#Cash Withdrawal

Text

Bangladesh Bank Limits Daily Cash Withdrawals to Tk3 Lakh for Security

Bangladesh Bank (BB) has imposed a restriction limiting daily cash withdrawals to Tk3 lakh per account for security reasons. The directive was communicated to the managing directors (MDs) and chief executive officers (CEOs) of banks via SMS on Saturday night, and will remain in effect until further notice.

While cash withdrawals are capped at Tk3 lakh, customers are still permitted to transfer…

0 notes

Text

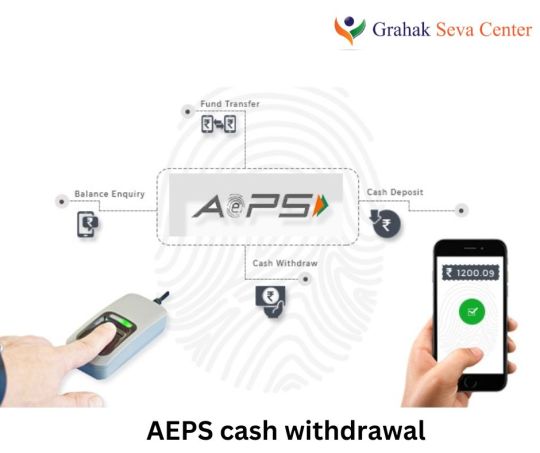

AEPS cash withdrawal

AEPS, or Aadhaar Enabled Payment System, is a financial inclusion initiative in India that allows people to make basic banking transactions using their Aadhaar number and fingerprint authentication. One of the services offered under AEPS is "AEPS cash withdrawal," which enables individuals to withdraw cash from their bank accounts without the need for a traditional ATM card or debit card.

0 notes

Text

Best AePS Commission in India: AePS Service mai milne wala commission ki baat kare toh adhiktam 10.50 rupee tak commission reatailers ko diya jata hai. Yaadi apko zyada commission chahiye toh aap humse judkar zyada se zyada comssion prapt kar sakteh hai.

0 notes

Text

Marquis “fighting” 1 Titan (he’s trying to not be noticed):

Victoria fighting 3 Titans back-to-back (she has to be told to stop fighting):

#parahumans#Marquis with a dry throat be like ‘I’m pushing my limits!’#Meanwhile Victoria is withdrawing all her blood from the bank and cashing in on violence#wildbow#ward#ward web serial#wardblr#victoria dallon#antares#glory girl#Marquis

108 notes

·

View notes

Text

happy pride month to mr. will-be-in-denial graham

#hannibal#will graham#yes there’s only a few hours left I’m still cashing in#🏳️🌈#there’s no straight explanation for the fantasies he had#nbc hannibal#day 3228 of hannibal withdrawal

22 notes

·

View notes

Text

Withdraw

#Withdraw#withdraw money#money#money art#cash money#cash#fashion#luxury#luxury fashion#street fashion#authentic fashion statements

75 notes

·

View notes

Note

Me clicking “see all” on the tags of that post on why Nate likes Peter: “Holy shit”

#sci speaks#i feel obligated to put a lengthy something something in these tags just to keep the joke up. so i'll tell you about my day.#i really wanted to get chinese takeout today and yesterday but i still haven't gotten it and it's upsetting because#i'm the sort of person who if there's a thing i really want i'll just keep thinking about it restlessly until it happens.#so i guess i'll be thinking about chinese takeout for the foreseeable future. maybe one night this coming week.#i should have bigger things to worry about than when my next chinese takeout fix will be but i'm a simple man with simple needs.#i don't know if the place even takes card and i havent seen a physical note of cash in months. do i need to withdraw money.#do i need to think that far ahead. should i withdraw some money tomorrow just incase.#i really like this chicken and aubergine dish from there it's my favourite. i really love aubergine.#do you guys like aubergine? sensory delight. it melts in your mouth. aughngh. ungh. moans whorishly.

73 notes

·

View notes

Note

HI ok I gotta ask - your post has made me insanely curious - you mention having cash at hand while waiting for your new card (resourceful) but none of the sources of cash was a bank or ATM.

Where I'm from cash is still used a lot (as we minimum wage workers get paid in cash) and as a result there are multiple ATM's within walking distance at all times and banks no more than 15-20 minutes drive away. Is this... different where you're from? (For context I'm from Africa)

We get paychecks directly to the bank account here, and I usually just pay with my card everywhere I need to, because it's more convenient than having a lot of coins and bills around. While there are ATM machines here (there are several within a walking distance from where I live), you use them with your card, so without having one, I can't get money out of the money withdrawing machine. I don't know how you do it, but without a card I can only get money out of the bank account by (online) bank transfers, and that's pretty hard at grocery store register.

Our bank offices stopped handing out cash several years ago, of which I am still very salty about.

I got some cash from my mom, and I had a handful of coins left over from the last time I had used an ATM a while back, but that's kinda rare for me, since most places accept card.

#I used to have cash savings last year but that was specifically for a tattoo in a studio that preferred cash payments#so I saved up by withdrawing a little bit of money every month to stash in my book shelf#but other than that it's generally easier to not handle cash#but like mobilepay links to the card so I need one to use it#and so does this delivery service app I've used before#linking to a card instead of directly to your bank account is safer#even if it makes it inconvenient if you lose your card#(it is only afterwards that I notice there's an option to close one's card TEMPORARILY in my mobile bank app...)#(but by that time I had already called my bank and terminated the old card and ordered the new one)#(hind sight is great)

11 notes

·

View notes

Text

heard theres not much to be done at work but they still approved my OT for sunday so im going anyway and will just work very slowly

#slayyyy weekend premium... ok cash money withdrawal#its a bunch of breasts apparently which I don't like grossing but for 80 an hour hell yea

9 notes

·

View notes

Text

Everything You Need to Know About Cash App Withdrawal Limits

With the rapid shift towards digital payments, Cash App has emerged as one of the leading platforms for quick and easy transactions. Whether it's sending money to friends, paying bills, or even buying Bitcoin, Cash App offers a versatile and user-friendly experience. However, as with any financial tool, there are certain limitations to remember—especially when withdrawing funds. Understanding the Cash App withdrawal limit is crucial for anyone who relies on the platform for their day-to-day financial activities.

Cash App allows users to withdraw funds in multiple ways, including ATMs, using a cash card, or transferring Bitcoin to an external wallet. However, these actions come with daily and weekly limits, which are set for security and compliance purposes. If you're unfamiliar with these restrictions or looking for ways to increase your withdrawal limits, you're in the right place.

In this blog, we'll provide a detailed breakdown of Cash App withdrawal limits, explain how they work, and offer guidance on increasing them if necessary. We'll also address frequently asked questions to help you navigate the app more effectively.

What are the Cash App ATM Limits?

One of the critical features of Cash App is the ability to withdraw money from ATMs using the Cash Card—a customizable debit card linked directly to your Cash App balance. This makes accessing cash simple and convenient, but there are limits on how much money you can withdraw from ATMs within a given time frame.

Currently, the Cash App ATM limit is structured as follows:

Daily ATM Withdrawal Limit: Cash App users can withdraw up to $310 daily from ATMs.

Weekly ATM Withdrawal Limit: The total withdrawal amount is capped at $1,000 over seven days.

Monthly ATM Withdrawal Limit: Cash App users can withdraw a maximum of $1,250 from ATMs over a 30-day period.

These limits are designed to protect users from fraudulent activity and ensure compliance with financial regulations. However, they can sometimes feel restrictive for those who frequently need access to larger amounts of cash. It's also worth noting that Cash App charges a standard $2.50 fee for ATM withdrawals, though users can get these fees reimbursed if they receive $300 or more in direct deposits each month.

What are the Cash App ATM Withdrawal Limits?

Understanding the timeframes for Cash App ATM withdrawal limits is essential for managing your finances effectively. Cash App users are subject to daily and weekly ATM withdrawal limits, which prevent them from withdrawing more than a certain amount within a 24-hour or seven-day period.

Let's break it down further:

Cash App Daily ATM Withdrawal Limit: You can only withdraw $310 daily from any ATM using the Cash Card. This limit is refreshed every 24 hours, starting from your last withdrawal.

Cash App Weekly ATM Withdrawal Limit: The total cash you can withdraw from ATMs over seven days is $1,000. This rolling limit resets every week based on the timing of your transactions.

The critical takeaway is to plan, especially if you anticipate needing more cash than the daily or weekly limits allow. Users may want to explore ways to increase their withdrawal limits for frequent or large withdrawals, which we'll discuss in a later section.

What are the Cash App BTC Withdrawal Limits?

In addition to standard cash withdrawals, Cash App offers cryptocurrency enthusiasts the ability to buy, sell, and withdraw Bitcoin (BTC) directly from the app. This makes Cash App a convenient platform for those involved in cryptocurrency transactions. However, similar to cash withdrawals, there are limits on how much Bitcoin you can withdraw.

The Cash App BTC withdrawal limit is set as follows:

Daily BTC Withdrawal Limit: Cash App users can withdraw up to $2,000 worth of Bitcoin in 24 hours.

Weekly BTC Withdrawal Limit: Users can withdraw up to $5,000 worth of Bitcoin in seven days.

It's important to note that these limits are separate from the cash withdrawal limits, and they are specifically for Bitcoin transfers. For users who are actively engaged in trading or transferring Bitcoin to external wallets, understanding these limits is crucial to managing your cryptocurrency assets effectively.

Bitcoin transactions on the Cash App also come with fees, generally based on the network's congestion and the transaction size. Always check the applicable fees before withdrawing to ensure you get the best transaction value.

How to Increase Cash App Withdrawal Limit?

One simplest and most effective way to increase Cash App withdrawal limit is to verify your identity on the platform. Unverified users have significantly lower limits, but once you provide the necessary information, Cash App may raise your withdrawal limits.

Open Cash App and go to your account settings.

Provide your full name, date of birth, and the last four digits of your Social Security number.

Sometimes, you may be asked to provide additional documents, such as a government-issued ID.

Once verified, you may see an increase in your withdrawal limits for ATMs and Bitcoin transactions.

Reach Out to Customer Support

If you've followed all the steps above and still find the withdrawal limits restrictive, consider contacting Cash App's customer support team. In some cases, they may be able to adjust your withdrawal limits based on your specific needs, especially if you're a long-time user with a solid transaction history.

While support may not immediately raise your limits, it's worth trying if you need to access more cash or cryptocurrency through the platform.

FAQs

1. What is the Cash App withdrawal limit per day?

The Cash App daily withdrawal limit from ATMs is $310. This limit applies to Cash Card withdrawals and resets every 24 hours.

2. What is the Cash App weekly withdrawal limit?

Cash App allows users to withdraw up to $1,000 weekly from ATMs. This limit is spread over a rolling seven-day period and refreshes based on the timing of your withdrawals.

3. How can I increase my Cash App withdrawal limit?

You can increase your Cash App withdrawal limit by verifying your identity, linking your bank account, setting up direct deposits, and maintaining regular account activity. Verified users with direct deposits often have higher limits.

4. What is the Cash App BTC withdrawal limit?

Cash App users can withdraw up to $2,000 worth of Bitcoin daily and up to $5,000 weekly. These limits apply specifically to cryptocurrency transactions.

5. Are there fees associated with Cash App ATM withdrawals?

Yes, Cash App charges a standard $2.50 fee for ATM withdrawals. However, this fee can be reimbursed if you receive at least $300 in direct deposits to your Cash App account monthly.

6. Can I withdraw over $310 from the Cash App in one day?

No, the maximum daily withdrawal limit from an ATM using Cash App is $310. However, you may be able to increase this limit by verifying your identity and setting up direct deposits.

Conclusion

Understanding the Cash App withdrawal limit is essential for anyone who frequently uses the platform for financial transactions. Whether withdrawing funds from an ATM using the Cash Card or transferring Bitcoin to an external wallet, knowing the daily and weekly limits ensures you won't face unexpected restrictions.

By verifying your identity, maintaining an active account, and setting up direct deposits, you can increase your Cash App withdrawal limit and access significant amounts of cash or cryptocurrency when needed. With these strategies, you can make the most out of Cash App's features while enjoying the convenience of digital transactions.

Remember, withdrawal limits are put in place for security and compliance reasons, but with a few simple steps, you can manage these limits and raise them to suit your financial needs.

#cash app atm withdrawal limit#increase cash app withdrawal limit#cash app atm withdrawal limit per day#cash app daily atm withdrawal limit#cash app withdrawal limit#cash app card atm withdrawal limit per week

2 notes

·

View notes

Text

How Cash App Bitcoin Withdrawal Limits Work and How to Increase Them

In the evolving landscape of digital finance, Bitcoin has emerged as a significant player, capturing the interest of investors and casual users alike. Cash App, a popular mobile payment platform developed by Square, Inc., offers users the ability to buy, sell, and withdraw Bitcoin. However, navigating the intricacies of Bitcoin transactions on Cash App can be challenging, particularly when it comes to understanding the withdrawal limits. This blog provides a comprehensive overview of the Cash App Bitcoin withdrawal limit, exploring its nuances, implications, and how you can manage or increase these limits effectively.

Understanding Cash App's Bitcoin Features

Cash App has integrated Bitcoin trading into its platform, allowing users to engage with the cryptocurrency market seamlessly. Whether you're a seasoned investor or a newcomer, Cash App provides a straightforward interface to buy and sell Bitcoin. However, before diving into transactions, it's crucial to understand the associated limits, especially concerning withdrawals.

What Is a Bitcoin Withdrawal Limit?

A Bitcoin withdrawal limit refers to the maximum amount of Bitcoin you can withdraw from your Cash App account to an external wallet or another account within a specific time frame. This limit can vary based on factors such as your account verification status, transaction history, and platform policies.

Cash App Bitcoin Withdrawal Limits: A Closer Look

Cash App sets specific limits on Bitcoin transactions to ensure security and regulatory compliance. These limits can impact how much Bitcoin you can withdraw and how frequently. Here’s an in-depth look at the key aspects of Cash App's Bitcoin withdrawal limits:

1. Daily and Weekly Withdrawal Limits

Cash App imposes both daily and weekly limits on Bitcoin withdrawals. These limits can affect how you manage your Bitcoin assets. For example:

Daily Withdrawal Limit: This is the maximum amount of Bitcoin you can withdraw on Cash App in a single day. Cash App sets this limit to mitigate risks and ensure that transactions are processed securely.

Weekly Withdrawal Limit: This refers to the maximum amount you can withdraw within a week. It is essential to plan your transactions according to these limits to avoid exceeding them.

2. Bitcoin Purchase Limits

Alongside withdrawal limits, Cash App also has purchase limits for Bitcoin. These limits can influence how much Bitcoin you can buy and subsequently withdraw. Understanding these limits helps in managing your overall Bitcoin transactions effectively.

3. Monthly Withdrawal Limit

Some users may be interested in understanding their monthly withdrawal limits. While Cash App primarily emphasises daily and weekly limits, it's useful to be aware of how these limits aggregate over a month.

4. Increasing Cash App Bitcoin Withdrawal Limits

For users looking to increase their Bitcoin withdrawal limits, verification plays a crucial role. Cash App typically offers higher limits for verified accounts. By providing additional verification documents and information, you can enhance your withdrawal capacity.

Managing Your Bitcoin Withdrawal Limits

Effectively managing your Bitcoin withdrawal limits on Cash App involves several strategies:

1. Account Verification

To increase Cash App withdrawal limits, complete the account verification process. This involves submitting personal information and documentation to confirm your identity. Once verified, your limits are usually increased, providing greater flexibility in managing your Bitcoin transactions.

2. Monitor Your Limits

Regularly check your Bitcoin withdrawal limits within the Cash App interface. Staying informed about your current limits helps in planning transactions and avoiding potential issues.

3. Plan Transactions Strategically

Plan your Bitcoin withdrawals according to the limits set by Cash App. If you need to withdraw large amounts, consider breaking them into smaller transactions spread across multiple days or weeks.

4. Contact Cash App Support

If you encounter issues with your withdrawal limits or need specific information, contact Cash App support. They can provide detailed insights into your limits and offer assistance in managing them.

FAQ About Increasing Cash App Bitcoin Limits

1. What is the Cash App Bitcoin withdrawal limit per day?

The daily Bitcoin withdrawal limit on Cash App varies depending on your account verification status and transaction history. Generally, verified accounts have higher withdrawal limits compared to unverified ones.

2. How can I increase my Cash App Bitcoin withdrawal limit?

To increase Cash App Bitcoin withdrawal limit, complete the account verification process. This includes providing personal information and documentation to Cash App.

3. What is the Cash App Bitcoin sending limit per week?

Your account verification status determines the weekly Bitcoin sending limit. Verified accounts typically have higher limits compared to unverified accounts.

4. Can I check my Bitcoin withdrawal limit on Cash App?

Yes, you can check your Bitcoin withdrawal limits within the Cash App interface. Navigate to the Bitcoin section or account settings to view your current limits.

5. What happens if I exceed my Bitcoin withdrawal limit?

If you exceed your withdrawal limit, you may need to wait until the limit resets or adjust your transaction plans. Contact Cash App support for guidance if needed.

6. Are there any monthly withdrawal limits for Bitcoin on Cash App?

Cash App primarily focuses on daily and weekly limits, but it's helpful to understand how these limits aggregate over a month. For specific details, refer to Cash App support.

7. How does Cash App handle Bitcoin deposit limits?

Cash App also has limits for depositing Bitcoin into your account. These limits can impact how much Bitcoin you can add to your Cash App balance.

8. What should I do if I need to withdraw more Bitcoin than my limit allows?

Consider breaking your withdrawal into smaller amounts and spreading them across multiple days or weeks. Alternatively, contact Cash App support for assistance.

Conclusion

Navigating Cash App's Bitcoin withdrawal limits requires an understanding of the various factors that influence these limits. By being aware of your daily, weekly, and monthly limits and by completing the necessary account verification, you can manage your Bitcoin transactions effectively. For any specific concerns or issues, Cash App support is available to provide assistance and ensure a smooth experience with your Bitcoin transactions.

For the latest updates on Cash App's Bitcoin features and limits, keep an eye on official announcements and resources provided by Cash App.

2 notes

·

View notes

Text

Increasing Higher ATM Withdrawal Limits on Cash App: Essential Tips

Cash App has revolutionised the way people manage their finances by providing a seamless and user-friendly platform for sending, receiving, and withdrawing money. One of the most common features users inquire about is how to increase the Cash App ATM limit. Whether you're a frequent traveller, a business owner, or simply someone who often uses ATMs, understanding the limits imposed on withdrawals and knowing how to increase them can be crucial.

In this comprehensive guide, we will break down everything you need to know about the Cash App ATM withdrawal limit, the factors that affect your withdrawal capabilities, and, most importantly, how you can maximise your withdrawal limit to meet your needs.

What is the Cash App ATM Withdrawal Limit?

Before we dive into the steps for increasing your withdrawal limit, it’s essential to understand what the Cash App ATM withdrawal limit is and how it works.

Cash App provides a Cash Card, a customizable debit card that allows users to withdraw cash from ATMs. While convenient, there are certain limits set on how much you can withdraw from an ATM daily, weekly, and monthly. These limits are in place to protect your account from fraud while ensuring the platform remains secure.

Here’s a breakdown of the basic cash app withdrawal limits:

Daily Withdrawal Limit: Cash App users can withdraw up to $310 per day.

Weekly Withdrawal Limit: Users can withdraw a maximum of $1,000 per week.

Monthly Withdrawal Limit: The limit for monthly withdrawals is $1,250.

While these limits are sufficient for many users, those who need higher withdrawal limits may find them restrictive. Fortunately, there are ways to increase your Cash App ATM withdrawal limit, and we’ll cover those in detail.

How to Increase Cash App ATM Withdrawal Limit?

Increasing your Cash App ATM withdrawal limit is a relatively straightforward process, but it requires verification of your account and responsible usage. Below are the steps you can follow to boost your withdrawal limit.

Step 1: Verify Your Account

The first and most crucial step to increasing your withdrawal limit is verifying your Cash App account. Unverified accounts have much lower limits compared to verified ones. To verify your account, Cash App will require some personal information, including:

Full legal name

Date of birth

The last four digits of your Social Security Number (SSN)

To do this:

Open Cash App and navigate to your profile by tapping the icon in the top right corner.

Scroll down and select "Personal."

Enter the required information, including your SSN.

Follow the prompts to submit your information for verification.

Once your account is verified, you will notice a significant increase in your withdrawal limit, including your ATM withdrawal limits.

Step 2: Order a Cash App Card

To take advantage of ATM withdrawals, you need to have a Cash App Cash Card. This card allows you to use your Cash App balance at any ATM that accepts Visa. If you haven’t already ordered one, follow these steps:

Open the Cash App and tap the Cash Card icon.

Follow the prompts to customize and order your Cash Card.

Once your Cash Card arrives, activate it in the app.

Having an active Cash Card is necessary for ATM withdrawals and is a key component in increasing your Cash App card ATM withdrawal limit.

Step 3: Monitor Your Transaction Behaviour

Cash App often increases your withdrawal limit over time as it monitors your usage patterns and transaction history. Consistently using the platform responsibly—such as making regular deposits, avoiding flagged transactions, and maintaining a good balance—can lead to higher limits being granted.

If you regularly use the Cash App for various transactions, Cash App’s algorithm may recognize this behavior and automatically offer you higher limits. Keep in mind that maintaining a good transaction record plays a role in earning trust with the platform.

Step 4: Contact Cash App Support

If you have a verified account and still find that your Cash App daily withdrawal limit is too low, it’s worth reaching out to Cash App support. While they won’t necessarily increase your limit upon request, they may offer guidance on what you can do to qualify for higher limits.

Open Cash App and tap your profile icon.

Scroll down to “Support” and select “Something Else.”

Follow the prompts to submit a query about increasing your ATM withdrawal limit.

Support can help clarify any specific steps you need to take to qualify for higher limits, or they may assess your account activity to determine if an increase is possible.

Step 5: Link a Bank Account for Larger Withdrawals

If increasing your Cash App withdrawal limit per day ATM is not feasible, linking a bank account to your Cash App can provide a workaround. By transferring funds directly from your Cash App to a linked bank account, you can withdraw larger amounts from your bank’s ATM without being bound by Cash App’s limits.

This method is particularly useful for users who need to access higher sums of money than the Cash App withdrawal limit allows.

Additional Limits to Be Aware Of

Apart from ATM withdrawal limits, there are other transaction limits within Cash App that you should know, especially if you use Cash App for other types of payments:

Cash App Bitcoin Withdrawal Limit: If you deal with Bitcoin, you can withdraw up to $2,000 worth of Bitcoin per day and up to $5,000 per week.

Cash App Sending Limits: Verified users can send up to $7,500 per week. Unverified users are limited to $250 per week.

Cash App Receiving Limits: There is no limit on how much money you can receive on Cash App, regardless of verification status.

FAQ About Increasing Cash App ATM Withdrawal Limits

1. What is the withdrawal limit for Cash App?

The standard Cash App ATM withdrawal limit is $310 per day, $1,000 per week, and $1,250 per month. Verified users may have access to higher limits.

2. Can I increase my Cash App ATM withdrawal limit?

Yes, by verifying your account and demonstrating responsible transaction behavior, you can increase your cash app withdrawal limit over time. Ordering a Cash Card and contacting support may also help.

3. How long does it take to verify a Cash App account?

Verification typically takes up to 24-48 hours. Once verified, your limits will automatically increase, allowing for higher withdrawals and transfers.

4. Is there a limit on Bitcoin withdrawals?

Yes, Cash App has a Bitcoin withdrawal limit of $2,000 per day and $5,000 per week.

5. How do I get a Cash App Cash Card?

You can order a Cash Card directly through the Cash App. Tap the Cash Card icon in the app and follow the instructions to customise and receive your card.

6. Can I withdraw more than $310 from an ATM using a Cash App?

No, the daily CashApp ATM limit is set at $310. However, verified users may have access to increased limits for other types of withdrawals.

Conclusion

Understanding how to increase Cash App ATM withdrawal limit can make a significant difference in how you manage your finances through the platform. While Cash App's standard limits are sufficient for many users, those with higher withdrawal needs can benefit from account verification, consistent usage, and responsible transaction habits.

By following the steps outlined in this guide, you can unlock higher withdrawal limits and take full advantage of everything Cash App has to offer. Whether you're withdrawing cash from an ATM or managing large transactions, Cash App provides the flexibility and convenience that makes it a popular choice for millions of users. Don’t let withdrawal limits hold you back—take control of your Cash App experience today!

2 notes

·

View notes

Text

Steps to Increase Your Cash App Bitcoin Withdrawal and Purchase Limit

Bitcoin has rapidly become one of the most popular and widely used cryptocurrencies globally. With its increasing relevance in the financial landscape, platforms like Cash App have made it easier for users to buy, sell, and withdraw Bitcoin directly through their mobile apps. Cash App, known for its simplicity and accessibility, provides users with an efficient way to handle Bitcoin transactions, but like any financial platform, it comes with certain restrictions. One of the most critical limitations users face is the Cash App Bitcoin withdrawal limit and the purchase limit.

Whether you are an experienced cryptocurrency trader or a new user exploring Bitcoin for the first time, it's essential to know how to increase your withdrawal and purchase limits on Cash App. These limits can initially be restrictive for more significant transactions, but fortunately, there are ways to raise them.

In this blog, we will examine in detail how you can increase your Cash App Bitcoin withdrawal limit, explain the withdrawal and purchase limits for Bitcoin, and explore practical ways to unlock higher limits for more flexibility in your transactions.

What are the different Cash App Bitcoin Withdrawal Limits?

The Cash App Bitcoin withdrawal limit refers to the maximum amount of Bitcoin a user can withdraw from their Cash App account within a specific period. Understanding this limit is important for users who want to transfer their Bitcoin holdings to external wallets or engage in larger transactions. Cash App currently sets the following limits for Bitcoin withdrawals:

Bitcoin Withdrawal Limit Per Day: The Cash App allows users to withdraw up to $2,000 worth of Bitcoin within 24 hours.

Weekly Bitcoin Withdrawal Limit: Users are restricted to a total of $5,000 worth of Bitcoin withdrawals within a seven-day period.

These withdrawal limits are in place to ensure security and compliance with financial regulations. For most casual users, these limits are sufficient for regular Bitcoin transactions, but these caps can feel restrictive for those looking to make larger withdrawals. Fortunately, there are ways to increase Cash App Bitcoin withdrawal limits, which we'll explore further in this blog.

What are the different Cash App Bitcoin Purchase Limits?

In addition to withdrawal limits, Cash App also imposes restrictions on the amount of Bitcoin users can purchase. These limits may vary depending on whether you have verified your identity on the platform and your account activity.

As of now, the Cash App Bitcoin purchase limit is as follows:

Bitcoin Purchase Limit Per Day: Cash App users can buy up to $10,000 daily.

Weekly Bitcoin Purchase Limit: The purchase limit for Bitcoin over seven days is capped at $10,000 as well.

While this limit is generous compared to the withdrawal limits, users who need to purchase more significant amounts of Bitcoin might want to consider increasing these limits.

How to Increase Cash App Bitcoin Withdrawal Limit?

The default limits can be an obstacle for users looking to handle larger Bitcoin withdrawals. However, Cash App provides opportunities to raise these limits by verifying your identity and providing additional account details. Here's a step-by-step guide on how to increase Cash App Bitcoin withdrawal limit:

1. Verify Your Identity

The first and most straightforward way to increase your Cash App Bitcoin withdrawal limit is to verify your identity within the app. Unverified accounts have lower limits due to security and regulatory measures, but once you verify your account, Cash App may raise your withdrawal and purchase limits.

To verify your identity on Cash App:

Open the Cash App on your phone and navigate to the Bitcoin section.

Tap on "Withdraw Bitcoin" to prompt the verification process if not already done.

You'll be asked to provide personal details, including your full name, date of birth, and the last four digits of your Social Security number.

In some cases, you might also need to take a clear picture of your ID and a selfie for further verification.

Once verified, your Cash App Bitcoin withdrawal limit will increase, allowing for larger transactions.

2. Enable Bitcoin Transactions

After verifying your identity, you must enable Bitcoin transactions on your Cash App account. This feature is only sometimes automatically enabled for all users, especially those with unverified accounts. Here's how you can do it:

Navigate to the Bitcoin tab on your Cash App.

Tap on "Enable Withdrawals" if you haven't already activated this feature.

Complete any additional steps required, such as linking an external wallet.

Enabling Bitcoin transactions ensures you can buy and withdraw Bitcoin with higher limits.

3. Maintain Active Account Usage

Another way to gradually increase your limits is to consistently and actively use your Cash App account. By regularly sending, receiving, and purchasing Bitcoin or using the app for other financial transactions, you demonstrate reliability to the platform. Over time, Cash App may increase your limits based on your usage and account history.

4. Upgrade to a Verified Cash App Account

Upgrading to a fully verified Cash App account is essential for users looking for higher limits. Cash App usually offers higher Bitcoin withdrawal and purchase limits to users who have completed the entire identity verification process. Once you're verified, you'll unlock additional features, such as increased limits for Bitcoin and cash withdrawals from ATMs.

5. Contact Cash App Support

If you've verified your identity and enabled Bitcoin transactions but still need higher limits, reaching out to Cash App's customer support team might be helpful. In some cases, Cash App may grant custom limits depending on your needs, account activity, and overall account history. When contacting support, explain your reasons for needing a higher Bitcoin withdrawal limit and provide any relevant documentation that may help support your request.

Why Does a Cash App Impose Bitcoin Withdrawal Limits?

You might wonder why Cash App imposes limits on Bitcoin withdrawals and purchases. These limits are put in place for several reasons:

Security: Cash App withdrawal limits help protect users from potential fraud or unauthorised access to their accounts.

Regulatory Compliance: Cash App, like other financial platforms, must adhere to strict financial regulations, especially when dealing with cryptocurrency. Setting limits on withdrawals ensures the platform complies with these regulations.

Risk Management: By imposing limits, Cash App manages the risk associated with large transactions. This helps the platform maintain stability while ensuring users can perform transactions securely.

FAQs

1. How can I increase my Cash App Bitcoin withdrawal limit?

To increase your Cash App Bitcoin withdrawal limit, you must verify your identity by providing personal details such as your full name, date of birth, and Social Security number. Once verified, your limit will be increased.

2. What is the Cash App Bitcoin withdrawal limit per day?

Cash App users can withdraw up to $2,000 worth of Bitcoin within 24 hours.

3. What is the Cash App weekly Bitcoin withdrawal limit?

The Cash App weekly Bitcoin withdrawal limit is $5,000. This means users can withdraw up to $5,000 worth of Bitcoin within a seven-day period.

4. Can I increase my Cash App Bitcoin purchase limit?

Yes, you can increase your Bitcoin purchase limit by verifying your identity and maintaining an active Cash App account. The current limit is set at $10,000 per day and $10,000 per week.

5. What fees does Cash App charge for Bitcoin withdrawals?

When you withdraw Bitcoin, Cash App charges a dynamic fee based on blockchain congestion. The fee is not fixed and can fluctuate depending on the network's activity.

6. How long does verifying my Cash App account for Bitcoin transactions take?

Verification on Cash App can take anywhere from a few minutes to 24 hours. Once your account is verified, your Bitcoin withdrawal and purchase limits will increase.

Conclusion

Increasing your Cash App Bitcoin withdrawal and purchase limits is possible but relatively straightforward. By verifying your identity, enabling Bitcoin transactions, and maintaining an active account, you can unlock higher limits and enjoy more flexibility with your Bitcoin transactions on the Cash App. Whether withdrawing funds to an external wallet or purchasing larger amounts of Bitcoin, following these steps ensures that you can easily manage your cryptocurrency holdings.

As cryptocurrency continues to grow, increasing your withdrawal and purchase limits on platforms like Cash App will give you greater control over your financial decisions.

#cash app bitcoin limit#how to increase cash app bitcoin limit#cash app bitcoin limit per day#cash app bitcoin weekly limit#cash app bitcoin limit reset#increase cash app btc limit#cash app bitcoin purchase limit#cash app bitcoin withdrawal limit

2 notes

·

View notes

Text

A Guide to Cash App's Daily and ATM Withdrawal Limits

Cash App has grown in popularity as a convenient peer-to-peer payment platform, enabling users to send, receive, and withdraw money with ease. However, when it comes to withdrawing money, the Cash App has different limits that users need to be aware of, especially if they rely on the platform for frequent or large withdrawals. Let’s dive into the specifics of the withdrawal limits on Cash App.

Cash App Withdrawal Limits Explained

Cash App imposes different withdrawal limits depending on the method and type of account. These limits include general withdrawal limits as well as ATM-specific limits. The limits can vary based on whether your account is verified or unverified, which significantly impacts the amount you can withdraw in a given period.

1. Cash App Withdrawal Limit Per Day

Cash App limits the amount of money you can withdraw to $1,000 per day for standard transactions. This daily limit applies to sending money, transferring funds to a bank, or using your Cash Card. For unverified accounts, the Cash App daily limit is even lower, so it’s highly recommended to verify your account for higher withdrawal capacities.

2. Cash App ATM Withdrawal Limit

If you’re using the Cash Card (Cash App's debit card), Cash App has specific limits for ATM withdrawals. Users can withdraw up to $310 per transaction, $1,000 per day, and $1,000 per week via ATMs. This limit is consistent for all users with a Cash Card, and it does not vary unless otherwise specified by Cash App.

3. Cash App Daily Withdrawal Limit

The daily withdrawal limit for both Cash App transactions and ATM withdrawals is set to ensure user security. While you may be able to withdraw up to $1,000 per day in total from various sources, ATM-specific withdrawals still cap at $310 per transaction.

How to increase Cash App Withdrawal limit?

To increase Cash App withdrawal limit, you need to verify your identity with Cash App. Verification involves providing your full name, date of birth, and the last four digits of your Social Security number. Verified users enjoy higher withdrawal and transaction limits, giving them more flexibility in managing their funds.

FAQs on Cash App Withdrawal Limits

1. What is the Cash App withdrawal limit per day?

Cash App allows a daily withdrawal limit of up to $1,000 for verified accounts. Unverified accounts may have a lower withdrawal limit.

2. What is the Cash App ATM withdrawal limit?

The Cash App ATM withdrawal limit using the Cash Card is $310 per transaction, with a total of $1,000 allowed per day and $1,000 per week.

3. Can I increase my Cash App withdrawal limit?

Yes, by verifying your Cash App account with your full name, date of birth, and the last four digits of your Social Security number, you can increase your Cash App withdrawal limit.

4. Does Cash App have a weekly withdrawal limit?

Yes, the weekly ATM withdrawal limit for Cash App is $1,000, regardless of the number of transactions.

5. How long does it take to verify my Cash App account to increase withdrawal limits? Account verification on Cash App typically takes a few minutes to a few days, depending on the information provided. Once verified, your withdrawal limit will automatically increase.

By staying informed about the withdrawal limits on the Cash App, users can better plan their transactions and avoid running into unexpected restrictions while accessing their funds.

3 notes

·

View notes

Text

How to Increase Your Cash App ATM Withdrawal Limits?

Managing cash flow effectively is crucial in today’s fast-paced world, and Cash App offers a convenient way to access cash through ATM withdrawals. However, users often encounter limitations that can affect how much they can withdraw at any given time. Understanding these limits and learning how to increase them can significantly enhance your ability to access cash when needed. In this comprehensive guide, we'll break down the ATM limits on Cash App, including exact numbers, and provide actionable steps for increasing these limits.

Understanding Cash App ATM Limits

Cash App sets various limits on ATM withdrawals to ensure security and regulatory compliance. Here’s an overview of the different types of ATM limits you might encounter:

1. Cash App ATM Limit

The Cash App ATM limit is the maximum amount you can withdraw from an ATM using your Cash App card. This limit helps to prevent fraud and ensure security for your transactions.

2. Cash App ATM Limit Per Day

The daily ATM withdrawal limit is the maximum amount you can withdraw from ATMs in a single day. For most Cash App users, the daily limit is set at $250. This means you can withdraw up to $250 worth of cash from an ATM in one day.

3. Cash App ATM Limit Per Week

The Cash App weekly ATM withdrawal limit is the total amount you can withdraw from ATMs over a week. Generally, this limit is set at $1,000. Therefore, you can withdraw up to $1,000 worth of cash from ATMs in one week.

4. Cash App ATM Limit After Verification

Once your Cash App account is verified, you may be eligible for higher withdrawal limits. Verified accounts often have increased limits, such as $1,000 per day and $3,000 per week. Verification typically involves submitting identification documents and other personal information.

5. Cash App ATM Withdrawal Limit

This term refers to the specific amount of cash you can withdraw per transaction or within a certain period. The standard limit for individual ATM transactions is $250. This is part of the daily limit, meaning if you withdraw $250, it will count against your daily limit for that day.

6. Cash App ATM Withdrawal Limit Reset

Cash App ATM withdrawal limits reset either daily or weekly. The daily limit resets every 24 hours, while the weekly limit resets at the start of each new week. This allows you to make the maximum number of withdrawals according to the limits set.

7. Cash App ATM Weekly Limit

The weekly ATM withdrawal limit is the total amount you can withdraw from ATMs in a week. As mentioned earlier, this limit is typically $1,000. Once you reach this amount, you'll need to wait until the start of the next week for your limit to reset.

How to Increase Your Cash App ATM Limits?

If you find that the standard ATM limits are not sufficient for your needs, there are several steps you can take to increase them potentially:

1. Verify Your Account

Verifying your account can lead to increased ATM withdrawal limits. To verify your account:

Open Cash App: Launch the Cash App on your mobile device.

Navigate to Account Settings: Go to the account settings or profile section.

Complete Verification: Submit the required identification documents and other personal information as requested.

Once verified, you may benefit from higher limits, such as $1,000 per day and $3,000 per week.

2. Contact Cash App Support

If you need higher limits than those typically offered, contacting Cash App support can help:

Open Cash App: Access the support section in the app.

Submit a Request: Provide details about your need for increased ATM limits.

Follow-up: Monitor your request and follow up if necessary.

FAQs About Cash App ATM Limits

1. What is the Cash App ATM limit per day?

The standard Cash App daily ATM withdrawal limit is $250.

2. How do I reset my Cash App ATM limit?

Cash App ATM limits reset daily and weekly. Your daily limit resets every 24 hours, and your weekly limit resets at the start of each new week.

3. Can I increase my Cash App ATM withdrawal limit?

Yes, you can increase Cash App ATM withdrawal limit by verifying your account, contacting Cash App support, and maintaining a positive transaction history.

4. What is the Cash App ATM limit after verification?

After verifying your account, you can often withdraw up to $1,000 per day and $3,000 per week.

5. How often does the Cash App ATM weekly limit reset?

The weekly ATM withdrawal limit resets at the beginning of each week.

6. How can I increase my Cash App ATM limits?

Increase your limits by completing the account verification process, contacting Cash App support, and maintaining a good transaction history.

7. Is there a specific order for Cash App ATM limits?

There is no specific “ATM limit order.” Cash App sets limits based on account verification and usage.

Conclusion

Navigating ATM withdrawal limits on Cash App can be manageable once you understand the specifics and know how to manage and increase these limits effectively. By verifying your account, contacting support, and maintaining a positive transaction history, you can enhance your Cash App experience and access larger sums of cash when needed.

For the most up-to-date information and personalised assistance, always refer to Cash App’s official resources or contact their support team. If you have additional questions or need further guidance, don’t hesitate to ask!

#cash app atm withdrawal limit#increase cash app withdrawal limit#cash app atm withdrawal limit per day#cash app daily atm withdrawal limit#cash app withdrawal limit#cash app card atm withdrawal limit per week

3 notes

·

View notes

Text

How to Withdraw Beyond the $1,000 Limit from an ATM Using Cash App?

Mobile payment apps have transformed how we manage our finances, and Cash App is at the forefront of this revolution. Whether you're sending money to friends, paying bills, or withdrawing cash, Cash App offers a convenient way to handle your financial transactions. However, one question often arises among users: "Can I withdraw $1,000 from an ATM with Cash App?" Understanding the limits associated with ATM withdrawals on Cash App is crucial for maximising your usage and managing your finances effectively. This blog will explore the various aspects of Cash App ATM withdrawals, including where you can withdraw cash, the maximum limits, and strategies to increase your withdrawal limits.

Where Can I Withdraw $1,000 from Cash App?

Before diving into whether you can withdraw $1,000 from an ATM with Cash App, it's essential to understand where you can access your Cash App funds. Cash App provides users with a versatile Cash Card, a customizable debit card linked directly to their Cash App balance. You can use this card at any ATM that accepts Visa, which covers a vast network of ATMs across the United States and globally.

To withdraw money from Cash App account using the Cash Card, follow these steps:

Locate an ATM: Find an ATM that accepts Visa cards. Most ATMs in the U.S. and worldwide accept Visa, so this should not be a problem.

Insert Your Cash Card: Insert your Cash App card into the ATM and follow the prompts to begin your transaction.

Enter Your PIN: When prompted, enter the PIN associated with your Cash Card. Ensure you keep your PIN confidential to prevent unauthorised access.

Select Withdrawal Amount: Choose the amount you wish to withdraw. If you are attempting to withdraw $1,000, ensure you understand the Cash App's ATM withdrawal limits.

Confirm the Transaction: Follow the prompts to confirm your transaction and receive your cash.

While withdrawing cash from an ATM using your Cash Card is straightforward, there are limits to how much you can withdraw in a single transaction and within a certain period. Understanding these limits is crucial for effective financial management on Cash App.

Can I Withdraw $1,000 from an ATM with Cash App?

Can you withdraw $1,000 from an ATM with Cash App? The answer is yes, but there are caveats. Cash App sets specific limits on ATM withdrawals to ensure security and comply with regulatory standards. The standard Cash App ATM withdrawal limit for most users is $310 per transaction and $1,000 per 24-hour period. This means that while you can withdraw a total of $1,000 from an ATM in a day, you might need to perform multiple transactions to reach that amount.

For example, if you need to withdraw $1,000 in cash, you could perform three separate transactions: two for $310 each and one for $380. This approach allows you to stay within the transaction limits while accessing the total amount you need.

However, it's essential to be mindful of the daily limit. If you attempt to withdraw more than the permitted $1,000 within 24 hours, the ATM will likely decline the transaction. To maximise your ATM withdrawals, consider withdrawing cash at different times or planning your withdrawals around the 24-hour reset period.

What is the Max ATM Withdrawal for Cash App?

The max ATM withdrawal for Cash App is designed to protect both the user and the platform. For most users, the maximum amount of cash that can be withdrawn from an ATM using the Cash App card is $1,000 per 24-hour period. This daily cap applies regardless of the number of transactions you perform, so even if you spread your withdrawals over multiple ATMs or locations, you cannot exceed this limit within a single day.

Additionally, Cash App imposes a $310 limit per ATM transaction, meaning you cannot withdraw more than $310 in a single attempt if you need to access the total $1,000 and plan to conduct multiple transactions within the allowable limits.

Cash App Withdrawal ATM

Using your Cash App card for ATM withdrawals is a convenient way to access your funds when needed. The Cash Card works just like any other debit card, allowing you to withdraw cash from ATMs, make purchases, and even receive cash back at participating retailers. However, to use your Cash App card effectively, you need to be aware of the withdrawal limits and plan your transactions accordingly.

Here are some key points to remember about Cash App withdrawal ATM transactions:

Daily Limit: The maximum you can withdraw from an ATM in a day using your Cash App card is $1,000.

Per Transaction Limit: You can only withdraw up to $310 per ATM transaction. Multiple transactions are necessary if you need more cash.

Fees: Cash App may charge a fee for ATM withdrawals, typically around $2.50 per transaction. Additionally, the ATM operator may charge its own fees, so always check for fee disclosures before proceeding with a withdrawal.

Understanding these limits and fees can help you plan your cash withdrawals more effectively and avoid any unexpected charges or declines.

Cash App ATM Withdrawal Limit

The Cash App ATM limit is an essential aspect for users who rely on their Cash Card for accessing cash. The withdrawal limit is set at $310 per transaction and $1,000 per 24-hour period. This dual-limit system is designed to enhance security, minimise the risk of fraud, and ensure compliance with financial regulations.

If you frequently reach your ATM withdrawal limit or need to withdraw large amounts, consider verifying your Cash App account and building a strong transaction history. Verified users may have the opportunity to request higher limits, although this is not guaranteed and will depend on various factors, including account history and usage patterns.

Cash App ATM Limit

The Cash App ATM limit not only includes the withdrawal caps but also encompasses the broader limits on Cash Card usage. In addition to the $1,000 daily withdrawal limit, Cash App imposes a $1,000 per 7-day period limit on total cash withdrawals. This means that over any seven-day rolling period, you cannot withdraw more than $1,000 in total cash from ATMs.

These limits are crucial for users who need to plan their cash withdrawals over a week. If you need more than $1,000 in cash in a week, you'll need to consider alternative options or request a limit increase.

Cash App Withdrawal Limit ATM

The Cash App withdrawal limit ATM is particularly important for those who rely on cash for daily transactions. Whether you're traveling, paying for goods and services, or simply prefer to use cash, understanding these limits can help you manage your finances more effectively.

The standard ATM withdrawal limits for most Cash App users are as follows:

$310 per transaction

$1,000 per 24-hour period

$1,000 per 7-day period

These limits are designed to balance convenience with security. While they may be sufficient for most users, those with higher cash needs may find them restrictive.

How Much Can You Withdraw from Cash App?

Understanding how much you can withdraw from Cash App is crucial for managing your finances. The standard withdrawal limits for most users are $1,000 per week for ATM withdrawals and $1,000 per 24-hour period. These limits apply regardless of how many transactions you perform or where you make them.

To maximise your withdrawals, consider the following strategies:

Plan Ahead: If you anticipate needing more than the allowed amount in cash, plan your withdrawals around the 24-hour reset period to maximise your access to funds.

Verify Your Account: Verified users may be eligible for higher withdrawal limits. Ensure your account is fully verified by providing all required information, including your full name, date of birth, and Social Security number.

Build a Transaction History: Regular use of your Cash App card for transactions, coupled with a good account history, can sometimes result in automatic increases in your withdrawal limits.

FAQs

1. Can I withdraw more than $1,000 from an ATM with Cash App?

No, the standard ATM withdrawal limit for Cash App is $1,000 per 24-hour period. However, you can request a limit increase from Cash App support if you need more.

2. How can I increase my Cash App ATM withdrawal limit?

To increase Cash App ATM withdrawal limit, verify your account by providing your full name, date of birth, and Social Security number. Regularly using your Cash App card and maintaining a good transaction history can also help.

3. Are there any fees for withdrawing cash from an ATM with Cash App?

Yes, Cash App typically charges a fee of around $2.50 per ATM withdrawal. Additionally, the ATM operator may charge its fees, which vary by location.

4. What should I do if I reach my ATM withdrawal limit on Cash App?

If you reach your ATM withdrawal limit, wait for the 24-hour reset period before attempting another withdrawal. You can also contact Cash App support to request a limit increase.

5. Can I use my Cash App card at any ATM?

Yes, you can use your Cash App card at any ATM that accepts Visa. However, be mindful of the ATM's fees and your withdrawal limits.

6. How often can I withdraw cash from an ATM with Cash App?

You can withdraw cash as often as you like, provided you stay within the $1,000 per 24-hour period and $1,000 per 7-day period limits.

Conclusion

If you've been wondering, "Can I withdraw $1,000 from an ATM with Cash App?" the answer is yes, but with specific limits and conditions. Understanding these limits and how they apply to your Cash App account is crucial for effectively managing your finances and ensuring you have access to cash when needed. By following the steps outlined in this guide, you can make the most of your Cash App experience and navigate its withdrawal limits with confidence.

#cash app atm withdrawal limit#increase cash app withdrawal limit#cash app atm withdrawal limit per day#cash app daily atm withdrawal limit#cash app withdrawal limit#cash app card atm withdrawal limit per week

3 notes

·

View notes