#Financial Sector

Explore tagged Tumblr posts

Text

This is a Short-Cut, I Think

STAR WARS EPISODE II: Attack of the Clones 00:18:31

#Star Wars#Episode II#Attack of the Clones#Coruscant#Galactic City#Federal District#Anakin Skywalker#Senator Simon Greyshade’s custom XJ-6 luxury airspeeder#Obi-Wan Kenobi#unidentified cargo ship#comm antenna#Financial Sector#bounty hunter

2 notes

·

View notes

Text

Shape Africa's Financial Landscape: Senior Investment Officer Opportunity at the African Development Bank - February 2025

The African Development Bank (AfDB) is seeking a highly skilled and experienced Senior Investment Officer to join their Financial Sector Development Department in Abidjan, Côte d’Ivoire. This is a fantastic opportunity for finance professionals with a passion for driving sustainable development and economic growth in Africa. About the AfDB: The AfDB is a leading pan-African development…

View On WordPress

#Abidjan#AfDB#africa#CotedIvoire#Development Bank#finance#Financial Sector#Hiring#Investment Officer#Job Opportunity

0 notes

Text

Crypto ETFs Set to Explode in 2025: 50 New Launches on the Horizon

Nate Geraci, president of the ETF Store and a trusted authority in the crypto ETF industry, forecasts a monumental shift in the investment landscape as 2025 approaches. He predicts the launch of at least 50 new cryptocurrency exchange-traded funds (ETFs), including innovative offerings such as covered call ETFs, Bitcoin-denominated equity ETFs, and “Bitcoin bond” ETFs. The most striking…

0 notes

Text

RBI Imposes Business Restrictions on Edelweiss ARC and ECL Finance

In a recent development, the Reserve Bank of India (RBI) has put business restrictions on two companies from the Edelweiss group — Edelweiss Asset Reconstruction Company (EARCL) and ECL Finance Ltd (ECL) due to significant concerns observed during supervisory examinations.

Key Restrictions Imposed:

EARCL: The RBI barred EARCL from acquiring financial assets, including security receipts (SRs), and reorganizing existing SRs into senior and subordinate tranches.

ECL Finance Ltd (ECL): ECL was directed to cease structured transactions for its wholesale exposures, except for repayment or closure of accounts in the normal course of business.

Reasons for Restrictions:

The RBI cited material concerns arising from the conduct of the group entities, including structured transactions aimed at evergreening stressed exposures of ECL, using the platform of EARCL and connected Alternate Investment Funds (AIFs). Additionally, incorrect valuation of SRs was observed in both ECL and EARCL.

Evergreening Concerns:

Evergreening of loans refers to a practice where lenders extend additional loans to borrowers on the verge of default to revive the loan temporarily. The RBI has previously expressed concerns about banks using innovative methods for evergreening loans.

Company Responses:

Both EARCL and ECL have responded to the RBI’s directives. EARCL stated it is reviewing the order and will address the observations mentioned. ECL mentioned discontinuing its wholesale exposure business and stated that the RBI’s directions will not significantly impact its strategy.

Regulatory Oversight:

The RBI has been actively engaging with the management of these entities but found no meaningful corrective action, leading to the imposition of business restrictions. Similar actions have been taken by the RBI on other financial institutions for various regulatory violations.

Conclusion:

The RBI’s actions underscore the importance of regulatory compliance and transparency in the financial sector. Companies like EARCL and ECL are now tasked with strengthening their assurance functions to ensure adherence to regulatory norms in letter and spirit.

0 notes

Text

Let's go to the Financial Landscape and Make Smart Money Management

In an ever-evolving financial landscape, individuals and businesses alike are constantly seeking ways to make informed decisions and optimize their financial well-being. The world of finance services plays a crucial role in empowering people to achieve their financial goals, whether it's building wealth, managing debt, or planning for the future. In this blog, we will explore key aspects of finance services and provide insights on how you can navigate the complexities of the financial world.

Understanding Your Financial Goals: Before diving into the myriad of financial services available, it's essential to have a clear understanding of your financial goals. Are you looking to invest for the long term, save for a specific milestone, or manage debt more effectively? Defining your objectives will guide your financial decisions and help you choose the right services to meet your needs.

Budgeting and Financial Planning: The foundation of sound financial management lies in effective budgeting and planning. Finance services can assist you in creating a realistic budget, identifying areas for potential savings, and developing a comprehensive financial plan. Whether you're an individual or a business owner, having a well-thought-out financial strategy is crucial for achieving financial success.

Investment Strategies: Investing is a powerful tool for wealth creation, but it comes with its own set of complexities. Finance services offer a range of investment options, from traditional stocks and bonds to alternative investments like real estate and cryptocurrencies. Understanding your risk tolerance, time horizon, and financial objectives will help you tailor an investment strategy that aligns with your unique situation.

Debt Management: Many individuals and businesses grapple with debt, and effective debt management is vital for financial health. Finance services can provide solutions such as debt consolidation, refinancing, and negotiation with creditors. These services aim to help you reduce interest rates, lower monthly payments, and ultimately eliminate debt more efficiently.

Insurance and Risk Management: Protecting yourself and your assets from unforeseen events is a critical aspect of financial planning. Finance services can guide you in selecting the right insurance coverage, whether it's life insurance, health insurance, or property and casualty insurance. Understanding and mitigating risks is essential for long-term financial stability.

Retirement Planning: Planning for retirement is a long-term goal that requires careful consideration. Finance services can assist you in creating a retirement plan that takes into account your desired lifestyle, expected expenses, and potential sources of income. From 401(k) accounts to individual retirement accounts (IRAs), these services can help you make informed decisions to secure your financial future.

Embracing Technology for Financial Management: The rise of financial technology (fintech) has revolutionized the way we manage money. Online banking, budgeting apps, and robo-advisors are just a few examples of how technology can enhance financial services. Embracing these tools can streamline your financial management processes and provide real-time insights into your financial health.

Conclusion: In the dynamic world of finance services, staying informed and making proactive decisions are key to achieving financial success. Whether you're an individual looking to manage your personal finances or a business owner seeking strategic financial planning, the right finance services can make a significant difference. By understanding your goals, leveraging technology, and tapping into the expertise of financial professionals, you can navigate the financial landscape with confidence and pave the way for a secure and prosperous future.

0 notes

Text

#finance career#financial profession#career in finance#finance industry#investment banking#corporate finance#financial research#job options#career opportunities#financial sector#high-paying field#finance executives#financial rewards#financial services employment#job growth#JobsBuster blog post#managing money#finance study#personal finance#public finance#distribution of assets#financial resources#financial transactions#budgetary management#financial model creation#high-interest savings accounts#cash flow forecasting#career success#bachelor’s degree#specialized degree

0 notes

Text

Bharat Co-operative Bank (Mumbai) Ltd. Wins an Eminent Award for Best Security Initiative at the 17th ANCBS by NAFCUB and Banking Frontiers

NewsVoir HT Image Mumbai (Maharashtra) [India], November 28: Bharat Bank a respected name in banking sector known for its commitment to innovation and customer security, is proud to announce that it has been honoured with the highly coveted “Best Security Initiative” award at the 17th Annual National Co-operative Banks Summit held in Goa organised by NAFCUB and Banking Frontiers. This…

View On WordPress

0 notes

Text

AI’s Big Break: How Technology Is Transforming The Financial Sector

Attention all finance enthusiasts and tech aficionados! Brace yourselves for a groundbreaking revelation. Artificial Intelligence (AI), the futuristic force that has already revolutionized countless industries, is now set to unleash its magic on the financial sector. That’s right – expect nothing short of a seismic shift as we dive into how AI is transforming every nook and cranny of banking, investments, insurance, and more. Get ready to witness AI’s big break in action as we unravel the mind-boggling ways it is reshaping the world of finance right before our very eyes. So buckle up, because this blog post will take you on an exhilarating journey through cutting-edge innovations and game-changing disruptions that are turning traditional finance upside down!

Introduction to AI and Its Impact on Financial Services

Artificial intelligence (AI) is one of the most transformative technologies of our time. With its ability to learn and evolve, AI has the potential to revolutionize how we live, work and interact with the world around us.

In the financial services sector, AI is already starting to make an impact. From retail banks using chatbots to answer customer queries, to insurance companies using AI to detect fraud, the applications of AI in finance are vast and varied.

What’s more, as AI technology continues to develop, so too will its impact on financial services. In the future, AI could be used for things like automating investment decisions, providing personalised financial advice and even detecting financial crimes.

The possibilities are endless – and it’s exciting to think about what the future of AI in finance might hold.

How AI is Changing the Financial Services Industry

Artificial intelligence (AI) is big news in the financial services industry. From retail banking to investment management, AI is being used to drive better customer experiences, automate back-office processes and create new revenue opportunities. Here are some of the ways AI is changing the financial services landscape:

1. Improved customer service: AI-powered chatbots and digital assistants are being used to provide 24/7 customer support. These virtual assistants can handle simple tasks like providing account balances and transaction history, as well as more complex requests like mortgage rate quotes and loan applications.

2. Smarter fraud detection: AI is helping financial institutions detect and prevent fraud more effectively. By analyzing large data sets, AI can identify patterns of fraudulent behavior that human analysts might miss. This helps banks and other companies save money on fraudulent claims while also protecting customers from identity theft and other types of fraud.

3. Greater insight into customer behavior: Banks are using AI to gain a deeper understanding of their customers’ needs and preferences. By analyzing customer data, AI can help banks personalize products and services, offer targeted recommendations and even predict future behavior. This allows banks to proactively address potential problems and seize new opportunities.

4. Automated back-office processes: AI is streamlining many back-office processes in the financial services industry, from claims processing to compliance monitoring. This increased efficiency frees up employees to focus on higher-value tasks, such as developing new products or providing one

Automation & Automated Trading

The financial sector is under pressure to keep up with the accelerating pace of change in the world around it. In particular, the industry is feeling the need to catch up with the automation revolution that is transforming other sectors.

There are many ways in which automation can benefit the financial sector. For example, it can help reduce costs, speed up processes, and free up staff for more value-added activities. Automation can also help improve accuracy and compliance.

One area where automation is having a big impact is in trading. Financial institutions are using algorithms to automatically execute trades based on pre-set parameters. This has led to a significant increase in trading volumes and has made markets more efficient.

Another area where automation is making inroads is in customer service. Financial institutions are using chatbots and artificial intelligence (AI) to provide customers with 24/7 support. This is particularly beneficial for tasks such as answering simple questions or providing account balances.

Automation and AI are transforming the financial sector by making it more efficient, accurate, and responsive to customer needs. This is benefiting both businesses and consumers alike.

Fraud Detection & Prevention

Fraud detection and prevention is one of the most important applications of AI in the financial sector. Financial institutions lose billions of dollars every year to fraud, and traditional methods of detecting and preventing fraud are often ineffective. AI can help financial institutions reduce their losses by identifying patterns of behavior that indicate fraud, and by constantly monitoring transactions for suspicious activity.

AI is already being used by some financial institutions to detect and prevent fraud. Banks are using AI to monitor customer transactions and flag suspicious activity, and insurance companies are using AI to identify fraudulent claims. In the future, AI will become even more important for detecting and preventing fraud, as it will allow financial institutions to monitor more data points and identify more sophisticated patterns of behavior.

Banking & Lending

Banking and lending are two of the most heavily regulated industries in the world. Banks and other financial institutions are required to follow strict rules and regulations designed to protect consumers and ensure the stability of the financial system.

However, these regulations can also make it difficult for banks to compete in today’s digital world. New technologies, such as artificial intelligence (AI), are providing a way for banks to overcome some of these regulatory hurdles and better compete in the digital age.

AI is helping banks automate many of their processes, from customer service to fraud detection. This not only saves the bank time and money, but it also helps improve the quality of service they provide to customers. In addition, AI is providing new opportunities for banks to offer personalized services and products that are tailored specifically to each customer’s needs.

As AI continues to advance, we can expect to see even more changes in the banking and lending industry. For now, AI is providing a much-needed boost to an industry that is struggling to keep up with the pace of change in the digital world.

Investment Management

The financial sector is under pressure as consumers shift their spending habits and traditional brick-and-mortar businesses close their doors. In response, the industry is turning to artificial intelligence (AI) for help.

AI is already being used in a number of ways within the financial sector, including investment management. Investment managers are using AI to help identify opportunities, make decisions, and manage portfolios.

One company that is using AI for investment management is Wealthfront. Wealthfront is an automated investing service that provides personalized advice and invests your money for you. The company uses machine learning algorithms to monitor your investments and make recommendations based on your goals.

Another company using AI for investment management is Betterment. Betterment is an online financial advisor that provides personalized advice and invests your money for you. The company uses algorithms to monitor your investments and make recommendations based on your goals.

If you’re looking for an investment manager that uses AI, there are a few options to choose from. However, it’s important to do your research to find one that best suits your needs.

Security & Compliance Solutions

Security and compliance solutions are critical for financial institutions as they look to adopt AI technologies. These solutions can help ensure that data is properly secured and that any potential risks are identified and mitigated. By implementing these solutions, financial institutions can not only protect their data, but also improve their overall compliance posture.

Challenges of Adopting AI in Financial Services

When it comes to AI, the financial sector is lagging behind other industries. This is due to a number of factors, including the regulations that govern the industry, the need for data privacy, and the conservative nature of the sector.

However, there are a number of ways that financial institutions can adopt AI. One way is through chatbots. Chatbots can be used to provide customer service, process transactions, and even give financial advice.

Another way is through the use of predictive analytics. Predictive analytics can be used to identify trends and patterns in customer behavior. This information can then be used to make better decisions about products, services, and marketing campaigns.

The biggest challenge for financial institutions when it comes to AI is data privacy. Financial institutions have a lot of sensitive customer data that they need to protect. This makes it difficult to share data with third-party AI providers.

Another challenge is regulations. The financial sector is highly regulated and there are strict rules about how data can be used and shared. This makes it difficult for financial institutions to experiment with new AI applications.

Despite these challenges, there are a number of ways that financial institutions can adopt AI. By chatbots and predictive analytics, financial institutions can provide better customer service, process transactions more efficiently, and make better decisions about products and services

Conclusion

As AI continues to develop, it will be interesting to see how the financial sector evolves and capitalizes on its benefits. Automation of processes and abilities like predictive analytics are key steps in creating efficient markets that can better serve their customers. Furthermore, by using technologies such as machine learning and natural language processing, companies can create more personalized experiences for their customers. It is clear that Artificial Intelligence has revolutionized the financial sector, making it easier than ever before for people to access banking services from anywhere in the world.

0 notes

Text

#ArtistVanguard - Brit Marling

Brit Heyworth Marling (born August 7, 1982) is an American actress and screenwriter. She rose to prominence after starring in several films that premiered at the Sundance Film Festival, including Sound of My Voice (2011), Another Earth (2011), and The East (2013), each of which she co-wrote in addition to playing the lead role. She co-created, wrote, and starred in the Netflix series The OA, which debuted in 2016.

#gentlemans code#film#actress#screenwriter#screenplay#Hollywood#Los Angeles#arbitrage#financial sector#goldman sachs#cannes film festival

1 note

·

View note

Text

What was everybody's nightly random brain spiral this fine evening (it's 5am)?

Mine was spending 3+hrs deep diving into researching the US military nuclear naval officer program due to a recruitment email I got in my school email (I'm an engineering major rn) despite the fact that I knew realistically I have too many medical conditions to qualify.

At the end of my brain spiral, I found an official document listing every disqualifying medical condition and I disqualify on a MINIMUM of 4 separate accounts from that list. I was literally WEEPING in laughter. The absolute delulu and audacity I had thinking my chronically-ill ass could even CONSIDER this.

Anyways that's how my evening went.

#cherry rambles#us military#hear me out#their nupoc program is SO financially appealing#and im fascinated by life on the sea#dont get me wrong its bloody grueling af and i basically sweeped the entire usnavy subreddit for all the first-hand accounts i could get#and the nuclear sectors i was looking at was more maintenance and supervision of nuclear power plants and stuff#not nuclear warfare 💀#and the career opportunities post-service in engineering/trade was rlly appealing#im atp in life where i just wanna try out random and novel experiences and opportunities bc why tf not#give up the next 5-6 years of my life to the military in exchange for life-long financial stability and fascinating experiences#with a sprinkle of trauma probably#BUT ITS FINE#IM TOO SICK LMAOOOOO#I DIDNT EVEN READ THE WHOLE DOCUMENTED MEDICAL LIST#BUT I HAD AT LEAST 4 CONDITIONS ON THAT LIST LMAOOOO

7 notes

·

View notes

Text

as someone who is looking for EA work, my refusal to work for a bank, in fintech, for investment firms or equity firms or hedge funds, and similar means my job search involves dismissing like 80% of search results

16 notes

·

View notes

Text

soooooo annoying how a year ago i was like hahaaaa leaving the legal sector FOREVER & now i'm like being a public prosecutor would pay really well though 🥺🥺🥺

#like yeah i wanna stay in the cultural sector and yeah i hated the legal sector but like. the legal sector made sense to me#also the legal sector has money to put into training new employees#i'm sad about quitting my job i LOVE my job but it's too much for meee & sometimes it feels like everything is gonna be too much forever#but to be fair rn i am in charge of office management. HR. volunteer recruitment & management for TWO companies. financial admin. customer#contact. like 7 different mailboxes. secretary for a 3rd company#actually now that i'm summing it up that doesn't sound like a lot :( but it feels like a lot

11 notes

·

View notes

Text

Thriving in the Financial World: Keys to Successful Business in Finance

The finance sector, a dynamic and ever-evolving industry, is a cornerstone of global economic health. For entrepreneurs and businesses, carving a successful path in this competitive field requires not only an understanding of financial concepts but also a strategic approach to operating within this complex environment. This blog offers insights into the critical aspects of running a successful business in the finance sector, highlighting key strategies and trends that can help businesses flourish. From innovative financial solutions to navigating regulatory landscapes, we delve into what it takes to succeed in the world of finance.

Embracing Technological Advancements : In the digital age, technology plays a pivotal role in the finance industry. Businesses in finance must embrace technological advancements to stay competitive. This includes adopting fintech solutions, leveraging data analytics for informed decision-making, and utilizing blockchain for secure transactions. Embracing digital transformation is not just about staying relevant; it's about enhancing efficiency, improving customer experience, and opening new revenue streams. For instance, implementing AI and machine learning can automate complex processes and provide personalized financial services, setting your business apart in this tech-driven landscape.

Understanding Regulatory Compliance: The financial sector is heavily regulated to ensure stability and protect consumers. Businesses operating in finance must have a thorough understanding of these regulations and comply with them. This includes adhering to local and international financial laws, understanding anti-money laundering (AML) policies, and keeping abreast of changes in financial regulations. Failure to comply can lead to legal repercussions and damage to reputation. Therefore, investing in compliance is crucial, as it not only safeguards the business but also builds trust with clients and stakeholders.

Innovative Financial Products and Services : To stand out in the finance industry, businesses need to offer innovative financial products and services that meet the evolving needs of consumers. This could involve developing new investment products, offering customized financial planning services, or creating user-friendly digital banking platforms. Innovation in finance is not just about product development; it's about rethinking traditional financial models and finding new ways to deliver value to customers. By focusing on innovation, businesses can differentiate themselves and capture new market segments.

Building Strong Customer Relationships : In finance, trust and reliability are paramount. Building strong relationships with customers is essential for long-term success. This involves not just providing excellent customer service but also engaging with customers through financial education, transparent communication, and personalized advice. Establishing a strong customer relationship management (CRM) system can help in maintaining and analyzing customer interactions, ensuring a more personalized and efficient service. By prioritizing customer relationships, businesses can enhance customer loyalty, increase referrals, and build a strong brand in the financial sector.

Conclusion: Running a successful business in finance requires a multifaceted approach that includes embracing technology, ensuring regulatory compliance, innovating in products and services, and building strong customer relationships. In the fast-paced world of finance, staying ahead means continuously adapting and evolving to meet the changing demands of the industry. By focusing on these key areas, businesses can navigate the complexities of the financial sector and carve a path to success. Whether you’re a startup or an established player, these strategies are fundamental in shaping a thriving business in the dynamic world of finance.

1 note

·

View note

Text

Zam Speeds Past the Bank of the Core

STAR WARS EPISODE II: Attack of the Clones 00:18:48

I used a little bit of conjecture here for the Bank of the Core info.

Inside the Worlds/Complete Locations shows Zam passing the Bank of the Core before she starts her climb. The map looks to me like she passes it on her right after she leaves the skytunnel.

Then in the Republic Commando novel Triple Zero from 2006, the Bank of the Core's building is named Bank of the Core Plaza.

And we know from the Han Solo and the Corporate Sector Sourcebook from West End Games in 1993, the Bank of the Core was one of the original signatory sponsors of the Corporate Sector.

The Corporate Sector info is in the context of existing during the Empire, but this sourcebook was written almost 10 years before Episode II. I don't think it really contradicts anything canon since we know the Corporate Sector existed at this point in time anyway.

#Star Wars#Episode II#Attack of the Clones#Coruscant#Galactic City#Financial District#Zam Wesell#Koro-2 exodrive airspeeder#unidentified building#unidentified cargo ship#Bank of the Core#the Galaxy#Bank of the Core Plaza#signatory sponsor#Corporate Sector

2 notes

·

View notes

Text

Once again preoccupied with the thought that while I’m not particularly pleased to have made a career at this point in childcare, so many other people are and do, and for all the time they spend watching other people’s children so those people can go have their own careers, those childcare workers are paid such a tiny fraction of what the parents make. And if they weren’t there, there goes that parent’s career.

These are generalizations, because IN GENERAL, yeah daycare workers will watch a very successful lawyer’s kids and get to hear all about the many European vacations these kids have already gone on in their short lives, meanwhile the daycare worker has daily visions of what they’d have to do to make ends meet if they were suddenly solely financially responsible for themselves. Not to project or anything. Sometimes parents choose daycare because it’s a necessary expense to make ends meet. Those childcare workers still deserve to be paid more.

#quilly has issues#being part of a bitterly underpaid overworked labor sector is that issue today#and I have it so easy gang#compared to some of my coworkers#both in class load and in how living with my parents eases the majority of my financial burden#I’m just. so. angry.#and I can’t even go do something else bc what I want to do doesn’t make any money either!!!#and is way more unstable bc the market is so heavily skewed to freelance work#plus I’ve been in childcare for almost a decade with no other work experience. nobody wants me y’all#sigh.

9 notes

·

View notes

Text

They were warned

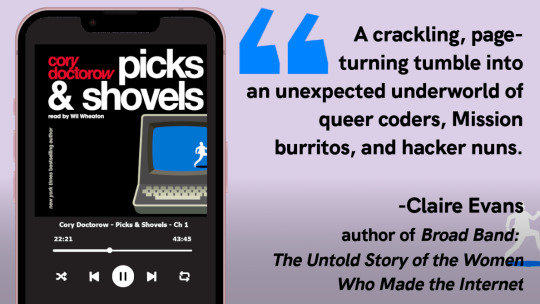

Picks and Shovels is a new, standalone technothriller starring Marty Hench, my two-fisted, hard-fighting, tech-scam-busting forensic accountant. You can pre-order it on my latest Kickstarter, which features a brilliant audiobook read by Wil Wheaton.

Truth is provisional! Sometimes, the things we understand to be true about the world change, and stuff we've "always done" has to change, too. There comes a day when the evidence against using radium suppositories is overwhelming, and then you really must dig that radium out of your colon and safely dispose of it:

https://pluralistic.net/2024/09/19/just-stop-putting-that-up-your-ass/#harm-reduction

So it's natural and right that in the world, there will be people who want to revisit the received wisdom and best practices for how we live our lives, regulate our economy, and organize our society. But not a license to simply throw out the systems we rely on. Sure, maybe they're outdated or unnecessary, but maybe not. That's where "Chesterton's Fence" comes in:

Let us say, for the sake of simplicity, a fence or gate erected across a road. The more modern type of reformer goes gaily up to it and says, "I don't see the use of this; let us clear it away." To which the more intelligent type of reformer will do well to answer: "If you don't see the use of it, I certainly won't let you clear it away. Go away and think. Then, when you can come back and tell me that you do see the use of it, I may allow you to destroy it."

https://en.wikipedia.org/wiki/G._K._Chesterton#Chesterton's_fence

In other words, it's not enough to say, "This principle gets in the way of something I want to do, so let's throw it out because I'm pretty sure the inconvenience I'm experiencing is worse than the consequences of doing away with this principle." You need to have a theory of how you will prevent the harms the principle protects us from once you tear it down. That theory can be "the harms are imaginary" so it doesn't matter. Like, if you get rid of all the measures that defend us from hexes placed by evil witches, it's OK to say, "This is safe because evil witches aren't real and neither are hexes."

But you'd better be sure! After all, some preventative measures work so well that no living person has experienced the harms they guard us against. It's easy to mistake these for imaginary or exaggerated. Think of the antivaxers who are ideologically committed to a world in which human beings do not have a shared destiny, meaning that no one has a moral claim over the choices you make. Motivated reasoning lets those people rationalize their way into imagining that measles – a deadly and ferociously contagious disease that was a scourge for millennia until we all but extinguished it – was no big deal:

https://en.wikipedia.org/wiki/Measles:_A_Dangerous_Illness

There's nothing wrong with asking whether longstanding health measures need to be carried on, or whether they can be sunset. But antivaxers' sloppy, reckless reasoning about contagious disease is inexcusable. They were warned, repeatedly, about the mass death and widespread lifelong disability that would follow from their pursuit of an ideological commitment to living as though their decisions have no effect on others. They pressed ahead anyway, inventing ever-more fanciful reasons why health is a purely private matter, and why "public health" was either a myth or a Communist conspiracy:

https://www.conspirituality.net/episodes/brief-vinay-prasad-pick-me-campaign

When RFK Jr kills your kids with measles or permanently disables them with polio, he doesn't get to say "I was just inquiring as to the efficacy of a longstanding measure, as is right and proper." He was told why the vaccine fence was there, and he came up with objectively very stupid reasons why that didn't matter, and then he killed your kids. He was warned.

Fuck that guy.

Or take Bill Clinton. From 1933 until 1999, American banks were regulated under the Glass-Steagall Act, which "structurally separated" them. Under structural separation, a "retail bank" – the bank that holds your savings and mortgage and provides you with a checkbook – could not be "investment bank." That meant it couldn't own or invest in businesses that competed with the businesses its depositors and borrowers ran. It couldn't get into other lines of business, either, like insurance underwriting.

Glass-Steagall was a fence that stood between retail banks and the casino economy. It was there for a fucking great reason: the failure to structurally separate banks allowed them to act like casinos, inflating a giant market bubble that popped on Black Friday in October 1929, kicking off the Great Depression. Congress built the structural separation fence to keep banks from doing it again.

In the 1990s, Bill Clinton agitated for getting rid of Glass-Steagall. He argued that new economic controls would allow the government to prevent another giant bubble and crash. This time, the banks would behave themselves. After all, hadn't they demonstrated their prudence for seven decades?

In fact, they hadn't. Every time banks figured out how to slip out of regulatory constraints they inflated another huge bubble, leading to another massive crash that made the rich obscenely richer and destroyed ordinary savers' lives. Clinton took office just as one of these finance-sector bombs – the S&L Crisis – was detonating. Clinton had no basis – apart from wishful thinking – to believe that deregulating banks would lead to anything but another gigantic crash.

But Clinton let his self interest – in presiding over a sugar-high economic expansion driven by deregulation – overrule his prudence (about the crash that would follow). Sure enough, in the last months of Clinton's presidency, the stock market imploded with the March 2000 dot-bomb. And because Congress learned nothing from the dot-com crash and declined to restore the Glass-Steagall fence, the crash led to another bubble, this time in subprime mortgages, and then, inevitably, we suffered the Great Financial Crisis.

Look: there's no virtue in having bank regulations for the sake of having them. It is conceptually possible for bank regulations to be useless or even harmful. There's nothing wrong with investigating whether the 70-year old Glass-Steagall Act was still needed in 1999. But Clinton was provided with a mountain of evidence about why Glass-Steagall was the only thing standing between Americans and economic chaos, including the evidence of the S&L Crisis, which was still underway when he took office, and he ignored all of them. If you lost everything – your home, your savings, your pension – in the dot-bomb or the Great Financial Crisis, Bill Clinton is to blame. He was warned. he ignored the warnings.

Fuck that guy.

No, seriously, fuck Bill Clinton. Deregulating banks wasn't Clinton's only passion. He also wanted to ban working cryptography. The cornerstone of Clinton's tech policy was the "Clipper Chip," a backdoored encryption chip that, by law, every technology was supposed to use. If Clipper had gone into effect, then cops, spooks, and anyone who could suborn, bribe, or trick a cop or a spook could break into any computer, server, mobile device, or embedded system in America.

When Clinton was told – over and over, in small, easy-to-understand words – that there was no way to make a security system that only worked when "bad guys" tried to break into it, but collapsed immediately if a "good guy" wanted to bypass it. We explained to him – oh, how we explained to him! – that working encryption would be all that stood between your pacemaker's firmware and a malicious update that killed you where you stood; all that stood between your antilock brakes' firmware and a malicious update that sent you careening off a cliff; all that stood between businesses and corporate espionage, all that stood between America and foreign state adversaries wanting to learn its secrets.

In response, Clinton said the same thing that all of his successors in the Crypto Wars have said: NERD HARDER! Just figure it out. Cops need to look at bad guys' phones, so you need to figure out how to make encryption that keeps teenagers safe from sextortionists, but melts away the second a cop tries to unlock a suspect's phone. Take Malcolm Turnbull, the former Australian Prime Minister. When he was told that the laws of mathematics dictated that it was impossible to build selectively effective encryption of the sort he was demanding, he replied, "The laws of mathematics are very commendable but the only law that applies in Australia is the law of Australia":

https://www.eff.org/deeplinks/2017/07/australian-pm-calls-end-end-encryption-ban-says-laws-mathematics-dont-apply-down

Fuck that guy. Fuck Bill Clinton. Fuck a succession of UK Prime Ministers who have repeatedly attempted to ban working encryption. Fuck 'em all. The stakes here are obscenely high. They have been warned, and all they say in response is "NERD HARDER!"

https://pluralistic.net/2023/03/05/theyre-still-trying-to-ban-cryptography/

Now, of course, "crypto means cryptography," but the other crypto – cryptocurrency – deserves a look-in here. Cryptocurrency proponents advocate for a system of deregulated money creation, AKA "wildcat currencies." They say, variously, that central banks are no longer needed; or that we never needed central banks to regulate the money supply. Let's take away that fence. Why not? It's not fit for purpose today, and maybe it never was.

Why do we have central banks? The Fed – which is far from a perfect institution and could use substantial reform or even replacement – was created because the age of wildcat currencies was a nightmare. Wildcat currencies created wild economic swings, massive booms and even bigger busts. Wildcat currencies are the reason that abandoned haunted mansions feature so heavily in the American imagination: American towns and cities were dotted with giant mansions built by financiers who'd grown rich as bubbles expanded, then lost it all after the crash.

Prudent management of the money supply didn't end those booms and busts, but it substantially dampened them, ending the so-called "business cycle" that once terrorized Americans, destroying their towns and livelihoods and wiping out their savings.

It shouldn't surprise us that a new wildcat money sector, flogging "decentralized" cryptocurrencies (that they are nevertheless weirdly anxious to swap for your gross, boring old "fiat" money) has created a series of massive booms and busts, with insiders getting richer and richer, and retail investors losing everything.

If there was ever any doubt about whether wildcat currencies could be made safe by putting them on a blockchain, it is gone. Wildcat currencies are as dangerous today as they were in the 18th and 19th century – only moreso, since this new bad paper relies on the endless consumption of whole rainforests' worth of carbon, endangering not just our economy, but also the habitability of the planet Earth.

And nevertheless, the Trump administration is promising a new crypto golden age (or, ahem, a Gilded Age). And there are plenty of Democrats who continue to throw in with the rotten, corrupt crypto industry, which flushed billions into the 2024 election to bring Trump to office. The result is absolutely going to be more massive bubbles and life-destroying implosions. Fuck those guys. They were warned, and they did it anyway.

Speaking of the climate emergency: greetings from smoky Los Angeles! My city's on fire. This was not an unforeseeable disaster. Malibu is the most on-fire place in the world:

https://longreads.com/2018/12/04/the-case-for-letting-malibu-burn/

Since 1919, the region has been managed on the basis of "total fire suppression." This policy continued long after science showed that this creates "fire debt" in the form of accumulated fuel. The longer you go between fires, the hotter and more destructive those fires become, and the relationship is nonlinear. A 50-year fire isn't 250% more intense than a 20-year fire: it's 50,000% more intense.

Despite this, California has invested peanuts in regular controlled burns, which has created biennial uncontrolled burns – wildfires that cost thousands of times more than any controlled burn.

Speaking of underinvestment: PG&E has spent decades extracting dividends for its investors and bonuses for its execs, while engaging in near-total neglect of maintenance of its high-voltage transmission lines. Even with normal winds, these lines routinely fall down and start blazes.

But we don't have normal winds. The climate emergency has been steadily worsening for decades. LA is just the latest place to be on fire, or under water, or under ice, or baking in wet bulb temperatures. Last week in southern California, we were warned to expect gusts of 120mph.

They were warned. #ExxonKnew: in the early 1970s, Exxon's own scientists warned them that fossil fuel consumption would kick off climate change so drastic that it would endanger human civilzation. Exxon responded by burying the reports and investing in climate denial:

https://exxonknew.org/

They were warned! Warned about fire debt. Warned about transmission lines. Warned about climate change. And specific, named people, who individually had the power to heed these warnings and stave off disaster, ignored the warnings. They didn't make honest mistakes, either: they ignored the warnings because doing so made them extraordinarily, disgustingly rich. They used this money to create dynastic fortunes, and have created entire lineages of ultra-wealthy princelings in $900,000 watches who owe it all to our suffering and impending dooml

Fuck those guys. Fuck 'em all.

We've had so many missed opportunities, chances to make good policy or at least not make bad policy. The enshitternet didn't happen on its own. It was the foreseeable result of choices – again, choices made by named individuals who became very wealthy by ignoring the warnings all around them.

Let's go back to Bill Clinton, because more than anyone else, Clinton presided over some terrible technology regulations. In 1998, Clinton signed the Digital Millennium Copyright Act, a bill championed by Barney Frank (fuck that guy, too). Under Section 1201 of the Digital Millennium Copyright Act, it's a felony, punishable by a five year prison sentence, and a $500,000 fine, to tamper with a "digital lock."

That means that if HP uses a digital lock to prevent you from using third-party ink, it's a literal crime to bypass that lock. Which is why HP ink now costs $10,000/gallon, and why you print your shopping lists with colored water that costs more, ounce for ounce, than the sperm of a Kentucky Derby winner:

https://pluralistic.net/2024/09/30/life-finds-a-way/#ink-stained-wretches

Clinton was warned that DMCA 1201 would soon metastasize into every kind of device – not just the games consoles and DVD players where it was first used, but medical implants, tractors, cars, home appliances – anything you could put a microchip into (Jay Freeman calls this "felony contempt of business-model"):

https://pluralistic.net/2023/07/24/rent-to-pwn/#kitt-is-a-demon

He ignored those warnings and signed the DMCA anyway (fuck that guy). Then, under Bush (fuck that guy), the US Trade Representative went all around the world demanding that America's trading partners adopt versions of this law (fuck that guy). In 2001, the European Parliament capitulated, enacting the EU Copyright Directive, whose Article 6 is a copy-paste of DMCA 1201 (fuck all those people).

Fast forward 20 years, and boy is there a lot of shit with microchips that can be boobytrapped with rent-extracting logic bombs that are illegal to research, describe, or disable.

Like choo-choo trains.

Last year, the Polish hacking group Dragon Sector was contacted by a public sector train company whose Newag trains kept going out of service. The operator suspected that Newag had boobytrapped the trains to punish the train company for getting its maintenance from a third-party contractor. When Dragon Sector investigated, they discovered that Newag had indeed riddled the trains' firmware with boobytraps. Trains that were taken to locations known to have third-party maintenance workshops were immediately bricked (hilariously, this bomb would detonate if trains just passed through stations near to these workshops, which is why another train company had to remove all the GPSes from its trains – they kept slamming to a halt when they approached a station near a third-party workshop). But Newag's logic bombs would brick trains for all kinds of reasons – merely keeping a train stationary for too many days would result in its being bricked. Installing a third-party component in a locomotive would also trigger a bomb, bricking the train.

In their talk at last year's Chaos Communications Congress, the Dragon Sector folks describe how they have been legally terrorized by Newag, which has repeatedly sued them for violating its "intellectual property" by revealing its sleazy, corrupt business practices. They also note that Newag continues to sell lots of trains in Poland, despite the widespread knowledge of its dirty business model, because public train operators are bound by procurement rules, and as long as Newag is the cheapest bidder, they get the contract:

https://media.ccc.de/v/38c3-we-ve-not-been-trained-for-this-life-after-the-newag-drm-disclosure

The laws that let Newag make millions off a nakedly corrupt enterprise – and put the individuals who blew the whistle on it at risk of losing everything – were passed by Members of the European Parliament who were warned that this would happen, and they ignored those warnings, and now it's happening. Fuck those people, every one of 'em.

It's not just European parliamentarians who ignored warnings and did the bidding of the US Trade Representative, enacting laws that banned tampering with digital locks. In 2010, two Canadian Conservative Party ministers in the Stephen Harper government brought forward similar legislation. These ministers, Tony Clement (now a disgraced sex-pest and PPE grifter) and James Moore (today, a sleazeball white-shoe corporate lawyer), held a consultation on this proposal.

6, 138 people wrote in to say, "Don't do this, it will be hugely destructive." 54 respondents wrote in support of it. Clement and Moore threw out the 6,138 opposing comments. Moore explained why: these were the "babyish" responses of "radical extremists." The law passed in 2012.

Last year, the Canadian Parliament passed bills guaranteeing Canadians the Right to Repair and the right to interoperability. But Canadians can't act on either of these laws, because they would have to tamper with a digital lock to do so, and that's illegal, thanks to Tony Clement and James Moore. Who were warned. And who ignored those warnings. Fuck those guys:

https://pluralistic.net/2024/11/15/radical-extremists/#sex-pest

Back in the 1990s, Bill Clinton had a ton of proposals for regulating the internet, but nowhere among those proposals will you find a consumer privacy law. The last time an American president signed a consumer privacy law was 1988, when Reagan signed the Video Privacy Protection Act and ensured that Americans would never have to worry that video-store clerks where telling the newspapers what VHS cassettes they took home.

In the years since, Congress has enacted exactly zero consumer privacy laws. None. This has allowed the out-of-control, unregulated data broker sector to metastasize into a cancer on the American people. This is an industry that fuels stalkers, discriminatory financial and hiring algorithms, and an ad-tech sector that lets advertisers target categories like "teenagers with depression," "seniors with dementia" and "armed service personnel with gambling addictions."

When the people cry out for privacy protections, Congress – and the surveillance industry shills that fund them – say we don't need a privacy law. The market will solve this problem. People are selling their privacy willingly, and it would be an "undue interference in the market" if we took away your "freedom to contract" by barring companies from spying on you after you clicked the "I agree" button.

These people have been repeatedly warned about the severe dangers to the American public – as workers, as citizens, as community members, and as consumers – from the national privacy free-for-all, and have done nothing. Fuck them, every one:

https://pluralistic.net/2023/12/06/privacy-first/#but-not-just-privacy

Now, even a stopped clock is right twice a day, and not every one of Bill Clinton's internet policies was terrible. He had exactly one great policy, and, ironically, that's the one there's the most energy for dismantling. That policy is Section 230 of the Communications Decency Act (a law that was otherwise such a dumpster fire that the courts struck it down). Chances are, you have been systematically misled about the history, use, and language of Section 230, which is wild, because it's exactly 26 words long and fits in a single tweet:

No provider or user of an interactive computer service shall be treated as the publisher or speaker of any information provided by another information content provider.

Section 230 was passed because when companies were held liable for their users' speech, they "solved" this problem by just blocking every controversial thing a user said. Without Section 230, there would be no Black Lives Matter, no #MeToo – no online spaces where the powerful were held to account. Meanwhile, rich and powerful people would continue to enjoy online platforms where they and their bootlickers could pump out the most grotesque nonsense imaginable, either because they owned those platforms (ahem, Twitter and Truth Social) or because rich and powerful people can afford the professional advice needed to navigate the content-moderation bureaucracies of large systems.

We know exactly what the internet looks like when platforms are civilly liable for their users' speech: it's an internet where marginalized and powerless people are silenced, and where the people who've got a boot on their throats are the only voices you can hear:

https://www.techdirt.com/2020/06/23/hello-youve-been-referred-here-because-youre-wrong-about-section-230-communications-decency-act/

The evidence for this isn't limited to the era of AOL and Prodigy. In 2018, Trump signed SESTA/FOSTA, a law that held platforms liable for "sex trafficking." Advocates for this law – like Ashton Kutcher, who campaigns against sexual assault unless it involves one of his friends, in which case he petitions the judge for leniency – were warned that it would be used to shut down all consensual sex work online, making sex workers's lives much more dangerous. This warnings were immediately borne out, and they have been repeatedly borne out every month since. Killing CDA 230 for sex work brought back pimping, exposed sex workers to grave threats to their personal safety, and made them much poorer:

https://decriminalizesex.work/advocacy/sesta-fosta/what-is-sesta-fosta/

It also pushed sex trafficking and other nonconsensual sex into privateforums that are much harder for law enforcement to monitor and intervene in, making it that much harder to catch sex traffickers:

https://cdt.org/insights/its-all-downsides-hybrid-fosta-sesta-hinders-law-enforcement-hurts-victims-and-speakers/

This is exactly what SESTA/FOSTA's advocates were warned of. They were warned. They did it anyway. Fuck those people.

Maybe you have a theory about how platforms can be held civilly liable for their users' speech without harming marginalized people in exactly the way that SESTA/FOSTA, it had better amount to more than "platforms are evil monopolists and CDA 230 makes their lives easier." Yes, they're evil monopolists. Yes, 230 makes their lives easier. But without 230, small forums – private message boards, Mastodon servers, Bluesky, etc – couldn't possibly operate.

There's a reason Mark Zuckerberg wants to kill CDA 230, and it's not because he wants to send Facebook to the digital graveyard. Zuck knows that FB can operate in a post-230 world by automating the deletion of all controversial speech, and he knows that small services that might "disrupt" Facebook's hegemony would be immediately extinguished by eliminating 230:

https://www.nbcnews.com/tech/tech-news/zuckerberg-calls-changes-techs-section-230-protections-rcna486

It's depressing to see so many comrades in the fight against Big Tech getting suckered into carrying water for Zuck, demanding the eradication of CDA 230. Please, I beg you: look at the evidence for what happens when you remove that fence. Heed the warnings. Don't be like Bill Clinton, or California fire suppression officials, or James Moore and Tony Clement, or the European Parliament, or the US Trade Rep, or cryptocurrency freaks, or Malcolm Turnbull.

Or Ashton fucking Kutcher.

Because, you know, fuck those guys.

Check out my Kickstarter to pre-order copies of my next novel, Picks and Shovels!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/01/13/wanting-it-badly/#is-not-enough

#pluralistic#we told you so#told you so#foreseeable outcomes#enshittification#crypto cars#cryto means cryptography#data brokers#cda 230#section 230#230#newag#drm#copyfight#section 1201#wildcat money#backdoors#wanting it badly is not enough#dragon sector#great financial crisis#structural separation#guillotine watch#nerd harder

321 notes

·

View notes