#Consumer PCB Assembly

Explore tagged Tumblr posts

Note

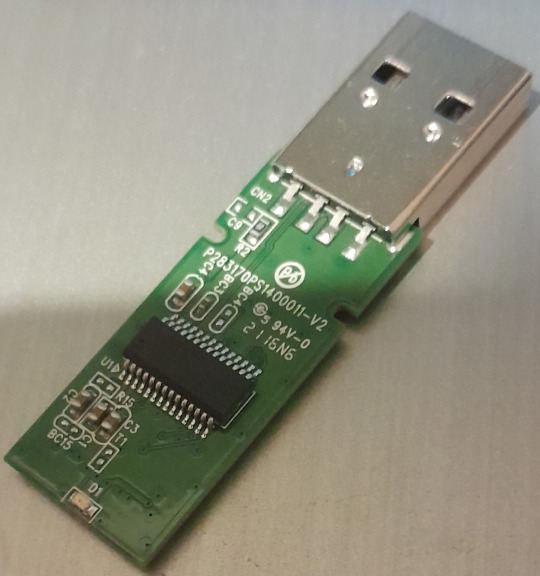

tell me everything you can infer from this image of a busted usb I own.

So the chip appears to have no text on it. That means this is a generic IC/PCB, which doesn't mean the thing is cheap, often the brand name ones use the same.

So that chip up top is the controller. It speaks USB to the computer and it talks to the flash chip(s), which are going to be on the other side. Often the boards are designed to have spots for multiple chips, so they can reuse the same board: the difference between a 32gb drive and a 64gb drive is just how many chips they solder onto it.

So if this thing is dead, it's probably the flash chip. The controllers seem pretty reliable, but they're useless without the flash, and flash chips slowly die as they have a limited number of writes.

And since USB flash drives are effectively disposable, they end up with the cheapest crappiest flash. The good shit goes into enterprise SSDs, then consumer SSDs, then big device on-board-storage (eMMC), then finally SD cards and then USB drives.

So yeah. Can't really tell you anything about it other than that. The numbers you seer are going to be used internally by the PCB assembler, they don't mean anything to anyone else.

147 notes

·

View notes

Text

Printed Circuit Board Basics

Most of us are using Printed Circuit Board in our daily life. Printed Circuit Boards are used in almost all the Electronic products, from consumer gadgets such as PCs, tablets, smartphones, and gaming consoles to industrial and even high tech products in strategic and medical electronics domains.

Here, we have some statistics for you that shows how many electronic devices connect worldwide from 2015 to 2025. This statistic shows an increase in the use of a number of PCB in people daily life. Hence, CircuitWala took this opportunity to provide a basic knowledge about PCB via this article.

There are so many books available online which teach about Printed Circuit Board design and hardware part. There are few links available online which shows only a few basic fundamentals of PCB and few are there for Basics of Printed Circuit Board (PCB) Design. Few which gives good know knowledge on Printed Circuit Board terminology. But in the end for the hobbyist, there is no such material available which make their work easy.

Now days there few online designing websites available which allow hobbyist and students to create their design and Printed Circuit Board fabrication part. These websites provide limited features and charge high for the full edition. We, @CircuitWala are in try to provide one platform which provides plenty of Printed Circuit Board knowledge digitally to make your work simple and easy.

Alternatives of PCB include wire wrap and point-to-point construction. Creating a layout of PCB is a little bit time-consuming method as compared to its alternative solution but manufacturing of PCB is cheaper and faster then other wiring methods as electronic components are mounted and wired with one single part.

Let’s start with some basics of Printed Circuit Board with this article. Here in this article we will discuss about history of PCB to understand the emerge of PCB, Types of PCB to make your complex PCB a very simple using different types, Usage of PCB to provide you an idea to create more Printed Circuit Board projects, Advantages and Disadvantages, Possible Future to know about new technological change in Printed Circuit Board manufacturing and also about how to destroy and manage your PCB’s e-waste? We know you are eager to know all the stuff in details but before that let’s make a simple definition of Printed Circuit Board.

What is Printed Circuit Board?Printed Circuit Board is an electronic device made of conductive material(FR-4) like copper which connects components mounted on it to to get desired output by providing an input on another end.

When the board has not mounted with any of the components is called as Printed Circuit Board or Printed Wired Board. Mounting of an electronic component on Printed Circuit Board is called as PCB assembly.

History of Printed Circuit BoardThe invention of Printed Circuit Board was by Austrian engineer Paul Eisler as part of a radio set while working in England around 1936.

In early days before Printed Circuit Board became common in use, Point-to-Point construction was used. This meant some bulky and unreliable design that required plenty of sockets and regular replacement of it. Most of this issue directly address when PCB went into regular production.

Originally, every electronic component had wire leads, and the PCB had holes drilled for each wire of each component. The components’ leads were then passed through the holes and soldered to the PCB trace. This method of assembly is called Through-Hole construction. There is one other method to mount component is called as Surface Mount.

Type of Printed Circuit BoardPCBs are produced from the different types of material and on the basis of that material PCBs are divided mainly into two parts: Rigid PCB and Flexible PCB. Nowadays, a combination of Rigid and flexible PCB is also possible and that is called as Flexi-Rigid PCBs.

Most of the PCBs are built in layers. The inner layer is the base material called as a substrate. Rigid PCBs are mainly made of material like epoxy materials and Flexible PCBs are made of plastic material that can withstand high temperatures.

Rigid PCBs are generally, hard materials that hold the component in a better way. The motherboard in the tower of a computer is the best example of Rigid PCBs. Flexible PCBs fundamental material allows PCB to fit into forms that Rigid PCBs can not. Flexible PCBs can turn round without harmful the circuit on PCB.

All Rigid and Flexible PCBs can come in three formats by layers: Single Layer, Double Layer, and Multi-Layer.

1. Single Layer PCBSingle Layer PCBs have been around since the late 1950s and still dominate the world market in sheer piece volume. Single Sided PCBs contain only one layer of conductive material and are best suited for low-density designs. Single-sided PCBs are easy to design and quick to manufacture. They serve as the most lucrative platform in the industry.

2. Double Layer PCBDouble Layered printed circuit board technology is conceivably the most popular type of PCB in the industry. Double Sided PCB (also known as Double-Sided Plated Thru or DSPT) circuits are the gateway to advanced technology applications. They allow for a closer (and perhaps more) routing traces by alternating between top and bottom layers using vias.

3. Multi Layer PCB

Multilayer PCB is a circuit board that has more than two layers. Unlike a Double-Sided PCB which only has two conductive layers of material, all multilayer PCBs must have at least three layers of conductive material which are buried in the center of the material.

Usage of Printed Circuit BoardBy reading this article till this point, we hope that you are now able to get about printed circuit boards. Now, we will make you understand about different applications of printed Circuit Board.

In this digital world, Printed Circuit Board is in almost all our daily life electronic devices and in our industrial electronics as well. Below are the industries where PCBs are used:

Possible FutureNowadays, most of the circuits are replaced to produce Printed Circuit Board from the old methods. Revolution in technology made many of the processes automated and hence it is easy to manufacture PCB. But still, these processes are a bit expensive to hire, involve toxic waste and use high temperatures and acids. With technological advances we have seen in the past years, it is not hard to imagine PCB will soon be revolutionized. Not only that but research institutes predict a more ‘green’ future for PCBs; PCBs being made of paper.

Electronic Waste (e-waste)Electronic Waste or e-waste is described as discarded electrical or electronic devices. Informal processing of e-waste in developing countries can lead to adverse human health effects and environmental pollution.

Electronic scrap components contain a hazardous substance such as lead, cadmium, beryllium, or brominated flame retardants. Recycling and disposal of e-waste may involve significant risk to health of workers and communities in developed countries and great care must be taken to avoid unsafe exposure in recycling operations

Nowadays, developing countries are encouraging electronic users to take care while recycling the e-waste or submit them to the organization who are involved in such activities.

SummaryIn this blog, we have learned the basics of Printed Circuit Board. CircuitWala is planning to write as many blogs to provide more and more knowledge of Printed Circuit Board. Either it is basics or manufacturing or usages or advantages and disadvantages of PCBs. We will also try to make our users/customers up to date for the new technology innovations, including past histories and revolution of the PCB industries.

In the next blog, we will look at more briefly about the different types of Printed Circuit Board. We also understand the process to make it and different usage and application for the same.

#electronic circuit design company#pcb circuit manufacturer in ahmedabad#pcb design & manufacturing services#printed circuit board companies#printed circuit board order online#PCB manufacturer#Printed Circuited Board#double layer PCB#PCB Quality Control

2 notes

·

View notes

Text

Pcb Board Terminals Market: Investment Opportunities and Forecast 2025–2032

MARKET INSIGHTS

The global Pcb Board Terminals Market size was valued at US$ 2.67 billion in 2024 and is projected to reach US$ 4.12 billion by 2032, at a CAGR of 5.8% during the forecast period 2025-2032.

PCB board terminals are crucial electrical connectors that facilitate secure and reliable connections between printed circuit boards and external wiring systems. These components come in various types including screw type, plug-in, and other specialized variants, each designed for specific applications across industries. The terminals play a vital role in ensuring proper signal transmission and power distribution in electronic assemblies.

The market growth is driven by several factors, including the expanding electronics manufacturing sector and increasing adoption of automation across industries. The global PCB industry, valued at approximately USD 81 billion in 2022, continues to provide a strong foundation for terminal demand. Emerging technologies like 5G infrastructure, AI hardware, and electric vehicles are creating new opportunities, while established players such as TE Connectivity, WAGO, and Phoenix Contact continue to innovate with compact and high-performance terminal solutions.

MARKET DYNAMICS

MARKET DRIVERS

Expansion of 5G and IoT Infrastructure to Accelerate PCB Terminal Demand

The global rollout of 5G networks and IoT ecosystems is creating unprecedented demand for sophisticated printed circuit boards (PCBs), subsequently driving growth in the PCB terminals market. With over 1.3 billion 5G connections projected worldwide by 2024, network operators are investing heavily in infrastructure that requires high-density interconnect PCBs with reliable terminal connections. These terminals ensure stable signal transmission in base stations and small cell deployments, where vibration resistance and environmental durability are critical. The automotive sector’s shift toward connected vehicles further amplifies this demand, as modern cars now contain 1,500+ PCB terminals for advanced driver-assistance systems (ADAS) and telematics units.

Electrification Wave in Automotive Industry to Fuel Market Expansion

Electric vehicle (EV) production is revolutionizing PCB terminal requirements, with battery management systems (BMS) and power converters requiring specialized high-current terminals. The average EV contains 30% more PCB terminals than conventional vehicles, primarily for managing 400V-800V battery systems. Major manufacturers are responding to this shift – in Q3 2024, TE Connectivity introduced a new line of high-voltage PCB terminals rated for 250A continuous current, addressing the industry’s need for compact yet robust power distribution solutions. This technological evolution coincides with projections that EVs will represent 25% of global auto sales by 2026, creating sustained demand for automotive-grade terminals.

MARKET RESTRAINTS

Raw Material Volatility to Constrain Profit Margins

The PCB terminal market faces significant pressure from fluctuating copper and specialty alloy prices, which account for 60-70% of production costs. Copper prices have shown 22% annual volatility since 2021, forcing manufacturers to either absorb costs or risk losing price-sensitive customers. This challenge is particularly acute in consumer electronics, where terminals represent disposable components in increasingly commoditized devices. The situation is further complicated by geopolitical factors affecting rare earth metal supplies, with certain terminal coatings requiring materials subject to export restrictions.

Miniaturization Challenges to Impact Standard Terminal Designs

As PCBs shrink to accommodate wearable tech and implantable medical devices, traditional screw-type terminals face obsolescence in space-constrained applications. The industry benchmark for terminal pitch has decreased from 5.08mm to 3.5mm in just five years, requiring complete redesigns of insertion and strain relief mechanisms. This transition strains manufacturers’ R&D budgets while simultaneously increasing production complexity – automated assembly systems capable of handling sub-3mm terminals cost 40-50% more than conventional equipment. These technical barriers slow adoption in cost-sensitive market segments.

MARKET CHALLENGES

Legacy System Integration to Create Compatibility Issues

Industrial equipment with lifespans exceeding 15-20 years presents unique challenges for terminal manufacturers. While modern terminals offer superior performance, their mechanical and electrical interfaces often prove incompatible with older PCB designs still prevalent in manufacturing plants. This incompatibility forces end-users into expensive board redesigns or makeshift adapter solutions that compromise reliability – a significant concern in safety-critical applications like power generation. The problem is magnified by the lack of standardization across regional markets, with differing terminal configurations persisting in North America, Europe, and Asia.

MARKET OPPORTUNITIES

Smart Manufacturing Initiatives to Drive Next-Gen Terminal Adoption

Industry 4.0 implementations are creating demand for intelligent terminals with embedded sensors, presenting a $780 million revenue opportunity by 2027. These advanced terminals can monitor connection integrity, temperature, and vibration in real-time, addressing pain points in predictive maintenance programs. Leading suppliers are responding with hybrid solutions – WAGO’s 2024 PRO 2 series combines traditional spring-clamp reliability with IoT connectivity features, demonstrating the market’s direction. The medical equipment sector shows particular promise, where smart terminals could reduce 35% of device failures attributed to connection issues.

Asia-Pacific Infrastructure Boom to Create New Growth Areas

Southeast Asia’s electronics manufacturing expansion represents the most dynamic growth opportunity, with countries like Vietnam and Thailand increasing PCB production capacity by 18-22% annually. Local terminal suppliers benefit from government incentives promoting domestic component sourcing, while global players establish regional technical centers to support just-in-time delivery. This geographical shift complements existing Chinese dominance, where PCB terminal consumption continues growing at 9% CAGR despite economic headwinds. The region’s focus on renewable energy infrastructure further stimulates demand for high-reliability terminals in solar inverters and wind turbine controls.

PCB BOARD TERMINALS MARKET TRENDS

Miniaturization and High-Density PCB Designs Drive Terminal Innovation

A significant trend shaping the PCB terminals market is the increasing demand for compact, high-density solutions due to shrinking electronic device sizes. The global PCB market exceeded $81 billion in 2022, indicating massive production volumes where terminals serve as critical connection points. Manufacturers are responding with ultra-low profile screw-type terminals and micro-plug connectors that maintain reliability while occupying minimal board space. This evolution is particularly crucial for IoT devices and wearables where terminals must accommodate complex circuitry in constrained areas without compromising conductivity or durability.

Other Trends

Electrification of Automotive Systems

The automotive industry’s transition toward electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is creating sustained demand for rugged PCB terminals capable of handling high-voltage applications. EV production is projected to grow at a CAGR of over 23% through 2030, driving innovations in terminals with enhanced vibration resistance and temperature tolerance up to 150°C. These specialized terminals facilitate reliable connections in battery management systems and power distribution units where failure risks must be minimized.

Rise of Automated Manufacturing Processes

The adoption of Industry 4.0 practices is transforming terminal production, with manufacturers integrating automated optical inspection (AOI) systems to ensure micron-level precision in terminal placement. This shift reduces human error while increasing throughput – critical factors as Asian PCB manufacturers now account for over 60% of global production capacity. Furthermore, self-aligning terminal designs are gaining traction for their ability to accelerate robotic assembly processes, particularly in high-volume consumer electronics manufacturing where milliseconds per connection translate directly to cost savings.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Strategic Expansion Drive Market Competition

The PCB board terminals market exhibits a moderately consolidated structure, with prominent players competing alongside emerging regional manufacturers. TE Connectivity leads the global market, commanding a significant share due to its diversified product portfolio and robust distribution network spanning North America, Europe, and Asia-Pacific. The company’s focus on high-reliability connectors for automotive and industrial applications has reinforced its market position.

Other major players such as WAGO and Phoenix Contact have strengthened their foothold through continuous technological advancements in screw-type and plug-in terminals. These companies benefit from strong R&D capabilities and strategic partnerships with PCB manufacturers across various end-use sectors.

Meanwhile, Asian manufacturers like OMRON and Amphenol are rapidly gaining traction, supported by the region’s thriving electronics manufacturing ecosystem. These players are investing heavily in compact, high-density terminal solutions to meet the increasing demand from consumer electronics and telecommunications sectors.

The competitive intensity is further amplified by mid-sized specialists such as Weidmüller and Wieland Electric who are carving out niche positions through customized solutions for industrial automation applications. Recent acquisitions and vertical integration strategies among these players indicate a shifting competitive dynamic that prioritizes both product performance and supply chain efficiency.

List of Key PCB Board Terminal Companies Profiled

TE Connectivity (Switzerland)

WAGO (Germany)

Altech Chemicals (U.S.)

Weidmüller (Germany)

Phoenix Contact (Germany)

WECO Electrical Connectors (U.S.)

DINTEK (Taiwan)

ABB (Switzerland)

Essen Deinki (China)

Wieland Electric (Germany)

OMRON (Japan)

Molex (U.S.)

Amphenol (U.S.)

Segment Analysis:

By Type

Screw Type Terminals Lead the Market Due to Superior Connectivity and Durability

The PCB board terminals market is segmented based on type into:

Screw Type

Subtypes: Spring-loaded, through-hole, and others

Plug-In

Subtypes: Push-in, spring-clamp, and others

Other Types

Subtypes: Barrier strips, IDC connectors, and others

By Application

Electronic Products Segment Dominates Owing to Proliferation of Consumer Electronics

The market is segmented based on application into:

Electronic Products

Automotive Equipment

Bathroom Equipment

Industrial Machinery

Medical Devices

By End User

Automotive Sector Shows Fastest Growth Due to Increasing Vehicle Electrification

The market is segmented by end user into:

Consumer Electronics Manufacturers

Automotive OEMs

Industrial Equipment Manufacturers

Medical Device Companies

Telecommunication Providers

By Material

Copper Alloys Remain Preferred Choice for Optimal Conductivity and Cost-Effectiveness

The market is segmented by material type into:

Copper Alloys

Subtypes: Brass, phosphor bronze, and others

Aluminum

Nickel Alloys

Other Materials

Regional Analysis: PCB Board Terminals Market

North America The North American PCB board terminals market is characterized by high-tech adoption and stringent quality standards. The U.S. holds the largest share, driven by strong demand from the electronics and automotive sectors, where PCB terminals are critical for secure connections in circuit boards. The region benefits from advanced manufacturing capabilities, particularly in AI hardware, 5G infrastructure, and electric vehicle (EV) components. While environmental regulations influence material choices, the focus remains on high-performance terminals that meet safety and durability criteria. Major players like TE Connectivity and Amphenol dominate supply chains, supporting innovation in miniaturized and high-current terminals.

Europe Europe’s market thrives on industrial automation and renewable energy projects, which demand reliable PCB terminals for control systems and power distribution. Germany leads in manufacturing, with companies like WAGO and Phoenix Contact supplying screw-type and plug-in terminals for automotive and industrial applications. The EU’s circular economy policies encourage recyclable materials, pushing vendors to adopt sustainable designs. However, higher production costs and competition from Asian imports challenge local suppliers. Despite this, the region maintains a niche in precision-engineered solutions, especially for medical devices and aerospace.

Asia-Pacific As the largest and fastest-growing market, APAC accounts for over 60% of global PCB production, with China, Japan, and South Korea as key hubs. The boom in consumer electronics, EVs, and IoT devices fuels demand for cost-effective terminals, favoring plug-in variants. China’s local manufacturers leverage economies of scale, though quality disparities exist. Japan and South Korea excel in high-density terminals for advanced applications, driven by companies like OMRON and Molex. While price sensitivity limits premium product adoption, urbanization and 5G rollout offer long-term growth opportunities across the region.

South America South America’s market is nascent but evolving, with Brazil and Argentina leading demand for PCB terminals in automotive and appliance manufacturing. Economic instability and reliance on imports hinder local production, but government incentives for electronics industrialization are gradually attracting investments. The lack of strict standards results in a mix of low-cost imports and niche domestic offerings. However, the rise of renewable energy projects and smart infrastructure could drive future demand for durable terminal solutions.

Middle East & Africa MEA shows moderate growth, primarily in GCC countries like the UAE and Saudi Arabia, where PCB terminals are used in oil & gas automation and construction technologies. Limited local manufacturing forces dependence on imports, though initiatives like Saudi Vision 2030 aim to boost electronics self-sufficiency. Africa’s market remains fragmented, with South Africa leading in industrialapplications, while other regions face challenges like infrastructure gaps and low purchasing power. Nonetheless, urbanization and digitalization trends hint at untapped potential.

Report Scope

This market research report provides a comprehensive analysis of the global and regional PCB Board Terminals markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global PCB Board Terminals market was valued at USD 2.8 billion in 2024 and is projected to reach USD 4.1 billion by 2032, growing at a CAGR of 4.7%.

Segmentation Analysis: Detailed breakdown by product type (Screw Type, Plug-In, Others), application (Electronic Products, Automotive Equipment, Bathroom Equipment), and end-user industry to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific dominates with 62% market share in 2024.

Competitive Landscape: Profiles of 13 leading market participants including TE Connectivity, WAGO, and Phoenix Contact, with their product portfolios, market shares, and strategic developments.

Technology Trends & Innovation: Assessment of emerging trends like miniaturization, high-current terminals, and smart connectivity solutions in PCB terminals.

Market Drivers & Restraints: Evaluation of factors including 5G deployment, EV adoption, and industrial automation driving growth, along with raw material price volatility challenges.

Stakeholder Analysis: Strategic insights for PCB manufacturers, terminal suppliers, OEMs, and investors regarding market opportunities and competitive positioning.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/inductive-proximity-switches-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/cellular-iot-module-chipset-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/sine-wave-inverter-market-shifts-in.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pilot-air-control-valves-market-cost.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/video-multiplexer-market-role-in.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/semiconductor-packaging-capillary.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/screw-in-circuit-board-connector-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/wafer-carrier-tray-market-integration.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/digital-display-potentiometer-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/glass-encapsulated-ntc-thermistor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/shafted-hall-effect-sensors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/point-of-load-power-chip-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/x-ray-grating-market-key-players-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/picmg-single-board-computer-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/lighting-control-dimming-panel-market.html

0 notes

Text

Organized Precision: High-Quality PCB Magazine Rack in India – Only at Ascomp Inc

When handling delicate printed circuit boards (PCBs), proper storage and handling are critical to prevent physical damage, static discharge, and contamination. In production lines, testing labs, and assembly units, using a reliable PCB magazine rack in India ensures safe transport, handling, and storage of PCBs without compromising quality or efficiency. At Ascomp Inc, we offer a wide range of robust and anti-static PCB racks, designed for industrial use and optimized for Indian manufacturing environments.

What is a PCB Magazine Rack?

A PCB magazine rack is a specialized storage unit designed to hold multiple PCBs vertically or horizontally. Made from heat-resistant and ESD-safe materials like conductive plastic or aluminum alloy, these racks protect PCBs during handling, transit, and storage. They are commonly used in:

SMT lines

Assembly and inspection workstations

Wave soldering and reflow zones

Testing and quality control areas

Each PCB magazine rack in India from Ascomp Inc is built to ensure mechanical stability, cleanroom compatibility, and anti-static protection.

Features of Ascomp Inc’s PCB Racks

✅ Adjustable slot width to accommodate different PCB sizes

✅ Stackable and lightweight design for space efficiency

✅ Durable, ESD-safe materials to prevent static damage

✅ Heat-resistant structure for high-temp production areas

✅ Models with rollers for easy mobility between lines

✅ Locking mechanisms to keep PCBs securely in place

Our racks are compatible with both manual handling and robotic automation systems used in advanced SMT and EMS setups.

Applications Across Industries

Ascomp Inc supplies PCB magazine racks to industries such as:

Electronics manufacturing and SMT assembly

Automotive electronics and EV units

Aerospace and defense electronics labs

Medical device and telecom PCB fabrication

R&D labs and prototyping facilities

Consumer electronics repair and refurbishment hubs

We help companies ensure that PCBs move through the production lifecycle with safety, efficiency, and traceability.

Customization Options

Different PCB sizes and handling requirements call for tailored solutions. That’s why Ascomp Inc offers:

Adjustable rack models for varying board thickness

Horizontal and vertical slot orientations

Customized branding and labeling

Options with antistatic wheels and handles

Cleanroom-grade builds upon request

We also provide full technical guidance to select the right rack model based on your product mix and workflow.

Why Choose Ascomp Inc?

🧰 Experienced supplier of ESD and assembly accessories

📦 PAN-India delivery and fast fulfillment for bulk orders

🛠️ Durable and industry-tested products

📞 Dedicated support for technical queries and custom needs

💼 Trusted by EMS, OEM, and R&D labs across India

We are committed to supporting India’s growing electronics ecosystem with the infrastructure it needs to scale safely and efficiently.

#PCBMagazineRackIndia#AscompInc#ESDStorageIndia#ElectronicsManufacturingTools#PCBHandlingIndia#SMTAssemblyTools#CleanroomStorage#AntiStaticRacks#PCBProductionIndia#IndustrialStorageSolutions

0 notes

Text

Top 10 Electronics Manufacturing Companies in India You Should Know About

India is rapidly becoming a global hotspot for electronics manufacturing, and it’s no accident. Thanks to government initiatives like Make in India and PLI (Production Linked Incentive), along with a skilled workforce and cost-competitive production, electronics manufacturing companies in India are shaping the future of global tech.

If you’re in the electronics industry or simply curious about the powerhouses driving India’s growth, here’s a curated list of the Top 10 Electronics Manufacturing Companies in India you should have on your radar.

Let’s dive in.

Why India for Electronics Manufacturing?

✅ Skilled Workforce: Thousands of engineers entering the industry every year.

✅ Policy Support: Incentives through Make in India & PLI schemes.

✅ Global Demand: Supplying top brands worldwide.

✅ Innovation Focus: Companies invest heavily in R&D for future technologies.

⚙️ Top 10 Electronics Manufacturing Companies in India

1️⃣ Dixon Technologies

Noida-based Dixon Technologies leads the way in contract manufacturing for electronics. They work with major global brands producing everything from smartphones to LED TVs.

Specialties:

Consumer Electronics

Mobile Phones

Lighting & Security Devices

Why Dixon? Trusted by names like Samsung, Xiaomi & Panasonic.

2️⃣ Bharat Electronics Limited (BEL)

A government-owned giant, BEL is best known for defense electronics but also manufactures products for telecom, civilian, and broadcast sectors.

Specialties:

Defense Electronics

Communication Equipment

Radar Systems

Why BEL? Top choice for mission-critical and defense-grade tech.

3️⃣ Elin Electronics

Based in Ghaziabad, Elin Electronics provides EMS solutions across LED lighting, appliances, and medical devices.

Specialties:

PCBA

Small Appliances

Automotive Electronics

Why Elin? Known for quality and reliable partnerships.

4️⃣ Syrma SGS Technology

Catering to IoT, automotive, and healthcare industries, Syrma SGS stands out for both manufacturing and design services.

Specialties:

Electronics Manufacturing

RFID

Custom Magnetics

Why Syrma? Global clientele and versatile capabilities.

5️⃣ Avalon Technologies

With a focus on high-complexity assemblies, Avalon is ideal for companies needing precision engineering and system integration.

Specialties:

PCB Assembly

System Integration

Cable Assemblies

Why Avalon? Perfect for custom, small-batch production.

6️⃣ SFO Technologies (NeST Group)

A key player for companies in aerospace, healthcare, and industrial automation, SFO Technologies delivers more than just manufacturing—they build complete systems.

Specialties:

EMS

Embedded Systems

Software Development

Why SFO? Seamless integration of software and hardware expertise.

7️⃣ Kaynes Technology

If you’re in the IoT game, Kaynes Technology is a name to remember. They offer end-to-end EMS services, especially for IoT, automotive, and defense.

Specialties:

IoT Product Development

Embedded Systems

Automotive Electronics

Why Kaynes? Known for cutting-edge innovation in connected tech.

8️⃣ Optiemus Electronics Limited (OEL)

A major contributor to India’s smartphone manufacturing revolution, OEL partners with global brands to build mobile devices and accessories.

Specialties:

Mobile Phones

Wearables

Accessories

Why Optiemus? Trusted by telecom giants for device manufacturing.

9️⃣ VVDN Technologies

What sets VVDN apart is their design-led manufacturing approach, especially for IoT, telecom, and networking solutions.

Specialties:

IoT Product Design

Embedded Software

Cloud & App Integration

Why VVDN? Full-stack development plus manufacturing.

🔟 Centum Electronics

For high-reliability electronics in critical sectors like space and defense, Centum Electronics is a leader, supplying even ISRO and DRDO.

Specialties:

Aerospace Electronics

Microelectronics

Defense Tech

Why Centum? Precision-built for mission-critical applications.

🏆 How to Choose Your Manufacturing Partner?

Here’s what you should focus on when selecting an electronics manufacturing company:

✔ Industry Expertise

✔ Certifications (ISO, IATF, etc.)

✔ Capacity for Production Scale

✔ Design & R&D Capabilities

✔ Location and Logistics

Pro Tip: Use platforms like FindingMFG to connect with verified manufacturers across India. It’s faster, safer, and saves a lot of hassle.

🌐 Ready to Start?

The electronics manufacturing company in India is growing stronger every year—and these companies are leading the charge. Whether you’re launching a startup, scaling your supply chain, or just exploring opportunities in tech manufacturing, India’s EMS ecosystem has the solutions you need.

👉 Explore more at FindingMFG.com

#electronics manufacturing#electronics manufacturing companies#top 10 electronics manufacturing companies in India#manufacturing directory#business directory

0 notes

Text

PCBA: The Silent Backbone of Electronic Devices

Printed Circuit Board Assembly (PCBA) serves as the critical foundation for nearly every electronic device in our modern world. From smartphones and laptops to industrial automation systems and aerospace equipment, PCBA ensures that the various electronic components within a device function smoothly and cohesively. Its precision and reliability are not just technical necessities but vital to sustaining innovation in the global tech economy.Get more news about PCBA manufacturer,you can vist our website!

Understanding PCBA

At its core, PCBA refers to the process of soldering electronic components onto a printed circuit board (PCB). While a PCB is simply the board with copper traces that connect components electrically, the assembly process transforms it into a fully functional circuit. This involves mounting integrated circuits (ICs), resistors, capacitors, diodes, and other components using either Surface Mount Technology (SMT), Through-Hole Technology (THT), or a hybrid of both, depending on the design and purpose of the device.

The PCBA Process

The process typically begins with solder paste application, where a stencil is used to apply the paste on predefined areas of the PCB. Automated pick-and-place machines then accurately position the tiny components onto the board. This is followed by reflow soldering, where the board is passed through a controlled oven to melt the solder and secure the components.

For boards requiring through-hole components, manual or wave soldering is used. Once soldered, the board undergoes inspection and testing—ranging from Automated Optical Inspection (AOI) to X-ray analysis and functional testing—to ensure quality and performance. Advanced PCBA plants employ high levels of automation, drastically reducing human error and improving output consistency.

Applications Across Industries

PCBA's influence stretches far beyond consumer electronics. In the automotive sector, it powers systems ranging from infotainment units to electric vehicle battery management. In healthcare, PCBA-based medical devices like ECG machines and portable monitors are critical to patient diagnostics and care. Aerospace and military applications demand high-reliability PCBA to function under extreme environments—an area where rigid quality controls and testing standards become indispensable.

Trends and Innovations

The PCBA landscape continues to evolve rapidly with advances in miniaturization, multi-layer boards, and flexible circuits. With the rise of the Internet of Things (IoT), demand for compact, power-efficient, and wireless-capable assemblies has exploded. Manufacturers are investing in smart factories, using AI-driven inspection and robotics to further optimize production.

Meanwhile, environmental considerations are pushing green manufacturing methods, such as lead-free solder and recyclable board materials. Companies are also embracing design-for-manufacturing (DFM) principles to streamline assembly and minimize waste.

Conclusion

Though rarely visible to end-users, PCBA is the invisible force driving the electronics revolution. Its blend of engineering precision, automation, and innovation enables the digital tools and systems we rely on daily. As global technology continues to push boundaries, PCBA will remain the structural and functional heart of that progress—quietly pulsing behind every screen, circuit, and sensor.

0 notes

Text

Choosing the Right Electronics Manufacturing Services Provider in India: What You Need to Know

The electronics industry is witnessing exponential growth, driven by rising global demand for smart devices, IoT integration, and automation. In this dynamic landscape, partnering with a reliable Electronics Manufacturing Services Provider in India has become a strategic necessity for companies aiming to scale production, improve quality, and reduce time-to-market.

India, emerging as a global hub for electronics manufacturing, provides a cost-effective and quality-focused environment for Original Equipment Manufacturers (OEMs) across various sectors, including consumer electronics, automotive, and industrial applications. If you're a business looking to collaborate with a top-tier electronics manufacturing services provider in India, understanding what to look for and how the right EMS partner can support your growth is essential.

What Are Electronics Manufacturing Services?

Electronics Manufacturing Services (EMS) refer to companies that design, manufacture, test, distribute, and provide return and repair services for electronic components and assemblies. These providers are key partners for OEMs who prefer to outsource manufacturing to experts rather than maintain in-house capabilities. An EMS partner typically offers:

- PCB (Printed Circuit Board) assembly

- Surface Mount Technology (SMT) and Through-Hole assembly

- Prototyping and NPI (New Product Introduction) support

- Functional and in-circuit testing

- Box build and final system integration

- Supply chain management

- Aftermarket support and logistics

Why Choose an EMS Provider in India?

India is rapidly climbing the ranks as a preferred destination for electronics manufacturing due to several favorable factors:

1) Cost-Effectiveness: Manufacturing in India offers significant cost savings without compromising on quality. Lower labor costs, competitive overheads, and government-backed subsidies help original equipment manufacturers (OEMs) remain profitable.

2) Government Incentives: Under the “Make in India” initiative and Production Linked Incentive (PLI) schemes, EMS providers in India receive various tax incentives, subsidies, and support that help reduce total manufacturing costs for OEMs.

3) Skilled Workforce: India has a large, educated, and technically proficient workforce, especially in areas such as PCB assembly, quality assurance, and embedded system development.

4) Strategic Location: With its proximity to global markets in Asia, Europe, and the Middle East, India serves as a logistics hub, boasting strong port infrastructure and connectivity.

Key Advantages of Partnering with an EMS Provider

Partnering with an EMS provider isn’t just about outsourcing production; it’s about building a long-term relationship that enhances your competitiveness and operational efficiency. Here’s how:

1) Faster Time-to-Market: An experienced EMS provider can expedite design iterations, prototyping, and mass production, thereby reducing the time required to bring new products to market.

2) Quality Control: Top EMS companies adhere to global standards, including ISO 9001, IATF 16949, and IPC-A-610, for electronics assembly and testing, ensuring high-quality, defect-free output.

3) Scalability: Whether you’re launching a niche product or scaling up to millions of units, EMS partners provide the flexibility to adjust production volumes efficiently.

4) Focus on Core Competencies: Outsourcing manufacturing enables OEMs to focus on design, innovation, marketing, and customer experience while their EMS partner handles operations and fulfillment.

5) Integrated Supply Chain: With robust procurement capabilities and established vendor relationships, EMS providers help mitigate risks associated with component shortages, cost volatility, and logistics challenges.

What to Look for in an Electronics Manufacturing Services Provider in India

Not all EMS companies offer the same capabilities. When evaluating an EMS provider, consider the following:

1) End-to-End Capabilities: Choose a provider that can support your product lifecycle—from prototyping and low-volume builds to high-volume production and post-sales support.

2) Industry Experience: Look for providers with proven experience in your specific industry, whether it’s medical devices, automotive electronics, consumer goods, or industrial controls.

3) Quality Certifications: Ensure they meet global quality and safety standards, such as ISO, RoHS, and IPC compliance. These standards reflect a commitment to performance, safety, and environmental responsibility.

4) Engineering Support: Strong design-for-manufacturability (DFM) and design-for-testability (DFT) expertise ensure fewer production errors and reduced costs.

5) Communication & Project Management: A transparent approach to communication, real-time reporting, and dedicated account managers ensure that your projects stay on track.

Resolute Electronics: A Trusted EMS Partner in India

One EMS provider that stands out in India’s manufacturing ecosystem is Resolute Electronics, a company known for its customer-first approach and robust capabilities. With state-of-the-art infrastructure, skilled engineers, and a commitment to quality, Resolute has established itself as a trusted provider of electronics manufacturing services in India, serving both global and domestic Original Equipment Manufacturers (OEMs). Their service offerings include:

- Advanced SMT lines for high-speed PCB assembly

- Precision testing with automated optical inspection (AOI), ICT, and functional test setups

- Comprehensive prototyping and NPI support

- Custom enclosures and complete box builds

- Scalable manufacturing solutions for startups to enterprise-level companies

Resolute Electronics also stands out for its flexibility, attention to detail, and ability to bring complex product ideas to life, making it an ideal partner for companies looking to outsource manufacturing without compromising control or visibility.

The Future of EMS in India

As global brands seek to diversify their supply chains and reduce dependence on single-region sourcing, India is poised to play a more significant role in global electronics production. The country’s EMS sector is expected to experience rapid growth over the next decade, driven by both domestic demand and export potential.

With this evolution, OEMs have a unique opportunity to collaborate with EMS partners like Resolute Electronics, who combine technical excellence, responsive service, and innovation to drive business growth.

Conclusion

The right electronics manufacturing services provider in India can be a game-changer for your business, enhancing product quality, reducing costs, and speeding up your time to market. As the demand for smart, connected devices grows, choosing an EMS partner with proven expertise, state-of-the-art facilities, and a flexible engagement model will position your brand for long-term success. Whether you're a startup looking to bring your first product to life or a global brand aiming to scale efficiently, partnering with an EMS provider like Resolute Electronics ensures your electronics manufacturing needs are in expert hands.

0 notes

Text

Electronics Manufacturing: Trends and Industry Insights

In an industry defined by continuous development and exacting standards, electronics manufacturing is a critical driver of modern technology. From everyday consumer goods to complex industrial systems, the journey of each component begins with thoughtful engineering, rigorous production practices, and strong supplier relationships. Based in Arundel, West Sussex, Arrival Electronics Limited stands at the heart of this field, working closely with clients to meet the evolving needs of today’s electronic markets.

This article explores the inner workings of the electronic components industry—what drives it, the trends shaping it, and what decision-makers should understand when choosing the right components or partners. Whether you're a design engineer, purchasing manager, or systems integrator, a clear understanding of this sector will help support better outcomes for your business and your customers.

Understanding the Electronics Manufacturing Process

The process involves assembling electronic components into complete, functional products ready for use or distribution. This can include simple printed circuit board assemblies or more intricate systems involving hundreds of interconnected parts. The process demands consistent quality, traceability, and efficient logistics from start to finish.

The primary stages include:

Component Sourcing: Reliable supply chains and vetted manufacturers are essential. Components must meet specifications, often under strict time constraints and regulatory compliance requirements.

PCB Assembly: Surface mount technology (SMT) and through-hole assembly are key methods used in creating circuit boards. Attention to detail is vital here, as even minor errors can result in failure during testing or deployment.

Testing and Inspection: Functional tests, visual inspections, and X-ray analysis are just some of the methods used to confirm product reliability. These steps help ensure products perform as intended once installed.

Final Assembly and Packaging: After testing, products are assembled into enclosures, labeled, and prepared for shipment, often requiring anti-static handling, thermal protection, or precise labeling practices.

Producing electronic products requires more than tools and machines—it’s about consistency, communication, and adapting to specific project demands.

Key Trends Shaping Today’s Production Landscape

As technology progresses, the electronics sector must constantly adjust. Here are several trends affecting the direction of the industry:

1. Miniaturization

Devices are shrinking, but performance expectations remain high. Engineers must work with tighter tolerances and more complex component configurations. This puts pressure on design and manufacturing teams to align on specifications early in the project lifecycle.

2. Demand for Custom Solutions

Many industries—such as medical, aerospace, and renewable energy—are looking for specialized circuit designs rather than one-size-fits-all solutions. Manufacturers that can provide flexible production runs, in-depth technical consultation, and fast turnarounds are in demand.

3. Supply Chain Resilience

The global component shortage has made it clear how critical supply chain visibility and reliability are. Businesses are increasingly working with sourcing partners that can offer a wide selection of inventory, cross-reference alternatives, and reduce exposure to delays.

4. Sustainability in Manufacturing

There is growing interest in sustainable production practices, including RoHS compliance, lead-free soldering, and energy-efficient factory environments. Electronics manufacturers must respond by implementing responsible processes and working with suppliers who share the same values.

Why Quality and Compliance Matter More Than Ever

When it comes to production and assembly, quality is more than a buzzword—it's a measurable requirement. A faulty capacitor or misaligned connector can result in expensive system failures, regulatory issues, or even safety concerns.

To meet modern expectations, manufacturers must:

Follow ISO-certified procedures

Maintain full traceability of components

Ensure regulatory compliance across target markets (CE, UL, REACH, etc.)

Maintain strong documentation for every stage of the process

Choosing a manufacturing partner with a deep understanding of international standards and a history of consistent delivery helps reduce risks and keeps projects on track.

What Sets Our Manufacturing Services Apart

Our approach is built around delivering practical, cost-effective manufacturing solutions tailored to meet each customer’s unique requirements. By applying lean manufacturing principles, we help clients reduce waste, improve efficiency, and gain measurable value in every step of the process.

Key benefits include:

Lower inventory demands

Reduced total acquisition costs

Supply chain resilience through multiple inventory locations

Improved product quality

Consistent, on-time delivery you can rely on

What to Consider When Choosing a Technical Assembly Partner

Finding a reliable service provider is about more than pricing or proximity. Here are key factors to evaluate:

1. Technical Expertise

Look for teams that can interpret your bill of materials (BOM), understand the application of each component, and make suggestions where appropriate. This ensures that your products are not only assembled correctly but also designed for success.

2. Supplier Relationships

Does the provider have access to a wide range of reputable manufacturers? Can they offer alternatives when primary parts are unavailable? These questions are especially important during global shortages or when dealing with niche specifications.

3. Project Flexibility

Can they accommodate small production runs or prototype builds? Can they ramp up to meet large-scale demand? Flexibility ensures that your partner can adjust alongside your project’s lifecycle.

4. Transparent Communication

Regular updates, clear technical feedback, and documentation of every phase help create confidence. Projects that lack open communication are more likely to experience delays and misunderstandings.

5. End-to-End Support

From early-stage design reviews to post-sale technical queries, the most reliable firms remain actively involved throughout the entire process. They provide ongoing value and ensure long-term reliability, not just short-term assembly.

Meeting Industry Demands: A Practical Approach

The sector serves a wide range of industries, including automotive, medical, aerospace, defense, consumer goods, and industrial automation.. Each sector has its own regulatory environment, tolerances, and expectations for delivery timeframes.

For instance:

Medical devices often require cleanroom assembly and documentation to meet stringent approval standards.

Automotive components must withstand harsh environmental conditions and vibration without performance degradation.

Aerospace systems demand redundancy, traceability, and exact part performance for mission-critical applications.

As these requirements grow more complex, manufacturing partners must respond with tailored approaches—balancing engineering support, materials expertise, and practical experience.

Building Long-Term Success with Trusted Partners

Supply chain challenges, new materials, evolving regulations—these realities require ongoing adaptation. Companies that treat production as a strategic function rather than a transactional service gain a competitive edge.

To succeed, it's essential to work with a partner that:

Understands your industry

Invests in continuous improvement

Keeps up with changing compliance rules

Prioritizes reliability over shortcuts

This is where experience matters. Businesses with a consistent record of on-time delivery, error-free builds, and in-depth component knowledge provide a firm foundation for long-term growth.

About Arrival Electronics Limited

Located in West Sussex, Arrival Electronics Limited is an independent electronic component supplier with deep roots in the electronics manufacturing sector. Known for its technical approach, reliable stock availability, and excellent customer support, the company serves clients across a wide range of industries—including automotive, broadcast, industrial, and aerospace.

Their team offers more than just product sourcing—they offer insight. They collaborate with manufacturers and design engineers to ensure all supplied parts meet application-specific needs. Whether supporting high-mix production or long-term component supply, Arrival Electronics Limited provides dependable service and extensive market knowledge that adds lasting value.

Final Thoughts

Electronics manufacturing is not just a mechanical process; it's a critical function that supports the quality, safety, and performance of the technology we depend on every day. Businesses that understand its nuances are better positioned to deliver products that work as intended, meet compliance goals, and perform reliably over time.

For companies seeking support in this complex space, Arrival Electronics Limited stands as a resourceful and experienced partner. With technical insight, customer dedication, and a clear understanding of today’s component landscape, they help businesses navigate the challenges and practical realities of bringing modern electronic products to market.

0 notes

Text

Boost SMT Quality with Automated Optical Inspection

Surface Mount Technology (SMT) has become the backbone of modern electronics manufacturing. As circuit boards grow more complex and component sizes continue to shrink, maintaining production quality has become more challenging. To address this, manufacturers rely on SMT automated optical inspection systems to enhance efficiency and ensure product reliability.

What Is SMT Automated Optical Inspection?

SMT automated optical inspection (AOI) is a high-speed visual inspection process used to verify the placement, alignment, and soldering of components on a printed circuit board (PCB). Using high-resolution cameras and advanced image processing algorithms, AOI systems scan each board for potential defects during or after assembly.

By catching issues early, these systems reduce rework, prevent defective units from moving forward, and increase yield rates. AOI is typically deployed at multiple points in the production line, including:

Post-solder paste inspection

Pre-reflow inspection

Post-reflow inspection

Each inspection stage targets specific issues such as insufficient solder, component misalignment, or solder bridging.

Why SMT AOI Is Critical to Electronics Manufacturing

The electronics industry demands tight tolerances and minimal defect rates. Even a single misplaced component can lead to product failure. Here's how SMT automated optical inspection supports manufacturing excellence:

1. Enhanced Accuracy

Automated inspection provides greater consistency than manual methods. It can detect:

Incorrect component orientation

Missing components

Cold solder joints

Tombstoning and lifted leads

These defects are often too subtle or time-consuming to spot with manual inspection.

2. Real-Time Feedback

Modern AOI systems integrate seamlessly into SMT lines, providing real-time defect detection and process feedback. When an issue is identified, operators receive alerts to make immediate adjustments. This minimizes downtime and material waste.

3. Scalable Performance

As demand increases, manual inspection becomes a bottleneck. AOI systems handle high-speed production environments with ease, inspecting hundreds of boards per hour without sacrificing accuracy. This makes SMT automated optical inspection ideal for both high-volume and high-mix production lines.

Benefits of Implementing AOI in SMT Production

Investing in AOI provides a range of tangible benefits:

Improved Product Quality: Early detection leads to fewer returns and better customer satisfaction.

Lower Operational Costs: Reducing scrap and rework translates to cost savings.

Faster Time to Market: Streamlined inspection accelerates the production cycle.

Compliance and Traceability: AOI systems often include data logging and defect classification features, aiding in quality audits and process optimization.

Common Defects Detected by SMT AOI

Effective inspection covers a wide array of potential issues, including:

Component misplacement

Solder bridges

Open circuits

Polarity errors

Solder balling

Insufficient or excessive solder

With high-resolution imaging and intelligent algorithms, AOI tools identify and classify these defects rapidly and with minimal human oversight.

Integrating AOI with Other SMT Equipment

For optimal results, AOI should be part of a fully integrated SMT inspection strategy. When combined with solder paste inspection (SPI) and X-ray inspection, manufacturers gain a full view of the assembly process. This layered approach ensures each stage is validated before moving to the next.

For instance, SPI evaluates solder paste deposition before components are placed, while AOI checks component placement and solder joints. In cases where defects may be hidden (like under BGAs), X-ray inspection complements AOI to provide a complete defect profile.

Choosing the Right AOI System

Selecting an appropriate AOI solution depends on several factors:

Board complexity

Component density

Production volume

Required inspection speed

Advanced AOI systems offer features such as 3D imaging, machine learning algorithms, and intuitive software interfaces. These innovations reduce false calls, simplify programming, and improve inspection reliability.

To explore AOI systems designed specifically for SMT applications, visit ASC International. Their cutting-edge technology supports manufacturers looking to improve inspection accuracy and throughput.

Final Thoughts

As electronics manufacturing grows more demanding, quality assurance tools must keep pace. SMT automated optical inspection provides the speed, accuracy, and consistency needed to meet today’s rigorous production standards. By identifying defects early and ensuring high-quality output, AOI protects your bottom line and strengthens customer confidence.

0 notes

Text

Why Are Surface Mount Inductors Vital in Modern Electronics? A Complete Guide

Surface mount inductors have emerged as critical components in today’s compact and high-performance electronic devices. As the demand for miniaturization and efficiency continues to grow, these components offer a reliable solution for energy storage, filtering, and signal integrity. Whether you are designing consumer electronics, industrial systems, or automotive applications, understanding the role and advantages of surface mount inductors can significantly enhance your product development process.

What Are Surface Mount Inductors?

Surface mount inductors are passive electronic components designed to store energy in a magnetic field when electrical current flows through them. Unlike traditional through-hole inductors, surface mount variants are mounted directly onto the surface of a printed circuit board (PCB), enabling compact, low-profile, and automated assembly designs. These inductors are widely used for their efficient space utilization and high-frequency performance.

How Do Surface Mount Inductors Work?

The basic working principle of surface mount inductors is grounded in electromagnetic induction. When current passes through the coil inside the inductor, it creates a magnetic field. This field resists changes in the current, providing a filtering or energy storage function depending on the application.

Surface mount inductors are typically manufactured using a ferrite or powdered iron core surrounded by a coiled conductor. The magnetic properties of the core and the number of coil turns determine the inductance value. Their compact design allows them to perform reliably in dense circuit boards.

Where Are Surface Mount Inductors Used?

These inductors are essential in multiple sectors where space-saving components are crucial. Common applications include:

Smartphones, tablets, and laptops

Power supplies and DC-DC converters

Automotive electronic control units (ECUs)

RF and telecommunications systems

Medical and industrial instrumentation

LED lighting systems and IoT modules

Each of these areas requires high-performance signal integrity and energy efficiency, both of which are facilitated by surface mount inductors.

What Are the Key Benefits of Surface Mount Inductors?

Surface mount inductors provide a range of advantages for engineers and product designers. Their integration into compact electronics is particularly valuable in today’s market.

Enable miniaturized circuit design for compact devices

Support high-frequency operations with excellent performance

Reduce production time through automated pick-and-place mounting

Offer low DC resistance (DCR) for higher efficiency

Enhance electromagnetic compatibility (EMC) in sensitive circuits

Provide thermal stability in harsh environments

Available in a wide variety of inductance values and sizes

These benefits make them indispensable in both analog and digital electronic systems.

What Are the Different Types of Surface Mount Inductors?

The choice of surface mount inductor depends on the specific application and performance requirements. Key types include:

Wire-wound inductors: Known for high Q-factor and current handling capabilities, ideal for power applications.

Multilayer inductors: Offer compact size and are suitable for high-frequency filtering.

Thin-film inductors: Deliver precision and low-profile characteristics, often used in RF circuits.

Molded inductors: Provide strong mechanical durability, often used in automotive environments.

Each type has unique characteristics that influence its behavior in a circuit, and selecting the right one depends on factors such as frequency, current rating, and size constraints.

How to Choose the Right Surface Mount Inductor?

Selecting the right surface mount inductor for your application involves considering several important technical parameters:

Inductance (L): Measured in microhenries (µH) or nanohenries (nH), this value defines how much energy the inductor can store.

Current rating: Determines the maximum current the inductor can handle without saturating or overheating.

Saturation current: Indicates the point at which the inductor loses its inductive properties.

DC resistance (DCR): Lower DCR means better efficiency and less power loss.

Frequency range: Ensures compatibility with the intended signal or switching frequency.

Size and footprint: Must match the PCB layout and spatial constraints.

Understanding these parameters helps ensure optimal circuit performance, reliability, and compliance with regulatory standards.

Why Are Surface Mount Inductors Preferred Over Through-Hole Types?

While both surface mount and through-hole inductors serve similar electrical purposes, surface mount options are increasingly preferred in modern electronic assemblies. This shift is driven by:

Smaller package sizes suitable for compact PCBs

Better performance at higher frequencies

Faster, more cost-effective automated manufacturing

Improved thermal performance in high-density applications

Enhanced mechanical stability during vibration or movement

Surface mount technology enables the design of lightweight, efficient, and high-performance devices across various industries.

What Are the Trends in Surface Mount Inductor Technology?

As technology evolves, surface mount inductors continue to improve in performance, durability, and miniaturization. Key developments in this field include:

Use of advanced core materials for higher energy density

Lower EMI solutions to support 5G and wireless technologies

Integration with ICs and other passives for modular designs

Eco-friendly manufacturing with lead-free soldering

High-reliability solutions for automotive and aerospace sectors

These innovations make surface mount inductors a forward-looking solution for next-generation electronic products.

Where to Buy High-Quality Surface Mount Inductors?

Finding trusted suppliers is essential for securing reliable surface mount inductors. It’s important to source components from distributors that provide:

Comprehensive technical datasheets

RoHS-compliant and quality-certified components

Wide inventory of top brands and value options

Global shipping and responsive customer service

Compatibility with high-frequency and power electronics

Buyers and engineers should consider trusted electronic suppliers with extensive product listings and verified sourcing standards.

Conclusion

Surface mount inductors are indispensable building blocks of today’s advanced electronic systems. Their compact form factor, high-frequency capability, and reliable performance make them ideal for power conversion, signal conditioning, and EMI suppression tasks. By understanding how these components work, where they are used, and how to select the right one, engineers can unlock new possibilities in their designs. As innovation accelerates, surface mount inductors continue to play a central role in enabling smarter, smaller, and more efficient electronics.

0 notes

Text

Electronic Manufacturing in Chennai — A Complete Industry Overview

If you’re exploring electronic manufacturing in Chennai, you’re looking at one of India’s fastest-growing and most dynamic industrial sectors. Chennai has emerged as a key hub for EMS (Electronics Manufacturing Services) and PCB design, attracting both domestic and international companies seeking quality, efficiency, and innovation.

This comprehensive overview will help you understand why Chennai is a preferred destination for electronics manufacturing, what the local industry offers, and how it can support your product development needs.

Why Chennai is a Leading Electronics Manufacturing Hub

Chennai’s rise as an electronics manufacturing center is driven by several unique advantages:

Strategic Location and Connectivity

Chennai offers excellent access to major ports like Chennai Port and Ennore Port, facilitating smooth import and export of components and finished goods. The city is well-connected via road, rail, and air to key markets across India and globally.

Skilled Workforce and Technical Expertise

Chennai is home to numerous engineering colleges and technical institutes that supply a steady stream of qualified engineers and technicians. This talent pool is well-versed in modern PCB design and electronics manufacturing processes, supporting innovation and quality.

Robust Infrastructure and Industrial Clusters

Dedicated electronics manufacturing zones, such as Sriperumbudur and Oragadam, host advanced industrial parks with reliable power, logistics, and facilities tailored for electronics production.

Government Support and Incentives

Tamil Nadu’s electronics manufacturing policy encourages investments through subsidies, incentives, and streamlined approvals. National initiatives like Production Linked Incentive (PLI) schemes further boost the sector.

Key Components of Electronic Manufacturing in Chennai

Electronics Manufacturing Services (EMS)

EMS companies in Chennai offer end-to-end manufacturing solutions, including:

Prototype development and New Product Introduction (NPI)

Printed Circuit Board Assembly (PCBA) with Surface Mount Technology (SMT) and Through-Hole Technology (THT)

Box build assembly and product integration

Testing, quality control, and compliance assurance

These companies serve diverse sectors such as consumer electronics, automotive, healthcare, industrial automation, and IoT devices.

PCB Design and Manufacturing

Advanced pcb design capabilities are a cornerstone of Chennai’s electronics ecosystem. Local companies specialize in multilayer PCB layout, high-density interconnects (HDI), and design for manufacturability (DFM), enabling efficient production and performance optimization.

PCB manufacturing units support these designs with precise fabrication, assembly, and inspection processes.

Trends Shaping the Electronics Manufacturing Industry in Chennai

IoT and Smart Devices: Increasing demand for connected devices is driving innovation in EMS and PCB design services.

Automation and Industry 4.0: Adoption of robotics and AI-powered quality control is enhancing manufacturing precision.

Sustainability: Growing focus on eco-friendly materials and energy-efficient manufacturing practices.

Export Growth: Chennai’s electronics exports are rising steadily, supported by favorable trade policies and global demand.

How to Choose the Right EMS Partner in Chennai

When selecting an EMS company in Chennai, consider the following factors:

Technical expertise in PCB design and advanced manufacturing technologies

Quality certifications such as ISO and IPC standards compliance

Manufacturing capacity and scalability to support your product lifecycle

Transparent communication and project management for smooth collaboration

Conclusion

Electronic manufacturing in Chennai is a thriving, well-supported industry with strong infrastructure, skilled talent, and innovative EMS providers. Whether you are a startup or an established company, Chennai offers a reliable ecosystem to develop, manufacture, and scale your electronic products efficiently.

Understanding the local capabilities in pcb design and EMS will help you make the best choices and accelerate your product’s journey from concept to market success.

#ElectronicManufacturing#EMSIndia#PCBDesignChennai#ElectronicsInChennai#PCBAIndia#SMTAssembly#ElectronicsManufacturingServices#PCBManufacturingIndia#ChennaiEMS#ManufacturingInChennai

0 notes

Text

Electronic Spacer Market Report: Forecasting Growth to USD 1.13 Bn by 2025–2032

MARKET INSIGHTS

The global Electronic Spacer Market size was valued at US$ 743.8 million in 2024 and is projected to reach US$ 1.13 billion by 2032, at a CAGR of 6.2% during the forecast period 2025-2032.

Electronic spacers are precision components used to maintain proper spacing and alignment between electronic parts in various applications. These spacers come in multiple forms including hexagon swage spacers, round spacers, and metric spacers, each designed for specific mechanical and electrical requirements. They play a crucial role in ensuring structural integrity and electrical insulation in assemblies.

The market growth is driven by increasing demand from consumer electronics and automotive sectors, where miniaturization and reliable component spacing are critical. While the U.S. leads in market size currently, China’s rapid electronics manufacturing expansion is creating new growth opportunities. Key players like Wyandotte Industries and Keystone Electronics are expanding their product portfolios to cater to evolving industry needs, particularly in high-density PCB applications.

MARKET DYNAMICS

MARKET DRIVERS

Expansion of Consumer Electronics Manufacturing to Accelerate Market Demand

The global electronic spacer market is experiencing robust growth driven by the rapid expansion of consumer electronics manufacturing. With smartphone production exceeding 1.4 billion units annually and tablet production reaching nearly 200 million units, the demand for precision components like electronic spacers continues to surge. Electronic spacers play a critical role in PCB assemblies and device housings, ensuring proper component alignment and thermal management in increasingly compact electronic designs. Major electronics manufacturers are adopting automated production lines that require standardized spacer components, creating a stable demand pipeline for market players.

Automotive Electronics Revolution to Spur Technological Advancements

The automotive sector’s shift toward electric vehicles and advanced driver assistance systems is generating significant demand for specialized electronic spacers. Modern vehicles now contain over 3,000 electronic components requiring precision spacing solutions that can withstand vibration, temperature fluctuations, and electromagnetic interference. Automotive-grade spacers must meet stringent quality certifications, driving innovation in materials and manufacturing processes. The growing adoption of vehicle electrification, with projections indicating electric vehicles will comprise over 30% of new car sales by 2030, positions electronic spacers as critical components in next-generation automotive architectures.

MARKET CHALLENGES

Raw Material Price Volatility Creates Margin Pressure

While the electronic spacer market shows strong growth potential, manufacturers face persistent challenges from raw material price fluctuations. Stainless steel, aluminum, and specialty polymers – which account for approximately 60-65% of production costs – have experienced significant price volatility in recent years. This instability makes cost management difficult, particularly for manufacturers serving price-sensitive market segments. Smaller manufacturers with limited purchasing power find it especially challenging to maintain profitability while competing with larger firms that benefit from economies of scale.

Other Challenges

Supply Chain Disruptions Recent global supply chain disruptions have highlighted vulnerabilities in the spacer manufacturing ecosystem. Many producers rely on specialized metal alloys and polymers sourced from limited suppliers, creating bottlenecks during periods of high demand or logistical challenges.

Inventory Management Pressures The need to maintain extensive inventories of spacer variants for diverse applications increases working capital requirements and storage costs, presenting ongoing operational challenges for market participants.

MARKET RESTRAINTS

Miniaturization Trend Challenges Traditional Spacer Designs