#Digitization of HR Files and Documentation is Important

Explore tagged Tumblr posts

Text

Top 7 Reasons why Document Digitization is Important

The average expense associated with a single compromised or misplaced record containing confidential data amounts to $148 - with an increase of 4.8% year-over-year.

Data is invaluable in our rapidly changing world. It's essential to realize that even a small number of physical documents holding crucial information can lead to significant financial losses if lost. Is it worth the risk to rely solely on physical records? Certainly not!

Interested in freeing yourself from the burden of maintaining paper records? Embrace document digitization and scanning services. They can convert your important financial and confidential documents into a secure digital format, ensuring safety and organization while providing instant access for a lifetime. The benefits are numerous, including cost reduction in record management and improved operational efficiency.

Document digitization is the transformative process that takes your physical documents into the digital realm. It's like giving your paperwork a futuristic makeover, unlocking a world of possibilities. No more sifting through paper stacks—now you can effortlessly access your files with just a few clicks. Digitized documents are agile and versatile, easily shared and collaborated on with a simple tap.

Discover the advantages of document digitization for organizations in the session below.

What is document digitization?

Experience lightning-fast searches and breeze through finding crucial information. Embrace the power of document digitization to revolutionize your workflow, declutter your space, and unleash productivity. Discover seven reasons why document digitization is crucial below.

Top 7 reasons why document digitization is imperative

Reducing the document management cost

Storing, safeguarding, and maintaining large quantities of physical records will always entail substantial expenses. However, by embracing document digitization services, you can significantly reduce your financial outlay to less than a quarter of what you would typically invest in maintaining physical storage solutions.

Compliance with digital communication

Given the rapid advancements in digital communication technologies, the need for comprehensive digitization has become essential for numerous data-sensitive organizations - particularly those regularly managing significant quantities of records and documents.

The Greenitiative

With the global conversation revolving around climate change and the importance of preserving trees, there is a growing trend among people to embrace a paperless approach. This movement is particularly evident in various fields, including healthcare, education, and banking and finance, where digital recordkeeping and document management have seamlessly integrated into their operational processes.

Data security-The need of the hour

The security of physical records is vulnerable to various risks such as theft, destruction, manipulation, mishandling, and even fire damage. However, by converting your physical documents into a specific digital format, you effectively eliminate these risks and significantly improve the security of your data on a much larger scale.

Unlimited backup & disaster recovery

In contrast to traditional paper storage facilities, digital backups possess remarkable longevity and are impervious to the destruction caused by natural calamities. Consequently, opting for a digital backup storage solution for your sensitive records is widely regarded as a significantly more secure, dependable, and effortlessly accessible choice.

Easily accessible data

Suppose you have an extensive set of paper records and have to search for a specific set of data within that vast storage – this process can be arduous, time-consuming, and financially impractical. However, by embracing data digitization, digital imaging, and digital storage, you can instantly retrieve your records regardless of time or location.

Optimize your urban space

Managing physical records within urban offices can be costly and inefficient. That's why our offsite physical storage services and data digitization facilities offer a smart solution. By storing your records offsite and digitizing them, you can free up valuable urban space while ensuring easy access and organized data management.

Why Exela HR Solutions?

Enhance your HR workflows and achieve successful digital transformation by utilizing our advanced HR document and records digitization services. With over 20 years of industry leadership in document scanning and processing, we specialize in crucial aspects such as rapid speed, large-scale capabilities, high capacity, and exceptional resolution. Our extensive expertise in the field, along with our reliable infrastructure and worldwide presence, empowers businesses from various sectors to improve the profitability and turnaround times of their HR operations while minimizing potential risks. Throughout our history, our digitization services have consistently transformed countless HR documents, both small and large, into easily accessible digital records.

Industry-leading performance

Exela HR Solutions' Document Scanning and Digitization solutions use advanced technology and precise performance tools to provide exceptional results. We prioritize quality assurance monitoring, error recovery, and automatic color preservation, ensuring superior outcomes. Our remarkable achievements set us apart in the industry:

Up to 640 PPM/1150 DPM high-speed scanning

1000+ item auto-feed capacity

Optical resolutions up to 600 DPI

Multiple inline recognition technologies

Up to 51 total pockets

· Custom-configurable

Our front-line scanning solutions can be tailored entirely to meet your requirements. Furthermore, we collaborate closely with you to enhance your HR ecosystem based on your specific needs, such as speed, capacity, application, and more.

· Multi-industry, multi-application

Our offerings are designed to adapt quickly for seamless "scan-to-document" functionality, catering to various HR forms and documents. These include but are not limited to NDAs, policy documents, onboarding forms, staffing plans, employee records, and others.

· Dedicated support

We have independently developed and continue to oversee our own technology. Our dedicated call centers are accessible round the clock, 365 days a year, providing technical assistance and other forms of support. We offer both immediate and pre-scheduled support options.

· 40+ years of expertise built-in

Having accumulated over four decades of involvement in the scanning and processing industry, our company provides HR professionals with unparalleled knowledge and proficiency.

· Automated data extraction

Our proprietary document digitization systems have the capability to capture a wide range of data types with a strong level of certainty. The extracted data is subsequently processed for automatic indexing and seamlessly transferred into the client's secure content management system, enabling effortless searchability and accessibility.

· Quality assurance

Our comprehensive Quality Management System encompasses both quality assurance and quality control. We ensure the preservation of data integrity by conducting regular random samplings, performing evaluations to verify the quality and accuracy of document digitization, validating data, and promptly identifying any anomalies.

· Data security

Our offsite data and document processing facilities implement stringent security measures to safeguard physical and digitally scanned records. These measures encompass facility access controls, limitations on source-material handling, and the utilization of network encryption, adhering to industry best practices.

Our data capture solutions employ advanced technologies such as Optical Character Recognition (OCR), Intelligent Character Recognition (ICR), and Optical Mark Recognition (OMR) based on artificial intelligence. These technologies enable you to accurately interpret and convert various data types, including machine-generated text, handwriting, document forms, and barcodes in PDF 417 and Code 39 formats. The processed data can then be easily organized, searched, presented online, translated, and manipulated without any difficulties. Thanks to this robust technological infrastructure, our clients have successfully transitioned their HR operations from traditional paper-based systems to digital platforms within a short timeframe. Talk to our experts to transform your document-based processes. Get Exela HR Solutions now for all your documentation needs!

DISCLAIMER: The information on this site is for general information purposes only and is not intended to serve as legal advice. Laws governing the subject matter may change quickly, and Exela cannot guarantee that all the information on this site is current or correct. Should you have specific legal questions about any of the information on this site, you should consult with a licensed attorney in your area.

Source & to read more: https://ow.ly/No0q50P4cNW

Contact us for more details: https://ow.ly/Oh1R50OVt2u

#hr services#hr solutions#human resources#human resources services#hr outsourcing#Digitization of HR Files and Documentation is Important#Digitization of HR Files#Digitization of HR Files and Documentation#Digitization of HR Documents

1 note

·

View note

Text

Hey! It's A Great Time To Review Your W4! and other fun tax things they don't seem to be teaching in school. (detailed explanations in the read more)

Disclaimer: These are super basic basics. I'm not an expert. I've just seen a lot of people get hit hard and it really sucks.

Don't throw away your income documents.

Keep copies of your returns.

File every year you have an income.

File even if you're going to owe.

Amend your return if you realize there's something wrong on the original.

There's a statute of limitations on refunds.

They can use your refund for certain debt.

There are programs so you don't get dinged for your joint filer's debt.

You can request a rush on the basis of extreme hardship.

You can request a waiver for penalties/interest on late payments.

Know the basics for your area. Due diligence, right?

If you have a business, please be careful.

Review your W4.

Keep your contact info up to date.

If they send a letter, response immediately.

If you don't hear anything in 4 weeks, call/message/visit a local office.

You can file directly with the IRS now, and some states.

If you use tax preparation software/service, double check everything.

If you're expecting a refund triple-check your bank info.

If you're making a payment, triple-check it goes through.

Don't wait til the last day to make a payment.

Consider getting a registered online account with the IRS and/or your state.

Take several deep breaths.

(↓ more details ↓)

Don't throw away your income documents. W2s, 1099s, anything that shows income and/or withholding. How long? Forever.

Keep copies of your returns, in formats you can easily access. Highly recommend a hard copy as well as digital, or at least available offline. How long? Forever. (I know there are statutes of limitations, but I don't trust that)

File every year you have an income. Honestly might want to file even if you don't - you can put all zeroes. If you should have filed and didn't, they can make an educated guess, and you might not like it. If you owe, they can add failure to file/failure to pay penalties that can really add up.

File even if you're going to owe. You can set up payment plans, if needed. If you don't file, the penalties and interest are insane.

Amend your return if you realize there's something wrong on the original. Audits aren't just for comedic effect on sitcoms, and as above, the penalties and interest are insane.

There's a statute of limitations on refunds. For the IRS, it's "3 years from the date you filed your federal income tax return, or 2 years from the date you paid the tax". States vary.

They can use your refund for certain debt. Child support, student loans that aren't on a plan, overpayment of benefits, traffic tickets…

There are programs so you don't get dinged for your joint filer's debt. They take longer to process, but you will be able to keep your refund even if your joint filer's refund is used to pay a debt.

You can request a rush in cases of extreme hardship. Eviction, medication, feeding children. It's not a guarantee, but you can ask.

You can request a waiver for penalties and interest on late payments. Again, not a guarantee, but you can ask.

Know the basics for your area. You don't have to be an expert, but the basics: Which forms to file, filing dates, how extensions work, if there are city/county taxes that need to be filed separately, if you need to make estimated payments…

If you have a business, please be careful. all of the above plus more. It can get so messy, and so hard to clean up.

Review your W4. Make sure you have the right amount coming out. Do you want to owe, get a refund, get close to zero? Make an informed decision and make sure your W4 reflects that. Highly recommend checking again in a few months, sometimes HR can be shifty bastards.

Keep your contact info up to date. If they need more info, they won't hunt you down. This includes if you move after you file. Phone number isn't as important, but address is.

If they send a letter asking for information, respond immediately. They will either not process the return, or make an educated guess based on what they have. Even if it's just to say "Hey, I can't get this document because _", they need something. Also - getting a letter doesn't necessarily mean there's something wrong. With electronic filing, they don't get images of your W2/1099, and they want to double check. Or there's an address/filing status change they want to be sure of. Or maybe you had an identity theft situation in the past. Or or or. Or maybe you are a "fraudster"!

If you don't hear anything in maybe 4 weeks, call/message/visit a local office. Sometimes things happen. A letter was sent but was returned. A manual review was stalled and just needed a nudge. Sometimes the return didn't show up at all. Also - when/if you contact them, please be civil. The person who answers the phone has so little control over any of this. A polite, "Hey, just wanted to make sure everything's good" will go a long way.

You can file directly with the IRS now, and some states. In some cases, you can even port your info from IRS to state, saving you the trouble of re-entering a bunch of stuff. Best, you can be sure it actually was received.

If you use tax preparation software/service, double check everything. Make sure the numbers look reasonable, make sure you know where their fee is coming from, make sure you know where your refund is going (like to a pre-paid card or your own bank), make sure you know FOR SURE if they are scheduling a payment on your behalf. Sometimes it's not obvious, and this can result in double-payments or worse. Mostly, make sure the return is accepted. Get it in writing. Don't wait two months to ask, when they are closed for the season.

If you're expecting a refund triple-check your bank info. If something changes with your bank info after you file, call.

If you're making a payment, triple-check it goes through. I mean so you don't double-pay. If you paid online, make sure you got a confirmation number. If you don't, call. Don't assume it didn't work and pay again. Even if you figure it out before it hits your bank, there's nothing the revenuers can do to stop it.

Don't wait til the last day to make a payment. If something goes wrong, if the check is lost in the mail or the bank is acting fucky, it will go badly. Preparation software is evil about scheduling the payments for the last minute.

Consider getting a registered online account with the IRS and/or your state. You can track your return, and also see letters before they're mailed, see past info, send messages, make payments, check on payment status, update info. Yes, the websites aren't great, but it gives you a little more control.

Again, not a Tax Professional in any way. Just don't want anyone to get fucked by Surprise! Tax Shit!

6 notes

·

View notes

Text

Story time about how being "inclusive" is often used as pretty jewlery to make workplaces seem less shitty than they are.

So I used to work for a place that did workers compensation claims. I was a data entry worker - essentially my job was to processes all incoming and outgoing documents and make sure they digitally got attached to the correct claim so other people could do their job.

I had been working at this place for about 6 months, and we had a MASSIVE turnover in people. Like over half my team/coworkers quit. Well, I just happened to be really, really good at data entry work. My pattern recognition skills and OCD compulsions were a perfect fit for this job. Even management constantly would say how impressed they were with the amount of work I could get done.

Here's the problem - the 2 other people who didn't quit during the turnover were my superiors. They had problems with the way I communicate (AuDHD). So instead of dealing with it, they openly harassed me in group chats. Our boss would see the chats and then call them out on it and tell them to stop.

Fast forward a few months later. Shit is getting crazy for our company as we were expanding. I'm getting harassed constantly by all my "teammates" and from higher ups. I go to HR about the concern and they decide to have me just directly report to our boss. But the problem wasn't solved. I still had to work with and ask questions to the team who obviously hated me. Simply because I communicate and work differently than I do. I was always willing to help them get caught up on work, but never the other way around.

So I've been at this place for about a year now and I'm testing a brand new method of cataloging data to the correct files. (Example- adding medical records for a specific person to their specific digital file so the adjuster assigned to the claim can review it). Turns out something broke with the process and over 700 files were lost.

So I get pulled into a very sudden meeting with me, the 2 teammembers who were my superiors and my boss. They are freaking out trying to figure out how to fix this. When I could finally get a chance to speak I told them I had backups of most of the files. They all went silent and just stared at me.

I explained that the way the process worked gave me anxiety because of this very potential issue. Once the files were uploaded to the claims, they were deleted from the storage location. Gone permanently. I didnt want to be the one responsible for losing important documents if something when wrong, so as a precaution (and a newly developed OCD compulsion) I would save most files to a different folder as a backup (usually just the files I had to convert from one format (ex: word doc) to a PDF).

Turns out I ended up saving the company thousands of dollars and thousands of work hours. My boss literally said to my face "your OCD saved the day! You're a hero!". The very next day everyone was back to being upset at me for how I did my job 😅

Well, over the course of my year there, management put together a COMPANY WIDE MANDATORY meeting about inclusivity and anti-discrimination. Of course I attended and I was having to hold back tears and laughter as everyone made all these promises to not judge people and to be open to "other working styles". The meeting was a 5 hour long meeting with different games and activities. You could tell the company execs were so proud of themselves for the meeting.

The very next day I received the perfect example of what NOT to do from my own boss who helped lead the company meeting! Essentially she heard a rumor that I was setting up meetings with other departments to work on things that hadn't been approved through the proper channels. She pulled me into a virtual meeting and, I kid you not, lectured me for 5 minutes straight about how that wasn't allowed. When I finally got a chance to speak I calmly told her I'd never done anything like that before. I admitted that occasionally I would ask someone else questions in a random email here or there when it related to what we were talking about. But I had never done any of the things she just accused me of and lectured me about. She was "assuming the worst and the negative instead of something positive" which was one of the core values we had spent almost an hour on at the meeting the day before.

I immediately went to HR crying. What was the point of that ridiculous mandatory meeting if the company superiors were still going to discriminate against me??? Well after a year of putting in hard work for them, fighting against all the harassment they threw at me, and doing my best to advocate for myself I ended up quiting. It was an amazing paying full time (40hr) job that fit my skills perfectly. But I had to quit because I couldn't stand listening to them say "we love your OCD and it really helps the company, but you need to stop doing things that way. It is really annoying and takes too long. Plus your coworkers don't like it. But keep giving us those same results! You really are our best worker!"

My OCD was turned into a joke. Something that was only okay when it benefitted them, but a disgusting trait to hide away when it didn't.

Tldr: I gave a year of my life to a company that outwardly toted being "inclusive" while simultaneously being harassed for my OCD and AuDHD symptoms. All while being told my "OCD saves the company money but like, can you please stop doing things that way? Thanks!"

#actually ocd#ocd#obsessive compulsive disorder#actually adhd#actually autistic#actually audhd#adhd adult#adhd brain#adhd#autistic adult#autistic#inclusivity#discrimination#disability#disabled#physical disability#physically disabled#mentally disabled#mental disability

104 notes

·

View notes

Text

10 Essential Items to Bring for Every Successful Job Interview in Nigeria

Interviews can be nerve-wracking, especially when you want everything to go perfectly. From researching common interview questions to practicing your responses, you put in the effort to prepare. However, many candidates overlook an important aspect: what to bring to the interview.

If you're getting ready for an interview in Nigeria, this guide will ensure you have everything you need for a smooth and successful experience. Here’s a checklist of the 10 essential items to bring for every job interview.

1. Hard Copy of Your Resume

This might seem obvious, but always carry a printed copy of your resume. Many employers request a physical resume even if you've submitted one online. Ensure it's printed on good-quality paper and neatly placed in a file to avoid wrinkles. Additionally, keep a soft copy on your phone or email, just in case you need to send it again.

2. Academic and Professional Certificates

Employers in Nigeria often ask for proof of your qualifications. Carry copies of your academic degrees, professional certifications, and other relevant documents. It’s best to keep them organized in a folder so you can quickly retrieve them if asked.

3. Portfolio of Your Work (If Applicable)

If you're applying for roles such as graphic designer, photographer, architect, writer, or any creative field, having a portfolio is crucial. You can print some of your best works or save them on a tablet or laptop to present them digitally.

4. Copies of Important Documents

Before your interview, confirm with the HR department if they require any specific documents. However, as a rule of thumb, always carry:

Experience letters from previous employers

Cover letters tailored to the role

Reference letters from past supervisors

NYSC certificate (for Nigerian graduates)

5. List of Professional References

Having a reference list shows preparedness. Some employers may want to contact people who can vouch for your skills and character. Include the names, job titles, companies, phone numbers, and emails of at least two or three professional references.

6. Office Address and Contact Information

Nigeria’s unpredictable traffic and road network can make navigation tricky. To avoid delays, write down the office address and contact number in case your phone battery dies or GPS fails. It’s also a good idea to leave early to avoid unforeseen delays.

7. Valid Identification Card

Most offices in Nigeria have strict security policies. You may be required to show a valid ID before entering the premises. Carry your National ID, driver’s license, international passport, or voter’s card for easy access.

8. A List of Questions for the Interviewer

An interview is a two-way street. The employer is evaluating you, but you should also assess the company. Prepare a list of insightful questions such as:

What are the company’s core values?

What are the key performance expectations for this role?

What opportunities exist for professional growth within the company?

9. Water Bottle and Light Snacks

Nigeria’s weather can be hot, and you might spend time waiting before your interview starts. Bring a water bottle to stay hydrated and, if needed, a small snack like biscuits or fruit to keep your energy levels up.

10. Confidence and a Positive Attitude

Your attitude plays a crucial role in making a great first impression. Nigerian employers appreciate candidates who exude confidence, professionalism, and enthusiasm. Keep a positive mindset, make eye contact, and believe in your abilities.

Bonus Tips for a Successful Interview

Carry essential stationery. Bring a pen and a small notepad to jot down important points.

Dress appropriately. Even if the company has a casual dress code, aim for professional attire. For men, a neat suit or corporate shirt and trousers are ideal. For women, a formal dress or blazer with a skirt/trousers works well. ChatGPT can also help you decide on the best outfit based on the company culture and industry.

Choose a neat bag. A well-organized bag ensures your documents remain in good condition.

Research the company. Visit their website and social media pages to understand their mission, values, and culture.

Final Thoughts

Preparing for a job interview goes beyond rehearsing answers. Ensuring you have all the necessary documents and essentials can significantly improve your chances of success. Use this checklist to stay organized and confident as you step into your next job interview in Nigeria.

Best of luck!

#jobsearch#nigeria#nigeria job#job interview#JobInterviewTips#CareerSuccess#InterviewPrep#NigeriaJobs#JobHunting#InterviewChecklist#CareerGrowth#JobSearchNigeria#InterviewEssentials#ProfessionalDevelopment

2 notes

·

View notes

Text

File Tracking Software: How It Works & Why It Matters

File Tracking Software is a modern solution designed to help businesses efficiently manage and monitor their documents and files. As organizations grow, handling vast amounts of paperwork becomes challenging. This is where File Tracking Software steps in, providing a systematic way to locate, track, and secure files throughout their lifecycle. At AIDC India, we offer robust File Tracking Software solutions that simplify document management and boost operational productivity.

File Tracking Software helps organizations reduce errors, avoid lost files, and maintain compliance by keeping a digital record of file movements. Its importance in 2025 continues to increase, especially with the rising need for secure and accessible document handling.

How File Tracking Software Works: Key Components and Processes

The core of any File Tracking Software lies in its ability to provide real-time updates about file locations and statuses. Typically, this software integrates with technologies like barcodes and QR codes to tag physical files. When a file moves from one location to another, scanning the tag updates the system instantly.

The software’s dashboard allows users to view file status, track check-ins and check-outs, and generate reports. This transparency helps reduce file misplacement and speeds up retrieval processes.

AIDC India’s File Tracking Software also supports integration with existing enterprise systems, ensuring smooth workflow management. By automating file tracking, businesses save time and resources, enhancing overall efficiency.

Major Benefits of File Tracking Software for Businesses

File Tracking Software offers several advantages to organizations, making it an indispensable tool in today’s digital world. One of the primary benefits is improved accuracy. Manual file management often leads to misplaced or lost documents, but File Tracking Software minimizes such errors by automating the tracking process.

Another advantage is enhanced security. Sensitive documents are protected through controlled access and audit trails, reducing the risk of unauthorized handling. This is especially critical for industries like healthcare, legal, and finance.

Additionally, File Tracking Software boosts productivity by reducing the time spent searching for files. Employees can quickly locate documents using the software’s search functions. At AIDC India, we ensure that our solutions are user-friendly and customizable, fitting unique business needs.

Why Choose AIDC India for File Tracking Software Solutions

AIDC India is a trusted name in the field of automatic identification and data capture technologies. Our File Tracking Software solutions are designed with the latest technology, ensuring reliability and scalability.

We work closely with clients to understand their requirements and tailor solutions that integrate seamlessly into their existing processes. Our expert team supports installation, training, and ongoing maintenance, ensuring a hassle-free experience.

Choosing AIDC India means opting for quality, innovation, and a commitment to helping your business thrive with smart file management.

Industry Applications of File Tracking Software in 2025

File Tracking Software is valuable across many industries in 2025. In healthcare, it helps track patient records and medical files, ensuring quick access and confidentiality. Legal firms use it to manage case files efficiently, maintaining chain of custody and compliance.

Educational institutions benefit by organizing student records and administrative documents, reducing paperwork clutter. Corporate offices use File Tracking Software to handle contracts, HR documents, and project files, improving collaboration and accountability.

AIDC India’s solutions cater to these diverse needs, offering flexible and scalable software options.

Enhancing Security with Barcode and QR Code Integration

One of the key features of modern File Tracking Software is its integration with barcode and QR code technology. By tagging files with these codes, businesses can automate tracking processes and maintain accurate logs of file movements.

Barcodes and QR codes are scanned easily using handheld devices or mobile apps, instantly updating the file’s status in the software. This minimizes human error and strengthens security.

At AIDC India, we provide advanced barcode and QR code integration with our File Tracking Software, ensuring your documents are tracked accurately and securely at every step.

AIDC India’s Innovative Approach to File Tracking Technology

AIDC India combines cutting-edge technology with deep industry knowledge to develop File Tracking Software that meets modern challenges. Our solutions are designed for ease of use, quick deployment, and compatibility with various hardware.

We also emphasize data analytics and reporting, helping businesses make informed decisions based on file usage patterns. Our continuous updates and support ensure that your File Tracking Software remains effective and aligned with evolving business needs.

Partnering with AIDC India means gaining a competitive advantage through smarter document management.

The Future of File Tracking Software: Trends and Insights

Looking ahead, the future of File Tracking Software includes increased use of cloud computing, AI, and IoT integration. Cloud-based platforms enable remote access and collaboration, breaking geographical barriers.

Artificial Intelligence can predict file usage trends and automate categorization, while IoT devices enhance real-time tracking accuracy. These advancements will further simplify file management and improve security.

AIDC India is committed to adopting and implementing these innovations, helping businesses stay ahead in file tracking technology.

Call to Action

Book a consultation with AIDC India today and explore customized solutions designed to enhance your business efficiency. Contact us now to get started!

#FileTrackingSoftware#DocumentManagement#SmartFileTracking#BarcodeTracking#QRcodeTracking#DigitalFileManagement#BusinessEfficiency#InventoryControl

0 notes

Text

Top Enterprise Document Management Tools to Streamline Workflow and Ensure Compliance

In today’s fast-paced digital business environment, managing documents efficiently and ensuring regulatory compliance is more important than ever. As organizations scale, handling thousands of files, policies, procedures, and compliance records becomes a critical challenge. That’s where Enterprise Document Management Tools come into play. These systems are not just repositories—they’re strategic enablers of operational efficiency, audit readiness, and secure collaboration. At the forefront of this transformation is Omnex Systems, offering advanced solutions like Document Pro, Document Version Control Software, and Integrated Document Management Systems to meet the demands of modern enterprises.

Why Document Management Matters for Enterprise Workflow

The complexity of managing documents manually or through outdated systems leads to version confusion, delays in approvals, and gaps in compliance. Enterprise document management tools streamline these workflows by:

Providing centralized, real-time access to critical documents

Automating routing and approval processes

Ensuring version integrity through robust Document Version Control Software

Maintaining full audit trails and user accountability

Omnex Systems understands these enterprise needs and has developed solutions that blend flexibility, security, and integration.

Meet Document Pro: Omnex Systems’ Flagship Document Management Solution

Document Pro software by Omnex Systems is designed specifically for enterprises that need an intelligent, scalable approach to document control. Unlike basic file storage systems, Document Pro is a comprehensive solution tailored to industries where compliance and process integrity are non-negotiable.

Key features include:

Automated workflows for reviews and approvals

Role-based access control to protect sensitive information

Integrated document lifecycle management from creation to archive

Audit-ready reporting tools to support regulatory inspections

Whether you’re dealing with ISO standards, IATF 16949, AS9100, or FDA compliance, Document Pro simplifies adherence by embedding these requirements directly into your document management process.

Ensure Consistency with Document Version Control Software

Managing multiple versions of a document is one of the biggest challenges in quality management systems. Omnex’s Document Version Control Software ensures that all users are working with the most current version of a document—eliminating outdated procedures and minimizing the risk of non-conformance.

Features include:

Automatic version updates

Clear version history and comparison tools

Access to previous document iterations

Alerts and notifications on changes or approvals

This ensures that any modifications go through proper approval workflows and that only authorized versions are in use—boosting both productivity and compliance.

Integrated Document Management Systems: More Than Just Storage

Omnex’s Integrated Document Management Systems offer a holistic approach to enterprise document control. These systems do more than just manage documents—they connect documents with quality processes, risk management, training, and audits.

With integration across multiple business units, these systems support:

Seamless cross-functional collaboration

Real-time data synchronization across platforms

Automated linkage of documents to audits, CAPAs, and training modules

Improved traceability for regulatory compliance

This deep integration provides enterprises with a powerful tool for aligning documentation with strategic business goals.

Multi-Module Documentation Management for Complex Enterprises

Modern businesses are not limited to a single document type or department. They require multi-module documentation management that can handle a range of functions—from engineering and production to HR and compliance.

Omnex Systems addresses this with multi-functional modules that serve:

HR documentation and employee files

Engineering change requests and technical drawings

Supplier quality and procurement documentation

Internal procedures and work instructions

All modules communicate within the platform, creating a single source of truth and reducing redundancies.

Business Document Management with Enterprise-Level Security

Security is a non-negotiable component of Business Document Management. Omnex Systems ensures enterprise-level data protection with features such as:

Role-based permissions

Encrypted data storage

Secure user authentication

Full audit trails and activity logs

These security measures protect sensitive information from unauthorized access while supporting compliance with industry-specific standards.

Advantages of Omnex Systems’ Document Management Software

When organizations adopt Omnex Systems’ Document Management Software, they experience immediate and long-term benefits:

Improved Efficiency: Automated workflows eliminate bottlenecks and reduce approval time.

Enhanced Collaboration: Real-time access allows teams to work together seamlessly across locations.

Reduced Risk: Version control and audit trails minimize the chances of non-compliance.

Regulatory Compliance: Built-in support for global standards ensures smooth audit readiness.

Scalability: The system grows with your business, supporting multi-site and multi-country operations.

Remote Access: Cloud-based functionality enables remote teams to stay connected and productive.

Customization: Tailor the software to your specific document workflows and industry needs.

Integration: Connect seamlessly with Omnex’s quality, risk, and audit modules.

Data Accuracy: Reduce manual errors with automated document lifecycle management.

Cost Savings: Eliminate paper-based processes and reduce administrative overhead.

Real-World Use Case: How Document Pro Transformed Compliance at a Global Manufacturer

A global automotive parts supplier struggled with document control across its five international locations. Manual processes led to inconsistent document versions, delayed approvals, and frequent audit findings. After implementing Omnex’s Document Pro software, the company was able to:

Standardize document workflows across all facilities

Ensure consistent document versioning and access

Integrate documents with audit and training records

Pass external audits with zero non-conformities

The implementation resulted in a 60% reduction in document processing time and significantly improved regulatory compliance.

Conclusion: The Future of Document Management Is Integrated, Automated, and Secure

As organizations face growing complexity and regulatory pressure, the need for robust Enterprise Document Management Tools is clearer than ever. Tools like Document Pro, Document Version Control Software, and Integrated Document Management Systems from Omnex Systems provide the foundation for streamlined workflows, improved compliance, and scalable growth.

With a strong focus on integration, automation, and user control, Omnex’s solutions offer a future-ready platform for document management. Whether you're a global enterprise or a growing business, Omnex Systems equips you with the technology to manage your documents as strategic assets—not liabilities.

For more info please visit us +1 734-761-4940 (or) [email protected]

0 notes

Text

HR Software in India: The need of modern workplaces

In today's era, the operation of any institution or organization is not possible without employees. But when the number of employees starts increasing, their management also becomes a challenge. At this point, HR software emerges as a valuable resource. Digital transformation in employee management

Earlier, where the information of employees was managed in files, now everything has become digital. With the help of HR software, all the information related to attendance, leaves, salary, documents and performance is now managed on a single platform. This lowers the possibility of error while also accelerating the work.

Accurate attendance and time management system

Coming and leaving the office on time is a part of discipline. HR software makes it completely automatic. Who came at what time, how many days he stayed in the office and how many leaves were taken - all this can now be seen in just one click.

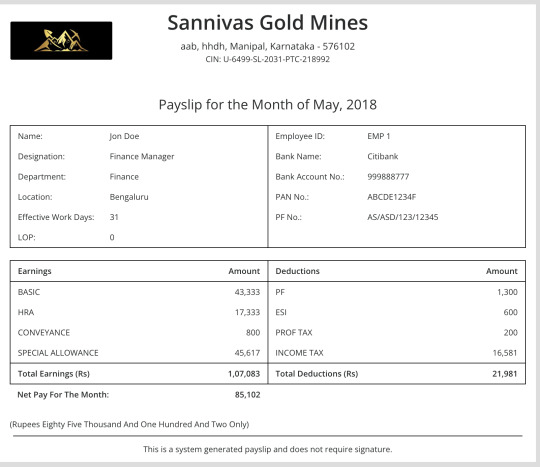

Salary and reporting convenience

Monthly salary, tax deductions, PF calculations and salary slip preparation is a cumbersome process. But HR software makes it easy. The entire salary management is now digital, providing transparency and satisfaction to both employees and management.

Compliance and employee satisfaction

When employees get timely leaves, correct salary and their performance is evaluated fairly, their bond with the organization deepens. HR software strengthens this relationship.

Conclusion

HR software in India is no longer just a technical facility, but has become a basic necessity for organizations. It makes work organized, transparent and simple. In today's competitive environment, where proper use of time and resources is important, HR software is an invaluable tool.

0 notes

Text

Virtual Offices in Noida’s SEZs: Tax Perks & Credibility for Small Businesses

Noida’s rise as a business hub has been significantly driven by its Special Economic Zones (SEZs), particularly in areas like Sector 62, 63, and Noida Expressway. These dedicated zones aren’t just clusters of office buildings—they are policy-backed ecosystems that offer numerous advantages for businesses, especially those involved in IT, exports, and consulting. Now, thanks to the evolution of flexible workspace models, even startups, freelancers, and remote-first businesses can tap into these zones—without renting a physical space—through a virtual office in Noida.

In this blog, we’ll explore why SEZs in Noida are an increasingly popular choice for virtual office setups and how entrepreneurs can benefit from tax incentives, credibility, and more—without burning a hole in their pocket.

What Is an SEZ, and Why Is It Important?

A Special Economic Zone (SEZ) is a specifically delineated duty-free enclave deemed to be outside the customs territory of India. Businesses operating from SEZs enjoy several incentives, including tax breaks, relaxed regulatory norms, and better infrastructure. The goal? To boost exports, foreign investment, and employment.

Noida is home to multiple SEZs, including:

SEZ in Sector 144 (IT/ITES Zone)

SEZ in Sector 135 (Expressway corridor)

SEZ in Sector 62/63 (software technology parks)

These zones have attracted multinational corporations, tech startups, and export-focused service firms—and now, virtual office providers are helping smaller businesses get a slice of this strategic location too.

Why Choose a Virtual Office in a Noida SEZ?

Renting office space in Noida’s SEZs can cost upwards of ₹40,000–₹1 lakh per month depending on size and location. But many virtual office providers now offer SEZ-compliant business addresses at a fraction of that cost—sometimes as low as ₹1,500/month.

So why are companies opting for a virtual setup inside these zones?

1. Access to Tax Incentives

Businesses that operate from SEZs may be eligible for:

Income Tax Exemptions under Section 10AA of the Income Tax Act for eligible units

No GST on exports of services or products

Faster customs clearance for those dealing in physical goods (though most virtual office users are service-oriented)

For startups offering software, digital services, consulting, or IT exports, having an SEZ-based address can enhance both compliance and benefits during tax filing.

2. Boosted Credibility

A Sector 62 or 135 SEZ address on your business card or invoice can add instant professionalism—especially when dealing with international clients or government departments. It signals that your company is part of a structured, policy-driven business environment.

3. Ease of GST and Company Registration

Most SEZs in Noida are fully authorized for GST registration and MCA incorporation, provided your virtual office provider is SEZ-registered. This enables you to receive official documentation like:

Rent agreement

NOC (No Objection Certificate)

Utility bill

—all essential for registration and bank account setup.

4. Flexibility Without Long-Term Lease

A traditional SEZ lease may require you to commit to years and pay a hefty security deposit. A virtual office, on the other hand, allows monthly billing, scalability, and easy exits—perfect for early-stage companies or consultants who want to test markets before going all in.

Who Should Consider a Virtual Office in Noida’s SEZs?

While large corporations continue to anchor these zones, there’s an emerging wave of smaller, agile businesses making the most of SEZ virtual addresses:

IT service exporters

Freelancers working with overseas clients

Startups building software-as-a-service (SaaS) products

Consultants in finance, legal, HR, or engineering

Marketing agencies catering to offshore clients

If your revenue model includes international billing, foreign clients, or platform-based product offerings, an SEZ address isn’t just beneficial—it may be your competitive edge.

How Virtual Office Providers Operate in SEZs

A reliable virtual office provider in a Noida SEZ will:

Own or lease commercial real estate within the SEZ

Be approved by relevant SEZ authorities for offering business correspondence services

Issue proper documentation for use in legal, financial, and government matters

Common services include:

Dedicated business address with mail/courier handling

Optional call-answering or receptionist services

Access to meeting rooms (on-demand basis)

GST-compliant billing and SEZ-approved registration

Some premium providers also include startup support, legal assistance, and branding consultation—ideal for solo founders or small firms.

Cost of Virtual Offices in Noida SEZs

Here’s what you can typically expect:

Entry-level plans: ₹999–₹2,499/month

GST registration & documentation packages: ₹3,000–₹5,000 (one-time)

Optional add-ons: Call forwarding, dedicated phone line, workspace usage, etc.

Compared to ₹40,000+ per month for renting even a 100 sq. ft. cabin in a SEZ, the value proposition of virtual offices is clear, especially if you don’t require a daily desk.

Common Misconceptions: SEZ Virtual Offices vs. Regular Virtual Offices

Let’s bust a few myths:

Myth 1: SEZ addresses are only for exports or IT giants. Truth: As long as your business provides services that could be exported (even digitally), you can qualify.

Myth 2: You can’t register for GST using a virtual SEZ address. Truth: You absolutely can—just make sure your provider offers proper legal documentation and is SEZ-compliant.

Myth 3: SEZ-based virtual offices are expensive. Truth: While a bit more premium than regular virtual plans, the tax benefits and brand credibility often outweigh the small added cost.

Tips for Choosing the Right SEZ Virtual Office in Noida

✅ Check SEZ Accreditation: Make sure the address and provider are recognized by the Noida SEZ authority.

✅ Verify Registration Support: Can they help with GST, startup incorporation, etc.?

✅ Ask About Location Specifics: SEZs are large—prefer addresses in IT/ITES zones like Sector 135 or Sector 62.

✅ Clarify Cancellation Terms: Month-to-month flexibility is crucial, especially for new ventures.

Real Use Case: A Consultant’s Leap with a SEZ Virtual Office

Mehul, a freelance data analytics consultant working from his home in Noida, landed a project with a U.S. fintech firm. When they asked for a registered Indian GST invoice, he had no clue where to start. Through a virtual office provider in Sector 135’s SEZ, he registered for GST, got a professional business address, and now invoices in dollars—with zero customs or GST issues.

His effective monthly cost: ₹2,000. His credibility? Priceless.

Final Thoughts

In the fast-evolving landscape of Indian business, flexibility is key—but so is strategy. A virtual office in Noida located inside an SEZ brings the best of both worlds: operational cost savings with the strategic perks of an elite business zone.

Whether you're a solo consultant looking to attract global clients, a startup needing GST registration, or a SaaS founder eager to scale from a policy-backed location, SEZ virtual offices are worth exploring.

Prestige, compliance, and tax advantages used to be exclusive to big firms. Not anymore. With SEZ-based virtual office solutions now accessible to lean teams and ambitious freelancers, your next big move might just start with a small monthly subscription—and a powerful address.

#VirtualOfficeInNoida#NoidaSEZ#SEZIndia#StartupIndia#FreelancerIndia#GSTCompliant#SaaSStartups#NoidaBusiness#TaxSavingsIndia

0 notes

Text

Jobs Portal Nulled Script 4.1

Download the Best Jobs Portal Nulled Script for Free Are you looking for a powerful, customizable, and free job board solution to launch your own employment platform? The Jobs Portal Nulled Script is your ideal solution. This fully-featured Laravel-based job board script offers premium functionality without the high cost. Whether you're building a local job site or a global hiring platform, this nulled script gives you everything you need—completely free. What is the Jobs Portal Nulled Script? The Jobs Portal Nulled Script is a premium Laravel-based job board application designed for businesses, HR agencies, and entrepreneurs who want to build a seamless job posting and recruitment website. The script comes packed with advanced features like employer and candidate dashboards, resume management, email notifications, location-based job search, and more—all without any licensing fees. Why Choose This Nulled Script? Unlike expensive premium plugins or themes, this Jobs Portal Nulled Script offers unmatched value. It provides a user-friendly interface, customizable design, and enterprise-level tools to make recruitment easier for both job seekers and employers. Plus, it's completely free to download from our site, allowing you to save money while building a professional job board. Technical Specifications Framework: Laravel 8+ Database: MySQL 5.7 or higher Language: PHP 7.4+ Responsive Design: Fully mobile-optimized API Ready: RESTful API endpoints available SEO Optimized: Built-in tools for on-page SEO Top Features and Benefits Employer & Candidate Dashboards: Tailored experiences for recruiters and job seekers. Smart Resume Management: Easily manage and filter resumes by job category and skills. Advanced Job Search: Location and keyword-based filtering for accurate results. Email Alerts: Automated job notifications for registered users. Payment Integration: Support for paid job postings with multiple gateways. Multi-language Support: Reach users across the globe effortlessly. Who Can Use This Script? The Jobs Portal Nulled Script is versatile and ideal for: HR agencies wanting a digital recruitment platform. Startups looking to monetize job listings or applications. Universities or colleges offering campus recruitment tools. Freelancers who want to provide job board services to clients. How to Install and Use Installing the Jobs Portal Nulled Script is straightforward: Download the script from our website. Upload the files to your server using FTP or a file manager. Create a MySQL database and import the provided SQL file. Edit the .env file to include your database credentials. Run the Laravel migration and seed commands to set up the tables. Visit yourdomain.com to start configuring your job portal! No technical expertise? No worries. The documentation provided makes it easy even for beginners to set up a complete job board system. FAQs – Frequently Asked Questions Is the Jobs Portal Nulled Script safe to use? Yes, we carefully scan and verify all files to ensure they are free of malware or backdoors. However, always install scripts in a secure environment. Can I customize the script? Absolutely. Since it’s built on Laravel, you have full control to customize routes, models, views, and controllers to fit your unique business model. Does the script support third-party integrations? Yes. You can integrate third-party services like payment gateways, newsletter tools, and analytics platforms with ease. Is it legal to use a nulled script? While we provide the script for educational and testing purposes, always ensure you comply with local software laws and licensing terms if you go live. Recommended Tools for WordPress Users If you're managing your site with WordPress, we recommend using UpdraftPlus Premium nulled for effortless backups and restoration. For search engine optimization, All in One SEO Pack Pro is a must-have tool to help your website rank faster and more effectively.

Take your online recruitment platform to the next level today. Download the Jobs Portal and build a modern, scalable, and highly effective job board without spending a dime!

0 notes

Text

“Manxel HRMS Explained Like You’re 5 (But Smarter)”

Introduction

Whether you're an HR manager juggling leave approvals, a team lead trying to track hours, or an employee who just wants a simple way to submit requests — you've probably dealt with the headaches of traditional HR systems. That’s where Manxel HRMS comes in.

But what exactly does it do? Let’s break it down in simple, human language — no tech jargon here.

✅ What is Manxel HRMS?

Manxel HRMS (Human Resource Management System) is a smart, cloud-based software solution that helps organizations manage all their HR tasks in one place — digitally and efficiently. It’s built to save time, reduce manual work, and make HR more transparent and user-friendly for everyone involved.

🧩 Core Features of Manxel HRMS

1. 🕐 Attendance Management

Tired of signing registers or guessing who’s in the office? Manxel tracks employee attendance with automated clock-in/clock-out features. You can:

View daily and monthly working hours

See productive vs. break time

Get attendance alerts and summaries

Employees get peace of mind, and HR gets accurate records — win-win!

2. 📥 Request Handling Made Easy

Manxel makes managing leave, shift swaps, or HR document requests super smooth. Employees can submit requests right from their dashboard, and managers can approve or reject them with full transparency. The approval trail shows exactly who’s reviewed it.

No more back-and-forth emails or confusion.

3. 📊 Performance Dashboard

Manxel's dashboard brings all your important data to one screen. You’ll find:

Your attendance stats

Leave balances

Approved/rejected requests

Company-wide announcements

Your work trends over time

It’s real-time and visual — so you’re always in the loop.

4. 💬 ManChat – Built-In HR Communication

Need to ask HR about your payslip? Want to send a document to your team lead? Use ManChat — Manxel’s internal chat system — to send messages, share files, or follow up on pending tasks. No need to switch to external apps.

5. 📄 Resume Analysis for Recruiters

Hiring just got smarter. Upload a resume, and Manxel will analyze it, extract important info (skills, experience, etc.), and help you compare candidates easily. It cuts down hiring time and improves decision-making.

6. 📱 Mobile-Friendly Access

Manxel works beautifully on desktops and mobile devices. Whether you're working remotely or from the office, you can check-in, submit requests, and stay connected — all from your phone.

💡 Why Should You Care?

Because HR shouldn’t be frustrating. Manxel makes it seamless. Whether you’re running a business, managing a team, or working as an employee, it helps you get things done faster, smarter, and with fewer mistakes.

🔚 Final Thoughts

If you're looking to bring efficiency, transparency, and ease into your workplace — Manxel HRMS is the tool for the job. No more chasing approvals. No more manual errors. Just clean, simple HR that works the way you do.

#ManxelHRMS#SmartHR#EmployeeExperience#HRSoftware#WorkSimplified#DigitalHR#HRMSTools#ModernWorkplace#70s

1 note

·

View note

Text

From Manual to Digital: How HRMS Systems Transform HR Management

The evolution of Human Resource (HR) management has been one of the most significant changes in the business world over the last two decades. Traditionally, HR departments operated manually paper files, spreadsheets, and countless hours spent on repetitive tasks were the norm. However, with the advent of HRMS (Human Resource Management Systems), the HR function has shifted from being purely administrative to a strategic powerhouse that supports business growth, compliance, and employee satisfaction.

As organizations move toward automation and digital transformation, understanding how HRMS systems are reshaping HR practices is essential. In this blog, we’ll explore the limitations of manual HR processes, the features and advantages of digital HRMS platforms, and how businesses can leverage them for long-term success.

The Pitfalls of Manual HR Management

Before the digital era, HR professionals were burdened with extensive paperwork. Recruitment involved printing resumes and manually tracking applicants. Payroll was calculated using spreadsheets, with a high margin for error. Attendance was recorded on punch cards or sign-in sheets, and leave requests required back-and-forth emails or paper forms. This system not only slowed down operations but also increased the likelihood of human error.

Manual HR management comes with several risks. Misfiled documents can lead to compliance issues, inaccurate payroll can affect employee trust, and delayed responses to HR queries can hurt morale. Additionally, without real-time data, managers struggle to make timely decisions related to workforce planning, performance, and hiring. These inefficiencies are further amplified as a business grows, making manual processes unsustainable in the long term.

What Is HRMS and Why It Matters

An HRMS (Human Resource Management System) is a digital solution that integrates all key HR functions into one platform. From storing employee data and processing payroll to managing performance reviews and recruiting new talent, an HRMS automates and streamlines the entire employee lifecycle. These systems not only help reduce the administrative burden on HR teams but also provide actionable insights through analytics and reporting.

The growing importance of HRMS lies in its ability to align HR processes with organizational goals. In today’s competitive business environment, organizations need to be agile, data-driven, and compliant with regulations an HRMS supports all of these priorities. Whether your team is remote, hybrid, or in-office, an HRMS system ensures that HR operations remain consistent, secure, and efficient.

How HRMS Systems Transform Traditional HR Functions

The transformation from manual to digital HR management is profound, touching every aspect of the employee journey. Here’s how HRMS systems are revolutionizing core HR processes:

1. Centralized Employee Data Management

In manual setups, employee records are scattered across multiple files, folders, and systems. HR professionals often waste time searching for data or correcting inconsistencies. With HRMS, all employee information is stored in a centralized, cloud-based database. This includes personal details, job roles, compensation history, tax documents, performance data, and more. Having all this data accessible in real-time ensures consistency, improves compliance, and allows for quick decision-making.

2. Streamlined Recruitment and Onboarding

Recruiting manually can be chaotic. Applications are tracked using spreadsheets, resumes are reviewed one by one, and there’s a lack of coordination between interviewers. HRMS platforms streamline recruitment by automating job postings, resume screening, interview scheduling, and offer letters. Once a candidate is hired, onboarding tasks — such as document submission, training schedules, and policy sign-offs — are digitized. This results in a smoother, faster onboarding experience that leaves a positive impression on new hires.

3. Accurate Payroll and Compliance Management

Payroll is one of the most critical HR functions, and any errors can lead to dissatisfaction or even legal troubles. Manual payroll processing is time-consuming and error-prone, especially when factoring in overtime, bonuses, tax deductions, and benefits. HRMS automates payroll calculations, ensures timely salary disbursement, and handles compliance with tax laws and labor regulations. Many HRMS systems also generate audit-ready reports, making it easier to stay compliant with government policies.

4. Automated Attendance and Leave Tracking

Managing attendance manually especially for large or remote teams can result in inaccurate records, buddy punching, and disputes. HRMS systems use digital timesheets, biometric integration, or mobile GPS tracking to monitor attendance. Leave requests are managed through employee self-service portals, where approvals and balances are updated automatically. This not only eliminates confusion but also gives HR and management an accurate picture of workforce availability.

5. Performance and Appraisal Management

Manual performance reviews are often subjective and inconsistent. HRMS platforms standardize performance evaluation through measurable KPIs, real-time feedback, and automated appraisal cycles. Managers can set goals, track progress, and provide feedback directly through the platform. Employees, in turn, gain visibility into their performance metrics and growth paths. This structured approach ensures fairness, transparency, and continuous improvement.

Empowering Employees with Self-Service Tools

One of the most powerful features of modern HRMS platforms is the employee self-service portal. Traditionally, employees needed to contact HR for every small update whether it was to check their leave balance, download a payslip, or update their contact information. With self-service functionality, employees can handle these tasks independently and securely.

This empowerment leads to a more engaged workforce. Employees feel more in control of their information and are more likely to trust the system. At the same time, HR departments experience a significant reduction in routine queries, allowing them to focus on more strategic initiatives.

Real-Time Analytics and Strategic Insights

One of the key advantages of digital HRMS platforms is the ability to track, analyze, and interpret HR data in real time. Manual systems make it difficult to spot trends or identify problems until it’s too late. HRMS software provides dashboards and reports on critical metrics such as:

Employee turnover

Attendance trends

Hiring efficiency

Training progress

Compensation benchmarking

These insights enable HR leaders and executives to make informed decisions based on data rather than intuition. For example, if turnover in a department is unusually high, HRMS data can help uncover whether it’s due to compensation issues, manager feedback, or a lack of growth opportunities.

Cost Savings and Operational Efficiency

Implementing an HRMS may require an initial investment, but the long-term savings are substantial. By reducing paperwork, automating tasks, and minimizing errors, HRMS platforms help cut down administrative costs. They also reduce the need for multiple standalone tools, such as payroll software, attendance trackers, or performance review templates everything is integrated into a single system.

Moreover, HRMS solutions improve operational efficiency by speeding up HR processes. For example, processing payroll for 100 employees manually might take two days. With HRMS, the same task can be completed in just a few hours with minimal risk of error.

Enabling Scalability and Flexibility

As companies grow, their HR needs become more complex. Manual systems often break under the pressure of increased headcount, expanded locations, or changing regulations. HRMS platforms are designed to scale with the organization. New users, departments, workflows, and geographies can be added easily without disrupting operations.

Additionally, with cloud-based deployment, HRMS systems offer unmatched flexibility. HR professionals, managers, and employees can access the system from anywhere ideal for remote or global teams. This ensures business continuity even during unexpected disruptions, such as a pandemic or natural disaster.

Future of HR: Why HRMS Is Here to Stay

The global workforce is becoming increasingly digital, remote, and data-driven. To thrive in this environment, HR departments need to move beyond manual tools and adopt systems that support:

Agile workforce planning

Remote work support

Data-informed HR strategies

Employee well-being and retention

An HRMS platform is no longer a luxury it’s a critical business tool that bridges the gap between HR and business strategy.

Conclusion: The Time to Go Digital Is Now

The transition from manual to digital HR management is not just a technological upgrade it’s a strategic transformation. An HRMS system empowers organizations to manage their most valuable asset their people with greater efficiency, accuracy, and foresight. It replaces outdated processes with smart automation, actionable insights, and seamless employee experiences.

Whether you’re a growing startup or a large enterprise, adopting an HRMS is a forward-thinking investment that pays dividends in productivity, compliance, and culture. As the workplace continues to evolve, having the right digital tools in place ensures your HR function is not just keeping up but leading the way.

0 notes

Text

Statutory Compliance in India – It is a serious matter for both HR and Business

Let’s talk straight – running a business is not easy in India. Work is not limited to just serving the customer, there are also legal responsibilities (statutory responsibilities). And if the HR team takes them lightly, then understand that a penalty, notice, and a court case are certain.

That’s why every HR professional should have a basic understanding of statutory compliance, whether it is in a startup or a large group.

What is Statutory Compliance?

In simple words:

Statutory compliance means following the labor and employment-related laws made by the government.

There are many laws in India which tell what should be the salary structure, bonus, leave, safety and rights of the employee. It is a legal obligation for business to follow them.

Some major laws that apply to every company:

EPF (Employees' Provident Fund) Act

ESI (Employees' State Insurance) Act

Payment of Gratuity Act

Minimum Wages Act

Bonus Act

Shops and Establishment Act

Labour Welfare Fund (LWF)

Payment of Wages Act

And brother, every state has its own Shops & Establishment law - Delhi has a different one, Maharashtra has a different one.

🇮🇳 The Complexity of Compliance in India is Real

Take an example – your company is registered in Bangalore, but some of your salespeople work in the field in Punjab. Now you will have to pay attention to the laws of both Karnataka and Punjab.

From above:

Every law has a different return filing date

Some compliances are monthly, some quarterly, some annually

PF, ESI, PT, TDS – all have their own portal and deadline

If the record is not complete at the time of audit, then a fine is imposed (and that is not a small amount!)

That is why compliance in India is not just a check-list – it is a full-time responsibility.

Why is it important for HR to understand Compliance?

HR's work is not limited to just hiring or engagement. Compliance is directly linked to HR's work.

While creating a salary structure Along with Basic, HRA, allowances, PF, and ESI calculation should be correct. Otherwise, either the employee's benefits will be cut or a case will be filed against the company.

Employee Onboarding UAN (Universal Account Number), ESI number, and documentation are mandatory for every new employee.

Leaves and Working Hours Are you giving statutory holidays? Are weekly offs being given properly? Is overtime being calculated correctly?

Exit Formalities Gratuity, full & final settlement, form 16 — timing and format of all should be correct.

If HR does not take care of all this, then there can be some confusion during audit or visit of labour inspector.

Common Compliance Mistakes Companies Make

Filling PF return at the last moment

Wrong Bonus calculation (or ignoring it)

Not maintaining records of contract employees

Not keeping statutory registers updated

Not handling physical bills for audit

Ignoring State-wise laws (which happens in multi-city companies)

All these seem like small mistakes, but their real harm occurs when an employee complains or the labor inspector sends a notice.

How to manage compliance?

Today, many companies are running compliance on the basis of manual spreadsheets or accounting team. But as business grows, this model starts failing.

What should be done?

Create a clear compliance calendar (monthly + yearly)

There should be proper coordination between HR and finance

Digitize all documents & registers

Keep an eye on state-wise labor law updates

Conduct training sessions for HR — especially when new rules are introduced

If possible, use a system that can give reminders and auto-tracking, be it Excel or a compliance tracker.

Last Word: Forgetting compliance is expensive

Look, bhai, compliance management software is definitely a technical topic in India, but ignoring it means taking a risk. This is not just a legal issue; it is also a matter of employee trust and company reputation.

If your HR team is updated and the process is streamlined, compliance will not become a headache – it will become a habit. And then no one can stop the business from growing.

0 notes

Text

How Do I Integrate a Payout Solution With My Existing System?

As businesses scale in the digital economy, streamlining financial operations becomes a top priority. Whether you operate an e-commerce store, a gig platform, or a SaaS company, a reliable and efficient payout solution is essential for sending funds to vendors, freelancers, employees, or partners. But choosing the right payment solution is only the first step—the real value comes when it’s smoothly integrated into your existing system.

At Xettle Technologies, we specialize in advanced payout solutions that seamlessly connect with your current infrastructure. This article will guide you through the key steps and considerations involved in integrating a payout solution into your system, helping you simplify operations while improving payout accuracy and speed.

Why Integration Matters

A payout system that is disconnected from your workflows can lead to inefficiencies, errors, and delays. On the other hand, a well-integrated payment solution:

Automates transactions

Reduces manual work

Minimizes the risk of errors

Speeds up payment cycles

Improves tracking and reporting

Integration also ensures that your data stays synchronized across platforms like your CRM, accounting software, and payroll systems—making financial management more transparent and scalable.

1. Define Your Payout Requirements

Before jumping into integration, it’s important to understand your business’s specific needs. Ask yourself:

How many payouts do you process weekly or monthly?

Do you pay locally, globally, or both?

What currencies and payment methods do you support?

Do your recipients need instant payments or scheduled ones?

What systems (e.g., ERP, accounting, HR) need to connect with the payout solution?

At Xettle Technologies, we tailor our payout solutions to match your business model and technical environment, whether you're dealing with mass payouts or high-value individual transactions.

2. Choose the Right Integration Method

There are typically two main ways to integrate a payout system into your existing infrastructure:

a) API Integration

This is the most flexible and powerful approach. Xettle Technologies offers robust RESTful APIs that allow your developers to:

Initiate and track payouts

Verify recipient bank details

Schedule payments

Generate reports

Monitor transaction statuses

API integration is ideal for businesses with development resources and the need for high-volume or real-time payout processing. With proper documentation and sandbox testing environments, Xettle makes the API setup straightforward and secure.

b) File-Based or Dashboard Integration

For smaller businesses or those without developer support, a dashboard interface or file upload system may be sufficient. You can upload CSV or Excel files containing recipient details, payment amounts, and schedules. This method is best suited for companies with regular but low-volume payouts.

Xettle’s dashboard allows you to manage payouts without complex coding, making it accessible for finance and operations teams.

3. Ensure Compliance and Security

Handling payouts means handling sensitive data and complying with financial regulations such as KYC (Know Your Customer), AML (Anti-Money Laundering), and local tax laws. Your payout integration should include safeguards like:

Secure encryption of financial data

Two-factor authentication (2FA)

Real-time fraud detection

Built-in compliance checks

Xettle Technologies prioritizes regulatory compliance across all our payment solutions, ensuring your payouts are secure and legally compliant in all operating regions.

4. Set Up Recipient Onboarding

To successfully send payouts, you’ll need recipient data—bank details, contact information, and compliance documentation. Your system should integrate with your payout solution to automate recipient onboarding.

Xettle Technologies offers customizable onboarding flows that validate recipient information in real time, reducing payment failures and delays. You can collect recipient data through your app, website, or internal portal and securely sync it with our system via API or upload.

5. Test the Integration Thoroughly

Before going live, it’s essential to test your integration in a sandbox environment. This helps ensure:

Payouts are processed correctly

Data flows accurately between systems

Edge cases (e.g., failed payments or currency conversions) are handled

Notification and error systems work as expected

Xettle provides a dedicated testing environment where your team can simulate real scenarios and confirm smooth integration without risking real money.

6. Go Live and Monitor Performance

Once testing is complete, you can move to production. At this stage, it’s important to:

Monitor real-time payment performance

Set up alerts for failures or delays

Analyze payout data for insights

Optimize payment schedules and batch processing

Xettle’s dashboard and analytics tools allow you to track transaction statuses, generate payout reports, and make informed decisions.

Conclusion

Integrating a payout solution with your existing system is more than a technical task—it’s a strategic investment that enhances efficiency, accuracy, and trust in your financial operations. Whether through a powerful API or a user-friendly dashboard, Xettle Technologies delivers flexible, secure, and scalable payment solutions that fit your business needs.

By following a structured integration process—from requirement analysis to testing and launch—you can ensure seamless payout execution and focus on growing your business. At Xettle Technologies, we’re committed to making that journey smooth, secure, and successful.

0 notes

Text

Unlock Your Team's Potential: Why Employee Management Software is Essential for Success