#Engulfing Candle Strategy

Text

"Mastering the Art of Price Action Trading: A Comprehensive Guide to Technical Analysis, Risk Management, and Emotional Discipline"

Price action trading is a popular approach to technical analysis in the financial markets. It involves making trading decisions based solely on the price movements of an asset, without relying on traditional indicators or other external factors.

Traders who follow price action believe that all relevant information is already reflected in the price, and by studying the patterns and movements,…

View On WordPress

#candlestick patterns#Continuous Learning#Diversification#Emotional Discipline#Engulfing Candle Strategy#Inside Bar Strategy#Market Conditions#Market Developments#Market Trends#Pin Bar Strategy#Position Sizing#Price Action Trading#Risk Management#Stop-Loss and Take-Profit#Support and Resistance#technical analysis#Trading Education#Trading Psychology#Trading Strategies#trendlines

0 notes

Text

Of Dragons and Maelstroms: Aemond POV

Themes and Warnings: slow burn, enemies to lovers, blood, violence, explicit language, sexual violence, period-typical misogyny, sexual themes, smut, tension, marriage, jealousy, pregnancy, childbirth, miscarriage, attempted sexual assault, breastfeeding, major character death, divergent timelines

Disclaimer: I do not own any of the House of The Dragon/Fire & Blood/Game of Thrones characters nor do I claim to own them. I do not own any of the images used nor do I claim to own them.

Chapter One

“You have each other. It would be nice if Helaena had a companion too.”

His mother’s words echoed in her chamber as the family sat down to eat their dinner. The King was not present of course. On the evenings he was well enough, he dined with Rhaenyra and her brood. Other times, he remained in his chambers being attended to by the Maesters. Aegon, engulfed in his cups, exuded the air of a habitual indulger, even in his young age, his shimmering silver locks catching the candlelight. Meanwhile, Helaena remained withdrawn, her violet gaze fixed on a tome detailing insects, intermittently glancing up between bites.

In stark contrast, Aemond’s unwavering focus on his mother painted him as the epitome of diligence, his attentiveness a testament to his filial devotion. It did irk him though. Aegon and Aemond did not have each other. Far from it actually, they could not have been more different. Aemond spent most of his time in his history and philosophy books, or with tutors attempting to master High Valyrian. Aegon, however, spent most of his time abed. And even when he was awake, he would terrorise the servant girls, secretly making his way down into Flea Bottom, or stealing wine from the kitchens.

Aemond wondered if things would have been different if Daeron had remained in Kings Landing, alas he was destined for Oldtown. From what he understood, it was a political strategy to ensure House Hightower maintained power as hosting a Prince of the Realm was a high honour. The brothers exchanged letters sometimes, but it was not like a physical friendship in the Keep.

The second son often found himself at the butt of his elder brother’s jokes, relentlessly teased for not having a dragon of his own to command; an injustice in Aemond’s eyes. Why should Rhaenyra’s very obvious bastards have dragons yet Aemond did not? Even Helaena had a dragon! Granted, she never spent a great deal of time with the beast. But still, they were Targaryens, and Targaryens were meant to have dragons. Nevertheless, Aemond just wanted to belong. They were supposed to be a family. Their father ignored them enough so they should at least stick together. Yet Aemond always found himself the odd one out.

“I need you to make her feel welcome and be on your best behaviour. Aegon,” Queen Alicent commanded with a warning, her brown eyes glaring at her oldest son.

Aegon rolled his eyes. “Why me?”

“Because you treat the servants horrendously already,” Alicent reasoned, taking a bite of her food. Aemond looked ahead at the empty chair in front of him, the chair that was meant for Viserys, but was mostly always empty. Perhaps it would be nice for the chair to be filled.

In the vast expanse of the throne room, every corner was adorned with intricate craftsmanship and lavish ornamentation. Gilded pillars rose to meet the high ceiling, where frescoes depicting ancient legends stretched across the expansive canvas. Golden sconces cast a warm glow upon the marble floors, reflecting the flickering light of the numerous candles that lined the room.

Alicent and her children, resplendent in their fine green attire, stood in a line, awaiting the arrival of their guests. Alicent's gown, intricately embroidered with delicate patterns of ivy and emerald thread, spoke of her Hightower lineage and refined taste. Aegon's doublet shimmered with silver accents, catching the light with every movement, while Helaena's gown, adorned with subtle hints of amethyst, complemented the violet hues of her eyes. Aemond, ever the dutiful son, wore a crisp green tunic embellished with subtle motifs of dragons, a symbol of his family's legacy.

As the grand doors creaked open, the imposing figure of Lord Jasper Wylde strode into the room, his presence commanding respect and deference. His short dark hair was meticulously styled, while his neatly trimmed beard added an air of gravitas to his countenance. Dressed in robes of turquoise and gold, embroidered with intricate patterns reminiscent of ocean waves and sunbursts, he exuded an aura of authority befitting his station.

Beside Lord Jasper, a young girl emerged, her presence a stark contrast to the solemnity of the room. Her dark brown curls tumbled in tight ringlets down her back, framing a cherubic face alive with curiosity and excitement. Clad in a matching ensemble of turquoise and gold, her dress sparkled in the ambient light, accentuating her youthful exuberance. With hands clasped together in anticipation, she approached Alicent and her children, her eyes alight with the prospect of meeting her new companions.

“Podgy thing, isn’t she?” Aegon snickered down Aemond’s ear as they approached, earning a smack on the back of his head from his mother. As they neared, Lord Jasper executed a deep bow, a testament to his reverence for the crown. The little girl, following her father's lead, curtsied gracefully, her demeanor mirroring his humility.

“Lord Wylde,” Alicent's warm voice echoed across the chamber, her regal presence welcoming them.

“My Queen, My Princes, Princess,” Lord Jasper acknowledged with reverence, his voice carrying a note of gratitude. “I must thank you again for this tremendous honor. May I present my eldest daughter, Lady Maera.”

Maera's face lit up with a radiant smile, her chubby cheeks flushed with excitement. “I am pleased to meet you all,” she said with youthful exuberance, her eyes bright with curiosity.

Alicent returned the smile, her heart swelling with joy at the sight of another young girl in the castle. “How old are you, sweetling?” she inquired, her tone gentle and inviting.

“Nine, your Grace,” Maera replied, her voice steady and polite, a reflection of her upbringing.

“She looks big for nine,” Aegon remarked with a mischievous smirk, his voice laced with playful teasing as he leaned towards his brother, Aemond.

“Aegon,” Aemond chided firmly, his gaze shifting to Maera, empathetic to her plight as she navigated the unfamiliar courtly environment.

However, Maera seemed unfazed by Aegon's jest, her composure unshaken as she turned towards him, curtsying once again with a twinkle in her eye. “And you must be Princess Helaena. I will be delighted to braid that unruly hair of yours,” she quipped, her words causing Aegon's smile to falter and even coaxing a giggle from Helaena, a rare and precious sound in the solemn halls of the throne room.

Lord Jasper's firm grip on Maera's shoulder sent a jolt through her, prompting her to whirl around and shoot her father a reproachful frown, silently demanding an explanation for his sudden intervention. “Forgive my daughter, my Prince,” Lord Jasper interjected, his tone carrying a hint of apology as he addressed the royal family. “Her mother has passed, she has no older sisters, and my wife has her hands full with her own children.”

He leveled a stern gaze at Maera, silently conveying his expectations. “Having many older brothers means she does not know the ways of a Lady. I am hoping that is something she can learn under your care, my Queen.”

Alicent nodded understandingly, her expression sympathetic as she regarded Maera. “Most definitely, my Lord,” she assured him with a gentle smile, extending her reassurance to the young girl.

Feeling the nudge from her father, Maera snapped back to attention, realizing her duty as a representative of House Wylde. With a graceful curtsy, she turned towards Princess Helaena, her movements guided by her father's silent cue. “Princess, in honor of our new friendship, I have brought you a gift you may enjoy,” she announced, her voice tinged with earnestness.

Lord Jasper's gesture summoned a squire who presented a small wooden box, a token of House Wylde's regard for the royal family. Aemond couldn't help but roll his eyes at the sight. What could a minor house possibly offer to a Princess of the Realm?

As Maera opened the box, revealing its contents, Helaena approached with a mix of curiosity and skepticism, her violet eyes alight with wonder. “Ugh, is that shit?” Aegon blurted out in disgust, earning a reprimanding dig from his mother.

“No!” Maera retorted defiantly, her cheeks flushing with indignation at Aegon's crude remark. She watched intently as Helaena reached into the box and delicately stroked the elongated brown lumps nestled within.

“They are chrysalises,” Helaena declared with a mixture of fascination and delight, her initial skepticism giving way to genuine intrigue.

Lord Wylde's laughter rang out awkwardly, breaking the tension that lingered in the air. He bent down to Maera's level, his expression a mix of amusement and mild reprimand. “What happened to the bracelet you made her?”

Maera shrugged nonchalantly, her tone matter-of-fact. “That? Oh, it was awful,” she declared with a dismissive wave of her hand. "Also, why would a Princess need a bracelet from me? I bet she has hundreds!"

Aemond couldn't help but chuckle to himself at Maera's boldness and unfiltered honesty. She was a refreshing departure from the usual courtly decorum, clearly intelligent and unapologetically herself.

Before Lord Jasper could issue a warning, Princess Helaena's voice cut through the conversation. “I do not recognize the pattern on the shell,” she observed, her curiosity piqued.

“They are called Perisomena. I do not think you have them in King's Landing,” Maera replied with a mischievous grin, her eyes sparkling with mischief. “We have lots of them in Rainwood, so I thought I would bring you some. I understand you have a keen interest in insects.”

Helaena's face lit up with genuine excitement at Maera's thoughtful gesture. “Yes, I do,” she admitted with a shy smile, her fingers brushing over her cheeks in a subtle display of uncertainty. “I have accumulated quite the collection.”

Maera's enthusiasm was palpable. “Truly? That is incredible! Do you have any beetles from Essos? My brother says in his letters they are much more colorful in the East.”

“Indeed. Would you like to see them?” Helaena offered, her eyes bright with anticipation.

“Yes, please!” Maera replied eagerly, her excitement evident in the way she bounced on her heels. Helaena seized her by the forearm, leading her away from the throne room to her chambers, the excitement evident on both girls’ faces as they shared a secret moment. Glancing over her shoulder, Maera waved goodbye to the others with a warm smile. Her gaze lingered on Prince Aemond, who returned her smile shyly, their eyes meeting briefly before she turned away.

As Maera’s head turned, Aemond’s attention was drawn to the striking silver streak entwined with her dark locks. He had never seen anything quite like it before, and though it was unusual, it only served to enhance her unique beauty in his eyes. A sense of intrigue sparked within him, igniting a newfound curiosity about the enigmatic girl who had just departed.

A chuckle escaped the Queen’s lips. “Gods be good. That went better than expected.”

“Indeed, my Queen,” the Master of Laws smiled. “I know my daughter is a little rough around the edges. But she will be a good companion to the Princess. Hopefully she will be able to bring her out of her shell.”

The days passed swiftly, and Aemond found himself immersed in the solace of the library, a break from the company of his brother or tutors. Rows of towering bookshelves lined the walls, filled with ancient tomes and scholarly volumes. The scent of leather-bound books and parchment permeated the air, mingling with the faint aroma of beeswax candles that flickered on ornate brass sconces.

Aemond settled into a cozy alcove, the soft glow of candlelight illuminating the pages of a tome written in High Valyrian. The book, its pages weathered with age, contained intricacies of the ancient language spoken by the noble houses of Valyria. With furrowed brow, Aemond traced the elegant script with his finger, committing the words to memory as he jotted down notes in a leather-bound journal beside him.

His quill scratched across the parchment, capturing the nuances of pronunciation and grammar, as he diligently practiced the tongue. With each stroke of the pen, Aemond delved deeper into the mysteries of High Valyrian, his thirst for knowledge driving him to master the language of his ancestors. He was not sure if this was genuine interest, or a way to prove himself, but it was a skill that would surely make him stand out as opposed to just being labelled ‘the second son.’

Delving into the intricacies of dragon commands, he was interrupted by the soft patter of approaching footsteps. Glancing up from the pages, he beheld the sight of Lady Maera standing a few paces away, her presence unexpected yet oddly intriguing.

“Good afternoon, my Prince,” Maera greeted him with a radiant smile, executing a polite curtsy with practiced grace.

Returning her greeting with a nod of acknowledgment, Aemond couldn’t help but feel a sense of curiosity stir within him. Why had she sought him out? What prompted her to engage in conversation with him? Though he resolved to maintain his composure and politeness, a subtle wariness lingered in his demeanor. “Should you not be with my sister?” he inquired, his gaze returning to the pages of his book, his curiosity veiled behind a façade of casual indifference.

“The Princess is in an embroidery lesson with her Septa,” Maera explained, her fingers fidgeting nervously with the folds of her sleeves.

“And you do not partake?” Aemond questioned, his puzzlement evident in his tone.

A blush painted Maera’s cheeks as she emitted an awkward giggle. “Truthfully, I am terrible at it. I do not think I possess the fingers or patience for such a skill,” she admitted candidly, her vulnerability shining through her words.

Aemond couldn’t suppress a genuine laugh, the sound rich and warm as it filled the air. Lord Jasper Wylde’s intentions to refine his daughter’s ladylike qualities were evidently not misplaced, but Aemond found himself appreciating Maera’s candidness and authenticity. There was a refreshing genuineness about her that resonated with him.

However, what caught him off guard was the sudden closeness of the girl, who scooted herself into the alcove next to him, her turquoise skirts rustling softly as she settled into a comfortable position. Aemond’s cheeks flushed slightly, his heart skipping a beat at the unexpected proximity.

“What are you reading?” Maera asked inquisitively, her green eyes sparkling with genuine interest, drawing Aemond's attention away from the words on the page and meeting her gaze head on.

Aemond drew in a steadying breath, his violet eyes meeting Maera's as she leaned in, her curiosity palpable. “It’s called Fire and Blood: A full history of House Targaryen,” he replied, his voice steady despite the slight flutter in his chest.

Maera's eyes widened with interest. “You enjoy reading about your ancestors?” she inquired, her tone laced with genuine curiosity.

“I think it’s important to remember the past, as well as learn from the mistakes of old,” Aemond declared, his conviction evident in his words.

As Maera nodded in agreement, she leaned in even closer, her proximity causing Aemond's breath to catch in his throat. He couldn't help but notice the subtle scent that enveloped her – rainwater with a hint of vanilla – a comforting aroma that stirred something within him. He watched intently as she squinted her eyes, studying the text on the page with keen interest.

“It is written in High Valyrian,” she concluded with a determined nod as she leaned back, her observation leaving Aemond momentarily stunned. Even Aegon struggled to identify some of the words on the page, yet Maera seemed to discern the language effortlessly.

“How do you know that?!” Aemond asked, a frown of suspicion creasing his brow.

“I am learning,” Maera stated with a raised brow, taken aback by the Prince’s reaction.

“Are not,” Aemond challenged teasingly, shutting the book abruptly to shield its contents from her view.

“Am too!” Maera retorted, her voice rising in defiance as she stood up from her seat, crossing her arms in a display of determination.

“Prove it,” Aemond challenged with a playful smirk, his gaze locking with Maera's as they stood poised on the edge of a friendly competition of wits.

Maera’s initial reaction to Aemond’s challenge was one of outward fluster, her cheeks flushing with uncertainty at the unexpected request from the prince. Despite her momentary hesitation, she squared her shoulders and jutted out her chin with determination, accepting the challenge laid before her. “Nyke gūrēñagon kesrio syt issa muñnykeā ȳdratan,” I’m learning because it was my mother’s language, she stated confidently with a cheeky shake of her head.

Aemond’s initial shock was palpable, his eyebrows shot up in surprise, and his lips parted slightly in disbelief as he watched her form the unfamiliar words with ease.The flicker of curiosity that had ignited within him earlier now blazed into a roaring flame of intrigue, his admiration for the young girl deepening as he realized the depth of her knowledge and skill. Her smirk widened at his reaction.

“Impressive. But your accent could use some improvement,” the Prince remarked with a playful glint in his eyes, a hint of teasing in his tone.

Maera simply laughed, her amusement bubbling forth like a spring. “Such criticism, and yet I have yet to hear you speak it,” she countered, her tone light and teasing.

Aemond couldn’t help but bite back a smile before responding in High Valyrian, “Nyke sepār gūrēntan ao kostagon ȳzaldrīzes ziry rȳ,” I am just surprised you can speak it at all, his words laced with a mixture of admiration and surprise.

Lady Maera hummed thoughtfully, uncrossing her arms as she took a step closer to him. “Good, but I do have one improvement you could make,” she remarked, her tone shifting to one of encouragement.

Aemond’s brow furrowed in curiosity. “Oh?” he prompted, intrigued by her suggestion.

Maera leaned in, her playful jab in his shoulder accompanied by a mischievous glint in her eyes. “Speak it with more confidence, or else no one will be able to hear you. You are a Prince, and should be proud you can speak the language so well,” she advised, her words carrying a genuine sincerity that resonated with Aemond.

Aemond’s mouth practically fell open at Maera’s straightforward yet uplifting feedback. There were no veiled compliments or hidden agendas, just pure honesty and positive reinforcement. They shared a moment of laughter, the tension dissipating like morning mist under the warmth of their burgeoning friendship. As they stood there, Aemond couldn’t help but wonder if this was what it was like to have a true friend within the confines of the Red Keep – someone who accepted him for who he was and encouraged him to be the best version of himself.

The moment between the friends was shattered by the sudden clamor of books crashing to the floor and the sharp rebuke of the Maester echoing through the library. Startled, Aemond and Maera turned their heads towards the source of the disturbance, their camaraderie momentarily interrupted by the chaotic disruption.

Emerging from behind the shelves, Aegon staggered slightly, his state of slight drunkenness evident in the unsteady sway of his movements. Aemond couldn't help but sigh inwardly at the sight of his older brother, his heart heavy with a mixture of frustration and embarrassment. If the natural order of things had prevailed, Aegon would be the heir to the throne instead of their older half-sister Rhaenyra. Thank the Gods that would never happen, Aemond thought.

With a careless disregard for his surroundings, Aegon reclined back in the alcove, propping his dirty boots on top of the cushions without a hint of respect or consideration. Aemond and Maera exchanged a knowing glance, their silent communication betraying a shared sentiment of disappointment and exasperation at the elder Prince’s behavior.

“What are you two doing in here?” Aegon slurred, his words dripping with mockery as he let out a drunken giggle. “Reading dirty books?”

Before Aemond could formulate a response, Maera interjected, her voice steady despite the underlying tension. “Prince Aemond has been kind enough to give me a tour of the library, my Prince,” she declared, her tone laced with a hint of defiance.

“Awww, that’s so sweet,” Aegon sneered mockingly, his theatrics accompanied by exaggerated batting of his eyelashes. “Have you got your eye on her, Aemond? Perhaps when she flowers, you could ride her like the Pink Dread. She’s certainly built like him,” he added with a cruel laugh, his words dripping with venom.

Aemond felt his frustration simmering beneath the surface, his cheeks flushing with indignation. He could sense Maera’s questioning gaze upon him, but the memories of the Pink Dread – the cruel jape gifted to him – stifled his urge to confide in her. Instead, he redirected his attention to his brother, his voice tinged with thinly veiled irritation. “What are you doing in here?”

Aegon’s response was dismissive, his tone dripping with arrogance. “I am bored, dear brother, so I have come to seek entertainment,” he replied with a nonchalant shrug.

“Entertainment? You do not strike me as the type of person to find that within a library, Prince Aegon,” Maera retorted with a teasing grin, her boldness and fire evident in her words.

Aemond’s initial grin widened as he observed Maera’s boldness in teasing Aegon, a rare display of defiance against his usually unchallenged older brother. Her ease and fiery demeanor in addressing Aegon sparked a sense of admiration within Aemond, who found himself silently cheering her on.

However, Aemond’s grin faltered and his heart sank as Aegon leaned forward and cruelly grabbed a fistful of Maera’s hair, pulling her close with a mixture of confusion and malice evident on his face as he studied the mixture of colours.

“What is with this silver bit in her hair?” Aegon demanded, his fingers still tightly knotted around Maera’s locks, his drunken haze masking any sense of empathy or restraint. Aemond’s eyes widened in disbelief as he witnessed the older prince’s callous actions towards his friend.

Watching Maera’s reaction, Aemond’s heart twisted with a mixture of anger and sympathy. Despite the obvious pain inflicted upon her by Aegon’s rough handling, Maera remained resolute, her jaw clenched and her gaze unwavering. Determined not to give Aegon the satisfaction of seeing her falter, she refused to utter a yelp of pain, though tears welled in her green eyes, betraying the hurt she endured.

Aemond felt a surge of protective instinct rise within him, his fists clenching at his sides as he struggled with the conflicting emotions swirling within him. “Let her go, Aegon,” he demanded, his voice laced with barely contained anger.

His older brother simply laughed, his breath hot against Maera’s face as he leaned in closer. “Oh, my little brother is so taken with you. You are his delicate little flower. His Mayflower! Yes, I like the sound of that!” Aegon’s words were laced with mockery, his grip on Maera tightening despite her struggles.

Maera wriggled and twisted, attempting to free herself from Aegon’s grasp, but his hold remained firm. Aegon sighed theatrically, turning his attention back to Aemond. “If you can answer my question, Aemond, I will let her go,” he declared, his tone slurred with the effects of his drunkenness.

Aemond huffed in frustration, his mind racing as he searched for a response. He doubted his brother’s sincerity, but he couldn’t risk Maera’s safety by ignoring the demand. “She has a rare pigment condition. The reason the streak is silver is probably due to the fact she’s part Targaryen,” he stated firmly, his words carrying a note of authority.

Aegon’s surprise was evident in the faltering of his grip, allowing Maera to yank herself free and take refuge beside Aemond, who cast her a reassuring glance before turning back to his brother. He could still see traces of Maera’s brown and silver strands wrapped around Aegon’s fingers, a stark reminder of the confrontation that had just unfolded.

“You? You are part Targaryen?” Aegon questioned incredulously, his tone laced with skepticism as he eyed Maera with suspicion.

Maera could only nod in response, her composure regained as she stood tall beside Aemond, her gaze steady despite the lingering tension in the air. Aegon hummed dismissively. “I don’t believe you,” he retorted, his arrogance palpable.

“Have you not been listening at our dinners?” Aemond shot back angrily, his frustration bubbling to the surface.

Aegon snickered, his laughter tinged with disdain. “Of course not,” he replied flippantly, his disregard for their family’s conversations evident in his dismissive tone.

Aemond's frustration boiled over, irritation clear in the furrow of his brow as he realized he was the lone listener during their family's evening gatherings. “We all share the same great-grandfather, Aegon. Lady Maera is the granddaughter of Archmaester Vaegon,” he retorted, his voice edged with annoyance at his brother's ignorance.

Aegon's eyebrows shot up in surprise, a smirk playing at the corners of his lips. “Oh, so you are not a real Targaryen then, are you?” he teased, directing his mocking gaze towards Maera.

“Neither are you,” Lady Maera hissed back, her voice tinged with defiance as she brought her hair around her shoulder, stroking it soothingly. “You’re part Hightower,” she added with a pointed emphasis, her words a sharp retort to Aegon's taunts.

Aegon's temper flared at her words, his fists clenching at his sides as he stood up from his seat, his towering form casting a menacing shadow over them. “I am more Targaryen than you,” he snarled, his voice dripping with venom as he advanced towards them.

Maera stood her ground, her stance defiant as she positioned herself protectively in front of Aemond, much to his shock as he attempted to pull her back. His heart raced with a mixture of concern and bewilderment at Maera's audacity, her willingness to stand up to Aegon both admirable and disconcerting.

“Only because of your ridiculous hair. You won’t even be the King,” Maera sneered, her words cutting through the tense atmosphere like a knife, her defiance unyielding in the face of Aegon's fury.

Aegon's anger reached a boiling point, his face contorted with rage as he struggled to find words to match his escalating emotions. “You insolent little-”

“Enough!” a voice boomed from around the corner, cutting through the heated exchange like a sudden gust of wind.

From behind the shelf emerged old Maester Mellos, his weathered features etched with annoyance at the disruption of his previously quiet library. Aemond and Maera clasped their hands together, their heads bowed in a display of respect and contrition, each feeling a pang of guilt for their role in the altercation. Aegon, however, scoffed at the old man's interruption, his defiance evident in the dismissive curl of his lip.

“My Prince,” Maester Mellos addressed Aegon calmly, his tone tinged with authority. “The Queen knows you are back. And she is looking for you,” he added sternly, his words a clear indication that further disobedience would not be tolerated.

Aegon huffed in annoyance and stormed out of the library, his departure leaving behind a palpable tension that hung thick in the air. Maera and Aemond released a collective breath they hadn't realized they'd been holding, their shock giving way to nervous giggles in the aftermath of the altercation, but their levity was short-lived as they were promptly chastised by the stern old man.

“This is a place of study, not a nursery. You must keep noise to a minimum,” Maester Mellos admonished, his tone carrying a weight of authority that brooked no argument.

“Yes, Maester,” Maera replied with a sickeningly sweet edge to her voice, her contrition palpable as she met the maester's stern gaze. “It will not happen again.”

The old man huffed in response before retreating back to his desk, leaving Maera and Aemond to pick up the fallen books scattered by Aegon's drunken stumbling, restoring order to the quiet sanctum of the library.

Once the books were back in their rightful places, Maera broke the silence, her voice soft with gratitude. “Thank you, my Prince, for sticking up for me as best you could,” she murmured, her eyes reflecting a mixture of appreciation and lingering unease.

Aemond smiled sadly and nodded, his gaze flickering with a hint of regret. He wished he could have done more to protect her, but the reality of his brother's towering aggression loomed large in his mind, rendering any attempt futile.

He watched as Maera made her way over to the alcove, gathering Aemond's scattered belongings before approaching him with a quiet determination. “And thank you... for remembering my mother, and our shared blood,” she confessed softly, her vulnerability shining through in the tremor of her voice. “In truth, I don’t get to talk about her often. I don’t think my father likes it.”

Aemond accepted the items from her, their fingers brushing in a fleeting touch that sent a jolt of electricity coursing through him, his heart pounding loudly in his chest. He cleared his throat, struggling to maintain his composure. “Like I said, it is important to remember history,” he replied earnestly, his words carrying a weight of sincerity as he met Maera's gaze with a shared understanding of the significance of their shared heritage.

As they exited the library and made their way down the corridor, Maera couldn’t contain a mischievous giggle bubbling up from within her.

“We should get him back for that,” Maera chortled with a twinkle of mischief in her green eyes.

Aemond watched her with a mixture of amusement and curiosity. “What do you suggest?”

“Well… the Princess has a millipede we could use.”

Before he could fully comprehend her intentions, Maera grabbed his hand, sending a jolt of nervous excitement coursing through him. Feeling her touch, Aemond’s palms grew sweaty with anticipation as they ran down the corridor together, their fingers intertwined in a silent pact of solidarity.

Despite the lingering tension from their encounter with Aegon, Aemond couldn’t help but feel a glimmer of hope blossoming within him for the budding friendship he shared with Maera. In that moment, as they raced through the castle hallway hand in hand, Aemond dared to believe that perhaps the pair of them had found a kindred spirit in one another.

Notes: Thought we could all use a break and have some fluffy baby Maemond as well as Aemond’s perspective on everything. But to do that we gotta go right back to the beginning. So I’ll be posting these intermittently, probably maximum get about ten chapters out of him. But yeah, this was nice to write. Aemond POV chapter three though is going to be back to our usual nasty dark horrible shit 🤣 Also points to everyone who can point out callbacks from previous chapters 🖤

Tags: @blue-serendipity @abecerra611 @saltedcaramelpretzel @marvelescvpe @manipulatixe @watercolorskyy @shesjustanothergeek @0eessirk8

Thank you so much for reading! Comments, feedback, likes, and reblogs are greatly appreciated 🖤

#maera wylde#aemond targaryen#aemond x oc#aemond fanfiction#chapters#hotd aemond#hotd fanfic#house targaryen#house wylde#hotd helaena#Aemond POV#aemond fluff

50 notes

·

View notes

Text

Come to Bed

F!LDB x Miraak || Slight-NSFT || 675 words

AO3 & FF.net

Prompt: "trying to concentrate on a task, but your lover’s kissing your neck, making your head spin" for our favorite pair of dragonborns, please :D

The candles were nearing their last minutes of life, the flame dimming with each second passed. And still Miraak remained hunched over the table, the whites of his fingertips surrounded in the pink of irritation, the weight of him and his worries pressing into the table.

“If you haven’t found it by now…” Telyra’s voice trailed off. Her body leaned against the doorframe across the room, her arms crossed over her chest.

Miraak’s form deflated with the long release of breath. “So you have said.”

“Will you come to bed?” she asked, the usual mirth in her voice replaced by fatigue.

Moments of silence carried on the dust motes illuminated by the fading candles whorled between them.

Letting out a sigh, Telyra stepped toward him, her sheer night robe brushing along the stone floor; skin unbothered despite the chill in the air. Her pale, silver hand pressed into the map on the table, sliding it to rest against his.

“Miraak.”

He turned at her voice, shadows well at home under his eyes and familiar with the red surrounding his irises.

“You can’t see an answer if you can’t see,” she said. “The candles are just about through. We’ll gather again tomorrow, but you need to sleep.”

“My mind will not grant me the peace needed to sleep,” he muttered. “Not until we discern a viable strategy.”

Telyra placed her hand atop his. “The war can wait a night.”

A sigh was his only acknowledgment.

With another of her own, she moved beneath his arm and placed herself between him and the table; it wasn’t the most comfortable of positions, her back having to arch around Miraak’s torso as he didn’t make any effort to provide her space. He simply looked at her, or perhaps through her to the map.

“Come to bed,” she repeated.

“I will shortly,” he replied, not meeting her eyes.

“No. Now.”

He offered nothing more than a soft grunt, no tonal inclination of ‘yes’ or ‘no.’

Asking politely found only failure. She touched his waist, opting for a new means of persuasion. His stomach twitched under her fingers, but otherwise, he remained still. Telyra’s hands grazed along his torso, slipping beneath the deep-cut collar of his shirt; his heart thrummed under her skin, harder and faster as he recognized the game she instigated. This was not their first stand-off in which words failed.

“Please,” she whispered.

With a deep sigh, he ignored her. It was naught but mere pride keeping him here at this point, Telyra believed.

“The bed is far too cold without you,” she pleaded.

“You do not feel cold,” he replied.

“Maybe not, but…” Telyra leaned up and pressed a kiss at the edge of his jaw. “I certainly feel you.”

He leaned into her on instinct, growing rigid as soon as he realized her play.

“I can take your mind elsewhere,” she promised against his skin as her lips followed the taut muscle of his neck.

“There is little that could free my thoughts of this war,” Miraak retorted. The color filling his cheeks spoke otherwise.

Lower her kisses traveled, sucking on his skin briefly before placating it with tender presses of her mouth, leaving no physical trace of her affections beyond the blush creeping along his neck. She reached his collarbone and gave it the softest nick of her teeth.

“No honor to be found in your tactics,” he mumbled.

She smiled. “I’ve always preferred to play dirty.”

As she continued tracing the lines of his neck, her hands traveled down his torso, his waist, stopping only when they felt his growing excitement. A quiet moan vibrated in the back of his throat as she brushed across the front of his pants.

Her mouth returned to his ear, and she asked, “Now will you come to bed?”

“No,” he replied. His embrace engulfed her, and without a chance to react, he lifted her onto the table and stepped between her legs.

Telyra stared at him for a breath’s moment before his lips claimed hers.

“Not yet.”

#miraak#skyrim#miraak x dragonborn#miraak x ldb#ldb#tes#the elder scrolls#telyra ravencast#fic: tmdrabble#ship: it's only been a lifetime#Thank you so much for the prompt!!! and 'our' favorite??? THAT MEANS SO MUCH <333#alxxiis actually wrote something

57 notes

·

View notes

Text

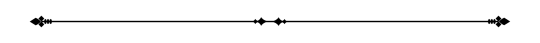

Mastering Single Candlestick Patterns: A Comprehensive Guide

Introduction:

Candlestick patterns are an essential tool in the arsenal of any technical analyst. They provide valuable insights into market sentiment and potential price movements. Among the various types of candlestick patterns, single candlestick patterns stand out for their simplicity and effectiveness. In this article, we'll delve into the world of single candlestick patterns, exploring their significance, interpretation, and practical application in trading.

Understanding Candlestick Patterns:

Before diving into single candlestick patterns, let's recap what candlestick patterns represent. Each candlestick on a price chart illustrates the open, high, low, and close prices for a specific period, whether it's a minute, hour, day, or week. The body of the candlestick represents the price range between the open and close, while the wicks (or shadows) indicate the high and low prices reached during that period.

Single Candlestick Patterns:

Single candlestick patterns consist of individual candles that provide valuable information about market sentiment and potential reversals or continuations in price trends. While they may seem simplistic compared to multi-candle patterns like engulfing or harami, single candlestick patterns carry significant significance and can offer traders valuable insights when interpreted correctly.

Doji:

The Doji is perhaps the most well-known single candlestick pattern. It forms when the open and close prices are virtually equal, resulting in a small or non-existent body and long wicks. A Doji suggests indecision in the market, signaling a potential reversal or continuation depending on its context. For example, a Doji following a strong uptrend may indicate a potential trend reversal, while a Doji during a consolidation phase could signal further ranging.

Hammer and Hanging Man:

The Hammer and Hanging Man patterns are characterized by a small body near the top or bottom of the candlestick, with a long lower wick and little to no upper wick. The Hammer occurs after a downtrend and suggests a potential bullish reversal, especially if it appears near support levels. Conversely, the Hanging Man forms after an uptrend and indicates possible bearish pressure, particularly if it appears near resistance.

Shooting Star and Inverted Hammer:

The Shooting Star and Inverted Hammer patterns are similar to the Hammer and Hanging Man but appear at the end of uptrends and downtrends, respectively. The Shooting Star features a small body near the bottom of the candle, with a long upper wick, signaling potential bearish reversal. On the other hand, the Inverted Hammer, with its small body near the top and long lower wick, suggests a possible bullish reversal after a downtrend.

Spinning Top:

The Spinning Top is characterized by a small body and long upper and lower wicks, indicating a tug of war between buyers and sellers. This pattern suggests indecision in the market and often precedes trend reversals or continuations, depending on its context within the price chart.

Practical Application:

Mastering single candlestick patterns requires both theoretical knowledge and practical experience. Traders can integrate these patterns into their trading strategies by using them in conjunction with other technical indicators and price action analysis. Here are a few tips for effectively utilizing single candlestick patterns:

Context is Key: Consider the broader market context, including trend direction, support and resistance levels, and trading volume, when interpreting single candlestick patterns.

Confirmation: Single candlestick patterns are most effective when confirmed by other technical indicators or multiple timeframes. Look for confluence with moving averages, trendlines, or volume analysis to validate potential trading signals.

Risk Management: Always use proper risk management techniques, including setting stop-loss orders and adhering to position sizing principles, to protect against adverse market movements.

Practice: Like any skill, mastering single candlestick patterns requires practice and observation. Regularly analyze price charts, identify patterns, and reflect on their outcomes to improve your trading proficiency over time.

Conclusion:

Single candlestick patterns offer valuable insights into market sentiment and potential price movements, making them indispensable tools for traders of all experience levels. By understanding the significance and interpretation of patterns like Doji, Hammer, Hanging Man, Shooting Star, Inverted Hammer, and Spinning Top, traders can enhance their decision-making process and improve their trading results. However, it's essential to remember that no single pattern guarantees success, and incorporating proper risk management and technical analysis is crucial for sustained trading success.

0 notes

Text

Nifty forms Doji candle on weekly scale. What traders should do next week

Nifty on Friday ended 172 points lower to form a Doji candle on the weekly chart, which indicates indecisiveness prevailing in the marketplace at the current juncture.

Technically, the index closed below the level of 22,500, which has been acting as a minor support for the last couple of days. While this is a negative development, it’s not something that opens a big downside, Tejas Shah of JM Financial & BlinkX said.

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities

Nifty is showing signs of near-term bearishness as it forms a double-top pattern on the daily chart, coupled with a bearish engulfing candle. This suggests a sell-on-rise approach in the market. Confirmation of the double-top pattern would require follow-up selling in the upcoming week. Immediate resistance is noted at the 22,600-22,700 zone, where aggressive call writing has been observed in the options market. On the downside, the index has immediate support at 22,300, and a breach below this level could accelerate the downside momentum.

YOU CAN CHECK THIS OUT OPTION STRATEGY BUILDER IN OPTIONPERKS PLATFORM.

0 notes

Text

Understanding Technical Analysis in Crypto Trading

A firm grasp of technical analysis principles is like having a powerful instrument when trading cryptocurrencies. Technical analysis must be considered when making informed trading decisions. The Bitcoin landscape is always changing and becoming more widely known. Let us explore the blockchain technology that powers these digital assets as we delve into the basic concepts and intricacies of technical analysis in cryptocurrency trading.

Trading Cryptocurrencies: An Adaptive World

Many traders seeking to profit from market volatility have been drawn to the rapidly increasing popularity of cryptocurrencies like Bitcoin and Ethereum, as well as other cryptocurrencies. However, due to the cryptocurrency market's innate volatility and sharp price swings, trading requires an intelligent strategy. In this situation, using technical analysis as a helpful tool becomes relevant.

Understanding the procedure of technical analysis

The main goal of technical analysis is to predict future price changes by examining past market data, especially volume and price. It operates on the idea that past price movements tend to recur, allowing traders to identify patterns and trends and generate forecasts based on reliable data.

Important Technical Analysis Elements

Candlestick charts: These visual depictions of market movements provide crucial details about the opening, closing, high, and low values within a specific period. Patterns like hammers and engulfing candles indicate potential price reversals or continuations.

Oscillators and Indicators: Moving averages (MA), moving average convergence divergence (MACD), the relative strength index (RSI), and other oscillators and indicators are examples. These offer data on momentum, trend direction, and overbought and oversold circumstances to help traders make judgments.

Support and Resistance Levels: At these psychological price levels, the price may encounter obstacles. In the market, they are also referred to as supply and demand. By being aware of these levels, traders can more accurately choose the correct entry and exit points for their trades.

Blockchain Technology: Cryptocurrency's Foundation

The core of cryptocurrencies is blockchain technology, a distributed and immutable ledger that logs every transaction via a network of computers. This technology eliminates the need for intermediaries while facilitating security and transparency in peer-to-peer transactions.

Technical Analysis's Contribution to the Impact

Because of its transparency, blockchain offers a sizable historical dataset that technical analysts can use. Furthermore, because blockchain is decentralized, external influences are less likely to have an impact, which could make technological patterns more dependable.

Educational Materials and Professional Advice

Those who want to learn more about the technical analysis of Learn Crypto Trading have several options at their disposal. Students who take forex trading lessons have a thorough understanding of technical analysis techniques explicitly created for the bitcoin market. These seminars cover various topics, two of which are understanding advanced indicators and interpreting chart patterns. Additionally, seeking assistance from cryptocurrency experts and advisors can offer crucial perspectives and valuable knowledge that has been honed via experience in negotiating the intricacies of bitcoin trading.

Constant Evolution and Learning in Cryptocurrency Trading

The cryptocurrency sector is changing quickly, so staying current on the latest developments, market trends, and emerging technologies is essential. Traders can stay informed about new techniques and technical analysis tools tailored to the ever-evolving cryptocurrency market by participating in the most recent seminars and courses on crypto trading, such as Blockchain Council.

Maintaining a steep learning curve is essential since cryptocurrencies are constantly evolving. Gaining a thorough understanding of the critical concepts and technological features governing cryptocurrency is crucial. Technological advancements, market sentiment, and regulatory changes are just a few of the variables that significantly impact how successful technical analysis is.

These variables greatly affect the Bitcoin market. Working with knowledgeable crypto advisors and specialists can help one obtain essential insights into market trends, risk management strategies, and original applications of technical analysis. It is simpler for traders to share their ideas and experiences by participating in groups, forums, or mentorship programs specifically focused on bitcoin trading. This promotes continuous learning and development.

In summary

Successful trading strategies in the cryptocurrency market are based on integrating technical analysis and blockchain technology. The trading industry's use of technical analysis is strengthened when traders embrace blockchain data's transparency and reliability, giving them a more informed foundation for making decisions. Furthermore, because the bitcoin market is constantly shifting, it's critical to remain committed to lifelong learning and keep an open mind when picking up tips from more experienced experts. If traders combine a deep understanding of blockchain technology with their technical expertise, they can traverse cryptocurrency markets confidently and flexibly.

Additionally, traders can improve their chances of success in this dynamic and always-shifting industry by consistently improving their abilities through education and teamwork. Technical analysis is essential for traders who need guidance amidst volatile cryptocurrency markets. By comprehending the core ideas of cryptocurrency trading, gaining knowledge of blockchain technology, and utilizing the resources and advice provided by professionals, one can significantly increase one's ability to make wise trading calls in the rapidly evolving realm of cryptocurrency trading. Even though the cryptocurrency landscape is constantly changing, traders who want to succeed in this quickly expanding industry still need to grasp technical analysis.

0 notes

Text

Mastering Options Trading Technical Analysis: Insights from My Trading School

Options trading technical analysis has emerged as a cornerstone for many traders seeking to navigate the complexities of the financial markets. Within this realm, understanding intricate patterns and employing strategic approaches like the W pattern trading and trading candle patterns can significantly enhance one's trading prowess. In the following discourse, we delve into the essence of technical analysis in options trading, explore the nuances of W pattern trading and trading candle patterns, and reflect on the insights gained from My Trading School.

Understanding Technical Analysis in Options Trading:

Technical analysis in options trading involves the examination of historical price and volume data to forecast future price movements. It relies on the premise that market trends tend to repeat themselves due to human psychology, which manifests in price charts. Traders use various tools and techniques to analyze these patterns and make informed trading decisions.

In the realm of options trading, technical analysis becomes even more critical due to the complex interplay of factors influencing option prices, including underlying asset movement, implied volatility, and time decay. By applying technical analysis, traders aim to identify potential entry and exit points, gauge market sentiment, and manage risk effectively.

Options Trading Technical Analysis Strategies:

Two prominent strategies within options trading technical analysis are W pattern trading and trading candle patterns. The W pattern, a type of double bottom formation, signifies a reversal of a downtrend and often precedes a bullish move. Recognizing and capitalizing on this pattern can provide traders with lucrative opportunities to enter trades at favorable prices.

Trading candle patterns, on the other hand, involves analyzing the formations created by candlesticks on price charts. Each candlestick represents the open, high, low, and close prices for a specific period, typically ranging from minutes to days. Traders scrutinize patterns such as engulfing candles, doji candles, and hammer candles to decipher market sentiment and anticipate potential price movements.

Exploring the Significance of W Pattern Trading:

The W pattern, characterized by two successive troughs separated by a peak, symbolizes a shift from a bearish sentiment to a bullish one. Traders keen on options trading technical analysis leverage this pattern to identify potential entry points for bullish positions. The completion of the second trough typically confirms the reversal, prompting traders to initiate long positions or implement options strategies tailored to capitalize on upward price movements.

Moreover, the W pattern often coincides with other technical indicators, such as moving averages and momentum oscillators, further reinforcing its significance. By integrating multiple technical signals, traders can enhance the reliability of their trading decisions and mitigate the risk of false signals.

Harnessing the Power of Trading Candle Patterns:

Trading candle patterns offer invaluable insights into market dynamics and investor sentiment. For instance, an engulfing candlestick pattern, where the body of one candle completely engulfs the body of the preceding candle, signifies a potential reversal of the prevailing trend. Traders interpret this pattern as a shift in momentum, with the engulfing candle acting as a bullish or bearish signal depending on its position relative to the preceding candles.

Similarly, doji candles, characterized by their small bodies and long wicks, indicate indecision in the market. These patterns suggest a temporary stalemate between buyers and sellers, often preceding significant price movements or trend reversals. By monitoring the occurrence of doji candles within various timeframes, traders can gauge market volatility and adjust their trading strategies accordingly.

Insights from My Trading School:

My Trading School serves as a beacon of knowledge and mentorship for aspiring traders seeking to master options trading technical analysis. Through comprehensive courses, interactive workshops, and personalized coaching, My Trading School equips traders with the necessary tools and expertise to navigate the dynamic landscape of the financial markets.

Drawing on the collective wisdom of seasoned traders and industry experts, My Trading School empowers individuals to develop robust trading strategies, cultivate disciplined trading habits, and adapt to evolving market conditions. By fostering a supportive learning environment and fostering a culture of continuous improvement, My Trading School nurtures the growth and success of its students, enabling them to thrive in the competitive world of options trading.

In conclusion, options trading technical analysis represents a formidable framework for navigating the intricacies of the financial markets. By embracing strategies such as W pattern trading and trading candle patterns, traders can unlock a myriad of opportunities to capitalize on market inefficiencies and achieve their trading objectives. With institutions like My Trading School paving the way for education and enlightenment, aspiring traders can embark on a transformative journey towards trading mastery and financial prosperity.

0 notes

Text

Deciphering the Forex Market's Hidden Forces: A Roadmap to Trading Mastery

The forex market, often perceived as an intricate and challenging domain, continues to captivate the aspirations of individuals seeking financial independence. While many embark on the path of forex trading, only a select few unravel the cryptic dynamics that underlie this global financial realm. In this comprehensive exploration, we will delve deep into the enigmatic behaviors of the forex market, unveiling insights that empower traders to make informed decisions and navigate the intricacies of currency exchange with precision.

Decoding Market Behavior

Unearthing the concealed behavior of the forex market necessitates a profound comprehension of how currency pairs interact and evolve over time. This approach, conceived by seasoned trader Andrea Unger, revolves around conducting a systematic backtest of specific trading rules using historical data. By adhering to these rules, traders gain invaluable insights into the unique behavior of different currency pairs, insights that often elude conventional analysis.

Let's delve into the fundamental rules for executing this insightful backtest:

Breakout Strategy: When a currency pair breaches the prior week's high, contemplate initiating a long position.

Trend Reversal Strategy: Maintain a long position until the price dips below the prior week's low, signaling a trend reversal. Then, transition to a short position.

Continuous Assessment: Remain in a short position until the price surpasses the prior week's high, indicating a potential trend reversal. Revert to a long position and continue the cycle.

These rules exhibit flexibility and adaptability to various time frames, including daily and weekly charts. The primary aim is to discern whether a currency pair exhibits a trending or reversal behavior, a pivotal factor influencing trading strategies.

Categorizing Currency Pairs: Trending and Reversal

In the intricate tapestry of the forex market, not all currency pairs dance to the same tune. Some gracefully follow discernible trends, while others are more inclined to change direction swiftly. Categorizing currency pairs based on their behavior empowers traders to craft strategies that harmonize with prevailing market conditions.

Trending Currency Pairs:

GBP/JPY

AUD/JPY

USD/TRY

Reversal Currency Pairs:

AUD/CAD

GBP/CAD

USD/CAD

Comprehending these distinct behaviors is akin to unlocking the forex market's secrets. It equips traders with the ability to align their strategies with the ever-changing dynamics of the currency exchange landscape, ultimately enhancing their chances of success.

Translating Knowledge into Tactical Action

Now that we have unveiled the intrinsic behavior of currency pairs, let's embark on a journey to apply this newfound knowledge in real-world trading scenarios. We'll amalgamate this understanding with the Moving Average Excess Return Expectancy (MAEE) formula to execute well-informed trading decisions.

Example 1: AUD/CAD (8-Hour Time Frame)

AUD/CAD currently resides in a downtrend, characterized by a series of lower highs and lows. After a pullback to previous support, the price surges above the prior week's high, a significant area of value. Given that AUD/CAD falls into the category of reversal currency pairs, there is a strong likelihood of a downward reversal.

To confirm this hypothesis, we patiently await the emergence of a bearish engulfing pattern, a reliable signal that signifies the dominance of sellers. This pattern serves as the entry trigger, prompting a short position upon the opening of the next candle.

Example 2: GBP/CAD (8-Hour Time Frame)

GBP/CAD exhibits an uptrend, characterized by higher highs and lows. After a pullback to previous resistance, it plunges below the prior week's low, a crucial area of value. Since GBP/CAD falls into the category of reversal currency pairs, there is a potential for an upward reversal.

To capitalize on this potential, we seek a valid entry trigger—an affirmative close above support. This signals a shift in momentum, prompting a long position as the next candle embarks on its journey.

Example 3: USD/TRY (Weekly Time Frame)

USD/TRY currently basks in an uptrend, boasting clear higher highs and lows. After retracing to previous resistance, which now functions as support, a robust bullish close materializes. USD/TRY belongs to the category of trending currency pairs, indicating its potential to persist in an upward trajectory.

In this instance, instead of entering the trade upon the next candle's open, we opt for a buy stop order strategically placed above the previous week's high. This strategic maneuver capitalizes on the currency pair's propensity to trail a trend once a breakout occurs.

The Perceived Dilemma of Forex News

A lingering question emerges: should traders closely monitor forex news releases? The answer hinges on their chosen trading style and risk tolerance. Traders operating on extended time frames, such as the 4-hour or daily, often possess more generous stop losses capable of withstanding market volatility induced by news events. As such, they may opt for a less vigilant approach to news monitoring.

Conversely, traders navigating the shorter time frames, such as the 1-hour or lower, must tread more cautiously. Major news releases can trigger abrupt market spikes, potentially activating stop-loss orders. To mitigate this risk, they should remain attuned to impending news events and contemplate exiting trades before the news triggers.

In Conclusion: Unlocking the Forex Market's Mysteries

In conclusion, unraveling the cryptic behavior of the forex market stands as a transformative journey for traders. Categorizing currency pairs based on their behavior, coupled with astute technical analysis, empowers traders to refine their strategies with precision.

The choice to engage with forex news releases or not hinges on trading style and risk tolerance, necessitating a pragmatic approach.

Empowered by this newfound knowledge, traders are poised to navigate the intricate realm of forex trading with resilience and an elevated likelihood of success. Every loss becomes not a setback, but a stepping stone on the path to mastery—a valuable lesson contributing to the trader's growth and evolution in the captivating world of forex trading.

For the best Forex VPS solutions, visit cheap-forex-vps.com to enhance your trading experience with top-notch virtual private servers tailored for forex trading.

#vpsforex#cheap forex#cheap vps forex#forex vps#forex trading servers#forex vps Malaysia#best trading vps#forex vps India#forex vps Italy#forex vps Nigeria#forex vps Latvia#forex vps Singapore#forex vps Australia#forex vps United Kingdom#forex vps USA#forex vps Canada

0 notes

Text

A lot of unplanned, emotional decisions and lack of preparations costing me high. Bit certainly not in terms of huge losses but in terms of decline in profits... While i am still in Rs. 50L profits in this FY after tax it would have been much higher provided I had some discipline... Trying to maximize the profit is giving cuts in existing profits. In Nov 2022 when exiting from Reliance Futures i was in 14L profit after tax. This was after struggling at a 15L loss in Jul 2022. Even after Nov in the attempt of maximizing profits in Reliance i had come down to 6L loss in Mar 2023 wiping out all 14L profits 4 months back.

However, sticked onto Reliance more firmly to make a 11L profit after tax by July 2023 but even then a change in prepared strategy made me exit early at a wrong level after which stocked rallied another 200 points in 10 days. However that made me to enter to Vodafone Idea which has given me wonderful returns. With heavy bets on Vodafone idea I had been to a whopping profit of 85L after tax. But couple of decisions with light hearted thought has reduced it to 55L as of today. First mistake was, 11.55 being a resistance point as i was always thinking, i decided against exiting on the day. Next day it went down 10% creating a strong bearish engulfing candle forced me to exit. Though the price went above next few days I continue to believe technically the decision was correct after such rally from 7 to 11. The second decision that went wrong was after the exit when the price negated the engulfing candle, i entered again as it became ultra bullish, that too in just a matter of 3 days. Though the decision was technically correct, the unawareness of getting the stock into ASM stage was not considered. So it was expected to be weak in next trading session. So the mistake was not that i entered again to the stock, the mistake was even after a gap up opening today i waited more to exit of which i could have saved 9L today after tax. In a detailed study I came to know that even the last engulfing candle was due to ASM in BSE and this time it was on NSE. So the ASM lesson was learnt with a whopping 28L fee of cost.

And that's ok, it is learning after all. I am here to stay, market is here to stay, as long as i can cover the 28L in upcoming years I am still in good returns, in fact even otherwise i am with some handful numbers..

My analysis and study on the move to 12 was almost accurate, but the intermediate decisions spoiled. Now in similar way after some consolidated there will be a move to 16 so need to watch on and make right decisions. An entry around 9.70 would be lesser risky.

0 notes

Text

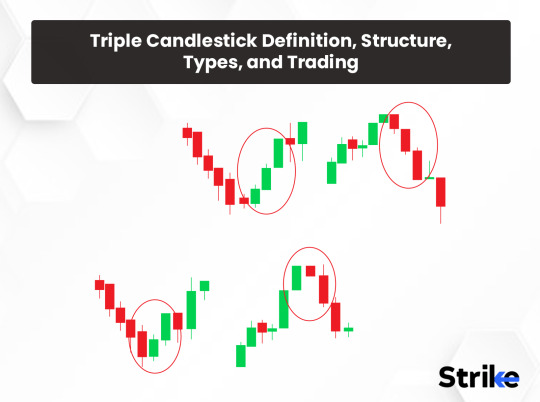

Mastering the Triple Candlestick Pattern: A Comprehensive Guide

Introduction:

In the vast landscape of technical analysis, candlestick patterns serve as invaluable tools for traders seeking to decipher market sentiment and make informed decisions. Among these patterns, the Triple Candlestick formation stands out as a powerful indicator of potential trend reversals or continuations. In this comprehensive guide, we delve into the intricacies of the Triple Candlestick pattern, its various forms, and how traders can effectively utilize it to enhance their trading strategies.

Understanding Candlestick Patterns:

Before delving into the Triple Candlestick pattern, it's essential to grasp the fundamentals of candlestick analysis. Candlestick charts visually represent price movements within a specific time frame, displaying open, high, low, and close prices for a given period. Each candlestick consists of a body and wicks (also known as shadows or tails), with the body representing the price range between the open and close, and the wicks indicating the high and low points reached during the session.

The significance of candlestick patterns lies in their ability to convey market psychology and sentiment. Traders analyze the formation and arrangement of candlesticks to anticipate potential price movements, identifying patterns that signal buying or selling pressure, trend reversals, or continuation patterns.

The Triple Candlestick Pattern:

The Triple Candlestick pattern is characterized by three consecutive candlesticks with specific characteristics, indicating a potential shift in market sentiment. These patterns can appear in both bullish and bearish market conditions, offering opportunities for traders to capitalize on emerging trends.

Bullish Engulfing:

One of the most widely recognized Triple Candlestick patterns is the Bullish Engulfing formation. This pattern occurs during a downtrend and consists of two candlesticks: a bearish candle followed by a larger bullish candle. The bullish candle's body completely engulfs the body of the preceding bearish candle, signaling a reversal in sentiment from bearish to bullish. Traders often interpret this pattern as a strong buying signal, anticipating further upward momentum.

Bearish Engulfing:

Conversely, the Bearish Engulfing pattern occurs in an uptrend and signals a potential reversal to the downside. It comprises a bullish candle followed by a larger bearish candle whose body engulfs the previous candle's body entirely. This pattern suggests a shift from bullish to bearish sentiment, with traders viewing it as a signal to sell or short the asset in anticipation of a downtrend continuation.

Evening Star:

The Evening Star pattern is a bearish reversal formation that typically appears at the peak of an uptrend. It consists of three candlesticks: an initial bullish candle, followed by a small-bodied candle (or doji) characterized by indecision, and finally, a large bearish candle. The appearance of the Evening Star suggests that bullish momentum is waning, with sellers gaining control and potentially heralding a trend reversal to the downside.

Morning Star:

Contrary to the Evening Star, the Morning Star pattern is a bullish reversal formation observed at the bottom of a downtrend. It comprises three candlesticks: a bearish candle, a small-bodied candle indicating indecision, and a bullish candle. This pattern signals a potential reversal from bearish to bullish sentiment, with buyers regaining control and likely driving prices higher.

Three White Soldiers / Three Black Crows:

The Three White Soldiers pattern is a bullish reversal formation characterized by three consecutive long bullish candlesticks, each opening within the previous candle's body and closing near its high. This pattern signifies a strong uptrend, with each candlestick's bullish momentum reinforcing the likelihood of further upward movement.

Conversely, the Three Black Crows pattern is a bearish reversal formation comprising three consecutive long bearish candlesticks, each opening within the previous candle's body and closing near its low. This pattern indicates a strong downtrend, with each candlestick's bearish momentum suggesting a continuation of the downward trajectory.

Conclusion:

The Triple Candlestick pattern is a versatile tool that empowers traders to identify potential trend reversals or continuations with a high degree of accuracy. By understanding the various forms of this pattern and their implications, traders can make informed decisions and develop robust trading strategies. However, it's essential to remember that no pattern guarantees success, and risk management remains paramount in trading. As with any technical analysis tool, combining the Triple Candlestick pattern with other indicators and factors can enhance its effectiveness and improve trading outcomes.

1 note

·

View note

Text

How to Read and Interpret Candlestick Charts

Unveiling the Secrets of Candlestick Chart Interpretation

By Amir Shayan

Candlestick charts are a fundamental tool in the world of financial trading. They provide crucial insights into the price movements of various assets, helping traders make informed decisions. Understanding how to read and interpret candlestick charts is a skill that can greatly enhance your trading acumen. In this article, we will delve into the intricacies of candlestick charts, unraveling their significance and guiding you through the process of deciphering their patterns.

The Language of Candlestick Charts

Candlestick charts originated in Japan centuries ago and have since become a cornerstone of technical analysis. Each candlestick represents a specific time frame, whether it's a minute, an hour, a day, or longer. The chart consists of individual candles, and the patterns they form can reveal potential trends, reversals, and price movements.

Anatomy of a Candlestick

A single candlestick consists of several key components: the body, the wick (or shadow), and sometimes the tail. The body represents the difference between the opening and closing prices during the given time frame. If the closing price is higher than the opening price, the body is typically colored or filled. Conversely, if the opening price is higher than the closing price, the body is usually empty or transparent.

The wick or shadow extends above and below the body, indicating the range between the highest and lowest prices during the time period. The tail, if present, extends from the body's top or bottom, signifying the range beyond the wick.

Common Candlestick Patterns

Doji: A Doji occurs when the opening and closing prices are very close or even identical. It suggests uncertainty in the market and a potential reversal.

Hammer and Hanging Man: These patterns have small bodies and a long lower tail. A Hammer appears after a downtrend and implies a potential bullish reversal, while a Hanging Man after an uptrend can indicate a bearish reversal.

Bullish and Bearish Engulfing: A Bullish Engulfing pattern occurs when a small bearish candle is followed by a larger bullish one. The reverse is the Bearish Engulfing pattern. These suggest a reversal of the current trend.

Morning Star and Evening Star: The Morning Star is a three-candle pattern featuring a large bearish candle, a small bearish or bullish one, and a large bullish one. It indicates a potential reversal from a downtrend. The Evening Star is the opposite, signaling a potential reversal from an uptrend.

Interpreting Candlestick Patterns

Candlestick patterns provide valuable information about market sentiment and potential price movements. For instance, a series of bullish candlesticks indicates a strong uptrend, while a succession of bearish ones suggests a downtrend. Reversal patterns, as the name suggests, may indicate an impending change in the current trend.

It's important to note that while candlestick patterns can offer insights into market movements, they should be considered alongside other technical and fundamental analysis tools for a comprehensive understanding.

Conclusion

Candlestick charts are a visual representation of market dynamics, revealing the battle between buyers and sellers. By understanding the patterns they form, traders can gain a deeper understanding of market sentiment and potential price movements. However, like any tool, candlestick charts are most effective when used in conjunction with other forms of analysis.

Learning to read and interpret candlestick charts takes time and practice, but it's a skill that can greatly improve your trading decisions. As you become more proficient in deciphering these patterns, you'll be better equipped to navigate the complexities of financial markets and make informed choices that align with your trading strategy.

Read the full article

#candlestickcharts#candlestickpatterns#Chartinterpretation#financialmarkets#marketanalysis#marketsentiment#PriceMovements#Technicalanalysis#Tradingpatterns#tradingstrategy

0 notes

Text

Understanding Technical Analysis in Crypto Trading

Technical analysis is a powerful instrument that enables traders to traverse tumultuous markets more confidently and precisely. In cryptocurrency trading, having a solid understanding of technical analysis concepts is comparable to having a powerful tool at your disposal. When making educated decisions about trading, the value of technical analysis cannot be understated. This is because the cryptocurrency environment is constantly shifting and gaining recognition from the general public. Let us go into the fundamental ideas and complexities of technical analysis in the context of cryptocurrency trading while investigating the blockchain technology that underpins these digital assets.

Cryptocurrency Trading: A Dynamic Realm

The meteoric rise in popularity of cryptocurrencies such as Bitcoin and Ethereum and a plethora of alternative cryptocurrencies has drawn many traders on the lookout for opportunities to profit from the volatility in the market. When it comes to trading, however, a strategic approach is required because of the inherent volatility and rapid price swings that are characteristic of the cryptocurrency market. Applying technical analysis as a helpful tool comes into play within this context.

Comprehending the technical analysis process

The primary focus of technical analysis is to estimate future price movements by analyzing historical market data, primarily on price and volume. It functions on the premise that historical price movements tend to repeat themselves, enabling traders to recognise patterns and trends to produce forecasts based on accurate information.

Critical Components of Technical Analysis

Candlestick Charts: These graphical representations of price movements offer essential information regarding the opening, closing, high, and low prices in a particular time frame. Hammers, engulfing candles, are all examples of patterns that can predict possible price reversals or continuations.

Indicators and Oscillators: Moving averages (MA), the relative strength index (RSI), the moving average convergence divergence (MACD), and other indicators and oscillators are examples of these types of indicators and oscillators. To assist traders in making decisions, they provide information regarding momentum, trend direction, and overbought or oversold conditions.

Support and Resistance Levels: These psychological price levels indicate where the price will likely find barriers in its movement. They are also known as supply and demand in the market. By recognising these levels, traders can better determine the appropriate entry and exit positions for their transactions.

Blockchain Technology: The Backbone of Cryptocurrencies

Blockchain technology, a distributed and unchangeable ledger that records all transactions across a network of computers, is the fundamental component of cryptocurrencies. Regarding peer-to-peer transactions, this technology facilitates transparency and security while doing away with the requirement for intermediaries.

The Role of Technical Analysis in the Impact

Blockchain's transparent nature provides an extensive historical dataset, allowing technical analysts to access a trove of information for their analysis. Additionally, the decentralized nature of blockchain minimizes the impact of external factors, making technical patterns potentially more reliable.

Educational Resources and Expert Guidance

There are a variety of paths available to individuals interested in delving further into the technical analysis of Learn crypto trading. Forex trading classes give students a complete understanding of technical analysis strategies designed for the cryptocurrency industry. Interpreting chart patterns and gaining a knowledge of advanced indicators are only two of the topics that are covered in these classes. Furthermore, obtaining help from cryptocurrency specialists and crypto advisers can provide vital insights and practical information that has been polished through experience in navigating the complexities of cryptocurrency trading.

Continuous Learning and Evolution in Crypto Trading