#Database Market

Explore tagged Tumblr posts

Text

#crypto#politics#us politics#political#donald trump#president trump#elon musk#news#american politics#jd vance#law#money#cryptocurrency#etherium#database#fraud#hacked#billions#economic#economics#economy#government#banks#cash#market#6% drop#investments#investors#us policy#bybit

22 notes

·

View notes

Text

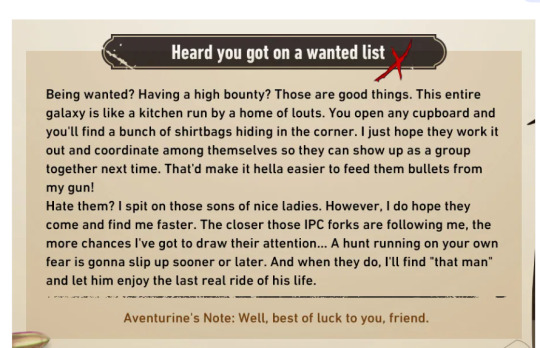

not to overthink but I find it interesting that Aventurine is the one who comments on Boothill's announcement that goal to find Oswaldo

#the will team up trust#okay but the database says that the strategic investment department and the marketing development department have 'troubled past'#Aventurine's goal was to get into the strategic investment department since the very beginning#what if he also tries to reach Oswaldo but haven't succeeded yet#hsr boothill#aventurine

89 notes

·

View notes

Text

youtube

Went down a bit of a research rabbit hole and found this analysis of the musical structure of "Take Me to Church". The use of and twist on the amen cadence is sly and brilliant and pretentious as fuck in a really great way.

#hozier#take me to church#hozierposting#i love when artists are just so unrepentantly weird in their work#the other singer-songwriter that comes to mind who does this is vienna teng#she wrote a song about a marketing database ffs#and 'stray italian greyhound' is about the revival of hope in politics#be strange; be yourself#the type of people who are into that will find you

67 notes

·

View notes

Text

#Ashkan Rajaee#executive outreach strategy#B2B lead generation 2025#best lead gen techniques#business development strategy#efficient outreach methods#offshore team management#social media integrated database#how to build accurate email lists#LinkedIn lead generation expert#admin team cost efficiency#Ashkan Rajaee Medium#lead generation innovation#executive database marketing#targeted outreach strategy

2 notes

·

View notes

Text

The RFP asks for some relevant projects, and please include the following information, including budget and "actual cost."

The information I have for a project includes:

Pre-bid cost estimate

Construction contract award amount

Final construction contract amount

Our company's fee

Construction cost

. . . none of which look like "budget," but one or two might, maybe? count as "actual cost." (We'll probably use one of those! Because people are very bad about recording every. last. type. of cost. for the fucking projects.)

#UGH#angst and woe#work bullshit#i hate it here#and - bonus round! - the project principals magically expect us to always have all the numbers!#because they provided them in the past of course!#sometimes they did; or perhaps they have lost track of which of the dozen or types of cost/fee/etc they HAVE provided us#but of course it's -marketing's- fault if we don't have allllllllll the fucking numbers#not the design team's fault for never filling out the big comprehensive company database :) :) :)

2 notes

·

View notes

Text

I actually have, like, work tomorrow. and probably more consistently work coming up?? which is nice but weird for me lmao

#i spreadsheeted so well i got an executive assistant position for a marketing company#full disclosure it is my DAD'S marketing company#but he started this shit when i was in high school and ive been doing the shit he doesnt want to the entire time#i just actually have a title now and a more consistent schedule for doing that work#instead of one random unpaid weekend a month#its also more database stuff for one of his teams#glad my autism can be of service

12 notes

·

View notes

Text

"We Have Solutions" Enhance your business growth with our customized B2B contact databases. Connect with the right companies in various industries to achieve success. 1. All our data are 100% Human Verified. 2. We verify our data in every 90 days. 3. You will receive FREE SAMPLES to check our data accuracy. 4. Countries we cover - USA, CANADA, EUROPE, UK, AUS, NZ, MENA, LATAM, ASIA & More. If you need any assistance feel free to DM or drop mail to [email protected] (or) [email protected]

#b2b#b2bmarketing#b2b lead generation#b2bsales#database marketing#digital marketing#emailmarketing#market research#market analysis#sales#business#internet marketing

2 notes

·

View notes

Text

.

#maybe im becoming a lil more petty asa person or something idk#but my manager will make some kinda snide comment about me not managing my team better#and im just sitting here thinking of all the ways i would be uniquely capable of making his work life hell#too many processes and too many features that im the only one who understands#our biggest marketing push rn is dependent on one of my projects i could torpedo this shit rn#it would not be difficult to work around a test case to introduce a bug i know wont be caught until it hits production#if i just bounced no one else understands our regulatory reporting shit#if i was really in a ‘burn it all down fuck consequences’ state of mind i could do a lot more#lemme just start deleting customer database. dropping tables. whoops everyones account balance got reset to $0 howd that happen#woah this place lost all its data the day they’re scheduled to be audited! what are the odds!!!

2 notes

·

View notes

Text

Microsoft has and is attempting to maintain a monopoly on military enterprise database contracts by suppressing the availability of certain information and negatively affecting the usability of its products if certain parameters are met by the user.

4 notes

·

View notes

Text

Home Furnishings Products & Materials Database Provider

#b2b data provider#b2b data services provider in india#b2b database#marketing#business directory#business news#sale data#latest news#trending

2 notes

·

View notes

Text

TARGET DECISION MAKER DATABASE FOR YOUR BUSINESS

Is your marketing team require defined target audience?

At Navigant, our Target Decision Maker (TDM) Database Services are administered by a distinct, specialized team of professionals. This team excels in various data-related tasks, including data sourcing, organizational data profiling, data cleansing, data verification, data validation, and data append.

Our backend team goes beyond mere data extraction. They possess the experience to grasp the campaign's objectives, target audience, and more. They strategize and plan campaign inputs, share market insights to refine the approach, depth, and reach, and even forecast potential campaign outcomes.

Book A Meeting: https://meetings.hubspot.com/sonal-arora

Contact us Web: https://www.navigant.in Email us at: [email protected] Cell: +91 9354739641

#Navigant#database#dataprofiling#generation#demandgeneration#marketing#socialmediamarketing#business#seo#emailmarketing#marketingstrategy#leads#sales#socialmedia#contentmarketing#onlinemarketing#marketingtips#branding#leadgenerationstrategy#entrepreneur#smallbusiness#salesfunnel#leadgen#advertising

2 notes

·

View notes

Text

Data-driven marketing uses consumer data and analytics to make informed decisions, personalize content, and optimize strategies for more effective and targeted campaigns. For more information read the article.

2 notes

·

View notes

Link

2 notes

·

View notes

Text

Support small enterprises! Spread only organically grown balderdash and artisanal homemade poppycock!

re: google AI. seriously. do you want machine generated misinformation or do you want to come here, to our beloved tumblr, and receive specially hand crafted misinformation. support real artists, guys. come to tumblr for your misinformation

#The student misbehaviour database form at work has a category called ‘purveyor of misinformation’#i feel like that phrase should be on a business card you’d get from a vendor at the weekend markets#also describes some parts of tumblr very well

50K notes

·

View notes

Text

Coal Prices Index: Trend, Chart, News, Graph, Demand, Forecast

In the first quarter of 2025, the coal market in the United States displayed fluctuating price patterns, influenced by supply limitations, demand shifts across sectors, and seasonal weather events. A notable spike in January saw coal prices climb by 4.4%, largely driven by a polar vortex that disrupted mining operations across major coal-producing states. The harsh winter weather hampered extraction and transportation, limiting supply during a period of increased consumption. Additional upward pressure stemmed from growing demand from data centers and AI-powered industrial operations, sectors increasingly reliant on stable energy sources. Speculative buying intensified as market participants anticipated policy reversals under the new U.S. administration, particularly regarding energy regulations, which could favor coal and fossil fuel industries.

However, the momentum did not carry into February, when prices slipped by 0.8%. The decline was primarily attributed to a rebound in coal supply, which helped balance the earlier disruptions. Although the steel industry experienced a surge in domestic production due to a 25% tariff on imported steel—thereby boosting demand for coking coal—this increase was offset by a mild winter and reduced electricity consumption from the power generation sector. Power utilities, which traditionally account for a large share of coal usage, scaled back procurement, limiting the potential for sustained price increases during the month.

Get Real time Prices for Coal: https://www.chemanalyst.com/Pricing-data/coal-1522

By March, coal prices recovered with a 3.4% rise, supported by continued demand from both the steel and power sectors. Crude steel production remained elevated, and projections of record-high electricity usage during the upcoming warmer months revived interest in securing coal supplies. Despite the increasing penetration of renewable energy sources, coal retained a critical role in industrial and energy production due to its reliability and storage advantages. As a result, the U.S. coal market ended Q1 2025 with a modest net gain, underpinned by intermittent supply constraints, industrial demand, and political speculation.

In the Asia-Pacific region, particularly Indonesia, coal market dynamics during Q1 2025 were shaped by a complex interplay of weather disturbances, regulatory changes, and evolving international demand. January saw a price increase of 1.5%, as heavy monsoon rains disrupted coal mining in key regions, tightening supply. At the same time, a new government mandate requiring exporters to retain foreign exchange earnings within Indonesia increased operational complexities and costs. These factors collectively supported price growth. Demand from key international buyers such as India and other Southeast Asian nations, particularly for low-calorific-value (low-CV) coal, remained robust, adding further price pressure.

The initial strength waned in February, with prices declining by 2.4%. Although mining operations stabilized and output recovered, market sentiment was dampened by uncertainty surrounding the new fiscal and export policies. Demand for medium- and high-CV coal began to weaken, particularly as international buyers grew cautious amid shifting regulatory frameworks. Some support was provided by steady demand from Chinese utilities for low-CV coal, but it was not enough to offset overall market pessimism.

By March, Indonesian coal prices dropped another 2.3%, influenced by a decrease in the HBA (Harga Batubara Acuan) index and mounting competition from South African coal, which was priced more competitively in global markets. Domestic consumption in Indonesia remained firm, especially in power generation and stainless-steel manufacturing, but sluggish export demand and ongoing policy concerns weighed on prices. Despite short-term headwinds, Indonesia’s coal industry maintained its strategic focus on long-term projects like coal gasification, suggesting a potential rebound in domestic usage in future quarters.

In Europe, coal prices trended downward throughout Q1 2025, reflecting the continent’s long-term shift toward renewable energy sources. January witnessed a temporary increase in coal consumption as surging natural gas prices pushed countries like Germany and Poland to rely more heavily on coal for electricity generation. This short-term economic pivot was driven by coal’s comparative cost-effectiveness amid volatile gas markets, though it also sparked debate about environmental backsliding due to higher carbon emissions associated with coal combustion.

Despite the initial boost in coal usage, the overall demand trajectory remained negative. The International Energy Agency forecasted a significant 19% drop in European coal consumption for the year, driven by weak industrial activity, stagnating electricity demand, and increasingly stringent environmental regulations. EU member states continued to invest heavily in renewable energy infrastructure, reinforcing their commitment to reducing dependence on coal. By the end of Q1, the initial gains in coal consumption had been erased, reaffirming the region’s strategic pivot away from fossil fuels.

In the Middle East and Africa, South Africa's coal market experienced steady price declines throughout the quarter due to sluggish demand and persistent oversupply. In January, coal prices fell by 1.8%, affected by a combination of weak industrial demand and elevated stockpiles at the Richards Bay Coal Terminal. The closure of several ArcelorMittal South Africa steel plants significantly reduced coal offtake, especially for coking coal, weakening the overall market tone.

The bearish sentiment deepened in February with a further 2.8% price decline. Increased coal inventories and underwhelming demand from export markets like India and other parts of Asia-Pacific kept prices under pressure. While Mid-CV coal showed some price resilience, broader market conditions remained unfavorable. Compounding the situation was Sasol’s decision to halt coal exports starting in May and recurring logistical bottlenecks, particularly in rail transportation.

By March, South African coal prices dipped by another 1.9%, bringing the total quarterly decline to 6.5%. International buying interest remained tepid, and domestic stockpiles remained high despite steady consumption for electricity generation. Infrastructure issues, such as rail line disruptions, further limited export efficiency, creating a supply glut within domestic borders. The combination of declining export demand, oversupply, and logistical constraints left the South African coal market under significant pressure, with limited signs of immediate recovery.

Get Real time Prices for Coal: https://www.chemanalyst.com/Pricing-data/coal-1522

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Coal Price#Coal Prices#Coal Pricing#Coal News#Coal Database#Coal Price Chart#Coal Price Trend#Coal Market Price#Price of Coal

0 notes

Text

Biotech vs Pharma

The biotech and pharma industries are evolving at breakneck speed. But most professionals still lump them together—missing the nuances that define their risks, opportunities, and strategic decisions.

#pharma database provider in India#latest news on paracetamol#paracetamol global market practices in India#paracetamol manufacturers in India#Paracetamol manufacturing process#list of pharmaceutical export companies in India#list of pharmaceutical products exported from India

0 notes