#Financial Forecasts

Text

Citi India expects $22 billion in equity capital deals in 2023

Citi India hopes to see equity capital market deals worth $22 billion out of 2023, up from $18 billion out of 2022. This development is being driven by various variables, including areas of strength for the of the Indian economy, the rising number of Indian organizations opening up to the world, and the developing revenue of unfamiliar financial backers in the Indian market.

For what reason is…

View On WordPress

#Capital market outlook#Citi India#Equity capital deals#Equity fundraising#Financial forecasts#Investment banking#Investment opportunities

0 notes

Text

#pick a card#dailytarot#spiritualguidance#tarotreading#spiritualmessages#divination#starseed#spiritualalignment#love tarot reading#tarot#divinecounterpart#forecast#divine intervention#twinflames#financial responsibility#selfwaraness#chakras#lifepurpose#energy work#esoteric

169 notes

·

View notes

Text

August Crypto Market Astrology Report is LIVE!!

https://www.patreon.com/posts/86990582?utm_campaign=postshare_creator

Click link to Read August Crypto Astrology Forecast

View On WordPress

4 notes

·

View notes

Text

5 notes

·

View notes

Text

How Moolamore Cash Flow Forecasting Improves Business Resilience

Do you keep your ins and outs hidden from others? Struggling to keep up with an ever-changing landscape? Are you unsure whether your small and medium-sized business is on track for financial success or failure?

Let go of your worries! There's a game-changing solution that will help you streamline your financial management and provide you with the clarity and crystal ball of foresight you need to avoid pitfalls, confidently navigate the what-ifs, make well-informed decisions, and build resilience. It's not a dream—welcome to the simple but brilliant Moolamore cash flow tool! Make sure to read the entire blog. Let's do it!

#cash flow forecasting#financial forecasting#business forecasting#financial crystal ball#Moolamore cash flow forecasting#cash flow projection

0 notes

Text

AI in Financial Forecasting: Revolutionizing Consumer Investment Strategies with Matt Britton's Expertise

In the rapidly evolving world of finance, where precision and foresight are paramount, the integration of Artificial Intelligence (AI) into financial forecasting is revolutionizing how consumers approach investment strategies. As we delve deeper into this transformative era, the need for expert insights and futuristic viewpoints has never been more critical. One name that stands out in bridging the gap between next-gen technology and consumer trends is Matt Britton.

Matt Britton, a renowned AI expert and keynote speaker, has carved a niche as a formidable thought leader in the intersection of AI and consumer behavior. As the Founder & CEO of the innovative consumer research platform Suzy, Britton has been at the forefront of leveraging technology to decode and predict consumer patterns. His expertise is not just theoretical but deeply entrenched in practical, real-world applications which have shaped strategies for over half of the Fortune 500 companies.

The Expertise of Matt Britton

Matt Britton’s journey through the realms of consumer insights and technological innovations has been nothing short of exemplary. His best-selling book, YouthNation, cemented his reputation as a visionary, highlighting his profound understanding of new consumer trends, particularly among millennials and Generation Z. This demographic is crucial, as their investment preferences and strategies significantly differ from previous generations, increasingly leaning towards AI-driven solutions.

AI in Financial Forecasting: A Game-Changer

AI’s role in financial forecasting is a game-changer, offering unprecedented accuracy and efficiency. AI algorithms can analyze vast datasets — far beyond the capability of human analysts — identifying patterns and predicting market trends that can inform consumer investment strategies. This capability not only enhances the accuracy of forecasts but also democratizes investing, making sophisticated investment strategies accessible to the average consumer.

Why Matt Britton?

As a top keynote speaker and AI expert speaker, Matt Britton stands out for several reasons in the context of AI and financial forecasting:

Real-World Experience: Having led a consumer research platform, Britton understands the practical applications of AI in real-world scenarios, making his insights particularly valuable for financial institutions and individual investors alike.

Consumer Trend Expertise: His deep understanding of consumer behavior dynamics, backed by data from Suzy, allows him to provide unique insights into how AI can be tailored to enhance consumer investment strategies.

Proven Track Record with Fortune 500: His consulting experience with over half of the Fortune 500 companies imbues a level of trust and reliability in his recommendations and forecasts.

Engaging Presentation Style: Known for his dynamic and engaging speaking style, Britton can transform complex AI concepts into understandable and actionable insights for a diverse audience.

Structuring AI Enhancements in Consumer Investment Strategies

In his keynote speeches, Britton often emphasizes the structured approach to integrating AI with consumer investment strategies:

Data Collection and Analysis: Leveraging AI to parse through complex and voluminous financial data to spot emerging trends that can impact investment decisions.

Predictive Analytics: Utilizing AI to forecast future market movements with a higher degree of accuracy, thus enabling more informed investment choices.

Personalization of Investment Solutions: AI’s capability to tailor investment advice based on individual consumer profiles, risk appetites, and financial goals.

Risk Management: Enhancing the ability to predict and mitigate risks associated with various investment options.

The Takeaway

For anyone involved in finance, from industry professionals to individual investors, understanding the impact of AI on financial forecasting is crucial. A keynote speech by Matt Britton, with his dual expertise in AI applications and consumer trends, provides not just insights but actionable strategies that can be implemented to harness the potential of AI in enhancing investment outcomes.

In conclusion, as we look towards a future where AI becomes increasingly central to financial decision-making, the insights from leaders like Matt Britton are invaluable. His ability to elucidate complex technologies in the context of everyday consumer impacts makes him one of the top conference speakers and innovation speakers today. Whether you are looking to understand big picture trends or detailed, actionable strategies, Britton’s keynotes offer a roadmap to the future of investing in an AI-driven world.

0 notes

Text

Unlocking Financial Potential: Forecast & Projection Services

Understanding your financial future is key to making informed decisions and achieving your goals. SAI CPA Services offers forecast & projection services to help businesses and individuals gain valuable insights into their financial outlook.

Our team of experts utilizes advanced forecasting techniques to analyze historical data and market trends, providing accurate projections for future performance. Whether you're planning for growth, securing financing, or making strategic decisions, our forecast & projection services can help you chart a path to success.

With SAI CPA Services, you can unlock your financial potential and confidently plan for the future. Contact us today to learn more about our forecast & projection services and take control of your financial destiny.

Stay tuned for more insights into our comprehensive range of accounting and financial services, designed to empower you to achieve your financial goals.

Connect Us: https://www.saicpaservices.com/contact-us/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct

East Brunswick, NJ 08816

#saicpaservices#financial planning#forecasting#financial management#business growth#financial services#strategic decision making#financial analysis#cpa services

1 note

·

View note

Text

Is that you'll be met with the appearance at an opportunity for new commerce. Gauge your options carefully.

#weather?#text post#forecast#I am not licensed to provide financial advice don't listen to me your fool

0 notes

Text

Empower Your Accounting with Next-Gen BI and Automation

Maximize your accounting functions with PathQuest, which is a subsidiary of Pacific Accounting & Business Services (PABS). With PathQuest, you can efficiently manage accounts payable, gain valuable insights, and take control of your financial landscape. By eliminating manual tasks, you can focus on business growth. Experience advanced financial operations for informed decision-making, automated workflows, and simplified accounting processes. Utilize data and automation to drive next-generation financial intelligence, streamline accounts payable processes, and transform real-time financial data into actionable insights. With PathQuest, you'll harness the power of financial efficiency and achieve business success.

Read More at https://patch.com/users/pathquest-solutions

#Financial Management Software#Accounting automation software#cash flow forecasting software#fp&a software

0 notes

Text

Imagine a steady stream of income flowing in month after month, providing your business with financial stability and the freedom to focus on what truly matters – delivering value to your customers.

Isn’t it like your business has reached heights?

This can become true if you master cash flow in your business. It’s the fine art of balancing incoming revenue with outgoing expenses, ensuring a seamless financial rhythm that hums your business.

This comprehensive guide talks extensively about cash flow management for subscription-based businesses. Whether you have just started or looking to optimize your existing strategies, we’ve got you covered.

We’ll delve into the common pitfalls that can trip you and the proactive measures you can take to steer clear of cash flow woes.

Are you ready to unlock the secrets of mastering cash flow?

#instant cash flow#free instant cash flow system#payment processing for subscription-based companies#instant cash flow business#subscription based financial planning#best subscription based businesses#cash flow forecasting techniques

0 notes

Text

#pick a card#dailytarot#tarotreading#spiritualguidance#spiritualmessages#divination#starseed#spiritualalignment#tarot#love tarot reading#divinecounterpart#twinflames#forecast#divine intervention#financial responsibility#lifepurpose#selfwaraness#chakras#energy work#esoteric

69 notes

·

View notes

Text

Oct 19 -25 2022

Oct 19 -25 2022

Oct 19 -25 2022 Astro Crypto BTC Forecast

Astro Crypto BTC Forecast Oct 19-25 2022

By iCryptobeing | Astro Crypto | 19 Oct 2022

DISCLAIMER: I am not a Financial Advisor, this is NOT Financial Advice, Do your own Research, this is for Entertainment purposes only.

I am not a professional Astrologer and the info in this report should not be taken a financial advice.

Note: I am using Western…

View On WordPress

3 notes

·

View notes

Text

Tom Lee Predicts Bitcoin to Hit $150K! Shocking Insights!

Well-known financial markets expert Tom Lee has recently said some things about the fastest-growing coin of the cryptocurrency market, Bitcoin, which has brought a smile to the faces of cryptocurrency investors.

In a recent interview on CNBC, he talked about his positive views on Bitcoin, saying that it could reach $150k in the next 12 to 18 months, an increase of about 119%.

Tom Lee, head of…

View On WordPress

#Bitcoin forecast#Bitcoin halving#Cryptocurrency insights#cryptocurrency news#cryptocurrency news predictions#ETF success#Financial analysis#Investment opportunities#Investment predictions#Market Trends#Regulatory outlook#Tom Lee

0 notes

Text

Automated cash flow forecasting can help you streamline your finances

Are you tired of dealing with unpredictable cash flow? Do you constantly worry about whether you have enough money to cover essential expenses and seize growth opportunities? Does the thought of managing your company's finances send chills down your spine?

So, put your worries aside and welcome peace! The revolutionary Moolamore is now available, and it is a game-changing management and cash flow forecasting tool that you can always rely on! With this platform, you can automate complex manual tasks, reclaim valuable time, reduce stress, and gain crystal-clear insights into your SME company's financial future.

#automated cash flow forecasting software#financial forecasting tool#cash flow management software#automated financial analysis

0 notes

Text

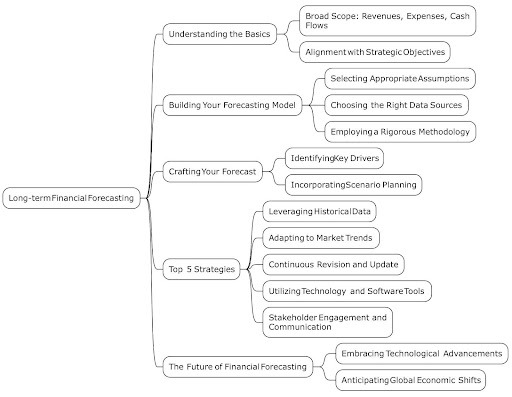

The Time Traveler's Guide to Long-term Financial Forecasting

In the complex world of business strategy and financial management, long-term financial forecasting emerges as a pivotal tool, akin to a time machine that allows businesses to peer into the future. This process involves using current data, trends, and analyses to predict future financial outcomes, thereby equipping businesses with the foresight needed to make informed decisions. The essence of long-term financial forecasting is not just in predicting numbers but in enabling organizations to navigate the future with confidence, ensuring they are prepared for various scenarios that could impact their sustainability and growth.

The importance of this financial tool in strategic planning, risk management, and decision-making cannot be overstated. In today's rapidly changing economic landscape, the ability to forecast long-term financial performance is crucial for businesses aiming to achieve sustained growth. This guide aims to delve into the methodologies, tools, and strategies that underpin effective long-term financial forecasting. It will explore the intricacies of creating forecasts that are both accurate and reliable, addressing common challenges faced in the process and offering insights on how to overcome them.

Foundations of Long-term Financial Forecasting

Understanding the Basics

Long-term financial forecasting is an essential process that spans beyond the confines of short-term financial predictions, offering a vision of financial health and prospects years into the future. It encompasses a broad scope, from projecting revenues, expenses, and cash flows to anticipating capital needs and investment returns. Unlike short-term forecasting, which often focuses on immediate financial management and operational planning, long-term forecasting aims to align with the strategic objectives of the business, providing a roadmap for achieving long-term goals.

The key components of a long-term financial forecast include revenue growth projections, cost and expense estimates, investment requirements, and financing strategies. These elements are crucial for crafting a comprehensive view of the company’s future financial landscape, enabling strategic decision-making and long-term planning.

Building Your Forecasting Model

Constructing a robust long-term financial forecasting model is a nuanced process that requires careful consideration of various factors. The first step involves selecting appropriate assumptions that reflect both the internal dynamics of the business and external market conditions. These assumptions might include growth rates, inflation rates, market trends, and competitive dynamics, which form the foundation of the forecasting model.

Choosing the right data sources is equally important, as the reliability and accuracy of the forecast depend on the quality of the data used. Financial records, industry reports, market research, and economic forecasts are among the key sources that can provide valuable insights.

The methodology employed in building the forecasting model should be rigorous yet flexible, allowing for adjustments as new information becomes available. Techniques such as scenario analysis and sensitivity analysis are invaluable in this regard, as they enable businesses to explore different future scenarios and understand how varying conditions could impact financial outcomes.

Long-term financial forecasting is a critical strategic tool that enables businesses to anticipate the future and make informed decisions. By understanding the basics and carefully constructing a forecasting model, organizations can navigate the uncertainties of the future with greater confidence and strategic insight.

Crafting Your Long-term Financial Forecast

Identifying Key Drivers

Crafting a long-term financial forecast begins with a thorough identification and analysis of the key drivers that significantly influence your business's financial trajectory. These drivers could range from internal factors such as product development, sales volumes, and operational efficiency, to external elements like market trends, regulatory changes, and economic conditions. Start by mapping out all potential drivers and assessing their likely impact on your revenue, costs, and overall financial health. This process involves not only a deep understanding of your business model but also an awareness of the broader industry landscape and economic environment. Tools such as PESTLE analysis (Political, Economic, Social, Technological, Legal, and Environmental analysis) can be instrumental in this phase, providing a structured method to evaluate external factors that could impact your business.

Scenario Planning and Sensitivity Analysis

Once key drivers are identified, the next step is to incorporate scenario planning and sensitivity analysis into your long-term financial forecast. Scenario planning involves creating different "what-if" scenarios based on various combinations of your identified key drivers. This could include best-case, worst-case, and most-likely scenarios, each reflecting different outcomes based on changes in the key drivers. Sensitivity analysis, on the other hand, assesses how variations in individual drivers affect your financial outcomes. This method helps in understanding which drivers have the most significant impact on your forecasts and where your financial plan might be most vulnerable to changes. Both techniques are crucial for accommodating uncertainties and variabilities, enabling you to prepare for a range of future possibilities and make informed strategic decisions.

Top 5 Strategies for Accurate Long-term Financial Forecasting

1. Leveraging Historical Data

The foundation of any reliable long-term financial forecast is the effective use of historical financial data. Analyzing past performance trends provides critical insights into how your business responds to various internal and external factors over time. This historical perspective is invaluable in predicting future performance, as it allows you to identify consistent patterns and anomalies in your financial data. When leveraging historical data, ensure accuracy and relevance by considering the context of each data point and adjusting for any anomalies that are not expected to recur.

2. Adapting to Market Trends and Economic Indicators

Long-term financial forecasting must be dynamic, adapting to ongoing changes in market trends and economic indicators. This means continuously monitoring industry reports, market research, and economic forecasts to identify emerging trends that could affect your business. Integrating this external information into your forecasting model helps in making your financial projections more responsive to the real-world environment, ensuring they remain relevant and accurate over time.

3. Continuous Revision and Update

The only constant in business is change, making it essential to regularly revise and update your long-term financial forecast. As new information becomes available, whether it's related to internal performance or external market conditions, incorporate these insights into your forecast to ensure it reflects the most current understanding of your business and its environment. Setting up regular review intervals, such as quarterly or annually, can help institutionalize this process within your financial planning cycle.

4. Utilizing Technology and Software Tools

Advancements in technology and software tools have significantly enhanced the accuracy and efficiency of long-term financial forecasting. Tools such as financial modeling software, data analytics platforms, and AI-driven predictive analysis can automate complex calculations, identify trends, and predict future financial scenarios with a higher degree of precision. Embracing these technologies can streamline your forecasting process, allowing for more time to be spent on strategic analysis and decision-making.

5. Stakeholder Engagement and Communication

Effective long-term financial forecasting is not a solitary endeavor; it requires the involvement and buy-in of key stakeholders across the organization. Engage with department heads, board members, and other stakeholders early in the forecasting process to gather insights, set realistic expectations, and ensure alignment with overall business objectives. Additionally, clear and transparent communication of your forecasting assumptions, methodologies, and findings is essential for building trust and ensuring that stakeholders are informed and supportive of the strategic direction informed by your financial forecast.

Crafting an accurate long-term financial forecast is a multifaceted process that involves a deep understanding of your business, the external environment, and the application of strategic analysis techniques. By identifying key drivers, leveraging historical data, adapting to market trends, continuously revising your forecast, utilizing technology, and engaging stakeholders, you can develop a financial forecast that not only predicts future financial performance but also informs strategic decision-making and drives business growth.

The Future of Financial Forecasting

Embracing Technological Advancements

The landscape of financial forecasting is on the cusp of a revolution, driven by the rapid advancement of emerging technologies such as artificial intelligence (AI), machine learning, and big data analytics. These technologies are not just enhancing the accuracy and efficiency of financial forecasts but are fundamentally transforming the process by enabling the analysis of vast datasets, uncovering patterns and insights that were previously inaccessible. AI and machine learning algorithms can process and analyze data in real-time, offering predictive insights that allow businesses to anticipate future financial trends and outcomes with a higher degree of precision. Big data analytics, on the other hand, provides the framework for aggregating and analyzing data from diverse sources, offering a more holistic view of the financial landscape. The integration of these technologies into financial forecasting processes marks a significant shift towards more dynamic, data-driven decision-making, setting the stage for a future where financial forecasting is not just a planning tool but a strategic asset.

Anticipating Global Economic Shifts

In today's interconnected global economy, financial forecasting must also account for the wide array of economic shifts and uncertainties that can impact business outcomes. From geopolitical tensions and trade disputes to environmental concerns and pandemics, the global economic landscape is fraught with variables that can drastically affect market conditions and, by extension, financial forecasts. The necessity of anticipating and adapting to these shifts has never been more critical. Financial forecasters must employ a global perspective, incorporating international economic indicators and trends into their models to ensure that forecasts reflect the potential impact of worldwide events. This global outlook, combined with the analytical power of emerging technologies, equips businesses to navigate the complexities of the global economy, making informed strategic decisions that safeguard their future.

Charting the Future: The Art of Financial Forecasting

In the evolving narrative of corporate strategy, the ability to forecast financial outcomes over the long term stands as a critical chapter, detailing the methodologies that businesses employ to navigate the uncertainties of the future. The "Forecasting Framework" diagram serves as a visual compendium of this complex process, breaking down the intricate components and strategies into a cohesive map that guides organizations towards sustained growth and resilience.

At the heart of this framework lies the foundational understanding of financial forecasting, emphasizing the broad scope of projections—revenues, expenses, and cash flows—and their alignment with strategic objectives. This alignment is crucial, as it ensures that financial planning is not just an isolated activity but an integral part of the strategic decision-making process, steering the company towards its long-term goals.

Building upon this foundation, the diagram delves into the construction of a robust forecasting model. This process is characterized by the careful selection of assumptions that mirror both internal dynamics and external market conditions, the utilization of reliable data sources, and the adoption of a rigorous methodology that balances precision with flexibility. Such a model is not static; it evolves with the business, adapting to new insights and changing environments.

Crafting the forecast itself is an exercise in foresight, requiring a deep dive into the key drivers of financial performance. Through scenario planning and sensitivity analysis, CFOs and financial strategists can explore various future landscapes, preparing the organization for a spectrum of possibilities.

The diagram further outlines the top strategies for ensuring the accuracy and relevance of long-term forecasts. These include leveraging historical data for insight, adapting to market trends, continuously revising forecasts to reflect the latest information, employing advanced technology and software tools for enhanced analysis, and maintaining open lines of communication with stakeholders to align expectations and strategies.

Looking to the future, the diagram anticipates the impact of technological advancements and global economic shifts on financial forecasting. It underscores the importance of embracing new tools such as AI and big data analytics, which offer unprecedented predictive capabilities, and maintaining a global perspective to navigate the complexities of the international economic landscape.

Incorporating this comprehensive overview and the accompanying diagram into the article provides readers with a clear and structured understanding of long-term financial forecasting. It highlights the strategic importance of this process in shaping the future of businesses, offering a blueprint for navigating the uncertainties of the financial landscape with confidence and strategic insight.

FAQs on Long-term Financial Forecasting

How far into the future should a long-term financial forecast extend?

The horizon of a long-term financial forecast typically ranges from three to five years, although the specific timeframe can vary based on the industry, the nature of the business, and the intended use of the forecast. Strategic planning requires looking far enough into the future to guide decision-making while remaining realistic about the predictability of financial outcomes.

What are the most common challenges in creating long-term financial forecasts?

Among the challenges are dealing with uncertainties and variabilities in economic conditions, integrating a wide array of internal and external data sources, and maintaining the flexibility to adjust forecasts as new information emerges. The dynamic nature of the global economy and rapid technological changes add layers of complexity to long-term financial forecasting.

How can small businesses approach long-term financial forecasting with limited resources?

Small businesses can leverage simplified forecasting models, focusing on key financial drivers relevant to their operations. Utilizing free or low-cost forecasting software and tools, seeking advice from financial advisors, and staying informed about industry trends and economic conditions can also aid in the process. Prioritizing flexibility and adaptability in their forecasts allows small businesses to respond swiftly to changes.

What role do assumptions play in financial forecasting, and how can they be validated?

Assumptions are foundational to financial forecasting, underpinning projections of revenue, expenses, market growth, and other key financial metrics. Validating these assumptions requires a combination of historical data analysis, industry benchmarking, and scenario planning. Regular review and adjustment of assumptions based on actual performance and changing conditions are crucial for maintaining forecast accuracy.

In Conclusion

The journey of long-term financial forecasting is akin to navigating through time, with the twin beacons of technological advancement and strategic foresight guiding businesses towards a prosperous future. This guide has traversed the foundational elements of financial forecasting, from embracing AI and big data analytics to adapting to global economic shifts, offering a blueprint for crafting forecasts that are both accurate and adaptable. As we stand on the brink of a new era in financial forecasting, the role of this strategic tool has never been more vital. It demands a blend of adaptability, continuous learning, and foresight—qualities that are indispensable for businesses aiming to chart their course through the uncertainties of the future. In essence, mastering the art of long-term financial forecasting is not just about predicting financial outcomes but about shaping them, steering businesses towards success in an ever-changing world.

0 notes

Text

Strategic Financial Planning for Growth: Financial Statement, Forecast & Projection Services

Effective financial planning is crucial for businesses seeking sustainable growth and profitability. At SAI CPA Services, our financial statement, forecast & projection services offer invaluable insights to help businesses make informed decisions and achieve their financial goals.

Our team of experts utilizes advanced financial analysis techniques to create comprehensive financial statements, forecasts, and projections tailored to your business's unique needs. By analyzing historical data and market trends, we provide valuable insights into your business's financial health and future performance.

With SAI CPA Services, you can develop strategic financial plans that drive growth and success. Contact us today to learn more about our financial statement, forecast & projection services and take the first step towards a brighter financial future.

Stay tuned for more insights into our wide range of accounting and financial services, designed to empower businesses to thrive.

Connect Us: https://www.saicpaservices.com/contact-us/

908-380-6876

1 Auer Ct

East Brunswick, NJ 08816

#saicpaservices#financial planning#financialgoals#financialsecurity#businessgrowth#businesssuccess#financial analysis#strategicplanning#cpa services#forecasting#financialinsights

1 note

·

View note