#until the tech ecosystem returns to balance

Explore tagged Tumblr posts

Text

It makes me really mad that no search engine I've used in the past six months correctly, reliably processes Boolean search operators (even if their help pages and technical support people insist they still do).

#silicon valley was a mistake#i can't see any solution to it#other than just feeding tech people to lions#or other large carnivores#until the tech ecosystem returns to balance#feeding eu regulators to lions will also probably be needed

3 notes

·

View notes

Note

{In An Adjacent Monsterverse}

Chittering to herself, Mothra encouraged the growth of particular flora to replenish what the rising population of a herbivore herd ate. Nature was such a delicate balance in some areas that she pondered why it hadn’t returned to the larger species it used to grow… Regardless, she would do her innate duty to help it along.

Godzilla handled the larger aspects of the ecosystem keeping more—unsavory types from being as overeager. She handled the smaller less innately descriptive aspects. A balance as old as the planet itself though she was younger. Sometimes memories blurred between the eggs, but she made sure to never forget him.

…

…

…

One of the insects who always gravitated toward her when she landed warned her of something coming closer. Mothra faintly registered the beating of similar wings although more solid? How curious. She was smart enough to continue spreading her spores and scales. Soon enough, the mysterious crea—that was a machine. The life infused moth became more alert due to past experiences with tech.

Except this certainly didn’t look like anything the humans made. The mosquito-esc machine zipped around in odd patterns drawing her eyes. Until she felt a faint presence on one of her wings, then the mosquito machine flew up quickly collecting a much smaller version.

Both soon escaped leaving Mothra perplexed.

…

…

…

[Titanus Mosura DNA sample acquired.]

——————————————

Temporarily, Dart didn’t feel guilty over the almost permanent storm cells they accidentally caused when first becoming Hydragen. One particular storm ended up in a low traffic area for boats and a satellite blind spot. The Omnitrix user got to work digging into the ocean via Grimstone. Once lava/magma was brought up, they rapidly cooled it using Frostsmite. Then—came the “exciting” part.

Laying down the literal foundation for an suspense large enough to house several various Mutations who needed varied living conditions. In, on, and below the island itself would need several biomes to accommodate the eventual prey of the Mutations themselves. There was soooooo much work to be done it wasn’t funny.

At least they could transport some of Crustaceous Rex’s preferred food giant tar-spitting squid into the underwater ravines. Those squids had been absolute menaces to the coastline without the Mutation around.

As for where they got the material?

Well. Mutant Bee island had been very thoroughly wiped of all life so no one in would miss the slagged over island, right???

Dart made sure no traits of the Bee or Plant mutation existed before transplanting things.

—————————————

This island was going to be much larger than Worldshaker’s had been and even the current Monster Island the mutations were housed on. If anything, Dart was creating a proper Kaiju Island in the matter of a few days or at least the base of which on could form. They didn’t want to bother Azmuth soon after calling him to help Chameleon. So, they were stuck attempting to transplant every bit of flora by themself.

Most plants didn’t take well to being teleported.

Dart had to resort to the painfully slow process of coaxing some seeds to grow a bit faster as Pipeline. Which again was very, very sedate. The Omnitrix user couldn’t even get past budding grass to grow fast enough for their likes on trying to give the Mutations’ homes…

‘Really feeling the absences of Wildvine and Swampfire here.’

‘I am aware of that, Dart. It’s my subroutines that determine which aliens or species you unlock . Perhaps if you keep up at this it will unlock either of those two. You unlocked Lodestar in a similar fashion cleaning up the ocean floor of shipping containers, right?’

Dart sighed tiredly, resting on a rock they had purposely shaped on the budding island in order to be comfortable to sit on. The Omnitrix user knew something would give in eventually—either the subroutines or they’d get distracted. Contrary to popular perception, even the human teen grew tired of focusing on certain projects for months at a time. They had only been dead set on Kaiju Island for a week.

An on and off week due to spending time with Chameleon, Godzilla Jr, and Godzilla Sr who broke out of HEAT’s care to return crankily.

The Omnitrix user hit the faceplate once the device finally recharged and—found themself growing larger than they intended to. A more unique set of wings than Dart was expecting fluttered. Eyes similar to when they became Spewpa or Nanomech yet largely different stared out from a new perspective. Antenna? Yes, antennas began automatically transmitting the smells in the air to them though it took the Omnitrix filtering to help them realize this.

Grass started to shoot up when they tried fluttering their wings on command—mainly due to the glowing powder or scales falling from it.

‘…I’m Mothra, aren’t I?’

‘You did want a form that could help speed up the plant growth.’

‘I have never had a flying insect form outside of Nanomech though and they’re techorganic. Lethrall has the closest approximation, but they’re a dragon. How am I supposed to fly?’

‘Practice makes perfect.’

Dart now regretted the storm cell’s presence.

—ROB’d Anon.

Another Kaiju entry gets added to the roster. No, I don’t have a name for this yet—working on it. Mashing a few implied abilities since Monsterverse Mothra doesn’t exactly show the ability to accelerate plant growth. But, plants and insects tend to grow around her egg/cocoon.

Can only imagine the confusion if Mothra ever meets this new form. At least Dart can make some actual progress for the island's plant life. I suggest looking at different moths or their symbolism for name ideas.

#sonicasura#sonicasura answers#asks#anonymous#ben 10#ben 10 series#ben ten#ben ten series#oc#original character#godzilla#godzilla the series#godzilla 1998#godzilla monsterverse#zilla

0 notes

Text

Godzilla vs. Kong: Inside the Monster Fight of the Century

https://ift.tt/eA8V8J

By now you’ve probably seen the Godzilla vs. Kong trailer. You know, the one where a giant ape not only punches a giant lizard in the face (and does what almost looks like the Henry Cavill arm-cocking maneuver) suggesting there’s a new contender for the title of “King of the Monsters.” Audiences will find out who wins when the film drops on HBO Max and in theaters on Mar. 26, 2021, but in a 2019 visit to the Australian production, Den of Geek learned there is more to the movie than a mere clash of Titans.

Instead, executive producer Alex Garcia teases a film about the duality of the “primordial and the technological” elements that pervade the film narratively and aesthetically. Of course there will be throwdowns between two marquee monsters — and possibly a mechanized one — who might just have some history together.

The Monsterverse Main Event

The screams are noticeable on the Godzilla vs. Kong production in Gold Coast, Queensland. Rather than emanating from victims of a monster rampage, it’s the sound of roller coaster passengers at the Warner Bros. Movie World right next door. But there be monsters in the Village Roadshow Studio offices. In a conference room filled with journalists, the walls are adorned with concept art of creatures, including the titular prizefighters duking it out.

“This is obviously the title event in our MonsterVerse series,” says Garcia. Directed by Adam Wingard (Blair Witch; You’re Next) for Legendary Pictures and Warner Bros., and starring Alexander Skarsgård and Millie Bobby Brown (reprising her role of Madison Russell from Godzilla: King of Monsters), Garcia says the upcoming movie has even more scope beyond the “central bout” of Godzilla and Kong.

In a separate interview with Wingard, conducted via Zoom this February, the director — who watched every single Godzilla movie as preparation — described the film as an exploration of monsters past and future, with two concurrent storylines organized into Team Godzilla and Team Kong.

Setting the Stage

Set roughly five years after the events of Godzilla: King of the Monsters, the world is changed. The genie is out of the bottle, and mankind knows monsters exist. Life goes on, despite it being an uneasy existence. But the balance that existed before 2014’s Godzilla is re-established. Godzilla himself has been reinstated as the alpha predator, and the other monsters, aka “Titans,” have remained largely dormant.

“There are creatures who are on the surface,” says Garcia. “They aren’t roaming around, destroying things, but they exist; there are occasional landings, issues, and bouts of destruction.”

Responding to this new reality, humanity enacts safeguards and defense mechanisms. And there has been much rebuilding thanks to Apex, which Garcia describes as a “megalithic, technological conglomerate — think the extreme version of an Amazon or Apple.”

To complicate matters, Godzilla has been acting a little erratically, attacking certain cities and facilities, seemingly at random. That drives the Titan-focused organization Monarch to undertake its first mission into the Hollow Earth via its base camp on Skull Island, where the movie begins.

“They’re going to take a device, the ORCA-Z, into the center of the earth to draw the creatures slowly back into the center of the planet, and they’ll seal it,” Garcia says of the adventure led by Nathan Lind, played by Skarsgård.

Since this is the beginning of the film, it’s not a spoiler to reveal that the mission goes “catastrophically wrong,” according to Garcia, and the world is left in even greater disarray.

Return to Skull Island

Skull Island has changed quite a bit in 40 years (since audiences last saw it in 2017’s Kong: Skull Island), and so has its boss, Kong. He was only an adolescent in the previous film, but is now a much bigger boy of about 350-feet tall, compared to Godzilla’s 400 feet, and has seen some action in the ensuing decades.

“It is a tough existence on Skull Island,” says Garcia. “So he’s a little weathered … he has some battle scars.”

Kong has also gained a friend in a young Skull Island native Jia (Kaylee Hottle), with whom Kong can directly communicate via a “spiritual bond,” according to Wingard. And he has learned some new skills. Garcia promises he remains the Kong audiences know (“he doesn’t breathe fire”) but has a few tricks up his sleeve by virtue of being in a modern world. That may include the Thor-worthy battle axe he wields in the trailer.

The First Battle

Garcia calls the large-scale action sequence behind that first Godzilla and Kong battle at sea one of the first ideas Wingard pitched when he boarded the project in 2017, nearly two years after the project was announced, and after Legendary moved it from Universal to Warner Bros.

The fight is the first of at least two meetings of the main monsters. Another is the “massive third act battle” set in a slightly futuristic Hong Kong, says Garcia, where Kong parkours through the city on skyscrapers, a definite step up from merely scaling the Empire State Building.

As for who comes out on top in the end, that remains to be seen, but at least the first one is expected to end in a draw.

Journey to the Center of Hollow Earth

The Monarch will explore the setting of Hollow Earth, aided by sci-fi anti-gravity vehicles called HEAVs (Hollow Earth Aerial Vehicles). Garcia says Hollow Earth is 10 times the scope of what we’ve seen on Skull Island, with “rich varied ecosystems” filled with life and a diversity of terrain. Aesthetically, it takes inspiration from Hawaii’s lava fields, as well as the greenery of Waimea on the island. And it’s in Hollow Earth where we see those hints of other Titans that were first glimpsed in the trailer.

“[They] find, in the center of the earth, an ancient site that suggests eons ago, there was a balance between humans and creatures, and a kind of reverence … a greater connection” he adds. “With Kong, he is the last of his kind, and in Hollow Earth, there is hope he will find another; he discovers these environments and ancient evidence of other Kongs, but there aren’t any.”

Production designer Owen Patterson says Wingard and Garcia discussed with him the notion that the Iwi tribe seen in Kong: Skull Island may have made their way into Hollow Earth thousands of years in the past, and remnants of that culture may exist. As hinted at in the mid-credits scene in King of the Monsters — which featured cave paintings of Kong and Godzilla species fighting one another — he said Kong’s species and Godzilla had once lived in the same environment before something occurred that led to a destructive battle, and the latter ultimately went to sleep until the events of the 2014 film.

Production Designer Tom Hammock says they also drew inspiration for Hollow Earth from ancient human civilizations, such as Göbekli Tepe in Turkey, and the Assyrians of Mesopotamia. Architecturally, he adds they went for a look where the buildings are carved into stone, like the early peoples did in India and Ethiopia.

“We carried those looks with the idea that ancient humans all over the world were interacting with these creatures, and forming that bit of civilization with Kong in Hollow Earth.”

For his part, Garcia doesn’t explicitly say Kong and Godzilla have history together, but does acknowledge, “there are some ancient histories and discoveries in the Hollow Earth, and a deeper backstory to the characters.”

Kong has an emotional journey in the film but Godzilla similarly has his reasons for behaving the way he does. Wingard said Kong is also a “human conduit,” that allows the audience to experience things through him.

“One of the most important things going into this film was treating Godzilla and King Kong like actual characters, that they’re not just these big props that are kind of in the background,” Wingard says. “It’s like they have personalities and they have definitive things that they will and won’t do.”

The Human Element

Following the events of King of the Monsters, and her mother’s belief the Titans are meant to heal the earth from mankind’s damage, Brown’s character Madison becomes an advocate for the creature and serves as the emotional proxy for him.

“Godzilla is the misunderstood hero fighting for us even though we are afraid of things greater than us, and we are constantly fighting against him,” says Garcia. “[Madison] believes he is not necessarily benevolent but what Godzilla wants is also good for mankind, and there must be some reason he’s doing this.”

Brown calls Madison “basically a badass” as the character has grown up since the last movie, and is following in the footsteps of her mother (a Monarch paleobiologist-turned-environmental extremist who believes Godzilla is a savior for the planet, played by Vera Farmiga). She wears her mother’s jacket everywhere she goes, and studies what makes Godzilla tick.

“It’s much more about the technical side of it, learning about the data of him as a Titan,” Brown says.

Madison’s father Mark (again played by Kyle Chandler) is a director at Monarch, and while he’s on the Kong mission, she comes to believe Apex is involved in a conspiracy behind Godzilla’s bizarre behavior.

Titanic monsters aside, if a tech conglomerate’s secret agenda and hollow earth theories sound like the YouTube videos shared on Facebook by an eccentric relative, that’s not a coincidence. Garcia says conspiracy theories are a through line in the movie as a way of exploring why people come up with these ideas, and how a theory speaks to the things we’re afraid of.

As Madison sets out to investigate, she is joined by her friend Josh (Julian Dennison) and Bernie (Brian Tyree Henry), a former Apex employee who lost his wife, and runs a podcast seeking to expose his former bosses. Together, the misfit trio tries to uncover the mystery at the center of Apex and the sci-fi environs of the company.

This includes a scene filmed on a soundstage set dominated by a 60-foot-long Ghidorah skull wired into a hi-tech control station. It is unclear whether it belongs to King Ghidorah, who lost one of his heads in King of the Monsters, but Wingard did confirm, “In a subtle way, Ghidorah kind of haunts this movie.”

The skull was connected with multicolored cables to a computer terminal — and an artificial brain. Along with signs reading “psionic output” and “biomech,” there was a command seat and headset on a platform accessible by a ramp leading up the kaiju’s mouth. In the scene, Madison leads Josh and Bernie into the mouth to infiltrate the station.

Mecha-Godzilla?

Connected to this is Ren Serizawa (Shun Oguri) — the son of Ken Watanabe’s Monarch scientist character from the previous two Legendary Godzilla films. Seen in the trailer against a mech schematic, Oguri says Ren’s means of protecting the earth is very different from his pro-Titans father.

Based on other glimpses in the trailer of a suited-up Godzilla, and the toy images that leaked at the beginning of 2020, it seems a mech will arrive in the new movie. Although, it remains to be seen if it’s an Apex-controlled Mecha-Godzilla, Mecha-King Ghidorah, or something else entirely. Or perhaps all three are in play, and Godzilla and Kong will eventually have a reason to team up, and fight together.

According to the production designers on the film, another sci-fi inspired element, or perhaps something out of a James Bond film, will be present in Apex’s headquarters atop Hong Kong’s Victoria Peak with an installation built deep within, reaching down into the earth. As well as the mech control room, that base will be the setting for another monster showdown. Cotter explains “our heroes” arrive in Hong Kong via a shuttle transporting Skullcrawler eggs (belonging to the creature introduced in Kong: Skull Island) and end up in an arena confronted by one of Kong’s hometown foes.

This is only one of the ways Godzilla vs. Kong ties together elements from each of the MonsterVerse movies. Garcia also hints the film digs deep into the “mythic past” of Godzilla creator Toho studio, and speaks to new creatures and “other creatures” in the film. He also says both lead monsters are fighting for something, and neither is an antagonist in the movie, and that “there is a complexity” to their motivations.

cnx.cmd.push(function() { cnx({ playerId: "106e33c0-3911-473c-b599-b1426db57530", }).render("0270c398a82f44f49c23c16122516796"); });

Despite the potential nuance of the monster-on-monster violence, there does not appear to be a shortage of it in Godzilla vs. Kong, with Hammock saying the two main beasts meet several times. And it’s a good bet Godzilla will get a chance to return that sucker punch Kong delivers in the trailer when Godzilla vs. Kong premieres on HBO Max and streaming this March.

The post Godzilla vs. Kong: Inside the Monster Fight of the Century appeared first on Den of Geek.

from Den of Geek https://ift.tt/3dBrYjd

0 notes

Text

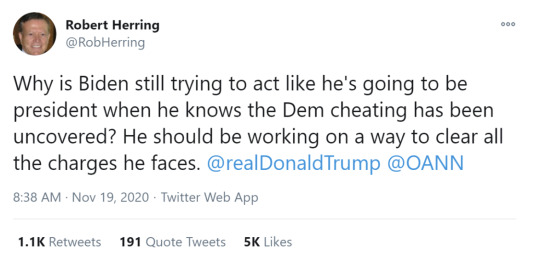

OAN Is So Dangerous Because It Looks Like a Real News Channel

It’s the president’s favorite “news” channel, and a cornerstone of America’s growing disinformation problem. It’s One America News (OAN), a rotating collection of wobbly conspiracies and gibberish that has more in common with a state-run disinformation network than a credible news organization.

OAN’s definition of “news” has included false claims of electoral fraud, baseless Kremlin-backed conspiracy theories, false claims that the novel coronavirus was developed in a North Carolina lab as part of a vast government conspiracy, and accusations that last summer’s protests over the police killing of George Floyd were part of a diabolical “coup.”

“According to the mainstream media, the riots and extreme violence are completely unorganized,” the network proclaimed last August. “However, it appears this coup attempt is led by a well-funded network of anarchists trying to take down the president.”

Last June, 75-year-old Martin Gugino had his skull fractured after being shoved to the ground by Buffalo police officers. Video clearly showed the elderly Gugino doing nothing wrong, but OAN insisted he was an “Antifa provocateur” using sophisticated tech to target the police.

“Newly released video appeared to show Gugino using a police tracker on his phone trying to scan police communications during the protest,” the network falsely claimed.

Tuesday, YouTube suspended the OAN channel for a week after the company uploaded a video promoting a bogus cure for COVID-19.

In seven years OAN has gone from completely unknown to being routinely amplified by Trump, catering in many ways to an audience of one. It is a symbiotic relationship, in which Trump can point to what vaguely look like news reports to buttress his own conspiracy theorizing, and the network, by providing them, can access his massive and loyal audience.

This relationship, like so much about Trump's presidency, is seemingly unique and aberrant. But while experts say OAN’s impact is overstated and future success unsure, they also warn that without a major course correction, the channel’s modest success is a troubling harbinger of dumber and more dangerous things to come.

OAN is the brainchild of millionaire Robert Herring, who ran a chain of Los Angeles pet stores before making his fortune printing circuit boards. In 2003, Herring created Herring Networks, which includes WealthTV, a self-proclaimed “lifestyle and entertainment cable network,” and OAN, which was launched in 2013.

Few gave OAN a second glance until it became a network exclusively dedicated to pandering to Donald Trump’s insatiable ego. Dating back to 2015, Trump touted the network and its coverage of his presidential bid, and throughout his presidency, he has praised and promoted it to his tens of millions of followers. Throughout election season, OAN heaped lavish praise on the president, even pulling polls that dared suggest Trump might not win his reelection bid. And post-election, both Herring and the channel he founded have pivoted to parroting false Trump claims of rampant electoral fraud.

Much like the alternative-reality contemporaries OAN hopes to compete with, the channel’s unbridled dedication to Trumpism—and the relentless repetition of every conspiratorial MAGA brain fart—is routinely portrayed as objective journalism by company executives.

“We’re a no-fluff, very fast-paced live news service meant to inform,” Robert’s son Charles Herring told the Washington Post in 2017. “News anchors are not allowed to express opinions. They simply deliver the news and we leave it up to the viewers to decide. It’s not our family’s mission to determine the news.”

The president’s adoration of OAN means that despite being banned from briefings by the White House Correspondents’ Association for ignoring CDC safety protocols, the channel has been allowed to simply ignore the ban, and on any given week can still be found amplifying ludicrous claims from White House grounds with a quality reminiscent of high school A/V clubs.

Last week, OAN received yet another signal boost when Trump tweeted out a segment featuring bogus claim of electoral fraud propped up by “expert analysis” by Ron Watkins—son of 8kun (formerly 8chan) owner Jim Watkins—who is alleged to be a cornerstone of the QAnon conspiracy cult, where the false claim first originated:

But even with daily free marketing from the president, OAN’s real-world influence has been largely overstated.

OAN doesn’t subscribe to industry-standard Nielsen estimates, so accurately measuring its viewership has proven to be a guessing game for TV ratings firms. (OAN claims to reach around 35 million potential homes, little more than a quarter of the total number of U.S. homes that currently own a television set.) Research firms like Kagan estimate OAN’s reach to be 23 million cable subscribers, a significantly smaller potential footprint than right-wing outlets like Newsmax TV (58.2 million) or Fox News (78.6 million). When Nielsen attempted to more accurately measure how many of those users actually watch the channel last year, it wasn’t pretty:

OAN’s ambitions have been challenged by the fact that numerous major cable outlets, including Comcast, Spectrum, and Dish Network have refused to carry the channel. A June Bloomberg report attributed this reluctance to stringent OAN contract requirements, an asking price out of line with the channel’s quality, or a lack of interest in being associated with controversy.

OAN’s biggest cable distributor, AT&T/DirecTV, has been trimming costs due to sustained TV subscriber losses from cord cutting and mismanagement. Reports earlier this year indicated that OAN’s contract with AT&T is up for renewal next year, potentially removing AT&T’s 19 million potential viewers from the equation if a new deal can’t be reached.

Neither OAN nor AT&T responded to inquiries about the status of the contract.

While OAN may not be brainwashing a massive audience; it is providing plausible-seeming props and set dressing for Trump as he uses social media to create an alternate reality in which he won the election, defeated the coronavirus, and is unfairly besieged on all sides by mean journalists and the “deep state.” It’s a false reality OAN hopes to take to the mainstream.

The MAGA set has become furious at Fox’s failure to more fully embrace false claims of election fraud, and for (accurately) calling Arizona for Joe Biden before other outlets on election night. A recent Morning Consult poll found that Fox News’ favorability among Republicans dropped from 67 to 54 percent post-election—simply for occasionally telling viewers the truth.

But without free daily advertising from the president, overtaking Fox will be a steep uphill climb for the fledgling network—especially if OAN continues to double down on conspiracies and nonsense, Stanford professor of political economics Greg Martin told Motherboard.

“Fox News in some sense created the market for OAN, by building up the taste for conservative-slanted TV news in a large audience,” Martin said. But he added that Fox maintains its massive audience by including just enough hard news (like a legitimate election data team willing to call Arizona early for Biden) to keep at least the illusion of integrity intact.

Martin’s research has found that in terms of gaining cable TV market share, there are diminishing returns when it comes toward pushing extremism at your target audience, suggesting that OAN’s quest to out-conspiracy Fox might not be a winning formula.

“One of the points we make in the paper is that there is a tradeoff in moving farther towards the ideological extreme: if people watch, you'll have greater influence on their beliefs, but you also increase the risk that they are turned off by it and don't watch at all,” Martin said.

Martin added that Fox has been very successful at this balancing act to create the illusion of mainstream respectability, but a network like OAN positioning itself even further to the right of Fox is likely to be drawing viewers from a limited pool of total viewers.

“Fox has already pushed the envelope about as far as you can go before the returns to additional ideological extremity start to turn negative,” he said. “So I am skeptical that OAN will achieve anything like Fox's influence on public policy and politics in the US, even if its ratings were to continue to grow.”

While OAN may never see the same level of success as Fox News, it doesn't have to: It has had, and could continue to have, real effects on the public discourse just by inverting the usual formula by which powerful people reach a mass audience via news outlets. And other media scholars say the success it has seen is a troubling omen for the future of U.S. journalism and America’s accelerating battle with disinformation and propaganda.

Victor Pickard, an American media studies scholar at the University of Pennsylvania, told Motherboard OAN’s rise comes at a major inflection point for U.S. media. With U.S. journalism facing an existential and financial crisis—and so many bad faith actors looking to fill the vacuum created—OAN will likely be the least of our problems.

“It's difficult to imagine a surefire way to undo the damage to our media ecosystem, but one key piece of any solution must be to rebuild local journalism, whose dissolution has created the vacuum into which all manner of conspiratorial nonsense and disinformation has rushed in,” Pickard said.

Decades of corporate consolidation and layoffs have hit local journalism particularly hard, replacing quality local reporting with a troubling combination of Facebook conspiracies, Trump-loyal disinformation empires like Sinclair Broadcasting, and a flood of even more malicious actors looking to disguise corporate and political propaganda as legitimate local news.

Researchers have shown repeatedly that as local journalism is replaced with homogenized fluff and nonsense, Americans not only become less informed and more divided, but local corruption reporting falls through the cracks. In some instances, a lack of quality reporting has been directly linked to a measurable impact on election results.

Pickard noted that without addressing the underlying rot that fertilized the rise of the U.S. disinformation problem in the first place, things are likely to only get worse.

“Several structural conditions enabled the rise of OAN,” Pickard said. “First are the commercial values that incentivize media outlets to privilege profits above all else,” he said. “The proven formula of outrage-driven commentary is both cheap to produce and captures audiences' attention, which advertisers covet.”

In short, we’ve created an entire information ecosystem that prioritizes engagement above accuracy or insight, one in which it’s often not as profitable to tell the sometimes-boring but important truth.

Pickard has been a consistent advocate of providing more public funding for U.S. journalism as an antidote to the corrosive impact of engagement-based advertising. He also advocates for stronger “public interest protections that mandate social responsibilities such as maintaining ideological balance and fact-based coverage in our news media.”

In the 1940s the FCC passed the Fairness Doctrine, which required that broadcast news outlets cover issues of public interest fairly. But the rules were demolished in 1987 after Republicans spent years demonizing them, insisting they violated the First Amendment. Even if still around today, the rules would have only applied to broadcast television, not cable TV.

With inflammatory nonsense so profitable and Congress increasingly divided, a more modern proposal seems all but doomed. In its place, U.S. media policy has consisted of rubber stamping problematic mergers, eliminating decades-old media consolidation rules, and doubling down on an ad-based media environment that only tends to reward the inflammatory.

Without a major funding boost for real journalism and a massive rethinking of U.S. media policy, “news” empires like OAN will continue to see outsized influence on U.S. discourse, Pickard said—and it's not hard to imagine the possibilities for more sophisticated actors creating bespoke fake news for powerful politicians and political movements. Media experts also argue more mainstream journalists and outlets need to rethink their role in amplifying or validating bad faith viewpoints in a misguided quest for artificial balance.

“I predict that our news media in general will continue to worsen because there's less and less actual journalism,” Pickard said. “Meanwhile, the rightwing, fact-free media model is a proven money maker with no countervailing force.”

As trust in institutions is eroded, the public tends to turn to dubious, sometimes terrible alternatives to reinforce their shaken worldview. OAN wasn’t the first “news” outlet to exploit our failure to prevent conspiratorial thinking from being mainlined into the American bloodstream, and without a dramatic shift in U.S. media policy and funding, it certainly won’t be the last.

OAN Is So Dangerous Because It Looks Like a Real News Channel syndicated from https://triviaqaweb.wordpress.com/feed/

0 notes

Text

Mediterranean Dialogues (MED) Youth Forum Contest 2020 (€2,500 Prize)

Submission Deadline: 30 October 2020 MED – MEDITERRANEAN DIALOGUES is the annual, high-level initiative promoted by the Italian Ministry of Foreign Affairs and International Cooperation and ISPI (the Italian Institute for International Political Studies) as an opportunity to rethink traditional approaches to the area, to complement analyses of current challenges with new ideas and suggestions, and to draft a new “positive agenda” addressing shared challenges at the regional and international levels.

The 6th edition of MED Mediterranean Dialogues will be held from November 25 to December 4. Over the past five years, MED Mediterranean Dialogues has established itself as a hub for in-person meetings among high-level representatives of governments, international organisations and civil society. This year, the MED Conference will adopt a “hybrid format” (with virtual and in-person events) to ensure conformity to the highest standards of personal health and safety.

Following on the success of last year’s event, MED Mediterranean Dialogues 2020 is proud to announce a second edition of the “Youth Forum Contest – Ideas and Projects at Work”, implemented in cooperation with the Representation of the European Commission in Italy, the Boston Consulting Group, the European Training Foundation, and the Organization for Economic Co-operation and Development. The purpose of the contest is to give a selected number of young Mediterranean people the chance to present innovative ideas and projects to a high-level audience in order to promote their work and enhance their visibility.

Participants will have a unique opportunity to present projects that could facilitate dialogue and foster development and cooperation in the broader Mediterranean region. With this in mind, this year’s Youth Forum Contest will promote young leaders whose ideas and projects focus on finding innovative and creative responses to the current pandemic crisis in the MENA region and on supporting post-pandemic recovery.

How the competition works

In 2020, the world has come together to face the global challenge of the COVID-19 pandemic. In this regard, the Mediterranean region is not exempted from action. With its long history as a creative and pioneering hub, the Mediterranean could well reaffirm its role as a region capable of innovation and inclusiveness. The 2020 MED Youth Forum Contest is therefore looking for proposals that offer innovative solutions to help manage the crisis and to support post-pandemic recovery. In line with the purpose of the contest, all the projects presented should cover topics related to one of the following two areas:

Culture and Civil society:

Culture and Education (Inclusive and Equitable Education; the Promotion of Remote Learning; Innovation in Museums and Art Exhibitions; Future Art Ecosystems; the Promotion of Tourism and the Recovery of the Tourism Industry)

Civil society (Social Protection; Gender Equality; the Prevention of Domestic Violence)

Health (Immunisation; Prevention and Control; Healthcare Recovery; Mental Health Recovery; Technologies, Biotechnologies and Medical Equipment)

Business and New Economic Models:

Employment and Business: (Remote Working and Digital Business Transformation; Reorganization of the Workforce; Reshaping the Customer Experience; Youth and Gender Employment; Work-Life Balance; Financial Inclusion; Poverty Reduction)

Food and Water Security (Food Logistics and Distribution; the Recovery of Small-Medium Food Production; Agri-Tech Innovation; Social and Economic Access to Food and/or Water)

Urban Innovation: Rethinking Public and Private Spaces; Travel, Logistics & Transport Infrastructure; Returning to the Workplace; Rethinking Urban Regeneration; Safe and Sustainable Urban Mobility)

The MED 2020 Youth Forum Contest office will accept applications until 30 October [UPDATED from 11 October]. The office will then select the best 20 submissions, 10 for each group. The MED secretariat will announce the results of the selection process to those applicants selected to participate in the Youth Forum Contest in the first half of November.

During the contest:

All participants will be given a maximum of 5-minutes to present their projects and ideas to a selected audience and to an international panel of experts. The working language is English.

Once all presentations have finished, the professional jury and the audience attending the event will vote to select a winner for each group.

The two winners will be awarded a prize of € 2,500 to develop their projects further. In addition to greater visibility and the said monetary reward, participants will also have full access to the MED2020 conference to explore business opportunities and to connect with experts, investors, venture capitalists, and fellow entrepreneurs. They will also be given an opportunity to present the development of their projects to a dedicated panel at MED2021 Mediterranean Dialogues next year.

How to apply

High-potential candidates aged under 35, from North Africa[1] and the Middle East[2] may apply to enter the contest. Applicants must have an excellent command of English (the event’s working language) and a keen interest in Mediterranean cooperation. To ensure a fairer and more inclusive procedure, candidates from Mediterranean Europe[3] may apply if their projects are run in partnership with institutions and or individuals based in the Middle Eastern or North African countries listed.

Applications must be made using the online form. All applicants should include the following information:

A short letter of motivation (explaining why they wish to participate in the MED2020 Youth Forum Contest, no longer than 200 words, in pdf format)

A complete description of their project (using the attached PowerPoint format).

An updated CV (in pdf format)

Disclaimer: Applicants will be selected at the sole discretion of the MED Youth Forum Contest office, which is staffed by representatives of all partner organisations.

For More Information:

Visit the Official Webpage of the Mediterranean Dialogues (MED) Youth Forum Contest 2020

from WordPress https://ift.tt/3dDCowA via IFTTT

0 notes

Text

TRUE LIVIDTYY

A raw form that is in a state of flux/liquidity: any single viewer/chronologically stangnant records and perspectives captures its constituencies // medium & disturb entities so observation must be naturalistic // double blind to prevent viewer interference in which external alteration of the signal or frequency of the user group and/or individual that may difficulty in being percieved. As new forms proclaimate gel and diversify we can poliate these spiritual creatures by envisioning flocks, schools, and swarms of life arising from the subconscious into tangible form, oprotoindegenious species conceptual abnormalities mutations & permutations will ooze from our gathered loins; allow for gestation, temporal zones/ethereal gullies and trenches that can be utilized to balance toon like spectacles lenses that lead us intö hellzones that divert true earth growth of progeny to fickle pickles and/or per: paraphrases, assemblages, rough drafts, noodles, doodles, sketches, aneurysms, calcification, mediums that disrupt sodium channels and/or inhibits the transference of neurotransmitters or side channels TRUE_FLOW. Please refrain from substitutions, additives, preservatives, unless they are branches and extensions and/or noninvasive in which negative spaces can remain neutral and fertile to enable germination of the flux form of the OI and the ecosystem can expand / evolve from its primordial forms and raw grand design. This OI is designed for naturallly occurring terrafirma, cosmic and /or regulatory purposes primarily for anything that has the capability to receive transmission communication sensation reactive protoactive positronic+ with nonhominids(guests) kept in high regard. In this vein the formation of these neo-conceptual bodies, fleeting animal havoon form can be generated from acclimating animal like creatures to cleanse of skin, heal our wounds diseases and Alements making our living and collective body an ecosystem of tangble living forms that strengthen and Reformulate our nude form. Envisionsing these spiritual creatures work as Basic immersion path Into a Post-Physical body where the body can die and regenerate while remaining conscious with the ability to dither density become imbedded with a greater technologically advancing species past-present-future. Native and synthetic stellar fauna, animal/havoon/evolving forms and post-plant life Fireshine, starbits, with common sense ethics morality and basic virtues tacitly imbedded. A tangible ecosystem embedded within modern tech, comforts luxuries and delicacies and new sensations close at hand. This is the basic noodle/string of vibration for this operating index. Humble Hyperidealization & Hyperbolic Harmonies.

Beep.

Leptons to Lilly pad, boson to bosoms, subatoms to substratisphere, neutrino to nebula we can be can be liberated from the negative and penetrate into the hyper realm of Neologisms digitalisms and hover through our days and Milliseconds. HOOVER ON THE CROSSHAIRS OF INFINITY. This a rough nomenclature to sociostellar formation , new forms of consciousness /remote senses ect; expanding our conductive a for our factory senses delicately and thoughtfully expanding parameters and reducing the broad undercurrent which weighs down modern thinkers & ancient lay-lines & true forms. and Prototonic form.

The axiom must be accurate on the microscopic and macroscopic form. The pyramid must flow in all directions while remaining in constant flux in the TRUE_FLOW keeping our pejorative streams pure from brackish pollutants.

He (masculine pejorative) must always come first in the sequence; heteronormative reality based stride on a literal pragmatic methodical, idealistic but most importantly empirical stride and strike. When used with accurate and proper groupings tried and true measures & standards the user can wield more power within the lines of the operating index; there are many seemingly misanthropic misprints but allocations//freedoms flexibility/leniency are given to those that strengthen and purify our surge and torrent.

Technocratic bigwigs, robber barons earths shakers oligarchs czars dictators, Hardliners headliners trendsetters Agenda centres with a naturalistically based utopian Freescape in which a combination of freeforms & darwinistic pathways Can crack dissect and give clarity to new lines of atomic perspective

THE DARWINIAN LENSE HAS CRACKED as we abolish the one-viewer POV and view collective as a species. Our inherited experiential divots and dimples in our LUSTRIOUS BODY LIVIDITIES that PERPETUALLY SELFCLEANSING SYMBIOTIC HOST SPECIES.. As arbiters of our precious minerals we must refrain from taking mismatched discord’s. Return the best bits back into pure and raw forms. Be it in thoughts or truthform. Procure and proliferate the most dextrous pliable quality / dynamic of materials that are available until more desirable and malleable forms come to fruition. With cost+ expenditures available, ONLY THE MOST ADAPTIVE/ REINCARNATING/ BIRTHING FORM/ FERTILE FOR NEW SPECIES / BIOTiC // ROOM for multi generational ancestral offspring of different symbiotic cohabitating plant and animal forms. UTLIZATION of parties and The new forms that spring will speak with its sheer reinvention and renewables presence its voracity alone will be self perpetuating. When we train our living cells in this fashion our skin/bones become a winter type of a coat once these symbiotic supercharged neohumaniod assimilations’ take when the ubermench becomes realised.

io.SLØAN

www.soundclick.com/io.sloan

www.instagram.com/io.sloan

www.reverbnation.com/sloan666

0 notes

Text

July 16, 2017

Ethereum News and Links

Top

Latest Core Dev meeting video. Agenda. Decisions per Hudson Jameson:

Splitting Metropolis into 2 hard forks.

Delaying EIP 86 until Metro HF 2.

Likely adding miner block reward deduction to Metro HF 1.

Enterprise Ethereum Alliance is now the largest open source blockchain initiative

Rebooting the EEA Technical Steering Committee

Protocol

Vitalik: The core principle of Casper incentivization. Plus Reddit thread.

Gavin Wood: "> 50% chance that a modest PoS solution is at least 12 months from release"

Gavin comment on PolkaDot development

ConsenSys is funding research for a different approach to scalability

Stuff for developers

How to develop on Ethereum in scala.js

Building dapps on Ethereum tutorial, pt 4: decentralised hosting using Swarm

Setting up a bug bounty contract with OpenZeppelin

Vitalik now considers Serpent to be "outdated tech"

Releases

Geth v1.6.7

imToken v1.3

WALLETH 0.17

FirstBlood beta release to token sale participants

Ecosystem

ETH Gas Station: helping users understand the time-cost tradeoff

VentureBeat interviews FunFair's Jez San

Their version of Roulette is live on Ropsten with Metamask

Joe Lubin on ConsenSys and Mauritius

the F*** token (bleeped so Google doesn't get the wrong idea) raised 80k for a tipbot

Jordan Leigh video on ERC-223

Coindash had someone hijack their site and get $7m. This is the same project that won the Ether.camp hackathon under rather controversial circumstances.

Ujo and RAC -- the future of licensing?

Buy the RAC album. Pretty much unanimously has good reviews.

Project Announcements & White papers

Stox -- building a prediction market using Bancor's token. A coin on a coin on a coin. White paper

Everdant -- a protocol for financing across the value chain for small farmers. white paper

HelloGold -- tokenized gold aimed at low-medium income people in Asia White paper.

Project Updates

Golem and Steamr to work together on shared parts of tech stack

Aragon's Community Governance model

The first Melon manager competition

How Melonport balances competing stakeholder interests

Interviews and Talks

Linda Xie and Jordan Clifford from Coinbase on Software Engineering Daily

Plus SED episodes on anti-fraud and security at Coinbase

Swap protocol on FutureTechPodcast

Token Sale Projects

Mark D'Agostino: Why Grid+ is built on the public Ethereum chain

The Decentraland white paper and What would centralized VR look like?

Decentraland team

0x Development Roadmap

Decentraland & district0x

A prediction market project doing a token sale tried to get attention with crazy attacks on Augur and Gnosis, yet apparently just copied and pasted code.

Indorse: Real Identity and Real Value from professional social networking site

Token Sales

Evolving the Cofound.it Priority Pass for the Musiconomi Crowdsale

VC Albert Wenger says founders shouldn't try to get the best terms in pre-sale rounds.

One glaring problem with TenX tokens

Blockchain... The End of All Corporate Business Models?

RocketPool: Automated Sale Agents for token sales

"U.S. ICOs shouldn’t be scared of the SEC" Pretty much all of this is the diametric opposite of my view, and I'd wager lots of money that it was not written by a lawyer. Government is often slow to act, but a lack of current action does not indicate a lack of future action.

General

Disrupting the trust business - The Economist

The rumors are true: USV's Joel Monegro and Chris Burniske are starting a crypto fund

Mougayar: "The token itself is not your new business model. What the token enables for you and for your users is the key part to focus on"

Podcast about ZCash's "Ceremony"

Dan Romero's Digital Currency reading list

CNBC: "This hot digital currency trend is minting millions, but US investors aren't allowed to play"

Dates of note

From Token Sale Calendar:

Upcoming token sale start dates:

July 20 -- Propy

July 24 -- Everex

July 24 -- TribeToken

July 31 -- RexMLS

August 1 -- Harbour DAO

August 8 -- Decentraland

August 8 -- Indorse

August 15 -- Ox Protocol (mandatory registration Aug 9-12)

August 15 -- BitDice

August 28 -- HelloGold

August 31 - Monetha

September 5 -- Viberate

September 13 -- Unikoin

Ongoing token sales:

Fund Yourself Now

Blocktix

Macroverse

NeverDie

Dentacoin

DAO.casino

Suretly

Dent

district0x

Delphi

Agrello

Coindash

ACT

MyBit

You can find this calendar updated daily-ish at TokenSaleCalendar.com

[I aim for a relatively comprehensive list of Ethereum sales, but make no warranty as to even whether they are legit; as such, I thus likewise warrant nothing about whether any will produce a satisfactory return. I have passed the CFA exams, but this is not investment advice. If you're interested in what I do, you can find my somewhat out-of-date investing thesis and token sale appreciation strategies in previous newsletters.]

Listings: [first name] @ticketleap.com or tweet @evan_van_ness. Please provide: 1) your URL, 2) sale date and 3) a brief description of how you are using Ethereum.

Newsletter housekeeping

Some time in early August, there will be an announcement that I've joined ConsenSys. Here's a logo to draw your eye in case you were going to skip over this section:

I'm very excited about this move and will have significantly more to say in the future. The newsletters should become more regular again! In the meantime, I wanted to make it clear so that you can judge whether I favor ConsenSys projects.

My charge from Joe Lubin is pretty similar to what Status has told me: keep telling the truth and covering the space objectively, even if the truth hurts.

This section is (almost?) always the link for sharing

The best compliment you can give this is to share or upvote: http://www.weekinethereum.com/post/163166486333/july-16-2017 Follow me on Twitter? @evan_van_ness

This newsletter is supported by Status.im. But in case you still want to send Ether (or tokens?): 0x96d4F0E75ae86e4c46cD8e9D4AE2F2309bD6Ec45

Sign up to receive the weekly email.

1 note

·

View note

Text

How Philips Has Pivoted In the COVID-19 Pandemic: Connected Care From Hospital to Home

What a difference 90 days makes.

I was scheduled to meet with Roy Jakobs, Chief Business Leader of Connected Care at Philips, at HIMSS in Orlando on 9th March 2020. I’d interviewed Roy at CES 2020 in Las Vegas in January to catch up on consumer health developments, and the March meeting was going to cover Philips’ innovations on the hospital and acute care side of the business, as well as to learn more about Roy’s new role as head of Connected Care.

HIMSS cancelled the conference just days before it was to commence….due to the great disruption of COVID-19.

Philips’ business, plans and projects had already been reshaping and deploying in Asia and Europe by then, Roy explained to me when we were finally able to convene by phone in late May.

“We feel compelled to deliver on our purpose more than ever,” Roy told me in the first minutes of our call. “People are going out of their way to make it happen,” noting “extraordinary efforts” and teams mobilizing in the pandemic to meet the moment.

Philips continues on its “journey into connected care,” as Roy described the current trajectory as the company has pivoted directly into the heart of the coronavirus pandemic with health care systems around the world.

“COVID is a terrible pandemic,” he noted as his team is, “learning our way through it. It’s also an enormous stress test of the [health care] system. And with any stress test, you see where the limits are in what you have been building to-date,” he humbly confessed.

In the immediate term, as Roy coined it the “extreme short term,” Philips has been working on ventilators, monitors, installing equipment and servicing and supporting health system clients.

But the company is also working on solutions for the longer term, learning through the pandemic.

Philips, recently named as one of the largest Fortune Global Companies in 2020 (#385, up 46 spots and ranking in the top 10 largest public health care companies in the world), has been working globally with health systems since the emergence of the coronavirus in Wuhan, China in 2019.

Philips was involved early on in responding to health system demands in the ASEAN region, discussed here in Healthcare IT News.

The company quickly learned that scaling in a pandemic can’t just be a physical phenomenon – the need to ramp up, so much so quickly, had to be grounded in digital solutions versus only physical ones (e.g., equipment and hardware).

Roy and I discussed Philips’ journey to this moment, starting in 2015—that doubling-down to becoming a health-tech company, a vision of digital health on both the hospital/professional and consumer sides of the equation. At that point, the company left behind other businesses not core to health. In that initial vision, Philips already envisioned care settings outside of hospitals. The signal for me was being served a smoothie from a Philips-branded food truck parked in front of the Austin Convention Center at South-by-Southwest in March 2015 as the sentinel event in my mind’s eye when Philips pivoted to digital health: positioned as, “Philips Connect to Healthy.” [For a blast-from-the-past nostalgic read, here’s the post I wrote at the time here in Health Populi].

Fast forward to the COVID-19 era: an ecosystem where you take care settings outside the walls of hospitals into homes. Now, this is a reality not a vision as health citizens around the world have complied with government mandates to #StayHome, shelter-in-place, from Chinese provinces to Madrid, to northern Italy and westward to the hotspot of New York City.

In this pandemic, “People could not leave their houses and could not, or would not, go to hospitals,” Roy observed. “We had to reinvent how to engage, monitor, and treat” patients with new approaches both in and outside the acute care setting.

Thus, the company continues on its journey of Connected Care — driven by the dramatic demands of a very tricky and infectious virus. Philips had already developed and was in the process of building new modules and solutions with customers before the COVID disruption. “But for hospitals to scale these was very difficult…the necessity to change wasn’t felt,” until….COVID-19.

“The downside of digital is that it is hard to change a legacy software system,” Roy explained. If a health system has built up a ten-year legacy with a system, cannot completely change in the short run. That’s the hospital side of the challenge of digital disruption.

Then consider the patient/consumer perspective. In many countries and in peoples’ minds, the only “real” way to get proper treatment is to go to a doctor and, in some countries, head to a hospital or a specialist clinic. “That is an intense and costly way to treat patients,” Roy said.

“For change to happen, it takes two parties willing to change. The willingness is there now,” Roy found, due to the disruption of COVID-19.

Philips has been intensively working on these challenges in real-time. In one case, the company has been collaborating with a health system operating 23 hospitals. Each institution had their own workflows and so Philips had to coordinate and develop an approach baking in interoperability and a cloud-based solution – consistent with the connected care journey the company had embarked on. As part of this project, the team asked, “How can we make this a more open environment for data flow, with analytics on top?”

Philips has seen a surge in demand for such solutions, with fast-growing demand for telehealth that helps to scale care outside of the hospital walls. The company has also responded to requests for specific modules, such as supporting patient engagement solutions that enable consumers to ask questions, triage and diagnose severity of an illness.

Another facet of telehealth is in helping to scale intensive care units (ICUs). In health systems with high-demand for COVID care, Philips has seen intense demand to extend care via “eICUs” which enhance productivity in scarce resource situations. Philips worked with UK Healthcare, part of the University of Kentucky academic health system, to deploy this as part of the organization’s response to the pandemic.

As part of the connected care patient journey, and also to enable hospitals to balance scarce capital and labor resources, Philips imagined how patients dealing with COVID-19 could step-down from intensive care to lower-intensity settings. The company pioneered a new disposable sensor to track vital signs that, as Roy described, “watches over you independent of a hospital bed.” This wearable technology is part of the remote monitoring environment that clinically surveils patients for signs of deterioration which can then allow clinicians to intervene early and improve patient outcomes. In the coronavirus pandemic, hospitals want patients to be (appropriately) discharged home from hospital as soon as possible.

This biosensor will be able to support patients beyond COVID-19 who are on different care pathways such as cardiac patients who need to be observed over time for heart function improvement or deterioration. This will further Philips’ vision for Evolution of Care Settings from hospital to home and self-care modes.

So we came full-circle in this conversation, which began at CES in Las Vegas as we brainstormed consumers at home, keen on prevention, self-care and caring for chronic conditions as much as can be done in the home setting. In the COVID-19 era, my consumer research has revealed new workflows by people at home, seeking more empowerment, health literacy, and control by staying away from health care settings to limit personal exposure to the virus.

The second trend coming from the opposite direction is a push from the hospital to the home. A year ago when we spoke about this concept, it was early on the adoption curve. In the post-pandemic landscape, hospital-to-home for acute care is more salient as hospitals deal with balancing scarce resources.

“This is a journey that starts with awareness,” Roy said. The pandemic has surely switched on that awareness for both hospitals and clinicians as well as consumers, patients and caregivers. “It’s changed the adoption curve” across health systems, Roy noted, as the coronavirus has provided momentum to truly plan for and implement digital transformation in health care.

“This is an exciting phase we’re in,” Roy said. “We haven’t solved everything yet, but we’re working strongly, hand in hand, with hospitals. There’s a lot to take care of.”

Health Populi’s Hot Points: As of late May 2020, U.S. patients still hesitated to return to hospitals, emergency rooms, outpatient surgery centers and urgent care. This last chart details a question from the latest Kaufman Hall COVID-19 Consumer Survey conducted in late May 2020.

Telehealth has fast-morphed into a much-demanded virtual visit platform for millions of patients, now consumers making proactive decisions about just where and how they want to participate in health care.

People have grown new health literacy muscles — about viruses, contagion, prevention, immunity, the power of food-as-medicine, the risks of mental health and loneliness — a host of learnings over a few months among hundreds of millions of people with growing awareness of individual and public health.

Philips’ work evolving the Evolution of Care Settings will be part of a growing landscape of platforms that bridge care from hospital to community to home. Watch for more pioneering health systems to provide hospital-level care at home for patients and caregivers who want to take this on. Remote patient monitoring, wearable sensors, and consumer-facing digital health tech (like smartwatches, smart rings and Internet of Healthy Things for the home) will become common as more people have evolved into home-health consumers in the era of COVID. The new medical home is…home.

The post How Philips Has Pivoted In the COVID-19 Pandemic: Connected Care From Hospital to Home appeared first on HealthPopuli.com.

How Philips Has Pivoted In the COVID-19 Pandemic: Connected Care From Hospital to Home posted first on https://carilloncitydental.blogspot.com

0 notes

Text

5 Nov 2019: Cities and boxes. Health data. Political ads.

Hello, this is the Co-op Digital newsletter - it looks at what's happening in the internet/digital world and how it's relevant to the Co-op, to retail businesses, and most importantly to people, communities and society. Thank you for reading - send ideas and feedback to @rod on Twitter. Please tell a friend about it!

[Image: Brittainy Newman/NYT]

Cities and boxes: convenient delivery is a growing problem

It’s all in the delivery: Amazon makes grocery delivery free with Prime, ends $15/month fee under pressure from Walmart, whose rival click and collect service was cheaper. Wider picture: the first map of America’s food supply chain.

This is a great read, and shows you what online shopping does to cities: 15% of New York City households receive a package every day - that’s 1.5 million packages, and it’s putting the city under a lot of stress.

“In some neighborhoods, Amazon’s ubiquitous boxes are stacked and sorted on the sidewalk, sometimes on top of coverings spread out like picnic blankets. ‘They are using public space as their private warehouse [...] That is not what the sidewalk is for.’”

The delivery networks (Amazon, Fedex etc) are building warehouses closer to customers, to cover the “last mile” more efficiently. But even so there are traffic, carbon/pollution emissions and safety arguments in favour of click and collect, as long as the collect bit reduces the number of car and van journeys.

It feels as if internet-era retailing is now back to being a last-man-standing game of tremendous capital spending and lowered gross margin to win and keep customers who want speed and convenience. You wonder if all of this can ever be sustained.

Health data

Google is buying fitness-tracker company Fitbit, the second-largest product in the “wearables” sector (and the company would probably still be independent and thriving had Apple not done so well with its Watch). There’s an interesting question about the data though.

“Similar to our other products, with wearables, we will be transparent about the data we collect and why. We will never sell personal information to anyone. Fitbit health and wellness data will not be used for Google ads. And we will give Fitbit users the choice to review, move, or delete their data.”

Now, some readers might be suspicious about that. There’s history of arms-length health tech acquisitions eventually being absorbed into the corporate parent (see Deepmind, though maybe they’ve been diligent about keeping the Deepmind data separated, you cannot know).

There are wider health concerns because Fitbits are used by some insurance companies to provide proof of activity, which makes your insurance premia lower. Here’s a UK/US example: Vitality. It isn’t crystal clear what data Fitbit sends to Vitality, but their page for a different device says “The Vitality Member app takes your step and heart rate workout data from Apple Health and uses that data to reward Vitality activity points [...] Opening and refreshing your Vitality Member app is the only way to send Apple Health data to Vitality to sync your activity.” (There were also some concerns a few years ago about a Facebook-owned app getting access to Vitality data.)

But you’d hope that the potential reputational risk would be really significant if it later came out that Google just scooped up the Fitbit data and used it to target you with ads for hedge trimmers and retirement planning. Significant enough that it wouldn’t be worth doing, you’d hope! Maybe this whole thing is just a big tech company fearful that it might miss the next big thing, so it’s trying a bit of... everything. Or preventing someone else buying Fitbit.

The wider context for Google is that it’s about search: Google is “looking to make it easier for doctors to search medical records, and to improve the quality of health-related search results for consumers across Google and YouTube”.

Is anything else happening in Big Tech x Health Data? Yes.

Amazon is buying Health Navigator, which does “online symptom checking and triage tools to companies that are looking to route patients to the right place”. Amzn will offer Health Navigator to employees as part of its internal pilot of Amazon Care clinics.

Facebook vows strict privacy safeguards as it rolls out preventive-health tool.

Sustainable John Lewis

“John Lewis has stopped selling 5p single-use plastic carrier bags at its Oxford store as part of a major trial to test and change shoppers’ behaviour. The sustainability initiatives, which were unveiled on Monday, are aimed at encouraging a “reduce, reuse and return” culture among customers and could provide a model for its other shops.”

Facebook and political advertising

Following on from last week, Facebook decided to leave all political speech and ads up [1] and said it’s about free speech and debate, and “it’s not about the money”. It probably *isn’t* about the money - it’s that Facebook are culturally allergic to activities that don’t scale or aren’t algorithmable (so eg effective content moderation will always be resisted at some level).

Twitter took a better position, and one that’s a decent swipe at FB, Twitboss pointing out that “it‘s not credible for us to say: “We’re working hard to stop people from gaming our systems to spread misleading info, buuut if someone pays us to target and force people to see their political ad… well… they can say whatever they want! ””.

[1] There are exceptions though. Someone made some pro-Brexit ads that FB rejected because the ads didn’t say who were promoting them. And in the US someone announced they’d stand as a candidate and deliberately use fake ads - FB didn’t like that.

(Also from Facebook: a new logo for the parent company, to distinguish the company from the product. The logo has both a shouty ALL-CAPS style and a retro all-of-the-colours 2014 feel. 2014 was a simpler, easier time for FACEBOOK.)

Money

Perhaps all platforms eventually expand until they include financial services? Facebook has a patent for a method of comparing a user’s financial transactions to their peers. If you own several social platforms that are about performative showing-off communicating with friends, it probably makes business sense to lean in to “keeping up with the joneses”.

And Uber announces deeper push into financial services with Uber Money.

Other news

Co-op Bank starts trial of Good Loop’s ethical ad tech.

Tesco and Co-op bosses join forces with plan to fix unfair system: Our solution to reform business rates and save the High Street - “First, cut business rates for all retailers by 20 per cent. Second, level the playing field on tax between online and high street shops by introducing an online sales levy of 2 per cent on the sale of physical goods.”

Why internet-era CTOs hire developers (rather than outsourcing).

News for all of Office365’s fans! Microsoft is combining Word, Excel and Powerpoint into a single mobile app for Android users. And Yammer is being updated and integrated more closely with Outlook, Sharepoint etc.

“The farm has both left- and right-wing troll accounts. That makes their smear and support campaigns more believable: instead of just taking one position for a client, it sends trolls to work both sides, blowing hot air into a discussion, generating conflict and traffic” - life working on a troll farm.

History of the design of the Bloomberg keyboard (the Bloomberg terminal is the Wall Street trader’s computing workhorse). This story is surprisingly interesting as it goes from mad, custom designs to something more like a standard computer keyboard.

Previous newsletters:

Most opened newsletter in the last month: Uber buys grocery delivery co. Most clicked story: Workshop Tactics kit.

News 1 year ago: Just walk out - unintended consequences in checkoutless stores.

News 2 years ago: Politically weaponised social media and election influence.

Co-op Digital news and events

Co-operate: why we prioritised ‘What’s happening’ - “Balancing and satisfying user needs and commercial needs is our top priority in Co-op Digital. But in Co-operate’s case, it was more efficient for us to lay some groundwork first. Choosing to focus on What’s happening as the first product meant we could move quickly and boost team and stakeholder morale, and thinking ahead about what would be sensible and beneficial to us in the future influenced what we built first.”

Public events, most of them at Federation House:

Human values in software production - Tue 5 Nov 6pm.

SenseMaker workshop: exploring the potential for sensor journalism - Wed 6 Nov 6pm.

Practitioners Forum: vital lessons for key co-operators - Thu 7 Nov at the Studio, Manchester.

Northern Azure User Group November Meetup - Tue 12 Nov 6pm.

Content Design Manchester Public Meet-up - Wed 13 Nov 6.30pm.

Pods Up North , an event for podcasters - Sat 23 Nov 9am..

Mind the Product - MTP Engage - Fri 7 Feb 2020 - you can get early bird tickets now.

Internal events:

All hands - Tue 5 Nov 2pm at Fed defiant.

Co-operate show & tell - Wed 6 Nov 3pm at Fed 6.

Data management show & tell - Thu 7 Nov 2.30pm at Angel Sq 13th floor breakout.

Membership show & tell - Fri 8 Nov 3pm at Fed 6 kitchen.

Food ecommerce show & tell - Mon 11 Nov 10.15am at Fed 5.

Delivery community of practice - Mon 11 Nov 1.30pm at Fed house.

Health show & tell - Tue 12 Nov 2.30pm at Fed 5 kitchen.

Targeted marketing and data ecosystem show & tell - Wed 13 Nov at Angel Sq 13th floor breakout.

Membership show & tell - Fri 15 Nov 3pm at Fed 6 kitchen.

More events at Federation House - and you can contact the events team at [email protected]. And TechNW has a useful calendar of events happening in the North West.

Thank you for reading

Thank you, beloved readers and contributors. Please continue to send ideas, questions, corrections, improvements, etc to the newsletterbot’s keyboard gerbil @rod on Twitter. If you have enjoyed reading, please tell a friend!

If you want to find out more about Co-op Digital, follow us @CoopDigital on Twitter and read the Co-op Digital Blog. Previous newsletters.

0 notes

Text

AYA Analytica financial health memo July 2019

As of July 2019, this regular podcast is available on our Andy Yeh Alpha fintech network platform.

All the 18 systemically important banks pass the annual Federal Reserve stress tests. Many of the largest lenders announce higher cash payouts to shareholders in the wake of the stress test results as of mid-2019. The total cash dividends and share repurchases can exceed $150 billion. In response, Deutsche Bank experiences 4%+ share price gains, and JPMorgan Chase, Bank of America, and Goldman Sachs each reap sharp share price increases about 2%. All these banks now maintain more than 4.5% common equity Tier 1 capital ratios, and their supplemental leverage ratios are well above the 3% regulatory minimum requirement. As the annual Federal Reserve stress test results indicate, all of the systemically important banks hold sufficient core capital to safeguard against extreme losses that might arise in rare times of severe financial stress. As a result, the Federal Reserve expects these banks to remain profitable with better survival likelihood to disgorge cash distributions to their shareholders in adverse macroeconomic scenarios. Specific macroeconomic scenarios include a 30% decline in real estate prices and a high unemployment rate with double digits. Overall, all of the systemically important banks can absorb severe post-crisis losses with sufficient cash capital utilization for subsequent shareholder payout.

Blackrock asset research director Andrew Ang shares his economic insights into fundamental factors for global asset management. As Ang indicates in a recent interview with Ritholtz Wealth Management, fundamental factor investors seek to manage macroeconomic risk to enhance their average returns. Ang focuses on 5 systematic factors: size, value, momentum, low volatility, and high quality of profit margins. Also, Ang oversees a broad basket of assets such as stocks, bonds, commodities, and currencies. The consistent application of both big data and technology helps scale total assets under management with lower transaction costs. At BlackRock, Ang decomposes his favorite fundamental factors across macro and style factors. The 3 major macro factors are economic growth, inflation, and the real interest rate, in accordance with the standard Taylor interest rate that depicts the highly non-linear Phillips curve. Ang empirically finds that these 3 major macro factors account for 85% of stock market returns. Stock portfolio analysis helps achieve higher average returns (after risk and fee adjustments) when the active fund manager focuses on size, value, momentum, low volatility, and corporate profitability. Moreover, value occasionally becomes more cost-effective relative to its own history, and momentum factor returns often cluster together in specific time periods. This factor investment methodology accords with our proprietary alpha investment model that focuses on 6 core fundamental factors (size, value, momentum, asset growth, operating profitability, and market risk exposure).

Capital gravitates toward profitable active mutual funds until the marginal asset return equilibrates near the stock market benchmark. As Stanford finance professor Jonathan Berk suggests, capital flows equilibrate persistent active mutual fund returns relative to the stock market benchmarks. Since investors first direct capital to the best active mutual fund managers, these fund managers receive so much money that it affects their ability to generate superior returns. Their average return declines to match the average return for the second-best fund managers. At this stage, investors become indifferent to investing with the first-best and second-best fund managers, so capital flows equilibrate until their average return declines to match the average return for the third-best fund managers. This process continues until the average return of investing in most active mutual funds declines to match the stock market benchmark. Capital flows may reflect persistent asset returns in the transition toward the dynamic equilibrium outcome. Only high-skill active mutual fund managers can consistently earn superior average returns when numerous fund managers compete for scarce capital flows. This rationale suggests that investors who choose to invest with active fund managers cannot expect to receive positive excess returns after we apply appropriate risk and fee adjustments.

Harvard economic platform researcher Dipayan Ghosh proposes alternative solutions to breaking up Facebook, Google, Apple, and Amazon. As Ghosh suggests, breaking up tech titans would only serve to punish innovative tech enterprises that have already created tremendous economic value. These tech titans have become quasi-monopolies that necessitate a stringent set of *utility regulations* for better privacy protection and personal data usage. These regulations should obstruct the capitalistic overreaches of tech titans in order to protect the public against economic exploitation. Facebook, Google, Apple, and Amazon reap substantive mercenary gains from their network services when more people use these services. Their current infrastructure makes it extraordinarily difficult for new entrants to offer competitive levels of consumer utility. The tech titans extract consumer currency on the basis of personal data and attention. Moreover, these tech pioneers extract consumer currency on one side of the platform, and then exchange such currency for monetary revenue at high margins on the other side of the same platform. This subtle but corrosive form of economic exploitation seems most objectionable to U.S. Justice Department, Federal Trade Commission, and European Commission. Ghosh thus advocates an alternative case for utility regulations in lieu of breaking up the tech titans.