#API integration

Explore tagged Tumblr posts

Text

Woxro: The Bright Head in the Lead of Ecommerce Development

Woxro is one of the highest level e-commerce development companies in the constantly changing digital economy. Woxro assures cutting-edge solutions for businesses with the sophisticated requirement of today's digital economy. Whether it's about B2B and B2C platforms or the most seamless integration, or simply a custom-built solution, the online business experiences get ignited through Woxro's services. Backed with the attitude of innovation and commitment towards making their clients successful, Woxro helps companies make strong digital platforms along with competitive markets. Check out these are the core e-commerce development services by which Woxro comes forward to be a preferred partner for businesses wanting to breathe new life into their online presence. Woxro is the leading ecommerce development company in India and is providing top notch services and solutions for you.

B2B Platform Development

The B2B interaction is at the heart of modern commerce; it has built B2B platforms that make such interactions easy and hassle-free. B2B marketplaces help a company reach its suppliers, shortlist potential partnerships, and make the transactions all from one centralized place. Woxro's B2B platforms are wide-ranging and ensure that customers experience security, reliability, and ease of use in all business operations in order to create confidence and efficient workflows. Woxro's B2B solutions are equipped with real-time inventory management, automated processes, and advanced analytics, meaning businesses can work efficiently and have valuable relationships that last long.

B2C Platform Development

Through ease-of-use, online shops to offer products for shopping, Woxro's B2C platform development services help businesses reach their customers and interact directly with them. Designed to convert visitors into loyal customers, Woxro's B2C platforms include all the comprehensive tools for managing products, processing secure payments, and engaging in more personalized experiences for shopping. Each is optimized to give an easy, enjoyable experience to the user as businesses stretch their reach to the customer, marketing being directed, and giving an enjoyable shopping experience that creates a sale and brand loyalty.

Platform Migration

Moving out from the outdated systems to modern scalable platforms often marks the beginning for businesses that want to remain competitive. Woxro professionals successfully migrate complexly numerous business operations from less than the minimum level of disruption. Woxro takes cautious control of data migration, system configuration, and testing processes while making the move to become more distant in terms of on-premise systems to cloud infrastructure, updating legacy technology, or changing platforms. When businesses engage with Woxro, they embrace the latest technologies, realize cost savings on operations, and boost the performance of the system with business continuity and efficiency intact.

Custom-Designed Platform Development

Woxro realises that every business is unique and has custom platform development services that provide bespoke solutions for a specific goal or workflow in place. These platforms are off-the-shelf by definition, designed from the ground up to meet a precise business need. Woxro's custom solutions are scalable and adaptive, allowing businesses to implement proprietary features, streamline workflows, and maximize flexibility. About Woxro's customization innovation integration: It ensures that the platforms continue to grow with the business and, thus, become an excellent basis for long-term growth as well as a competitive edge in the market.

CMS Integration

The integration of a content management system with your e-commerce platform has vast benefits within the operation, ranging from effective product management to advanced SEO capabilities. Woxro's content management system integration services enable businesses to access a single, easy-to-use interface for managing product descriptions, optimizing search content for better search engine rankings, and personalising shopping experiences. CMS integration, therefore, promotes ease of updates while bringing increased online visibility and engagement from customers. CMS integration helps companies create more engaging and dynamic experiences that talk to customers to convert them.

API Integration

API integration is a necessary concept for e-commerce platforms in an interlinked digital world, integrating with third-party applications, payment systems, and other services. Woxro's API integration services provide smoother interoperability between different software applications for easy information sharing and add-on features. Of course, payment gateway, CRM system, and APIs all resolve issues because their performance can grow without getting disconcerting of existing operations, Woxro ensures that. API integration makes the overall functionality and responsiveness of e-commerce platforms robust, flexible, and scalable enough to expand on further expectations.

Why Woxro for ECommerce Development?

At Woxro, you will find industry expertise, innovative technology and, above all, a client-centric approach that seeks tailored solutions for each business. Ecommerce development with Woxro's services is done to cater for the unique needs of every client so as to ensure robust, scalable solutions adapting to changing market demands. Whether it is a B2B, B2C platform, handling platform migrations, or integration with CMS and APIs, Woxro connects with technical pools of expertise in alignment with strategic insight to yield results. Businesses partner with Woxro to achieve advanced tools and custom solutions in enforcing the new path forward through their digital success.

Conclusion

Woxro e-commerce development solutions give businesses the possibility of a powerful and agile web presence. The products offered by Woxro for creating B2C growth strengthen customer engagement, streamline B2B relations, smooth migrates, and unlock API and CMS integrations that facilitate business clients' digital transformation with the platform. Equipping businesses with solutions that solve the challenges of the digital age, creating future-proof, impact-generating e-commerce, to drive business growth and success-all of these Woxro does.

#ecommerce#ecommerce development agency#ecommerce development services#ecommerce development company#ecommerce website development#ecommerce developers#web developers#web development#web graphics#web resources#shopify#woocommerce#online store#smallbusiness#websitedevelopmentcompany#search engine optimization#web design#website design#web hosting#website#social media#content creation#content creator#cms development services#cms#b2b#b2bmarketing#api integration

5 notes

·

View notes

Text

🌟 SmilePayz Payment Solution: Covering All Industries, Seamless Integration! 🌟

SmilePayz specializes in Indonesia, Thailand, Brazil, and Mexico, offering cryptocurrency payment solution as well. Since we are a direct payment source for these countries, we can provide the lowest rates in the market. We also offer same-day settlement/D0 settlement!

✅ Easy Integration: Diversified API interfaces for quick system compatibility, improving efficiency. ✅ 24/7 Support: Professional service around the clock, ensuring peace of mind.

Whether you're in online gaming, forex, online casino, live streaming, entertainment, forex, or financial services, SmilePayz is your best payment solution! [We do not accept business that is related to pornography and scamming.

🌐 Contact us now to experience more convenient and secure payment services!

Telegram: @Thompson7837

Telegram: @Thompson7837

Telegram: @Thompson7837

#payment gateway#api integration#high risk payment processing#high risk payment gateway#paymentsolutions#payment#payments#e commerce#online gambling#forex

2 notes

·

View notes

Text

Acemero is a company that strives for excellence and is goal-oriented. We assist both businesses and individuals in developing mobile and web applications for their business.

Our Services include:

Web/UI/UX Design

CMS Development

E-Commerce Website

Mobile Apps

Digital Marketing

Branding

Domain & Hosting

API Integration

Our Products include :

Support Ticket System

Direct Selling Software

Learning Management System

Auditing Software

HYIP Software

E-Commerce Software

#Mobosoftware#software development#software developers#web development#cms web development services#cms website development company#cms#mlm software#hyip#ecommerce software#lms#audit software#API Integration#Branding#Digital Marketing#ui/ux design

2 notes

·

View notes

Text

Best API Platforms Online | AI Platform 2023 - Conektto

Discover the Best API Platforms Online that streamline integration, provide extensive documentation, and offer seamless connectivity. From reliable data retrieval to efficient communication, these platforms are designed to fuel your development projects and take your applications to new heights. Explore a world of possibilities with these industry-leading API platforms.

2 notes

·

View notes

Text

Why Every Developer Should Embrace Headless CMS

Flexibility > Limitations.

Headless CMS platforms like Ghost and Strapi are game-changers for developers. No more being tied to restrictive templates. Build your frontend how you want, React, Vue, Next.js—and simply fetch the content via APIs. With a headless CMS, you’re in control of the structure and design without compromising on performance.

Perfect for scaling apps, customizing user experiences, and delivering content across multiple platforms without breaking a sweat.

This one’s for the devs who value freedom in how they build and who know that the future of web development is headless.

Let’s headless, let’s scale. 🚀

#headless cms#webdevelopment#api integration#frontenddevelopment#reactjs#contentmanagement#developerlife

0 notes

Text

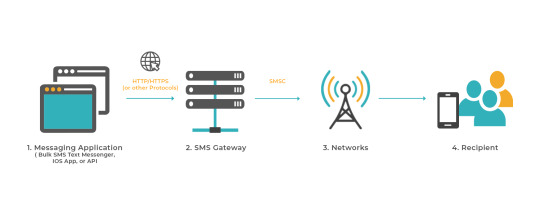

API для SMS: как интегрировать текстовые сообщения в корпоративные системы

Коммуникация с клиентами и сотрудниками остаётся важной задачей для любой компании. Среди множества каналов связи текстовые сообщения по-прежнему удерживают высокую эффективность: они быстро доставляются, не требуют интернета и подходят для массовых уведомлений.

Для автоматизации отправки SMS компании всё чаще используют API. С помощью SMS API сообщения легко подключаются к CRM, ERP, сайтам и другим корпоративным платформам. В статье расскажем, как происходит подключение, какие преимущества это даёт и на что обратить внимание.

Что такое API для SMS и зачем его подключать

SMS API — это способ для программ автоматически отправлять и получать текстовые сообщения без необходимости ручного вмешательства. Это решение помогает автоматизировать важные коммуникационные процессы и сократить нагрузку на персонал.

Через SMS API можно настроить автоматические уведомления о заказах, напоминания о встречах, двухфакторную аутентификацию, подтверждение операций и многое другое. Особенно востребовано такое решение в ритейле, банковской сфере, логистике и службах поддержки.

Этапы настройки SMS API в корпоративной системе

Интеграция требует планомерного подхода. Чтобы всё прошло гладко, первым делом выберите подходящего поставщика услуг, внимательно изучив тарифы и отзывы клиентов. После этого получите необходимые ключи доступа и тщательно ознакомьтесь с технической документацией.

Следующим шагом настройте подключение API в вашей корпоративной системе, строго следуя инструкциям поставщика. Затем обязательно проведите тестовую отправку сообщений и настройте корректную обработку возможных ошибок.

Завершающим этапом организуйте постоянный мониторинг отправки SMS для своевременного контроля стабильности работы всей системы. Это позволит вам оперативно реагировать на любые сбои и поддерживать качество сервиса на высоком уровне.

Какие задачи решает SMS интеграция

SMS интеграция помогает бизнесу автоматизировать отправку сообщений и оперативно решать ключевые задачи:

оперативная доставка клиентам уведомлений о заказах и изменениях в сервисе;

напоминания о встречах, оплатах, мероприятиях;

отправка кодов подтверждения для безопасного входа в аккаунты;

продвижение акций и спецпредложений через прямые рассылки;

повышение информированности сотрудников внутри компании.

Благодаря такому подходу можно быстро реагировать на запросы клиентов и повысить качество взаимодействия.

Реальные примеры, где применяется интеграция смс сервисов

Рассмотрим ситуации, когда интеграция смс сервисов становится необходимой частью цифровой инфраструктуры:

CRM-системы используют SMS для автоматических напоминаний клиентам;

ERP-решения уведомляют сотрудников о логистических изменениях;

платёжные сервисы отправляют коды подтверждения для безопасности операций;

службы поддержки информируют о статусе заявок через SMS без звонков.

Во всех этих случаях API помогает встроить отправку сообщений в ключевые процессы компании.

Преимущества SMS API для бизнеса

Работа с SMS API даёт компаниям множество практических выгод. Этот инструмент открывает для бизнеса целый ряд практических возможностей:

быстрое масштабирование уведомлений без нагрузки на персонал;

автоматизация стандартных коммуникаций;

сокращение времени реагирования на события;

повышение безопасности через аутентификацию пользователей;

доступ к отчётности о доставке сообщений.

Эти плюсы делают подключение SMS API одним из обязательных этапов цифрового развития.

Почему от правильной настройки SMS API зависит качество сервиса

Подключение API для отправки SMS — это не просто технический процесс. От качества настройки зависит скорость уведомлений, защита данных клиентов и общая стабильность сервисов.

Компании, которые внедряют автоматизированную отправку сообщений, получают важное конкурентное преимущество: мгновенное взаимодействие с пользователями, снижение ручных ошибок и повышение доверия к сервису. Именно поэтому грамотная интеграция SMS API становится ключевым элементом успешных корпоративных систем.

0 notes

Text

Overview

Our client runs a cloud-based platform that turns complex data from sources like firewalls and SIEMs into clear insights for better decision-making. It uses advanced ETL processes to gather and process large volumes of data, making it easy for users to access accurate and real-time information.

Why They Chose Us

As they launched a new app, they needed a testing partner to ensure high performance and reliability. They chose Appzlogic for our expertise in functional and automation testing. We built a custom automation framework tailored to their needs.

Our Testing Strategy

We started with manual testing (sanity, smoke, functional, regression) and later automated key UI and API workflows. Poor data quality and manual ETL testing are major reasons why BI projects fail. We addressed this by ensuring data accuracy and reducing manual work.

Manual Testing Process:

Requirement Analysis: Understood the product and its goals

Scope Definition: Identified what to test

Test Case Design: Created test cases for all scenarios

Execution & Defect Logging: Ran tests and reported issues in JIRA

Automation Testing Results:

We reduced manual effort by 60%. Automated tests were created for data validation across AWS and Azure services. Modular and end-to-end tests boosted efficiency and coverage.

Source Data Flow Overview

These events flowed through the volume controller and were distributed across multiple processing nodes, with one rule node actively handling 1 event. The transformation stage processed 1 event, which was then successfully delivered to the Raw-S3-1 destination. This streamlined flow highlights a well-structured and reliable data processing pipeline.

Centralized Data Operations Briefly

The Data Command Center showcases a well-orchestrated flow of data with 2,724 sources feeding into 3,520 pipelines, resulting in 98.4k events ingested and 21.3 MB of log data processed, all at an average rate of 1 EPS (event per second). Every connected destination received 100% of the expected data with zero loss. Additionally, 51 devices were newly discovered and connected, with no pending actions. This dashboard reflects a highly efficient and reliable data pipeline system in action.

Smooth and Reliable Data Flow

The source TC-DATAGENERATOR-SOURCE-STATUS-1745290102 is working well and is active. It collected 9.36k events and processed 933 KB of data. All events were successfully delivered to the Sandbox with no data loss. The graph shows a steady flow of data over time, proving the system is running smoothly and efficiently.

Tools & Frameworks Used:

Python + Pytest: For unit and functional tests

RequestLibrary: For API testing

Selenium: For UI automation

GitHub + GitHub Actions: For CI/CD

Boto3: To work with AWS

Paramiko: For remote server access

Conclusion

Our testing helped the client build a reliable and scalable platform. With a mix of manual and automated testing, we boosted test accuracy, saved time, and supported their continued growth.

We are The Best IT Service Provider across the globe.

Contact Us today.

0 notes

Text

API Integration: The Ultimate 2025 Guide to Connecting Your Digital World

Introduction to API Integration

The digital ecosystem in 2025 is more interconnected than ever. Whether it's mobile apps, websites, or cloud services, everything needs to talk to everything else. That’s where API integration becomes the hero behind the scenes. If you're running an e-commerce store, a SaaS platform, or even a blog, chances are you’re already using multiple APIs without even realizing it.

But what is API integration exactly, and why is it so crucial for businesses and developers today? In this in-depth guide, we’ll explore everything from the basics to the technicals, tools, benefits, reviews, and frequently asked questions.

What is API Integration?

API integration is the process of connecting two or more applications through their APIs (Application Programming Interfaces) to let them exchange data and perform functions automatically.

🧠 In Simple Terms:

Imagine your website needs to process payments using PayPal. Instead of building a payment system from scratch, you simply integrate PayPal’s API—and voilà, you’re accepting payments within minutes.

Why is API Integration Important in 2025?

From automation to improved user experience, here are the key reasons businesses rely on API integration:

🚀 Automation – Eliminate manual processes like order fulfillment, data entry, or email follow-ups.

🌍 Connectivity – Seamlessly connect CRMs, ERPs, and third-party tools.

⏱️ Efficiency – Save time and resources by reducing repetitive tasks.

📈 Scalability – Quickly add new features or platforms without starting from scratch.

💡 Innovation – Enables rapid innovation using third-party services (AI, analytics, etc.).

Types of API Integrations

Third-Party Integrations

Example: Adding Google Maps or Stripe to your site.

Custom API Integrations

Built in-house to connect proprietary systems.

Webhooks

Push updates in real-time (e.g., Slack notifications).

Middleware Platforms

Tools like Zapier or Integromat that connect multiple services.

Popular API Integration Examples

API TypeReal-World Use CasePayment APIStripe, PayPal, RazorpayEmail APIMailchimp, SendGridSocial MediaFacebook Graph API, Twitter APIMaps APIGoogle Maps API for location servicesCRM APISalesforce, HubSpotAI APIOpenAI, IBM Watson

How API Integration Works

Request – Your app sends a request (e.g., "Get user data").

Processing – API server processes it.

Response – API returns the data to your system.

Protocols used:

REST (most common)

SOAP (used in enterprise apps)

GraphQL (used for flexible querying)

Steps to Implement API Integration

1. Identify Your Integration Goals

What do you want to automate or simplify? For example, syncing customer data between Shopify and Mailchimp.

2. Choose the Right API

Select based on reputation, reliability, and documentation.

3. Obtain API Credentials

Most APIs require an API key or OAuth token for authentication.

4. Set Up the Endpoint

Define what data you want to send or receive using the API’s endpoint URL.

5. Write Integration Code

Use programming languages like:

JavaScript (Node.js)

Python

PHP

Java

6. Test Thoroughly

Use tools like Postman or Insomnia to simulate requests and validate responses.

7. Monitor & Maintain

APIs change over time. Monitor your integration for downtime or deprecations.

Best Tools for API Integration

Tool/PlatformPurposePostmanTesting and simulating API callsZapierNo-code API integrationsMake.comWorkflow automationSwaggerAPI design and documentationApigeeAPI management & analytics

Benefits of API Integration

✅ Business Advantages

Improved Workflow Automation

Faster Time to Market

Enhanced Customer Experience

✅ Technical Advantages

Modular Development

Reduced Server Load

Real-time Data Sync

Challenges in API Integration

Despite the advantages, API integration does come with its set of challenges:

⚠️ Security Risks – Improperly secured APIs can lead to data leaks.

��� Compatibility Issues – Not all APIs play well together.

🔄 API Deprecations – Providers may change or shut down APIs.

🕵️♂️ Monitoring – Ongoing maintenance is crucial.

Solution: Use API monitoring tools like Runscope, New Relic, or custom logging solutions.

Review: API Integration from a Marketer’s Perspective

As a digital marketing expert at diglip7.com, I’ve implemented dozens of API integrations—from CRMs like HubSpot to eCommerce tools like WooCommerce.

Here’s what I’ve observed:

🌟 Pros:

Saves countless hours by automating marketing emails, leads, and workflows.

Boosts lead conversion with real-time sync between platforms.

Makes campaign reporting more dynamic using analytics APIs.

⚠️ Cons:

Some third-party APIs are poorly documented.

Rate limits can restrict how often data updates.

Needs solid backend support for large-scale integrations.

Final Verdict:

“API integration is the backbone of modern marketing and automation. If your business isn't using APIs, you’re already behind.”

Use Case Scenarios for API Integration in 2025

1. E-Commerce Automation

Sync inventory between Shopify and Amazon.

Automatically send shipping updates via WhatsApp.

2. Lead Generation

Capture leads from Facebook Ads and push them to CRM.

3. AI & Chatbots

Connect AI-powered chatbots with your helpdesk or CRM.

4. Finance

Integrate real-time currency conversion APIs or payment gateways.

Best Practices for API Integration

🔐 Secure your API keys using environment variables.

📖 Read the documentation before starting any integration.

🛠️ Use versioned APIs to avoid breaking updates.

🧪 Always test in sandbox environments first.

📊 Log every request and response for future debugging.

Future of API Integration

By 2027, Gartner predicts that over 65% of digital transformations will depend heavily on APIs. Here’s what’s next:

Hyperautomation via API chaining.

API-as-a-Service will become mainstream.

AI-integrated APIs for intelligent decisions.

Voice-based API interactions for IoT and smart homes.

FAQs About API Integration

Q1: What’s the difference between API development and API integration?

API development involves creating an API.

API integration means connecting existing APIs to your system or software.

Q2: Do I need coding knowledge to use APIs?

Not always. Platforms like Zapier or Make.com allow no-code integrations.

Q3: Is REST or GraphQL better for integration?

REST is widely supported and simpler.

GraphQL is better for complex data requirements and performance.

Q4: How much does API integration cost?

Depends on complexity. Simple integrations can be free (Zapier), while enterprise-level custom integrations can cost thousands.

Q5: Can I integrate multiple APIs at once?

Yes, middleware tools or custom backend services can handle multiple API connections.

Q6: How do I know if an API is reliable?

Check:

Documentation quality

Uptime reports

Community reviews

Rate limits

Conclusion

API integration is no longer just a “developer thing”—it’s a business necessity. In 2025, APIs are the glue binding your digital platforms, services, and tools. Whether you're a marketer, developer, or entrepreneur, mastering API integration will future-proof your operations and accelerate growth.

Want more digital growth strategies, automation tools, and tech tutorials? 👉 Visit diglip7.com — your hub for modern digital marketing solutions.

0 notes

Text

Hire Expert React JS Developer for Dynamic Web Applications

Looking to build fast, responsive, and scalable web apps? Hire a skilled React JS developer to bring your ideas to life. I specialize in crafting interactive UIs, integrating APIs, and optimizing performance for modern front-end solutions. Whether it's a startup MVP or an enterprise-grade app, I deliver clean, maintainable code tailored to your project goals.

#react js developer#web application#api integration#full stack developer#front end development#react js#freelance react js developer

0 notes

Text

Odoo API Integration Services: A Game Changer for Manufacturing ERP Solutions

Odoo API integration in manufacturing ERP means connecting Odoo’s different tools with other systems and apps. The integration helps manufacturers share data easily between systems, perform tasks automatically, and work better. With this connection, businesses can keep data the same between their factory work and other essential parts like accounting, sales, and stock management.

0 notes

Text

What Are Integration Services?

Integration services involve connecting various IT systems, software applications, and data sources so they function as one unified solution. The goal is to ensure seamless communication and data exchange across platforms, departments, and business functions.

Whether you're combining on-premise systems with cloud apps, syncing CRM with invoicing tools, or linking your e-commerce site to your inventory management system, integration services allow your business processes to run smoother, faster, and smarter.

https://transcodezyitsolutions.com/integration-services.html

0 notes

Text

Eko API Integration: A Comprehensive Solution for Money Transfer, AePS, BBPS, and Money Collection

The financial services industry is undergoing a rapid transformation, driven by the need for seamless digital solutions that cater to a diverse customer base. Eko, a prominent fintech platform in India, offers a suite of APIs designed to simplify and enhance the integration of various financial services, including Money Transfer, Aadhaar-enabled Payment Systems (AePS), Bharat Bill Payment System (BBPS), and Money Collection. This article delves into the process and benefits of integrating Eko’s APIs to offer these services, transforming how businesses interact with and serve their customers.

Understanding Eko's API Offerings

Eko provides a powerful set of APIs that enable businesses to integrate essential financial services into their digital platforms. These services include:

Money Transfer (DMT)

Aadhaar-enabled Payment System (AePS)

Bharat Bill Payment System (BBPS)

Money Collection

Each of these services caters to different needs but together they form a comprehensive financial toolkit that can significantly enhance a business's offerings.

1. Money Transfer API Integration

Eko’s Money Transfer API allows businesses to offer domestic money transfer services directly from their platforms. This API is crucial for facilitating quick, secure, and reliable fund transfers across different banks and accounts.

Key Features:

Multiple Transfer Modes: Support for IMPS (Immediate Payment Service), NEFT (National Electronic Funds Transfer), and RTGS (Real Time Gross Settlement), ensuring flexibility for various transaction needs.

Instant Transactions: Enables real-time money transfers, which is crucial for businesses that need to provide immediate service.

Security: Strong encryption and authentication protocols to ensure that every transaction is secure and compliant with regulatory standards.

Integration Steps:

API Key Acquisition: Start by signing up on the Eko platform to obtain API keys for authentication.

Development Environment Setup: Use the language of your choice (e.g., Python, Java, Node.js) and integrate the API according to the provided documentation.

Testing and Deployment: Utilize Eko's sandbox environment for testing before moving to the production environment.

2. Aadhaar-enabled Payment System (AePS) API Integration

The AePS API enables businesses to provide banking services using Aadhaar authentication. This is particularly valuable in rural and semi-urban areas where banking infrastructure is limited.

Key Features:

Biometric Authentication: Allows users to perform transactions using their Aadhaar number and biometric data.

Core Banking Services: Supports cash withdrawals, balance inquiries, and mini statements, making it a versatile tool for financial inclusion.

Secure Transactions: Ensures that all transactions are securely processed with end-to-end encryption and compliance with UIDAI guidelines.

Integration Steps:

Biometric Device Integration: Ensure compatibility with biometric devices required for Aadhaar authentication.

API Setup: Follow Eko's documentation to integrate the AePS functionalities into your platform.

User Interface Design: Work closely with UI/UX designers to create an intuitive interface for AePS transactions.

3. Bharat Bill Payment System (BBPS) API Integration

The BBPS API allows businesses to offer bill payment services, supporting a wide range of utility bills, such as electricity, water, gas, and telecom.

Key Features:

Wide Coverage: Supports bill payments for a vast network of billers across India, providing users with a one-stop solution.

Real-time Payment Confirmation: Provides instant confirmation of bill payments, improving user trust and satisfaction.

Secure Processing: Adheres to strict security protocols, ensuring that user data and payment information are protected.

Integration Steps:

API Key and Biller Setup: Obtain the necessary API keys and configure the billers that will be available through your platform.

Interface Development: Develop a user-friendly interface that allows customers to easily select and pay their bills.

Testing: Use Eko’s sandbox environment to ensure all bill payment functionalities work as expected before going live.

4. Money Collection API Integration

The Money Collection API is designed for businesses that need to collect payments from customers efficiently, whether it’s for e-commerce, loans, or subscriptions.

Key Features:

Versatile Collection Methods: Supports various payment methods including UPI, bank transfers, and debit/credit cards.

Real-time Tracking: Allows businesses to track payment statuses in real-time, ensuring transparency and efficiency.

Automated Reconciliation: Facilitates automatic reconciliation of payments, reducing manual errors and operational overhead.

Integration Steps:

API Configuration: Set up the Money Collection API using the detailed documentation provided by Eko.

Payment Gateway Integration: Integrate with preferred payment gateways to offer a variety of payment methods.

Testing and Monitoring: Conduct thorough testing and set up monitoring tools to track the performance of the money collection service.

The Role of an Eko API Integration Developer

Integrating these APIs requires a developer who not only understands the technical aspects of API integration but also the regulatory and security requirements specific to financial services.

Skills Required:

Proficiency in API Integration: Expertise in working with RESTful APIs, including handling JSON data, HTTP requests, and authentication mechanisms.

Security Knowledge: Strong understanding of encryption methods, secure transmission protocols, and compliance with local financial regulations.

UI/UX Collaboration: Ability to work with designers to create user-friendly interfaces that enhance the customer experience.

Problem-Solving Skills: Proficiency in debugging, testing, and ensuring that the integration meets the business’s needs without compromising on security or performance.

Benefits of Integrating Eko’s APIs

For businesses, integrating Eko’s APIs offers a multitude of benefits:

Enhanced Service Portfolio: By offering services like money transfer, AePS, BBPS, and money collection, businesses can attract a broader customer base and improve customer retention.

Operational Efficiency: Automated processes for payments and collections reduce manual intervention, thereby lowering operational costs and errors.

Increased Financial Inclusion: AePS and BBPS services help businesses reach underserved populations, contributing to financial inclusion goals.

Security and Compliance: Eko’s APIs are designed with robust security measures, ensuring compliance with Indian financial regulations, which is critical for maintaining trust and avoiding legal issues.

Conclusion

Eko’s API suite for Money Transfer, AePS, BBPS, and Money Collection is a powerful tool for businesses looking to expand their financial service offerings. By integrating these APIs, developers can create robust, secure, and user-friendly applications that meet the diverse needs of today’s customers. As digital financial services continue to grow, Eko’s APIs will play a vital role in shaping the future of fintech in India and beyond.

Contact Details: –

Mobile: – +91 9711090237

E-mail:- [email protected]

#Eko India#Eko API Integration#api integration developer#api integration#aeps#Money transfer#BBPS#Money transfer Api Integration Developer#AePS API Integration#BBPS API Integration

2 notes

·

View notes

Text

How To Make Payment Using Stripe API Integration

Stripe is a platform to accept payment and it is a company that builds economic infrastructure for the internet. Every size of business- from startups to established companies can use the Stripe and accept payment and manage their business digitally.

Beginners may feel that it is tough and difficult to integrate Stripe on their website. No matter which stack you are using, this guide will describe how you can accept payment using this platform. Revenue data will be at the heart of the business operations and it combines payment platforms with applications.

Now, you will wonder how Stripe API Integration works and how can you accept payments through Stripe? This guide will get you through the process and will provide you with the overall flow.

3 Steps to use Stripe for first-timers

With these 3 easy steps, move your business online and make payment using the safe and secure way!

Step 1

For the first step, you have to fill up the user details on the front-end of your application or website. It purely depends on the type of payment you are integrating. For every front-end stack, stripe contains a Software Development Kit (SDK).

If you want to go implement the form or redirect to the bank’s page then you will use SDK. By inserting the details, the user will allow the payment to be made. Stripe also takes online crime very seriously and to avoid hacking attacks due to leakage of a card or bank details; it creates a token from the submitted user details.

On your front-end application, you will get a token.

Step 2

After getting the token, it is time to make the payment. You have to send the token to the backend server. Till now, you have not charged the customer. To charge the customer, use the Stripe SDK to charge the customer. The amount, Stripe token, currency, and your Stripe secret key; you will need to specify these things to move further.

If you are using net banking where you will be redirected to the bank’s homepage for payment then you have to check the transaction status by implementing a webhook.

Step 3

You have to check and confirm the status of your last request and see whether the payment was successful or not. Use webhook to confirm the payment if you are using online banking or other related payment methods.

The status will be interpreted on the front-end to show it to the users. And boom! You have integrated the stripe payment API successfully on your website and now you can start making money!

Final Word

With only 3% of global commerce happening online, it is time to encourage and use the huge potential of the online economy. Removing the barriers in online commerce will help new businesses to get started, quicken growth for subsisting companies, and increase economic output and trade worldwide. If you want to expand your business globally and want to engage in a safe and secure money transfer scheme then choosing Stripe API Integration might be a masterstroke from your side!

0 notes

Text

12 Best Practices for Effective API Integration

Discover best API integration practices to ensure smooth connectivity, enhance security, and optimise application performance. Read More.

#api#api documentation#api integration#api development#api security#company data#company information

0 notes

Text

The Technology Powering Instant Cash Advance Apps: Speed, Security, and APIs

In today's fast-paced digital world, consumers expect immediate access to services, and finance is no exception. The rise of instant cash advance apps reflects this demand, offering quick financial relief directly through smartphones. But what's the technology stack that makes these near-instantaneous transactions possible? It's a complex interplay of real-time payment networks, robust APIs, cloud infrastructure, and sophisticated security measures.

The Need for Speed: Why Instant Access Matters

The expectation for instant gratification has permeated consumer behavior. When facing unexpected expenses, waiting days for funds to clear is often impractical. Financial institutions and fintech innovators recognized this gap, leading to solutions designed for speed and convenience. Instant cash advance apps leverage technology to meet this critical user need, providing access to funds within minutes in many cases. This immediacy requires a seamless and highly efficient backend infrastructure.

Core Technologies Enabling Instant Transfers

Several key technologies underpin the functionality of instant cash advance applications. Understanding these components is crucial for appreciating both the capabilities and the challenges involved in building and maintaining these services.

Real-Time Payment Networks (RTP)

Traditional bank transfers (ACH) can take several business days. Modern instant finance apps often utilize newer rails like The Clearing House's RTP® network or similar real-time systems. These networks operate 24/7/365, enabling payment processing and settlement in seconds, forming the backbone of instant transfer capabilities. Implementing RTP requires significant integration effort but provides a vastly superior user experience.

Secure API Integrations

To assess eligibility and facilitate transfers, apps need secure access to users' bank account information. This is typically achieved through APIs provided by financial data aggregators like Plaid. These APIs act as secure intermediaries, allowing apps to verify account details, check balances, and initiate transfers without storing sensitive login credentials, thus enhancing security and user trust. Developers must carefully manage API keys and data handling protocols.

Scalable Cloud Infrastructure

Handling fluctuating demand and ensuring high availability requires a robust and scalable infrastructure. Most fintech apps rely on cloud platforms like Amazon Web Services (AWS), Google Cloud, or Microsoft Azure. These platforms provide the necessary computing power, storage, and network capabilities to process transactions quickly and reliably, scaling resources up or down based on real-time user activity. This elasticity is vital for maintaining performance during peak times.

Security and Compliance: Non-Negotiables in Fintech

Moving money instantly introduces significant security challenges, primarily concerning fraud prevention and data protection.

Advanced Fraud Prevention

Instant transactions leave little room for manual review, necessitating automated fraud detection systems. Many apps employ machine learning algorithms to analyze transaction patterns, user behavior, and device information in real-time to identify and block potentially fraudulent activities. Continuous monitoring and model refinement are essential to stay ahead of evolving threats.

Data Protection and Compliance

Protecting sensitive user data is paramount. Apps must adhere to strict data security standards, such as those outlined by the PCI Security Standards Council (PCI DSS) for handling cardholder data. Implementing end-to-end encryption, secure authentication methods, and regular security audits are critical components of a trustworthy financial application. Compliance ensures user data is handled responsibly.

Comparing App Models and User Experience

While the underlying technology shares similarities, the business models and user experiences of fee-free instant cash advance apps can vary significantly. Some apps charge subscription fees, interest, or expedite fees for faster transfers. Others adopt different revenue models. For developers and consumers alike, understanding these differences is key. Exploring resources that compare instant cash advance apps can provide valuable insights into features, costs, and transfer speeds.

One alternative approach is seen with apps like Gerald, which offers fee-free cash advances and Buy Now, Pay Later (BNPL) options. Gerald generates revenue through partnerships when users shop within its ecosystem, allowing it to forgo typical service fees. To access a fee-free cash advance transfer, users first need to utilize a BNPL advance. For users with supported banks, Gerald even offers instant transfers at no extra cost, showcasing how technology can enable innovative, user-centric financial models.

The Future of Instant Finance Tech

The technology behind instant cash advance apps continues to evolve. We can expect further integration of AI for personalization and risk assessment, broader adoption of real-time payment networks, and enhanced security measures like biometric authentication. As developers push the boundaries, the goal remains to provide faster, safer, and more accessible financial tools.

#instant cash advance apps#fintech technology#API integration#real-time payments#financial app security#mobile finance#Plaid API#RTP network#cash advance#cash advance apps#free instant cash advance apps

1 note

·

View note

Text

RRFINCO Wishing you Happy Women's Day #rrfinco #rrfinpay #fintech #fintechsolutions #womensdayspecial #WomensDay2025 https://rrfinco.com

#dmt software#loan service#recharge software#gst services#account opening#aeps software#api integration#api solution#b2b service#b2c services#women's day#international women's day#women's history month#women

1 note

·

View note