#Expense Reimbursement Software

Explore tagged Tumblr posts

Text

Simplify Client Management with AI

Expedite client book reviews effortlessly with Docyt Copilot, one stop Solution for accounting Assessment and Audit. Start a free trial today!" For more information click here: https://docyt.com/docyt-copilot/

#financial reporting software#expense management software#accounting workflow software#accounts payable automation#accounts payable automation software#accounts payable software for small business#bookkeeping services for business#bookkeeping software for accountants#bookkeeping software for accounting firms#business bookkeeping software#employee expense report#expense management solutions#expense reimbursement report.

0 notes

Text

In a competitive business landscape, efficient money management is a strategic advantage. Embracing expense management technology is not just a choice; it's a smart investment in the financial health and success of your corporate endeavors.

#moneymanagement#financial management#financial mastery#business expenses#reimbursement#employees#expense management#business software

0 notes

Text

The Trump administration, working in coordination with Elon Musk’s so-called Department of Government Efficiency, has gutted a small federal agency that provides funding to libraries and museums nationwide. In communities across the US, the cuts threaten student field trips, classes for seniors, and access to popular digital services, such as the ebook app Libby.

On Monday, managers at the Institute of Museum and Library Services (IMLS) informed 77 employees—virtually the agency’s entire staff—that they were immediately being put on paid administrative leave, according to one of the workers, who sought anonymity out of fear of retaliation from Trump officials. Several other sources confirmed the move, which came after President Donald Trump appointed Keith Sonderling, the deputy secretary of labor, as the acting director of IMLS less than two weeks ago.

A representative for the American Federation of Government Employee Local 3403, a union that represents about 40 IMLS staffers, said Sonderling and a group of DOGE staffers met with IMLS leadership late last month. Afterwards, Sonderling sent an email to staff “emphasizing the importance of libraries and museums in cultivating the next generation’s perception of American exceptionalism and patriotism,” the union representative said in a statement to WIRED.

IMLS employees who showed up to work at the agency on Monday were asked to turn in their computers and lost access to their government email addresses before being ordered to head home for the day, the employee says. It’s unclear when, or if, staffers will ever return to work. “It’s heartbreaking on many levels,” the employee adds.

The White House and the Institute of Museum and Library Services did not immediately respond to requests for comment from WIRED.

The annual budget of IMLS amounts to less than $1 per person in the US. Overall, the agency awarded over $269.5 million to library and museum systems last year, according to its grants database. Much of that money is paid out as reimbursements over time, the current IMLS employee says, but now there is no one around to cut checks for funds that have already been allocated.

“The status of previously awarded grants is unclear. Without staff to administer the programs, it is likely that most grants will be terminated,” the American Federation of Government Employee Local 3403 union said in a statement.

About 65 percent of the funding had been allocated to different states, with each one scheduled to receive a minimum of roughly $1.2 million. Recipients can use the money for statewide initiatives or pass it on to local museum and library institutions for expenses such as staff training and back-office software. California and Texas have received the highest allocated funding, at about $12.5 million and $15.7 million, respectively, according to IMLS data. Individual libraries and museums also receive grants directly from IMLS for specific projects.

An art museum in Idaho expected to put $10,350 toward supporting student field trips, according to the IMLS grant database. A North Carolina museum was allotted $23,500 for weaving and fiber art workshops for seniors. And an indigenous community in California expected to put $10,000 toward purchasing books and electronic resources.

In past years, other Native American tribes have received IMLS grants to purchase access to apps such as Hoopla and Libby, which provide free ebooks and audiobooks to library patrons. Some funding from the IMLS also goes to academic projects, such as using virtual reality to preserve Native American cultural archives or studying how AI chatbots could improve access to university research.

Steve Potash, founder and CEO of OverDrive, which develops Libby, says the company has been lobbying Congress and state legislatures for library funding. “What we are consistently hearing is that there is no data or evidence suggesting that federal funds allocated through the IMLS are being misused,” Potash tells WIRED. “In fact, these funds are essential for delivering vital services, often to the most underserved and vulnerable populations.”

Anthony Chow, director of the School of Information at San José State University in California and president-elect of the state library association, tells WIRED that Monday was the deadline to submit receipts for several Native American libraries he says he’d been supporting in their purchase of nearly 54,000 children’s books using IMLS funds. Five tribes, according to Chow, could lose out on a total of about $189,000 in reimbursements. “There is no contingency,” Chow says. “I don’t think any one of us ever thought we would get to this point.”

Managers at IMLS informed their teams on Monday that the work stoppage was in response to a recent executive order issued by Trump that called for reducing the operations of the agency to the bare minimum required by law.

Trump made a number of other unsuccessful attempts to defund the IMLS during his first term. The White House described its latest effort as a necessary part of “eliminating waste and reducing government overreach.” But the president himself has said little about what specifically concerns him about funding libraries; a separate order he signed recently described federally supported Smithsonian museums as peddling “divisive narratives that distort our shared history.”

US libraries and museums receive support from many sources, including public donations and funding from other federal agencies. But IMLS is “the single largest source of critical federal funding for libraries,” according to the Chief Officers of State Library Agencies advocacy group. Libraries and museums in rural areas are particularly reliant on federal funding, according to some library employees and experts.

Systems in big metros such as Los Angeles County and New York City libraries receive only a small fraction of their budget from the IMLS, according to recent internal memos seen by WIRED, which were issued in response to Trump’s March 14 executive order. "For us, it was more a source of money to innovate with or try out new programs,” says a current employee at the New York Public Library, who asked to remain anonymous because they aren’t authorized to speak to the press.

But the loss of IMLS funds could still have consequences in big cities. A major public library system in California is assembling an internal task force to advocate on behalf of the library system with outside donors, according to a current employee who wasn’t authorized to speak about the effort publicly. They say philanthropic organizations that support their library system are already beginning to spend more conservatively, anticipating they may need to fill funding gaps at libraries in areas more dependent on federal dollars.

Some IMLS programs also require states to provide matching funding, and legislatures may be disincentivized to offer support if the federal money disappears, further hampering library and museum budgets, the IMLS employee says.

The IMLS was created by a 1996 law passed by Congress and has historically received bipartisan support. But some conservative groups and politicians have expressed concern that libraries provide public access to content they view as inappropriate, including pornography and books on topics such as transgender people and racial minorities. In February, following a Trump order, schools for kids on overseas military bases restricted access to books “potentially related to gender ideology or discriminatory equity ideology topics.”

Last week, a bipartisan group of five US senators led by Jack Reed of Rhode Island urged the Trump administration to follow through on the IMLS grants that Congress had authorized for this year. "We write to remind the administration of its obligation to faithfully execute the provisions of the law," the senators wrote.

Ultimately, the fate of the IMLS could be decided in a showdown between Trump officials, Congress, and the federal courts. With immediate resolution unlikely, experts say museums and libraries unable to make up for lost reimbursements will likely have to scale back services.

11 notes

·

View notes

Text

Why Payroll Outsourcing in Delhi is Essential for Business Efficiency

Streamline Your Business with Payroll Outsourcing in Delhi

As businesses expand and compliance regulations become more demanding, many organizations are now turning to payroll outsourcing in Delhi to simplify their internal operations. Managing payroll in-house can be tedious, especially when dealing with frequent legal updates, tax deductions, and employee benefits. Outsourcing this function not only ensures accuracy but also provides companies the freedom to focus on core business activities.

What is Payroll Outsourcing?

Payroll outsourcing is the process of hiring an external service provider to manage a company's entire payroll system. This includes calculating employee salaries, processing tax filings, managing provident fund (PF) and employee state insurance (ESI) contributions, generating payslips, and ensuring legal compliance. For businesses in Delhi—a city teeming with startups, SMEs, and large enterprises—this approach has become a practical necessity.

Benefits of Payroll Outsourcing

1. Cost and Time Efficiency Managing payroll internally can consume significant time and resources. With outsourcing, companies save on the cost of hiring specialized staff or purchasing expensive payroll software. It also eliminates the need for constant training to stay up-to-date with changing laws.

2. Regulatory Compliance Indian payroll laws are complex and ever-evolving. From income tax rules to statutory deductions like PF, ESI, and gratuity, compliance is critical to avoid penalties. A payroll outsourcing provider in Delhi ensures all calculations and filings are handled accurately and on time.

3. Enhanced Accuracy Manual payroll processing can lead to errors in salary calculations or tax filings. With automated systems and expert oversight, outsourced payroll services offer greater accuracy and reliability, reducing the chances of employee dissatisfaction or legal issues.

4. Data Security and Confidentiality Reputable payroll outsourcing firms use secure, cloud-based systems with encryption to protect sensitive employee data. This minimizes the risk of data breaches and ensures confidentiality is maintained at all times.

5. Scalability and Flexibility As your workforce grows or contracts, outsourcing partners can easily scale their services to match your needs. Whether you’re hiring 10 or 100 new employees, your payroll operations remain smooth and efficient.

Services Included in Payroll Outsourcing

Most payroll outsourcing providers in Delhi offer comprehensive solutions that include:

Monthly salary processing and disbursement

Payslip generation and distribution

Tax deductions and filings (TDS, PF, ESI, etc.)

Year-end tax form preparation (Form 16)

Compliance with labor laws and statutory reporting

Attendance and leave management integration

Reimbursement and bonus management

Employee helpdesk support for payroll queries

Advanced service providers may also offer integration with HR software, mobile apps for employees, and dashboards for real-time payroll analytics.

Why Delhi-Based Companies Should Consider Payroll Outsourcing

Delhi is a highly competitive and regulatory-sensitive business environment. Companies in this region must be agile and compliant while controlling costs. Payroll outsourcing is especially beneficial here because local providers have expertise in regional labor rules, state-specific regulations, and offer fast turnaround times for urgent payroll processing needs.

Additionally, Delhi is home to a wide pool of professional payroll service providers who offer tailored solutions for different industries—from IT and education to manufacturing and healthcare.

Choosing the Right Payroll Partner

Before selecting a payroll outsourcing company in Delhi, consider the following:

Experience and Reputation: Look for a provider with proven experience and client testimonials.

Technology Platform: Ensure they use a secure, modern payroll system.

Compliance Knowledge: They should stay updated with the latest changes in tax and labor laws.

Customization Options: Your business may have unique payroll structures or benefits.

Customer Support: Timely and responsive communication is essential for resolving issues quickly.

Final Thoughts

In a fast-moving market like Delhi, where talent retention, compliance, and cost control are key concerns, outsourcing payroll can offer a significant competitive advantage. It streamlines processes, ensures accuracy, and reduces operational stress—allowing companies to concentrate on strategic goals.

Whether you're a small business owner or the HR head of a growing enterprise, payroll outsourcing in Delhi could be the smartest step you take this year toward efficiency and peace of mind.

3 notes

·

View notes

Text

How Do I Choose Best expense management software for small business ?

Every small business has its inspiring challenges, but perhaps most challenging is the management of expenses. It means every rupee counts, and every penny that is withheld is between profit and loss. All these reasons make an appropriate decision in choosing the best expense management software for small business not just an idea-good but critical.

Again, there are too many tools available, so how does one know the right one for him or her? This article will chop through all such questions into components required to check out, comparing options with other people, and why the right software may change the management of your business.

Why Do You Need Expense Management Software ?

If your business is growing, so is the complexity related to your receipts, travel expenses, reimbursements, and even the company spending by the team. It's tedious to manually enclose this information into spreadsheets; in addition, the process is quite error-prone and delays occur.

That's where the best expense management software for small businesses comes in. It automates, keeps your finances sorted, and gives you a real-time view of where the money is going. Whether it is day-by-day purchases or your monthly bills or even employee reimbursements, a good tool can turn things around all the way.

Essential Features You Should Look For in Best Expense Management Software that Suits Small Businesses

1. Usability

You need software that is intuitive and user-friendly. It should also be feature-rich and seamless when it comes to onboarding. Often, small businesses do not have dedicated IT teams, qualified individuals or resources to be able to deploy specialized software easily by an expert.

2. Automated and Integrated

The best software in this regard should also go further by automating all areas related to income and expenses, including the accounting tools involved, banks, and by supplementing with HR platforms. Applicants should take onboard, for example, automated expense capture as a recurrence and categorization.

3. Customizable Reporting

Good detailed reports facilitate spending trend analysis. Customizable reports are a basic need, be it a small business expense report software for sharing with your accountant or receiving insights for budget optimization.

4. Travel and Absence Management

If the workforce is going to take trips on a company basis, invest in a good travel management system that would have a good module for absence management, hence making things simple from booking to reimbursement to leave approvals.

5. Performance and HR Integration

Household expenses management tools now provide those in-house HR management, performance management systems, and other HR-related utilities as extensions of usage. All the above has made it very convenient for both HR and finance.

Seeking the Best Digitalization Benefits

Changing from manual processes to the best software for tracking revenues and expenditures brings quite a few advantages:

for example, time savings in approvals and reimbursements, less paperwork and reduced administration, visibility into spending by the team and department; guarantee policy compliance and the elimination of fraud risks, and real-time improvements in budgeting.

Bringings along small business expense report software, and preparing clearwashed, very professional reports for investors, partners or accountants can be accomplished in just a few clicks.

Conclusion

The best expense management software for small business, look for one that will simplify workflows, save time, minimize the human error, and grow with you.

If that seems hard to get, though, BillPunch makes all these things—and more—affordable and very user-friendly. So if you're looking for the best in travel management software or absence management software, or wish to know the best income and expense-tracking software in one, BillPunch surely covers it.

Ready to Simplify Your Business Finances ?

Allow BillPunch to take the pain out of expense tracking; automate your financial workflows, integrate with your HR tools, and get real-time control of your business spend-all on one platform.

#hr management#hr software#hris system#911 abc#arcane#artists on tumblr#batman#cats of tumblr#cookie run kingdom#elon musk

2 notes

·

View notes

Note

What if Four and Acht brought Gibbous to pick out his own DJ equipment?

He wants to buy everything in the store. Acht and Four have to explain to him that he can’t have everything, but he can have some things. He ends up picking out the most expensive stuff he can find, but does manage to convince them to let him buy it because, as he argues, he needs quality equipement to make quality music. Acht disagrees, having made a song using a ten year old laptop and a free music making software, but they let him get the equipment anyway. Part of that is because they want to try it out too. Four doesn’t want to have to pay for all that, but they do anyway to make Gibbous happy.

Thank you for the ask!!! When Pearl finds out, she insists on reimbursing Four and then buys the entire store.

#splatoon oc#agent 4#agent 4 splatoon#dedf1sh#acht splatoon#ahato mizuta#dedfour#acht x agent 4#asks#ask box

3 notes

·

View notes

Text

Why You Need to Outsource Medical Billing Services to a Third-Party Medical Billing Company

In today's complex healthcare landscape, managing medical billing can be a daunting task for healthcare providers. From coding and claims submission to payment posting and denial management, the intricacies of medical billing can significantly impact a practice's revenue cycle. Outsource medical billing services to a third-party medical billing company can streamline operations, improve efficiency, and ultimately boost your bottom line.

Benefits of Outsourcing Medical Billing Services

Enhanced Efficiency: A dedicated medical billing company has the expertise and resources to streamline your billing processes. They can automate tasks, reduce errors, and accelerate claim processing, leading to faster payments.

Increased Revenue: By outsourcing, you can ensure accurate and timely claims submission, minimizing denials and maximizing reimbursement. A specialized billing company can identify and recover lost revenue, optimizing your revenue cycle.

Reduced Administrative Burden: Offloading medical billing tasks to a third-party company allows your staff to focus on patient care and other core competencies. This frees up valuable time and resources, improving overall productivity.

Compliance Adherence: Staying up-to-date with ever-changing healthcare regulations can be challenging. A reputable medical billing company has the knowledge and experience to ensure compliance with HIPAA, ICD-10, and other relevant regulations, mitigating legal and financial risks.

Improved Cash Flow: Timely claim processing and efficient payment collection can significantly improve your cash flow. A dedicated billing company can optimize your revenue cycle, ensuring you receive payments promptly.

Challenges of In-House Medical Billing

High Staffing Costs: Hiring and retaining qualified billing staff can be expensive, especially in competitive markets.

Complex Regulations: Keeping up with the ever-evolving healthcare regulations requires specialized knowledge and ongoing training, which can be a significant burden.

Time-Consuming Tasks: Manual data entry, claim submission, and follow-up can be time-consuming and prone to errors.

Limited Expertise: In-house staff may lack the specialized expertise to handle complex billing scenarios and appeals processes effectively.

Services Offered by a Medical Billing Company

Claims Submission: Accurate and timely submission of claims to payers.

Coding and Billing: Correct coding of medical services and procedures.

Payment Posting: Efficient posting of payments and adjustments.

Denial Management: Effective handling of denied claims, including appeals and resubmissions.

Follow-up on Claims: Timely follow-up on outstanding claims to expedite payment.

Financial Reporting: Detailed financial reports to track revenue and expenses.

Staffing Cost Savings

By outsourcing medical billing, you can significantly reduce staffing costs. You won't need to hire and train in-house billing staff, saving you money on salaries, benefits, and overhead expenses.

Overhead Cost Savings

Outsourcing can also help you save on overhead costs. You won't need to invest in billing software, hardware, and other infrastructure. Additionally, you can reduce office space requirements, further lowering your overhead expenses.

How Right Medical Billing LLC Can Save Your Money and Time

Right Medical Billing LLC is a leading medical billing company that can help you streamline your revenue cycle and improve your bottom line. Our experienced team of billing experts offers a comprehensive range of services, including:

Expert Billing Services: Our team stays up-to-date with the latest industry regulations and coding guidelines to ensure accurate and timely claims submission.

Advanced Technology: We leverage cutting-edge technology to automate tasks, reduce errors, and accelerate the billing process.

Dedicated Account Managers: You'll have a dedicated account manager to oversee your billing operations, ensuring smooth communication and timely resolution of issues.

Improved Cash Flow: Our efficient follow-up and denial management processes help you collect payments faster, improving your cash flow.

Reduced Administrative Burden: By outsourcing your medical billing, you can free up your staff to focus on patient care, leading to increased productivity and patient satisfaction.

Why Choose Right Medical Billing LLC?

By choosing Right Medical Billing LLC, you can:

Increase Revenue: Our expertise in coding, billing, and claims submission can help you maximize reimbursement.

Improve Efficiency: Our streamlined processes and advanced technology can significantly reduce turnaround time for claims.

Enhance Compliance: Our team ensures adherence to all relevant regulations, mitigating legal and financial risks.

Reduce Costs: Our cost-effective solutions can help you save money on staffing, technology, and overhead expenses.

Improve Patient Satisfaction: By freeing up your staff to focus on patient care, you can enhance patient satisfaction and loyalty.

In conclusion, outsourcing medical billing services to a reputable company like Right Medical Billing LLC can provide numerous benefits, including increased efficiency, improved revenue, reduced administrative burden, and enhanced compliance. By partnering with us, you can streamline your operations, improve your cash flow, and focus on what matters most: providing quality patient care.

2 notes

·

View notes

Text

The Ultimate Guide to Payroll Outsourcing in India with MAS LLP

Introduction: Managing payroll can be a complex and time-consuming task for any business. As companies grow, the intricacies of payroll management increase, making it challenging to stay compliant with ever-changing regulations. Payroll outsourcing India is becoming an increasingly popular solution, offering businesses a way to streamline their payroll processes while ensuring accuracy and compliance. MAS LLP is a trusted name in payroll outsourcing, providing comprehensive services tailored to meet the unique needs of businesses. In this blog, we will explore the benefits of Payroll outsourcing India and how MAS LLP can help your business achieve seamless payroll management.

Why Payroll Outsourcing is Essential for Businesses in India

Compliance with Regulations: India’s payroll regulations are complex and subject to frequent changes. Non-compliance can lead to hefty penalties and legal issues. MAS LLP’s payroll outsourcing services ensure that your business stays compliant with all statutory requirements, including tax deductions, provident fund contributions, and employee benefits.

Cost-Effective Solutions: Maintaining an in-house payroll department can be expensive, requiring specialized software and skilled personnel. Outsourcing payroll to MAS LLP reduces overhead costs, allowing you to focus resources on core business activities.

Accuracy and Timeliness: Payroll errors can lead to dissatisfied employees and potential legal issues. MAS LLP uses advanced payroll software and employs experienced professionals to ensure accurate and timely payroll processing, minimizing the risk of errors.

Data Security: Handling sensitive employee information requires stringent data security measures. MAS LLP implements robust data protection protocols to safeguard your payroll data, ensuring confidentiality and security. Key Benefits of Payroll Outsourcing with MAS LLP

Expertise and Experience: With years of experience in payroll management, MAS LLP offers unparalleled expertise. Our team of professionals stays updated with the latest payroll regulations and best practices, ensuring your payroll is managed efficiently.

Customized Solutions: We understand that each business has unique payroll needs. MAS LLP provides tailored payroll outsourcing solutions that align with your specific requirements, from small startups to large enterprises.

Advanced Technology: MAS LLP leverages cutting-edge payroll software to streamline payroll processes. Our technology-driven approach ensures accuracy, efficiency, and scalability, allowing us to handle payroll for businesses of all sizes.

Comprehensive Services: Our payroll outsourcing services cover all aspects of payroll management, including salary calculations, tax filings, statutory compliance, leave management, and employee reimbursements. MAS LLP’s end-to-end solutions ensure that all your payroll needs are met.

Focus on Core Business: By outsourcing payroll to MAS LLP, you can free up valuable time and resources, allowing you to concentrate on your core business functions. This can lead to increased productivity and business growth. How MAS LLP Ensures Seamless Payroll Outsourcing

Initial Assessment: We begin with a thorough assessment of your current payroll processes and requirements. This helps us understand your specific needs and tailor our services accordingly.

Transition Planning: MAS LLP creates a detailed transition plan to ensure a smooth and seamless shift from your existing payroll system to our outsourcing services. Our team handles the entire process, minimizing disruptions to your business.

Regular Updates: We provide regular updates on payroll processing, compliance changes, and other relevant information, keeping you informed and in control.

Dedicated Support: Our dedicated support team is always available to address any queries or concerns you may have. MAS LLP ensures that you receive prompt and efficient support whenever needed. Conclusion Payroll outsourcing India is a strategic move that can significantly enhance your business’s efficiency and compliance. MAS LLP offers expert payroll outsourcing services designed to meet the unique needs of your business, ensuring accuracy, timeliness, and compliance. By partnering with MAS LLP, you can focus on your core business activities, confident that your payroll management is in expert hands. Contact MAS LLP today to learn more about how our payroll outsourcing services can benefit your business.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ajsh#ap management services

6 notes

·

View notes

Text

Understanding the Costs of Hiring Contractors for Small Businesses

For small business owners, navigating the world of contractors can be a daunting task. Whether you're looking to undertake a construction project, revamp your company's website, or need specialized services, understanding the cost behind hiring a contractor is critical for budgeting and managing your company's resources effectively. In this comprehensive guide, we'll take you through everything you need to know about the complexities of contractor costs for small businesses.

The Essentials: What Is a Contractor?

Before we deconstruct the pricing strategies and factors that drive contractor costs, it's essential to define what a contractor is. A contractor, in business parlance, is an individual or a business entity that provides specialized services in a particular field. Contractors are typically hired on a project basis and are not full-time employees of the hiring business, which can offer cost-saving benefits in terms of benefits and salary.

Demystifying Contractor Costs

Hiring a contractor has a myriad of financial implications, and a crucial decision point for any entrepreneur is understanding the overall costs associated with this choice. Whether it's a general contractor managing a construction project or an IT specialist working on a software development job, the cost of their services can vary widely based on multiple factors.

How Much Do Contractors Cost?

The answer is both simple and complex. In general, contractor costs are not uniform and can be influenced by a range of variables. Some rough figures to consider are that a typical contractor might charge between $50 to $150 per hour, while general contractors involved in substantial construction projects can have daily rates ranging from $400 to $1,000, depending on the scope and complexity of the work.

Determining General Contractor Rates

There are five key elements to consider when estimating what you'll pay for a contractor's service:

Specialized Skills and Experience

The more specialized and in-demand an individual's skills are, the higher the potential cost. Years of experience can also play a significant role, as seasoned contractors will naturally command a higher fee.

Project Length and Complexity

Simple projects with clear parameters will generally be less expensive than those that are complex and prone to scope changes, which can lead to additional charges.

Materials and Tools

In some cases, the materials and additional tools required for a project are not included in the contractor's fee. Always clarify these costs beforehand to avoid surprises.

Market Conditions

Like any service, contractor prices are influenced by the market's supply and demand equilibrium. High-demand periods usually mean higher rates.

Reputation and Portfolio

Highly reputable contractors with a strong body of work may charge a premium for their services. However, this could also mean a higher likelihood of a successful project outcome.

Understanding the Type of Contract

The type of employment agreement you have with a contractor also significantly affects cost. There are several common kinds of contracts:

Fixed-Price Contract

This type of contract outlines a predetermined sum that a contractor is paid upon the project's satisfactory completion. It's considered one of the least risky options in terms of financial surprises.

Time and Materials Contract

Under this type of agreement, the contractor is paid based on the time spent on the project and materials used. It can be more flexible but also lead to unexpected costs if the project scope isn't well-defined.

Cost-Plus Contract

This less common agreement sees the contractor reimbursed for project expenses and also receive a percentage-based fee on top of the costs. It provides transparency but can be the most expensive option if the project faces delays or cost overruns.

Choosing Wisely: Selecting a Reputable Contractor

Finally, the quality of a contractor can significantly impact the overall cost of hiring them. Here are some best practices:

References and Reviews

Always ask for and follow up on references. Take the time to read reviews and testimonials to gauge the quality and reliability of past work.

Clear and Detailed Estimates

A reputable contractor will provide a detailed estimate that breaks down all costs, including labor, materials, and any unforeseen changes. This transparency is vital for budgeting.

Professionalism and Communication

Do they arrive on time for meetings? Are they responsive to calls or emails? Good communication indicates a professional approach, which can save you time and money by preventing misunderstandings.

Legal Considerations

Is the contractor properly licensed and insured? Ensuring that they are adequately covered can protect your business from potential liabilities and ensures you're working with a professional.

By taking these considerations into account, you'll be better equipped to understand and negotiate the costs involved in hiring a contractor for your small business. Remember, the cheapest option isn't always the best, and investing in quality can pay dividends in the long run.

Hiring a contractor can be the catalyst for your small business success, but understanding and managing the associated costs is key to a fruitful and profitable relationship.

@erastaffingsolutions

#erastaffingsolutions#era#hrsolution#workfocesolution#aorservice#contractorscost#howmuchdoesacontractorcost#costofcontractor#howmuchdocontractorscost

2 notes

·

View notes

Text

AI-powered Accounting Automation and Bookkeeping Platform

"Docyt 360 AI-powered Accounting Automation platform automates bookkeeping and delivers live financial insights to keep you ahead of the game.For more details click here: https://docyt.com/docyt-ai-accounting-automation-software/

#expense reimbursement report#financial bookkeeping software#financial reporting services#financial reporting tools#franchise reporting#restaurant bookkeeping#restaurant bookkeeping services#retail bookkeeping#revenue recognition automation.

0 notes

Text

Streamline corporate travel with seamless booking, intuitive itineraries, and responsive support. Effortlessly conquer complexities, ensuring productivity and comfort for your business journeys.

0 notes

Text

How to Start a Profitable Medical Billing Business: A Step-by-Step Guide for Entrepreneurs

how to Start a profitable Medical Billing Business: A Step-by-Step Guide for Entrepreneurs

Starting a medical billing business can be a lucrative opportunity for entrepreneurs interested in healthcare services. With the healthcare industry continually expanding and the increasing demand for efficient billing solutions, launching your own medical billing company can lead to a profitable and sustainable enterprise. This comprehensive guide walks you through each step necesary to establish a successful medical billing business, from understanding the fundamentals to scaling your operations.

Introduction

In the age of healthcare complexity,medical providers rely heavily on medical billing companies to handle insurance claims,payment processes,and revenue cycle management. Establishing your own medical billing business not only offers notable earning potential but also allows you to contribute meaningfully to the healthcare sector. With proper planning, technical expertise, and strategic marketing, you can build a thriving business that serves clinics, hospitals, and healthcare practitioners.

Understanding the Medical Billing Industry

Before diving into the startup process, it’s crucial to understand the fundamentals of the medical billing industry. Medical billing involves submitting insurance claims on behalf of healthcare providers to secure reimbursement from insurance companies. It encompasses claim generation, follow-up, denial management, and compliance with healthcare laws like HIPAA.

Key benefits of starting a medical billing business include:

High demand due to growing healthcare expenses

Recurring revenue streams

Low initial investment compared to other healthcare startups

Flexibility to operate remotely or locally

Step-by-Step Guide to Starting Your Medical Billing Business

1. Conduct Market Research & Identify Your Niche

Begin with thorough market research.Identify local healthcare providers who may need your services, such as small clinics, specialists, or dental practices. Study the competition to understand gaps you can fill.

Consider specializing in certain niches like:

Chiropractic billing

Dental billing

Pediatric billing

Home healthcare billing

2. Create a Solid Business Plan

A well-crafted business plan serves as your roadmap. It should include:

Target market analysis

Service offerings

Revenue model and pricing

Marketing strategies

Financial projections

Operational plan

Your business plan provides clarity and helps secure funding if needed.

3. Register your Business & Obtain Licenses

Select an appropriate business structure (LLC, sole proprietorship, corporation) and register with local authorities. Ensure compliance with state and federal licensing requirements, which may include obtaining a business license and Employer Identification Number (EIN).

Legal Structure

Benefits

Considerations

LLC

Limited liability, flexibility

Moderate setup costs

Sole Proprietor

Simple to establish

Liability risk

Corporation

Tax benefits, growth potential

More regulatory requirements

4. Invest in Necessary Equipment & Software

Key tools for your medical billing business include:

Secure computer systems with HIPAA compliance

Medical billing software (e.g., Kareo, NextGen, AdvancedMD)

Reliable internet and data backup solutions

Office furniture and communications tools

Choosing the right billing software is critical for efficiency, claims accuracy, and client satisfaction.

5. Obtain necessary Certifications & Training

While formal certifications are not always mandatory, acquiring credentials can boost credibility. Consider certifications such as:

Certified Professional Biller (CPB)

Certified Medical Reimbursement specialist (CMRS)

regular training helps stay updated on insurance rules, coding standards (ICD-10, CPT), and compliance standards.

6. Build Your Team & Outsource when needed

Initially, you can start solo, but as your client base grows, hire skilled billers, coders, and administrative staff. Alternatively, consider outsourcing some tasks to trusted freelancers, which reduces overhead costs.

7. Develop Your Marketing & Client Acquisition Strategies

effective marketing is vital for attracting clients. Strategies include:

Building a professional website with SEO optimization to rank for keywords like “medical billing services” or “medical billing company.”

Networking with healthcare providers at industry events

Utilizing social media platforms

Listing your services on healthcare directories

Offering free consultation or demo services to showcase your expertise

Additional Insights: Practical Tips & Common Challenges

Practical Tips

always stay compliant with HIPAA and other healthcare regulations

Invest in ongoing education for evolving coding standards and billing practices

Maintain accurate records and documentation

Establish clear contracts and service agreements to protect your business

Common Challenges & How to Overcome Them

Competition: Differentiate�� through specialization and excellent customer service.

Keeping Up with Regulations: Regularly attend industry webinars and training.

Technology Issues: Invest in reliable billing software and cybersecurity measures.

Case Study: success of an Independent Medical Billing Business

John’s Medical Billing Solutions started as a one-person operation serving small clinics in his area. By focusing on personalized service, clarity, and investment in the latest billing software, John increased his client base to over 50 healthcare providers within two years. His revenue growth exemplifies how strategic planning and dedication can lead to a profitable medical billing business.

Conclusion

Launching a profitable medical billing business requires strategic planning, industry knowledge, and dedication. By understanding the needs of healthcare providers, investing in the right technology, and continuously improving your skillset, you can turn this opportunity into a thriving enterprise.Remember, the keys to success include compliance, excellent customer service, and effective marketing. Start today, and build a rewarding career in the dynamic world of healthcare revenue cycle management.

https://medicalcodingandbillingclasses.net/how-to-start-a-profitable-medical-billing-business-a-step-by-step-guide-for-entrepreneurs/

0 notes

Text

Top 10 Corporate Cards for Indian Businesses in 2025: Unlock Exclusive Perks & Financial Control

In the fast-paced world of Indian business, managing company expenses efficiently has become more critical than ever. Whether you're a startup scaling rapidly or a large enterprise optimizing your spend, corporate credit cards can unlock powerful advantages—from real-time tracking to exclusive rewards and streamlined reimbursements. In 2025, corporate cards have evolved into strategic financial tools, especially when paired with smart solutions like travel booking software and travel management software.

Here’s our handpicked list of the Top 10 Corporate Cards for Indian Businesses in 2025 that offer unparalleled control, rewards, and automation.

1. SBI Corporate Credit Card

Why it stands out: Ideal for established businesses, the SBI Corporate Card offers detailed MIS reports, global acceptance, and custom spending limits.

Perk: Integration with travel management software enables seamless travel expense tracking and approval flows.

2. HDFC Corporate Platinum Card

Why it stands out: HDFC’s card is popular for its high credit limits and employee spend monitoring features.

Perk: Get exclusive travel rewards and pair it with travel booking software for effortless business trip planning.

3. ICICI Bank Business Advantage Black Card

Why it stands out: It provides cashback on every spend and tools to control employee usage.

Perk: Works great with travel management software to streamline reimbursements.

4. Axis Bank Business Credit Card

Why it stands out: Axis Bank offers customized solutions for SMEs with detailed spend insights.

Perk: Automate bookings and approvals using your preferred travel booking software.

5. American Express Business Gold Card

Why it stands out: A prestigious card offering rewards tailored for business purchases and global assistance.

Perk: Excellent for international business travel—sync with travel management software to manage itineraries and expenses.

6. RazorpayX Corporate Cards

Why it stands out: Built for digital-first companies, RazorpayX cards offer real-time expense tracking and virtual card options.

Perk: Integrates with accounting systems and travel booking software for complete financial visibility.

7. Karbon Corporate Card

Why it stands out: Startup-friendly, with no personal guarantees and instant issuance of virtual cards.

Perk: Can be easily linked with travel management software to handle multi-employee travel needs.

8. EnKash Corporate Card

Why it stands out: Offers flexible repayment, employee-wise limits, and AI-powered spend analytics.

Perk: Ideal for automating travel-related expenses via travel booking software.

9. Volopay Corporate Card

Why it stands out: Designed for Indian startups and SMEs, it provides detailed expense tracking and seamless foreign currency transactions.

Perk: Syncs with travel management software to manage team travel budgets efficiently.

10. Happay Expense Card

Why it stands out: Known for powerful expense management tools and analytics.

Perk: Best-in-class integration with travel booking software to reduce manual processing of travel invoices.

Final Thoughts

In 2025, the best corporate cards do more than just facilitate payments—they act as enablers of smart business operations. When used alongside robust travel booking software and travel management software, these cards provide financial control, reduce admin overhead, and unlock business growth through exclusive perks.

Whether your priority is travel rewards, detailed expense insights, or integration with digital tools, choosing the right corporate card.

0 notes

Text

Opening Earning Potential: A Comprehensive Guide to Salaries for Medical Billing and Coding Professionals

Unlocking Earning Potential: A Complete Guide to Salaries for Medical Billing and Coding Professionals

Are you considering a career in medical billing and coding but wondering about teh earning potential? You’re in the right place! This comprehensive guide will help you understand the salary landscape for medical billing and coding professionals, explore factors influencing earnings, provide practical tips to increase income, and share inspiring real-life success stories. Weather you’re just starting out or looking to advance yoru career,knowing how to unlock your full earning potential is essential.

Understanding Medical Billing and Coding: The Career Overview

Medical billing and coding is a vital part of the healthcare industry, ensuring accurate documentation for insurance claims, patient records, and billing processes. professionals in this field translate healthcare diagnoses, procedures, and services into standardized codes used for billing and documentation. This specialized skill set makes medical billing and coding a promising career path wiht steady growth prospects.

Salary Ranges for Medical Billing and Coding Professionals

National Average Salaries

The salary of a medical billing and coding specialist varies depending on experience, education, location, and the type of employer. According to recent data from the U.S. Bureau of labor Statistics and industry surveys, the typical salary ranges are:

Experience Level

Average Annual Salary

Range

Entry-Level

$35,000

$30,000 – $40,000

Mid-Level

$45,000

$40,000 – $55,000

Experienced/Advanced

$55,000

$50,000 – $70,000+

Regional Salary Variations

Location significantly impacts earnings. Urban areas with a high density of healthcare facilities tend to offer higher salaries compared to rural regions. Such as:

California and New York: $50,000 – $70,000+

Texas and Florida: $45,000 – $55,000

Rural areas: $35,000 – $45,000

Factors Influencing Salary in medical Billing and Coding

Education and Certification

Obtaining certifications like the Certified Professional Coder (CPC), Certified Coding Specialist (CCS), or Certified Medical Reimbursement Specialist (CMRS) can significantly boost your earning potential and job prospects.

Experience and specialization

As you gain experience and develop expertise in specialized areas such as outpatient coding, inpatient coding, or cardiology, your salary potential increases.

Type of Employer

hospitals: typically higher pay due to volume and complexity of cases

Physician Practices: Competitive salaries,especially in specialized fields

Remote/Contract Roles: May offer flexibility but sometimes lower pay unless compensated for specialization

Benefits and Practical Tips to Maximize Earnings

Benefits of a career in Medical Billing and Coding

work-from-home opportunities

Stable job market with low unemployment rates

Flexible schedules and career advancement options

Possibility to specialize and increase earning potential

Continuous learning due to evolving healthcare regulations

Practical Tips to Increase Your Salary

Earn Certifications: Certifications such as CPC or CCS can lead to higher-paying roles.

Gain Specializations: Focus on niche areas like oncology or Pediatric coding.

build Experience: The more years you spend in the field,the higher your earning potential.

upgrade Skills: Stay current with industry software, coding systems (ICD-10, CPT), and compliance updates.

Negotiate Wisely: always negotiate your salary and benefits during job offers or performance reviews.

Leverage Remote Work: Remote jobs often pay and also on-site roles and provide savings on commuting and related expenses.

Case Studies: Success Stories in medical Billing and Coding

From Entry-Level to Senior Coder

Jane started as a medical billing clerk earning around $35,000 annually. After earning her CPC certification and specializing in orthopedics, she quickly moved into a senior coding role, earning over $65,000 within three years. Her success underscores the importance of certifications and niche expertise.

Remote Coding Professional Achieves Flexibility and income Growth

Mark transitioned to remote medical coding roles,allowing him to work from home while earning a competitive salary of $60,000. Embracing telehealth coding and advanced certifications helped him grow his income and maintain a flexible work-life balance.

first-Hand Experience: Insights from Medical Billing and Coding Professionals

Many professionals highlight the importance of continuous learning and networking. Online courses, professional associations like the AAPC, and industry webinars are valuable resources that help professionals stay ahead, seize promotions, and unlock earning potential.

Conclusion

Medical billing and coding is a rewarding career with considerable earning potential, especially for those who invest in their education, gain relevant certifications, and specialize in high-demand areas. With the right skills, experience, and strategic career choices, you can unlock your full earning potential and enjoy a stable, flexible, and prosperous career in healthcare.

Start taking practical steps today-whether that’s earning certifications, exploring remote work, or focusing on niche specialties-to maximize your earnings and build a triumphant career in medical billing and coding.

https://medicalbillingcertificationprograms.org/opening-earning-potential-a-comprehensive-guide-to-salaries-for-medical-billing-and-coding-professionals/

0 notes

Text

How Does a Specialty Pharmacy Billing Company Boost Healthcare Productivity?

Specialty pharmacies portray an essential role in managing chronic conditions. These conditions include cancer, multiple sclerosis, and rheumatoid arthritis. As these drugs are highly priced, any slight mistake in billing can instigate massive financial problems. Specialty pharmacy billing companies entail entails extensive knowledge of insurance protocols, coding updates, and prior authorization requirements. Outsourcing the billing process helps pharmacies reduce errors, improve turnaround time, and focus on the most important aspect,; which is getting patients the treatments that change lives.

The Price of a Wrong Step in Specialty Billing

One single prescription may cost more than $10,000. However, one miscode can significantly cause even more losses in your claim denial, hence halting treatment and putting pharmacy finances under pressure. According to the AHIMA journal, around 20% of medical claims are denied due to coding discrepancies, causing massive revenue loss across the healthcare sector. Hence, this statistic shows that the price of a single misstep is huge. Hence, to tackle these issues, the specialty pharmacy billing company comes into the picture.

Why to Hire a Specialty Pharmacy Billing Company

There are several reasons to hire a specialty pharmacy service. The reasons start from less claim denials to scalable solutions for scaling up pharmacies. Let’s discuss all the reasons one by one:

Less Claim Denials

Claim denials are among the biggest threats to pharmacy profitability. When claims are denied, the pharmacy must continue to pay their staff without reimbursement for services rendered. That’s where the professional billing staff checks check insurance eligibility meticulously and utilizes precise medication codes to ensure clean claim submission. This level of attention dramatically reduces denial rates, enhancing cash flow and ROI.

Effective Prior Authorization

Prior authorization is often regarded as one of the most difficult processes in pharmacy billing. This involves cross-checking patient insurance coverage, procuring medical records, and securing official approval from payers before dispensing drugs. Outsourcing billing firms take care of this full RCM process. They prepare and send all the documents needed, ensure that they are in line with insurer specifications, and make follow-ups until claim approval is achieved.

Reduced Operational Costs

It is very expensive for a clinic to manage an in-house team. Because you have to invest in training, offer salaries and benefits, invest in software, and continually educate. Outsourcing eliminates these costs. The third-party specialty pharmacy billing company already has trained coders, support staff, and equipment. Pharmacies only pay for the service they use, which in many cases is considerably cheaper than maintaining an in-house staff.

Scalable Solutions for Scaling Up Pharmacies

As specialty pharmacies grow, administrative tasks also grow. Expanding an in-house billing department is costly and time-consuming because the staff needs extensive training and more office space. Outsourced billing companies help with scalability. They can deal with varying spikes in patient volume without the need for added overhead. Scalability increases long-term expansion without disrupting operations or lowering service quality.

Financial sustainability forms the very foundation of quality healthcare delivery. Settling claims on a frequent basis and payments made on time enable pharmacies to invest in advanced technologies and maintain better stock levels of drugs. This will allow patients to receive drugs timely and the pharmacy to build a name for efficiency and reliability.

Why Choose a Specialty Pharmacy Billing Company?

The specialty pharmacy billing company manages complex billing activities, automates prior authorizations, and gets rid of costly inaccuracies, which may delay care or cost revenue. Due to reduced claim denials and fewer administrative expenses, pharmacies can focus on what they should, which is to provide great patient care. That’s why specialty pharmacies need to outsource to a reputable billing company to take care of their whole billing process. These experts can be highly helpful in streamlining the PA process and also the billing inaccuracies.

0 notes

Text

1 Transfer That Can Pierce Your LLC Shield (Banking Compliance PSA)

You formed an LLC to protect your assets, right? Yeah, it’s tricky. But here’s the kicker: 62% of IRS audits targeting small businesses start with banking errors not tax filings. One client mixed personal groceries with business software purchases (oops!), triggering a $10k penalty and piercing their liability shield. Poof! Your protection disappears faster than free office snacks.

Let’s unpack why your business bank account for LLC isn’t just a formality it’s your legal moat.

The 3-Second Mistake That Pierces Your Liability Shield

Picture this: You pay your kid’s tuition from your LLC account. Seems harmless? Big mistake. Courts call this “commingling” mixing personal and business funds and it’s the #1 reason judges ignore LLC protections. Suddenly, your house, car, and savings are lawsuit targets.

Fix it now (literally 10 minutes):

1. Open a dedicated business account (not your personal checking with a new label). 2. Document every transfer as “owner’s draw” or “expense reimbursement.” 3. Cancel LLC debit cards used for personal errands yesterday.

| Pro Tip: Use apps like Relay (free ACH/wires) to auto-categorize transfers. No more “oops” moments .

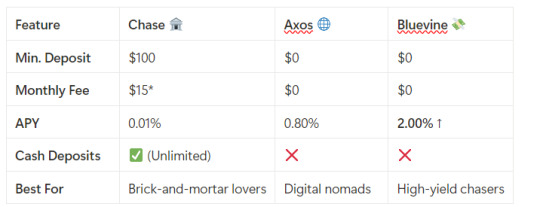

Chase vs. Axos vs. Bluevine: The LLC Banking Thunderdome

-Chase fees waived with $2k min balance. Bluevine’s 2% APY covers balances up to $250k free money, folks .

-Why it matters: Axos refunds all ATM fees globally crucial if you travel. But Bluevine wins for growth-stage LLCs hoarding cash. Chase? Only if you’re depositing cash weekly.

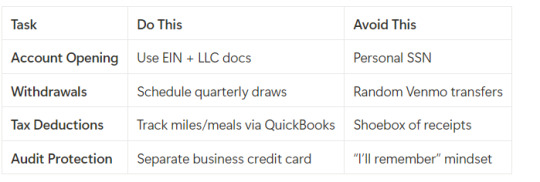

The EIN Trap: When Your SSN Isn’t Enough

Single-member LLCs think: “I’ll just use my Social Security Number for banking.” Stop! Banks like Mercury freeze accounts without an EIN (Employer Identification Number). Why? Fraud prevention.

Worse: If your LLC has foreign owners (e.g., a Chinese investor with 25%+ stake), you must file Form 5472 or face $25k+ fines. Yeah, the IRS doesn’t play .

Action plan:

-Get an EIN online (http://irs.gov/), 4-minute process). - Update EVERY account banking, payroll, utilities. - Foreign members? Hire a CPA who knows international KYC.

Tax Savings: How to Withdraw Cash Like a Mob Boss (Legally!)

Withdrawing LLC profits isn’t a free-for-all. Do it wrong, and you’ll pay 15.3% self-employment tax plus income tax. Ouch.

Smart moves:

- Owner’s Draw (Single-Member LLC): Take cash anytime. But: Set aside 30% for taxes (use Form 1040-ES quarterly) . - Guaranteed Payments (Multi-Member LLC): Pay yourself a “salary” pre-profit split. Deducts from company income. - S Corp Election: Slash self-employment tax by paying yourself a “reasonable salary” (e.g., $80k) and taking excess as distributions.

| Example: $200k profit? Save $12,000+ by electing S corp status.

Deduct EVERYTHING:

-Home office? Deduct 30% of rent. - Business meals? 50% off (keep receipts!). - Car use? Track miles 2025 rate: 67¢/mile.

The Compliance Bomb Hiding in Your Statements

Think “low fees” are the holy grail? Wait till you miss these landmines:

-BOI Report (2025): New law! LLCs must file Beneficial Ownership Info with FinCEN. Penalty: $500/day . - $10k+ Deposits: Banks file CTRs (Currency Transaction Reports). If your coffee shop deposits $9,999 weekly? Structured a federal crime. - PayPal/Stripe Freezes: Platforms hate “disregarded entities” (single-member LLCs). Solution: Incorporate as C-Corp if scaling globally .

Contrarian Take: Ditch Your LLC (Sometimes)

Here’s the twist: LLCs aren’t magic. For SaaS founders eyeing VC funding? Incorporate as a C-Corp. Delaware C-Corps avoid the 5472 foreign-owner trap and attract investors. E-commerce sellers? Stick with LLCs pass-through taxes keep it simple.

| Real talk: I’ve seen LLC owners lose $37k in tax savings by ignoring entity structure. Don’t be them.

Your 10-Minute Audit Fix:

1. Open Bluevine/Axos for high-yield, no-fee business banking. 2. Get an EIN. 3. Move all business transactions to this account. 4. Elect S corp status if earning >$80k profit (ask your CPA). 5. File that damn BOI report!

| CONTACT ME FOR MORE INFORMATION

| Mail: [email protected]

0 notes