst day of my entire life, my dad had another heart attack and the hospital said they would call back when he was stabilized. Instead they called back saying that they couldn’t save him. I know it’s only been two months since he’s been gone but it’s created a hole in my heart that will never be filled. I think back to those few days every single day. When I’m at my mom’s I’ll see things he’s worn and even go as far to sniff them just so I can smell him again. I constantly replay the few videos I have of him on my phone just to hear his voice. My life was miserable before but now it’s just down right unenjoyable. I’ve had to stop taking my screenwriting classes at UCLA for the time being cause I just could not focus on them. Hell, I’m so depressed I can’t even keep focus on my favorite tv shows right now. My GERD has come back and because of that I’ve been having many many panic attacks to the point where I can’t be left alone. I’m with my mom everyday cause I’m so anxious even though I know she is dealing with her own grief.

When people generalize and say things like “it’s been such a hard year for everyone.” Or “lots of other people have had bad experiences with Covid” I get so angry because we’ve normalized all the pain Covid has caused. Yes Covid has put everyone into a weird way of life and has ruined plans but some people choose to travel making the statement that they think they’re untouchable. I just don’t think they’re thinking at all cause if they had a brain to begin with they wouldn’t go. They would see that they are not immune to the pain. When your loved one dies, it always hurts but when Covid takes them it feels different. When your loved one was someone who was so scared of Covid they wore gloves and wouldn’t step in the mall it’s different. I’ve seen people who have had loved ones hospitalized with the virus and still go and travel places. Is death really the only thing stopping you? Is watching someone you love be sick not enough?

When my father first died I thought great, he’s a fucking statistic. He’s amongst the 500k people in America who have died the same death in the same pandemic. My grieving is no different from those other people’s. I thought that until I watched this film called Little Fish. There’s a quote that just has stuck with me from the second I heard it. “When your disaster is everyone’s disaster, how do you grieve?” I started to think that it’s okay to be self centered and grieve. My dad isn’t just a number he was the greatest person I’ve ever known and I should be able to be sad and suicidal and miserable about his death cause it’s MY life. I always say to my friend Sydney “I don’t mean to have a woe is me moment” and she always tells me that I should and it’s okay. If anyone else is unfortunately apart of the 500k please take time to feel sorry for yourself. Know that we are part of something other people will never understand. They will never get the rage of seeing people not taking Covid seriously and complaining about minuscule things why your loved ones death has absolutely destroyed your lives. They’ll never get why you see red when people ask if your loved one had an underlying health problem as if it fucking matters. They’ll never understand the feeling of not being able to say goodbye cause they wouldn’t let you even be in the hospital. They’ll never understand the feeling of not having a proper funeral for someone you cherished so deeply. They’ll never understand that people talking about last March all jokingly isn’t a joke to you. They’ll never get the weird specific type of grieving that comes with losing someone to this virus. A virus that some people pretend is over as they party for spring break or say “its just the flu.” They’ll never understand that your grieving has been public. That the triggers are everywhere because we are still living through a pandemic. I want you to know that it’s okay to feel like you are the only one who feels this, because you might be the only one in your circle of friends and family, but know that you are not alone. How you grieve is up to you and is sadly one of the only things we have complete control of. Be safe.

2 notes

·

View notes

Note

19 please

LOVE THIS QUESTION. I have BLESSED in my life with many great educators! I’ll talk about a few of them. This answer is going to be WAY longer than necessary, but this made me realize how much I miss my old teachers and how much they did for me.

High School

Mr. O’D - AP Lang, 11th grade. What a guy. A 6′5″ Middle Eastern man who loved death metal, poetry, speaks Russian, and hates the patriarchy. I was in the 11th grade during that fateful 2016 election, and I had his class first thing in the morning the morning after. He walked in ten minutes late, walked to the front of the class, and stared at us in silence. After a few minutes of us simply staring at each other, he suddenly bursts out into a long, tangental rage in Russian, with English words such as “orange” and “c*nt” popping out every few seconds. After he was done, took a few deep breaths, and sat down at his desk with his head down for the rest of class. Also, my friend group in this class (and for the whole year, really) was myself (a lesbian) and three trans guys. A few weeks into the school year after he got to know us a little bit, he brought his guitar to class and told us we had inspired him to write a song. He sang a song about coming out to your parents and the whole class was crying. He’ll always have a really special place in my heart.

Mrs. E - Oceanography, 12th grade. One of the smartest people I’ve ever known in my life. Told me in the 12th grade that we were overdue for a global-scale pandemic within the next five years, and look where that got us (I am in my third year of college now.) Just a week shy of being ten years older than me, she had a masters in Marine Biology and Molecular Biology. She was one of the teachers who ran a really great field trip where we got a cabin in a state park for a weekend and walked on long hikes, and during one of those hikes, it ended up being just the two of us for a while. We had some deep talks. At one point, three large men on bikes came toward us down the path, and she pulled me close and grabbed me tightly around the arm, proclaiming “If they try to talk to us, tell them you’re my daughter!” even though I looked older than she did. She hated the class I was in, but liked me and my friends because we made her laugh, so whenever she changed the seating chart, she left us together and close to her desk. There’s another story for another time about how I accidentally got super high in front her on my very last day of high school and she did not give a fuck, if y’all want to hear that sometime.

Mrs. H - Art/Photography/Director of Theatre Club, 10th-12th grade. Oh god, where do I start with her. A hot mess. A disaster of a person masquerading as someone who has their life together. Had a baby my junior year, took over the theatre club my sophomore year. She’s the reason I started theatre. We were SUPER close when I was in high school. She let me skip other classes and come to hers, we texted, I went to her house after I graduated. She’s also the aunt of one of my closest friends. She’s absolutely batshit, don’t get me wrong, but she also talked me out of s*icide a time or two. This one is shorter because there aren’t enough words to talk about how much this woman saved me.

College

Prof MH - So many theatre classes. Also my advisor. An absolute queen. Does not take my bullshit, and I am very grateful for that, but is also a shoulder to cry on if you need her. Very quirky. Absolutely digs Shakespeare, almost annoyingly (and that’s a lot, coming from me.) No-nonsense, but still knows how to have fun. She creates such a welcoming environment in her acting classes that puts everyone at ease, but isn’t afraid to take us outside of our comfort zones. She genuinely wants to see us become better actors and better people. I know if I ever won an Oscar, she’d be the first person on her feet cheering for me.

Prof RB - I haven’t had any of her classes yet, but she’s a theatre prof, and she’s directing the show I’m currently in (we open tomorrow - eep!) She’s the kind of person that’s au naturale, she introduced me to meditating, is always talking about how healthy she eats, and has two awesome kids that I babysit sometimes. She is an absolute SAVAGE when it comes to acting notes, though. Her acting classes/productions are ... not for the faint of heart. I would die for this woman.

Prof WY - Improv/Various lecture theatre classes. AN ICON. A KING. WE STAN. Bought me dinner when we were in another state at a conference one time. Had a huge margarita. He is not afraid to say whatever the fuck is on his mind, and god damn it, he is usually right. He’s the one that you come in and are afraid of, but as you get to know the professors, you realize that it’s RB you should be afraid of ... and then later on you realize, no, I should DEFINITELY be afraid of WY. I want to spend my 21st birthday at a vineyard with this man. Randomly texts me pictures of his dogs, saying “Just poking our nose in to see how you’re doing!” Will drop everything for you in a time of need.

This was long as fuck. Educators are so under-appreciated. I would die for everyone on this list.

2 notes

·

View notes

Text

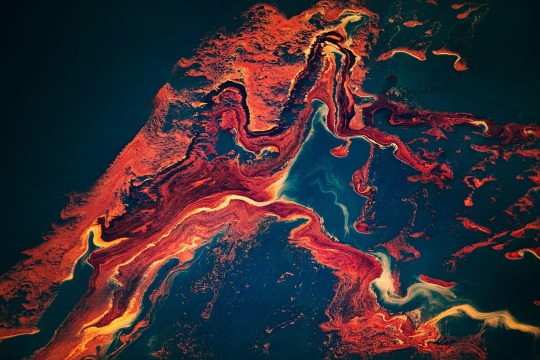

Pelicans, spoonbills, and herons nest on Cat Island, where oil washed ashore in May 2010. The spill sped the land’s ongoing erosion; today it’s underwater. Photo: Daniel Beltrá

Ten Years Later: Reflections on the Deepwater Horizon Oil Spill

Ten years ago, BP's Deepwater Horizon oil rig exploded, killing 11 people and pouring an estimated 4.9 million barrels of oil into the Gulf of Mexico. Audubon and other conservation partners sprang into action to repair the ecological damage.

To mark the 10th anniversary, we asked four writers to reflect on how this catastrophe has impacted people and birds over the last decade—and exactly what it will take to ensure a bright future for the gulf.

Audubon magazine asked four writers to contemplate what has and hasn't changed in the aftermath of the Gulf catastrophe.

The worst oil spill in U.S. waters began with a deadly explosion on April 20, 2010. Many of us remember the distress we felt as that day stretched into days, then months—a slow-building dread that no one could make a gaping hole drilled into the earth stop gushing. Capping the well took 87 days. The consequences unfurled long after.

Today BP penalty funds flowing to the region provide an enormous opportunity to not only repair environmental damages from that disaster, but also help restore a long-suffering Gulf Coast. In 2019 Audubon provided a roadmap for investing nearly $2 billion of this pot to shore up key habitats through 30 projects covering more than 136,000 acres. With partners, it’s now ensuring many of those projects are advancing. For example, this winter the state of Louisiana rebuilt Queen Bess Island, an eroding pelican rookery—thereby helping it avoid the fate of nearby Cat Island, which has already disappeared.

The Gulf holds all of these possibilities—tragedy, resilience, and hope. Each of the voices featured in this special package watched the Deepwater Horizon catastrophe unfold, and witnessed the repercussions to people and birds, but took away different lessons. We asked them to reflect on the spill’s political and personal legacy. What has transpired because of these horrific events? And what can we carry forward? —The Editor

We Need Another Way to Relate to the World—and Each Other

Remembering the BP spill tragedy offers an occasion for reconsidering how we interact with nature and what we value.

The first oiled pelicans I saw that spring didn’t look like the ones they put on TV. They looked almost normal at first, but an odd behavioral tic drew your gaze back to them. Then you saw that their belly feathers hung clumped and matted, looking wet, only this was oil.

Feathers protect birds from a world that is by turns too hot, too cold, too wet, too sunny—but oiled feathers can’t do their job. So the pelicans responded the only way they could. They preened, grabbing feather clumps in enormous bills and tugging over and over again. That was the tic that caught your eye, Brown Pelicans stuck in an endless preening loop, unable to save themselves but unable to stop trying. It looked like a form of insanity—I suppose it was—and I still think about the sight with a strangling sense of horror.

Brown Pelicans are highly social beings, flying together in tight, graceful formations and nesting noisily by the hundreds on sheltered islands on the fringes of coasts, feeding at sea. The edge of our world is the beginning of theirs.

They are gentle toward humans, even under stress, the wildlife rehabilitators would tell me. The muscular, seafaring Northern Gannets left triangular gashes on the forearms of people who offered them help they couldn’t understand, but the pelicans were patient as their eyeballs and palates were swabbed, quiet as their skin and feathers were scrubbed.

Oiled Brown Pelicans wait to be cleaned in June 2010, at a rescue center in Fort Jackson, Louisiana. Photo: Daniel Beltrá

I’d seen the Brown Pelicans at peace, just two weeks before the fog of madness began to seep in. It was evening on Louisiana’s California Bay, and the setting sun made the grass look as green as anything in this world. The pelicans packed onto a small island, inches apart, pairs sitting on mound nests on the ground, fearless. They had come off the endangered species list only months ago, the success story of a species rebounding after brutal overhunting and DDT poisoning. The rescue effort had worked. It seemed we had found a way to live together after all.

And then oil began roaring out of a violent bore in the seafloor, as if eager to make up for eons in the underworld. Eleven men died in chaos and terror. Humanity proved powerless against the onslaught. It would take a few more spins of this Earth around its axis, but wind and tides would bring that oil to the heart of the pelicans’ sanctuary.

The oil reached many other birds, too. I’d see adolescent Roseate Spoonbills, their pink feathers brown with oil, drowning Laughing Gulls, and doomed Royal Tern chicks. I would see the human toll: Servers weeping in restaurants. Businesses shuttered, communities scattered, families separated. Seafood industries in turmoil. Jobs gone. A lost summer of tourism. A couple standing together atop a dune as wave after wave of red and orange oil washed up onto the sand. The Gulf was closed for business.

The spill marked one more stanza in the long, uneasy ballad of our relationships with one another and with all life on Earth. Just five years before, Hurricane Katrina killed more than 1,800 people and wreaked more than $160 billion of havoc. The storm was magnified by decades of environmental degradation that had turned vast wetlands into open water, leaving New Orleans exposed. Katrina’s toll was also sharply intensified by human failures and prejudices that left the poor, the elderly, the disabled, and the city’s Black and brown residents most defenseless in the face of horrendous crisis. When we fail to consider the fullness of one another’s humanity in our environmental policies, we deepen cycles of injustice and harm.

We haven’t yet learned how to live alongside pelicans, and we haven’t learned how to live alongside one another, either. As I write, news is breaking of 1 billion animals dead from Australia’s wildfires, on top of immense human cost. Ice is melting, seas are rising, coral reefs are bleaching, extinctions are accelerating, peoples are being displaced, and droughts are deepening. In 2010 we saw people, birds, dolphins, and turtles suffer and die amid Deepwater Horizon’s flames and oil. Today the scale of suffering and death unfolding as our climate warms boggles the mind, activating all our individual and collective defense mechanisms. Block. Stop. Deny. Distract. Exploit.

The slowly spreading oil slick approaches the Louisiana coast, east of the Mississippi River, two weeks after the April explosion. Photo: Daniel Beltrá

In the Gulf, the best-funded environmental restoration initiative in world history is underway, cause for great hope. At the same time, our government is slashing environmental safeguards with abandon, even the venerable Migratory Bird Treaty Act, which defended all those birds in the Gulf and held BP financially accountable for its harm.

Today the scale of suffering and death unfolding as our climate warms boggles the mind

By now we know very well that human economic and social well-being depend on a clean and healthy environment. In such challenging times, we must boldly reimagine how we will relate to that environment and to one another.

I imagine that as a society, we could build a set of environmental policies and practices that lift up every person, not just the most able, fortunate, or powerful, and certainly not just those of one favored race or class. I imagine we could be brave enough to treat every other human being as fully equal to ourselves.

I imagine too that we could build into those environmental policies and practices a commitment to the innate worth and independence of all species with whom we share this planet, from Brown Pelicans to bald cypresses. I imagine that we could value their lives beyond the utility they lend our own.

These are not primarily scientific challenges. They are choices of morality, of politics, of faith, of will, of accountability. What do you choose, and what are you going to do about it?

Author’s note, April 13, 2020:

Since my essay about the 10-year anniversary of the Deepwater Horizon oil spill went to print in Audubon’s Spring 2020 issue, the Gulf Coast has closed for business once again—this time with the rest of America. The COVID-19 pandemic tearing through our communities has created a dire catastrophe across our nation and across the world. So many aspects of this crisis are unprecedented, yet so many are familiar, too. Years of warnings by scientific and medical experts were minimized or ignored. Some government responses have been shaped by ego and greed, instead of evidence and humanity. Marginalized people are dying at higher rates in a toll that already exceeds eleven times that of Hurricane Katrina and seven times that of 9/11. Under cover of chaos, polluters are making new gains in their quest to smash safeguards that protect us all. And yet, courageous people in communities, businesses, nonprofits, governments—and most especially in healthcare—are making a difference every day. So as this crisis deepens, as the BP oil spill anniversary passes quietly, and as we note the 50th Earth Day remembrance on April 22, I ask again: In what kind of world do you want to live, and what are you going to do about it?

While working in the Gulf for Audubon, David J. Ringer was deeply involved in the emergency spill response in 2010. He’s now Audubon’s Chief Network Officer.

0 notes

Link

Disaster? Let me paint a picture here:TL;DR: I have big list of customers already waiting for over a month on their order to go out and I'm simply powerless, uninformed and misguided by both EasyPost and Ruby Has. Still waiting on a daily base to finally see my stock return in the Ruby Has system and get started shipping orders again.The storylineOn the 21st of March, we are suddenly informed by EasyPost that they were bought out by Ruby Has with the core message from the email:"We look forward to a seamless transition and to a long and fruitful relationship with you, and thought we would take a moment now as we embark on this new phase together to tell you a bit about us."The day I was informed by email, a press release was issued.Article: https://www.businesswire.com/news/home/20200320005576/en/Ruby-Ecommerce-Fulfillment-Acquires-EasyPost-Fulfillment-ServicesThoughts: O that's strange, didn't expect this to suddenly happen. I'll see what Ruby Has has to offer and make a careful consideration on who I want to work with.26th of March, I suddenly receive an email to inform us that we basically have to gtfo or accept an abrupt transfer with new terms and conditions going in on May 1st. Basically the first possible date. From the email:"As previously communicated to you by EasyPost, effective as of April 1, 2020, all customers’ merchandise will be transported and stored in the Ruby Has Kentucky Facility unless you have made other arrangements with EasyPost."(We're in the PA facility) Oh, and the kicker? EasyPost (EP) has never communicated anything with us. The last update we received from EP was a COVID-19 update that conveniently covered their asses on the 13th of March:"Unfortunately, the response of different local agencies to the virus has severely impacted our business operations making it challenging to provide the normal service times you have come to expect. Easypost will still strive to hit SLAs as best we can to provide a great experience to your end customers, but we wanted to give you notice that we are suffering under a 'force majeure' event. "SLA = Service Level Agreement, the contractual agreement on what level of service they need to offer or else you can get a refund on it.So, not sure what EP/RH were thinking? "let's do an ill-prepared, rushed transfer during a Pandemic in which online sales are booming. Good idea."As a non-US based business, I basically had no choice than to go through with the transfer. Assessing a new 3PL fulfilment, negotiating rates, overweighing their services and checking the software/automation capabilities. on top of a large time difference. It all takes time. And none of us are located in the US, so also not an option.We went through with the transfer with the idea that we could offer our customers the fastest service without too much delay. We were wrong.1st of April, no news.... we continue to use the EP system and ship orders.2nd of April, No news. I decide to reach out and ask what to expect from the transfers, if any action is required and what dates to look forward to.4th of April, a sudden demo of the RH platform without access or anything relevant to the transfer. With an "additionally" accept our new terms and conditions. EP has stopped responding to a few different order issue tickets.6th of April, send a reminder email of ticket asking for information. Get a response, that basically says the transfer will happen, no action required, RH should be able to answer further questions.10th of April, suddenly an email that they will start moving goods to the KY facility. PA was planned for the 13th of April and should take 3 working days. In the meanwhile, I notice all my orders stopped shipping but I still have the inventory. This continued until the 18th of April.11th of April, receive information from their customer service on a few technical questions and suddenly receive a form to check what software integrations we're using.Let the shit show start.I inform all my customers that they can expect shipments on the 20th of April. I expected the goods transfer to finish on either 16 or 17th of April. For the month April, we could continue to use EP and their backend. It wasn't until the 1st of May that we'd have to worry about the software transfer etc.I noticed that none of my inventory had changed to 0 up to the 18th of April. Bad sign. I had already kept communicating with the RH rep about what to expect.By the 23rd of May, I get an answer that they are tirelessly working on check in the inventory and it should be be done any day now. I was also given a timeline that stated"Wednesday, April 22nd: all inventory is en route or already delivered to the KY facility.""Thursday, April 30th: will be the last day for orders fulfilled via the EasyPost platform, all open unshipped orders (if any) will be downloaded into your Ruby Has account on the Ruby Has platform"May 1st to 3rd, transfer to the Ruby Has platform, then May 4th will begin shipments.My expectations were set on the 27th of April, last moment to push out all the order... my expectation were plummeting.26th of April, I receive an email with basically the same timeline as described before with a bit more details on how the account transfer should go down. But know what, all my inventory from the PA facility is still not available to me.When I received that update, I lost hope on being able to ship anything before the RH transfer. I also still had a long list of orders that needed to ship in the EP system dating from the 10th to the 18th of April. Then that's of course not accounting for few customers from March with shipping issues, that needed new shipment and all the backorders we had to take in the meanwhile.30th of April. They turned off the EP system. Couldn't ship anything anymore. No account info from RH.There's an onboarding checklist website that changed its deadline dates up to 3 times.5th of May, I finally receive my RH platform account information. I can get started!? No. I can get in, but can't edit anything but my password, the PA inventory still not available and can't send shipment orders.To this date, onboarding checklist is still not updated, still can't do any of the next steps. Don't even have a billing section yet.I'm starting to doubt if they'll even finish everything by the end of the week, I have a long list of customers eagerly waiting for their product during these extremely boring times at home and I'm staring in the dark when it comes to expectations.How am I even going to make sure they 100% check in all my goods, don't lose any or all of it? What am I supposed to tell my customers at some point?When I imposed the breach of SLA to Ruby Has, and that regardless of the situation they should compensate for the loss in business. They referred back to the force majeure that EP had obtained, and in April we were officially under the EP contract. May, it's RH. I'm not a lawyer, nor US citizen, and we're not talking about millions in business.The customersI am thankful to have amazing, patient and understanding customers. Only few had refunded and canceled due to timing related issues (like a birthday). I have made sure to inform each customer on at least a weekly basis and keep a day-to-day updated page for my latest information.But at some point, there's a limit.So why can't I find anybody talking about this? Where are the real entrepreneur and business forums? It's been going on for a month, and I just can't find anybody talking about it.

0 notes

Text

Nellie Akalp of CorpNet: How to Submit Your Application for the Paycheck Protection Program

The early days of applying for the the Paycheck Protection Program (PPP) proved tough. Millions of small businesses tried. They struggled to take advantage of the opportunity to get the funding they need. Small businesses need this funding to ride out the economic shutdown due to the coronavirus pandemic. But consider the good news too. Some of those first to submit their applications received their approval notifications back. Take this week’s convo with Corpnet CEO and frequent Small Business Trends contributor Nellie Akalp. She shared the details of both the PPP and Economic Injury Disaster Relief Program(ECIDRP) opportunities. Meanwhile, a small business friend of mine sent me a message saying he had just been approved. He shared the process he went through. And just like that, Nellie got her approval notification!

So small business early to apply started to hear back. So if you haven’t submitted your application, get started! Nellie really helped us lay out the program in the recent interview. Learn who is eligible for the program. Also discover what you need to have ready before you apply. Get more details about these programs. Check out an edited transcript of a portion of our conversation below. Or see the whole conversation and hear all of Nellie’s tips and advice on these programs. Just watch the video or click on the embedded SoundCloud player below.

Small Business Trends: What’s the current environment for small businesses?

Nellie Akalp: Right now, it’s pandemonium. And I’m not kidding you. There is so much misinformation out there. And small business owners are running around trying to figure out what is the correct information. What is incorrect information? Where they need to turn to. And in dealing with a lot of accountants, CPAs, legal and tax professionals.

And doing webinars for that segment of our business. I continuously say right now. Accountants, CPAs, this is the silver lining for you guys. I mean your business should be rocking right now. And if you’re going dormant or if you’re thinking of closing up shop, then shame on you.

Because right now clients are really looking at their financial advisors. Whether it be their enrolled agents, their CPA, their accountant. To get them the correct information they need to be able to submit these applications. For financial aid and Paycheck Protection Program assistance. And as a result, we’re here to help.

Small Business Trends: Let’s talk about the Paycheck Protection Program. Exactly what is that?

Nellie Akalp: So right now under the CARES Act and through the stimulus, small business owners have the ability to apply for different types of financial aid and assistance out there through the SBA. The Paycheck Protection Program, is really your normal 7(a) SBA loan. And what this Paycheck Protection Program allows is for a small business owner with 500 or fewer employees, they can qualify up to a $10 million forgivable loan as long as it’s used for payroll costs, payroll benefits for their company.

And really there’s a list as to what qualifies. But generally the way this loan is qualified for is a small business owner takes their 2019 total payroll for the last 12 months, takes the average and times that by 2.5% and that is what is going to equal the amount that a small business owner can qualify for. And this loan is designed to allow small business owners with employees to get back up on their feet and prevent small business owners from laying off their employees. And it’s a very strict guideline that even until today there’s new rules and regulations added to it.

We have a team of six to 10 people working round the clock to find the actual laws that are governing this act that has been passed and what are the new developments. But generally, anyone who has a business and as a small business owner and has employees, employees that are on payroll can qualify for this Paycheck Protection Program loan, which is a forgivable loan that you can qualify up to $10 million. And most of it, if not all of it, can become forgivable.

Meaning you don’t have to pay it back as long as it is used for eight weeks preceding the time the loan is funded for payroll costs and keeping your employees and not having to lay them off. There is very strict rules with that in that 75% of this loan amount has to be used for payroll and the balance of 25% has to be used towards expenses such as rent, mortgage interest for your business, if you own the location where your business is being conducted or utilities expense and the list goes on.

Small Business Trends: A lot of small businesses, they have 1099 contract folks that do a lot of their work and these folks might work for a significant amount of time for them, but they’re not full-time employees. So if you’re in that situation, are you not able to apply for this?

Nellie Akalp: This is a great question. So independent contractors that are working with a business are eligible to apply for their own Paycheck Protection Program as of April 10th, 2020. So the program is going to be available to independent contractors and the application process for independent contractors to qualify for the Paycheck Protection Program will open up April 10.

Prior to that, and in answer to your question as to what about small business owners that have independent contractors that they’re working with and they’re paying? Well that is something that according to the SBA, if a small business owner has been approved for this PPP loan, a portion of the loan proceeds can be used to pay their independent contractors, but it has to fall under the guidelines of that 25% versus the 75%. They’re very strict because this is potentially a forgivable loan.

So they want to be very clear and have very strict guidelines as to what will qualify for it being forgivable. For those that think or have the notion of thinking that, oh, I’ll get this loan and immediately it’s forgiven as long as I follow steps one, two, three, that’s not the case. Your lender that will fund you this loan will immediately be invoicing you with the loan terms and the payment amounts.

When it’s time to pay it back, which is 18 months after funding, they’re going to give you a six month grace period and then you have to start paying the loan back, the portion of it that’s not forgivable. But for everybody, you as the business owner, the onus falls on you to apply for the loan amount becoming forgivable to you.

Small Business Trends: Talk about the process. How long does it take? Do you get some kind of an immediate answer? And I guess the most important question is when does the cash come into my hand?

Nellie Akalp: Yes. So that’s what we’re all waiting for. And this is something that I do not know the answer to, I don’t know the exact answer to, but what I can tell you is when I don’t know the answer to something, I will not and do not rely on hearsay and I don’t rely on opinions. I go and look for the information. And right now the most accurate information that you can get is on the United States Treasury website as it relates to this Paycheck Protection Program loan.

So from what I understand is that the SBA has contracted with many different banks as SBA third-party approved lenders and most of the smaller banks are hiring processors and strictly focusing on processing these types of loans. And what they’re telling us is ever since April 3. Which this application process opened up to small business owners. They’re taking applications online and it’ll take about three to six days for the application to be reviewed to see if they need any additional information.

And then it’s going to be assigned to an underwriter. And after that, the underwriter will directly work with the small business owner and it can take anywhere from the start of the process till the end, anywhere from two to four weeks till funding. Now there is a lot of media around this right now as we speak.

I mean even while I’m on this radio show, my phone is going off the hook. Oh my God, the funds are ran out, the funds have been run out. It is very true that Wells Fargo, from our understanding and from the news media, in that they bowed out of this program. However, as of this morning we understand that they want to participate. However, they’re waiting for certain guidelines. So I’m not sure about the information that’s out there.

I do know, having been a Bank of America client and having all my business banking through B of A, B of A is offering this service to their clients but they’re making it very rigorous, very hard for business clients to use B of A to go through the application process, to submit an application for the Paycheck Protection Program.

So right now, we’re at the mercy of the smaller banks and where our company, CorpNet, can assist the small business owner is that we have partnered with Liberty SBF bank and we’ve partnered with them to provide the small business owner with a Paycheck Protection Program loan submission assistance whereby we take the information from our client.

There is no upfront fees. We cannot charge our clients. No one can charge their client for assisting them with the Paycheck Protection Program application. It’s against the law. We as a third-party consultant, SBA loan packager, get our fees paid by the SBA at loan funding. It doesn’t come from the client and that’s if we get paid.

Small Business Trends: Do you have to go to a bank you already have a relationship with?

Nellie Akalp: If a small business owner has an existing relationship with their bank. We not only urge them but we want them, we encourage them, to go to their existing bank. Because they are going to get the fastest response from their current bank. However, the problem that many small business owners are facing to this morning is the fact that their existing bank doesn’t want to deal with them.

Or that their relationship with their bank is so new. Or the fact that their bank has rigorous requirements as to what they’re going to require from that applicant in order for the bank to process their application. But simply stated, and in answer to your question, absolutely, you are absolutely right. If a small business owner has a banking relationship already, they should go to their bank. If the bank offers them assistance in obtaining this Paycheck Protection Program loan.

Small Business Trends: What do they need to do to make sure their loan is forgiven if they are able to get it forgiven?

Nellie Akalp: So again, the Paycheck Protection Program SBA Disaster loan is a 7(a) SBA loan. And it’s a form of a loan where under the CARES Act, a small business owner can qualify for up to $10 million. Based on their average monthly payroll for last year times 2.5. And that would be the loan amount that they would qualify for.

Now when I talk about payroll, there’s a lot of things that can qualify as payroll costs. And you know I’ve written about this. It’s on the Small Business Trends website in the blog section under my blogs. And under the articles that I’ve written. But there’s many different bullets as to what would qualify. Payroll costs, healthcare insurance premiums paid on behalf of the company for the employees, vacation time, sick leave.

There’s a lot of things that go under there. But for the formula, it’s basically your average gross payroll costs. Times 2.5 equals the amount that you would qualify for. And once you get funded, you must use that amount within eight weeks. To pay for payroll and if you’ve laid off employees, bring them back.

And if you use 75% of the loan amount funded for those purposes of payroll costs. And 25% for other normal ordinary business expenses as your rent. Your mortgage interest, your utilities expense, expenses that you would normally incur in running a business under normal circumstances. Then the entire loan will be forgivable to that business owner. Meaning that business owner does not have to pay that loan back.

This article, “Nellie Akalp of CorpNet: How to Submit Your Application for the Paycheck Protection Program” was first published on Small Business Trends

https://smallbiztrends.com/

The post Nellie Akalp of CorpNet: How to Submit Your Application for the Paycheck Protection Program appeared first on Unix Commerce.

from WordPress https://ift.tt/2JWeGOf

via IFTTT

0 notes

Text

Nellie Akalp of CorpNet: How to Submit Your Application for the Paycheck Protection Program

youtube

The early days of applying for the the Paycheck Protection Program (PPP) proved tough. Millions of small businesses tried. They struggled to take advantage of the opportunity to get the funding they need. Small businesses need this funding to ride out the economic shutdown due to the coronavirus pandemic. But consider the good news too. Some of those first to submit their applications received their approval notifications back. Take this week’s convo with Corpnet CEO and frequent Small Business Trends contributor Nellie Akalp. She shared the details of both the PPP and Economic Injury Disaster Relief Program(ECIDRP) opportunities. Meanwhile, a small business friend of mine sent me a message saying he had just been approved. He shared the process he went through. And just like that, Nellie got her approval notification!

So small business early to apply started to hear back. So if you haven’t submitted your application, get started! Nellie really helped us lay out the program in the recent interview. Learn who is eligible for the program. Also discover what you need to have ready before you apply. Get more details about these programs. Check out an edited transcript of a portion of our conversation below. Or see the whole conversation and hear all of Nellie’s tips and advice on these programs. Just watch the video or click on the embedded SoundCloud player below.

Small Business Trends: What’s the current environment for small businesses?

Nellie Akalp: Right now, it’s pandemonium. And I’m not kidding you. There is so much misinformation out there. And small business owners are running around trying to figure out what is the correct information. What is incorrect information? Where they need to turn to. And in dealing with a lot of accountants, CPAs, legal and tax professionals.

And doing webinars for that segment of our business. I continuously say right now. Accountants, CPAs, this is the silver lining for you guys. I mean your business should be rocking right now. And if you’re going dormant or if you’re thinking of closing up shop, then shame on you.

Because right now clients are really looking at their financial advisors. Whether it be their enrolled agents, their CPA, their accountant. To get them the correct information they need to be able to submit these applications. For financial aid and Paycheck Protection Program assistance. And as a result, we’re here to help.

Small Business Trends: Let’s talk about the Paycheck Protection Program. Exactly what is that?

Nellie Akalp: So right now under the CARES Act and through the stimulus, small business owners have the ability to apply for different types of financial aid and assistance out there through the SBA. The Paycheck Protection Program, is really your normal 7(a) SBA loan. And what this Paycheck Protection Program allows is for a small business owner with 500 or fewer employees, they can qualify up to a $10 million forgivable loan as long as it’s used for payroll costs, payroll benefits for their company.

And really there’s a list as to what qualifies. But generally the way this loan is qualified for is a small business owner takes their 2019 total payroll for the last 12 months, takes the average and times that by 2.5% and that is what is going to equal the amount that a small business owner can qualify for. And this loan is designed to allow small business owners with employees to get back up on their feet and prevent small business owners from laying off their employees. And it’s a very strict guideline that even until today there’s new rules and regulations added to it.

We have a team of six to 10 people working round the clock to find the actual laws that are governing this act that has been passed and what are the new developments. But generally, anyone who has a business and as a small business owner and has employees, employees that are on payroll can qualify for this Paycheck Protection Program loan, which is a forgivable loan that you can qualify up to $10 million. And most of it, if not all of it, can become forgivable.

Meaning you don’t have to pay it back as long as it is used for eight weeks preceding the time the loan is funded for payroll costs and keeping your employees and not having to lay them off. There is very strict rules with that in that 75% of this loan amount has to be used for payroll and the balance of 25% has to be used towards expenses such as rent, mortgage interest for your business, if you own the location where your business is being conducted or utilities expense and the list goes on.

Small Business Trends: A lot of small businesses, they have 1099 contract folks that do a lot of their work and these folks might work for a significant amount of time for them, but they’re not full-time employees. So if you’re in that situation, are you not able to apply for this?

Nellie Akalp: This is a great question. So independent contractors that are working with a business are eligible to apply for their own Paycheck Protection Program as of April 10th, 2020. So the program is going to be available to independent contractors and the application process for independent contractors to qualify for the Paycheck Protection Program will open up April 10.

Prior to that, and in answer to your question as to what about small business owners that have independent contractors that they’re working with and they’re paying? Well that is something that according to the SBA, if a small business owner has been approved for this PPP loan, a portion of the loan proceeds can be used to pay their independent contractors, but it has to fall under the guidelines of that 25% versus the 75%. They’re very strict because this is potentially a forgivable loan.

So they want to be very clear and have very strict guidelines as to what will qualify for it being forgivable. For those that think or have the notion of thinking that, oh, I’ll get this loan and immediately it’s forgiven as long as I follow steps one, two, three, that’s not the case. Your lender that will fund you this loan will immediately be invoicing you with the loan terms and the payment amounts.

When it’s time to pay it back, which is 18 months after funding, they’re going to give you a six month grace period and then you have to start paying the loan back, the portion of it that’s not forgivable. But for everybody, you as the business owner, the onus falls on you to apply for the loan amount becoming forgivable to you.

Small Business Trends: Talk about the process. How long does it take? Do you get some kind of an immediate answer? And I guess the most important question is when does the cash come into my hand?

Nellie Akalp: Yes. So that’s what we’re all waiting for. And this is something that I do not know the answer to, I don’t know the exact answer to, but what I can tell you is when I don’t know the answer to something, I will not and do not rely on hearsay and I don’t rely on opinions. I go and look for the information. And right now the most accurate information that you can get is on the United States Treasury website as it relates to this Paycheck Protection Program loan.

So from what I understand is that the SBA has contracted with many different banks as SBA third-party approved lenders and most of the smaller banks are hiring processors and strictly focusing on processing these types of loans. And what they’re telling us is ever since April 3. Which this application process opened up to small business owners. They’re taking applications online and it’ll take about three to six days for the application to be reviewed to see if they need any additional information.

And then it’s going to be assigned to an underwriter. And after that, the underwriter will directly work with the small business owner and it can take anywhere from the start of the process till the end, anywhere from two to four weeks till funding. Now there is a lot of media around this right now as we speak.

I mean even while I’m on this radio show, my phone is going off the hook. Oh my God, the funds are ran out, the funds have been run out. It is very true that Wells Fargo, from our understanding and from the news media, in that they bowed out of this program. However, as of this morning we understand that they want to participate. However, they’re waiting for certain guidelines. So I’m not sure about the information that’s out there.

I do know, having been a Bank of America client and having all my business banking through B of A, B of A is offering this service to their clients but they’re making it very rigorous, very hard for business clients to use B of A to go through the application process, to submit an application for the Paycheck Protection Program.

So right now, we’re at the mercy of the smaller banks and where our company, CorpNet, can assist the small business owner is that we have partnered with Liberty SBF bank and we’ve partnered with them to provide the small business owner with a Paycheck Protection Program loan submission assistance whereby we take the information from our client.

There is no upfront fees. We cannot charge our clients. No one can charge their client for assisting them with the Paycheck Protection Program application. It’s against the law. We as a third-party consultant, SBA loan packager, get our fees paid by the SBA at loan funding. It doesn’t come from the client and that’s if we get paid.

Small Business Trends: Do you have to go to a bank you already have a relationship with?

Nellie Akalp: If a small business owner has an existing relationship with their bank. We not only urge them but we want them, we encourage them, to go to their existing bank. Because they are going to get the fastest response from their current bank. However, the problem that many small business owners are facing to this morning is the fact that their existing bank doesn’t want to deal with them.

Or that their relationship with their bank is so new. Or the fact that their bank has rigorous requirements as to what they’re going to require from that applicant in order for the bank to process their application. But simply stated, and in answer to your question, absolutely, you are absolutely right. If a small business owner has a banking relationship already, they should go to their bank. If the bank offers them assistance in obtaining this Paycheck Protection Program loan.

Small Business Trends: What do they need to do to make sure their loan is forgiven if they are able to get it forgiven?

Nellie Akalp: So again, the Paycheck Protection Program SBA Disaster loan is a 7(a) SBA loan. And it’s a form of a loan where under the CARES Act, a small business owner can qualify for up to $10 million. Based on their average monthly payroll for last year times 2.5. And that would be the loan amount that they would qualify for.

Now when I talk about payroll, there’s a lot of things that can qualify as payroll costs. And you know I’ve written about this. It’s on the Small Business Trends website in the blog section under my blogs. And under the articles that I’ve written. But there’s many different bullets as to what would qualify. Payroll costs, healthcare insurance premiums paid on behalf of the company for the employees, vacation time, sick leave.

There’s a lot of things that go under there. But for the formula, it’s basically your average gross payroll costs. Times 2.5 equals the amount that you would qualify for. And once you get funded, you must use that amount within eight weeks. To pay for payroll and if you’ve laid off employees, bring them back.

And if you use 75% of the loan amount funded for those purposes of payroll costs. And 25% for other normal ordinary business expenses as your rent. Your mortgage interest, your utilities expense, expenses that you would normally incur in running a business under normal circumstances. Then the entire loan will be forgivable to that business owner. Meaning that business owner does not have to pay that loan back.

This article, “Nellie Akalp of CorpNet: How to Submit Your Application for the Paycheck Protection Program” was first published on Small Business Trends

source https://smallbiztrends.com/2020/04/paycheck-protection-program-application.html

from WordPress https://businessreviewguidenow.wordpress.com/2020/04/10/nellie-akalp-of-corpnet-how-to-submit-your-application-for-the-paycheck-protection-program/

via IFTTT

0 notes

Text

Nellie Akalp of CorpNet: How to Submit Your Application for the Paycheck Protection Program

The early days of applying for the the Paycheck Protection Program (PPP) proved tough. Millions of small businesses tried. They struggled to take advantage of the opportunity to get the funding they need. Small businesses need this funding to ride out the economic shutdown due to the coronavirus pandemic. But consider the good news too. Some of those first to submit their applications received their approval notifications back. Take this week’s convo with Corpnet CEO and frequent Small Business Trends contributor Nellie Akalp. She shared the details of both the PPP and Economic Injury Disaster Relief Program(ECIDRP) opportunities. Meanwhile, a small business friend of mine sent me a message saying he had just been approved. He shared the process he went through. And just like that, Nellie got her approval notification!

So small business early to apply started to hear back. So if you haven’t submitted your application, get started! Nellie really helped us lay out the program in the recent interview. Learn who is eligible for the program. Also discover what you need to have ready before you apply. Get more details about these programs. Check out an edited transcript of a portion of our conversation below. Or see the whole conversation and hear all of Nellie’s tips and advice on these programs. Just watch the video or click on the embedded SoundCloud player below.

Small Business Trends: What’s the current environment for small businesses?

Nellie Akalp: Right now, it’s pandemonium. And I’m not kidding you. There is so much misinformation out there. And small business owners are running around trying to figure out what is the correct information. What is incorrect information? Where they need to turn to. And in dealing with a lot of accountants, CPAs, legal and tax professionals.

And doing webinars for that segment of our business. I continuously say right now. Accountants, CPAs, this is the silver lining for you guys. I mean your business should be rocking right now. And if you’re going dormant or if you’re thinking of closing up shop, then shame on you.

Because right now clients are really looking at their financial advisors. Whether it be their enrolled agents, their CPA, their accountant. To get them the correct information they need to be able to submit these applications. For financial aid and Paycheck Protection Program assistance. And as a result, we’re here to help.

Small Business Trends: Let’s talk about the Paycheck Protection Program. Exactly what is that?

Nellie Akalp: So right now under the CARES Act and through the stimulus, small business owners have the ability to apply for different types of financial aid and assistance out there through the SBA. The Paycheck Protection Program, is really your normal 7(a) SBA loan. And what this Paycheck Protection Program allows is for a small business owner with 500 or fewer employees, they can qualify up to a $10 million forgivable loan as long as it’s used for payroll costs, payroll benefits for their company.

And really there’s a list as to what qualifies. But generally the way this loan is qualified for is a small business owner takes their 2019 total payroll for the last 12 months, takes the average and times that by 2.5% and that is what is going to equal the amount that a small business owner can qualify for. And this loan is designed to allow small business owners with employees to get back up on their feet and prevent small business owners from laying off their employees. And it’s a very strict guideline that even until today there’s new rules and regulations added to it.

We have a team of six to 10 people working round the clock to find the actual laws that are governing this act that has been passed and what are the new developments. But generally, anyone who has a business and as a small business owner and has employees, employees that are on payroll can qualify for this Paycheck Protection Program loan, which is a forgivable loan that you can qualify up to $10 million. And most of it, if not all of it, can become forgivable.

Meaning you don’t have to pay it back as long as it is used for eight weeks preceding the time the loan is funded for payroll costs and keeping your employees and not having to lay them off. There is very strict rules with that in that 75% of this loan amount has to be used for payroll and the balance of 25% has to be used towards expenses such as rent, mortgage interest for your business, if you own the location where your business is being conducted or utilities expense and the list goes on.

Small Business Trends: A lot of small businesses, they have 1099 contract folks that do a lot of their work and these folks might work for a significant amount of time for them, but they’re not full-time employees. So if you’re in that situation, are you not able to apply for this?

Nellie Akalp: This is a great question. So independent contractors that are working with a business are eligible to apply for their own Paycheck Protection Program as of April 10th, 2020. So the program is going to be available to independent contractors and the application process for independent contractors to qualify for the Paycheck Protection Program will open up April 10.

Prior to that, and in answer to your question as to what about small business owners that have independent contractors that they’re working with and they’re paying? Well that is something that according to the SBA, if a small business owner has been approved for this PPP loan, a portion of the loan proceeds can be used to pay their independent contractors, but it has to fall under the guidelines of that 25% versus the 75%. They’re very strict because this is potentially a forgivable loan.

So they want to be very clear and have very strict guidelines as to what will qualify for it being forgivable. For those that think or have the notion of thinking that, oh, I’ll get this loan and immediately it’s forgiven as long as I follow steps one, two, three, that’s not the case. Your lender that will fund you this loan will immediately be invoicing you with the loan terms and the payment amounts.

When it’s time to pay it back, which is 18 months after funding, they’re going to give you a six month grace period and then you have to start paying the loan back, the portion of it that’s not forgivable. But for everybody, you as the business owner, the onus falls on you to apply for the loan amount becoming forgivable to you.

Small Business Trends: Talk about the process. How long does it take? Do you get some kind of an immediate answer? And I guess the most important question is when does the cash come into my hand?

Nellie Akalp: Yes. So that’s what we’re all waiting for. And this is something that I do not know the answer to, I don’t know the exact answer to, but what I can tell you is when I don’t know the answer to something, I will not and do not rely on hearsay and I don’t rely on opinions. I go and look for the information. And right now the most accurate information that you can get is on the United States Treasury website as it relates to this Paycheck Protection Program loan.

So from what I understand is that the SBA has contracted with many different banks as SBA third-party approved lenders and most of the smaller banks are hiring processors and strictly focusing on processing these types of loans. And what they’re telling us is ever since April 3. Which this application process opened up to small business owners. They’re taking applications online and it’ll take about three to six days for the application to be reviewed to see if they need any additional information.

And then it’s going to be assigned to an underwriter. And after that, the underwriter will directly work with the small business owner and it can take anywhere from the start of the process till the end, anywhere from two to four weeks till funding. Now there is a lot of media around this right now as we speak.

I mean even while I’m on this radio show, my phone is going off the hook. Oh my God, the funds are ran out, the funds have been run out. It is very true that Wells Fargo, from our understanding and from the news media, in that they bowed out of this program. However, as of this morning we understand that they want to participate. However, they’re waiting for certain guidelines. So I’m not sure about the information that’s out there.

I do know, having been a Bank of America client and having all my business banking through B of A, B of A is offering this service to their clients but they’re making it very rigorous, very hard for business clients to use B of A to go through the application process, to submit an application for the Paycheck Protection Program.

So right now, we’re at the mercy of the smaller banks and where our company, CorpNet, can assist the small business owner is that we have partnered with Liberty SBF bank and we’ve partnered with them to provide the small business owner with a Paycheck Protection Program loan submission assistance whereby we take the information from our client.

There is no upfront fees. We cannot charge our clients. No one can charge their client for assisting them with the Paycheck Protection Program application. It’s against the law. We as a third-party consultant, SBA loan packager, get our fees paid by the SBA at loan funding. It doesn’t come from the client and that’s if we get paid.

Small Business Trends: Do you have to go to a bank you already have a relationship with?

Nellie Akalp: If a small business owner has an existing relationship with their bank. We not only urge them but we want them, we encourage them, to go to their existing bank. Because they are going to get the fastest response from their current bank. However, the problem that many small business owners are facing to this morning is the fact that their existing bank doesn’t want to deal with them.

Or that their relationship with their bank is so new. Or the fact that their bank has rigorous requirements as to what they’re going to require from that applicant in order for the bank to process their application. But simply stated, and in answer to your question, absolutely, you are absolutely right. If a small business owner has a banking relationship already, they should go to their bank. If the bank offers them assistance in obtaining this Paycheck Protection Program loan.

Small Business Trends: What do they need to do to make sure their loan is forgiven if they are able to get it forgiven?

Nellie Akalp: So again, the Paycheck Protection Program SBA Disaster loan is a 7(a) SBA loan. And it’s a form of a loan where under the CARES Act, a small business owner can qualify for up to $10 million. Based on their average monthly payroll for last year times 2.5. And that would be the loan amount that they would qualify for.

Now when I talk about payroll, there’s a lot of things that can qualify as payroll costs. And you know I’ve written about this. It’s on the Small Business Trends website in the blog section under my blogs. And under the articles that I’ve written. But there’s many different bullets as to what would qualify. Payroll costs, healthcare insurance premiums paid on behalf of the company for the employees, vacation time, sick leave.

There’s a lot of things that go under there. But for the formula, it’s basically your average gross payroll costs. Times 2.5 equals the amount that you would qualify for. And once you get funded, you must use that amount within eight weeks. To pay for payroll and if you’ve laid off employees, bring them back.

And if you use 75% of the loan amount funded for those purposes of payroll costs. And 25% for other normal ordinary business expenses as your rent. Your mortgage interest, your utilities expense, expenses that you would normally incur in running a business under normal circumstances. Then the entire loan will be forgivable to that business owner. Meaning that business owner does not have to pay that loan back.

This article, “Nellie Akalp of CorpNet: How to Submit Your Application for the Paycheck Protection Program” was first published on Small Business Trends

https://smallbiztrends.com/

The post Nellie Akalp of CorpNet: How to Submit Your Application for the Paycheck Protection Program appeared first on Unix Commerce.

from WordPress https://ift.tt/2JWeGOf

via IFTTT

0 notes