#Mortgage calculator

Text

How to Teach Children About Business and Finance Through Free Online Browser Games

Financial education is often overlooked in the education system, much like other crucial life skills such as home maintenance and tax filing.

This oversight poses a significant problem as children grow up to become financially illiterate adults. As a result, they face ongoing financial struggles, limited opportunities for economic growth, and vulnerability to scams and predatory practices.

Ted Beck, the president and CEO of the National Endowment for Financial Education, emphasizes the importance of financial literacy for children, as it is a skill that will serve them throughout their lives.

"We all need to know how to manage our money," asserts Beck, noting that while some fortunate students learn about it in schools, it is essential to ensure that all children are equipped to handle their financial futures.

Beck even suggests that parents should begin teaching financial literacy to their toddlers, as this skill should be progressively nurtured throughout childhood. An effective way for children to grasp the concept of money as a "medium of exchange" is through educational games and activities.

How to Teach Children About Business and Finance Through Free Online Browser Games

It's a well-known fact that children are drawn to video games because they find them exciting and rewarding. Building on this, you can motivate your child to learn while having fun by introducing them to free online finance and business browser games available on Mortgage Calculator.

These games provide an entertaining and interactive platform through which your child can develop essential financial literacy skills.

Free Money Games on Mortgage Calculator

Mortgage Calculator is a versatile website that caters to both adults and children. While adults can use it to budget for their mortgage, children can engage in educational play.

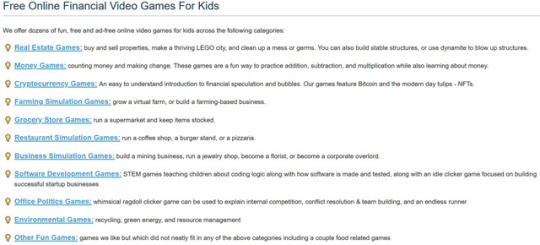

The website offers a wide range of interactive money games, covering topics such as grocery shopping, cryptocurrency, software development, and real estate. This diverse selection ensures that children can learn not only about financial literacy but also explore areas like software development and block coding.

No Downloads, No Ads, No Worries

The games available on Mortgage Calculator are conveniently hosted directly on their website, allowing your children to play them directly in the browser without any need for downloading.

These games are completely free of in-game advertisements, ensuring that your children can focus on playing and learning without any distractions. Moreover, these games are also compatible with mobile devices, allowing you to enjoy them on the go.

Additionally, after careful analysis of the website, it can be confirmed that there are no advertisements present on the entire site. Therefore, you can rest assured that your children would not accidentally click on any unwanted ads while browsing the website.

Money Game – Grocery Cashier

I highly recommend children give Grocery Cashier a try, as it is an engaging finance game that immerses players in the role of a cashier at a grocery store. In this game, players are responsible for processing payments from customers, allowing them to practice and improve their basic mathematics skills, such as addition and subtraction while using a virtual cash register that doubles as a calculator to input the correct amounts.

To add an element of challenge, each customer has a time limit, which progressively decreases as the game progresses. This feature encourages players to think quickly and make accurate calculations within a limited timeframe.

I appreciate the fact that players have the opportunity to learn more about the game before deciding to play it. Additionally, the inclusion of basic tutorials in every game ensures that players have a clear understanding of how to play and maximize their learning experience.

Overall, Grocery Cashier not only provides an entertaining gaming experience but also helps children strengthen their mathematical skills and develop quick thinking in a simulated real-world scenario.

Software Development Game - Code Panda

Mortgage Calculator goes beyond financial games. It also features block coding games, a prominent part of modern school curricula. These games help children understand basic concepts of coding and improve their cognitive functions.

One such game is Code Panda, where children are encouraged to use block codes to guide a panda through a grid and reach the bamboo. With 32 unique stages available, the game offers ample opportunities for children to engage and delve deeper into the world of block coding.

By playing Code Panda and similar games, children not only have fun but also develop essential problem-solving skills and logical thinking. These games provide a hands-on experience in a playful environment, making it easier for children to grasp coding concepts.

STEM Game – We Bare Bears Develobears

We Bare Bears Develobears is one of my top picks from the game list. It's an engaging STEM (science, technology, engineering, and mathematics) game designed to educate children about the various elements involved in creating a video game.

What I particularly enjoy about this game is the inclusion of a diverse range of mini-games that enable players to progress through different stages. As you play, you'll witness the bears' environment gradually improving, which adds to the overall experience. Moreover, the fact that it revolves around my favourite cartoon characters makes it even more appealing.

I strongly believe that this game has immense value for children as it helps enhance their critical thinking and problem-solving abilities. By immersing themselves in the game, they'll acquire valuable skills that can be applied beyond the virtual world.

How to Teach Children About Business and Finance Through Free Online Browser Games

The education system often overlooks financial education, resulting in many adults lacking financial literacy. It is vital to expose children to money management at an early age.

Mortgage Calculator addresses this issue by providing free online finance and business browser games that combine learning with enjoyment.

The games on Mortage Calculator empower children to acquire practical knowledge and develop valuable skills beyond the virtual realm. Ultimately, they equip children for a financially secure future by enabling them to make informed financial decisions.

Start your child's financial education journey today by exploring the games on Mortgage Calculator and helping them build a strong foundation for a lifetime of financial literacy.

#Mortgage Calculator#money games#games#online games#tech#game#short games#finance games#coding game#block coding

2 notes

·

View notes

Text

We are offers a powerful loan calculator tool tailored specifically for realtors and loan officers. This handy online calculator provides quick and accurate calculations for various types of loans, including mortgage loans, refinancing, and down payment estimates.

2 notes

·

View notes

Text

Money games for kids and kids at heart

I’ve been checking on the mortgage calculator site for the computation of my finances but I’ve been in a state of limbo lately (aka burnout), the reason why I’ve been doing so many things lately – more work, recreation on my free time, while still balancing my finances for my major upcoming move, which I’ll be posting soon.

As for my me time, I’m looking for games that keep me interested, one of…

View On WordPress

2 notes

·

View notes

Text

Mortgage Calculator Perth

For accurate and easy-to-use mortgage calculators in Perth, look no further than West Home Loans. Whether you’re a first-time homebuyer or looking to refinance, our mortgage calculator in Perth is an essential tool that helps you understand your potential loan repayments, giving you the confidence to make informed financial decisions.

At West Home Loans, we specialize in home mortgage loans…

#finance#First Home Buyers in Perth#Investment Loans#Investment Loans in Perth#Investment Loans Perth#Loans#Loans in Perth#Mortgage Calculator#Mortgage Calculator in Perth#Mortgage Calculator Perth#real-estate

0 notes

Text

Cracking the Code to Home buying with a Free Mortgage Calculator

Buying your first home? It’s an exciting milestone, but it also comes with a maze of financial decisions. Understanding your mortgage payments is a crucial step to making informed choices. Today, we’re breaking down how a simple and free mortgage payment calculator can be your best friend on this thrilling journey.

When you’re buying your first home, it's easy to get overwhelmed by the numbers. How much house can you afford? What will your monthly payments look like? Without clear answers, you might find yourself lost or, worse, in financial trouble. Understanding mortgage payments isn't just about crunching numbers; it's about securing your financial future and giving you peace of mind.

Meet Your New Best Friend: The Free Mortgage Calculator

Imagine having a tool that simplifies complex financial calculations into easy-to-understand figures. That’s exactly what a free mortgage calculator does. This handy tool helps you estimate your monthly mortgage payments, so you know what to expect before you even start looking at homes. Plus, it’s accessible to everyone, so you don’t need a financial degree to use it.

But how does a mortgage calculator actually work? First, you input your loan amount, interest rate, and loan term. Then, the calculator will do some number crunching based on these factors and give you an estimate of your monthly payment. It's that simple! You can also adjust different variables like down payments or property taxes to see how they affect your overall payments.

Using a free mortgage calculator is straightforward. You input details like the loan amount, interest rate, and loan term, and it does the math for you. It’s like having a financial advisor at your fingertips, minus the hefty fees. With just a few clicks, you can adjust different factors to see how they affect your payments. This allows you to compare different loan options and find the best fit for your budget.

The Benefits of Using a Mortgage Calculator

Easy to Use and Accessible- One of the greatest advantages of a free mortgage calculator is its simplicity. You don’t need to be a math whiz or have a finance degree to use it. With user-friendly interfaces, these calculators make it easy to get accurate estimates within minutes.

Financial Clarity- A mortgage calculator provides you with a clear picture of what your monthly mortgage payments will be. This clarity helps you plan your budget more effectively, ensuring you can afford your dream home without stretching your finances too thin.

Compare Different Scenarios- Considering different loan types or interest rates? A mortgage calculator allows you to compare various scenarios. You can see how changing the loan term or interest rate impacts your monthly payments, helping you choose the best option.

Step-by-Step Guide to Using a Mortgage Calculator

Step 1: Gather Your Information

Before you start, you’ll need some basic information:

Loan Amount: The total amount you’re borrowing.

Interest Rate: The annual interest rate for the loan.

Loan Term: The number of years you’ll be paying off the loan.

Step 2: Input the Details

Enter the gathered information into the mortgage calculator. Most calculators have simple fields where you input the loan amount, interest rate, and loan term.

Step 3: Review the Results

Once you’ve input your details, the calculator will provide you with an estimate of your monthly mortgage payments. Review these results to ensure they align with your budget.

Planning for Different Home Purchase Scenarios

Fixed vs. Adjustable Rates- Fixed-rate mortgages offer predictable payments, while adjustable-rate mortgages can fluctuate. Use the mortgage calculator to see how each option affects your payments.

Shorter vs. Longer Loan Terms-Shorter loan terms typically come with higher monthly payments but lower overall interest costs. Conversely, longer terms reduce monthly payments but increase total interest paid. The mortgage calculator helps you balance these factors.

Larger Down Payments- Increasing your down payment can reduce your loan amount and monthly payments. Use the calculator to see how a larger down payment impacts your finances.

Real-Life Examples of Mortgage Calculators in Action

A first-time homebuyer used a free mortgage calculator to determine her budget. By inputting different scenarios, she found a loan term and interest rate that fit her financial situation, helping her confidently purchase her first home.

Another first time homebuyer was unsure if he could afford his dream home. Using the mortgage calculator, he compared different loan options and found a manageable monthly payment, making his dream a reality.

One of the mortgage users used the mortgage calculator to explore the impact of a larger down payment. By adjusting her savings plan, she increased her down payment, reducing her monthly payments and saving on interest.

The Value of a Mortgage Calculator

A mortgage calculator is more than just a tool; it’s a key to financial confidence. By providing clear, accurate estimates of your mortgage payments, it helps you make informed decisions and avoid financial pitfalls.

Understanding your mortgage payments is a vital step in the home buying process. Whether you’re just starting your search or ready to make an offer, a free mortgage calculator can guide you every step of the way.

With the right tools and knowledge, buying your first home doesn’t have to be overwhelming. A free mortgage calculator puts the power in your hands, helping you turn your homeownership dreams into reality. Try it out today and take the first step towards financial clarity and peace of mind.

0 notes

Text

#mortgage advisor#mortgage agent#mortgage calculator#mortgage loan#mortgage refinancing#mortgage tips#mortgage broker#mortgage rates#mortgage lenders

1 note

·

View note

Text

How to Use the Mortgage Payment Calculator

Learn to navigate the mortgage payment calculator by starting with the home purchase price, specifying your down payment, setting loan terms and interest rates, and adding property taxes and insurance. Remember to include HOA fees if applicable, and calculate your monthly payments to fully understand your financial obligations.

0 notes

Text

Mortgage Calculator and Top Customer Service from SBM Bank Kenya

Discover the best banking solutions for your business with SBM Bank Kenya. Utilize our comprehensive mortgage calculator to plan your finances effectively. Experience top-notch customer service designed to cater to all your business banking needs. SBM Bank Kenya is your reliable partner in achieving financial success and stability.

0 notes

Text

Empower your home buying journey with precision. Explore our VA Loan Affordability Calculator and FHA Loan Mortgage Calculator tools. Navigate the complexities of loans with confidence. Visit our website to access these essential resources today!

1 note

·

View note

Text

Navigating the Mortgage Maze: A Journey with Revve

Embarking on the path to homeownership is often fraught with obstacles and uncertainties, especially when it comes to navigating the complex world of mortgage approvals. As an entrepreneur with a vision for change, I embarked on a personal journey to uncover the challenges and frustrations inherent in the mortgage approval process, all while laying the groundwork for my startup, Revve.

My…

View On WordPress

#finance#gig economy#home-buying#lending practices#loan#mortgage#mortgage calculator#pitfalls#real-estate#startups

1 note

·

View note

Text

FintechZoom Mortgage Calculator 2024

Buying a house is a tough and complex task for new house buyers. But don’t worry we make your homeownership journey simple with tools like the FintechZoom Mortgage Calculator.

0 notes

Text

Loan Calculator For Realtors, Loan Officers and Everyone else

2 notes

·

View notes

Link

Seeking a Home buyer in Weston FL? Look no further than Joel Freis, your trusted partner in real estate. As dedicated mortgage brokers near you, we specialize in securing the best loan options for home buyers, ensuring a smooth and hassle-free transaction process. Whether you're interested in rental properties or leasing opportunities, our team is here to assist you every step of the way. With our guaranteed realtors, clients receive unmatched expertise and personalized attention, making their home buying journey seamless and stress-free. Joel Freis is committed to delivering exceptional service and unparalleled results to our clients. Let us help you find your dream home in Weston, FL. Contact us today to get started on your home buying journey.

#Leasing properties#Mortgage calculator#Home for sales#First time home buyers#Rentals and Leasing Properties#Guaranteed realtor

0 notes

Link

Welcome to Joel Freis, your premier destination for superior real estate services. As leading Real estate agents in Weston FL, we are committed to providing unparalleled expertise and personalized attention to every client. Our comprehensive range of services includes access to guaranteed realtors nearby, seasoned real estate brokers, and trusted consultants in your vicinity. Whether you're in search of rental properties, homes for sale, or in need of professional home staging assistance, we are your dedicated partner throughout the process. Moreover, we specialize in guiding first-time homebuyers, ensuring a seamless and informed experience from start to finish. Choose Joel Freis for a personalized and results-driven approach to your real estate needs. Let us help you navigate the market with confidence and find your perfect property.

0 notes

Text

Simplify Your Home Buying Journey with a Free Mortgage Payment Calculator

Buying your first home is an exciting milestone, but it can also be a daunting financial commitment. Understanding your monthly mortgage payments is crucial for making informed decisions and ensuring you can comfortably afford your new home. This is where a free and easy mortgage payment calculator comes in handy. In this blog post, we’ll explore the benefits of using a mortgage calculator, provide a step-by-step guide on how to use it, and offer valuable tips for first-time home buyers.

The Importance of Understanding Mortgage Payments

Before jumping into home ownership, it’s essential to have a clear understanding of your potential mortgage payments. Your mortgage payment will likely be one of your largest monthly expenses, so knowing the details can help you plan your budget effectively. For first-time home buyers, this knowledge is particularly important as it sets the foundation for financial stability and future planning.

Using a mortgage payment calculator helps demystify the process, providing a clear picture of what to expect. These calculators are designed to give you accurate estimates of your monthly payments based on various factors such as loan amount, interest rate, and loan term. This blog will walk you through how to use a free mortgage calculator and explain why it's an invaluable tool for anyone looking to buy a home.

Understanding Mortgage Payments

To make the most of a mortgage payment calculator, you need to understand some key terms related to mortgage payments. Here are a few essential components:

Key Terms Explained

Principal: This is the amount of money you borrow to purchase your home. The principal decreases over time as you make payments.

Interest Rate: The percentage of the loan amount charged by the lender for borrowing the money. Interest rates can be fixed or variable.

Loan Term: The length of time you have to repay the loan. Common terms are 15, 20, and 30 years.

How These Factors Affect Your Monthly Payments

Interest Rates: Your interest rate significantly influences your monthly payments. Higher interest rates result in higher payments, while lower rates make your payments more manageable.

Loan Term: A longer loan term means lower monthly payments, but you'll pay more interest over the life of the loan. Conversely, a shorter term results in higher monthly payments but less interest paid overall.

Loan Amount: The higher the loan amount, the higher your monthly payments will be. It’s crucial to find a balance that fits your budget. Understanding these elements helps you use a mortgage payment calculator more effectively, allowing you to experiment with different scenarios and find the best option for your financial situation.

Benefits of Using a Mortgage Calculator

A free mortgage calculator is an indispensable tool for anyone planning to buy a home. Here are some of the key benefits:

Financial Planning Made Easy- Using a mortgage payment calculator simplifies the process of financial planning. By inputting different loan amounts, interest rates, and terms, you can see how each factor affects your monthly payments. This helps you set realistic expectations and make informed decisions about your budget.

Real-Life Examples- Consider Jane, a first-time home buyer. She used a mortgage calculator to compare different loan scenarios. By adjusting the interest rate and loan term, she found a combination that fit her budget, allowing her to avoid financial stress. Without the calculator, Jane might have overcommitted, leading to potential financial difficulties down the line.

Aid in Decision-Making- A mortgage calculator provides clarity and confidence when making decisions about buying a home. It helps you understand the long-term financial commitment and ensures you choose a mortgage that aligns with your financial goals.

Step-by-Step Guide to Using the Calculator

Using a mortgage payment calculator is straightforward. Here’s a step-by-step guide to help you get started:

Enter the Loan Amount: Input the total amount you plan to borrow for your home purchase.

Select the Interest Rate: Enter the interest rate for your mortgage. If you're unsure, you can use an average rate provided by the calculator.

Choose the Loan Term: Select the length of your loan, such as 15, 20, or 30 years.

Review Your Results: The calculator will display your estimated monthly payment, along with a breakdown of principal and interest.

Experiment with Different Scenarios: Adjust the loan amount, interest rate, and term to see how changes affect your monthly payment. Using a mortgage payment calculator is a simple yet powerful way to take control of your financial future.

Tips for First-Time Home Buyers

First-time home buyers face unique challenges, but with the right tools and knowledge, you can make the process smoother. Here are some tips to keep in mind:

Consider All Costs- When using a mortgage calculator; remember to factor in other costs such as property taxes, homeowners insurance, and maintenance. These expenses can add up and affect your overall budget.

Budget for Unexpected Expenses- It's wise to have a financial cushion for unexpected expenses like home repairs or medical bills. This ensures you won’t be caught off guard and can manage your mortgage payments without stress.

Seek Professional Advice- While a mortgage calculator is a great tool, consulting with a financial advisor or mortgage broker can provide additional insights and personalized advice. They can help you understand the nuances of different loan options and choose the best one for your situation.

Practical Examples and Case Studies

Real-life scenarios can provide valuable insights into how a mortgage calculator can benefit you. Here are a few examples:

Example 1: A recent college graduate used a mortgage calculator to determine her affordability range. By inputting different loan amounts, she found a comfortable monthly payment that fit her budget. This allowed her to focus her home search within a realistic price range.

Example 2: A young couple used a mortgage calculator to compare fixed and variable interest rates. They discovered that a fixed-rate mortgage offered more stability, which was important to them as they planned to start a family.

Example 3: David, a single professional, wanted to pay off his mortgage quickly. By using the calculator, he experimented with shorter loan terms and saw how higher monthly payments would save him money on interest in the long run. This helped him make an informed decision to choose a 15-year mortgage. These examples highlight the practical benefits of using a mortgage payment calculator and show how it can help you make informed financial decisions.

0 notes

Text

Navigating the Canadian Mortgage Landscape: Understanding Mortgage Rates

Securing a mortgage is a significant financial decision, and understanding the nuances of mortgage rates in Canada is paramount for prospective homebuyers. As one of the key elements in determining the cost of homeownership, mortgage rates can influence the overall affordability and financial feasibility of purchasing a property. In this guide, we delve into the factors that shape mortgage rates in Canada, guide about mortgage calculator and offer insights to help you make informed decisions in your homebuying journey.

The Basics of Mortgage Rates:

Mortgage rates represent the interest charged by lenders on the amount borrowed for a home loan. In Canada, these rates can be fixed or variable, each carrying its own set of advantages and considerations.

Influence of the Bank of Canada:

The Bank of Canada plays a pivotal role in shaping mortgage rates. The central bank's decisions regarding the overnight lending rate directly impact the interest rates offered by financial institutions. Understanding the Bank of Canada's rate movements is crucial for predicting trends in mortgage rates.

Fixed-Rate Mortgages:

Fixed-rate mortgages in Canada maintain a constant interest rate throughout the mortgage term. This stability offers predictability for homeowners, allowing them to budget effectively without being affected by fluctuations in interest rates.

Variable-Rate Mortgages:

Variable-rate mortgages, on the other hand, are linked to the prime rate set by financial institutions. These rates can change in response to shifts in the economy, making them potentially more flexible but also subject to market volatility.

Economic Factors Impacting Mortgage Rates:

Various economic factors influence mortgage rates in Canada. Factors such as inflation, employment rates, and global economic conditions can all play a role in shaping the interest rates offered by lenders.

Credit Scores and Mortgage Rates:

The creditworthiness of a borrower is a key determinant in the interest rate they are offered. Individuals with higher credit scores often qualify for lower mortgage rates, highlighting the importance of maintaining good credit health.

Market Competition Among Lenders:

The Canadian mortgage market is competitive, with numerous lenders vying for borrowers' attention. This competition can lead to variations in mortgage rates, providing homebuyers with opportunities to secure favorable terms through diligent comparison shopping.

Rate Comparison and Negotiation:

Homebuyers are encouraged to compare mortgage rates offered by different lenders. Negotiation is a valuable tool in securing a competitive rate, and borrowers should feel empowered to discuss terms with their lender to achieve the most favorable outcome.

Timing the Market:

Timing plays a role in securing favorable mortgage rates. Monitoring market conditions and being aware of potential shifts can empower homebuyers to lock in rates when they are advantageous.

Conclusion:

Navigating the landscape of mortgage rates in Canada requires a blend of economic awareness, financial acumen, and strategic decision-making. As you embark on your homeownership journey, understanding the factors that influence mortgage rates will empower you to make informed choices, ensuring that your mortgage aligns with your financial goals and circumstances. Whether opting for the stability of a fixed-rate mortgage or the potential flexibility of a variable-rate mortgage, knowledge is the key to securing a mortgage that suits your needs in the dynamic Canadian real estate market.

#savemaxcanada#save max realestate#savemax#canada#realestate#homes for sale#save max#real estate#houses for sale#realestatecanada#mortgage rates#mortgage calculator

0 notes