#CBD High-Risk Credit Card Processing

Explore tagged Tumblr posts

Text

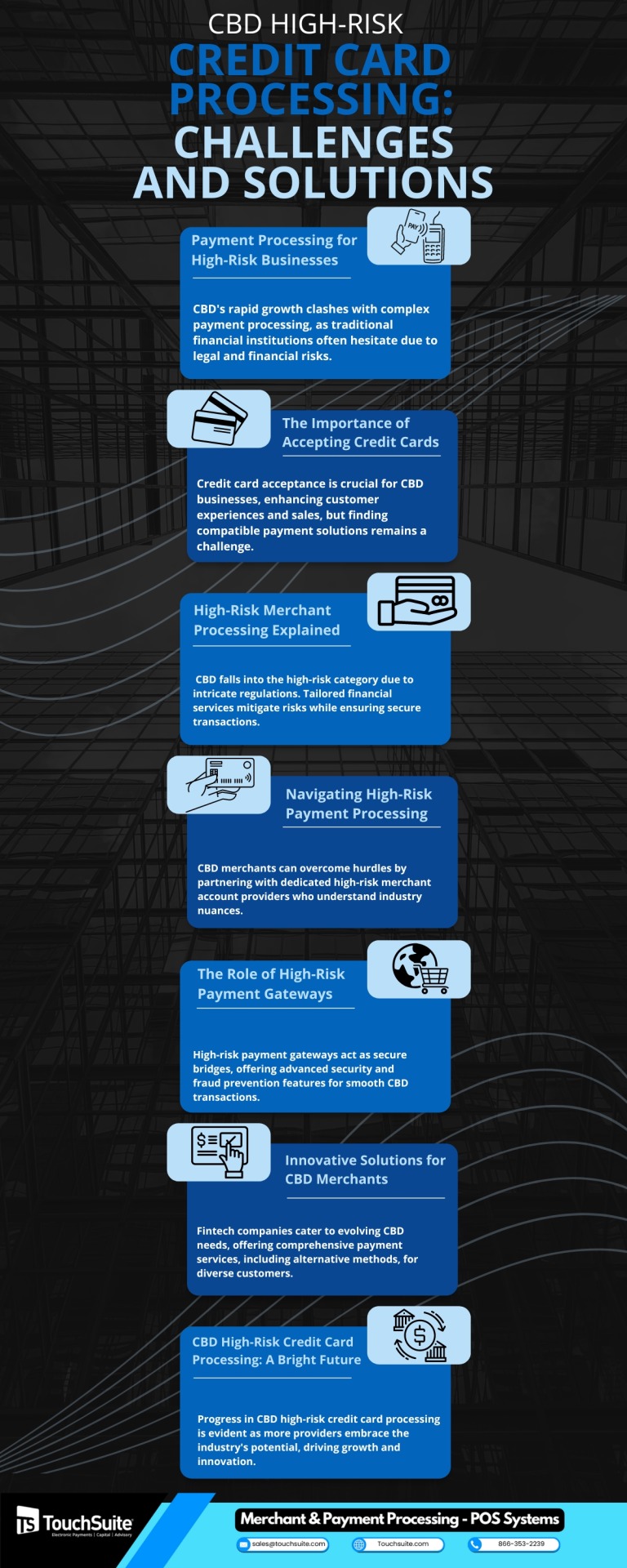

CBD High-Risk Credit Card Processing_ Challenges and Solutions

For more information visit at: https://touchsuite.com/cbd-hemp-payment-processing/

0 notes

Text

Navigating the Hazy World of CBD: High-Risk Credit Card Processing

Welcome to the wild, wild west of high-risk credit card processing in the CBD universe. Picture this: you've got a killer CBD product that's making waves in the market, but when it comes to accepting those oh-so-convenient credit card payments, you're in for a rollercoaster ride. So, grab your seatbelts, because we're about to explore the fascinating world of CBD high-risk credit card processing, and trust me, it's not as dull as it sounds.

Strap in for a Crazy Ride

If you're in the CBD business, you already know the drill. The mainstream financial world doesn't always play nice with your green dreams. CBD falls into the "high-risk" category due to its association with cannabis, which means traditional banks and payment processors often slam the door in your face faster than you can say "cannabidiol."

But fear not, intrepid CBD pioneer! While the road may be bumpy, it's not impassable. Let's break down this wild journey step by step.

High-Risk, High Reward?

First things first, what makes CBD high-risk in the world of credit card processing? Well, it's all about the stigma. Even though CBD won't get you high (it's the THC that does that), it's often painted with the same brush as its psychoactive cousin, marijuana. As a result, banks and payment processors worry about legal and reputational risks.

But here's the fun part: there's a silver lining to being a high-risk business. It means you're in an industry with high potential for growth, and where there's growth, there's opportunity. Cue the cowboys and cowgirls of the CBD world, riding the wave of demand for their products.

The Game Changer: CBD Payment Processors

So, how do you navigate these wild waters? Enter CBD payment processors, the unsung heroes of your business. These specialized companies understand the unique challenges you face and are here to make your life easier.

Imagine them as your trusty sidekicks in the Wild West, helping you handle those pesky credit card transactions. They've got the knowledge, the experience, and the connections to ensure your transactions are as smooth as a tumbleweed rolling across the desert.

Riding the Compliance Bull

Here's the real twist in our story: CBD payment processors are like sheriffs in a town full of outlaws. They make sure you stay on the right side of the law. This means tackling issues like age verification, keeping up with ever-changing regulations, and making sure your customers don't use CBD products in places where it's not allowed.

Compliance might not be as exciting as a showdown at high noon, but it's essential for keeping your business afloat. After all, you don't want the law knocking on your saloon door.

Taming the Chargeback Beast

Every Wild West adventure has its challenges, and in the world of CBD credit card processing, the chargeback is a formidable foe. Chargebacks occur when customers dispute a transaction, and they can be a real thorn in your side. But CBD payment processors have strategies to help you handle these pesky critters.

From keeping impeccable records to having a clear refund policy, your payment processor can guide you in taming the chargeback beast and ensuring your business stays in the saddle.

The Final Frontier: International Sales

Now, if you're aiming to conquer not just the Wild West but the entire world, you'll need to think globally. CBD payment processors can help you expand your reach and conquer international markets. They'll help you navigate the murky waters of international regulations and currencies, making sure your business thrives on a global scale.

So, there you have it, fellow CBD trailblazers - high-risk credit card processing might be a wild ride, but it's one that can lead to gold in them there hills. CBD payment processors are your trusty steeds, guiding you through the ups and downs of this exhilarating journey.

Remember, every adventure has its challenges, but with the right partners by your side, you can ride off into the CBD sunset with your pockets full and your business booming. Yeehaw, partner!

Visit accept-credit-cards-now.com to uncover the secrets of high-risk merchant processing in the CBD industry. Your journey to CBD success begins here!

0 notes

Text

Navigating Payment Processing Challenges in the CBD Industry

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

The CBD industry has experienced remarkable growth, yet it grapples with distinct challenges, particularly in the domain of payment processing. This article will delve into the intricacies of payment processing for high-risk industries, shining a spotlight on CBD businesses. We'll explore the various hurdles faced by CBD entrepreneurs and discuss effective solutions for navigating payment processing challenges in the CBD industry. In this ever-evolving landscape, mastering how to accept credit cards and manage payment processing can be the key to success.

DOWNLOAD THE NAVIGATING PAYMENT PROCESSING INFOGRAPHIC HERE

The Inherent High-Risk Nature of CBD

CBD businesses frequently find themselves labeled as high-risk by payment processors and financial institutions. This categorization stems from the intricate legal and regulatory landscape surrounding CBD products, subject to variations from state to state and country to country. Consequently, CBD merchants encounter numerous challenges when seeking reliable payment processing solutions.

The Fundamental Role of Merchant Accounts

Merchant accounts stand as pivotal players in the payment processing ecosystem. Serving as the bridge between a CBD business and financial institutions handling credit card transactions, obtaining a high-risk merchant account emerges as the initial step in addressing payment processing challenges. These accounts are meticulously crafted to meet the specific needs of businesses operating in high-risk industries, such as CBD.

Exploring Specialized High-Risk Payment Gateways

High-risk payment gateways represent specialized systems crafted to facilitate secure online transactions for businesses confronting heightened risks. These gateways act as a seamless connection between the merchant's website and financial institutions, ensuring the secure and efficient processing of customer payment data, even in high-risk scenarios.

CBD's Integration with E-commerce Payment Processing

The CBD industry has enthusiastically embraced e-commerce as its primary sales channel. Thriving in this competitive landscape requires CBD businesses to not only accept credit cards for e-commerce but also to provide a seamless and secure shopping experience for their customers. This entails the integration of e-commerce payment processing solutions tailored explicitly for high-risk industries.

youtube

Navigating the Intricacies of CBD Payment Processing

Payment processing challenges in the CBD industry are undeniably present but entirely manageable. By securing high-risk merchant accounts and implementing specialized payment gateways, CBD businesses can confidently accept credit card payments, delivering convenience to their customers. With the right payment processing system in place, CBD entrepreneurs can shift their focus to growing their businesses and effectively addressing the unique demands of this continually evolving industry.

#high risk merchant account#payment processing#credit card processing#high risk payment processing#high risk payment gateway#accept credit cards#credit card payment#payment#cbd#cbd industry#high risk industry#Youtube

21 notes

·

View notes

Text

What is a Merchant Processing Gateway?

#What is a Merchant Processing Gateway?#payment processing#credit card processing#what is a payment gateway#merchant processing#payment gateway#merchant account#high risk merchant processing#what is a merchant account#merchant account gateway#merchant services#high risk merchant account#what is a merchant account?#merchant account vs payment gateway#how does a payment gateway work#cbd merchant processing#merchant account processing#merchant payment processing comparison#what is merchant services

1 note

·

View note

Text

The Best Credit Card Processor in the UK for High-Risk Businesses

Running a high-risk business in the UK? Finding a reliable credit card processor that understands your industry can be a game-changer. From CBD and adult services to forex and gaming, traditional banks often label these businesses as "too risky." That’s where high-risk merchant accounts come in — and we’ve got the perfect solution for you.

Why You Need the Best Credit Card Processor in the UK

Not all processors are created equal. High-risk businesses face:

Frequent chargebacks

Account holds or terminations

Increased compliance checks

Difficulty integrating international payments

Choosing the best credit card processor in uk means more than fast payments — it means long-term stability and global reach.

What is a High-Risk Merchant Account?

A high risk merchant account uk is a specialized payment account tailored for industries with elevated risk. These accounts are designed to:

Handle large volumes of transactions

Reduce the risk of chargebacks and fraud

Comply with local and international regulations

Support alternative and offshore payment routes

If you’re in industries like crypto, adult, supplements, or fantasy sports, you qualify as high-risk.

Features of Our High-Risk Credit Card Processing

Here’s why UK businesses trust us with their payment needs:

✅ Multi-currency payment gateways ✅ 3D Secure & fraud filters ✅ Fast payouts (even for high volume) ✅ PCI-DSS compliant platforms ✅ Chargeback prevention tools ✅ Seamless integration with websites and apps

Whether you're scaling an e-commerce brand or launching an adult content site, our high risk credit card processing makes sure you get paid securely and reliably.

Industries we support include:

CBD and vape products

iGaming and fantasy sports

Adult entertainment and dating

Forex and crypto trading platforms

Nutraceuticals and supplements

Ticket brokers and travel

If your payment processor has ever shut down your account without notice, it’s time to switch to experts who specialize in high-risk merchant accounts UK.

At OffshoreUniPay, we make approvals fast and hassle-free. No red tape. No hidden terms. Just solid payment infrastructure built for high-risk merchants like you.DM us now or visit our site to apply.Let’s get your business paid — fast, global, and secure.

0 notes

Text

High-Risk Merchant Account Solutions in Europe - Your Complete Guide

For businesses operating in high-risk industries across Europe, securing reliable payment processing can be challenging. At Radiant Pay, we specialize in providing tailored merchant account services for high-risk businesses throughout the European market, helping you accept payments smoothly while navigating complex financial regulations.

Why High-Risk Businesses Need Specialized Merchant Accounts

Understanding High-Risk Classification

European payment providers consider businesses high-risk based on:

Industry type (gaming, adult, CBD, etc.)

Transaction patterns (high-ticket, recurring)

Chargeback history

Geographical operations

Challenges Faced Without Proper Processing

Account freezes and sudden terminations

Higher processing fees (3-6% vs standard 1-3%)

Lengthy settlement periods (7-14 days vs 1-3 days)

Limited banking options in the SEPA zone

RadiantPay's High-Risk Merchant Account Services

We provide comprehensive payment solutions designed specifically for European high-risk businesses:

1. Guaranteed Approval Accounts

Solutions for previously declined businesses

Custom underwriting beyond credit scores

Start processing within 48 hours

2. Multi-Currency Processing

Accept EUR, GBP, USD + 20+ currencies

Dynamic Currency Conversion (DCC)

Local IBANs across Europe

3. High-Risk Industry Specialization

Gaming & Betting (licensing support)

Adult Entertainment (discreet billing)

CBD & Nutraceuticals (compliant solutions)

Travel & Tickets (high-ticket processing)

Tech Services (recurring billing)

European Payment Solutions We Offer

Card Processing: This service supports major card networks like Visa, Mastercard, and UnionPay.

Key Benefit: It enables access to a global customer base, making it ideal for international transactions.

Alternative Payments: Includes options such as SEPA, Sofort, and Trustly.

Key Benefit: These are cost-effective solutions, especially for transactions within the EU.

EWallets: Popular eWallets like PayPal, Skrill, and Neteller are supported.

Key Benefit: Highly favored by EU consumers, with 44% preferring these payment methods.

Cryptocurrency: Accepts digital currencies such as Bitcoin and Stablecoins.

Key Benefit: Offers a chargeback-proof alternative, ideal for reducing fraud risk.

Regulatory Compliance Across Europe

Navigating Europe's complex payment landscape requires expertise in:

1. PSD2 Requirements

Strong Customer Authentication (SCA)

3D Secure 2.0 implementation

Transaction risk analysis

2. AML/KYC Protocols

Customer identification procedures

Transaction monitoring systems

Reporting obligations

3. Country-Specific Rules

Germany: BaFin licensing

France: ACPR regulations

Netherlands: DNB oversight

Spain: Bank of Spain compliance

Implementation Process

Getting started with your high-risk merchant account:

Application (Submit business documentation)

Underwriting (Custom risk assessment)

Integration (API, plugins or hosted page)

Testing (Verify transaction flows)

Go-Live (Start processing payments)

Why European Businesses Choose RadiantPay

🚀 High-Risk Specialists - Deep industry expertise 💳 98% Approval Rate - Even for tough cases 🛡️ Chargeback Protection - Advanced fraud tools 🌍 Pan-European Coverage - Local IBANs available 📈 Scalable Solutions - Grow without limits

Cost Structure & Fees

Our transparent pricing for European high-risk merchants:

Setup Fee: €0-€250 (waived for volume)

Transaction Fee: 3-5% (based on risk)

Monthly Fee: €20-€100 (includes fraud tools)

Chargeback Fee: €15-€25 (with mitigation support)

Compared to standard accounts: More features tailored for high-risk needs

Success Story: Berlin-Based CBD Company

After 3 processor rejections, RadiantPay provided us with a stable merchant account. We now process €350,000 monthly with just 0.9% chargebacks." - Markus T., Founder

Getting Started with Your Merchant Account

Identify your processing needs

Prepare business documents

Apply for your account

Integrate payment solution

Launch and optimize

Ready to Solve Your Payment Challenges?

Contact Radiant Pay today for European high-risk merchant accounts!

0 notes

Text

Simplify Your High Risk Transactions with E-Check Payment Processing

Quadrapay has been a reliable source of low-risk merchant accounts for businesses across the US, Canada, the UK, and the European Union since 2016. Our team has designed this guide, which we refer to as the Swiss Army knife of low-risk merchant accounts. In this article, we will discuss various aspects related to low-risk merchant accounts. You can identify industries considered low-risk due to minimal fraud and legal complications. Such industries maintain a consistent transaction pattern. Reading this guide, you will be able to understand whether you qualify as a low-risk merchant.

e-check payment processing

E-check payment processing involves a customer authorizing payment from their bank account, which is then electronically transferred via the Automated Clearing House (ACH) network to the merchant's account. An electronic check, or e-check, is similar to a paper check, except that customers provide their bank account information, including the routing number and payment authorization, through an online form for electronic processing.

Paper checks are dying off, but high transaction fees make credit card payments a terrible alternative. E-checks are a more affordable alternative to credit cards, faster than paper checks, and allow you to automate your billing process with recurring charges. Not all e-check offerings are the same: only Quadrapay gives you everything you need to accept e-check alongside credit cards in a single checkout with instant funds verification.

High-risk merchant account

A high-risk merchant account is a specialized credit card processing solution designed for businesses that experience high chargebacks, above-average fraud, and rigorous regulatory scrutiny. Specialized high-risk processors provide these accounts. Merchants from industries such as dating, gaming, vaping, CBD, paraphernalia, business coaching, and adult e-commerce utilize these credit card processing accounts.

Finding the right high-risk credit card processing company is not an easy task. Many merchants continue to submit applications but never find a solution. The QuadraPay team has massive experience working with high-risk PSPs and merchants. Our team has written this guide for you. The guide examines various factors associated with high-risk merchant account processing. After reading it, you can easily find the best high-risk merchant account provider for your business.

0 notes

Text

Secure your CBD business with trusted CBD Merchant Account services

As the CBD industry continues to grow rapidly, one of the biggest hurdles for business owners remains payment processing. Due to its classification as a high-risk sector, many banks and traditional processors decline services to CBD companies. That’s where a CBD Merchant Account becomes an essential tool for any CBD business looking to operate smoothly and scale effectively.

A CBD Merchant Account is a specialized payment processing solution designed to handle the unique challenges faced by CBD merchants. It allows businesses to accept credit card, debit card, and alternative payment method transactions with ease. More importantly, it offers a secure and compliant infrastructure that helps prevent sudden account freezes or transaction declines that can disrupt business operations.

One of the key features of a CBD Merchant Account is its focus on compliance. The CBD industry is heavily regulated, and any misstep can lead to legal complications or shutdowns. A good CBD payment processing partner ensures that your account adheres to all relevant federal and local laws, reducing your risk and helping you stay in business for the long term.

Another major advantage of a CBD Merchant Account is its built-in fraud prevention tools. These security features protect your business and customers from chargebacks, fraudulent transactions, and cyber threats. With these tools in place, you can confidently offer your products online or in-store without worrying about data breaches or financial losses.

Fast approval is also a major benefit of choosing a CBD Merchant Account. While traditional banks may take weeks only to reject your application, high-risk merchant account providers specialize in quickly assessing and onboarding CBD businesses. This means less downtime and more time focused on growth and customer satisfaction.

In addition to robust support and seamless integration with e-commerce platforms and POS systems, a CBD Merchant Account gives you access to ongoing customer service from professionals who understand the specific needs of your industry. They can help you troubleshoot issues, navigate compliance updates, and scale your processing capabilities as your business grows.If you’re in the CBD space and want to future-proof your operations, investing in a CBD Merchant Account is a smart move. It’s more than just a way to process payments—it’s a strategic decision that supports stability, customer trust, and long-term success. Apply now to secure your CBD payment processing solution and elevate your business today.

0 notes

Text

Trusted High Risk Payment Processing by Adaptiv Payments

What Is High Risk Payment Processing

High risk payment processing is a special service that helps businesses in risky industries accept credit card and online payments. These businesses may face high chargebacks, refunds, or legal rules that make it hard to get approved by normal banks. Adaptiv Payments offers solutions for these companies so they can process payments safely and without delays. This service is important for businesses that often get declined by regular payment providers.

Why Some Businesses Are High Risk

Some industries are labeled as high risk because of the type of products they sell or the way they operate. For example, CBD, travel, credit repair, subscription services, and telehealth are considered high risk. These industries may deal with many refunds, changing laws, or complaints. Adaptiv Payments understands these challenges and works with trusted banks to offer support and approval to these businesses when others say no.

Fast and Easy Setup

Adaptiv Payments makes it fast and simple for high-risk businesses to get started. Their digital application process takes only a few minutes, and most accounts are approved within hours. After approval, you can start accepting payments in just 24 to 48 hours. This quick process helps business owners start selling without long delays or complicated steps. It’s a big help for companies that need payment solutions right away.

Wide Industry Coverage

Adaptiv Payments supports more than 20 high-risk industries. These include ecommerce, nutraceuticals, kratom, MLM, telehealth, and more. They have over 20 years of experience and work with banks in the US and worldwide. This gives them the power to find the best payment solution for each business. No matter what you sell or where you are, they have a payment option for you.

Complete Payment Tools

Adaptiv Payments gives you more than just a merchant account. They also offer a full set of tools like virtual terminals, payment gateways, and e-commerce integration. Their system works with all major credit card brands like Visa, Mastercard, Amex, and Discover. You can accept payments online, over the phone, or in person. This makes it easier for high-risk businesses to manage sales in any form.

Strong Fraud Protection

Fraud and chargebacks can hurt high-risk businesses. Adaptiv Payments uses smart technology to stop fraud before it happens. Their system watches your transactions in real time and blocks suspicious activity. They also offer chargeback prevention tools to help you keep more of your money. This means better protection for your business and fewer problems with banks or customers.

Global Payment Support

Adaptiv Payments helps high-risk businesses grow worldwide. They support payments in many currencies, so you can accept money from customers across the globe. Whether your business is based in the United States or another country, their system can handle global transactions smoothly. This helps your business reach more customers without worrying about payment limits.

Conclusion

High risk payment processing is important for businesses that face more challenges when accepting payments. Adaptiv Payments provides a trusted and flexible solution that helps these companies stay safe, grow, and succeed. With fast approvals, strong fraud protection, and tools for every type of payment, they are a reliable partner for high-risk merchants. If your business is in a high-risk industry, Adaptiv Payments is ready to help you process payments with ease and confidence.

0 notes

Text

Marcus Todd Brisco Leads the Future of High-Risk Retail Payments with Smokeable Receipt Paper and Free Credit Card Terminal

When visionary entrepreneur Marcus Todd Brisco introduced the world to Rolly Receipt, the industry didn’t just take notice—it took a deep breath. What started as an eco-conscious innovation in receipt paper has now evolved into a full-fledged revolution for high-risk merchants across the U.S. With the launch of Rolly Receipt’s all-in-one credit card terminal, Marcus and his team are making it easier than ever for vape shops, CBD stores, hookah bars, and smoke retailers to accept payments while standing out in a crowded market.

This new offering is not just about smokeable receipt paper—though that in itself is a market disruptor—it’s about empowering businesses labeled "high-risk" by traditional payment processors. Rolly Receipt’s solution combines sustainability, affordability, and accessibility in one sleek terminal that comes fully loaded for merchants who are often underserved.

Free Equipment, Free Receipt Paper, and No Processing Fees

Rolly Receipt’s newest package is designed with the merchant in mind. For just $39.95 per month, qualifying businesses receive:

A free credit card terminal equipped to handle modern payment methods.

An ongoing supply of free smokeable receipt paper, a product that has quickly become both a conversation starter and an eco-friendly alternative to traditional thermal paper.

Zero credit card processing fees—a game-changer for small to mid-sized merchants looking to protect their margins.

No long-term contracts, providing ultimate flexibility.

This bold move helps remove the financial friction often associated with setting up a compliant and functional point-of-sale system—especially for retailers in the high-risk space.

The Innovation Behind Smokeable Receipt Paper

At the heart of the Rolly Receipt revolution is its patent-pending smokeable receipt paper, made from natural, hemp-based materials that are safe to use, non-toxic, and fully biodegradable. What sets it apart is not only its sustainability but also its dual purpose: it functions as a legally compliant receipt and can later be rolled and used in the same way one would use traditional rolling paper.

The product is FDA-compliant for indirect contact and made without bleach, BPA, or harmful dyes, making it an ideal solution for vape and CBD customers who value cleaner consumption options.

Empowering High-Risk Retailers

Businesses like CBD dispensaries, vape shops, smoke stores, and hookah lounges have historically struggled to find fair and reliable payment processing due to their classification as high-risk merchants. This categorization often leads to higher processing fees, limited banking options, and restrictive contracts. Rolly Receipt is changing that narrative by offering:

Fair, flat-rate pricing with no hidden fees.

Access to modern, reliable credit card equipment without upfront cost.

Approval for high-risk merchant accounts, tailored to meet industry compliance standards.

By removing the barriers that have held back high-risk merchants, Rolly Receipt is leveling the playing field and enabling these businesses to grow with confidence.

Built for Smoke Culture, Backed by Innovation

Rolly Receipt’s new terminal isn’t just functional—it’s also a branding tool. The smokeable receipt paper becomes a signature touchpoint, one that customers often photograph, share, or ask about. It's memorable, reusable, and aligned with the lifestyle of the average vape or CBD buyer.

Marcus Todd Brisco believes this is just the beginning. “The future of retail is creative, sustainable, and flexible. Rolly Receipt sits at the intersection of all three. We’re not just offering tools—we’re creating experiences that build loyalty and buzz.”

Where to Find It

Rolly Receipt’s terminal program is now available nationwide and is actively being adopted by vape shops, dispensaries, smoke lounges, tobacco shops, and even alternative lifestyle boutiques. The onboarding process is quick, with no hidden startup fees, no long-term contracts, and dedicated customer support to help businesses set up in days.

A Brand with a Bigger Mission

Beyond providing merchant services and innovative paper, Rolly Receipt is part of a larger movement toward sustainability and creative branding in retail. Every product under the Rolly Receipt name is designed to reduce waste, spark curiosity, and elevate the customer experience.

By combining eco-conscious materials with practical functionality, Marcus Todd Brisco and Rolly Receipt are making it possible for merchants to do more than just process transactions—they’re helping them tell a story.

Final Thoughts

For too long, high-risk merchants have been left out of the conversation when it comes to financial innovation. With the launch of this new credit card terminal program, Marcus Todd Brisco and Rolly Receipt are rewriting the rules. Affordable, sustainable, and unforgettable—this is payment processing reimagined for today’s culture.

Reference - https://www.ecothermal.org/post/marcus-todd-brisco-leads-the-future-of-high-risk-retail-payments-with-smokeable-receipt-paper-and-fr

0 notes

Text

Unlock 7 Secrets to CBD Credit Card Processing Success in Dubai & UAE for 2025

Imagine launching your CBD business in Dubai’s thriving market. Your products are ready, but your payment processor rejects CBD credit card transactions. Sales plummet, and customers vanish. It’s a nightmare, right?

In the UAE, over 50% of CBD merchants face payment hurdles. Strict regulations and cautious banks make CBD credit card processing tricky. But don’t despair—this guide unlocks seven secrets to succeed in 2025.

Whether you’re in Dubai or Abu Dhabi, I’ll show you how to accept CBD credit card payments seamlessly. You’ll learn to stay compliant and grow your business. Ready to dive into CBD credit card processing? Let’s go!

CBD credit card processing lets UAE businesses accept credit and debit card payments for hemp-derived CBD products. It works online or in stores across Dubai, Abu Dhabi, or Sharjah. The system involves a merchant account, payment gateway, and processor.

A merchant account is your payment hub, linked to a UAE bank like Emirates NBD. The payment gateway securely processes CBD credit card transactions. The processor connects your bank to the customer’s bank and networks like Visa.

In the UAE, CBD credit card processing is complex. Strict regulations and high-risk banking policies create challenges. The UAE’s CBD market is booming, though.

Industry estimates predict the Middle East’s CBD sector could hit $1 billion by 2027. Dubai is a key driver. Yet, many merchants struggle with CBD credit card payments.

Take Fatima, a Dubai CBD skincare entrepreneur. In 2024, she launched an online store. She expected to use Stripe for CBD credit card processing.

Within days, her account was frozen. She lost thousands in sales. Fatima’s story is common in the UAE.

CBD credit card processing builds customer trust. It ensures steady cash flow. It helps you compete in Dubai’s wellness market.

Dubai’s global customers demand seamless CBD credit card payments. They want options in AED, USD, or EUR. This guide will help you avoid Fatima’s mistakes.

You’ll navigate UAE regulations with ease. You’ll choose the best CBD credit card processor. Let’s explore why CBD payments are high-risk in the UAE.

CBD credit card processing is high-risk in the UAE. This label affects fees, approvals, and banking relationships. Several factors drive this classification.

The UAE permits CBD products with 0% THC. The Emirates Authority for Standardization and Metrology (ESMA) oversees this. So does the Ministry of Health and Prevention (MOHAP).

Even a trace of THC violates Federal Law No. 13/2021. Penalties are severe. Banks see CBD credit card processing as a compliance risk.

Chargebacks are another issue. Customers dispute CBD credit card transactions over product misunderstandings. Quality issues also spark disputes.

Chargebacks drain finances. They can lead to account terminations. Gulf Business reported in 2024 that CBD sees chargeback rates above 1.5% in the UAE.

CBD’s cannabis link raises concerns. UAE drug laws are strict. Banks avoid CBD merchants to dodge legal risks.

Fraud is a growing problem. Dubai’s eCommerce market fuels online CBD sales. Card-not-present CBD credit card transactions are fraud targets.

Processors invest in security. This increases costs and scrutiny. Gulf Business says 65% of UAE banks avoid CBD businesses.

Merchants turn to high-risk CBD credit card processors. Fees range from 3–6% per transaction. Understanding this high-risk status is crucial.

You need to navigate CBD credit card processing in Dubai. The UAE market demands it. Let’s see how to choose the right processor.

Have you hit payment roadblocks in the UAE? Share your story in the comments!

The right CBD credit card processor is vital. It’s like choosing a business partner. The wrong choice means frozen accounts or high fees.

In the UAE, processors must understand ESMA and MOHAP rules. Your CBD credit card processing needs to comply with the 0% THC mandate. This is non-negotiable.

Security is critical. PCI-compliant gateways are a must. Tools like Address Verification Service (AVS) and 3D Secure prevent fraud.

Dubai’s eCommerce scene is prone to fraud. CVV checks add protection. Your processor should have these features.

Dubai attracts global customers. Your processor must handle AED, USD, and EUR. Multi-currency support boosts CBD credit card sales.

Fees matter. High-risk CBD credit card processors charge 3–6%. Fixed fees range from $0.10–$0.50 per transaction.

Hidden costs hurt. Demand transparent pricing. This avoids surprises in your UAE business.

Chargebacks are common in CBD. Robust monitoring tools like CB-ALERT help. Dispute resolution saves money and accounts.

Your processor should integrate with platforms. Shopify and WooCommerce are popular in Dubai. UAE-specific POS systems work for retail.

Dubai’s 24-hour economy needs support. Choose processors with UAE-based teams. Arabic-speaking support is a bonus.

Here are ten top CBD credit card processors for UAE in 2025. They’re based on research and merchant feedback.

PaymentCloud offers high approval rates. It supports multi-currency and Shopify. Fraud prevention suits Dubai’s eCommerce.

Fees are 4–5.5%. Startups may find this high. It’s best for online CBD stores in Dubai.

Payzli has competitive rates, 3.5–4.5%. It complies with UAE regulations. Chargeback tools are strong.

It’s limited for non-AED transactions. Payzli suits Abu Dhabi retail and eCommerce. It has a Middle East focus.

Corepay approves accounts in 24–48 hours. Its Netvalve tool fights fraud. It works with WooCommerce.

High-volume merchants face higher rates. Corepay is ideal for Dubai CBD startups. It’s fast and reliable.

Shift Processing offers 3.8–5% rates. It has no termination fees. High-risk expertise helps UAE merchants.

POS options are limited for retail. It’s best for Sharjah small businesses. Transparency is a strength.

PayDiverse partners with multiple banks. Fraud protection is robust. It supports Dubai’s international customers.

Applications can be complex. It’s best for high-volume Dubai merchants. Approval odds are high.

Easy Pay Direct uses load-balancing. This reduces risk across accounts. It supports UAE retail and online.

Setup fees are steep for startups. It suits growing CBD brands. Scalability is a plus.

PayKings offers customizable gateways. Onboarding is fast. Dedicated UAE support helps Dubai merchants.

Monthly fees impact small businesses. It’s best for service-focused firms. Customer care shines.

Square’s high-risk division is user-friendly. It supports UAE POS systems. Rates are 3.7–5%.

Approvals are slower for CBD. It’s ideal for Abu Dhabi retail. Ease of use is key.

Instabill specializes in high-risk CBD. It offers global banking options. UAE compliance is strong.

Customer support can lag. It suits Dubai eCommerce with international sales. Banking flexibility helps.

Merchant Scout provides tailored solutions. It negotiates UAE banking terms. Fraud tools are advanced.

Fees start at 4.5%. It’s best for established UAE merchants. Customization is a strength.

To choose a processor, request AED-based quotes. Verify ESMA/MOHAP document checks. Test support with UAE questions.

Confirm scalability for growth. You might expand across emirates. International sales could follow.

Negotiate fees if sales are high. This saves money. Your CBD credit card processing depends on the right choice.

Which processor are you eyeing for your UAE business? Comment below!

Setting up CBD credit card processing in the UAE takes effort. Strict banking rules apply. You need the right documents.

A trade license is essential. Get it from Dubai DED or another emirate. It proves your business is legal.

ESMA certification is mandatory. It verifies 0% THC in your CBD products. UAE compliance depends on this.

Bank statements are needed. Provide 3–6 months from a UAE bank. Emirates NBD or FAB work well.

Lab reports are critical. Third-party tests confirm 0% THC. MOHAP rules require safety checks.

Your business plan matters. Outline your CBD operations. Target Dubai’s wellness market clearly.

Your website must comply. UAE’s Federal Law No. 15/2020 bans health claims. Audit your site carefully.

VAT registration may apply. Provide your Tax Registration Number (TRN). This ensures tax compliance.

The owner’s Emirates shi ID is needed. A passport copy works too. It verifies your identity.

To start, shortlist processors. Payzli and Corepay are UAE-friendly. They understand local rules.

Submit documents online. Use the processor’s portal. Be transparent to avoid rejections.

Underwriting takes 48–96 hours. Processors check risk and compliance. UAE’s strict rules slow this down.

Once approved, integrate the gateway. Shopify and WooCommerce are common. Dubai POS systems work for retail.

Test AED payments. Confirm funds settle in your UAE bank. This ensures CBD credit card processing works.

Go live with payments. Monitor transactions closely. Catch issues early to avoid disruptions.

Omar’s story shows success. He’s an Abu Dhabi CBD retailer. In 2024, his global processor failed.

Omar switched to Payzli. He submitted his DED license. ESMA certifications and lab reports followed.

Approved in 72 hours, he integrated with WooCommerce. Fees dropped from 5.5% to 3.9%. Sales rose 30%.

Partner with local banks. Mashreq or FAB streamline integration. They’re CBD-friendly in the UAE.

Audit your website. Ensure no unverified claims. This keeps your CBD credit card processing active.

Handle VAT carefully. UAE’s 5% VAT applies to transactions. Clarify this with your processor.

Submit all documents upfront. Delays hurt your setup. Complete paperwork speeds up CBD credit card processing.

Struggling with UAE compliance? Our Understanding CBD Compliance and Regulations guide helps.

UAE regulations are strict for CBD credit card processing. CBD is allowed with 0% THC. ESMA and MOHAP oversee compliance.

Products must be THC-free. UAE-accredited labs verify this. Federal Law No. 13/2021 imposes harsh penalties.

Health claims are banned. Don’t say CBD cures insomnia. Use “supports wellness” instead.

Register products with ESMA. This applies to cosmetics and supplements. Topicals need approval too.

Labels must be clear. List ingredients and batch numbers. Confirm 0% THC on packaging.

Dubai requires a DED trade license. It must specify CBD activities. Free zone businesses need checks.

DMCC free zone licenses vary. Ensure yours permits CBD sales. Some zones restrict high-risk industries.

Dubai’s National Media Council bans misleading ads. Stick to factual CBD claims. Avoid exaggeration.

Abu Dhabi needs MOHAP approval. Retail sales require permits. Submit these to processors.

Sharjah is stricter. Enforcement is tight. Keep lab reports ready for inspections.

Ras Al Khaimah is lenient. Free zones are flexible. ESMA compliance is still required.

Ajman supports CBD businesses. Its free zone is growing. THC-free lab reports are key.

Fujairah has emerging CBD markets. Retail needs MOHAP permits. Processors check compliance.

Umm Al Quwain is smaller. Regulations align with federal rules. ESMA certification is mandatory.

To maintain CBD credit card processing, share lab reports. Use UAE-accredited labs. Submit during onboarding.

Document your supply chain. Prove ESMA-compliant sourcing. This builds processor trust.

Train your team. They must know UAE CBD laws. Avoid accidental violations.

Monitor MOHAP and ESMA updates. Regulations change fast. Stay informed to protect CBD credit card processing.

Need a compliance checklist? See our Understanding CBD Compliance and Regulations guide.

Optimization boosts CBD credit card sales. It cuts costs in the UAE. Your customers will thank you.

Mobile checkouts are vital. Over 60% of UAE sales are mobile. Gulf Business confirms this trend.

Ensure responsive checkouts. They must work on phones. Dubai customers expect seamless CBD credit card payments.

Use AED as default. Conversion confusion hurts sales. Local currency keeps things simple.

Fast load times matter. Optimize for under 3 seconds. UAE consumers demand quick CBD credit card checkouts.

Offer guest checkouts. No account creation boosts conversions. It reduces friction for Dubai shoppers.

Chargebacks are a headache. Payzli’s tools monitor disputes. Catch issues early to save money.

Use clear descriptions. Say “THC-free CBD oil.” Avoid vague claims that spark disputes.

Return policies need clarity. Offer them in Arabic and English. UAE consumer laws require this.

Dispute chargebacks fast. Provide lab reports or order confirmations. This protects your CBD credit card account.

Use processor analytics. Track peak sales periods. Dubai Shopping Festival is a big one.

Flag suspicious orders. High-value CBD credit card purchases need checks. Fraud is common in Dubai.

Refine marketing with data. Instagram ads drive Dubai sales. Track which campaigns work best.

Security is non-negotiable. PCI compliance meets UAE standards. Your CBD credit card processing depends on it.

Use Verified by Visa. 3D Secure tools fight fraud. They’re essential for Dubai’s eCommerce.

Encrypt data with TLS. All CBD credit card transactions need protection. UAE cyber laws are strict.

Audit security quarterly. Catch vulnerabilities early. This keeps your CBD credit card processing safe.

Educate UAE customers. Many are new to CBD. FAQs in Arabic and English build trust.

Link to lab reports. ESMA-compliant reports reassure buyers. Add them to product pages.

Offer WhatsApp support. Dubai customers love it. Quick responses boost CBD credit card sales.

Want to cut chargebacks? See our Tips for Reducing Chargebacks in CBD Businesses.

Challenges are common in CBD credit card processing. UAE merchants face unique hurdles. Let’s tackle them.

Global processors reject CBD. PayPal and Stripe don’t work. Use Corepay or PayDiverse instead.

Fees are high. Expect 3–6% per transaction. Negotiate with Shift Processing for better rates.

Chargebacks stem from misunderstandings. UAE customers may not know CBD. Use fraud tools to manage disputes.

Arabic communication helps. Clear policies reduce chargebacks. Offer support in both languages.

Some UAE banks avoid CBD. RAKBank is cautious. Partner with Mashreq for CBD credit card processing.

Processor banking solutions help. They bypass reluctant banks. This keeps your account active.

Aisha’s story inspires. She’s a Dubai CBD vape retailer. In 2024, she faced high fees.

Chargebacks were frequent. Aisha switched to PaymentCloud. Fees dropped to 4%.

Fraud tools cut chargebacks by 40%. She integrated with Shopify. Sales soared in Dubai.

Khalid’s experience adds insight. He runs a Sharjah CBD store. His processor froze funds.

He moved to PayKings. Approvals were fast. Dedicated support fixed his CBD credit card issues.

These stories show solutions. Choose UAE-friendly processors. They make CBD credit card processing smoother.

Facing these issues? Comment below!

Fraud is a major concern. Dubai’s eCommerce market is a fraud target. CBD credit card processing needs protection.

Use AI detection. It flags suspicious AED transactions. This catches fraud early.

Set transaction caps. Limit orders to AED 2,000. Manually verify high-value CBD credit card purchases.

Geolocation checks help. Verify UAE billing addresses. This stops VPN-based fraud.

Monitor velocity. Frequent CBD credit card use signals trouble. Track it closely.

Train your Dubai team. They should spot fraud red flags. Mismatched billing details are a clue.

The UAE Central Bank reported a 20% fraud rise in 2024. eCommerce is vulnerable. CBD is a prime target.

Advanced tools are evolving. Machine learning improves detection. It adapts to new fraud patterns.

Blockchain could help. It verifies CBD credit card transactions. Transparency reduces fraud risks.

Partner with secure processors. PaymentCloud and PayDiverse excel. Their tools protect your business.

Regular audits are key. Check your systems monthly. This ensures CBD credit card processing stays safe.

I’m excited about the UAE’s CBD market. Dubai is a global hub. The wellness boom fuels CBD growth.

The UAE’s Vision 2030 drives innovation. CBD regulations may ease. This could simplify CBD credit card processing.

But challenges remain. Strict laws persist. Banks are cautious about CBD.

Processors like Payzli lead the way. Corepay follows closely. They offer UAE-specific solutions.

Merchants must stay proactive. Compliance is critical. Fraud prevention is non-negotiable.

Consumer trust is growing. UAE customers embrace CBD. Education will accelerate this.

AI will shape the future. It improves fraud detection. It streamlines CBD credit card processing.

Blockchain is promising. It could verify transactions. This reduces risks for UAE merchants.

Lower fees are possible. More banks may join the CBD space. Competition will drive this.

2025 is pivotal. Dubai’s market is ready. CBD credit card processing will evolve fast.

Stay ahead of trends. Partner with trusted processors. Your CBD business will thrive.

Why can’t I use PayPal for CBD credit card processing in Dubai? PayPal bans CBD due to high-risk status. Use PaymentCloud or Corepay.

What fees apply to CBD credit card processing in the UAE? Expect 3–6% per transaction. Fixed fees are $0.10–$0.50.

How can I reduce chargebacks in my UAE CBD business? Use fraud tools and clear descriptions. Arabic/English policies help.

Is CBD credit card processing legal in the UAE? Yes, with 0% THC. ESMA/MOHAP compliance is required.

How long does setup take for CBD credit card processing in Dubai? Approvals take 48–96 hours. Setup adds 1–2 days.

Can I accept international CBD credit card payments? Yes, with processors like PayDiverse. Comply with global CBD laws.

Got questions? Comment below!

CBD credit card processing in the UAE is challenging. But it’s not impossible. This guide equips you to succeed.

Choose the right processor. Stay compliant with ESMA and MOHAP. Optimize your CBD credit card transactions.

Dubai’s wellness boom is here. 2025 is your year to shine. Don’t let payment hurdles stop you.

Partner with a UAE-friendly processor. Act now to grow your CBD business. Seize the UAE market!

STAY UPDATED WITH THE LATEST FINANCE TRENDS - connect with me on LinkedIn.

0 notes

Text

Strategies for Seamless CBD Merchant Processing

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the continuously expanding realm of e-commerce, the CBD market stands out for its remarkable growth and potential. However, businesses in this domain often face a significant hurdle when it comes to payment processing. The high-risk nature of CBD sales can make it challenging to find reliable solutions. But fear not, because, in this article, we'll explore the world of CBD Merchant Processing and reveal strategies that will enable you to accept credit cards for your CBD business seamlessly.

DOWNLOAD THE STRATEGIES FOR SEAMLESS CBD INFOGRAPHIC HERE

Understanding the Challenge

Before we delve into the strategies, let's grasp the complexity of the issue. Payment processing for high-risk industries like CBD involves a unique set of challenges. The stigma and legal ambiguities surrounding CBD products classify them as high-risk, making traditional credit card processing solutions hesitant to provide services. The result? Many CBD merchants struggle to find suitable merchant accounts and merchant processing solutions, leaving them with limited options.

The Power of High-Risk Payment Processing

Embracing the high-risk label doesn't mean defeat. It's about recognizing the opportunities that specialized high-risk payment processing can bring to your CBD business. While conventional payment processors may shy away, providers specializing in high-risk industries understand the nuances of your trade. They offer tailored high-risk payment gateway and high-risk merchant accounts, aligning perfectly with your needs.

E-commerce as the CBD Gateway

In today's digital era, e-commerce has become the lifeblood of businesses across the globe. To thrive in the CBD industry, establishing a robust online presence is essential. To do this effectively, you need a reliable e-commerce payment processing solution, an e-commerce gateway, and an e-commerce merchant account specifically designed for high-risk transactions. With these tools, you can tap into the vast online market and accept credit cards for your CBD products effortlessly.

Credit Repair and CBD: A Similar Struggle

Interestingly, the world of credit repair shares similarities with CBD when it comes to payment processing. Both industries are often classified as high-risk, and consequently, face difficulties in securing merchant services. But there's a silver lining – many payment processors offer specialized credit repair merchant processing, credit repair merchant accounts, and credit repair payment processing solutions. Leveraging these options can help you navigate the challenges effectively.

CBD Merchant Account - Your Gateway to Success

A CBD merchant account is the linchpin of your payment processing strategy. It not only allows you to accept credit cards for CBD but also provides a secure platform for your customers to make transactions. When searching for a CBD merchant account, prioritize providers that understand the unique requirements of your industry. Look for terms like CBD payment processing, CBD payment gateway, and CBD High-risk credit card processing to ensure you're on the right track.

The Role of Credit Card Payment Gateways

In the digital age, the importance of credit card payment gateways cannot be overstated. These gateways act as the bridge between your online store and the payment processor. Choosing a reliable credit card payment processing system is vital for a seamless customer experience. It should offer robust security measures, ensuring that sensitive information is protected during every transaction.

Diversify Your Payment Options

To cater to a broader customer base, consider diversifying your payment options. While credit card payments are popular, integrating an online payment gateway can broaden your reach. This allows customers to use debit cards, online wallets, and other convenient payment methods, enhancing their shopping experience.

Compliance and Regulations

In the world of CBD merchant processing, staying compliant with ever-evolving regulations is paramount. The legal landscape surrounding CBD products can be murky, with varying rules and restrictions from one jurisdiction to another. It's essential to partner with a payment processing provider well-versed in the intricacies of CBD regulations. Look for terms like CBD payment processing compliance and CBD merchant processing legal expertise when selecting your service provider. By staying ahead of the regulatory curve, you can avoid costly fines and interruptions to your business operations.

Customer Trust and Payment Security

Earning your customer's trust is a vital aspect of running a successful CBD business. One way to build this trust is by ensuring the security of their payment information. The mention of secure payment processing and trustworthy payment gateway solutions in your marketing materials can reassure customers that their data is safe. Furthermore, consider seeking credit card payment services that offer features like tokenization and encryption, which provide an extra layer of protection for sensitive financial data. The peace of mind your customers gain from knowing their information is secure can lead to increased loyalty and repeat business.

youtube

Leveraging Analytics for Growth

In today's data-driven world, the insights gained from payment processing can be a goldmine for your CBD business. Look for a payment processing system that offers robust analytics tools. By analyzing transaction data, you can gain valuable insights into customer behavior, peak buying times, and product preferences. Armed with this information, you can tailor your marketing efforts and product offerings to better meet the needs of your target audience. Credit card payment gateways with advanced analytics can help you make data-driven decisions that drive growth and profitability.

Navigating the complexities of CBD merchant processing can be challenging, but with the right strategies and service providers, success is within reach. By understanding the unique challenges and opportunities presented by the high-risk nature of the CBD industry, you can make informed decisions about your payment processing solutions. Remember to prioritize compliance, security, and data-driven growth as you build and expand your CBD business. With the support of specialized payment processors and a commitment to providing a seamless payment experience for your customers, you can thrive in the CBD market. Don't miss out on the tremendous potential of the CBD industry – seize it with confidence and determination. Your journey to success begins with the right payment processing strategy.

#high risk merchant account#merchant processing#payment processing#high risk payment gateway#high risk payment processing#credit card processing#accept credit cards#credit card payment#payment#cbd#cbd industry#Youtube

18 notes

·

View notes

Text

Decoding High-Risk Products and Services in the Payment Industry

#Decoding High-Risk Products and Services in the Payment Industry#payment processing#merchant services#financial services#merchant account services#high risk payment processor#what is merchant services#credit card merchant services#payments news under the lens#payment processor#payment gateway#high risk payment processing#accept credit card payments#under the lens#product manger interview#payments news#cbd payment processing#high risk payment gateway#cbd and hemp oil merchant accounts#international payments

1 note

·

View note

Video

youtube

Elevate Your CBD Business with High-Risk Credit Card Processing

0 notes

Text

Secure Your Sales with a Vape Merchant Account and CBD Merchant Account

Quadrapay has been a reliable source of low-risk merchant accounts for businesses across the US, Canada, the UK, and the European Union since 2016. Our team has designed this guide, which we refer to as the Swiss Army knife of low-risk merchant accounts. In this article, we will discuss various aspects related to low-risk merchant accounts. You can identify industries considered low-risk due to minimal fraud and legal complications. Such industries maintain a consistent transaction pattern. Reading this guide, you will be able to understand whether you qualify as a low-risk merchant.

Vape merchant account

A vape merchant account at Quadrapay is a tailored account made for companies, especially vape shops, that fall under high-risk categories and find it more difficult to get a traditional merchant account. Businesses are able to take credit cards and other electronic payments thanks to these accounts. Due to factors like product regulation, misuse potential, and industry-specific problems, the vaping industry is frequently regarded as high-risk, which makes it challenging to get traditional merchant accounts.

Vape merchants face unique challenges in the payment processing world. As a high-risk industry, many traditional banks and payment processors hesitate to work with vape merchants. At Quadrapay, we specialize in providing merchant accounts and payment processing tailored to the specific needs of the vape industry, ensuring you can process payments securely and efficiently.

CBD Merchant Account

For companies that sell CBD products, a CBD merchant account is a specialized high-risk credit card processing option. Digital wallets, ACH transfers, debit cards, and a number of other payment methods are all accepted by CBD merchants with this kind of account. For a variety of reasons, including the intricate legal environment surrounding the products, traditional sponsor banks and payment processors view the CBD sector as high-risk.

The CBD industry is expected to grow into a substantial global market, with significant demand for CBD products in the health, wellness, and skincare sectors. All these businesses require reliable CBD merchant accounts to facilitate the processing of local and international transactions. Sometimes, CBD merchants get their accounts approved through shady or inexperienced processors.

0 notes

Text

CBD Payment Solutions_ The Ultimate Guide to Merchant Processing

For more information visit at: https://accept-credit-cards-now.com/high-risk-credit-card-processing-for-growth-cbd-businesses/

0 notes