#Forex Trading Explained

Text

Unlocking Trading Potential with Volume Oscillator: A Comprehensive Guide

In the vast ocean of financial markets, traders and investors are constantly seeking tools and indicators to aid their decision-making processes. One such powerful tool that has garnered attention over the years is the Volume Oscillator.

In this comprehensive guide, we’ll delve into what a Volume Oscillator is, how it works, its applications, and strategies for maximizing its…

View On WordPress

#Divergence Trading Strategies#Financial Markets#forex trading#Investing#Market Indicators#Price Volume Relationship#stock market#technical analysis#Technical Indicators In Trading#trading signals#Trading Strategies#trading tools#Trend Confirmation Signals#Using Volume Oscillator#Volume Analysis Techniques#Volume Based Trading Signals#Volume Confirmation Patterns#Volume Oscillator#Volume Oscillator Explained#Volume Oscillator Strategy

0 notes

Video

youtube

Mastering the DOUBLE BOTTOM FOREX TRADING for Maximum Gain 2023

#youtube#youtube trending#Double Bottom Pattern Explained#Trading Strategies with Double Bottom#Identifying Double Bottom Reversals#Double Bottom Chart Pattern Tutorial#How to Spot Double Bottoms in Forex#Double Bottom Candlestick Patterns#Double Bottom Trading Signals#Double Bottom vs. Double Top Differences#Double Bottom Formation Analysis#Successful Double Bottom Trading Tips#Double Bottom Pattern for Beginners#Real Examples of Double Bottom in Stock Market#Double Bottom Breakout Strategies#Double Bottom Technical Analysis Guide#Common Mistakes in Double Bottom Trading

0 notes

Text

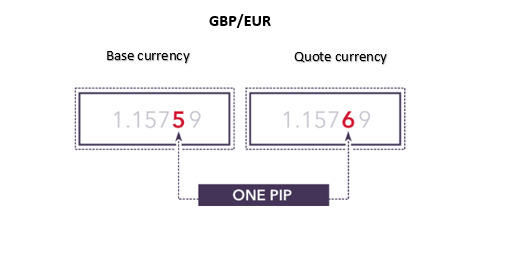

Forex4Money Forex Trading pip Spread

A forex trading pip spread is the smallest whole unit measurement for the difference between the ask and bid in a foreign exchange quote. Forex4Money charges 4 PIP Tight Spread for Mini Account, 3 Pip Tight Spread for Standard Account, and 2 Pip Tight Spread for Premium Account

0 notes

Text

What is MACD Indicator & How to Get More Accurate Trading Signals Using MACD?

What is MACD Indicator & How to Get More Accurate Trading Signals Using MACD?

What is MACD Indicator & how to read it to get buy and sell signals?

In my last post, I discussed about Support, Resistance, and Trends.

Today I am going to explain about a lagging but very useful indicator called Moving Average Convergence Divergence or in a short MACD.

Like SMA or EMA, MACD is also a trend-following indicator.

It was invented in 1979 by Gerald Appel.

You can use MACD for…

View On WordPress

#forex indicator macd#how to read macd indicator#how to use macd indicator#macd indicator#macd indicator explained#macd indicator formula#macd indicator how to use#macd indicator settings#macd indicator strategy#macd indicators#mtf macd indicator#options trading#swing trading#what is macd indicator#what is the macd indicator used for

1 note

·

View note

Text

Aglobaltrade Review

Is Aglobaltrade Legit?

After taking a look at their website, it shows that they do not fall under any regulating agency. That is a MAJOR RED FLAG!! That should be enough for you NOT to invest with them. And they also work with websites that offer “Automated trading software” which is another red flag, as this kind of websites are infamous for scamming schemes.

So, Aglobaltrade is just another unregulated forex broker, which means the customers aren’t protected, and there is highly likely they will get away with your hard-earned money and there will be no regulating agency to hold them responsible.

How does the scam work?

Usually, unregulated forex brokers work in the following way. They will call people to persuade them to make the initial minimum deposit. And they will try any conceivable method in order to make that happen. They will offer deals that sound too good to be true. Like we will double your initial deposit or you will make hundreds of dollars per day easily. Please don’t fall for anything they say!!! It is a SCAM! After making the initial deposit, they transfer clients to a smarter scammer, called a “retention agent”, who will try to get more money out of you. Also, one thing we need to add here is: don’t trust the good Aglobaltrade reviews you might see online. They pay websites and services to improve their online reputation by posting good reviews about them.

Withdrawing funds

You should submit a withdrawal request ASAP, because your funds are never safe with an unregulated broker. And here is when things get tricky.

If you want to withdraw your money and it does not matter if you have profits or not, they will delay the withdrawing process for months. If they delay it for six months, you won’t be able to file a chargeback anymore and your money is gone for good. It doesn’t matter how often you remind them or insist in withdrawing your money, you will NOT get them back. And if you signed the Managed Account Agreement or MAA, which is basically authorizing them to do anything they want on your account, they will lose all your funds so there won’t be anything to request anymore.

How to get your money back Aglobaltrade?

If you already deposited your money with them and they refuse to give your money back, which is very likely to happen, don’t worry, it might be a way or two to get your money back.

First of all, you need to keep the emails as proof that you have been requesting the money back from them but they don’t give it to you. Or they delay the process for too long, with the intention of not refunding your money.

The first thing you should do is perform a chargeback! And you should do this right away! Contact your bank or credit card provider and explain how they deceived you into depositing money for a non-regulated trading company. Mention also that they refuse to give your money back. This is the simplest way of getting your money back and is also the way that hurts them the most. Because if there are many chargebacks performed, it will destroy their relation with the payment service providers. If you haven’t done this before or you are not sure where to start or how to present your case to your bank or credit card company, we can assist you in preparing your chargeback case. Just contact [email protected] but don’t let your broker know they you read this article or that you are contacting us.

What about wires?

If you sent them a wire, there is no way to perform a chargeback on a wire. For this step you need to raise the fight to a different level. Tell them you will go to the authorities and file a complaint against them. That will get them to rethink the refund possibility. Another thing you can do is prepare a letter or email for the regulating agencies. Depending on where you live, you can search google to find the regulatory agency for Forex brokers in your country. After that you can prepare a letter or an email describing how they deceived you. Make sure you show this letter or email to them, and tell them you will send it to the regulating agency if they don’t refund your money. If you don’t know where to start, reach us at [email protected] and we’ll help you with this step as well.

Make sure you leave Aglobaltrade reviews in other sites

Another way to hurt them and save other people from falling victims is to leave bad reviews on other sites. See what other sites have posted reviews about Aglobaltrade, and describe shortly what happened. If you fallen victim, please leave a review and a comment on this site at the comment section. Also, when these people change their website, they tend to call the old clients. So, if they call you from a new website, mention it in the comment or let us know about it. That would be really appreciated by us by our users. Also, if you get phone calls from other companies, please put the name of these companies also in the comment. Or you can send them to us and we will expose them too.

Aglobaltrade Review Conclusions

Making the Aglobaltrade review was our pleasure, and we hope to save as many people from losing their hard-earned money. A good rule of thumb is to carefully review all the Forex companies and any other company for that matter, before you perform any transaction. We hope that our Aglobaltrade review has been helpful to you. If you have any questions or you need an advice about the withdrawing process, feel free to contact us at [email protected]

If you like to trade, please do it with a trustworthy, regulated broker, by choosing one of the brokers listed below.

2 notes

·

View notes

Text

How to Short Forex: Short Selling Currency Details

This article explores the basics of short selling forex, using the EUR/USD currency pair as an example to explain the steps involved. It also advises on suitable risk management throughout the trade journey.

What does short selling currencies involve?

The term ‘short selling’ often confuses many new traders. After all, how can we sell something if we don’t own it?

This is a relationship that began in stock markets before forex was even thought of. Traders that wanted to speculate on the price of a stock going down created a fascinating mechanism by which they could do so.

Traders wanting to speculate on price moving down may not own the stock they want to bet against; but likely, somebody else does. Brokers began to see this potential opportunity; in matching up their clients that held the stock with other clients that wanted to sell it without owning it. The traders holding the stock long (buy position) can be doing so for any number of reasons. Perhaps they have a low purchasing price and do not want to enact a capital gains tax.

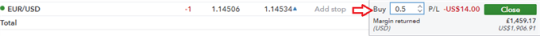

How to short forex: EUR/USD short selling example

Taking a short position in forex involves understanding currency pairs, trading system functionality and risk management.

First, each currency quote is provided as a ‘two-sided transaction.’ This means that if you are selling the EUR/USD currency pair, you are not only selling Euros; but you are buying dollars. Because of this, no ‘borrowing,’ needs to take place to enable the short sale. As a matter of fact, quotes are provided in a very easy-to-read format that makes short-selling more simplistic.

Want to sell the EUR/USD?

Easy. Just click on the side of the quote that says ‘Sell.’ After you have sold, to close the position, you would want to ‘Buy,’ the same amount (if you end up buying at a lower price than where it was sold, you would end up with a profit — excluding commission and fees). You could also choose to close a partial portion of your trade.

For example, let’s assume we initiated a short position for $100 000 and sold EUR/USD when price was at 1.29.

If the price has moved lower, the trader could realize a profit on the trade (excluding commissions and fees). But let’s assume for a moment that our trader expected further declines and did not want to close the entire position. Rather, they wanted to close half of the position to cover the initial cost, while still retaining the ability to stay in the trade.

Our trader, at that point, would have realized the price difference on half of the trade (50k) from their 1.29 entry price to the lower price they were able to close on. The remainder of the trade would continue in the market until the trader decided to buy another 50k in EUR/USD to ‘offset,’ the rest of the position.

How to manage the risk of short selling currencies

Short selling forex carries high risk as there is no maximum loss on a trade. Losses are unlimited, as forex values can theoretically increase to infinity. On a long (buy) trade, the value of a currency can never fall below zero which provides a maximum loss level.

Managing risk on accounts was a trait we discovered with successful traders. Fortunately, there are ways to mitigate this short selling risk:

Implement stop losses.

Monitor key levels of support and resistance for entry/exit points.

Stay up to date with the latest economic news and events for potential downside risk.

Employ price alerts on trades is a good way to stay informed when you’re away from your platform. Price alerts are mobile/email notifications that update traders when certain price levels are reached on a specific market. These price alerts can be predetermined to suit the traders key levels.

Short selling forex is preferred for down trending markets, however careful consideration is required before trading as it brings extra risk even with a bearish outlook. It has been utilised by large institutions/traders as hedges, or by traders looking to trade descending markets. Risk management is essential for proper application, and the methods mentioned in this article should be given the utmost consideration as adverse movements in price can be detrimental.

Further reading recommendations

Many forex traders have significant experience trading in other markets, and their technical and fundamental analysis is often quite good. However, this is not the case 100% of the time. Take a look at What is the Number One Mistake Forex Traders Make? for more insight.

Successful trading requires sound risk management and self-discipline. Find out how much capital to risk on your open trades.

We host multiple webinars throughout the day, covering a lot of topics related to the Forex market like central bank movements, currency news, and technical chart patterns being followed.

To get involved in the large and exciting world of forex check out our Forex for beginners trading guide.

#financialservices#forextrading#gambit#marketing#youtube#forexbot#accounting#forex online trading#wealthmanagement#forex

2 notes

·

View notes

Link

Are you fond of playing basketball? Are you looking for the best in ground basketball hoop? Here we are going to mention nine best inground basketball hoops

5 notes

·

View notes

Text

youtube

Simple Forex Trading Tool You Must Learn

In Today's video I share with you A Simple Forex Trading Tool You Must Learn. I will give you an explanation how to use it, on what timeframe and what to look for. Please remember to add other tools and patterns I explain in my other videos to get even better results! My website: https://www.andywltd.com/ My Whatsapp: +447414100686

#Trading success#Learn from the best forex trader#How to trade#Folllow the best forex trader#Learn to trade#Trading course#Forex course#Follow trader#Best trader in the world#AndyW#Trading reviews#Technical analysis#Youtube

3 notes

·

View notes

Link

Are you fond of playing basketball? Are you looking for the best in ground basketball hoop? Here we are going to mention nine best inground basketball hoops

4 notes

·

View notes

Text

Forex Trading For Idiots

Forex trading is a popular choice for investors seeking to diversify and grow their portfolios in the current global economy. It can be a bit daunting and overwhelming for those who are new to the world of foreign currency trading. This guide for beginners will help you understand Forex trading.

This complete guide will provide Forex trading basics, discuss aspects that impact the price of currency and provide strategies to ensure your trades are profitable. This guide will provide you with the information and tools to understand the fascinating realm of Forex trading, regardless of whether you are an experienced investor or a novice.

Foreign Exchange Market's daily trading volume is more than USD 6 trillion.

Forex trading (also called foreign currency trading) is the act or selling or buying currency to make money. Out of all financial markets that exist, the Forex market is the biggest in the world, with an average daily turnover of $5 trillion. Contrary to bonds and stocks currency exchanges can occur by pairs. One currency is bought while the other is sold. If you think that the Euro will rise against US dollars and you want to buy Euros, and then sell US Dollars.

Investors who wish to diversify their portfolios or make a profit from currency fluctuations need to understand currency trading. Today's global economy is susceptible to fluctuations in currency due to a range of political and economic factors such as inflation rates, interest rates and geopolitical issues.

Forex trading can be a means investors can earn money from fluctuations. They can buy at a low price and then sell them at a higher price. However, it requires knowledge and expertise to be successful in this marketplace. Investors may lose money rather than earn a profit if they do not understand how Forex trading works and the elements influence the prices of currency.

Forex trading is a thrilling investment opportunity. Before investing in the currency trading industry with actual money, it is important that investors are well-versed.

A study carried out by the Bank for International Settlements found that the most popular currency pairs traded in Forex markets included USD/USD, USD/JPY and GBP/USD. Forex trading is the trading of futures on the market.

Chapter 1 - Understanding the basic principles of Forex trading

Currency Pairs:

Forex trading is a market based on pairs where currency pairs can be traded. One currency is bought while the other one is sold. The currency that is the base usually the first currency in a pair. The second currency is known as the quote. In the EUR/USD scenario in the example, the Euro is the base currency, and the US dollars the quote currencies.

Pips:

Pip (percentage to point) determines the variation between currencies in terms of exchange rates. It represents the smallest possible price shift exchange currencies can create. A pip is a unit of measurement which represents the smallest change in price an exchange rate could create for major currency pairs.

Bid/Ask Spread:

The bid/ask spread explains the difference between the top price a buyer would pay for an item (the bid price) and the cheapest price a seller will accept (the asking cost). This spread covers transaction costs for traders and brokers.

Broker:

A broker acts as an intermediary between sellers and buyers in Forex trading. They execute trades on behalf clients. They charge commissions or may charge charges for trades that they conduct through their platform.

Leverage:

Leverage is a way for traders to control large amounts of money with relatively low investments. This can be done by borrowing funds from their broker. A trader who has an account with $1,000 can utilize leverage of 50:1 to manage up to $50,000 in currency their trades. While leverage may help boost profit, it could also increase risk as losses could exceed the initial investment amount because of the increased risk. A high degree of leverage can lead to the loss of the Forex trade, which could wipe out your entire account.

What are the steps to make currency pairs work?

Forex trading relies on currencies being exchanged in pairs. A currency pair simply refers to the exchange of two currencies against one another, and the value of the two currencies is listed together.

The first currency of the pair is known as the base currency, while the second is called the quote currency. One US Dollar for 110.50 Japanese Yoen, for instance, by looking at an exchange rate of USD/JPY at 110.50.

Currency pairs are commonly abbreviated with three letters. The first two letters signify the country code and the third letter is the name of the currency. USD is the abbreviation for United States Dollar. JPY stands to Japanese Yen.

There are three kinds: major, minor, and exotic currency pair. Major pairs are comprised of major currencies from developed countries like the US dollar (USD), Euro, EUR), British pound(GBP), Japanese currency (JPY), Swiss and Canadian dollars (CAD). These currencies account for around 80% of Forex trades.

Minor pairs are less-traded currencies such as South African rands, Australian dollars (AUD), New Zealanddollar (NZD) or the Australian dollar. Exotic pairs are currencies that originate from emerging and developing countries , like the Brazilian real (BRL), Mexican Pesososososososososososososososos (MXN) or Turkish lirasososososososososososososososus (TRY).

The goal of a trader when trading currency pairs is to earn profits from any changes to exchange rates. If they believe that the value of the base currency of a particular pair will rise in relation to its quoted currency the pair will be purchased by that specific pair. They could also decide to sell the pair if they believed that a base currency would decrease relative to its quoted counterpart.

Forex trading success is dependent on knowing how currency pairs function. It forms the basis of studying market trends, making informed trading decisions, and permitting you to make informed choices.

Chapter 2 - Factors that Influence Forex Prices

Forex prices are affected by a myriad of factors, such as the mood of the market, economic indicators as well as political and economic events. It is vital to know these variables for Forex trading because they can have a major impact on price of currency.

Economic Indiantors:

The value of the currency can be affected by economic indicators, like GDP (gross domestic product), inflation rates , and employment statistics. For instance, if the growth rate of a country's GDP is higher than anticipated and its currency appreciates, it could due to increased investor confidence in its economy. If inflation rates rise, it may cause the central bank to raise rates of interest to manage the rate of inflation, leading to an increase in value of its currency.

Politic Events:

Events like elections and government policies can affect the value of currency. Imagine a nation experiencing instability or uncertainty due to upcoming elections or changes in the policies of its government. Investors might be less likely to invest in the country's currency when this happens and can result in a drop in value. Positive developments in the political arena, such as trade deals or stimulus programs, can improve investor confidence and increase the value of currency.

Market Sentiment:

Market sentiment is the overall attitude or mood of investors towards a market or asset. Forex trading is an example of market sentiment. It can be affected by news stories and rumors as and speculation regarding the future.

The general optimism regarding the possibility of an economic recovery across the globe following the COVID-19 pandemic could result in an increase in market for more risky instruments like emerging market currencies, to the detriment of safe-haven currencies, like the US Dollar.

In order for traders to be successful in trading, it is important to know how these elements impact Forex price. This allows them to make informed trade decisions in light of the current conditions in the market.

Chapter 3: Strategies that make Forex trading successful

Forex trading is a complex business that requires various strategies for each trader the risk tolerance and their preferences. The three most sought-after strategies for Forex traders are technical analysis, basic analysis and risk management.

Technical Analys:

The term "technical analysis" refers to the study of previous market data, particularly volume and price, in order to discover patterns and patterns that could be used to predict future price movements. The traders who employ technical analysis depend on charts as well as other tools to determine the levels of resistance and support, trend lines, and other key indicators that can assist them in making informed trading decisions.

Fundamental Analysis:

Fundamental analysis involves analyzing economic indicators, such as a GDP growth rate and inflation rates, central bank policies, political developments and other vital factors that influence currency values.

Fundamental analysis allows traders to gain a better understanding of the forces that impact the currency's value. They can then make informed trade decisions by focusing more on long-term patterns than the short-term fluctuations in market prices.

Risk Management:

Forex trading success depends on the management of risk. It helps protect the capital of traders and aids to limit losses. To reduce your losses on trading that is against you the rules, you can create stops-loss orders, spread your portfolio through different currencies and asset types, and use leverage responsibly. This means that you should only take on positions with an acceptable risk.

Forex traders need to be skilled in fundamental analysis, technical analysis strategies for risk management, and various other aspects of Forex trading. This knowledge and staying up to current on the latest developments in the market will give you a significant advantage in this complicated arena. The path to success is achievable with dedication and hard work to learn the intricate nuances of Forex trading.

Finance Magnates discovered that 84% Forex traders are losing capital due to their trades, but only 16% are profitable.

Chapter 4 - How to choose a Forex Broker

The choice of the correct Forex broker can have a significant impact on the experience of traders and their performance. There are a few things to take into consideration when choosing an agent:

Basic criteria

Regulation:

Selecting a regulated broker which adheres to strict regulations and guidelines set by government agencies (e.g., the National Futures Association of (NFA) and Commodity Futures Traders Commissions (CFTC). These organizations ensure that brokers are honest and with integrity.

Fees:

Brokers have different fees. They have spreads and commissions. Thus, traders need to compare fees across multiple brokers to find one that has a price that is competitive.

Leverage:

This is the most commonly offered type offered by Forex brokers. It permits traders to manage accounts with more than balance, with typical ratios of 50:1 up to 400:1.

Customer Support:

Forex brokers that are reliable and responsive should offer customer assistance 24 hours a day. This is crucial because traders may need assistance anytime during the trading day.

Mobile Trading

As we approach 2023, mobile trading on forex becomes more crucial for traders. Trading accounts for traders are accessible anywhere, because of the rapid growth of mobile technology and increasing use of smartphones and tablets. This lets traders monitor and make trades, as well as monitor their portfolios, without having to rely on desktop computers.

Mobile trading applications are increasing in popularity in the Forex sector. Statista conducted a study and found that 47% of Forex traders utilized trading apps on mobile devices for trading purposes in 2020.

Brokers can offer a variety of accounts, such as:

Demo Accounts:

These accounts allow traders to trade with virtual money prior to risking real funds.

Standard Accounts

These accounts are ideal for traders who have very little capital.

No Swap/Interest/Islamic Accounts:

A Islamic Forex account (also known as a no swap or interest Forex account) is a trading account that follows the Islamic Finance principles. Islamic Finance forbids interest on investment and loans. The same principle applies to Forex trading.

Forex trading accounts without interest or swap need traders to pay fee for swaps that are not overnight. The accounts do not charge any fees to trade Forex. Instead they charge a fixed commission. It covers the administrative expenses.

Avoid scams and fraudulent brokers by following these guidelines:

Choosing a regulated broker that is licensed by reputable regulatory bodies.

You can read reviews online by traders to judge the credibility of the broker.

Avoid brokers who offer unrealistic returns or employ aggressive selling techniques.

Some examples of U.S.-based Forex News are OANDA as well as TD Ameritrade. Interactive Brokers. Charles Schwab.

If you are looking for the top Forex broker, you need be aware of key elements like regulatory oversight, transaction fees and account types. Before making any commitments, thoroughly research potential brokers to avoid common pitfalls and to find a trustworthy broker to partner with in your trading ventures.

This will allow you to make an informed decision in deciding on the most suitable Forex brokerage firm.

Automated Forex trading systems have experienced significant growth in recent times. Transparency Market Research projects that the market worldwide for trading algorithms will exceed $27 Billion in 2026 as per their report.

These are interesting facts

Automated trading platforms, commonly known as "bots," are becoming more popular because they allow traders to trade without human intervention based on pre-defined requirements.

Through the implementation of monetary policies that affects the price of currency central banks play a crucial role in the Forex market.

The Forex market is available 24 hours a day, seven days a week and allows traders to take part in trading at any time.

Forex market trades over the counter (OTC) using a decentralized platform. There is no central clearinghouse exchange, clearinghouse, or exchange.

USD/USD/JPY, USD/JPY/USD and GBP/ are among the most well-known currency pairs used in Forex. USD makes up more than half of transactions. USD also accounts for around 80% of all trading volume.

Before selecting a broker for trading, traders should consider their investment goals and risk tolerance. Traders must also be kept updated on fluctuations in the market and conditions so that they can make informed trade decision.

Demo accounts are highly recommended to anyone who is unfamiliar with Forex trading. Brokers usually provide demo accounts that allow traders to trade using virtual money in an actual market. This is a great way to help traders gain confidence and gain experience prior to opening a real account.

Forex trading can be a lucrative opportunity for traders who are willing and able to invest the necessary time to understand the markets and create trading strategies. Understanding leverage is only one element of the success of Forex trading, but it's an important one that could significantly affect your trading performance. Start learning about Forex trading using a demo account today! It's a risk-free way to begin your journey towards becoming a successful Forex trader!

4 notes

·

View notes

Video

youtube

Transform Your Trading Today with Our Exclusive Offer on Forex Trading E...

#forex#forex trading#support and resistance levels#How to Identify Support and Resistance#Trading with Support and Resistance#Support and Resistance Tutorial#Price Action Analysis#Drawing Support and Resistance Lines#Support and Resistance Strategies#Support and Resistance Explained#Support and Resistance in Forex

0 notes

Text

Forex4Money Forex Trading Account Types

Forex4Money has three Forex trading account types Demo accounts, mini-accounts, normal accounts, and premium accounts are among the available account kinds.

0 notes

Text

Currency Trading For Dummies

For individuals who want to diversify their portfolios and profit from the global economy, trading forex is becoming a popular investment option. It can be daunting and overwhelming for newcomers to trading foreign currencies. That's why we've put together a beginner's guide to Forex trading.

This comprehensive guide will cover the fundamentals of Forex trading and explain the elements that affect currency prices. It also provides strategies for trading that are successful. Therefore, whether forex trading for beginners 're a complete novice or have some experience with investing, this guide will give you the knowledge and tools needed to navigate the exciting market of Forex trading.

Foreign Exchange markets are the biggest financial markets worldwide, with an estimated USD 6 Trillion of daily trade.

Forex trading, also referred to simply as foreign exchange trading is the practice of buy and sell currencies in order make a profit. https://www.currencynewstrading.com/how-to-get-started-with-news-trading/ is the biggest financial market in the world with an average daily turnover exceeding $5 trillion. Contrary to bonds and stocks, currencies are traded by pairs. One currency is purchased while the other is sold. To put it another way If you think that the Euro against the US will rise, you would sell US dollars to buy Euros.

Investors who wish to diversify their portfolios and gain profit from currency fluctuations need to understand the importance of understanding currency trading. Changes in the currency market are constant in the current global economy. They can be caused by a range of political and economic factors such as interest rates, inflation rates, geopolitical issues as well as other factors.

The Forex market allows investors to take advantage of these fluctuations by buying and selling at low prices. This market requires experience and knowledge. If the investors aren't familiar with what Forex trading is done or what factors affect the prices of currencies, they could lose money.

Investors should be aware of Forex trading before investing in real money in the market for currency. If they have a good knowledge of Forex trading and the strategies employed by successful traders investors can reap significant rewards from this exciting investment opportunity.

According to the Bank for International Settlements' study, the most commonly traded currency pairs on Forex markets include EUR/USD, USD/JPY , or GBP/USD. Forex trading involves the trading of futures.

Chapter 1: The basic principles of Forex trading

Currency Pairs:

Forex trading involves the use of currency pairs. One currency may be purchased or traded. The base currency is the currency that determines the currency pair, while the quote currency is the currency used to indicate the currency being traded. In the EUR/USD scenario it is the Euro is the base currency and US dollars are the quoted currencies.

Pips:

Pip (percentage of point) is a measurement unit which expresses the change in exchange rates between two currencies. It represents the smallest possible price shift that an exchange currency could make. A pip is a measure of measurement that is the smallest amount of change in price that one exchange rate can create for major currency pairs.

Bid/Ask Spread:

The bid/ask spread is the difference in the price a buyer will pay for acquiring a certain currency (the bid price), and the price that a seller will accept (the asking price). This spread represents the cost of transactions for brokers and traders.

Broker:

A broker is an intermediary between buyers/sellers in Forex trading. They execute trades for clients. They typically charge fees or take commissions when trades are executed through their platform.

Leverage:

Leverage allows traders to manage large amounts of cash by investing relatively little. It can be achieved through borrowing funds from their broker. For instance, if a trader has 1,000 dollars in their account and leverages 50:1, they can control up to $50,000 worth of foreign currencies during trades. Although leverage may improve your chances of achieving profits, it has a higher risk. The possibility of losses which exceed the initial investment could be increased through leverage. If leverage is excessively used the loss of a Forex trade can ruin a whole account.

How do currency pairs work

Forex trading involves currency pairs. A currency pair is simply referring to the exchange of two currencies with each other, in which the value of each currency is listed together.

The base currency is the one that determines the currency pair, and the quote currency is the currency used to calculate quotes. If you find a USD/JPY quote at 110.50, then one US dollar could be converted to 110.50 Japanese won.

Currency pairs are usually abbreviated by three letters, with the first two letters representing the country code , and the third letter being the name of the currency. For instance, USD stands for United States Dollar, and JPY stands for Japanese Yen.

There are three kinds of currency pairs that are major, minor pairs, and exotic pair. Major pairs include major currencies of developed nations, such as the US dollar (USD), Euro (EUR), British pound (GBP), Japanese yen (JPY), Swiss franc (CHF) and Canadian dollar (CAD). These are the pairs that account for approximately 80percent of all Forex trades.

There are minor pairs that involve currencies that aren't often traded, such as the New Zealand Dollar (NZD), Australian Dollar (AUD) and South African rands (ZAR). Exotic pairs refer to currencies from emerging and developing countries like the Brazilian real (BRL), Mexican Pesososososososososososososososos (MXN), or Turkish Lirasosososososososo (TRY).

Forex traders seek to make money by trading currencies. If traders believe that one particular base currency will appreciate in comparison to its quoted currencies, they will buy the particular pair. They may also choose to sell that pair if they believe the base currency is likely to decrease in relation to the quoted currency.

Forex trading is possible only when you know the inner workings of currency pairs.

Chapter 2 - Factors that Affect Forex Prices

Various factors influence forex prices that affect prices for forex, including economic indicators, political events and market sentiment. Knowing these factors is crucial to Forex trading since they could have a major impact on values of currencies.

Economic Indiantors:

Economic indicators such as Gross Domestic Product (GDP) and the rate of inflation, and employment figures can significantly impact currency values. Also, if the growth rate of a country's GDP is higher than anticipated, its currency might appreciate due to greater investor confidence. Similarly, if inflation rates rise, it may cause the central bank to raise rates of interest to manage inflation, which could lead to an increase in value of its currency.

Public Events:

In addition to affecting currency value, political events like elections and changes in government policies also can have an impact on them. Consider, for example the case where a country's political environment is in flux or uncertain because of an election coming up or a change in the policies of government. Investors might be less likely to invest in the country's currency in the event of a change and could result in a drop in value. Positive political developments like the trade agreement or stimulus programs can boost investor confidence, and increase currency value.

Market Sentiment,

Market sentiment is the term used to describe the general mood of investors or attitude towards a particular asset or market. Forex trading is an instance of market sentiment. It can be affected by news reports and rumors as well as speculation about the future.

One possible scenario is that there could be an increased demand for more risky assets like emerging market currencies. This could result in the decline of the demand for safe-haven currencies such as USD.

It is crucial to understand these elements and how they affect Forex prices for traders to make money.

Chapter 3: Strategies to make Forex trading profitable

Achieving success Forex trading requires a combination of strategies that are customized to the individual's preferences and tolerance to risk. The three most popular strategies used by Forex traders are technical analysis, basic analysis and risk management.

Technical Analysis:

Technical analysis is the study historical market data, such as volume and price, to identify patterns and trends that could help forecast future price changes. The use of technical analysis is to aid traders make more informed decisions about trading.

Fundamental Analysis:

Fundamental analysis is the study of economic indicators such as the rate of growth in GDP, inflation rates, central bank policies, political events, and other vital factors that affect currency values.

Fundamental analysis is utilized to help traders comprehend the factors that affect the value of currency. It helps them make trading choices based on long time trends, instead of market fluctuations.

Risk Management:

Forex traders must be careful in assessing risk. This helps them to reduce potential losses and protect capital. Stop-loss orders help reduce your losses on any transactions that are against. Diversifying your portfolio between assets or currencies is another standard risk management technique. It is also important to use leverage responsibly to only invest in positions that carry a low risk.

Forex traders need to be skilled in fundamental analysis, technical analysis, risk management strategies, as well as other aspects of Forex trading. You will have a significant advantage in this highly competitive market if you stay up-to-date on the latest developments and market conditions and learn these strategies. If you put the time and effort forth to learn the fundamentals and nuances of Forex trading you can achieve success!

A study by Finance Magnates found that 84% of Forex traders lose money on their trades. However, only 16% make money.

Chapter 4 - Choosing the right Forex Broker

It is essential that traders select the best Forex broker. This can make a huge difference in the trading experience. These are the top things to look at when choosing the right broker.

The fundamental criteria

Regulation:

Choose a broker that is regulated and is regulated according to strict standards and guidelines that are set by government agencies, like the National Futures Association (NFA) or Commodity Futures Trading Commission (CFTC). These agencies assist brokers to perform their business in a transparent, honest and in a professional manner.

Fees:

Brokers have different fees to provide their services, such as spreads, commissions and various other fees. Thus, traders need to compare fees across multiple brokers to determine which provides competitive pricing.

Leverage:

It is also referred to as "retail" or "common" leverage. It is the most popular kind of leverage that is offered by Forex brokers. It gives traders access to positions larger than their account balance. The typical ratios vary between 50 and 400 up to 1.

Customer Services:

Forex brokers who are good in customer service must be available 24/7. This is vital because traders might require assistance at any hour of the day.

Mobile Trading

As we move closer to 2023, forex mobile trading will become more essential for traders. The trading accounts of traders are accessible from anywhere because of the rapid growth of mobile technology and the increasing use of smartphones and tablets. This allows traders to monitor market trends and trade without being tied to a PC.

In the Forex business the use of mobile apps for trading has been growing in popularity. A study by Statista discovered that by the year 2020 47 percent of Forex traders used mobile devices for trading purposes.

There are many types of accounts brokers can offer, including:

Demo Accounts:

These accounts enable traders to trade using virtual money, before they have to risk real money.

Standard Accounts:

These accounts are ideal for traders starting out with minimal capital.

No Swap/Interest/Islamic Accounts:

A Islamic Forex account (also known as a no swap or interest Forex account) is a trade account that is based on Islamic Finance rules. In Islamic Finance, earning interest on investments or loans is not permitted, and this principle also applies to Forex trading.

Forex traders who open no-swap, no-interest Forex trading accounts don't have to pay for overnight swap fees , nor pay extra charges for keeping their positions open for longer than 24 hours. The accounts are able to pay an agreed-upon commission which allows traders to trade Forex. This helps cover administrative costs.

Beware of scams and fake brokers by following these guidelines:

Choose a broker who is certified by an accredited regulator.

Reviews from traders online are a good way to assess the credibility of a broker.

Avoiding brokers that offer unrealistic returns or employ sales techniques that are high-pressure.

A few examples of US-based Forex brokers include OANDA as well as TD Ameritrade. Interactive Brokers. Charles Schwab.

When searching for the perfect Forex broker, it's crucial to consider important aspects, like regulation oversight, transaction charges, customer service, and the types of accounts. To avoid the common scams and discover a reliable partner on your trading quest be sure to thoroughly research potential brokers before making any commitments.

By doing this, you'll be sure that you have the right information to make an informed choice when choosing the best Forex broker.

Automated Forex trading platforms have been growing rapidly in recent times. Transparency Market Research predicts that in 2026, the global algorithmic market will have reached $27billion.

Here are some interesting facts

Automated trading platforms, commonly called "bots," are becoming more popular because they allow traders to execute trades without any human involvement based on previously-described requirements.

Through implementing monetary policies that affect the price of currencies, central bankers play an important part in Forex markets.

The Forex market is accessible all day all week long, allowing traders to participate in trading anytime.

Forex market trades over the counter (OTC) through an open platform. There isn't a central clearinghouse, exchange or clearinghouse.

USD/USD and EUR/USD are among the most popular currency pairs on Forex market. They make up more than 50% of transactions, and USD makes up 80% of all trade volume.

When choosing a broker for trading, traders should be aware of their goals for investing and their risk tolerance. Traders must be well informed about market conditions so that they can make informed trade choices.

Demo accounts are highly advised to anyone unfamiliar with Forex trading. Demo accounts offered by brokers allow traders to test trading with virtual money in a real market environment. This is a great opportunity to gain experience and build confidence prior to opening a live account.

Forex trading offers exciting opportunities for those who invest the effort and time into learning about markets and creating effective trading strategies. Understanding leverage is just one element of Forex trading achievement, but it will be a major factor in the performance of a trader. Start practicing Forex trading with Demo accounts today! This is a great opportunity to start your path to becoming a successful Forex trader.

3 notes

·

View notes

Text

Step-By-Step Forex Guide

Forex trading has become an increasingly sought-after investment choice for investors looking to diversify their portfolios today's global economy. But, it can be intimidating and overwhelming for people who are new to foreign exchange trading. The beginner's guide to Forex trade was created.

This comprehensive guide will help you understand the basics of Forex trading. It will also explain the factors that affect prices of currencies and suggest strategies for ensuring successful trades. This guide will provide you with the necessary information and tools to navigate the fascinating world of Forex trading regardless of whether or not you're an experienced trader or are a beginner.

The daily trading volume of the Foreign Exchange market is over 6 trillion USD, making it the largest global financial market.

Forex trading (also known as forex trading) is the act or buying or selling currencies to earn money. The Forex market is the most important global financial market with a daily average turnover that exceeds $5 trillion. In contrast to bonds and stocks, currencies are traded in pairs and one currency is purchased while the other is sold. To put it another way in the event that you believe the value of the Euro against the US will rise, you would sell US dollars and purchase Euros.

Investors looking to diversify their portfolios or earn a profit from currency fluctuations have to understand the basics of currency trading. The global economy today is susceptible to fluctuations in currency because of a variety of economic and political factors such as interest rates, inflation rates, and geopolitical developments.

The forex market offers investors the opportunity to profit from fluctuations in prices by selling high and buying low. But, it takes knowledge and expertise to make a profit in this market. If an investor does not know the basics of Forex trading and how currency prices can be affected, they could be liable to lose capital.

Forex trading is a thrilling investment option. Before investing in currency trading real money, it's crucial that investors are educated.

According to a report of the Bank for International Settlements, the most popular currencies in the Forex markets include USD/USD, USD/JPY and GBP/USD. Forex trading takes place in the market for futures.

Chapter 1: Forex Trading Fundamentals

Currency Pairs:

Forex trading involves currencies in pairs. One currency is purchased and the other currency is sold. The currency that is the base (or currency) is the first currency in a pair. While the quote currency (or currency) is the second and the base currency is often the one being bought. For instance, in the EUR/USD pair , the Euro is considered to be the base currency, while the US dollar is the quote currency.

Pips:

Pip (percentage of point) is a measurement unit which expresses the rate of exchange between two currencies. It is the smallest price change that an exchange currency could make. A pip represents the smallest possible price change for major currency pairs, for example 0.0001 and 1/100ths percent.

Bid/Ask Spread:

The bid/ask spread is the difference between what that a buyer pays to purchase a particular currency (the bid price) and the amount that the seller is willing to accept (the asking price). This spread covers the transaction costs of traders as well as brokers.

Broker:

The broker acts as intermediary between buyers and sellers and buyers in Forex trading. They also trade on behalf their clients. They usually charge commissions or fees on transactions executed via their platform.

Leverage:

Leverage gives traders the capability to manage large sums of capital even with small investment. They can borrow money from their broker in order to gain this leverage. For instance when a trader holds $1,000 in their account and uses 50:1 leverage, they can control up to $50,000 worth of currencies in their trades. Leverage could increase your profit, but it also can increase the risk. Due to the multiplied positions the risk of losing more than the initial investment. Leverage that is excessive can lead to the loss of Forex transactions that wipe out whole accounts.

How do currency pairs work

In Forex trading, currencies are always exchanged in pairs. A currency pairing is simply the comparison of two currencies against one another. The currency value is compared with the currency in question.

The base currency is the primary currency in the pair. The currency of the quote (the second) is the second. One US dollar is able to be traded for 110.50 Japanese currency if there is a quotation for USD/JPY.

A currency pair is typically abbreviated by three letters. The first two letters represent the country code, while the third letter is the name of the currency. USD can be translated as United States Dollars and JPY to mean Japanese Yuens.

There are three kinds: major, minor and exotic currency pairs. Major pairs comprise major currencies, such as the US dollar, Euro (EUR), British pounds (GBP), Japanese and Swiss yens (JPY) as well as Swissfranc (CHF) and Canadian dollars (CAD). These are the pairs that account for approximately 80percent of all Forex trades.

Some minor pairs refer to less-traded currencies such as South African rands, Australian dollars (AUD), New Zealanddollar (NZD), or the Australian dollar. Exotic pairs are currencies that originate that come from developing or emerging nations like the Brazilian real (BRL), Mexican peso (MXN) and Turkish lira (TRY).

Forex traders seek to benefit from fluctuations in currency exchange rates when trading pairs. A trader who believes that the base currency of a particular pair will appreciate relative to its quoted currency will invest in the pair. Conversely, they would sell the pair if they believe the base currency will decline in relation to the quoted currency.

Understanding how currency pairs function is vital to succeed in Forex trading, as it provides the basis for analyzing market trends and making informed trading choices.

Chapter 2: Factors that have an impact on Forex price

Forex prices are affected by many factors, including the mood of the market, economic indicators as well as political and economic events. Forex trading is only feasible when you can identify these influences.

Economic Indicators:

The value of currencies are dependent on economic indicators like Gross Domestic Product (GDP), inflation and employment. If, for instance, the growth rate of a country's GDP is greater than expected the currency could appreciate due to greater investor confidence. The same is true for the rising rate of inflation could prompt the central bank of a country to raise interest rates in order to curb inflation. This could lead to a rise in currency value.

Political Events:

Values of currency are affected through political events like elections or changes to the policies of government. For instance, suppose the country's political environment changes or becomes uncertain due to an imminent election or a change in policy. Investors could be less likely to invest in the currency of the country if that happens, which can lead to a drop in value. Positive developments in the political arena such as trade agreements and stimulus packages are able to boost confidence of investors and also boost the value of currencies.

Market Sentiment:

Market sentiment refers to the general attitude or mood of investors about a certain market or asset. Forex trading is an example of market sentiment. It is affected by news stories and rumors as also speculation on the future.

For instance, the widespread optimism regarding the global economy's recovery prospects following the COVID-19 pandemic could result in a rise in demand for more risky assets, like emerging market currencies, at the loss of safe-haven currencies, such as the US dollar.

Understanding these elements and how they influence Forex prices is crucial to profitable trading because it helps traders to make educated decisions based on current market conditions and trends.

Chapter 3: Strategies and methods to help you achieve Forex trading successful

Forex trading is not easy without a mix of strategies, each one customized to each trader's personal risk tolerance and preferences. The three most well-known strategies used by Forex traders are basic analysis, technical analysis, and risk management.

Technical Analysis:

The study of technical analysis is the analysis of market data from the past (mainly price and volume) to determine trends and patterns that can be utilized for future price changes. It is utilized to aid traders in making more informed decisions about trading.

Fundamental Analysis:

Fundamental analysis is the analysis of economic indicators, such as the rate of growth in GDP as well as inflation rates, and central bank policies.

Fundamental analysis can be used to help traders understand the economic elements that influence the value of currencies. It helps them make trade decisions based on long trend lines, not market fluctuations.

Risk Management:

Risk management is essential for success in Forex trading because it can help traders mitigate potential losses and safeguard their capital. To minimize your losses in transactions that are against, you can set stop-loss orders, diversify your portfolio with different currencies and asset types, and use leverage responsibly. This means that you should only take on positions with a manageable risk.

In order to be a successful Forex trader, you need to be well-versed in technical analysis, fundamental analysis and risk management techniques tailored to your trading style. It is a huge advantage to be aware of the latest market trends and conditions and learn these strategies. It is possible to succeed with determination and dedication to learning the intricacies of Forex trading.

Finance Magnates reported that 84% of Forex traders are losing money, while only 16% of them make profits.

Chapter 4 - How to choose a Forex Broker

The choice of the right Forex broker is a critical decision for any trader, because it will have a significant impact on the trading experience and even their performance. Here are some factors to think about when selecting an agent:

Basic criteria

Regulation:

You should choose a regulated brokerage that adheres to the regulations and standards that are set by government agencies such the National Futures Association (NFA) or the Commodity Futures Trading Commission(CFTC). These organizations help ensure brokers are honest, transparent, and with integrity.

Fees:

Brokers have different fees to provide their services, which include commissions, spreads, and other charges. To determine the most competitive cost, traders must compare fees among brokers.

Leverage:

It's also known as "retail" as well as "common" leverage. It is the most popular type of leverage provided by Forex brokers. It permits traders to manage larger amounts than the balance of their account. The typical ratios range from 50:1 to 400:1.

Customer Service:

Forex brokers should provide customers with 24/7 support. This is essential as traders may require assistance when trading.

Mobile Trading

Mobile trading in forex is becoming increasingly important for traders as we approach 2023. Trader's can access their accounts at any time and anywhere thanks to the increasing popularity of technology that is mobile. This lets them track market movements, execute trades and monitor their positions without needing to be connected to a computer on a desktop.

Mobile trading apps have also witnessed an increase in popularity within the Forex market. The survey by Statista found that 47% of Forex traders use mobile devices for trading in 2020.

Different types of accounts offered by brokers are:

Demo Accounts:

These accounts allow traders to practice trading with virtual money before they take on real money.

Standard Accounts

These accounts are for beginner traders looking to get started trading with a modest amount of capital.

No Swap/Interest/Islamic Accounts:

A Islamic Forex account is also described as an Islamic Forex account without interest or swap. It is based on Islamic Finance's fundamentals. Islamic Finance forbids interest on loans and investments. This same rule applies to Forex trading.

Forex traders who open no-swap, interest Forex trading accounts do not have to pay overnight swap fees , nor pay additional charges to keep their accounts open longer than 24 hours. The accounts do not charge any fees for trading Forex. Instead they charge a fixed commission. It covers the administrative expenses.

Here are some suggestions to avoid fraud and scam brokers:

Choose a broker who is regulated and is licensed by reputable regulatory bodies.

Review websites of other traders can help determine the reputation of the broker.

Beware of high-pressure sales tactics and brokers that promise unrealistic results.

OANDA is an American-based Forex broker that is based in the US. It comprises Interactive Brokers, Interactive Brokers and The TD Ameritrade.com, FOREX.com and FOREX.com.

When you're looking for the most reliable Forex broker, you need to take into account key elements like regulatory oversight, transaction fees and the types of accounts. It is possible to avoid the common mistakes and find an honest partner in your journey to trading by thoroughly investigating potential brokers prior to making any commitments.

This will enable you to make an informed choice about the most reliable Forex brokerage firm.

Automated Forex trading platforms have grown rapidly in recent times. Transparency Market Research projects that the market worldwide for trading algorithms will surpass $27 billion in 2026, according to their report.

Interesting facts

Automated trading software, also known as "bots" are becoming more popular because they let traders to trade only on defined requirements.

In the Forex market, central banks play an essential part by implementing actions that influence on the price of currency.

Forex market hours of trading are accessible seven days a săptămână, twenty-four hours a day.

Forex markets operate on a decentralized platform, which means that trades are conducted through the internet (OTC) which means there is no clearinghouse nor central exchange.

The most traded currency pairs on the Forex market are USD/USD, EUR/USD and GBP/USD, accounting for more than 50% of all transactions, and USD being on the majority of trading volume.

It is important to remember that traders should take into consideration their levels of risk tolerance and goals for investing before selecting a broker and deciding on an appropriate amount of leverage to use for their trading needs. In addition, traders must be aware of current market conditions and levels of volatility to make educated trade decisions.

Demo accounts are recommended to those who are just beginning to learn about Forex trading and want to test various strategies without the risk of real money. Demo accounts are provided by numerous brokers that permit traders to test trading in virtual markets. It is a great opportunity to test your skills and gain confidence prior to opening a live account.

Forex trading can be a lucrative opportunity for traders willing and able to invest the time required to learn about the market and develop trading strategies. Understanding leverage is only one aspect of Forex trading success, but it can be a major factor in the performance of a trader. Why not open an account for a demo and begin trading now? It's risk-free and a great way for you to get started on your path to becoming a professional Forex trader.

3 notes

·

View notes

Link

Are you fond of playing basketball? Are you looking for the best in ground basketball hoop? Here we are going to mention nine best inground basketball hoops

2 notes

·

View notes

Text

Iltalehti (siirryt toiseen palveluun) readers reported unusual light phenomena early Monday morning on the eastern border, with many suggesting rockets caused the display.

IL, however, reports that Finnish officials have been tight-lipped on what exactly caused the bright lights. According to the paper, Russian state news agency Tass last week reported that the country was planning to launch a Soyuz-2 rocket from its northwestern Plesetsk launch facility.

The Finnish Defence Forces have not commented on the event, citing operative concerns, according to IL.

Rubble rouble?

Tens of thousands of Russians have arrived in Finland since Vladimir Putin's call-up. Hufvudstadsbladet (siirryt toiseen palveluun) asks how Russians are managing to get a hold of euros.

While Forex said it had stopped exchanging roubles, Tavex, an Estonian company, still buys and sells the Russian currency.

"There are no limits for how much Russian passport holders with a residence permit can exchange. Those without residence permits can exchange up to 500 euros' worth of roubles," Marek Viskman of Tavex Finland told the Swedish-language daily.

As the demand for roubles outside of Russia has plummeted, HBL asks what Tavex is planning to do with the roubles coming in.

"There's always buyers, including Finns. Our exact rouble amounts or who's buying them is a trade secret. In the end, we carry the risk," he explained.

Forced labour

Police suspect a multi-million euro Finnish berry company and Thai recruitment agency of forced labour, reports Helsingin Sanomat (siirryt toiseen palveluun).

Officials said they suspect the pickers were in a dependent position and housed in poor, mould-infested conditions.

An investigation by regional newspaper Keskipohjanmaa found that the company deducted housing, food, flights and use of a shared car from pickers' earnings, according to HS.

Up until last year foreign berry pickers were in a legal grey area, HS explains, as they were considered independent contractors. However, the "berry law," which came into force last year defines the rights of gatherers and the obligations of companies purchasing the natural products. The law has made occupational safety interventions possible.

The National Bureau of Investigation (NBI), Border Guard, Helsinki and Lapland police have cooperated in the case.

3 notes

·

View notes