#Algorithm Trading Market

Explore tagged Tumblr posts

Link

0 notes

Text

5 notes

·

View notes

Text

UAITrading (Unstoppable AI Trading): AI-Powered Trading for Stocks, Forex, and Crypto

https://uaitrading.ai/ UAITrading For On trading volumes offers, many free trade analysis tools and pending bonuses | Unstoppable AI Trading (Uaitrading) is a platform that integrates advanced artificial intelligence (AI) technologies to enhance trading strategies across various financial markets, including stocks, forex, and cryptocurrencies. By leveraging AI, the platform aims to provide real-time asset monitoring, automated portfolio management, and optimized trade execution, thereby simplifying the investment process for users.

One of the innovative features of Unstoppable AI Trading is its UAI token farming, which offers users opportunities to earn additional income through decentralized finance (DeFi) mechanisms. This approach allows traders to diversify their investment strategies and potentially increase returns by participating in token farming activities.

The platform's AI-driven systems are designed to analyze vast amounts of market data, identify profitable trading opportunities, and execute trades without human intervention. This automation not only enhances efficiency but also reduces the emotional biases that often affect human traders, leading to more consistent and objective trading decisions.

By harnessing the power of AI, Unstoppable AI Trading aims to empower both novice and experienced traders to navigate the complexities of financial markets more effectively, offering tools and strategies that adapt to dynamic market conditions

#Uaitrading#AI Trading#Automated Trading#Forex Trading AI#Crypto Trading Bot#UAI Token#Token Farming#Decentralized Finance (DeFi)#AI Investment Platform#Smart Trading Algorithms#AI Stock Trading#Machine Learning in Trading#AI-Powered Portfolio Management#Algorithmic Trading#Uaitrading AI Trading#Forex AI#Smart Trading#Stock Market#AI Investing#Machine Learning Trading#Trading Bot#Crypto AI#DeFi#UAI#Crypto Investing

2 notes

·

View notes

Text

DeepSeek AI vs Algo Trading: Automate Your Stock Trading Strategies

DeepSeek AI is a low cost Artificial intelligence chatbot Integrating DeepSeek AI with Algo Trading can improve the decision making process in stock market.

Read more..

#deepseek ai#open ai#algo trading india#artificial intelligence#open AI#algo trading#algo trading app#algo trading platform#algo trading strategies#algorithm software for trading#bigul#bigul algo#finance#free algo trading software#ai#stock market#share market#share market news#DeepSeek LLM#DeepSeek Coder#Python#Algorithmic Trading#algorithm#algo trading software india#best algo trading app in india#Best share trading app in India#best algorithmic trading software

5 notes

·

View notes

Text

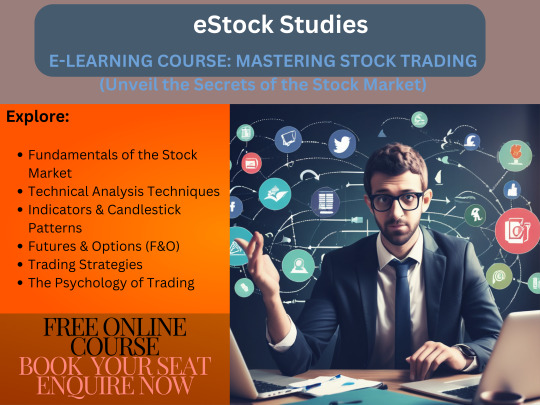

eStock Studies: Online Trading Courses from Basics to Advanced.

eStock Studies: free Online Stock Market Trading Courses from Basic to Advanced, Including Algorithmic Trading Techniques, for Aspiring Trading Experts.

#estock studies#free online stock market trading courses#trading expert#Basic of Stock Market#ALGORITHMIC TRADING TECHNIQUES#trading from basic to advanced#free online Trading Courses#expert trading institute

2 notes

·

View notes

Text

#automated crypto trading#AI trading bots#machine learning#crypto investment strategies#trading automation#risk management#cryptocurrency market#Intellectia.ai#predictive analytics#algorithmic trading

0 notes

Text

Global Algorithmic Trading Market: A Data-Driven Revolution

The global algorithmic trading market was valued at USD 21.06 billion in 2024 and is forecasted to expand at a robust compound annual growth rate (CAGR) of 12.9% from 2025 to 2030. A primary factor contributing to this impressive growth is the increasing integration of advanced technologies such as Machine Learning (ML) and Artificial Intelligence (AI) into algorithmic trading solutions. These technologies empower traders to design highly sophisticated algorithms that can process and analyze vast volumes of financial data in real time. This capability allows for rapid identification of trading patterns, faster decision-making, and the development of predictive models that far exceed the capabilities of traditional methods. Furthermore, AI and ML enable adaptive learning, whereby trading algorithms evolve and optimize themselves over time based on performance history and shifting market conditions, thereby continuously refining strategy effectiveness.

High-frequency trading (HFT) represents another significant trend bolstering market growth. HFT involves the use of complex algorithms to execute a large number of trades at extremely high speeds, often within milliseconds. The strategy capitalizes on minute price fluctuations in the market that exist for very short periods, allowing traders to gain profits through rapid trade execution and high turnover. The proliferation of HFT has been facilitated by continual advancements in technology, including ultra-fast network infrastructure and enhanced computational power. These developments support the high-speed data processing and execution capabilities that are critical for HFT operations. As more trading firms recognize the potential of HFT, its role is expected to become even more influential in shaping the future of algorithmic trading.

Another transformative factor in the algorithmic trading market is the democratization of trading technologies. Historically, access to advanced algorithmic tools was limited to institutional investors due to the high costs and technical expertise required. However, the market has seen a notable shift with the rise of intuitive, user-friendly platforms that offer customizable algorithmic trading solutions for retail investors. These platforms, combined with the growing availability of online educational resources, have enabled individual traders to implement sophisticated trading strategies without needing deep technical knowledge. As a result, retail participation in algorithmic trading is increasing, fostering greater diversity and competition in financial markets. This widening access is expected to further fuel innovation and growth across the sector.

In addition to technological advances and increased accessibility, regulatory support plays a critical role in fostering the growth of the algorithmic trading market. Governments and financial regulatory bodies are increasingly acknowledging the positive contributions of algorithmic trading to market efficiency, liquidity, and overall stability. To ensure responsible growth, regulatory frameworks are being established to enhance transparency, enforce accountability, and safeguard investor interests. This evolving regulatory landscape provides market participants—especially financial institutions—with the confidence to adopt and invest in algorithmic strategies, knowing they are operating within a clearly defined and secure framework. As regulations continue to adapt to emerging technologies, firms are likely to increase their investments in compliant algorithmic trading platforms, further propelling market expansion.

However, despite these encouraging trends, certain challenges could hinder market growth during the forecast period. One of the key limitations lies in the potential inconsistency and lack of accuracy in algorithmic models. Inadequate risk assessment tools and insufficient real-time monitoring capabilities can expose traders to significant financial risks. Since algorithmic trading operates on full automation, once a trade is initiated, human intervention is typically not possible. This creates a scenario where even if a trader recognizes that a strategy may not be performing optimally after execution, they lack the ability to pause or manually alter the algorithm mid-trade. Such limitations in oversight and adaptability could undermine confidence in these systems and act as a barrier to broader market adoption.

In summary, while the global algorithmic trading market is poised for significant growth, driven by technological innovation, increasing retail access, and supportive regulatory developments, it must also address key challenges related to accuracy, risk management, and system flexibility. Balancing these factors will be critical to ensuring the sustainable evolution of this rapidly transforming market.

Global Algorithmic Trading Market Report Segmentation

Grand View Research has segmented the global algorithmic trading market report based on component, deployment, trading types, type of traders, and region:

Component Outlook (Revenue, USD Million, 2018 - 2030)

Solution

Platforms

Software Tools

Service

Professional Services

Managed Services

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

Cloud

On-premise

Trading Types Outlook (Revenue, USD Million, 2018 - 2030)

Foreign Exchange (FOREX)

Stock Markets

Exchange-Traded Fund (ETF)

Bonds

Cryptocurrencies

Others

Type of Traders Outlook (Revenue, USD Million, 2018 - 2030)

Institutional Investors

Long-Term Traders

Short-Term Traders

Retail Investors

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Mexico

Europe

Germany

UK

France

Asia Pacific

China

Japan

India

South Korea

Australia

Latin America

Brazil

Middle East and Africa (MEA)

KSA

UAE

South Africa

Curious about the Algorithmic Trading Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Key Algorithmic Trading Company Insights

Some of the key companies in the market include BNP Paribas Leasing Solutions, AlgoTrader, and Argo Software Engineering. Organizations are focusing on integrating advanced technologies into their offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships.

BNP Paribas Leasing Solutions has made significant developments in algorithmic trading, particularly within the foreign exchange (FX) market. The company focuses on a select number of highly advanced core algorithms to meet client needs by providing seamless, automated end-to-end services. This includes pre-trade workflow analysis, real-time trade monitoring, and post-trade analytics and reporting to ensure ease of service for users.

AlgoTrader employs a range of strategies in algorithmic trading to optimize performance and meet client needs. The company identifies lucrative trading opportunities across a range of assets, including stock indexes, bonds, currencies, international markets, and commodities. Its algorithmic trading system is designed for individuals seeking to boost their income. This all-in-one trading service enhances performance while minimizing portfolio volatility, enabling users to profit in both rising and falling stock markets.

Key Algorithmic Trading Companies:

The following are the leading companies in the algorithmic trading market. These companies collectively hold the largest market share and dictate industry trends.

BNP Paribas Leasing Solutions

AlgoTrader

Argo Software Engineering

InfoReach, Inc.

Kuberre Systems, Inc.

MetaQuotes Ltd.

Symphony

Tata Consultancy Services Limited

VIRTU Finance Inc.

AlgoBulls Technologies Private Limited

Recent Developments

In July 2023, MachineTrader launched a beta version of its software that enables traders to automate their investment strategies without hiring programmers or writing code for a custom trading platform. The MachineTrader platform features a visual development interface that lets users create flow-based processes, enhanced with Open AI, allowing them to design complex programs without any coding required.

In October 2022, Scotiabank launched its next-generation algorithmic trading platform in Canada. This platform, offered to clients through a strategic partnership with BestEx Research, is equipped with advanced technology tailored to meet the specific needs of the Canadian equities market.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

0 notes

Text

0 notes

Text

Future of Algorithmic Trading Market: Predictions and Strategic Insights

According to a recent report published by Grand View Research, Inc., the global algorithmic trading market is projected to reach a valuation of USD 42.99 billion by 2030, growing at a compound annual growth rate (CAGR) of 12.9% from 2025 to 2030. This robust growth trajectory is primarily driven by the growing need for trading solutions that offer efficient, accurate, and rapid order execution, along with the benefit of lower transaction costs. Algorithmic trading systems are designed to automate the process of placing and executing orders using predefined instructions, which factor in elements such as timing, price, and trade volume.

A key component of this market is the widespread adoption of high-frequency trading (HFT) technology by professional investors and algorithmic traders. This advanced technology enables trading firms to execute tens of thousands of trades per second, offering significant advantages in speed and market responsiveness. In addition to high-frequency trading, algorithmic trading tools are also employed for a variety of strategic purposes including arbitrage, order execution optimization, and trend-following trading strategies. The increasing volume of global financial trading is placing greater demands on trading desks to enhance execution efficiency and accuracy, which in turn is expected to stimulate further demand for algorithmic trading solutions.

Furthermore, the market is expected to benefit significantly from the growing adoption of algorithmic trading platforms by brokerage firms and institutional investors, who are under pressure to minimize trading costs while handling increasingly complex and sizable orders. These market participants are leveraging algorithmic systems to execute large volumes of trades with greater precision and lower market impact. Additionally, businesses across different geographies are using these platforms to generate market liquidity, making algorithmic trading a crucial component of the modern financial ecosystem.

Get a preview of the latest developments in the Algorithmic Trading Market? Download your FREE sample PDF copy today and explore key data and trends.

Frequently Asked Questions (FAQ) About the Algorithmic Trading Market

1. What is the projected size of the global algorithmic trading market?

The global algorithmic trading market was valued at USD 21.06 billion in 2024 and is expected to reach USD 42.99 billion by 2030, growing at a compound annual growth rate (CAGR) of 12.9% from 2025 to 2030.

2. What factors are driving the growth of the algorithmic trading market?

Key drivers include:

• Demand for efficient and reliable order execution: Traders seek systems that can process orders quickly and accurately.

• Reduction in transaction costs: Algorithmic trading helps minimize trading expenses.

• Advancements in technology: Integration of machine learning and artificial intelligence enhances trading strategies.

• Increased trading volumes: Higher volumes necessitate automated solutions for effective management.

3. Which regions are leading in algorithmic trading adoption?

North America held the largest market share in 2024, accounting for approximately 33.6%. The region's growth is attributed to significant investments in trading technologies and the presence of numerous algorithmic trading firms.

4. What are the challenges faced by the algorithmic trading market?

Challenges include:

• Regulatory Compliance: Ensuring adherence to financial regulations.

• Data Security: Protecting sensitive trading data from breaches.

5. Who are the key players in the algorithmic trading market?

Prominent companies in the market include:

• BNP Paribas Leasing Solutions

• AlgoTrader

• Argo Software Engineering

• InfoReach, Inc.

• MetaQuotes Ltd.

• Symphony

• Tata Consultancy Services Limited

• VIRTU Finance Inc.

• AlgoBulls Technologies Private Limited

Order a free sample PDF of the Algorithmic Trading Market Intelligence Study, published by Grand View Research.

#Algorithmic Trading Market#Algorithmic Trading Market Size#Algorithmic Trading Market Share#Algorithmic Trading Market Analysis

0 notes

Text

How Algo Trading Works: An In-Depth Exploration

Discover how algo trading works in this in depth guide Learn about automated strategies, market analysis, and the benefits of algorithmic trading

1 note

·

View note

Text

The global algorithmic trading market size reached USD 17.2 billion in 2024. Looking forward, IMARC Group expects the market to reach USD 42.5 billion by 2033, exhibiting a CAGR of 9.49% during 2025-2033.

0 notes

Text

2 notes

·

View notes

Text

DeepSeek AI is an artificial intelligence chatbot developed by a Chinese AI team.

DeepSeek AI is an artificial intelligence chatbot developed by a Chinese AI team. DeepSeek AI Models can also benefit stock market traders in many ways.

Read more...

#DeepSeek AI#Open AI#Stock Market#Algo Trading#Artificial Intelligence#DeepSeek LLM#DeepSeek Coder#Python#bigul#best algo trading app in india#bigultradingapp#bigulalgo#algo trading software india#ipo alert#algo trading app#algo trading india#algo trading platform#algo trading strategies#algorithm software for trading#bigul algo#finance#free algo trading software#investment#investmentplatform#algotrading

4 notes

·

View notes

Text

The Digital Euro in 2025: How This Game-Changer Will Impact Forex Traders

The European Central Bank’s plan to roll out the Digital Euro in 2025 is set to reshape the forex landscape. As a central bank digital currency (CBDC), it promises greater financial inclusion, enhanced security, and faster transactions. But what does this mean for traders? Will it create new opportunities or add more volatility to the market? PipInfuse, a leading Forex & Investment consultancy, explores how the Digital Euro could impact currency trading, offering expert trading solutions to help you navigate the changes.

What is the Digital Euro and Why Does It Matter?

The Digital Euro is a fully digital form of fiat currency issued by the European Central Bank (ECB). Unlike cryptocurrencies, it is centralised and backed by the EU, ensuring stability. The key objectives behind its launch include:

Reducing dependence on cash

Enhancing payment security

Strengthening the EU’s financial sovereignty

Offering an alternative to private digital payment solutions

For forex traders, this introduction means potential shifts in liquidity, volatility, and trading strategies.

Impact on the Forex Market

1. Liquidity and Volatility Shifts

The Digital Euro is expected to influence EUR trading pairs significantly. If widely adopted, it could increase liquidity in the forex market, making it easier to trade. However, during the initial rollout, uncertainty and speculation may create short-term volatility, presenting both risks and opportunities.

2. Changes in EUR/USD and EUR/GBP Dynamics

With the EU strengthening its monetary control, traders may see the Digital Euro influencing major forex pairs like EUR/USD and EUR/GBP. Any policy shifts by the ECB regarding CBDC interest rates or usage restrictions could impact price action, requiring expert market analysis to make informed trading decisions.

3. Effect on Forex Trading Strategies

Profitable forex strategies will need to adapt to the Digital Euro’s influence. Algorithmic trading models, liquidity forecasting, and AI-based analysis will become even more crucial. PipInfuse provides advanced forex tools and expert solutions tailored for all trader types, helping traders stay ahead of market changes.

4. Regulation and Transparency

The introduction of the Digital Euro could lead to stricter regulatory measures affecting brokers and forex trading platforms. While increased transparency may benefit traders, brokers offering unregulated services might face challenges. Trusted forex partners and copy trading solutions will become even more valuable for those looking to trade securely.

How Traders Can Prepare for the Digital Euro

Stay Updated with Expert Insights: Following reliable sources like PipInfuse ensures traders receive timely forex trading insights and expert market analysis on the Digital Euro’s impact.

Upgrade Trading Tools: As the forex market evolves, using advanced analytics and automation tools will be crucial for staying competitive.

Refine Risk Management: Increased volatility requires disciplined risk management. A well-structured forex trading plan is essential to mitigate potential losses.

Seek Expert Consultation: Understanding the broader economic impact of CBDCs can be complex. Free forex trading plan and expert consultation by PipInfuse can help traders develop strategies tailored to the changing forex landscape.

The Digital Euro marks a major shift in the financial world, with significant implications for forex traders. Whether it leads to increased liquidity, regulatory challenges, or new trading opportunities, being prepared is key. PipInfuse, an expert forex trading and investment consultancy, provides traders with the knowledge, tools, and strategies to navigate these changes confidently. By staying informed and leveraging expert trading solutions, traders can turn this disruption into a profitable opportunity.

Happy Trading

PipInfuse

#Digital Euro#Forex Trading#CBDC#Central Bank Digital Currency#Forex Market#EUR/USD#EUR/GBP#Forex Strategies#Risk Management#Advanced Forex Tools#Expert Trading Solutions#PipInfuse#Forex & Investment Consultancy#Forex Trading Insights#Market Analysis#Trusted Forex Partners#Copy Trading Solutions#Free Forex Trading Plan#Expert Consultation#Forex News#Trading Opportunities#Forex Regulation#Liquidity#Volatility#ECB#Algorithmic Trading#AI in Forex#Forex Brokers#Forex Education

0 notes

Text

#best online stock trading courses for beginners#stock market trading courses#stock tutor#stock market master class#algorithmic trading bootcamp

0 notes

Text

Algocrat AI Review - Top-Performing Cryptocurrency Copy Trading Platform

https://www.bestforexeas.com/algocrat-ai-review/

#investing#crypto#cryptocurrency#bitcoin#bitcoin bot#ethereum#btcusd#ethusd#Algocrat AI#cryptocurrency trading#copy trading platform#Bitcoin trading#Ethereum trading#automated trading#trading algorithms#risk management#Valeriia Mishchenko#trading strategies#financial success#trading tools#investment strategies#market analysis#trading automation#real-time performance tracking#user-friendly interface#trading community#novice traders#experienced traders#profit maximization#sustainable returns

1 note

·

View note