#Double Bottom Chart Pattern Tutorial

Explore tagged Tumblr posts

Video

youtube

Mastering the DOUBLE BOTTOM FOREX TRADING for Maximum Gain 2023

#youtube#youtube trending#Double Bottom Pattern Explained#Trading Strategies with Double Bottom#Identifying Double Bottom Reversals#Double Bottom Chart Pattern Tutorial#How to Spot Double Bottoms in Forex#Double Bottom Candlestick Patterns#Double Bottom Trading Signals#Double Bottom vs. Double Top Differences#Double Bottom Formation Analysis#Successful Double Bottom Trading Tips#Double Bottom Pattern for Beginners#Real Examples of Double Bottom in Stock Market#Double Bottom Breakout Strategies#Double Bottom Technical Analysis Guide#Common Mistakes in Double Bottom Trading

0 notes

Text

Sweater resizing

There's a million tutorials out there, but I'm just talking about what I'm working on.

In the sweater I'm working on, the sleeves seem to be on the bicep. It strongly looks like there's a box pleat at the top, which is a very common 1940's style shaping. Here's a video by Engineering Knits with a similar "make a tab at the top of the sleeve" instruction, and I strongly suspect the sleeve will sew up a similar way.

So, let's start with the instructions. For copyright, and poor quality scan reasons, I'll rewrite these in my own words. "Using a knitted on cast on, cast on 44 stitches and knit in the back of the stitches. Then increase at the start end the end of a row, working all other stitches in pattern, and work a row normally in pattern. Repeat until you have 82 stitches. Cast off 3 stitches at the start of the next 4 rows. Cast off 1 stitch at the beginning of each row until you are back at 44 stitches. Knit in pattern for 3 inches. Cast off. To sew up, connect sleeve seams, work seams into the armscye, pleat in fullness at top of arm."

The original row gauge is 6 stitches to the inch, and 6 rows to the inch. I'm closer to 6 stitches to the inch and closer to 8 rows to the inch.

So, let's do some math. The sleeve is originally 7 inches around, in a stretchy broken rib pattern. Let's look at a size chart to see how this works for standard "modern" sizing. Looking at the actual size of the stitches, you've got a 30 inch waist / high hip, a 35 inch bust (pattern mentions a 34 inch bust), and now we know the bicep ish is 7 inches. It's probably meant to be snug on the arm to not slide down and lose the poof at the top of the shoulder.

So, measure your own bicep. I like some room in my sleeves, so I measured around my arm with a finger under the tape and got about 15". My cast on is 90 stitches.

Now 38 stitches, every other row, that is between 76 to 75 rows, depending on if you end on a blank row. That'll come out to about 12 inches in height. Now, I need to calculate how big I need to go. Lazy math says it's a little under double the stitches, but let's do the proper math. 82 divided by 44 says you've got a ratio of 1.86 and some repeating numbers. That makes sense, since we already know it's a bit less than two.

Multiply it times 90, and we get 167.7272 repeating. The next nearest even number is 168, so we need to add 78 stitches over 12 inches.

If you do the original instructions of "increase pattern increase, blank row in pattern," then you'll get 78 rows. 12 times 8 = 96 rows. Therefore, add another blank row during your early increases 18 times to get yourself up to 96 rows. The slightly slower pitch will just give you more of a cuff at the bottom.

How do you decrease? You remove 12 stitches over 4 rows. That means you go from 82 to 70. The ratio of that is 70 divided by 82 = .85365. I'm at 168 and the ratio says I'm going to 143.4 - let's say that's 26 stitches removed.

Now, the upper part of the sleeve is decreased one each row from 70 to 44. That means 30 rows happen from the start of the decreases to the end of the decreases. That should be 5 inches. We instead have 40 rows to play with.

7, 7, 6, 6 = 4 rows and 26 stitches, ending at 142

2, 2, 2, 2, 2, 2, 2, 2, 2, 2 = 20 stitches, over 10 rows

2, 2, 2, 2 = 8 over 4 rows. (22 rows left, 24 stitches left)

2, 2, 1, 1, 1, 1, 1, 1, 1, 1, 1,

1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1 = 24 stitches over 22 rows

Could this be a more "elegant" decrease pattern? Sure. But this would get you close to the "size" of the decreases wanted, while preserving the ratio of puff the original wanted.

3 notes

·

View notes

Text

Dive into the Crypto Frontier: Learn How to Trade Crypto with Trading DX

The world of cryptocurrency has exploded in popularity, attracting investors seeking exciting opportunities and a glimpse into the future of finance. However, for newcomers, navigating the unfamiliar terrain of crypto trading can feel daunting. Fear not, aspiring crypto trader! Trading DX is here to equip you with the knowledge and skills to confidently enter the crypto market.

Understanding the Crypto Landscape

Before diving headfirst into trading, let's establish a solid foundation. Here's what you need to know:

What is Cryptocurrency? Cryptocurrencies are digital assets built on blockchain technology, a decentralized and secure ledger system. These digital tokens can be used for various purposes, including payments, storing value, and accessing decentralized applications (dApps).

Types of Cryptocurrencies: The vast crypto world offers a diverse range of tokens, each with unique functionalities. Bitcoin remains the most well-known, while Ethereum, with its smart contract capabilities, fuels the DeFi (Decentralized Finance) space. Stablecoins, pegged to traditional assets like the US dollar, offer price stability.

Crypto Trading Platforms: Your Gateway to the Market

To trade cryptocurrencies, you'll need to choose a reputable crypto exchange. These platforms facilitate buying, selling, and trading crypto assets. Here's what to consider when selecting a platform:

Security: Cryptocurrency exchanges are prime targets for hackers. Choose a platform with robust security measures to protect your funds.

Trading Fees: Compare transaction fees and trading commissions charged by different exchanges.

Supported Cryptocurrencies: Ensure the platform offers the cryptocurrencies you're interested in trading.

User Interface: Choose a user-friendly platform with a clear and intuitive interface, especially if you're a beginner.

Trading DX Resources: Equipping You for Crypto Success

Trading DX is committed to empowering your crypto trading journey. Here's what we offer to support you:

Free Educational Content: Our YouTube channel (@tradingdx) provides a wealth of free video resources – from crypto trading tutorials and technical analysis breakdowns to market insights specific to the crypto space.

Cryptocurrency Glossary: Demystify the jargon with our comprehensive glossary of cryptocurrency terms – from "altcoins" to "proof-of-stake," we've got you covered.

Trading Community: Connect with fellow crypto enthusiasts in our online community. Share experiences, ask questions, and learn from each other's journeys.

Technical Analysis: Unlocking Crypto Market Insights

Technical analysis (TA) plays a crucial role in crypto trading. It involves studying historical price data to identify patterns and trends that may indicate future price movements. Here are some core TA concepts for crypto traders:

Charting: Learn to "read" crypto charts by analyzing price patterns like head and shoulders or double tops and bottoms.

Technical Indicators: Utilize technical indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to gauge market momentum and identify potential entry and exit points.

Candle Chart Patterns: Master the art of interpreting candlestick chart patterns, which visually represent price movements over a specific timeframe.

Fundamental Analysis: Understanding the "Why" Behind the Price

While technical analysis focuses on price movements, fundamental analysis delves deeper, examining factors that could influence a cryptocurrency's value. When applied to crypto, fundamental analysis focuses on:

Project Goals & Technology: Evaluate the underlying technology of the cryptocurrency and its potential for real-world application.

Team & Development: Research the team behind the project and their development roadmap.

Market Adoption & Community: Assess the level of adoption and the strength of the coin's community.

Trading Strategies for Crypto: Tailoring Your Approach

The beauty of crypto trading lies in its flexibility. Here are some popular trading strategies you can explore, depending on your risk tolerance and time horizon:

Day Trading: This strategy involves entering and exiting multiple trades within a single day, capitalizing on short-term price fluctuations. This requires a significant time commitment and a strong understanding of technical analysis.

Swing Trading: Swing trading focuses on capturing price movements over several days or weeks. This strategy targets larger swings in price but requires less active monitoring than day trading.

Positional Trading: This long-term approach involves holding cryptocurrencies for a longer period, based on their underlying value and future potential. Positional trading requires a good understanding of fundamental analysis.

Also See;

Top 5 Meme coin for Bull Run

Crypto Trading Course 2024

How to earn by crypto

About Crypto

How to trade for Beginners

0 notes

Text

How to Become a Great Trader: Mastering the Art of Trading

Introduction

Although it can be a thrilling and profitable endeavour, trading in the financial markets also calls for knowledge, discipline, and skill. We will examine the fundamental ideas and methods that can make you a profitable trader in this extensive tutorial. Gaining long-term success in the financial markets requires learning the art of trading, regardless of the expertise level of the investor.

Understanding the Basics of Trading

What is Trading?

Buying and selling financial instruments including stocks, bonds, currencies, and commodities with the intention of making money off of price changes is known as trading.

Types of Trading

Buying and selling assets during the same trading day in order to profit from momentary price changes is known as day trading.

Swing trading is the practice of holding positions for a few days or weeks in order to profit from medium-term market trends.

Long-term investing is the practice of holding investments for a considerable amount of time—often years—with the goal of generating large returns over time.

Developing a Trading Plan

Setting Clear Goals

Establish your trading time horizon, risk tolerance, and financial objectives. Set reasonable expectations regarding profits and losses.

Creating a Strategy

Select a trading approach that fits your personality and ambitions. Technical analysis, fundamental analysis, or a mix of the two may be used in this.

Risk Management

To guard against losses, use risk management strategies include portfolio diversification, stop-loss orders, and position sizing.

To Becoming A Great Trader JOIN NOW

Mastering Technical Analysis

Understanding Price Charts

To find possible trade chances, become knowledgeable about the interpretation of candlestick patterns, trendlines, support and resistance levels, and other technical indicators.

Using Technical Indicators

To analyse price trends and momentum, familiarise yourself with widely used technical indicators such as stochastic oscillators, moving averages, and the relative strength index (RSI).

Chart Patterns

To predict future price changes, identify typical chart patterns like head and shoulders, double tops and bottoms, and flags and pennants..

Utilising Fundamental Analysis

Economic Indicators

Keep yourself updated on important economic indicators that might affect asset values and market mood, such as GDP growth, inflation rates, interest rates, and employment data.

Company Analysis

Prior to considering an investment, consider each company's competitive position, growth potential, management team, and financial standing.

Market Sentiment

To determine market trends and mood shifts, track sentiment in the market using investor sentiment indicators, social media, and news.

Developing Discipline and Patience

Stick to Your Plan

Stick to your trading plan religiously and refrain from acting on impulse in response to transient market swings or feelings.

Manage Your Emotions

By keeping a logical attitude and concentrating on the long-term goals of your trading strategy, you may control your emotions of fear and greed.

Continuous Learning

With books, courses, webinars, and trading networks, stay current on market trends, trading strategies, and industry advancements.

To Becoming A Great Trader JOIN NOW

Practising Risk Management

Capital Preservation

Avoid overleveraging and only risk a small portion of your portfolio on each trade to protect your trading money.

Stop-Loss Orders

Stop-loss orders are a useful tool for controlling possible losses and quitting losing trades before they cause large losses.

Diversification

To minimise risk and optimise profits, diversify your investing portfolio among several industries, geographical areas, and asset types.

Conclusion

Great traders are made by commitment, self-control, and lifelong learning. You may improve your chances of making money in the financial markets by learning the principles of trading, creating a strong trading strategy, and managing risk. As you set out on your path to become a profitable trader, never forget to use patience, discipline, and focus on your long-term objectives.

#rogue trader#stock market#crypto#cryptoexchange#cryptocurrency#investing stocks#day trading#trading strategies#trading market#stock exchange

1 note

·

View note

Text

Introduction to MS Excel: Essential Tips for Beginners

Are you a student or a professional looking to enhance your spreadsheet skills? Look no further than Microsoft Excel, a powerful tool that can simplify your data management and analysis tasks. In this Beginner's Excel Tutorial, we'll explore some basic Excel techniques that will set you on the path to becoming a proficient user.

Understanding the Excel Interface

Let's start with the basics. When you open Excel, you'll be greeted with a grid of cells arranged in rows and columns. Each intersection of a row and a column is called a cell, and it is where you can enter and manipulate your data. The ribbon at the top of the screen contains various tabs, each dedicated to a specific set of tools.

Entering Data

To input data into Excel, simply click on the desired cell and start typing. You can enter numbers, text, or a combination of both. Press Enter to move to the next cell below or use the arrow keys to navigate. If you make a mistake, don't worry! You can edit the content of a cell by double-clicking on it.

Basic Formulas

Excel's real power lies in its ability to perform calculations. Formulas are expressions that perform operations on the data in your spreadsheet. The most basic formula involves using arithmetic operators such as addition (+), subtraction (-), multiplication (*), and division (/). For instance, to add the contents of two cells, use the formula =A1+B1, assuming A1 and B1 are the cells you want to add.

Auto fill Feature

Save time and effort by utilizing Excel's Autofill feature. If you have a series of numbers or a pattern, enter the first few and then drag the small square at the bottom right corner of the selected cell to fill the rest automatically. This feature is handy for creating numbered lists, dates, or any sequential pattern.

Cell Formatting

Make your spreadsheet visually appealing and easy to read by formatting cells. You can change the font, font size, color, and even apply borders to cells. Excel also allows you to format numbers, dates, and currency to suit your preferences or the requirements of your data.

Sorting and Filtering

Efficiently organize your data by sorting and filtering. Highlight the range of cells you want to organize, go to the "Data" tab, and choose the desired sorting or filtering option. This is particularly useful when working with large datasets, allowing you to focus on specific information.

Charts and Graphs

Excel makes it simple to represent your data visually through charts and graphs. Highlight the data you want to visualize, go to the "Insert" tab, and choose the type of chart that best suits your data. Whether it's a pie chart, bar graph, or line chart, Excel has you covered.

Saving and Sharing

Once you've created your masterpiece, don't forget to save your work. Click on the floppy disk icon (or use the shortcut Ctrl + S) to save your spreadsheet. You can also share your Excel file with others by clicking on the "Share" option, allowing multiple users to collaborate on the same document.

Conclusion

This brief Beginner's Excel Tutorial covers the fundamental skills you need to get started with Microsoft Excel. As you become more comfortable with these basic techniques, you'll be ready to explore more advanced features and functionalities. Excel is a versatile tool that can be an asset in various fields, so embrace the learning process and watch your spreadsheet skills grow

0 notes

Video

tumblr

Forex Education : Double Bottom Chart Pattern Hindi - Price Action Series The Simplest, Easiest, most Commonly found and probably the first Chart pattern that people learn is the 'Double Bottom Chart Pattern' in Price Action. This Video will try to explain ; 1) What is 'Double Bottom Chart Pattern'? 2) How to Identify a Double bottom pattern? 3) Pre-requisites for double bottom & ideal conditions 4) Confirmations 5) How to use Volume to confirm the chart pattern? 6) Take Profit targets and Stop loss strategies for double bottom chart patterns and much much more.. if you are beginner, you Must watch this video as this will be the basis of our Chart pattern analysis. Hope it helps. https://video.forexreview.top/forex-education-double-bottom-chart-pattern-hindi-price-action-series_cf64b3f49.html by

#Forex Education and Tutorial Video - RSS Feed#Forex Education : Double Bottom Chart Pattern Hindi -

0 notes

Text

Medical, Cloth, and DIY Mask Tips

Hey folks, guess we’re doing another little masterpost! This one is for mask tips and tricks.

We’ll update as we run into things or as readers share them, so pop on back to the original post to see what’s new :)

For Starters: How to Use a Cloth Mask

Check out this instructional video, which includes how to put them on and take them off. This can help even if you are using a non-standard type of mask, just so you know what the standards are.

Here’s a second instructional video on how to use masks, in case you wanted to see multiple takes.

DIY Tricks

General resources

Masks For COVID-19 forum post - several DIY options plus additional info.

A couple links that were suggested in this post from @howilearnedtocope (sorry, we can’t possibly do video descriptions for all of these):

DIY facemask with filter pocket from Maker’s Habitat (video)

Facemask with adjustable wire and filter pocket from Easy2Sew (video)

Craft Passion Face Mask Pattern (pattern & instructions)

A Dr Explains how to make a facemask from a HEPA filter (video)

Experts devise do-it-yourself face masks to help people battle coronavirus (video)

No-sew masks

This no-sew mask video tutorial uses a piece of square fabric and hair ties; might be a little fragile. Fold the fabric into a long and thin band about three times the width you’d want the final mask to be. Put hair ties at the 1/3 and 2/3 marks, then fold the ends over and tuck them into each other. Pick up by the hair ties and put on as usual. We’re guessing this will work best with a well-place safety pin or two.

A no-sew mask made only of a cut up t-shirt (skip to 5:15). Cut across the chest from armpit to armpit; cut across the shoulders so the line rests just below the bottom of the collar. You should have a long rectangle that comprises the chest and sleeves of the shirt. Now, cut a triangle into the sleeve sections so each sleeve is split into two ties. The bottom of the triangle would be dead center and about 1/3 the sleeve height, with the point at the seam between sleeve and chest. Place mask on face, tying the top ties first at the base of your skull and the bottom ties second, pulling them up higher and putting them at the back of your head. This will twist the fabric around your jaw to improve the fit.

How to Make a Face Mask in 20 Seconds with a T-Shirt - put a long-sleeved shirt on your shoulders with head through collar and collar pulled up over your nose. Use sleeves to tie behind your head/neck to tighten the fit.

Mask materials

If you’re not sure what to use for your mask, consider this infographic:

[Chart: Household Materials’ Effectiveness Against 0.02-Micron Particles. Surgical mask: 89%; vacuum cleaner bag: 86% dish towel: 73%; cotton blend: 70%; antimicrobial pillowcase: 68%; linen: 62%; pillowcase: 57%; silk: 54%; 100% cotton t-shirt: 51%; scarf: 49%]

This chart comes from Smart Air Filters and seems decently well-sourced. Click through for further mask material analysis, such as whether it helps to double fabric over (looks like only for dish towels) and how breathable each option. Their best and most balanced pick is pillowcases of 100% cotton tees.

The study the above chart is based on can be found here: Testing the Efficacy of Homemade Masks: Would They Protect in an Influenza Pandemic? (Davies, et. al., 2013)

Earloop materials for homemade masks

Since elastic is selling out all over, here are some other ideas to try:

Circles cut from sock legs

Elastic loops from those loop weaving kits kids use to make potholders

Elastic cut out of old clothes or fitted sheets

Shoelaces for tie-backs

Hand-crocheted strings for tie-backs

With a little imagination…

Anything can serve as a mask! Entertain yourself and get some tips by watching this man quite effectively repurpose a jockstrap as a mask.

Troubleshooting & Making Masks Suck Less

The ear loops hurt your ears

If you have long hair and the ear loops are long enough (or you can make them long enough), try looping them around a bun in the back of your head! May also work to do a bun on either side, behind your ears, but we don’t have any field testing on that.

Try the kind of mask with loose strings from each corner, that you tie behind your head.

Make or buy bands with buttons at either end, then attach the ear loops to either button instead of your ears. The band goes around the back of your head. This video by Emily Rinke walks you through how to crochet one of these for yourself; the pattern is written in the video description. Emily also has a Facebook post where you can connect with folks making these, if you need some and can’t do it yourself.

[Image: Emily, a person with dyed red hair and a low ponytail, demonstrating how these bands are used, plus pictures of crocheted bands of different colors. Source: Emily Rinke]

Sew buttons on a headband so they’re just above your ears, and attach your mask there.

[Image: a medical professional with light skin and curly dark hair swept back by a cloth headband. They are demonstrating the button-on-headband method.]

You’ve got a beard

Try putting a t-shirt over your head and resting the collar over your nose and ears. The rest of the shirt falls over your shoulders for coverage.

[Image: A woman with gray hair with a pink t-shirt over her face as described above.]

Thanks to friend of the blog Hawthorn Wright for getting this on our radar! Hawthorn is a fantastic sci-fi writer, so maybe check out her Proxima Alliance series on Amazon to help you through this boring-ass quarantine 😉

Your glasses fog up

Using a mask with a wire that forms it around the bridge of your nose is a big help, so make or buy with that in mind.

Covering the nose wire with a flannel casing on the underside of the mask helps too, as the flannel more readily absorbs the moisture. Full information on putting flannel around the nose wire in this Twitter thread, and thank you to @ark-shifter for this one.

@juliainfinland pointed out that if you wear your glasses so that they hold the mask against your nose and face, there’s less room for the air to escape. Your mileage may vary based on face mask and glasses size/style.

162 notes

·

View notes

Photo

ENTERLAC JACKET PATTERN "LILAC BLOSSOM" 💜

In the today post I want to remember you this enterlac jacket pattern "Lilac blossom". Due to enterlac part I wouldn't recommend it for beginners, but if you're an advanced knitter and you like to try new knitting methods it's the best choice! 👍 Find it in my shops on:

Ravelry: https://buff.ly/35XrXQM

LoveCrafts: https://buff.ly/2StpeMw

NOTE: Jacket is worked both flat and in the round in one piece. Knitting starts from enterlac pattern which is made separately; top and down parts are made bottom-up and top-down respectively in stockinette stitch; yoke is realized in raglan. Jacket is decorated with seed stitch pattern and colored lines, has a hood and can be joined with buttons. To make this pattern easier to follow the sizing instructions are color-coded

Realizing this model you’ll learn how to:⠀

✔ knit a seamless jacket for a newborn;

✔ knit in enterlac knitting technique;

✔ work raglan bottom-up in round;

✔ make a provisional cast on with crochet;

✔ work in short row technique;

✔ join stitches with tapestry needle. ⠀

PATTERN INCLUDES:⠀

➡️ written pattern (row by row, stitch by stitch);⠀

➡️ model chart;⠀

➡️ 4 video tutorials about enterlac knitting and 2 videos about other knitting techniques;⠀

➡️ photo tutorials;

➡️ baby measurement table;

➡️interesting information about knitting and a surprise for all customers ⠀

AVAILABLE SIZES: 3, 6 and 12 months.

YARN: Lana Grossa Cotone (100% cotton; 125 m/136 yds per 50g skein) or similar cotton yarn. 1 skein of yarn A: lilac color (n. 7) 3-5 skeins of yarn B: multi-color (n. 336)

NEEDLES AND ACCESSORIES:

• 3.5 mm (UK/US 4.0) circular needles (60 cm length);

• set of 3.5 mm (UK/US 4.0) double-pointed needles;

• 8 stitch markers;

• 2 pieces of additional yarn (30 cm length) for sleeves;

• 7 buttons (12 mm diameter);

• 3.0 mm crochet;

• 2 stitch holders;

• tapestry needle.

LANGUAGE: English ⠀

FILE FORMAT: PDF ⠀

KNITTING LEVEL: Medium/Advanced (knowledge of knit and purl stitches, YO, K2tog; P2tog, wrapped stitches).

PRICE: 10.98€ (including all fees and taxes).

To buy it visit my shops:

Ravelry: https://buff.ly/35XrXQM

LoveCrafts: https://buff.ly/2StpeMw

0 notes

Text

options trading research Louisiana If the market were to behave in the same way every day, then trading would be child's play.

Table of Contents

options trading research Louisiana The term "trading system" is not necessarily confined to a series of computerized "black box" trading signals.

practice options trading Louisiana Options brokers these days have advanced order technology that will allow you to enter swing trades based on the price movement of the stock so you don't have to watch this stock all day.

what are options in stock trading Louisiana The options market is very complex.

make a living trading options Louisiana Each term has a specific application for yielding profits under certain market conditions.

taxes on options trading Louisiana Knowing the ins and outs of various trade setups is useless if you don't have a trading methodology that guides you in every step of the trade process.

options trading course tradewins pdf Louisiana Try to focus on percentage gains versus dollar amount gains in your trading.

options trading stories Louisiana There is no shame in being wrong.

options trading crash course pdf Louisiana If your average holding time for an option trade is seven days then you don't want to buy an option with three months of time premium left on it because you would be paying more for the extra time with the option's purchase price.

options trading research Louisiana The more tools that are in your toolbox, the more prepared you will be for changing market conditions.

That said, your trading system doesn't need to work for all stocks it just has to work for certain types of stocks, certain volatility of stocks and certain price levels of stocks etc. So focus your trading system on certain stocks that have price behavior that is predictable to the net results you wish to abstract from a stock. You can develop a trading system, a trading approach, and a trading methodology by identifying a price movement pattern (or lack of price movement pattern) or some event that occurs on some sort of regular basis. This means you can trade price behavior patterns on price charts such as: traditional chart patterns, trends, swings, pivot points, boxes etc. or you can trade events that motivate stock price such as earnings runs, post earnings runs, stock splits, seasonal factors etc. Bottom line to make the maximum profit in options trading you want your stock to move in your favor fast and you want it to move far. Just a relatively small movement in the price of a stock can double your money in options!There are so many different strategies and combinations that you can trade with options.

Unique Ideas:

the best options trading course Louisiana

xlt options trading course Louisiana

interactive brokers options trading tutorial Louisiana

sugar options trading Louisiana

best course for learning options trading Louisiana Human beings and there mental makeup are extremely complex so it is extremely important that stock option traders not only have a sound stock option trading methodology but the discipline to follow their trading methods.

Whether it is long calls, covered calls, bear spreads, or selling naked index options, each has its own trading system model. An option trading system that is worth its salt will help you weed out false signals and build your confidence in entries and exits. How Important is an Options Trading System?The options market is very complex. Trading options without a system is like building a house without a blueprint. Volatility, time and stock movement can all affect your profitability. You need to be cognizant of each of these variables. It is easy to be swayed by emotion when the market is moving. Having a system helps to control your reaction to those very natural and normal emotions. How often have you sat and watched a trade lose money the instant your buy order filled? Or, have you ever watched a stock skyrocket in price while you are pondering over whether or not to buy it? Having a structured plan in place is crucial to make sound and objective trading decisions. By creating and following a good system, you can hone your trading executions to be as emotionless and automatic as a computer. Advantages of an Options Trading SystemLeverage - Trading options gives your account leverage on the stock market.

best options trading newsletter reviews Louisiana Finding Or Creating Your Own Options Trading System That WorksStock Options are wonderful!

Nor would you buy an option with less that 30 days till expiration as time decay would erode the value of option so quickly that even if the option's underlying stock movement moved favorably to you the time decay would prevent you from realizing a gain in the option itself. The third thing to profitable option trading is understanding the relation of volatility between the market, the underlying stock that underlies the stock option, and the effect is has on the value of the option itself. When the general stock market as an index goes through periods of volatility or low trading ranges the stocks that make up the market tend to follow overall trend and also begin to experience periods of low overall volatility which in turn can cause derivative like stock options to become cheap or low premiums. But if the market's volatility rises it is likely that individual stocks will follow the trend causing stock option premiums to increase in value given that the market moves in the trader's favor. The next key in how to trade stock options successfully is having a stock option trading method that takes these key factors into consideration while giving clear entry signals, clear exit signals, a defined system of trade management, and a profit factor greater than your average loss over a series of trades. Knowing the ins and outs of various trade setups is useless if you don't have a trading methodology that guides you in every step of the trade process. A solid trading method holds you by the hand and defines each step while leading you to being a consistent winner in the markets and a profitable trader when all is said and done. Finally, the fifth and final key to successfully trading stock options is yourself, particularly your trading psychology. Human beings and there mental makeup are extremely complex so it is extremely important that stock option traders not only have a sound stock option trading methodology but the discipline to follow their trading methods. You can give two people the same exact winning trading system but it is very common for them to have different results. Invariably, the one that has the ability to remain as detached from his losing trades as well as his winning trades while maintaining the discipline to follow the system's rules no matter the trading result will emerge the greatest winner in the end. Using these five keys as a basis to develop your stock option trading methodology can help you avoid the mistakes and pitfalls of many beginning option traders. By understanding time decay, factoring an option's time into your trading method, how volatility impacts a stock option's value, what defines a reliable stock option trading methodology, and your own trading psychology you now have a foundation to develop into a winning stock option trader. Finding Or Creating Your Own Options Trading System That WorksStock Options are wonderful! This clever derivative of the equities market has to be one of the most ingenious inventions of modern times. For the trader who can learn how to win at trading options there are many luxuries in life that can be experienced. Success in options trading requires a consistent approach for long-term success.

trading 60 second binary options Louisiana This methodical way of money management trading options is the fastest way to potentially rapid account growth, helping you avoid needless set backs.

) You can go to cboe. com for more information on options trading. Directional options trading systems are the best. Keep it simple, buy calls for and upside trade or buy puts for a downside trade. But this means you need a directional stock trading system in order to trade directional options. Here are a couple of different approaches for directional systems:Develop an options trading systems that trades the swings in stock price movement.

introduction to options trading Louisiana A five to ten percent change in the price of a stock can equate to a gain of one hundred percent or more in an option.

A trading system could be something as simple as "buy an option on a stock in an uptrend that breaks the high of the previous bar after at least two days of pull back down movement that make lower lows. " A trading system is simply an organized approach that takes advantage of a repeated pattern or event that brings net profits. Since an Option is a "Derivative" of the stock you must derive your options trading system from a stock trading system. This means your trading system must be based around actual stock price movement. That said, your trading system doesn't need to work for all stocks it just has to work for certain types of stocks, certain volatility of stocks and certain price levels of stocks etc. So focus your trading system on certain stocks that have price behavior that is predictable to the net results you wish to abstract from a stock. You can develop a trading system, a trading approach, and a trading methodology by identifying a price movement pattern (or lack of price movement pattern) or some event that occurs on some sort of regular basis. This means you can trade price behavior patterns on price charts such as: traditional chart patterns, trends, swings, pivot points, boxes etc. or you can trade events that motivate stock price such as earnings runs, post earnings runs, stock splits, seasonal factors etc. Bottom line to make the maximum profit in options trading you want your stock to move in your favor fast and you want it to move far. Just a relatively small movement in the price of a stock can double your money in options!There are so many different strategies and combinations that you can trade with options. You can buy calls and puts for directional trades. You can employ call spreads and put spreads to trade directional movements with a buffered risk, and profit. You can sell or purchase spreads to receive the credit of the premium decay by options expiration. You can trade straddles and strangles if you expect a big move but are not sure in which direction. You can also get into ratio back spreads, condors, and butterflies. And if you're really feeling crazy you can sell 'naked' options (just better use a stop loss or you'll end up like one of my old trading buddies who ran an account to $20 million then gave it all back selling naked options. ) You can go to cboe. com for more information on options trading.

The second way is related to stops. A good system will cut losses quickly and keep them small. Any Option Trader Can Develop an Options Trading SystemAs a trader, it is important build a system that utilizes different types of option strategies-iron condors, broken wing butterflies, calendar spreads, back ratios, straddles, strangles, and collars. It might sound like a foreign language right now, but work on the vocabulary one lesson at a time. Break it down piece by piece and make it your own. Each term has a specific application for yielding profits under certain market conditions. Learn them all at your own pace to enhance upon and build your options trading system. The more tools that are in your toolbox, the more prepared you will be for changing market conditions. If the market were to behave in the same way every day, then trading would be child's play. In order to get started in developing your options trading system, you have to create a trading plan or blueprint to guide you in the right direction. Begin with a basic system and tweak it to define your trading criteria and hone your system.

crash course options trading Louisiana A trading system could be something as simple as "buy an option on a stock in an uptrend that breaks the high of the previous bar after at least two days of pull back down movement that make lower lows.

This is where the big money is.

options trading bots alerts Louisiana This is where the big money is.

It takes the subjectivity and second guessing out of your trading so you can focus on preset factors that make for an explosive trade. Flexibility - Nearly all options traders will tell you that options allow for flexibility in your trading. Opportunities in the options market make it incredibly easy to profit from short-term positions. With earnings events and weekly options, you can build strategies for overnight gains with clearly defined risk. There are a several ways to profit in any kind of market condition from trending to range bound. Protection - An options trading system based on the appropriate strategy for prevailing market conditions can act as a hedge against other investments. Protective puts are commonly used this way. Risk - A good options trading system limits risk in two important ways. The first way is cost. The price of options is very low compared to buying the same amount of stock. The second way is related to stops.

stock options trading alerts Louisiana Protection - An options trading system based on the appropriate strategy for prevailing market conditions can act as a hedge against other investments.

How Important is an Options Trading System?The options market is very complex.

Important Thoughts:

trading options explained Louisiana

options trading basics 3 course bundle Louisiana

trading weekly options for income Louisiana

options trading crash course pdf Louisiana

0 notes

Text

The Knitting and Crochet Post

Alright, so I’ve been posting a lot of my nerdy knitting and crochet lately and several followers have been curious about getting into knitting and crochet so here my own little master post about how to get started! Now this is just a very basic post just to help you get started, but all the sites I've used are great resources where you can learn everything else you need!

(List of resources at bottom!)

The beginning

So first things first, needles and hooks. Most craft store are going to carry 3 types: wood, plastic, and metal, as to what is best it’s going to be all personal preference. The first pair of needles I ever bought were wood so I just kept buying different sizes from the same brand (Clover). Some people swear by their needle/hook material, but really it’s just about what you get used to so just get whatever you feel like for now.

Knitting needles come in different sizes (they’ll have a number and a size in millimeters on them), crochet hooks have a letter and a size in millimeters.

Bigger is better to start (to a point). For knitting starting with something from 8 to 12 is probably best because it’ll be easier to see what you’re doing with bigger needles. Crochet hooks usually come in beginner packs with sizes f, g, h, i, j, and k, start with i, j, or, k.

There are also straight needles (exactly what you’d picture when someone says knitting needles), double pointed needles (pointy on both ends, used for making tube shaped things like socks, mittens, etc), and circular needles (like double pointed, but with a cord connecting them, great for tube things and blankets).

Yarn comes in standard weights too, you’ll see things like worsted or medium, but on the back of a skein of yarn you’ll see a picture of a yarn ball with a number printed on it (1 to 6+) along with what size hook/needle that particular manufacturer recommends for it. For now just buy a yarn in category 4, 5, or 6 and whatever size hook/needle they recommend.

Starting to knit

So you got some yarn and needles, now what?

Now you cast on your first row. Newstitchaday has a nice video here but it’s a little long and he does have a habit of over explaining, though it is the easiest way to cast on.

There’s a lot of ways to cast on

Here’s a guide with pictures for the basic cast on and it also explains the two basic stitches (knit and purl)

Here’s a video of how to knit the first row after casting on (with knit stitches)

Here’s the same thing but with purls

This shows how to bind off/cast off your work when you’re done

You can make a lot of things with just knowing how to cast on, knit, purl, and cast off. Yarnspirations.com has a lot of good free patterns and you can search by a lot of different factors. Here’s 203 free beginner patterns from them.

Ravelry is also a great site for finding patterns.

Knitting in the round is pretty simple too and you can start to make easy socks and what not pretty quickly.

How to knit in the round with double pointed needles

How to knit in the round with circular needles

How to do the invisible join in the round

You can do the basic cast on and off the exact same way as on straight needles.

Increases and decreases

Sometimes you need to add more stitches or take away stitches in a work to shape it or create gaps in it. Here’s the most basic ways to do that.

Basic increase (yarn over/YO)

Knit front back increase (KFB)

Knit 2 together

Don’t be afraid of patterns with other stitches! Knits, purls, YOs, KFBs, and K2togs are just the beginning! Newstitchaday and Craftyarncouncil both have great tutorials for literally everything.

Crochet basics

So many people start with crochet before knitting, supposedly it’s easier than knitting but I learned to knit first and I think they’re the same difficulty and its ll about what you get used to.

One of the main differences between the two is that in knitting you have an entire row of open stitches just on your needle vs in crochet each time you make a stitch (called a crochet) it’s a complete and closed stitch, ergo there’s not need to bind off.

Casting on is (predictably) very different, it’s called chaining (ch) in crochet and here’s how to do it (also used to make cords/ropes in a pattern)

Slip stitch (ss)

How to do a single crochet (sc)

Half double crochet (hdc)

Double crochet (dc)

Treble (tr)

Double Treble (dtr)

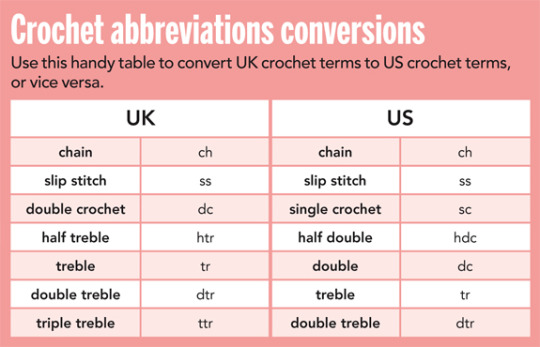

Treble vs double treble vs triple treble, what’s the difference? Mostly semantics, in the US we call it a treble (or triple), though in the UK it’s usually called a double treble. Make sure you always know if your pattern is in US or UK terms! Here’s handy chart of conversions (stitches I listed above are all in US terms)

Crochet in the Round

Crochet in the round can be used to make plushies, rugs, and a million other things and it’s just as easy as doing rows!

How to crochet in the round

There’s a million things I haven’t touched on, but all the sites used above have tutorials for everything. This is just a quick guide on how to start and some basic techniques to get you going.

Feel free to message me about anything and I can see if I can help with questions!

Resources

newstitchaday (how to’s)

lionbrand (how to’s and patterns)

craftyarncouncil (how to’s and patterns)

yarnspirations (patterns)

annie’s catalogue (how to’s and patterns)

ravelry (patterns)

45 notes

·

View notes

Text

The test run was done in miniature because not only was this my first time with actual colorworking but I also had to teach myself doubleknitting. I used super cheap leftover yarn which unfortunately turned out to be different weights, contributing to the yellow wrapping around one edge slightly.

(We don't talk about the other edge. It is a messy, poorly-tensioned eyesore.)

But whatever. Practice piece. It's fine! (It's fine.)

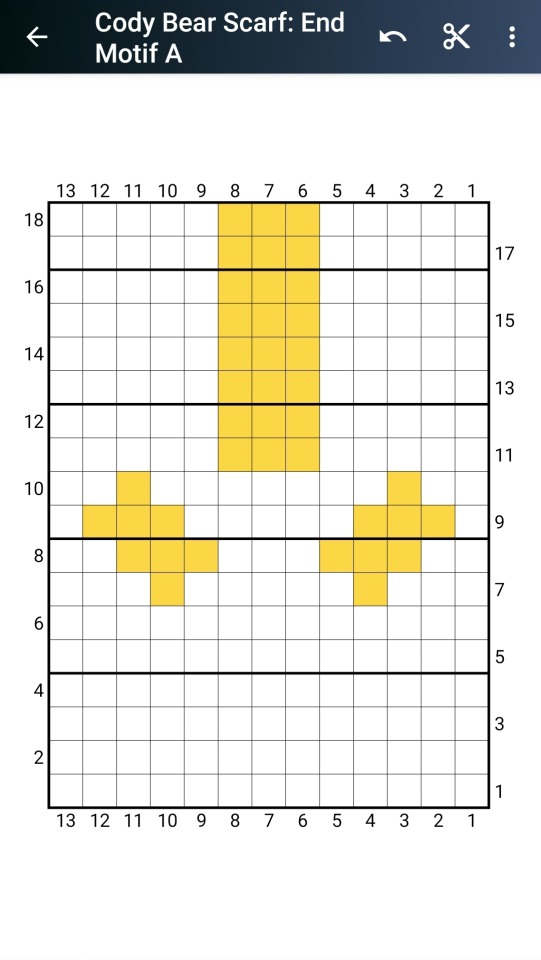

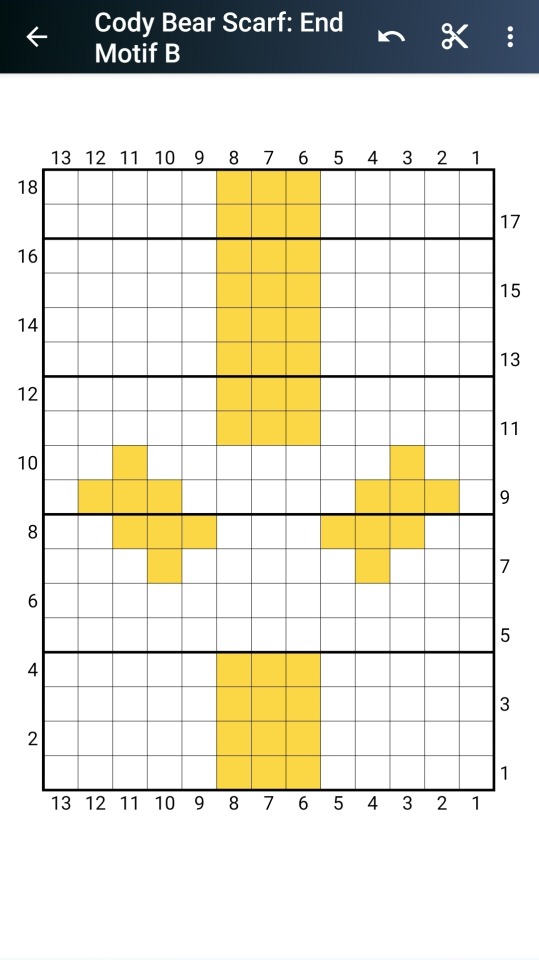

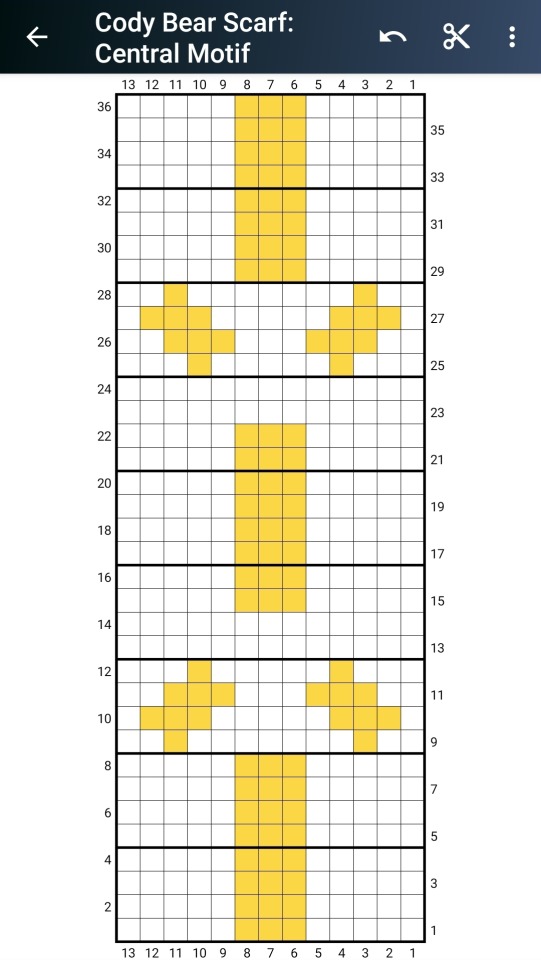

Anyway, next up is the "do as I say, not as I do" pattern for a Commander Cody teddy bear scarf! Mix and match the motifs as you like: I'm indecisive af but hopefully they will be useful to someone.

--------------------------------------

Let's knit!

Required Skills:

Invisible double knitting cast-on: it feels incredibly similar to the long-tail cast-on.

Double knitting: can you do a 1x1 rib and hold two strands at once? you're probably good.

Kitchener stitch to bind off.

Knowing how to read a stitch chart helps, but we're using it purely for the colors. And knitting flat is for the fucking birds, but that's also a requirement for this. Alas.

Required Materials:

Color A: One ball of white yarn, aran/worsted weight is fine.

Color B: One ball of warm yellow (goldenrod, orange-leaning, whatever floats your Venator) yarn, same type and weight. (Don't be like me, use the exact same weight!)

Knitting needles of smaller-than-recommended size, circular or straight. (I used 3.75mm circulars because. I don't think I own any small straight needles? Huh.)

Two double pointed needles or two circular needles in vaguely similar sizes, for binding off.

A blunt tapestry needle, also for binding off.

Directions:

1. Cast on 13 stitches of each color, using the invisible doubleknitting cast-on method.

2. Set up (rows 1-2)! This is covered in the linked tutorial, with one change: In Row 2 ONLY, all knit stitches should be knit through the back loop. This is to compensate for the twist direction of the cast-on method.

3. Choose your end motif, A or B, and follow the chart directions from the bottom up. Since this scarf is reversible, the alternating rows will have the inverse (the gold "wrong" side, but can it really be wrong? Nope!) facing you.

4. No color working, just plain double knitting for the next 48 rows.

5. If your brain is melting from boredom, it's central motif time! If you like the fic version, continue plain double knitting for 36 rows.

6. It's back! 48 rows of plain double knitting.

7. End motif again, this time knitting the chart from top to bottom.

8. Kitchener stitch bind off. **HOWEVER FOR CLARITY'S SAKE, if you're depending on a tutorial like me, you're gonna take the tapestry needle around the right side under the knitting needle points every time you switch from back to front and vice versa. no tutorial indicated this movement and I had to redo stitches an embarrassing number of times.

9. IT'S THE END DOOT-DOO DOO-DOOT-DOO-DOOT

(unless you wanna add fringe, which is totally valid)

Which end motif do you prefer? I'm also open to suggested changes, as the human-sized pattern will require modifications regardless.

I considered other central motif designs like ニ一ニ or 212 in Aurebesh, but they weren't quite balancing in such a narrow space. Aurebesh numbers, in particular, seem to be on a 10x10 grid? Suggestions/chart requests welcome! ^^

Commander Cody Teddy Bear Scarf

Inspired by @jessepinwheel's Star Wars fic, Dielectric Breakdown.

There is a gift waiting for Cody when he visits the Archives to do some work a few days later. It is a double knit scarf in 212th colors--gold-on-white on one side, white-on-gold on the other. It is a wide scarf with a stylized sunburst pattern at both ends, which looks shockingly similar to the pattern he had once painted on his armor.

Modeled by Butters!

(knitting pattern to follow)

27 notes

·

View notes

Text

BITCOIN MINERS HIT with MAJOR BLOW Pre-Halving!! This NEWS Changes EVERYTHING!!

VIDEO TRANSCRIPT

What’s going on, guys? It’s K-Dub here with another episode of Crypto Zombie. Welcome back to the Channel. Hope you’re having a great start to your week, although let’s be honest, every day pretty much just sort of blends and melts into the next day. There’s really no difference between weekends and weekdays. It’s quarantine. Hope you’re doing all right. That being said, let’s have a look at what is going on in the price. Now, we did actually have Bitcoin have a little bit of an interesting weekend where we got all the way up to basically almost seven thousand two hundred dollars. And then we fell even lower than we were yesterday. Now, what is going on right now? Well, I do want to talk about the fact that we actually have seen the previous support turn into resistance. So short term, this isn’t really looking too great. You are having a lot of bitcoin bears coming out saying we’re going to go lower. We’re going to go down to three thousand eight hundred three thousand five hundred. Well, I do want to get into all that today. One of the biggest complaints that you’re hearing out there is pretty much essentially that Bitcoin is just too correlated with the S&P. You could see this is the Bitcoin chart and this is the S&P 500. And if I go back and forth between them really quick, they do tend to look a little bit similar. Right. I’m going to talk about that. I’ll give you my opinion on that moving forward. I also want to talk about Ray Dalio. You may be familiar with him. He’s pretty much expecting a new world order for pretty much the world. And we’re going to talk about whether or not Bitcoin actually plays a role in that. I want to talk about one major problem for the Bitcoin miners. Now, this is something that not a lot of people are talking about. This isn’t the having this is in difficulty adjustment. This is an expensive mining fees. This is something very different, very new. And it could get out of hand relatively quickly. So I want to discuss that as well as obviously I do have some positives as well. At the end, we do want to talk about some Bitcoin adoption and how there’s still companies building in the background to basically make this crypto experience so much easier for newcomers. So lots to go over today. We didn’t make a video yesterday, so we’re going to make up for it double today. If that sounds good to you, you know what to do if you’re not subscribed. What do consider it? And without further ado, we’re hopping directly into the charts. Now, the one thing I want to point out is if we do put on this trend over here on the Bitstamp chart, if we actually look at just the solid parts of the candles, not the Wickes, you actually do notice that we are still being supported. Right. We actually whipped down to this line and we did pull back up. So this is actually good. This shows us that we’re still putting in higher lows and higher low. So essentially, we are still trending upwards. Right. However, a lot of people are comparing this to the S&P, for example. You actually have Larry sirnak over here. And he says everyone who’s longing bitcoin here is effectively along the S&P 500. There is some small divergence, but the correlation is undeniable. And no where close to going away, Bitcoin was even trading sideways over the weekend because it didn’t know what to do. Now, before we get into the rest of the chart analysis, I will give my opinion on this. And actually, while it does appear that Bitcoin is sort of essentially following it, if you actually look at the overall movements and the dates, if I just get all of this out of here, for example, you could see that Bitcoin had its biggest plummet right here on March 12th. And then we started a bit of the recovery. But if you actually look over here, you can have a look and see that the S&P had its lowest on March 23rd. So the question is, is Bitcoin following the S&P or is the S&P following Bitcoin? I. I beg to differ. Maybe it’s the other way around. Maybe it’s not. But what I am trying to say is, even if you look at the gains, for example, from bottom to top, you know, going down to basically this Wyk to the top right here, you notice that the S&P has had about a 25 percent recovery or actually if we move over to bitcoin from the bottom to the top of the Wyk right now, Bitcoin has actually had almost a 75 percent recovery. So while they are moving somewhat similarity, I would argue that Bitcoin is still somewhat uncorrelated granted. Yes, the situation is quite severe. I mean, we have seen the Dow’s best week since 1938 being, you know, basically promoted. At the same time, more than 16 million Americans have lost their job in three weeks. You could see 6.6 million in the week of ending April 4th. So this is not something to be celebrating, so. OK, great. The Dow had a good week, but we have all of this unemployment. So something is definitely wrong here. And we are going to get into this a little bit later in the video. Let me just finish with the chart super quick and then we’ll get to this so you can see that we have fallen below the previous support of this ascending flag, bear, flag, whatever you want to call it. So when you do have previous support, you know, we were bounced here, right? We bounced here, here, here. But then we fell below. And now that is acting as the resistance. That is not necessarily good for Bitcoin short term. But actually, if we have a look. If you look at the 50 moving average on the daily, it does appear that this is actually playing a very significant role in the bitcoin price, at least short. Term, if you could see right here, every single time we hit the 50 moving average, we got rejected, rejected, rejected. We even had a little bit of a wick up here yesterday and we got rejected again. Now, if I go back over here, you do notice that right before we had the crazy plummet right on March 7th, when we started to basically go into our multi-day descent, that was sort of the last line of defense where the bears were pushing down and that was the 50 moving average. So short term, I think that Bitcoin needs to get above this 50 day, which is currently sitting around the seven thousand two hundred dollar level. So if we can get above the $7200 level on the chart right here, stay above it, put in a nice solid daily close, then I think that would be a lot better for Bitcoin. And then we can head back up to my seven thousand eight hundred dollar level that I’ve been talking about for quite some time now. Have I gone bearish? No. As long as bitcoin can maintain within this green triangle, which I’m not gonna go into how we came up with this. We went into this weeks ago on the channel. But essentially, you know, I think Bitcoin, even if we were to fall all the way down to like the five thousand four hundred dollar level would still actually be pretty bullish for Bitcoin. Now, granted, you do sort of want it to maintain above the 200 weakly moving average, which I guess you could say that’s sitting at around the five thousand six hundred dollar level. So five thousand five hundred five thousand six hundred, give or take. But really, I would still be bullish. We would still be in an uptrend on the macro. Right. If you zoom out, that’s still good. However, we are noticing, for example, we have seen sorrow over here saying that he’s looking at a potential head and shoulders pattern. Now, we know that head and shoulders patterns usually mean that the trend is reversing. So an inverse would be going up, a regular going down. So he’s got some of these targets and having a look right here. You know, if you do have the shoulder, the head, the shoulder right here, then you could be looking to potentially come down maybe all the way to the five thousand eight hundred dollar level where we were putting in some previous support back here at the end of March. Okay. Also, I wanted to just one quick mention about the seemy futures. Not going to talk about a gap today specifically, but I do want to talk about the fact that we are being supported right here by the V.P. v.r. You can see right behind my head right here. And this is essentially the most accumulated level for Bitcoin on the CMU futures. This is a level of super high interest for Bitcoin. So I do anticipate there to be a little bit of a struggle around this level. I’m not going to go full bare just yet. You know, we could actually potentially have this sort of maybe double bottom out around the four thousand five hundred before having our blast off. Now, I’m not sure if we’re gonna go back down to the three thousand eight hundred dollar level. I’m just saying it’s a potential possibility. But that being said, if we do go down to some of these lower levels, I personally think it would be an amazing opportunity to accumulate bitcoin before the major blast off. If you do think Bitcoin is going to go to the moon, if you think that bitcoin is a piece of crap and it’s going to zero, well, you could always short it right over on something like by bit. If you’re interested in learning how to short bitcoin and make money, you can check out my tutorial above. I do have a link below obviously when you use it. It does support the channel. But guys, you do know that on the crypto zombie channel we are hollars of last resort. We do believe in bitcoin. If you don’t believe in bitcoin not to share while you’re watching this channel, maybe you’re just interested. I don’t know. But I do have to point out what Robert Kiyosaki has said. And recently he’s become a very big Bitcoin proponent. He’s been all over Twitter lately. And you can see he asks the question, is the Fed broke? Now, before you jump in, let’s hear what he has to say. He says, Hidden in the recent 2.2 trillion Congress rescue bill was buried, a $425 forgien $25 billion for the Fed. He says the Fed has been bailing out the world since 2008. But the question is, who bails out the Fed? Well, now we know we are. Why are the Fed and Treasury hiding this from us? Buy more gold and silver and bitcoin screwed. Now, let’s be honest, he does say that. Come on. The Fed can’t actually go broke, but he does add that it could lose the public’s trust or the population’s trust all around. The Fed cannot go broke in theory, but we can lose confidence, he says, when he talks about the four hundred twenty five billion that the U.S. gave the Fed secretly, he says that could expand to 4.5 trillion of fake dollars into the economy for over 9 trillion from fake Fed dollars. And when confidence goes game over, the IMF steps in and when the IMF steps in. Essentially, he says that IMF stands for I am literally asked if you know what he’s saying. If you get if you catch the drift right now. Here’s an interesting thing before we get into the big story of the day about something that could be quite detrimental for the miners. I want to talk about months ago when the stock market was actually setting all time highs. We did have Ray Dalio. Now he’s co-head of the world’s largest hedge fund. He came out with a bunch of sort of posts. Right. And they were a little bit shocking. The most popular one was called The World Has Gone Mad and the system is broken. You may have remembered that. OK. Now, interestingly enough, for things that he had predicted have actually come true, being number one, the Federal Reserve dropped its policy interest rate to zero percent. Number two, the deficits of government have skyrocketed, especially in the U.S.. Number three, sound finance has gone out the window as central banks have printed billions and trillions of dollars. And most notably, number four, there’s been a lot of controversy about the extent of the corporate bailouts, which many say is way too big compared to the measly twelve hundred dollar check that will eventually get. I guess some people that have direct deposits, it’s already showing up for the rest of us. We may have to wait up to five months. Now he is expecting a new world order. OK, and he came out and talked about this on a recent TED talk. So basically, could Bitcoin be the answer? Well, Raul Powell, he’s a former Goldman Sachs executive, by the way. He basically responded to the overall recent crisis in the global markets. And to quote him, he said, many of you don’t know it. You’re still debating whether Bitcoin is real or not. But there’s literally hundreds of thousands of people and billions of dollars of capital racing to build a new system, whether it’s a payment mechanism, storage mechanism, custody mechanism, a verification mechanism. It is all coming. And we’re going to get into some pretty good Bitcoin adoption news a little bit later. But here is the kicker. Here’s the big problem now. We know that crypto miners have to deal with the having. Right. That’s coming up. If the bitcoin having comes around and the price doesn’t go up. Well, they’re not going to be making enough money. We also have a lot of these newer, you know, ant miners coming out. They’re very expensive. Plus electricity costs. Well, if that wasn’t enough. Now, check this out. Crypto miners in Washington state have to pay what is referred to as evolving industry rates. Now, this goes back to twenty seventeen, OK? Basically, they claim that during the summer of that year, there was a huge influx of power request. Obviously, twenty seventeen was a pretty big month for cryptocurrencies. And this was they said that they were basically having requests from crypto miners to basically use their dirt cheap energy rates. Now, just to put this into perspective, requests from cryptocurrency miners in twenty seventeen totaled one thousand five hundred megawatts of new load, which is more than twice the district’s average load of six hundred million. This is Grant County, by the way. So to access how to assess how to cope with this surges, they basically put in what was known as an evolving industry class. They created a class essentially, and they put the miners in it. So if you fall into this category, essentially, you show high signs of risk regarding regulatory changes, business operations, sustainability and their reliance on large amounts of power over sporadic intervals. So this has led to an increase rate established for crypto miners under this evolving industry’s classification. So not only do the miners have to deal with energy costs as well as buying equipment to compete with each other. You know, a lot of these new miners are quite expensive. They also have to deal with the fact that they’re having is coming up. And they do need those prices to be high enough to maintain profitability. And now they have to deal with an evolving industries classification. Now, I know what you’re saying. Well, this is only in Washington. What’s the big deal? Well, it’s only in Washington now. What if the other states to adopt a start to adopt it? What if it starts to get adopted globally? And now we have everyone around the world basically having this evolving industry’s classification where they’re charging extra money for miners. And now miners have this extra cost on top of everything else. It could be detrimental and it could cause a major unforeseen setback. Right now, we do know that the bitcoin, you know, protocol is designed to have a difficulty adjustment. So it will factor this in over time as miners that cannot afford to basically mine, they will drop out and then it will become more profitable for the miners that stay in. I do anticipate it having a bit of probably thrown a wrench in the gear. Let’s just say that now talking about recently, some people are saying that while the Bitcoin cash having was a flop, it’s probably going to be the same for Bitcoin. You can see just two days after the Bitcoin having mining event, it wasn’t profitable. And actually some of the miners that were mining Bitcoin cash moved to bitcoin, which is great. But if it doesn’t work out for bitcoin, then where do they go? Right. Well, basically, if we have a look over here in case you weren’t paying attention, Bitcoin’s Bitcoin cash is having took place last week and there was a small bump in the price. But essentially those gains have been wiped away. And here’s the big kicker. Since April 6th, the hash rate has fallen 55 percent, basically to the same levels that we had around April of twenty nineteen. So the having seems to have intensified selling pressure from the miners. Some analysts fear that this is basically what’s going to be happening to the Bitcoin having, which is coming up in just a month. Now, according to a. Diction from Morgan Creek. They actually think that Bitcoin is going to go lower over the next month, leading into the having causing lower bitcoin prices. And we did talk about the conspiracy. Not really a conspiracy. It’s a more of a just a theory. But we could see the miners putting some selling pressure on the markets because they want to accumulate more bitcoin leading in to the having right now. If we come over here, our good old buddy, Matty Greenspan, he says that having a bitcoin is fundamentally different than that of Bitcoin cash in that bitcoin itself is the embodiment of digital scarcity, whereas Bitcoin cash represents free money created on the back of Bitcoin. So he says he views these two events as diametrically different from a token OMICS perspective. And a lot of people do say that, well, can’t you just keep forking Bitcoin and forking Bitcoin and forking Bitcoin? It’s like, well, you can, but you can also 51 percent attack bitcoin cash. I think it’s somewhere between $7000 and $12000, whereas it costs over half a million things like five hundred and eighty thousand dollars per hour to attack the Bitcoin network. So it kind of can’t compare the two, right? One is clearly more secure than the other. I’m not getting into fundamentals right now, but I think you can see that even though Bitcoin did have its crazy drop off right here around March 20th, it has literally been going up and up ever since. I mean, you could see we are actually literally we’re starting to curve. But for the most part, we’ve had a very nice recovery for the bitcoin hash rate. Right. So I do want you to basically let me know what you think about that moving forward. What I don’t know why I have this in the back. I was just really weird. It was like a error from coindesk. Look kind of cool. Anyway, let me know what you think about this moving forward. Do you think that this is gonna be a problem with the having? Do you think it’s going to act similar to how the bitcoin cash having, you know, was basically a flop? Personally, I could see prices going lower leading into it and I could see prices going sideways after it. Keep in mind that if we actually have a look at the previous havingthe they didn’t blast off directly to the moon. They actually had some redistribution. Rio cumulation, whatever you want to call it before then starting to take off. Now, for example, with Morgan Creek, they are still looking for a new all time high at the end of this year, but maybe not until September October. Of course, this does depend on what is happening with the economy, right? We have people still out of jobs. They need to pay bills. You’re going to see a lot more panic selling still happening moving forward. Now, I told you guys, I don’t want to just only talk about bad news. I do have some good news. In fact, if we come over here and have a look at this Forbes article, you guys might be familiar with it. They are a peer to peer exchange, something like local bitcoins, but they’re actually trying to do something way cooler than local big and local. Bitcoin’s actually been having a lot of problems lately. But basically they’re looking to expand by launching what they’re calling essentially a sky scanner for Bitcoin. So using a A.I., the platform is going to compare the best prices for bitcoin, aggregating the data pretty much like the Skyscanner does if you’re looking for flights. Not too sure who’s flying right now. But anyway, ineffect, crypto traders can save money by finding better deals. But that’s not even the biggest news. So recently they have partnered with Coinbase. I’m sure a lot of you out there use them and they’re using them essentially for the provision of a wallet and custodial services. But here’s the thing. If we actually look in the near future, they’re looking to integrate what they call an Two-Bit Pass, which is a digital I.D. that’s going to basically unify the know your customer procedure. KYC know that’s one of the biggest problems in cryptos. All of these different exchanges because they’re trying to have compliance. Right. You have to basically enter your information. And this is all done manually. This is a person in the back looking at your I.D., looking at your passport. And sometimes this verification process takes forever. In fact, to be honest, when I was trading a lot of old coins. I remember a new old coin would get listed on an exchange and I would want to hop over there. But the verification process would take multiple days and by the time I was able to get into trade, too late. Right. So you could see, according to essentially over here, the ADR, he says many of the users reached out to us with difficulties about going through the KYC process. So basically, they’re going to be using these military grade sort of like, you know, facial recognition and stuff like that. And these innovations are going to cut down the time required by the users in digital submissions as well as improve the accuracy. And these are like those ones where, you know, how you see people faking out, basically, like you can take a picture of somebody and then use that for a facial recognition. No, they’re actually going to need movement and depth. So this is pretty cool. Now, currently, I am going to admit that they don’t have a Fiat withdrawal option, but they are looking to integrate it into the future. But what they’re trying to do is become the merchant gateway to crypto exchanges. And actually, the chairman of Lubert says the data showed that the number one reason why most people do not even get involved is because of the complexity. My dad still doesn’t have a coin base account. I’m pretty ashamed to admit that, but, you know, he doesn’t want to go to the bank, you know, get his friends even use online banking and then set it up, you know, do the deposit check to see the difference, they deposit like 73 cents and all that. But currently you can see they’re also looking to do a crypto card for liquidating crypto assets, P2P atomic swaps, a fiat wallet. And yeah, I mean, they’re basically looking to also add altcoins into the system as well. Also, in other random news before we go, I just wanted to put this in the video. So apparently the Light Coin Foundation has acted as an executive producer for the heavy metal horror flick. We summon the darkness. Now, I heard it was just one person. This article says it’s the foundation as a whole. But regardless, like Coin is somehow involved in this heavy metal horror movie. Now, here’s the interesting thing. It actually stars ALEXANDRA daddario, Amy for Sife and Johnny Knoxville. Funny enough, I was actually watching the old some of the old Jackass movies there on TV. I was really cracking up. But yes, apparently Johnny Knoxville is in this movie as well, like KOIN is involved in it. Not sure really how much or the validity of that, but I just thought that was interesting. And apparently I did check it out. And we summon the darkness is available to rent or purchase right now digitally. So check it out. Let me know if you saw it. I’m not guaranteeing that it’s going to be good because Litecoin was involved. Looks like kind of a B rate horror film, but just wanted to kind of throw that in there for some fun at the end of the video. And essentially, that is it for me today, guys. So thank you so much again for coming back to the channel. You guys do rock. You are the reason that I try to make videos as friendly as possible. I do appreciate all of your support in this crazy time, and that is why I continue to be here for you as well. Because let’s be honest, this quarantine is getting kind of boring. Actually, did anybody see did you see Saturday Night Live? Anybody that was so weird, they were like doing it from their homes. The news from their houses. You have late night TV shows from home. It’s just totally like a twilight zone is actually what it feels like. But yeah. Anyway, let me know how you’re doing. Hope you’re doing well out there. Stay safe. Be well, of course. Definitely get subscribed. If you have enjoyed the Free Cryptocurrency Telegram Group, if you want to talk to a bunch of other like minded individuals about bitcoin and cryptocurrency. That’s it for me today, guys. Definitely consider getting subscribed. My name is K-Dub. This is Crypto Zombie. Until next time, stay crypto and of course, peace out.

source https://www.cryptosharks.net/bitcoin-miners-hit-major-blow-pre-halving/ source https://cryptosharks1.blogspot.com/2020/04/bitcoin-miners-hit-with-major-blow-pre.html

0 notes

Text

BITCOIN MINERS HIT with MAJOR BLOW Pre-Halving!! This NEWS Changes EVERYTHING!!

VIDEO TRANSCRIPT