#EITC

Text

The IRS will do your taxes for you (if that's what you prefer)

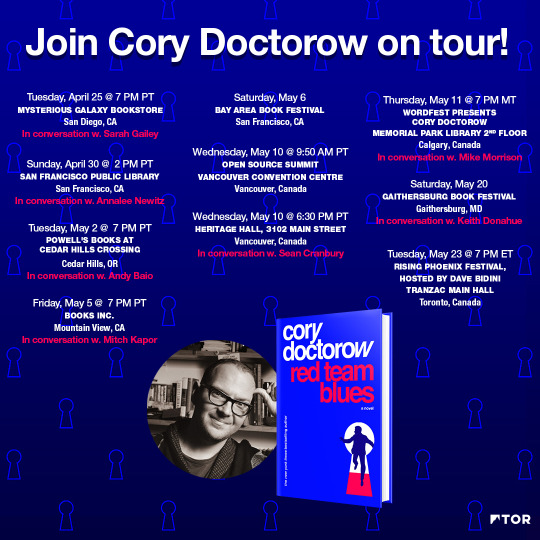

This Saturday (May 20), I’ll be at the GAITHERSBURG Book Festival with my novel Red Team Blues; then on May 22, I’m keynoting Public Knowledge’s Emerging Tech conference in DC.

On May 23, I’ll be in TORONTO for a book launch that’s part of WEPFest, a benefit for the West End Phoenix, onstage with Dave Bidini (The Rheostatics), Ron Diebert (Citizen Lab) and the whistleblower Dr Nancy Olivieri.

America is a world leader in allowing private companies to levy taxes on its citizens, including (stay with me here), a tax on paying your taxes.

In most of the world, the tax authorities prepare a return for each taxpayer, sending them a prepopulated form with all their tax details — collected from employers and other regulated entities, like pension funds and commodities brokers, who must report income to the tax office. If the form is correct, the taxpayer signs it and sends it back (in some countries, taxpayers don’t even have to do that — they just ignore the return unless they want to amend it).

No one has to use this system, of course. If you have complex finances, or cash income that doesn’t show up in mandatory reporting, or if you’d just prefer to prepare your own return or pay an accountant to do so for you, you can. But for the majority of people, those with income from a job or a pension, and predictable deductions, say, from caring for minor children, filing your annual tax return takes between zero and five minutes and costs absolutely nothing.

Not so in America. America is one of the very few rich countries (including Canada, though this is changing), where the government won’t just send you a form containing all the information it already has, ready to file. As is common in complex societies, America has a complex tax code (further complexified by deliberate obfuscation by billionaires and their lickspittle Congressjerks, who deliberately perforate the tax code with loopholes for the ultra-rich):

https://pluralistic.net/2021/08/11/the-canada-variant/#shitty-man-of-history-theory

That complexity means that most of us can’t figure out how to file our own taxes, at least not without committing scarce hours out of the only life we will ever have to poring over the ramified and obscure maze of tax-law.

Why doesn’t the IRS just send you a tax-return? Well, because the tax-prep industry — an oligopoly dominated by a handful of massive, ultra-profitable firms — bribes Congress (that is, “lobbies”) to prohibit this. They are aided in this endeavor by swivel-eyed lunatic anti-tax obsessives, like Grover Nordquist and Americans for Tax Reform, who argue that paying taxes should be as difficult and painful as possible in order to foment opposition to taxation itself.

The tax-prep industry is dominated by a single firm, Intuit, who took over tax-prep through its anticompetitive acquisition of TurboTax, itself a chimera of multiple companies gobbled up in a decades-long merger orgy. Inuit is a freaky company. For decades, its defining CEO Brad Smith ran the company as a cult of personality organized around his trite sayings, like “Do whatever makes your heart beat fastest,” stenciled on t-shirts worn by employees. Other employees donned Brad Smith masks for selfies with their Beloved Leader.

Smith’s cult also spent decades lobbying to keep the IRS from offering a free filing service. Instead, Intuit joined a cartel that offered a “Free File” service to some low- and medium-income Americans:

https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free

But the cartel sabotaged Free File from the start. They blocked search engines from indexing their Free File services, then bought Google ads for “free file” that directed searchers to soundalike programs (“Free Filing,” etc) that hit them for hundreds of dollars in tax-prep fees. They also funneled users to versions of Free File they were ineligible for, a fact that was only revealed after the user spent hours painstaking entering their financial information, whereupon they would be told that they could either start over or pay hundreds of dollars to finish filing with a commercial product.

Intuit also pioneered the use of binding arbitration waivers that stripped its victims of the right to sue the company after it defrauded them. This tactic blew up in Intuit’s face after its victims banded together to mass-file thousands of arbitration claims, sending the company to court to argue that binding arbitration wasn’t enforceable after all:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

But justice eventually caught up with Intuit. After a series of stinging exposes by Propublica journalists Justin Elliot, Paul Kiel and others, NY Attorney General Letitia James led a coalition of AGs from all 50 states and DC that extracted a $141m settlement for 4.4 million Americans who had been tricked into paying for Turbotax services they were entitled to get for free:

https://www.msn.com/en-us/news/us/turbotax-to-begin-payouts-after-it-cheated-customers-new-york-ag-says/ar-AA1aNXfi

Fines are one thing, but the only way to comprehensively end the predatory tax-prep scam is to bring the USA kicking and screaming into the 20th century, when most of the rest of the world brought in free tax-prep for ordinary income earners. That’s just what’s happening: the IRS is trialing a free tax prep service for next year’s tax season:

https://www.washingtonpost.com/business/2023/05/15/irs-free-file/

This, despite Intuit’s all-out blitz attack on Congress and the IRS to keep free tax-prep from ever reaching the American people:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

That charm offensive didn’t stop the IRS from releasing a banger of a report that made it clear that free tax-prep was the most efficient, humane and cost-effective way to manage an advanced tax-system (something the rest of the world has known for decades):

https://www.irs.gov/pub/irs-pdf/p5788.pdf

Of course, Intuit is furious, as in spitting feathers. Rick Heineman, Intuit’s spokesprofiteer, told KQED that “A direct-to-IRS e-file system is wholly redundant and is nothing more than a solution in search of a problem. That solution will unnecessarily cost taxpayers billions of dollars and especially harm the most vulnerable Americans.”

https://www.kqed.org/news/11949746/the-irs-is-building-its-own-online-tax-filing-system-tax-prep-companies-arent-happy

Despite Upton Sinclair’s advice that “it is difficult to get a man to understand something, when his salary depends on his not understanding it,” I will now attempt to try to explain to Heineman why he is unfuckingbelievably, eye-wateringly wrong.

“e-file…is wholly redundant”: Well, no, Rick, it’s not redundant, because there is no existing Free File system except for the one your corrupt employer made and hid “in the bottom of a locked filing cabinet stuck in a disused lavatory with a sign on the door saying ‘Beware of the Leopard.’”

“nothing more than a solution in search of a problem”: The problem this solves is that Americans have to pay Intuit billions to pay their taxes. It’s a tax on paying taxes. That is a problem.

“unnecessarily cost taxpayers billions of dollars”: No, it will save taxpayers the billions of dollars (they pay you).

“harm the most vulnerable Americans”: Here is an area where Heineman can speak with authority, because few companies have more experience harming vulnerable Americans.

Take the Child Tax Credit. This is the most successful social program in living memory, a single initiative that did more to lift American children out of poverty than any other since the days of the Great Society. It turns out that giving poor people money makes them less poor, which is weird, because neoliberal economists have spent decades assuring us that this is not the case:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

But the Child Tax Credit has been systematically sabotaged, by Intuit lobbyists, who successfully added layer after layer of red tape — needless complexity that makes it nearly impossible to claim the credit without expert help — from the likes of Intuit:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It worked. As Ryan Cooper writes in The American Prospect: “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies”:

https://prospect.org/economy/2023-05-17-irs-takes-welcome-step-20th-century/

So yes, I will defer to Rick Heineman and his employer Intuit on the subject of “harming the most vulnerable Americans.” After all, they’re the experts. National champions, even.

Now I want to address the peply guys who are vibrating with excitement to tell me about their 1099 income, the cash money they get from their lemonade stand, the weird flow of krugerrands their relatives in South African FedEx to them twice a year, etc, that means that free file won’t work for them because the IRS doesn’t actually understand their finances.

That’s a hard problem, all right. Luckily, there is a very simple answer for this: use a tax-prep service.

Actually, it’s not a hard problem. Just use a tax-prep service. That’s it. No one is going to force you to use the IRS’s free e-file. All you need to do to avoid the socialist nightmare of (checks notes) living with less red-tape is: continue to do exactly what you’re already doing.

Same goes for those of you who have a beloved family accountant you’ve used since the Eisenhower administration. All you need to do to continue to enjoy the advice of that trusted advisor is…nothing. That’s it. Simply don’t change anything.

One final note, addressing the people who are worried that the IRS will cheat innocent taxpayers by not giving them all the benefits they’re entitled to. Allow me here to simply tap the sign that says “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies.” In other words, when you fret about taxpayers being ripped off, you’re thinking of Intuit, not the IRS. Just calm down. Why not try using fluoridated toothpaste? You’ll feel better, and I promise I won’t tell your friends at the Gadsen Flag appreciation society.

Your secret is safe with me.

Catch me on tour with Red Team Blues in Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

If you’d like an essay-formatted version of this thread to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

[Image ID: A vintage drawing of Uncle Sam toasting with a glass of Champagne, superimposed over an IRS 1040 form that has been fuzzed into a distorted halftone pattern.]

#pluralistic#earned income tax credit#eitc#irs#grover nordquist#guillotine watch#turbotax#taxes#death and taxes#freefile#monopoly#intuit

176 notes

·

View notes

Text

Hey Pirates of the Caribbean Fans!

Celebrate the 20th anniversary of Disney's Pirates of the Caribbean with our new " Property of the EITC Athletic Department" Design. Find it on Shirts, Mugs, Phone Cases, Hats and much more at the link below!

#Disney#POTC#pirates of the caribbean#Jack Sparrow#Captain Jack Sparrow#PiratesOfTheCaribbean#20th anniversary#movies#pirates#Lord Beckett#Cutler Beckett#EITC#East India Trading Company#James Norrington#Commodore Norrington#Admiral Norrington#Johnny depp#Keira Knightley#Orlando Bloom#Jack davenport#Elizabeth Swann#Norribeth

5 notes

·

View notes

Text

How someone so brash, so loud, so ungainly, and so drunk can move about so quietly is something that Cutler can’t figure out.

You’re not here, Jack,” he says softly, dipping his quill into the ink bottle in front of him and continuing to write. He doesn’t turn around. His desk is piled high with documents, charts, ledgers, proposals; each demanding his attention. Everything and everyone demands his attention these days, it seems. “The shadows are simply playing their usual tricks with the windows and curtains again.”

“Just a figment of an overtired imagination,” breathes a low, gravelly voice into his ear. Calloused hands slip down over Cutler’s eyes. “Been staying up too late, mate. Startin’ to hear things. You’ve not seen hide nor hair of me.”

“No,” Cutler agrees, and puts down his quill so it won’t blot the paper. He sits still, ramrod straight as always, folds his hands neatly on his lap. Keeps his eyes shut, even when the pressure from Jack’s fingers on his lids is gone.

“Such a good little bureaucrat.”

“I’ve been called worse by better.”

“No need to take that tone.” Warm fingers fiddle skillfully with the knot of his ascot and pull it off. Silk slides coolly away against Cutler’s neck.

A lesser man might shiver.

“Need me hands free, you understand,” Jack hums. He wraps the cloth around Cutler’s head, covering his eyes. It tightens as Jack ties up the ends. “And we can’t have you sneakin’ glimpses of pirates who aren’t here. Nothing personal.”

“Just good business.”

Jack chuckles. His fingers dance at the collar and lapels of the richly embellished jacket before removing that too. He starts to knead at the muscles in Cutler’s shoulders, working slowly upward until his fingertips are easing out the tensions at the back of Cutler’s neck.

A lesser man would definitely shudder at the contact.

A greater man would perhaps not allow his head to droop forward, would not allow his normally impeccable posture to loosen.

“That’s it, mate. Or that isn’t it, considering I’m not here and this isn’t happening.”

“No. It isn’t.” As if Cutler Beckett would ever permit himself to slump.

To dip forward, and then back, barely in control of his own movements, curving obligingly to every compulsion of Jack’s fingers, being manipulated like putty in the hands of a notorious and thoroughly disreputable pirate.

Certainly not.

He scarcely notices Jack’s attention to his arms, wrists, and hands until the man chuckles again, digging his thumbs into Cutler’s palms and decidedly not eliciting a barely-stifled squeak. “Hands like a pampered noblewoman, you’ve got.”

A lesser man would be unable to come up with a suitable retort, but a greater man would perhaps not lower himself to exchange such sallies anyway.

So Cutler doesn’t.

“Seen ladies with hands rougher than yours, anyway,” Jack hums. Lower and lower he goes, sliding the rings off Cutler’s fingers, one by one, before massaging each digit. Were this to be happening (and it is not) it would be the most wonderful sensation he’s felt in weeks.

“I don’t suppose I’ll ever see those again.”

He can hear Jack’s grin. “The shadows like shinies, mate.”

“I’m sure they do,” Cutler murmurs, and feels Jack gently return his hands to his lap before turning his attention to his shoulders and back again.

He hopes the shadows remembered to lock the window. It wouldn’t do to announce the non-presence of an intruder who isn’t here in the EITC office. Cutler thinks he’ll need to invest in some heavier curtains.

Jack performs some intricate maneuver that tears a strangled gasp unbidden from Cutler’s throat and Cutler doesn’t think anymore.

#potc#pirates of the caribbean#jack sparrow#captain jack sparrow#cutler beckett#midnight massages#jack is very good with his hands and cutler is very touch-starved#and the shadows like shinies#lord cutler beckett#eitc#east india trading company

2 notes

·

View notes

Text

#eitc 2024#eitc#tax preparation services#tax prep#accounting and bookkeeping service#bookkeeperlive#united states

0 notes

Text

IRS to reduce audits of EITC claimants

The service said Monday it plans to lower its audit rate of low-income taxpayers, even as some criticize its ability to protect taxpayer information.

0 notes

Text

EITC for Low to Moderate-Earning People in 2022

For a taxpayer to claim the Earned Income Tax Credit, they must have filed a tax return. The tax return is mandatory, irrespective of whether the taxpayer owes any tax money to the government. Upon successfully calculating a taxpayer’s EITC, they must provide information regarding their qualified children through Schedule EIC(Form 1040 / Form 1040-SR).

0 notes

Photo

Members of the military can include their combat pay as earned income for purposes of the Earned Income Tax Credit. Military families have options when deciding whether to include combat pay to claim the Earned Income Tax Credit. #IRS reminds members of the military and veterans that they may qualify for the Earned Income Tax Credit. Don’t miss the #EITC—file a tax return. See: www.irs.gov/eitc https://www.instagram.com/p/Cn06aU7u1X-/?igshid=NGJjMDIxMWI=

0 notes

Text

근로/자녀장려금 대해부 (올 최대 490만원 현금 지원)

근로/자녀장려금 대해부 (올 최대 490만원 현금 지원)

가난은 눈에는 잘 보이지 않아도 통계로는 그 실체가 드러난다.

13일 통계청 가계동향 자료에 따르면 지난 3분기 기준 월 200만원도 못 버는 가구는 전체의 19.9%에 달한다.

5가구 중 1가구꼴로 연소득이 2400만원 이하인 셈이다. 학원비로 월 300만~400만원을 쓰는 이들도 있지만 누군가는

학원비의 절반도 안 되는 돈으로 생계를 유지해야 한다.

[국세청, 올 최대 490만원 현금 지원]

이 통계를 가구 수로 추려보면 체감도는 더 높아진다. 통계청의 가장 최근 인구총조사 결과에 따르면 2020년 기준 한국 가구 수는 2092만6710가구다.

여기에 ‘19.9%’라는 수치를 대입해보면 416만4415가구가 월 200만원조차 못 버는 가구로 분류된다.

해당 통계의 시점이 서로 다른 만큼…

View On WordPress

0 notes

Text

I am still thinking about tmagp 2, did you know that ep was written specifically for me?

#empty thoughts#the magnus protocol#tmagp#tmagp spoilers#daria tmagp#Daria if you are out there!!! Daria please if you are out there!!!!#But seriously the way an artist's obsession with perfection is combined with body issues#It would have never been enough girl!!! You would have never been satisfied girl!!!#And just the way she was trying so hard to preserve the one thing that she liked about herself#And that one thing was technically what was destroying her#And she didnt even care! She still believed what she was doing was ok and sane!!!#Girl you kept giving yourself plastic surgeries with your art kit!!! You need that therapy!!!!!#The way so many people would destroy their bodies to achieve the unreachable perfection!#Plastic surgeries! Dieting! Hair plucking eitc etc! Like!!! Like!!!!!#The way artists are never satisfied with their masterpiece!!! Only someone elses art!!!!!#Also! Also! Just the way her pain was literally exploited! First Ink5ouls literally streams her tortorous tattoo session#And she is given such a minimal choices!! Even for the artpiece put on her body!! And then OIAR records her therapy session!!!! God!!!!!!!#Love me a good Flesh episode#Insane episode i love it

16 notes

·

View notes

Text

DO YOUR TAXES NOW FREE FILE I RECOMMEND OLT IF YOU'RE LOW-MID INCOME AND YOU DONT WANT TO RAWDOG IT ok have fun gamers. you need your previous year AGI if you want to e-file dont forget

14 notes

·

View notes

Text

This Tumblr account will occasionally become a pre-EITC Cutler Beckett appreciation account. I.E. I will randomly make a post about how nice and innocent Cutler Beckett was when he was a kid and how we should protect the child at all costs. I don't care that I legally and physically cannot adopt kid Beckett, I will become his dad now and no one can stop me.

#Movie and book Beckett is a dick#But pre EITC Beckett is a ball of sunshine and needs to be protected at all costs#cutler beckett#lord cutler beckett#potc#tpof#i might regret posting this#but oh well

7 notes

·

View notes

Note

Error in code is a good fic. Thank you so much for it.

Thank you so much for reading! I'm super happy you enjoyed it!

3 notes

·

View notes

Text

@harringtontm sent a meme: sleep. it's all right. i'll keep watch.

It was the first time he'd stopped to take a breath in at least four hours, maybe more. If he hadn't been up and down ladders, ensuring that hatches had indeed been battened down and that none of the torrential rain or ship-sized waves had pierced the hull, he was at the helm barking orders or in his cabin consulting his detailed, annotated charts. He couldn't afford to stop, particularly after nearly taking a tumble over the side of the ship ( after a rogue wave struck the Wicked Wench at an unexpected angle ), or else this would happen: he'd lean against the rail, his feet and legs would protest at the prospect of moving so much as another inch, and his eyes would slowly drift shut.

Fortunately he did not get so far as to actually drift off, brought back to attention as Jack was by the sound of a soft voice beside him. He opened his eyes to the sight of Steve Harrington, looking as wet and bedraggled as he probably did — but he couldn't quite stop looking at him. It was still raining, even though the storm had passed, and Jack had to acknowledge that the distracting way in which the water clung to Steve's shirt was a sign, if he'd needed one, that he'd been at sea far too long.

“ I'm fine. I'll manage a little longer. At least until the rain stops. ” Jack flashed what he hoped was a reassuring, grateful smile. Yet it wasn't just how Steve looked that was playing on his mind in that moment; it was the lightning fast way in which he'd jumped to attention and caught Jack before toppling over the side of the railing; it was the way he'd seen him helping out the other hands and mates on board in spite of his lack of experience; it was the stunning amount of maturity he'd displayed over the past few hours. Not even now, as the danger subsided, had Jack heard a single complaint from that direction.

“ Thank you. ” He deserved to hear it. As much as Jack enjoyed the thrill of a good squall, it was always a taxing affair — even more so as a captain. “ Were it not for you, I'd be over the side right now wishing I'd grown a tail and fins. ” Jack smiled again, more teasingly this time. “ Turns out you're not so bad at this after all. ”

#harringtontm#&. and you want to turn pirate yourself. is that it? ( answered. )#&. verse. five sodding years of work ( eitc. )#just some gay longing in this club tonight#i'm obsessed by this verse for many reasons you know this#but one of them is the fact that jack is not completely oblivious for half of it fkdjgdfg#steve: saves jack's life and looks hot doing it#jack: i'm in danger.gif

2 notes

·

View notes

Text

the way pirates of the caribbean online has more gun control than the us

#i never really thought about how yeah you can't use guns on human opponents but they dont use them on you either#the navy stabbing u with their bayonets only#and i think the most eitc does is range throwing knives?#✘; i have seventy two exams and i have not studied for one ( ooc )

5 notes

·

View notes

Text

fanfiction friday

when you just can’t control yourself and you have to post a snippet from the fic that’s taken over my brain for the past two weeks

i could be your blue heron sky (paint me in celadon and gold)

It rains the morning of Kate’s wedding. The maids frown at the sky, muttering under their breath about bad omens and ill signs, sighing sadly every time they look Kate’s way. They know that almost none of the pre-wedding ceremonies had been performed. Kate would not allow it. Not for this marriage. Not to this man who she had barely chosen, who viewed her as nothing more than a mere broodmare.

While there had been a ball and a dinner celebrating Kathyani Sharma’s engagement to James Harris, the 2nd Earl of Malmesbury, amongst the upper echelon of Bombay society, there had been no wagdaan. No written vows had been exchanged between herself and her betrothed. No sangeet was held, no puja performed, and her husband would not paint his eyelids with tilak.

Kate had only conceded to Edwina and Mary’s many pleas for the smallest of blessings. The mehndi had been applied to her hands and feet with little fanfare while she reviewed Edwina’s lessons and the family ledgers, Edwina’s piano playing filling the room with the sweet sounds of music. Her husband would not participate but it did not stop Mary and Edwina from painting her arms and cheeks with haldi in the wee hours of the morning though their smiles were subdued and their laughter non-existent. The paste had left Kate’s skin feeling soft and glowing, the smell of rosewater coming off of her in waves.

#bridgerton#kanthony#linette writes#this is the widow fic for anyone who cares#celadon and gold#it makes me emotional okay???? so emotional#wip#fanfiction friday#kate x anthony#kathony#kate sharma#anthony bridgerton#except anthony is not around during this part lol#remember when i was talking about all the tabs i had open about hindi words and the eitc - it was for this bad boy#the widow fic

21 notes

·

View notes