#FreshBooks Features

Explore tagged Tumblr posts

Text

The Ultimate Guide to Software Tools for Nonprofits - Technology Org

New Post has been published on https://thedigitalinsider.com/the-ultimate-guide-to-software-tools-for-nonprofits-technology-org/

The Ultimate Guide to Software Tools for Nonprofits - Technology Org

Every day, we think of new ways technology can help humanity. While we are opening the new horizons of AI and machine learning, we shouldn’t forget how technology can help the previous concepts. Every nonprofit organization continues to face difficult challenges and needs definite help in streamlining its budget and resources. That’s where software tools can be a huge blessing for NPOs.

Business card exchange – illustrative photo. Image credit: Van Tay Media via Unsplash, free license

Common challenges faced by non-profit organizations include budget allocations, generating new leads, and reaching out to new audiences. God knows what not! It is not only beneficial but extremely crucial for them to do focused fundraising for the sake of the needy.

In this article, I will dive into the software needs of NPOs to help them drive toward their immediate goals as soon as possible.

Understanding Nonprofit Needs

As mentioned earlier, Non-profits face a different set of difficulties and challenges when compared with for-profit businesses. They must balance operational efficiency with current mission-driven goals. Especially when offered with way too less human resources, as is with most of the nonprofit organizations.

The software tools for nonprofit organizations must be pocket-friendly, offering features specific to the organization’s nature. Not to forget the necessity of being user-friendly to a range of people. So, think about making a checklist of the current needs and requirements of your organization so that you can look for the tool with better clarity. Don’t forget that most of you might be on a super tight budget.

One thing that’s going to be common with all the NPOs is to boost fundraisers and propagate crowdfunding channels. That’s precisely what I am going to help you with. By the time you reach the end of this piece, you will have a better understanding of your own goals.

Categories of Software Tools for Nonprofits

Now, there are multiple categories of software tools for Nonprofits. Some might be looking for donation software, and others might be in need of a great outreach tool. If you have no idea whether you need volunteer management or any of the tools I have mentioned, just stick with me for a few more minutes-

Donation and Fundraising Software

Donation software allows you to track the source of donations and amounts, as well as manage and even engage with the donors. This can be a huge leap for your non profit organization. Once your fundraising has started, you can streamline the revenue spending process and support your needs in a far more meaningful way.

There are many such software in the market, but you should only check the top donation software. Donorbox is a personal recommendation in the fundraising scene. With its robust features and great UX/UI, all your donations will be properly tracked and managed.

Communication and Outreach Tools

Obviously, if you want more people to know about your non-profit you need to reach out to as much as a bigger audience as you are able to. With restricted resources, the same becomes a little tricky and to be fair, quite difficult to do. That’s where social media and outreach tools can help you a great deal.

Celebrate your wins on Instagram, connect with similar NGOs on X (previously Twitter) and maintain a strong presence on all of the platforms. There are so many people actively looking for ads to help NGOs as not many can do it themselves. Bridge the gap between the donor and you. Run ads, reach out to celebrities and social media influences for additional support. The scope is truly endless.

Do not underestimate the power of emails. Even in 2024, it is one of the most revenue-generation business models for many businesses. Simply emailing the right donors will skyrocket your NGO like nothing else. You can ask the rich of businesses to be your sponsors, and to your surprise, many will also do it gladly to maintain a good reputation on the internet.

Project and Volunteer Management Software

If you are an international or even an interstate organization, God bless your soul by manually managing the volunteer workforce. Needless to say, volunteers are the backbone of any non-profit organization. That’s why a good Project and Volunteer Management software will ensure you keep track of all the people, what tasks they are assigned, and whether the project gets completed on time.

Financial Management Tools

Financial transparency and accountability are paramount for any organization and even more important if you are a non-profit. With a limited budget and limited resources, having a master financial management tool like MoneyMinder and Freshbooks will not only do the correct financial reporting but also regulate the revenue flow making the organization more efficient.

Implementing Software Solutions

After you have recognized your NGOs need and chosen the right one for your organization, the last step is to integrate and implement the software. This might be technical for many, so it’s best if you let someone experienced implement the software. It will require them to feed the software existing data and information, which can take a little time. However, once done, you have no idea how easy your processes are going to be.

Conclusion

I hope the article helped you with choosing the right category of software for your non profit organization. After thorough research and brainstorming, you will get the right fit for you. Fundraising software are the new cool and once you get the hang of them, you are never coming back to the ordinary world.

#2024#ai#Article#bridge#Business#communication#data#deal#easy#efficiency#Experienced#Features#financial#Fintech news#freshbooks#fundraising#gap#how#human#human resources#instagram#Internet#it#learning#LESS#Machine Learning#management#media#nature#new horizons

0 notes

Text

#accounting#bookkeeping#finance#outsourcing#offshore#tax#startup#accounting softwares#freshbooks#netsuite#accounting services#vital features#CRM

0 notes

Text

CREVH - GOLD

QuickBooks is a renowned accounting software that offers a seamless solution for small businesses to manage their financial tasks efficiently. With features designed to streamline accounting processes, QuickBooks simplifies tasks such as tracking receipts, income, bank transactions, and more. This software is available in both online and desktop versions, catering to the diverse needs of businesses of all sizes. QuickBooks Online, for instance, allows users to easily track mileage, expenses, payroll, send invoices, and receive payments online, making it a comprehensive tool for financial management. Moreover, QuickBooks Desktop provides accountants with exclusive features to save time and enhance productivity. Whether it's managing income and expenses, staying tax-ready, invoicing, paying bills, managing inventory, or running reports, QuickBooks offers a range of functionalities to support businesses in their accounting needs.

Utilizing qb accounting software purposes comes with a myriad of benefits that can significantly enhance business operations. Some key advantages of using QuickBooks include:

- Efficient tracking of income and expenses

- Simplified tax preparation and compliance

- Streamlined invoicing and payment processes

- Effective management of inventory

- Generation of insightful financial reports

- Integration with payroll and HR functions

These benefits not only save time and effort but also contribute to better financial decision-making and overall business growth. QuickBooks is designed to meet the diverse needs of businesses, offering tailored solutions for various industries and sizes.

When considering accounting qb software options, QuickBooks stands out as a versatile and comprehensive choice. To provide a holistic view, let's compare QuickBooks with two other popular accounting software options - Xero and FreshBooks. quick book accounting package and offers robust features for small businesses, including advanced accounting capabilities, invoicing, payment processing, and payroll management. Xero, on the other hand, is known for its user-friendly interface and strong collaboration features, making it a popular choice among startups and small businesses. FreshBooks excels in invoicing and time tracking functionalities, catering to freelancers and service-based businesses. By evaluating the features, pricing, and user experience of these accounting software options, businesses can make an informed decision based on their specific needs and preferences.

555 notes

·

View notes

Text

Revolutionizing Transactions with PayWint Digital Wallet

In a world where convenience and efficiency dominate, the demand for reliable and feature-rich digital wallets has skyrocketed. Enter PayWint, the ultimate digital wallet solution designed to streamline your financial transactions while ensuring security and ease of use. Whether you're a student, traveler, freelancer, or small business owner, PayWint is here to revolutionize how you manage, send, and receive money.

Why Choose PayWint?

PayWint stands out in the crowded digital wallet space with its seamless features tailored to meet diverse user needs. From real-time alerts to AI-powered fraud detection, PayWint ensures your transactions are not just swift but also highly secure.

Key Features at a Glance:

Instant Money Transfers: Request, send, and receive money in real-time, making it the perfect companion for personal and professional needs.

Multi-Currency & Multi-Language Support: Operate effortlessly across borders, thanks to PayWint's global usability.

Shared Wallets: Split bills or manage group expenses with family, friends, or business partners through shared wallets.

Virtual & Physical Cards: Open a digital bank account and enjoy the convenience of virtual or physical cards.

Perfect for Everyone

PayWint caters to a diverse audience, ensuring inclusivity and functionality for all.

Students and Freelancers can use PayWint to manage international payments, ensuring they can receive funds from clients or family abroad without delays.

Small Business Owners can streamline payroll, vendor payments, and even customer transactions, all from one centralized platform.

Travel Enthusiasts can enjoy hassle-free currency conversions and transactions no matter where they are.

Unparalleled Integrations

One of PayWint's standout features is its ability to integrate with leading financial and payment platforms such as Apple Pay, Google Pay, PayPal, CashApp, and Venmo. Users can also link multiple bank accounts or credit and debit cards for effortless transactions. Moreover, businesses can integrate accounting platforms like QuickBooks, Zoho, or FreshBooks to simplify bookkeeping.

Enhanced Security & Real-Time Updates

Security is at the heart of PayWint. With encryption and AI-powered fraud detection, users can trust their financial data is always safe. Real-time alerts via text, email, or push notifications ensure you stay informed about every transaction.

Beyond Payments

PayWint isn't just a digital wallet; it's a comprehensive financial management tool. The AI-powered budget planner helps users track expenses and set financial goals. For businesses, the ability to schedule recurring payments and integrate payment widgets into websites adds unparalleled convenience.

Always There for You

With 24/7 customer support available via phone, email, text, and chat, help is always just a call or message away. You can reach us at (408) 516-1413 for any assistance. Whether it's a quick query or a technical issue, PayWint ensures you're never left in the dark.

Get Started with PayWint

Ready to transform how you handle money? Download the PayWint Digital Wallet Mobile App today from the Apple Store or Google Play Store. Alternatively, visit PayWint.com to access your financial world instantly.

2 notes

·

View notes

Text

Melio is a financial technology platform designed to streamline accounts payable and receivable processes for small and medium-sized businesses. It aims to simplify bill payments, improve cash flow management, and enhance overall financial operations. Here is a detailed review of its features and functionalities:

Key Features

Bill Payments:

Multiple Payment Methods: Melio allows businesses to pay vendors using ACH bank transfers, credit cards, or checks. This flexibility helps businesses manage cash flow and earn credit card rewards, even if the vendor only accepts checks. Schedule Payments: Users can schedule payments in advance, ensuring timely bill payments and avoiding late fees. Batch Payments: The platform supports batch payments, allowing users to pay multiple bills at once, saving time and reducing administrative burden.

Accounts Receivable:

Payment Requests: Businesses can send payment requests to customers via email, including a link for customers to pay directly through the platform.

Customer Management: Track customer payments, manage outstanding invoices, and automate reminders to improve collection rates.

Integration and Syncing:

Accounting Software Integration: Melio integrates with popular accounting software like QuickBooks, Xero, and FreshBooks, ensuring seamless data synchronization and reducing manual data entry.

Bank Integration: Direct integration with banks facilitates easy payment processing and reconciliation. User-Friendly Interface:

Dashboard: A clean and intuitive dashboard provides an overview of pending and completed payments, cash flow status, and upcoming bills.

Mobile Access: The platform is accessible via mobile devices, allowing users to manage payments and view financial data on the go.

Security and Compliance:

Secure Transactions: Melio employs robust security measures, including encryption and secure data storage, to protect user information and financial transactions.

Compliance: The platform adheres to financial regulations and industry standards, ensuring compliance with relevant laws.

Cash Flow Management:

Flexible Payment Options: By allowing credit card payments for bills, Melio helps businesses manage cash flow more effectively, providing the flexibility to defer payments while still meeting obligations.

Payment Scheduling: Advanced scheduling options enable better planning and control over outgoing cash flow.

Collaboration Tools:

Team Access: Multiple users can be granted access to the platform, allowing for collaborative financial management. Permission settings ensure that sensitive information is accessible only to authorized personnel.

Audit Trail: Detailed records of all transactions and activities help maintain transparency and accountability.

Pros Flexibility in Payments: The ability to pay bills via credit card, even when vendors don’t accept them, provides a unique advantage in managing cash flow and earning rewards. Ease of Use: The platform’s user-friendly interface and straightforward setup make it accessible for businesses of all sizes.

Integration with Accounting Software: Seamless integration with major accounting tools ensures accurate financial tracking and reduces manual workload.

Security: Strong security measures and compliance with industry standards provide peace of mind for users.

Batch Payments: Support for batch payments simplifies the process of paying multiple bills, saving time and reducing errors.

Cons Cost: While Melio offers a free version, certain advanced features and payment methods (like credit card payments) incur fees, which might be a consideration for cost-sensitive businesses. Limited Global Reach: Melio primarily serves businesses in the United States, which may limit its usefulness for companies with significant international operations or those based outside the U.S. Learning Curve for Advanced Features: Some users might find the advanced features complex initially, requiring time to fully utilize all functionalities.

Melio is a powerful and flexible tool for small and medium-sized businesses looking to streamline their accounts payable and receivable processes. Its ability to manage payments through various methods, integration with popular accounting software, and user-friendly design make it an attractive option for businesses aiming to enhance their financial operations. While there are costs associated with some features and a learning curve for advanced functionalities, the overall benefits, including improved cash flow management and operational efficiency, make Melio a valuable tool for modern businesses.

4 notes

·

View notes

Text

Smarter Numbers, Less Stress: How AI Bookkeeping Is Changing the Game for Small Businesses

Managing books isn’t just about numbers—it’s about peace of mind. For small business owners and freelancers, balancing income, expenses, taxes, and payroll can feel overwhelming. That’s where AI bookkeeping comes in—not as a replacement for accountants, but as a powerful tool that simplifies your financial life and saves hours of manual work.

If you’ve ever wished for a system that just handles the books, it’s time to understand what AI bookkeeping can actually do—and how it’s revolutionizing the way businesses stay organized and compliant.

What is AI Bookkeeping?

AI bookkeeping uses artificial intelligence to automate and streamline accounting tasks like data entry, expense tracking, invoice categorization, and financial reporting. It works behind the scenes reading receipts, matching transactions, reconciling bank statements, and even spotting errors before you do.

Instead of spending hours on spreadsheets or paying for reactive accounting, AI bookkeeping gives you a real-time snapshot of your business finances.

Why Small Business Owners Are Making the Switch

Time-Saving Automation

No more chasing receipts or updating ledgers line by line. AI systems pull data directly from your bank, POS, or payment platforms and categorize it instantly.

Fewer Mistakes

Let’s face it—humans make errors, especially when multitasking. AI bookkeeping reduces manual entry mistakes and flags unusual transactions so nothing slips through the cracks.

Cost-Effective Growth

Hiring a full-time bookkeeper can be expensive. AI bookkeeping platforms are scalable and affordable, making them ideal for startups and growing businesses.

Real-Time Insights

AI tools offer dashboards that show your cash flow, income, and expenses—updated daily. This helps you make smarter financial decisions and avoid surprises during tax season.

Stress-Free Tax Prep

AI keeps everything organized, categorized, and audit-ready. When it’s time to file taxes, your accountant has everything they need—clean, accurate, and compliant.

Who Can Benefit from AI Bookkeeping?

Freelancers juggling multiple income sources

E-commerce stores with high transaction volume

Restaurants and cafés with complex daily sales

Consultants who need to track billable hours and expenses

Nonprofits managing donations and grants

If you’re tired of feeling behind or unsure about your books, AI bookkeeping can give you clarity and control.

AI + Human = The Perfect Pair

AI powered bookkeeping doesn’t eliminate the need for accountants—it empowers them. Instead of spending time cleaning up spreadsheets, your accountant can focus on strategy, tax planning, and growth. Think of AI as your digital assistant and your accountant as the trusted advisor.

Choosing the Right AI Bookkeeping Platform

When choosing an AI bookkeeping tool, look for:

Bank-level security

Seamless integration with your bank, CRM, or POS

User-friendly dashboards

Live support or accountant access

Transparent pricing

Popular tools include QuickBooks Online with AI features, Xero, FreshBooks, and newer AI-driven platforms like Bench and Botkeeper.

Final Thoughts

AI bookkeeping is not a trend—it’s the new standard. Whether you’re a solo entrepreneur or scaling your team, automating your books is one of the smartest decisions you can make. You’ll save time, reduce stress, and gain real clarity on your business health.

Start small, stay consistent, and let AI do the heavy lifting. Your future self—and your bottom line will thank you.

0 notes

Text

Streamline Your Business with an Online Billing System: Here’s How

In today’s fast-paced digital landscape, efficiency is the key to staying ahead. One of the most overlooked yet impactful ways to improve operational efficiency is by adopting an Online Billing System. Whether you’re a freelancer, small business owner, or managing a growing enterprise, shifting from manual invoicing to a digital billing platform can save time, reduce errors, and enhance your customer experience.

1. What Is an Online Billing System?

An online billing system is a cloud-based platform that allows businesses to create, send, and manage invoices electronically. These systems often come with features like automated recurring billing, payment reminders, tax calculations, and real-time reporting.

Popular platforms include FreshBooks, QuickBooks, Zoho Invoice, and many others — each designed to help businesses simplify their financial processes.

2. Benefits of Using an Online Billing System

Time Savings

Manual invoicing can take hours every week. Online systems automate repetitive tasks like generating invoices, calculating totals, and sending reminders — freeing up your time for more strategic work.

Fewer Errors

Human errors in calculations, dates, or client information can lead to payment delays. Digital billing minimizes these mistakes with built-in checks and templates.

Faster Payments

Online billing platforms often include integrated payment gateways. Clients can pay directly from the invoice using credit cards, bank transfers, or digital wallets — improving your cash flow.

Better Record-Keeping

All your invoices, payment history, and customer data are stored in one secure place. This makes financial reporting and tax filing easier and more accurate.

Professionalism

Customized templates and branded invoices enhance your business’s image. A sleek, professional invoice leaves a better impression than a handwritten or generic one.

3. Key Features to Look For

When choosing an online billing system, consider these must-have features:

Recurring invoicing

Multi-currency support

Mobile accessibility

Payment integration

Automated tax calculations

Reporting and analytics

4. How to Get Started

Assess Your Needs: Consider the size of your business, the number of invoices you send, and whether you need features like inventory tracking or time billing.

Choose a Platform: Try demos or free trials to see which interface works best for you.

Set Up Your Account: Input your company details, add client information, and customize invoice templates.

Automate and Monitor: Set up recurring billing if applicable, and use dashboard analytics to monitor outstanding payments.

5. Conclusion

Switching to an Online Billing System is a smart move for any modern business. It saves time, boosts accuracy, improves cash flow, and helps you project a more professional image. If you're still relying on spreadsheets or paper invoices, it's time to embrace digital billing and streamline your financial processes for good.

0 notes

Text

Streamlining Your Business Finances with Invoice Payment Services

In today’s fast-paced business environment, managing cash flow effectively is critical to long-term success. One of the key components of maintaining healthy finances is ensuring timely and accurate handling of invoices. That’s where invoice payment services come into play — offering businesses a streamlined, efficient, and secure way to manage their billing and payments.

What Are Invoice Payment Services?

Invoice payment services refer to digital platforms or solutions that facilitate the creation, delivery, tracking, and settlement of invoices between businesses and their clients. These services can automate the entire process, from generating invoices to collecting payments and reconciling accounts, drastically reducing the manual effort involved in traditional invoicing.

These services are often integrated with accounting software and payment gateways, allowing for a seamless financial ecosystem. This integration enables businesses to send professional invoices, offer various payment methods (credit card, bank transfer, e-wallets), and even set automated reminders for overdue payments.

Benefits of Using Invoice Payment Services

1. Faster Payments One of the primary advantages of invoice payment services is speed. Automated invoicing and multiple payment options often encourage clients to pay faster, improving cash flow and reducing the stress of chasing payments.

2. Improved Accuracy and Fewer Errors Manual data entry is prone to errors. With invoice payment platforms, much of the information is auto-filled or pulled directly from databases, reducing the chances of mistakes and disputes.

3. Better Tracking and Reporting With built-in tracking features, these services offer complete visibility into your invoicing and payment status. You’ll know exactly when an invoice was sent, viewed, and paid — giving you greater control over your accounts receivable.

4. Time and Cost Efficiency Automating your invoicing process saves valuable time and cuts administrative costs. This efficiency frees up your team to focus on more strategic tasks, such as business development or customer service.

Choosing the Right Service for Your Business

There are many invoice payment services available today, such as QuickBooks, FreshBooks, Xero, and Zoho Invoice. The right choice depends on your specific business needs, industry, and scale. Look for services that offer:

User-friendly interface

Integration with your existing tools

Robust customer support

Scalable pricing models

0 notes

Text

Freelance ecom pros—stop chasing invoices and start getting paid like a pro 💸

Sick of clunky spreadsheets, late payments, and tracking down client info? You’re not alone. In 2025, digital invoicing tools have leveled up—and we broke down the best software options to help you save time, get paid faster, and stay on top of your biz. From FreshBooks to QuickBooks to Stripe Invoicing, we cover which tools are best for solopreneurs, growing teams, and international sellers. Plus: top features to look for ,like automation, mobile apps, and built-in client portals,, cost comparisons, and where to integrate with Shopify, Amazon, and more. Ready to upgrade your freelance finance game?👇

#ecommerce#freelancing#digitaltools#invoicing#smallbusiness#getpaid#shopify#amazonfba#remotework#businessgrowth

0 notes

Text

AI-Powered Automation: The Competitive Advantage for Small Businesses

What is AI-powered automation, and how does it work?

AI-powered automation is when machines use artificial intelligence (AI) to do tasks that normally need human thinking. These tasks include answering customer questions, managing emails, creating reports, scheduling meetings, and even making smart business decisions.

It combines machine learning, natural language processing, and data analytics to automate both simple and complex business processes. For small businesses, this means they can operate faster, smarter, and with fewer resources.

Why should small businesses care about AI automation?

Because AI helps small businesses do more with less. Here’s how:

Time savings: AI can reduce time spent on repetitive tasks by up to 80% (McKinsey & Company).

Cost efficiency: A study by Accenture found AI can lower operating costs by up to 30%.

Growth: Businesses that adopt AI grow revenue 50% faster than those that don’t (Forrester Research).

Competitive edge: In a crowded market, speed and precision matter. AI gives smaller companies tools that used to be available only to large enterprises.

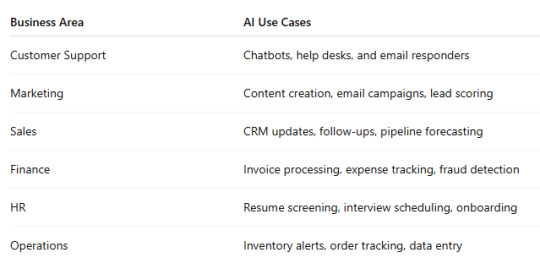

What areas of business can AI automate?

What are the benefits of using AI for small businesses?

Here’s how AI changes the game:

Saves time and resources

Automates repetitive tasks like data entry, scheduling, and follow-ups

Lets your team focus on work that requires real thinking

2. Improves customer service

Chatbots like Tidio or Drift respond 24/7

Personalizes responses based on customer history

3. Boosts marketing performance

AI tools like Mailchimp and ActiveCampaign send smarter emails

Tracks customer behavior and adjusts campaigns in real-time

4. Makes better decisions faster

AI tools can analyze data and show trends that humans might miss

Helps with forecasting sales or choosing the right products to promote

5. Scales with your business

AI doesn’t need a lunch break. As your business grows, it grows with you.

How much does AI automation cost for small businesses?

Good news — it’s more affordable than you think.

AI chatbots like Tidio start at around $29/month

AI email marketing tools like MailerLite start free, then scale up

AI scheduling tools like Calendly offer free tiers for solo users

AI bookkeeping software like QuickBooks with AI features start at $25/month

Even platforms like HubSpot and Zoho CRM have built-in AI tools now, often included in their base plans.

How do I get started with AI automation?

Step 1: Identify repetitive tasks Start with things you or your team do daily: sending emails, answering the same customer questions, or pulling reports.

Step 2: Choose the right tools Here are a few to consider:

CRM automation: Zoho CRM, HubSpot, Salesforce

Marketing AI: Mailchimp, Jasper, Copy.ai

Finance AI: QuickBooks, Xero, FreshBooks

Operations: Zapier, Make, Monday.com

Step 3: Start small Automate one task, track the results, and build from there. For example, use an AI chatbot to handle FAQs, then expand to email automation.

Step 4: Train your team Make sure your team understands the tools and knows how to use them. Choose platforms with good customer support or training videos.

Step 5: Monitor and adjust Check how automation affects your time, customer satisfaction, and budget. Tweak your system as needed.

Are there real-world examples of small businesses using AI?

Yes. Many small businesses are already using AI to succeed:

Coffee shop in Chicago used AI-powered email marketing and saw a 35% increase in repeat customers.

Online craft store in Texas used AI chatbots and reduced customer support response time by 70%.

Digital marketing agency in Florida automated lead scoring with Zoho CRM and boosted conversion rates by 25%.

These are simple use cases with big impact. None of them required full-time IT staff.

What are the risks or downsides of using AI for small businesses?

Like any tool, AI comes with challenges:

Over-automation: Customers still want to talk to humans sometimes.

Data privacy: You need to make sure the tools you use are secure and follow data laws.

Learning curve: Some tools require time to learn or train properly.

Wrong expectations: AI helps — but it doesn’t solve every problem magically.

The key is to use AI where it makes sense, not everywhere.

What should I look for in an AI solution provider?

When choosing a tool or consultant, make sure they:

Understand your industry and business size

Offer setup, support, and training

Work with trusted AI platforms

Can show real examples and results

Help you integrate with tools you already use

Don’t just pick the tool with the flashiest features. Choose the one that solves your problems best.

Final thoughts: Is AI automation worth it for small businesses?

Yes. AI-powered automation is no longer just for big companies. It’s for any business that wants to:

Save time

Lower costs

Serve customers better

Grow smarter

By starting with small changes — like chatbots, email automation, or CRM updates — you can see big returns quickly. And as the tools grow smarter and more affordable, the benefits will only increase.

If you’re unsure where to begin or want expert guidance, AeyeCRM offers personalized support to help small businesses get started with cloud-based AI tools that drive real results.

1 note

·

View note

Text

FreshBooks: Where Your Love for Reading Doesn’t Cost a Fortune

In a world of skyrocketing prices and shrinking wallets, one thing we shouldn't have to sacrifice is books — the very fuel of our imagination, knowledge, and growth.

But here's the truth: buying books online in India can feel like you're paying for gold-wrapped pages. That is, until you discover FreshBooks – India’s new favorite online bookstore where affordability meets passion for reading.

So, What Exactly is FreshBooks?

📚 FreshBooks (visit: https://freshbooks.in) is more than just another online bookstore. It’s a reader-first platform offering books across genres at student-friendly, budget-friendly, and book-lover-friendly prices.

Whether you're binge-reading thrillers, brushing up on textbooks, or building a personal library, FreshBooks has your back — and your bookmark.

5 Reasons Why FreshBooks is the Bookmark You’ve Been Missing

💸 1. Books That Don’t Break the Bank

At FreshBooks, the prices are genuinely surprising — in a good way. Most books are available at half (or less!) of what you'd pay on other platforms. You can finally buy 3 books without second-guessing your grocery budget.

📦 2. Fast, Hassle-Free Delivery

No more long waits or delivery hiccups. FreshBooks ensures safe, quick shipping across India, so your next adventure arrives right at your doorstep ��� on time.

🌿 3. Preloved is the New Cool

One of their standout features? A preloved book collection that’s easy on the planet and even easier on your wallet. Same content, lower cost, and zero guilt.

🧠 4. Designed for Students and Lifelong Learners

Looking for competitive exam guides? Academic references? Engineering or MBA textbooks? FreshBooks knows what students need — and they deliver (literally).

🛍️ 5. Curated Collections & Combo Offers

Handpicked bundles, genre-specific packs, and seasonal deals make shopping feel more like treasure hunting than task-doing.

The FreshBooks Vibe: Real, Relatable, and Reader-Friendly

What’s refreshing about FreshBooks is that it doesn’t pretend to be fancy. It’s clean, clutter-free, and clearly built by people who understand book lovers.

The website is easy to navigate. The categories make sense. And the prices are too good to keep to yourself (but go ahead, share the love).

Final Thoughts: India Needs FreshBooks — And So Do You

In a world drowning in streaming shows and digital distractions, FreshBooks gently reminds us of something beautiful: 📖 That turning a page still feels better than swiping a screen. And now, it doesn’t cost a fortune to do it.

If you’ve been holding off on buying books because of price, let FreshBooks restore your faith — and refill your shelf.

➡️ Explore FreshBooks now: https://freshbooks.in

0 notes

Text

How to Print and Mail Cheques from QuickBooks and Other Accounting Software

Even in 2025, cheques remain essential for many businesses. From vendor payments to payroll processing, printed cheques offer control, traceability, and compliance. While digital payments dominate in many sectors, printing and mailing cheques through accounting software like QuickBooks, Xero, and Sage is still a preferred option for thousands of companies.

In this comprehensive guide, you’ll learn how to securely print and mail cheques from QuickBooks and other accounting software—automatically, efficiently, and in compliance with today’s financial regulations.

Why Businesses Still Use Printed Cheques in 2025

Despite the rise of ACH and wire transfers, printed cheques continue to play a role due to:

Vendor preferences in certain industries.

Record-keeping requirements for auditing and reconciliation.

Security controls offered by physical documents.

Cross-border transactions where electronic systems may lag.

Advantages of Automated Cheque Printing and Mailing

AdvantageDescriptionSaves TimeNo manual printing, signing, or stuffing envelopes.Improves SecurityMICR-encoded, fraud-resistant checks with audit trails.Enhances WorkflowSyncs directly with your accounting system.Reduces CostsNo need for in-house printers, supplies, or postage.Offers Mailing FlexibilitySend via USPS, FedEx, or Canada Post.

How Cheque Printing & Mailing Works from QuickBooks

Step-by-Step for QuickBooks Online Users

Connect to a Cheque Mailing Service

Use integrations like Checkeeper, Melio, or Deluxe eChecks.

Enter Bill or Payment Info

Record the vendor payment like any other transaction.

Choose “Print Later” Option

Flag the cheque for batch processing.

Log into Your Cheque Mail Service

Import the pending cheques.

Select Cheque Style and Template

Use company-branded checks with MICR encoding.

Confirm Mailing Preferences

Select envelope type, delivery method, and speed.

Process and Track

Monitor mailing status and delivery confirmations.

Using Checkeeper: A QuickBooks-Integrated Solution

Checkeeper is a popular tool for QuickBooks users due to:

Full QuickBooks Online and Desktop integration.

Unlimited check printing and cloud-based templates.

USPS mailing with delivery tracking.

Same-day processing.

Printing Cheques from QuickBooks Desktop

Install Compatible Printer with MICR Toner

Insert Blank Cheque Stock

Go to File > Print Forms > Cheques

Select Bank Account and Cheques

Preview and Print

For mailing, integrate with services like PrintBoss, which automates batching and postal fulfillment.

Mailing Cheques from Other Accounting Software

1. Xero

Integrate with Plooto or Checkeeper.

Export payment details or sync directly via API.

Set up cheque layouts and print/mail options.

2. Sage

Use Sage-integrated tools like Deluxe or Checkflo.

Enable multi-user access for approvals and print queues.

3. FreshBooks

FreshBooks doesn’t have native cheque support but works via Zapier and tools like VersaCheck or Checkeeper.

Features to Look for in Cheque Printing Software

FeatureBenefitMICR EncodingMeets bank processing standards.Cloud Sync with Accounting SoftwareEnsures accurate data flow.USPS/Canada Post SupportOffers mail tracking and delivery options.Custom TemplatesAllows brand consistency.Batch PrintingSpeeds up bulk operations.Two-Factor AuthenticationAdds security for sensitive payments.

Security and Compliance Tips

Use Secure Printers or Cloud Providers

Prevent unauthorized access with role-based controls.

Enable Multi-User Approval Workflows

Require sign-off from finance or management.

Encrypt All Transactions

Ensure data in transit and storage is secured.

Store Cheque Images and Logs

Useful for audits and dispute resolution.

Comply with NACHA & CRA Standards

Meet U.S. and Canadian cheque compliance laws.

Cost Considerations

Cost ItemTypical CostBlank Cheque Stock$25–$60 per 500 checksMICR Toner Cartridges$80–$150 eachMailing Service Fees$1.50–$3.50 per chequeSoftware Subscription$10–$50/month depending on features

Using an all-in-one provider is often more affordable than managing in-house.

Best Practices for Efficiency

Automate recurring payments like rent or contractor payroll.

Outsource high-volume payments to print-and-mail vendors.

Centralize cheque logs for internal control and audit readiness.

Add QR codes for recipients to scan and confirm deposit instructions.

Cheque Printing API Integrations

For developers and finance teams:

Lob API – Ideal for enterprise cheque workflows.

Checkeeper API – Simple integration with CRMs and billing tools.

Melio API – Focused on bill pay and expense management.

These APIs enable fully automated cheque issuance from custom applications.

Conclusion

In 2025, printing and mailing cheques from QuickBooks and other accounting software is easier, faster, and more secure than ever. Whether you're a small business paying local vendors or a large organization handling payroll, leveraging cheque automation tools saves time, reduces errors, and ensures compliance.

By selecting the right platform, integrating with your accounting software, and following best practices, you can modernize your cheque workflow while keeping the trust and flexibility that paper payments provide.

youtube

SITES WE SUPPORT

Automated Postal APIs – Wix

0 notes

Text

Why Accounting & Bookkeeping Are Crucial for Business Success

Effective financial management is essential for any successful company, regardless of size. Accounting & bookkeeping procedures, which include documenting, categorising, and summarising financial transactions, are at the heart of this. These duties assist businesses in keeping correct financial records, which are necessary for deliberative decision-making. Without them, companies run the risk of experiencing financial mismanagement, tax problems, or legal problems. The difference is straightforward: accounting includes the interpretation, analysis, and reporting of those financial records, whereas bookkeeping deals with the daily recording of transactions. They are the foundation of any organization's finances.

The Role of Bookkeeping

The cornerstone of efficient financial management is bookkeeping. The consistent recording of all sales, purchases, receipts, and payments is guaranteed by bookkeepers. Tracking cash flow, figuring out spending patterns, and creating financial statements all depend on this consistency. Costly errors can result from even minor mistakes in record-keeping. In the current digital era, a lot of companies automate and streamline these procedures using software like Xero or QuickBooks. In addition to keeping your company in compliance with legal requirements, accurate bookkeeping also aids in spotting areas for expansion and enhancement.

How Accounting Helps You

Accounting analyses data to produce useful insights, whereas bookkeeping is primarily concerned with data recording. An accountant with training is able to create financial statements, carry out audits, and identify patterns that inform future plans. Here is where accounting & bookkeeping work in tandem to create a coherent financial narrative. Bookkeeping collects the raw data. Business owners can use these insights to forecast revenue, create budgets, and choose wisely what investments to make. Businesses can effectively scale and optimise operations by comprehending cost trends, return on investment, and profit margins.

The Importance of Financial Accuracy

Building credibility and trust is more important than simply avoiding mistakes when it comes to financial accuracy. Your financial records are used by investors, lenders, and tax authorities to evaluate the success of your company. Legal repercussions or missed business opportunities may result from misstated accounts. To make sure that financial reports accurately depict the state of your company, you should regularly reconcile accounts, look for discrepancies, and perform internal audits. Your ability to obtain loans or funding, as well as your tax filings, may be impacted by inaccurate records.

In-House and Outsourced Services

Businesses must choose between outsourcing to experts or maintaining operations internally when handling financial records. Although it can be expensive and time-consuming, hiring in-house employees gives you more control. Conversely, outsourcing lowers overhead expenses and provides you with access to specialists. When making this choice, it is critical to consider your budget, transaction volume, and business needs. As they expand, many startups and small businesses gradually switch from outsourcing to in-house teams. Every option has advantages and disadvantages, so it's critical to select the one that best suits your objectives.

Leveraging Technology

The field of accounting & bookkeeping has undergone a revolution thanks to technology. Businesses can manage their finances in real time, from any location in the world, thanks to cloud-based platforms. Financial reporting, expense tracking, and automated invoicing are among the features provided by programs like FreshBooks, Wave, and Zoho Books. These platforms offer immediate access to financial data and minimise human error. Efficiency is increased through integration with other business apps, such as banking, payroll, and inventory. Businesses can simplify their financial management and concentrate more on strategic expansion by utilising contemporary tools.

Tax Preparation and Compliance

Tax season is one of the most stressful times of the year for any business. However, tax preparation becomes much easier with proper accounting and consistent bookkeeping. You'll be prepared with all the required paperwork, such as balance sheets, expense reports, and income statements. Maintaining compliance with tax laws guarantees timely filings and helps you avoid penalties. Numerous accounting software programs have tax computation tools that adjust rates and regulations automatically according to your location. Speaking with an accountant on a regular basis also enables you to benefit from tax-saving techniques and legal deductions.

Planning for Growth

Planning for future expansion is made possible for business owners by accurate financial data. Predicting future income, costs, and cash flow using historical data and current trends is known as financial forecasting. This aids in the prudent distribution of resources, the detection of possible obstacles, and the development of expansion plans. A sound financial forecast is essential whether you're looking for funding, launching a new product, or breaking into a new market. Through data analysis and scenario modelling, accountants are essential in creating these forecasts. Financial stability and sustainable growth are guaranteed by careful planning.

Common Mistakes to Avoid

When it comes to handling their finances, many business owners make common mistakes. These include putting off financial reviews, disregarding minor transactions, and combining personal and business finances. Over time, such behaviours may cause misunderstandings and mistakes. Not getting professional assistance in a timely manner is another common error. A lack of financial knowledge can lead to major problems even with the best software. Avoiding these pitfalls can be facilitated by setting financial goals, keeping discipline, and routinely reviewing your records. Proactive action is always preferable to responding to financial crises.

Conclusion

Financial management is crucial in the cutthroat business world of today. Accounting & bookkeeping make sure your business stays financially stable, from budgeting to tax compliance. These procedures give you the information and understanding you need to make wise choices and succeed in the long run. Whether your business is new or well-established, making an investment in sound financial management will eventually pay off. You can confidently guide your company towards a prosperous future by appreciating their worth and enlisting the help of the appropriate experts and resources.

0 notes

Text

ROC Compliance Services Hyderabad

Smart Accounting Solutions for Business Success: How to Streamline Your Financial Operations

Effective accounting practices are critical for the growth and success of any business. Staying on top of your finances not only ensures compliance with tax laws but also provides a clear picture of your company’s financial health. The modern business landscape demands more efficient and innovative solutions to make financial management accurate and effortless. This article will explore smart accounting solutions, explaining how they can contribute to business success and give you a competitive edge. Income Tax Filing Madhapur Hyderabad

The Importance of Streamlining Accounting Processes

Managing a company’s finances can be a challenging task, especially for small to medium-sized businesses (SMBs) with limited resources. Complex spreadsheets, manual calculations, and scattered paperwork can slow operations, waste time, and lead to costly errors. This is where smart accounting solutions come in to revolutionize traditional bookkeeping methods. Best Ca Firms In Madhapur

Streamlining these processes offers several benefits, including:

Accuracy: Automated systems reduce the risk of human error.

Time Efficiency: Digital tools save countless hours spent on repetitive calculations.

Financial Insights: Real-time access to data helps in making informed business decisions.

Cost Savings: Outsourcing or investing in robust tools leads to long-term savings.

Let’s dive deeper into some of the best practices and tools that help simplify accounting for business success. TDS Return Filing Madhapur

Automated Accounting Software: A Game-Changer for Businesses

The advent of automated accounting software has changed the way businesses handle finances. These tools eliminate manual processes, allowing business owners to focus on growth strategies instead of spending excessive time on paperwork.

Some of the most popular accounting software options include:

QuickBooks: Designed for small businesses, QuickBooks simplifies expense tracking, payroll, and tax preparation.

Xero: A top choice for startups, offering cloud-based solutions with easy collaboration features.

FreshBooks: Ideal for freelancers and service providers, boasting exceptional invoicing capabilities.

Key Features of Smart Accounting Software

Real-Time Reporting: Access up-to-the-minute data for enhanced decision-making.

Cloud Integration: Manage finances from anywhere using cloud-based technology.

Scalability: Adjust the features as your business grows.

Compliance Support: Ensure you meet tax regulations effortlessly.

Whether your goal is to reduce the burden of manual inputs or prepare for yearly tax seasons, adopting automated tools can save your business valuable resources.

Outsourcing to Professional Accountants: Is It Worth It?

While some businesses thrive using automated tools, others find it beneficial to outsource their accounting needs to professionals. Hiring a certified accountant or bookkeeper frees up time and adds an expert’s perspective to your financial strategy. But is outsourcing the right move for your business?

Benefits of Outsourcing Your Accounting

Expertise: Professional accountants provide valuable insights and industry knowledge.

Time-Saving: Focus on core business operations while leaving accounting in capable hands.

Error Mitigation: Avoid costly mistakes with experienced oversight.

Tax Optimization: Leverage their expertise to maximize deductions and minimize liabilities.

When choosing between outsourcing and software adoption, assess your business’s size, needs, and complexity to determine the best fit. For larger companies, combining automation with outsourced professionals can provide the best of both worlds.

Key Steps to Implementing Smart Accounting Solutions

Adopting innovative accounting practices doesn’t have to be overwhelming. Here are some actionable steps to set up smart accounting solutions for your business:

1. Evaluate Your Needs: Begin by auditing your current system and identifying inefficiencies.

2. Research Software Options: Compare functionalities, pricing, and features of accounting tools.

3. Train Your Team: Educate your employees to use new systems effectively.

4. Set Up Automation: Automate recurring processes—like invoicing or payroll—to save time.

5. Monitor and Adjust: Regularly review performances and make necessary adjustments to improve efficiency.

By following these steps, businesses can ensure a seamless transition into smarter accounting practices without disrupting operations.

The Rise of Cloud-Based Accounting Solutions

One of the most significant advancements in accounting is the integration of cloud-based platforms. Unlike traditional software that requires frequent updates and storage on local devices, cloud solutions offer unmatched flexibility by securely storing files online.

Advantages of Cloud Accounting

Accessibility: Access your financial data from any internet-enabled device.

Collaboration: Easily share files with team members or accountants in real time.

Security: Advanced encryption protects sensitive financial information.

Updates: Enjoy automatic updates without additional costs.

Cloud accounting platforms like Xero, Wave, and Zoho Books have become essential for modern businesses aiming to stay competitive in a digital world.

Avoiding Common Accounting Mistakes

Even with advanced tools, certain accounting errors can still harm your business. Avoiding these pitfalls is vital to maintaining accurate financial records.

Top Accounting Mistakes to Avoid

1. Failing to Separate Personal and Business Finances: Always maintain separate accounts to simplify recordkeeping.

2. Ignoring Bank Reconciliation: Regularly match bank statements with financial records to catch discrepancies early.

3. Overlooking Tax Deadlines: Use alerts and reminders to avoid penalties.

4. Underestimating the Importance of Cash Flow: Always monitor inflows and outflows to ensure steady operations.

By avoiding these mistakes and staying proactive, businesses can secure long-term financial stability.

Why Smart Accounting Solutions Drive Business Success

Smart accounting tools and strategies play a transformative role in modern business operations. They empower business owners to make data-driven decisions, comply with regulations, and unlock opportunities for scalability.

Incorporating these solutions not only alleviates financial stress but also allows you to dedicate more time to innovation and consumer satisfaction. Whether you’re a small business owner just starting out or a large enterprise looking to optimize, investing in smart accounting practices is a step toward achieving sustainable growth.

Make financial management smarter, faster, and more precise—it’s time to adopt the accounting technology that will shape your business’s future.

By understanding the numerous advantages of these solutions, businesses can position themselves for long-term success and financial clarity. Implement the right tools today and watch your business thrive!

Tirumalesh & Co | Chartered Accountants offers expert Best CA Firms In Madhapur Get accurate, timely solutions from trusted professionals near you.

Call/What’s App – +91 84998 05550.

Location: https://bit.ly/42ljdS4

Visit link: https://www.catirumalesh.in/

#Income Tax Filing Madhapur Hyderabad#Best Ca Firms In Madhapur#TDS Return Filing Madhapur#Company Registration Madhapur#ROC Compliance Services Hyderabad#Professional Tax Filing Madhapur#Company Audit Services Near Me#GST Filing Services Madhapur#GST Registration Consultants Madhapur

1 note

·

View note

Text

The Essential Tools That Drive Entrepreneurial Success

Entrepreneurs face a wide range of challenges, from managing daily operations to growing their businesses and staying competitive. To help streamline processes, increase efficiency, and ensure smooth operations, the right tools are essential. In this article, we’ll explore the must-have tools that every entrepreneur should consider for their business journey.

Time Management Tools: Maximizing Productivity

By monitoring their daily activities, entrepreneurs can eliminate distractions, focus on high-priority tasks, and ensure that they’re making the most of their time. These tools also offer features like time tracking, scheduling, and goal setting, which are crucial for maintaining productivity in a fast-paced business environment.

Financial Management Tools: Keeping Your Business Profitable

Sound financial management is essential for long-term business success. Entrepreneurs need tools that simplify accounting, monitor cash flow, and ensure taxes are correctly filed. Financial management tools such as QuickBooks, Xero, and FreshBooks help entrepreneurs manage invoicing, track expenses, and generate financial reports.

These tools provide automated features that save time and reduce errors, allowing entrepreneurs to focus on growing their businesses while maintaining healthy financial practices. Having a reliable financial tool helps prevent costly mistakes and ensures the business remains profitable.

CRM Tools: Enhancing Customer Relationships

Building strong relationships with customers is critical to growing a sustainable business. Customer relationship management (CRM) tools like HubSpot, Salesforce, and Zoho CRM allow entrepreneurs to manage customer data, track interactions, and streamline communication.

These platforms help entrepreneurs stay organized by storing valuable customer information, automating follow-ups, and offering insights into customer behavior. By using a CRM, entrepreneurs can improve customer retention, personalize marketing efforts, and ultimately boost sales.

Email Marketing Tools: Effective Outreach

Email marketing is a powerful tool for nurturing relationships and increasing conversions. Email marketing platforms such as Mailchimp, Send Grid, and ConvertKit allow entrepreneurs to create, automate, and track email campaigns that engage their audience.

These tools help entrepreneurs design visually appealing emails, segment their audience, and measure campaign performance through open rates, click-through rates, and conversions. With the right email marketing tool, entrepreneurs can keep customers engaged, promote products, and build a loyal customer base.

Social Media Management Tools: Boosting Brand Presence

Social media is an essential marketing tool for most businesses. However, managing multiple accounts across platforms can be overwhelming. Social media management tools like Hootsuite, Buffer, and Sprout Social allow entrepreneurs to schedule posts, track engagement, and analyze their performance.

By using social media tools, entrepreneurs can save time on manual posting, maintain a consistent presence across various platforms, and monitor how their content performs. These tools also provide insights that help businesses refine their social media strategies and increase audience engagement.

Project Management Tools: Organizing Tasks and Teams

As a business grows, it becomes increasingly important to manage tasks and projects efficiently. Project management tools like Asana, Monday.com, and Trello provide entrepreneurs with an easy way to break down complex projects, assign tasks, and track deadlines.

These tools help entrepreneurs coordinate with teams, prioritize tasks, and ensure that every project stays on track. With project management tools, entrepreneurs can increase collaboration, reduce bottlenecks, and complete projects more efficiently, ultimately contributing to business growth.

Legal Tools: Ensuring Business Compliance

Entrepreneurs need to ensure that their business operates within the bounds of the law. Legal tools like LegalZoom, Rocket Lawyer, and DocuSign provide entrepreneurs with essential legal documents, contract templates, and digital signatures, simplifying the legal side of business operations.

These platforms help entrepreneurs create legally binding contracts, register trademarks, and ensure compliance with local and international laws. Legal tools reduce the need for in-house legal counsel, helping entrepreneurs save time and money while ensuring legal protection for their businesses.

E-commerce Platforms: Reaching a Global Audience

For entrepreneurs in the retail business, having an online presence is crucial. E-commerce platforms like Shopify, Woo Commerce, and Big Commerce enable entrepreneurs to set up and manage online stores with ease.

These platforms provide everything from product listings and payment processing to inventory management and customer support. Entrepreneurs can use e-commerce tools to build a professional online store, expand their customer base, and provide a seamless shopping experience for customers worldwide.

Cloud Storage Solutions: Safe and Accessible Data

Entrepreneurs need a secure place to store important business documents, from contracts and invoices to marketing materials and financial records. Cloud storage tools like Google Drive, Dropbox, and OneDrive provide entrepreneurs with a secure and easily accessible location to store and share files.

These tools enable collaboration between team members, secure data backup, and easy sharing of important files. Cloud storage ensures that entrepreneurs can access their data from anywhere, anytime, and helps keep important documents safe from hardware malfunctions or data loss.

Analytics Tools: Measuring Business Performance

To make informed decisions and drive business growth, entrepreneurs need access to data and insights. Analytics tools like Google Analytics, Tableau, and Kiss metrics provide valuable data on website traffic, user behavior, and business performance.

These platforms help entrepreneurs track key performance indicators (KPIs), monitor marketing campaign success, and understand customer behavior. With the insights provided by analytics tools, entrepreneurs can optimize their strategies, improve user experience, and ultimately make better business decisions.

Entrepreneurs wear many hats, and having the right tools is essential for running a successful business. The tools discussed in this article—from time management and financial tracking to customer relationship management and analytics—provide entrepreneurs with the necessary resources to streamline operations, stay organized, and scale their businesses effectively.

0 notes

Text

Top Accounting Websites for Reliable Financial Tips and Business Solutions

The Power of Accounting Websites: A Modern Resource for Financial Success

In today’s fast-paced digital world, businesses and individuals alike are turning to online platforms to manage their finances more efficiently. Accounting websites have become essential tools for entrepreneurs, small business owners, freelancers, and even accountants themselves. These platforms not only offer powerful financial tools and resources, but they also provide insights, automation, and compliance features that simplify the often complex world of accounting.

In this article, we’ll explore the importance of accounting websites, highlight key features to look for, and review how they can support better financial management and business growth.

What Are Accounting Websites?

Accounting websites are online platforms or portals that offer a range of services related to bookkeeping, tax preparation, invoicing, payroll, and financial reporting. These sites can be educational, software-based, or service-oriented, depending on the needs of the user.

Some of the most popular examples include QuickBooks, FreshBooks, Xero, and Wave Accounting. Meanwhile, educational accounting websites such as AccountingCoach or Investopedia provide tutorials, glossaries, and guides for those learning the basics of finance.

Why Use Accounting Websites?

Whether you're a business owner or a solo entrepreneur, managing your books manually or through spreadsheets can quickly become overwhelming. Accounting websites offer multiple advantages, such as:

1. Efficiency and Automation

One of the greatest benefits of accounting websites is the automation of routine tasks. Most platforms automatically import bank transactions, generate invoices, and categorize expenses. This saves hours of manual data entry and reduces the risk of human error.

2. Real-Time Financial Insights

With cloud-based accounting websites, users can access their financial data in real-time from any device. Dashboards and analytics tools provide instant snapshots of cash flow, profits, and outstanding invoices. These insights allow for better decision-making and proactive financial planning.

3. Tax Compliance and Preparation

Staying on top of taxes is one of the most stressful parts of running a business. Many accounting websites are designed with built-in tax tools to help track deductible expenses, generate tax reports, and even file returns. Some also integrate directly with tax preparation software or services, making the process seamless.

4. Scalability for Growing Businesses

Whether you're a freelancer just starting out or a growing enterprise, accounting websites are designed to scale with your needs. You can start with basic features and add more robust tools like payroll processing, inventory management, or multi-currency support as your business expands.

Features to Look for in Accounting Websites

Not all accounting websites are created equal. When choosing the right platform, consider the following features:

User-friendly Interface: The best accounting websites are easy to navigate, even for users with little to no financial background.

Cloud Accessibility: Cloud-based solutions allow for on-the-go access and collaboration with your accountant or team.

Integration Options: Look for platforms that integrate with other tools you already use, such as CRM systems, payment gateways, or e-commerce platforms.

Security Protocols: Ensure the website uses strong encryption and data protection protocols to keep your financial information safe.

Customer Support: Responsive customer service, tutorials, and a strong knowledge base are key when questions or issues arise.

Top Accounting Websites Worth Exploring

Here are a few notable accounting websites that cater to various financial and business needs:

QuickBooks Online: One of the most well-known accounting software platforms, QuickBooks offers a full suite of features including invoicing, reporting, and payroll.

Xero: A cloud-based platform favored by small businesses, Xero provides simple accounting tools with strong bank integration and multi-user access.

FreshBooks: Ideal for freelancers and service-based businesses, FreshBooks offers easy invoicing, time tracking, and expense management.

Wave: A free accounting website geared toward small businesses, offering invoicing, accounting, and receipt scanning with no hidden fees.

AccountingCoach: A valuable educational website for those wanting to learn accounting concepts from scratch, featuring lessons, quizzes, and tutorials.

Final Thoughts

In the modern financial landscape, accounting websites have become more than just convenient tools—they are critical resources for business success. From automating daily tasks to offering in-depth financial insights and tax compliance, these platforms help businesses operate more efficiently and make smarter financial decisions.

Choosing the right accounting website depends on your business’s specific needs, budget, and growth plans. With the right platform, even those with limited financial knowledge can gain control over their books, ensure compliance, and focus more on strategic growth.

Whether you're starting a new business or looking to streamline your current financial processes, investing time in finding the right accounting website can lead to long-term success and peace of mind.

#BusinessAccountant#SmallBusinessAccounting#AccountingForBusiness#FinanceExpert#TaxPlanning#BusinessFinance

0 notes