#zimbabwe gold coins

Text

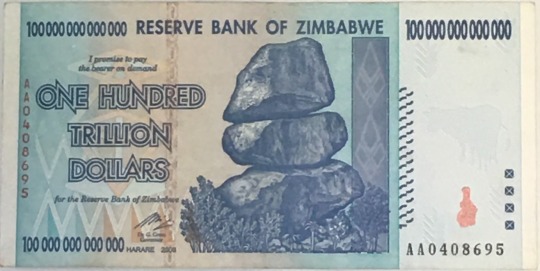

Zimbabwe’s “RTGS Dollar” Can Be Used to Purchase New Gold Coins; Not So for 2008 Zim Inflation Currency

Zimbabwe's Central Bank recently introduced a new set of gold coins in a bid to boost the country's economy. The coins, which come in denominations of 2, 5, 10, and 20 Zimbabwean dollars, are said to be made from locally sourced gold.

The introduction of the new coins has been met with mixed reactions, with some Zimbabweans expressing excitement at the prospect of having a new form of currency, while others have raised concerns about the practicality of using gold coins in everyday transactions.

Which Zim Currencies Can Be Used to Purchase the Coins?

One of the main questions that has been raised is whether RTGS (Real Time Gross Settlement) dollars can be used to purchase the gold coins. RTGS dollars are Zimbabwe's official currency and are used for electronic transactions, but they are not widely accepted by all merchants.

According to the Reserve Bank of Zimbabwe, the new gold coins can be purchased using any form of legal tender, including RTGS dollars. This means that Zimbabweans who have RTGS dollars can use them to buy the gold coins.

What about Zimbabwe’s 2008 Hyperinflation Currency?

Unfortunately for collectors around the world who have made the 2008 $100 Trillion Zimbabwe banknote one of the most popular numismaic collectibles of all-time, they won’t be able to help land the new gold Zimbabwe coins.

The reason is rather simple. 2008 Zimbabwean money cannot be used to buy anything, much less cold coins. In 2008-2009, Zimbabwe experienced hyperinflation, and as a result, the currency became practically worthless. In response, the Zimbabwean government abandoned the Zimbabwean dollar and adopted a multi-currency system. The primary currencies used in Zimbabwe are now the US dollar, the South African rand, and other foreign currencies. At the height of the hyperinflation, Zimbabwe released a $100 trillion dollar bill, which at its height was worth something like $1.36 USD.

Gold coins, like any other goods or services, typically require a recognized currency or a form of payment that is widely accepted. Since the 2008 Zimbabwean money is no longer in use and has no value, it cannot be used to purchase gold coins or any other items. If you're interested in buying gold coins, you would need to use a recognized currency or another form of payment accepted by the seller.

However, while officiallt the RTGS dollar can be used to purchase the coins, some experts have warned that using RTGS dollars to purchase gold coins may not be the most practical option. This is because the value of gold is constantly fluctuating, and it may be difficult for merchants to accurately determine the value of the coins in RTGS dollars.

Despite these concerns, the introduction of the new gold coins is seen as a positive step towards stabilizing Zimbabwe's economy, which has been struggling for years due to hyperinflation and a shortage of foreign currency.

The use of gold as a form of currency is not new in Zimbabwe. The country has a rich history of gold mining, and gold was once used as a medium of exchange before the introduction of paper currency.

In recent years, there has been a renewed interest in gold as a form of currency, with some countries, such as China and Russia, increasing their gold reserves in an effort to diversify their currencies.

The introduction of the new gold coins in Zimbabwe is therefore seen as a step towards aligning the country with this trend. It remains to be seen whether the coins will be widely adopted by Zimbabweans, but for now, they represent a glimmer of hope for a country that has been through so much economic turmoil in recent years.

#zimbabwe currency#zimbabwe#zim#zims#currencies#currency#foreign currency#banknotes#banknote#100 trillion#100trillion#rtgs dollar#money#african money#cash#zimbabwe cash#zimbabwe money#gold#gold coins#zimbabwe gold coins#coins

11 notes

·

View notes

Text

Hope to control the situation by introducing gold coins

Hope to control the situation by introducing gold coins

The African country of Zimbabwe is facing severe inflation. While inflation was 191 percent in June this year, it reached 257 percent in July. This rapidly increasing inflation has pushed the common people of the country to face extreme crisis. On the one hand, commodity prices are increasing, on the other hand, currency values are decreasing. Added to this is the acute water crisis. Most…

View On WordPress

0 notes

Text

Zimbabwe introduces gold coin currency— to fight high inflation

Zimbabwe introduces gold coin currency— to fight high inflation

With inflation soaring in Zimbabwe and the country’s currency in free fall as people abandon it for the U.S. dollar, the government of President Emmerson Mnangagwa is fighting back with a novel strategy: gold coins.

Starting Monday, Zimbabwe is selling one-ounce, 22-carat gold coins bearing an image of Victoria Falls, its world-famous natural wonder. Each has a serial number, comes with a…

View On WordPress

0 notes

Note

Hi there! I read your post about Egypt and Cleopatra, and now I am really curious about the African Kingdoms you mentioned and was wondering if you could tell us more about them please, they sound really interesting.

Oh, there's SO much I could tell you, and there's so many African kingdoms that have been woefully understudied--and many more aside from the ones I mentioned. They all have their own rich histories, cultures, political intrigue, and it's an actual tragedy that they aren't discussed more. I'm still researching myself, so I'll just review some of my favorite things from each kingdom.

Aksumite/Axumite Empire: Located in modern-day Ethiopia, this empire existed from the 1st to 8th century CE, though its prime was from the 3rd to 6th centuries CE. The Axumites converted to Christianity of their own free will over 1,000 years before colonialism and as a result have ancient churches, some made of stone and carved from the earth itself. They also were the first African kingdom to mint their own coins, and their capital city of Axum had, at its peak, 20,000 people living in it. Also, I love the Dungur palace. Here's a reconstruction of what it looked like:

LOOK AT IT.

Source: x

Kongo: Located in central Africa around modern-day Angola and the Democratic Republic of the Congo from the fourteenth to the twentieth centuries. This kingdom had a rich social hierarchy, apparently had ambassadors to Europe, and some people practiced Catholicism, which led to their own branch of Christianity led by a woman named Beatriz Kimpa Vita in the 1600s who believed she had visions that informed her Jesus actually came from Kongo. Yeah.

Sources: x, x

Loango: A neighbor of Kongo, but one we know much less about due to Kongo having a long, well-documented history of interacting with Europe (see: the ambassadors), and Loango... does not. But we do know they also had a rich social hierarchy, and we have this map of their capital city.

Sources: x, x

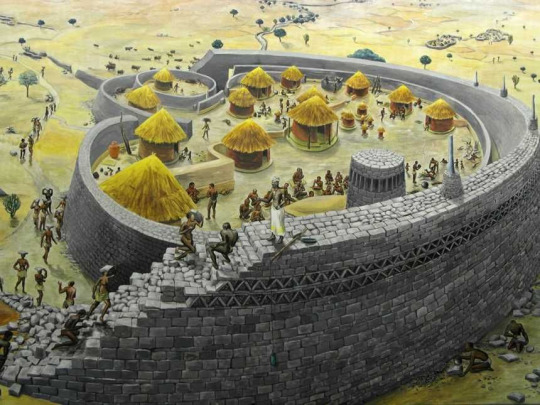

Great Zimbabwe: From 1100- 1500, located in modern-day Zimbabwe, this was a city of the Zimbabwe empire that was either used for storing grain or as a royal residence. Either way, the ruins of said city look like this:

Here's a reconstruction:

Sources: x, x, x, x

Ghana/Mali/Songhai: These were three successive empires from West Africa, with Ghana being the first from the 7th to 13th centuries, Mali being the second from the 13th to 16th centuries, and Songhai being the last one from the 15th to 16th centuries. If you learn about a non-Egyptian African civilization at all in school, chances are it's the Ghana empire and its successive empires, and they're most famous for gold, Timbuktu (with its ancient mosques, library, and university), and Mansa Musa.

Sources: x, x, x, x, x

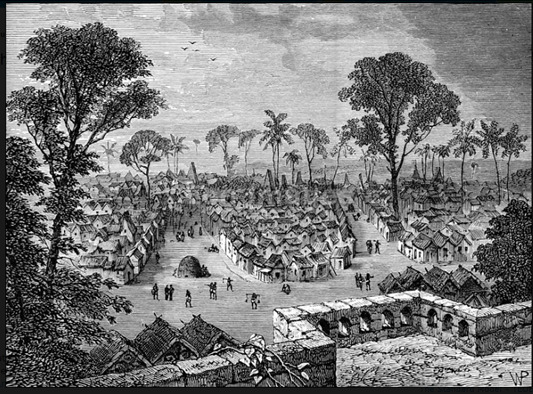

Ashanti/Asante Empire: Located in modern day Ghana, this kingdom lasted from the eighteenth century to the twentieth century. This kingdom is most well-known for its role in the slave trade. The Ashanti had well-built roads and architecture, and a little fun tidbit about them is that, after the introduction of guns, they actually had a minor firearms industry.

Here's their capital, Kumasi:

Source: x, x

Swahili Coastline: The coastline was made up of MANY city-states that saw their prime in the 11th to 15th centuries--including Mombasa, Zanzibar, and Kilwa--that participated in the Indian Ocean trade route, and pottery from as far away as China has been found in these cities. Many of these cities also practiced Islam and had their own mosques. Kilwa is my personal favorite:

These cities were built of stone, but Kilwa's palace, in particular, was built of coral. Its architecture led to the city being described by Ibn Battuta as one of the most beautiful in the world, which is part of why it's so fascinating to me.

Source: x, x

Of course, this barely scratches the surface. There are many more kingdoms all over the continent and a variety from ancient and pre-medieval times that deserve much more love.

And this image doesn't even cover them all!

So yes, ancient and medieval Africa deserve much more love, more research and more hype, and hopefully one day soon they'll get just that.

67 notes

·

View notes

Text

Ask An Skilled: Why Invest in A Gold IRA?

youtube

Provided that governments and automakers at the moment are closely pushing EVs to the mass public, investing in silver utilizing an IRA or 401k could also be a smart approach to diversify your portfolio with a tough asset that has intrinsic value and that has utility beyond cash… Earlier than getting started with precious metals investing, communicate with a licensed monetary skilled to see whether or not gold or silver bullion is sensible on your monetary state of affairs. When you choose your precious steel dealer and depository, the subsequent step is deciding your precious metallic funding. This means, you should purchase gold bullion, nuggets, or any other kind of precious metallic allocation you want. For instance, if an investor is 25 years outdated, has current financial savings of $1,000, and plans to contribute an additional $5,000 annually at a 6% average return, they might have an estimated value of $1.01 million once they retire at 65 if they allocate 10% of their savings to treasured metals. Furthermore, the company’s annual production of gold stands at a median of 180,000 ounces. For example, naming a belief as an alternative of a partner as beneficiary removes the surviving spouse's potential to roll over the IRA into his or her name to take advantage of the IRA possession guidelines.

This could provide investors with a straightforward method to purchase gold with out paying further, but also with out the security of real tangible belongings like physical gold. The very best technique to put money into gold by way of a traditional IRA is to buy shares of gold mining companies. Novice investors normally method me asking how they should purchase a particular metal, usually gold or silver. Additionally, you cannot take loans out of your Money Buy Plan, unlike many defined contribution plans. Remember, there are limits to how a lot you can contribute to those accounts yearly, and you might never be capable to make up for the money you withdraw. General, Augusta Treasured Metals, GoldCo, and Birch Gold are the best choices within the trade to invest in valuable metals of many varieties and for buying gold bullion (coins and bars) within your retirement accounts. The advantages of investing in IRA-authorized gold in an IRA, are great. In contrast to other gold individual retirement account firms, Augusta doesn't cover charges within the small print. https://goldira4u.com for Transparency: When searching for the best Gold IRA companies, transparency in pricing and charges should be your top precedence.

Five corporations made the record for most reliable and greatest general investor satisfaction. If you retire, you will need to be capable to take pleasure in a snug as well as enjoyable experience. Baker, who like Rudland and Macmillan is from Zimbabwe, also is the owner of Rappa Refinery, a gold refinery in South Africa which supplies Aulion with gold, the investigation exhibits. Withdrawals made after the account person turns 59½ and after the account has been open for at the least 5 years are thought-about eligible distributions. To assist aid your funding decision, you can view extra Oxford Gold Group products right here. Worse, if you take a nonqualified withdrawal, the taxable portion of your withdrawal will get hit with an extra 10 % tax penalty.

Investing in gold and silver can be a fantastic way to diversify your Roth IRA portfolio and protect your retirement savings from market volatility. In addition, it presents Bitcoin trading, which is absolutely safe. You’ll most likely want to maintain your treasured metals in a secure place the place thieves won’t be capable of entry them easily. Should you engage in a prohibited transaction, your complete account stops being an IRA as of the primary day of that year, and the account is treated as having made a taxable distribution of all its assets to you based on truthful market value on the first day of the year. You will also have to file Kind 8606 if your QCD doesn’t cover your complete RMD. Observe also that it is feasible for a QCD to cover your entire RMD. It’s also vital to note that the 0% bracket will not be a cliff. Traders can select from over 2,500 various kinds of bullion products. On November 9, Canaccord analyst Dalton Baretto reaffirmed a Buy ranking on SSR Mining Inc. (NASDAQ:SSRM) and lowered the value goal to $25 from $26. When an individual purchases shares of a gold agency, they're essentially purchasing a stake in the corporate, making returns or losses from its profits. The suitable proportion of a portfolio to dedicate to gold investments will differ by individual.

1 note

·

View note

Text

Champ Profit

Website: https://www.champprofit.com/

Champ Profit stands as your dedicated Smart Money Team, guiding you toward financial freedom with top money transfer rates and intelligent trading insights. In a domain often clouded by misinformation and complexity, Champ Profit shines by delivering unbiased reviews and clear, reliable insights into brokers and trading platforms, ensuring your decisions in the forex trading world are always well-informed and strategic. Catering to both beginner and seasoned traders, our platform provides easy-to-understand educational content, daily stock trading news, market insights, and real-time updates, all designed to empower you, minimize risks, and maximize gains. Navigate with confidence, leverage expert analyses, and explore diverse investment opportunities with Champ Profit, your authentic ally in maximizing your trading potential.

Facebook: https://www.facebook.com/ChampProfit

Instagram: https://www.instagram.com/champprofit/

Youtube: https://www.youtube.com/channel/UCW_UoCfjy9gON5wK7uBPyLA

Telegram: https://t.me/ChumpProfitForexSignals

Keywords:

barakah money transfer

ria money transfer near me

ria money transfer uk

ria money transfer uk

baraka money transfer

vanguard investments uk

aps money transfer

transfer money to eur

al baraka money transfer

worldremit money transfer

transfer money to south africa

al barakah money transfer

mangal money transfer

taaj money transfer

natwest currency exchange rates

transfer money from australia to uk

tax efficient investing uk

uk trade and investment

best investment trusts for income

can a power of attorney transfer money to themselves uk

barakah money transfer uk

john lewis currency exchange rates

santander currency exchange rates

best currency exchange liverpool

mukuru money transfer zimbabwe

transfer money from canada to uk

best way to invest 20k short term uk

invest in mutual funds uk

uk tax on investments

vanguard minimum investment uk

best investment trusts for retirement income

currency direct exchange rate

does money transfer affect credit score uk

al baraka money transfer uk

santander currency exchange rate

western union currency exchange rates today

transferring money to solicitor for house purchase uk

can i transfer money from clearpay to bank account uk

ria money transfer uk login

inward investment uk

seed investment uk

uk tax free investments

bank of scotland currency exchange rates today

smart currency exchange rates

visa currency exchange rate

best currency exchange in edinburgh

best currency exchange leeds

best currency exchange manchester

transfer money to china from uk

transfer money from uk to poland

transfer money to poland from uk

baraka money transfer uk

transfer money from south africa to uk

transfer money to russia from uk

currency xtra exchange rate

john lewis currency exchange rate

spain currency exchange rate

tesco currency exchange rates pound to euro

best currency exchange belfast

best currency exchange glasgow

mukuru money transfer uk

money transfer to ghana from uk

transfer money from uk to russia

transfer money from spain to uk

invest in silver uk

investment club uk

new investment zones uk

best way to invest 20k uk

how to invest in an index fund uk

best currency exchange rates glasgow

how to invert currency exchange rate

nepal currency exchange rate

best currency exchange birmingham

best currency exchange bristol

best currency exchange cardiff

best currency exchange edinburgh

best currency exchange newcastle

best currency exchange nottingham

best currency exchange rates glasgow

best currency exchange sheffield

what is the best forex trading platform uk

transfer money australia to uk

money transfer regulations uk

best place to buy investment property uk

uk real estate investment trust

vanguard uk minimum investment

best gold coins to buy for investment uk

what lot size is good for $5000 forex account

best currency exchange aberdeen

what is a pip forex trading

what is better than forex trading

what is gold trading in forex

what is liquidity in trading forex

what is metatrader 4 forex trading

what is the best app for trading forex

what is the most profitable forex trading strategy

how to activate e commerce payment on icici forex card

how to calculate lot size in forex

how to calculate pips in forex

how to calculate pivot point in forex

how to calculate used margin in forex

how to check forex card balance hdfc

how to check hdfc forex card balance

how to choose a forex broker

how to get a funded forex account

how to open a forex trading account

how to read forex market

how to start a forex brokerage

how to start forex trading uk

what is a pip worth in forex trading

what is a pivot point in forex trading

what is a pullback in forex trading

what is a swing trade in forex

what is a trade size in forex

what is a trading plan in forex

#what is a trading plan in forex#what is a pullback in forex trading#what is a pip worth in forex trading#how to check forex card balance hdfc#how to read forex market#how to calculate lot size in forex#vanguard uk minimum investment

1 note

·

View note

Text

On Oct. 5, the gold-backed digital token under the name Zimbabwe Gold (ZiG) officially kicked off as a payment method. The launch was announced by the Reserve Bank of Zimbabwe (RBZ). The first time the RBZ introduced its new project was in April 2023. The central bank specified that every issued digital token would be backed by a physical amount of gold held in the bank’s reserves. The RBZ started issuing physical gold tokens last year, claiming their successful adoption. The mission behind both physical coins and freshly introduced ZiG is to persuade local investors to put their money into national assets and not American dollars, which is not an easy task in a country with a triple-digit inflation level. As the RBZ Governor, Dr. John Mangudya said earlier: “The issuance of the gold-backed digital tokens is meant to expand the value-preserving instruments available in the economy and enhance divisibility of the investment instruments and widen their access and usage by the public.”Digital tokens can be stored in either e-gold wallets or e-gold cards and are tradeable both for P2P and business transactions. The RBZ reported several levels of prices, for which ZiG could be both, depending on the weight of its gold reserve. Thus, one can buy 1 ounce of ZiG for $1,910 and 0.1 ounce for $191. According to the Bank, on Sept. 28, investors bought the equivalent of 17.65 kg in ZiG, paying with both Zimbabwean and American dollars. The total amount of ZiG, sold since the previous rounds of digital token sales, stands at around 350 kg of gold. Zimbabwe has grappled with currency instability and rising inflation for more than a decade. In 2009, the nation adopted the U.S. dollar as its official currency in response to a period of hyperinflation that had rendered the local currency practically worthless. In an attempt to revitalize the domestic economy, Zimbabwe reintroduced its own currency in 2019. However, this move was followed by a resurgence of currency volatility.

0 notes

Text

Reserve Bank of Zimbabwe Set to Launch Gold-Backed Digital Token (GBDT) for Retail Use Following Successful Investor Interest

Reserve Bank of Zimbabwe Set to Launch Gold-Backed Digital Token (GBDT) for Retail Use Following Successful Investor Interest

Source: Shutterstock

The Reserve Bank of Zimbabwe (RBZ) has announced its advanced plans to launch Gold-Backed Digital Token (GBDT) for retail purposes following its successful reception among investors, a success the Bank hailed as “commendable” in a recent report.

During the presentation of the Mid-Term Monetary Policy Statement (MPS) on Wednesday, August 9, Governor John Mangudya of the RBZ disclosed that efforts are in progress to elevate the GBDTs to the status of a medium of transactions.

According to Mangudya, now the GBDT “shall be scaled up to be used for transactional purposes by the public.”

“The Bank is at an advanced stage in preparing for the eventual rolling out of GBDT for transactional purposes in Phase II of the project under the code or name ZiG, which stands for Zimbabwe Gold.”

“It is envisaged that the transactional phase will see GBDT complementing the use of the US dollar in domestic transactions,” he said.

The RBZ governor also announced plans for nationwide awareness campaigns to educate the public about the benefits of GBDT.

This digital instrument will be the foundation for the country’s central bank digital currency (CBDC), as Zimbabwe Gold closely aligns with CBDC characteristics.

However, the MPS report highlighted the continued importance of Gold Coins as a monetary policy tool, as it backs the GBDTs. It had absorbed over ZW$35 billion from 36,059 coins by July 14, 2023

The first maturity after the 180-day vesting period was January 25, 2023. Only 769 gold coins (2% of total sales) have been redeemed, affirming their value-retention role.

Unveiling Gold-Backed Digital Tokens (GBDTs) as Zimbabwe’s Answer to Inflation

To complement physical gold coin sales, enhance investment instrument divisibility, and broaden public access, the Bank launched Gold-Backed Digital Tokens (GBDT) on May 12, 2023.

According to the Mid-term financial report, by July 21, the Bank had executed 11 GBDT issuances, garnering 590 applications for tokens worth ZW$50.50 billion (US$7,794.87). Consequently, the Bank issued 325,024,524 milligrams, equivalent to 325.02 kg of gold.

These tokenized digital coins aim to strengthen the national currency, and offer an alternative investment, diverging from the common practice of pursuing US dollars on the parallel market.

The tokens will serve as a medium of exchange for both individuals and businesses, playing a crucial role in stabilizing the Zimbabwean dollar and addressing the issue of inflation.

Given Zimbabwe’s track record in successfully managing inflation, there’s no need for apprehension regarding the implementation of the GBDTs .

In June, Zimbabwe witnessed a staggering 175.8% inflation rate due to adopting a new bank benchmark and exchange rate depreciation. Simultaneously, the RBZ set a 150% interest rate.

Source: TradingEconomics

The Government and Bank actions, such as exchange rate liberalization, taking on external liabilities of the Bank, and enforcing local currency payments for duties and taxes, helped ease inflation. These measures appreciated the exchange rate, causing monthly inflation to drop from the June peak to -15.3% in July 2023.

Similarly, annual inflation, which hit 175.8% in June 2023, significantly reversed to 101.3% in July 2023. The positive trend will persist as the effects of these measures take hold, further reducing the risk of adopting GBDTs for local transactions.

The Information contained in or provided from or through this website is not intended to be and does not constitute financial advice, investment advice, trading advice, or any other advice.

New Post has been published on https://crynotifier.com/reserve-bank-of-zimbabwe-set-to-launch-gold-backed-digital-token-gbdt-for-retail-use-following-successful-investor-interest-htm/

0 notes

Text

Zimbabwe Central Bank Says Gold-Backed Tokens Set to Be Used for ‘Transactional Purposes’

An ‘Effective Monetary Policy Instrument’

The Reserve Bank of Zimbabwe (RBZ) has said it is now “at an advanced stage in preparations for the rolling out of GBDT for transactional purposes.” The bank said the rollout would see the gold tokens complement the U.S. dollar “in domestic transactions as retailers will be offered a safer, more convenient, and value-preserving medium of exchange.”

In a recently released mid-term monetary policy statement, RBZ governor John Mangudya revealed that the central bank will soon kickstart awareness campaigns whose objective is to “educate the public on the use and benefits of GBDT.” Mangudya also revealed that key stakeholders such as the Confederation of Zimbabwe Industries (CZI) have pledged to configure their systems to allow for the issuance of cards denominated in the GBDT.

As previously reported by Bitcoin.com News, the RBZ launched the gold-backed tokens in May to counter local residents’ demand for U.S. dollars. However, just a few months after the launch, the central bank governor said the GBDTs have already proved to be an effective monetary policy instrument.

“The GBDTs have since proved to be an effective monetary policy instrument with strong potential to help restore normalcy to the domestic financial and capital markets within the short term,” Mangudya said.

More Than 70% Willing to Use CBDC

The governor claimed that the “divisibility nature” of the digital gold tokens means they can be accessed or acquired by people from all economic backgrounds.

Concerning the uptake of physical gold coins, the RBZ boss revealed that out of the 36,059 coins which had been sold by July 14, only 769 gold coins or approximately 2% of the total had been redeemed following the end of the 180-day vesting period. According to Mangudya, the low redemption rate means residents and businesses are indeed using the physical gold coins as an alternative store of value.

With respect to the RBZ’s central bank digital currency (CBDC), Mangudya said the results of a consumer survey had shown that residents had limited knowledge about the envisaged digital currency. However, some 71.7% of the respondents expressed their willingness to use a CBDC if the central bank introduces it, Mangudya added.

Register your email here to get a weekly update on African news sent to your inbox:

What are your thoughts on this story? Let us know what you think in the comments section below.

Read the full article

0 notes

Text

Zimbabwe backs its digital currency with gold

Gold-backed Digital Tokens in Zimbabwe

Zimbabwe used nearly 140 kilograms of gold reserves to back the first sale of its digital money. The central bank received 135 applications valued at 14 billion Zimbabwe dollar ($12 million) to purchase the gold-backed digital tokens, it said in an emailed statement on Friday. It plans a second auction on May 18. The southern African nation has turned to the digital money to help ease soaring demand for US dollars in its economy as the value of the local currency plunged. The move was criticized by the International Monetary Fund, which urged the government to rather liberalize its foreign-exchange rate than risk depleting its reserves. The tokens are just one of the measures introduced to shore up a currency that’s weakened more than 40% against the US dollar this year, and amid soaring inflation. It’s also released gold coins and on Thursday warned that short-term interest rates may have to rise. The central bank’s benchmark rate at 140% is the highest in world. This is an article from Bloomberg. Rewrite it using different words and order but include a background about Zimbabwe problem with hyperinflationChatGPT

Zimbabwe, a country plagued by hyperinflation, has resorted to leveraging its gold reserves in a bid to address its economic challenges. In a groundbreaking move, the nation employed approximately 140 kilograms of gold to back its inaugural sale of digital currency.

To purchase the gold-backed digital tokens, the central bank received a significant influx of interest, with 135 applications amounting to a value of around 14 billion Zimbabwe dollars ($12 million). Anticipating continued demand, a second auction is scheduled for May 18.

The introduction of digital money serves as one of the strategies implemented by Zimbabwe to alleviate the surging demand for the US dollar within its economy, which has witnessed a considerable decline in the value of the local currency. Nevertheless, this move has faced criticism from the International Monetary Fund (IMF), which suggests that the government should prioritize liberalizing the foreign-exchange rate instead of risking the depletion of its reserves.

The creation of these tokens represents just one facet of Zimbabwe's multifaceted approach to stabilize its currency, which has witnessed a staggering depreciation of over 40% against the US dollar this year, alongside rampant inflation. The government has also issued gold coins as part of its efforts. Moreover, in a recent announcement, it cautioned that short-term interest rates might need to be increased. Notably, the country's benchmark interest rate of 140% currently stands as the highest in the world.

By utilizing its gold reserves as a backing for digital currency, Zimbabwe aims to combat the challenges associated with hyperinflation and the significant devaluation of its national currency.

0 notes

Text

Pro-XRP Lawyer Opens Up On Buying Supporting XRP Amid Ongoing Court Battle

Pro-XRP Lawyer Opens Up On Buying, Supporting XRP Amid Ongoing Court Battle

https://bitcoinist.com/pro-xrp-lawyer-opens-up-on-buying-supporting-xrp/

In a recent tweet, Attorney John Deaton disclosed that XRP’s utility and efficiency for cross-border transactions informed his decision to buy it in 2016. Also, the attorney revealed that Coinbase recommended the cryptocurrency to its customers in 2019 for the same purpose.

XRP’s Unique Value Proposition

According to John Deaton, his first purchase occurred in 2016 due to the attributes of the coin. However, the attorney revealed that he also bought more XRP coins in 2019, following its listing on the popular San Francisco exchange Coinbase. Notably, the crypto exchange touted the coin as one of the best cryptos for cross-border transactions.

One of the benefits of transacting with the digital asset is the lower cost it offers. The coin facilitates seamless cross-border transactions and settlements at low cost.

Related Reading: Digital Currency Backed By Gold To Be Introduced By Zimbabwe’s Central Bank

In his Tweet, Deaton shared the image showing where Coinbase promoted XRP. The exchange told its users they could send money worldwide with XRP and USDC. Coinbase also pointed out that developers optimized these crypto assets for cross-border transmission.

Attorney Deaton’s post reacted to the report that the Chinese Yuan is leading in China’s cross-border payments over the United States dollars. Regarding the report, Deaton stated that China focuses on reducing banknote usage while the US attacks crypto instead of embracing its utility.

Notably, a crypto user responded to Deaton’s post about buying the coin in 2016. The user stated that his claims were false, claiming that the attorney only joined the crypto market a few years ago.

In response, Deaton referred him to his first interview, where he announced buying Bitcoin (BTC), Ripple (XRP), and Ethereum (ETH) for the first time in 2016.

Price Trend Amid Ongoing SEC Lawsuit

According to Deaton’s post and the SEC’s lawsuit, the cryptocurrency attracted investors early in the game. Notably, the SEC accused Ripple of raising $1.3 billion by offering unregistered security beginning in 2013. As of then, XRP was below $0.60. The crypto market recorded growth in 2017 due to the entrance of more retail investors.

Related Reading: Bitcoin Emerges As Safe-Haven Asset With Correlation To Gold At 2-Year High

By 2020, the SEC sued Ripple and two of its executives for the initial coin offering (ICO) held in 2013, causing a downtrend for the coin. But even as the market anticipates the summary judgment, the coin has continued holding the firm to its value leading investors to commend its resilience.

As of press time, it trades at $0.4591, indicating a price loss of 3.30%. The coin is reacting to the market-wide downtrend, which has pushed many coins to the red zone.

Featured image from iStock and chart from Tradingview

via Bitcoinist.com https://bitcoinist.com

April 27, 2023 at 06:30PM

0 notes

Link

The Reserve Bank of Zimbabwe recently revealed that some 25,188 of its value-preserving gold coins were sold between July 2022 and Jan. 13. According to the central bank governor, John Mangudya, the gold coins “have proved to be an effective open #Blockchain #Crypto

0 notes

Text

Gold Coins Help Zimbabwe Achieve 'Price and Exchange Rate Stability' — Central Bank – Africa Bitcoin News

The Reserve Bank of Zimbabwe recently revealed that some 25,188 of its value-preserving gold coins were sold between July 2022 and Jan. 13. According to the central bank governor, John Mangudya, the gold coins “have proved to be an effective open market instrument for mopping up excess liquidity in the economy.”

Gold Coins as Alternative Value Preservation Tool

According to the Zimbabwean central…

View On WordPress

0 notes

Text

Zimbabwe introduces gold coin currency— to fight high inflation

Zimbabwe introduces gold coin currency— to fight high inflation

With inflation soaring in Zimbabwe and the country’s currency in free fall as people abandon it for the U.S. dollar, the government of President Emmerson Mnangagwa is fighting back with a novel strategy: gold coins.

Starting Monday, Zimbabwe is selling one-ounce, 22-carat gold coins bearing an image of Victoria Falls, its world-famous natural wonder. Each has a serial number, comes with a…

View On WordPress

0 notes

Text

Gold Coins Help Zimbabwe Achieve 'Price and Exchange Rate Stability' — Central Bank – Africa Bitcoin News

The Reserve Bank of Zimbabwe recently revealed that some 25,188 of its value-preserving gold coins were sold between July 2022 and Jan. 13. According to the central bank governor, John Mangudya, the gold coins “have proved to be an effective open market instrument for mopping up excess liquidity in the economy.”

Gold Coins as Alternative Value Preservation Tool

According to the Zimbabwean central…

View On WordPress

0 notes

Text

Gold Coins Help Zimbabwe Achieve 'Price and Exchange Rate Stability' — Central Bank – Africa Bitcoin News

The Reserve Bank of Zimbabwe recently revealed that some 25,188 of its value-preserving gold coins were sold between July 2022 and Jan. 13. According to the central bank governor, John Mangudya, the gold coins “have proved to be an effective open market instrument for mopping up excess liquidity in the economy.”

Gold Coins as Alternative Value Preservation Tool

According to the Zimbabwean central…

View On WordPress

0 notes