#Investment Funding

Text

#Venture Capital Funds#Venture company#capital venture fund#Venture capital process#Venture capital industry#Joint venture partner#Venture capital startup#Investment Funding#Types of venture capital#venture capital in india#Capital venture fund#Stages of venture capital#Capital venture funding#Capital Venture Company#Venture capital equity#Venture capital firms in india#Venture Capital Ecosystem#truth ventures#truth venture#truth vent#Capital venture UK#Capital venture US#Capital venture India

0 notes

Text

Todays the day. I need to get a job, even if that jobs not in the gaming industry. So I’m heading to the library to print up a resume and apply at a little local chain of mattress stores.

The guy instantly liked me when I went in to do a secret shop for a competing store and offered to hire me on the spot so I figure if I can chat with him he’ll still like me enough to consider me.

#ramblies#I’m dreading this so much I had dreams about getting hired by dropout tv instead#also my beloved was very sweet and when I said this was hard reassured me that I can do hard things#I wish I could wait for an industry job but it’s just not feasible#because we desperately need to move my beloved out of our current carpeted home#and moving costs are no joke#I’ll also need to get myself a laptop so I can keep honing rigging skills at the mattress job which I’m dreading#I have little to know idea how much I’ll need to invest to get a machine that can run Maya like a champ#which I’ll also need to buy an indie Maya license#god life is stressful and expensive#I long to be a little renaissance artist kept in a garret making what I please on the funds of patrons#alas

241 notes

·

View notes

Text

Why is there suddenly a mysterious old man with long hair who clearly gives off Final Boss vibes???

This… this is still a football manga, right???

#blue lock#and pifa cracked me up after i googled it 😭#it says philippine investment funds associaton sdjhfjsghdj#miyamiwu.src#miyamiwu.live#miyamiwu.live.bllk

157 notes

·

View notes

Text

I do think if there was a special kind of grant/fellowship out there that literally just provided room and board to freaks working on their theories it would probably pay for itself pretty easily. maybe some funding for equipment too... obviously most wouldn't make it but enough would

#remember reading something#about maxwell's meagre funding from the brits or something#being like the best investment of all time

84 notes

·

View notes

Note

I need you to know that there is a gucci shoe where the bottom of the sole is shaped like a snake- that is all

You came to the right person

#Pathologic#Daniil Dankovsky#Modern AU#Featuring Daniil Dankovsky's 830 Gucci snake deck shoes#And Daniil Dankovsky's 1024 dollar Gucci ankle boots#Funded in part by Thanatica's grant money#It's an investment#It's dressing to impress the board of directors it's a justified purchase

635 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Retirement and How to Retire

How to start saving for retirement

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over.

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

How To Save for Retirement When You Make Less Than $30,000 a Year

Workplace Benefits and Other Cool Side Effects of Employment

Your School or Workplace Benefits Might Include Cool Free Stuff

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Financial Order of Operations: 10 Great Money Choices for Every Stage of Life

Advanced retirement moves

How to Painlessly Run the Gauntlet of a 401k Rollover

The Resignation Checklist: 25 Sneaky Ways To Bleed Your Employer Dry Before Quitting

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 8: “I’m Queer, and Want To Find an Affordable Place To Retire. How Do I Balance Safety With Cost of Living?”

How Dafuq Do Couples Share Their Money?

Ask the Bitches: “Do Women Need Different Financial Advice Than Men?”

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Speaking of advanced money moves, make sure you’re not funneling money to The Man through unnecessary account fees. Roll over your old retirement accounts FO’ FREE with our partner Capitalize:

Roll over your retirement fund with Capitalize

Investing for the long term

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Stocks vs. Bonds

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Financial Independence, Retire Early (FIRE)

The FIRE Movement, Explained

Your Girl Is Officially Retiring at 35 Years Old

The Real Story of How I Paid off My Mortgage Early in 4 Years

My First 6 Months of Early Retirement Sucked Shit: What They Don’t Tell You about FIRE

Bitchtastic Book Review: Tanja Hester on Early Retirement, Privilege, and Her Book, Work Optional

Earning Her First $100K: An Interview with Tori Dunlap

We’ll periodically update this list with new links as we continue writing about retirement. And by “periodically,” we mean “when we remember to do it.” Maybe remind us, ok? It takes a village.

Contribute to our staff’s retirement!

Holy Justin Baldoni that’s a lot of lengthy, well-researched, thoughtful articles on the subject of retirement. It sure took a lot of time and effort to finely craft all them words over the last five years!

In case I’m not laying it on thick enough: running Bitches Get Riches is a labor of love, but it’s still labor. If our work helped you with your retirement goals, consider contributing to our Patreon to say thanks! You’ll get access to Patreon exclusives, giveaways, and monthly content polls! Join our Patreon or comment below to let us know if you would be interested in a BGR Discord server where you can chat with other Patrons and perhaps even the Bitches themselves! Our other Patrons are neat and we think you should hang out together.

Join the Bitches on Patreon

#retirement#retire#how to retire#retirement account#retirement fund#retirement funds#401k#403b#Roth IRA#Traditional IRA#investing#investors#investing in stocks#Capitalize#401k rollover#personal finance#money tips

136 notes

·

View notes

Text

Kind of nuts to see so many news reports and journalists uncritically parrot the narrative that students protesting the violence in Gaza have to be funded by (or just all are) outside sources because their gear is too advanced and when they show the gear in question it’s all just stuff you can get on Amazon with Prime or by walking into an REI

#like idk man maybe these kids really do just believe that thousands of children slaughters is thousands too many#and that it’s ridiculous that their schools’ portfolios involve funding and investing in what’s killing those kids

79 notes

·

View notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

63 notes

·

View notes

Text

I know that logically Draxum probably got away with making the mutagen and oozequitos because he was very careful about hiding his research and whatnot, but the much funnier explanation is that he's already so weird that when he rolled up to an academic conference two months after his lab exploded the first time with his 200 page paper on how he's going to bioengineer mosquitos to be the size of his hand (without giving a single reason as to why he wants to do this), the most he was met with was maybe a few raised eyebrows and a couple people wondering how he still gets grant money

#rottmnt#rottmnt au#minor interference au#rottmnt baron draxum#rise of the tmnt#rise of the teenage mutant ninja turtles#rottmnt fanfiction#it's of course much more logical that he has at least some degree of independent wealth he uses to fund his experiments#but the funnier explanatiom is that people's response to his research proposal is just#'there's no what this is gonna go well. but i wanna see how it goes investing at 200 notes'#*no way#because the idea of draxum being so so particular about his reputation and how people see him#only for his actual reputation to be 'he's batshit insane' is so funny to me#this is a man who canonically blew up his lab TWICE in thirteen years#like it is not normal scientist behavior to keep having major lab accidents like that#he tries to criticize someone else's research like 'have you consider that your methodololgy may be flawed'#'well have you considered not BLOWING UP your HOUSE'#he's a mad scientist and everyone around him is completely used to it is what im saying

187 notes

·

View notes

Text

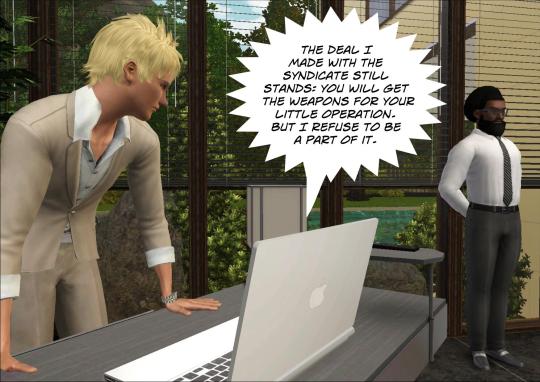

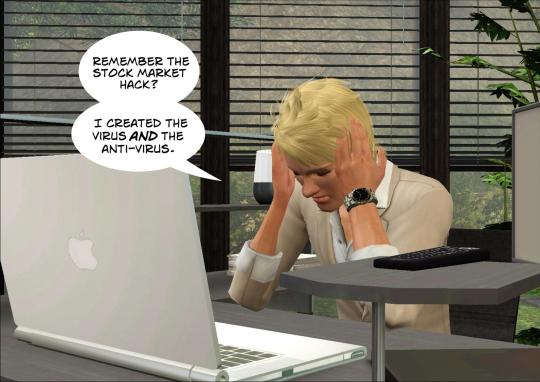

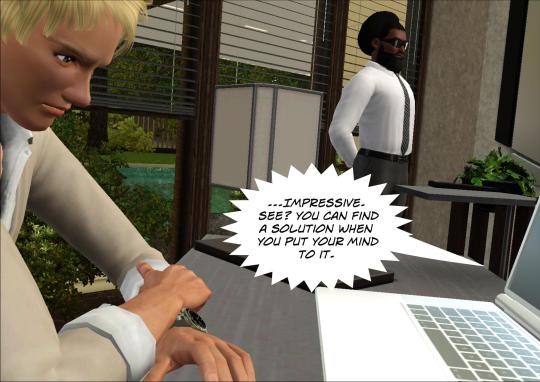

Author's note: Reference is made to the following scenes: (1), (2), (3)

#ts3#sims 3#sims 3 story#sims stories#tteot story#laurie golzine#omar ayad#muhammad al-saud#i'm sorry for going into details#i hate doing that#look i work in investment but imposter syndrome is kicking me hard#plus it's kind of difficult to make a plot look seamless when there is so much time between updates#in summary: laurie is managing a conglomerate including an investment fund of which noah is a partner#so laurie is a shareholder of a small tech company through that fund#he sold the antivirus via noah to that company as a solution to the virus he developed himself#when the stock market got hacked (by laurie) all companies rushed to get an anti-virus#but it also contained a spyware (also by laurie)#and this is how laurie's main business is now stealing data#laurie arc

68 notes

·

View notes

Text

This page is not politics free, but what I am about to talk about is not political. It is humanitarian.

I think everyone NEEDS to be educated on what is going in in Palestine now, as an active genocide of our time. Right here is a good link for information on the Palestinian plight, please feel free to peruse it.

Please, please consider donating to Palestine Red Crescent Society (a part of the Red Cross, which I'm sure you've all heard of), The Palestine Children's Relief Fund (to aid suffering children), and/or ANERA (the American Near East Refugee Aid, for humanitarian relief to refugees).

Given the blackout and subsequent indiscriminate bombings in Gaza today, everyone needs to spread information like this. There's a media blackout right now in the area (a deliberate cut off), and Palestinians are completely unable to communicate with the outside world.

If you're from the United States (or EU, I'm not entirely sure how representatives work over there) call your representatives as these two places are among the largest conglomerates of pro-Israel, pro-settler state allies. Voice your support for ceasefire. Boycott until the Israeli occupation is no longer profitable.

The only way out is an end to the Apartheid state and occupation of Palestinian people. But in the meantime, do what you can to help the civilians currently suffering and spread awareness (that being said, awareness is not enough. Awareness alone will not help material conditions. Do what you can to protest, boycott, donate, and combat propaganda, to the best of your ability).

#I know you've probably heard a lot of news outlets tell you misinformation if you're American because Israel is political ally of our gov#and Evangelicals hold a huge proportion of power here and are personally invested in colonial expansion there#But I ask you to at least consider the relief funds#because people are dying. Kids. That's not going to change regardless of whatever our personal opinions are.#thanks for listening. kissies.

73 notes

·

View notes

Text

#the vatican bank#savings#offshore banking#investing#emergency fund#wealth management#assets#the 1%#tax haven#elite#tax shelter#private banking

24 notes

·

View notes

Text

Turns out it wasn't just Bank Chanwut who left M.Flow but Willi Arawill, Frame Noraphat, Float Nattawut, Poom Soravis and Phuri Phuwanon as well (so basically their whole boygroup project that was showcased in Beyond the Star the series).

I wonder if this is a sign of another production company running into financial trouble or just a case of contracts not being renewed.

#bl industry#m.flow#thai bl#i think what we're seeeing here might indicate that the thai bl bubble is about to burst#not for creatives but for bl as a quick investment#the market must be saturated now#lots of previously announced projects are in limbo presumably due to a lack of funding#and compared to last year fewer projects are announced esp by smaller companies#add to that that big companies like gmm are dividing up the cake among themselves#there's not much room past the pandemic boom for even established smaller companies to stay afloat#this might not be a bad thing#but much like in the gaming industry it could be largely mitigated by good management and union-like structures

7 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Investing for Beginners

Fundamentals of investing:

What’s the REAL Rate of Return on the Stock Market?

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Dark Magic of Financial Horcruxes: How and Why to Diversify Your Assets

Dafuq Is Interest? And How Does It Work for the Forces of Darkness?

Booms, Busts, Bubbles, and Beanie Babies: How Economic Cycles Work

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch series:

Investing Deathmatch: Managed Funds vs. Index Funds

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Stocks vs. Bonds

Investing Deathmatch: Timing the Market vs. Time IN the Market

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

Investing Deathmatch: What Happens in a Bull Market vs. a Bear Market

Now that we’ve covered the basics, are you ready to invest but don’t know where to begin? We recommend starting small with micro-investing through our partner Acorns. They’ll round up your purchases to the nearest dollar and invest the change in a nicely diversified portfolio of stocks, bonds, and ETFs. Easy as eating pancakes:

Start saving small with Acorns

Alternative investments:

Small Business Investing: A Kinder, Gentler Alternative to the Stock Market

Bullshit Reasons Not to Buy a House: Refuted

Investing in Cryptocurrency is Bad and Stupid

So I Got Chickens, Part 1: Return on Investment

Twelve Reasons Senior Pets Are an Awesome Investment

How To Save for Retirement When You Make Less Than $30,000 a Year

Understanding the stock market:

Ask the Bitches Pandemic Lightning Round: “Did Congress Really Give $1.5 Trillion to Wall Street?”

Season 3, Episode 2: “I Inherited Money. Should I Pay Off Debt, Invest It, or Blow It All on a Car?”

Money Is Fake and GameStop Is King: What Happened When Reddit and a Meme Stock Tanked Hedge Funds

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Season 4, Episode 1: “Index Funds Include Unethical Companies. Can I Still Invest in Them, or Does That Make Me a Monster?”

Retirement plans:

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over

How to Painlessly Run the Gauntlet of a 401k Rollover

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

Workplace Benefits and Other Cool Side Effects of Employment

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

Got a retirement plan already? How about three or four? Have you been leaving a trail of abandoned 401(k)s behind you at every employer you quit? Did we just become best friends? Because that was literally my story until recently. Our partner Capitalize will help you quickly and painlessly get through a 401(k) rollover:

Roll over your retirement fund with Capitalize

Recessions:

Season 1, Episode 12: “Should I Believe the Fear-Mongering about Another Recession?”

There’s a Storm a’Comin’: What We Know About the Next Recession

Ask the Bitches: How Do I Prepare for a Recession?

A Brief History of the 2008 Crash and Recession: We Were All So Fucked

Ask the Bitches Pandemic Lightning Round: “Is This the Right Time To Start Investing?”

#investing#how to invest#stock market#finance#personal finance#investing in stocks#retirement fund#retirement account#investing for beginners#investing 101

72 notes

·

View notes

Text

Clearly Idiot Doom Spiral would be into NFTs, but who else in Elysium?

#I wanna say Joyce calls it nonsense but invests in funds that bet on crypto#and Jesper probably let somebody make NFTs of his stuff he doesn't care#who else#disco elysium

25 notes

·

View notes

Text

Hrmm... Revising my game and I feel like there's still sooo much writing left to do, for something that probably won't even amount to much, so.. I do want to narrow my focus more (especially given my health problems seeming to get worse/less energy the past few years), but I'm not sure how would be best to...

I currently have 5 characters as the Main ones with full planned questlines and such, with each character having 6 quests you can do for them. But I haven't really started the writing for the 5th main character.

So then I was thinking, if I were going to write 6 full quests worth of content anyway... is it better to allocate that time on just doing a Complete 6 Quests for ONE single character, OR would it be better to do something like.. choose THREE side characters and do 2 quests for each of them? So that people have a wider variety to interact with and sort of sample around (of course with the idea that, once the first version of the game is released, IF people actually care about it enough to make it worth the effort, I would then add additional content to complete those 3 characters stories as well)

-

SO... If you were playing an interactive fiction sort of game centered around talking to & doing quests for a cast of characters (like there's no larger plot, more it's just about interacting with people, every character kind of has a self contained story, the focus is just learning about them and the world and exploring the area) --- Which would you rather have?

(and of course it would be stated up front which characters have only partial questlines, so people don't expect them to have full quests like the others and then get disappointed, or etc. etc.)

Basically, is it better to just focus in specifically on having one fully complete questline? Or for there to be a few stories that are not complete yet, but have more initial options available?

#I guess I just feel weird about investing too much into characters if possibly nobody will like them. so the idea of being able to sample#around a wider variety opens up the option of like 'hey even if neither of these 4 are your favorite - you have 3 other options soon too!'#or whatever. BUT I also am very anti-the trend of releasing half finished games or shit like that where people preorder and then#the game sucks on actual release and isn't fully playable or good until 5 updates later#HOWEVER.. those are giant companies with hundreds of employees and millions in funding. I feel like it's different for someone#if they're just like ''hey I am getting zero money for this and doing it entirely on my own in my free time and before I do like 50+ hours#of work on top of the 100+ hours of work that I already did - I would like maybe to at least see some proof#people are interested in this - so I'm releasing the game with like a small amount of the originally intended content removed#that I still have planned out and hope to add later and the game is still entirely done and completely functional#except for just a few quests I might add later.. sorry'' etc. etc. ??? like I think that's different. but maybe some people dont see#it that way and would still be like 'grrr.. how dare there be unfinished options..>:V" idk#And the nature of the quests is such that it's not weird to have it be partial like.. again.there's no major plot. it's not like the quests#are leading up to some dramatic thing and having them half done would make it feel like a cliffhanger. It's meant to be very casual just#chilling and doing little tasks and such. And last thing to clarify I guess - by 'side character' I don't mean taking some unimportant bac#ground character and forcing them to have quests. I mean like.. originally the game had 8 full characters and I thought that was#too much so I cut it down to 5. So I still had everything planned for all the side characters too. Id' just be like.. re-giving them#quests and focuses that were already planned from the beginning but that I got rid of.. former main characters banished to the side lol..#ANYWAY... hrmm... hard to decide... It's just so niche I think. I feel more and more like I should just get it to a 'proof#of concept' state and get it out there to interest check rather than invest in it soooo much for nothing. Because I really do not have the#tastes other people do or interact with games or have interest in things in the same way. A lot of the stuff that I love (slow. character#focused things with basicaly no action or plot where its' just about getting to explore a world and learn about#people in a casual low stakes setting but ALSO not romance) I think people find very boring so... lol...#This year as I try to pick the project back up again after abandoning it for like 3 years I keep looking at stuff and going.. ough...#yeah... cut this maybe.. I should cut that too.. I should make them a side character.. remove this.. blah blah..#Though I did ADD a journal and inventory system and other things that like People Expect Games To Have so.. maybe#that will count for something.. hey..you can collect items.. it's not just 'talking to elves for 600 hours simulator'.. are you#entertained yet? lol.... When I was making my other tiny game for that pet website and I gave it to the play testers and someone was like#''it should have achievements so I feel I'm working towards something concrete'' I was literally so blindsided like..??... people WANT that#in games..? is the goal not simply to wander aimlessly &fixate on world/character lore& make your own silly pointless personal goals? I did#do them though because it IS fun to make up little achievement names and such but.. i fear i am out of touch so bad lol..

10 notes

·

View notes