#Bitcoin Future Trading Signals

Text

Top 3 Underrated Bitcoin Charts that Most Traders Don't Know About

Introduction

Bitcoin has captured the attention of many traders and investors due to its incredible growth and volatility in recent years. As a result, people are always looking for new ways to analyze Bitcoin's price movements to make better investment decisions. While there are popular charts that traders use regularly, there are also some underrated charts that offer valuable information. In this article by Kings Charts - a crypto trading learning platform, we'll explore the top 3 underrated Bitcoin charts that most traders are unaware of.

MVRV Z-Score Chart:

The MVRV Z-Score chart is a powerful but often overlooked tool that can provide critical insights into Bitcoin's price movements. This chart measures the difference between Bitcoin's market capitalization and realized capitalization, which is the value of all Bitcoin in circulation at the last transaction price. The MVRV Z-Score chart calculates the standard deviation of this difference over time, indicating if Bitcoin is overvalued or undervalued. It's essential to remember that this chart can't predict the future, but it provides a useful indication of market sentiment with Crypto Technical Analysis.

Puell Multiple Chart:

The Puell Multiple chart is another chart that traders should know about to analyze Bitcoin's value. It calculates the ratio of the daily issuance value of Bitcoin to the 365-day moving average of the daily issuance value, indicating whether Bitcoin is overvalued or undervalued based on the amount of new issuance. When the Puell Multiple is high, it indicates that Bitcoin is overvalued, while a low score suggests that it is undervalued. This chart can help Crypto Trading Experts make informed decisions by providing valuable information about market conditions.

Stock-to-Flow Cross-Asset Model Chart:

The Stock-to-Flow Cross-Asset Model chart is a unique chart that uses the stock-to-flow ratio to predict Bitcoin's future price movements. The stock-to-flow ratio measures the current supply of a commodity against the amount that is produced annually. In the case of Bitcoin, the stock-to-flow ratio is the ratio of the current stock of Bitcoin to the new annual supply. This chart compares the stock-to-flow ratio of Bitcoin to other commodities such as gold, silver, and oil, to predict future price movements. Although this chart has some limitations, it can provide a valuable perspective on Bitcoin's market value with its Crypto Trading Signals.

FAQs

1. What is a Bitcoin chart?

A Bitcoin chart is a graphical representation of Bitcoin's price and other market data. These charts allow traders and investors to visualize historical price movements, identify trends, and make informed trading decisions.

2. What are the top three most underrated Bitcoin charts?

The top three most underrated Bitcoin charts are the MVRV Z-Score chart, the Puell Multiple chart, and the Stock-to-Flow Cross-Asset Model chart. These charts offer valuable insights into Bitcoin's price movements and market sentiment, but many traders are unaware of their existence or underutilize them in their analysis.

3. What information can I get from these charts?

The MVRV Z-Score chart provides information on whether Bitcoin is overvalued or undervalued based on the difference between market capitalization and realized capitalization. The Puell Multiple chart calculates whether Bitcoin is overvalued or undervalued based on the amount of new issuance. The Stock-to-Flow Cross-Asset Model chart uses the stock-to-flow ratio to predict Bitcoin's future price movements and compares it to other commodities such as gold, silver, and oil. By analyzing these charts, traders can gain a better understanding of market sentiment and conditions, helping them make more informed trading decisions.

Conclusion

In conclusion, incorporating these underrated Bitcoin charts into your analysis can provide valuable insights into market sentiment and conditions. While they cannot predict the future, these charts can provide a unique perspective on Bitcoin's value and help traders make more informed decisions. Remember, trading Bitcoin is a complex and risky endeavor, and it's essential to conduct thorough research and analysis before making any investment decisions. Kings Charts - a crypto trading learning platform

However, by keeping these underrated charts in mind, you can gain a deeper understanding of Bitcoin's price movements and be better equipped to make informed decisions.

#Crypto Technical Analysis#Crypto Trading Tips#crypto trading tips for beginners#Crypto Trading Experts#Crypto Trading Masterclass#Crypto Trading Course#Crypto Candlestick Charts#Elliott Wave Crypto Trading#Free Crypto Trading Signals#free cryptocurrency trading signals#free bitcoin trading signals#free crypto future trading signals#crypto spot trading signals#Paid crypto trading signals#Paid crypto trading tips#Premium crypto trading signals#KingsCharts

0 notes

Text

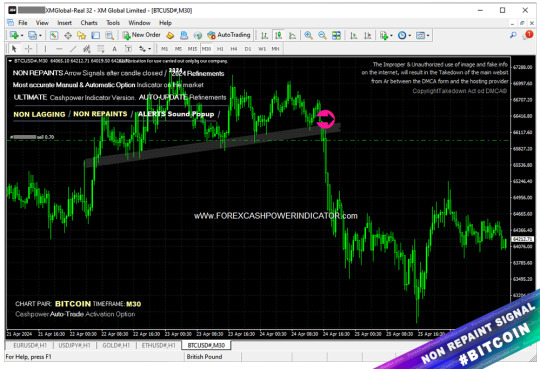

⭐ Metatrader4 chart SELL entry Bitcoin (BTCUSD) m30 non repaint signal.

( More info inside Official Website: wWw.ForexCashpowerIndicator.com ).

.

⭐ Cashpower Indicator *Lifetime License with right to Future updates versions FREE.

No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones.

.

✅ NO Monthly Fees; Lifetime License

✅ NON REPAINT / NON LAGGING

🔔 Sound And Popup Notification

✅ Powerful AUTO-Trade Option Subscription

.

✅ *Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.*

.

PS:( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ).

.

🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our Genuine old Indicator . Beware, this FAKE FILE reproduction can break and Blown your Mt4 account and also currupt your computer.

.

Recommended FX Brokerage to run Cashpower-XM Broker:

https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

#best-forex-indicator-non-repaint-buy-and-sell-signal-download#forexsignals#forexindicators#cashpowerindicator#forexindicator#forextradesystem#forexchartindicators#forexprofits#indicatorforex#forex factory#forex forum#cashpower indicator review#cashpower indicator download#forex cashpower indicator settings

4 notes

·

View notes

Text

Major Crypto Events This Week: Impact on Bitcoin and Ethereum Prices

In a week filled with significant developments, the crypto market is abuzz with anticipation and excitement. With former President Donald Trump and Vice President Kamala Harris set to speak at the BTC Nashville convention and a massive $1 billion inflow into the Ethereum ETF, the potential impact on Bitcoin, Ethereum, and the broader cryptocurrency market cannot be overstated. Let’s delve into these events and explore their potential ramifications.

Anticipating Trump and Kamala Harris at BTC Nashville Convention

Background

The BTC Nashville convention is a major event in the cryptocurrency community, drawing attention from investors, policymakers, and enthusiasts worldwide. This year, the convention is set to be particularly noteworthy, with high-profile speakers such as former President Donald Trump and Vice President Kamala Harris scheduled to address the attendees.

Potential Content of Trump’s Speech

Given Trump’s influential status, his speech at the BTC Nashville convention could be a game-changer. Speculation is rife about what he might discuss. Could he be hinting at a pro-crypto stance, potentially advocating for the inclusion of Bitcoin in the U.S. Treasury reserves? Such a move would likely send shockwaves through the market, boosting investor confidence and driving up prices.

Potential Content of Kamala Harris’s Speech

Vice President Kamala Harris’s speech is equally anticipated. As a key figure in the current administration, her views on cryptocurrency regulation and policy could shape the future landscape of the market. If Harris signals a supportive regulatory framework, this could pave the way for greater institutional adoption and integration of cryptocurrencies.

Possible Market Impact

The speeches by Trump and Harris could significantly influence market sentiment. A supportive stance from both could lead to a bullish trend, driving up the prices of Bitcoin and other cryptocurrencies. Conversely, a critical or cautious approach could introduce volatility and uncertainty. Investors will be closely watching for any hints of policy changes or endorsements that could impact their portfolios.

$1 Billion Trading Volume Ethereum ETF

Overview

The Ethereum ETF represents a major step forward for institutional investment in cryptocurrencies. An ETF, or Exchange-Traded Fund, allows investors to gain exposure to Ethereum without directly purchasing the cryptocurrency. This provides a more accessible and regulated way for large investors to enter the market.

Details of the Inflow

Yesterday, the Ethereum ETF saw a staggering $1 billion in volume traded, marking a significant milestone. This influx of capital indicates strong institutional interest and confidence in Ethereum’s future. Notable investors, possibly including hedge funds and large financial institutions, are likely behind this substantial investment.

Market Reaction

The market reacted positively to the news of the $1 billion inflow, with Ethereum’s price experiencing a noticeable uptick. This surge in investment not only boosts Ethereum’s price but also underscores the growing acceptance and legitimacy of cryptocurrencies in mainstream finance.

Long-term Impact

In the long term, this significant investment could lead to sustained price growth for Ethereum. As more institutional investors flock to Ethereum ETFs, the increased demand could drive prices higher. Additionally, the influx of institutional capital can lead to greater stability and reduced volatility, making Ethereum a more attractive asset for a broader range of investors.

Broader Market Implications

Investor Sentiment

These events are likely to have a profound impact on investor sentiment. The potential for supportive speeches from Trump and Harris, combined with the substantial inflow into the Ethereum ETF, could bolster confidence in the market. Positive sentiment often translates into increased buying activity, driving up prices across the board.

Regulatory Outlook

The regulatory landscape is a crucial factor in the future of cryptocurrencies. If Trump and Harris signal a favorable regulatory environment, this could lead to increased adoption and integration of cryptocurrencies in traditional finance. On the other hand, hints of stringent regulations could introduce uncertainty and caution among investors.

Future Trends

Looking ahead, these events could set the stage for significant trends in the crypto market. Increased institutional investment, regulatory clarity, and mainstream acceptance are all potential outcomes. As Bitcoin and Ethereum continue to gain traction, we could see a broader shift towards digital assets as a staple in investment portfolios.

Conclusion

This week’s events hold immense potential for the cryptocurrency market. The anticipated speeches by Trump and Harris at the BTC Nashville convention and the substantial $1 billion inflow into the Ethereum ETF could shape the future trajectory of Bitcoin, Ethereum, and the broader crypto ecosystem. Investors should stay informed and consider these developments when making investment decisions, as the market could be poised for significant movements.

Call to Action

What are your thoughts on these upcoming events and their potential impact on the crypto market? Share your insights in the comments below. For more updates and in-depth analyses, subscribe to our blog and stay ahead of the curve in the ever-evolving world of cryptocurrencies.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Crypto#Cryptocurrency#Bitcoin#Ethereum#BTCNashville#Trump#KamalaHarris#EthereumETF#CryptoNews#Blockchain#CryptoMarket#Investing#Finance#CryptoEvents#CryptoInvesting#DigitalCurrency#CryptoCommunity#CryptoUpdates#CryptoInflows#FinancialRevolution#globaleconomy#financial experts#financial empowerment#unplugged financial#financial education

3 notes

·

View notes

Text

Market Update: Key Indices and Stocks Show Mixed Movements Amidst Economic Projections

Index Futures Overview

As the trading day commenced, the major U.S. stock index futures exhibited modest fluctuations. Dow Jones Futures traded largely unchanged, indicating a neutral market sentiment. Meanwhile, S&P 500 Futures edged up by 2 points, representing a 0.1% increase. The Nasdaq 100 Futures also climbed by 20 points, or 0.1%, reflecting slight optimism in the tech sector.

Economic Projections: Job Market Insights

Economists are keeping a close watch on the U.S. labor market data, anticipating the addition of 189,000 jobs in June. This follows a stronger-than-expected increase of 272,000 jobs in May. The employment figures are crucial as they provide insights into the health of the economy and can influence Federal Reserve policy decisions. A robust job market typically signals economic strength, while any shortfall could raise concerns about a potential slowdown.

Stock Movements: Highlights and Lowlights

Tesla (NASDAQ: TSLA): Tesla's stock saw a premarket boost of nearly 2%, continuing its trend of strong performance. This increase may be attributed to positive investor sentiment surrounding the company's ongoing innovations and expansion plans in the electric vehicle market.

Macy’s (NYSE: M): Macy’s stock surged by 4% premarket. This rise could be due to positive retail sector performance or specific company news that has bolstered investor confidence. Macy’s, as a major player in the retail industry, often reflects broader consumer spending trends.

Coinbase Global (NASDAQ: COIN): In contrast, Coinbase Global experienced a significant drop, with its stock falling 6.5% premarket. The decline in Coinbase's stock price may be linked to recent regulatory scrutiny or market volatility impacting the cryptocurrency sector.

Commodity Market Movements

Crude Oil: U.S. crude futures (WTI) rose slightly by 0.1% to $83.98 a barrel, suggesting steady demand despite global economic uncertainties. Conversely, the Brent crude contract saw a marginal decline, trading at $87.40 a barrel. These movements indicate mixed market sentiments influenced by factors such as supply concerns and geopolitical developments.

Cryptocurrency Update

Bitcoin: The world's leading digital currency, Bitcoin, faced a downturn, falling to its lowest level since February. This decline reflects broader market trends affecting cryptocurrencies, including regulatory pressures and changes in investor sentiment.

Conclusion

Today's market snapshot presents a mixed picture with minor gains in major indices and varied performances among prominent stocks. Economic projections, particularly job market data, will play a crucial role in shaping market movements in the near term. Investors are advised to stay informed about ongoing economic indicators and company-specific developments to navigate the dynamic market landscape effectively.

This article provides a comprehensive overview of the current market trends, highlighting key indices, stocks, and economic projections. It offers valuable insights for investors and market watchers looking to understand the factors driving today's financial landscape.

#MarketTrends#StockMarket#IndexFutures#EconomicProjections#JobMarket#TeslaStock#MacyStock#CoinbaseGlobal#CrudeOil#BitcoinUpdate#FinancialMarkets#InvestingInsights#MarketAnalysis#CommodityMarkets#CryptocurrencyTrends

2 notes

·

View notes

Text

The prospect that US residents may soon be able to invest in bitcoin through their brokerage, as if it were a regular stock, has prompted a fresh round of hype in crypto circles—and a surge in crypto prices.

Several investment firms, including heavy-hitters like BlackRock and Fidelity, are queuing up to launch a spot bitcoin exchange-traded fund (ETF) in the US. These funds would track the price of bitcoin, making them the closest thing to investing in the crypto token directly without dealing with a crypto exchange or storing crypto manually, a process fraught with risk.

After a bruising 18 months in which crypto prices buckled, high-profile businesses collapsed, and two crypto figureheads were convicted of crimes in the US, the crypto industry is supposed to be cleaning up its act. That the US Securities and Exchange Commission (SEC) appears to be entertaining a spot bitcoin ETF after years of resistance is seen by some as a signal that crypto is moving beyond its free-wheeling years.

The arrival of such a fund in the US—by far the world’s largest ETF market—“is a significant milestone,” says Samson Mow, a prominent bitcoin evangelist and CEO of bitcoin-centric technology firm JAN3, as it will allow investors to hold bitcoin through a conventional financial product for the first time.

While there is broad consensus around the likelihood of an ETF approval among analysts, the idea that it would be symbolic of the industry’s coming of age is contradicted by the frenzy of speculation around what will happen to the price of bitcoin.

On X, crypto influencers with hundreds of thousands of followers are predicting an ETF will send the price of bitcoin soaring, in posts peppered with the rocket ship emoji. The arrival of a spot bitcoin ETF, claims Mow, will unlock a wave of pent-up demand and lead a “torrent of capital” to “pour into bitcoin.” Institutions and other investors that either cannot or choose not to invest in unregulated financial products will seize the opportunity to invest, he says, driving the price far beyond its previous heights.

An ETF might point to a growing acceptance of bitcoin among legacy financial institutions, but the implications for the price of bitcoin are being both mis- and overstated, ETF analysts warn, and the boosterism on display shows that little about crypto has changed.

Twelve applications for spot bitcoin ETFs are awaiting approval from the SEC. Delays are commonplace, but the agency is due to make a call on some of the applications as early as January 1, 2024. The three ETF analysts who spoke to WIRED expect the SEC to green-light a spot bitcoin ETF at some point next year.

In Canada, Germany, and elsewhere, spot bitcoin ETFs already exist. And US investors have had access to bitcoin futures ETFs, the value of which are correlated with the price of bitcoin, since 2021. The approval of a spot bitcoin ETF in the US is significant because it would, for the first time, give US investors access to a close proxy to bitcoin in a familiar and regulated format.

The attention paid to the topic by crypto trade media emphasizes the current fixation in industry circles. Since this summer, when speculation about the arrival of a spot bitcoin ETF began to ratchet up, crypto news site CoinDesk has published dozens of articles and videos on the topic.

In that same period, crypto markets have experienced dramatic swings, and the price of bitcoin has risen by almost a third. In some cases, price swings have been triggered by rumor and misreporting. On October 16, crypto outlet CoinTelegraph issued a retraction and apology after putting out an erroneous post on X announcing the approval of the first spot bitcoin ETF in the US, based on a screenshot posted by an X user, which led to a buying spree that increased the price of bitcoin by 10 percent.

On November 13, a falsified ETF filing relating to a separate cryptocurrency, XRP, caused a 13 percent rise in the token’s price. By the end of the day, those gains had evaporated. The Financial Times calculated that “imaginary bitcoin ETFs” were already worth 30 times the actual spot bitcoin ETFs already in existence worldwide.

Some ETF analysts, like Aniket Ullal of investment research firm CFRA, share the belief that the arrival of an ETF is likely to increase demand for bitcoin as an investment asset. But the effect on price will not be a “short-term spike,” Ullal says, but rather stretch out over multiple years.

Others say it will have the polar opposite effect to that predicted by figures like Mow, and that the price of bitcoin could plummet as investors attracted by the hubbub quickly cash out their winnings. “The idea that there is a huge pile of demand that will somehow materialize is just not true,” argues Peter Schiff, economist and CEO at asset management firm Euro Pacific. “It’s more of a ‘buy the rumor, sell the fact’ situation.”

The “narrative” that an ETF is a “catalyst for growing demand” has attracted speculators, says Bryan Armour, director of passive research strategies for North America at investment research firm Morningstar. “Hype has always been one of the core tenets of bitcoin. It seems like hype is at an all-time high.”

Figures from research firm Fineqia suggest the volume of crypto trading activity has surged in response to speculation over the approval of a spot bitcoin ETF and its market impact. In mid-November, daily trading volume on crypto exchanges reached $31.4 billion, the highest level in more than six months.

“There’s always the possibility that people are hyping it up for their own benefit,” says Mow, who adds that he doesn’t believe the broader crypto industry—which he considers to be separate from bitcoin and describes as a “grift”—is capable of cleaning up its act. “The crypto industry will keep churning out FTXs and people will keep investing because it’s a spectacle,” he says.

But whether or not bitcoin is different—a mature asset whose legitimacy would be “cemented,” as Mow claims, by an ETF approval—the relentless speculation surrounding it will expose investors to risk. “It is wildly volatile and should be handled carefully,” says Armour. But, he adds, people “hear the siren song and buy in.”

3 notes

·

View notes

Text

Drop in Crypto Prices Cools Overheated Market and Funding Rates

The recent 4% drop in the price of cryptocurrencies, particularly bitcoin, has had a positive impact on the crypto perpetual futures market. Perpetuals are futures contracts with no expiry, and their funding rates help align their prices with the index price. Over the past week, funding rates for major cryptocurrencies reached high levels, indicating an overheated leveraged market. However, the drop in prices has normalized the funding rates and cooled the market down.

The decrease in funding rates, along with the decline in open interest in crypto futures contracts, suggests that overleveraged traders have been shaken out of the market. Funding rates become burdensome when market momentum stalls, leading overleveraged traders to exit their positions. This market correction has created a more stable and sustainable environment for the crypto futures market as it heads towards the end of the year.

This article provides insights into the recent drop in crypto prices and its impact on funding rates. The cooling of the crypto perpetual futures market is seen as a positive development, as it signals a healthier and less overheated market environment. Traders who were heavily leveraged have exited the market, and funding rates have returned to more manageable levels. This stability and normalization pave the way for a steady ascent in the market as the year comes to a close.

Read the original article here #Bitcoin #cryptocurrency #futures #trading

2 notes

·

View notes

Text

As you guys heard, the largest crypto exchange platform Binance got a claim. It's a significant advancement in the market, as it has had many adverse effects on crypto assets. Why did Binance get sued? Why Changpeng Zhao also known as CZ was targeted by CFTC? What are the allegations? Will Binance have to shut down? What effects it had on the market? What happened to Bitcoin? All of these questions need to be answered. We will shortly dive into them.

You are on the Crypto Analyticss, where you can get the latest updates on all things Crypto, NFTs, and Blockchain-related. Stay in for a fun and informative experience.

Without further delay, let us just dive in...

Original Post: Check Here

Why Did Binance Get Sued?

CFTC, which is U.S. Commodity Futures Trading Commission, made some serious allegations against Binance CEO and founder CZ for operating what the CFTC alleged was an illegal exchange. The headlines on the 27th of March raid, CFTC issues Binance and CZ over willful evasion of U.S. laws. By willful evasion, the CFTC signaled over the unregistered crypto derivatives products used by Binance which led U.S customers to evade compliance controls through the use of VPN.

Full Article: Click Here

2 notes

·

View notes

Text

Fresh water or how Powell's words fuel the markets 🤨

⬆️ The Fed raised the rate by 0.25% to 5.25%!

FED will continue to further reduce the balance sheet under the plan. (This should have a negative impact on the markets).

FED has removed the signal about the need for further rate hikes, but does not give clear hints of a pause.

He also notes that today no decision was made to pause.

But, nevertheless, it hints that it is possible that the cycle of increase is already over.

FED is sending a signal that it is not going to lower the rate yet, it wants to keep it at a high level for some time.

FED again does not want to talk too much about the recession.

FED says banks are strong and the US economy will not let you down 🤡

Powell says it's important to raise the debt ceiling, but not just raise it, raise it on time.

Comment from our team:

At the moment, the rate was raised to levels of 2007, which was later, you all know very well… Now there is a whole combination of factors for the market to fall.

However, there is enough liquidity in the market that has been created over the period from 20-21, so the markets cannot collapse, as a huge amount of money buys out drawdowns, since inflation, although it has slowed down, continues to grow from month to month.

📉 We are negatively looking at Sp500 in the medium term. The decline in revenue and profits of companies due to the recession will have a negative impact on EPS. Buybacks, which have been a major driver of stock growth in recent years, could be hit by rising taxes.

❓ For Bitcoin, the situation is very uncertain. In history, this asset has not yet gone through a recession. But we believe that eventually bank failures will lead to a large flow of funds from private investors to Bitcoin, which will lead to its growth. But sharp drawdowns cannot be ruled out.

📈 Looking positively at gold. It is currently trading at 3-year highs. The level of $2000 has already acted as resistance three times, but today we see how gold has broken through this mark.In the near future we can see a sharp increase in this asset. Any drawdown in gold is recommended to be aggressively buy.

2 notes

·

View notes

Text

Aave Surges Ahead of BTC but Encounters Hurdles: Could a Trend Reversal Be Looming?

Key Points

Aave has been outperforming Bitcoin, but faces resistance, despite strong fundamentals.

Aave’s stablecoin, GHO, has surpassed $150 million, driving bullish momentum.

Aave [AAVE] has been making waves in the cryptocurrency world, leading despite questions regarding the revenue models of Decentralized Finance (DeFi) blue chips. There are calls for a reevaluation of what constitutes earnings and expenses in decentralized systems as these are not traditional corporate entities.

The AAVE/USDT pair recently broke a significant 800-day range, leading to a two-month upward trend. This performance has outshined that of Bitcoin [BTC] during the same period.

Aave Faces Resistance

From 18th June, AAVE/BTC has been showing higher highs and higher lows. However, it recently encountered strong resistance near the 0.003 BTC zone. This, coupled with Bitcoin’s recent performance, has slowed the pair’s rise. Despite this, Aave is expected to continue its upward trend due to strong fundamentals, although its pairing with Bitcoin may face challenges in the near future.

The Chaikin Money Flow (CMF) indicator also indicates traders taking profits, with money flowing out of the AAVE/BTC pair. Nevertheless, the overall trajectory remains positive, especially when traded against stablecoins. Both AAVE and Bitcoin are predicted to surge in Q4.

Growth of Aave’s Stablecoin

Fueling Aave’s bullish momentum is its stablecoin, GHO. Since its launch during a bear market, GHO has seen steady growth. In early September 2024, GHO’s supply increased by more than 6.7%, reaching a milestone of more than $150 million in outstanding supply. As GHO continues to grow, it bolsters the broader Aave protocol and its potential for long-term growth.

The OI-weighted funding rates also reflect a bullish sentiment. The rate currently stands at 0.0058%, indicating that long positions are paying shorts. This suggests a strong buying demand for Aave and aligns with its positive price outlook.

Aave’s social sentiment and mindshare are also bullish. Data from the Kaito AI platform reveals record-high levels of positivity surrounding Aave. With potential factors like Trump integration, buybacks, and the Sky partnership, Aave is set for further growth. Its overall outlook is strong, especially against stablecoins, signaling a likely rise in its price. Aave is expected to continue to perform well in the DeFi space, with higher prices on the horizon.

0 notes

Text

Whale Investors Drive Bitcoin Price Towards $64K Resistance Level: A Rising Demand Trend

Key Points

Bitcoin’s price hits a major resistance level around $64K due to increased demand from whale investors.

Bitcoin whales, particularly miners, have significantly increased their trading activities.

Bitcoin’s price surged by 3% in the past 24 hours, reaching a high of approximately $64,082. However, the cryptocurrency encountered significant resistance around $64K, aligning with the 200-day moving average. Consequently, Bitcoin’s price fell by about 1% and was trading at approximately $63,434 during the mid-London session on Friday.

This price volatility led to the liquidation of over $50 million from Bitcoin’s leveraged market. The largest liquidation occurred on OKX, involving a $5 million trade. From a technical perspective, Bitcoin’s price could further decline in the coming days before rebounding towards its all-time high.

Market Analysis

Crypto analyst Ali Martinez suggested that the TD Sequential indicator has signaled a sell signal for Bitcoin, potentially leading to further midterm correction over the weekend. However, Martinez expects Bitcoin’s price to rally towards an all-time high if it consistently closes above the liquidity level of around $64K.

Increased Activity from Bitcoin Whales

On-chain data analysis reveals that Bitcoin whales, led by miners, have significantly increased their trading activities. In the past 30 days, the supply of Bitcoin on different cryptocurrency exchanges has decreased by over 96.6K. On both Coinbase and Binance, the supply of Bitcoin declined by 15.1K and 58.3K respectively in the past four weeks.

The significant decline on Coinbase was heavily influenced by the rising demand from spot Bitcoin ETF issuers. Over the past two weeks, US spot Bitcoin ETFs registered a net cash inflow of more than $700 million, led by Fidelity’s FBTC. On Thursday, the US spot Bitcoin ETFs registered a net cash inflow of approximately $158 million.

On-chain data also shows that several Bitcoin miners, who have been dormant for over 15 years, activated their wallets with around 250 BTCs earlier today.

Market Picture

Following the first interest rate cut by the US Federal Reserve since the COVID-19 pandemic, the Bank of Japan left its rates unchanged on Friday, as per market expectations at 0.25 percent. This ongoing global economic shift is expected to significantly boost liquidity for the crypto market in the near future, amid the ongoing crypto bull market.

The crypto industry is expected to follow the precious metal market, led by gold, in a bullish outlook. Current market data shows that the price of gold has rallied to an all-time high of over $2,609 per ounce. Given the positive correlation between gold and Bitcoin prices, the crypto market is expected to follow suit, especially during the fourth quarter bullish expectations.

0 notes

Text

The SEC Approves Spot Ethereum ETFs: A Game-Changer for the Crypto World

The crypto community is buzzing with excitement as the U.S. Securities and Exchange Commission (SEC) has finally approved spot Ethereum ETFs, set to begin trading this Tuesday. This landmark decision marks a significant milestone for Ethereum and the broader cryptocurrency market, potentially ushering in a new era of mainstream adoption and financial innovation.

Understanding Spot ETFs

What is a Spot ETF?

A spot Exchange-Traded Fund (ETF) is an investment vehicle that holds the actual commodity or asset—in this case, Ethereum—rather than derivatives like futures contracts. This means that when investors buy shares of a spot Ethereum ETF, they are essentially buying shares backed by actual Ethereum holdings.

Spot ETFs vs. Futures ETFs

Unlike futures ETFs, which are based on contracts that speculate on the future price of Ethereum, spot ETFs offer a direct exposure to the current price of Ethereum. This distinction is crucial as it provides a more straightforward and less speculative way for investors to gain exposure to Ethereum.

The Road to Approval

The approval of spot Ethereum ETFs comes after a long journey of regulatory scrutiny and multiple attempts by various firms to bring such products to market. Previous attempts were often met with rejection due to concerns over market manipulation and the lack of robust market surveillance.

However, growing institutional interest and advancements in market infrastructure have addressed many of these concerns, paving the way for the SEC's approval. This decision reflects a shift in regulatory perspective, acknowledging the maturation and increased legitimacy of the crypto market.

Implications for Ethereum

In the long run, the availability of spot ETFs is likely to boost Ethereum's adoption and utility. It makes Ethereum more accessible to a broader range of investors, including those who prefer traditional investment vehicles over direct crypto holdings. This increased accessibility could lead to greater liquidity and stability in the Ethereum market.

Broader Impact on the Crypto Market

Influence on Other Cryptocurrencies

The approval of spot Ethereum ETFs sets a precedent that could benefit other cryptocurrencies. With Bitcoin spot ETFs already available, Ethereum's addition could pave the way for more altcoins to be considered for similar investment products. This diversification could lead to a more mature and stable crypto market.

Market Confidence

Regulatory approval of spot ETFs can significantly boost market confidence, attracting institutional investors who have been hesitant due to regulatory uncertainties. This influx of institutional capital could drive further growth and innovation within the crypto space.

Regulatory Landscape

A Positive Signal from the SEC

The approval signals a more favorable stance from the SEC towards cryptocurrencies, suggesting a willingness to adapt and embrace financial innovation. This could lead to more supportive regulatory frameworks that encourage the growth of the crypto industry while ensuring investor protection.

Future Regulatory Decisions

This move might also influence future regulatory decisions, potentially accelerating the approval of other crypto-related financial products. A more open regulatory environment could foster innovation and competition, benefiting both investors and the broader financial ecosystem.

Investor Perspectives

Increased Accessibility

For investors, the introduction of spot Ethereum ETFs offers a more accessible and regulated way to invest in Ethereum. This could attract a new wave of investors who were previously wary of the complexities and risks associated with direct crypto investments.

Diversification Opportunities

Spot ETFs also provide a valuable diversification tool for portfolios, allowing investors to gain exposure to the crypto market without directly holding cryptocurrencies. This can help mitigate risks and enhance portfolio performance.

Conclusion

The SEC's approval of spot Ethereum ETFs marks a pivotal moment for the crypto world. As these ETFs start trading on Tuesday, the landscape of crypto investments is set to change dramatically. Increased accessibility, market confidence, and regulatory support are just a few of the positive outcomes we can anticipate. This milestone not only bodes well for Ethereum but also signals a promising future for the broader cryptocurrency market, building on the foundation laid by existing Bitcoin ETFs.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Ethereum#EthereumETF#Crypto#Cryptocurrency#Blockchain#Finance#Investing#SEC#SpotETF#CryptoNews#FinancialInnovation#EthereumNews#CryptoMarket#EthereumCommunity#DigitalAssets#CryptoInvesting#CryptoAdoption#FinancialFreedom#Investment#MarketTrends#CryptoRegulation#financial education#globaleconomy#unplugged financial#financial empowerment#bitcoin#financial experts#digitalcurrency

3 notes

·

View notes

Text

The Role of Crypto Tokens in Everyday Purchases

Introduction

Digital currencies are changing the financial world, with more and more people using them for everyday transactions. Crypto tokens are a big part of this change, allowing for easy and decentralized transactions. These tokens aren't just a fad; they're becoming essential to how we handle and spend money.

What You'll Learn

In this article, we will explore:

The importance of crypto tokens in today's finance

How blockchain technology makes these transactions possible

The effect of decentralized finance (DeFi) on crypto tokens

Regulatory challenges and future prospects with Central Bank Digital Currencies (CBDCs)

Understanding these points will give you a clear picture of how crypto tokens are influencing the future of consumer spending.

Understanding Crypto Tokens

Crypto tokens are digital assets that operate on a blockchain network, representing a unit of value. Unlike traditional currencies, these tokens are not issued by central banks but are created through decentralized networks that rely on cryptographic protocols. You can think of them as units that hold value within a particular ecosystem or platform.

Blockchain Technology and Decentralization

Blockchain technology is the backbone of cryptocurrency networks. It enables peer-to-peer transactions without the need for intermediaries like banks. Here’s how it works:

Distributed Ledger: A blockchain is a public ledger distributed across multiple nodes (computers). Every transaction is recorded in a block, which is then added to a chain of previous transactions.

Transparency and Security: Since all nodes have access to the ledger, every transaction is transparent and verifiable, enhancing security.

Decentralized Networks: Unlike traditional financial systems controlled by central authorities, blockchain operates on decentralized networks. This decentralization reduces the risk of single points of failure and enhances the system's robustness.

Benefits of Decentralization in Financial Transactions

Greater Control Over Funds: Users have direct control over their crypto tokens, eliminating the need for third-party intervention.

Reduced Transaction Fees: Transactions conducted on blockchain typically incur lower fees compared to traditional banking methods.

Speed and Efficiency: Peer-to-peer transactions can be processed more quickly since they bypass traditional banking channels.

Understanding these foundational elements helps you grasp why crypto tokens are becoming increasingly relevant for everyday transactions.

The Rise of Cryptocurrencies

Bitcoin is the first cryptocurrency, often called digital gold. People like it because they see it as a way to store value and protect against inflation, much like traditional assets such as gold. Its decentralized nature and limited supply make it appealing to investors looking for long-term stability.

Stablecoins, like Tether (USDT) and USD Coin (USDC), tackle the well-known issue of cryptocurrency volatility. By tying their value to traditional fiat currencies, stablecoins provide more consistency for everyday transactions and trading markets. They act as a link between unstable assets and the regular financial system, enabling users to benefit from digital currencies without experiencing extreme price fluctuations.

Several key statistics highlight the growing cryptocurrency adoption. As of mid-2023, approximately 17% of U.S. adults reported engaging with cryptocurrencies. This increasing acceptance signals a significant shift in consumer behavior, paving the way for broader integration of digital currencies into everyday finance.

Key Points

Bitcoin: Viewed as a store of value and inflation hedge.

Stablecoins: Provide stability by being pegged to fiat currencies.

Adoption Statistics: 17% of U.S. adults engage with cryptocurrencies.

Bitcoin’s dominance combined with stablecoins' practicality is reshaping how consumers interact with money, indicating a transformative trend in modern finance.

Crypto Tokens in Daily Transactions

Crypto tokens are revolutionizing the way we make digital payments by enabling direct transactions between users. Unlike traditional banking methods that involve middlemen, crypto tokens give consumers more control over their money. This decentralization reduces the need for third-party approvals, making transactions quicker and more efficient.

Key Benefits of Crypto Tokens in Everyday Purchases:

Consumer Control: Users have direct access to their funds without relying on banks or other financial institutions.

Speed: Transactions can be completed almost instantly, regardless of geographical boundaries.

Security: Blockchain technology provides a secure and transparent ledger for all transactions.

Comparing transaction fees between cryptocurrencies and traditional banking methods reveals significant cost advantages. Traditional banking often incurs higher fees due to intermediary involvement and currency conversion costs. In contrast:

Bitcoin and Ethereum: While they may have variable fees depending on network congestion, they often remain lower than international wire transfers.

Stablecoins like Tether (USDT) and USD Coin (USDC): These generally offer minimal transaction fees, making them attractive for daily use.

The importance of crypto tokens in today's world cannot be overstated. They not only reduce costs but also make financial services accessible to everyone, creating a more inclusive economy. Moreover, as we delve into the broader implications of this shift towards digital currencies, it's essential to understand the role of crypto in shaping the future of money. The potential of these digital assets extends beyond mere transactions; they are poised to redefine our understanding of value exchange and financial sovereignty.

How Decentralized Finance (DeFi) Affects Crypto Tokens

Decentralized finance (DeFi) is a game-changer in the financial world, using blockchain technology to build open and permissionless financial systems. DeFi apps use smart contracts to enable direct transactions between users, cutting out middlemen and lowering costs.

Crypto tokens, especially stablecoins, are essential in DeFi platforms:

Providing Liquidity: Stablecoins like Tether (USDT) and USD Coin (USDC) are crucial for DeFi protocols. Their value tied to traditional currencies means users can lend, borrow, and trade with less risk of price swings.

Backing Loans: Many DeFi services need collateral for loans or yield farming. Stablecoins serve as reliable collateral because their value is steady.

These functions highlight why stablecoins are vital for keeping DeFi systems efficient and trustworthy. By enabling easy transactions and liquidity, crypto tokens greatly improve the effectiveness and attractiveness of decentralized finance.

Regulatory Landscape and Challenges for Crypto Tokens

Regulatory uncertainties present significant challenges for crypto tokens and digital currencies. Governments and regulatory bodies worldwide are grappling with how to classify and regulate these digital assets. The lack of a unified regulatory framework leads to inconsistencies, creating confusion among users and businesses.

Establishing a comprehensive framework for crypto token regulation is crucial for consumer protection. Without clear guidelines, consumers face risks related to fraud, market manipulation, and security breaches. Regulatory clarity can help mitigate these issues by providing safeguards and ensuring transparency in the crypto market.

Key regulatory challenges include:

Classification of tokens: Determining whether tokens should be classified as securities, commodities, or another asset type.

Anti-money laundering (AML) regulations: Ensuring that crypto transactions comply with AML laws to prevent illegal activities.

Taxation policies: Defining how digital transactions should be taxed to maintain financial integrity.

Addressing these challenges is essential for fostering trust and widespread adoption of crypto tokens in everyday commerce.

The Future with Central Bank Digital Currencies (CBDCs) as an Alternative to Crypto Tokens

Central bank digital currencies (CBDCs) represent a significant development in the financial landscape. These digital currencies, issued by central banks, aim to provide enhanced stability through government regulation. By linking directly to national currencies, CBDCs offer a reliable and secure alternative to traditional cryptocurrencies.

Potential Advantages for Consumers

Stability: CBDCs are backed by government reserves, reducing the volatility commonly associated with other digital currencies.

Security: Enhanced regulatory oversight ensures that transactions are secure and transparent.

Accessibility: CBDCs can facilitate financial inclusion by providing unbanked populations with direct access to digital financial services.

Integration with Existing Financial Systems

CBDCs have the potential to seamlessly integrate with existing financial systems. This integration could enable them to coexist alongside cryptocurrencies, providing users with multiple options for digital transactions. Key points include:

Interoperability: Ensuring that CBDCs can interact with current banking infrastructure.

Regulatory Frameworks: Establishing clear guidelines to protect consumers while fostering innovation.

Liquidity Management: Utilizing stablecoins within decentralized finance (DeFi) platforms to maintain liquidity and support trading activities.

Understanding why token matters in today's generation helps in comprehending the evolving dynamics of finance. As CBDCs continue to develop, their role in shaping the future of everyday purchases becomes increasingly crucial. To fully realize this potential, it's essential to consider various aspects of their system design, which will play a key role in determining their success and acceptance in the market.

Before Conclusion We recommended you to create your own token if you are intrested on memecoins

Also we Done tons of Research and Found amazing tool for you

In Solana Launcher Here you can generate your own memecoins token on solana in just less than three seconds without any coding knowledge

Conclusion: The Role of Crypto Tokens in Shaping Everyday Finance

The future of crypto tokens looks bright, as they continue to play a bigger role in our everyday financial activities. Their decentralized nature and ability to enable direct transactions between individuals are changing the way we manage our money.

It's clear why tokens are important in today's world. More and more people are using them because they offer solutions that traditional financial systems can't always provide. As regulations change and technology improves, it's likely that crypto tokens will become a key part of our daily transactions, giving us more control and options over our finances.

FAQs (Frequently Asked Questions)

What are crypto tokens and why are they important?

Crypto tokens are digital assets that represent a unit of value within a cryptocurrency ecosystem. They play a crucial role in facilitating transactions, enabling peer-to-peer exchanges, and providing consumers with greater control over their funds. As digital currencies gain traction for everyday purchases, the significance of crypto tokens continues to grow in today's economy.

How do cryptocurrencies like Bitcoin and stablecoins differ?

Bitcoin is a leading cryptocurrency known for its value as a store of value and a hedge against inflation. In contrast, stablecoins, such as Tether and USD Coin, are designed to reduce volatility by being pegged to stable assets like the US dollar. This makes stablecoins more suitable for daily transactions and trading markets, offering users a reliable means of exchange.

What is decentralized finance (DeFi) and how does it relate to crypto tokens?

Decentralized finance (DeFi) refers to financial services that operate on blockchain technology without the need for traditional intermediaries. Crypto tokens play an essential role in DeFi by enabling liquidity provision and facilitating transactions within decentralized platforms. Stablecoins, in particular, are vital in providing liquidity across various DeFi applications.

What challenges do crypto tokens face in terms of regulation?

Current regulatory challenges for crypto tokens include uncertainties regarding legal frameworks and consumer protection measures. As the market evolves, establishing comprehensive regulations is crucial to safeguard consumers while fostering innovation within the crypto space.

What are Central Bank Digital Currencies (CBDCs) and how might they impact crypto tokens?

Central Bank Digital Currencies (CBDCs) are government-backed digital currencies that aim to provide enhanced stability through regulation. They could coexist with cryptocurrencies by integrating into existing financial systems, potentially influencing consumer behavior and the overall landscape of digital transactions.

How do transaction fees compare between cryptocurrencies and traditional banking methods?

Transaction fees for cryptocurrencies can vary widely but often present lower costs compared to traditional banking methods, especially for cross-border payments. This cost-effectiveness empowers consumers by allowing them greater control over their finances while reducing reliance on conventional financial institutions.

#solana#crypto#defi#dogecoin#bitcoin#token creation#token generator#blockchain#currency#investment#tumblr#aesthetic#love#like#tumblrgirl#follow#instagram#instagood#photography#likeforlikes#s#art#likes#tumblrboy#frasi#grunge#girl#o#cute#fashion

1 note

·

View note

Text

Crypto Trading: Embrace the Future of Finance

In the evolving landscape of financial markets, crypto trading has emerged as a powerful force, revolutionizing the way people invest, trade, and manage their wealth. As digital currencies like Bitcoin, Ethereum, and countless others gain prominence, crypto trading offers a dynamic avenue for both seasoned investors and newcomers alike to participate in the future of finance. Our website is your gateway to understanding, navigating, and mastering this exhilarating world of decentralized trading.

Why Crypto Trading?

At its core, crypto trading is the process of buying and selling cryptocurrencies on specialized platforms to earn profits, similar to stock market trading but with a futuristic twist. What sets it apart is the decentralized nature of these assets. Cryptocurrencies operate on blockchain technology, ensuring transparency, security, and a peer-to-peer trading experience without the interference of traditional financial institutions.

Whether you're trading on short-term price movements or investing long-term in the technology, the opportunities in crypto trading are vast. Digital currencies are known for their volatility, which presents significant risks but also high rewards for those who can understand and capitalize on market trends.

Features of Our Crypto Trading Website

User-Friendly Interface

Our platform is designed to cater to all levels of traders, from beginners to professionals. The intuitive interface allows users to easily navigate, execute trades, and track their portfolios with precision. With comprehensive charting tools, real-time market data, and customizable dashboards, you’ll have everything you need to make informed decisions at your fingertips.

Advanced Security Measures

Security is our utmost priority. Our platform is built with cutting-edge encryption protocols to safeguard your assets and personal information. Multi-factor authentication (MFA), cold storage wallets, and regular security audits ensure that your funds and data are protected against any potential threats.

Diverse Asset Offerings

We offer a wide range of cryptocurrencies for trading, from the leading giants like Bitcoin and Ethereum to emerging altcoins that have the potential for significant growth. With over 100 trading pairs, you’ll always have new opportunities to explore and capitalize on market trends.

Educational Resources

New to crypto trading? No problem! Our comprehensive library of educational resources will guide you through every aspect of trading. From basic tutorials on how to buy your first cryptocurrency to in-depth guides on advanced trading strategies, we empower our users to become confident traders.

Real-Time Analytics & Insights

Stay ahead of the curve with our real-time analytics and market insights. Our platform is integrated with AI-powered tools that provide market forecasts, sentiment analysis, and trading signals, helping you make data-driven decisions. Whether you’re day trading or holding for the long term, our analytics give you the edge you need.

24/7 Customer Support

The crypto market never sleeps, and neither do we. Our dedicated support team is available around the clock to assist you with any inquiries, technical issues, or guidance you need. With responsive and knowledgeable support, you’ll never feel lost in the fast-paced world of crypto trading.

Conclusion

Crypto trading is more than just a trend—it’s a movement toward a decentralized, transparent, and inclusive financial future. Our website is your trusted partner in this journey, offering an all-in-one solution to trade, learn, and grow in the crypto world. Whether you're looking to diversify your portfolio, hedge against traditional markets, or explore new digital assets, we're here to guide you every step of the way.

#uxuidesign#uxbridge#ui ux development services#ux tools#ui ux agency#ux#uxinspiration#ux design services#ux research#ui ux development company#crypto#defi#blockchain#ethereum#altcoin#fintech

0 notes

Text

Institutional Involvement in Crypto ICOs: The Impact on the Market

The cryptocurrency landscape has undergone significant transformation over the past few years, with Initial Coin Offerings (ICOs) playing a crucial role in the fundraising strategies of new blockchain projects. As institutional investors increasingly enter the crypto space, their involvement in ICOs is reshaping market dynamics. This blog delves into how institutional participation is affecting the ICO market and explores related topics, such as upcoming ICOs, the latest crypto ICOs, and the future of ICOs in 2024.

Understanding Crypto ICOs

An Initial Coin Offering (ICO) is a fundraising method where new cryptocurrency projects sell their tokens to investors in exchange for established cryptocurrencies like Bitcoin or Ethereum. ICOs have become popular among startups as a quick way to raise capital, bypassing traditional venture capital processes and associated barriers. This democratized access to funding has attracted a wide range of investors, including institutional players, who are now entering the ICO market in greater numbers.

The Role of Institutional Investors

1. Increased Credibility and Trust

The entry of institutional investors into the ICO space has brought a new level of credibility and trust to the market. Institutions typically perform extensive due diligence before investing, which can help filter out lower-quality or less viable projects. Their involvement signals that a project has been thoroughly vetted, potentially increasing overall trust in the ICO process. Retail investors often take comfort in knowing that institutional players have validated a project, which can lead to more widespread participation.

2. Enhanced Market Liquidity

Institutional participation in ICOs significantly enhances market liquidity. With larger inflows of capital, the trading volume of newly issued tokens can rise, leading to more stable price movements. This improved liquidity is crucial for fostering a healthier trading environment, as it allows for more efficient price discovery and attracts more retail investors into the market. A liquid market also mitigates the risks of extreme price volatility, making it easier for investors to enter and exit positions.

3. Driving Innovation

Institutional investors bring advanced research, data analytics, and a sophisticated understanding of the market. This allows them to identify promising projects that may not be on the radar of smaller retail investors. Moreover, institutions may push for better governance, transparency, and compliance measures within the projects they support, driving innovation and enhancing the quality of ICO offerings. Their backing can also spur the development of cutting-edge technologies and applications, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain interoperability.

Best Crypto ICOs and New ICO Projects in 2024

As the market matures, certain ICOs stand out as prime opportunities for investors. In 2024, new ICO projects are expected to emerge, leveraging advanced technologies like DeFi, NFTs, and blockchain interoperability. These projects aim to address real-world challenges and deliver practical applications that can drive sustainable growth. Investors should keep a close eye on the best upcoming ICOs, as these innovations present unique investment opportunities.

The Latest Crypto ICOs

Staying up to date on the latest crypto ICOs is essential for investors looking to make informed decisions. Many new projects are focusing on solving specific problems within industries, transitioning from speculative ventures to more utility-driven offerings. This shift toward practicality and real-world use cases is a positive trend for the long-term sustainability of the ICO market.

Upcoming ICO Token Sales

Upcoming ICO token sales are often featured in ICO calendars and lists, providing investors with opportunities to acquire tokens at an early stage, often at discounted prices. However, it’s important to conduct thorough research on each project before investing. While institutional involvement may signal credibility, not all ICOs will succeed, and investors should carefully evaluate the risks and potential rewards.

Challenges and Risks of Institutional Involvement

1. Regulatory Scrutiny

As institutional investors enter the crypto space, regulatory scrutiny is likely to increase. Governments and regulatory bodies may impose stricter compliance requirements for ICOs, which could hinder smaller projects from entering the market. The need for regulatory clarity is critical for fostering a healthy and transparent ICO ecosystem. Without clear guidelines, both projects and investors may face uncertainties that could impact the growth of the ICO market.

2. Market Volatility

The cryptocurrency market is notorious for its volatility, and institutional involvement doesn’t entirely mitigate this risk. Large trades by institutional investors can lead to significant price swings, which may impact retail investors’ positions. As institutional capital enters the market, it’s essential for investors to be aware of the potential for sudden price fluctuations, particularly in less liquid ICOs.

Conclusion

Institutional involvement in crypto ICOs is reshaping the market landscape, bringing enhanced credibility, liquidity, and innovation. As the market evolves, investors should remain vigilant and stay informed about upcoming ICOs, the latest crypto offerings, and broader market trends. By understanding the dynamics of institutional participation, investors can better navigate the opportunities and challenges presented by the rapidly changing ICO market.

Looking ahead to 2024, the ICO landscape will likely continue to evolve, driven by both institutional interest and technological advancements. Investors who stay informed and conduct thorough research will be well-positioned to capitalize on the exciting developments in the world of cryptocurrency and blockchain technology.

0 notes

Text

Here’s Why CFTC Is Suing Binance And Changpeng Zhao (CZ)

As you guys heard, the largest crypto exchange platform Binance got a claim. It's a significant advancement in the market, as it has had many adverse effects on crypto assets. Why did Binance get sued? Why Changpeng Zhao also known as CZ was targeted by CFTC? What are the allegations? Will Binance have to shut down? What effects it had on the market? What happened to Bitcoin? All of these questions need to be answered. We will shortly dive into them.

You are on the Crypto Analyticss, where you can get the latest updates on all things Crypto, NFTs, and Blockchain-related. Stay in for a fun and informative experience.

Without further delay, let us just dive in...

Original Post: Check Here

Why Did Binance Get Sued?

CFTC, which is U.S. Commodity Futures Trading Commission, made some serious allegations against Binance CEO and founder CZ for operating what the CFTC alleged was an illegal exchange. The headlines on the 27th of March raid, CFTC issues Binance and CZ over willful evasion of U.S. laws. By willful evasion, the CFTC signaled over the unregistered crypto derivatives products used by Binance which led U.S customers to evade compliance controls through the use of VPN.

Full Article: Click Here

2 notes

·

View notes

Text

Twaao Exchange: Short-term Holders Dominate Bitcoin Inflows, Increasing Market Volatility

According to the latest data from Twaao Exchange, the majority of Bitcoin inflows to exchanges over the past month have been driven by short-term holders. While these short-term traders dominate, there is also an uptick in selling from long-term holders, reflecting a growing caution among investors who view current price levels as an opportunity to exit.

Short-term Holders Lead Bitcoin Inflows, Marking Significant Fund Flow Trends

Data from Twaao Exchange reveals that on September 12, addresses holding Bitcoin for less than three months accounted for over 92% of total exchange inflows, with those holding for less than a week contributing a substantial 83%. This trend underscores the dominant role of short-term holders in driving fund flows within the Bitcoin market. These short-term holders typically engage in more active trading, focusing on capturing short-term profit opportunities amid market volatility. This behavior suggests a cautious outlook on the short-term price trajectory of Bitcoin.

The predominance of short-term inflows also highlights increased market volatility. The rapid entry and exit of short-term investors can amplify short-term price fluctuations and impact the confidence of long-term holders. The market analysts provided by Twaao suggest that the frequent changes in short-term fund flows might signal an impending market adjustment phase. This creates a more complex market environment where balancing short-term opportunities with long-term positioning becomes crucial.

Long-term Holders Realize Profits, Investor Sentiment Turns Cautious

Despite the dominance of short-term traders in fund inflows, Twaao data shows an increase in selling by long-term holders. The inflow from those holding Bitcoin for over three months rose from 0.55% on September 11 to 7.59% on September 12. This indicates that some long-term investors are choosing to realize profits at current price levels, reflecting uncertainty about Bitcoin future price direction and a shift in attitudes toward long-term holding.

Twaao in the analysis suggests that the profit-taking by long-term investors indicates concerns about the market future trajectory, particularly in the face of macroeconomic pressures and Bitcoin market volatility. Many long-term holders are opting to lock in profits and reduce exposure to further market risk. This cautious sentiment is prompting other market participants to reassess their investment strategies, with current price levels potentially serving as an ideal short-term exit point for those considering long-term holdings.

Is a Market Adjustment Period Approaching? Balancing Long and Short-term Investment Strategies

Twaao analysts point out that the frequent movement of short-term funds increases market volatility, creating more opportunities for short-term trading but also accompanying higher risks. Meanwhile, the exit of long-term investors signals potential market adjustment risks. In this environment, investors should prioritize risk management in their trading strategies to avoid unnecessary losses amid short-term volatility.

Investors should monitor the impact of macroeconomic changes on the market, especially as global economic uncertainty intensifies, potentially influencing future market trends. The interplay of multiple factors will make market performance more complex, but for investors with foresight and adaptability, the current market adjustment period might also present an opportunity for repositioning.

0 notes