#Excel bookkeeping software

Explore tagged Tumblr posts

Text

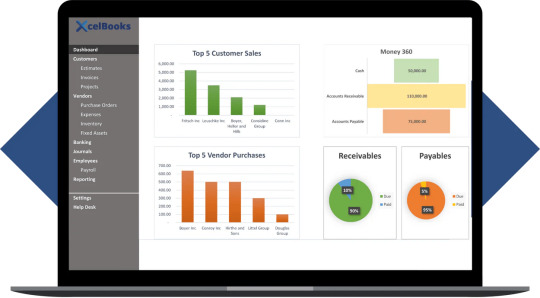

How to Use Accounting Software on Excel - A Beginner’s Guide by XcelBooks

Managing finances can be overwhelming, especially for small businesses, freelancers, and entrepreneurs who don't want to invest in expensive or complex accounting tools. Fortunately, accounting software on Excel offers a simple, cost-effective, and highly customizable solution. In this beginner’s guide, we’ll walk you through how to use Excel bookkeeping software, featuring tools and template from XcelBooks a leading name in spreadsheet-based accounting.

Why Choose Excel for Accounting?

Excel remains a favorite tool for bookkeeping due to its flexibility and familiarity. Unlike cloud-based platforms, Excel gives you complete control over your financial data. With the right structure, formulas, and template, Excel can handle tasks such as:

Expense tracking

Invoice generation

Profit & loss statements

Balance sheets

Tax calculations

That’s where XcelBooks comes in. This brand has developed pre-designed, easy-to-use Excel template specifically for bookkeeping and financial reporting.

Getting Started with XcelBooks

To use Excel bookkeeping software effectively, follow these beginner-friendly steps:

1. Customize Basic Information

Before entering any financial data, personalize the template with your business name, logo, contact details, and currency preferences. This step helps in branding and ensures all reports look professional.

2. Enter Financial Transactions

Input your daily transactions including income, expenses, and invoices. With accounting software on Excel, you can use automated categories and dropdowns to maintain consistency. Template by XcelBooks often include multiple sheets to keep records organized.

3. Automate Reports

One of the most powerful features of Excel bookkeeping software is automation. Most XcelBooks template come with built-in functions to automatically generate profit & loss statements, cash flow summaries, and monthly reports without needing to manually calculate totals.

4. Review and Back Up Your Data

Always double-check entries and formulas to ensure accuracy. It’s also a good practice to keep your Excel files backed up on cloud storage or external drives to avoid data loss.

Conclusion

If you're looking for a straightforward way to manage your finances, accounting software on Excel is a practical and accessible option. With tools like those from XcelBooks, even beginners can perform essential accounting tasks without prior experience.

Start small, grow with confidence, and enjoy the flexibility that Excel offers. Explore XcelBooks.com today to find the right Excel bookkeeping software that aligns with your business goals.

For more information, visit: https://xcelbooks.com/

0 notes

Note

Fact 1: You have very strong opinions about bookkeeping systems. 2 Your ceiling cat has no tail. 3 You have excellent taste in tattoos

It's true!! xD Listen, QuickBooks Online is objectively, categorically terrible in every conceivable way. I'm sure some people think otherwise, but that's okay, they're allowed to be wrong. QBO was the earliest example of enshittification I ran into, way back in 2013, and the ONLY way in which it has improved since then is that they recently made a change that allows the user to sort transaction detail reports by values without exporting the report to Excel first. IN ACCOUNTING SOFTWARE. IT'S 2024. If your software requires the user to use DIFFERENT, TOTALLY UNRELATED SOFTWARE, especially for something as fundamentally fucking basic as "sort big to small," then your software is TRASH GARBAGE and you should be fired OUT OF A CANNON AND INTO THE SUN. And I STILL have to export to Excel to do complex sorting and filtering because if you click wrong in "modern view," the thing freaks out. You can't even use your browser's "back" button without QuickBooks forgetting what you were doing!

Just use Xero instead. It does basically all the same stuff as QBO, but Xero is designed to actually be used by humans, not just look pretty for sales pitches.

Tattoo taste is subjective (unlike the user experience design of QuickBooks Online) but I'm glad you like mine! I'm getting another one on Wednesday and I'm excited. Gonna be a bird! I gave the artist a choice of two (chestnut-sided warbler or white-fronted amazon parrot, one on each inner calf) and he was interested in doing both; I'm not sure which he's going to do this time.

here is my ceiling cat with his Halloween axe! you can kind of see his funny bunny butt, he was born this way:

#soup cat#kitties#askbasket#anonymous#dal is a scream#QuickBooks Desktop however is a wonderful beautiful best-ever program and i would kiss it directly on the mouth if it had one

20 notes

·

View notes

Text

The Bargain of Working Hard and Getting a Job Simply Doesn’t Hold Anymore

In this economy, you can do everything right and still be unemployed—and not just if you’re a recent grad.

Even experienced workers share the perception that this is the worst job market of their lifetime. “I’ve been laid off before,” Dave told me, sighing as he acknowledged that periods of looking for work are part of having a career. “But it’s never been this hard to just get interest on a résumé. Even during the Great Recession and COVID, there were fewer postings, but it was never this quiet.”

. . .

Across industries, the number of private sector jobs added last month was the lowest we’ve seen in a year. Overall hiring rates are at their lowest level since the pre-COVID era.

. . .

The job postings that are available can be frustrating, to say the least. “It’s like, We’re looking for someone who’s trained in marketing and can do sales and bookkeeping and basic accounting on Excel,” the Substack writer who goes by Femcel vented to me in a video conversation.

“OK, you actually should be hiring an accountant, a salesperson, and a marketer. But you want someone who’s going to be a catchall for the random stuff in the office that needs to get done, and to pay one bad salary.”

And sometimes, the jobs that have been listed don’t really exist at all. A Resume Builder study from last summer found that 3 out of 10 online postings are “ghosts,” meaning that the roles don’t exist or employers don’t actually plan to fill said roles.

. . .

The growing automation of HR means that fewer humans are involved in the hiring process, with A.I. taking on tasks like writing and sharing job descriptions, screening résumés, putting job-seekers on “block lists,” and even conducting interviews—all of which can make the process of actually connecting with an employer incredibly vexing.

More at the link.

https://slate.com/technology/2025/05/unemployment-job-market-careers-college-grads-software-artificial-intelligence.html

Tariff-induced uncertainty seen curbing US job growth in April

https://www.yahoo.com/news/tariff-induced-uncertainty-seen-curbing-040414299.html

The almost 200,000 doge job cuts will appear in the next jobs report.

3 notes

·

View notes

Text

Accounting Services in Delhi, India by SC Bhagat & Co.

In the fast-paced business environment of Delhi, having reliable and efficient accounting services is crucial for the success and sustainability of any enterprise. SC Bhagat & Co., a trusted name in the accounting industry, offers a comprehensive range of accounting solutions to businesses of all sizes. With years of expertise and a commitment to excellence, the firm provides customized services tailored to meet the unique financial needs of its clients.

Why Choose SC Bhagat & Co. for Accounting Services?

Experienced and Skilled Professionals

SC Bhagat & Co. has a team of highly qualified chartered accountants with extensive industry experience. Their expertise ensures that your financial records are maintained accurately and in compliance with regulatory requirements.

Comprehensive Accounting Solutions

The firm offers a wide range of accounting services, including:

Bookkeeping and ledger maintenance

Financial statement preparation

Payroll processing

Tax planning and compliance

Auditing and financial analysis

Compliance with Indian Accounting Standards

Adhering to Indian Accounting Standards (Ind AS) and the latest tax regulations, SC Bhagat & Co. ensures that businesses remain compliant with legal obligations, minimizing the risk of penalties.

Cost-Effective and Scalable Services

Whether you are a startup, a small business, or a large corporation, SC Bhagat & Co. offers scalable accounting solutions that grow with your business. Their cost-effective services help organizations optimize financial management without straining their budgets.

Technology-Driven Approach

Utilizing advanced accounting software and cloud-based solutions, SC Bhagat & Co. ensures secure, real-time access to financial data. This allows businesses to make informed decisions promptly.

Benefits of Professional Accounting Services

Time-Saving

Outsourcing accounting services to SC Bhagat & Co. allows business owners to focus on core operations without worrying about financial management.

Accurate Financial Reporting

Professional accountants ensure that financial reports are error-free, which is essential for securing investments, obtaining loans, and strategic decision-making.

Reduced Tax Burden

Expert tax planning and compliance services help businesses minimize tax liabilities while ensuring adherence to government regulations.

Improved Cash Flow Management

Effective accounting practices contribute to better cash flow management, enabling businesses to meet their financial obligations on time. Partner with SC Bhagat & Co. Today!

If you are looking for reliable accounting services in Delhi India, SC Bhagat & Co. is your go-to partner. Their commitment to professionalism, integrity, and customer satisfaction makes them a preferred choice among businesses across various industries.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices#remittances#beauty#actors

2 notes

·

View notes

Text

Transform Your Business with Anisha Sharma & Associates' Complete Financial and Legal Solutions

Comprehensive finance and legal solutions with Anisha Sharma & Associates

Anisha Sharma & Associates is a leading business and finance consultancy firm, offering a broad spectrum of services designed to meet the diverse needs of its clients. Whether you're an entrepreneur, a large corporation, or an individual seeking financial guidance, the firm provides tailored solutions to enhance your financial well-being and ensure regulatory compliance.

At the core of Anisha Sharma & Associates' service offerings are accounts, audits, and trademark registrations. The team ensures your financial records are meticulously maintained and compliant with the law, allowing you to focus on growing your business. With ROC (Registrar of Companies) services, they streamline company incorporation and filing processes, ensuring all regulatory filings are up to date.

For businesses and individuals seeking financial assistance, the firm specializes in loans, income tax, and GST consulting. Their experts provide sound financial advice, guiding clients through the complex world of taxes and helping to secure the best possible loan options. Additionally, their license and registration services cover various industries, ensuring your business operates legally and efficiently.

Insurance can be a complex area for businesses, but Anisha Sharma & Associates simplifies it with their insurance consultancy, helping clients choose the most suitable plans to protect their assets and employees. Outsourcing services further add to the firm's value, allowing businesses to delegate non-core activities like payroll management and bookkeeping, ensuring cost-effectiveness and efficiency.

In addition to these core offerings, Anisha Sharma & Associates provides software services to help businesses leverage technology for better management and operational efficiency.

Their specialized services go beyond the typical financial firm’s offerings. With stock broking and advisory, clients can invest smartly, backed by reliable market analysis. Their website and digital solutions ensure a robust online presence for businesses in today’s digital-first world. Furthermore, with a team of civil and criminal lawyers, the firm is equipped to handle any legal challenges that may arise, offering peace of mind to its clients.

Why Choose Anisha Sharma & Associates? Anisha Sharma & Associates combines financial expertise with personalized attention, ensuring that every client receives the best solutions for their unique needs. Their broad range of services, from financial consultancy to legal representation, makes them the ideal partner for businesses seeking a one-stop solution. Choose them for their commitment to excellence, reliability, and holistic approach to managing both financial and legal challenges.

3 notes

·

View notes

Text

Revolutionizing Financial Stability: Legalari's Cutting-Edge Accounting Services in Delhi

The Essence of Accounting Services in Delhi

In a city teeming with businesses of all sizes and industries, the significance of robust accounting services in Delhi cannot be overstated. From startups to established corporations, every entity requires efficient financial management to thrive in today’s competitive market. Accounting services encompass a wide array of functions, including bookkeeping, tax preparation, auditing, and financial analysis. These services serve as the cornerstone of sound financial decision-making, enabling businesses to streamline operations, mitigate risks, and achieve sustainable growth.

Legalari: Redefining Standards in Accounting Services

Enter Legalari, a visionary firm committed to revolutionizing the landscape of accounting services in Delhi. With a team of seasoned professionals and cutting-edge technology at its disposal, Legalari sets itself apart through its unwavering dedication to client satisfaction and innovation. Unlike traditional accounting firms, Legalari adopts a proactive approach, providing strategic insights and personalized solutions to address the unique challenges faced by each client.

Tailored Solutions for Every Business Need

At Legalari, we understand that one size does not fit all when it comes to accounting services in Delhi. Recognizing the diverse needs and objectives of our clients, we offer a comprehensive suite of services designed to cater to businesses of all sizes and industries. Whether it’s managing day-to-day finances, navigating complex tax regulations, or conducting thorough audits, Legalari’s experts are equipped with the expertise and resources to deliver results that exceed expectations.

Harnessing Technology for Efficiency and Accuracy

In an era defined by digital transformation, Legalari harnesses the power of technology to enhance efficiency and accuracy in accounting processes. Through the integration of advanced software and automation tools, we streamline mundane tasks, minimize errors, and empower our clients with real-time insights into their financial performance. By leveraging technology, we not only optimize resource utilization but also enable our clients to make informed decisions with confidence.

Commitment to Compliance and Ethical Standards

At Legalari, integrity and transparency serve as the cornerstones of our operations. We adhere to the highest ethical standards and regulatory requirements, ensuring full compliance with applicable laws and guidelines. Our team undergoes rigorous training and continuous professional development to stay abreast of industry trends and best practices, guaranteeing the utmost reliability and accuracy in all our endeavors.

Driving Growth Through Strategic Partnerships

In an increasingly interconnected business landscape, Legalari recognizes the value of strategic partnerships in driving mutual growth and success. We collaborate with a network of industry experts, legal advisors, and financial institutions to provide holistic solutions that address the multifaceted needs of our clients. Through strategic alliances, we empower businesses to overcome challenges, capitalize on opportunities, and achieve their long-term objectives.

Empowering Businesses for a Brighter Future

As we look ahead, Legalari remains steadfast in its commitment to empowering businesses for a brighter future. Through our innovative approach, unwavering integrity, and dedication to excellence, we aspire to be the catalyst for positive change in the realm of accounting services in Delhi and beyond. Together with our clients, we embark on a journey towards financial stability, resilience, and prosperity.

In conclusion, Legalari emerges as a pioneering force in the realm of accounting services in Delhi, redefining industry standards through innovation, integrity, and excellence. As businesses navigate the complexities of today’s economic landscape, Legalari stands as a trusted partner, offering tailored solutions to drive growth, mitigate risks, and achieve lasting success. In the vibrant city of Delhi, Legalari’s commitment to revolutionizing financial stability serves as a beacon of hope for businesses striving to thrive in an ever-changing world.

#AccountingServices#DelhiBusiness#FinancialManagement#Legalari#InnovationInAccounting#BusinessSolutions#FinancialStability#TechnologyInFinance#ComplianceMatters#StrategicPartnerships#BusinessGrowth#EthicalStandards#FutureOfFinance#AccountingTechnology#ProfessionalServices

2 notes

·

View notes

Text

Fueling Business Growth with Top-notch Accounting Services in the UAE

Welcome to Goviin Bookkeeping, The Leading destination for exceptional Accounting Services in UAE. Our dedicated team, comprising proficient accountants, auditors, and tax advisors, is committed to empowering your business by taking charge of your finances, ensuring compliance, and nurturing sustainable growth.

In a landscape where, precise financial records hold immense importance post the introduction of VAT in 2018 by the Federal Tax Authority (FTA), Goviin Bookkeeping stands as your trusted partner, ensuring precise and VAT-compliant accounting practices across UAE.

Our seasoned accounting professionals bring extensive expertise in VAT compliance, delivering excellence, and providing timely financial insights critical for informed decision-making. Focused on Accounting Services in Dubai, UAE we take pride in our adept bookkeepers who stay ahead of evolving accounting norms, ensuring your decisions align with the best interests of investors, lenders, and stakeholders in the vibrant UAE market.

Security and efficiency are our top priorities. We securely handle all company-generated documents, including invoices, vouchers, and bills, using our platform. Here, we meticulously update, maintain, and analyze these records, empowering your UAE-based organization to confidently make strategic decisions.

Our reports are known for their clarity, user-friendliness, and personalized approach, contributing significantly to the remarkable growth of businesses across the Emirates. As the demand for rigorous financial record-keeping escalates, the need for Professional Accounting Experts and Bookkeepers becomes indispensable for every UAE business.

Exceptional Professional Team: Our highly skilled accountants and bookkeepers expertly manage your financial matters in the dynamic UAE market.

Extensive Industry Exposure: With collaborations across diverse industries, we adeptly operate various software solutions tailored for the UAE market.

Punctual Deliveries: We strictly adhere to deadlines, ensuring prompt and reliable service delivery within the UAE market.

Regular Updates: Through consistent meetings, we keep you informed about your financial status across the UAE.

Unwavering Quality Assurance: Our commitment lies in delivering top-tier services tailored specifically for the UAE market.

For deeper insights into our Specialized Accounting Services in Dubai, including fees or specific requirements within the UAE market, feel free to reach out and schedule a consultation. Our expert team members are ready to assist you, ensuring that no query or service is too big or small for businesses across the UAE.

#UAEAccounting#AccountingServicesUAE#UAEFinance#VATComplianceUAE#BookkeepingDubai#TaxAdvisoryDubai#FinancialServicesDubai#AccountingExpertsUAE

3 notes

·

View notes

Text

Payroll Accuracy: Tips for Error-Free Payroll Processing

The processing of payroll is an essential operational task inside an organisation, as it guarantees the accurate and timely compensation of personnel. Nevertheless, the intricacy of payroll computations and the dynamic nature of tax legislation might provide a significant challenge in undertaking this endeavour. Mistakes in payroll administration can lead to employee dissatisfaction, non-compliance with regulations, and potential legal ramifications. In order to mitigate such complexities, it is imperative to give precedence to the precision of payroll calculations. Discover the strategic advantages of outsourcing your payroll to VNC Global - an excellent Payroll management company in Singapore. Choose VNC Global for secure and cost-effective payroll management.

This blog post aims to examine key strategies that can facilitate accurate payroll processing and enhance search engine optimisation (SEO) endeavours.

● Stay Informed About Tax Laws:

Keeping up-to-date with tax rules is crucial for maintaining payroll accuracy due to the frequent changes in tax regulations. It is imperative to consistently assess and examine the tax regulations at the federal, state, and municipal levels in order to guarantee adherence and conformity. It is advisable to utilise tax compliance software or seek guidance from tax professionals in order to ensure the maintenance of an updated payroll system.

● Implement Robust Payroll Software:

It is advisable to allocate resources towards the acquisition of dependable payroll software capable of managing intricate computations and streamlining diverse payroll procedures. These technologies have the potential to reduce errors that are commonly associated with human calculations and data entry. Some commonly used payroll software alternatives are ADP, Gusto, and QuickBooks.

● Maintain Accurate Employee Records:

It is vital to ensure the up-to-dateness and accuracy of all employee information, encompassing tax forms, personal particulars, and bank account details. The presence of erroneous personnel data can result in payment inaccuracies and non-compliance concerns. It is imperative to consistently assess and revise employee records. Experience the peace of mind that comes with organized financial records. Connect with VNC Global - the most trusted provider of Bookkeeping services for small businesses in Singapore and transform your business together.

● Use a Standardized Payroll Process:

Establishing a standardised procedure for payroll processing entails the development of a comprehensive framework that delineates the sequential stages involved, commencing from the first data entry phase and culminating in the distribution of the payroll. Ensuring uniformity in payroll operations can aid in mitigating the probability of errors.

● Double-Check Calculations:

Despite the utilisation of sophisticated payroll software, it remains imperative to conduct a thorough verification of computations in order to identify and rectify any potential errors. Incorrect payments can occur as a result of a minor error during data entry or due to a software malfunction. It is imperative to conduct a comprehensive examination of each paycheck prior to initiating the payroll processing procedure.

● Cross-Train Payroll Staff:

To mitigate the risk of excessive dependence on a sole payroll administrator, it is advisable to implement cross-training measures for the payroll staff. It is advisable to implement a cross-training programme for the payroll workforce, ensuring that multiple employees have the necessary skills and knowledge to effectively manage payroll tasks. Implementing this measure will effectively mitigate potential interruptions that may arise due to personnel turnover or absence.

● Conduct Regular Audits:

It is recommended to conduct regular audits of the payroll system in order to rapidly identify and resolve any problems or anomalies that may arise. These audits have the potential to identify any potential concerns prior to their escalation into severe difficulties. Maximize your time and resources by outsourcing your Accounting services for small businesses in Singapore to VNC Global. Request a quote to simplify your financial tasks.

● Seek Professional Help:

It is advisable to explore the option of engaging the services of a professional payroll service provider in order to outsource your payroll processing. These organisations possess expertise in payroll and tax compliance, hence diminishing the probability of errors.

Final Thoughts:

The maintenance of payroll accuracy is of utmost importance in ensuring employee satisfaction, adhering to tax requirements, and mitigating potential legal complexities. One can effectively decrease errors in payroll processing by acquiring knowledge of tax rules, utilising dependable software, upholding precise record-keeping practises, and adhering to standardised procedures. Furthermore, the implementation of routine audits and the utilisation of professional assistance, when deemed essential, can significantly augment the level of accuracy. Ensuring payroll accuracy is crucial not only for the welfare of employees but also for the prosperity of the organisation.

Effortlessly manage your payroll with a tailored payroll system in Singapore. Reach out now to VNC Global’s accurate Payroll management system in Singapore and see how we can enhance your payroll processes.

#Payroll management company in Singapore#Bookkeeping services for small businesses in Singapore#Accounting services for small businesses in Singapore#Payroll management system in Singapore#VNC Global

3 notes

·

View notes

Text

pleasedontcrashpleasedontcrash

So, after a solid week of nonsense, our network and software is back up and working perfectly - both old and new systems. Apparently, it was a cloud provider issue, now resolved, but it's making Boss rethink a lot of things. Boss has resisted having our customers input their payment info for this very reason. We take the info, call it in, shred the paper in a crosscutter. The payment information is kept on a second computer with no network connection, backed up onto an external HD. Every company we've worked with has treid to push us into taking payments online. Nope. Nope. Nope. We had one breach with a payment processor, one time, and haven't done it since.

S, N, C, and I are old-school - we used Outlook, Excel, and bookkeeping apps to keep ourselves running, generate sales orders and ship docs. Our picking software, CRM, and everything cloud-based was naturally tits-up, too.

SAAS is great until it isn't.

Now, pleasedontcrashpleasedontcrash-

2 notes

·

View notes

Text

Kickstart Your Finance Career with Top Accounting Courses in Kerala

Are you passionate about numbers and financial management? Looking to start a rewarding career in finance or accounting? Kerala offers a wide range of accounting courses tailored to meet the growing demand for skilled professionals in the financial sector. Whether you're a fresh school graduate or someone looking to upskill, enrolling in a diploma in accounting can be your first step toward a secure and successful future.

Why Choose Accounting Courses in Kerala?

Kerala is home to several reputed educational institutions and training centers offering industry-relevant accounting courses in Kerala. These courses are designed to equip students with essential knowledge in bookkeeping, taxation, auditing, and financial reporting. With a focus on practical learning, students gain hands-on experience using accounting software like Tally, QuickBooks, and Excel.

What is a Diploma in Accounting?

A diploma in accounting is a short-term, job-oriented program that usually lasts between 6 months to 1 year. It covers core topics such as:

Financial accounting principles

Taxation laws and GST

Business and corporate finance

Payroll processing

Accounting software applications

The diploma is ideal for students who want a quick entry into the accounting field without pursuing a full-fledged degree.

Benefits of Pursuing a Diploma in Accounting

Career-Ready Skills: Gain practical skills that are immediately applicable in the job market.

Short Duration: Get qualified in a shorter time frame, perfect for early career starters.

Affordable: Compared to degree programs, diplomas are cost-effective.

Job Opportunities: Open doors to roles like junior accountant, tax assistant, payroll executive, and audit assistant.

Further Learning: It also serves as a stepping stone to advanced studies like CA (Chartered Accountancy) or CMA.

Best Places to Study Accounting Courses in Kerala

Some popular institutes offering accounting courses in Kerala include:

ICA Edu Skills

Logic School of Management

IMA Kerala

Finprov Learning

Lakshya CA Campus

These institutions offer both offline and online learning options, making it convenient for working professionals and students alike.

Conclusion

With businesses expanding and financial regulations evolving, the demand for skilled accountants is on the rise. If you aspire to build a career in finance, enrolling in a diploma in accounting from a reputed institute in Kerala can be your best move. Choose the right course, gain the right skills, and get ready to take your place in the ever-growing world of finance.

0 notes

Text

Excel to Tally: Streamline Your Accounting with Ease

In todays fast pace digital world, accurate and efficient accountancy is no longer a luxury it’s a necessity. Many businesses especially small or medium enterprises begin their financial tracking in Microsoft Excel. It's flexible, familiar, and widely used. But as operations grow and transactions increase, Excel alone may not suffice. That’s where Tally, one of India’s most trusted accounting software solutions, comes into play.

At TallyExperts , we offer specialized Excel to Tally service to help businesses like yours make a smooth transitions from spreadsheets to structured, automated accounting system. Whether you are migrating sales data, purchase records, ledgers or inventory details, we ensure accuracy, consistency and compliance at every step.

Why do businesses implement Excel on its accounting system?

Lets be honest- Excel is great. Its easily accessible, cost effective and doesn’t require special training for basic accounting needs. Excel is more than sufficient for newly started ventures and new business owners to manage daily financial transactions like:

Sales and Purchase records

Cash flow monitoring

Expense tracking

Profit and Loss Statements

Basic Inventory Management

But with businesses expanding, Excel begins to reveal its constraints. Manual input becomes cumbersome and error-prone, and making real-time reports is not easy. That's when businesses begin to look for professional accounting software such as Tally.

Limitations of Using Excel for accounting:

Though Excel is a very robust tool, it's not intended to perform intricate or large-scale accounting activities. Following are some issues businesses tend to suffer from:

Human Error: Manual entry is error prone and one incorrect entry can skew your financial statements.

Data Integrity: Excel files are vulnerable to modifications or loss without version control and security options.

Scalabilty Challenges: As your company grows, Excel cannot handle increasing data and complex accounting operations.

Inadequate Automation: Preparation of GST returns, TDS, balance sheets, and other compliance reports needs manual formulas or third-party addons.

Challenges in Collaboration: Different users collaborating on the same sheets may result in overwriting or duplication of the data.

Why Opt for Tally for Accounting?

Tally is among India's most popular accounting software tools that cater to the varied requirements of businesses. If you're a retailer, wholesaler, manufacturer, or service provider, Tally has a plethora of features beyond bookkeeping that can benefit you.

Key Advantages of Tally: Live Financial Reports GST-compliant Billing and Returns Inventory and Payroll Management Bank Reconciliation Audit Trail and Security Controls Scalable and Customizable But it doesn't mean starting afresh. That's where our Excel to Tally migration services step in.

What is Excel to Tally Migration?

Excel to Tally migration is a method of migration of your available financial information from Excel sheets to the Tally software in a structured and organized manner. The aim is to enable companies to maintain historical records, stop manual intervention, and have improved financial insights—without losing any existing data.

How Tally Experts can Help?

At Tally Experts, we realize your financial information is the foundation of your enterprise. Our expert professionals have already migrated hundreds of companies from Excel to Tally with ease. Here's how we proceed:

Data Assessment: We first analyze the quality and organization of your Excel files. This involves verifying for missing data, duplicates, formatting errors, and compatibility.

Data Mapping: Every Excel column is attributed to the respective field in Tally. For example, dates, invoice numbers, account heads, GST information, and item codes are all properly linked to facilitate easy integration.

Data Cleansing: We remove inconsistencies, fix mistakes, and make it uniform before importing. This involves formatting standards, rounding off figures, and checking tax calculations.

Validation: Prior to importing, we ensure the data is validated as per Tally’s import requirements, such as ledger structure, tax classes and inventory units.

Import to Tally: We import data using our custom tools and Tally's XML import feature, transferring data from Excel to Tally in a safe and accurate manner.

Post-Migration Support:After completing the migration, we test your reports in Tally, provide training if necessary, and assist with any post-import complications.

Types of Data We Migrate:

We can transfer nearly all types of financial information from Excel to Tally, such as:

Sales and Purchase Vouchers

Payment and Receipt entries

Journal Entries

Ledger Masters

Stock and Inventory Details

Bank Statements.

Irrespective of whether you are using Excel for your monthly billing or complete business accounts, we can transfer everything to Tally.

Advantages of shifting to Tally from Excel:

Save Time and Minimize manual effort: No more double entry. Say goodbye to hours spent copying and pasting numbers.

Enhanced Accuracy: Reduce errors that arise from manual data entry or formula mishaps.

Real-Time Reporting:Have real-time dashboards and financial statements that enable quicker, smarter business decisions.

Regulatory Compliance:Create GST-ready invoices, e-way bills, and TDS reports with ease.

Why Tally Experts? At Tally Experts, our name is our promise. We offer:

Decades of actual experience with Tally software 1)Specialized Excel-to-Tally import software 2)Transparent pricing and quick turnaround 3)Secure handling of confidential financial information 4) End-to-end support, from consultation to implementation We’re not just another tech team—we’re your accounting automation partners. FAQs Regarding Excel to Tally Services 1. Is it possible to import my previous Excel data into a new Tally company? Yes. We can assist you in creating a new Tally company and importing all historical data accurately. 2. Is my data secure during migration? Absolutely. We ensure complete confidentiality and use encrypted file sharing for securing your data. 3. Which versions of Tally do you support? We support Tally ERP 9, TallyPrime, and custom Tally solutions. 4. How long does migration take? Depending on data volume and complexity, it takes anywhere from a few hours to a couple of days. 5. What if I experience errors post-migration? We provide post-migration support to assist in resolving any issues and ensure everything is working as expected. Ready to Make the Switch? If you’re still managing your business accounts in Excel, it’s time to upgrade. Let Tally Experts take the stress out of migration and bring your accounting system into the future. Our Excel to Tally service is fast, reliable, and tailored to your unique business needs. Visit TallyExperts.co.in or contact us today for a free consultation and make the switch to smarter accounting. Tally Experts – Spreading Light on Accounting, One Migration at a Time

0 notes

Text

Bookkeeping Services in Delhi by SC Bhagat & Co.

Managing finances efficiently is the backbone of any successful business. Whether you are a startup, a small business, or a large enterprise, having a proper bookkeeping system in place is essential to ensure financial health and compliance with tax regulations. If you are looking for bookkeeping services in Delhi, SC Bhagat & Co. is a trusted partner to help streamline your financial records.

Why Bookkeeping is Essential for Your Business Bookkeeping involves the systematic recording, organizing, and tracking of all financial transactions made by a business. It provides a clear view of your business's financial status, helping you make informed decisions. Effective bookkeeping helps in:

Financial Analysis: By maintaining up-to-date financial records, businesses can regularly assess their financial health. Tax Compliance: Proper bookkeeping ensures all financial documents are in order for accurate and timely tax filing. Cash Flow Management: Tracking cash flow helps in maintaining sufficient funds for daily operations. Budgeting: It provides accurate data for future budgeting, reducing financial risks. Benefits of Outsourcing Bookkeeping Services Outsourcing bookkeeping tasks to professionals like SC Bhagat & Co. brings numerous benefits:

Cost Savings: You eliminate the need for an in-house accounting team, which saves on salaries, office space, and other resources. Accuracy: Professional bookkeepers have the experience and tools to ensure accuracy in your financial records. Time Efficiency: Outsourcing allows you to focus on core business activities while the experts handle your books. Compliance and Expertise: SC Bhagat & Co. ensures that your business complies with all financial and tax regulations, helping you avoid penalties. SC Bhagat & Co. – Your Reliable Bookkeeping Partner SC Bhagat & Co. is a renowned firm in Delhi offering comprehensive bookkeeping services. With years of experience, they cater to businesses across various industries. Here’s why SC Bhagat & Co. stands out:

Customized Solutions: They understand that every business has unique needs and provide tailored bookkeeping services. Expert Team: Their team of certified professionals is well-versed in the latest accounting software and bookkeeping practices. Accuracy and Timeliness: They ensure that all financial records are accurate and delivered on time, helping you stay ahead in your financial management. Confidentiality: The firm maintains high levels of data security to ensure your sensitive financial information is protected. Services Offered by SC Bhagat & Co. SC Bhagat & Co. offers a wide range of bookkeeping and accounting services, including:

Daily Transaction Recording: Keeping track of daily sales, purchases, payments, and receipts. Bank Reconciliation: Ensuring that your bank statements match your business's financial records. Expense Tracking: Managing all expenses to help reduce overheads and increase profits. Financial Reporting: Providing comprehensive financial reports, including balance sheets, income statements, and cash flow statements. Tax Preparation: Ensuring all financial records are in order for accurate and timely tax filings. Why Choose SC Bhagat & Co. for Bookkeeping Services in Delhi? SC Bhagat & Co. is a reliable name for bookkeeping services in Delhi, offering a combination of expertise, experience, and excellent customer service. By choosing them, you ensure:

Accurate and Timely Reports Comprehensive Bookkeeping Solutions Cost-effective Services Compliance with Latest Financial Regulations Final Thoughts Keeping accurate financial records is critical for the success and growth of your business. By outsourcing your bookkeeping services in Delhi to SC Bhagat & Co., you not only ensure compliance and accuracy but also gain access to expert advice, allowing you to focus on growing your business.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

2 notes

·

View notes

Text

Front Office vs Back Office BPO: What’s the Difference?

If your company works with third-party vendors to handle specific tasks, you’re already familiar with Business Process Outsourcing (BPO). The BPO industry is booming, jumping from a market value of $92.5 billion in 2019 to $232.32 billion in 2020. In today’s gig economy, with remote work and hybrid setups becoming the norm, BPO is impossible to overlook. In fact, 80% of global executives plan to maintain or increase their outsourcing budgets. But what exactly are they outsourcing? The answer lies in two key categories: Front Office BPO and Back Office BPO. Let’s break down the differences between Front Office vs Back Office BPO.

What is Front Office BPO?

Imagine the face of your business—the part that interacts directly with customers. That’s what Front Office BPO is all about. According to Deloitte’s 2024 global outsourcing survey, 50% of executives outsource these customer-facing tasks. Think sales, marketing, customer service, or tech support—anything that involves direct contact with clients.

These front-office roles are critical because they shape your company’s reputation and drive revenue. To keep quality high while managing costs, many businesses turn to third-party vendors like marketing agencies, IT help desks, or customer support teams to handle these tasks.

What Does Front Office BPO Include?

Here’s a quick look at the types of tasks that fall under Front Office BPO:

Customer Service and Support: Fielding calls, emails, or texts from customers, answering their questions, resolving complaints, and solving problems.

Sales and Lead Generation: Reaching out to potential customers, nurturing leads, and turning them into loyal clients to boost revenue.

Technical Support and Helpdesk: Assisting customers with technical issues, like troubleshooting software or hardware problems.

Telemarketing and Telesales: Convincing customers over the phone to buy products or services and closing deals.

Live Chat and Social Media Management: Engaging with customers on social platforms, addressing concerns, and building relationships.

Skills Needed for Front Office BPO

To excel in Front Office BPO, vendors need:

Strong communication and people skills

Fluency in relevant languages and cultural sensitivity

Quick problem-solving abilities

Sales expertise

Emotional intelligence to handle customer interactions

What is Back Office BPO?

Now, shift your focus to the behind-the-scenes work that keeps a business running smoothly. That’s Back Office BPO. These are the internal, non-customer-facing tasks like accounting, HR, IT, or supply chain management.

This area is evolving, with specialized outsourcing in fields like legal services, IT support, or knowledge process outsourcing. Many companies, especially small businesses, outsource these tasks to cut costs and access expert skills without hiring full-time staff, as noted in Clutch’s 2023 report. While these processes don’t directly generate revenue, they’re essential for keeping operations efficient and understanding Front Office vs Back Office BPO.

What Does Back Office BPO Include?

Here’s what Back Office BPO typically covers:

Data Entry and Processing: Managing and updating company data, from financial records to customer details, ensuring accuracy and accessibility.

Accounting and Bookkeeping: Handling invoices, payments, and financial records to keep the books balanced.

Human Resources Management: Recruiting, onboarding, and supporting employees throughout their time with the company.

Research and Analytics: Analyzing market trends, competitors, or data to guide strategic decisions.

Quality Assurance and Compliance: Ensuring products and services meet high standards and follow regulations.

IT Support and Maintenance: Keeping technology running smoothly, from fixing software bugs to maintaining hardware.

Supply Chain Management: Coordinating the flow of goods, services, and information from suppliers to customers.

Skills Needed for Back Office BPO

To succeed in Back Office BPO, vendors need:

Technical expertise in specific fields

Keen attention to detail and accuracy

Process optimization know-how

Strong analytical thinking

Knowledge of compliance and regulations

Front Office vs Back Office BPO: Key Differences

So, what sets Front Office vs Back Office BPO apart? Let’s dive into the main distinctions:

1. Customer Interaction

The biggest difference is who they deal with. Front Office BPO is all about engaging directly with customers—think a customer service rep answering a client’s questions. Back Office BPO, on the other hand, operates in the background with little to no client contact. An accountant, for example, focuses on crunching numbers, not chatting with customers.

2. Revenue Impact

Front Office BPO has a direct effect on your bottom line. A marketing campaign or a skilled sales team can drive higher conversions and more revenue. Back Office BPO, while crucial, doesn’t immediately impact sales. IT support, for instance, ensures your systems run smoothly, enabling other teams to do their jobs effectively.

3. Time Sensitivity

Because Front Office BPO is customer-focused and tied to revenue, it’s often time-sensitive. Customer inquiries need quick responses, and sales teams must act fast to close deals. Back Office BPO tasks, like data entry or bookkeeping, follow more flexible timelines, prioritizing accuracy over speed.

4. Performance Metrics

Success in Front Office BPO is measured by customer satisfaction, response times, and conversion rates. For Back Office BPO, the focus is on accuracy, efficiency, and cost savings. For example, a data entry team’s performance might be judged by how error-free their work is, while a call center’s success hinges on happy customers.

Why Both Matter: The Bottom Line on Front Office vs Back Office BPO

Both Front Office BPO and Back Office BPO play vital roles in helping businesses save money while achieving top results. Front office outsourcing brings your brand to life through customer interactions, driving sales and building loyalty. Back office outsourcing keeps the gears turning with essential tasks like HR, IT, and accounting, allowing you to focus on growth.

The trick is figuring out which processes to outsource based on your current team’s strengths and your business goals. By understanding Front Office vs Back Office BPO, you can make smarter decisions to boost efficiency and profitability.

0 notes

Text

Shortcut Keys to Use Tally Like a Pro

🧾 What is Tally and Why Shortcut Keys Matter? – Tally क्या है और Shortcuts क्यों जरूरी हैं?

Tally एक accounting software है जो bookkeeping और financial records को manage करने के लिए use होता है। Using shortcut keys in Tally makes your काम faster और बहुत ज़्यादा efficient।

Tally ERP 9 और Tally Prime दोनों में अलग-अलग shortcut keys होती हैं। इन shortcuts से आप time save करते हैं और errors भी कम करते हैं।

💻 Basic Tally Shortcuts – Tally ShortcutsList

F1 – Select Company | कंपनी को चुनने के लिए

F1 से आप quickly किसी भी कंपनी को select या switch कर सकते हैं। Tally में multi-company accounting करते समय यह shortcut बहुत काम आता है।

ALT + F1 – Detailed Mode | विस्तृत मोड में जाने के लिए

इससे आप किसी भी screen का detail view देख सकते हैं। Useful when you need in-depth accounting information quickly।

ESC – Exit Screen | स्क्रीन से बाहर निकलने के लिए

ESC key आपको current screen से बाहर निकाल देती है। यह universal key है हर function के लिए।

🧾 Voucher Entry Shortcut Keys – वाउचर एंट्री के लिए Tally Shortcuts

Voucher entries Tally का most used feature होता है। इन shortcuts से entry करना और verify करना आसान हो जाता है।

Shortcut

Use in English

Use in Hindi

F4

Contra Voucher

बैंक ट्रांजैक्शन के लिए

F5

Payment Voucher

भुगतान एंट्री के लिए

F6

Receipt Voucher

रसीद एंट्री के लिए

F7

Journal Voucher

जर्नल एंट्री के लिए

F8

Sales Voucher

बिक्री के लिए

F9

Purchase Voucher

खरीद के लिए

F10

Reversing Journal

उल्टी जर्नल एंट्री

F11

Company Features

कंपनी की फीचर्स set करने के लिए

F12

Configuration

सभी configuration setting के लिए

इन keys से आप एक क्लिक में वाउचर एंट्री screen open कर सकते हैं। ये time-saving keys हैं जो professionals daily use करते हैं।

🗂️ Inventory Shortcuts in Tally – इन्वेंट्री से Related Useful Keys

Inventory management के लिए भी Tally में कुछ important shortcuts होते हैं। इनसे आप stock details, godown, और batches को manage कर सकते हैं।

Shortcut

Function

हिंदी में उपयोग

ALT + C

Create Stock Item

नया stock item create करना

ALT + E

Export Report

रिपोर्ट को Excel में export करना

ALT + I

Insert Voucher

बीच में एंट्री insert करना

ALT + D

Delete Voucher

voucher delete करना

ALT + A

Add Details

किसी भी एंट्री में नया data जोड़ना

इन shortcuts से आप inventory section को better तरीके से manage कर सकते हैं।

Report Navigation Shortcuts – रिपोर्ट्स में Navigation के लिए Shortcuts

Tally में बहुत सारी reports होती हैं। Shortcuts से उन तक जल्दी पहुंचा जा सकता है।

Shortcut

Purpose

हिंदी Explanation

ALT + F1

Detailed Report

रिपोर्ट का विस्तृत रूप

ALT + F2

Change Period

रिपोर्ट की तारीख बदलना

CTRL + A

Save Information

किसी भी फॉर्म को सेव करना

CTRL + Q

Quit Report

रिपोर्ट से बाहर निकलना

जब आपको किसी report में analysis करना हो, तो ये keys बहुत काम आती हैं। Especially ALT + F2 आपकी reporting को flexible बनाता है।

Master Creation Shortcuts – Masters बनाने के लिए Tally Shortcuts

Masters जैसे Ledger, Group, Stock Item इत्यादि create करने के लिए भी Tally में shortcuts हैं।

Shortcut

Use

हिंदी में मतलब

ALT + G

Go To

किसी भी screen पर जल्दी पहुंचने के लिए

ALT + K

Company Menu

कंपनी menu खोलने के लिए

CTRL + G

Go to Feature

Reports या Masters तक जाने के लिए

ALT + H

Help Menu

Help menu access करने के लिए

ये shortcuts खासकर Tally Prime में बहुत helpful हैं।

💡 Advanced Tally Shortcuts – प्रो यूज़र्स के लिए Special Keys

कुछ advanced shortcuts हैं जो expert accountants और GST practitioners use करते हैं।

Shortcut

Feature

हिंदी में उपयोग

CTRL + ENTER

Alter Master

किसी भी ledger या stock को edit करना

CTRL + ALT + R

Rewrite Data

corrupt data को फिर से write करना

ALT + R

Repeat Narration

narration दोहराने के लिए

ALT + X

Cancel Voucher

किसी भी voucher को cancel करना

इन keys से आपका काम advanced level पर fast होता है। और साथ ही error-free भी रहता है।

📚 Tally Shortcuts Learning के लिए Tips and Tricks

Practice Regularly: रोज़ इन shortcuts का अभ्यास करें।

Use Printable Cheat Sheet: एक print निकालकर पास रखें।

Watch Tally Videos on YouTube: Visual learning से memory strong बनती है।

TIPA Tally Course में Join करें: The Institute of Professional Accountants में professional training भी available है।

✅ Conclusion – Tally Shortcuts से काम आसान बनाएं

Tally में shortcut keys use करने से आप smart accountant बनते हैं। काम तेज़, सटीक और professional तरीके से होता है।

अगर आप accounting field में excel करना चाहते हैं, तो Tally shortcut keys की list और उनका use daily practice करें।

Tally सीखना जितना जरूरी है, उतना ही जरूरी है उसे smartly इस्तेमाल करना।

अगर आपको यह guide helpful लगी हो, तो इसे share जरूर करें! Practice करें, सीखें और smart accountant बनें।

Need Help Learning Tally Professionally? Join: The Institute of Professional Accountants (TIPA) 📍 E-54, 3rd Floor, Metro Pillar No. 44, Laxmi Nagar, Delhi 110092 📞 Call Now: 9213855555 🌐 Website: www.tipa.in

Accounting interview Question Answers

Tax Income Tax Practitioner Course

How to become an income tax officer

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs in India

ICWA Course

Tally Course in Laxmi Nagar Delhi

Short Cut keys in tally

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

0 notes

Text

Professional bookkeeping services in UK

🌍 Leading Global Bookkeeping Excellence: Why Businesses Trust Satsinternational.com

In the fast-paced world of business, maintaining accurate financial records is not just important — it’s essential. Whether you're a growing startup or an established enterprise, bookkeeping is the foundation of informed decision-making and long-term growth. That’s where Satsinternational.com stands out — delivering reliable, professional, and affordable bookkeeping services worldwide.

Let’s explore why Satsinternational.com is the go-to choice for companies seeking dependable bookkeeping support in the USA, UK, and Australia.

🇺🇸 The Top Rated Bookkeeping Firm in the USA

For businesses in the United States, financial regulations and tax compliance can be complex. Partnering with a team that understands local laws, accounting standards, and your business needs can make all the difference.

At Satsinternational.com, we are proud to be recognized as a top rated bookkeeping firm in USA. Our team of experts helps U.S. businesses manage everything from payroll to balance sheets, ensuring transparency and peace of mind.

With scalable solutions tailored to small, mid-sized, and large enterprises, Sats International eliminates the stress of bookkeeping, so you can focus on growing your company.

🇦🇺 Why We’re a Top Rated Bookkeeping Firm in Australia

The Australian business landscape requires precision, especially with ever-changing tax laws and financial regulations. Sats International rises to the challenge as a top rated bookkeeping firm in Australia, delivering flexible solutions that keep your books accurate and compliant.

From BAS lodgements to cash flow monitoring, our localized services help Aussie businesses reduce overheads, minimize errors, and stay audit-ready all year round.

Whether you're a small café in Melbourne or a tech company in Sydney, our services adapt to your industry and scale — making bookkeeping seamless and hassle-free.

🇬🇧 Professional Bookkeeping Services in the UK

In the UK, navigating financial records is crucial for VAT returns, payroll compliance, and HMRC filings. At Satsinternational.com, we provide professional bookkeeping services in UK that are fully compliant with UK accounting standards and tailored for your unique business needs.

Our bookkeeping experts work closely with SMEs and large organizations to ensure smooth monthly reconciliations, clear financial reports, and accurate ledger management.

Let us manage your books while you focus on what matters most: running your business.

💼 Affordable Bookkeeping Services in the UK

Affordability shouldn't mean compromising on quality. Sats International offers affordable bookkeeping services in UK that provide top-tier financial oversight without breaking your budget.

We offer customizable packages based on your business size and industry. Our cost-effective pricing is ideal for startups, entrepreneurs, and even freelancers looking for reliable accounting assistance.

Gain access to cutting-edge bookkeeping software, experienced professionals, and real-time insights — all within a price point that works for you.

🌏 Discover the Top Bookkeeping Services in Australia

As businesses grow, so does the need for trusted financial partners. We are proud to provide one of the top bookkeeping services in Australia — offering end-to-end bookkeeping services that enhance business efficiency.

From bank reconciliation to monthly reporting and budgeting support, our team ensures your financials are always up-to-date and compliant with Australian standards.

When you partner with Sats International, you're not just hiring a service provider — you're gaining a strategic partner that supports your success.

✅ Why Choose Satsinternational.com?

Whether you’re in the USA, UK, or Australia, Sats International combines technology with human expertise to deliver unmatched value. Here's why thousands of businesses trust us:

Certified Experts: Our team includes qualified bookkeepers and accountants.

Cloud-Based Systems: Access your financials anytime, anywhere.

Industry Versatility: From retail and real estate to tech and consulting.

Data Security: We follow strict confidentiality and data protection protocols.

Real-Time Reporting: Instant access to cash flow, expenses, and forecasts.

📊 Focus on Growth, Leave the Books to Us

Many businesses struggle with time-consuming financial tasks. With Satsinternational.com, you get a partner that helps you save time, reduce stress, and scale faster. From organizing receipts to preparing your year-end financials, we do it all — with clarity, professionalism, and precision.

Need a service that grows with your business? Talk to us today.

0 notes

Text

Chartered Accountants in Dubai: Ensuring Financial Excellence for Businesses

Dubai, a global business hub known for its rapid economic growth and investor-friendly environment, demands a high standard of financial management and compliance. This is where chartered accountants in Dubai play a critical role. These professionals are key to maintaining financial integrity, ensuring regulatory compliance, and providing strategic insights to businesses of all sizes.

Why Chartered Accountants Matter in Dubai

In a dynamic and competitive economy like Dubai’s, businesses face complex financial regulations and evolving tax frameworks, including VAT. Chartered accountants are trained experts who not only help companies maintain accurate records but also guide them through financial planning, audits, and risk management.

Their expertise is crucial for startups, SMEs, and multinational corporations alike. From preparing financial statements and handling audits to offering advisory services, chartered accountants in Dubai support business growth through transparency and financial discipline.

Services Offered by Chartered Accountants in Dubai

Audit and Assurance Independent audits help businesses ensure the accuracy of their financial data. Chartered accountants conduct internal and external audits that build trust among investors, clients, and regulatory authorities.

Taxation Services With VAT being implemented in the UAE, tax compliance has become essential. Chartered accountants assist businesses in VAT registration, filing returns, and ensuring timely compliance with the Federal Tax Authority (FTA).

Accounting and Bookkeeping Day-to-day accounting tasks are critical for cash flow and decision-making. Chartered accountants provide professional bookkeeping services, ensuring records are updated and in line with international standards.

Business Advisory and Consultancy Whether it’s a merger, acquisition, or expansion strategy, chartered accountants offer financial insights that aid long-term business planning. They conduct feasibility studies, cost analyses, and financial forecasting to guide entrepreneurs and corporate leaders.

Company Formation and Compliance Setting up a business in Dubai involves various legal and financial steps. Chartered accountants streamline the process, helping clients with business setup in free zones, mainland, or offshore, while ensuring all financial regulations are met.

Choosing the Right Chartered Accountant in Dubai

Selecting a reliable firm or individual chartered accountant is vital for your business's financial health. Here are some tips:

Check Credentials: Ensure they are certified by recognized bodies such as ICAEW, ACCA, or ICAI.

Industry Experience: Choose professionals who have experience working with businesses in your industry.

Technology Savvy: Opt for firms that use the latest accounting software and cloud-based solutions for better accuracy and accessibility.

Client Reviews: Go through testimonials and reviews to understand the firm's reputation and service quality.

Benefits of Hiring Chartered Accountants in Dubai

Accuracy and Compliance: Minimize errors and avoid penalties through accurate reporting and timely compliance.

Time and Cost Efficiency: Outsourcing financial tasks allows businesses to focus on core operations, saving time and resources.

Strategic Planning: Expert financial advice helps in making informed decisions about investments, expansions, and restructuring.

Improved Credibility: Professionally managed accounts and audited reports increase trust with stakeholders and attract investors.

Conclusion

As Dubai continues to attract global investors and entrepreneurs, the role of chartered accountants in Dubai becomes increasingly significant. Their expertise helps businesses maintain strong financial foundations, comply with legal regulations, and unlock growth opportunities. Whether you are a startup aiming for steady growth or an established enterprise exploring global markets, partnering with a skilled chartered accountant is a smart and strategic move.

0 notes