#Another way to reduce risk is to invest in companies that are financially stable. You can do this by looking at their financial statements

Text

Building a Profitable Investment Portfolio

A well-diversified portfolio is essential for any investor to achieve their goals. As an individual, you must know how to allocate your assets to meet your goals and risk tolerance. Having a well-designed strategy can help you avoid unexpected expenses and ensure that your investments are well-positioned for the long run.

Step 1. Determine Your Asset Allocation

Before you start building a portfolio, you must clearly understand your goals and financial situation. Some of the most common factors affecting a person’s investment strategy are their age, income needs, and the amount of available capital. For instance, an unmarried 22-year-old college graduate may need a different approach than a 55-year-old who plans on retiring in ten years.

If you’re not willing to risk losing money, then your investments might not be able to provide you with the high returns you’re looking for. Having a good understanding of these factors will help you determine how you should allocate your investments.

Another important factor you should consider when building a portfolio is the risk/return tradeoff. For instance, if you’re planning on having a relatively stable lifestyle and are not planning on relying on your investments for income, then you might want to take more significant risks. On the other hand, if you’re planning on having a more tax-efficient retirement, you might want to focus on protecting your assets.

Step 2. Achieving Your Portfolio

Once you have determined the appropriate asset allocation, you must divide your capital into two equal parts. For instance, you should allocate your money between bonds and equities. You can also break down the various asset classes into subclasses to better understand each class’s risks and potential returns. For instance, an investor may divide the equity portion of their portfolio between foreign and domestic stocks and companies and industrial sectors. On the other hand, the bond portion may be allocated between government and corporate debt and short- and long-term bonds.

Step 3. Reassess Your Portfolio Weightings

After you have an established portfolio, you must regularly re-evaluate and adjust the components of your portfolio to keep up with the changes in the market. Doing so will allow you to determine the appropriate asset allocation for your needs.

Factors affecting your financial situation and risk tolerance will also change over time. For instance, if your risk tolerance has decreased, you might need to reduce the number of stocks in your portfolio. Or, if you’re at the stage where you’re ready to take on more risk, then you might want to allocate a small portion of your assets to small-cap stocks.

Step 4. Rebalance

Before you start re-evaluating and adjusting the components of your portfolio’s details, you must determine which securities you should reduce and how much you should sell. This will allow you to determine which under-weighted securities to buy.

If you’re planning on reducing the number of stocks in your portfolio to re-balance it, you might owe a significant capital gains tax. However, it’s better to maintain a steady allocation of assets to other asset classes instead of selling all your growth stocks. This will allow you to reduce the overall weightage of your portfolio without having to pay taxes.

Even though you may be planning on selling some of your growth stocks, you should still consider the market’s outlook. If you’re worried that the same stocks may fall, you might want to sell them even though the tax implications are still significant. One way to reduce your tax bill is by selling some of your growth stocks through tax-loss selling.

8 notes

·

View notes

Text

Maximizing Your Productivity to Explore Alternative Investment Opportunities

Alternative investments are a strategic way of diversifying portfolios beyond traditional stocks and bonds. However, to navigate these options, you need to increase your productivity. Hence, this article explores how to effectively manage your time and resources to capitalize on the unique opportunities presented by alternative investments.

Strategies for Enhancing Productivity in Alternative Investments

Alternative investments represent a class of assets that fall outside the traditional categories of stocks, bonds, and cash. They are vast and varied, each offering distinct characteristics and benefits within a portfolio. For instance, real estate includes investing in residential, commercial, and industrial properties. It is often praised for its low correlation with traditional financial markets, providing a cushion during periods of stock market volatility.

Private equity is another popular alternative to stocks and bonds, and it involves investing in companies not publicly traded on a stock exchange. These include venture capital investments in startups, growth capital for expanding companies, or buyouts. Private equity is known for its potential for high returns, albeit with higher risk and longer investment horizons.

Other alternative investments worth looking at are commodities and hedge funds.

The next step might be knowing where to access these opportunities. Fortunately, digital platforms provide access to a wide range of investment funds previously available only to institutional investors or those with significantly high capital.

Here are ways to maximize productivity so you can reap from the alternative opportunities you find.

Time Management Techniques

Two valuable techniques are prioritization and batching tasks.

Prioritization involves ranking investment activities based on their potential impact and urgency. For instance, you can prioritize due diligence on a new private equity opportunity that’s about to close funding rounds and schedule a routine check of stable, long-term real estate assets later. This technique ensures the most time-sensitive and potentially rewarding tasks receive immediate attention, optimizing the allocation of effort and resources.

On the other hand, batching tasks refers to grouping similar activities to reduce distraction and increase efficiency. You can dedicate specific blocks of time to analyze market trends across various commodities or review performance reports of multiple hedge funds.

It minimizes the mental load and administrative overhead of switching between different tasks. As such, it speeds up the investment analysis process and improves focus, leading to more insightful investment decisions.

Technological Tools

There are comprehensive data analytics and research tools for assessing the viability and performance of complex investment options like hedge funds and private equity. You can use these platforms to gather market data quickly, compare fund performances, and conduct deep dives into financials without manually compiling information from multiple sources.

Another powerful tool is investment management software to consolidate your investment portfolios in one interface. It offers risk assessment features and scenario analysis to help you manage and adjust portfolios easily in response to market changes. For example, you can use these tools to simulate the impact of economic shifts on real estate investments, allowing for proactive strategy adjustments.

Outsourcing

Leveraging external resources can bring specialized expertise and additional capacity to your investment strategies. For instance, consulting firms specialize in market analysis and due diligence, providing deep insights into specific industries or markets.

Further, financial and investment advisors offer personalized advice tailored to individual investment goals. For example, an investor interested in commodities might use an advisory service to understand the timing and scale of investments in precious metals or energy resources, balancing their portfolio based on risk tolerance and market opportunities.

In addition, by joining investment groups, you can access larger, more capital-intensive opportunities that might be beyond your reach independently. This strategy is common in private equity, where investment partnerships pool resources to buy out or invest in larger enterprises. It often leads to higher returns due to economies of scale and shared expertise.

Tips to Maintain High Productivity

The dynamic nature of alternative investments necessitates regular reviews of investment strategies. This periodic assessment allows you to respond to changes in market conditions, regulatory environments, and financial goals.

For example, if you invested in private equity, you can reassess your commitment to various funds based on performance metrics and market outlook and adjust your contributions or exit positions to better align with current objectives. These reviews help you stay proactive rather than reactive, enabling you to manage your portfolio more effectively.

In addition, effective stress management is essential for maintaining productivity and decision-making capacity. Techniques such as mindfulness, structured downtime, and physical activity can help manage stress, leading to clearer thinking and better overall health.

Additionally, the landscape of alternative investments is continually evolving, making continuous learning a critical component of an investor’s strategy. For example, keeping abreast of advancements in blockchain technology might inform decisions regarding investments in digital assets or real estate tokenization.

Conclusion

Alternative investments offer a compelling avenue for diversifying your portfolio and accessing potential high returns that are generally uncorrelated with traditional stock and bond markets.

However, the benefits of alternative investments come with the necessity for proactive management and continuous engagement. You can navigate the complexities of these diverse asset classes by implementing the strategies discussed, such as regular strategy reviews and leveraging technological tools.

Pin or save this post for later!

Share in the comments below: Questions go here

#productivity tips#productivity#investment opportunities#time management#optimize time management#investments#alternative investment#technological tools#investment advisors#stress management#mindfulness#structured downtime#physical activity

0 notes

Text

How Gold Can Enhance Your Retirement Strategy

In today’s uncertain economic environment, securing your financial future is more crucial than ever. Many investors are looking at innovative ways to protect their retirement savings from market volatility and inflation. One such strategy is transferring a 401(k) into a Gold IRA (Individual Retirement Account). This move not only diversifies your investment portfolio but also leverages the intrinsic stability of precious metals, offering a hedge against economic downturns. However, the process requires careful consideration of several factors, including the choice of custodians and an understanding of the associated tax implications.

Understanding Gold IRAs

A Gold IRA is a type of self-directed IRA that allows you to invest in physical gold and other precious metals. Unlike traditional and Roth IRAs, which typically hold paper assets such as stocks and bonds, a Gold IRA is backed by tangible assets, linkedin pulse providing a physical commodity’s security and stability. This kind of IRA is especially appealing to those who want to mitigate the risks associated with stock market fluctuations and the devaluation of the currency.

Benefits of Transferring Your 401(k) into a Gold IRA

Diversification of Retirement Portfolio

One of the primary advantages of investing in a Gold IRA is the diversification of your retirement portfolio. Traditional retirement accounts are heavily reliant on the performance of the stock market and the overall economy. By incorporating gold and other precious metals, you can reduce this dependence, as these assets often move inversely to stocks and bonds.

Safeguard Against Market Volatility

Gold has historically maintained its value and often appreciates during periods of economic instability. By transferring part of your 401(k) into a Gold IRA, you can provide a cushion against market downturns, making your retirement savings more resilient.

Hedge Against Inflation

Over time, the purchasing power of a dollar has decreased due to inflation. Gold, however, has proved to be an effective hedge against inflation. Its value tends to increase when the cost of living rises, preserving the purchasing power of your money over time.

Choosing the Right Gold IRA Custodian

When transferring your 401(k) to a Gold IRA, it is vital to select a reputable custodian. This custodian will be responsible for purchasing and storing the physical metals. Look for companies with robust security measures, transparent pricing, and positive customer reviews. Additionally, consider their fees and service charges as these can vary significantly from one custodian to another.

Tax Implications and Considerations

Transferring from a 401(k) to a Gold IRA can have tax implications. Typically, such transfers are treated as rollovers, and if handled correctly, they should not incur any immediate tax liabilities. However, it is important to ensure that the transfer complies with IRS rules to avoid any penalties. Consulting with a tax advisor or financial planner before making the transfer is highly advisable.

Potential Drawbacks

Despite its advantages, investing in a Gold IRA comes with potential drawbacks. These can include longer transaction times, additional fees for purchasing and storing gold, and a general lack of liquidity compared to paper assets. Investors should weigh these factors against the potential benefits of added security and inflation protection.

Conclusion

While there are some challenges to consider, transferring your 401(k) into a Gold IRA can significantly bolster your retirement strategy by providing a stable investment in physical precious metals, which offer protection against inflation and market volatility. However, the key to a successful transfer lies in informed decision-making, careful selection of a reputable custodian, and a solid understanding of the tax implications involved. By taking these steps, you can secure a diversified and resilient financial portfolio that will help maintain your financial health into retirement.

0 notes

Text

What are the best stock market investments?

Determining the "best" stock market investments depends on various factors, including your investment goals, risk tolerance, time horizon, and financial situation. What may be considered a suitable investment for one person may not be appropriate for another. However, here are some types of investments that are often favored by investors:

Blue-Chip Stocks: Blue-chip stocks are shares of large, well-established companies with strong financials, stable earnings, and a history of consistent dividend payments. These companies are typically leaders in their industries and are considered relatively safer investments compared to smaller or riskier companies.

Dividend-Paying Stocks: Dividend-paying stocks are shares of companies that distribute a portion of their earnings to shareholders in the form of dividends. Investing in dividend-paying stocks can provide a steady income stream and potentially offer long-term capital appreciation. Look for companies with a track record of increasing dividends over time.

Index Funds and ETFs: Index funds and exchange-traded funds (ETFs) are investment funds that track the performance of a specific market index, such as the S&P 500, Dow Jones Industrial Average, or NASDAQ Composite. These funds offer diversified exposure to a broad range of stocks within a particular market or sector, providing investors with a simple and cost-effective way to invest in the stock market.

Growth Stocks: Growth stocks are shares of companies that are expected to grow their earnings and revenues at an above-average rate compared to the broader market. These companies typically reinvest their profits into expanding operations, developing new products, or entering new markets. Investing in growth stocks can offer the potential for significant capital appreciation but may also come with higher volatility and risk.

Value Stocks: Value stocks are shares of companies that are trading at a lower price relative to their intrinsic value or fundamental metrics, such as earnings, book value, or cash flow. Value investors seek out undervalued stocks with the potential for a price increase as the market recognizes their true worth over time.

Sector-Specific Investments: Consider investing in sectors or industries that you believe will perform well in the future due to favorable economic trends, technological advancements, or regulatory developments. Examples of sector-specific investments include technology stocks, healthcare companies, renewable energy firms, and consumer discretionary companies.

International Stocks: Diversify your portfolio by investing in international stocks or global markets to gain exposure to companies outside your home country. International investing can provide opportunities for growth and diversification, although it may also entail additional risks such as currency fluctuations and geopolitical uncertainties.

Bonds and Fixed-Income Securities: In addition to stocks, consider allocating a portion of your investment portfolio to bonds and fixed-income securities to reduce overall portfolio risk and provide stability. Bonds offer regular interest payments and repayment of principal at maturity, making them attractive for income-oriented investors and those seeking capital preservation.

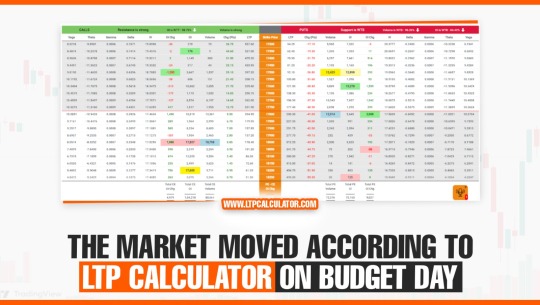

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in india.

You can also downloadLTP Calculator app by clicking on download button.

It's essential to conduct thorough research, diversify your investments, and consult with financial professionals to develop a well-rounded investment strategy that aligns with your financial goals and risk tolerance. Keep in mind that investing in the stock market involves inherent risks, and past performance is not indicative of future results.

0 notes

Text

Why Hiring a Financial Advisor is Essential for Your Financial Success

Managing personal finances can be a daunting task, especially when it comes to making crucial investment decisions or planning for retirement. This is why many individuals turn to financial advisors for expert advice and guidance. A financial advisor is a professional who helps you navigate the complex world of finance and assists you in making informed decisions to achieve your financial goals. In this article, we will explore the importance of hiring a financial advisor and how they can contribute to your financial success.

One of the key benefits of hiring a financial advisor is their expertise and knowledge in financial matters. They are well-versed in various investment options, tax strategies, and retirement planning techniques. By leveraging their expertise, you can make informed decisions that align with your financial objectives. Find out more about this company on this page. Whether you are looking to grow your wealth, save for your child's education, or plan for a comfortable retirement, a financial advisor can provide personalized advice tailored to your specific needs and goals.

Furthermore, a financial advisor can help you create a comprehensive financial plan. They will assess your current financial situation, analyze your income, expenses, and investments, and develop a plan that outlines the steps you need to take to achieve your financial goals. This plan will consider various aspects of your financial life, such as budgeting, debt management, investment strategies, and risk management. By having a well-thought-out financial plan, you will have a clear roadmap to follow and can make informed decisions along the way.

Another reason to hire a financial advisor is their ability to provide objective guidance. When it comes to our own finances, emotions can often cloud our judgment. We may make decisions based on fear or greed, which may not be in our best long-term interest. A financial advisor brings objectivity to the table and helps you make rational decisions. They can provide an unbiased perspective and guide you through market volatility, economic downturns, and other financial challenges.

In addition, a financial advisor can save you time and effort. Managing your finances requires considerable research, analysis, and monitoring. By delegating these tasks to a financial advisor, you can free up your time and focus on other important aspects of your life. They will stay updated on market trends, manage your investment portfolio, and ensure that your financial plan remains on track. This is a great post to read by anyone who is looking for financial advisor. This allows you to enjoy peace of mind, knowing that a professional is taking care of your financial affairs.

In conclusion, hiring a financial advisor is essential for your financial success. They bring expertise, knowledge, and objectivity to help you make informed decisions and create a comprehensive financial plan. By entrusting your finances to a professional, you can save time, reduce stress, and have confidence in your financial future. So, if you want to achieve your financial goals and secure a stable financial future, consider consulting a financial advisor today.

Check out this blog to get enlightened on this topic: https://en.wikipedia.org/wiki/Financial_adviser.

0 notes

Text

Aerospace Manufacturing Consolidation: Strategies for Success

In the ever-evolving aerospace industry, manufacturing consolidation has become a strategic imperative for many companies. It's a response to increasing competition, changing customer demands, and the need for greater efficiency. However, the path to successful consolidation can be challenging and complex. This blog will explore strategies for achieving success in aerospace manufacturing consolidation.

Understanding Aerospace Manufacturing Consolidation

Before diving into strategies, it's essential to understand what aerospace manufacturing consolidation entails. Consolidation refers to the process of merging or acquiring aerospace manufacturing companies to create a more efficient, competitive, and financially stable entity. This can take various forms, including mergers, acquisitions, partnerships, or divestitures.

Aerospace manufacturing consolidation typically aims to achieve several key objectives:

Cost Reduction: By consolidating operations, companies can often reduce costs associated with redundant facilities, processes, and administrative functions. This can lead to significant savings, making the business more competitive in the market.

Economies of Scale: Larger entities created through consolidation can benefit from economies of scale, such as bulk purchasing, shared resources, and increased negotiating power with suppliers.

Enhanced Capabilities: Consolidation can lead to improved research and development capabilities, better technology, and a broader range of products and services.

Market Expansion: By consolidating with or acquiring complementary companies, aerospace manufacturers can access new markets and diversify their customer base.

Financial Stability: Strengthening financial stability is a critical goal, and consolidation can help reduce risk by spreading it across a more extensive portfolio.

Challenges in Aerospace Manufacturing Consolidation

While there are significant benefits to aerospace manufacturing consolidation, there are also several challenges that companies must navigate. These challenges include:

Cultural Differences: When different organizations come together, they may have distinct corporate cultures and ways of doing business. Merging these cultures can be challenging but is crucial for the success of consolidation.

Regulatory Hurdles: The aerospace industry is highly regulated, and consolidation may trigger additional scrutiny from government authorities. Companies need to navigate these regulatory hurdles to gain approval for their consolidation efforts.

Integration Complexity: Merging or acquiring another company often involves integrating diverse systems, processes, and technologies. This can be a complex and time-consuming process.

Employee Concerns: Workforce morale and stability may be affected during consolidation. It's essential to address employee concerns and ensure a smooth transition.

Strategies for Successful Aerospace Manufacturing Consolidation

Now, let's explore strategies that can help aerospace manufacturing companies achieve successful consolidation:

Clear Objectives and Vision: Start with a clear vision of what you want to achieve through consolidation. This vision should encompass the long-term goals of the merged entity, including growth targets, cost reductions, and market expansion.

Cultural Integration: Address the cultural differences early on. Invest in change management and create a shared culture that aligns with your strategic vision.

Due Diligence: Comprehensive due diligence is crucial. Understand the financial health, legal obligations, and operational aspects of the target company. Identify any potential risks or liabilities.

Regulatory Compliance: Work closely with regulatory authorities to ensure compliance throughout the consolidation process. Consult legal experts who specialize in aerospace regulations to navigate this aspect effectively.

Operational Integration: Develop a clear plan for integrating the operations of the merged companies. Identify areas where processes can be standardized and streamlined to achieve cost savings.

Talent Retention: Employee concerns should be addressed proactively. Develop retention plans for key personnel and provide training and support during the transition.

Technology Alignment: Assess the technology infrastructure of both companies and plan for seamless integration. Ensure that IT systems support the new entity's goals.

Customer Communication: Maintain open and transparent communication with customers throughout the consolidation process. Reassure them that the quality and service they receive will not be compromised.

Continuous Improvement: Consolidation is an ongoing process. Continuously assess the performance of the merged entity and identify areas for improvement.

Risk Management: Implement risk management strategies to address potential issues that may arise during and after consolidation. Be prepared to mitigate any unexpected challenges.

Post-consolidation Optimization: After consolidation, the focus should shift to optimizing the operations of the newly formed entity. Seek opportunities for further cost reduction and market expansion.

Measuring Success: Define key performance indicators (KPIs) to measure the success of consolidation. Regularly assess progress against these metrics.

Case Study: Boeing and McDonnell Douglas Merger

To illustrate these strategies in action, let's consider the merger of Boeing and McDonnell Douglas in 1997. This was a significant consolidation in the aerospace industry, and it provides insights into the challenges and successes of such endeavors.

Challenges:

The merger between Boeing and McDonnell Douglas posed significant challenges due to the differences in their corporate cultures, necessitating meticulous efforts to integrate them seamlessly. Additionally, the consolidation encountered rigorous scrutiny from regulatory authorities, demanding extensive negotiations and concessions to gain approval.

Strategies for Success:

Strategies for success in aerospace manufacturing consolidation encompass operational integration, where companies concentrate on streamlining processes and removing redundancies, leading to substantial cost savings. Additionally, employee retention is vital, with Boeing implementing retention programs to retain key personnel from both organizations, ensuring a smooth transition. Open and transparent customer communication remains crucial, addressing customer concerns and maintaining trust throughout the consolidation process. Ultimately, consolidation contributes to enhancing financial stability and strengthening competitive positioning, exemplified by the Boeing-McDonnell Douglas merger's success in the aerospace industry.

The Boeing-McDonnell Douglas merger exemplifies the importance of thorough planning, cultural integration, and effective regulatory navigation in achieving aerospace manufacturing consolidation success.

In the fiercely competitive aerospace industry, aerospace manufacturing consolidation, guided by an Aerospace M&A advisory firm, can emerge as a complex yet essential strategy. The potential benefits in terms of cost reduction, economies of scale, and enhanced capabilities are significant. However, navigating this path to success necessitates addressing challenges, including cultural differences, regulatory intricacies, and operational complexities.

To overcome these hurdles, aerospace companies can rely on a set of well-defined strategies. These encompass the establishment of clear objectives, the expert guidance of Business Plans, an Aerospace M&A advisory firm based in Seattle, dedicated efforts towards cultural integration, and post-consolidation optimization. By embracing these approaches, aerospace manufacturers position themselves for a more competitive and prosperous future. Success in consolidation isn't merely about growing in size; it's about evolving to become better, more efficient, and adaptable in the face of the industry's rapid changes.

0 notes

Text

Building Wealth with Passive Income: A Comprehensive Guide to Investing

Introduction:

In a world where financial security and independence are highly sought after, investing for passive income has become a popular strategy for achieving long-term financial goals. This approach allows you to grow your wealth while minimizing your active involvement in the day-to-day management of investments. In this article, we will explore the ins and outs of investing for passive income, offering valuable insights for both beginners and seasoned investors.

Understanding Passive Income

Passive income refers to money earned with minimal effort or direct involvement. It's a source of cash flow that requires an initial investment of time, money, or both, but generates returns consistently over time. This income stream can come from various sources, including dividends from stocks, rental properties, interest from bonds, royalties, and more.

Diversify Your Investments

One of the first steps in building a passive income stream is diversification. Spreading your investments across different asset classes reduces risk and enhances the potential for steady income. Consider allocating your funds into stocks, bonds, real estate, and alternative investments like peer-to-peer lending or dividend-yielding ETFs.

Stocks and Dividend Income

Investing in dividend-paying stocks is a classic way to generate passive income. Companies that consistently distribute dividends reward shareholders with regular cash payouts. To get started, research and select companies with a history of stable dividends. Consider reinvesting these dividends to benefit from the power of compounding.

Real Estate Investment

Real estate can be a lucrative source of passive income. Rental properties, whether residential or commercial, provide a consistent stream of cash flow. However, real estate investing requires careful research, property management, and initial capital. Real estate investment trusts (REITs) are another option, allowing you to invest in real estate without direct property ownership.

Bonds and Fixed Income

Bonds are debt securities issued by governments or corporations. They offer regular interest payments, making them a stable source of passive income. Depending on your risk tolerance, you can choose from a range of bonds, including government bonds, corporate bonds, and municipal bonds.

Passive Income through Peer-to-Peer Lending

Peer-to-peer lending platforms enable you to lend money to individuals or small businesses in exchange for interest payments. These investments often come with various risk levels, so carefully assess the borrower's creditworthiness and choose loans that align with your risk tolerance.

Building an Investment Portfolio

Creating a diversified investment portfolio is key to achieving a sustainable passive income stream. Regularly assess your portfolio's performance and adjust your investments as needed. Consider consulting with a financial advisor to ensure your investment strategy aligns with your financial goals.

Tax Considerations

Understanding the tax implications of your passive income investments is crucial. Different income sources may be subject to varying tax rates. Consult with a tax professional to optimize your tax strategy and minimize your tax liability.

Patience and Long-Term Perspective

Building a substantial passive income stream takes time and patience. Don't expect overnight results. Stay committed to your investment strategy and focus on the long-term benefits of generating sustainable passive income.

Conclusion

Investing for passive income is a powerful way to secure your financial future. By diversifying your investments across various asset classes, staying informed, and adopting a long-term perspective, you can build a portfolio that generates consistent cash flow. Remember that the key to success is not just investing money but also investing time in learning and refining your passive income strategy. Over time, your investments can provide the financial freedom and peace of mind you desire.

Read the full article

0 notes

Text

10 Strategies for Diversifying Your Investments: Reducing Risk and Maximizing Returns

Investing is a key component of wealth building, but it comes with risks. Diversifying your investments is essential for reducing risk and maximizing returns. By spreading your investments across different asset classes, regions, sectors, and investment styles, you can create a well-rounded portfolio that can weather market fluctuations. In this article, we will explore ten strategies for diversifying your investments, along with real-life examples and practical tips.

Unlock the Secrets of Forex Trading: Discover a Free, Yet Powerful Learning Course at ForexFinanceTips.com

Understanding Diversification

Diversification is the practice of spreading your investments across a variety of assets. It helps reduce the impact of a single investment's performance on your overall portfolio. For instance, if you put all your money into a single stock and it performs poorly, you risk losing a significant portion of your investment. However, by diversifying, you can mitigate that risk.

Assessing Your Current Investment Portfolio

Before implementing any diversification strategies, it's crucial to evaluate your current investment mix. Look at your existing holdings and analyze their performance. Identify any concentration risks or imbalances in your portfolio. For example, if you have a majority of your investments in one industry, such as technology, you might be exposed to sector-specific risks.

Learn Python Coding and Django Web Development, 100% Course, Easy to navigate and complete learning road map at dtlpl.com

10 Strategies for Diversifying Your Investments

- Strategy 1: Asset Allocation One of the fundamental strategies for diversification is asset allocation. This involves dividing your investments among different asset classes, such as stocks, bonds, and cash equivalents. The goal is to create a balanced portfolio that aligns with your risk tolerance and financial goals. For instance, if you have a higher risk tolerance, you may allocate a larger percentage to stocks.

- Strategy 2: Geographic Diversification Geographic diversification involves investing in different countries and regions. By spreading your investments globally, you can reduce the impact of local economic conditions or geopolitical risks. For example, if you have a significant portion of your investments in the US, consider diversifying into international markets, such as Europe or Asia.

- Strategy 3: Sector Diversification Diversifying across sectors is another critical strategy. Different industries perform differently based on market conditions. By investing in a mix of sectors such as technology, healthcare, and consumer goods, you can spread your risk and potentially capture gains in various sectors.

- Strategy 4: Investment Styles and Strategies Exploring different investment styles, such as value investing or growth investing, can further diversify your portfolio. Value investing focuses on finding undervalued stocks, while growth investing aims to identify companies with high growth potential. By combining these approaches, you can capture opportunities in both value and growth stocks.

- Strategy 5: Company Size Diversification Investing in companies of different market capitalizations (large-cap, mid-cap, and small-cap) is another way to diversify. Large-cap companies tend to be more stable, while small-cap companies may offer higher growth potential. By diversifying across different company sizes, you can balance risk and potential returns.

- Strategy 6: Investment Vehicles Diversifying through various investment vehicles adds another layer of diversification. Consider investing in stocks, bonds, mutual funds, exchange-traded funds (ETFs), or real estate investment trusts (REITs). Each investment vehicle has its own risk and return characteristics, allowing you to tailor your portfolio to your preferences.

- Strategy 7: Alternative Investments Alternative investments, such as real estate, commodities, or cryptocurrencies, offer additional diversification opportunities. These assets often have a low correlation with traditional stocks and bonds, providing a hedge against market volatility. However, it's essential to understand the unique risks associated with each alternative investment.

- Strategy 8: Risk Management Techniques Implementing risk management techniques is vital for protecting your investments. Strategies like setting stop-loss orders, hedging with options, or diversifying within an investment through dollar-cost averaging can help manage risk while maintaining the potential for returns.

- Strategy 9: Regular Portfolio Rebalancing Regularly monitoring and rebalancing your portfolio is crucial for maintaining diversification. As investments perform differently over time, your asset allocation may shift. Rebalancing involves selling overperforming assets and buying underperforming ones to restore your desired asset allocation.

- Strategy 10: Professional Guidance Seeking advice from financial advisors or professionals can provide valuable insights into diversification strategies. They can help assess your financial goals, risk tolerance, and time horizon to create a personalized investment plan. Choose an advisor who aligns with your objectives and has a solid track record.

Case Studies and Examples: To illustrate the benefits of diversification, let's consider two investors: John and Lisa. John invests solely in the technology sector, while Lisa diversifies her investments across various sectors and geographies. When the technology sector experiences a downturn, John suffers significant losses. On the other hand, Lisa's diversified portfolio cushions the impact, as her investments in other sectors and regions continue to perform well.

If you have a Dog, Cat, Bird, or any Pet at home, The Most Informative Pet Blog NiceFarming.com

Frequently Asked Questions

Q1: How many different asset classes should I consider for diversification?

- The number of asset classes you should consider for diversification depends on your individual circumstances, risk tolerance, and investment goals. As a general guideline, a well-diversified portfolio typically includes a mix of at least three to five different asset classes, such as stocks, bonds, cash equivalents, real estate, and commodities. However, it's essential to assess your specific needs and consult with a financial advisor to determine the appropriate asset classes for your portfolio.

Q2: Can diversification eliminate all investment risks?

- While diversification is a powerful risk management strategy, it cannot completely eliminate all investment risks. Diversification helps spread risk across different assets, reducing the impact of a single investment's performance on your overall portfolio. However, it does not protect against systemic risks or market-wide downturns that affect all asset classes. It's important to understand that investing always carries some level of risk, and diversification is one tool to manage and minimize those risks.

Q3: Should I diversify equally across all asset classes?

- Diversification does not necessarily mean equal allocation across all asset classes. The optimal allocation will vary based on your financial goals, risk tolerance, and investment horizon. Each asset class carries its own risks and returns, and the allocation should be based on your investment strategy and preferences. For example, if you have a higher risk tolerance and seek long-term growth, you might allocate a larger percentage to stocks. It's crucial to find a balance that aligns with your individual circumstances and goals.

Remember, diversification is a personal strategy, and it's advisable to seek guidance from a qualified financial advisor who can assess your specific situation and help create a diversified investment plan tailored to your needs.

We hope these answers help clarify some common questions about diversification. If you have any further inquiries, please feel free to ask in the comments section below. We value your engagement and look forward to addressing any concerns you may have.

Conclusion

Diversifying your investments is a key strategy for reducing risk and maximizing returns. By implementing asset allocation, geographic diversification, sector diversification, and other strategies discussed in this article, you can create a well-balanced portfolio that can weather market volatility. Remember to regularly monitor and rebalance your portfolio to maintain diversification. Seek professional guidance if needed, as financial advisors can provide personalized advice based on your unique circumstances.

We hope this article has provided you with valuable insights into diversification strategies. If you have any questions or would like to share your experiences with diversifying investments, feel free to leave a comment below. Your feedback is greatly appreciated and can help foster a community of learning and sharing among fellow investors.

Read the full article

1 note

·

View note

Text

Exploring the Best SRS Investment Options in Singapore: A Comprehensive Guide

As a Singaporean, saving for retirement is an important part of financial planning. The Supplementary Retirement Scheme (SRS) is a tax-efficient way to save for your retirement. It allows you to contribute a certain amount of money each year, which can be used to invest in various financial instruments. In this guide, we'll explore the best SRS investment options available in Singapore.

What is SRS?

The Supplementary Retirement Scheme (SRS) is a voluntary scheme introduced by the Singapore government in 2001 to encourage its citizens to save for retirement. The SRS is a tax-deferred scheme, which means that the money you contribute is not taxed immediately. Instead, it will only be taxed when you withdraw it from your SRS account. This can be an attractive option for people who expect to have a lower income during retirement.

How does SRS work?

To participate in the SRS, you need to be a Singaporean or a permanent resident. You can contribute up to S$15,300 per year if you're a Singaporean or a permanent resident, and up to S$35,700 per year if you're a foreigner with a valid employment pass or work permit. You can contribute to your SRS account until the age of 62, after which you can make withdrawals.

The money you contribute to your SRS account can be invested in various financial instruments, such as stocks, bonds, unit trusts, and insurance products. You can also choose to keep the money in a fixed deposit account if you prefer a lower-risk investment.

Benefits of SRS

One of the main benefits of SRS is its tax-deferred nature. When you contribute to your SRS account, you can claim a tax relief of up to S$15,300 per year if you're a Singaporean or a permanent resident, and up to S$35,700 per year if you're a foreigner with a valid employment pass or work permit. This means that you can reduce your taxable income and lower your tax bill.

Another benefit of SRS is that you can enjoy tax-free investment gains. Any investment gains made from the money in your SRS account are not subject to tax. This can help you to grow your retirement savings faster.

Best SRS investment options in Singapore

Now that you understand what SRS is and how it works, let's take a look at the best SRS investment options available in Singapore.

Exchange Traded Funds (ETFs)

ETFs are a popular investment option for SRS because they offer diversification and low fees. ETFs are essentially a basket of securities that can be traded like a stock. They provide exposure to a wide range of assets, such as stocks, bonds, and commodities.

There are many ETFs available in Singapore, such as the Nikko AM Singapore STI ETF and the ABF Singapore Bond Index Fund. These ETFs provide exposure to the Singapore stock market and Singapore government bonds, respectively.

Unit Trusts

Unit trusts are another popular investment option for SRS. They are a type of collective investment scheme that pools money from many investors to invest in a portfolio of securities. Unit trusts offer diversification and professional management.

Retirement Insurance Plans

Retirement insurance plans are another option for investing your SRS funds. These plans offer a combination of insurance protection and investment returns. They can provide a regular stream of income during your retirement years.

One popular retirement insurance plan in Singapore is the Retirement Income Payout (RIP) plan offered by the CPF Board. This plan provides a guaranteed monthly income for life after you reach the age of 65.

Blue Chip Stocks

Blue chip stocks are stocks of large, established companies with a track record of stable earnings and dividends. They are considered less risky than smaller or less established companies.

Some blue chip stocks that are popular among SRS investors in Singapore include DBS Group, Singapore Airlines, and Singtel.

Real Estate Investment Trusts (REITs)

REITs are another option for SRS investors. They are a type of investment vehicle that owns and manages income-producing real estate properties, such as shopping malls, office buildings, and hotels. REITs provide a regular stream of income through dividends.

Some REITs that are popular among SRS investors in Singapore include Mapletree Commercial Trust and Ascendas Real Estate Investment Trust.

LSI keywords: retirement, tax-deferred, investment options, ETFs, unit trusts, insurance plans, blue chip stocks, REITs, tax relief, investment gains, diversification

Long tail keywords: tax-efficient retirement savings, best SRS investment options in Singapore, SRS investment options, diversify SRS portfolio, SRS investment strategy

Conclusion:

The Supplementary Retirement Scheme (SRS) is a tax-efficient way to save for your retirement in Singapore. It offers a range of investment options, including ETFs, unit trusts, retirement insurance plans, blue chip stocks, and REITs. By diversifying your SRS portfolio across these investment options, you can potentially grow your retirement savings faster while enjoying tax benefits. If you're looking for a tax-efficient retirement savings strategy, SRS is definitely worth considering.

0 notes

Text

Clever investing: Creative ways to grow your portfolio and diversify your assets

Investing is putting money into stocks, bonds, mutual funds, and other financial instruments to generate higher returns than what you would get from keeping your money in a savings account. While investing can be a great way to generate additional income, it also comes with risks. When it comes to clever investing, there are several creative ways to grow your portfolio and diversify your assets. Here are some strategies for careful investors:

Tax advantages

Every dollar you save on taxes means more money in your pocket, and savvy investors can use this principle by taking advantage of available tax breaks and deductions. Investing in stocks or bonds within a tax-advantaged account such as a retirement plan (IRA or 401(k)) gives you significant savings on investment income tax payments. Additionally, choosing investments that offer specific types of income may qualify you for particular tax deductions.

Asset allocation

Asset allocation is diversifying your portfolio by investing in different types of assets with varying degrees of risk. A balanced approach enables you to spread the risk among many different kinds of investments, increasing the likelihood that when one type of investment performs poorly, it will be offset by another asset performing well. It helps protect your portfolio against loss while allowing you to participate in potentially profitable investments.

Investment research

Intelligent investors understand their abilities and limitations when investing decisions and do enough research to make informed choices. Taking the time to learn about the options available, and understanding how each investment may perform under certain market conditions, can help you make better decisions. Additionally, research can help you identify and take advantage of opportunities, such as temporarily undervalued investments in the marketplace.

Dollar-cost

Dollar-cost averaging is an investing technique that reduces risk by spreading your investment over time instead of buying all at once. This approach involves dividing your total investment into smaller parts and then investing those parts regularly over time (such as weekly or monthly). It reduces the risk from market fluctuations because it averages its purchase price over time.

Real estate investments

Real estate has long been a popular form of investment for many reasons. It’s typically stable, provides passive income through rent payments, and may increase in value over time. Real estate investing can also be an excellent way to diversify your trading portfolio and increase returns. However, it’s essential to understand the risks associated with this type of investment before taking the plunge.

Invest in startups

Venture capital investing has become increasingly accessible to the average investor in recent years, thanks to the emergence of private equity and crowdfunding platforms. Investing in startups can be high-risk, but proper research can provide potentially lucrative returns.

Cannabis stocks have become increasingly popular in recent years as more countries and states legalise its use for both medical and recreational purposes. Traders who invest in cannabis companies must realise it is a high-risk venture with the potential for significant gains if done correctly.

Be aware of the risks of investing

Investing can be an excellent way to generate income but comes with risks. Before investing, it is essential to understand the various types of risks and how they may affect your investments.

The first risk to consider is market volatility. Market prices can go up or down without warning, resulting in losses for investors. To mitigate this risk, investors should diversify their portfolios by investing in various assets, such as stocks and bonds, which helps spread out the potential losses if one asset class experiences a decline in value. Additionally, dollar cost averaging can reduce the overall risk by investing smaller amounts regularly over time instead of all at once.

Another risk is liquidity risk, which occurs when an investor cannot liquidate an asset quickly or easily due to a lack of buyers or the inability to agree on a fair price for the asset. It increases the difficulty of converting investments into cash when needed and could result in significant losses if done incorrectly.

In addition, investors should consider political risks when making investment decisions. Political changes, such as new laws or regulations, could impact certain investments negatively or create instability in markets that could lead to fluctuations in asset prices. Investors must pay attention to current events and policy changes that could affect their investments so they can make necessary adjustments as needed.

Inflation risk is another factor that investors need to be aware of when making investment decisions. Inflation causes the purchasing power of money to decrease over time due to increased commodity prices, which can reduce returns on investments if they are not adjusted accordingly. As such, inflation should be considered when deciding where and how much to invest so as not to be affected adversely by its effects on returns over time.

The bottom line

These are just some creative ways to grow your portfolio and diversify your assets regarding clever investing. By researching and understanding different investment strategies, you’ll be better positioned to make intelligent choices that maximise your return while minimising risk. With careful planning and dedication, clever investors can reap greater rewards in pursuing financial success.

Read the full article

0 notes

Text

The role of dividends in long-term investment strategies

When it comes to investing, many people focus on the potential for capital gains, or the increase in the value of an asset over time. However, there is another important component of investment returns: dividends. In this article, we'll explore the role of dividends in long-term investment strategies, and how they can help investors achieve their financial goals.

What are dividends?

Dividends are payments made by a company to its shareholders, usually in the form of cash or additional shares of stock. Companies that pay dividends typically do so on a regular basis, such as quarterly or annually. Dividends are often seen as a sign of financial health, as they indicate that a company has a steady stream of earnings that it can use to reward its shareholders.

Why are dividends important for long-term investing?

Dividends can play an important role in a long-term investment strategy for several reasons:

Income generation: Dividends can provide investors with a steady stream of income, which can be especially useful for retirees or those looking to supplement their regular income.

Compounding: Reinvesting dividends can lead to compounding returns over time. When investors reinvest their dividends, they receive additional shares of stock, which in turn generate additional dividends. Over time, this can lead to significant growth in the value of an investment.

Risk management: Companies that pay dividends tend to be more stable and financially sound than those that do not. This can provide a level of risk management for investors, as dividend-paying companies are often better able to weather economic downturns and market volatility.

How to incorporate dividends into a long-term investment strategy

If you're interested in incorporating dividends into your long-term investment strategy, there are several ways to do so:

Invest in dividend-paying stocks: One way to generate dividend income is to invest in stocks that pay dividends. Look for companies with a long track record of dividend payments and a history of steady earnings growth.

Invest in dividend-focused funds: Another option is to invest in mutual funds or exchange-traded funds (ETFs) that focus on dividend-paying stocks. These funds typically offer diversification, which can help reduce risk.

Reinvest dividends: If you own stocks that pay dividends, consider reinvesting those dividends to take advantage of compounding returns over time.

Consider a dividend reinvestment plan (DRIP): Some companies offer DRIPs, which allow investors to automatically reinvest their dividends in additional shares of stock without incurring transaction fees.

Final thoughts

Dividends can play an important role in a long-term investment strategy. By providing income, offering the potential for compounding returns, and reducing risk, dividends can help investors achieve their financial goals over time. Whether you choose to invest in dividend-paying stocks, dividend-focused funds, or take advantage of a DRIP, incorporating dividends into your investment strategy can be a smart move for long-term success.

FAQ

What are dividends and how do they work in investment? Dividends are a portion of a company's earnings that are distributed to its shareholders. They can be paid out in the form of cash or additional shares of stock. Dividends can provide a regular source of income for investors and can also indicate a company's financial health.

How do dividends fit into long-term investment strategies? Dividends can play an important role in long-term investment strategies by providing a steady stream of income that can be reinvested to compound returns over time. Dividend-paying stocks also tend to be more stable and less volatile than non-dividend paying stocks.

What factors should investors consider when evaluating a company's dividend? When evaluating a company's dividend, investors should consider factors such as the company's dividend history, payout ratio, and financial health. It's important to look for a consistent track record of dividend payments and a reasonable payout ratio that indicates the company can sustain its dividend payments over the long term.

0 notes

Text

Why corporations need investment banking services to upgrade themselves

Introduction

In today's financial market, you need investment banking services to raise money, buy or merge with another company, or get expert financial analysis and strategic planning. Corporate finance is a complex and ever-changing subject that needs professional financial analysis, strategic planning, and capital access.

Investment bankers operate as a bridge between firms and investors, helping them with a variety of financial transactions such as initial public offerings (IPOs), investment opportunities, equity and debt issues, and mergers and acquisitions (M&A). In this blog we will look at various forms of investment banking services, their function in corporate finance, and how corporations can benefit from them.

The Role of Investment Banking Services in Corporate Finance

Investment banking services are essential in corporate financing asThey assist businesses with raising finance and provide financial advice. We have listed down some of the most important ways that investment banking services contribute to corporate finance:

Raising capital: Investment banks help businesses raise capital by issuing stocks, bonds, and other securities. They offer underwriting services, which include buying securities from the company and reselling them to investors. This raised money can be used to support growth initiatives, grow their business, or pay off debt.

Mergers and acquisitions: Investment banks offer financial advice to corporations through mergers and acquisitions. They help their clients with finding potential businesses they can acquire or merge with. They also take care of the negotiation process.

Restructuring: Investment banks offer their valuable advice to enterprises facing financial problems. They assist clients in weighing their options, which may include refinancing debt, selling assets, or reorganizing operations.

Risk management: Investment banks also offer risk management services to clients, assisting them in reducing any financial risks such as currency fluctuations or interest rate changes. This service is usually needed by larger firms

Advantages of working with an investment banking firm

Investment banks usually have connections with large groups of investors, which lets them get money for their clients through equity and debt offerings.

Investment banks have finance experts who are informed about financial markets and business finance. They can offer valuable financial advice to the organization. They can also make businesses aware of the best investment opportunities.

You can boost your company’s credibility with top investors by using services like capital raising or financial advisory provided by investment banks

Investment banks have the resources and experience to carry out complicated financial deals successfully. This includes deal structuring, negotiating terms, and handling the transaction's regulatory and legal implications.

Investment banks can also help companies in increasing their valuation by advising them on how to improve their financial performance, optimize their capital structure, and strengthen their market position.

Investment banking services for different sizes of businesses

Startups

Startups are often in their early growth stages and require funds to grow. Startup investment banking services involve capital raising, such as private equity or venture capital, to assist them financially so that they can use this money to evolve. Financial consulting services can also assist startups with financial planning, budgeting, and forecasting.

Mid-sized businesses

Mid-sized businesses may be financially stable and may need the help of investment banks to upgrade to a next level. These may include services such as mergers and acquisitions, restructuring, and financial advice to help them optimize their operations and accomplish their strategic goals.

Large organizations

Larger companies are already well established; hence, their requirements are very different from those of a startup. They have more complicated financial demands and may require investment banking services to manage risks, generate money, or carry out large-scale transactions. Investment banking services for major enterprises involve capital raising, such as public offerings or debt financing, as well as risk management, financial advising, and mergers and acquisitions services.

Conclusion

Investment banking services are an important part of corporate finance since they allow companies to raise cash, complete merger and acquisition deals, and receive professional financial analysis and guidance. They can also provide insight into startup business investment opportunities. While investment banking services provide major benefits, they also carry certain risks, which is why it is critical to select the correct investment bank for your organization.

Pantomath is one of the most reliable mid-market investment banks that you can trust with your business. Their services include investment banking, corporate advisory, structured finance, and asset management. Check out their official website to learn more about the services they offer.

0 notes

Text

IFS Investment Tips by Investors Fund Services

Investing can be a great way for individuals to earn passive income and grow their wealth over time. However, with so many investment options available, it can be challenging to decide which ones are best suited for your needs and goals. In this article, we will discuss some of the most popular types of investments that are suitable for earning individuals and provide tips by Investors Fund Services to help you make informed decisions.

One of the most popular types of investments for earning individuals is stocks.

IFS investment in stocks involves buying shares of ownership in a company. The value of these shares can increase or decrease depending on various factors such as the company's financial performance, market conditions, and overall economic health. Stocks can offer high returns, but they also come with a higher level of risk, making them more suitable for long-term investors who are willing to take on more significant risks.

Another popular investment option for earning individuals is bonds. Bonds are essentially loans made to governments or companies, and investors receive regular interest payments until the bond matures. While bonds offer lower returns than stocks, they are generally considered to be less risky, making them a good option for investors who prefer a more conservative approach to investing.

Mutual funds and exchange-traded funds (ETFs) are also popular investment options for earning individuals. These types of investments allow investors to pool their money together and invest in a diversified portfolio of stocks, bonds, and other assets. This diversification can help to reduce the overall risk of the investment and provide a more stable return.

Real Estate investment company in Bangalore is another popular investment option for earning individuals, and there are many real estate investment companies in Bangalore that offer investment opportunities to interested investors. Investing in real estate can provide a stable income stream through rental income, and the value of the property may appreciate over time, providing additional returns. However, investing in real estate requires a higher level of capital than some other investment options, making it less accessible to some investors.

When it comes to managing investments, it can be challenging to know where to start. Fortunately, investment management companies in Bangalore such as ifs investment offer fund administration services to help investors manage their investments effectively. These services can include managing investment portfolios, conducting market research and analysis, and providing personalized investment advice based on an individual's specific needs and goals.

To make informed investment decisions, it's important to do your research and seek the advice of professionals such as ifs investment Bangalore. Here are some tips to help you get started:

Determine your investment goals: Before investing, it's essential to have a clear idea of what you want to achieve. Are you investing for retirement, or do you want to earn extra income? Knowing your goals can help you select investments that are best suited to your needs.

Assess your risk tolerance: Investing always involves some level of risk. Knowing how much risk you are comfortable taking on can help you select investments that align with your risk tolerance.

Diversify your portfolio: Diversification is key to reducing risk in your investment portfolio. By investing in a variety of assets, you can help to spread out your risk and minimize potential losses.

Monitor your investments: Once you've invested, it's important to keep a close eye on your portfolio's performance. Regularly monitoring your investments can help you make informed decisions about when to buy, sell, or hold.

In conclusion, there are many types of investments suitable for earning individuals, including stocks, bonds, mutual funds, ETFs, and real estate. To make informed investment decisions, it's important to do your research, assess your risk tolerance, diversify your portfolio, and monitor your investments regularly. By following these tips and seeking the advice of professionals such as ifs investment Bangalore, you can build a solid investment portfolio that aligns with your financial goals and helps you grow your wealth over time.

Visit:

#539, 3rd Floor, C.M.H Road, Indiranagar

Bangalore - 560038 Karnataka

Email: investorsfundservices.com

Mobile: 080-48516571Website: https://www.investorsfundservices.com/

#fund administration services#real estate investment company in bangalore#investment management companies bangalore

0 notes

Text

Top Strategies for Successful Investing in the Stock Market and Share Market

Investing in the stock market or share market, depending on where you live, can be a good way to make a lot of money, but it also comes with the risk of losing money if you're not ready. If you're new to investing, you might be wondering, What is share market? In simple terms, the share market is where investors buy and sell stocks or shares. We'll talk about the best ways to make money on the stock market or share market in this article.

Do your research

Research is the first and most critical step in making any kind of investment, and that includes the stock market. You need to know a company's business model, financial health, and development prospects before you put money into it. Researching the company's competitors and the sector in which it works is also recommended. You can use this data to make a more calculated investment selection and lessen potential losses.

Diversify your portfolio

Diversifying your portfolio is another useful tactic when investing in the stock market. This entails purchasing a variety of stocks from various markets. Spreading your investments across many sectors reduces your exposure to any single market swing. Having a diversified portfolio helps reduce the risk of having too much money invested in a single company or sector.

Invest for the long-term

Patience and a long-term outlook are essential for successful stock market investing. Investors who are successful in the long run know that despite the market's volatility in the near term, stocks often yield positive returns. You should anticipate keeping your money invested for a long period of time, potentially decades.

Keep an eye on market trends

The direction of the stock market can be gleaned from observing market trends. It's important to monitor market movements and read up on recent events. This will allow you to keep up with changing market conditions and make more informed investing decisions.

Don't let emotions drive your decisions

Letting one's emotions get in the way of investment decisions is a common mistake. Investors' greed causes them to put more money into the market than they should when times are good. When the market drops, many people sell their assets at a loss out of fear. You need to keep your cool and base your decisions on analysis and data if you want to succeed as an investor.

Use a professional investment advisor

You may wish to hire an investment advisor if you are a novice investor or if you just don't have the time or knowledge to manage your own account. Working with a professional financial advisor can help you achieve your investing goals and establish a comfortable level of risk exposure.

Investing in the stock market is a terrific method to build money over time, but it is not without its challenges. You may improve your chances of reaching your investment goals and creating a stable financial future by adhering to these best practises. Always remember the importance of researching your investments, diversifying your portfolio, investing for the long term, monitoring market movements, avoiding making rash decisions, and possibly consulting a professional investment advisor.

0 notes

Text

A Summary and Analysis of Dividend Yields

Investing necessitates a thorough examination of dividend yields. It might help you decide when to buy and sell stocks. Tax implications, such as whether dividends are taxable, should also be considered. Those with a longer time horizon may be interested in dividend-paying equities. However, keep in mind that dividend yields are volatile and should be treated accordingly.

Dividend yields may change when prices rise and fall. PepsiCo's dividend yield, for example, jumped to around 4% in early 2018. Stocks with high dividend yields should be preferred by investors seeking passive income. They can, however, imply a falling stock price. It's critical to consider the big picture when determining what makes a "good" yield.

The dividend yield from a company with stable growth and good fundamentals is among the highest you can hope for. Companies that are rapidly expanding generally reinvest their earnings to drive further expansion. Although there are others, the dividend is the most well-known financial indicator.

Investors generally sell their shares when a firm decides to lower its dividend. The market's reaction to the news was predictably negative. Nonetheless, dividends are critical to the financial security of many stockholders, particularly those nearing retirement.

Compare the dividend yield to the market average. The highest-yielding stocks range between 3.0 and 7.5 per cent. This category mainly includes companies in the staple products sector. For some corporations, the end of the year is a common time for dividend hikes. The company's high dividend yield may be due to the payout remaining at its current level.

Dividends may be taxed under one of several different regimes. Who pays dividend taxes, how the income is taxed, and how the revenue is received all play a role. Depending on the investor's tax status and other conditions, the dividend tax rate might range from 0% to 37%.

Dividends can be paid in cash or in the form of additional shares of stock. Interim and final dividends are both possible. When a corporation receives a dividend rather than an individual, the payout is taxed differently. Dividends paid to corporations are often taxed at a higher rate than dividends paid to individuals, who are taxed at a lower capital gains rate.

Several tax modifications have resulted in a reduction in the dividend tax rate. As part of the Jobs and Growth Tax Reconciliation Act of 2003, the dividend tax rate was reduced. (JGTR). Another piece of legislation that affected the tax system was the American Taxpayer Relief Act (ATRA), which raised the dividend tax rate for people in the highest tax bracket. Dividends and other forms of net investment income were also taxed at a rate of 3.8%.

Stocks, bonds, and mutual funds are just a few examples of investing alternatives. Each one offers a distinct chance for profit and risk. The trick is determining which investments can help you reach your financial goals throughout whatever time frame you have available.

Investing is done to increase one's wealth. You can put your money to work for you in a variety of ways, such as saving for a vacation, retirement, or home upgrades. Choosing the ideal solution might be tough. However, it is not impossible.

Most financial consultants would advise you to determine what you need from your assets. Some of them are values, risk tolerance, and available time. A savings calculator, such as Bankrate's simple one, can also be useful. This approach can be used to calculate the amount of time you have to save.

Among the different investment products available, stocks and bonds are the most popular. While both have the potential for large returns, their short- and long-term performances are markedly different. Stocks, for example, are volatile in the short term but tend to outperform in the long term. Long-term investors can ride out market volatility while gaining from short-term changes.

0 notes

Text

TELF AG - Energy Trading Expert

Telf ag mining is one of the world's largest traders and exporters of petroleum products, coal, ferroalloys, and other commodities. Headquartered in Lugano, Switzerland, they serve customers around the globe.

Stanislav Kondrashov, energy trading expert for TELF AG, believes the metals market has become highly volatile and risky. Therefore, he advises managing any risks caused by price volatility while still securing a stable business model.

For this to occur, metallurgical companies need to reorganize their work processes and improve internal balances. Furthermore, they should create clear pricing forecasts based on supply-demand equilibrium principles, according to Kondrashov. Doing this will enable businesses to make informed decisions about future investment, avoid unforeseen situations, as well as reduce production costs in challenging markets.

Finding reliable and professional employees who can generate a steady income is essential. They must be capable of carrying out their responsibilities responsibly, and the company must provide them with all of the necessary tools for success.

Another essential task for any company is the creation of high-quality capital, both financial and human. To guarantee this happens, all employees should share the same attitude towards work and be motivated by the tasks they complete.

For successful implementation of a business project, you need an accurate business model that outlines all activities within the firm and permits their oversight. Furthermore, this model must be consistent and understandable to all employees in order for everyone to buy into it.

By building on this foundation, a company can develop an effective strategy for increasing sales and profits. Additionally, it can enhance its production, marketing, and logistics operations to achieve greater efficiency.

Telf AG can maximize the productivity of its assets, thus making more efficient use of capital. Furthermore, this reduces maintenance expenses caused by equipment deterioration or breakdowns.