#Amortization Calculator

Explore tagged Tumblr posts

Text

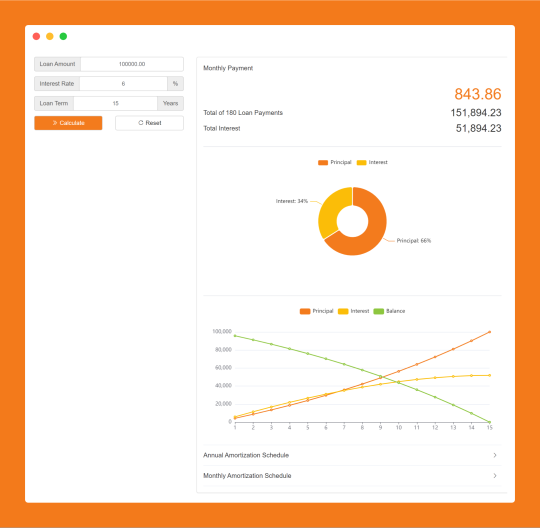

Amortization Calculator will estimate and show you how much your monthly payments will be and the breakdown of your payments based on your loan amount, interest rate, and loan term.

#Online Web Tools#Web Tools#Free Web Tools#Online Tools#Free Online Tools#A.Tools#Finance Calculator#Amortization Calculator

0 notes

Text

Mortgage Recast Calculator

Calculate Now

Calculate Now

A Mortgage Recast Calculator is a handy financial tool that helps homeowners estimate the new monthly payments and potential savings when they make a large lump-sum payment toward their mortgage principal. Unlike refinancing, which often involves closing costs and changing your loan terms, a mortgage recast simply recalculates your monthly payments based on the reduced principal balance while keeping the same interest rate and loan term. This can significantly lower your monthly burden and save you thousands in interest over the life of the loan. By inputting key details like your current loan balance, interest rate, monthly payment, and the amount of the lump sum you plan to pay, the calculator quickly shows you what your new payment will look like. It's an excellent resource for those who come into extra funds—like a bonus, inheritance, or savings-and want to improve their financial position without the hassle of refinancing.

#Mortgage Recast Calculator#Mortgage amortization calculator#Mortgage payment calculator#Mortgage calculator#Mortgage payoff calculator#Mortgage refinance calculator

0 notes

Text

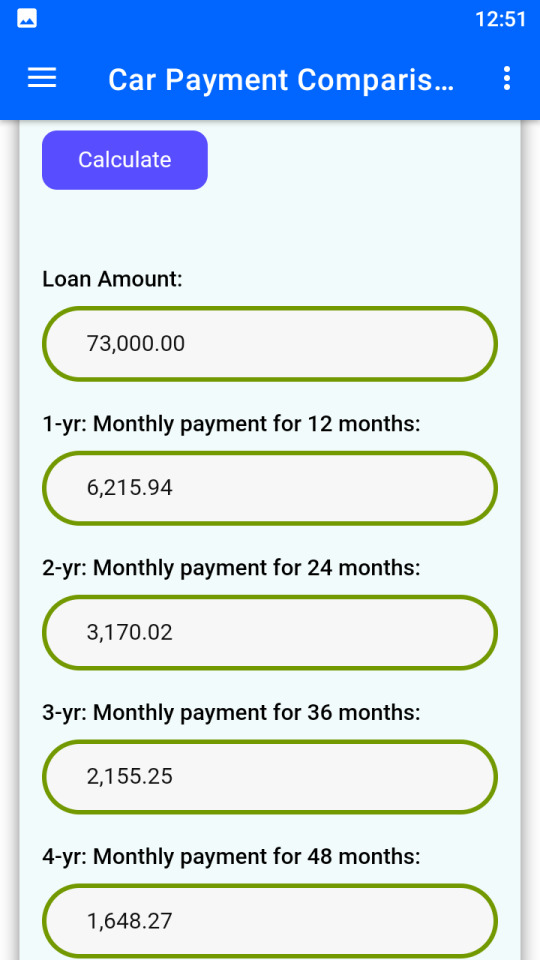

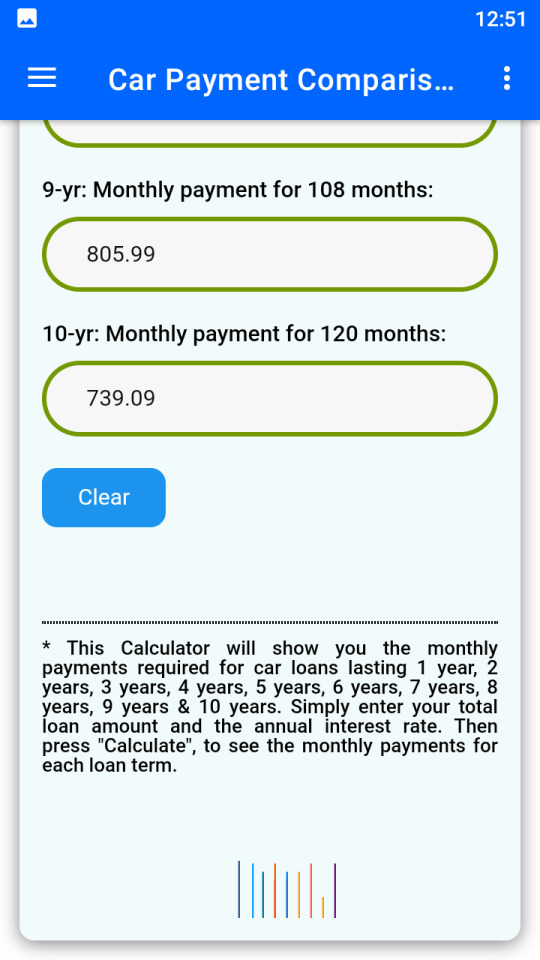

Know & compare the monthly payments from 1 year to 10 years. This App will show you the monthly payments required for car loans lasting 1 year, 2 years, 3 years, 4 years, 5 years, 6 years, 7 years, 8 years, 9 years & 10 years. Simply enter your total loan amount and the annual interest rate. Then press "Calculate", to see the monthly payments for each loan term.

#car payment calculator#auto loan calculator#vehicle loan comparison#monthly car payment estimator#car finance calculator#loan term comparison#car affordability calculator#auto financing tool#car loan repayment#interest rate calculator#car lease calculator#car loan EMI calculator#vehicle financing calculator#auto loan payment tracker#car purchase planning#car budget calculator#car loan interest calculator#auto finance planner#car loan schedule#loan amortization calculator#car cost estimator#easy car loan calculator#car financing made simple#monthly installment calculator#car loan planning tool#vehicle cost calculator#auto credit calculator#auto loan affordability#best car loan calculator#smart car finance app

0 notes

Text

Financial Calculators for Smart Money Management in the USA – Free Tools at Maveric Elite Tech

Managing personal and business finances requires careful planning and accurate calculations. Whether you are budgeting your salary, planning a mortgage, evaluating an investment, or figuring out how much you need to save, having the right financial tools at your fingertips is crucial. That’s where Maverick Elite Tech comes in.

At Maverick Elite Tech, we offer a range of free financial calculators designed to simplify your financial decisions and help you gain better control over your money. From determining your take-home pay to calculating interest rates and loan amortizations, our tools provide quick and precise answers to your financial queries.

Why Use Financial Calculators?

Financial calculators are essential tools for making informed financial decisions. They help individuals, business owners, and investors assess their financial health and plan for the future. Instead of manually performing complex calculations, you can rely on these tools to get instant and accurate results.

Our financial calculators in the USA are designed to help you:

Understand how much you will take home after taxes.

Plan your mortgage payments and home-buying expenses.

Estimate your returns on investments (ROI).

Calculate interest on loans and savings.

Budget for rent and other monthly expenses.

Create an amortization schedule for loan repayments.

With Maverick Elite Tech, you get access to these essential financial calculators for free, ensuring that you make the best financial choices without hassle.

Types of Financial Calculators Available at Maverick Elite Tech

1. Salary Calculator in the USA

If you want to determine your take-home salary after deductions such as federal and state taxes, Social Security, and other withholdings, our salary calculator in the USA is the perfect tool. It helps employees and freelancers understand how much they will actually earn after tax deductions, allowing for better financial planning.

2. ROI Calculator in the USA

Investing your money wisely requires an understanding of potential returns. Our ROI calculator in USA helps investors estimate their return on investment by calculating the percentage of profit or loss relative to the initial investment. Whether you are investing in stocks, real estate, or a new business venture, this tool provides valuable insights into your investment decisions.

3. Simple Interest Calculator in the USA

For those who want to determine how much interest they will earn or pay on a loan, our simple interest calculator in USA makes it easy. This tool calculates the interest based on the principal amount, rate of interest, and time period, making it useful for personal loans, savings accounts, and short-term investments.

4. Interest Calculator in the USA

Unlike simple interest, compound interest calculations can be more complex. Our interest calculator in USA helps you determine how much interest will accrue over time on savings, investments, or loans, factoring in compounding periods. This is an essential tool for those looking to maximize their earnings or understand loan repayment structures.

5. Rent Calculator in the USA

Are you planning to move to a new apartment or house? Our rent calculator in USA helps you estimate how much rent you can afford based on your income and expenses. This tool is particularly useful for renters who want to budget wisely and ensure they do not overspend on housing costs.

6. Mortgage Calculator in the USA

Buying a home is one of the biggest financial decisions you’ll make. Our mortgage calculator in USA helps you estimate your monthly mortgage payments based on loan amount, interest rate, and loan term. This tool allows homebuyers to plan their finances accordingly and choose the best mortgage option.

7. Amortization Calculator in the USA

Loan repayment schedules can be complex, especially with interest calculations. Our amortization calculator in USA breaks down your loan repayment schedule, showing how much of each payment goes toward interest and principal. This tool is essential for borrowers who want to understand their loan structure and repayment strategy.

8. Saving Calculator in the USA

Saving money requires discipline and proper planning. Our saving calculator in USA helps users estimate how much they need to save each month to reach their financial goals. Whether you are saving for retirement, an emergency fund, or a big purchase, this tool provides clear savings projections.

Why Choose Maverick Elite Tech for Financial Calculators?

At Maverick Elite Tech, we believe financial clarity should be available to everyone. That’s why we offer these tools completely free of charge. Our financial calculators provide:

Accuracy – Get precise calculations for your financial needs.

Ease of Use – Simple, user-friendly interfaces make calculations quick and easy.

Instant Results – Save time with immediate financial insights.

Comprehensive Tools – A wide range of calculators to cover all financial aspects.

Whether you are an individual looking to plan your finances, a homebuyer assessing mortgage payments, or an investor analyzing returns, our financial calculators offer everything you need in one place.

Get Started with Free Financial Calculators Today!

Take control of your finances today with Maverick Elite Tech. Our suite of financial calculators in USA is designed to make money management effortless. No hidden fees, no complicated steps—just reliable financial tools at your fingertips.

Explore our financial calculator, salary calculator, ROI calculator, interest calculators, rent calculator, mortgage tools, amortization calculator, and saving calculator in the USA for free now and start making smarter financial decisions!

#financial calculators#salary calculator in usa#roi calculator in usa#simple interest calculator in usa#interest calculator in usa#rent calculator in usa#financial calculator in usa#amortization calculator in usa#mortgage calculator in usa#saving calculator in usa

0 notes

Text

What is Amortization?

An amortization calculator, whether it’s a basic tool or specialized like a home loan amortization calculator, is invaluable for understanding your financial commitments. By breaking down each payment into its components—principal and interest—it empowers borrowers with clarity about their loans' repayment structure.

Whether you're using it for financial planning or comparing different loans, tools like free amortization calculators or monthly mortgage payment calculators make managing debt simpler and more transparent. Take advantage of these resources today to make informed decisions about borrowing and repayment strategies!

0 notes

Text

Unlock the Power of Your Mortgage: Use a Calculator to See the Benefits of Extra Payments

and subheadings in the word count Unlock the Power of Your Mortgage: Use a Calculator to See the Benefits of Extra Payments Making extra payments on your mortgage can be a great way to save money and pay off your loan faster. By making extra payments, you can reduce the amount of interest you pay over the life of the loan and potentially save thousands of dollars. But how do you know if making…

View On WordPress

#best Mortgage Calculators#mortgage calculator amortization#Mortgage Calculators#mortgage calculators australia#mortgage calculators canada#mortgage calculators nationwide#mortgage calculators uk#mortgage calculators with extra payments#new Mortgage Calculators

0 notes

Text

The Power of Modern Calculators: Tools for Financial, Health, and Planning Needs

In today's fast-paced world, access to accurate and efficient calculators is a necessity for making informed decisions in various aspects of life. Whether you're managing your finances, planning for the future, or tracking your health and fitness goals, modern calculators play a pivotal role. In this article, we will explore a range of online calculators provided by Modern Calculators, each designed to address specific needs and assist you in making well-informed choices.

1. Online Loan Calculators

Online Loan Calculators are invaluable tools for individuals seeking loans. These calculators help you estimate monthly payments, interest rates, and repayment schedules, ensuring that you choose the loan that best fits your financial situation.

2. Debt to Income Ratio Calculator

Managing your debt is crucial for financial stability. The Debt to Income Ratio Calculator allows you to determine your DTI ratio, aiding in better decision-making when it comes to taking on new debts.

3. Depreciation Calculator

For business owners and individuals with assets, the Depreciation Calculator is a valuable tool. It assists in understanding how assets depreciate over time, aiding in financial planning and tax considerations.

4. Discount Calculators

Whether you're a shopper or a business owner, Discount Calculators help you calculate discounts, savings, and final prices, ensuring you get the best deals.

5. Due Date Calculator

Expecting parents can rely on the Due Date Calculator to estimate their baby's due date based on various factors.

6. EER Calculator or Estimated Energy Requirement Calculator

Maintaining a healthy diet is easier with the EER Calculator. It helps you determine your daily calorie needs based on factors like age, gender, and activity level.

7. Future Value Calculator

Planning for retirement or long-term savings? The Future Value Calculator aids in estimating the future value of your investments, allowing you to set achievable financial goals.

8. Healthy Weight Calculator

Achieving and maintaining a healthy weight is essential for overall well-being. The Healthy Weight Calculator helps you determine a healthy weight range for your height.

9. Height to Waist Ratio Calculator

Assessing your health risks is made easier with the Height to Waist Ratio Calculator, which provides insights into your abdominal obesity risk.

10. Debt Consolidation Calculator

Those looking to simplify their debt repayment strategy can turn to the Debt Consolidation Calculator to explore consolidation options.

11. Home Loan Affordability Calculator

Before purchasing a home, use the Home Loan Affordability Calculator to determine what you can afford and avoid overextending your finances.

12. Home Loan Calculator with Down Payment

When buying a home, calculating the down payment is essential. The Home Loan Calculator with Down Payment simplifies this process.

13. Ideal Body Fat Percentage Calculator

Maintaining a healthy body composition is vital. The Ideal Body Fat Percentage Calculator helps you set realistic fitness goals.

14. Ideal Body Weight Calculator

Determine your healthy weight range with the Ideal Body Weight Calculator, making it easier to manage your weight.

15. Ideal Calorie Intake Calculator

Achieving your fitness goals requires a balanced diet. The Ideal Calorie Intake Calculator assists in determining your daily calorie needs.

16. Inflation Calculator

Planning for future expenses is essential. The Inflation Calculator helps you understand the impact of inflation on your finances.

17. Skipping Rope Calories Burned Calculator

Stay fit with the Skipping Rope Calories Burned Calculator, which estimates calories burned during jump rope workouts.

18. LDL Calculator

Monitor your cardiovascular health with the LDL Calculator, helping you understand your low-density lipoprotein levels.

19. Lean Body Mass Calculator

Fitness enthusiasts can track their progress with the Lean Body Mass Calculator, which calculates lean body mass and body fat percentage.

20. Loan Down Payment Calculator

Planning to buy a car or home? The Loan Down Payment Calculator helps you determine the down payment required for your purchase.

21. Loan Payments Calculator

Manage your loan repayment schedule efficiently using the Loan Payments Calculator.

22. Macronutrient Calculator

Tailor your diet to your nutritional needs with the Macronutrient Calculator.

23. Meal Calories Calculator

Keep track of your calorie intake with the Meal Calories Calculator, aiding in weight management.

24. Mortgage Payoff Calculator

Accelerate your mortgage repayment strategy using the Mortgage Payoff Calculator.

25. Conception Calculator

For those planning to expand their families, the Conception Calculator helps estimate conception dates.

26. One Rep Max Calculator or 1RM Max Calculator

Fitness enthusiasts can gauge their strength using the One Rep Max Calculator.

27. Ovulation Calculator

Couples trying to conceive can benefit from the Ovulation Calculator to determine fertile periods.

28. Savings Calculator

Whether you're saving for a rainy day or a specific goal, the Savings Calculator helps you track your savings progress.

29. SIP Calculator or SIP Return Calculator

Investment planning becomes more accessible with the SIP Calculator, allowing you to estimate returns on Systematic Investment Plans.

30. Period Due Date Calculator

The Period Due Date Calculator aids in tracking menstrual cycles and predicting due dates.

31. Personal Loan Calculator

Evaluate personal loan options efficiently with the Personal Loan Calculator.

32. Pregnancy Conception Date Calculator

Expecting parents can use the Pregnancy Conception Date Calculator to estimate conception dates.

33. Pregnancy Timeline Calculator

Monitor your pregnancy progress with the Pregnancy Timeline Calculator, providing insights into the stages of pregnancy.

34. Present Value Calculator

Financial planning often requires understanding the present value of future cash flows. The Present Value Calculator simplifies this calculation.

35. Real Estate Calculators

For property investors, the Real Estate Calculators offer valuable tools to assess property yield and rental returns.

36. Rent Calculator

Choosing between renting and buying a home is a significant decision. The Rent Calculator helps you analyze the financial aspects of renting.

37. Rent vs Buy Calculator

Make an informed decision about homeownership with the Rent vs Buy Calculator.

38. Rental Property Calculator

Property investors can assess the potential income from rental properties using the Rental Property Calculator.

39. Retirement Plan Calculator

Plan for your retirement with confidence using the Retirement Plan Calculator.

40. RMR Calculator or Resting Metabolism Calculator

Understand your basal metabolic rate with the RMR Calculator to optimize your calorie intake for weight management.

41. Return on Investment Calculator or ROI Calculator

Evaluate investment opportunities using the Return on Investment Calculator, ensuring your investments yield desirable returns.

42. Simple Interest Rate Calculator

Calculate the interest on loans or investments with the Simple Interest Rate Calculator.

43. Squat One Rep Max Calculator

Fitness enthusiasts can track their strength gains with the Squat One Rep Max Calculator.

44. Steps to Miles Calculator

Keep your fitness goals on track by converting your daily steps to miles using the Steps to Miles Calculator.

45. Student Loan Calculator

Plan your student loan repayment strategy with the Student Loan Calculator.

46. VO2 Max Calculator

Assess your cardiovascular fitness with the VO2 Max Calculator.

47. Waist to Hip Calculator

Monitor your waist-to-hip ratio, a key indicator of cardiovascular health, using the Waist to Hip Calculator.

48. Weight Gain Pregnancy Calculator

Expectant mothers can track their weight gain during pregnancy with the Weight Gain Pregnancy Calculator.

In conclusion, Modern Calculators provides a diverse range of online tools that cater to various financial, health, and planning needs. These calculators empower individuals to make informed decisions, manage their finances, and lead healthier lives. Whether you're a fitness enthusiast, a homeowner, or an investor, these calculators are valuable assets in your quest for success and well-being.

#bmi calculator#bmr calculator or basal metabolism calculator#alc calculator#amortization loan calculator#anc calculator#annual interest rate calculator#annualized percentage rate calculator#auto loan calculator#bench press one rep max calculator#refinance calculator#tdee calculator#body shape calculator#bsa calculator or body surface area calculator#business loan calculator#weight loss calculator#calories burned calculator#carbohydrate calculator or carb intake calculator#cash back or low interest calculator#compound investment calculator#compound Interest rate calculator#credit cards calculator credit cards payoff calculator#daily protein intake calculator#daily water intake calculator#deadlift one rep max calculator#debt consolidation calculator#debt to income ratio calculator#depreciation calculator#discount calculators#due date calculator#eer calculator or estimated energy requirement calculator

1 note

·

View note

Text

Creating a Loan Amortization Schedule with Prepayments using Python and Pandas

Creating a Loan Amortization Schedule with Prepayments using Python and Pandas

Introduction Managing a loan can be a complex task, especially when it comes to tracking payments, interest, and prepayments. In this article, we’ll explore a Python script that generates a loan amortization schedule with the ability to apply prepayments. The script utilizes the Pandas library for data manipulation and Excel export. Loan Amortization Schedule A loan amortization schedule is a…

View On WordPress

#Compound interest#Excel export#Financial management#Financial planning#Loan amortization schedule#Loan analysis#Loan interest savings#Loan management tool#Loan optimization#Loan payment breakdown#Loan payoff calculator.#Loan payoff strategy#Loan repayment#Loan schedule generation#Loan tenure reduction#Loan tracking#Pandas library#Personal finance#Prepayments#Python loan calculator

1 note

·

View note

Text

How much does your craft cost? And why "cost of supplies X2" formula is absolutely harmful for artists?

A lot of artists & artisans keep asking this question: how much should I charge for my craft?

There is a simple way to calculate the cost of the item: calculate the cost of supplies that went into it, and multiply by 2.

I can't track the origin of this idea, but I keep stumbling upon it in many craft groups - and I can't help, but cringe every time.

Why this formula is used by many? It's no secret for me. Many artsy people are not great with math and finances, so they cling to it because of its simplicity.

Why offering this formula to craft novices is a major disservice that may severely harm their approach?

Because each type of craft has its own financial accounting.

What actually should be calculated:

- The cost of supplies, including shipping to your location,

- The amount of time spent on the item, multiplied by the cost of your single working hour,

- The time spent on making photos of the item,

- The cost of packaging,

- The cost of time you spend on packaging and shipping the item.

These are easier to calculate.

Also there are costs that you spend every now and then, like monthly or even once in a several years, like:

- The time and cost of maintaining site (if any), Etsy, Pinterest, etc., and also social media presence,

- The cost of rent if you rent the space, or the cost of maintenance if you own it,

- The cost of electricity/water/etc. you spend while doing the job,

- The cost of tools used (sewing machine, 3D printer, scissors, hammers, glues, paints, photo gear, whatever), it's called amortization,

- The cost of courses, workshops, etc. you attend to improve your skills, or time&supplies you spend self-learning or experimenting.

I mentioned just the major ones, but it may vary from craft to craft greatly.

I suggest to calculate all that stuff for a single month. If it's some tool like a sewing machine that you know you'll be using for many years, I'd recommend to set its amortization time to 5 years (aka 60 months), so after that term, if the tool is still usable, you kinda use it for free. And you can add 1/60th of the cost of the tool to your monthly accounting.

And, knowing the cost of the monthly expenses and number of hours spent on all of your items during a month, you can calculate the percent of the cost that you should add on top of each item.

As you already know, I do doll stuff. To simplify the process, I count the cost of my working hours only, and then add a certain percent to the cost, that I calculated previously. It still may vary from item to item, but it all evens out in a long run.

As for the "cost of supplies x2" formula, let's see how it absolutely doesn't work for me.

Let's say I do faceups. I charge $150 per faceup. My supplies are:

- high quality Rembrandt pastels, Albrecht Duhrer watercolor pencils, acrylic varnish, ox gall and some brushes that were a noticeable investment, but will serve me not for 5 years, but for like 20 years ahead. Even the initial investment is completely covered within a single faceup.

- MSC. I don't overspray, so a single can lasts for at least 5 faceups. Definitely a spendable, but less than $5 per faceup.

- Cotton discs, cotton swabs, some toothpicks, nail polish remover, electricity, whatever else - definitely less than $5 again.

- 3M respirator mask with cartridges. Lasts for at least 5 years, is used for not only faceups but for many other tasks, its cost is almost non-noticeable.

So how much should I charge???

Obviously, I charge for skills mostly.

What if there is a developed market already, you calculated everything, and you see that people aren't ready to pay the honest price?

Then you should think twice if you want to sell your craft, or to move to other business. Or to admit you do it as a hobby and sell for whatever people are ready to pay you, and don't call it a business. And make sure people whom you sell your stuff are informed about the difference. Because skilled manual labor never should cost as little as mass produced items.

111 notes

·

View notes

Text

You see stuff about "generative AIs are not sucking up all the power", they use some amount of power to train them models and a small amount to use them. But then there's "data centers for generative AI are taking up more and more power." Can both of these be correct, is there a contradiction there?

I think there is a way to reconcile those I think, and that is that many AI models are being quickly built, tested, and thrown away. That is also what you might expect if these things are being developed into useful tools as well. Does raise questions of how to calculate of amortized power use of models by generative AIs, I think I will leave those to the reader though.

123 notes

·

View notes

Text

The thing is, even if Ruby is immortal (one could argue amortal, she isn't really alive or dead in a sense) and has a healing factor, the opponents she faces are often those that negate said immortality and either slow down the healing factor or completely stop it from working. Be it by their weapon, their skills or simply a natural ability they possess.

Ruby had canonically died three times in the story. Two of those times were because she was overpowered by her enemies and killed outright. The third was different - she sacrificed herself, blowing herself up along with her enemy to save everyone else.

Why bring this up?

Because even though Ruby had been brought back by the Remnant Dragon Balls each time, the fact remained that she had died. Death left its mark, no matter who or what you were. The first two times changed her. She became more serious and colder, determined never to experience that again and, more importantly, to prevent her family, friends, or allies from having to face it themselves.

For most of the first five Sagas, this mindset defined how Ruby fought. She rarely let herself enjoy a fight, always focusing on ending things as quickly as possible. In some ways, she became similar to Blair, her Eternal Rival, but without Blair’s enjoyment of battle. Ruby was more focused, almost detached, and always calculating.

Her third death, the one where she sacrificed herself, was different. It wasn’t just a loss but a choice, and it left a bigger impact on her. She spent nearly five years in the Afterlife after that, reasoning that most of the threats to Remnant had come because of her. And honestly, she wasn’t wrong. Without her presence, the planet enjoyed five years of peace.

When Ruby finally returned for 24 hours to attend a festival Blair was hosting, a new enemy attacked. She was revived halfway through the arc, but by then, she had changed. The time she spent in the Afterlife had given her a chance to heal. She wasn’t as cold or serious anymore. She was more relaxed and easygoing, allowing herself to enjoy life again, like how she used to be a long time ago.

This change was obvious during said arc. Ruby didn’t approach fights with the same cold, calculated mindset she had before. She faced them with more confidence and a renewed sense of joy, no longer weighed down by her past.

The shift in Ruby's characters didn't erase her past strugges, but showed how she grew from them. The trauma she endured, her choices, and the time she spent reflecting all contributed to a more balanced version of herself. She learned to let go of some of the guilt that had weighed her down, accepting that she couldn't control everything and that it was okay to live for herself, too. Ruby didn't lose her stubborn determination or confidence - she simply stopped letting those things consume her.

By the end of the first part of the story, Ruby felt more like herself again, but with the maturity and perspective she gained from her experiences. She wasn't just a warrior fighting to protect others anymore - she was a Vacosian who could genuinely enjoy life and fighting again. It was this balance she should have strived for in the first place and what ultimately allowed her to tackle challenges with a newfound, boundless confidence.

#long post#meta#cyverse#;Ruby#retrospection#anyways i wanted to do this for a while now but never ws able to put it into words#at the end of the day ruby is still a flat character arc#it's just that her character development happend well over 8+ years ago#she's been more or less the same since

9 notes

·

View notes

Text

Cheeseburger Cost Too Much: Take 2

AN: Americans explaining economic hardship: "Imagine a hamburger."

Summary: Employee wages can double and the price of a meal can be halved and the company still turns a profit. But you already knew that. This is about going insane with a calculator.

A double cheeseburger meal* costs between $9.00 and $13.00 depending on which restaurant you're at. *That's two patties, any toppings you want, medium fries and drink.

That's an absurd amount of money.

It costs on average $3.00 for all the ingredients if they're just bought at the grocery store and not in bulk, y'know like restaurants do.

Of course, restaurants have to make a profit and pay their employees. They also have to pay to ship their ingredients and pay for utilities. Some restaurants don't even own the building they run out of, and instead lease it for cheaper.

Let's do some experiments based on this under the cut:

Suppose you have a typical 2000sqft burger franchise. Your lease, shipping, and utilities come out to $3500 a month. You have six employees- four of them make $15/hr and work 20 hours a week, two of them make $17/hr and work 40 hours a week. You're open 7 days a week, and are closed on Christmas.

Let's pay those employees first and foremost: $1200 for the part-timers, $1360 for the full-timers.

So as soon as you open the doors in the morning, you need to be able to pay out $6060/mo.

==========

You are a very simple burger franchise, with a single menu item- the Double Cheeseburger Combo. Comes with lettuce, onion, pickle, tomato, ketchup, mustard, and mayo, atop two 1/8lb all-beef patties with two slices of American cheese. This is served with a side of fries and a 16oz fountain beverage. Like the combo, you get one. It's Coke.

You make the best burger in town, and average 100 customers a day.

Your combo costs $10.99. So you make $1,099/day.

Now let's factor in the cost of ingredients. At $3.00/combo, you're actually making $7.99/combo, or $799/day.

In a month, you make $23,790 from sales after the cost of ingredients. You pay your bills, and you have $17,730 left over. This is what corporate keeps.

Let's say business is steady for a year. Your franchise makes $212,760 for corporate.

You are one of 21,000 franchises worldwide. They all do exactly as good as you. Your corporation has amassed $4,467,960,000. For brevity's sake, we'll just say $4.47Bn.

You've made this amount after accounting for wages, utilities, shipping, and leasing. Let's say you get a Superbowl ad, and run a healthy ad campaign to promote your combo all year. I'll be generous and say that the regular ad campaign is the same price as the Superbowl ad- so you're out $14 million dollars. Taking you down to $4.45Bn.

You pay your CEO 24 million dollars as a bonus. You have $4.3Bn.

What's left here is called EBITDA- Earnings Before Interest, Taxes, Depreciation, and Amortization.

Let's pay your taxes. It's about 23% of your income. $1,012,000,000. $1.01Bn- you have $3.44Bn left.

Throw all that in the bank. With a 7% interest rate, you'll have made an extra $241 million or so.

Leave it alone for five years, that's a cool billion you made doing nothing.

==========

I'm not gonna talk about stocks, shares, or "worth." This is about a sandwich and what it should cost. Suppose instead that it's $7.99. Let's see what happens to the company when I make it so!

You now make $499/day, $13,972/mo. Subtract your operating costs-you now earn $7,912/mo.

Every month. Every franchise. What has the company made after a year?

$1,993,824,000 - $1.99Bn.

Superbowl ad. Regular ad campaign. CEO bonus. Taxes. All at the same rate.

14 million dollars, 24 million dollars, and... 457.7 million dollars.

So what do we keep? $1,532,300,000. Or 1.53Bn.

So the company is still a billion dollar company. Just not a four billion dollar company. This is why I won't talk about stocks, shareholders, stuff like that- it's just scorekeeping. It's just making the number go up so that the fans at home can make a number go up for themselves- and it's all at the expense of the working poor.

You put 1.53Bn in the bank for 5 years at 7% interest, you're making 107 million additional dollars, by doing nothing.

After 10 years, that's a cool billion without any effort on your part.

==========

Let's see what we can do with just the interest.

107 million, split across 21,000 franchises, that's $509.50 you can pay out every year, to every franchise.

Doesn't sound like a lot, but two things- one, this is just interest, and two, you'd be surprised what a little pocket change can do for a restaurant. You can replace a heating element in a fryer. You can get the floors waxed. You can buy your staff concert tickets. If someone gets sick, you can help them out! On interest.

You haven't gone a penny under the 1.53Bn you put in the bank.

Suppose you did. Suppose you raised the minimum wage at all franchises to 20 dollars, with managers making 24 dollars.

$1600/mo for part-timers now, and $3840/mo for full-timers. You still have a staff of six and your shipping, utility, and lease haven't changed. Your new monthly total is $8940/mo.

And fuck it, a combo is $5.99 now. Ready for round 3?

$299/day -> $8970/mo.

Your franchise now makes 30 dollars a month for the company.

That's $630,000 a year when you multiply it across all franchises worldwide.

You can't pay your CEO a 24 million dollar bonus. You can't buy 14 million dollars worth of advertising. You make $44,100 a year in interest. You pay $144,900 in taxes.

You're a 486 thousand dollar company. You pay your CEO a 10,000 dollar bonus. You make it back fourfold in a year.

You can no longer give every store $509.50 extra a year. Heck, on the interest you're making, you can barely scratch $25 per store in terms of money you can give away every year. But that was always just bonus money. Playing with your interest.

You're half the size of McDonalds, feeding people all over the planet, reaching further than Burger King, and your company is valued at 413,000 times less than they are.

And you're still half a million dollars in profit that you don't have to spend on anything but paying your CEO- who makes $30 an hour, salaried to 45 hours a week. $64,800/yr for the special boy.

You've still got $420,000 in the bank, which, in a world where a combo meal costs $5.99, is the perfect amount.

This is as good as it gets in 2024. A time traveler from 1995 would laugh at us:

#burger#cheeseburger#economics#cheeseburger economics sounds like a really awful book i would find in a thrift shop#be glad you didn't see the first draft of this post

28 notes

·

View notes

Text

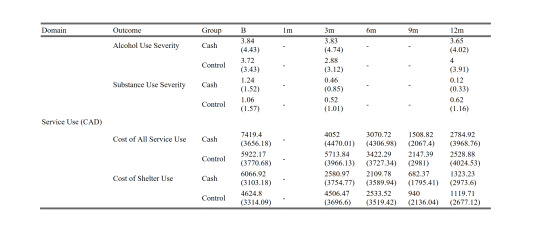

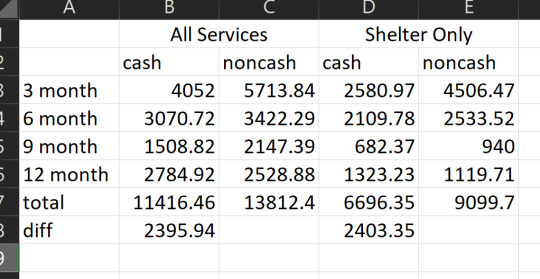

Unfortunately it's really easy to exaggerate the implications of the finding. I went down a pretty massive rabbit hole reading the study being referenced here (“Unconditional cash transfers reduce homelessness” (Ryan Dwyer, Anita Palepu, Claire Williams, and Jiaying Zhao 2023)). and looking at where the numbers came from, and that $8277 per person cost savings shows up in the discussion of the results but directly contradicts the findings. When they directly estimated the cost of services provided to the people in the study by counting the days the people used those services, they found a savings of around $2400 per person over the year - meaning with the $7500 lump sum payment, it was $5100 more expensive to give people a lump sum rather than $777 cheaper.

So where did the $8277 value come from? Why was it brought up in discussion? As far as I can tell, it comes from

Saying the participants who received cash spent 89 fewer days homeless and assuming, contrary to what they measured, that ALL days homeless were spent in shelters (as opposed to on the streets, in cars, couch surfing)

Assuming a cost of $94 per night for shelter

... based on a different study

... which had ranges of $14 to $144 per night for different kinds of housing

... which includes the MARKET VALUE PRICE OF THE BUILDING AMORTIZED AS A CAPITAL EXPENSE

which you would find if you dug through that study's appendix.

And if you pick that value you see a "cost savings", even though you measured a loss in the work at hand.

Now, this study has some other major problems, but that one seems glaring. Come on. You calculated the cost based on the actual number of days spent in the shelter, found that it was only $2400ish lower, and then made a worse estimate based on other people's approximations and intentionally misrepresented how long people spent in the shelters?

Here's their actual data.

Values without parentheses are means, values in parens are standard deviations. "B" is the baseline survey and it covers the 12 month period before the study. Each 3-month survey captures 3 months' worth of spending. You can see that neither the cash nor control group used more than $7500 worth of housing in the prior year. Here's my little table showing the sums, for convenience:

so. their own data really seem to contradict the conclusion they draw by estimating with other people's approximations.

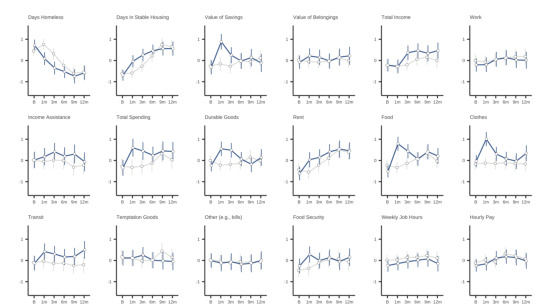

anyway. there are a dozen other glaring issues but I think the main point is well-summarized by figures they left in the appendix. These figures show the standardized outcomes for a bunch of things they measured at the 1, 3, 6, 9, and 12-month surveys:

Blue lines got cash, grey lines didn't.

By the end of the study period - really, after the first three months - there was virtually no difference on any metric between the cash and non-cash groups. None.

This study was pre-registered. It stated its hypotheses ahead of time as well as the way it was going to do its power analysis, and

EVERY SINGLE HYPOTHESIS IT PREREGISTERED FAILED. Not significant.

Even in the exploratory findings, they found short-term benefits but "The cash transfer did not have overall impacts on employment, cognitive function, subjective well-being, alcohol use severity, education, or food security."

Like, yes! Giving people money increased the time they spent in stable housing by about 55 days over the year. That's valuable! That's good! But it didn't have any meaningful effect on whether they ended the year in stable housing, or whether they got a job, or even the value of their savings.

There's a whole nother rabbit hole, which I'll spare you, about the sampling bias they have here (only people 19-65 years old, homeless LESS THAN 2 YEARS, citizen or permanent resident, with nonsevere levels of substance use, alcohol use, and mental health symptoms, which excluded 69% of the shelter population) (and who agreed to participate, and stuck with the study - down to just 35 people in the sample group, <5% of the shelter population) - and two more rabbit holes about their "people don't want to give homeless people cash transfers because they think they'll spend it on drugs" studies. The news story screenshotted in the tweet kinda misrepresents that aspect too - if you explicitly exclude people with substance use and alcohol use issues from your study, the people you study don't spend money on drugs and alcohol! and water is wet. But that's a post for another day.

but in short:

the program did not save money. and the study sucks.

**** for the record! I think that society should absolutely ensure housing for everyone, especially the people with highest support needs. that's the point of society! and in general I think cash transfers can be far more effective at getting people fed and housed for many of the same reasons the study authors do. I really, really wanted this study to hold water because it would be a great piece of evidence in favor of faster and easier and cheaper ways to house people. But because I wanted it to be true so badly, I knew I ought to give it extra scrutiny. which I think was solidly warranted. ****

Source

Source

#sorry for coming onto your reblog and spilling trash everywhere#it's#I got curious about the study and was not pleased with what I found when I looked closer#fact checking#long post#for the record i believe in the value of cash transfers and donate money for cash transfers in poorer countries.#and i think housing and shelter are fundamental human rights#and like the function of a society is in large part to care for the people least able to care for themselves#and sobriety shouldn't be a prerequisite for housing and people with substance use problems should have safe and comfortable housing

55K notes

·

View notes

Text

Mortgage Calculations: Factors Affecting Payments

Multiple factors influence mortgage payments in Canada. Best Mortgage Online identifies principal, interest rates, terms, amortization, payment frequencies, property taxes, insurance, and fees as key determinants. Larger loans or longer amortizations increase costs, while frequent choices impact savings. Using online calculators helps Canadians assess affordability and plan strategically for long-term mortgage management.

0 notes

Text

Funny you should mention sewing machines. The very bottom of the line sewing machines are built to a price. In order to meet that price the most expensive part that doesn't get appreciable cheaper in bulk is typically the motor. This is because motors are already made in bulk and the cost of design and tooling has been amortized up front. Everything else is more or less custom for the machine, so it's made as cheaply as possible. These are things like gears and the housing pieces that are made in plastic. Molds are expensive, so the more you use them, the cheaper the pieces get. Now the most common stitches: straight, zig-zag, satin and triple stitch can all be managed by mechanical means. These types of machines are cheap to make and are extremely serviceable. Unfortunately, the servicing typically costs more than the machine and isn't worth it unless you can do it yourself.

When you add dozens of stitches, well, these usually require a microprocessor and all of a sudden you have a part which is hard to source when it breaks. Worse than that, when there is a failure in these parts, it's usually in power handling and involves the failure of capacitors, which are astoundingly cheap and of the cheap ones, the manufacturer likely sourced the absolute cheapest ones they could find. They are replaceable, but it takes time. If it takes more than an hour to replace a part which not in bulk will cost $.50, then you've eclipsed the cost of the machine. A lot of people recognize this and choose not to repair because 1. they don't know how to diagnose, source, and replace these parts and 2. the cost of replacing it doesn't justify the repair.

In 1995 or so I bought a bottom-of-the-line Elna sewing machine for $150US. I drove that machine like a rented mule for nearly 30 years. In the last year, it was not sounding so good and was clearly in need of service. While sewing something outside of its capability, I borked the timing between the needle and the bobbin. This is fixable. Not be me, though. So I brought it in to the shop and asked for an estimate and they quoted $150 minimum. If you look at an inflation calculator, $150 in 1995 is worth roughly $300 today. So it was not worth having it fixed, so I replaced it, but I figured that 30 years of use was pretty good for what I got out of it. The equivalent bottom-of-the-line machine still cost about $150 and sorry, no. That means that they seriously cheaped out on everything in that machine.

I have the means so I upgraded. Most everything at the midpoint price range has a microprocessor and I will probably end up fixing that myself when it goes.

A couple years later, I took advantage of an opportunity my employer offers that lets each employee spend a chunk of money on "skill improvement" things and they're very flexible about what that means and sewing counts, so I bought this beast:

It cost about $1000US. What does it do? One thing. It does straight stitch. It's built like a tank and it runs like a well-tuned Ferrari. It's amazing. Most machines I've used, I quickly get to the point where I'm flooring the pedal and wondering why it's so slow. Not this machine. It has a maximum speed control which I keep close to the minimum because damn. Everything that's important about this machine is made of metal. It weighs a ton. There's a metal guard over the thread uptake lever. Why? Because it will hit you and hit you HARD. The motor is under the table and everything in the machine is belt-driven. It has an oil sump that it uses to draw oil up into the machine and cool off the parts. At my age, this machine will easily outlive me and there will still be parts for it because the parts that are most likely to fail are the belt, the bearings, and the motor - all of which are easy to find.

What really capped it for me was that while I was in the store buying this, another person came in who works at one of the oldest casket manufacturers in the US and they were replacing one of their industrial machines with one of these. Why were you replacing one of your machines? Because they have been in constant use for more than 100 years and the parts that are failing now are impossible to find. Everything else: belt, bearings, motor are still replaceable. It's just the metal parts they can't get. So they are buying one of these because they meet the same profile: does one thing, does it very well and built to be maintainable.

231K notes

·

View notes

Text

Calculating the EMI for Your Used Luxury Car

So, you've finally decided to invest in that dream luxury car. Whether it's a sleek Mercedes Benz, a sporty Porsche, or a sophisticated Audi, the allure of owning a used luxury car can be truly irresistible. However, before you drive off into the sunset in your new (or new-to-you) luxury car, there's an important aspect you need to consider - your Equated Monthly Installment (EMI). Calculating your EMI is crucial to ensure that you can comfortably afford your prized possession without putting a strain on your finances.

Understanding EMI Calculations:

EMI is the amount you pay each month to the lender until you've fully repaid your loan. The EMI consists of both the principal amount and the interest charged on the outstanding balance.

The formula to calculate EMI is:EMI = [P x r x (1 + r)^n] / [(1 + r)^n - 1]

Where,

n is the loan tenure in monthsAvailable Options to Calculate EMI:

Manual Calculation: You can use the formula mentioned above to manually calculate your EMI. While this method provides you with a precise figure, it can be time-consuming and prone to human error.

Online EMI Calculators: Numerous financial websites and lending institutions offer free online EMI calculators. These user-friendly tools allow you to input the loan amount, interest rate, and tenure to instantly determine your EMI amount.

Mobile Apps: There are several mobile applications available that can help you calculate your EMI effortlessly on-the-go. These apps often provide additional features like amortization schedules and repayment reminders.

Factors Influencing EMI:

When calculating your EMI for a used luxury car, several factors come into play:

Interest Rate: The rate at which interest is charged on the loan amount.

Loan Tenure: The duration over which you choose to repay the loan. Opting for a longer tenure reduces your monthly EMI but increases the total interest paid.

Credit Score: Your creditworthiness plays a significant role in determining the interest rate offered by lenders.

to know more, visit.. https://themotorpedia.com/blog/calculating-the-emi-for-your-used-luxury-car/38589f1cc0014f9e742ff465aef2870d

0 notes