#Features of Omnichannel software

Explore tagged Tumblr posts

Text

In today's dynamic retail landscape, customers expect a seamless shopping experience across all channels. Whether it's browsing online, visiting your physical store, or interacting on social media, they crave a unified journey.

0 notes

Text

I recorded the yard animals last night but got pissed that I only get mp4s but everything needs mp3s.

When do we get the Ikea version of software. Like... I want a printer that doesn't gouge me for ink and programs that work even when it's time to update. I want feature-poor. I'm talkin no ads. No data harvesting. No omnichannel ecosystems. Nothing designed by marketing teams. No gamification. I don't want any plug ins. I want a fucky little laptop that could be dropped off a roof and little software lego blocks. No illustrations no byzantine customizations no ai no 'clever gestures' no scrolling

144 notes

·

View notes

Text

How are traditional financial institutions responding to the growth of FinTech?

As the FinTech industry continues to disrupt the traditional financial landscape, traditional financial institutions are undergoing a significant transformation to stay relevant in today's digital age. From embracing FinTech software solutions to partnering with innovative startups like Xettle Technologies, traditional banks and financial firms are adapting their strategies to meet the evolving needs of customers and remain competitive.

Understanding the Impact of FinTech on Traditional Financial Institutions

The rise of FinTech has fundamentally changed the way consumers and businesses interact with financial services. From mobile banking apps to peer-to-peer lending platforms, FinTech companies offer convenient, user-friendly alternatives to traditional banking services. This shift has forced traditional financial institutions to reassess their business models, innovate their offerings, and adopt digital technologies to stay ahead of the curve.

Embracing FinTech Software Solutions

One of the primary ways traditional financial institutions are responding to the growth of FinTech is by leveraging FinTech software solutions to enhance their operations and customer experiences. By incorporating features such as mobile banking, online account management, and digital payment options into their offerings, banks and financial firms can meet the expectations of today's digitally savvy consumers.

Moreover, traditional financial institutions are investing in advanced FinTech software platforms that enable them to streamline internal processes, improve efficiency, and reduce operational costs. These solutions, powered by technologies like artificial intelligence and blockchain, help banks automate routine tasks, mitigate risks, and deliver personalized services to customers.

Partnerships with FinTech Innovators like Xettle Technologies

In addition to developing their own FinTech capabilities, traditional financial institutions are forming strategic partnerships with FinTech innovators like Xettle Technologies to access cutting-edge solutions and expertise. By collaborating with FinTech startups, banks and financial firms can tap into new technologies, accelerate innovation, and expand their service offerings.

Xettle Technologies, a leading provider of FinTech solutions, offers a range of innovative products and services designed to help businesses optimize their financial operations. Traditional financial institutions can benefit from partnering with Xettle to enhance their digital banking platforms, improve payment processing systems, and develop innovative lending solutions.

Through strategic partnerships with companies like Xettle Technologies, traditional financial institutions can leverage the agility and innovation of FinTech startups to drive growth, attract new customers, and stay competitive in today's rapidly evolving financial landscape.

Digital Transformation Initiatives

Many traditional financial institutions are also embarking on comprehensive digital transformation initiatives to modernize their infrastructure, processes, and services. By embracing digital technologies and redesigning their customer experiences, banks and financial firms can deliver seamless, omnichannel interactions that meet the expectations of today's consumers.

This includes investing in user-friendly interfaces, implementing advanced security measures, and offering personalized financial advice and recommendations. Through digital transformation, traditional financial institutions can create a more agile, responsive, and customer-centric organization that is better equipped to compete in the FinTech-driven marketplace.

Regulatory Compliance and Risk Management

While embracing FinTech innovation, traditional financial institutions must also navigate regulatory requirements and manage associated risks. Compliance with regulations such as Know Your Customer (KYC), Anti-Money Laundering (AML), and data protection laws is essential to maintain trust and credibility with customers and regulators alike.

Furthermore, as FinTech introduces new risks such as cybersecurity threats and data breaches, banks and financial firms must invest in robust risk management practices and cybersecurity measures to safeguard their systems and protect customer data.

Conclusion

The growth of the FinTech industry presents both challenges and opportunities for traditional financial institutions. By embracing FinTech software solutions, forming strategic partnerships with innovators like Xettle Technologies, and embarking on digital transformation initiatives, banks and financial firms can adapt to the changing landscape, enhance their offerings, and deliver superior customer experiences.

Through these efforts, traditional financial institutions can remain competitive in the digital age, meet the evolving needs of customers, and position themselves for long-term success in the increasingly FinTech-driven financial ecosystem.

#fintech#ecommerce#fintech software#development#technology#xettle technologies#fi̇ntech#software development

2 notes

·

View notes

Text

Harnessing Data Potential: The Rising Landscape of the Product Information Management Market

The rising revenue generation capacity in the product information management market can be attributed to the need for PIM solutions amidst the increasing complexity of managing large volumes of product information across diverse channels. Seamless integration with third-party applications and platforms provided by product information management businesses makes it a priority in the market dynamics. The scope for the product information management market increased with the increasing awareness of the importance of efficient data management, as businesses realize that accurate and latest product information is critical for success in the digital age. PIM helps to standardize the increasingly complex demands of product content including size, ingredients, weight, colors, and other product specifics.

The growing adoption of PIM software solutions across various industry verticals delivers better consumer and omnichannel experience by streamlining an organization's internal and external marketing processes. PIM system facilitates the distribution of product information across various sales channels ensuring consistent and accurate data presentation. E-commerce websites, marketplaces, print catalogs, mobile applications, and many more sales channels use PIM to focus on robust data governance frameworks for data quality assurance.

The integration of AI with PIM is revolutionizing the entire market dynamics. Automated processes are streamlining data management to improve efficiency. This contributes largely to market growth. Market players are leveraging blockchain technology to enhance data security and transparency by providing trustworthy product information. There are several investment opportunities in companies that are innovating within the PIM space, particularly those incorporating technologies like AI, machine learning, and automation to enhance data enrichment.

The product information management market landscape includes various players offering PIM software Solutions with innovative features, cost-effective price models, and regional audiences. The strategies adopted by market players to remain relevant in the market scenario include investing in companies that emphasize providing omnichannel experience across various touchpoints like online marketplaces, mobile apps, social media, and physical stores. This also helps them increase their consumer footprint.

3 notes

·

View notes

Text

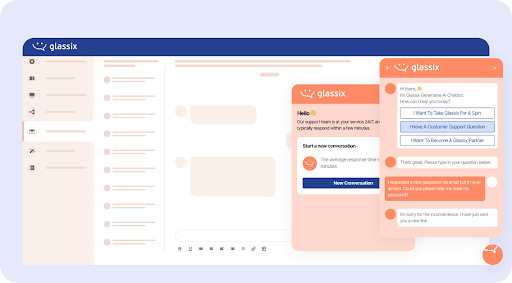

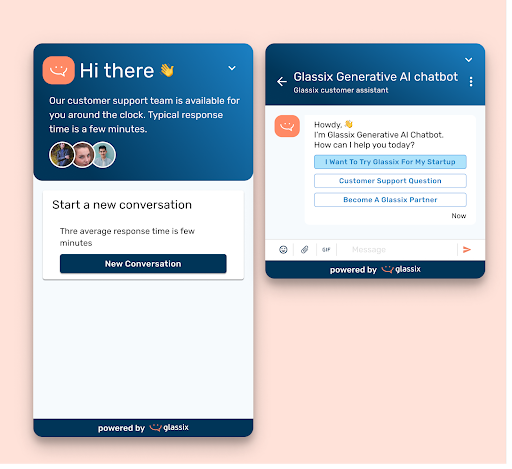

Glassix

Software Development Company

Glassix is a top-rated AI customer support and messaging platform, leveraging the advanced capabilities of conversational AI integrated with the GPT-4 engine. It’s designed to empower busy teams to excel in customer support and experience, featuring an AI-powered unified inbox that consolidates communications across all business channels and apps, including WhatsApp, Apple Messages for Business, social media, email, SMS, and more. Complementing this robust unified inbox, Glassix offers an intuitive drag-and-drop chatbot flow builder and templates, making it effortless to craft smart, efficient automation flows and deploy chatbots to any channel with just a single click. The platform's distinctiveness lies in its comprehensive AI suite and omnichannel features, providing users with innovative and modern tools such as auto-suggested replies, automatic tagging of conversations, one-click conversation summaries, and the capability to deploy generative AI chatbots. These features collectively ensure stellar customer support and experience, setting Glassix apart in the realm of customer engagement solutions.

Contact Details

Glassix

One Boston Place, Suite 2600, Boston, MA, USA 02108

Phone- +1 (617) 683-1236

Website- https://www.glassix.com/

Business Email- [email protected]

Business Hours- Mon - Thu: 9AM - 5PM.

Payment Methods- Credit/ Debit Card, PayPal, Apple Pay, Google Pay, Wire Transfer.

Owner Name- Guy Shalom.

Follow On:

Facebook- https://www.facebook.com/GlassixCompany

YouTube- https://www.youtube.com/@Glassix_CX

Instagram- https://www.instagram.com/glassix_cx/

TikTok- https://www.tiktok.com/@glassix.com

LinkedIn- https://www.linkedin.com/company/glassix

#Customer Support Software#Customer Service Software#Chatbot Platform#Ticketing System#Help Desk Software#WhatsApp Business Chatbot Solution#AI Chatbot tool#AI Customer Communications and Messaging Platform

2 notes

·

View notes

Text

Cloud Contact Center Software Solutions in India

Webwers is a leading provider of cloud contact center software solutions in India. They offer a wide range of features, including:

Omnichannel support: Webwers' cloud contact center software allows businesses to support their customers through various channels, including phone, email, live chat, and social media.

IVR solutions: Webwers' IVR solutions can help businesses automate their customer service operations and improve the customer experience.

Cloud call center: Webwers' cloud call center software allows businesses to manage their operations from anywhere with an internet connection.

WhatsApp API: Webwers' WhatsApp API allows businesses to integrate WhatsApp into their customer service operations.

Affordable WhatsApp business API provider: Webwers is an affordable WhatsApp business API provider in India.

If you are looking for a cloud contact center software solution in India, then Webwers is a great option. They offer a wide range of features at a competitive price.

You can learn more about Webwers' cloud contact center software solutions on their website: https://www.webwers.com/

2 notes

·

View notes

Text

What’s the Easiest Way to Manage Multi-Channel Inventory?

Managing inventory across multiple platforms can be complex—but it doesn’t have to be. With multi-channel e-commerce inventory management, businesses can sell on various platforms, meet customer demands effortlessly, and grow their revenue with confidence.

Let’s explore how modern retailers can streamline their inventory, which tools help, and why this strategy is essential in today’s competitive market.

What Is Multi-Channel E-Commerce Inventory Management?

Multi-channel inventory management refers to tracking and managing product stock across various sales channels—like your website, marketplaces (Amazon, Flipkart), and physical stores—in real time.

Instead of juggling spreadsheets or manually updating stock on each platform, this system centralizes everything. It ensures:

Real-time stock updates

No more double selling

Accurate order fulfillment

Improved customer satisfaction

The Challenge: Inventory Chaos Without Integration

Selling on multiple platforms without integration can lead to serious issues:

Overselling

Stockouts

Order cancellations

Lost revenue

This is why modern businesses adopt centralized inventory tools that sync across all platforms and warehouses.

Why Warehouse Inventory Management Is Key

A warehouse inventory management system is the backbone of multi-channel retail. It helps businesses:

Track stock movement

Optimize storage

Route orders efficiently

Forecast demand

When connected to cloud technology, it provides real-time visibility and control, which is crucial for scaling operations.

Smart Product Inventory Management

Your inventory must match your listings—always.

With automation tools, stock levels are updated across all platforms as soon as a sale happens. Advanced features include:

SKU mapping

Batch tracking

Expiry date monitoring

This ensures accurate fulfillment and fewer returns.

Barcode Scanning = Zero Errors

Barcode scanning systems make inventory handling faster and error-free. From procurement to delivery, every product can be scanned and tracked.

When integrated with your multi-channel inventory software, barcode scanning ensures:

Instant stock updates

Reduced manual errors

Better inventory accuracy

The Best Way to Manage Multi-Channel Inventory

If you're managing dozens or hundreds of SKUs across channels and warehouses, automation is your best friend.

The ideal solution? A cloud-based inventory management system that offers:

Sales channel integration

Warehouse syncing

Barcode support

Detailed analytics

It helps you identify bestsellers, dead stock, and discrepancies in one place.

Omnichannel Retailers: Bridge Online + Offline Stock

Retailers operating both offline and online need tight sync between in-store POS and e-commerce platforms.

A connected store inventory management system ensures:

In-store sales instantly reflect online

Staff can manage restocking and returns smoothly

Inventory stays accurate across locations

Manufacturing Inventory Integration

Manufacturers deal with raw materials, WIP, and finished goods. A manufacturing inventory system, when integrated with e-commerce channels, allows:

Direct sales to consumers or B2B buyers

Real-time production and stock tracking

Better supply chain control

Inventory Solutions for Small Businesses

Even small retailers face inventory challenges. A stock control system for small business operations helps avoid:

Stockouts

Over-ordering

Revenue loss

Look for an easy-to-use tool with:

Cloud access

Barcode scanning

Low-stock alerts

Reporting dashboard

POS + Inventory = Smarter Retail

A combined POS and inventory system ensures every in-store transaction updates your central stock in real-time. This leads to:

Faster restocking

Better sales insights

Reduced inventory mismatches

Cloud-Based Inventory: Future-Ready Operations

Cloud technology transforms how businesses manage inventory:

Access from anywhere

Automatic syncing across users

Secure data storage

Scalable as your business grows

With cloud and multi-channel management combined, your entire team stays updated—no matter where they work.

Meet Shopaver: Smart Inventory for Smart Retailers

Shopaver is your all-in-one platform for managing multi-channel e-commerce inventory with ease. It connects your:

Online store

Marketplaces

POS systems

Warehouses

With Shopaver, manage everything from one dashboard—whether you sell fashion, electronics, beauty, or more. Automate stock updates, reduce errors, and grow your business with confidence.

Conclusion

In today’s competitive e-commerce environment, multi-channel inventory management isn’t just a convenience—it’s a necessity.

From automation to barcode scanning, from cloud access to real-time updates—everything contributes to smoother operations and higher customer satisfaction.

Start simplifying your inventory today with Shopaver.

#MultiChannelInventory#EcommerceInventory#InventoryManagement#WarehouseManagement#StockManagement#RetailTech#POSIntegration#BarcodeInventorySystem#CloudInventory#InventoryAutomation#InventorySoftware#EcommerceSolutions#InventoryControl#OmnichannelRetail#SmallBusinessInventory#ProductInventoryTracking#Shopaver#SmartRetail#SellEverywhere#UnifiedInventory

0 notes

Text

Retail ERP Software That Grows with Your Business – Try It Now

In today’s fast-paced retail environment, businesses—both small and large—are under constant pressure to streamline operations, manage inventory efficiently, and deliver superior customer experiences. This is where the right ERP for retail industry can transform your operations and fuel long-term growth.

Whether you operate a single-store boutique or a multi-chain retail enterprise, choosing the right ERP partner like Nowara Infotech can mean the difference between chaos and control. This article explores the key skills business owners gain when adopting retail ERP solutions, drawing parallels with the strategic decision-making required in technical fields like online master’s in data science—which also teaches scalability, integration, and data insight.

Why Retailers Need ERP Now More Than Ever

Retailers today are grappling with multiple challenges: fragmented supply chains, rising customer expectations, and evolving sales channels (online, offline, mobile). Manual systems are no longer viable.

Here’s what a modern ERP software for retail industry addresses:

Real-time inventory management

POS (point of sale) synchronization

Multi-location tracking

Vendor and purchase management

Customer relationship optimization

According to a 2024 Statista report, over 67% of mid-sized retail businesses that adopted ERP saw improved operational efficiency and inventory accuracy within 6 months. This is why retail ERP solutions are no longer a luxury—they’re a necessity.

What You’ll Learn by Implementing ERP: Transferable Business Skills

Adopting ERP software for retail industry is like earning a degree in business efficiency. Similar to what students learn in a master’s in data science, you’ll gain the ability to:

1. Make Data-Driven Decisions

Just as data scientists leverage insights for strategic value, retailers using ERP can:

Track best-selling products in real time

Forecast stock demands during festivals

Understand peak shopping hours via dashboards

2. Automate Repetitive Tasks

Retail ERP solutions automate everything from:

Barcode-based inventory entry

GST-compliant invoicing

Supplier communication and reorders

This reduces human error and lets staff focus on customer engagement.

3. Improve Collaboration Across Departments

From inventory to sales to finance, ERP bridges internal silos. Everyone works from a single source of truth.

Top Features of Nowara Infotech’s ERP for Retail Industry

Nowara Infotech is known for providing scalable, affordable, and feature-rich ERP for retail business. Here’s what makes them stand out:

Omnichannel Capabilities

Whether you sell online, offline, or via social commerce, Nowara’s ERP unifies transactions, promotions, and inventory across all platforms.

GST & Compliance Ready

No more scrambling during audits. Everything is digitized, auto-updated, and compliant with Indian government standards.

Mobile POS & Reporting

Owners can view reports, monitor stock, and approve orders right from their phone. This is especially useful for small retailers with limited staff.

Multi-Store & Warehouse Integration

Ideal for larger businesses, Nowara’s ERP helps track stock across cities, schedule transfers, and detect shrinkage in real time.

User Journey: From Discovery to Implementation

Let’s walk through the stages retail businesses typically go through:

Awareness Stage:

You realize manual spreadsheets and cash registers are slowing you down. Mistakes happen. Stockouts are frequent. Sales data is a mess.

Keyword fit: Looking for “erp for retail industry” or “erp for retail business” that’s easy to use?

Consideration Stage:

You explore different retail ERP solutions, compare features, pricing, scalability, and industry specialization. You might Google “best ERP software for retail industry India.”

You find Nowara Infotech has excellent reviews, responsive support, and India-specific compliance built-in.

Decision Stage:

You book a free demo. After seeing the ease of use and ROI potential, you implement Nowara’s system and transform your business within weeks.

Case Study: A Small Retailer’s ERP Success Story

Consider Ritu’s Fashion Boutique, a small shop in Nagpur. Before Nowara’s ERP:

Inventory was manually tracked

Monthly losses occurred due to mismatched billing

Staff wasted time on reorder processes

After 3 months of ERP usage:

Inventory accuracy improved by 80%

Billing was automated and error-free

Sales increased by 35% due to faster checkout

Conclusion: Ready to Grow Your Retail Business?

If you’re serious about taking your business to the next level, it’s time to move beyond manual processes. Nowara Infotech’s ERP for retail industry adapts to your business size, goals, and challenges—offering a future-ready platform for sustainable success.

Ready to get started? Book your free ERP demo now and discover how seamless retail operations can be!

0 notes

Text

Top Lead Management Software to Boost Your Sales in 2025

In today’s hyper-competitive market, businesses must not only attract leads but also nurture them efficiently to convert them into loyal customers. That’s where Lead Management Software comes in. As we step into 2025, sales teams are increasingly relying on smart tools to streamline lead capturing, tracking, engagement, and conversion. Choosing the right lead management software can dramatically improve sales performance, customer retention, and overall productivity.

Why Lead Management Software Matters in 2025

Before diving into the top tools, it’s crucial to understand why lead management systems are indispensable in 2025:

Automation & AI: Manual lead tracking is outdated. AI-powered tools now score leads, suggest follow-ups, and automate responses.

Omnichannel Lead Capture: Leads come from social media, websites, events, and emails — software centralizes them.

Data-Driven Decisions: Real-time analytics help teams prioritize high-converting leads.

Team Collaboration: Modern tools foster better coordination between marketing and sales departments.

Key Features to Look for in Lead Management Software

When selecting the best lead management solution, look for the following features:

Lead capturing & scoring

Contact and pipeline management

Custom workflows & automation

CRM integration

Analytics and reporting

Mobile accessibility

Scalability and customization

Final Thoughts: Choosing the Right Tool in 2025

The ideal lead management software depends on your business size, sales strategy, and automation needs. Whether you’re a solo entrepreneur, a scaling startup, or a large enterprise — there’s a solution tailored for you.

Before making a decision, consider:

What channels do most of your leads come from?

How complex is your lead nurturing process?

What tools need to be integrated (email, marketing, accounting)?

What is your budget and team size?

A demo or free trial can go a long way in helping you test the waters before committing.

Ready to Supercharge Your Sales?

2025 is the year of smarter, faster, and AI-driven selling. With the right lead management software, your sales team can focus on what they do best: converting leads into long-term customers. Start exploring these tools today and give your sales the competitive edge it deserves.

#project management software#task management software#client management software#lead management software#attendance management software

0 notes

Text

In the dynamic landscape of customer engagement, businesses are embracing omnichannel strategies to create seamless, integrated experiences. Here are some key omnichannel software features transforming the way companies connect with their audience:

0 notes

Text

BFSI Software Testing: Elevate Financial Software Quality with ideyaLabs’ Proven Services

The Future of BFSI Software Testing: Ensuring Security and Compliance with ideyaLabs

Banks and financial institutions shape the backbone of today’s digital economy. Digital transformation in the banking, financial services, and insurance (BFSI) sector accelerated rapidly over the past decade. Consumers demand seamless experiences. Companies must meet stringent regulatory requirements. Reliable and secure software solutions power financial operations, but the risk of system malfunction, data breaches, or compliance failure remains high. Rigorous BFSI software testing emerges as the foundation for flawless digital banking.

Why BFSI Software Testing is Essential for Banks and Financial Institutions

Highly sensitive transactions take place every second in the BFSI sector. Customers trust financial software to safeguard their data and financial assets. A minor glitch can undermine this confidence and cause significant losses. ideyaLabs recognizes the stakes. BFSI software testing in 2025 has to deal with increasingly sophisticated challenges. Real-time payment systems, mobile banking, online lending, wealth management platforms, and insurance claim processing depend on complex integrated systems. Testing verifies accuracy, security, interoperability, and performance.

Digital-First Banking Amplifies Software Testing Demands

Customer expectations continue to evolve. Institutions roll out omnichannel capabilities, chatbots, AI-driven customer service, and instant payments. ideyaLabs’ BFSI software testing services forecast future demands. They ensure flawless integration, consistent experience, and effective data protection across channels. Testing strategies consider expansive device and browser variations, cyber threats, and accessibility standards. Financial institutions use ideyaLabs’ expertise to validate innovative solutions before launch.

BFSI Software Testing Safeguards Regulatory Compliance

Financial regulations are strict. Non-compliance can result in heavy penalties and reputational damage. ideyaLabs employs industry-aligned BFSI software testing services to ensure seamless compliance. Test automation covers anti-money laundering (AML), know your customer (KYC), and payment card industry (PCI DSS) standards. Tests uncover gaps in encryption, audit trails, and authentication mechanisms. Regulatory requirements evolve, and so ideyaLabs’ testing frameworks adapt continually to ensure organizations always remain audit ready.

Mitigate Risks of Digital Transformation With Expert Testing

New-age banking applications process billions of transactions annually. Systems need to be resilient and scalable. ideyaLabs’ BFSI software testing accelerates release cycles and reduces production risk. End-to-end automation and thorough performance testing protect platforms from outages during peak loads. Simulation of real-world transaction volumes reveals potential bottlenecks. Continuous integration and continuous delivery (CI/CD) pipelines with embedded testing allow BFSI institutions to release features at speed without sacrificing quality.

Comprehensive Testing Solutions for Complex Financial Applications

The BFSI sector requires more than basic functional testing. ideyaLabs delivers a full spectrum of dedicated BFSI software testing services:

Functional Testing: Validate workflows, business rules, calculations, and integrations.

Security Testing: Identify vulnerabilities, protect customer data, prevent unauthorized access.

Performance Testing: Ensure fast response times, optimal throughput, and resource efficiency.

User Experience Testing: Test usability across platforms and devices.

Compliance Testing: Verify solutions adhere to international and regional standards.

Regression Testing: Safeguard core functionalities amid frequent updates.

Banks, payment processors, and insurance firms rely on ideyaLabs for tailored test automation frameworks, robust toolchains, and real-world experience in complex BFSI environments.

Addressing Unique BFSI Software Testing Challenges Head-On

The BFSI landscape poses unique hurdles. Core banking applications intertwine with legacy infrastructure. High data volumes need encrypted storage and transmission. Digital wallets, open banking APIs, and mobile payment platforms expand the attack vector for cybercriminals. ideyaLabs takes a proactive approach. BFSI software testing specialists simulate fraud attempts, penetration threats, and denial-of-service attacks. Real-time alerts and detailed reports allow immediate risk mitigation, keeping systems resilient.

Elevate Customer Trust with Precision Testing

Trust builds the foundation for any financial relationship. Undetected software bugs decrease customer satisfaction and invite regulatory attention. ideyaLabs integrates precision testing into every development lifecycle stage. Test case coverage aligns with business risk. Automated regression cycles catch defects before product launch. Integration with DevOps workflows ensures faster time-to-market for new features. Customers experience fewer outages, smooth transactions, and increased confidence.

The Role of Automation in Modern BFSI Software Testing

Manual testing falls short in today’s fast-paced financial innovation landscape. ideyaLabs champions automated BFSI software testing to achieve large-scale validation. Automation enables:

Faster feedback with every release cycle.

Reliable defect tracking and documentation.

Repeatable regression testing eliminating human error.

Performance benchmarks under real user loads.

Financial organizations streamline operations with test automation and reallocate resources towards customer-centric initiatives.

Test Data Management: Protecting Sensitive Financial Information

Test data management is critical for BFSI organizations. Unauthorized disclosure of customer data during testing constitutes a serious compliance risk. ideyaLabs enforces best practices in test data masking, anonymization, and secure storage. Testing environments replicate real-world conditions without exposing genuine customer details. Data privacy regulations stay in focus so organizations avoid severe legal and financial consequences.

Quality at Every Release Milepost: ideyaLabs’ Structured Approach

Quality assurance extends far beyond simple bug detection. ideyaLabs approaches BFSI software testing with a structured process:

Define business and regulatory requirements.

Map critical functionalities and data flows.

Develop exhaustive test scenarios.

Implement robust automation for quick releases.

Conduct periodic security and compliance reviews.

Integrate user experience (UX) validation.

Organizations receive comprehensive reports detailing test results, defect trends, and suggested improvements. Decision makers gain visibility into risk exposure and compliance posture.

Trends Driving BFSI Software Testing in 2025

Digital banking ecosystems keep advancing rapidly. Five trends drive the evolution of BFSI software testing:

Shift to cloud-native microservices and API-centric architectures.

Increased demand for real-time transaction processing.

Widespread adoption of artificial intelligence and machine learning models.

Enhanced focus on environmental, social, and governance (ESG) compliance.

Aggressive cyber threat landscape targeting financial systems.

ideyaLabs embeds advanced testing methods that evolve with these trends. Financial institutions remain future-proof and well-prepared.

Partner with ideyaLabs and Transform Your BFSI Software Testing Experience

BFSI enterprises recognize that robust software testing is not a luxury. It is an operational necessity. ideyaLabs stands out with unmatched domain expertise, end-to-end automation capabilities, and a strong focus on security and compliance. Banks, insurance companies, fintech startups, and payment platforms benefit from:

Faster go-to-market for new offerings.

Drastically reduced operational and reputational risk.

Elevated customer loyalty and satisfaction.

Assurance of regulatory compliance at every juncture.

Conclusion: Secure, Compliant, and Scalable BFSI Solutions with ideyaLabs

The BFSI industry requires unwavering trust and continuous innovation. Partnering with ideyaLabs reshapes your BFSI software testing for the digital era. ideyaLabs empowers organizations to deliver secure, reliable, and customer-centric financial products. Elevate your quality standards and gain a competitive edge with ideyaLabs. BFSI software testing from ideyaLabs unlocks the future of digital banking.

0 notes

Text

Best ERP Software – Unlocking Smarter Business Management

Introduction: Why ERP Is the Beating Heart of Modern Businesses

In today’s hyperconnected economy, success is driven by synergy—between departments, data, and decisions. That’s where Enterprise Resource Planning (ERP) software enters the spotlight. The best ERP software isn’t just a digital tool; it’s the operational nucleus that keeps every aspect of a business aligned, agile, and accountable.

From automating financials to managing supply chains with surgical precision, ERP systems have redefined how businesses operate—cutting down redundancies, improving collaboration, and turning raw data into actionable intelligence.

What Defines the “Best” ERP Software?

The answer is simple yet nuanced. The best ERP system doesn’t just check boxes—it transforms operations. It brings clarity where there’s chaos. Flexibility where there’s rigidity.

Here’s what top-tier ERP software brings to the table:

Modularity: Tailored functionality across finance, sales, inventory, HR, and more

Scalability: Seamless expansion as the business grows

Real-Time Analytics: Data-driven decisions powered by intuitive dashboards

Customizable Workflows: Built to fit your unique processes, not the other way around

Cloud or On-Premise Flexibility: Deploy however your infrastructure demands

The best ERP system is the one that adapts to your rhythm—without forcing you into its own.

Key Features to Look for in a Top ERP Solution

Not all ERP platforms are created equal. To truly elevate operations, look for these indispensable features:

Integrated Modules: Unified systems across accounting, inventory, CRM, HR, and procurement

User-Friendly Interface: Intuitive design that reduces training time and boosts productivity

Mobile Accessibility: Run operations on the go—across devices and geographies

Role-Based Access: Granular control over data visibility and permissions

Compliance Ready: Built-in support for tax, regulatory, and industry-specific standards

Automation Tools: From invoice generation to stock reordering, automate the mundane

AI & Forecasting: Predict trends, manage risk, and optimize operations with machine intelligence

These aren’t just features—they’re strategic assets that streamline efficiency across departments.

Best ERP Software Solutions in the Market

Several ERP systems have carved a niche in global markets by offering distinct advantages. Here's a snapshot of industry leaders:

1. Odoo ERP

Highly modular, open-source, and cost-effective. Perfect for startups, SMEs, and even growing enterprises.

Wide app ecosystem (CRM, POS, Manufacturing, etc.)

Affordable and highly customizable

Cloud and on-premise options

Active global community and integrations

2. SAP Business One / S/4HANA

A trusted legacy player for enterprises with complex operations.

Deep financial and operational modules

Built-in analytics and IoT integrations

Scales well for multinational corporations

3. Microsoft Dynamics 365

Combines ERP and CRM with the power of the Microsoft ecosystem.

AI and data-driven tools for smarter forecasting

Seamless integration with Outlook, Excel, Teams

Flexible pricing and deployment

4. Oracle NetSuite

Cloud-native ERP solution tailored for fast-growth companies.

Real-time global business management

Strong financial and compliance tools

Ideal for SaaS, ecommerce, and services

5. Zoho ERP

A rapidly growing contender for small to medium businesses.

Fully cloud-based and mobile-friendly

Budget-conscious without sacrificing functionality

Integrated with Zoho’s broader app suite

Industries That Benefit Most from ERP Implementation

While ERP can elevate nearly every industry, some sectors witness transformative results:

Manufacturing: BOM tracking, production planning, quality assurance

Retail & E-commerce: Inventory sync, POS, omnichannel coordination

Healthcare: Patient records, billing, compliance with health regulations

Logistics: Fleet management, route planning, delivery tracking

Construction: Budget monitoring, project management, contractor coordination

Education: Admissions, scheduling, fee collection, academic tracking

By replacing fragmented systems with an all-in-one platform, industries experience reduced errors, faster decisions, and sharper profitability.

How ERP Software Fuels Growth and Efficiency

ERP software doesn’t just centralize data—it transforms how businesses think and act. With one unified system:

Decisions become proactive, not reactive

Collaboration thrives through shared data and visibility

Costs decrease, thanks to streamlined processes and reduced manual work

Customer satisfaction improves, with faster service and accurate updates

Teams stay aligned, no matter their location or function

In essence, ERP becomes the silent architect behind every strategic move.

Future Trends in ERP: What’s on the Horizon?

The ERP landscape is evolving rapidly. Here’s what’s shaping the next generation of ERP software:

Artificial Intelligence: Automating forecasting, anomaly detection, and decision-making

Machine Learning: Smarter recommendations for inventory, hiring, and customer behavior

Voice-Activated Interfaces: Simplifying operations with conversational AI

Blockchain: Enhancing traceability, especially in supply chain and finance

IoT Integration: Real-time data from machines, fleets, or wearable devices

Low-Code Customization: Enabling non-tech users to tweak workflows and reports

These innovations will redefine what’s possible in enterprise management.

Final Thoughts

The best ERP software is the one that works with your business, not against it. It should grow with you, adapt to your needs, and enhance every layer of your organization. In an era where speed, data, and accuracy dictate success, ERP is no longer a luxury—it’s a necessity.

Businesses ready to scale smartly, cut through operational noise, and future-proof their systems will find their strongest ally in a powerful ERP solution.

Ready to transform your operations with the best ERP software? Banibro IT Solutions offers tailored ERP systems backed by expert consultation and ongoing support. Discover what’s possible when your business runs on intelligence.

0 notes

Text

This comprehensive guide explores how apparel ERP software transforms the retail apparel industry by streamlining inventory, billing, POS, customer data, supply chain, and omnichannel operations. The article emphasizes why LOGIC ERP stands out as the #1 ERP solution for apparel retailers, highlighting its powerful features, industry-fit design, and business growth capabilities.

#apparel software#apparel management software#apparel retail software#apparel billing software#apparel inventory software#apparel erp software#apparel retail erp

0 notes

Text

Call center Suite Company in Philippines

As customer expectations evolve and competition grows, businesses need more than just a basic calling system—they need an intelligent, integrated, and scalable communication platform. Enter Aria Telecom, the most trusted Call Center Suite Company in Philippines, offering a unified solution to manage all aspects of customer interaction efficiently and effectively.

The Philippines has long been the global leader in BPO and contact center services. Known for its talented, English-speaking workforce and strong customer service culture, the country attracts companies from across the world. But even the best human resources need the right technology behind them. That’s where Aria Telecom’s powerful, all-in-one call center suite makes a real difference.

What Is a Call Center Suite?

A call center suite is more than just software—it’s a complete ecosystem designed to streamline every part of customer communication. It includes:

Inbound and outbound calling tools

Automated IVR systems

Omnichannel capabilities (voice, chat, email, SMS, social media)

CRM integrations

Real-time monitoring and reporting

AI and automation features

As a premier Call Center Suite Company in Philippines, Aria Telecom ensures all of these features are accessible in one seamless, cloud-based platform.

Why Choose Aria Telecom?

At Aria Telecom, we understand the unique challenges faced by call centers in the Philippines. From handling high call volumes to scaling operations for global clients, your infrastructure needs to be both powerful and flexible. Our call center suite is designed to adapt to your business needs, whether you’re managing a 10-agent team or a 2,000-seat contact center.

Here’s what makes us the preferred Call Center Suite Company in Philippines:

Omnichannel Integration Manage calls, chats, emails, and social media messages from a single interface. No more switching tabs or platforms.

Advanced Call Management Route calls intelligently with skills-based routing, auto-attendants, and real-time queue management.

Cloud-Based Flexibility Access your system anytime, anywhere. Perfect for remote, hybrid, or multi-site call centers.

Custom CRM Integration Whether you’re using Salesforce, Zoho, HubSpot, or a custom CRM, our software integrates seamlessly to provide your agents with full customer context.

Data Security & Compliance We meet global security standards including GDPR and HIPAA. Your data—and your customers’—is safe with us.

Industries We Serve

Aria Telecom proudly works with clients across a wide range of industries:

Business Process Outsourcing (BPO)

Healthcare & Telemedicine

E-commerce & Retail

Telecom & Utilities

Financial Services

Education & Government Helplines

Our platform is designed to support industry-specific workflows, compliance needs, and customer service goals. Whether you're in Metro Manila, Cebu, or Davao, Aria Telecom is your local partner with a global perspective.

Future-Ready Features

We don’t just build for today—we innovate for tomorrow. Our call center suite includes:

AI-Powered Chatbots & Voice Assistants

Speech Analytics & Sentiment Detection

Workforce Management & Quality Monitoring

Real-time Dashboards for Supervisors

Self-service Portals for Customers

By enabling automation and smart analytics, we help reduce average handling time, increase first-call resolution, and boost overall customer satisfaction.

Your Partner for Growth

At Aria Telecom, we believe that great technology should be backed by great support. That’s why we offer:

24/7 customer support

Onboarding and training assistance

Regular software updates

Dedicated account managers

Choosing the right Call Center Suite Company in Philippines isn’t just about technology—it’s about trust, scalability, and partnership. Aria Telecom brings all three to the table.

0 notes

Text

Types of Automated Direct Mail

In the fast-evolving world of marketing, automation is not a luxury—it's a necessity. Direct mail automation has emerged as a powerful tool to personalize customer outreach, improve campaign efficiency, and increase ROI. But what are the different types of automated direct mail, and how can businesses use them effectively?

In this guide, we explore the various types of automated direct mail, their use cases, benefits, and how they fit into a modern marketing strategy.

What Is Automated Direct Mail?

Automated direct mail refers to the process of sending physical mail—postcards, letters, brochures, catalogs, etc.—triggered by specific customer actions or integrated via software platforms. Unlike traditional bulk mail, automated direct mail uses APIs and workflows to deliver personalized, timely messages without manual effort.

1. Triggered Direct Mail

Triggered mail is sent based on user behavior or lifecycle events. Think of it as the physical version of an automated email workflow.

Examples:

Welcome postcards after email sign-up.

Abandoned cart mailers.

Birthday or anniversary greetings.

Re-engagement mailers for inactive users.

Benefits:

Highly personalized.

Stronger customer engagement.

Higher conversion rates.

2. Programmatic Direct Mail

Programmatic mail is data-driven and integrates real-time analytics to deliver physical mail based on digital interactions. It connects with your CRM or CDP to act on customer journeys.

Use Cases:

Retargeting website visitors.

Sending follow-up mail after a digital ad impression.

Creating omnichannel experiences.

Why It Works:

Combines online behavior with offline outreach.

Feels less intrusive than digital ads.

3. Transactional Direct Mail

Transactional mail refers to essential, legally required documents sent through the mail.

Examples:

Invoices.

Bills and payment reminders.

Policy updates.

Bank statements.

Why Automate It?

Ensures compliance.

Reduces administrative workload.

Improves delivery timelines.

4. Promotional Direct Mail

Promotional direct mail includes marketing content such as sales flyers, discount postcards, or catalogs.

When to Use:

Seasonal campaigns.

Product launches.

Customer loyalty programs.

Key Features:

Variable data printing (VDP).

Geographic or demographic targeting.

QR codes or personalized URLs.

5. Lifecycle Marketing Mailers

These are direct mail pieces sent at key stages in the customer journey.

Lifecycle Touchpoints:

Welcome kits.

Thank you notes post-purchase.

Referral program invites.

Win-back campaigns.

Why It's Valuable:

Reinforces brand loyalty.

Encourages repeat purchases.

Creates emotional connections.

6. Bulk Direct Mail Automation

Ideal for mass mailing with personalization. This type of automation sends thousands of printed materials with dynamic fields like name, address, or offer codes.

Common Use:

Nationwide promotions.

Political campaigns.

Event invitations.

7. On-Demand Mailings

On-demand mail automation allows businesses to print and send a single piece of mail as needed.

Examples:

Sending a contract to one client.

Individual donation receipts.

Product samples with dynamic packing slips.

Tools Used:

Print APIs.

CRM-integrated platforms.

Choosing the Right Type of Automated Mail

Ask These Questions:

Is your goal awareness or conversion?

Do you have behavioral or transactional triggers?

What’s your budget and mail volume?

Do you have clean customer data?

Final Thoughts

The right type of automated direct mail depends on your business objectives, audience behavior, and marketing stack. Whether you're nurturing leads, reactivating dormant customers, or fulfilling legal obligations, there's a mail automation solution to match.

youtube

SITES WE SUPPORT

API To Automate Mails – Wix

1 note

·

View note

Text

Point-of-Sale (POS) Machine Market Future Trends Highlight Tech Integration and Mobile-Driven Retail Transformation

The Point-of-Sale (POS) machine market is undergoing a technological renaissance, driven by evolving consumer expectations, digital transformation, and the need for seamless retail experiences. Future trends in this market point to a shift from traditional, static cash registers to dynamic, intelligent, and highly integrated systems. As retailers and service providers seek to enhance customer interactions and streamline operations, POS machines are becoming central to their digital strategy.

The future of POS technology is not just about handling transactions; it's about merging physical and digital experiences, gathering actionable insights, and enabling omnichannel service. The emerging trends in this space are shaping a highly competitive and innovation-driven landscape.

Rise of Mobile and Tablet-Based POS Systems

One of the most prominent future trends is the widespread adoption of mobile and tablet-based POS systems. These devices offer portability, flexibility, and ease of use, making them especially popular among small and medium-sized enterprises (SMEs), restaurants, pop-up stores, and on-the-go service providers.

Mobile POS (mPOS) devices allow staff to process transactions anywhere within a store or even offsite, significantly reducing queue times and improving customer service. As contactless payments and digital wallets gain traction, mobile POS systems are becoming an essential component of modern retail environments.

Cloud-Based POS Solutions Transforming Retail

Cloud integration is revolutionizing POS functionality by enabling real-time data synchronization, centralized inventory management, and remote access to transaction history and analytics. Businesses are increasingly shifting to cloud-based POS solutions to gain greater agility and scalability.

These systems allow retailers to manage multiple locations from a single dashboard, simplify software updates, and reduce upfront hardware investments. The cloud also supports seamless integration with CRM, ERP, and e-commerce platforms, providing a unified view of customer data and sales performance.

AI and Data Analytics Driving Smart Decisions

Artificial Intelligence (AI) and data analytics are poised to play a significant role in the future of POS machines. Modern POS systems are being equipped with AI capabilities that allow businesses to analyze customer behavior, forecast demand, and personalize marketing efforts.

Predictive analytics derived from POS data can help retailers optimize inventory levels, reduce waste, and improve sales strategies. AI-driven recommendations at checkout can also enhance upselling and cross-selling opportunities, boosting average order value and customer satisfaction.

Integration With Loyalty Programs and CRM

Another emerging trend is the deeper integration of POS systems with customer relationship management (CRM) tools and loyalty programs. As competition intensifies, businesses are looking for ways to increase customer retention and lifetime value.

Advanced POS systems now allow users to collect and store customer data, track purchase history, and offer personalized rewards or discounts. This not only strengthens customer relationships but also provides valuable insights for targeted promotions and engagement campaigns.

Enhanced Security and Compliance

With the increase in digital transactions and personal data sharing, security remains a top priority for POS system developers. Future POS machines are expected to include advanced security features such as end-to-end encryption, biometric authentication, and tokenization.

Additionally, compliance with global data protection regulations like GDPR and PCI DSS is becoming standard. Secure POS infrastructure helps build trust with customers and reduces the risk of data breaches or fraud.

Omnichannel Integration for Unified Commerce

Modern consumers expect a consistent shopping experience across in-store, online, and mobile channels. As a result, POS systems are evolving to support omnichannel commerce, enabling businesses to synchronize customer accounts, loyalty points, and inventory data across all platforms.

This integration allows customers to place orders online and pick them up in-store (BOPIS), return online purchases at physical locations, and use mobile apps for quick checkouts. Omnichannel POS solutions are becoming vital for retailers aiming to meet customer expectations and stay competitive.

Subscription and SaaS-Based Pricing Models

The POS market is also shifting toward subscription-based and Software-as-a-Service (SaaS) pricing models. These models offer affordability, flexibility, and ease of adoption for small and growing businesses. Rather than large upfront costs, users can pay a monthly or annual fee that includes hardware, software, updates, and support.

SaaS-based POS solutions also enable frequent feature upgrades and easier scaling as business needs change. This trend is making advanced POS capabilities accessible to a broader range of industries, including healthcare, hospitality, and field services.

Integration With Emerging Payment Technologies

The future of POS machines is closely linked to payment innovation. As consumers increasingly adopt digital wallets, QR code payments, cryptocurrencies, and Buy Now Pay Later (BNPL) services, POS systems are being upgraded to accommodate these new methods.

Future-ready POS machines will support multi-currency transactions, offer real-time currency conversion, and integrate with fintech solutions to provide flexible payment options. This versatility helps businesses attract tech-savvy customers and compete in a globalized economy.

Sustainability and Eco-Friendly POS Solutions

Sustainability is becoming an important consideration in technology adoption. The POS market is witnessing a trend toward energy-efficient devices, paperless receipts, and environmentally conscious hardware manufacturing.

Cloud-based and mobile POS systems also reduce the carbon footprint by minimizing hardware dependencies and supporting remote access. As consumers become more eco-conscious, businesses using green POS solutions will be viewed more favorably.

Conclusion

The future trends in the Point-of-Sale (POS) machine market underscore a shift toward smarter, faster, and more customer-centric solutions. From mobile integration and AI analytics to omnichannel capabilities and sustainable designs, POS machines are evolving into powerful business tools that go beyond processing payments.

Businesses that embrace these trends will not only improve operational efficiency but also deliver richer customer experiences and gain a competitive edge in the rapidly changing retail and service landscape. As technology advances, POS systems will continue to be a cornerstone of digital transformation across industries.

0 notes