#trusted trader program

Explore tagged Tumblr posts

Text

Authorized Economic Operator (AEO)

Learn everything about Authorized Economic Operator (AEO) programs. This includes their meaning, history, and types. Also, understand the certification process, benefits, and challenges. Discover their global impact and the future of AEO in international trade. Authorized Economic Operator (AEO) In today’s interconnected global economy, international trade relies heavily on the smooth and…

#AEO application process#AEO benefits#AEO certification#AEO certification guide#AEO challenges#AEO customs clearance#AEO EU#AEO global impact#AEO India#AEO meaning#AEO mutual recognition#AEO program WCO#AEO security standards#AEO types#AEO USA#AEO-C#AEO-F#AEO-S#Authorized Economic Operator#customs trade facilitation#global AEO programs#international trade compliance#supply chain security#trusted trader program#WCO SAFE Framework

0 notes

Text

How to Make Money on Coinbase: A Simple Guide

Coinbase is a leading platform for buying, selling, and managing cryptocurrencies like Bitcoin and Ethereum. With millions of users worldwide, it’s a trusted choice for both beginners and experienced traders. Here’s how you can make money using Coinbase.

Why Use Coinbase?

Coinbase offers:

User-friendly interface: Ideal for newcomers.

Top-notch security: Advanced encryption and offline storage keep your assets safe.

Diverse earning methods: From trading to staking, there are plenty of ways to earn.

Ready to get started? Sign up on Coinbase now and explore all the earning opportunities.

Setting Up Your Coinbase Account

Sign up on Coinbase’s website and provide your details.

Verify your email by clicking the link sent to you.

Complete identity verification by uploading a valid ID.

Navigate the dashboard to track your portfolio, view live prices, and access the "Earn" section.

Ways to Make Money on Coinbase

1. Buying and Selling Cryptocurrencies

Start by buying popular cryptocurrencies like Bitcoin and Ethereum at a lower price and selling them when the price goes up. It’s the basic strategy for making profits through trading.

2. Staking for Passive Income

Staking allows you to earn rewards by holding certain cryptocurrencies. Coins like Ethereum and Algorand offer staking options on Coinbase. It’s a straightforward way to earn passive income.

Maximize your earnings—get started with Coinbase today and start staking your crypto.

3. Earning Interest

Coinbase lets you earn interest on some of your crypto holdings. Just hold these assets in your account, and watch your crypto grow over time.

Advanced Trading with Coinbase Pro

For those with more trading experience, Coinbase Pro provides lower fees and advanced trading tools. Learn how to trade efficiently using features like market charts, limit orders, and stop losses to enhance your profits.

Coinbase Earn: Learn and Earn

With Coinbase Earn, you can earn free cryptocurrency by learning about different projects. Watch educational videos and complete quizzes to receive crypto rewards—an easy way to diversify your holdings with no risk.

Coinbase Affiliate Program

Promote Coinbase using their affiliate program. Share your unique referral link (like this one: Earn commissions with Coinbase), and earn a commission when new users sign up and make their first trade. It’s a fantastic opportunity for bloggers, influencers, or anyone with an audience interested in crypto.

Want to boost your income? Join the Coinbase Affiliate Program now and start earning commissions.

Coinbase Referral Program

You can also invite friends to join Coinbase and both of you can earn bonuses when they complete a qualifying purchase. It’s a win-win situation that requires minimal effort.

Conclusion

Coinbase is an excellent platform for making money in the cryptocurrency world, offering various ways to earn through trading, staking, and affiliate marketing. Explore all its features to maximize your earnings.

Ready to dive in? Sign up today and start earning with Coinbase.

#coinbase#bitcoin#binance#ethereum#bitcoin news#crypto#crypto updates#blockchain#crypto news#make money on coinbase

557 notes

·

View notes

Note

heeeelllooo

saw u were taking yan!fallout requests so..

lucy maclean meeting r first time headcanons?

Lucy Maclean x Reader

╰・゚✧☽ you have no idea how much I am in love her. She is so pretty, so badass and sweet. Let me marry her please?

╰・゚✧☽ warnings: slight spoilers for the show, fluff, survival and wasteland content, short and fluffy.

Meeting lucy for the first time, you’d probably have to be a hero or nice person of some sort for her to trust you a bit at first.

For this lets say you are a trader. But not just any trader….The trader.

You have a small area and have barricaded and set up terminals all over, even a few robots you built (programmed) to defend if anything were to happen.

You had a house inside the walls, along with ones for guests when they come around. It’s a market for other wondering traders do set up shop. It’s a place you pride yourself in for safety of others.

But not only do you sell, you go out and find. You’ll hunt for days for things to bring back, which is why you get so rich.

Anyway moving on, this is how Lucy come across you.

You’ll be searching some old buildings for supplies and happen to come across a vault dweller in need of some help from mole rats. And lucky for her you helped.

After all is send and done you are hesitant to let her roam.

“Look lady, you seem like a fresh fish out of water. And you sure as hell don’t belong here, I suggest you find another place to raid.”

She smiles nervously and tells you she has no interest in hurting you or stealing anything from you…She just wants directions and information.

She’s been tricked, hunting and tortured but you ask her to leave peacefully. She could tell you weren’t a true monster.

“My name’s lucy,” she reaches out her hand slowly

When you take her back to your small settlement she is overjoyed by the kindness you show her. No one around is trying to kill her, and the food and water isn’t as good as her vault but she’s glad she can be safe.

If you offer anything to help her on her journey…She becomes smitten so hard. Yes, she was already interested in you when you saved her and brought her back.

But being a badass and kind human was rare. And boy did she find it hot on you.

#Lucy MacLean#Lucy MacLean x reader#Lucy MacLean fic#Lucy MacLean Headcanons#fallout x reader#fallout show x reader#fallout lucy x reader

516 notes

·

View notes

Text

Optional Mods and Custom Portrait Guide

Essential Mods (I feel) are here

These are mods that add to the game but aren't essential for your playthrough. Feel free to pick and choose as you wish but this is just what I use.

Homeworlds of the Expanse

Expands to the list of homeworlds and gives perk to each choice depending on the manuals.

Better Type Sorting

Sorts by not only the spec but also the type of article it is. Really helps keep the inventory more organized.

ReDress

Allows you to change your characters appearance by adding and removing pieces of articles. Adds more hairs to the menu and also allows you to edit your character wherever.

Enhanced Graphics (DLSS Upscaling)

Upscales graphics. I don't feel the base graphics are that bad so that's why it's down here. Also only works with Nvidia cards.

Bi Heinrix Pronouns Fix

This is just a personal choice so down here. But fixes the pronouns for Heinrix's romance if you romance him as a male. DOES NOT ADD A BI ROMANCE FOR HEINRIX, YOU NEED TOY BOX FOR THAT.

Commorragh Cure

Enough said, if you haven't played to there yet trust me it'll really irritate you if you don't have this.

Allow Modded Achievements

This can be fixes with Toy Box if you remember to select the option but if you're particularly anxious and just want to make sure. Here is a mod for it.

Installing Custom Portraits

I'm not linking to any custom portraits, i feel like you can find those yourself due to your own taste but here's a guide on how to install.

Make sure you have run the game at least one and then go into your Appdata folder, this is usually in your main hard drive if you have multiple.

C:\Users\(your computer name here)\AppData\LocalLow\Owlcat Games\Warhammer 40000 Rogue Trader

If you cannot see your Appdata folder make sure you have hidden items set to visible. Look at the top of the file explorer box and click view then check off hidden items.

Create a folder called Portraits in the Rogue Trader Folder and then drag the custom folder into the Portraits Folder. Each custom portrait is in a singular folder - if you use a mod do not have it in the main folder, drag the singular folders into the main - with three png files inside.

You can also make your own custom portait in game. You need a folder with the picture cropped at varying sizes. "Fulllength" at 692x1024 pixels, "Medium" at 330x432, and "Small" at 180x242. These are for the varying usages of the portait and name each resolution as such

Here is a website to help crop if you don't wish to do manually.

And a program as well.

9 notes

·

View notes

Text

BigProfitPulse.io Reviews Explore the Best Trading Conditions

The online trading world is dynamic and ever-evolving making it crucial to choose a reliable and efficient platform that provides traders with the best opportunities. BigProfitPulse.io reviews showcase why this platform stands out as a leader in the financial industry offering a combination of innovative tools competitive trading conditions and high-speed execution. With a diverse range of financial instruments and a user-friendly interface traders can seamlessly engage in trading without unnecessary hurdles. The ability to access real-time market prices and leverage personalized support ensures that every trader from beginners to professionals can optimize their strategies and achieve financial success.

BigProfitPulse.io Reviews Why Traders Choose Us

Traders are always in search of a platform that not only meets their expectations but also exceeds them. BigProfitPulse.io reviews highlight how this platform consistently delivers top-tier trading services ensuring that every trader has access to the best possible conditions. A major reason why traders trust BigProfitPulse.io is the platform’s commitment to transparency and efficiency. With instant order execution and competitive spreads traders can capitalize on opportunities without worrying about delays or hidden fees. Additionally the platform’s training programs provide users with invaluable insights helping them refine their skills and develop well-informed trading strategies. Whether you are just getting started or already an experienced trader BigProfitPulse.io has the tools and resources to support your journey.

BigProfitPulse.io A Cutting-Edge Trading Platform

One of the most discussed features in BigProfitPulse.io reviews is its cutting-edge trading platform which is designed to cater to traders of all levels. The web-based terminal allows users to analyze financial markets track real-time price movements and execute trades effortlessly from their browsers. There is no need for additional software installations or complicated setup procedures making it easier than ever to engage in global trading. Whether you are trading stocks foreign currencies or precious metals BigProfitPulse.io provides an advanced yet accessible trading environment. The platform is equipped with the latest tools for technical analysis ensuring that traders can make data-driven decisions with confidence.

BigProfitPulse.io Reviews Comprehensive Client Support

A key highlight in BigProfitPulse.io reviews is the comprehensive customer support that ensures traders receive assistance whenever they need it. The platform prides itself on offering professional support services with a team of knowledgeable experts available to answer questions resolve technical issues and provide valuable insights. Whether traders require help navigating the trading terminal understanding market trends or optimizing their trading strategies BigProfitPulse.io’s support team is always ready to assist. This level of commitment to customer service sets the platform apart making it a preferred choice for traders looking for reliability and security.

BigProfitPulse.io Real-Time Liquidity and Instant Execution

Market conditions can change in an instant and traders need a platform that provides real-time liquidity and swift order execution. BigProfitPulse.io reviews emphasize how the platform ensures that trades are processed without delays allowing traders to take advantage of market fluctuations as they happen. The integration of interbank liquidity ensures that users get the best available prices maximizing their profitability. By eliminating execution lags and providing seamless order processing BigProfitPulse.io enhances the overall trading experience giving users a competitive edge in the financial markets.

BigProfitPulse.io Reviews Personalized Training for Traders

Education and continuous learning play a significant role in a trader’s success and BigProfitPulse.io reviews highlight how the platform offers personalized training programs to support users at every stage of their trading journey. Traders are matched with experienced tutors who provide insights into market movements risk management and profitable trading strategies. This hands-on approach helps traders develop confidence and refine their skills ensuring they can navigate financial markets with greater precision. The platform’s commitment to education makes it an ideal choice for both newcomers and seasoned professionals looking to expand their knowledge.

BigProfitPulse.io Reviews Secure and Fast Withdrawals

Security and convenience are top priorities for traders and BigProfitPulse.io reviews confirm that the platform provides a safe and efficient withdrawal process. Users can request fund withdrawals at any time knowing that transactions will be processed swiftly without unnecessary delays. The platform employs advanced security measures to protect user funds and personal data giving traders peace of mind while they focus on their trading activities. Whether traders are actively trading or cashing out their profits they can trust BigProfitPulse.io to handle their transactions smoothly and securely.

BigProfitPulse.io Getting Started is Easy

A major advantage noted in BigProfitPulse.io reviews is the simplicity of getting started on the platform. Registration is quick and straightforward allowing traders to create an account and begin trading within minutes. The low minimum deposit requirement makes it accessible to traders of all backgrounds whether they are testing the waters or fully committing to the trading lifestyle. The platform also provides personalized guidance during the onboarding process ensuring that new traders have all the necessary tools and knowledge to begin their journey with confidence.

BigProfitPulse.io The Advantages of Trading Here

Traders continue to choose BigProfitPulse.io for the numerous advantages it offers. BigProfitPulse.io reviews frequently mention the following key benefits

Competitive spreads and low trading commissions ensuring maximum profitability

Swift and hassle-free processing of withdrawal requests allowing traders to access their funds at any time

Timely updates on significant market events helping traders stay informed and make strategic decisions

Access to global financial markets enabling users to diversify their portfolios and explore multiple investment opportunities

Professional customer support dedicated to resolving issues and providing expert assistance

BigProfitPulse.io Reviews Your Path to Financial Success

Finding the right trading platform is essential for achieving success in the financial markets. BigProfitPulse.io reviews highlight how this platform combines advanced technology expert guidance and superior trading conditions to create an unparalleled trading experience. Whether you are an aspiring trader or a seasoned professional looking for a reliable partner BigProfitPulse.io provides all the tools and resources necessary for success. By choosing BigProfitPulse.io traders gain access to a secure transparent and innovative trading environment that empowers them to reach their financial goals.

6 notes

·

View notes

Text

Character Traits: Daephrin Astramente

— B A S I C S

Name: Daephrin Rosamar Astramente Nicknames: Dae, Lark, Samar, 'hey asshole!' Age: Somewhere around 32 Nameday: 15th sun of the 3rd Umbral Moon Race: Ishgardian Elezen Gender: Cisgender male Orientation: Bisexual and yes, please Profession: Sky pirate, treasure hunter, leather-worker, professional scoundrel

— P H Y S I C A L A S P E C T S

Hair: Warm black and windswept; straighter when it's very short or very long, wavy when it's a little shaggy. Eyes: Vivid emerald. Skin: Sun-tanned and lightly freckled. Tattoos/scars: No tattoos, a fading burn scar on his upper shoulders.

— F A M I L Y

Parents: Lucarian Astramente and Ilystra Rochenoire. Lucarian was a Temple Knight and Ilystra a noblewoman. When Lucarian married her, the official name of the noble house changed to his surname instead of hers. House Rochenoire was known for producing profound intellects and the Astramente line a knack for navigation. Ilystra died of pneumonia and several months later, Lucarian dropped dead of a heart attack. They say that couples in love rarely survive one another. Siblings: His older brother, Sarin, was a lancer and died in the Dragonsong War. His younger brother, Onaerion, is currently the head of House Astramente. Grandparents: Daephrin never knew them, but the Rochenoires were stiff, devout Ishgardians who had fallen on hard times and were very pleased to marry their daughter off to a relatively wealthy Temple Knight. The Astramente family was proud to count a Knight among their sons; they were mostly traders and trackers, barely a step above scoundrels but for their wealth. Wealth hides a multitude of sins. In-laws and Other: Though he is formally dating one man and unofficially entangled with another, Dae doesn't have any in-laws at this point. He has an Astramente uncle he's never met, but his mother was an only child. Pets: While he would like to have live pets one day, he fears he can't care for them at this time with his lifestyle. Instead, he has Sniffer, Spotter, and Sparrow - mammets made for him by his lover, Jaxon. Sniffer is a delightful little cat-dog mammet that sniffs out treasure. Spotter is a spider-like trap finder. And Sparrow is a bird-shaped recording device.

— S K I L L S

Abilities: Daephrin is quite a decent leather-worker, though he makes no fuss over it. More of a fuss is made over the fact that he's a crack shot with any ranged weapon of any kind (a manifestation of the Echo), including thrown knives. Just don't hand him a lance; he'll put someone's eye out. He knows Allagan programming language and technological construction. He can play piano pretty well. Hobbies: Aforementioned leather-work and Allagan treasure hunting. Airship maintenance for fun and profit.

— T R A I T S

Most Positive Trait: Dae is charming nearly to a fault. He can convince snakes to dance on their tails and Monetarists to part with their gil. He's got the perfect mix of a kind air, a clever mouth, and a fast mind; it makes him easy to trust, even when you probably shouldn't. Most Negative Trait: He is horribly, terribly self-centered. He struggles to put himself in other people's shoes or to think outside himself. He's working on it, but he's still pretty selfish.

— L I K E S

Colours: Black, gold, green. Smells: Well-oiled leather, bay rum, sun-warmed wood, his lovers' colognes (Jaxon and M'rath smell different, but equally amazing), fresh citrus. Textures: Silk, leather, black cat's fur, lacquered wood. Drinks: Whiskey, tea, hot chocolate, coffee, the occasional orange juice.

— O T H E R D E T A I L S

Smokes: Not anymore. Drinks: Sometimes. Drugs: Once in a great while, though he did more when he was younger. Mount Insurance: Uh... No? His usual mount is a motorbike, as he has not the facilities to care for an animal. (In practice, he rides a kamuy because I love them, but he wouldn't know what a kamuy is.) Been Arrested: He has so far escaped the law, but his luck may one day run out.

14 notes

·

View notes

Text

The CFA Charter in the Age of Algorithms: Can Certification Outlast Clout?

Evidently, in the last few years, there has been a visible change in the entire financial landscape. The former traditional heroes of the investment banking industry, CFA charterholders, and certified analysts are now being challenged by a new group- the “finfluencers,” who have emerged rather more as a digital class than as an institution or a regulatory body. These are the social media-savvy financial influencers reshaping how young investors and aspiring finance professionals consume their financial educations via platforms like YouTube, Instagram, and TikTok. The big question is can rigorous, structured qualifications like the CFA Charter withstand this wave of simplified, fast-paced content?

Finfluencers: Fast Fame, Greater Reach

Finfluencers are financial influencers, not necessarily with credentials and degrees. Most of them self-taught traders, people interested in personal finances, or early investors who share some tips, tricks, and general opinions on the market with others online. They cover things from stock market explainers to cryptocurrency predictions, budgeting hacks, and passive income strategies.

The allure is straightforward. Finfluencers cover complex finance concepts in widely understandable, digestible parcels that speak to the digitally born Gen Z and millennials. They do not use academic language but tap into everyday analogies and personal accounts to bring understanding. In this case, when such a message goes viral with high speed through social media algorithms, it provides them with unparalleled reach.

Is There A Trust-Gap?

Finfluencers, like with most other professions, could reach a wide audience lacking all the credentials and depth. In fact, misinformation among financial content creators is a major concern. In March 2024, swings of the Securities and Exchange Board of India (SEBI) against unregistered investment advisers who misled their followers with false or exaggerated claims surged. A few finfluencers were fined or banned from offering investment advice without proper registration.

That is a glaring example of the growing trust deficit. The determinants include severe fines that barely catch the eye of talents on the online stock market. Finfluencers whose motivations tilt virality over responsibly, thus leaving virulent investment strategies or incomplete financial insights for public consumption; thus, unlike CFA Institute, which stands for a strong Code of Ethics and Standards of Professional Conduct, these influencers remain unaccountable.

CFA: The Gold Standard of Finance

The CFA Charter, therefore, stands tall in this very setting as a mark of trustworthiness, depth, and professionalism. The three levels of the CFA examination process test candidates on a wide range of subjects including equities, derivatives, ethics, portfolio management, and alternative investments. The process is not geared toward anything viral; it is designed to develop expertise over the long term.

CFA charterholders are not simply financial analysts; they are also often the decision-makers in asset management firms, hedge funds, and investment banking. Their pronouncements are data-supported, model-supported, and framework-supported.

How The CFA Charter is Adapting

Surprisingly, the CFA Institute is not ignorant to digital evolution. They have just launched new micro-credential programs an updated curriculum concentrating on the real world and fintech as a result of the increasing interest among young candidates. The latest modules include blockchain, decentralized finance (DeFi), and ESG (Environmental, Social, and Governance) investing.

This is to say that values are updated to adapt and remain relevant without compromise to traditional ethics and analytical rigor. These movements are important to remain vibrant in a world loaded with information but as rare as real insight.

Location and Global Awareness

The overall growth of the financial influencer will find its acme in the rapidly developing financial markets. In India, where the digital tentacles are outspreading so fast, platforms such as YouTube and Instagram are becoming the most important conduits for financial literacy. Cities like Mumbai, India's financial capital, are experiencing a dual surge: a rise in fintech content creators alongside a rise in CFA aspirants.

The appetite for structured learning continues unabated. Increases in enrollments for courses like CFA course mumbai have been noted as finance students scramble for credibility in an age of omnipresent but often misleading online content.

Are Influencers and Analysts Able to Work Together?

Finfluencers and CFA professionals have the ability and potential to work together. Some charterholders have started to build their personal brands via LinkedIn and YouTube, a blend of credibility yet relatability. They use digital tools to help facilitate an understanding of finance while maintaining professionalism. This voice is desperately needed!

With enough regulations, cooperation, and transparency in disclosures, these finfluencers can move towards becoming aware educators. Charterholders with a CFA can escape the insular space of the boardrooms and reach the general population. Merging entertainment and expertise is the golden intersection.

Effect of Regulation and AI

The roles of both finfluencers and analysts are poised for change as AI tools like ChatGPT, portfolio optimization bots, and sentiment analysis engines become entrenched. While content creation is becoming easier, verifying the quality has become harder. Across the world, regulatory scrutiny is increasing on financial content posted on social media, which has led platforms to introduce disclaimers and to flag or, in some cases, discontinue specific hashtags regarding investment tips.

This new way signals more demand for verified professional advice. Everybody will keep searching on social media for financial education, but for those decisions that truly matter, CFA qualifications do provide some level of protection.

Conclusion: Coexistence Through Evolution

The arrival of finfluencers has brought a certain democratization to finance. Labels such as investing, saving, and creating wealth are on more lips than ever. However, with that democratization comes responsibility: with volatile markets and complex products, something like the CFA Charter provides a safety net-an anchor in the sea of fast-moving and oftentimes, untested advice.

What is ironically true for cities like Mumbai, where the wave of financial content promotes the 'fast', holds just as much for the 'slow'. The well-trodden paths remain a strong second option. CFA Training Program in Mumbai continues to attract serious-minded candidates who value substantive knowledge, ethical standards, and career credibility.

A balance between virality and tangible value will, in the long run, favor whoever can harness both sets of skills. Whoever merges insight and clout will thrive in the next ten years—finfluencers, CFA candidates, or whichever other designation may come by. That's a journey already worthy of pursuit!

2 notes

·

View notes

Text

Best Share Market Courses in Pune to Kickstart Your Trading Journey

If you're looking to build a solid foundation in stock trading and investments, enrolling in Share Market Courses in Pune can be a game-changer. Pune has emerged as a hub for financial education with an increasing number of professionals, students, and homemakers taking interest in the stock market. Whether you are a complete beginner or someone with basic knowledge looking to sharpen your skills, Pune offers a wide range of share market training programs to meet your needs.

Why Take Share Market Courses in Pune?

The share market may appear overwhelming to many, with its fluctuating trends and complex charts. However, the right guidance and structured learning can help anyone become a confident trader or investor. Share Market Courses in Pune are designed to offer practical knowledge and real-world exposure. From learning how to read candlestick charts to understanding market psychology, these courses simplify technical and fundamental analysis in an easy-to-understand manner.

These programs often include:

Basics of stock market & trading terminology

Introduction to NSE, BSE, Sensex, and Nifty

Technical analysis using indicators and chart patterns

Fundamental analysis for long-term investment

Live trading sessions and mock practices

Risk management and portfolio building strategies

The city is home to several reputed institutes and trainers who bring years of industry experience, which is crucial when learning something as dynamic as trading.

Who Should Consider These Courses?

Share Market Courses in Pune are suitable for a wide audience, including:

College students aiming to build an early financial understanding

Working professionals looking for alternative income sources

Entrepreneurs and business owners seeking investment knowledge

Retired individuals planning for wealth preservation

Homemakers interested in passive income opportunities

These courses usually don’t require any prior experience in finance, making them accessible to everyone with the willingness to learn.

What Makes Pune a Great Place for Learning?

Pune, being an educational and IT hub, has a vibrant ecosystem of learners and professionals. The city offers a mix of online and offline courses, weekend batches for working individuals, and short-term certifications. Many institutes also offer internships or mentorship support to help students transition from learning to actual trading.

Moreover, the affordability and quality of education make Share Market Courses in Pune an attractive option compared to other metro cities. Learners also benefit from regular seminars, webinars, and stock market meetups conducted locally.

Key Benefits of Enrolling in Share Market Courses

While YouTube videos and blogs offer fragmented learning, structured courses provide:

Systematic and step-by-step training

One-on-one mentorship and doubt-clearing sessions

Real-time market case studies and simulations

Certifications that can enhance your professional profile

Community access for ongoing support and networking

These benefits ensure you're not just gaining theoretical knowledge but also learning how to apply it in real market conditions.

Conclusion

When it comes to top-rated institutions offering Share Market Courses in Pune, eMS Stock Market Institute stands out as a go-to choice for aspiring traders and investors. With experienced mentors, hands-on training, and a strong focus on practical learning, eMS has helped hundreds of individuals confidently step into the world of stock markets.

Whether you want to become a full-time trader or simply wish to manage your own investments better, enrolling in one of the trusted Share Market Courses in Pune is a smart first step. Start your journey today and take control of your financial future.

#stock market classes in pune#stock market institute in pune#stock market classes#stock market classes near me

2 notes

·

View notes

Text

How to Evaluate Liquidity Pools Like a Pro: A Deep Dive into STON.fi

Decentralized finance (DeFi) is redefining the way traders and investors interact with digital assets, and at the core of this evolution is liquidity provision. If you’ve ever swapped tokens on a decentralized exchange (DEX), you’ve relied on liquidity pools—whether you realized it or not.

But here’s the real challenge: not all liquidity pools are created equal. Some are goldmines for passive income, while others expose you to impermanent loss, low returns, and poor liquidity.

So how do you separate the profitable from the risky? Let’s break it down.

Understanding the Metrics That Matter

When evaluating a liquidity pool, three critical factors determine its viability and profitability:

✔ Total Value Locked (TVL) – The amount of capital inside the pool

✔ Annual Percentage Rate (APR) – Your potential yearly earnings

✔ Trading Volume – How frequently assets are swapped within the pool

Getting these right can help you maximize earnings while minimizing risk.

1. TVL: The Foundation of a Strong Liquidity Pool

Total Value Locked (TVL) represents the total amount of assets deposited into a liquidity pool. This number is an indicator of the pool’s strength and stability.

A higher TVL typically means:

Greater liquidity for traders

Lower risk of slippage and price manipulation

More trust in the pool’s long-term sustainability

A lower TVL, on the other hand, can mean:

Higher volatility in token prices

Greater exposure to impermanent loss

Potentially higher rewards (but with more risk)

Before entering a liquidity pool, assess the TVL in relation to its trading activity. A pool with decent TVL but low trading volume might not generate consistent earnings.

2. APR: What You Stand to Earn

Annual Percentage Rate (APR) is the metric everyone watches—it tells you how much yield you can expect from a liquidity pool over a year.

However, APR fluctuates based on:

✔ The number of transactions generating fees

✔ The number of liquidity providers splitting rewards

✔ External incentives like reward programs

While a high APR may seem attractive, it’s essential to check its consistency over time. Short-term spikes can be misleading, while stable APR pools often provide better long-term earnings.

Best approach? Track pools over a few weeks before making a move.

3. Trading Volume: The Key to Sustainable Rewards

A pool can have high TVL, but without active trading, liquidity providers won’t earn much.

Consistent trading volume means:

✔ Regular transaction fees flowing into the pool

✔ Lower risk of impermanent loss due to frequent price corrections

✔ A steady income for liquidity providers

Low-volume pools, on the other hand, might offer high APRs initially, but if trading activity dries up, so do your returns.

The key takeaway? Always check the trading volume trends of a pool before committing funds.

How to Pick the Right Liquidity Pool on STON.fi

Finding the best liquidity pool isn’t about chasing the highest APR—it’s about finding the right balance. Here’s a simple process to help you evaluate pools on STON.fi:

✔ Step 1: Look at the TVL—high enough for stability, low enough for potential rewards

✔ Step 2: Analyze APR fluctuations—avoid pools with extreme volatility in rewards

✔ Step 3: Check trading volume—steady volume means consistent earnings

✔ Step 4: Diversify—don’t put all funds into one pool; balance risk and reward

Following this approach ensures you build a portfolio of liquidity positions that generate sustainable income.

Why STON.fi is a Game-Changer for Liquidity Providers

STON.fi is built for speed, low fees, and optimized earnings. As a DEX on The Open Network (TON) blockchain, it provides a seamless experience for liquidity providers, offering:

✔ High-speed transactions with ultra-low fees

✔ A transparent and efficient system for tracking TVL, APR, and trading volume

✔ Access to unique earning opportunities through the STON.fi ecosystem

Unlike some DEX platforms with unpredictable reward structures, STON.fi ensures that liquidity providers get fair compensation for their capital.

Final Thoughts: Smart Liquidity Provision for Long-Term Growth

DeFi opens massive opportunities for earning, but success depends on how well you evaluate liquidity pools. Instead of blindly jumping into high-APR pools, focus on TVL, trading volume, and sustainable earnings.

STON.fi provides one of the best environments for liquidity providers looking to earn with lower risk and higher efficiency. If you’re serious about making DeFi work for you, choose pools strategically, monitor their metrics, and diversify wisely.

Want to get started? Check out STON.fi’s liquidity pools today and start earning.

4 notes

·

View notes

Text

1381 to 1392

Library of Circlaria

Remikra Timeline

1381-1386

The passage of the Fair Standard Housing Act (FSHA) in March 1381 authorized the nationwide construction of estate super-cantons, which raised standards of living for many Commonwealth citizens. Later that year, the Commonwealth Council passed a budget for the construction of the National Institute of Research and Development (NIRD), which would open in September 1383. In 1382, the passage and signing of the Chemkan Environmental Restoration Act (CERA) led to the release of long-classified documents detailing the events of 1264, and budgeted the environmental reconstruction of the natural Chemkan landscape in 1384. And on 7 March 1383, fulfilling a cornerstone promise to the Commonwealth, Prime Minister Wen signed the Exceptional Case Trade Act (ECTA), which placed constraints upon the Deep-Trade Administration and protections for citizens. In 1385, budget reconciliation authorized for NIRD campuses to be constructed in every county of the Commonwealth, including its territories.

While the Stage I construction phase of FSHA began in 1386, Prime Minister Wen ran against her challenger, Chek Malley, of the Trader Party. With Malley's policy centered solely around deep-trade program expansion, Prime Minister Wen secured an election victory that year.

1387-1392

In the past, the Leon and Kontacet families existed as rivals within the ranks of the Combrian elite. And in the years leading up to this period, they were constantly volleying for control over the dymensional planecrafting industry, which had been expanding since 1369. In March 1387, however, the Leons and Kontacets conducted diplomacy and merged business interests to establish a new organization: The Leon-Kontacet Trust (LKT). Championed by Rit Leon, the LKT gained popularity among Combrian workers as it promised a raise in pay and direct representation in its newly-established Headquarters in Jestopole. And by the end of 1387, acquisition proposals for the LKT won majority votes in nearly all dymensional planecrafter businesses across Combria, winning Rit Leon popular favorability and a call for him to run for political office. On election day of 1387, Leon more than attained the signature endorsement threshold for him to officially become a member of the Trader Party. Soon after, he announced his run for Governor of Combria.

On election day the following year, Rit Leon won the Trader Party Combria Governor Primary, and, in the general election of 1389, won the Combria Governor nomination. As required by both the Combrian and Commonwealth Constitutions, Leon made plans to leave the LKT to serve his public office. In his place, he endorsed the young James Lawrence Kontacet. That October, the LKT held a special business election for this, which handed Kontacet an easy win.

As the co-Chief Executive Officer of the LKT, James Kontacet expanded upon Leon's policies to further strengthen and unite the Combrian dymensional planecrafter businesses, while making numerous calls upon the Commonwealth OPEN Forum for more funding. Unsatisfied with the response, Kontacet, in March 1390, announced a run for a seat in the OPEN Forum, which he would ultimately win with the most votes attained historically by any past OPEN Forum candidate.

An Ancondrian-based business agenda attempting to reignite the Commonwealth lightfire industry was countered, in January 1391, by Kontacet's counter-agenda, which made further gains to firmly establish the dymensional planecrafter industry, especially to help Library of Circlaria to attain more if its desired funding. This agenda gained more popular support in the wake of the surprising pro-Imperialist takeover of the Circlarian Union Council elections, as a growing number of Commonwealth citizens saw Kontacet as being a stubborn but reasonable figure. On election day of 1391, the dymensional planecrafter industry won a simple majority in the OPEN Forum.

With this new majority, the OPEN Forum, in 1392, passed a budget to boost funding for the dymensional planecrafter industry.

In light of growing popularity with the dymensional planecrafter industry and having won the Combria Governor election, Rit Leon, beginning in 1391, launched a campaign to succeed Meghan Wen as Prime Minister. His platform centered around a deep-trade program expansion like that of Chek Malley, along with a stubborn agenda to further follow through with Kontacet's agenda for the dymensional planecrafter industry. Meanwhile, Prime Minister Wen aimed to maintain the lightfire industry in terms of OPEN Forum funding, keep the status quo with the ECTA, and to maintain and strengthen the housing reforms under FSHA.

Although the dymensional planecrafter industry was gaining popularity and momentum, concerns over Leon's desire to make reductions to the housing agenda and take risks with ECTA led Prime Minister Wen to win re-election in 1392 for a fourth and final term.

<- 1369 to 1380 <- || -> 1393 to 1404 ->

3 notes

·

View notes

Text

Free Stock Market Courses by ICFM - Start Now

Begin your financial education at zero cost with ICFM's (Institute of Career in Financial Market) valuable free stock market courses. These comprehensive beginner programs are designed to make market education accessible to everyone, covering essential topics like market fundamentals, basic technical analysis, and investment principles. Through engaging video tutorials and interactive quizzes, you'll learn how to read stock charts, understand market trends, and make informed trading decisions - all completely free.

ICFM's free courses stand apart by offering genuine educational value without hidden charges. You'll receive the same quality instruction as our paid programs, just focused on foundational knowledge. The curriculum is crafted by professional traders who simplify complex concepts into easy-to-digest lessons. Practical exercises help reinforce learning, while downloadable resources serve as handy future references.

These courses serve as the perfect introduction before considering advanced training. Many students who start with our free resources later enroll in ICFM's certification programs, having gained confidence in their market understanding. The self-paced online format allows you to learn conveniently, with lifetime access to all materials.

By joining these free courses, you'll become part of ICFM's learning community with access to exclusive market insights. While these programs don't offer certification, they provide all the basic tools to begin your financial journey. Thousands of successful traders started with these free resources from India's most trusted financial education institute. Explore market concepts risk-free and discover your trading potential today.

0 notes

Text

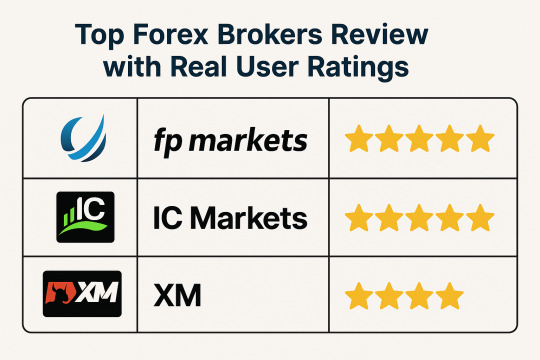

Top Forex Brokers Review with Real User Ratings

Choosing the right forex broker can be a critical step in a trader’s journey. In this Top Forex Brokers Review, we provide a clear and professional evaluation of the most trusted brokers in the market, incorporating real user ratings and insights. Whether you're a novice or an intermediate trader, this guide will help you compare the best platforms based on regulation, features, platform performance, and overall user satisfaction.

Key Qualities of a Top Forex Broker

Before diving into the Top Forex Brokers Review, it's important to understand what distinguishes a reliable broker:

Strong regulatory oversight by ASIC, FCA, or CySEC

Tight spreads with transparent fee structures

High-speed order execution

Dependable trading platforms such as MetaTrader 4, MetaTrader 5, or cTrader

Solid customer support and educational resources

Positive user reviews and community feedback

Broker Reviews Based on Features and User Experience

Eightcap

Regulated by ASIC and SCB with tight spreads

Integrates TradingView with MT4 and MT5

Offers a wide range of crypto CFDs and forex instruments

Eightcap is favored by traders who value innovation and advanced charting tools. Its crypto offering adds a competitive edge for diversified traders.

FP Markets

Licensed by ASIC and CySEC, providing strong regulatory safety

ECN-style execution with access to Iress, MT4, and MT5

Consistently high user ratings for customer service and execution speed

FP Markets is ideal for serious traders who want reliable pricing and a platform that’s proven to perform well under market pressure.

FBS

Regulated by IFSC and CySEC with flexible account types

Offers high leverage up to 1:3000 and strong promotional bonuses

Known for user-friendly support and localized services

FBS attracts beginners with its low entry requirements and variety of learning tools. Many users rate it highly for customer support responsiveness.

XM

Regulated by ASIC, IFSC, and CySEC with multi-lingual support

Low spreads from 0.0 pips and negative balance protection

Praised for educational materials and community outreach

XM remains a user favorite for its consistent performance and excellent learning ecosystem. It’s a well-rounded platform suitable for most traders.

IC Markets

Overseen by ASIC, CySEC, and FSA with true ECN trading

Raw pricing with ultra-low spreads and deep liquidity

Popular among algorithmic and professional traders

IC Markets consistently receives high user ratings for its stable infrastructure and efficient execution. A top choice for experienced traders.

FxPro

Regulated by FCA, CySEC, and FSCA with NDD execution

Offers MT4, MT5, and cTrader platforms

Rated highly for reliability and order transparency

FxPro is suitable for traders who value a mix of automation and discretion. Users commend its consistent uptime and trade execution.

Axi

Regulated by ASIC, FCA, and FMA with global recognition

Offers MT4 with integrated PsyQuation analytics

Well-rated for analytical tools and trader support

Axi provides a data-driven edge for traders who like to track performance and optimize strategies. Its educational services are also appreciated.

Pepperstone

Regulated by ASIC, FCA, and DFSA for broad international access

Offers low-latency trading with MetaTrader, cTrader, and TradingView

Frequently top-rated for speed and reliability

Pepperstone is a go-to broker for fast execution and deep liquidity. Scalpers and technical traders give it consistent five-star ratings.

HFM (HotForex)

Overseen by FCA, FSCA, and DFSA for global credibility

Offers multiple account types including Zero, PAMM, and copy trading

Rated well for its comprehensive educational content

HFM is a strong choice for both individual and social traders. New users often cite its ease of use and well-structured training programs.

Octa

Regulated by CySEC and FSA with bonus offers

Provides cashback and commission-free trading options

Known for a user-friendly mobile trading experience

Octa is best for entry-level traders who need simplicity and mobile-first functionality. User reviews highlight its intuitive platform and reward systems.

Real User Success Story: Learning Through Experience

Carlos Mendoza, a 29-year-old engineer from Peru, started trading part-time in 2022 with Pepperstone. Initially, he was drawn to the platform’s fast execution and tight spreads. Carlos spent months refining his strategy through demo accounts and later shifted to a live ECN account. With consistent support and educational tools, he scaled his capital from $500 to over $12,000 in 18 months. Carlos credits his growth to Pepperstone’s transparent pricing and the support of a strong online trading community.

How to Check If a Broker's Website is Safe?

Security is a vital concern when trading online. Here's how to assess a forex broker’s website for safety:

Regulatory Proof: Check for valid licenses from financial authorities such as ASIC, FCA, or CySEC.

SSL Encryption: Look for “https” and a padlock icon in the address bar.

Two-Factor Authentication: A secure platform will offer 2FA to protect user accounts.

Fund Segregation: Ensure client funds are kept separate from broker operational funds.

Clear Legal Documentation: Terms, privacy policies, and risk warnings should be readily available.

Click Now

Frequently Asked Questions (FAQs)

How can I tell if a broker is regulated?

Visit the official website and scroll to the footer where license numbers are usually listed. Verify them on the regulator’s site.

What’s the best platform for beginners?

Platforms like XM and FBS offer beginner-friendly tools, demo accounts, and educational resources for starting out.

Can I make money in forex with little capital?

Yes, but it requires discipline, strategy, and realistic expectations. Brokers like FBS and Octa offer micro and cent accounts.

What’s the difference between raw spreads and standard spreads?

Raw spreads come with lower pip differences but include commissions. Standard spreads are wider but often commission-free.

Are mobile trading apps reliable?

Yes, if offered by reputable brokers like Pepperstone, Octa, or IC Markets. Always download apps from official stores.

youtube

Final Words: Make an Informed Choice

This Top Forex Brokers Review provides a transparent look at the best forex brokers as rated by real users. From Pepperstone to XM and FBS, each platform has its unique advantages. The right choice depends on your trading needs, experience level, and desired features. Take time to compare offerings, use demo accounts, and ensure platform safety. With informed decision-making, you’ll be well-positioned to succeed in your forex journey. Revisit this Top Forex Brokers Review anytime you need guidance on choosing the right broker.

0 notes

Text

Learn Profitable Stock Market Trading from Experts with the Most Trusted Stock Market Course by ICFM Institute

Why Learning Through a Professional Stock Market Course is Essential for Success in Trading

The financial markets offer tremendous opportunities, but without proper knowledge and discipline, those opportunities can turn into risks. That's why aspiring traders and investors are actively seeking a trusted stock market course to help them build a strong foundation. The complexity of trading, from understanding market trends to analyzing charts and managing emotions, demands structured education. This is where ICFM – Stock Market Institute leads the way, offering India���s most reliable and practical stock market course tailored for success.

Unlike random online tutorials or scattered learning resources, a well-structured stock market course helps learners understand the mechanics of market operations, technical tools, and risk management principles. It eliminates guesswork and equips you with data-driven decision-making skills. Whether you’re a beginner, an intermediate trader, or someone preparing for a financial career, joining a professional stock market course is the smartest way to master the market.

ICFM - A Premier Institute Offering the Most Comprehensive Stock Market Course in India

When it comes to choosing the right platform, ICFM - Stock Market Institute is the top choice among learners across the country. With over a decade of experience and thousands of successful students, ICFM has built its name as the most dedicated institute for learning the stock market course in India. Their programs are crafted by market veterans and structured to match the real-world challenges traders face daily.

Every stock market course offered by ICFM blends theoretical knowledge with practical application. The faculty comprises professionals with hands-on experience in equities, derivatives, technical analysis, fundamental analysis, and trading psychology. Their teaching is not just academic—it’s shaped by their experience of winning and losing in the actual market.

What Makes ICFM’s Stock Market Course Unique and Effective for Real Trading Results

ICFM’s stock market course includes live training sessions, demo accounts, mock trading exercises, charting software use, and case studies. The modules begin with the basics—what is the stock market, how stock exchanges function, the role of SEBI and brokers—and gradually progress into technical indicators, price action, risk control strategies, portfolio design, and behavioral finance.

One of the most attractive features of ICFM’s program is its live market analysis, where students get to see real trades being made, market reactions in real time, and the decision-making process of seasoned traders. This experience is crucial and is rarely offered by any other stock market course in the country. ICFM’s learning model empowers students to implement strategies in a safe environment before moving into live capital markets.

Flexible Learning Options Make ICFM’s Stock Market Course Ideal for Everyone

Understanding the varied needs of learners, ICFM provides flexible learning formats. Their stock market course is available in both classroom and online modes, making it accessible for students, job holders, homemakers, and business owners alike. With weekday and weekend batches, learners can choose the schedule that fits their routine without compromising the quality of education.

The online stock market course is conducted live, offering two-way interaction, real-time chart sharing, screen demos, and personalized query resolution. Even the recordings are provided for revision purposes. Whether you attend from Delhi, Mumbai, or any part of India, you receive the same high-quality education as those attending the physical classroom sessions at ICFM’s centers.

Career Opportunities After Completing a Stock Market Course at ICFM

The ultimate goal of any learner is to generate consistent profits or secure a career in the financial domain. ICFM’s stock market course is designed to help students achieve both. From day trading to swing trading, from short-term investing to full-time broking or advisory roles—this course opens many doors.

ICFM also provides career support to deserving candidates, including job assistance, interview prep, resume polishing, and referrals to trading firms and financial consultancies. Many ICFM alumni are now employed as research analysts, portfolio managers, stock brokers, and proprietary traders—all thanks to the solid training they received through this powerful stock market course.

Trust, Track Record, and Student Satisfaction at ICFM - Stock Market Institute

ICFM is not just another educational brand—it’s a trusted name built over years of delivering successful outcomes. Thousands of students who have passed through ICFM’s doors now trade confidently, support their families through passive income, or lead careers in finance. What makes this possible is the institute’s consistent dedication to offering the most well-rounded, accessible, and practical stock market course in the country.

Every testimonial shared by former students highlights the hands-on teaching style, updated course material, approachable faculty, and effective trading strategies that actually work in real markets. This level of student satisfaction and repeat enrollments speaks volumes about the value that ICFM’s stock market course provides.

Conclusion: Choose ICFM’s Stock Market Course for a Career-Changing Learning Experience

In today’s fast-paced economy, knowing how to navigate the financial markets is a valuable life skill. With uncertainty in jobs and inflation rising, having the ability to trade smartly and invest wisely gives you financial independence and peace of mind. But don’t leave it to trial and error. Instead, build your skills professionally with the most proven and trusted stock market course in India, offered by ICFM.

If you're serious about your financial future, don’t settle for free online gimmicks or incomplete guides. Join ICFM’s stock market course today and experience what structured learning, expert mentorship, and live practice can do for your trading journey. This is more than just a course—it’s your launchpad into the world of financial success.

Read more: https://www.icfmindia.com/blog/stock-market-courses-in-delhi-online-free-get-ahead-without-spending-a-rupee

Read more: https://www.openpr.com/news/4065877/shocking-air-india-crash-triggers-stock-market-panic-across

0 notes

Text

Unlock Financial Firepower With This Unique Stock Market Course

The world of finance has changed drastically over the past decade, with retail investors playing an increasingly active role in the markets. People from all walks of life are now exploring trading as a way to grow wealth, supplement income, or even build full-time careers. However, without the proper foundation, entering the stock market can be overwhelming and risky. This is why enrolling in a professional Stock Market Course is a crucial first step—and no institute does it better than ICFM INDIA.

The Stock Market Course offered by ICFM INDIA is uniquely structured to transform beginners into confident, knowledgeable traders. It combines theory, hands-on training, and live market exposure to prepare students for real-world market conditions. Whether you're new to investing or struggling to find consistency in trading, ICFM INDIA’s program will equip you with the tools, strategies, and discipline needed to succeed.

Why a Stock Market Course Matters More Than Ever Today

Millions of Indians have opened trading accounts over the last few years, driven by rising financial awareness and access to mobile trading platforms. Yet, most traders operate without the guidance or education required to make profitable decisions. As a result, many fall into the trap of emotional trading, uninformed speculation, and poor risk management.

That’s where a quality Stock Market Course becomes indispensable. A well-structured course, like the one offered by ICFM INDIA, teaches you how to interpret charts, understand market psychology, and apply disciplined strategies. This transforms trading from a gamble into a calculated, strategic endeavor. The right education builds confidence, and confidence creates consistency.

ICFM INDIA – A Trusted Name in Stock Market Education

ICFM INDIA is one of the most respected institutes in the financial education space. Known for its practical and results-driven approach, ICFM has trained thousands of individuals across India. The institute's Stock Market Course stands out because it combines academic knowledge with live market application, enabling students to experience the ups and downs of trading firsthand.

ICFM INDIA believes in mentorship, not just instruction. Its experienced faculty members come from professional trading and investing backgrounds, and they offer insights you won’t find in ordinary courses. They guide learners through each concept, ensuring clarity, practical understanding, and personalized support.

What the Stock Market Course Covers – A Comprehensive Learning Path

The Stock Market Course at ICFM INDIA covers everything a new trader or investor needs to get started and grow in the stock market. The course begins with the fundamentals:

Introduction to capital markets

Functions of stock exchanges

Trading mechanisms and account setup

Once the basics are in place, students move on to:

Technical analysis tools and chart reading

Understanding candlestick patterns and price action

Day trading and swing trading strategies

Futures and options (derivatives) trading

Risk management and capital preservation techniques

Trading psychology and discipline in decision-making

What makes ICFM’s program unique is its practical approach. The Stock Market Course is not just theory—it includes real-time case studies, live trading simulations, and market analysis so students can apply what they learn instantly.

Live Market Practice – The Core of ICFM INDIA’s Stock Market Course

One of the biggest advantages of ICFM INDIA’s Stock Market Course is the emphasis on live market training. Students participate in real trading sessions under the guidance of expert mentors. This helps them understand how theory translates into action and how markets behave in different conditions.

From identifying trade setups to placing orders and analyzing post-trade performance, every part of the process is covered. This kind of exposure is crucial for building the confidence to handle actual trades, manage risks, and respond to market volatility.

Who Can Join the Stock Market Course at ICFM INDIA?

The beauty of this Stock Market Course is that it's open to everyone. You don't need a background in finance or mathematics. Whether you are:

A student looking to start young

A working professional seeking a second income

A retiree managing personal wealth

A homemaker wanting to explore the markets

…ICFM INDIA’s course adapts to your learning pace and trading goals. The language is simple, the concepts are clearly explained, and the focus is always on practical application.

Career Opportunities After the Stock Market Course

After completing the Stock Market Course, many students pursue full-time or part-time careers in the financial industry. Job roles that open up include:

Equity trader

Technical analyst

Investment advisor

Financial content creator

Research associate

Others choose to become independent traders or consultants. Some even start their own stock market training channels or blogs. Whatever your direction, ICFM INDIA’s certification adds credibility and helps you stand out in a competitive industry.

Support, Certification, and Continued Learning with ICFM INDIA

Upon completion of the course, you’ll receive a recognized certificate from ICFM INDIA. This certificate validates your skills and can be a valuable asset if you're applying for financial sector jobs or launching your own financial brand.

More than that, ICFM offers post-course support. This includes access to alumni forums, discussion groups, advanced strategy workshops, and regular market updates. You’ll become part of a growing community of traders, analysts, and financial professionals who continue to learn and grow together.

Flexible Learning Options for Everyone

ICFM INDIA understands that learners come from different backgrounds and regions. That’s why its Stock Market Course is available in both classroom and online modes. Classroom learners benefit from peer interaction and direct mentor access. Online students enjoy the flexibility of learning from anywhere with recorded sessions, live classes, and full study material.

The content remains consistent across formats, and every student gets personal guidance from faculty members. Whether you choose online or offline, the experience remains impactful and career-enhancing.

Testimonials and Success Stories

Thousands of individuals have transformed their understanding of finance and trading through ICFM INDIA’s Stock Market Course. Many started as complete beginners and are now confident traders, working in brokerage houses, or running their own investment portfolios.

The testimonials highlight the effectiveness of ICFM’s teaching methods, the responsiveness of faculty, and the practical exposure students gain during the course. These real-life success stories prove that with the right training, anyone can succeed in the stock market.

Stock Market Course: Learn, Grow, and Profit with ICFM INDIA’s Career-Focused Training Program

Success in the stock market doesn’t come from luck—it comes from knowledge, practice, and the right mindset. The Stock Market Course from ICFM INDIA brings all these elements together in a single, well-structured program. Whether you want to manage your investments, trade professionally, or start a career in finance, this course will prepare you with real skills and real experience.

You’ll learn how to read markets, build strategies, avoid losses, and act with confidence. Most importantly, you’ll gain the financial independence that comes with being an informed trader.

Read more blogs - https://www.icfmindia.com/blog/stock-market-courses-in-delhi-online-free-get-ahead-without-spending-a-rupee

0 notes

Text

Why Europeans country for Indian student Study, Work & Visa Expert Consultants

This post is actually spot-on for how a lot of India targets visa assistance: ● Europe visa consultant ● Europe work visa for Indian HOW TO APPLY FOR EUROPE WORK PERMIT VISA FOR Indian. ● Europe study visa consultants Affordable education, work opportunity and visa support A combination of affordable education, strong work opportunities and guaranteed visa support has led to a phenomenal increase in interest from Indian students, professionals and families from all over Europe." With professional Europe visa consultants by your side, securing Europe’s study visas, work permit visas and family alternatives has never been easier. Here you will learn why Europe is the new Indian favorite, How choices are influenced by the costs and of course Where to find trusted Europe work permit visa agents in India and that too much easier than you perceived. Why Europe Now? Rising Popularity & Visa Ease European countries such as Germany, Spain, Ireland and Malta are the most popular for Indians due to lower costs and clear visa norms. Germany, for instance, is a favored target, with predictable rules, few tuition fees and more than 2,300 English-taught programs. Conversely, places like Austria, Malta, Portugal and Spain are pulling in students – not just for affordability, but also for strong post-study career opportunities. This transformation reflects a trend: cost-effective and quality education is available now with the help of trustworthy Europe visa consultants. Europe Study Visa: What You Must Know Process & Requirements ● Schengen student visas can cost anything between €50–€180 depending on the country. ● Applications are typically processed within 4–12 weeks —apps open 3 months before course start. ● Documents include passport, acceptance letter official receipt, financial guarantee (~€9,600 – €14,400 per year), insurance, and proficiency in English (IELTS/TOEFL) Several countries permit you to apply at the same time — a work facilitation and study inclusiveness option for spouses. Europe Job Visa for Indian Professionals: A Guide Types & Eligibility ● Well-Skilled Work Visas: EU Blue Card, Talent Passport in France and Germany ● Post-study work rights: e.g., 18 months after graduation in Germany ● Employer-sponsored visas: Job offer needed at a certain salary level. Cost & Time ● Visa fees: ~€100–€200 + consulate fees + service provider fees ● Processing time: 4–8 weeks. Germany fast-tracks by PMMP (association with India). For Indians Fees Applicants of Indian passport pay the normal visa application charge and normal VFS service fee. With employer support the Europe work permit visa for Indians are easier to get now days. The PMMP with Germany makes things much simpler. Selecting a Europe Visa Consultant Collaborating with a specialist Europe visa consultant or European study visa consultant, reduces transactional friction- especially when you need to work remotely- and decreases the likelihood of any costly mistakes. Key Selection Criteria ● Expertise in all types of visas: student, work, family ● Honest and open fees & terms ButtonTitlesасk tо Top ● On the ground: embassy + university contacts ● High winning ratio and real From Trader s real testimonials What They Offer ● Boutique university matching ● Document prep (SOP, bank statement, health insurance) ● Application scrap to visa ● Pre-arrival and post-arrival support including help with accommodations and part-time jobs

Avoiding Scams Be cautious of the over priced/unlicensed agents asking for ₹2–3 lakh for common visa applications. Honest companies charge depending on the service scope, and cost anywhere between ₹50k – ₹1lakh. Hands-On: Lucknow Students Connecting the Dots with Europe In Lucknow, demand for European education swelled by 40% in 2024-2025, as about 1,400 students chose Europe for the good of lower tuition fees, more relaxed visas and better employment opportunities. Beyond the pandemic, many have rediscovered Europe’s appeal for students and professionals - many were searching for Europe study visa consultants and more, from across India.

0 notes

Text

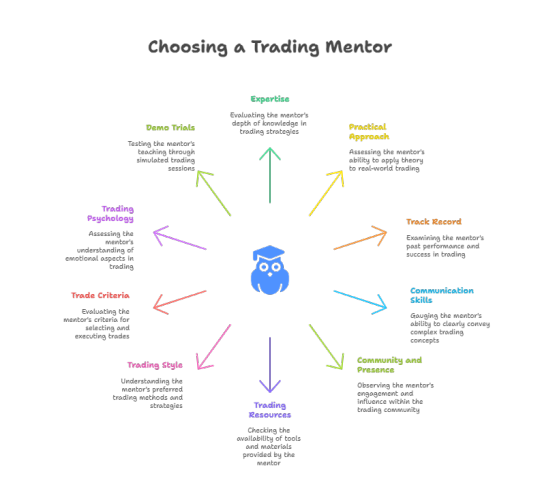

Trading Mentor: Signs You’re Ready to Work With One

Have you ever felt driven to ask every question or concern you have to a trade mentor?

Every trader requires a seasoned person to guide them across the always shifting market.

In the financial market, you need a mentor as much as in a classroom where you have a teacher. Still, you have to choose the right mentor.

We will look at the finest qualities of a trade coach in this post and decide whether one is absolutely necessary.

A Trading Mentor is Who?

A trading mentor is someone who guides less experienced traders in selecting and applying trading instruments based on great awareness of the financial market.

Important concepts including market analysis, strategy development, risk management and leverage use let a trading mentor impart knowledge of the workings of the market. It eventually helps news traders negotiate the always shifting financial landscape.

To put it simply, a trade mentor could also be considered as a role model. Most people start trading by seeing them; many follow their strategy; some even seek their help in starting their trading career.

Forms of Mentorship

Usually acting as a personal trading coach, a financial trading mentor provides one-on-one training and trading support. They often offer trading mentoring programs or act as online trading mentors for those who prefer remote learning.

Considerations to Guide Choosing the Best Trading Mentor

Everyone on social media says they are trading mentors. Many people start mentoring initiatives merely following a few successful trades.

It becomes difficult to choose the right and trustworthy mentor. Still, don't worry—the following will help guide your choice:

Knowledge & Expertise

A mentor should be deeply familiar with the financial market, its dynamics, analysis techniques, and strategies.

Most mentors specialize in one market: Forex, stocks, commodities, etc. Choose one aligned with your trading interest.

Practical Experience

Many traders make the mistake of picking mentors based on theory alone.

Your mentor should have placed real trades and show live results. Real-world experience is crucial.

Track Record

Review client feedback, testimonials, trade history, and data.

Ask traders who previously enrolled about their experience.

Communication Skills

Many know the market, but few can teach it clearly.

Ensure the mentor can simplify complex topics for you.

Presence and Community

Trusted mentors have a strong presence on YouTube, Twitter, Telegram, or WhatsApp.

Look for mentors with high ratings, community feedback, and active engagement.

Learning Resources

A good mentor provides materials like courses, webinars, PDFs, live sessions, and trading tools.

Check what resources are included before signing up.

Trading Style Compatibility

Match your style (scalping, swing trading, copy trading) with your mentor’s.

Confirm they offer signals or strategies aligned with your preferences.

Mentor’s Trade Criteria

Study their approach: leverage used, timeframes, indicators, risk-reward ratios, and strategies.

Trading Psychology

A good mentor will emphasize consistency, patience, and discipline—not just profits.

Trials for Demo Notes

A competent mentor will allow you to test their services.

At Market Investopedia, we provide:

Free demo classes

One-on-one trial meetings

Sample webinars These help evaluate your mentor before making a financial commitment.

Why Should You Seek a Trading Mentor?

It’s not mandatory to have a mentor, but it can significantly improve your trading path. Here's how they help:

1. Spotting Trade Opportunities

Helps you understand when to buy or sell across asset classes.

2. Strategy Development

Supports you in building a sound, sustainable trading plan.

3. Motivation

Trading is emotional. Mentors keep you on track when you feel like giving up.

4. Building Networks

Mentors often introduce you to active trading communities.

5. Learning Technical Skills

They guide you through tools, trading bots, AI-based systems, and more.

Where to Find Trading Mentors & Learning Resources

Educational Platforms

Market Investopedia

Baby Pips

Unacademy

Communities & Forums

Reddit (e.g. r/Forex, r/Daytrading)

Discord trading servers

Live chatrooms and webinars

Social Media

YouTube for tutorials

Twitter for trade ideas

Telegram and WhatsApp groups for live updates

Referrals

Ask fellow traders for trusted mentor recommendations.

Last Words: Should One Have a Trading Mentor?

Having a mentor is a personal choice—but it offers value, especially for beginners.

There's no harm in learning from experienced professionals.

The market is complex—think of your mentor as a skilled sailor helping you through rough financial seas.

Like to Meet Our Trading Mentors?

Market Investopedia hosts a team of expert trading mentors with diverse market expertise.

They provide:

Daily market analysis

Live forecasts

Educational updates

Contact us today for free access to their live webinars.

1 note

·

View note