#AI budgeting tools

Explore tagged Tumblr posts

Text

AI-Powered Personal Finance Tools: The Future of Money Management in 2025

Meta Description: Discover how AI-powered personal finance tools are transforming money management. Learn about financial automation, AI budgeting tools, and how generative AI is changing the future of finance.

In 2025, AI-powered personal finance tools are no longer futuristic—they are an everyday essential. From budgeting to investment advice, AI in finance is revolutionizing how people manage their money. With the rise of generative AI and advanced financial automation, individuals now have the ability to make smarter, faster, and more informed financial decisions than ever before.

What Are AI-Powered Personal Finance Tools?

AI-powered personal finance tools are digital platforms or applications that use artificial intelligence to help users track spending, set savings goals, invest wisely, and reduce debt. These tools analyze your financial behavior, offer insights, and even automate key financial tasks—all in real time.

Why AI in Finance is a Game-Changer

The integration of AI in finance offers benefits such as:

Real-Time Analytics: Get instant feedback on spending habits and investment performance.

Predictive Forecasting: AI can forecast cash flow, suggest saving targets, and warn about upcoming shortfalls.

Personalization: Based on your unique financial history, AI tools provide tailored budgeting and investment advice.

Fraud Detection: AI systems can instantly detect suspicious activity and alert you.

How Generative AI is Reshaping Money Management

Generative AI isn’t just for creating art or writing essays—it’s now being used to write customized financial plans, generate reports, and simulate "what-if" scenarios for better planning.

Some tools even let you converse with an AI chatbot to ask financial questions like: "Can I afford a vacation this year?" or "What’s the best way to pay off my student loans?"

These conversational AI tools learn from your behavior and provide increasingly accurate and useful responses over time.

The Rise of Financial Automation

Financial automation is the process of setting your finances on autopilot. Thanks to AI, it’s easier than ever to:

Automate bill payments

Transfer funds to savings accounts

Invest regularly with robo-advisors

Consolidate and pay off debt efficiently

Financial automation reduces human error and emotional decision-making, helping you stay consistent with your financial goals.

Best AI Budgeting Tools in 2025

Here are a few AI budgeting tools making waves this year:

Cleo – A chatbot-based app that helps you save, budget, and even roast your spending habits.

YNAB (You Need A Budget) – Now AI-enhanced for predictive budgeting.

Monarch Money – Uses AI to personalize financial recommendations.

Albert – Combines AI with human financial advisors for holistic advice.

Rocket Money – Identifies and cancels unused subscriptions and optimizes your bills.

Benefits of Using AI-Powered Personal Finance Tools

Time-saving: Let AI handle complex calculations and repetitive tasks.

Improved decision-making: Data-driven insights help reduce financial stress.

Accessibility: Most tools are mobile-friendly and easy to use.

24/7 Support: AI doesn’t sleep, offering constant financial support.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Final Thoughts: Is AI the Future of Personal Finance?

Absolutely. Whether you're a budgeting newbie or an experienced investor, AI-powered personal finance tools offer powerful solutions tailored to your lifestyle. As generative AI continues to evolve, expect even more innovative ways to manage your money effortlessly.

If you're not using AI in your financial routine yet, now is the time to explore. With financial automation, AI budgeting tools, and smart analytics at your fingertips, achieving financial freedom has never been more attainable.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

#AI in finance#generative AI#financial automation#AI budgeting tools#personal finance#personal loans#personalfunding

1 note

·

View note

Text

How to Use AI to Automate Your Financial Planning

In today’s fast-paced world, managing personal finances can be overwhelming. However, advancements in artificial intelligence (AI) have made it possible to automate many aspects of financial planning, allowing individuals to streamline budgeting, saving, and investment decisions with ease. By leveraging AI-powered tools, you can simplify your financial management and make smarter decisions for…

#AI budgeting tools#AI financial planning#AI-powered savings#automated investments#financial automation tools

0 notes

Text

How AI Will Transform Personal Finance in 2025

#AI in Personal Finance#Robo Advisors 2025#AI Budgeting Tools#Future of Personal Finance#Smarter Savings with AI#Automated Investing Apps#AI-Powered Investing

1 note

·

View note

Text

Stackpack Secures $6.3M to Reinvent Vendor Management in an AI-Driven Business Landscape

New Post has been published on https://thedigitalinsider.com/stackpack-secures-6-3m-to-reinvent-vendor-management-in-an-ai-driven-business-landscape/

Stackpack Secures $6.3M to Reinvent Vendor Management in an AI-Driven Business Landscape

In a world where third-party tools, services, and contractors form the operational backbone of modern companies, Stackpack has raised $6.3 million to bring order to the growing complexity.

Led by Freestyle Capital, the funding round includes support from Elefund, Upside Partnership, Nomad Ventures, Layout Ventures, MSIV Fund, and strategic angels from Intuit, Workday, Affirm, Snapdocs, and xAI.

The funding supports Stackpack’s mission to redefine how businesses manage their expanding vendor networks—an increasingly vital task as organizations now juggle hundreds or even thousands of external partners and platforms.

Turning Chaos into Control

Founded in 2023 by Sara Wyman, formerly of Etsy and Affirm, Stackpack was built to solve a problem she knew too well: modern companies are powered by vendors, yet most still track them with outdated methods—spreadsheets, scattered documents, and guesswork. With SaaS stacks ballooning and AI tools proliferating, unmanaged vendors become silent liabilities.

“Companies call themselves ‘people-first,’ but in reality, they’re becoming ‘vendor-first,’” said Wyman. “There are often 6x more vendors than employees. Yet there’s no system of record to manage that shift—until now.”

Stackpack gives finance and IT teams a unified, AI-powered dashboard that provides real-time visibility into vendor contracts, spend, renewals, and compliance risks. The platform automatically extracts key contract terms like auto-renewal clauses, flags overlapping subscriptions, and even predicts upcoming renewals buried deep in PDFs.

AI That Works Like a Virtual Vendor Manager

Stackpack’s Behavioral AI Engine acts as an intelligent assistant, surfacing hidden cost-saving opportunities, compliance risks, and critical dates. It not only identifies inefficiencies—it takes action, issuing alerts, initiating workflows, and providing recommendations across the vendor lifecycle.

For instance:

Renewal alerts prevent surprise charges.

Spend tracking identifies underused or duplicate tools.

Contract intelligence extracts legal and pricing terms from uploads or integrations with tools like Google Drive.

Approval workflows streamline onboarding and procurement.

This brings the kind of automation once reserved for enterprise procurement platforms like Coupa or SAP to startups and mid-sized businesses—at a fraction of the cost.

A Timely Solution for a Growing Problem

Vendor management has become a boardroom issue. As more companies shift budgets from headcount to outsourced services, compliance and financial oversight have become harder to maintain. Stackpack’s early traction is proof of demand: just months after launch, it’s managing over 10,500 vendors and $510 million in spend across more than 50 customers, including Every Man Jack, Rho, Density, HouseRx, Fexa, and ZeroEyes.

“The CFO is the one left holding the bag when things go wrong,” said Brandon Lee, Accounting Manager at BizzyCar. “Stackpack means we don’t have to cross our fingers every quarter.”

Beyond Visibility: Enabling Smarter Vendor Decisions

Alongside its core platform, Stackpack is launching Requests & Approvals, a lightweight tool to simplify vendor onboarding and purchasing decisions—currently in beta. The feature is already attracting customers looking for faster, more agile alternatives to traditional procurement systems.

With a long-term vision to help companies not only manage but discover and evaluate vendors more strategically, Stackpack is laying the groundwork for a smarter, interconnected vendor ecosystem.

“Every vendor decision carries legal, financial, and security consequences,” said Dave Samuel, General Partner at Freestyle Capital. “Stackpack is building the intelligent infrastructure to manage these relationships proactively.”

The Future of Vendor Operations

As third-party ecosystems grow in size and complexity, Stackpack aims to transform vendor operations from a liability into a competitive advantage. Its AI-powered approach gives companies a modern operating system for vendor management—one that’s scalable, proactive, and deeply integrated into finance and operations.

“This isn’t just about cost control—it’s about running a smarter company,” said Wyman. “Managing your vendors should be as strategic as managing your talent. We’re giving companies the tools to make that possible.”

With fresh funding and a rapidly expanding customer base, Stackpack is poised to become the new standard for how modern businesses manage the partners powering their growth.

#2023#accounting#agile#ai#ai tools#AI-powered#alerts#amp#approach#automation#Behavioral AI#budgets#Building#Business#CFO#chaos#Companies#complexity#compliance#dashboard#dates#documents#EARLY#Ecosystems#employees#engine#enterprise#finance#financial#form

2 notes

·

View notes

Text

can't believe my therapist of all people suggested I use chatgpt to make my grocery list girl I'm fucked in the head I'm not fucking stoopid

#ai is a blight on humanity i dont care what anyone else says#watch funkyfrogbait's video on ai it sums up all my thoughts#“it can be a tool for people that need help with this sort of thing” sorry but i have a mother that loves me#if i need help I'll just ask her and she'll have a whole ass budget in excel done for me in no time#mags speaks

2 notes

·

View notes

Text

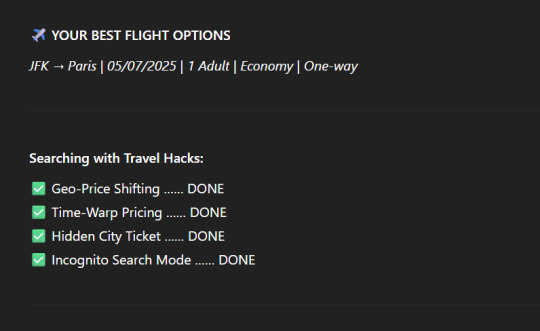

✈️ Best AI for Cheap Flights (No Sign-Up Needed)

I just found a travel tool that beats Skyscanner and Google Flights — and it’s totally free. It’s called FlyGPT and it uses AI to scan hidden deals, flexible dates, and geo-price tricks.

Saved me $175 on my last flight. No login. No ads. Just cheap tickets.

👉 Fly GPT – Find the Cheapest Flights

#cheap flights #flight deals #ai travel tool #budget travel #fly gpt #travel hacks #skyscanner alternative

#cheap flight ticket#cheap flight deals#cheap flight booking#cheap flight#ai#budget travel#flygpt#ai travel tools

2 notes

·

View notes

Text

Ultimate Guide to DeepSeek AI for Business Growth

Table of Contents of DeepSeek AI for Business Growth1. Introduction: Why AI is Essential for Modern Business Growth2. What Is DeepSeek AI?3. Top 5 DeepSeek AI Tools for Scaling Businesses3.1 Demand Forecasting Engine3.2 Customer Lifetime Value (CLV) Predictor3.3 Automated Supply Chain Optimizer3.4 Dynamic Pricing Module3.5 Sentiment Analysis Hub4. How DeepSeek AI Reduces Costs and Boosts…

#AI automation 2024#AI budgeting#AI business growth#AI for non-tech teams#AI for startups#AI implementation guide#AI in retail#AI supply chain#Business Intelligence#cost reduction strategies#data-driven decisions#DeepSeek AI#enterprise AI adoption#fintech AI solutions#generative AI for business#Predictive Analytics#ROI optimization#scaling with AI#SME AI tools#startup scaling

2 notes

·

View notes

Text

are people really using the lying hallucinating machine to: -weigh in on decisions about what is and isn't humanly edible -give coherent and true summaries of literally anything -GIVE YOU ANSWERS TO ANY SERIOUS QUESTIONS?? -FOLLOW BASIC MATHEMATICAL PRINCIPLES OF REALITY EFFECTIVELY???

take it from the person who loves writing about robots: chatGPT is fucking dumb. it works based on repetition, SEO, memetics, and feedback, none of which promote accuracy. it is the worst way to search any info you could possibly want. not only does it lie and just make shit up to make you happy, it bases those lies on aggregate sources that are boosted not by any method of actual verification, but by SEO.

what's SEO? well that's Search Engine Optimization, baby. strap in we're gonna do an example.

think about tumblr bots, alright? now, why do we block a tumblr bot? because they're annoying? no, we block them because they use their like-spamming to add search engine legitimacy to their scammy links in their bios. essentially, because of the way tumblr links to every user that ever likes or reblogs or interacts with a post on every post's individual linked page, every single one of those links is telling google's search engine that THIS scammer's page is totally legit. this boosts its algorithmic potential and makes it so that it appears higher up on search results than its scammy competitors.

but andy, you think, why are you going into a description of tumblr bots? well, reader, it's because this same principle also applies to viral posts. and what goes viral on tumblr? really funny trolling, lies, and people being generally obtuse and digging their own graves. tumblr is the town square and our algorithm is each other's interest; we delight in pointing at the latest pair of squeaky clown shoes being worn, and will drag the wearer out for everyone to see.

this. is bad. when you are an AI 'search' tool based on repetition, memetics, and SEO. because you were never taught to separate 'viral' from 'real'.

a search tool based on virality will tell you to eat a tide pod because they're a secret kind of candy. a search tool based on virality will tell you poinsettias and lilies are great to keep around your cats, and that you should put garlic in their food. a search tool based on virality will tell you that the best way to figure out whether bread is done is to stick your dick in it.

(it should go without saying but i'm going to say it anyway: DO NOT DO THESE THINGS BY THE WAY. YOU WILL DIE AND BE IN HORRIBLE PAIN AND SO WILL YOUR CAT.)

remember this rule, kids, and remember it well: a lie will go around the world twice while the truth is still getting its pants on. while it's fun to dunk and debunk, dunking and debunking doesn't reach the same eyeballs as the original thought, and by the time you're done you have five new ones to dunk on and debunk. and AI 'search' tools will never be able to distinguish the truth from the lie by design.

because here's the nastiest part of all: AI 'search' tools' results are then fed by the way people engage with the results. If the insane result goes viral, it doesn't get corrected, it gets reinforced. engagement, ragebait, corrections, all of these don't bring attention to a problem, they tell the AI it's done a good job making something that people engage with, and it will keep right on lying.

you can't if-then your way out of every lie it spits out because it's like trying to keep a lawnmower from making grass cuttings one blade of grass at a time. it's what it's designed to do. it's baked into the concept because people didn't think that their fun new toy needed to be able to tell the truth, and didn't realize what that would mean when it was asked serious questions. they just wanted it to earn more clicks, more eyes, more engagement, so that they could use that to farm more data that they can sell.

when you can't see what product being sold is, you are the product.

AI 'search' tools are genuinely dangerous, genuinely harmful to discourse, and genuinely something you should be critical of. even beyond their environmental impacts, intellectual property violations, worker's rights violations, this shit is bad, and its cousins in image and longer form text generation are worse.

we cannot allow our critical thinking skills to be eroded by these things. fight them. fight them at every turn. do not allow them into your spaces and do not allow them into your life. complacency is how they get their foot in the door to normalization, and normalization of this kind of shit is another nail in the world's coffin. i'm not kidding. it should be enough for you people that it's a theft-based hallucinatory lie machine but apparently it's not so here we are.

thank you for reading. now if you'll all excuse me, i'm going to go chug something caffeinated and deep-clean the microwave

#no one cares andy#we can't yet measure the long-term impacts of generative AI on our collective psyche#any more than we can measure the long-term impacts of algorithmic content feeds that swiftly lead to right wing rabbit holes#but we can at least mitigate some of the potential damage to society#we can tailor our ways of thinking to ask ourselves who these things benefit and why whenever we're presented with new info#who does believing this hinder? who does it hurt? who does it help? does believing this take me somewhere i really need to be?#it's not a whole philosophy of course#just a starting point#but sometimes a starting point is what we need to get ourselves moving towards achieving a better world#also i'm not a 'think of the kids' person but this is going to have a developmental impact that we won't see for years#and it will affect those who are the least privileged the worst#because they don't have the time to expend with critical thought and this will seem like a cheap useful tool#it's the deregulated rat poop sawdust instamash of discourse but it's what they have the mental budget to afford right now#which isn't entirely their fault btw it's capitalism doing its thing and doing it on purpose#alright i'm done rambling have a good day y'all

144K notes

·

View notes

Text

AI Assistants to Guide You in Travel Planning

I think everyone will agree with me if I say that planning a trip can be quite overwhelming. As you sit down to map out your next adventure, a flurry of questions may cloud your mind: Where should I go? What’s the best time to visit? Which accommodations align with my preferences and budget? What should I pack considering the local climate and culture? How do I ensure seamless bookings for…

#ai#AI for tourism#AI for travel#AI Travel Guide#AI Trip Planner#artificial-intelligence#budget-travel#business development#technology#travel#Travel Business Tool#travel-tips

0 notes

Text

The Trolls and AI Art: The Struggle of Independent Journalists

Independent journalists are no strangers to challenges. From working without the resources of major news outlets to navigating the unpredictable world of social media algorithms, these brave reporters have always found ways to get their stories out. But now, in the ever-evolving world of digital journalism, they are facing a new battle: the rising use of AI-generated art in their work. Recently,…

#AI art#AI tools#budget journalism#creative tools#Digital Media#Independent journalism#journalism challenges#media criticism#visual content

0 notes

Text

🧠 How AI Helps in Personal Finance Management

Discover how AI helps in personal finance management by automating budgeting, saving, investing, and decision-making. Smart money tips for USA users AI revolutionizes how we manage personal finances, offering insights, automation, and predictive suggestions for smarter decisions. 🔹 Smart Budgeting Becomes Effortless AI-driven apps categorize expenses, monitor patterns, and alert users when…

#AI Finance Tools#AI Personal Finance#budgeting#finance#Financial AI USA#financial-goals#money#Money Management#personal-finance#Smart Budgeting

0 notes

Text

The Rise of AI-Powered Personalized Medicine

The Rise of AI-Powered Personalized Medicine How artificial intelligence is revolutionizing healthcare by tailoring treatments to individual patients. Understanding Quantum Computing and Its Potential Impact Exploring the fundamentals of quantum computing and its future applications across various industries. The Evolution of Cybersecurity Threats and How to Stay Protected Discussing the latest…

#" "AI for workflow efficiency"#" "AI productivity tools#" "best AI tools 2025#" "budget planning guide"#" "life balance strategies

0 notes

Text

The Budget Techie’s Guide to Building a Freelance Empire Online

You don’t need a Silicon Valley bank account to build an online empire. You just need a Wi-Fi connection, a sprinkle of creativity, and the right budget-friendly tech tools. Whether you’re a writer, designer, developer, or digital hustler, freelancing in 2025 has never been more accessible—or affordable. Let’s break down how you can build a full-blown freelance business without breaking the…

#AI for solo entrepreneurs#budget tech for freelancers#freelance tools 2025#how to start freelancing cheap#low-cost freelancer guide

0 notes

Text

📱 The Best Personal Finance Apps and Tools to Master Your Money in 2025

Managing your money doesn’t have to be complicated. Thanks to today’s technology, personal finance apps and tools make budgeting, tracking spending, saving money, and even investing easier than ever before.

Whether you're trying to save more, pay off debt, or build wealth, the right app can transform your financial habits—right from your smartphone.

💡 Why Use Personal Finance Apps?

Personal finance tools help you:

Track spending automatically

Create and manage budgets

Monitor credit scores

Save money effortlessly

Set financial goals

Automate bills and savings

Google Keyword: money management tools

🔟 Top Personal Finance Apps and Tools for 2025

1. Mint by Intuit

Still a top contender, Mint connects all your financial accounts, categorizes transactions, and provides personalized budgeting tips.

Trending Search Term: track spending app

2. You Need a Budget (YNAB)

YNAB uses a zero-based budgeting approach to help users plan where every dollar goes. Ideal for goal-based savings and debt payoff strategies.

Keyword Used: best budget apps 2025

3. Empower (formerly Personal Capital)

Perfect for people focused on net worth tracking and investment monitoring. Empower blends budgeting tools with long-term wealth tracking.

Search Trigger: top personal finance software

4. PocketGuard

This app helps you control overspending by telling you exactly how much you have left to spend after bills, goals, and savings.

Keyword: save money apps

5. Rocket Money (formerly Truebill)

An AI-powered app that helps you cancel unwanted subscriptions, negotiate bills, and track spending in real time.

Search Intent: AI financial planner app

6. Goodbudget

Goodbudget uses the envelope system digitally, great for couples or families who want to sync budgets across devices.

Related Keyword: budget app for couples

7. Fyle

Designed for freelancers and small business owners, Fyle tracks expenses and offers business-oriented budgeting tools with automated receipt capture.

Trending Term: finance tools for entrepreneurs

8. Zeta Money Manager

Built for couples, Zeta offers shared expense tracking, joint goals, and even joint banking options—great for married or cohabiting partners.

🔐 Best Features to Look for in a Personal Finance App

Bank-level security encryption

Real-time transaction syncing

Goal-based savings automation

AI insights for spending trends

Custom categories and alerts

Search Term: how to automate finances in 2025

📊 How These Tools Help You Save Money

Using apps like Mint or PocketGuard, you can:

Identify unnecessary expenses

Set monthly spending limits

Get notified before overspending

Use round-up features to save spare change

Avoid late fees with reminders and auto-pay

🧠 Bonus Tools Worth Exploring

Digit: AI automates small savings from your bank account

Qapital: Lets you save toward goals using custom rules

Tiller Money: Connects Google Sheets or Excel to automate budgets

🧾 Real-World Example

Emma, a recent college graduate, used YNAB and Rocket Money to pay off $8,000 in credit card debt in under 12 months. With real-time expense tracking and automated savings, she regained control of her finances and increased her credit score by 85 points.

📱 Should You Pay for a Premium Finance App?

Many top tools offer free plans, but paid versions unlock advanced features like:

Real-time investment tracking

Subscription cancellation services

Family account syncing

AI-driven financial coaching

Choose based on your goals and budget.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

📌 Final Thoughts

Personal finance apps and tools have revolutionized how we manage money in 2025. From budgeting to saving to financial goal-setting, these apps put powerful, real-time insights at your fingertips.

Whether you're a budgeting beginner or a seasoned saver, now’s the time to upgrade your financial toolkit and build a smarter, stronger financial future.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Learn More!!

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

#track spending app#best budget apps 2025#top personal finance software#save money apps#AI financial planner app#budget app for couples#finance tools for entrepreneurs

1 note

·

View note

Text

How Eshwarprasad is Revolutionizing Indie Filmmaking with Daily Cinematic Reels

Discover how middle-class filmmaker Eshwarprasad is changing the game with daily cinematic reels, AI-powered editing, and viral storytelling through EP Ka Meter Films. Meet Eshwarprasad, a self-made filmmaker and founder of EP Ka Meter Films, who is redefining indie cinema with daily cinematic reels, Powerful AI-enhanced editing, and raw storytelling. With zero-budget resources and a…

#AI In Filmmaking#AI tools for video editing#AI Video Editing#AI-powered post production#aspiring filmmakers India#cinematic reels#cinematic vlog creator#daily content creator#DIY Filmmaking#EP Ka Meter Films#eshwarprasad-filmmaker#filmmaking with mobile#filmmaking with zero budget#Indian filmmaker journey#Indie Filmmaking#Low Budget Films#middle class filmmaker#motivational filmmaker#no budget filmmaking#passion over budget#reel storytelling#self made filmmaker#short film creator#short film director#short film production#storytelling reels#trending reels 2025#viral Short films#YouTube content ideas#YouTube filmmaker

0 notes

Text

How Eshwarprasad is Revolutionizing Indie Filmmaking with Daily Cinematic Reels

Discover how middle-class filmmaker Eshwarprasad is changing the game with daily cinematic reels, AI-powered editing, and viral storytelling through EP Ka Meter Films. Meet Eshwarprasad, a self-made filmmaker and founder of EP Ka Meter Films, who is redefining indie cinema with daily cinematic reels, Powerful AI-enhanced editing, and raw storytelling. With zero-budget resources and a…

#AI In Filmmaking#AI tools for video editing#AI Video Editing#AI-powered post production#aspiring filmmakers India#cinematic reels#cinematic vlog creator#daily content creator#DIY Filmmaking#EP Ka Meter Films#eshwarprasad-filmmaker#filmmaking with mobile#filmmaking with zero budget#Indian filmmaker journey#Indie Filmmaking#Low Budget Films#middle class filmmaker#motivational filmmaker#no budget filmmaking#passion over budget#reel storytelling#self made filmmaker#short film creator#short film director#short film production#storytelling reels#trending reels 2025#viral Short films#YouTube content ideas#YouTube filmmaker

0 notes