#Dynamic Random Access Memory (DRAM) Market

Explore tagged Tumblr posts

Text

The global dynamic random access memory (DRAM) market size reached USD 135.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 359.0 Billion by 2033, exhibiting a growth rate (CAGR) of 11.4% during 2025-2033. The rising consumer electronics industry, along with the widespread adoption of tablets, laptops, smartphones, etc., is primarily driving the market. The integration of AI into DRAM systems is a significant market trend. At present, Asia Pacific holds the largest market share, driven by rapid development in consumer electronics.

0 notes

Text

#Dynamic Random Access Memory (DRAM) Market#Dynamic Random Access Memory (DRAM) Market Share#Dynamic Random Access Memory (DRAM) Market Size#Dynamic Random Access Memory (DRAM) Market Research#Dynamic Random Access Memory (DRAM) Industry#What is Dynamic Random Access Memory (DRAM)?

0 notes

Text

How Apple Relies on Samsung for iPhone Production

Apple and Samsung are two big rivals in the technology industry, and are often portrayed as rivals in the smartphone market. Behind the scenes, however, Apple relies on Samsung for key components used in its flagship product, the iPhone. This relationship may seem odd, but it illustrates the complex nature of global supply chains in the technology sector. In this blog we will examine how Apple trusts Samsung and why this relationship is so important to the creation of the iPhone.

1. The OLED Displays: Samsung’s Technological Edge

One of the most critical components in modern iPhones is the OLED (Organic Light-Emitting Diode) display. These displays are known for their vibrant colors, deep blacks, and energy efficiency, significantly enhancing the user experience compared to older LCD technology. Samsung Display, a subsidiary of Samsung Electronics, is the world’s leading manufacturer of OLED screens.

When Apple transitioned to OLED screens with the iPhone X in 2017, it turned to Samsung due to the company’s unparalleled expertise and production capacity in OLED technology. While Apple has since diversified its suppliers, with LG Display and others entering the fray, Samsung remains the largest provider of OLED screens for iPhones. Samsung’s dominance in this sector gives Apple little choice but to collaborate with its competitor.

2. Chips and Semiconductors: More Than Just Displays

Apple designs its own A-series chips, but the actual production of these chips relies on external manufacturing. While companies like TSMC (Taiwan Semiconductor Manufacturing Company) handle most of Apple’s chip production, Samsung has also played a role in this arena. Samsung is one of the few companies with the technological prowess and manufacturing capabilities to produce advanced semiconductor components.

In previous iPhone generations, Samsung produced the A-series chips that powered these devices. Although TSMC has since become Apple’s primary chip manufacturer, Samsung’s semiconductor division remains a key player in the global chip market, offering Apple an alternative supplier when needed.

3. Memory and Storage: Another Piece of the Puzzle

In addition to displays and semiconductors, Samsung provides memory components such as DRAM (Dynamic Random-Access Memory) and NAND flash storage for the iPhone. These memory components are essential for the smooth operation and storage capacity of iPhones. With its dominance in the memory market, Samsung is one of Apple’s main suppliers, providing the high-quality memory needed to meet the iPhone’s performance standards.

Apple has worked to reduce its reliance on Samsung for memory, but the reality is that Samsung’s market share in the memory and storage sectors is so substantial that avoiding them entirely is nearly impossible. Furthermore, Samsung’s advanced manufacturing techniques ensure that its memory components meet the rigorous standards required for the iPhone.

4. Why Apple Sticks with Samsung Despite the Rivalry

Given their rivalry in the smartphone market, one might wonder why Apple doesn’t completely break away from Samsung. The answer lies in the intricate balance between quality, capacity, and supply chain stability.

Quality: Samsung’s components, particularly OLED displays and memory, are some of the best in the industry. Apple has always prioritized quality in its products, and Samsung’s technological capabilities align with Apple’s high standards.

Capacity: Samsung has the production capacity to meet Apple’s enormous demand. With millions of iPhones sold each year, Apple needs suppliers that can manufacture components at scale without compromising quality. Samsung’s factories are among the few capable of handling such volume.

Supply Chain Risk: Diversifying suppliers is a strategy Apple uses to reduce risk. However, removing Samsung from the supply chain entirely would expose Apple to greater risk if another supplier fails to meet production needs or quality standards. By maintaining Samsung as a key supplier, Apple can ensure a more stable and reliable supply chain.

5. Apple’s Efforts to Reduce Dependency

While Apple remains dependent on Samsung in several areas, the company has made moves to reduce this reliance over the years. For instance, Apple has invested in alternative display suppliers such as LG Display and BOE Technology, as well as expanded its collaboration with TSMC for chip production. Additionally, Apple has explored developing its own in-house components, such as its rumored efforts to create proprietary display technology.

Despite these efforts, it’s unlikely that Apple will be able to completely eliminate Samsung from its supply chain in the near future. Samsung’s technological leadership in key areas, especially OLED displays and memory, ensures that Apple will continue to rely on its competitor for critical components.

Conclusion: A Symbiotic Rivalry

The relationship between Apple and Samsung is a fascinating example of how competition and collaboration can coexist in the tech industry. While they are fierce competitors in the smartphone market, Apple depends on Samsung’s advanced manufacturing capabilities to produce the iPhone, one of the most iconic devices in the world. This interdependence shows that even the most successful companies cannot operate in isolation, and collaboration between rivals is often necessary to bring cutting-edge products to market.

For Apple, the challenge lies in maintaining this balance — relying on Samsung for essential components while exploring new avenues to reduce dependency. For now, however, Samsung remains a crucial partner in the making of the iPhone, demonstrating how complex and interconnected the global tech supply chain has become.

4 notes

·

View notes

Text

0 notes

Text

0 notes

Text

The Mind Behind Simmtronics: Indrajit Sabharwal’s Tech Legacy

Indrajit Sabharwal, a visionary technocrat, has made a deep impact on the semiconductor and technology sectors in India and globally. As the founder and chairman of Simmtronics, his path from humble origins to heading a global company is an epitome of innovation, perseverance, and strategic vision.

Early Life and Education

Having finished his engineering degree from Pune University, Indrajit Sabharwal joined his professional career with ICL UK (currently Fujitsu ICIM) in Pune at a salary of Rs 1,500 per month. With an unrelenting passion for self and professional development, he did three part-time management degrees at this time, setting a strong foundation for his subsequent entrepreneurial ventures.

Entrepreneurial Ventures

In January 1989, Indrajit Sabharwal forayed into business by starting SI Consultants, a small consultancy company in Delhi, with a seed capital of Rs 10,000. Arranging a bank loan helped him purchase basic equipment and put together a dedicated team. During the next eight months, SI Consultants worked with top clients like Modi Lufthansa, Xerox, HP Digital, and Sahara Airlines on business development and IT solutions. This business earned him about Rs 30 lakh in revenue, a good beginning to his entrepreneurial career.

Establishment of Simmtronics

In 1990, drawing on his industry expertise and experience, Indrajit Sabharwal established Simmtronics. With a small office in New Friends Colony, Delhi, the company was engaged in producing and distributing memory modules and Dynamic Random Access Memory (DRAM) technology. Some of the early customers were major companies such as Tulip Telecomm, HCL, LG, and Sahara, indicating fast market acceptance and expansion.

Expansion and Diversification

Simmtronics under Indrajit Sabharwal's vision diversified its product line to motherboards, graphic cards, LED monitors, pen drives, micro SD cards, and hard disk drives. The company set up manufacturing units in Bhiwadi, Rajasthan, and Roorkee, and strengthened its international presence with Singapore and Dubai subsidiaries. By 2012, Simmtronics grew to 21 offices in 14 nations with a workforce of 500 employees. The turnover of the company was Rs 550 crore, with 10-12% annual profit margin.

Innovations and Industry Impact

Simmtronics has led the way in technology innovation. The company rolled out a line of tablets, 24 of which were custom-made in-house products, in March 2012. Over a few million tablets have been sold globally by the company, with high market penetration in the Middle East. Such efforts have entrenched Simmtronics as an integrated manufacturing leader and major global technology player.

Recent Developments

In May 2024, Indrajit Sabharwal revealed plans to launch innovative technology on the cusp of revolutionizing the semiconductor and tech industries. The move reflects his unshakable focus on innovation and his vision for Simmtronics' future expansion.

Accolades and Recognition

Over his long and glorious career, Indrajit Sabharwal has earned many honors. He has been listed in the Top 100 Magazine for semiconductors and technology excellence and is regularly called the "Steve Jobs of India" and the "Guru in Semiconductors." His ambition is to have Simmtronics among the world's most valuable tech firms by 2030.

Conclusion

Indrajit Sabharwal's rags-to-riches transformation from a humble background into a shining figure in the global technology industry is an epitome of grit, ingenuity, and visionary leadership. His achievements have left a lasting impact on the semiconductor industry, establishing benchmarks of quality and motivating upcoming generations of technocrats and entrepreneurs.

0 notes

Text

DRAM Module and Component: Powering High-Performance Computing and Electronics

Dynamic Random-Access Memory (DRAM) modules and components are integral to modern computing and electronic devices, providing essential memory storage for data processing and system operations. DRAM is a type of volatile memory that requires constant power to maintain stored information, and it is widely used in computers, servers, smartphones, and other electronic devices. DRAM modules come in various configurations and capacities, designed to meet the performance and memory needs of different applications. The ongoing advancements in DRAM technology continue to enhance speed, capacity, and energy efficiency.

The DRAM Module and Component Market, valued at USD 97.24 billion in 2022, is projected to reach USD 108.68 billion by 2030, growing at a compound annual growth rate (CAGR) of 1.4% during the forecast period from 2023 to 2030.

Future Scope

The future of DRAM modules and components is characterized by significant advancements aimed at increasing memory density, speed, and energy efficiency. Innovations include the development of new DRAM architectures, such as DDR5 and beyond, which offer higher data transfer rates and improved power efficiency. The integration of DRAM with emerging technologies like artificial intelligence (AI) and machine learning is expected to drive demand for specialized memory solutions that support high-performance computing. Additionally, advancements in memory stacking and 3D DRAM technologies will enable more compact and high-capacity memory solutions for a wide range of applications.

Trends

Key trends in the DRAM market include the transition to higher-speed memory standards, such as DDR5, which offers significant improvements in data transfer rates and overall performance. The focus on energy efficiency is driving the development of low-power DRAM solutions that reduce power consumption in mobile and embedded devices. The growing demand for high-performance computing and data centers is influencing the development of high-capacity and high-bandwidth DRAM modules. Additionally, advancements in memory technology, such as 3D DRAM stacking, are enabling the creation of more compact and efficient memory solutions.

Applications

DRAM modules and components are used in a wide range of applications, including personal computers, servers, smartphones, and tablets. In computing systems, DRAM provides fast and temporary storage for data being processed by the CPU. Servers and data centers rely on high-capacity DRAM to handle large volumes of data and support demanding applications. In mobile devices, DRAM supports smooth and responsive operation by providing quick access to frequently used data. Additionally, DRAM is used in gaming consoles, automotive systems, and industrial electronics to enhance performance and functionality.

Solutions and Services

Manufacturers and service providers offer a range of solutions and services for DRAM modules and components. Solutions include the design and production of DRAM modules with various capacities, speeds, and configurations to meet different application requirements. Services encompass memory testing, validation, and integration support to ensure optimal performance and compatibility with other system components. Customization options are available for specialized memory needs, and companies provide research and development support to advance DRAM technology and explore new applications. Additionally, technical support and consulting services help optimize memory solutions for specific use cases.

Key Points

DRAM modules and components provide essential memory storage for computing and electronic devices.

Future advancements focus on higher-speed memory standards, energy efficiency, and memory stacking technologies.

Trends include the adoption of DDR5, energy-efficient solutions, high-performance computing demand, and 3D DRAM.

Applications span personal computers, servers, smartphones, tablets, gaming consoles, and industrial electronics.

Solutions and services include DRAM module design, memory testing, integration support, customization, and R&D support.

0 notes

Text

Fluorine Aromatic Pi Film Market Developments, Trends & Opportunities till 2032

Fluorine Aromatic Pi Film Market provides in-depth analysis of the market state of Fluorine Aromatic Pi Film manufacturers, including best facts and figures, overview, definition, SWOT analysis, expert opinions, and the most current global developments. The research also calculates market size, price, revenue, cost structure, gross margin, sales, and market share, as well as forecasts and growth rates. The report assists in determining the revenue earned by the selling of this report and technology across different application areas.

Geographically, this report is segmented into several key regions, with sales, revenue, market share and growth Rate of Fluorine Aromatic Pi Film in these regions till the forecast period

North America

Middle East and Africa

Asia-Pacific

South America

Europe

Key Attentions of Fluorine Aromatic Pi Film Market Report:

The report offers a comprehensive and broad perspective on the global Fluorine Aromatic Pi Film Market.

The market statistics represented in different Fluorine Aromatic Pi Film segments offers complete industry picture.

Market growth drivers, challenges affecting the development of Fluorine Aromatic Pi Film are analyzed in detail.

The report will help in the analysis of major competitive market scenario, market dynamics of Fluorine Aromatic Pi Film.

Major stakeholders, key companies Fluorine Aromatic Pi Film, investment feasibility and new market entrants study is offered.

Development scope of Fluorine Aromatic Pi Film in each market segment is covered in this report. The macro and micro-economic factors affecting the Fluorine Aromatic Pi Film Market

Advancement is elaborated in this report. The upstream and downstream components of Fluorine Aromatic Pi Film and a comprehensive value chain are explained.

Browse More Details On This Report at @https://www.globalgrowthinsights.com/market-reports/fluorine-aromatic-pi-film-market-100576

Global Growth Insights

Web: https://www.globalgrowthinsights.com

Our Other Reports:

Global Data Acquisition MarketMarket Share

Global Radiation Dose Monitoring MarketMarket Growth

Digital Workplace Transformation Service MarketMarket

CAD CAM Milling Machines MarketMarket Share

Private LTE MarketMarket Growth Rate

Respiratory Drug MarketMarket Forecast

Global Cyber-Physical System MarketMarket Size

Structural Heart Devices MarketMarket Growth

Ship Exhaust Gas Scrubber MarketMarket Analysis

Predictive Genetic Testing and Consumer Genomics MarketMarket Size

Global Strapping MarketMarket Share

Global Silicone Elastomers For Medical Applications MarketMarket Growth

Location Based Advertising MarketMarket

Panoramic Camera MarketMarket Share

Dental CAD and CAM Milling Machines MarketMarket Growth Rate

Light Switches and Electrical Sockets MarketMarket Forecast

Global E-Merchandising Software MarketMarket Size

Satellite-enabled IoT MarketMarket Growth

Microsatellite MarketMarket Analysis

Active Optical Cable MarketMarket Size

Global Composable Infrastructure MarketMarket Share

Global Advanced Metering Infrastructure (AMI) MarketMarket Growth

Dynamic Random Access Memory (DRAM) MarketMarket

Water and Wastewater Treatment Chemicals (WWTCs) MarketMarket Share

Rotomoulding Powder MarketMarket Growth Rate

Phytogenics MarketMarket Forecast

Global Automotive Electric Window Regulator MarketMarket Size

Heli-Coil Thread Inserts MarketMarket Growth

Virtual Reality in Gaming MarketMarket Analysis

Touch Based Human Machine Interface (Hmi) MarketMarket Size

Global Garage Door Replacement Parts MarketMarket Share

Global Semiconductor Used High Purity Sputtering Target Material MarketMarket Growth

RH (Wet Strength Resin) Polyaminoamide-epichlorohydrin (PAE) MarketMarket

Meetings, Incentives, Conventions and Exhibitions (MICE) MarketMarket Share

Advanced Materials and Technologies for Public Works Infrastructure Projects MarketMarket Growth Rate

Remote Proctoring Solutions MarketMarket Forecast

Global Drywall Screws Market Market Size

Lead Melting Furnace MarketMarket Growth

Spacer Bar MarketMarket Analysis

Brass Fastener MarketMarket Size

0 notes

Text

The Dynamics of Bulk RAM Suppliers in the Global Market

In the rapidly evolving landscape of technology, Random Access Memory (RAM) stands as a fundamental component that fuels the performance of devices ranging from smartphones to supercomputers. The demand for RAM continues to surge as advancements in artificial intelligence, cloud computing, and big data analytics drive the need for faster and more efficient memory solutions. At the heart of this demand lies the critical role played by bulk RAM suppliers in the global market.

Understanding Bulk RAM Suppliers

Bulk RAM suppliers are entities that specialize in the mass production and distribution of memory modules to various industries and sectors worldwide. These suppliers operate within a highly competitive environment where factors such as price, quality, and technological advancements significantly influence market dynamics. Key players in this industry include major semiconductor manufacturers like Samsung Electronics, Micron Technology, and SK Hynix, among others.

Market Dynamics and Trends

The market for bulk RAM is characterized by several key trends that shape its growth and development:

1. Technological Advancements: The continuous evolution of semiconductor technology drives innovations in RAM, leading to higher capacities, faster speeds, and improved energy efficiency. Suppliers invest heavily in research and development to maintain a competitive edge in this rapidly advancing field.

2. Demand from Emerging Technologies: Emerging technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT) require robust memory solutions to handle vast amounts of data in real-time. This demand amplifies the need for reliable bulk RAM suppliers capable of scaling production to meet market requirements.

3. Global Supply Chain Challenges: The semiconductor industry, including bulk RAM suppliers, faces challenges related to supply chain disruptions, geopolitical tensions, and fluctuating raw material prices. These factors can impact production capabilities and lead to supply shortages or price volatility.

4. Shift Towards Mobile and Cloud Computing: With the proliferation of smartphones, tablets, and cloud computing services, there is a growing demand for mobile DRAM and server-grade RAM. Bulk RAM suppliers must cater to diverse product specifications while ensuring compatibility and performance across different platforms.

Key Players in the Industry

1. Samsung Electronics: As a global leader in semiconductor technology, Samsung Electronics dominates the market with its extensive range of DRAM and NAND memory solutions. The company’s vertical integration and advanced manufacturing capabilities enable it to maintain a competitive position in the bulk RAM market.

2. Micron Technology: Based in the United States, Micron Technology is renowned for its innovations in memory and storage solutions. The company focuses on delivering high-performance DRAM and NAND products tailored to meet the needs of various industries, including consumer electronics and enterprise computing.

3. SK Hynix: Headquartered in South Korea, SK Hynix has emerged as a key player in the semiconductor industry, offering a diverse portfolio of memory solutions ranging from mobile DRAM to high-capacity server memory. The company’s strategic partnerships and technological expertise contribute to its significant presence in the global bulk RAM market.

Challenges and Opportunities

Despite the robust growth prospects, bulk RAM suppliers face several challenges that warrant strategic considerations:

Intellectual Property Rights: The semiconductor industry is heavily regulated, with stringent intellectual property laws governing product development and innovation. Bulk RAM suppliers must navigate these legal complexities to safeguard their technological advancements and market competitiveness.

Environmental Sustainability: The manufacturing processes involved in producing bulk RAM can have significant environmental impacts, including energy consumption and waste generation. Suppliers are increasingly focusing on sustainable practices and green technologies to mitigate these effects and meet regulatory requirements.

Global Economic Uncertainty: Economic fluctuations, trade policies, and currency exchange rates can influence market demand and profitability for bulk RAM suppliers. Strategic diversification and risk management strategies are essential to navigate these uncertainties effectively.

Future Outlook

Looking ahead, the future of bulk RAM suppliers appears promising with continued advancements in technology and expanding applications across various industries. Key areas of focus include:

5G Expansion: The rollout of 5G networks will drive demand for high-speed memory solutions capable of supporting enhanced mobile connectivity and bandwidth-intensive applications.

Artificial Intelligence and Edge Computing: The proliferation of AI-driven technologies and edge computing platforms will necessitate innovative memory solutions that can deliver low-latency performance and high reliability.

Next-Generation Computing: Quantum computing, neuromorphic computing, and other disruptive technologies will create new opportunities for bulk RAM suppliers to innovate and differentiate their product offerings.

Conclusion

In conclusion, bulk RAM suppliers play a pivotal role in the global semiconductor industry, catering to diverse technological needs and market demands. As the demand for faster, more efficient memory solutions continues to grow, these suppliers must remain agile, innovative, and responsive to evolving market dynamics. By embracing technological advancements and strategic partnerships, bulk RAM suppliers can capitalize on emerging opportunities and maintain a competitive edge in this dynamic and rapidly evolving market landscape.

WANT TO BUY RAM in BULK?

VALUETECH is a premier global supplier specializing in bulk RAM distribution, catering to diverse business needs worldwide. Renowned for reliability and excellence, VALUETECH offers a comprehensive range of RAM models at competitive prices, tailored to meet the demands of large corporations, educational institutions, and government agencies. With a commitment to quality and customer satisfaction, VALUETECH ensures seamless procurement processes, from personalized quotations to efficient logistics and support services. Whether scaling up operations, upgrading technology infrastructure, or launching new initiatives, businesses trust VALUETECH for their bulk RAM purchases, backed by extensive industry expertise and a dedication to delivering superior products and services on a global scale.

0 notes

Text

The global DRAM market is poised for significant growth, having reached US$ 121.1 Billion in 2023. With a CAGR of 11.79% projected through 2032, the market is expected to expand to US$ 339.8 Billion. This growth is largely driven by the increasing demand for consumer electronics, including tablets, laptops, and smartphones.

0 notes

Text

#Dynamic Random Access Memory (DRAM) Market#Dynamic Random Access Memory (DRAM) Market Share#Dynamic Random Access Memory (DRAM) Market Size#Dynamic Random Access Memory (DRAM) Market Research#Dynamic Random Access Memory (DRAM) Industry#What is Dynamic Random Access Memory (DRAM)?

0 notes

Text

Samsung LPDDR5X Improves LPDDR DRAM Battery Efficiency

Samsung tested the fastest LPDDR5X on MediaTek’s flagship phone.

LPDDR5X Smartphone

MediaTek’s next-generation Dimensity platform confirmed Samsung’s 10.7Gbps LPDDR5X. Mobile devices with new LPDDR DRAM offer longer battery lives and stronger AI functions with about 25% higher power consumption and performance. Samsung, a memory technology leader, certified MediaTek’s next-generation Dimensity platform’s 10.7 Gbps LPDDR5X DRAM, the fastest in the industry.

LPDDR5X Samsung

MediaTek’s second-half flagship Dimensity 9400 System on Chip (SoC) verified 10.7Gbps operation speed utilising Samsung’s LPDDR5X 16-GB package. Together, the companies completed the certification in three months.

The 10.7Gbps LPDDR5X from Samsung outperforms the previous generation by 25% in performance and power consumption. This boosts AI performance like voice-to-text generation and extends mobile device battery life by not requiring a server or cloud connection.

The fastest LPDDR5X DRAM in the market, which is anticipated to dominate the AI smartphone market, has been confirmed by Samsung thanks to its strategic partnership with MediaTek, according to Samsung Electronics Memory Product Planning VP YongCheol Bae. “With active customer collaboration, Samsung will keep innovating and provide the best solutions for the on-device AI era.”

LPDDR5X Specs

MediaTek’s next-generation Dimensity chipset, which is the first in the world to be validated at LPDDR5X operating speeds up to 10.7Gbps, was made possible by collaborating with Samsung Electronics, according to company senior vice president JC Hsu.

This will allow future devices to deliver mobile performance and AI functionality that has never been seen before. “Developers and users will find it easier to take advantage of more features and AI capabilities with less impact on battery life thanks to this updated architecture.”

LPDDR DRAM

In light of the growing market for on-device artificial intelligence, particularly for AI smartphones, the need for high-performance, energy-efficient LPDDR DRAM systems is growing. In addition to extending the market for low-power, high-performance DRAM beyond smartphones to servers, PCs, and automobiles, Samsung is strengthening its technological leadership in this area with the validation with MediaTek.

Overview

(LPDDR DRAM)Low Power Double Data Rate Dynamic Random Access Memory, has become a key component in the rapidly developing field of mobile technology, propelling notable breakthroughs in mobile devices. The newest generation of LPDDR DRAM promises 25% higher power consumption and performance along with improved AI capabilities and a longer battery life. This article explores how this technology is transforming user experiences and establishing new standards for mobile performance.

LPDDR DRAM: What is it?

Mobile devices use LPDDR DRAM memory, which combines fast data processing with low power consumption. It is essential for controlling how well smartphones, tablets, and other mobile devices can multitask. The most recent version of LPDDR DRAM offers increased bandwidth, increased performance, and increased efficiency, making it an essential component of contemporary mobile devices.

Extended Life of Batteries

Extending battery life is one of the new LPDDR DRAM’s most notable features. This progress is made possible by a number of significant enhancements:

Enhanced Energy Efficiency

The most recent LPDDR DRAM has sophisticated power management methods that distribute power resources wisely. These chips dramatically cut total power consumption by minimizing needless power consumption during low-demand processes and dynamically altering power levels during high-demand tasks.

Reduced Voltage for Operation

When compared to its predecessors, modern LPDDR DRAM runs at a lower voltage. Mobile device batteries last longer because to this decrease in operating voltage because it uses less energy. Longer usage periods without the ongoing need for recharging are now possible for users.

Effective Data Transmission

Higher data transmission speeds are supported by the new LPDDR DRAM, allowing for quicker and more effective data processing. Because of its efficiency, the memory uses less time in active states, which further conserves energy and lengthens the life of the battery.

More Robust AI Features

Mobile devices’ AI capabilities have grown significantly, and the most recent LPDDR DRAM is essential to this development. This is how it improves the functionality of AI:

Enhanced Bandwidth

More bandwidth is available with the new LPDDR DRAM, enabling quicker data access and processing. This is especially helpful for AI systems that need to make decisions quickly based on data analysis. Increased bandwidth makes it possible for AI algorithms to function more effectively, producing faster responses and more precise outcomes.

Increased Capacity for Processing

The newest LPDDR DRAM offers roughly 25% more performance, giving it the power to tackle challenging AI tasks. With its increased processing capacity, LPDDR DRAM guarantees seamless and effective operation in a variety of applications, including facial recognition, natural language processing, and real-time data analysis.

Better Multitasking: AI-driven features frequently call for the simultaneous processing of several activities. The most recent LPDDR DRAM’s sophisticated multitasking features enable mobile devices to manage multiple AI tasks at once without sacrificing efficiency or performance. As a result, the user experience is more fluid and clear.

25% Increase in Performance and Power Consumption

With the launch of the new LPDDR DRAM, there is an interesting trade-off: a 25% increase in power consumption is required to achieve the much improved performance. Nonetheless, the many advantages it offers offset this increase:

Better Performance Measures

More responsive interfaces, smoother graphics, and quicker programme launches are all results of the 25% performance increase. When gaming, streaming, or multitasking on their mobile devices, users can experience a more seamless and dynamic engagement.

Improved Images and Graphs

The most recent LPDDR DRAM’s increased performance makes for better visual effects and graphics rendering. Higher resolution screens, more detailed visuals, and an immersive multimedia experience may now be supported by mobile devices.

Increased Productivity in High-Demand Situations

With applications like video editing and gaming that require a lot of processing power, the new LPDDR DRAM’s improved performance is evident. It guarantees that mobile devices may do demanding operations without experiencing any lag or stutter, resulting in a more seamless and delightful user experience.

Prospects and Innovations for the Future

The developments in LPDDR DRAM are merely the start. There will likely be further advancements in mobile technology that will push the envelope of what is feasible as it develops. A few potential futures are as follows:

LPDDR DRAM Combining 5G Technology

The potential for the latest LPDDR DRAM and 5G technologies to work together is enormous. When paired with LPDDR DRAM’s increased processing capacity, 5G’s high-speed connectivity will open up previously unthinkable new applications and services.

Developments in Machine Learning and AI

LPDDR DRAM will become more significant as AI and machine learning advance. AI programmes should benefit from next-generation memory technologies’ processing power and bandwidth.

Sustainability and Energy Efficiency

Efficiency and sustainability in energy will drive power-efficient memory technology. Future advances in LPDDR DRAM will priorities innovations that attempt to reduce power consumption without sacrificing performance.

In summary

The latest LPDDR DRAM improves mobile technology by 25% in performance and power consumption, AI features, and battery life. Further breakthroughs and user experience improvements are possible with these developments. Future mobile devices’ capabilities will be strongly influenced by LPDDR DRAM development.

Read more on govindhtech.com

#samsunglpddr5x#Improveslpddr#dream#batteryefficiency#mediatek#smatphone#samsung#LPDDR5Xspecs#ai#mobiledevice#aicapabilities#memory#data#dataanalysis#machinelearning#mobiletechnology#technology#technews#news#govindhtech

0 notes

Text

Global Top 5 Companies Accounted for 85% of total Dynamic Random Access Memory (DRAM) market (QYResearch, 2021)

Dynamic random access memory (DRAM) is a type of semiconductor memory that is typically used for the data or program code needed by a computer processor to function.

Dynamic random access memory, or DRAM, is a specific type of random access memory that allows for higher densities at a lower cost.

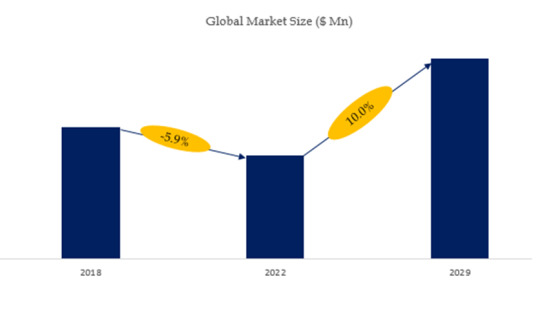

According to the new market research report “Global Dynamic Random Access Memory (DRAM) Market Report 2023-2029”, published by QYResearch, the global Dynamic Random Access Memory (DRAM) market size is projected to reach USD 146.64 billion by 2029, at a CAGR of 10.0% during the forecast period.

Figure. Global Dynamic Random Access Memory (DRAM) Market Size (US$ Million), 2018-2029

Figure. Global Dynamic Random Access Memory (DRAM) Top 5 Players Ranking and Market Share(Based on data of 2021, Continually updated)

The global key manufacturers of Dynamic Random Access Memory (DRAM) include Samsung Electronics Co. Ltd., SK Hynix Inc., Micron Technology Inc., Nanya Technology Corporation, Winbond Electronics Corporation, Company 6, Company 7, Company 8, Company 9, Company 10, etc. In 2021, the global top five players had a share approximately 85.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

For more information, please contact the following e-mail address:

Email: [email protected]

Website: https://www.qyresearch.com

0 notes

Text

0 notes