#ASIC

Explore tagged Tumblr posts

Text

Poll: Forgiveness Redux

I had asked this question a while back, but now I'll ask it again since polls are a thing:

(Remember: accepting an apology doesn't always equate to forgiveness)

115 notes

·

View notes

Text

2 notes

·

View notes

Text

RTI Appeal Process in Assam: A Case Study

sic.assam.gov.in says Petition submitted successfully. Your acknowledgement ID is : 1738118908358/197 Please keep the id safe for future references. OK ToChief Information Commissioner/ Companion Information CommissionersJonakee Complex, Shilpgram Path, Panjabari, Khanapara, Guwahati, Assam 781037Details of the appellant-Mohalla Surekapuram colony, Jabalpur Road, Sangmohal post office, District-…

5 notes

·

View notes

Text

What are the steps involved in registering a company with ASIC in Australia?

ASIC (Australian Securities and Investments Commision) is the regulatory authority in Australia in charge of managing and regulating businesses, financial markets, and financial services. There are various procedures that must be taken in order for an Australian business to be registered with ASIC. The following blog explains how to register a corporation with ASIC in Australia.

3 notes

·

View notes

Text

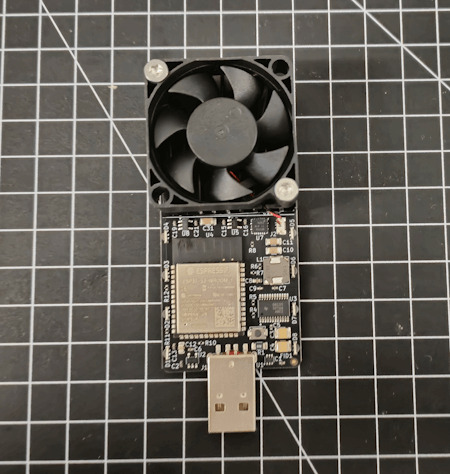

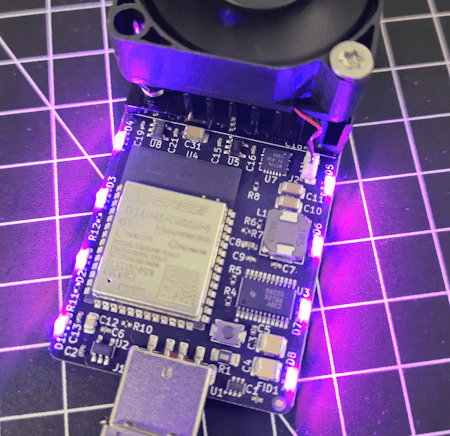

Kompakt, Stark, Leise? Der Disruptor USB Solo Miner im Review

Mit dem Disruptor USB Solo Miner von Bitcoin Merch kannst du – mit etwas Glück – deinen eigenen Bitcoin schürfen. Und das ganz ohne großen Lärm und mit erstaunlich wenig Stromverbrauch. In diesem Beitrag zeige ich dir, was der kleine Miner wirklich leistet und wie du ihn in Betrieb nimmst. https://youtu.be/Yf1SQaiONU4 Disclaimer: Das vorgestellte Gerät, wurde mir von der Firma Bitcoin Merch kostenfrei für dieses Review zur Verfügung gestellt. Die hier geäußerte Meinung basiert jedoch ausschließlich auf meinen eigenen Erfahrungen und spiegelt meine persönliche Einschätzung wider. Eine inhaltliche Einflussnahme durch den Hersteller fand nicht statt.

Was macht der Disruptor USB Solo Miner eigentlich?

Der Disruptor USB Solo Miner ist ein kompakter Bitcoin-Miner, der speziell für das Solo Mining konzipiert wurde – also das eigenständige Finden von neuen Blöcken im Bitcoin-Netzwerk ohne Mining-Pool. Mit einer Hashrate von über 300 GH/s richtet sich das Gerät an Enthusiasten und Bastler, die das Bitcoin-Mining im kleinen Stil ausprobieren oder optimieren möchten. Man sollte allerdings keine Wunder erwarten: Die Wahrscheinlichkeit, allein einen Block zu finden, ist extrem gering – gerade im Vergleich zu großen Mining-Farmen. Dennoch bietet das Gerät einen spannenden Einstieg ins Thema Mining, ohne großen Energieverbrauch oder Lärm – ideal für Lernzwecke, Technikbegeisterte oder als minimalistisches Mining-Setup im Heimnetzwerk.

Technische Daten des Disruptor USB Solo Miners

Der Disruptor USB Solo Miner überzeugt durch sein kompaktes Format und eine beeindruckende Rechenleistung für seine Größe. Die folgende Tabelle gibt dir einen schnellen Überblick über die wichtigsten technischen Eigenschaften des Geräts: EigenschaftWertModellDisruptor USB Solo MinerHerstellerBitcoin MerchMining-AlgorithmusSHA-256 (Bitcoin)Hashrate300 GH/s+AnschlussUSB Typ-AStromverbrauchca. 15 WattVersorgungsspannung5V DC (max. 3A empfohlen, z. B. über USB Hub)KühlungAktiv (leiser 35 mm Lüfter)Größeca. 70 × 35 × 20 mm (ohne Kühlkörper)Betriebssystem-KompatibilitätLinux, Windows (mit Mining-Software)Geeignet fürSolo Mining über USB Miner Software

Wichtiger Hinweis zur Stromversorgung

Bevor du mit der Einrichtung des Disruptor USB Solo Miners beginnst, solltest du sicherstellen, dass du ein geeignetes USB-Netzteil zur Hand hast. Der Miner benötigt mindestens 5 V bei 3 A, um zuverlässig zu arbeiten. Für kurze Leistungsspitzen ist es jedoch empfehlenswert, ein Netzteil mit etwas mehr Reserve einzuplanen. Dem Gerät liegt kein passendes Netzteil bei! Ich selbst verwende für meinen Test das 67-Watt-Ladegerät meines Smartphones, das bei 5 V bis zu 3 A liefern kann – das ist gerade so ausreichend. Ich werde mich daher noch nach einem leistungsstärkeren Netzteil mit konstanten 5 V und 4–5 A Ausgang umschauen. Ein geeignetes USB-Netzteil bekommst du beispielsweise schon ab ca. 8 € bei Amazon.de oder eBay.de* (zzgl. Versand). Achte darauf, dass es mindestens 3 A dauerhaft liefern kann – besser sind 4–5 A, um auf der sicheren Seite zu sein. Hinweis von mir: Die mit einem Sternchen (*) markierten Links sind Affiliate-Links. Wenn du über diese Links einkaufst, erhalte ich eine kleine Provision, die dazu beiträgt, diesen Blog zu unterstützen. Der Preis für dich bleibt dabei unverändert. Vielen Dank für deine Unterstützung! Achtung: Wattangabe ≠ konstante Leistung bei 5 V Wenn ein USB-Netzteil mit 67 Watt beworben wird, bedeutet das nicht, dass es bei 5 V automatisch über 13 A liefern kann. Die maximale Leistung verteilt sich auf verschiedene Spannungsstufen, abhängig davon, welche Spannung der Verbraucher (z. B. Smartphone, Laptop oder Miner) anfordert. 💡 Wichtig: Die einfache Formel I = P / U (Strom = Leistung / Spannung) gilt nur dann, wenn die Spannung konstant ist und die gesamte Leistung anliegt. In der Praxis liefern solche Netzteile bei 5 V meist nur bis zu 3 A = 15 W, da höhere Leistungen nur bei höheren Spannungen (z. B. 9 V, 12 V oder 20 V) möglich sind. ➡️ Fazit: Achte immer auf die Angabe „5 V / XY A“ in den technischen Daten, nicht nur auf die Gesamtleistung in Watt.

Einrichtung des Disruptor USB Solo Miners mit AxeOS

Die Inbetriebnahme des Disruptor USB Solo Miners ist erstaunlich unkompliziert, da das Gerät bereits mit dem vorkonfigurierten Betriebssystem AxeOS ausgeliefert wird. Eine separate Installation von Mining-Software ist daher nicht notwendig. Nach dem ersten Start musst du lediglich: - Die Zugangsdaten deines WLAN-Netzwerks eingeben, - Eine gültige Bitcoin Wallet-Adresse hinterlegen. Danach ist der Miner einsatzbereit und beginnt automatisch mit dem Solo Mining. Wichtig: Für den Betrieb wird zwingend eine eigene Bitcoin-Wallet benötigt. Da es viele Anbieter am Markt gibt – sowohl seriöse als auch weniger vertrauenswürdige – verzichte ich an dieser Stelle bewusst auf eine Empfehlung. Ich selbst habe mir zu Testzwecken eine Wallet bei Coinbase.com eingerichtet, habe dort jedoch bislang keine Trades durchgeführt, sondern nutze lediglich die Wallet-Funktion. AxeOS bietet darüber hinaus eine intuitive Weboberfläche, über die du Statuswerte, Netzwerkverbindung und Mining-Aktivität bequem im Browser einsehen kannst.

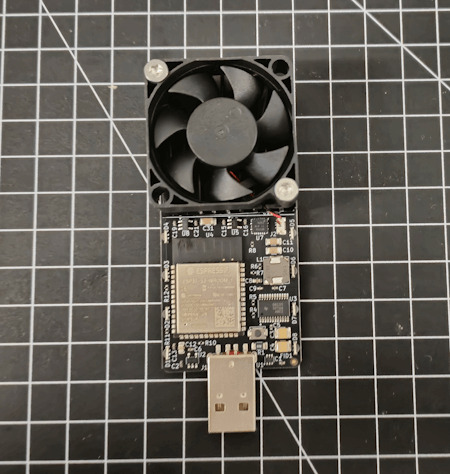

Disruptor vs. Mars Lander V2 – Kompakt oder Kraftpaket?

Ein sinnvoller Vergleich lässt sich zwischen dem Disruptor USB Solo Miner und dem deutlich größeren Mars Lander V2 ziehen. Beide stammen vom Hersteller Bitcoin Merch, richten sich aber an unterschiedliche Zielgruppen.

BitcoinMerch - Disruptor USB Solo Miner

Bitcoin Merch Mars Lander V2 Der Mars Lander V2 erreicht – je nach Ausstattung – eine Hashrate von 300 bis maximal 400 GH/s (mit dem leistungsstarken Compac A1 Modul). Damit liegt er unter idealen Bedingungen deutlich über dem Disruptor, der mit über 300 GH/s beworben wird.

Compac A1 Miner Allerdings hat die Mehrleistung ihren Preis: Der Disruptor ist bereits für 99 $ erhältlich, während der Mars Lander V2 stolze 479 $ kostet. 👉 Kurz gesagt: Wer maximale Leistung will und bereit ist, mehr zu investieren, greift zum Mars Lander V2. Wer hingegen ein kompaktes, energieeffizientes und preisgünstiges Setup sucht, findet im Disruptor USB Miner eine starke Alternative mit erstaunlich guter Performance fürs Geld.

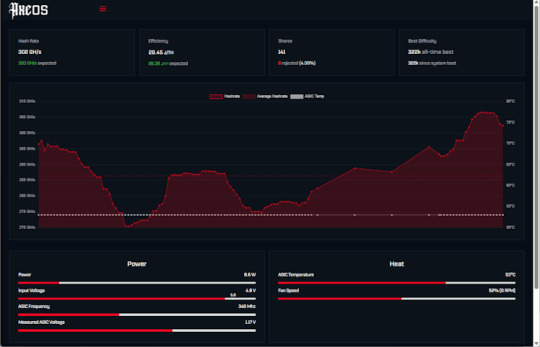

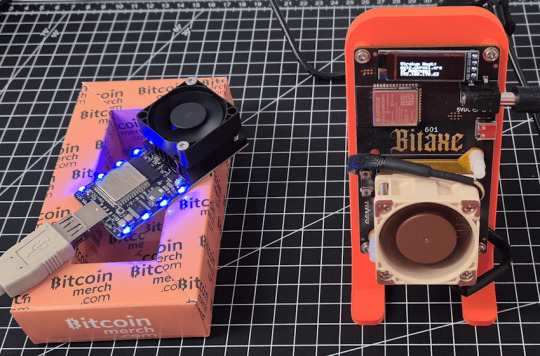

Bitcoin Solo Miner Swarm aus Bitaxe Gamma 601 & Disruptor USB Solo Miner

In meinem Test habe ich den Disruptor USB Solo Miner gemeinsam mit dem Bitaxe Gamma 601 zu einem kleinen Mining-Schwarm zusammengeschlossen. Die Einrichtung ist überraschend einfach:

Disruptor USB Solo Miner & Bitaxe Gamma 601 Beide Geräte müssen lediglich mit der gleichen Bitcoin-Wallet-Adresse und dem gleichen Mining-Pool konfiguriert werden – in meinem Fall ist das solo.ckpool.org. Der Rest wird automatisch vom Pool geregelt, sodass die beiden Miner gemeinsam auf die Lösung desselben Blocks hinarbeiten.

Bitcoin Swarm aus Bitaxe Gamma 601 und Disruptor Solo Miner 💡 Vorteil: So kannst du auch unterschiedliche Miner-Modelle kombinieren und die Gesamthashrate effektiv bündeln – ganz ohne zusätzliche Software oder komplexes Setup. Im untenstehenden Screenshot ist der Anstieg der Hashrate deutlich zu erkennen: Nach dem Hinzufügen des Disruptor USB Miners stieg sie auf knapp 1,48 TH/s. Zuvor lag die durchschnittliche Leistung bei rund 1,1 TH/s – ein Wert, den der Bitaxe Gamma 601 allein erreicht hat.

CKPoolStats-Bitcoin Solo Miner Swarm Swarm-Erweiterung? Zwischen Spaß, Kosten und Nutzen Theoretisch könnte ich meinen kleinen Mining-Schwarm ganz einfach erweitern, indem ich auch den Mars Lander V2 einbinde. Das würde mir nochmals rund 300 GH/s mehr Hashrate bringen – eine spürbare Steigerung der Gesamtleistung. Doch genau hier beginnt das Abwägen: Mit dem zusätzlichen Gerät steigen auch die Stromkosten deutlich an, und beim Solo Mining gilt weiterhin: Einen Block zu finden hat viel mit Glück zu tun. Deshalb frage ich mich: 🔋 Wie viel Strom will ich investieren? 💰 Wie viel bin ich bereit auszugeben – rein für den Spaß an der Sache? 🎯 Und wie realistisch ist der Nutzen im Verhältnis zur Wahrscheinlichkeit? Aktuell habe ich mich für eine schlanke, stromsparende Lösung entschieden – einfach, effizient und gut geeignet, um das Solo Mining zu beobachten, zu lernen und zu erleben. Read the full article

1 note

·

View note

Text

Ex-Macquarie funds Manager Banned

A former director of Macquarie Agricultural Funds Management Ltd (MAFM) has been banned from providing financial services for six years.

The Australian Securities and Investments Commission (ASIC) revealed that in early 2011 Timothy Hornibrook, along with some members of the MAFM sales team conceived the concept of a fake family office, named the Brook Family Office (BFO), that was used to extract confidential information from competitors in the agricultural investment sector.

"Between May 2011 and March 2013, the sales team used two BFO email addresses to send emails to at least nine competitor fund managers based in Australia and overseas, all of which were known by the sales team to be direct competitors of MAFML," ASIC said.

"The emails purported to come from the BFO and contained a ‘request for information' document containing a list of questions, which sought information from MAFM's competitors such as company background, investment process, fund performance and fees.

"The sales team intended to use the information obtained by the BFO in order to give MAFML and/or MCP a commercial advantage against its competitors."

ASIC found that Hornibrook had breached his duties as an officer of a responsible entity of a registered managed investment scheme by:

Failing to act honestly;

Misusing the information he acquired as a director of MAFML in order to gain an improper advantage for himself, MAFML and/or Macquarie Crop Partners LP (MCP); and

Misusing his position as director of MAFML to gain an advantage for MAFML and/or MCP. ASIC Commissioner Greg Tanzer said that "The deceptive conduct of Mr Hornibrook was not inadvertent nor was it the result of a momentary lapse".

"It was committed over a number of years and was intended to gain an advantage for himself and the Macquarie business for which he was responsible," Tanzer said.

1 note

·

View note

Text

Jihan Wu: Co-Fondatorul Bitmain și Actorul Major din Industria de Mining a Bitcoin

Jihan Wu: Co-Fondatorul Bitmain și Actorul Major din Industria de Mining a Bitcoin Jihan Wu este o personalitate esențială în universul criptomonedelor, recunoscut ca unul dintre co-fondatorii Bitmain, compania care a revoluționat industria de mining a Bitcoin. Prin inovațiile și strategiile sale, Wu a jucat un rol decisiv în dezvoltarea tehnologiei de mining, contribuind la creșterea eficienței…

#mining Bitcoin#model de afaceri digital#inovator#startup crypto#evoluție crypto#investitor digital#expert blockchain#lider de opinie#investitor crypto#capital digital#influență tehnologică#consultanță fintech#ecosistem digital#hardware de mining#co-fondator#optimizare mining#antreprenor tech#dezvoltare industrială#inovații în mining#performanță ASIC#mentor tech#viziune tech#strategii digitale#lider în crypto#analiza pieței#blockchain#Inovație Tehnologică#ASIC#Securitate Blockchain#Industria Crypto

0 notes

Text

Ex-Macquarie funds Manager Banned

A former director of Macquarie Agricultural Funds Management Ltd (MAFM) has been banned from providing financial services for six years.

The Australian Securities and Investments Commission (ASIC) revealed that in early 2011 Timothy Hornibrook, along with some members of the MAFM sales team conceived the concept of a fake family office, named the Brook Family Office (BFO), that was used to extract confidential information from competitors in the agricultural investment sector.

"Between May 2011 and March 2013, the sales team used two BFO email addresses to send emails to at least nine competitor fund managers based in Australia and overseas, all of which were known by the sales team to be direct competitors of MAFML," ASIC said.

"The emails purported to come from the BFO and contained a ‘request for information' document containing a list of questions, which sought information from MAFM's competitors such as company background, investment process, fund performance and fees.

"The sales team intended to use the information obtained by the BFO in order to give MAFML and/or MCP a commercial advantage against its competitors."

ASIC found that Hornibrook had breached his duties as an officer of a responsible entity of a registered managed investment scheme by:

Failing to act honestly;

Misusing the information he acquired as a director of MAFML in order to gain an improper advantage for himself, MAFML and/or Macquarie Crop Partners LP (MCP); and

Misusing his position as director of MAFML to gain an advantage for MAFML and/or MCP. ASIC Commissioner Greg Tanzer said that "The deceptive conduct of Mr Hornibrook was not inadvertent nor was it the result of a momentary lapse".

"It was committed over a number of years and was intended to gain an advantage for himself and the Macquarie business for which he was responsible," Tanzer said.

0 notes

Text

ASIC Miner Hosting: The Ultimate Optimization Guide

Cryptocurrency mining has undergone a dramatic transformation over the years, and the introduction of ASIC miners (Application-Specific Integrated Circuit) has revolutionized the industry. As mining becomes more competitive, ASIC miner hosting services have emerged as a critical solution for miners looking to maximize efficiency, reduce costs, and scale their operations. This guide delves into the world of ASIC miner hosting, exploring its benefits, how to select the right provider, and strategies to optimize your mining operations for peak performance.

What is ASIC Miner Hosting?

ASIC miner hosting is a specialized service that allows miners to outsource the housing and maintenance of their mining hardware to professional facilities. These data centers are equipped with advanced infrastructure, including high-efficiency cooling systems, reliable power supplies, and robust security measures. By leveraging these facilities, miners can focus on growing their operations without the headaches of managing hardware, electricity costs, or environmental controls.

The Benefits of ASIC Miner Hosting

Lower Electricity Costs Hosting facilities often secure bulk energy contracts, providing access to significantly cheaper electricity rates compared to residential or commercial power costs. This can drastically reduce operational expenses and improve profitability.

Advanced Cooling Solutions Overheating is a major concern for mining hardware. Hosting centers utilize cutting-edge cooling technologies, such as immersion cooling and optimized airflow systems, to maintain ideal temperatures and extend the lifespan of your ASIC miner hosting.

24/7 Monitoring and Maintenance Professional hosting services include round-the-clock monitoring to ensure minimal downtime. This proactive approach helps prevent hardware failures and maximizes mining efficiency.

Scalability and Flexibility Whether you’re a small-scale miner or running a large operation, hosting services allow you to scale your mining activities without worrying about infrastructure limitations or additional setup costs.

Enhanced Security Top-tier hosting facilities offer robust security measures, including surveillance systems, biometric access controls, and fireproof infrastructure, to protect your valuable mining equipment.

How Does ASIC Miner Hosting Work?

When you choose a hosting service like Avatron Mining, the process is simple and straightforward:

Select a Plan: Choose a hosting plan that suits your needs, based on the number of miners and the duration of hosting.

Ship Your Miners: Send your ASIC miners to the hosting facility. Some providers also offer the option to purchase miners directly through them.

Setup and Monitoring: The hosting team will set up your miners, connect them to the mining pool of your choice, and monitor their performance.

Earn Rewards: Sit back and watch your mining rewards accumulate while the hosting provider handles the technical aspects.

Conclusion: ASIC Miner Hosting

As the cryptocurrency mining landscape becomes more competitive, hosting ASIC miners has emerged as a smart and practical solution for miners of all levels. By leveraging the expertise and infrastructure of professional hosting providers like Avatron Mining, you can enjoy cost savings, enhanced performance, and peace of mind. If you’re looking to take your mining operation to the next level, ASIC miner hosting is undoubtedly the way to go.

Visit Avatron Mining today to learn more about their hosting services and start optimizing your mining journey!

#ASIC Miner Hosting #ASIC, #ASIC MINING #ASIC HOSTING, #BitcoinMining, #avatronmining, #mining, #CryptoMining, #MiningHosting

#ASIC Miner Hosting#ASIC#ASIC MINING#ASIC HOSTING#BitcoinMining#avatronmining#mining#CryptoMining#MiningHosting

0 notes

Text

ASIC slams ex-Macquarie agri chief for fake family office

ASIC has banned the former head of Macquarie Agricultural Funds Management (MAFM) for creating a fake family office.

PE firm acquires Mason Stevens

A $2 billion private equity firm will acquire Mason Stevens for an undisclosed figure.

Adamantem Capital has signed a binding agreement to acquire the managed accounts specialist.

Mason Stevens chief executive Tim Yule said the transaction will deliver significant value and benefits for clients, employees, and shareholders, taking the business to the next level.

Mason Stevens Group was formed in 2012 when managed accounts provider Mason Stevens acquired 2020 Funds Management and 2020 DIRECTINVEST.

#MAFM#ASIC#Macquarie Agricultural Funds Management for#Timothy Hornibrook#Brook Family Office#Greg Tanzer#Infrastructure#Mr Hornibrook#Real Assets

1 note

·

View note

Text

Supersega FPGA project for all Sega platforms and physical media to launch next month with special pre-reservation pricing!

Supersega FPGA project for all Sega platforms and physical media to launch next month with special pre-reservation pricing! #sega #supersega #fpga #dreamcast #console #genesis #megadrive #saturn #sms

As previously mentioned here on Armchair Arcade, a new FPGA/ASIC retro console project, Supersega, has been announced, which will be able to play almost all media and controllers from the Sega SG-1000/SC-3000, Sega Master System, Sega Genesis / MegaDrive, Sega Saturn, and Sega Dreamcast. After Supersega releases new in-hand videos next month (October 2024), they will allow interested individuals…

0 notes

Text

Mining bitcoin con computers quantistici

Satoshi contro la fisica, come i miner quantistici potrebbero rendere obsoleti gli ASIC. Le attrezzature quantistiche potrebbero rappresentare una minaccia maggiore per le blockchain rispetto alla decrittazione quantistica. Con la progressiva crescita del settore dell'informatica quantistica, la competizione per il mining di Bitcoin potrebbe essere sul punto di entrare nell'equivalente dell'era atomica. Sebbene i computer quantistici di oggi siano in gran parte sperimentali, i recenti progressi nella tecnologia dei chip quantistici e nelle funzioni ibride di intelligenza artificiale hanno fatto avanzare il settore più rapidamente di quanto molti scienziati avessero previsto. Una delle maggiori preoccupazioni del settore è lo sviluppo di soluzioni di crittografia quantum-proof. Il timore che i computer quantistici possano violare la crittografia standard ha portato all'introduzione di nuovi protocolli e standard. Questa, tuttavia, non è l'unica potenziale minaccia di livello catastrofico che i computer quantistici rappresentano per il settore della blockchain. Mining di Bitcoin Sebbene il mondo sia ancora lontano decenni dall'avere un computer quantistico universale in grado di surclassare i supercomputer nella maggior parte dei compiti, esistono già macchine in grado di raggiungere la supremazia quantistica nell'esecuzione di algoritmi specifici per risolvere compiti dedicati. Uno degli algoritmi in cui i sistemi quantistici sono in grado di eccellere si chiama “algoritmo di Grover” e, in teoria, potrebbe essere applicato direttamente al mining di blockchain. Il mining di Bitcoin, ad esempio, si basa su un concetto di proof-of-work che prevede la risoluzione di puzzle crittografici. Man mano che i computer e gli algoritmi di mining diventano più efficienti nel risolvere questi puzzle, la loro difficoltà aumenta. Ciò aiuta a mantenere la blockchain e funziona come un metodo di decentralizzazione de facto. Se qualcuno riuscisse a realizzare un computer abbastanza efficiente da risolvere facilmente i problemi, allora tutti i compiti diventerebbero più difficili. Teoricamente, il limite massimo di questa difficoltà crittografica - chiamato “target” nel gergo del mining - sarebbe da qualche parte nell'area di 2 elevato alla potenza di 256. Le leggi della fisica, così come le intendono gli scienziati, impedirebbero anche ad un computer quantistico universale con capacità di fault-tolerant di eseguire i calcoli necessari per risolvere questo problema di crittografia di quattuorvigintilioni (un numero di 78 cifre). Satoshi e la scienza Satoshi Nakamoto e altri, a cui si deve lo sviluppo di Bitcoin, prevedevano un futuro in cui i computer sarebbero diventati sempre più potenti. Hanno compreso che ciò minacciava la natura decentralizzata di Bitcoin e hanno implementato alcune protezioni. Il “genesis block” Bitcoin è stato estratto utilizzando una tipica CPU dell'era 2008, probabilmente equivalente ad un Pentium 4. Il blocco successivo, il 'blocco 1', fu stato estratto sei giorni dopo. Da quel momento in poi, tuttavia, il tempo previsto per ogni blocco successivo è stato di 10 minuti. I miner sono passati dalle CPU alle GPU, con una breve incursione negli FPGA, prima di stabilizzarsi sullo status quo a partire dal terzo trimestre del 2024, i miner a circuito integrato specifico per le applicazioni (ASIC). Mentre le CPU svolgevano una sorta di lavoro universale di calcolo e le GPU eccellevano nel calcolo specifico necessario per risolvere i puzzle crittografici associati al mining di Bitcoin, gli impianti ASIC sono stati appositamente sviluppati per risolvere la crittografia SHA-256. Tuttavia, nonostante i progressi hardware, la rete tenta ancora di garantire che ogni blocco richieda 10 minuti per essere estratto. Mining quantistico La prossima frontiera dell'industria del mining potrebbe essere rappresentata dagli impianti ibridi quantistici/classici. Sfruttando il già citato algoritmo di Grover, i miner che utilizzano un computer quantistico sufficientemente tollerante ai guasti potrebbero teoricamente aumentare quadraticamente l'efficienza di estrazione rispetto alle tecniche attuali. Ciò non varierebbe il tempo necessario per estrarre un blocco. Tuttavia, potrebbe aumentare la difficoltà oltre le capacità dell'hardware non quantistico. Così come nel 2024 non sarebbe possibile (o redditizio) minare Bitcoin utilizzando un PC, i miner quantistici potrebbero rendere obsoleti gli ASIC. Tuttavia, vi sono una miriade di sfide che dovrebbero essere risolte prima che ciò accada. La principale è che i computer quantistici non sono ancora abbastanza maturi. Ma, come detto, i miner non avrebbero bisogno di un computer quantistico universale. Un impianto di mining realizzato con apparecchiature classiche potrebbe interfacciarsi con un chip quantistico dedicato per eseguire funzioni algoritmiche di alto livello, sfruttando così i vantaggi della meccanica quantistica e la fattibilità dei computer binari. Esistono anche numerose soluzioni di calcolo quantistico basate su cloud che potrebbero scaricare le spese di sviluppo di un computer quantistico grazie a soluzioni quantum-as-a-service personalizzate per l'esecuzione dell'algoritmo di Grover. Read the full article

0 notes

Text

Madenciler daha güçlü ASIC'ler sipariş etmeye başladı

Yeni ASIC'lerin (uygulamaya özel entegre devre veya "belirli bir uygulama için entegre devre") fiyatlarındaki keskin artışa rağmen, başta Amerika Birleşik Devletleri olmak üzere dünyanın dört bir yanındaki madenciler, bilgi işlem güçlerini artırmak için yeni ekipman stoklamaya başladı. Bitcoin madenciliğinin artan maliyeti ve karmaşıklığı nedeniyle kripto madencilerinin daha güçlü ekipmana ihtiyacı oluyor. Cryptopotato portalına göre, BTC madenciliği için yeni ekipmanların toplam hash oranı 76,6 Eh/s olacak. Madenciler tarafından 2024 yılının ilk çeyreğinde alınan ASIC'lerin toplam hash oranı 12,9 Eh/s; ikinci çeyrekte ise toplam 36 Eh/s hash oranına sahip devrelerin teslimatı bekleniyor. Bu bağlamda entegre devrelerin mevcut versiyonlarının maliyeti% 80-90 oranında keskin bir şekilde azaldı. Madenciler aynı zamanda bilgi işlem gücünü kaybetmeden bitcoin madenciliğinin maliyetini azaltmak için bulut altyapısını kullanmanın ve dolayısıyla iyileştirmenin gerekli olduğunu söylüyor. Bu, dünyanın dört bir yanından ek kapasitenin kullanılmasına olanak sağlayacaktır. Read the full article

0 notes

Text

X16R – Algoritmul Dinamic de Proof-of-Work pentru Criptomonede

IntroducereÎn lumea criptomonedelor, algoritmii de proof-of-work (PoW) sunt esențiali pentru securizarea rețelelor și validarea tranzacțiilor. Unul dintre acești algoritmi inovatori este X16R, folosit inițial de criptomoneda Ravencoin și adoptat de și alte proiecte alternative. X16R se remarcă prin utilizarea unei lanțuri dinamice de 16 funcții de hashing, menită să descurajeze centralizarea…

#criptomonede#Ravencoin#ASIC#Securitate Blockchain#Proof of Work#descentralizare#hashing#GPU#X16R#Algoritm de minerit

0 notes