#Double Bottom Technical Analysis Guide

Explore tagged Tumblr posts

Video

youtube

Mastering the DOUBLE BOTTOM FOREX TRADING for Maximum Gain 2023

#youtube#youtube trending#Double Bottom Pattern Explained#Trading Strategies with Double Bottom#Identifying Double Bottom Reversals#Double Bottom Chart Pattern Tutorial#How to Spot Double Bottoms in Forex#Double Bottom Candlestick Patterns#Double Bottom Trading Signals#Double Bottom vs. Double Top Differences#Double Bottom Formation Analysis#Successful Double Bottom Trading Tips#Double Bottom Pattern for Beginners#Real Examples of Double Bottom in Stock Market#Double Bottom Breakout Strategies#Double Bottom Technical Analysis Guide#Common Mistakes in Double Bottom Trading

0 notes

Text

Trading Chart Patterns PDF Guide & Algo Tools

Mastering Market Moves: The Ultimate Guide to Trading Chart Patterns Book PDF

Introduction

Have you ever looked at a stock chart and thought, “What am I even looking at?” You’re not alone! Deciphering those zig-zagging lines can feel like trying to read an alien language. But what if I told you that those shapes — those patterns — actually tell a story? And once you understand that story, you could make smarter trading decisions. That’s where a trading chart patterns book PDF becomes your secret weapon.

In this article, we'll break down trading chart patterns in a friendly, no-nonsense way. We'll also explore how combining this knowledge with algorithmic trading software — especially the best algo trading software in India — can supercharge your trading game.

Download the best trading chart patterns book PDF. Learn how chart patterns, algorithmic trading software, and the best algo trading software in India help you win.

What Are Trading Chart Patterns?

Think of chart patterns like footprints in the snow. They show you where traders have been — and sometimes where they might go next. A chart pattern is just a visual formation on a price chart that helps traders make predictions. Whether it’s a triangle, a head and shoulders, or a double bottom — these shapes can signal buying or selling opportunities.

Why Use a Trading Chart Patterns Book PDF?

Let’s be real — the internet is loaded with scattered info. But a trading chart patterns book PDF puts everything in one place. It’s your go-to guide, available offline, structured, and perfect for both beginners and seasoned traders. Plus, you can refer to it anytime — even during a coffee break.

The 3 Main Types of Chart Patterns

Just like in movies, there are three main types of chart patterns:

Reversal Patterns: These hint that the trend is about to change.

Continuation Patterns: These suggest the trend will likely continue.

Bilateral Patterns: They could go either way — like a cliffhanger ending.

Understanding these gives you the power to react smartly, not emotionally.

Top Reversal Patterns Explained

Reversal patterns are like plot twists. They tell you the story is changing.

Head and Shoulders: Think of it like a person slumping. It often signals a shift from up to downtrend.

Double Top and Bottom: These patterns look like the letter ‘M’ or ‘W’. They scream, “Change is coming!”

Learning to spot these can save you from a bad trade — or help you enter just in time.

Key Continuation Patterns You Should Know

Continuation patterns keep the story flowing in the same direction.

Triangles (Ascending, Descending, Symmetrical): Imagine price compressing like a spring — ready to break out.

Flags and Pennants: These are like pit stops in a rally. The price pauses, then zooms off again.

Master these, and you’ll catch trends before others even notice.

How to Read Patterns Like a Pro

Reading chart patterns is part art, part science. Here’s how to get good at it:

Use candlestick charts for clarity.

Watch volume — it tells you how strong a move is.

Use support and resistance lines like guardrails.

It’s like learning to read music — confusing at first, but magical once you get it.

Common Mistakes Traders Make

Even the best traders mess up. Here are common traps:

Forcing patterns: If it doesn’t fit, don’t force it.

Ignoring volume: Patterns without strong volume are weak.

Overtrading: Don’t jump into every “almost” pattern.

Remember: Quality over quantity wins the game.

Best Resources for Chart Pattern PDFs

Here are some great places to find your next trading chart patterns book PDF:

Chart Patterns & Technical Indicators by Edward Dobson

Technical Analysis of the Financial Markets by John Murphy

Online libraries like Scribd, Academia, and even Reddit threads

Official broker platforms often offer free downloads

Just make sure you pick one with charts and examples, not just theory.

How Algorithmic Trading Software Helps

This is where things get exciting. Algorithmic trading software uses computer code to place trades. It can recognize patterns faster than any human. When you combine this with your knowledge of chart patterns, you’ve got a winning formula.

It’s like pairing Sherlock Holmes (your pattern spotting) with Watson (your algo software). Together, unbeatable!

Best Algo Trading Software in India

If you’re in India, here are some top-rated options:

Quanttrix – Known for speed and user-friendly interface.

Zerodha Streak – Drag-and-drop logic for non-coders.

AlgoTrader India – Offers institutional-grade automation.

Each has features like backtesting, live execution, and real-time analysis — ideal for traders who want results.

Using Chart Patterns in Algorithmic Strategies

Good algorithmic traders don’t just rely on numbers. They bake in pattern recognition rules:

Code to detect head and shoulders

Alerts for double tops

Algorithms that track breakout triangles

These strategies can be coded in platforms like MetaTrader, Python scripts, or even Streak.

Getting Started With a Chart Pattern Book

Here’s how to start:

Download a recommended trading chart patterns book PDF.

Start with 3-5 basic patterns.

Print a cheat sheet.

Look at real charts daily.

Journal what you see.

Consistency is key — don’t expect overnight success.

Tips to Practice Pattern Recognition

Think of pattern spotting like facial recognition. The more faces (charts) you see, the better you get.

Use trading simulators

Join trader communities

Quiz yourself using historical charts

Mark up charts manually

This hands-on practice boosts your confidence and instincts.

Mobile Apps & Tools for Chart Learning

Want to learn on the go? Try these:

TradingView: Mobile-friendly and packed with features.

Investing.com App: Clean charts and lots of news.

ChartSchool by StockCharts: A mini chart encyclopedia.

These help reinforce what you read in your chart pattern PDF.

Final Thoughts

Trading isn’t magic — it’s mastery. Understanding chart patterns gives you a serious edge. And when paired with powerful algorithmic trading software, especially the best algo trading software in India, you can turn insights into intelligent action.

So go ahead. Download that trading chart patterns book PDF, open up a demo account, and start seeing the market with new eyes. The journey from confusion to clarity starts with one pattern.

FAQs

What is the best trading chart patterns book PDF for beginners? “Technical Analysis for Dummies” and “Chart Patterns Explained” are great PDFs for those starting out.

Can I use chart patterns with algorithmic trading software? Yes! Many algorithmic tools allow you to code or automate pattern recognition and trading rules.

Which is the best algo trading software in India? Quanttrix and Zerodha Streak are widely recommended due to their user-friendly tools and performance.

Are trading chart patterns reliable for predicting markets? They’re not perfect, but when combined with volume and confirmation signals, they greatly improve your odds.

Where can I practice chart pattern recognition for free? Websites like TradingView and platforms like MetaTrader offer free tools and demo accounts.

0 notes

Text

Decoding Advanced Chart Patterns: Double Tops and Head & Shoulders

Understanding Technical Analysis and Chart Patterns

Technical analysis largely depends on identifying visual indicators that hint at potential market movements. Among the array of tools available, chart patterns, such as the double top formation, remain a steadfast choice. The Double Top and Head & Shoulders patterns are among the most reliable and extensively studied formations. These reversal patterns, including the double bottom, aren't mere shapes on a chart—they symbolize the collective psychology of traders and the ongoing battle between buyers and sellers.

The Role of Double Tops and Head & Shoulders in Trading

This guide delves into the formation of these patterns, how traders can leverage them across various markets, and the common pitfalls to avoid. Whether you're involved in forex, stocks, or crypto trading, mastering the Double Top and Head & Shoulders patterns, as well as other continuation patterns, can provide a structured approach to your trading strategy.

What Makes Reversal Patterns So Powerful?

The Importance of Reversal Patterns in Market Analysis

Reversal patterns indicate a change in market direction. They suggest that the current trend—often bullish reversal—is losing steam and that a shift to bearish momentum may follow. This makes them especially useful for traders looking to time exits from long positions or enter new short setups.

Contextualizing Reversal Patterns for Better Trading Decisions

What separates strong patterns from false alarms is context. A Double Top or Head & Shoulders setup means little if the broader trend, volume, and momentum indicators don’t support the narrative. That’s why seasoned traders treat these patterns as part of a wider toolkit—not a standalone signal.

Psychological Insights from Reversal Patterns

Reversal patterns like the Double Top and Head & Shoulders are common reversal patterns are essential for identifying potential trend reversals. These patterns highlight a change in market sentiment, often signaling that the existing trend is weakening. By recognizing these bullish continuation formations, traders can anticipate shifts in the prevailing trend, allowing them to adjust their strategies accordingly. The psychological aspect of these patterns is crucial, as they reflect the collective emotions of market participants—fear, greed, and indecision—leading to potential market reversals.

The Double Top Pattern Explained

Formation and Mechanics of the Double Top

The Double Top forms when price action rallies to a resistance level, pulls back, then rallies again, only to hit the same resistance and drop. The inability to break the previous high shows fading bullish momentum. Once the neckline (the low between the two peaks) is broken, the pattern confirms, and a potential downtrend may begin.

Psychological Insights and Trading Implications

The psychological takeaway is simple: buyers tried twice to push higher but failed. Sellers begin to dominate, and traders may look to capitalize on the shift. This pattern is a classic example of a bearish reversal pattern. It occurs after an upward trend, signaling that the bullish momentum is weakening. The pattern forms when the price hits a resistance level twice, failing to break through, and subsequently declines. This failure to surpass previous highs indicates that buying pressure is diminishing, making it an opportune moment for traders to consider short positions.

Best Conditions for a Double Top Pattern to Work

Optimal Market Conditions

This pattern performs best after a sustained uptrend. If the price has been ranging or consolidating, a double top may not carry as much weight. For maximum effectiveness, traders should confirm the pattern with volume indicators or a trendline break.

Using Technical Indicators for Confirmation

Some traders use oscillators like the RSI to spot bearish divergence at the second peak, which can strengthen the case for a reversal. For the Double Top bearish pattern to be most effective, it is crucial that it follows a strong upward trend. This context provides the pattern with the necessary momentum to signal a reversal. Additionally, confirming the pattern with volume indicators or trendline breaks enhances its reliability. Traders often look for bearish divergence using technical indicators like the RSI to further validate the pattern's potential for signaling a trend reversal.

The Head & Shoulders Pattern: A Stronger Reversal Indicator?

Structure and Significance

The head and shoulders pattern is often viewed as one of the most reliable reversal signals. With its three-peak structure, it reflects a market that's struggling to maintain upward momentum. The left shoulder marks the first rally and pullback, followed by a stronger push upward to form the head. The final rally—the right shoulder—falls short of previous highs, showing weakness in buying pressure.

Confirmation and Trading Strategy

Once the price breaks below the neckline, the pattern confirms. This typically signals a shift from bullish to bearish sentiment. The Head & Shoulders pattern is revered for its reliability as a bearish reversal chart pattern. Its distinct three-peak structure provides a clear visual representation of waning bullish momentum. The pattern's formation, with the head being higher than the shoulders, signifies a weakening of buying pressure. When the price breaks below the neckline, it confirms the pattern, often leading to a significant downward trend.

What Makes Head & Shoulders Patterns So Reliable?

Psychological and Technical Aspects

Institutional traders often watch this pattern because of its psychological clarity. The inability to create a higher high after the head shows that bullish energy is fading. Volume tends to decrease during the formation and then spike during the neckline break, providing additional confirmation.

Versatility Across Timeframes

These patterns also occur across all timeframes, from 5-minute charts in day trading to weekly charts for swing traders. The reliability of the Head & Shoulders pattern, as well as the symmetrical triangle pattern, lies in its clear depiction of market psychology. Institutional traders, in particular, value this pattern for its ability to highlight the exhaustion of buying pressure. As the pattern forms, volume typically decreases, indicating a lack of conviction among buyers. The subsequent volume spike when the neckline breaks serves as a strong confirmation of the bearish reversal. This pattern's versatility across various timeframes adds to its appeal for traders seeking to identify potential trend changes.

Double Top vs. Head & Shoulders: What's the Difference?

While both patterns are bearish reversal signals, they differ in complexity and interpretation.

Double Top is simpler and quicker to form. It shows resistance at a single level and failure to break it.

Head & Shoulders is more gradual and involves a higher high (the head) before the final failure. It's often seen as more reliable but also requires more patience.

In essence, the Double Top reflects rejection at a known resistance, while the Head & Shoulders shows an exhaustion of buyers across three separate waves.

The key distinction between the Double Top and Head & Shoulders patterns lies in their structure and complexity. The Double Top is a straightforward formation, characterized by two peaks at nearly the same level, indicating a clear resistance point. In contrast, the Head & Shoulders pattern is more intricate, featuring three distinct peaks with the head being higher. This complexity often makes the Head & Shoulders pattern more reliable, as it reflects a more gradual exhaustion of buying pressure. However, it also requires traders to exercise patience in waiting for the pattern to fully develop.

How to Trade the Double Top Pattern Effectively?

To trade the Double Top:

Wait for confirmation with a neckline break.

Place a stop-loss slightly above the second peak.

Measure the height from the peak to the neckline and project it downward to estimate your target.

Volume confirmation is important. Ideally, the second peak should form on lower volume, and the break below the neckline should come with a volume spike.

Trading the Double Top pattern effectively requires patience and discipline. Traders should wait for the trend lines and pattern to confirm with a break below the neckline before entering short positions. Setting a stop-loss slightly above the second peak helps manage risk. To estimate a profit target, measure the height from the peak to the neckline and project it downward. Volume plays a crucial role in confirming the pattern's validity, with a lower volume at the second peak and a volume spike during the neckline break serving as key indicators.

How to Trade the Head & Shoulders Pattern?

With the Head & Shoulders:

Identify the three peaks and draw the neckline.

Wait for the price to break below the neckline before entering.

Place your stop above the right shoulder.

Measure the height from the head to the neckline and subtract that from the breakout point to project your target.

Some traders refine this further by using Fibonacci retracement levels for profit-taking zones.

Trading the Head & Shoulders pattern involves a systematic approach. Traders should first identify the three peaks and draw the neckline. Entry should occur only after the price breaks below the neckline, signaling a confirmed reversal. A stop-loss placed above the right shoulder helps protect against potential losses. To determine a profit target, measure the height from the head to the neckline and subtract it from the breakout point.

In addition to these steps, traders often incorporate technical indicators to enhance their strategy. For instance, using the Relative Strength Index (RSI) can help identify overbought conditions, which may coincide with the formation of the right shoulder, further validating the pattern's bearish reversal potential. Moreover, monitoring volume is crucial; a decrease in volume during the formation of the head and shoulders, followed by a volume spike upon the neckline break, strengthens the case for a trend reversal.

Furthermore, it's essential to consider the broader market context. Patterns that align with existing bearish trends or coincide with key resistance levels tend to be more reliable. By integrating these factors, traders can increase their confidence in the pattern and make more informed decisions.

Advanced traders might also look for confluence with other chart patterns or technical indicators, such as moving averages or Bollinger Bands, to confirm the reversal signal. This multi-faceted approach helps in filtering out false signals and improving the accuracy of trade entries and exits.

Overall, the Head & Shoulders pattern, when combined with a comprehensive market analysis and risk management strategy, can be a powerful tool for identifying potential market tops and optimizing trading outcomes.

Can These Patterns Work in Crypto and Forex?

Absolutely. Double Tops and Head & Shoulders appear across all asset classes, including forex and cryptocurrencies. However, in markets like crypto—where price movements, such as during a double bottom formation, are more volatile—false breakouts can be more frequent. That’s why volume and momentum indicators become even more critical in these environments. Traders often rely on these technical indicators to filter out noise and validate genuine trend reversals, ensuring that their trading strategies are robust against market volatility.

In forex, where liquidity and institutional order flow play a larger role, traders often pair these patterns with tools like moving averages, Bollinger Bands, or the ADX to validate breakouts. These additional tools help traders gauge the strength of the trend and the likelihood of a successful breakout, providing a more comprehensive market analysis.

How Institutions and Advanced Traders Use These Patterns?

Institutional traders rarely rely on patterns alone. Instead, they use them in conjunction with order flow, volume profile analysis, and key support/resistance zones. When large players spot a Double Top or descending triangle forming near a major resistance, they may begin building short positions slowly, causing subtle shifts in price that retail traders can learn to recognize. This strategic approach allows them to anticipate market reversals and position themselves advantageously before the broader market reacts.

This deeper layer of pattern interpretation can help traders avoid false signals and better time their entries. By understanding the underlying market dynamics and integrating multiple technical analysis tools, traders can enhance their decision-making process and improve their trading outcomes.

Should You Rely Solely on Chart Patterns?

Not entirely. While patterns like the Double Top and Head & Shoulders can help guide decisions, they’re not predictive guarantees. Successful traders use a combination of chart patterns, market context, volume confirmation, and strict risk management. This holistic approach ensures that they are not solely dependent on one signal but rather have a comprehensive understanding of market conditions.

Combining patterns with indicators like RSI, MACD, or moving averages can increase confidence. Some also use candlestick patterns—like bearish engulfing or shooting stars—as added confirmation near the peaks. This multifaceted strategy allows traders to cross-verify signals, including bullish reversal patterns, and reduce the likelihood of errors.

Real Market Example (Descriptive Only)

Let’s say a currency pair like EUR/USD climbs steadily over two weeks, topping out at 1.1100. After a pullback to 1.1030, it rallies again to 1.1098 but fails to break higher. Shortly after, the price drops below 1.1030 on rising volume. That’s a textbook Double Top. Such scenarios demonstrate the importance of volume analysis in confirming pattern signals, as rising volume during the breakout reinforces the bearish reversal pattern.

Now, imagine a stock forms a high of $150, drops to $140, climbs to $155, and then fails to get past $150 again before collapsing. If you spot the three-peak structure forming over a month and the neckline breaks below $140, you’re looking at a solid Head & Shoulders setup. Recognizing these formations early allows traders to capitalize on potential downward trends, optimizing their profit targets.

Why Learning These Patterns Still Matters in 2025?

1. Enduring Relevance of Chart Patterns

Even in a world dominated by algorithms and high-frequency trading, human behavior doesn’t change. These patterns reflect hesitation, fear, overconfidence, and loss of momentum—all fundamental aspects of market psychology. Understanding these psychological components can give traders an edge in anticipating market reversals and adjusting their strategies accordingly.

2. Improving Timing and Outcomes

Whether you're an active day trader or building a longer-term swing strategy, learning how to confirm Double Tops with volume or spot a Head & Shoulders setup before the neckline break can significantly improve your timing and outcomes. This knowledge equips traders with the ability to navigate complex market environments with greater precision and confidence.

3. Adaptability Across Markets and Timeframes

In addition to their psychological insights, these patterns remain relevant due to their adaptability across various markets and timeframes. As financial markets continue to evolve, the ability to recognize and interpret chart patterns like Double Tops and Head & Shoulders becomes even more crucial for identifying potential bullish reversals. These patterns, as seen on the price chart, provide traders with a framework for understanding market sentiment and potential trend reversals, regardless of the asset class or trading style.

4. Complementing Modern Analytical Techniques

Moreover, as more traders incorporate advanced technical analysis and machine learning tools into their strategies, the foundational knowledge of chart patterns serves as a valuable complement. By combining traditional pattern recognition with modern analytical techniques, traders can enhance their ability to identify profitable opportunities and manage risks effectively.

5. A Timeless Tool for Future Trading

As we move further into the future, the significance of chart patterns in trading will likely persist, offering traders a timeless tool to decode market dynamics and make informed decisions. Whether you're trading stocks, forex, or cryptocurrencies, mastering these patterns will continue to be a critical component of successful trading strategies in 2025 and beyond.

Enhancing Your Strategy with Pattern Recognition

Using chart patterns isn’t about memorizing shapes. It’s about understanding what the market is telling you. When used with the right tools—volume, support, and resistance, momentum indicators—they become powerful allies, including the bullish flag pattern, in building a more disciplined trading plan. This approach encourages traders to focus on data-driven decisions rather than emotional reactions, ultimately leading to more consistent trading success.

Patterns like the Double Top and Head & Shoulders provide structure, helping you avoid emotional trades and focus on setups with a statistical edge. And in a world where markets move fast, having that structure makes all the difference. By integrating these patterns into a broader trading strategy, traders can enhance their market analysis and improve their overall performance.

0 notes

Link

#BullishReversal#candlestickpatterns#chartpatterns#DoubleBottom#ForexTrading#MarketSentiment#priceaction#riskmanagement#StockMarket#StrongSupport#supportandresistance#technicalanalysis#TradingSignals#TradingStrategy#TweezerBottom

0 notes

Text

Expert-Level Insights into Cryptocurrency Chart Patterns: Enhancing Trading Precision and Strategy

Navigating the volatile landscape of cryptocurrency trading demands not only technical skills but also a deep understanding of the patterns that govern market movements. This guide extends beyond basic pattern recognition, offering advanced insights into Crypto trading chart patterns, crypto charts patterns, crypto patterns chart, and cryptocurrency chart patterns to sharpen trading acumen and refine strategy.

The Psychological Foundation of Chart Patterns in Cryptocurrency Trading

Understanding crypto trading patterns is fundamental to interpreting the collective actions and sentiments of market participants. Each pattern tells a story of fear, greed, uncertainty, and collective decision-making that can help predict future market behavior.

Core Crypto Trading Chart Patterns for Strategic Market Entries and Exits

Head and Shoulders and Inverse Head and Shoulders

This crypto patterns chart is a cornerstone of technical analysis, signaling potential reversals. The pattern’s effectiveness lies in its ability to reflect shifts in market momentum and trader sentiment, making it a reliable indicator for strategic entries or exits.

Double Tops and Double Bottoms

These crypto trading patternsare pivotal for identifying price ceilings and floors. They provide clear signals for reversals, crucial for traders to minimize losses or take profits at optimal points.

Triple Tops and Triple Bottoms

These enhancements to the basic double patterns offer stronger confirmation of market reversals and are invaluable for traders demanding higher levels of validation before making significant trade decisions.

Bullish and Bearish Rectangles

Recognized in crypto chart patterns, these indicate a continuation of the current trend post-consolidation, providing traders opportunities to reinforce their positions in alignment with the prevailing trend.

Advanced Patterns for Sophisticated Crypto Trading Strategies

Broadening Formations

These patterns are essential for spotting volatility expansions in crypto charts patterns. They often indicate key reversal points where traditional trends start to break down, offering opportunities for high-reward trades if managed correctly.

Diamond Patterns: Tops and Bottoms

Complex and often challenging to identify, these crypto trading chart patterns offer critical insights at major turning points, indicating substantial reversals or continuations.

Harmonic Patterns: Gartley, Bat, Crab, and Cypher

These cryptocurrency chart patterns leverage Fibonacci numbers to forecast precise reversal zones, offering high precision in predicting future market movements. They require meticulous analysis but reward traders with superior accuracy in entry and exit strategies.

Elliott Wave Theory

This advanced theory provides a structured framework for understanding long-term market trends and cycles, crucial for strategic planning in crypto trading patterns. It helps traders anticipate price movements across different time frames, enhancing long-term trading approaches.

Integrating Chart Patterns with Other Technical Analysis Tools

Successful traders often combine chart patterns with other technical indicators like RSI, MACD, and volume analysis to confirm predictions and refine strategies. For instance, a bullish breakout in a Bullish Rectangle pattern with high trading volume and a rising RSI can confirm the likelihood of a continued uptrend.

Conclusion

Advanced mastery of crypto trading chart patterns and cryptocurrency chart patterns is critical for anyone serious about trading in the cryptocurrency space. This comprehensive understanding not only aids in making more informed decisions but also significantly enhances strategic planning and execution. The integration of psychological insights, combined with technical expertise, positions traders to capitalize on market opportunities and navigate the complexities of crypto trading with confidence.

1 note

·

View note

Text

Conquer the Day: A Beginner's Guide to Intraday Trading

The world of Online intraday trading is booming. Did you know that intraday trading volumes have surged by over 30% in recent years? This growth highlights how more individuals are drawn to the fast-paced nature of trading stocks within a single day. Simply put, intraday trading involves buying and selling financial instruments like stocks or commodities on the same day, aiming to take advantage of short-term price movements. This guide will help beginners grasp the essentials of intraday trading and consider stepping into this dynamic arena.

Understanding the Mechanics of Intraday Trading

Order Types

To engage in intraday trading, you need to understand different order types:

Market Orders: These are orders to buy or sell at the current market price. For example, if a stock is trading at $50, you might place a market order to buy it. This order completes instantly at that price.

Limit Orders: A limit order allows you to specify the price at which you're willing to buy or sell. If you only want to buy a stock at $48, you would set a limit order. It won’t execute until that stock reaches your desired price.

Stop-Loss Orders: This order helps minimize losses. If you own a stock at $50 and want to limit losses to 10%, you set a stop-loss order at $45. If the stock price drops to this point, your shares will automatically sell.

Trading Platforms

Choosing the right trading platform is vital. Some popular options include:

Robinhood: Known for its user-friendly interface. Great for beginners and offers commission-free trading.

TD Ameritrade: Offers advanced tools and excellent research resources, which can be beneficial for rookies.

E*TRADE: Provides a robust mobile app along with a web platform that’s easy to navigate.

(Screenshots would enhance understanding but are not included here.)

Leverage and Margin

Leverage allows traders to control larger amounts of money with a smaller investment. It means you borrow money from your broker to increase your buying power, potentially amplifying profits. However, this comes with risks. A statistic shows that around 70% of intraday traders use leverage. If the market moves against you, losses can exceed your initial investment.

Key Indicators and Chart Patterns for Intraday Traders

Technical Analysis Basics

Understanding technical analysis can boost your trading success. Here are a few key concepts:

Support and Resistance Levels: Support is where a stock tends to stop falling and bounce back up, while resistance is where it often stops rising. These levels can inform your buy or sell decisions.

Moving Averages: This tool smooths price data over a specific period, making trends clearer. For instance, a 50-day moving average might help identify whether a stock is in an uptrend or downtrend.

Relative Strength Index (RSI): A momentum oscillator that indicates whether a stock is overbought (above 70) or oversold (below 30).

Chart Patterns

Recognizing chart patterns can provide valuable insights:

Head and Shoulders: This pattern indicates a trend reversal. The “head” is a peak between two smaller “shoulders.”

Double Tops/Bottoms: A double top signals a potential price decline, while a double bottom suggests a price increase.

Flags/Pennants: These patterns represent brief price consolidations before a continuation of the trend.

Interpreting Market Sentiment

Market sentiment can sway price movements significantly. To gauge sentiment, traders often review news articles, social media, and reports from reliable financial news sources like CNBC or Bloomberg.

Risk Management Strategies in Intraday Trading

Position Sizing

Position sizing helps manage risk effectively. For instance, if you have a $1,000 account and are willing to risk 2% per trade, you would only risk $20. Therefore, if you buy a stock at $50, you should only purchase 0.4 shares to limit your risk.

Stop-Loss Orders

Setting stop-loss orders is vital for protecting your capital. For example, if a trader buys shares at $100 but sets a stop-loss at $95, they limit potential loss to 5%.

Emotional Discipline

Emotional control is crucial. Many traders face challenges with impulsive decisions. Trading expert Van Tharp states, “Your trading plan has to be solid, but your mind must also be calm to execute it.”

Choosing the Right Assets for Intraday Trading

Stocks vs. Futures vs. Forex

Each asset class has unique features.

Stocks are popular for intraday trading due to their volatility.

Futures offer high leverage but can be risky for beginners.

Forex trading provides high liquidity with low capital needed to start.

Liquidity and Volatility

Liquid assets have high trading volumes, making it easier to enter and exit trades. Volatile assets experience frequent price changes, providing more opportunities. Some highly liquid stocks include Apple, Amazon, and Tesla.

Diversification

Diversifying your portfolio helps mitigate risk. Trading across sectors or asset classes reduces the impact of a poor-performing asset.

Developing an Intraday Trading Plan

Defining Trading Goals

Setting clear and realistic trading goals is crucial. Goals could include achieving a specific profit amount each month or steadily growing your trading account.

Backtesting Strategies

Before entering live trades, backtesting strategies can show how they would have performed in the past. This helps in understanding potential profitability. Websites like TradingView offer backtesting features.

Journaling Trades

Tracking trades improves decision-making. Recording details, like entry and exit points, helps identify what works and what doesn’t. Over time, this practice can enhance your trading effectiveness.

Conclusion: Mastering the Art of Intraday Trading

Understanding intraday trading involves grasping various key components: order types, charts, and effective risk management. Prioritizing risk management and adopting a continuous learning mindset will enhance trading skills. With determination and the right resources, you can navigate the exciting world of intraday trading successfully. Start small, stay informed, and let your journey unfold.

#intaday tading#intraday trading in India#Intraday trading Platform#stock trading platform in india#forex trading in india

0 notes

Text

Decoding Crypto Trading Patterns: A Guide for Smarter Investments

Crypto trading patterns are crucial tools for navigating the volatile cryptocurrency market. These visual representations of price movements help traders predict future trends and make informed decisions. Leveraging patterns through technical analysis can provide a structured approach to trading, minimizing emotional decisions and maximizing potential profits. This guide will explore key trading patterns, tools, and strategies to help you decode market movements and improve your investment decisions.

Why Crypto Trading Patterns Matter

Crypto trading patterns are essential for understanding market behavior and making smarter trading choices. They help predict whether the market is entering a bullish or bearish trend, aiding in well-timed entries and exits. Patterns also create a disciplined approach to trading, reducing impulsive actions and emotional decision-making. Additionally, they work across trading styles—be it day trading, swing trading, or long-term investing—making them versatile tools for every trader.

Key Crypto Trading Patterns to Know

Understanding specific trading patterns is vital for success:

Candlestick Patterns:

Bullish Patterns:Hammer, Morning Star.

Bearish Patterns: Shooting Star, Evening Star.

Chart Patterns:

Continuation Patterns:Flags, Pennants, and Triangles, which indicate ongoing trends.

Reversal Patterns:Head and Shoulders, Double Top/Bottom, signaling trend reversals.

Breakout Patterns: Identify potential explosive price movements. Visual aids, such as graphics or examples, can help traders quickly recognize these patterns during analysis.

Understanding Support and Resistance Levels

Support and resistance levels are critical markers in technical analysis. Support represents price levels where demand increases, preventing further declines, while resistance marks points where selling pressure intensifies, halting upward movements. These levels are key in validating trading patterns, as they highlight areas for potential trend reversals or continuations, helping traders decide when to enter or exit positions.

Tools for Analyzing Trading Patterns Modern tools make analyzing trading patterns more efficient:

Charting Platforms: Platforms like TradingView, Binance, and PrimeTrader provide detailed visuals and pattern-recognition tools.

Indicators: Tools like RSI, MACD, and Fibonacci retracements confirm patterns and signal strength.

Automation:AI-driven tools identify patterns in real-time and execute trades, offering speed and accuracy. Using these tools helps traders refine their analysis and execute strategies with confidence.

Applying Trading Patterns in Different Strategies Trading patterns adapt to various trading strategies:

Day Trading:Identify intraday patterns like flags or triangles for quick profits.

Swing Trading:Use medium-term patterns for trades lasting several days.

Scalping:Rely on micro patterns for rapid, small-margin trades.

Long-Term Investing:Look for broader patterns, such as the cup and handle, to predict sustained trends. Each strategy benefits from incorporating patterns, tailoring them to specific market behaviors and timeframes.

Common Mistakes to Avoid When Using Patterns While trading patterns are powerful, common pitfalls can hinder success:

Overtrading:Acting on incomplete or weakly confirmed patterns can lead to losses.

Ignoring Volume:Trading volume is a critical factor that validates patterns.

Neglecting Risk Management:Always use stop-loss orders and proper position sizing.

Confirmation Bias:Avoid interpreting patterns to fit preconceived expectations. By steering clear of these mistakes, traders can improve accuracy and profitability.

Advanced Pattern Recognition with AI and Automation

AI and automation are revolutionizing how traders use patterns. Advanced tools can analyze charts and detect patterns in real-time, providing instant insights. Platforms like PrimeTrader incorporate AI-driven features, automating pattern recognition and trade execution. This technology reduces errors and ensures swift responses to market changes, giving traders an edge in a fast-paced environment.

The Role of Trading Psychology in Using Patterns

Trading success depends as much on psychology as it does on technical analysis. Discipline, patience, and objectivity are crucial for interpreting and applying patterns effectively. Sticking to a strategy during volatile market conditions and mastering emotions like fear or greed can significantly improve decision-making. A calm and focused mindset ensures better execution and long-term success.

Conclusion

Crypto trading patterns are indispensable tools for navigating the complexities of the cryptocurrency market. By understanding and applying these patterns, traders can make smarter, more informed decisions and reduce risks. Whether you're day trading, swing trading, or investing long-term, incorporating pattern analysis into your strategy can boost your success.

0 notes

Text

10 Most Powerful Chart Patterns for Traders!

@ParkaviFinance Discover the 10 Most Powerful Chart Patterns for Traders! 📈Unlock the secrets of technical analysis with our comprehensive guide to the 10 most powerful chart patterns. In this video, you'll learn how to identify and trade patterns like Head and Shoulders, Double Top, Double Bottom, and Wedge. Whether you're a beginner or an experienced trader, these patterns can be a game-changer for your trading strategy.

What You'll Learn:

- Identifying Chart Patterns: Spot patterns on stock charts with ease.

- Understanding Patterns: Learn the significance of different parts of a chart pattern.

- Trading Strategies: Utilize bullish, bearish, and neutral patterns in your trades.

- Risk Management: Be aware of common risks involved in trading chart patterns.

- Expert Tips: Enhance your technical analysis and trading strategies.

Watch till the end to gain the confidence to analyze trends and make informed trading decisions. Don't forget to LIKE, COMMENT, and SUBSCRIBE to Parkavi Finance for more stock market insights, tips, and strategies! Hit the notification bell so you never miss an update.

Watch in Tamil:

https://youtu.be/WjhhXfiFOFE

Watch in English:

https://youtu.be/A5udwIpo2p0

Read in English:

https://www.parkavifinance.com/2024/11/10-most-powerful-chart-patterns-every.html

Read in Tamil:

https://tamilparkavifinance.blogspot.com/2024/11/tamil-market-insights-10-chart-patterns.html

chart patterns, stock market trading, head and shoulders, double top, double bottom, wedge trading, bullish patterns, bearish patterns, technical analysis for traders, risk management in trading, trading strategies, top chart patterns, beginner trading tips, #ChartPatterns #TechnicalAnalysis #StockTrading #HeadAndShoulders #DoubleTop #DoubleBottom #TradingStrategies #Bullish #Bearish #WedgePattern #RiskManagement #TopChartPatterns #BeginnerTradingTips

#share market#technical analysis#financial freedom#trading strategies#financial updates#investing stocks#stock market#chartpatterns

0 notes

Text

What is Formation Trading? A Guide to the Basics

Start with a short introduction that defines "Formation Trading." Mention why it’s relevant to traders and investors looking for structured, profitable strategies. Use engaging language to encourage readers to learn more.

Example: "Formation trading is a powerful strategy that helps traders capitalize on market trends and structured setups. In this guide, we’ll explore what formation trading is, why it’s effective, and how to get started."

What is Formation Trading? Define formation trading in a simple, reader-friendly way. Describe how it involves using chart patterns or formations to predict future price movements. Common patterns could include head-and-shoulders, triangles, or flags. Mention that formation trading relies heavily on technical analysis.

Example: "Formation trading is a method of analyzing and trading market patterns to predict price changes. This approach uses popular formations, like head-and-shoulders, to help traders make informed decisions."

Why Formation Trading is Effective Discuss the advantages, such as helping traders identify entry and exit points, improve accuracy, and reduce emotional decision-making. Adding some benefits that align with traders’ goals (like increasing profitability or reducing risks) can make this section more relatable.

Example: "One of the primary benefits of formation trading is its ability to help traders identify precise entry and exit points. Recognizing reliable patterns can enhance trading accuracy and reduce risks."

Popular Formation Trading Patterns List and briefly explain the most common formations, like:

Head-and-Shoulders: A reversal pattern signaling a shift in trend.

Double Top/Bottom: Indicates a potential reversal in price movement.

Triangles (Ascending/Descending): Continuation patterns that show potential breakouts.

Including visuals or examples here (if possible) can increase reader engagement and comprehension.

Example: "Understanding key patterns like the head-and-shoulders or triangles can make a big difference in predicting future movements. These formations help traders anticipate where the market may head next."

How to Start Formation Trading Give readers actionable steps to begin formation trading. Suggest starting with a demo account to practice identifying formations, reviewing chart patterns, and using software tools for technical analysis.

Example: "To start formation trading, consider using a demo account to practice pattern recognition. Reviewing charts regularly and using technical analysis software can also help refine your skills."

Conclusion Summarize the key points and invite readers to learn more or start their formation trading journey.

Example: "Formation trading offers a structured approach to the markets, empowering traders to make data-backed decisions. With practice, you can master the skill of recognizing profitable patterns."

0 notes

Text

Stock Trading | Investing: Technical Analysis Stock Market

When it comes to navigating the stock market, there are two major paths traders and investors often take: fundamental analysis and technical analysis. While fundamental analysis focuses on the underlying financials and health of a company, technical analysis delves into studying price movements and patterns to make predictions. In this blog, we’ll walk you through the essentials of Stock Trading | Investing: Technical Analysis Stock Market and how it can empower your trading decisions. Whether you're new to investing or a seasoned trader, this guide will break things down in a simple, conversational tone to help you get started on the right foot.

What is Technical Analysis?

Technical analysis is the practice of examining historical price data and trading volumes to forecast future price movements. It’s based on the idea that market trends, rather than random events, drive price fluctuations. Unlike fundamental analysis, which digs into a company's earnings, revenue, or growth potential, technical analysis relies on charts, patterns, and indicators to find opportunities in the market.

For someone who is starting, it may seem a little complex, but trust me, once you get the hang of it, it's like having a roadmap in front of you. The central idea behind technical analysis is that history repeats itself. Prices often move in trends, and by recognizing those trends early, traders can make informed decisions about buying or selling. Traders and investors alike use technical analysis to time their trades and determine the right entry and exit points.

Why is Technical Analysis Important for Stock Trading and Investing?

The stock market can sometimes feel like a rollercoaster ride, with sudden ups and downs. Stock Trading | Investing: Technical Analysis Stock Market helps investors manage risks by offering a clearer view of market sentiment. By analyzing past price patterns, traders can develop strategies for when to buy or sell. One of the biggest advantages is that technical analysis works in any market—whether it's stocks, cryptocurrencies, or forex—because all markets exhibit price movement that can be studied.

For those of you just stepping into stock trading or investing, using technical analysis provides a much-needed edge. Rather than guessing or following emotions, this strategy gives you a concrete way to evaluate the potential success of a trade.

Key Concepts in Technical Analysis

To start, let’s explore some basic but crucial tools used in technical analysis:

Support and Resistance Levels: These are price points that act as barriers. Support levels indicate where a stock's price has historically had difficulty going below, while resistance levels show where it struggles to go above. Traders look for breakouts or bounces off these levels to guide their decisions.

Moving Averages: This is one of the most common tools used in technical analysis. A moving average smoothens out price data to create a single flowing line, which helps traders identify the trend direction. The most widely used are the simple moving average (SMA) and the exponential moving average (EMA).

Chart Patterns: These include formations like head and shoulders, double tops/bottoms, triangles, and flags. These patterns signal potential future movements based on historical behavior.

Indicators: Technical indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) help traders gauge market momentum, identify overbought or oversold conditions, and make more informed decisions.

How to Use Technical Analysis in Stock Trading and Investing

So, how exactly do you implement technical analysis in your trading strategy? It all starts with setting up a plan. Before buying or selling, identify trends by looking at price charts over different timeframes. Start with longer periods (e.g., a year or several months) to identify the overall trend. Then, zoom in to shorter time frames (e.g., days or weeks) to find the best moments to enter or exit a trade.

Once you’ve identified the trend, pay attention to support and resistance levels. If a stock is near a resistance level and looks like it will break through, that could be a sign to buy. Similarly, if it’s nearing support and shows no signs of breaking down, it might be a good moment to sell.

A key part of technical analysis is learning how to read candlestick charts. Each candlestick represents a period’s opening, high, low, and closing prices, and the formations can provide valuable clues about where the stock might be heading next.

Free AI Tools for Technical Analysis

In recent years, artificial intelligence has made its way into the world of stock trading, offering incredible tools for technical analysis. With free AI-powered platforms, traders can automate their analysis, get suggestions based on historical data, and optimize trading strategies. These tools make it easier for even beginners to get a handle on technical analysis, reducing the learning curve.

For example, some AI tools analyze thousands of charts in seconds and highlight patterns or trends that you might otherwise miss. They can also alert you when stocks are reaching critical levels of support or resistance. By incorporating AI into your trading strategy, you can significantly improve your chances of making successful trades.

How to Get Started with Technical Analysis as a Beginner

If you’re just getting started with Stock Trading | Investing: Technical Analysis Stock Market, don’t worry—it’s a skill that gets better with practice. Start by familiarizing yourself with the technical indicators we mentioned earlier, like moving averages, RSI, and MACD.

Next, try using demo trading platforms, many of which offer access to free technical analysis tools. These allow you to practice reading charts, spotting trends, and making trades without the risk of losing money. The goal is to build confidence before diving into live markets.

Combining Technical and Fundamental Analysis

While technical analysis is powerful, it’s even more effective when combined with fundamental analysis. When you analyze a company’s financials and pair that with technical indicators, you gain a complete picture of its potential. This strategy works particularly well for long-term investing.

For instance, a stock might show a bullish pattern on the technical side, but if the company has solid earnings growth, a healthy balance sheet, and positive news, it could be an even stronger buy signal.

Common Mistakes to Avoid in Technical Analysis

Overtrading: One of the biggest mistakes beginners make is trading too frequently. The temptation to jump in and out of trades based on small fluctuations can be costly. Remember, technical analysis is about identifying clear trends—not reacting to every small move.

Ignoring the Bigger Picture: Sometimes, traders get so caught up in short-term charts that they miss the bigger trend. Always keep an eye on longer timeframes to ensure you're not trading against the broader trend.

Not Managing Risk: Even with the best analysis, there’s no such thing as a sure bet in the stock market. Always use stop-loss orders to manage your risk and protect yourself from significant losses.

Final Thoughts on Technical Analysis

In conclusion, Stock Trading | Investing: Technical Analysis Stock Market is an essential tool for anyone looking to make informed decisions in the stock market. It’s especially helpful for short-term traders but can also benefit long-term investors when combined with fundamental analysis. By learning how to read charts, understand indicators, and recognize patterns, you’ll be able to anticipate market movements and position yourself for success.

For those ready to take their trading to the next level, incorporating free AI tools can give you a considerable advantage by analyzing data faster and more accurately than ever before. The world of technical analysis can seem daunting at first, but with consistent practice and a disciplined approach, you'll be able to navigate the markets with confidence.

0 notes

Text

HURRY: This Stock Can EXPLODE At Any Moment! (Buy Now)

😯HURRY😯: This Stock Can EXPLODE At Any Moment! (Buy Now) https://www.youtube.com/watch?v=dTe2-5IRFps The last two penny stocks I called out ran tremendous! Today I want to show you a super hot, beaten down stock. A great risk to reward opportunity for traders and investors to buy the dip, near the bottom, going into this month. I believe most of the downward momentum, selling pressure has been removed from the ticker. Very interesting: billion dollar entities are attaching their name to this company, could mean that they are poised to grow in the future, which could have a very positive impact on the stock! ✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ✅ Stay Connected With Me: 👉 (X)Twitter: https://twitter.com/RealAvidTrader 👉 Stocktwits: https://ift.tt/mNgpXnQ 👉 Instagram: https://ift.tt/fnI4zEe ============================== ✅ Other Videos You Might Be Interested In Watching: 👉 The ULTIMATE Guide to Finding Hidden Gem Stocks | AvidTrader https://youtu.be/pZAKJLk9o0I 👉 🧨GameStop Short Squeeze 2.0 Incoming??🧨 https://youtu.be/XeFVaq4BHfU 👉 🙌💎 When Should You Diamond Hand a Stock? 💎🙌 https://youtu.be/ZO62i0cq0PQ 👉 This Penny Stock is a GUARANTEED Double!! https://youtu.be/Yx6wZNz95dM ============================= ✅ About AvidTrader: Value Investor. Discussing Day & Swing Trades Also Long Term Investments! Stock Breakdowns. Grow Your Trading Account Effectively. Technical Analysis and Pattern Recognition. How to Make Money, But More Importantly Learning & Having Fun in The Process! Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. Avid Trader receives compensation from its clients in the form of cash and restricted securities for consulting services. 🔔 Subscribe to my channel for more videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ===================== #stockstobuy #breakoutstocks #undervaluedstocks #AvidTrader #swingtrade #pennystock #pennystockstobuynow #vuzi Disclaimer: We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk. I am not a certified financial advisor and you must do your own research and due diligence before ever buying or selling a stock. never trade solely based on someone else's word or expectations of a stock! Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use © AvidTrader via AvidTrader https://www.youtube.com/channel/UCK_XU3FW-ffEK8BG5EisnNA September 16, 2024 at 04:30PM

#stockanalysis#investmenttips#investmentstrategy#tradingstrategies#tradingtips#fundamentalanalysis#stockmarket#technicalanalysis

0 notes

Text

How to become a technical analyst?

Becoming a technical analyst involves developing a strong foundation in financial markets, acquiring the necessary skills, and gaining practical experience. Here's a step-by-step guide:

1. Educational Background

Finance/Economics Degree: While not mandatory, a degree in finance, economics, or a related field provides a strong foundation.

Self-study: Even if you don't have a formal finance background, self-study can be sufficient. Many technical analysts are self-taught through books and online resources.

2. Learn the Basics of Technical Analysis

Books: Start with foundational books like "Technical Analysis of the Financial Markets" by John Murphy, "Japanese Candlestick Charting Techniques" by Steve Nison, or "Technical Analysis Explained" by Martin J. Pring.

Online Courses: Platforms like Coursera, Udemy, and Investopedia offer courses on technical analysis.

3. Familiarize Yourself with Charting Tools

Charting Software: Get comfortable with charting software like TradingView, MetaTrader, or ThinkorSwim. These tools are essential for technical analysis.

Indicators: Learn about commonly used indicators such as Moving Averages, RSI, MACD, Bollinger Bands, and Fibonacci Retracements.

4. Understand Market Psychology

Study Market Sentiment: Understanding market psychology is crucial. Read about behavioral finance and how emotions drive market movements.

Practice Identifying Patterns: Learn to identify chart patterns like Head and Shoulders, Double Top/Bottom, Flags, and Triangles.

5. Get Certified

Certified Market Technician (CMT): Consider obtaining a CMT designation, which is globally recognized and covers in-depth technical analysis.

NSE Academy's Technical Analysis Courses: If you're in India, the National Stock Exchange (NSE) offers certified courses in technical analysis.

6. Develop a Trading Strategy

Paper Trading: Before risking real money, practice with paper trading to test your strategies without financial risk.

Risk Management: Learn the importance of stop-loss, position sizing, and risk-reward ratios.

7. Gain Practical Experience

Start Trading: Begin with small trades to gain experience. Keep a trading journal to analyze your trades and learn from mistakes.

Internships/Jobs: Seek internships or entry-level positions at brokerage firms, hedge funds, or investment firms to gain hands-on experience.

8. Stay Updated

Continuous Learning: Markets evolve, so it's essential to stay updated with new techniques and tools. Attend webinars, read industry blogs, and follow market news.

Networking: Join financial communities, attend seminars, and engage with other traders to learn and share knowledge.

9. Develop Patience and Discipline

Psychological Discipline: Successful technical analysts are disciplined and patient, avoiding emotional decisions during trading.

Long-term Focus: Technical analysis requires a long-term focus on learning and consistent practice to achieve success.

By following these steps, you can build the necessary skills and knowledge to become a proficient technical analyst.

0 notes

Text

Introduction to Candlestick Patterns and Hammer Candlestick Pattern for Beginners

Candlestick patterns are fundamental to technical analysis, offering traders visual insights into market sentiment and potential price movements. Among the plethora of candlestick patterns, the hammer candlestick pattern is particularly notable for its clear indication of a potential reversal. This guide is designed for beginners, providing an in-depth look at candlestick patterns and a detailed explanation of the hammer candlestick pattern.

What Are Candlestick Patterns?

Candlestick patterns are graphical representations of price movements in trading. They are composed of individual candlesticks, each representing a specific period's price action, including the open, high, low, and close prices. The body of the candlestick shows the range between the opening and closing prices, while the wicks (or shadows) display the highest and lowest prices reached during the period.

Candlestick patterns are crucial in identifying market trends and potential reversals. They are divided into single, double, and multiple-candlestick patterns, each with unique characteristics and implications.

Understanding the Hammer Candlestick Pattern

The hammer candlestick pattern is a single-candle pattern that signals a potential bullish reversal. It typically forms at the end of a downtrend, indicating that the market may start to move upwards.

Characteristics of the Hammer Candlestick Pattern

Long Lower Shadow: The lower shadow of the hammer candlestick pattern is at least twice the length of the body. This long shadow indicates that sellers initially drove the price down significantly during the trading session.

Small Real Body: The body of the hammer candlestick pattern is small and located at the upper end of the trading range. This suggests that, despite the initial selling pressure, buyers were able to push the price back up near the opening level.

Little to No Upper Shadow: The hammer candlestick pattern has little or no upper shadow, reinforcing the idea that sellers were unable to maintain the lower prices.

How to Identify the Hammer Candlestick Pattern

Identifying the hammer candlestick pattern involves recognizing its distinct characteristics within the context of a downtrend. Here’s how you can spot it:

Context: Ensure the pattern appears after a downward trend. The hammer candlestick pattern is only significant if it forms at the bottom of a downtrend.

Appearance: Look for a candlestick with a small body at the top, a long lower shadow, and little to no upper shadow.

Volume: Higher trading volume during the formation of the hammer candlestick pattern can add validity to the signal.

Trading Strategies Using the Hammer Candlestick Pattern

Incorporating the hammer candlestick pattern into your trading strategies can help you capitalize on potential bullish reversals. Here are some strategies to consider:

1. Confirmation with Next Candlestick

Wait for the next candlestick to confirm the reversal. If the following candlestick closes above the hammer’s close, it confirms the bullish reversal signaled by the hammer candlestick pattern.

2. Combining with Technical Indicators

Enhance the reliability of the hammer candlestick pattern by combining it with other technical indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). These indicators can help confirm the bullish reversal and provide additional entry signals.

3. Setting Stop Loss and Take Profit Levels

When trading the hammer candlestick pattern, it’s crucial to manage risk. Set a stop loss below the hammer’s low to protect against false signals. Determine take profit levels based on resistance levels or using a risk-reward ratio.

Conclusion

The hammer candlestick pattern is an essential tool for beginners in technical analysis. Its distinct characteristics and reliable signals make it a valuable addition to any trader’s toolkit. By understanding the hammer candlestick pattern and incorporating it into your trading strategies, you can enhance your ability to identify potential bullish reversals and make informed trading decisions.

0 notes

Text

Master Technical Analysis: Your Guide to the Indian Stock Market

Navigating the Indian stock market can feel overwhelming. With thousands of stocks and constant fluctuations, how do you make informed decisions? Technical analysis offers a way to understand market movements through charts and indicators. This guide will help you get a grip on the essentials of technical analysis, making it easier to trade wisely.

The Allure and Challenges of the Indian Stock Market

The Indian stock market has its own excitement. Investors are drawn to the potential for great returns. However, with opportunity comes risk. The market is volatile, and prices can change quickly. Understanding the tools available can help traders to manage that risk effectively.

Why Technical Analysis is Crucial for Indian Traders

Technical analysis simplifies the process of Stock Marketing Trading. It focuses on price movements and volume rather than company fundamentals. By studying price charts and patterns, traders can make predictions about future market behavior. This method helps reduce emotional decision-making and allows for a more disciplined approach.

Setting the Stage: What This Guide Covers

This guide covers key aspects of technical analysis, including:

Chart Patterns

Technical Indicators

Candlestick Patterns

Risk Management

Advanced Techniques

Each section aims to provide clear insights and actionable strategies for traders in the Indian market.

Chart Patterns: Deciphering Market Signals

Identifying Trend Reversals: Head and Shoulders, Double Tops/Bottoms

Chart patterns are graphical representations of price movements. Recognizing these patterns can signal potential trend reversals:

Head and Shoulders: Indicates a reversal from bullish to bearish.

Double Tops: Signals a peak before a downward trend.

Double Bottoms: Suggests a potential upward movement.

Spotting Continuation Patterns: Flags, Pennants, Wedges

Continuation patterns suggest that a trend will continue. Key patterns to watch include:

Flags: Short-term consolidation before a continuation.

Pennants: Small symmetrical triangles after a sharp price movement.

Wedges: Indicates a potential reversal in a strong trend.

Practical Application: Real-world examples of pattern recognition in Indian stocks

For example, if an Indian stock like Reliance Industries shows a head and shoulders pattern, it might indicate a shift from a bullish trend to a bearish one, guiding traders to adjust their positions accordingly.

Technical Indicators: Unveiling Market Momentum

Moving Averages: Simple, Exponential, Weighted – Explained

Moving averages smooth out price data to identify trends over a specific period. Key types:

Simple Moving Average (SMA): Averages prices over a set time.

Exponential Moving Average (EMA): Gives more weight to recent prices.

Weighted Moving Average (WMA): Assigns different weights to prices based on their age.

Relative Strength Index (RSI): Gauging Market Strength and Weakness

The RSI is a momentum oscillator that ranges from 0 to 100. It helps traders spot overbought or oversold conditions:

Above 70: Indicates overbought conditions.

Below 30: Suggests oversold conditions.

MACD: Identifying Momentum Shifts and Potential Trading Signals

The Moving Average Convergence Divergence (MACD) can identify shifts in momentum. When the MACD line crosses above the signal line, it may indicate a buy signal, and vice versa.

Candlestick Patterns: Unlocking Price Action Insights

Understanding Candlestick Formation and Interpretation

Candlestick charts provide visual insights into price movements. Each candle shows the open, close, high, and low prices for a specific time period.

Powerful Candlestick Patterns: Doji, Hammer, Engulfing Patterns

Some key candlestick patterns include:

Doji: Indicates indecision in the market.

Hammer: Suggests potential bullish reversal.

Engulfing Patterns: Signals strong shifts in market sentiment.

Combining Candlestick Patterns with Indicators for Enhanced Accuracy

By pairing candlestick patterns with indicators like RSI or MACD, traders can enhance their analysis and improve trade accuracy.

Risk Management and Position Sizing in the Indian Context

Defining Your Risk Tolerance and Setting Stop-Loss Orders

Understanding personal risk tolerance is crucial. Setting stop-loss orders helps limit potential losses. For example, if a trader is willing to risk 2% of their portfolio on a trade, they should set a stop-loss accordingly.

Position Sizing Strategies for Indian Stock Market Trading

Calculating position sizes based on risk tolerance aids better capital management. A common method is the fixed percentage approach, allowing traders to determine how much to invest in each trade.

Adapting Risk Management to the Unique Characteristics of Indian Markets

Consider the high volatility in Indian stocks. Adjust risk management practices to protect capital during price swings.

Advanced Technical Analysis Techniques

Fibonacci Retracements and Extensions: Identifying Support and Resistance Levels

Fibonacci levels are used to identify potential retracement levels. Traders often look for support or resistance at these levels during price corrections.

Elliott Wave Theory: Understanding Market Cycles and Trends

Elliott Wave Theory suggests markets move in predictable cycles. Identifying these waves helps traders anticipate future price movements.

Combining Multiple Techniques for Comprehensive Market Analysis

Using multiple technical analysis tools together provides a fuller picture. For instance, analyzing chart patterns alongside indicators can enhance trading decisions.

Conclusion: Mastering Technical Analysis for Sustainable Success

Key Takeaways: Actionable Steps for Indian Stock Market Traders

Focus on mastering chart patterns and technical indicators.

Incorporate risk management strategies tailored to the Indian market.

Continuously learn and adapt to market changes.

Continuous Learning and Adaptation in the Dynamic Indian Market

The Indian stock market is ever-changing. Stay updated with market trends and refine your strategies regularly.

Resources for Further Learning and Development

Books, online courses, and webinars can enhance your understanding. Explore resources like financial news platforms, stock market blogs, and trading forums to continue your education in technical analysis.

By mastering technical analysis, you position yourself for success in the dynamic Indian stock market. Embrace the tools and strategies outlined in this guide to make informed trading decisions. Start analyzing today!

0 notes

Text

Master Market Trends with Aaryaa Money's Online Technical Analysis Course

In today's fast-paced financial world, staying ahead of the market trends is crucial for successful trading and investment. This is where technical analysis comes into play. Whether you're a seasoned trader or a novice investor, understanding technical analysis can significantly enhance your market strategies. Aaryaa Money offers a comprehensive online technical analysis course designed to equip you with the skills needed to navigate the complexities of the financial markets.

Why Choose Aaryaa Money’s Online Technical Analysis Course?

Comprehensive Curriculum: Aaryaa Money's online technical analysis course covers everything from the basics to advanced techniques. You will learn about chart patterns, indicators, oscillators, and various technical tools that can help predict market movements.

Expert Instructors: The course is led by industry experts with years of experience in financial markets. Their insights and practical knowledge will guide you through the nuances of technical analysis.

Flexible Learning: The online format allows you to learn at your own pace, making it convenient for working professionals and students alike. You can access the course materials anytime, anywhere, ensuring that your learning is uninterrupted.

Practical Applications: The course emphasizes real-world applications of technical analysis. You will get hands-on experience with live trading sessions and case studies, which will help you apply your knowledge effectively in actual trading scenarios.

Certification: Upon successful completion of the course, you will receive a certification from Aaryaa Money. This certification is recognized in the industry and can enhance your professional credibility. What You Will Learn:

Introduction to Technical Analysis: Understand the basic concepts and principles of technical analysis and how it differs from fundamental analysis.

Chart Patterns: Learn to identify and interpret various chart patterns such as head and shoulders, triangles, and double tops/bottoms.

Indicators and Oscillators: Get to grips with key technical indicators like Moving Averages, MACD, RSI, and Bollinger Bands. Learn how to use these tools to gauge market momentum and trends.

Trading Strategies: Develop robust trading strategies based on technical analysis. Understand risk management techniques to protect your investments.

Live Trading Sessions: Participate in live trading sessions to see how theoretical knowledge is applied in real-time markets.

Aaryaa Money's online technical analysis course is a valuable investment for anyone looking to enhance their trading skills and market knowledge. Whether you're aiming to become a full-time trader or simply want to make informed investment decisions, this course provides the tools and knowledge you need to succeed.

Conclusion

In the dynamic world of financial markets, staying informed and skilled is key to success. Aaryaa Money’s online technical analysis course offers a structured and comprehensive approach to mastering technical analysis. Enroll today to start your journey towards becoming a proficient market analyst and trader. Visit the course page to learn more and sign up.

0 notes

Text

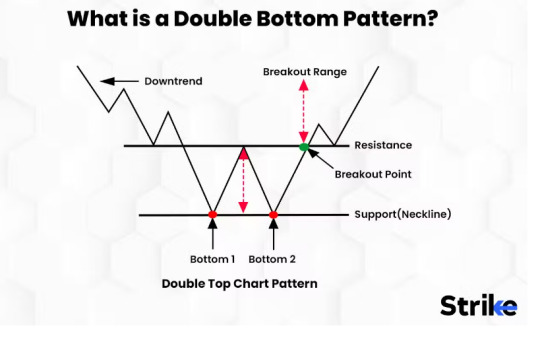

Complete Guide to Double Bottom Pattern: How to Spot, Trade & Win with This Powerful Reversal Signal

📉 What Exactly Is a Double Bottom Pattern (And Why Traders Love It)

The Double Bottom Pattern is one of the most powerful bullish reversal patterns in technical analysis. Shaped like a "W", this chart formation signals the potential end of a downtrend and the start of a new upward movement.

It forms when the price hits a low, bounces up, then returns to approximately the same low before rising again. This behavior suggests that sellers are exhausted and buyers are gaining control — a clear bullish signal for smart traders.

Traders and analysts across markets – whether stocks, forex, or cryptocurrencies – use this pattern to anticipate trend reversals with higher conviction.

In India, this pattern has played out beautifully in stocks like Tata Motors, Adani Ports, and Infosys after market corrections.

🧩 Understanding the Building Blocks of a Double Bottom

For a pattern to qualify as a true double bottom, it must have these components:

🔹 First Bottom: Occurs at the end of a downtrend — shows initial support 🔹 Neckline: Resistance level between the two lows 🔹 Second Bottom: Retest of the same support zone — often with lower volume 🔹 Breakout: Price breaks above the neckline with strong volume confirmation

On charting platforms like Strike Money, you can easily identify these levels and monitor volume spikes that confirm breakouts.

An ideal example? In 2023, Axis Bank formed a textbook double bottom around ₹720 with a neckline near ₹850. After breaking out, it surged past ₹1,000 — delivering over 30% return in weeks.

🔍 How to Confirm a Double Bottom and Avoid Costly Mistakes

Just spotting the "W" isn't enough. False signals can occur, especially in sideways markets.

✅ Volume Confirmation: Look for a noticeable increase in volume on the breakout above the neckline. ✅ RSI Divergence: If the Relative Strength Index shows higher lows when the price hits the second bottom, momentum is shifting. ✅ MACD Crossover: A bullish crossover close to the second bottom increases the chances of a real reversal.