#Commercial Lending Software

Text

Commercial Loan Origination Software

Empower your financial institution with Newgen's cutting-edge Commercial Loan Origination Software. Streamline the entire lending lifecycle, from origination and processing to disbursement and monitoring, on a unified digital platform. Enjoy features like omni-channel portals, intelligent underwriting, and integrated automation. Elevate your lending experience, stay compliant, and enhance profitability. Explore the future of commercial lending with Newgen—your key to efficient and competitive loan origination. Take charge of your lending journey today!

#Commercial Loan Origination Software#Commercial Lending Software#Consumer Loan Process#Electronic Files Management#e-Document Management

0 notes

Text

In today's rapidly evolving business landscape, access to credit is essential for growth and success. However, navigating the complexities of the credit industry can be daunting, especially for businesses looking to establish their brand and reputation. That's where white label business credit solutions come into play, offering a customizable and scalable approach to credit management.

#white label business credit building software#build business credit software#white label commercial lending

0 notes

Text

When we talk about private lending, a few necessary things which we can not overlook are efficiency and accuracy.

0 notes

Photo

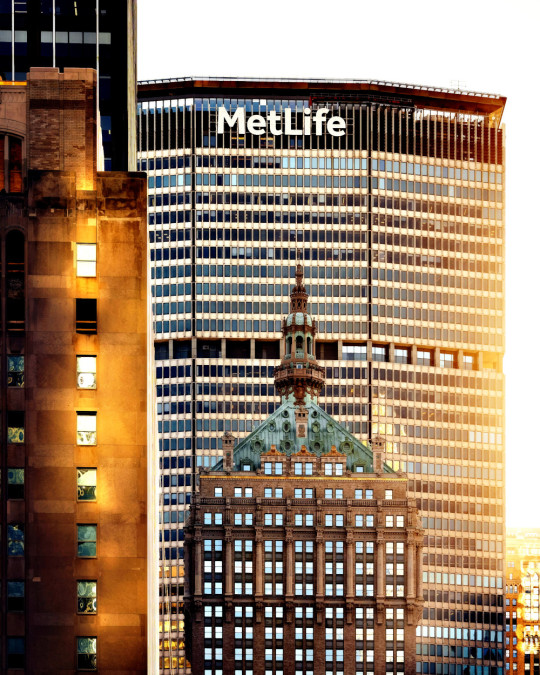

Why is the MetLife Building famous?

MetLife Building

It was advertised as the world's largest commercial office space by square footage at its opening, with 2.4 million square feet (220,000 m2) of usable office space. As of November 2022, the MetLife Building remains one of the 100 tallest buildings in the United States.

Can you enter the MetLife Building?

You can enter The MetLife Building from anywhere in Grand Central Station but the entrance closest to The Metlife Building entrance is on 45th Street between Lexington and Vanderbilt.

What offices are in the MetLife Building?

In addition to being the official headquarters of the Metropolitan Life Insurance Company, the MetLife Building houses a number of other major firms, including the headquarters of Dreyfus Corporation, Knight Vinke, the wealth and investment management division of Barclays, the largest office of Greenberg Traurig, DNB, CB Richard Ellis, Gibson, Dunn & Crutcher, Hunton & Williams, Computer Sciences Corporation, Winston & Strawn, Paul Hastings, and Lend Lease Corporation on Level 9. In addition the building serves as the U.S. Headquarters for Mitsui & Co. (USA) Inc, the American subsidiary of Japan’s largest trading company, BNP Paribas Investment Partners and its American subsidiary Fischer, Francis, Trees and Watts.

NOAA Weather Radio Station KWO35, a NOAA transmitter station, is located atop the building.

Impressive tenant roster includes:

There are about 400 tenants throughout Graybar’s 31 floors

Bank of America

Barclays

Bovis Lend Lease

CB Richard Ellis

CSC (Computer Software Corp)

DNB Nord Bank

Fischer Francis Trees & Watts

Hunton & Williams

IgnitionOne

Korn Ferry International

Magnitude Capital

CBRE Global Investors

Merrill Lynch

Dreyfus Corporation

MetLife

Met Life

Gibson Dunn

Novus Partners

Mitsui & Co.

Gibson Dunn & Crutcher

Swarovski

BNY Mellon

Paul Hastings

Winston & Strawn

Federal Home Loan Mortgage Corporation

UBS

J. Fitzgibbons

Metropolitan Life Insurance Company

Preferred Office Properties

Freddie Mac

Oppenheimer & Co.

Nor Bank ASA

Mitsui

Carr Workplaces

Medical Properties Trust

#New York City#new york#newyork#New-York#nyc#NY#Manhattan#urban#city#USA#United States#buildings#travel#journey#outdoors#street#architecture#visit-new-york.tumblr.com#MetLife Building#MetLife

144 notes

·

View notes

Text

What does it say about me when mistakes like this in a supposedly edited and proofread commercial publication make me twitch and then look it up to confirm my own correctness? This is the type of mistake I tell my students will force their reader out of their writing and off on a long explore.

It’s “Wile E. Coyote.” :::twitch:::

It lends credence to the theory that Ryan G. was saying “My relationship with Marisol is gone. I crushed that.” And not “my soul.”

P.S. In the clip just posted, when Eddie says “Marisol,” I can hear how a reporter might think “my soul.” Or they used software to do a transcript of a taped interview and didn’t catch the error.

Which actually makes me feel better and stop twitching.

3 notes

·

View notes

Text

Estonia's next satellite, largely built by undergrad students, to fly aboard Vega VV23

Estonia's next satellite will fly aboard Europe's Vega VV23 launcher later this week. While largely designed and built by undergraduate students, the shoebox-sized ESTCube-2 has ambitious goals in mind, including surveys of Estonian vegetation and the first successful in-orbit demonstration of "plasma brake" technology. Deployment of a charged microtether will slow the CubeSat's orbit, proving the prospect of helping to keep space clear of dangerous debris in the future.

If successful, ESTCube-2's plasma braking would mark the first use of electric sail, or E-sail, technology, devised by Pekka Janhunen of the Finnish Meterological Institute (FMI) as a propellant-free means of exploring the solar system. Beyond Earth's magnetic field, electrostatic charging of satellite tethers would cause them to repel protons of the solar wind, lending them momentum in the process.

Closer to Earth, the magnetosphere repels the solar wind. Instead an e-sail can perform the opposite function: the charged tether would repel the nearly stationary plasma making up our planet's ionosphere—an electrically active outer layer of our atmosphere—and cause drag as a result, leading it to slow down and its orbit to decay accordingly.

Hair-thick tether technology

Plasma brakes therefore offer a low-cost, low-mass method of quickly removing satellites from orbit after their mission ends, marketed commercially through Finland's Aurora Propulsion Technologies.

ESTCube-2's plasma brake e-sail is a 50-m long interweaved aluminum tether line made up of wires each just 50 micrometers (0.05 mm) in thickness—around the diameter of the average human hair.

Pekka Janhunen explains, "Historically, tethers have been prone to snap in space due to micrometeorites or other hazards, so ESTCube-2's net-like microtether design brings added redundancy with two parallel and two zig-zagging bonded wires."

Student-built satellite

ESTCube-2 has been developed and built by a team from Tartu Observatory of the University of Tartu and student organization Tudengisatelliit.

The miniature mission also carries student-built microcameras to survey Estonian vegetation, based on a design originally developed for ESA's European Student Earth Orbiter mission.

Their results will be compared to the full-size Copernicus Sentinel-2 mission, as well as a materials payload investigating the corrosive effects of "atomic oxygen" found at the top of the atmosphere, plus a software defined radio for amateur radio tests.

A 3-unit "CubeSat"—a low-cost satellite built up from standardized 10 cm boxes—ESTCube-2 is due to fly on Vega's Small Spacecraft Mission Service, a rideshare service for small satellites. It secured its place through the European Commission's In-Orbit Demonstration/In-Orbit Validation program.

Early in-orbit testing for novel technologies

Managed on behalf of the Commission by ESA's Small Satellite Platform Unit, this program allows the early orbital testing of new technologies to make Europe's space sector more competitive.

"As a volunteer student project, this IOD/IOV program is ideal," explains ESTCube-2 project manager Hans Teras. "It fits nicely with our timeline, including the testing we needed to be sure of our performance. Well over 600 university students across all study levels have played some role in making ESTCube-2 happen, but the mission as a whole is very ambitious, pushing the boundaries of what students can do."

ESTCube-2 will fly a decade after its predecessor, ESTCube-1, which launched on a Vega in 2013. It too carried an E-sail payload from FMI, but a motor problem meant it failed to deploy.

ESTCube-2 is equipped with a stronger, more robust deploying motor that has undergone extensive mechanical testing.

"The ESTCube-2 team has invested eight years of development work in order to have another chance of testing the revolutionary E-sail propulsion concept in orbit," explains the University of Tartu associated professor Andris Slavinskis who led the transition from ESTCube-1 to ESTCube-2.

Kristo Allaje, Principal Systems Engineer of ESTCube-2, adds, "Last time we could encourage students to join us by the challenge of being the first Estonian satellite. This time we have to motivate them in another way, by asking them to enable excellent science."

Around a year into the mission ESTCube-2 will be spun up using its reaction wheels. The ensuing centrifugal force should help serve to deploy the E-sail in a sufficiently taut fashion.

If successful, the E-sail is expected to lower the orbit of ESTCube-2 much more rapidly than normal.

Follow-up mission ESTCube-LuNa is being designed to test an E-sail beyond Earth orbit, to prove its usefulness as a method of deep space propulsion.

ESA has recently studied E-sail technology as an economical means of prospecting asteroids.

Earth monitoring and space effects study

ESTCube-2 pair of student-made microcameras designed have been optimized for the "Normalized Difference Vegetation" index to reveal plant health. The camera pair will be tilted as needed to observe Estonian territory as often as possible, offering more frequent revisits than other Earth observation missions.

Tartu University spin-off company Captain Corrosion is supporting a experiment mounted on ESTCube-2's hull. A set of 16 different materials will be evaluated for their resistance to 'atomic oxygen'—a variety of oxygen normally encountered only in low orbits, known to eat away at satellite surfaces.

ESTCube-2's software defined radio will also be busy, including transmitting 8-second video clips prerecorded by Estonian citizens, connecting to Estonian schools along its swath and performing ranging experiments with amateur radio enthusiasts.

Vega flight VV23 is due for lift-off this week from Europe's Spaceport in French Guiana. Along with its main satellite payloads it carries multiple CubeSats including ESA's PRETTY mission investigating reflected satnav for environmental monitoring, the Proba-V Companion CubeSat testing the performance of a previously flown spectral imager aboard a CubeSat and other IOD/IOV CubeSats.

TOP IMAGE....ESTCube-2 being carried into vibration testing. The CubeSat was tested against harsh launch vibrations at Stoneridge Electronics in Estonia. More specifically, the satellite undergoes a Quasi-Static Load, Sine and Random vibrations tests. These are different types of vibrations that ESTCube-2 has to withstand during its journey in space. Credit: University of Tartu

CENTRE IMAGE....The plasma brake consists of a thin wire, also known as a tether, which, when charged, creates an electrostatic drag in the ionosphere. The plasma brake can be used for deorbiting satellites and helping to clean up the low Earth orbit environment. Credit: University of Tartu

LOWER IMAGE....Infographic on Estonia's ESTCube-2 CubeSat, due to launch on Europe's Vega VV23 launcher. Credit: University of Tartu

11 notes

·

View notes

Text

2347 taylor swifts png folklore shirt taylor folklore shirt folklore shirt tswift taylor taylor cre 663jpg

"Are you obsessed with Taylor Swift's folklore album? Show your love for her musical masterpiece with this high-quality digital file. Featuring minimal yet meaningful artwork from the folklore era, it's perfect for sublimating or printing on an apparel item like a t-shirt or tote bag. Download the vivid PNG image today and customize the layout, size and placement on your creation. Wear or gift your unique folklore-inspired piece to spark conversations with other Swifties. By purchasing this digital file, you'll be able to commemorate an album that transported fans during a difficult year with its poetic lyrics and timeless sound."

🎈 USAGE:st for them? Order yours today to make their birthday extra memorable. It's the perfect gift idea for the fan who adores Taylor's music and style."

Can be used with Cricut Design Space, Silhouette Studio (Designer Edition), Make the Cut, Sir Cuts a Lot, Brother, Glowforge, Inkscape, SCAL, Adobe Illustrator, CorelDRAW, ScanNCut2, and any other software or machines that work with SVG/PNG files.

Please also make sure you have software that accepts SVG or PNG files before purchasing. Refunds are unfortunately not available for digital purchases. Thank you!

🎈 YOU MAY:

- Use SVGSWIFT images in both digital and printed format.

- Use SVGSWIFT images for both personal and commercial projects. Up to 50 units commercially.

- Re-size, re-colour, crop, rotate, or add other elements.

🎈 YOU MAY NOT:

- Claim SVGSWIFT images as your own, with or without alterations.

- Create new clipart sets, digital paper sets, digital scrapbooking kits or similar with SVGSWIFT images, with or without alterations.

- Re-sell the original SVGSWIFT images in a set or individually.

- Lend, trade, share or otherwise distribute the original SVGSWIFT images as a freebie, download or resource to others, in a set or individually.

PLEASE NOTE:

– Since this item is digital, no physical product will be sent to you.

– Due to monitor differences and your printer settings, the actual colors of your printed product may vary slightly.

– Due to the digital nature of this listing, there are “no refunds or exchanges”.

REFUNDS & EXCHANGES

There are absolutely no refunds or exchanges allowed on digital items. Please be aware of what you are purchasing prior to checkout.

✨ F O L L O W U S ✨

PINTEREST : https://www.pinterest.com/svgswift/

✨ C O N T A C T U S ✨

EMAIL: [email protected]

Thank you so much for visiting our store!

Read the full article

2 notes

·

View notes

Text

10 Tips for Becoming a Successful Voice Over Artist

Are you passionate about lending your voice to various projects? Do you dream of becoming a successful voice over artist? In today's fast-paced media industry, voice over work is in high demand, whether it's for commercials, animated films, video games, audiobooks, or corporate presentations. To help you kickstart your journey and increase your chances of success in this competitive field, we've compiled ten valuable tips for aspiring voice over artists.

Develop Your Unique Voice: Your voice is your most essential asset as a voice over artist. Embrace your natural tone and work on honing its unique qualities. Experiment with various vocal exercises to expand your vocal range and control.

Voice Acting Training: Just like any other profession, voice over artists benefit from training and education. Enroll in voice acting classes or workshops to learn essential techniques, such as character development, script interpretation, and proper breathing exercises.

Build a Home Studio: In today's digital age, having a home studio is crucial. Invest in quality recording equipment, including a microphone, headphones, and audio editing software. A professional-sounding setup will enhance your credibility and attract more opportunities.

Master Your Craft: Practice, practice, practice. Read scripts, narrate stories, and record yourself regularly. Analyze your recordings to identify areas for improvement. Consistent practice will help you refine your skills and build confidence.

Diversify Your Portfolio: Don't limit yourself to one style or genre. Explore a wide range of voice over work, from commercials to video game characters to audiobooks. The more versatile you are, the more opportunities you'll have.

Networking and Marketing: Networking is crucial in the voice over industry. Attend industry events, join online forums, and connect with professionals in the field. Create a professional website or portfolio showcasing your work and contact information.

Audition Regularly: Keep an eye on online casting platforms and audition for as many roles as possible. Consistency is key to landing gigs and gaining experience. Be prepared to face rejection, as it's part of the journey.

Develop Your Brand: Establish a unique brand identity for yourself. Determine what sets you apart from other voice over artists and use it to market your services. Consistency in branding will make you more memorable to potential clients.

Client Relationships: Building strong relationships with clients is essential for repeat business. Be professional, responsive, and reliable. Understand their needs and deliver high-quality work on time.

Continued Learning: The voice over industry is constantly evolving. Stay updated with industry trends and technology. Invest in ongoing training and seek feedback from peers and mentors to keep growing as an artist.

In conclusion, becoming a successful voice over artist requires dedication, training, and persistence. Developing your unique voice, investing in quality equipment, and networking with industry professionals are all critical steps. Remember that success may not happen overnight, but with consistent effort and a commitment to improvement, you can carve out a rewarding career in the world of voice over artistry. So, start practicing, keep learning, and let your voice be heard!

2 notes

·

View notes

Text

Pulled straight into the Quicksand

Sandbox is an online, multiplayer game built on blockchain technology that utilizes the cryptocurrency optimized primarily for the game: SAND.

Sandbox allows its players to mint non-fungible tokens (NFTs) as digital assets using a digital software called Vox Edit. These can be traded on the Marketplace for SAND which is a tradeable currency on global platforms like Binance. However, Sandbox doesn't really sound like a fun game if you can only create and trade NFTs. That's where the Alpha Version Game Maker comes in.

The Game Maker allows users to create gaming and other interactive experiences for other users to interact with to earn rewards while the creators can monetize their creations for SAND.

What actually blew my mind was this ad:

youtube

How is this related to worldbuilding?

Quite simply, Sandbox is a tool to world-build digitally and have other people immediately immerse themselves in the experience you have designed for them. It's a great way to test out the concepts you have come up with in a more practical manner than the usual theoretical idealism involved in the world-building process.

The short ad itself is very engaging. Constant upbeat tempo music keeps the viewers' spirits high, and it dives straight into the gameplay aspects such as the generation of Voxel Edit assets. The coolest-looking, undead blocky dragon pops up out of the screen of a nondescript laptop indicating how logistics (such as the quality of your laptop) will no longer restrict your imagination. The simple, loud, and clearly visible messages continuously announce the simplicity of the creative process on Sandbox.

Encouraging the viewer to immediately pick up their devices and get to building the worlds and experiences of their dreams. Pushing more and more people to log on and play, increasing the demand for the limited 3 billion SAND tokens and 166,464 LAND pieces (spaces to work and build your interactive experiences) in circulation which would increase the revenue for the company.

Sandbox does a great job at shedding its corporate skin and portraying itself as an enabler of the world-building fantasies each individual possesses. This commercial lends itself to the young, dreaming audience to believe in the future of technology and their imaginations.

In essence, rebuilding the image of a corporate from a piece of profit-oriented machinery to a fulfiller of dreams. Isn't it a type of worldbuilding in itself? Changing a seemingly self-centered entity into one carrying out a selfless purpose.

2 notes

·

View notes

Text

DFCU Bank Uganda Jobs 2022 – Business Systems SupportSpecialist

Job Title: Business Systems Support Specialist – DFCU Bank Uganda Jobs 2022

Organisation: DFCU Bank

Duty Station: Kampala, Uganda

Reports to: Manager (Applications and Channels)

DFCU Bank Profile:

DFCU Bank is a fast growing commercial bank offering a variety of innovative products and services. DFCU Limited was started by the Commonwealth Development Corporation (CDC) of the United Kingdom and the Government of Uganda through the Uganda Development Corporation (UDC) under the name of Development Finance Company of Uganda Limited. Later restructuring brought in DEG (of Germany) and International Finance Corporation (IFC) as equal partners with CDC and UDC, each having a 25% stake in the company. Its objective was to support long-term development projects whose financing needs and risk did not appeal to the then existing financial commercial lending institutions.

Job Summary:

Reporting to the Manager- Applications and Channels, the Business Systems Support Specialist is responsible for providing oversight on the day-to-day technical activities on back-office processing systems (non-channel) used by internal customers to facilitate internal processing through conducting regular service review engagements with vendors, documentation for all projects and change implementation related to business systems across the products and channel partners while adhering to bank policies and SLA standards.

Roles and responsibilities:

- Supervise the Application administrators supporting the bank’s back -office (non-channel) Applications.

- Escalation point for all internal Applications (back-office systems) on performance challenges.

- Participate in the IT projects change implementation & operations programs in accordance with the banks policies and standards; UAT testing, deployment activities into the production environment, post implementation reviews, operations and disaster planning and recovery.

- Monitoring and Performance Reporting on the Bank’s Business support applications.

- Coordinating regular field/technical service review engagements with service providers (including external third-party vendors and internal L3 support) – per established review framework (e.g., performance reviews, audits etc).

- Supporting L2 incident response, problem resolution and continuous improvement of the business technology service delivery.

- Document, advise and lead Service lifecycle management (SLM) activities for the bank ecosystem including software maintenance routines, license renewals and upgrades.

- Support the audit management process including audit issue resolution, and closure.

- Identify and report any exceptions that present unnecessary cost, risk, or degradation of customer experience to the relevant stakeholders.

- Assess all the configuration management (change configuration/release management) processes.

Minimum Qualifications:

- The ideal candidate for the DFCU Bank Business Systems Support Specialist job must hold a Bachelor of Science in Computer Science, IT, Engineering, or other numerical biased field from a reputable university.

- Certification in database management, digital finance practices, instant payments, and technology governance (ITIL etc.) are preferred.

- Three years of technical experience supporting bank IT applications and back-office applications in medium to large organizations.

- Practical hands-on Banking Applications Support skills.

- Exceptional oral and written communication skills with the ability to communicate clearly and persuasively, interpret documents, understand procedures, write reports and correspondence; speak clearly to third parties and fellow staff members.

- Knowledge of practical application of business concepts & administration procedures.

- Advanced hands-on systems Computing skills.

- Analytical Thinking & Complex Problem solving.

- Curious, engaging, detail oriented and organized.

- High level of integrity and ethical standards.

- Excellent interpersonal, verbal, written, communications and independent judgement skills.

- Ability to prioritize work.

- Inspire Commitment –Actions and behaviors are consistent with words.

- Self-Development – Pursues positive change in self and organization. Drives own personal development plan.

How To Apply for DFCU Bank Uganda Jobs 2022

If you believe you meet the requirements as noted above, please forward your application with a detailed CV including your present position and copies of relevant professional/academic certificates (University Transcript, O & A level), to the email address indicated below;

[email protected]

dfcu Bank is committed to give equal opportunities in employment and aims to ensure that it does not discriminate against gender or race. Only short-listed candidates will be contacted through +256 312 300391.

Disclaimer: dfcu Bank does not solicit/accept payment in cash/kind from prospective candidates in exchange for shortlisting or job placement. Any candidate who engages in this kind of transaction is aiding and abetting fraud and will be automatically disqualified.

Closing Date: 29th July 2022

For similar Jobs in Uganda today and great Uganda jobs, please remember to subscribe using the form below:

NOTE:

No employer should ask you for money in return for advancement in the recruitment process or for being offered a position. Please contact Fresher Jobs Uganda if it ever happens with any of the jobs that we advertise.

Read the full article

3 notes

·

View notes

Text

Unlocking Financial Freedom: How to Generate Passive Income Streams?

Today, where financial stability and independence are becoming increasingly elusive, the concept of generating passive income has gained immense popularity. Whether you’re looking to supplement your primary income, save for retirement, or achieve financial freedom, Generate passive income streams can be a game-changer. But what exactly is passive income, and how can you generate it? In this comprehensive guide, we’ll delve into the strategies and avenues available for generating passive income, empowering you to take control of your financial future.

Understanding Passive Income:

Passive income is money earned with minimal effort or ongoing work. Unlike active income, which requires you to trade time for money through employment or services, passive income allows you to generate revenue even when you’re not actively working. This concept is synonymous with financial freedom because it enables individuals to build wealth and create a steady stream of income that isn’t tied to traditional employment.

Why Generate Passive Income?

The allure of passive income lies in its ability to provide financial security and flexibility. By diversifying your income sources and establishing passive streams, you can:

1. Achieve Financial Independence

Passive income can cover your living expenses, freeing you from the constraints of traditional employment and allowing you to pursue your passions or spend more time with loved ones.

2. Build Wealth Over Time

Over time, passive income streams have the potential to grow exponentially, providing a path to long-term wealth accumulation and asset appreciation.

3. Create Resilience

Diversifying your income sources reduces reliance on any single source of revenue, making you more resilient to economic downturns or job loss.

Strategies to Generate Passive Income:

Now that we understand the importance of passive income, let’s explore some effective strategies for generating it:

1. Investing in Dividend-Paying Stocks

Dividend stocks are shares of companies that distribute a portion of their earnings to shareholders regularly. By investing in dividend-paying stocks, you can earn a steady stream of passive income through quarterly or annual dividend payments.

2. Real Estate Investments

Real estate has long been a favored avenue for generating passive income. You can earn rental income from residential or commercial properties, or invest in real estate investment trusts (REITs) for dividend income without the hassle of property management.

3. Creating Digital Products

In today’s digital age, creating and selling digital products such as e-books, online courses, or software can be a lucrative way to generate passive income. Once created, these products can be sold repeatedly without requiring ongoing time or effort.

4. Peer-to-Peer Lending

Platforms like Prosper and LendingClub allow individuals to lend money to others in exchange for interest payments. While there are risks involved, peer-to-peer lending can provide a passive income stream with potentially higher returns than traditional savings accounts.

5. Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission for every sale made through your referral link. By building a niche website, blog, or social media presence, you can earn passive income by recommending products or services relevant to your audience.

6. Passive Business Ownership

Investing in or starting a business that can be run with minimal day-to-day involvement can generate passive income. Examples include vending machine businesses, self-service car washes, or automated online stores.

7. Royalties from Intellectual Property

If you possess creative talents such as writing, music composition, or photography, you can earn passive income through royalties from licensing your work for commercial use.

Tips for Success:

While the potential for passive income is enticing, it’s essential to approach it with diligence and strategy. Here are some tips to maximize your success:

1. Diversify Your Income Streams

Avoid relying solely on one source of passive income. Diversification spreads risk and increases stability.

2. Invest in Education

Continuously educate yourself about different passive income opportunities, investment strategies, and financial management principles to make informed decisions.

3. Be Patient and Persistent

Building passive income takes time and effort. Stay patient and committed to your goals, even during periods of slow progress.

4. Automate and Delegate

Whenever possible, automate repetitive tasks or delegate responsibilities to free up your time and focus on growing your passive income streams.

5. Monitor and Adjust

Regularly review your passive income streams’ performance and make adjustments as needed to optimize returns and mitigate risks.

Conclusion

In a world where traditional employment models are evolving, you can generate passive income by diversifying your income sources and leveraging various strategies such as investing, creating digital products, and affiliate marketing, you can build a portfolio of passive income streams that provide stability, growth, and flexibility. Remember, success in generating passive income requires patience, diligence, and a willingness to continuously learn and adapt. Start exploring your options today and take control of your financial future.

0 notes

Text

What Is A Virtual Office And How Does It Work

It has been evident in recent years that individuals may work from almost anyplace with a plug and an internet connection, including home offices, coworking spaces, coffee shops, restaurants, and more. Today's office workers are disinclined to remain in a typical workspace. Employers are likewise reconsidering their decision to sign a 10-year commercial lease.

Naturally, the number of possibilities available to businesses looking to locate their operations expands along with the demand for flexibility. When looking for office space, they frequently take price and location into account. And it makes sense—having a location in the middle of a financial area, downtown, or even on a posh street is indicative of a reliable, long-running company.

But there is a cost associated with these esteemed locations, and we mean that in a very real sense. The most sought-after areas tend to have the most expensive office space.

Virtual offices are one easy way to avoid the typical overhead fees associated with renting an office while yet enjoying the advantages of having a downtown address.

What is a virtual office and how does it work?

With the help of a virtual office service, companies may take use of some traditional office benefits without having to pay for a full-time rental. These benefits include having a business address, a location for mail and goods to be received, conference room access, and actual workspaces.

Some even offer additional services like virtual assistants, company phone systems, onsite or remote receptionists, and many more. Virtual offices are typically coworking spaces or real workplaces that lend their location to other companies.

Who uses a virtual office?

Anybody can use a virtual office. Although the majority of these people and groups feel at ease working remotely, they nonetheless want an office address for formalities and to enhance their professional reputation.

Due to their affordability, virtual offices are perfect for one-person businesses or fledgling startups that do not yet have the funds to rent a physical space.

The advantages of a virtual office

Central locations and affordable rates are among the primary factors that influence firms to select virtual offices, as we have previously observed.

Flexibility is another benefit that adds to the list: you can operate your business remotely and still have easy access to useful resources, such as conference rooms at the business address, as and whenever you need them.

Apart from these, virtual offices have a minimum commitment, which is six months for a WeWork Business Address subscription. In a similar vein, they assist you in separating your personal and business assets, lowering your legal risk.

Additionally, virtual workplaces act as productivity boosters. Given that they enable you to work from any area that enhances your creativity and flow, how could they not? Additionally, because your virtual office has a commercially recognized address, it will assist you in maintaining and developing a credible and professional brand image even when you're on the go.

Elements of a virtual office

Virtual offices can be found in separate structures or as a group of smaller offices. A collaborative work area with open-concept desks may even be present in certain virtual offices. All the facilities that workers may find in a physical workplace, like desks and printers, can be found in a virtual workspace.

Here are few elements of a virtual office:

Physical mailing addresses: Businesses can use the mailing addresses that certain virtual offices offer to send and receive mail.

Conference rooms: Workers in virtual workplaces may be able to rent conference rooms ahead of time for events and meetings.

Receptionist services: An answering service for your own phone line and call forwarding are provided by certain virtual workplaces.

Software: Shared PCs in virtual offices could have the most recent versions of word processing and graphic design software loaded on them.

Furnishings: A few virtual workplaces include desks, chairs, and sizable tables for gatherings.

What to consider:

It's crucial to investigate your possibilities if you're trying to rent virtual office space. Before leasing a virtual office, take into account the following:

Location

Given that a virtual office comes with a physical address for mail, it's critical to think about where the business will be headquartered. You can choose to locate your office close to your house or in a place you visit regularly, such a big city where you meet with clients. Think about whether you want to use the conference room you rented for in-person meetings or if staff members will be working remotely.

Office equipment and amenities

Think about how frequently you might visit the actual place and what amenities you'll need to do your everyday tasks. For instance, you could need an office with many electricity outlets for plugging in computers and other devices, as well as high-speed internet. Additionally, you might need a kitchen area to store water bottles or snacks for meetings.

Furniture needs

While some companies might prefer to employ the virtual office's provided furniture, others could want to incorporate their own unique aesthetic into the area. For instance, a design firm would want to include more artistic touches in the setting of meetings to represent their brand values. Explore virtual workspaces to discover more about the furnishings and your potential contributions.

Services provided

Although there are a number of benefits to virtual office rentals, each one offers unique features. A postal mailbox with a physical address or receptionist services with a dedicated phone line are two possible extras for virtual offices. Think about how frequently you might receive mail and whether you require shipping, fulfilment, or receptionist services.

Rates

To reserve office space, some virtual workplaces may charge a daily, weekly, or monthly fee. Contracts for office space at this virtual location might exist. If there's a membership charge, think about if it makes sense to pay them in order to conduct business here.

Source Link : https://addindiagroup.com/what-is-a-virtual-office-and-how-does-it-work/

0 notes

Text

Streamline credit management with our customization white label business credit software. Enhance client services, automate processes, and boost efficiency effortlessly.

#white label business credit software#small business lending software#business credit checking software#white label commercial lending

0 notes

Text

CRR: Cash Reserve Ratio

Particularly, the CRR is the minimum amount of the total deposits of customers that need to be maintained by the commercial as a reserve bank either in cash or as deposits with RBI. The rate of CRR will be fixed as per the guidelines of the central bank. The amount of CRR is to be held or reserved in cash or cash equivalents with RBI. The main aim of CRR is to ensure that banks do not run out of cash to meet their depositors' payment demands. The cash reserve ratio is computed as a percentage of the net demand and time liabilities of each bank. In the case of depositors when the bank sincerely maintains the required CRR rate, then the depositors don't have to worry about their deposits as the portion of their money is safe in the form of reserve maintained with RBI. Both banks have to be likely to lend the maximum amount of funds to borrowers and return the very little money themselves for another purpose therefore the banks to be like it when the CRR rate is low. The rate of this CRR is to be fixed by RBI to avoid such situations where the banks cannot meet repayments due to a shortage of funds.

How Does Cash Reserve Ratio Work:

When the RBI decides to increase the CRR, the available amount of money with the banks reduces. This is the way of RBI's way that to be controlling the excess flow of money in the economy. The cash balance is to be maintained by scheduled banks with the RBI should not be less than 4% of the total NDLT. The NDLT refers to the total demand and time liabilities that are held by the banks which includes the deposits of the general public and the balances held by the bank with other banks.

Advantages of CRR:

CRR can help commercial banks to build and sustain their solvency position. RBI is to be gets to control and coordinate the credit that to be maintained by banks through the CRR rate which helps to a smooth supply of cash and credit in the economy. When the CRR rate is reduced by RBI, the commercial banks which turn increase the flow of cash to the public. It helps to improve declining rates by absorbing the liquidity when the market interest rates go down instantly.

Need for banks to maintain CRR:

The cash flow of the economy is to be constantly worked and monitored by RBI. The overall liquidity is to be managed thoroughly when all the commercial banks maintain the necessary CRR rate then which benefits each bank. The CRR helps banks hold the right amount of funds with them and never fall short of it when needed by their depositors for personal needs.

The CRR is to be used as a monetary policy tool by the central bank to influence the country's interest and borrowing rates by altering the available funds for banks to make loans with. When the government needs to pump funds into the system, then lowers the CRR rate which in turn helps the banks that provide loans to a large number of businesses and industries for investment purposes.

For such type of banking-related software, you will get it at Google.

Start Google search for a banking software provider near me. You will get the ShreeCom InfoTech. Pvt. Ltd. Pune.

They offer Retail banking software, Banking software, core banking software, mobile banking software, SMS banking software, Co-Operative credit society software, Employees Co-Operative credit society software, salary earners society software, path Sanstha software, path pedhi software, multi-state co-operative credit society software.

0 notes

Text

Easy Passive Income Strategies: Kickstart Your Earnings Without Constant Effort

The concept of earning money without constantly trading time for it has become increasingly popular. This is where passive income strategies come into play. By leveraging your resources wisely, you can set up streams of income that continue to generate revenue with minimal ongoing effort. Whether you’re looking to supplement your current income or build a more substantial financial portfolio, these easy passive income strategies can help kickstart your earnings.

1. Investing in Dividend-Paying Stocks

One of the simplest ways to earn passive income is through investing in dividend-paying stocks. Many established companies distribute a portion of their earnings to shareholders in the form of dividends. By investing in these stocks, you can earn regular dividend payments without actively managing the day-to-day operations of the company. With careful research and a diversified portfolio, dividend stocks can provide a steady stream of passive income over time.

2. Rental Income from Real Estate

Real estate can be a powerful vehicle for generating passive income. Whether you invest in residential properties, commercial spaces, or vacation rentals, renting out real estate can provide a consistent source of revenue. While there is some initial effort required to purchase and set up the property, property management companies can handle the ongoing tasks such as tenant communication, maintenance, and rent collection, making it a relatively hands-off income stream.

3. Create and Sell Digital Products

In today’s digital age, creating and selling digital products can be a lucrative passive income strategy. This can include e-books, online courses, stock photography, software applications, and more. Once created, these digital products can be marketed and sold repeatedly without the need for constant supervision. Platforms like Amazon Kindle Direct Publishing, Udemy, and Etsy offer opportunities to reach a wide audience and automate the sales process, allowing you to earn passive income from your creative endeavors.

4. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers with investors willing to lend money for interest. By participating in P2P lending, you can earn passive income through the interest payments made by borrowers. While there is some risk involved, many platforms offer tools to help assess borrower creditworthiness and diversify your lending portfolio. With proper research and risk management, P2P lending can be a viable passive income option.

5. Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission for each sale or lead generated through your referral. This can be done through blogs, social media, YouTube channels, or dedicated affiliate websites. By partnering with reputable companies and creating valuable content that drives traffic and conversions, you can earn passive income from affiliate commissions. It’s essential to disclose your affiliate relationships transparently and focus on promoting products relevant to your audience to maximize earnings.

6. Automated Online Businesses

Leveraging automation tools and technology, you can create and run online businesses with minimal manual intervention. This can include dropshipping, print-on-demand services, automated content websites, and more. While setting up these businesses may require initial effort and investment, once operational, they can generate passive income by handling most processes automatically. Regular monitoring and optimization can further enhance profitability over time.

Investing in Dividend-Paying Stocks

Dividend-paying stocks offer a straightforward path to passive income. Here are seven key points to consider when exploring this strategy:

Consistent Income: Dividend payments provide regular, predictable income, making them ideal for passive investors seeking stable returns.

Potential for Growth: Companies that pay dividends often have strong fundamentals and a track record of profitability, offering potential for long-term capital appreciation.

Diversification: Investing in a diverse portfolio of dividend stocks can spread risk and enhance stability, reducing the impact of market fluctuations.

Reinvestment Opportunities: Dividends can be reinvested to purchase additional shares, compounding returns over time and accelerating wealth accumulation.

Tax Advantages: Qualified dividends are taxed at lower rates than ordinary income, providing tax-efficient income for investors.

Dividend Aristocrats: Companies with a history of consistently increasing dividends, known as Dividend Aristocrats, offer reliable income and potential for capital appreciation.

Research and Due Diligence: It’s essential to research dividend stocks thoroughly, considering factors such as dividend yield, payout ratio, and company fundamentals before investing.

Investing in dividend-paying stocks can be a valuable strategy for passive income investors seeking consistent returns and long-term wealth accumulation.

Rental Income from Real Estate

Real estate investment offers a tangible avenue for passive income. Consider these key points:

Steady Cash Flow: Rental properties provide a regular income stream through tenant rent payments, offering stability for investors.

Property Appreciation: Real estate values tend to appreciate over time, potentially increasing the value of your investment and equity.

Leverage through Financing: Investors can leverage their capital by obtaining mortgage loans, allowing them to control larger assets with a smaller initial investment.

Tax Benefits: Real estate investors can benefit from tax deductions such as mortgage interest, property taxes, depreciation, and maintenance expenses.

Property Management: Hiring professional property management services can alleviate the day-to-day responsibilities of landlords, making it a more passive investment.

Market Research: Conduct thorough market research to identify high-demand rental areas, understand rental trends, and maximize rental income potential.

Rental income from real estate can be a lucrative passive income source with careful property selection, management, and market analysis.

Create and Sell Digital Products

Creating and selling digital products is a versatile way to generate passive income. Here are key points to consider:

High Profit Margins: Digital products have low production costs, leading to higher profit margins compared to physical goods.

Scalability: Once created, digital products can be replicated and sold indefinitely without additional production costs, allowing for scalable income.

Global Reach: Digital products can reach a global audience, expanding your market and revenue potential.

Flexibility: You have the flexibility to create various digital products such as e-books, online courses, software, templates, and more based on your expertise and audience demand.

Automation: Utilize automated platforms for sales, delivery, and customer support, reducing manual effort in managing your digital product business.

Passive Sales Channels: Utilize online marketplaces, e-commerce platforms, and affiliate marketing to create passive sales channels and increase product visibility.

Continuous Improvement: Regularly update and improve your digital products to maintain relevance, attract repeat customers, and generate ongoing passive income.

Digital product creation offers a lucrative opportunity for passive income with strategic marketing and continuous innovation.

Peer-to-Peer Lending

A Peer-to-peer lending is a modern passive income strategy with several key benefits:

Diversification: Spread investment risk across multiple borrowers, reducing the impact of defaults.

Competitive Returns: Earn potentially higher interest rates compared to traditional savings accounts or bonds.

Passive Management: Platforms handle borrower selection, loan servicing, and collections, requiring minimal ongoing effort from investors.

Accessible Investment: Start with small amounts and diversify across various loan types and risk levels.

Transparency: Platforms provide detailed borrower information, loan terms, and performance metrics for informed investment decisions.

Liquidity Options: Some platforms offer secondary markets or early exit options for liquidity and portfolio management.

Risk Management Tools: Utilize tools like auto-invest, diversification settings, and credit scoring to manage risk and optimize returns.

Peer-to-peer lending can be a rewarding passive income stream when approached with caution and a diversified portfolio strategy.

Affiliate Marketing

Affiliate marketing is a popular passive income method with several advantages:

Diverse Revenue Streams: Partner with multiple affiliate programs across different niches to diversify income sources.

Low Cost to Start: No need to create products or handle customer service, reducing upfront costs.

Scalability: Scale your affiliate marketing efforts by creating content that continues to attract new visitors and potential customers.

Performance-Based Income: Earn commissions based on sales or leads generated through your affiliate links, incentivizing results.

Flexibility: Work from anywhere and choose products or services that align with your audience’s interests and needs.

Analytics and Optimization: Use analytics tools to track performance metrics, optimize campaigns, and maximize earnings.

By leveraging affiliate marketing strategies effectively, you can create a sustainable passive income stream over time.

Automated Online Businesses

Automated online businesses offer passive income opportunities with these advantages:

Streamlined Operations: Automation tools handle routine tasks like order processing, customer inquiries, and inventory management.

Scalability: Automated systems can handle increased workload and sales volume without proportional increases in manual effort.

Time Efficiency: Free up time to focus on growth strategies, product development, and expanding your business.

Cost Savings: Reduce labor costs associated with manual operations and streamline workflows for greater efficiency.

Data-Driven Decisions: Analyze automated data and metrics to make informed decisions and optimize business performance.

Passive Income Potential: Once set up, automated businesses can generate income with minimal ongoing management, allowing for passive income streams.

By leveraging automation tools and technology, online entrepreneurs can create scalable and efficient businesses that generate passive income over time.

Passive Income Strategies: Conclusion

Achieving financial freedom and building wealth often requires diversifying income streams and incorporating passive income strategies into your financial plan. By exploring avenues such as dividend investing, real estate rentals, digital product creation, peer-to-peer lending, affiliate marketing, and automated online businesses, you can kickstart your earnings without constant effort. Remember to research each strategy thoroughly, assess risks, and seek professional advice when needed to make informed financial decisions and maximize your passive income potential.

Thank you for taking the time to read my article “Easy Passive Income Strategies: Kickstart Your Earnings Without Constant Effort”, hope it helps!

Affiliate Disclaimer :

Some of the links in this article may be affiliate links, which means I receive a small commission at NO ADDITIONAL cost to you if you decide to purchase something. While we receive affiliate compensation for reviews / promotions on this article, we always offer honest opinions, users experiences and real views related to the product or service itself. Our goal is to help readers make the best purchasing decisions, however, the testimonies and opinions expressed are ours only. As always you should do your own thoughts to verify any claims, results and stats before making any kind of purchase. Clicking links or purchasing products recommended in this article may generate income for this product from affiliate commissions and you should assume we are compensated for any purchases you make. We review products and services you might find interesting. If you purchase them, we might get a share of the commission from the sale from our partners. This does not drive our decision as to whether or not a product is featured or recommended.

1 note

·

View note

Text

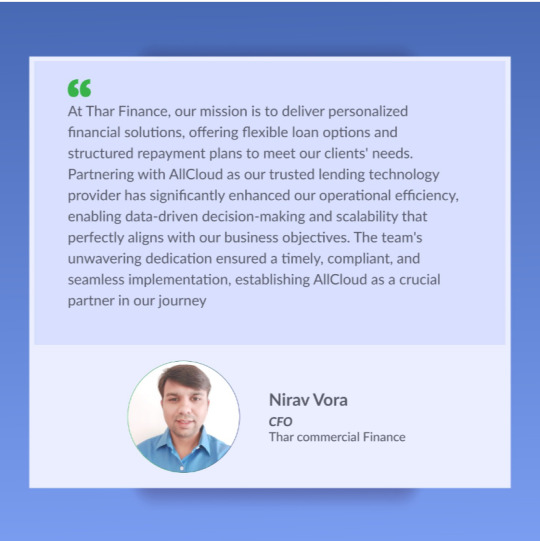

Thar Commercial Finance Successfully Implements AllCloud Unified Lending Technology, Marks Milestone in Financial Innovation

Thar Commercial Finance Pvt Ltd. (TCFPL), a leading financial institution headquartered in Mumbai, proudly announces a significant milestone in its journey of lending innovation. The company has officially gone live on the Unified Lending Technology platform provided by AllCloud, marking a pivotal moment in their commitment to enhancing customer experience and streamlining operations.

Mr. Nirav Vora, Chief Financial Officer at Thar Commercial Finance, expressed his enthusiasm for the transformative impact of AllCloud's Unified Lending Technology on their operations. He highlighted how the platform has revolutionized their lending processes, empowering them with increased efficiency and effectiveness.

At AllCloud, empowering financial institutions to succeed is at the core of our mission. Thar Commercial Finance's successful integration with our platform exemplifies our shared dedication to financial innovation and excellence. This collaboration underscores our commitment to empowering institutions and pioneering advancements in Lending Technology.

We extend our heartfelt appreciation to the implementation team for their dedication in ensuring a seamless Go-Live process. Their efforts have been instrumental in achieving this significant milestone.

Join us in celebrating this momentous achievement as we continue to lead the charge in revolutionizing the lending industry. Together with Thar Commercial Finance, we are shaping the future of finance through innovation and excellence.

About AllCloud

AllCloud is a leading provider of innovative technology solutions, specializing in cloud services, digital transformation, and enterprise software development. With a commitment to excellence and customer satisfaction, AllCloud empowers organizations to thrive in the digital age.

Please visit to read more about the features of loan management software

About Thar Commercial Finance

TCFPL has been consistently profitable – its investment team is focused on deploying capital efficiently in order to deliver sustainable and attractive returns to its stakeholders. The company maintains strong risk assessment practices at every stage of loan processing to ensure build-up of quality loan books. They provide Financial Assistance to their customers by offering them the credit scheme which caters the borrower needs through our various products including tailor made loans, flexible loan tenure, structured repayment options etc.

Contact:

For media inquiries or further information, please contact:

Ankith

Co- Founder

8121995632

Allcloud Enterprise Solutions Pvt Ltd

Connect with us on social media:

Facebook : https://www.facebook.com/AllCloudEnterpriseSolutions

LinkedIn : https://www.linkedin.com/company/13250196/

Instagram : https://www.instagram.com/allcloudhyd/

#AllCloud #TharCommercialFinance #LendingTechnology #Innovation #GoLive

0 notes