#Financial Inequality

Text

I really feel like we spent too much time trying to appeal to the non-existent empathy of rich people when talking about increasing poverty because the response has always been something along the lines of, 'not my problem.'

Now, the areas of the highest income are getting robbed where I live and all I can do is shrug. This is one of the most inevitable results of increasing poverty in the US and it could have been avoided if those with the most power actually worked to *do* something about it, but those with the most power never thought it was something that would affect them.

They are now becoming the victims of their own inactions, and I'm having a hard time sympathizing with them.

8 notes

·

View notes

Text

The COVID-19 pandemic has inflicted devastating effects on the U.S. economy, with job losses especially concentrated among women, minorities, and low-wage workers. Economists have described the uneven and unequal economic recovery from the COVID-19 recession as a “K-shaped” recovery, characterized by divergent recovery trajectories for the affluent relative to those of less means.

While considerable attention has been devoted to examining the preexisting disparities in labor market outcomes that left some households more vulnerable than others to the COVID-19 recession, less attention has been paid to the role of wealth in determining a household’s ability to buffer the pandemic’s economic shocks.

Wealth (defined as the difference between a household’s assets and debt) provides a critical safety net to households during economic downturns. Wealth holds several advantages over wages as an economic resource: In particular, income from wealth is taxed at much lower rates than income from work, and wealth can serve as a source of savings to absorb temporary setbacks such as a loss of employment income.

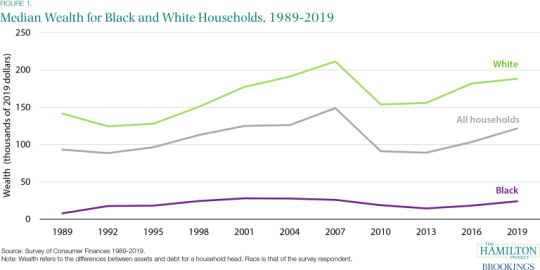

A previous Hamilton Project analysis revealed staggering inequalities in wealth held by white versus Black households. Using updated data from the Survey of Consumer Finances (SCF) for 2019, we find that the Black-white wealth gap persisted heading into the COVID-19 pandemic, leaving Black households with far fewer resources to weather the storm.

Wealth Inequality Preceding COVID-19

In 2019 the median white household held $188,200 in wealth—7.8 times that of the typical Black household ($24,100; figure 1). It is worth noting that levels of average wealth, which are more heavily skewed by households with the greatest amounts of wealth, are higher: white households reported average wealth of $983,400, which is 6.9 times that of Black households ($142,500; SCF). While median wealth is more reflective of the typical household, the scale of average wealth is indicative of the outsized levels of wealth held by the richest households.

The Black-white wealth gap today is a continuation of decades-long trends in wealth inequality, as shown in figure 1. Over the past 30 years, the median wealth of white households has consistently dwarfed that of Black households—ranging from a gap of $106,900 in 1992 to $185,400 in 2007 (both adjusted for inflation to 2019 dollars). Furthermore:

In the second quarter of 2020, white households—who account for 60 percent of the U.S. population—held 84 percent ($94 trillion) of total household wealth in the U.S.

Comparatively, Black households—who account for 13.4 percent of the U.S. population—held just 4 percent ($4.6 trillion) of total household wealth.

Buffering Economic Shocks during Downturns

The ability of wealth to buffer economic shocks can provide critical support to households during economic downturns—yet not all households have equal holdings of wealth at their disposal. The Black-white wealth gap serves as an important factor in understanding how economic recoveries can become uneven and unequal across demographics. Black and white households both experienced a reduction in median wealth from 2007 to 2010 during the Great Recession. Despite white households holding higher levels of wealth than Black households throughout the Great Recession, the decline in median wealth for white and Black households was nearly equal during this period: the median white household experienced a 27 percent decline in wealth from 2007 to 2010 compared to a 28 percent decline for the median Black household (figure 1; authors’ calculations).

Yet in the aftermath of the Great Recession, white households began to recover the wealth they had lost: wealth for the median white household rose by 1 percent from 2010 to 2013. By contrast, wealth for the median Black household continued to fall—declining by 23 percent during this period (figure 1; authors’ calculations). These divergent changes in wealth in the years immediately following the Great Recession illustrate how recoveries from recessions do not necessarily benefit all households equally. In fact, the Great Recession exacerbated the Black-white wealth gap and left Black households more vulnerable to the current COVID-19 recession.

The Intersection of the Black-white and Gender Wealth Gaps

In addition to the Black-white wealth gap, a gender wealth gap (and its intersections with race) reveals another dimension of wealth inequality. We use microdata from the 2019 Survey of Consumer Finances (SCF) to analyze how the Black-white wealth gap varies by gender throughout the life cycle. Because the SCF is a household-level survey and the vast majority of householder respondents within married couples are men, our analyses involving gender are limited to single households. In single households, male and female respondents are each representative of their personal holdings of wealth.

Figure 2 shows that single white men start with the highest median wealth, which continues to outpace that of single white women and single Black men and women throughout the life cycle. The median wealth of single white men under the age of 35 ($22,640) is 3.5 times greater than that of single white women ($6,470), 14.6 times greater than that of single Black men ($1,550), and 224.2 times greater than that of single Black women ($101). By the age of 55 and older, single white men hold 1.3 times more wealth than single white women and 8.1 times more wealth than single Black men. The median wealth of single Black women trails slightly behind that of single Black men until the age of 55, when single Black women hold $40,760 in median wealth compared to single Black men with $27,100.

Evaluating wealth gaps by race as well as gender provides clear evidence of the relatively meager resources that women—Black women, in particular—have to withstand the economic shocks of the COVID-19 recession. Labor market data show how women have been hit particularly during the COVID-19 recession: of the 1.1 million people who left the labor market in September 2020, over 860,000 were women. Black women have faced especially large job losses; the share of Black women with a job decreased by 11.0 percentage points from February to April 2020 compared to a 9.9 percentage point reduction in the share of white women with a job and a 9.2 percentage point decline in the share of white men with a job.

It is important to note that these racial and gender wealth gaps cannot simply be attributed to differences in household savings patterns or cashflow management challenges; rather, they are the outcome of public policy decisions spanning centuries throughout U.S. history. For example, landmark progressive laws, ranging from the New Deal to the formation of Social Security, excluded many occupations (such as domestic workers) widely held by Black women—the majority of whom remain excluded from Social Security today. Accordingly, it is imperative to evaluate wealth gaps by both race and gender to fully understand the depth and breadth of continued wealth inequality in the U.S. today.

Inherited Wealth

Though wealth accumulates with age, the persistence of wealth gaps at every stage of the life cycle further reflects disparities in the intergenerational transfer of wealth via inheritances. White households are substantially more likely to expect and receive inheritances than Black households. Figure 3 shows that in 2019, 17 percent of white households expected to receive an inheritance compared to just 6 percent of Black households. These differing expectations of inheritance receipt comport with disparities in the actual occurrence and magnitude of intergenerational wealth transfers: 30 percent of white households received an inheritance in 2019 at an average level of $195,500 compared to 10 percent of Black households at an average level of $100,000. Because inheritances are lightly taxed, inequalities in inheritances play a significant role in perpetuating a Black-white wealth gap that spans generations.

The Black-White Wealth Gap Intensifies the Effects of Labor Market Disparities

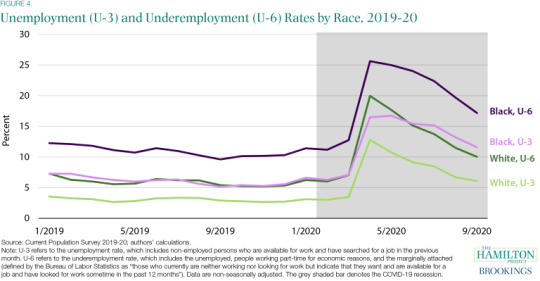

Racial disparities in wealth can intensify the severity of income shocks, as households with lower levels of wealth have fewer resources available to temper the adverse economic impacts of job loss. For Black households who have reported disproportionately high levels of unemployment—and even more so during the COVID-19 recession—this means the Black-white wealth gap can exacerbate the effects of the negative labor market outcomes that Black households are more likely to face.

When comparing the labor market distress of Black families relative to white families, it is important to consider trends in both unemployment and underemployment rates. Unemployment—the number of people who do not have a job and are actively seeking work—is a common indicator of labor market strength. However, an equally important measure is underemployment, defined as the number of people who currently work part-time but would rather have a full-time job and people who want and are able to take a job but have not sought work in the last four weeks. Underemployment can more broadly capture the share of the population that is ready and willing to work more if employers were hiring.

Rates of unemployment for Black individuals—whether measured by the traditional, narrower metric of unemployment (“U-3”) or the broader metric of underemployment (“U-6”)—have been consistently higher than unemployment among white individuals in every year since 1994 (authors’ calculations). Figure 4 focuses on unemployment and underemployment rates beginning in January 2019 through September 2020 of the COVID-19 recession. At the onset of the pandemic, unemployment and underemployment rates for Black and white Americans more than doubled from March to April 2020. Unemployment and underemployment peaked in April 2020 for both groups, but these rates were significantly higher for Black Americans. More than one quarter of Black Americans were classified as underemployed at its peak—1.5 times the underemployment rate for white Americans. Notably, even the narrower measure of unemployment for Black Americans surpassed the broader measure of underemployment for white Americans since June 2020. As of September 2020, the unemployment rate of Black Americans was still 5.5 percentage points higher than that of white Americans, while the underemployment rate of Black Americans was 7.2 percentage points higher than that of white Americans.

One reason that labor market outcomes in the COVID-19 recession have been worse for Black workers is that they are more likely to be employed in industries hit hardest by the COVID-19 recession. Three of the hardest-hit industries by the pandemic in terms of job loss—retail trade, transportation and warehousing, and leisure and hospitality—are among the top ten employers of Black workers. When it comes to outcomes for Black-owned businesses during the COVID-19 recession, the statistics are also grim: analysis by the Economic Policy Institute found that 28 percent of Black-owned businesses were in industries with the largest total job losses relative to just 20 percent of white-owned businesses. Although Black-owned businesses only represent a minority of all businesses, they are disproportionately likely to operate in sectors most severely affected by the COVID-19 pandemic and associated shutdowns.

Black Households Face Higher Rates of Distress during COVID-19

With lower levels of wealth prior to the pandemic, compounded by continued labor market disparities during the pandemic, access to emergency savings and other assets are crucial for Black households to withstand the COVID-19 recession. Yet black households have substantially less emergency savings than white households: the average value of liquid assets among white households was $8,100 in 2019 compared to $1,500 for Black households. Furthermore, 72 percent of white households say they could get $3,000 from family or friends compared to 41 percent of Black households.

Racial disparities between Black and white households are present in holdings of nonliquid assets as well. In 2019, 73 percent of white families compared to 42 percent of Black families owned a home. Black families are not only less likely to own a home, but their homeownership also yields lower levels of assets. In 2019 the typical white families’ home value was $230,000 compared to $150,000 for Black families. Similarly, of the $30.8 trillion in total real estate assets reported in the second quarter of 2020, white households held 78 percent ($23.9 trillion) compared to 5 percent ($1.6 trillion) held by Black households.

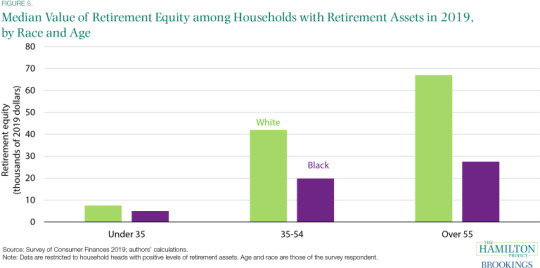

With fewer nonliquid assets to borrow against or sell, Black households were particularly vulnerable to economic shocks heading into the COVID-19 pandemic. For some Black households, this has led to taking extraordinary measures to stay afloat. Leveraging data from the Survey of Household Economics and Decisionmaking (SHED) along with the SCF, we can observe how families have been utilizing their retirement assets to weather the COVID-19 recession.

Despite holding lower levels of retirement assets, young Black families were more likely to borrow from or cash out their retirement savings during the current crisis. Among households with positive retirement equity, figure 5 shows that the median value of retirement equity for households with a household head under the age of 35 in 2019 was $5,000 for Black Americans compared to $7,500 for white Americans. Although Black households tended to hold lower levels of retirement equity at this age, 14 percent of Black Americans under the age of 35 borrowed from or cashed out their retirement savings compared to just 4 percent of white Americans under the age of 35 in July 2020 (SHED; authors’ calculations). Figure 5 shows that the median value of retirement equity among white households with a household head at least 55 with retirement assets was 2.4 times that among Black households—yet only 10 percent of white Americans over the age of 55 borrowed from or cashed out their retirement savings compared to 22 percent of Black Americans over the age of 55 (SHED; authors’ calculations).

Conclusion

In the short-term, renewed fiscal support is needed to curb the economic pain many households are experiencing because they are unable to absorb the economic shocks of the COVID-19 recession. More specifically, policies aimed at providing income support and strengthening the safety net, along with implementing automatic stabilizers that trigger expansions of economic aid during fiscal crises, are critical during this time.

Yet while a stronger safety net and additional income support can provide families with immediate protection against economic crises, it is unlikely to provide them with the long-term stability to prepare for future shocks in the same way that wealth can. Accordingly, when designing policies to reduce the Black-white wealth gap, avoiding the conflation of income with wealth is imperative. In fact, our previous Hamilton Project analysis showed that the Black-white wealth gap remains even among households of similar incomes. Neither differences in income nor differences in educational attainment, indebtedness, or a host of other demographic and socioeconomic indicators can fully account for the persistence of the Black-white wealth gap.

Indeed, closing the Black-white wealth gap will require that the deep and systemic economic disparities brought about by centuries of discriminatory policies are addressed through significant structural changes across a range of policy areas. As discussed in a previous Hamilton Project analysis, these policies range from redlining and the denial of financial services to minority communities, to the Jim Crow Era’s “Black Codes” strictly limiting opportunities in many southern states—all of which contributed to the disproportionate accumulation of wealth held by white households while exacerbating the economic fragility of many Black households. Overcoming the effects of these policies will necessitate substantive and systemic changes in education, small business, healthcare, broadband access, tax reform, and broader place-based policies.

The COVID-19 pandemic underscores the importance of the Black-white wealth gap and its impact on the ability of households to weather the economic shocks caused by recessions. By expanding policymakers’ focus not only on strengthening the safety net and income supports, but also on the inclusion of systemic and structural public policy changes across a range of areas to close the Black-white wealth gap, disparities in the ability of Black and white households to weather the next economic storm will be greatly reduced.

#The Black-white wealth gap left Black households more vulnerable#Black White wealth gap#financial inequality

1 note

·

View note

Text

*tries to organize my thoughts*

*remembers i'm not in school and therefore beholden to neither heaven nor hell nor any man's grading system*

*joyously shredding & tossing all my carefully arranged 3x5 mental notecards into the air like so much beige confetti. raising my arms in victory, cheering raucously until i accidentally inhale bits of homemade confetti*

(*coughing up itty bits of paper like a cat evicting a hairball with a firm understanding of tenants' rights*) wait wat happens next

#i marie kondoed my thoughts and *i* feel great. but now my stream-of-consciousness has escaped containment#so many innocent bystanders at stake#every time i try to organize my thoughts i run out of plastic bins and have to make a trip to the container store where i get even more dis#racted so. you can't just hand me THIS brain and NO catalogue OR library classification system#and expect me to single-handedly sort through all this nonsense? bad form but fucking form not in my job description#aNYways. formal education sure did a FUCKING NUMBER on us huh#(a number i measure not in gpa or dollars of student debt.#but in the number of therapy sessions & medical debt it will take to recover.)#seriously folks. our education systems are...innately traumatizing for a huge number of students. and we NEED to address this.#the fact that it is culturally common for adults to have anxiety nightmares about school/exams...even decades later?#that is not cute. it is Alarming.#no one--much less entire generations--should be spending their developmental years in an environment of chronic stress & pressure & strain#and yet that is the reality for millions and millions of pre-teen and teenage and young adult students#this isn't healthy and it serves and empowers NO ONE#...except of course the many exploitative educational & financial & debt-collecting institutions thriving from the current balance of power#and of course it's a nefarious and powerful way to sabotage/erase the middle class#which billionaires and the wealth-inequality creators they finance couldn't possibly have any noteworthy interest in whatsoever#it's not like there's an elite group of people with huge financial incentives to drain/steal resources from the masses...#anyways sorry for going all Conspiracy Theory on you.#obviously the billionaires who control the vast majority of our resources and news and political campaign funding#are not tied to every single itty bitty social issue and i'm a silly billy to imply it#please tell elon musk to ignore this tweet i am so subservient and acquiescent#mr musky u r so good at inheriting slavery-built mining fortunes & buying other people's companies#& building rocket ships & fancy cars that do NOT explode/catch fire & also NOT running billion dollar companies into the ground#mr musky u r so talented genius billionaire playboy with 10 kids and ex-wives who find you creepy af babe u r basically iron man

2K notes

·

View notes

Text

Just one. I'm telling you. We eat just one billionaire and the rest will fall into line.

#communist#anarchocommunism#anarchopunk#anarchism#antifascist#socialist#billionaire#financial#eat the rich#wealth inequality#capitalism#late stage capitalism#anti capitalism#fuck capitalism

444 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Repairing Our Busted-Ass World

On poverty:

Starting from nothing

How To Start at Rock Bottom: Welfare Programs and the Social Safety Net

How to Save for Retirement When You Make Less Than $30,000 a Year

Ask the Bitches: “Is It Too Late to Get My Financial Shit Together?“

Understanding why people are poor

It’s More Expensive to Be Poor Than to Be Rich

Why Are Poor People Poor and Rich People Rich?

On Financial Discipline, Generational Poverty, and Marshmallows

Bitchtastic Book Review: Hand to Mouth by Linda Tirado

Is Gentrification Just Artisanal, Small-Batch Displacement of the Poor?

Coronavirus Reveals America’s Pre-existing Conditions, Part 1: Healthcare, Housing, and Labor Rights

Developing compassion for poor people

The Latte Factor, Poor Shaming, and Economic Compassion

Ask the Bitches: “How Do I Stop Myself from Judging Homeless People?“

The Subjectivity of Wealth, Or: Don’t Tell Me What’s Expensive

A Little Princess: Intersectional Feminist Masterpiece?

If You Can’t Afford to Tip 20%, You Can’t Afford to Dine Out

Correcting income inequality

1 Easy Way All Allies Can Help Close the Gender and Racial Pay Gap

One Reason Women Make Less Money? They’re Afraid of Being Raped and Killed.

Raising the Minimum Wage Would Make All Our Lives Better

Are Unions Good or Bad?

On intersectional social issues:

Reproductive rights

On Pulling Weeds and Fighting Back: How (and Why) to Protect Abortion Rights

How To Get an Abortion

Blood Money: Menstrual Products for Surviving Your Period While Poor

You Don’t Have to Have Kids

Gender equality

1 Easy Way All Allies Can Help Close the Gender and Racial Pay Gap

The Pink Tax, Or: How I Learned to Love Smelling Like “Bearglove”

Our Single Best Piece of Advice for Women (and Men) on International Women’s Day

Bitchtastic Book Review: The Feminist Financial Handbook by Brynne Conroy

Sexual Harassment: How to Identify and Fight It in the Workplace

Queer issues

Queer Finance 101: Ten Ways That Sexual and Gender Identity Affect Finances

Leaving Home before 18: A Practical Guide for Cast-Offs, Runaways, and Everybody in Between

Racial justice

The Financial Advantages of Being White

Woke at Work: How to Inject Your Values into Your Boring, Lame-Ass Job

The New Jim Crow, by Michelle Alexander: A Bitchtastic Book Review

Something Is Wrong in Personal Finance. Here’s How To Make It More Inclusive.

The Biggest Threat to Black Wealth Is White Terrorism

Coronavirus Reveals America’s Pre-existing Conditions, Part 2: Racial and Gender Inequality

10 Rad Black Money Experts to Follow Right the Hell Now

Youth issues

What We Talk About When We Talk About Student Loans

The Ugly Truth About Unpaid Internships

Ask the Bitches: “I Just Turned 18 and My Parents Are Kicking Me Out. How Do I Brace Myself?”

Identifying and combatting abuse

When Money is the Weapon: Understanding Intimate Partner Financial Abuse

Are You Working on the Next Fyre Festival?: Identifying a Toxic Workplace

Ask the Bitches: “How Do I Say ‘No’ When a Loved One Asks for Money… Again?”

Ask the Bitches: I Was Guilted Into Caring for a Sick, Abusive Parent. Now What?

On mental health:

Understanding mental health issues

How Mental Health Affects Your Finances

Stop Recommending Therapy Like It’s a Magic Bean That’ll Grow Me a Beanstalk to Neurotypicaltown

Bitchtastic Book Review: Kurt Vonnegut’s Galapagos and Your Big Brain

Ask the Bitches: “How Do I Protect My Own Mental Health While Still Helping Others?”

Coping with mental health issues

{ MASTERPOST } Everything You Need to Know about Self-Care

My 25 Secrets to Successfully Working from Home with ADHD

Our Master List of 100% Free Mental Health Self-Care Tactics

On saving the planet:

Changing the system

Don’t Boo, Vote: If You Don’t Vote, No One Can Hear You Scream

Ethical Consumption: How to Pollute the Planet and Exploit Labor Slightly Less

The Anti-Consumerist Gift Guide: I Have No Gift to Bring, Pa Rum Pa Pum Pum

Season 1, Episode 4: “Capitalism Is Working for Me. So How Could I Hate It?”

Coronavirus Reveals America’s Pre-existing Conditions, Part 1: Healthcare, Housing, and Labor Rights

Coronavirus Reveals America’s Pre-existing Conditions, Part 2: Racial and Gender Inequality

Shopping smarter

You Deserve Cheap Toilet Paper, You Beautiful Fucking Moon Goddess

You Are above Bottled Water, You Elegant Land Mermaid

Fast Fashion: Why It’s Fucking up the World and How To Avoid It

You Deserve Cheap, Fake Jewelry… Just Like Coco Chanel

6 Proven Tactics for Avoiding Emotional Impulse Spending

Join the Bitches on Patreon

#poverty#economics#income inequality#wealth inequality#capitalism#working class#labor rights#workers rights#frugal#personal finance#financial literacy#consumerism#environmentalism

82 notes

·

View notes

Text

#leftism#anti capitalism#communism#socialism#anarchy#late stage capitalism#capitalism#financial#business#tweet#billionaires#economy#economics#taxes#eat the rich#fuck the rich#celebration#rich life#millionaire#income inequality#wealth inequality

32 notes

·

View notes

Text

unless you're a highly religious man, marriage just isn't worth the risk if you're a guy. you don't realize this when you're young, which is when you're most vulnerable, but as you get older, as you learn more about life, as you learn more about women, as you learn more about the games that are being played in relationships, as you learn more about divorce rates, as you learn more about people staying in unhappy marriages for the sake of kids, appearances, finances, etc., the more you realize that marriage is a gamble where the stakes are stacked against you as a man. this is especially true if you're not a wealthy man. if you're wealthy (like say a net worth of 50 million) and you lose half of that, you're still really rich and chances are you have the know-how and connections to make back what you lost. however, if you're a guy just making 50k a year and you suddenly lose half or more, you can literally find yourself homeless. it's crazy.

#marriage risks#marriage gamble#relationship insights#divorce awareness#gender dynamics#family law#marriage struggles#financial risk#men's issues#marriage perceptions#life lessons#relationship truths#marital concerns#divorce statistics#gender inequality#family dynamics#marriage advice#men's perspective#relationship realities

6 notes

·

View notes

Text

why do i see so many so-called "leftists" turn into right wingers when it comes to fat people

"i just don't wanna see it"

"it's gross"

"these people have no self control, it's all their fault"

"they did this to themselves, they don't deserve healthcare"

"just stop being fat. it's that easy"

#lotta people that gripe about financial inequality suddenly dont wanna confront that obesity can be and is a class issue as well#but since were so yuckygross to them they dont care they want us dead lol

6 notes

·

View notes

Quote

A commercial civilization is money-oriented, profit-oriented. Commercial values always tend to wrench a society free of tradition. Economics from education to public service is being reorganized on the self-destructive basis of self-interest.

John Ralston Saul

#spiritual gold#inspirational#humanity#society#civilization#commerce#financial system#selfishness#greed#profit#inequality#self destruction#interest#debt#economy#values#morality#integrity#wealth distribution#crisis

10 notes

·

View notes

Text

.

#tbh im sick of being made to feel. not working class. because i am. but poor. like as though i am ACTUALLY poor (im not! i have Enough)#by the income metrics of EVERY university I’ve attended. like that’s how little you’re exposed to normal people? that you class me as#financially struggling? ME? and i don’t mean it in a shame way it’s so hard to articulate this because I’m just surrounded by people who#really would not be able to live on my family’s very normal income. but im sick of middle class students pleading poverty because their#parents aren’t throwing money at them and im sick of institutions recognising there’s a very real class inequality but doing nothing aside#from low income grants if we’re lucky or ‘widening participation’ grants that are so narrow and contribute so little as to effectively be#worthless. not to MENTION the way middle class students AND academics talk about the working class like we’re a stupid monolith#next person to talk about the way they need to support post-92 unis because education is a universal good and the working class need a plac#to go ❤️ gets shot. honestly. like i actually can’t do it any more. im sick of you fucking people#IM ALREADY IN YOUR WORLD. SURPRISE!!!!!!! stop pricing me out or microaggressing me into giving up.#this is also not about cost of living crisis this absolutely predates it like it is Hurting right now. anyway.#didn’t get the widening participation grant. 👍 so whoever the fuck did. Well im calling bullshit on it honestly. i commute 4 hours each way#because it’s the only way i can afford my ma at redacted prestigious institution please tell me more about how you can afford to rent in#london and have an income below x. 👩❤️💋👩#dl

2 notes

·

View notes

Text

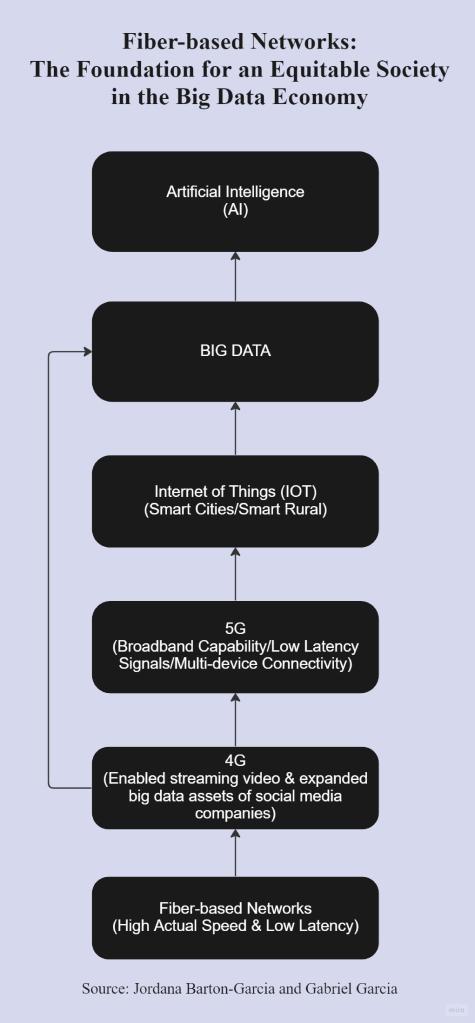

Advance digital equity today or usher in a future of egregious economic inequality - Connect Humanity

At Marconi Society’s “Decade of Digital Inclusion” conference last year, we heard from leaders in technology and digital equity. What follows is a précis of my remarks and some additional reflections for the session, ‘The (Big) Data Economy: Inclusion and Fairness’, in which I focus on the importance of digital equity now to secure a future that works for all.

When ‘good enough’, isn’t good enough

Rural and low-income communities have been expected to make-do with antiquated infrastructure and low-performing technologies offered at high costs, such as legacy copper (DSL) or coaxial cable networks, or satellite service. Time and again, communities are told not to expect fiber-based networks, but to settle for whatever technology is offered to them. In his book, Farm Fresh Broadband, Christopher Ali calls this the “politics of good enough”.

Digital inclusion — having access to quality broadband infrastructure, devices, and the digital skills to use them — is key to upward mobility. It is a portal to healthcare and education, a platform to start and grow a business, and the first rung on the ladder to a well paid job.

For much of the 20th Century, individuals were able to enter the middle class, with or without a college degree, through jobs in manufacturing and retail. Today most jobs have a digital component and employers across sectors look for candidates with well-honed digital skills. If you haven’t grown up with access to data and devices, you’re starting at a disadvantage. And if you don’t have a computer and a connection, good luck applying for a job in a world where recruitment happens almost entirely online.

Digital exclusion doesn’t just punish job seekers, it holds back the creation of jobs in the first place. When a community doesn’t have the fiber infrastructure to attract and retain 21st century businesses, it loses out on so many fronts. Fewer work opportunities. A lower tax base. Less activity in the local economy. Higher unemployment — and the economic and social costs that often follow in distressed communities.

Digital inclusion is economic inclusion

‘Digital exclusion’ is ‘economic exclusion’. By maintaining the digital divide, this politics of ‘good enough’ will perpetuate ever greater income and wealth inequality. By the same token, ‘digital inclusion is economic inclusion’ and by pursuing what Jonathan Sallet calls broadband networks ‘fit for the future’ we can start unwinding the entrenched poverty that has robbed communities of a brighter future.

We cannot miss this moment. The longer we wait to close the digital divide, the harder it’ll be for those on the wrong side to catch up. We have the technology, the established research methodologies and data sets, and best practices. We have business and operating models, philanthropy, and, in the U.S., the Community Reinvestment Act, that can support the connection of low-income, BIPOC, and rural communities that large national providers have not served equitably. Let’s heed the warning of one of our most trusted leaders in broadband policy, Blair Levin: “…our country may take the biggest backwards step any country has ever taken in increasing, rather than closing, the digital divide.” Let’s not blindly proceed on that path.

Civic participation at its best

There are local and regional ISPs, co-ops, local governments, and community partners across the country who are rolling up their sleeves and building next generation broadband networks for underserved communities. And they know better than to aim for the minimum speed, i.e., the FCC’s definition of 25/3 mbps that seems to be frozen in time, driven by a scarcity narrative in a world where accelerating technology demands require that networks ‘fit for the future’ offer far greater speeds. This is civic participation at its best — and the government, philanthropy, and the private sector must support these efforts.

Rather than wasting time entertaining inaccurate, unreliable, expensive maps (at least $44 million for the new FCC “Federal Broadband Map” by CostQuest) and catering to powerful companies that write the rules and misrepresent their service, we must engage with communities to understand their needs, their context, and work with them to shape our shared digital future. This is the work I joined Connect Humanity to do, with a special focus on the Texas-Mexico border region.

When we make investments in local communities, we support an inclusive economy and opportunities for under-represented groups to use, create, and own assets in the digital economy. That level of inclusion is necessary for a diversity of people to become the makers and shapers of fair algorithms, the owners of local and regional ISPs, the ethical managers of the internet of things, and the leaders who engage communities to make policy and law to protect people from the deleterious use of big data and AI.

Here’s a link to replay the panel.

#Advance digital equity today or usher in a future of egregious economic inequality#digital equity#AI#economic inequity#financial futures#skills sets#digital economy

3 notes

·

View notes

Text

Capitalism to Techno-Feudalism: The Evolution of Economic Systems

🌟 Dive into the intriguing world of economic evolution with our latest video "Capitalism to Techno-Feudalism: The Evolution of Economic Systems"! 🚀 Join us as we explore the rise of tech giants, wealth inequality, and strategies for navigating this digital landscape. Featuring insights from renowned economist Yanis Varoufakis.

Watch now:

youtube

#capitalism#techno-feudalism#economic systems#global financial crisis#tech giants#Yanis Varoufakis#wealth inequality#digital dominance#alternative infrastructure#regulatory environment#democratic norms#financialization#digital future#innovation#inequality#public discourse#cooperative models#societal challenges#Youtube

0 notes

Text

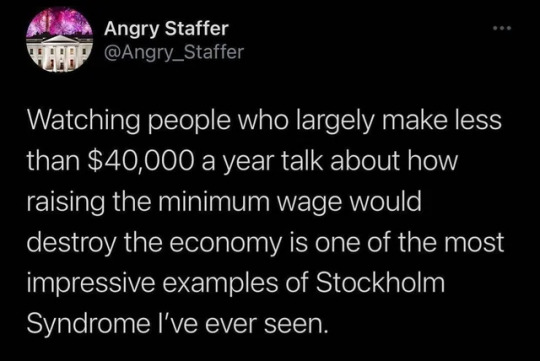

#stockholm syndrome#communist#anarchocommunism#anarchism#antifascist#anarcho#revolution#anarchy#cuban revolution#antifascism#minimum wage#minimum salary#income inequality#basic income#financial

355 notes

·

View notes

Text

#Financial Corruption#Tax Evasion#Economic Inequality#Banking Scandals#Money Laundering#Legal System#Social Justice#Political Power#Regulatory Failure#Elite Impunity

0 notes

Text

High-Level Dialogue for Latin America and the Caribbean "Financing for Gender Equality: reducing inequalities and strengthening democracies" (CSW68 Side Event).

The High-Level Event aims to promote dialogue and exchange of ideas among women leaders of government entities on financing for gender equality as a strategy for poverty eradication, inequalities and institutional and democratic strengthening.

Welcome words.

Financing for Gender Equality: reducing inequalities and strengthening democracies.

Panel: The role of States and financing for the achievement of gender equality and poverty. reduction in Latin America and the Caribbean.

Closing remarks.

Poverty eradication and the achievement of gender equality go hand in hand and that for this to happen, it is essential to transform and strengthen systems, institutions and financing, as the priority theme of the next CSW points out. The CSW68 is an opportunity for the countries of Latin America and the Caribbean to contribute to this transformation in line with the Regional Gender Agenda.

Progress towards gender equality in Latin America and the Caribbean is at a critical juncture. The multiple crises affecting the region are having a disproportionate impact on women and girls, affecting to a greater extent those who face discrimination based on socioeconomic, ethnic, age, sexual orientation, gender identity or migratory status, among others. To offer a strategic vision that addresses gender equality and women's empowerment as a central and transversal axis of an inclusive, sustainable and transformative development, UNDP has developed the Regional Gender Equality Strategy 2023-2025.

Concept note

Watch the High-Level Dialogue for Latin America and the Caribbean "Financing for Gender Equality: reducing inequalities and strengthening democracies" (CSW68 Side Event)

#latin america#caribbean#democracies#structural inequalities#gender equality#financial inclusion#csw68#side events

1 note

·

View note

Text

H-How Did We G-Get Here???

You all know by now that I am an admirer of Robert Reich and largely share his views. He did something a little different yesterday that I found both thought-provoking and at the same time humorous, and I think you’ll enjoy it, too. I’ll let him explain …

The Really Big Picture

Sometimes a single very big picture is worth many thousands of words

By Robert Reich

15 February 2024

By now you know…

View On WordPress

0 notes