#Ecommerce payment gateways

Text

Top 10 Best Ecommerce Payment Gateways In The USA

Discover the top 10 best eCommerce payment gateways in the USA, facilitating seamless online transactions for your business. Make informed choices to enhance your customers' payment experience.

0 notes

Text

The Ultimate Guide to Ecommerce Development: Tips, Trends, and Best Practices

#Ecommerce platform comparison#Best Ecommerce solutions#Ecommerce development tips#Ecommerce website design trends#Ecommerce website optimization#Custom Ecommerce development#Ecommerce website security#Mobile Ecommerce development#Ecommerce development services#Ecommerce plugin development#Ecommerce UX design#Ecommerce payment gateways#Ecommerce SEO strategies#Ecommerce analytics tools#Ecommerce CMS platforms#Ecommerce website migration#Ecommerce API integration#Ecommerce website performance#Ecommerce conversion rate optimization#pool

1 note

·

View note

Text

The Future of E-Commerce Payment Processing Solutions

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the perpetually evolving world of online commerce, the importance of efficient and secure e-commerce payment processing solutions has never been more critical. As businesses adapt to the digital age, ensuring seamless transactions while mitigating risks is essential. This article delves into the future of E-Commerce Payment Processing and how it's set to revolutionize the way we conduct online transactions, from accepting credit cards for high-risk industries to providing hassle-free services like credit repair payment gateways and CBD merchant accounts.

DOWNLOAD THE FUTURE OF E-COMMERCE INFOGRAPHIC HERE

The Power of Payment Processing for High-Risk Industries

When it comes to payment processing for high-risk businesses, traditional methods often fall short. These enterprises, including those involved in credit repair, have faced numerous challenges in accepting payments. However, the future is bright as innovative high-risk merchant processing solutions are emerging. These solutions not only enable them to accept credit cards but also offer enhanced security measures, reducing the risk of fraudulent transactions. One of the key advantages of these high-risk payment gateways is their ability to tailor services to the unique needs of high-risk industries. Whether you're in the credit repair business or dealing with CBD products, having a CBD payment processing system that understands the intricacies of your industry is a game-changer.

The Convenience of Credit Card Payment Services

In the world of E-Commerce, convenience is king. Consumers expect a seamless shopping experience, which includes hassle-free payment options. This is where credit card payment services play a pivotal role. By partnering with a reliable credit and debit card payment processor, businesses can offer their customers a variety of payment methods, enhancing their shopping experience and ultimately boosting sales. The future involves cutting-edge technology that ensures the security of sensitive data. With the rise of cyber threats, consumers are more cautious than ever about sharing their financial information online. Hence, investing in a top-notch online payment gateway is not just a choice but a necessity for businesses aiming to thrive in the competitive e-commerce landscape.

Merchant Processing: A Gateway to Success

A significant component of E-Commerce Payment Processing is merchant processing. This service bridges the gap between businesses and their customers, facilitating transactions smoothly and securely. By partnering with a reputable provider, businesses can ensure that they can confidently accept credit cards for e-commerce operations without the fear of payment disruptions. For high-risk industries, such as credit repair and CBD, finding the right high-risk merchant account is crucial. This ensures that businesses can conduct their operations without unnecessary hindrances. In the coming years, we can expect to see more tailored solutions for these industries, making it easier than ever to accept credit cards for credit repair and accept credit cards for CBD products.

The Future of E-Commerce Credit Card Processing

As we look ahead, the future of E-Commerce credit card processing is rife with possibilities. The technology driving this industry forward is poised to enhance security, streamline transactions, and open new avenues for businesses. With the rapid growth of online shopping, it's essential for businesses to stay ahead of the curve. One of the most promising developments is the integration of artificial intelligence and machine learning into credit card payment processing systems. These technologies can identify patterns of fraudulent activities and protect both businesses and consumers. Additionally, they can personalize the shopping experience, making recommendations based on past purchases and preferences.

youtube

Embracing the Future of E-Commerce Payment Processing

In conclusion, the future of E-Commerce Payment Processing is bright and promising. From accepting credit cards for credit repair to providing CBD payment processing solutions, the landscape is evolving to cater to the diverse needs of businesses. As the demand for online shopping continues to grow, businesses must invest in reliable payment processing solutions to thrive. The future will see more businesses benefiting from high-risk payment gateways, ensuring that they can operate without unnecessary restrictions. Credit card payment services will continue to evolve, offering consumers a seamless and secure way to make purchases. Merchant processing will play a pivotal role in connecting businesses with their customers, enabling them to accept credit cards for e-commerce without complications.

As we embrace the technological advancements on the horizon, we can expect a safer, more convenient, and more efficient E-Commerce Payment Processing landscape. Businesses that invest wisely in these solutions will not only meet the demands of today but also be prepared for the ever-evolving future of online commerce.

#high risk merchant account#payment processing#credit card processing#high risk payment gateway#high risk payment processing#merchant processing#accept credit cards#credit card payment#ecommerce#ecommerce business#Youtube

15 notes

·

View notes

Text

2 notes

·

View notes

Text

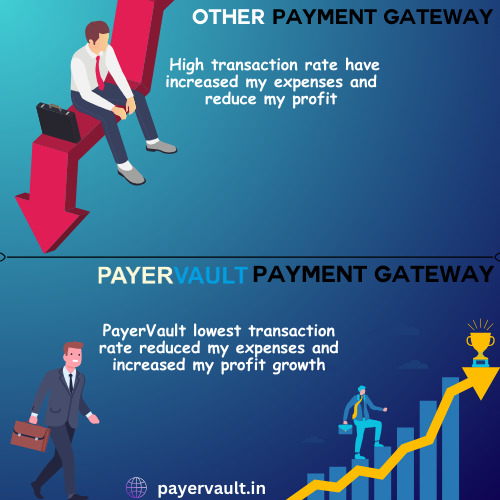

Ready to revolutionize your business's online transactions? Payervault offers seamless payment solutions at the lowest charges. Get started today! 💻💳 #Payervault #PaymentGateway #OnlineBusiness"

Visit the website to learn more- https://payervault.in/

#finance#payments#payment solutions#business consulting#payment gateway#payment collection#paying#payouts#payment processing#payment services#payment systems#ecommerce#online#online shops offer#online store#online shopping#small business

2 notes

·

View notes

Text

Hello I am a e-commerce website designer on fiverr

I am giving out upto 40% discount on all order with me this month, so kindly check me out and get the best website design for yourself either on wordpress,Etsy,ebay, Shopify and rest of the e-commerce platform

#fiverr#etsyseller#shopifystore#etsy#etsyshop#makemoney#onlinestore#shopify#woocommerce#fashionstore#payment gateway#stripegateway#fashionstyle#wordpressdeveloper#wordpress#redbubble store#ecommerce#etsysellersofinstagram#woman#business#bosslady#virtualassistant

4 notes

·

View notes

Text

Payment gateway vs. shopping cart

If you are creating an online presence to sell your goods or services and are ready to accept credit cards, all of the options, terms, and programmes available can be overwhelming. An online payment gateway and a shopping cart are two common components of an eCommerce credit card processing platform — but what's the difference and how do they work together?

Payment gateway – What is it?

Consider a payment gateway to be your company's online point-of-sale terminal. A gateway is most commonly used to authorise payments for an online eCommerce store; however, today's gateway technology allows businesses to accept payments in a brick-and-mortar retail environment using a credit card reader, POS system, or integration with accounting or CRM software.

A payment gateway works as follows:

i. Credit card information is swiped, dipped, or manually entered into an online hosted payment form or shopping cart.

ii. The payment gateway encrypts the credit card information of the customer and sends it to the payment processor.

iii. The payment processor sends the payment details to the card-issuing bank via the credit card network.

iv. Based on the available funds, the card-issuing bank approves or rejects the transaction.

v. The authorization or decline is communicated back to the payment gateway by the payment processor.

The decision is communicated to the merchant and the customer by the gateway.

What is a shopping cart?

A payment gateway and a shopping cart serve very different purposes. A shopping cart is similar to the grocery cart you use to navigate your local big-box store. You load your items into the cart and drive it to the cash register, which totals your order and gives you the total amount owed.

An online shopping cart does the following:

i. It adds up the costs of your items.

ii. It includes any applicable sales tax and delivery charges.

ii. It deducts discounts obtained through coupon codes and applicable credits.

iii. The total amount owed is then displayed.

To complete the payment process, the online shopping cart is linked to a payment gateway, typically via an API.

A hosted payment form is an alternative to a shopping cart integration. This method is ideal for businesses where each transaction typically consists of only one item or charges the same amount on a consistent basis. A secure hosted payment form is designed to look and feel like it belongs on your eCommerce website, but it is hosted on a third-party secure server to help reduce liability and PCI scope.

Why are payment gateways and shopping carts often confused?

It's easy to see how all of this terminology could confuse a business owner. Many aspects of eCommerce and credit card processing interact with one another. They are sometimes integrated as part of an all-in-one solution. Some websites and businesses use these terms interchangeably, adding to the confusion.

So, which do you require? Is the best online payment gateway India required for your company? Is a shopping cart required for your eCommerce site? What about other elements such as a merchant account? Where should you start?

Do you need an eCommerce solution?

We can help you accept payments the way your business requires, from merchant accounts to payment gateways to software integrations. Make an appointment with a payments expert today to learn more.

#Banking#online payment#payment gateway#ecommerce#PCI#credit card#fintech#UPI#payments#POS#money transfer#merchant#online business

8 notes

·

View notes

Text

Empower Your E-Commerce Payment gateway Journey with GO Mobi!

Revolutionize your online business with our cutting-edge Payment Gateway Services. Experience seamless integration, ultra-fast transactions, and fortified security that keep your customers coming back.

🌟 Why Choose GO Mobi?

✅ Seamless Integration

✅ Lightning-Fast Transactions

✅ Robust Security

Elevate your e-commerce game and watch your business thrive. Learn more and get started today at https://gomobi.io/!

#ecommerce#paymentgateway#businessgrowth#onlinesecurity#gomobi#paymentsolutions#paymentprocessing#payments#online payment gateway#payment gateway#malaysia payment gateway#forex payment gateway#top payment gateway malaysia#malaysiapaymentgateway#best payment gateway malaysia#onlinepaymentgateway

0 notes

Text

5 Payment Security Essentials Every E-Commerce Business Needs

Online transactions are the mainstay of many firms in the modern digital age. But along with this ease of use goes the constant risk of fraud and fake payments. Malicious actors are always coming up with new strategies to take advantage of weaknesses in e-Commerce payment systems, ranging from identity theft to phishing scams. Here's where e-Commerce payment security steps in, serving as a crucial barrier against monetary losses and harm to one's reputation.

This thorough guide will give you the information and resources you need to protect your online payments and run a safe and successful business. We will examine the many forms of fraud and bogus payments, examine current e-Commerce payment security trends and technology, and provide doable actions you can take to reduce risks and improve your payment security posture.

Regardless of your level of experience as an entrepreneur or where you are in e-Commerce Business, this article will help you navigate the tricky world of payment security. Recall that awareness and awareness are the first steps towards safeguarding your e-Commerce Business and your clients. Now go ahead and learn the essential actions you can take to guarantee safe and protect your online payments.

What Is Payment Security?

Payment security is the invisible barrier securing the most sensitive data of your clients; it goes beyond firewalls and sophisticated encryption methods. Every transaction is made sure to go through safely and smoothly by the invisible character. In a word, it's the solid assurance that your clients' sensitive financial information and hard-earned cash are secure.

Consider it as creating a stronghold around your web shop. Secure payment gateways, data encryption that jumbles information into unintelligible codes, and fraud detection systems that flag suspicious transactions before they even reach the gate are some of the payment security bricks that wall. It involves maintaining your consumers' financial lives worry-free and avoiding smart hackers with smart techniques.

Consequently, e-Commerce payment security is essential to building trust and is not an alternative, even for large online retailers. With peace of mind in every click, it's the key to unlocking growth, safeguarding your brand, and ultimately keeping your customers coming back for more.

Why Payment Security Is So Important for E-Commerce Businesses?

E-Commerce websites should give payment security a priority for many reasons for running safe and successful business.

First, when making transactions online, consumers are growing increasingly conscious of and concerned about their financial and personal security. Businesses that don't offer a secure environment risk losing their trust, which can drive customers away from their website and reduce revenue.

A security event or data breach can also have serious legal and financial repercussions for enterprises, such as penalties, litigation, and reputational harm.

Therefore, by avoiding potential fines and legal ramifications, online retailers may end up saving money over time by investing in strong e-Commerce payment security procedures.

Five Essential Payment Security Elements for Online Retailers-

Use e-Commerce payment security measures to safeguard clients' personal information and earn their trust in your online purchasing procedure. Still, depending just on these fundamental security measures is insufficient to protect your online payments.

You can find other vulnerabilities and apply the required security fixes by using tools such as ChatGPT.

You should give top priority to the following e-Commerce payment security features:

1. SSL Encryption

Secure Sockets Layer encryption, or SSL encryption, is a security technology that ensures the confidentiality and integrity of data transmitted over the internet.

It makes it extremely difficult for hackers to intercept and decode the information transferred between a web server and a web browser by encrypting the conversation. Consequently, SSL encryption protects private data, such as passwords, credit or debit card information, and personal information, against unauthorised access and malicious activities.

Additionally, SSL provides authentication, a procedure that verifies to the browser the identity of the web server. Potential attackers who would try to pose as a legitimate website and steal personal information are discouraged by this.

Depending on your company's demands and specifications, there are various ways that you can implement SSL encryption. Your web host or a reliable certificate authority (CA) can provide you with an SSL certificate.

Another option is to use a cheap SSL certificate that businesses offer. It is also simple to install these trustworthy CA-issued certificates on the server.

Furthermore, a few web hosts include integrated SSL certificates in their hosting packages. The installation and renewal of SSL certificates are frequently handled automatically by these hosting packages, saving website owners from having to do it by hand.

2. Tokenization

Tokenization is the process of dividing a lengthy text document into manageable chunks, such as words or phrases. Text analysis, machine learning, and natural language processing all make use of this procedure.

Tokenization is the process of replacing sensitive payment information, such as credit card numbers, with a reference token while making a payment. In this manner, the original sensitive data cannot be recovered, even in the event that the token is taken.

3. Two-Factor Authentication (2FA)

An additional security measure for the login procedure is two-factor authentication (2FA).

In order to authenticate themselves, users must supply extra data in addition to their login and special password. This additional information may consist of a PIN, a response to a security question, a code texted to their mobile device, a tangible token, or biometric information.

4. Penetration Testing

The practice of identifying security flaws in your e-Commerce system to stop breaches that could endanger your company is known as penetration testing.

Payment gateways are tested (or simulated), problems are checked for, and vulnerabilities such as XSS and SQL injections are searched for.

In order to adhere to regulatory standards such as PCI-DSS and ISO 27001, penetration testing is required. By using a pentest testing tool, you may evaluate your security from the outside in and make ongoing improvements.

You will receive a report following the test that lists all issues discovered and recommendations for resolving them. In addition to being essential for e-Commerce security, penetration testing can reduce costs by averting data breaches to run a safe and successful business.

5. PCI DSS compliance

Major credit card firms have developed a set of security requirements called PCI DSS compliance, or Payment Card Industry Data Security Standard compliance, to secure sensitive cardholder data. With the goal of preventing data breaches and ensuring improved security during payment processing, it applies to any organisation that handles, keeps, or transmits cardholder data.

A comprehensive set of rules covering a wide range of topics, including network security, physical security, data encryption, access control, and vulnerability management, has been made available by the Payment Card Industry Security Standards Council (PCI SSC). Strict access limits, frequent security testing, encryption of cardholder data, and firewall maintenance are a few essentials.

A screen grab from the PCI DSS compliance document is shown below. It addresses any areas that might need attention and provides an overview of the organization's compliance.

Why it's more important than ever to do secure payments?

An online retail company, sometimes referred to as an e-Commerce endeavour, makes it easier for people to exchange goods and services via the Internet. These companies use digital channels to reach a larger audience and guarantee smooth online transactions. Web design services, clothing, consumer goods, software development, and other industries are all included in e-Commerce firms. Entrepreneurs can use different online channels such as email marketing and social media platforms, or they can build a dedicated website to start their e-Commerce business. They are able to increase sales and reach a wider audience as a result.

The world of deception is booming: Cyber-attacks are getting worse and costing companies billions of dollars every year. Companies can be left reeling after a single breach that destroys confidence and damages reputations.

The regulatory maze: PCI DSS, GDPR, CCPA — the dizzying array of acronyms for compliance can be confusing. We'll simplify the essentials and provide you with the information you need to properly manage these obligations.

Expectations from customers are extremely high: they want safe and easy payment experiences. Neglecting to fulfil these demands may result in abandoned carts and lost profits.

Conclusion-

In the connected world of today, online payment security is an essential component of e-Commerce enterprises that should not be disregarded when safeguarding your e-Commerce Business. To prevent security breaches and securing sensitive customer data, it is recommended to include comprehensive payment security features such as SSL encryption, tokenization, 2FA, penetration testing, and PCI DSS compliance. All of these precautions also guard against any possible security breach or other data breach that might occur within your company.

Prioritising payment security can help you build your company's credibility, which is crucial for long-term success. Customers will feel comfortable making payments online, which will eventually boost your clientele, encourage repeat business, and help your company expand. Therefore, to protect your clients' data and establish a solid reputation in the e-Commerce sector, make sure to give payment security top priority and to put the required security elements in place.

Janet Watson MyResellerHome

MyResellerhome.com

We offer experienced web hosting services that are customized to your specific requirements.

FacebookTwitterYouTubeInstagram

0 notes

Text

Streamlining Tax Compliance: Using Quaderno to Automate Taxes for Businesses Shipping into the EU.

Quaderno is a powerful tool designed to simplify the process of managing taxes for online businesses. It automates the calculation, collection, and reporting of sales tax, VAT, and GST, helping businesses stay compliant with tax regulations around the world.

Introduction:

Automating taxes for businesses shipping into the EU can be a game-changer in streamlining operations and ensuring…

View On WordPress

#accounting#and GST#Automate Taxes#automated-eu-vat-calculator#automated-vat-tools#Automating taxes for EU shipments#automating-taxes-for-businesses-shipping-into-the-eu#avoiding EU penalties#Benefits of Automating Tax Compliance#bigcommerce#compliance-risks#DUTIES#DUTIES AND TAXES#e#e-commerce platforms#ecommerce#EU#EU market#EU Shipping#eu-vat-tools#European Union#finance#INTERNATIONAL#IOSS#online-shopping#payment gateways#Quaderno#real-time-insights#sales tax#shipping

0 notes

Text

Online Businesses are on the rise, the globe is tech-savvy and the E-Commerce/Payment gateway clutch is here to stay. Just to quote a few numbers, The Payment Gateway market was valued at USD 17.2 billion in 2019 and is expected to reach USD 42.9 billion by 2025, at a CAGR of 16.43% over the forecast period (2020-2025).

So,If you are a newbie to eCommerce you must be feeling spoilt for choice as to whichpayment gatewayto choose and by now you must have taken a headlong dive e-looking for cost comparisons and offerings. The factor here to consider is to see which payment gateway is specific to your business type, size and locale. With almost innumerable choices in the market, the sense of clarity has diminished.

Read More

0 notes

Text

Explore the advantages and disadvantages of using Shopify for dropshipping in 2024. Learn about Shopify's user-friendly interface, customization options, and scalability, along with considerations such as cost, transaction fees, and competition. Consider hiring Webgarh Solutions for expert Shopify dropshipping store development services to maximize your e-commerce success.

#shopify#dropshipping#ecommerce#shopify store#customization#shopify apps#payment gateways#ecommerce platforms#web development#shopify development#webgarh solutions

0 notes

Text

Ditch the Line, Embrace Bliss: PayCly Revolutionizes Payments for Businesses & Customers!

Say goodbye to:

Checkout lines longer than your to-do list: Streamline transactions with lightning-fast payments.

Friction so thick you need a butter knife: Our seamless experience makes payments a breeze.

Customers singing the "waiting-in-line blues": Happy payments lead to happy faces and boosted loyalty.

PayCly unlocks the future of payments:

Effortless transactions: Pay in seconds, whether in-store, online, or on-the-go.

Security fortress: Advanced technology protects your money and peace of mind.

Business boost: Reduce costs, enhance efficiency, and watch your sales soar.

Customer love at first swipe: Deliver a smooth experience that keeps them coming back.

Join the PayCly revolution! Experience the frictionless future of payments and watch your business (and customers) thrive.

Ready to ditch the line and embrace bliss? Get a free demo today!

P.S. Share this with other businesses ready to break free from payment purgatory! Together, we can create a checkout utopia.

+65-82400362

#payments #paymentprocessing #paymentgateway #paymentsystem #paymentsolutions #paycly ✨

#business#business strategy#fintech#payment systems#payment services#payment solutions#merchant services#finance#high risk merchant account#customerexperience#high risk payment processing#high risk payment gateway#payment gateway#payment processing#payments#ecommerce#credit cards

0 notes

Text

2024 Payment Gateway Trends for eCommerce Businesses and Startups - Semiosis Software Private Limited

Stay ahead in the dynamic world of eCommerce with the Latest Payment Gateway Trends in 2024! Streamline transactions, enhance security, and offer seamless payment experiences to your customers. From cryptocurrency integration to AI-powered fraud detection, our experts guide your business through the future of online payments. Elevate your eCommerce game and foster customer trust. Ready to embrace the trends shaping digital transactions? Call now at +91-8529122552, and let us pave the way for your success in 2024.

#Payment Gateway#ecommerce website design company#ecommerce solutions#ecommerce development company#ecommerce website development#ecommerce website design#ecommerce business#ecommerce photo editing services

1 note

·

View note

Text

Ditch checkout lines, embrace checkout bliss! AuxPay smooths payments, boosts business, & makes customers swoon. Frictionless future awaits! Join the revolution! +1-844-452-1234 #payments #paymentprocessing #paymentgateway #paymentsystem #paymentsolutions #auxpay ✨

#business#business strategy#fintech#payment systems#payment services#payment solutions#merchant services#finance#high risk merchant account#customerexperience#high risk merchant highriskpay.com#high risk payment processing#high risk payment gateway#payment gateway#payment processing#payments#ecommerce#credit cards

0 notes

Text

Unleashing Success: The Power of Ecommerce Development Companies

In the rapidly evolving digital landscape, ecommerce has become the driving force behind countless successful businesses. Behind the seamless online shopping experiences and robust digital storefronts are the unsung heroes – ecommerce development companies. In this blog post, we’ll delve into the pivotal role these companies play in unleashing success for businesses in the digital…

View On WordPress

#Brand Identity Online#Business Growth#Custom Ecommerce#Digital Commerce#Digital Storefront#Ecommerce Development#Ecommerce Features#Ecommerce Maintenance#Ecommerce Platforms#Ecommerce Security#Ecommerce Solutions#Ecommerce Success#Ecommerce Website#Mobile Ecommerce#Online Store Development#Payment Gateways#Scalable Ecommerce#User Experience Design#Web Development Services#Website Customization

0 notes