#Financial Management Assignment Help

Explore tagged Tumblr posts

Text

All Assignment Help is a comprehensive online platform provided by myassignmentspro.com. With All Assignment Help, students and professionals alike can access expert assistance and guidance for all their academic and professional needs. From essays to research papers to business reports, our team of experienced writers is here to help you succeed in your assignments. We understand the pressures of academia and are dedicated to providing top-notch quality work within tight deadlines. With All Assignment Help, you can trust that your assignments are in good hands and focus on other important aspects of your education or career.

#financial management assignment help#Architecture assignment help#mechanical engineering assignment help#All Assignment Help#history assignment help#macroeconomics assignment help#cipd assignment help#do my assignment#Help with my assignment#My assignment helper#mba financial management assignment help#online architecture assignment help#online mechanical engineering assignment help#all assignment help australia#online history assignment help#history assignment help online#best macroeconomics assignment help

0 notes

Text

Financial Management Assignment Help

Financial management is most likely the most important subject business, commerce, or finance students need to learn. It entails planning, organization, and control within the company. Financial management assignments can prove difficult as the student will be required to break down budgets, research investment opportunities, and interpret complex financial reports. Do not fret if you are having trouble with your assignment. The Tutors Help is available to provide top-notch financial management assignment help.

What Is Financial Management?

Financial management is all concerning careful and effective handling of money. It consists of making financial, budgeting, saving, expenditure, and investment decisions and assessing financial risk. Effective financial management is essential by every firm for growth and flourishing. Students understand how to create company finances, present financial statements, and analyze financial ratios.

But finance is not necessarily easy to understand, especially when tasks relate to numbers, calculations, and real-life situations of money. Therefore, most students require help to complete their assignments correctly and on time.

Issues Students Normally Face

Complex Formulae and Calculations: Finance assignments normally entail complex formulae like Net Present Value (NPV), Internal Rate of Return (IRR), and cost of capital, which are not easy to grasp.

Shortcomings in Concept Clarity: Students will not be able to understand concepts such as capital budgeting, working capital, or financial statement analysis.

Constricted Timetables: Students are most likely given a number of assignments to submit at short time intervals, with no sufficient time for careful work.

Format and Referencing Complications: Financial tasks have strict format and referencing guidelines, unknown to the students.

How The Tutors Help Can Assist You

Here at The Tutors Help, we deliver quality financial management assignment help to simplify your student life. Our finance experts are thoroughly familiar with the subject and can help you achieve higher grades in your course work.

Why Choose Us?

Experts Qualified: Our teachers have good academic qualifications and real-time experience in finance.

Personalized Solutions: We have personalized and customized solutions as per your assignment requirements.

Original Plagiarism-Free Work: We offer original and research-based work so that you can obtain good grades.

Guaranteed Delivery: We respect your time and submit the work on or before the deadline given.

Student-Friendly Prices: Our services are affordable.

Easy Steps to Ask for Help

Send Us Your Assignment: Give us your topic, instructions, and deadline.

Quote Your Assignment: We will give you a reasonable quote for the assignment.

Get Professional Help: Our finance expert will complete your work and submit it perfectly.

Download and Authenticate: We will provide your completed assignment on time.

Conclusion

Financial management is a useful subject that educates you about money in business. But the assignments are difficult. If you are having trouble with your financial management assignment, The Tutors Help can help you.

With the assistance of ours, you are able to study effectively, complete assignments without any hassle, and achieve good marks. You don't need to worry anymore. Chat with The Tutors Help today and get the best assignment help in financial management at your doorstep!

thetutorshelp.com/financial-management-assignment-help.php

0 notes

Text

Save the key concepts, topics and shortcuts you must know in financial management. Get expert financial management assignment help to solve trickiest problems.

0 notes

Text

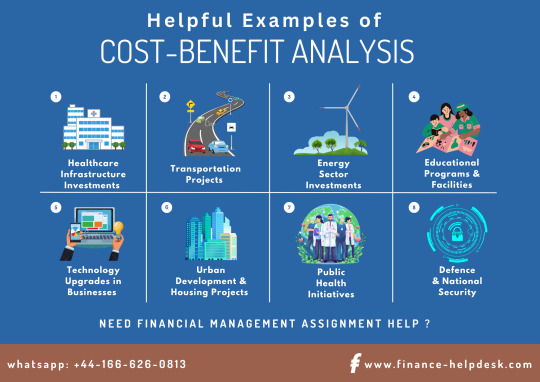

10 Helpful Examples of Cost-Benefit Analysis to Use in Financial Management Assignments

Cost-Benefit Analysis (CBA) is essential in financial management for evaluating the economic viability of projects and investments. For MBA students in financial management, understanding CBA is crucial as it helps in assessing both potential returns and associated costs, ensuring optimal resource allocation. CBA is a key method for determining the value of investments by comparing costs and benefits, aiding managers in deciding if a project is worthwhile. It provides a structured approach to evaluate economic, social, and environmental impacts, crucial in a competitive global economy.

However, students often find CBA challenging due to difficulties in quantifying intangible benefits and costs, the need for accurate data, and forecasting future cash flows. To overcome these challenges, many students seek help from financial management homework help, which offers expert guidance on CBA techniques, enhancing their ability to apply these concepts in real-world scenarios and preparing them for successful careers in financial management.

10 Real-World Examples of Cost-Benefit Analysis in Financial Management

Healthcare Infrastructure Investments

CBA has a significant importance in financial management of a country especially when used in investments in health infrastructure. For example, the establishment of a new hospital requires capital outlay such as land costs, construction and acquisition of equipment. However, the positive impacts include; increased accessibility to health services, increased employment, and overall improvement of welfare among the inhabitants.

One can cite example such as construction of the University Medical Center in New Orleans USA. The project, which cost approximately $1.2 billion, underwent a thorough CBA to justify its feasibility. The assessment included not only the direct costs and advantages but also the potential economic repercussions for the community. It further stated that the hospital would contribute more than $6 billion within a decade in terms of economic contribution and value.

Transportation Projects

CBA is also useful in transportation projects where organizations seek to know if constructing new highways or improving public transport is feasible. A recent example is High-Speed 2 (HS2) railway project in the UK that has faced numerous criticism due to its expenditures. The plan to build a network of linking the British capital to other key cities and towns in in the north has been subjected to extensive CBA.

The expenditure that is to be incurred for the completion of the HS2 project is almost £106 billion. Substantial benefits such as shorter travelling time, increased economic returns and reduction of congestion on the roads were presented in minutest detail. It is important to note that according to the CBA the investment would yield a return of approximately £2.30 for every £1 spent.

Energy Sector Investments

In the energy sector for instance, CBA is very essential for assessing prospective investments in projects in renewable power. For instance, the investment made with the intention of developing offshore wind farms in the UK entails enormous initial expenditures such as those that are incurred on turbines and connection to the grid. This resulted in some advantages such as greenhouse gas emissions, energy security, and long-term cost savings.

Hornsea One offshore wind farm which is one of the largest in the world, went through a rigorous CBA before its construction. The project which cost about £4.2 billion, proposed to yield numerous advantages, including available electricity to more than one million home and playing remarkable role in fulfilling the government renewable energy aspiration of the UK. The positive CBA results ensured that there was no cash crunch to fund the project and adequate political support.

Educational Programs and Facilities

CBA is used in education systems to determine the addition of more facilities or offering new programmes. An example is the spending on online learning solutions by universities across the USA and the UK in the face of the COVID-19 pandemic.

For instance, the University of California made certain improvements in the online education infrastructure. Investments were made towards software development, licensing, training of teachers. The advantages included the continuation of extending educational services during lock down and enhanced enrolment from remote student. The analysis of the case showed that the CBA provided a long-term advantage outweighing short-term expense.

Environmental Conservation Projects

CBA is also commonly used by the governments and NGOs to justify the funding for projects related to environment conservation. For instance, the attempt of restoring the Everglades in Florida, USA, required a huge capital of approximately $8 billion. A number of benefits were observed such as an increase in biological diversity, an increase in the quality of water and an increase in tourism.

The study established that the project would create benefits equivalent to $46 billion in fifty-year time frame, in relation to environment conservation. Such CBAs facilitates acquiring public and private funding in support of environmental projects.

Technology Upgrades in Businesses

Businesses often applies CBA when evaluating the financial feasibility of new technologies. The perfect example of this is the adoption of blockchain technology by numerous banks of UK to streamline their operations and minimize fraud.

The investment made in the technology of blockchain was made to covered the cost of development of the software, the cost of integration of the block chain software to the existing systems, and the cost of staff training. This resulted into decrease of transaction costs, increased security, and enhanced customer trust. The use of CBA indicated the technology would yield more than £1 billion within five years which garnered support to implement.

Urban Development and Housing Projects

Urban development projects, such as the construction of affordable housing, often require a thorough CBA to justify their economic and social benefits. The Crossrail project in London, UK, serves as an excellent example.

The improvement of transportation network within the city required about £18 billion throughout the course of the project. The benefits such as reduction of the time taken in traveling, increase in property value and employment opportunities were discussed. The CBA showed that the project would generate more than £42 billion in economic benefits, making such investment worthy and beneficial.

Public Health Initiatives

CBA is also widely used in public health interventions such as vaccination. For instance, the programme for mass vaccination against Covid-19 in the UK had to go through a stringent CBA evaluation.

This program, which cost billions of pounds, was aimed at vaccinating the entire population of adults. The advantages include decrease in healthcare cost, low mortality and the Economy revival. Using CBA, it was pointed out that the program would generate more than £100 billion in economic benefits by averting sickness and allowing for a faster return to pre-epidemic states.

Corporate Social Responsibility (CSR) Programs

CBA is used commonly by the companies to measure the efficiency of their CSR initiatives. For instance, the Unilever’s Sustainable Living Plan, which looks at its strategies to lessen its negative impact on the environment and to create a positive social impact were done through CBA.

The advantages which included increased customer loyalty, reduction in operational expenses, and adherence to the laid down regulations were weighed against the expenses of practices like the conservation of water and sourcing sustainably. The CBA revealed that the program would generate a profit of more than €12 billion in ten years, helping Unilever to fulfill its sustainability mission.

Defence and National Security Projects

Proposed defense projects, for instance, the development of a new weapon also go through extensive CBA to meet the costs. One recent example is Britain’s investment in F-35 fighter jet.

The program which costs over £9 billion carries benefits such as improved national security, employment and technological development. Further, a CBA showed that the strategic and economic gains accruing from the program outweigh the costs of the investment decisively.

Common Challenges in Understanding Cost-Benefit Analysis

It should be noted that even though CBA is one of the foundational tools in financial management, MBA students can encounter issues with ideas herein. Some of the common issues include:

Quantifying Intangible Costs and Benefits: Valuing qualitative benefits like such as improved employee morale or environmental sustainability, can be difficult.

Data Collection and Accuracy: It is often difficult to acquire authentic data to present an accurate CBA.

Complex Calculations: The mathematical complexity of calculating net present values, internal rates of return, and conducting sensitivity analyses can be difficult for many students.

To overcome these challenges, engaging with our financial management assignment help service can be immensely beneficial.

Improve grades with Our Financial Management Assignment Help!

Stuck with difficult finance coursework or financial management assignments? We offer Financial Management Assignment Help service to make you excel in your academic performance and teaching. Specializing in Cost-Benefit Analysis (CBA), we assist students in manageable financial decision in a simple manner.

Our USP

Our competitive advantage is offering easy to understand material that breaks down complex information into small digestible portions so that students grasp the important concepts related to CBA and other financial management concepts. We have a highly qualified team of individuals who have promising academic credentials and professional experience extending support to all students with their individual needs.

Beyond Cost-Benefit Analysis

Apart from CBA, we offer help in a wide range of financial management topics, including:

Capital Budgeting: Learn how to evaluate potential investments and projects to maximize returns.

Financial Statement Analysis: Understand how to interpret financial statements to assess a company’s performance.

Risk Management: Gain insights into identifying, analyzing, and mitigating financial risks.

Corporate Finance: Master the principles of managing a company’s financial activities.

What You Can Expect in Our Solutions

Every solution we provide is detailed and drafted with the finest detail in order to meet the specifications of your assignment. We provide the soft copies of the reference papers used along with excel files containing the computations. We ensure that only authentic data and figures are used to support the arguments in the solution. Our step-by-step approach not only helps in having a better understanding of the solution but help to secure decent grades.

Take the Leap Towards Excellence. Opt for our financial management assignment help and experience the improvement in your knowledge and overall performance in your course.

Also Read: How a Company Resolved an NPV vs IRR Conflict: A Financial Management Assignment Case Study

Helpful Resources and Textbooks

To further assist students in mastering CBA, here are some recommended textbooks and resources:

"Financial Management: Theory & Practice" by Eugene F. Brigham and Michael C. Ehrhardt

2. "Cost-Benefit Analysis: Concepts and Practice" by Anthony E. Boardman, David H. Greenberg, Aidan R. Vining, and David L. Weimer

0 notes

Text

Financial Management Assignment Help: Achieve Excellence in Finance Studies

Our financial management assignment help service provides expert guidance tailored to students navigating the complexities of finance. From budgeting and financial analysis to risk management and investment strategies, our seasoned professionals offer comprehensive support.

0 notes

Text

Financial Management Assignment Help - Expert Guidance & Assistance

Struggling with your financial management assignments? Get expert guidance and top-notch assistance with our professional financial management assignment help service. Boost your grades today!

0 notes

Text

https://www.articlewood.com/assignment-help-uae-best-writing-service-providers/

#business management assignment help#financial management assignment help#financial management assignment#project management assignment help

0 notes

Text

Financial Management Assignment Help

Financial Management Assignment Help is a valuable resource for students studying finance-related subjects. The complexities of financial management require a deep understanding of concepts like budgeting, investment analysis, risk assessment, and capital structure. This assistance provides students with expert guidance and support to tackle challenging assignments.

0 notes

Text

Kviku a non-banking credit organization that offers online loans in spain. 🇪🇸

providing hassle-free online loans to meet your urgent financial needs.

Instant approved : Finance Apply now

Read more..

#financial#financial planning#finance management#business#credit score#financial freedom#personal loans#credit cards#finance assignment help#moto: spain 2024#madrid spain#philip ii of spain#spa in ajman#hws spain#spa in chennai#spain eurovision#spain football#spain hetalia#spain news#spain hws#spain art#spain 2023#spain#spain travel#spain visa#spain nt#spain without the s#spain women's national team#spain x reader#spainese

3 notes

·

View notes

Text

Working Capital Optimization: Essential Help for Finance Assignments

Introduction: What is Working Capital?

Working capital constitutes a crucial principle in the field of finance, signifying the short-term liquidity position of a firm. It is defined as the difference between an organization's current assets—encompassing cash, inventory, and accounts receivable—and its current liabilities, including accounts payable and short-term debt. In essence, it denotes the financial resources available to the company to facilitate its daily operational needs. Effective working capital management ensures that a company can meet its operational needs and financial obligations, while also channeling available resources to facilitate growth in the company.

Every student or learner involved in finance studies or assignments particularly those that relate to working capital, must understand the factors that explain the working capital. Why? Working capital belongs to the most critical indicators of financial performance since they directly reflect the financial result, availability of funds for operations, and risks involved. Effective management of work capital can enhance or develop efficiency in the business hence enhancing the performance by the firm. For students, to understand these dynamics students are usually tasked to solve various numerical questions to gain insights into the practical financial operations of businesses.

By opting for finance assignment help, students can get to know more about the perspective of working capital optimization and other advanced techniques in the field. This means that one can seek working capital study assistance from professional experts, especially in complex working capital problems as opposed to what is found in textbooks and theories. This involves an opportunity for students to gain a greater understanding of the subject, hence exposing them to applicable strategies for succeeding in their assignments.

Working Capital Optimization: Issue Diagnosis in Details

Working capital optimization can be defined as the means and methods that are used in the management of the short-term assets and liabilities of a business with the aim of ensuring the operations of the firm are done in the most efficient and profitable manner. This also means that there is a fine line to be drawn between the need for liquid assets to meet short-term obligations and bringing down capital expenses.

As regards finance students, it may appear that working capital optimization is quite simple and quite basic as a subject however in a real sense, it is quite an elaborate and complicated subject that can make or break a business. In this regard, we shall look at why working capital optimization is important, how the companies achieve these goals and real cases where companies have demonstrated a working capital optimization impact.

Why Optimize Working Capital?

It is quite evident that working capital management is of great importance for all businesses as it influences many key performance metrics:

Liquidity: Sufficient working capital ensures that the company can perform its short-term obligations in terms of paying off suppliers and employees.

Profitability: Proper working capital management will minimize the capital cost incurred, therefore increasing cash flows available for financing growth and innovation.

Operational Performance: Focused and disciplined working capital management enables businesses to operate more efficiently, decrease waste, and enhance stock control.

Risk Management: Working capital management in a business alleviates the operational risk exposure – Supply Chain risks, economic downturns, and other surprises that a business may experience.

For students, such a study helps to understand the rationale behind the varying impacts of the financial decisions made in a company on its various operations.

Ways on how Working Capital can be Improved

There are various strategies that can be recommended for companies that require improvement of the working capital. These strategies are aimed at ensuring that companies maintain adequate amounts of cash, increase cash inflows, and reduce cash outflows that are unnecessary in the first place.

Inventory Management

Inventory management is one of the key components of working capital management. A firm can enhance its liquidity profile by lowering the total stock holding of unsold products by minimizing excess stocks.

Methods such as JIT manufacturing systems, where products are sourced and produced only when needed. This approach helps companies save on stockholding expenditure and overproduction.

Example: Toyota was able to change the face of the auto industry with the implementation of the manufacturing system called Just In Time (JIT), giving the extra edge of efficiency coupled with a reduction in working capital requirements.

Accounts Receivable Management

Customers paying their bills within the set timeframe is very important. For further optimization of receivables, some credit control measures are often applied such as allowing discounts for early payments or limiting credit for customers with a history of poor payments.

Another approach known as factoring helps in supplementing working capital. This involves receivables sold to a third party thus providing cash flow in a shorter time frame.

Case Study: In its attempt to improve cash flow, General Electric in the year, 2009 commenced sales of parts of its receivables and created 2 billion in capital within a year leading the firm to focus more on growth and investment avenues.

Accounts Payable Management

The payable side is much more interesting. This is about optimizing for the longest period before making any payment ta the supplier without jeopardizing any existing credit or relationships. Cash flow may be enhanced if payment terms can be adjusted without any serious penalty for longer terms.

Purchasers may utilize the assisted financial program to make early payments to their suppliers through financial institutions, while the purchaser gets extended terms to preserve working capital.

Example: Walmart has entered into extended payment terms with its suppliers to preserve its working capital for longer terms.

Cash Management

Firms need to ensure that there is an optimal cash reserve committed to the working capital requirements and also minimize cash that is idle earning no returns.

Firms utilize sweeping mechanisms, in which the excess cash is transferred to an interest-bearing account thereby making returns out of excess cash and at the same time preserving liquidity.

Example: Microsoft is well known for its cash management practices. The world’s biggest computer software company has for many years managed to keep positive working capital instead of spending it on many things and maintains generous cash reserves for investments, buying back stock, and paying dividends.

The Role of Working Capital Management

The effect of working capital optimization is not limited to the enhancement of liquidity and cash flow alone. This is capable of reinventing the potential of a company for growth and competitiveness within the industry.

Better Financial Condition: Reduction in the amounts tied up in working capital positively impacts the company's operating cycle and the balance sheet. Improvement in some of the operational ratios such as current and quick ratios is also observed. This subsequently increases the creditworthiness and the cost of borrowing reduces.

Secure Superior Position: Efficient working capital allows organizations to respond to changes in the market more effectively. For instance, they will be able to take advantage of bulk buying discounts and invest in new opportunities more quickly than its competitors.

Recovery from Impacts: When the economy is going through difficult times, the likelihood of companies that strategically manage their working capital to manage disruptions. For instance, during the most recent period when the majority of the companies were in a cash liquidity crisis due to covid19 pandemic, companies that effectively managed cash flows survived.

Long-Term Development: Firms can free up cash from operational efficiency which then allows them to seek more growth opportunities like R&D, marketing, or expansion. Optimization of working capital, therefore, becomes the initial move towards the attainment of competitive advantage in due time.

Case Example: Apple Inc.

Apple Inc. is probably the most referenced case when it comes to the optimization of working capital. This has been made possible because of the peculiarities in the businesses of Apple-it is able to maintain working capital which is negative by collecting money from customers before it pays suppliers. This offers the company a huge liquidity edge and a key reason behind its financial performance.

Due to Apple’s excellent supply chain management processes and beneficial contractual payment agreements with suppliers, the company does not require additional working capital. Such a strategy releases massive amounts of cash flow, which Apple has invested in R&D, advertising, and acquisitions. As a result, Apple has grown and become a market leader.

Expert Finance Assignment Help for MBA Students

Our finance assignment assistance service is primarily directed toward MBA students who are having a tough time comprehending and practicing difficult areas such as working capital management. We offer detailed, individualized help to students in dealing with difficult assignments, case studies, and analysis.

As for complicated financial topics including working capital optimization, our company employs seasoned financial specialists with expertise in sophisticated techniques on liquidity, cash flow, and operational efficiency management. We break down these concepts into simple steps for students to facilitate their understanding of the theory and practical aspects of the problem. Our aim is not only to assist the learners in solving practical problems but help them learn how and when to utilize these techniques when they face real financial problems.

How Our Service Makes Complex Financing Problems Simple

We use a combination of visuals, like flowcharts and financial models in order to simplify difficulties in complicated financial problems. By demonstrating the relation between the problem to its financial theory, we make sure that students never miss any important aspect of the solution. We offer tailored solutions for case studies and give in-depth information on different working capital strategies used by top companies. This helps students understand how to use these strategies in their studies.

More Sophisticated Techniques and Wider Scope

We introduce students to new and improved methods that they can adopt in solving questions that go beyond the basics of financial management. Among those advanced techniques include; modeling of dynamic working capital, cash conversion optimization, and enhancing working capital with financial technologies.

Apart from working capital optimization, we also offer finance assignment assistance in a wide range of subjects including but not limited to:

Corporate Finance

Risk Management

Investment Analysis

Financial Statement Analysis

Capital Budgeting

Mergers & Acquisitions

Benefits for MBA Students:

Many students ask the question: “Why should I choose your service?” The explanation is that they not only get custom-made solutions that enable them to complete their tasks in due time but also enhance their grasp of contemporary financial principles. Our specialists always give new ideas to the students to enable them to apply in their coursework assignments for top grades.

Conclusion:

Working capital management is an important aspect of financial management. This influences liquidity and profitability as well as risk factors. Students studying finance must learn the concepts to have a deeper understanding of the practical issues of business functioning. By opting for our service and getting help with finance assignments, students can learn from experts and understand important topics better. We provide sample problems, case studies, textbooks, and research papers to help students complete their assignments confidently and clearly.

Textbooks and References for Students

For students who want to undertake deeper studies in the area of working capital optimization, the is a selection of relevant textbooks and some research papers that lay a good base.

One such textbook is “Financial Management: Theory and Practice” by Eugene F. Brigham & Michael C. Ehrhardt.– This particular book attempts to explain the fundamentals of why decisions are made financially with reasonable chapters on working capital management.

Corporate Finance Jonathan Berk and Peter DeMarz– A commonly recommended textbook, which considers some of the working capital management aspects among other principles of financial management.

#Financial analysis homework help#Help with finance projects#Personal finance assignment assistance#Financial management homework help#Online finance tutoring services#Finance case study assistance#International finance assignment help#Accounting and finance assignment help#Financial modeling assignment support

0 notes

Text

Timely, Accurate, and Affordable History Assignment Help – Only at MyAssignmentsPro.com!

History is one of the most intriguing academic disciplines. It offers a window into the past, helping us understand the evolution of societies, cultures, economies, and governments. But as fascinating as history is, writing assignments on it can be daunting. From memorizing dates and analyzing historical contexts to constructing arguments and referencing sources correctly—history assignments demand both time and precision.

If you’re a student struggling with tight deadlines, complex topics, or the pressure to maintain high academic standards, MyAssignmentsPro.com is your reliable partner. We offer timely, accurate, and affordable online history assignment help tailored to students across all educational levels. Whether you’re tackling high school history or advanced university-level research, our expert team is here to help you succeed.

Why History Assignments Can Be Challenging

History assignments are not just about retelling events. They require a strong understanding of cause-and-effect relationships, historical debates, primary sources, and critical interpretation. Here are a few reasons students often seek help:

Complex Topics: Subjects like the French Revolution, World Wars, Cold War politics, ancient civilizations, and post-colonial history require deep knowledge and analytical skills.

Time Constraints: Balancing multiple courses, jobs, or personal responsibilities often makes it hard to meet deadlines.

Referencing Issues: History assignments often require detailed citations from primary and secondary sources using styles like Chicago, Harvard, APA, or MLA

Language Barriers: For international students, understanding historical texts and writing clear, concise arguments in English can be a struggle.

That’s where MyAssignmentsPro.com makes a difference.

What Makes MyAssignmentsPro.com the Best Choice?

At MyAssignmentsPro.com, we combine academic excellence with student-friendly services to provide unmatched support. Here’s how we help you ace your history assignments:

1. Expert History Scholars

Our team consists of professional academic writers with degrees in history, political science, and related fields. Whether you need help with ancient civilizations, European monarchies, African history, or modern political movements, we assign your work to someone who truly understands the topic and academic expectations.

2. Customized Solutions for Every Topic

We don’t believe in one-size-fits-all solutions. Every history assignment we deliver is:

Custom-written from scratch

Aligned with your syllabus and instructions

Properly structured with arguments, analysis, and evidence

Backed by credible sources and references

From essays and reports to research papers and case studies, we handle it all with care.

3. Timely Delivery – No Matter the Deadline

Missed deadlines can mean lost grades. At MyAssignmentsPro.com, we understand the urgency of academic timelines. Our experts work efficiently to ensure you get your history assignment:

Well before the due date

With time to review and request changes if needed

Without compromising on quality

Even if your submission is just a few hours away, we’ve got your back.

4. 100% Original, Plagiarism-Free Work

We take academic integrity seriously. Every history assignment we deliver is:

Written from scratch

Checked through plagiarism detection software

Accompanied by proper citations and referencing

Tailored to reflect your voice and style (if requested)

You can submit your work confidently, knowing it's completely authentic.

5. Affordable for Every Student

We know students often work within tight budgets. That’s why our pricing is:

Transparent – no hidden fees

Flexible – with discounts for bulk orders and returning clients

Affordable – so you don’t have to break the bank for quality academic help

Our goal is to make academic support accessible to everyone.

6. 24/7 Customer Support

Got a late-night question or a sudden update from your professor? No problem. Our customer service team is available 24/7 to:

Answer your queries

Provide updates on your order

Assist with revisions or urgent requests

Help you place new orders with ease

Studying history helps us understand how our present world came to be. But writing about it effectively takes skill, time, and research. If you’re overwhelmed with deadlines, confused by complex topics, or just aiming for better grades, MyAssignmentsPro.com is here to help.

With a focus on timeliness, accuracy, and affordability, we’re committed to being your most trusted academic partner. Let us take the stress out of your history assignments so you can focus on what matters most—learning and succeeding.

#financial management assignment help#Architecture assignment help#mechanical engineering assignment help#All Assignment Help#history assignment help#macroeconomics assignment help#cipd assignment help#do my assignment#Help with my assignment#My assignment helper#mba financial management assignment help#online architecture assignment help#online mechanical engineering assignment help#all assignment help australia#online history assignment help#history assignment help online#best macroeconomics assignment help

0 notes

Text

Order your financial management assignment help online in Australia. Call our expert writers by Request Call Back

0 notes

Text

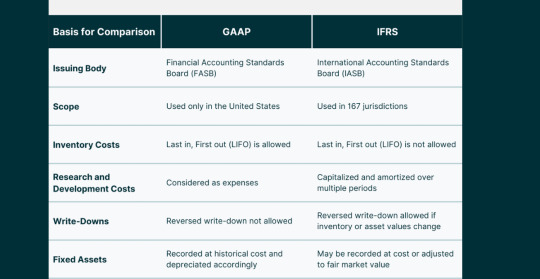

GAAP vs IFRS

Decoding US Accounting Rules: GAAP vs IFRS | Expert Insights in 2024

Navigate the GAAP vs IFRS debate in US Accounting effortlessly. Gain expert insights, make sense of regulations. Your guide to financial clarity.

The evolving landscape of accounting standards unfolds a nuanced debate between the Generally Accepted Accounting Principles and the International Financial Reporting Standards. These two frameworks, while sharing a common goal of transparent financial reporting, diverge in their approaches, giving rise to a multifaceted discourse with far-reaching implications for the financial world.

1. Introduction

The evolution of accounting standards has witnessed the crystallization of two dominant frameworks – General Accounting Accepted Principles and International Financial Reporting Standards. In the labyrinth of financial reporting, companies grapple with choosing between these standards, each with its unique history, principles, and global relevance. The debate surrounding GAAP vs IFRS is not a mere academic exercise but a pivotal consideration with implications for investment decisions, legal compliance, and the global financial landscape.

1.1. Evolution of Accounting Standards

The journey of accounting standards traces back to the aftermath of the 1929 stock market crash when the need for standardized, transparent financial reporting became glaringly apparent. What emerged were the General Accounting Accepted Principles, designed to restore investor confidence by providing a reliable framework for financial statements. Over time, GAAP has become deeply embedded in the U.S. financial system, shaping the way companies communicate their financial health.

On the global stage, the International Financial Reporting Standards evolved as a response to the growing interconnectedness of economies. The International Accounting Standards Board (IASB) took the reins in developing IFRS, aiming for a standardized global language of financial reporting. This set the stage for a two-pronged approach to financial reporting standards – General Accounting Accepted Principles dominating in the U.S. and International Financial Reporting Standards gaining traction internationally.

1.2. The Crucial Role of GAAP and IFRS

GAAP stands as the bedrock of accounting standards in the United States, overseen by the Financial Accounting Standards Board (FASB). Its principles, rooted in historical cost, revenue recognition, and matching, provide stability and a familiar structure for U.S. businesses. On the other hand, IFRS, under the stewardship of the IASB, operates as a global player, emphasizing fair value, substance over form, and materiality.

The significance of General Accounting Accepted Principles lies in its historical context and its alignment with the unique needs of the U.S. business environment. Its principles have served as a guiding light for American companies, offering a consistent framework for financial reporting. International Financial Reporting Standards, with its global perspective, caters to the interconnectedness of today’s businesses, providing a common language for multinational corporations.

1.3. Navigating the GAAP vs IFRS Dilemma

The choice between General Accounting Accepted Principles and International Financial Reporting Standards is not a one-size-fits-all decision. Companies grapple with a complex decision-making process, considering factors such as their geographical reach, industry nuances, and investor preferences. This debate is not isolated to boardrooms; it resonates in financial markets, legal proceedings, and regulatory landscapes, shaping the very fabric of financial reporting practices.

2. Understanding GAAP

2.1. The Foundation of GAAP

a. Historical Roots and Evolution

GAAP’s roots delve deep into the need for a standardized accounting framework post the 1929 stock market crash. FASB emerged as a response to the chaos that ensued, charged with the responsibility of establishing and improving financial accounting and reporting standards. The journey of GAAP has been one of continuous evolution, adapting to the changing business landscape and regulatory requirements.

b. FASB’s Ongoing Influence

The Financial Accounting Standards Board (FASB) stands as the guardian of GAAP, playing a pivotal role in setting and refining accounting standards. FASB’s mission goes beyond rule-making; it seeks to improve financial reporting, providing transparency and relevance in financial statements. The ongoing influence of FASB ensures that GAAP remains adaptive and responsive to the dynamic nature of business transactions.

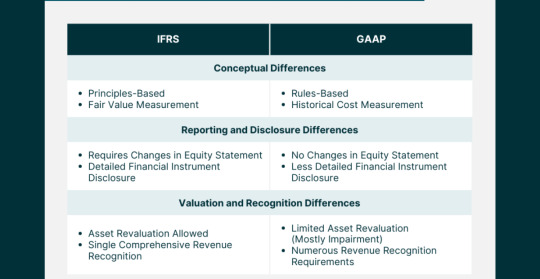

2.2. Core Principles Anchoring GAAP

a. Embracing the Historical Cost Principle

One of the cornerstones of GAAP is the historical cost principle, dictating that assets should be recorded at their original cost. This principle provides stability and reliability in financial statements, allowing users to assess the financial health of a company based on the actual cost of its assets at the time of acquisition. While critics argue that this approach may not reflect current market values, proponents emphasize the prudence and consistency it offers.

b. Revenue Recognition as a Cornerstone

GAAP’s approach to revenue recognition centers on the realization and earned criteria. Revenue is recognized when it is realized or realizable and earned. This conservative approach ensures that revenue is not prematurely recognized, aligning with the matching principle. While this method may defer recognizing revenue until later stages in the sales cycle, it safeguards against potential overstatement and presents a cautious picture to investors.

c. The Significance of the Matching Principle

The matching principle is a guiding force in GAAP, emphasizing the alignment of expenses with the revenue they generate. This principle ensures that the costs associated with generating revenue are recognized in the same period as the revenue itself, presenting a more accurate portrayal of a company’s profitability. While adhering to the matching principle might result in lower reported profits during high-revenue periods, it provides a more realistic long-term view.

2.3. Scrutinizing Criticisms and Recognizing Limitations

a. Rigidity vs. Stability

One common criticism leveled against GAAP is its perceived rigidity, particularly regarding the historical cost principle. Critics argue that this approach may not capture the true economic value of assets, especially in industries with rapidly changing market conditions. However, proponents assert that this rigidity provides stability and consistency, allowing for easier comparison across periods and industries.

b. The Balancing Act of Revenue Recognition

The conservative approach to revenue recognition in GAAP has faced scrutiny for potentially understating a company’s immediate financial performance. Critics argue that this caution may not be reflective of a company’s true economic position, especially in industries where revenue realization is instantaneous. However, the balancing act lies in mitigating the risk of premature revenue recognition, ensuring financial statements maintain integrity and accuracy.

c. Challenges in Adhering to the Matching Principle

While the matching principle aligns expenses with revenue, critics contend that it introduces complexities in determining the direct association between costs and specific revenue streams. This challenge becomes more pronounced in industries with diverse revenue sources. Despite these challenges, adhering to the matching principle remains integral in presenting a holistic view of a company’s financial health, helping investors make informed decisions.

3. Embracing IFRS

3.1. IFRS: A Global Framework

a. The Rise of International Financial Reporting Standards

The emergence of IFRS marks a significant shift towards a globalized approach to financial reporting. As businesses expanded internationally, the need for a common accounting language became evident. IFRS, under the stewardship of the International Accounting Standards Board (IASB), rose to prominence as a framework that transcends borders, providing a standardized set of principles for companies operating on the world stage.

b. IASB’s Pivotal Role in Shaping IFRS

The International Accounting Standards Board (IASB) shoulders the responsibility of developing and maintaining IFRS. Unlike GAAP, IFRS operates under a principles-based approach, focusing on broad principles rather than detailed rules. This flexibility allows for easier adaptation to diverse business environments, making IFRS an attractive choice for multinational corporations seeking a harmonized approach to financial reporting.

3.2. Unpacking Core Principles of IFRS

a. Fair Value Measurement: A Paradigm Shift

One of the fundamental differences between GAAP and IFRS lies in the approach to asset valuation. While GAAP predominantly adheres to the historical cost principle, IFRS leans towards fair value measurement. Fair value reflects the current market value of assets, providing a more dynamic and responsive perspective. Critics argue that fair value introduces volatility, but proponents emphasize its relevance in capturing real-time economic conditions.

b. Substance Over Form: Emphasizing Economic Reality

In IFRS, the substance of transactions takes precedence over their legal form. This principle ensures that financial statements reflect the economic reality of transactions, promoting transparency and accuracy. While this approach aligns with the overarching goal of providing relevant information to users, it requires careful judgment and interpretation, potentially introducing subjectivity in financial reporting.

c. Materiality’s Role in Flexibility

IFRS introduces greater flexibility in materiality judgments compared to GAAP. Materiality refers to the threshold at which information becomes relevant to users. The more flexible stance in IFRS allows entities to exercise judgment in determining what information is material, considering both quantitative and qualitative factors. This flexibility, while enhancing the adaptability of IFRS, also raises concerns about potential inconsistencies in financial reporting.

3.3. Weighing Advantages and Drawbacks

a. IFRS Flexibility: A Double-Edged Sword

The flexibility embedded in IFRS is both its strength and weakness. Proponents argue that this adaptability makes IFRS suitable for diverse business environments, allowing for easier integration with various industries and legal systems. However, critics contend that this very flexibility can lead to inconsistencies and a lack of comparability, challenging the reliability of financial statements for investors and stakeholders.

b. Global Appeal vs. Application Challenges

The global nature of IFRS makes it an attractive choice for multinational companies aiming for consistency in financial reporting across borders. The common language of IFRS facilitates international transactions and fosters a seamless global financial landscape. However, the application of IFRS can pose challenges in jurisdictions with varying legal and regulatory frameworks, potentially leading to complexities in implementation and interpretation.

4. Key Differences Between GAAP and IFRS

4.1. Delving into Variances

a. Revenue Recognition: The GAAP-IFRS Divergence

One of the pivotal differences between GAAP and IFRS lies in the recognition of revenue. While both frameworks aim to depict the economic reality of transactions, their approaches diverge in certain key aspects. GAAP tends to be more prescriptive, providing specific guidelines for various industries, whereas IFRS adopts a broader principles-based approach, allowing entities more room for interpretation.

b. Inventory Valuation: Differing Approaches

The treatment of inventory valuation varies significantly between GAAP and IFRS. GAAP typically follows a specific set of rules for valuing inventory, such as the Last In, First Out (LIFO) or First In, First Out (FIFO) methods. In contrast, IFRS permits the use of various methods, including FIFO and weighted average, offering companies more flexibility in choosing an approach that aligns with their specific business dynamics

c. Consolidation Methods: Navigating Complexity

Consolidation methods, particularly in the context of subsidiaries and investments, showcase differences between GAAP and IFRS. GAAP often employs a more rule-based approach, specifying conditions for consolidation. In contrast, IFRS focuses on a principles-based approach, considering the substance of relationships rather than relying on rigid criteria. This variance introduces nuances in financial reporting, influencing how companies present their financial position and performance.

4.2. The Impact on Financial Statements

a. Shaping Investor Perception

The differences in revenue recognition, inventory valuation, and consolidation methods contribute to variations in financial statements produced under GAAP and IFRS. Investors, as key stakeholders, must navigate these differences to gain an accurate understanding of a company’s financial health. The choice between GAAP and IFRS significantly shapes investor perception, influencing investment decisions and risk assessments.

b. Decision-Making Dynamics

Companies, in choosing between GAAP and IFRS, must consider the implications on decision-making dynamics. The framework adopted affects how financial information is presented, potentially influencing strategic decisions, mergers and acquisitions, and capital-raising activities. Understanding the impact of these frameworks on decision-making is crucial for entities operating in dynamic and competitive business environments.

4.3. Global Adoption Trends: A Comparative Analysis

The adoption trends of GAAP and IFRS provide insights into the global dynamics of financial reporting standards. While GAAP maintains dominance within the United States, IFRS has gained traction in numerous jurisdictions worldwide. Understanding the factors influencing these trends, such as regulatory requirements, investor preferences, and global market integration, sheds light on the evolving landscape of accounting standards.

“Accounting isn’t just about profits and losses; it’s about sculpting the financial soul of a company.” Michael Johnson

5. The Evolution of Accounting Standards

5.1. GAAP’s Historical Odyssey

a. Post-1929: A Catalyst for Change

The stock market crash of 1929 served as a catalyst for rethinking the approach to financial reporting. The chaos that ensued prompted the establishment of standardized accounting principles, laying the foundation for what would later become GAAP. The primary goal was to restore investor confidence by providing a reliable framework for financial statements, reducing uncertainty and fostering stability in financial markets.

b. Amendments and Updates: Shaping GAAP’s Trajectory

GAAP’s journey has not been static; it has evolved through amendments and updates to address emerging challenges and align with changing business dynamics. The Financial Accounting Standards Board (FASB) plays a pivotal role in shaping GAAP, ensuring that it remains relevant, transparent, and responsive to the needs of companies and investors. The ongoing commitment to refinement reflects a dedication to maintaining the integrity of financial reporting.

5.2. Internationalization Efforts

a. Pioneering Attempts at Global Standardization

As globalization gained momentum, so did the recognition of the need for global accounting standards. Efforts were made to align U.S. GAAP with international standards, but achieving a universal standard proved challenging. The push for global standardization gained traction with the rise of IFRS, offering a framework that transcends national boundaries and facilitates consistency in financial reporting for multinational corporations.

b. The Challenge of Aligning U.S. Standards Globally

While the concept of global accounting standards gained support, aligning U.S. GAAP with international standards presented formidable challenges. The unique legal, regulatory, and cultural landscape in the United States posed hurdles to seamless integration. Despite these challenges, the pursuit of convergence and harmonization continued, reflecting the recognition of the interconnectedness of global economies.

5.3. Convergence Initiatives

a. The Ongoing Pursuit of Harmonization

Convergence initiatives aimed at harmonizing GAAP and IFRS gained prominence in the early 21st century. The objective was to reduce disparities between the two frameworks, fostering a more standardized global approach to financial reporting. While full convergence remained elusive, progress was made in aligning specific standards, reflecting a commitment to minimizing inconsistencies and facilitating ease of comparison for investors and stakeholders.

b. Prospects and Hurdles in a Unified Global Standard

The prospects of a unified global accounting standard remain a tantalizing goal, promising enhanced comparability and consistency in financial reporting. However, hurdles such as divergent national interests, legal complexities, and varying levels of standard-setting infrastructure continue to challenge the realization of this vision. Navigating these obstacles requires ongoing collaboration and a commitment to the overarching goal of global financial transparency.

6. Regulatory Bodies Influencing GAAP

6.1. FASB’s Pivotal Role

a. GAAP’s Guardian: The FASB Mandate

The Financial Accounting Standards Board (FASB) stands as the guardian of GAAP, wielding influence over the development and refinement of accounting standards. FASB’s mandate goes beyond rule-making; it encompasses a commitment to improving financial reporting, ensuring that standards are not only relevant but also responsive to the evolving needs of businesses and investors.

b. FASB’s Mission in Financial Reporting Improvement

FASB’s mission revolves around the improvement of financial reporting through the development of high-quality accounting standards. The board operates under a due process system, seeking input from various stakeholders, including investors, auditors, and preparers of financial statements. This collaborative approach ensures that GAAP remains a robust and adaptive framework that reflects the intricacies of modern business transactions.

6.2. SEC’s Watchful Eye

a. SEC’s Authority in Recognizing GAAP Standards

The Securities and Exchange Commission (SEC) plays a crucial role in the oversight of financial reporting in the United States. While the FASB sets accounting standards, the SEC has the authority to recognize and prescribe the principles used in the preparation of financial statements for publicly traded companies. This dual-layered system ensures a balance between industry expertise and regulatory oversight in shaping GAAP.

b. SEC’s Contributions to Financial Transparency

The SEC’s contributions to financial transparency extend beyond its recognition of GAAP standards. The commission actively engages in rule-making and enforcement to ensure that companies adhere to accounting principles and provide accurate and timely financial information to investors. The synergy between the SEC and FASB reinforces the integrity of financial reporting in the U.S. capital markets.

6.3. AICPA’s Industry Impact

a. AICPA: Nurturing Professional Standards

The American Institute of Certified Public Accountants (AICPA) plays a vital role in shaping professional standards within the accounting industry. While not directly involved in setting GAAP, the AICPA contributes to the development of ethical and professional standards that guide the conduct of accountants. This commitment to excellence enhances the credibility of financial reporting, reinforcing the trust that stakeholders place in GAAP.

b. Industry-Wide Compliance through AICPA Guidance

The AICPA’s influence extends beyond standards development to encompass industry-wide compliance. The organization provides guidance on best practices, ethical considerations, and emerging issues within the accounting profession. This guidance ensures a cohesive and ethical approach to financial reporting, aligning with the principles embedded in GAAP and contributing to the overall reliability of financial statements.

7. International Bodies Shaping IFRS

7.1. IASB’s Global Mandate

a. IASB’s Significance in IFRS Development

The International Accounting Standards Board (IASB) holds a central role in the development and maintenance of IFRS. Unlike the FASB’s role in the U.S., the IASB operates on a global scale, aiming to set accounting standards that are applicable and relevant to entities worldwide. The IASB’s commitment to a principles-based approach reflects its recognition of the diverse needs of global businesses.

b. A Global Perspective in Standard Setting

The IASB’s global perspective is intrinsic to its standard-setting process. The board considers input from various regions, industries, and stakeholders, ensuring that IFRS reflects the nuances of international business. The principles-based approach allows for adaptability, catering to the diverse legal, economic, and cultural landscapes in which entities operate globally.

7.2. IFRIC’s Interpretative Role

a. Navigating Grey Areas: IFRIC’s Guidance

The International Financial Reporting Interpretations Committee (IFRIC) plays a crucial role in navigating interpretative challenges within IFRS. Given the principles-based nature of IFRS, grey areas may arise, requiring clarification and guidance. IFRIC addresses these challenges by providing interpretations and guidance, ensuring consistent application of IFRS standards across diverse industries and jurisdictions.

b. Consistent Application of IFRS Standards

Consistency in the application of IFRS standards is paramount to ensuring comparability and reliability in financial reporting. IFRIC’s interpretative role contributes to this objective by offering guidance on ambiguous or complex issues. This commitment to clarity and consistency aligns with the overarching goal of IFRS – to provide a common language for financial reporting that transcends geographical and industry-specific boundaries.

7.3. Monitoring Board’s Oversight

a. Ensuring Independence in Standard Setting

The Monitoring Board plays a crucial oversight role in ensuring the independence and effectiveness of the IFRS Foundation, which houses the IASB. Independence is a cornerstone of credible standard-setting, and the Monitoring Board’s role is to safeguard the integrity of the standard-setting process. This commitment to independence reinforces the trust that global stakeholders place in IFRS as a reliable and unbiased framework.

b. The Role of the Monitoring Board in IFRS Integrity

The Monitoring Board’s vigilance extends beyond independence to the broader integrity of the IFRS framework. By overseeing the activities of the IFRS Foundation and IASB, the Monitoring Board contributes to the credibility of IFRS as a global accounting standard. This oversight ensures that IFRS continues to meet the evolving needs of global financial markets and remains a trusted framework for transparent financial reporting.

8. Impact on Financial Reporting

8.1. Side-by-Side Comparison

a. Financial Statement Variances: GAAP vs IFRS

A side-by-side comparison of financial statements prepared under GAAP and IFRS reveals variances arising from differences in principles, approaches, and interpretations. These variances extend to revenue recognition, asset valuation, and consolidation methods, influencing the reported financial position and performance of entities. Investors and analysts must navigate these differences to glean accurate insights into a company’s financial health.

b. Interpretation Challenges for Investors

Investors face interpretation challenges when analyzing financial statements prepared under different frameworks. Understanding the nuances of GAAP and IFRS differences is crucial for making informed investment decisions. The ability to discern how specific accounting choices impact financial metrics empowers investors to evaluate risks, assess potential returns, and navigate the complexities of the global investment landscape.

8.2. Revenue Recognition Dynamics

a. The Nuances of Revenue Recognition

The nuances of revenue recognition under GAAP and IFRS reflect the underlying philosophies of each framework. GAAP, with its prescriptive guidelines, provides specific criteria for recognizing revenue in various industries. In contrast, IFRS adopts a broader approach, emphasizing the substance of transactions over rigid rules. Navigating these nuances requires a deep understanding of industry dynamics and the specific requirements of each framework.

b. Implications for Investor Decision-Making

The implications of revenue recognition dynamics extend to investor decision-making. Differences in when and how revenue is recognized can influence perceptions of a company’s immediate financial performance. Investors must factor in these nuances to make informed decisions, considering the impact on key financial metrics such as earnings per share, profit margins, and return on investment.

8.3. Asset Valuation Approaches

a. Valuation Philosophies: Fair Value vs. Historical Cost

The variance in asset valuation philosophies between GAAP and IFRS introduces complexities in financial reporting. GAAP’s adherence to historical cost provides stability and consistency, albeit potentially understating the current market value of assets. In contrast, IFRS’s emphasis on fair value introduces a more dynamic and responsive approach to asset valuation. Companies must navigate the trade-offs between stability and accuracy in presenting their financial position.

b. Balancing Accuracy and Stability in Asset Reporting

Balancing accuracy and stability in asset reporting requires careful consideration of the trade-offs between fair value and historical cost. Companies must weigh the benefits of presenting current market values against the potential volatility introduced by fair value measurements. Striking the right balance ensures that financial statements accurately reflect the economic reality of a company’s assets while providing stakeholders with a stable and reliable foundation for decision-making.

9. Challenges in Adoption

9.1. Corporate Resistance Factors

a. Unpacking Corporate Hesitations

The decision to adopt new accounting standards, whether transitioning from GAAP to IFRS or vice versa, is met with corporate hesitations. Companies fear the potential disruptions, costs, and uncertainties associated with the transition. Understanding these resistance factors is essential for regulatory bodies, standard-setters, and industry stakeholders to develop strategies that facilitate smoother adoptions and ensure widespread compliance.

b. Overcoming Corporate Resistance Challenges

Overcoming corporate resistance challenges requires a multi-faceted approach. Clear communication on the benefits of the new standards, comprehensive training programs, and support mechanisms can alleviate concerns. Regulators and standard-setters must collaborate with industry representatives to address specific challenges faced by different sectors, fostering a cooperative environment conducive to successful adoptions.

9.2. Implementation Costs

a. Financial and Operational Impacts

The implementation of new accounting standards incurs financial and operational impacts for companies. Costs associated with staff training, system upgrades, and adjustments to internal processes contribute to the overall financial burden. Companies must carefully assess these costs and develop comprehensive implementation plans to mitigate disruptions and ensure a seamless transition to the new standards.

b. Strategies for Mitigating Implementation Costs

Strategies for mitigating implementation costs involve proactive planning, phased adoption approaches, and leveraging technology. Companies can benefit from engaging with industry peers that have successfully navigated similar transitions, learning from best practices and challenges. Collaboration between standard-setters, regulatory bodies, and industry associations plays a crucial role in developing strategies that balance the need for improved standards with the practicalities of implementation.

9.3. Training and Skill Gaps

a. The Need for Specialized Training

The adoption of new accounting standards introduces the need for specialized training to ensure that professionals possess the skills required for compliance. Training programs must address the nuances of the new standards, focusing on changes in accounting principles, reporting requirements, and the application of new methodologies. Bridging skill gaps is crucial for maintaining the integrity and accuracy of financial reporting.

b. Collaborative Approaches to Skill Development

Collaborative approaches to skill development involve partnerships between educational institutions, professional organizations, and industry players. The goal is to create comprehensive training programs that equip professionals with the knowledge and skills necessary for successful compliance. Standard-setters and regulators can play a pivotal role in promoting and endorsing such collaborative initiatives, fostering a culture of continuous learning within the accounting profession.

10. Legal Implications for Corporations

10.1. Legal Challenges in GAAP Compliance

a. Litigation Risks in GAAP Adherence

The legal challenges associated with GAAP compliance include litigation risks arising from alleged non-compliance. Companies adhering to GAAP must navigate the complexities of the legal landscape, ensuring that their financial statements withstand scrutiny. Implementing robust internal controls, engaging in transparent communication, and staying abreast of legal developments are essential strategies for mitigating litigation risks.

b. Strategies for Legal Compliance in GAAP

Strategies for legal compliance in GAAP involve proactive measures to minimize litigation risks. This includes fostering a culture of compliance within the organization, conducting regular internal audits, and seeking legal counsel to ensure alignment with evolving regulations. Companies that prioritize legal compliance contribute to the overall stability and trustworthiness of the financial reporting ecosystem.

10.2. Legal Battles in IFRS Adoption

a. Navigating Legal Challenges in IFRS Transition

The transition to IFRS introduces legal battles that companies must navigate effectively. Disputes may arise over interpretations of IFRS standards, potentially leading to litigation. Companies must engage in comprehensive risk assessments, understanding the legal implications of IFRS adoption, and implementing measures to mitigate potential legal challenges.

b. Legal Safeguards for Companies Adopting IFRS

Legal safeguards for companies adopting IFRS involve proactive steps to minimize legal risks. This includes engaging legal experts in the transition process, conducting impact assessments, and implementing robust governance structures. Companies that prioritize legal safeguards position themselves to navigate the complexities of IFRS adoption with resilience and integrity.

10.3. Risk Mitigation Strategies

a. Legal Safeguards: Mitigating Risks in Regulatory Compliance

Legal safeguards play a pivotal role in mitigating risks associated with regulatory compliance. Companies must implement effective risk management strategies, including regular legal audits, compliance training, and a responsive approach to legal developments. A proactive stance towards legal safeguards enhances a company’s ability to navigate the intricate landscape of financial reporting standards.

b. Strategies for Minimizing Legal Challenges in Reporting Standards

Strategies for minimizing legal challenges in reporting standards involve a holistic approach to risk management. This includes collaboration with legal professionals, staying informed about evolving regulations, and fostering a culture of compliance within the organization. Companies that prioritize these strategies not only mitigate legal challenges but also contribute to the overall reliability and credibility of financial reporting standards.

11. Investor Perspectives

11.1. Investor Preferences

a. Surveying Investor Preferences: GAAP or IFRS?

Understanding investor preferences is crucial in the GAAP vs. IFRS discourse. Surveys play a valuable role in gauging investor sentiment and preferences regarding financial reporting standards. The insights gleaned from such surveys inform standard-setters, regulators, and companies in aligning financial reporting practices with investor expectations.

b. Implications of Investor Preferences on Reporting Standards

The implications of investor preferences on reporting standards are far-reaching. Companies that align with investor preferences enhance transparency and communication, fostering trust and confidence. Standard-setters and regulators, informed by investor feedback, can shape standards that not only meet regulatory requirements but also cater to the information needs of investors in a dynamic and competitive market.

11.2. Impact on Investment Decision-Making

a. Investor Decision Dynamics: GAAP vs IFRS

Investor decision dynamics are influenced by the choice between GAAP and IFRS. Differences in financial reporting standards can impact the comparability of financial statements, influencing investment decisions. Investors must consider the implications of these standards on key metrics, risk assessments, and overall financial analysis to make informed and strategic investment decisions.

b. Strategic Impacts on Investment Choices

The strategic impacts of financial reporting standards on investment choices go beyond compliance. Companies that recognize the link between transparent financial reporting and investor confidence gain a strategic advantage. Similarly, investors who factor in the nuances of GAAP and IFRS differences in their decision-making processes navigate the complexities of the investment landscape more effectively.

11.3. Investor Education Initiatives

a. The Imperative of Investor Education

The imperative of investor education underscores the need for initiatives that enhance investor understanding of financial reporting standards. Educational programs, informational resources, and collaborative efforts between financial institutions and regulatory bodies contribute to a more informed investor community. An educated investor base not only demands higher standards of transparency but also actively participates in shaping the future trajectory of financial reporting.

b. Educating Investors on GAAP vs IFRS Implications

Educating investors on GAAP vs. IFRS implications involves demystifying the complexities of these frameworks. Providing accessible information, conducting investor workshops, and leveraging digital platforms for educational outreach are essential components. Investors empowered with a deeper understanding of financial reporting standards contribute to market efficiency and hold companies accountable for transparent and reliable reporting.

12. Ethical Considerations

12.1. Ethical Dimensions in Financial Reporting

a. Ethics in Financial Reporting Standards

Ethical considerations are integral to the formulation and adherence to financial reporting standards. The principles of integrity, objectivity, and transparency underpin ethical financial reporting. Standard-setters, regulators, and companies must navigate ethical dimensions to ensure that financial reporting serves the interests of investors and the broader public.

b. Upholding Integrity and Objectivity in Reporting

Upholding integrity and objectivity in reporting requires a commitment to ethical conduct. Companies must prioritize accurate representation over short-term gains, fostering a culture that values transparency. Regulators play a crucial role in setting the ethical tone, emphasizing the importance of unbiased and principled financial reporting in maintaining the integrity of capital markets.

12.2. Ethical Challenges for Accountants

a. Common Ethical Dilemmas in GAAP and IFRS

Accountants face common ethical dilemmas in navigating the intricacies of GAAP and IFRS. Issues such as revenue recognition, asset valuation, and disclosure requirements present challenges where ethical considerations intersect with professional responsibilities. Accountants must navigate these dilemmas with a commitment to ethical conduct, considering the broader impact on stakeholders and financial markets.

b. Navigating Ethical Challenges in Reporting Standards

Navigating ethical challenges in reporting standards involves equipping accountants with the tools and guidance needed for principled decision-making. Ongoing professional development, ethical training programs, and mentorship initiatives contribute to a culture of ethical awareness within the accounting profession. Companies, in turn, benefit from the assurance that financial reporting is not only compliant but also aligns with the highest ethical standards.

12.3. Regulatory Measures for Integrity

a. Regulatory Safeguards: Ensuring Ethical Conduct

Regulatory safeguards play a crucial role in ensuring ethical conduct in financial reporting. Regulatory bodies must establish and enforce ethical standards, conduct regular audits, and impose sanctions for non-compliance. A robust regulatory framework promotes integrity in financial reporting, reinforcing public trust in the accuracy and reliability of financial statements.

b. Maintaining the Integrity of Financial Reporting Standards

Maintaining the integrity of financial reporting standards requires a collaborative effort between regulators, standard-setters, and industry stakeholders. Periodic reviews, stakeholder consultations, and responsiveness to emerging ethical challenges contribute to the ongoing refinement of standards. The commitment to upholding ethical principles ensures that financial reporting continues to serve as a cornerstone of trust in the global business landscape.

13. Future Trajectories

13.1. The Evolution of Reporting Standards

a. Anticipating Future Changes

Anticipating future changes in reporting standards involves considering the dynamic nature of global business, technological advancements, and shifts in investor expectations. Standard-setters must adopt a forward-looking approach, engaging in scenario planning and staying attuned to emerging trends. The ability to anticipate future changes ensures that reporting standards remain relevant and adaptive to the evolving needs of the business environment.

b. Technological Innovations and Reporting

Technological innovations are poised to shape the future trajectory of reporting standards. The integration of artificial intelligence, blockchain, and data analytics introduces opportunities for enhanced accuracy, efficiency, and transparency in financial reporting. Standard-setters and companies must embrace these innovations responsibly, balancing the benefits of technology with the imperative of maintaining ethical and transparent financial practices.

13.2. Convergence vs. Divergence

a. Assessing Convergence Prospects

The prospects of convergence between GAAP and IFRS continue to be a topic of consideration. While convergence offers the promise of a more standardized global approach, challenges such as differing legal frameworks and regulatory philosophies persist. Assessing convergence prospects involves a nuanced examination of global trends, regulatory developments, and ongoing efforts by standard-setters to bridge divergences.

b. Navigating Divergences in Global Standards