#Global Artificial Intelligence in Security Market research Global Artificial Intelligence in Security Market report Global Artificial Intel

Text

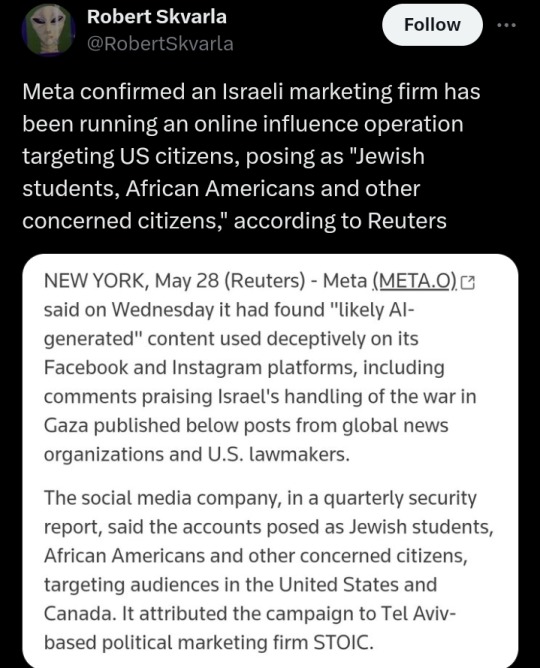

Meta identifies networks pushing deceptive content likely generated by AI

Meta (META.O) said on Wednesday it had found "likely AI-generated" content used deceptively on its Facebook and Instagram platforms, including comments praising Israel's handling of the war in Gaza published below posts from global news organizations and U.S. lawmakers.

The social media company, in a quarterly security report, said the accounts posed as Jewish students, African Americans and other concerned citizens, targeting audiences in the United States and Canada. It attributed the campaign to Tel Aviv-based political marketing firm STOIC.

While Meta has found basic profile photos generated by artificial intelligence in influence operations since 2019, the report is the first to disclose the use of text-based generative AI technology since it emerged in late 2022.

Researchers have fretted that generative AI, which can quickly and cheaply produce human-like text, imagery and audio, could lead to more effective disinformation campaigns and sway elections.

In a press call, Meta security executives said they removed the Israeli campaign early and did not think novel AI technologies had impeded their ability to disrupt influence networks, which are coordinated attempts to push messages.

#yemen#jerusalem#tel aviv#current events#palestine#free palestine#gaza#free gaza#news on gaza#palestine news#news update#war news#war on gaza#hasbara#israeli propaganda#ai#artificial intelligence#misinformation

460 notes

·

View notes

Text

Transforming the Health Landscape: The Global Blockchain in Healthcare Market

The integration of blockchain technology into the healthcare sector is revolutionizing the way medical data is managed, shared, and secured. As the demand for transparent, efficient, and secure healthcare services grows, blockchain offers promising solutions to longstanding challenges.

Understanding Blockchain in Healthcare

Blockchain Technology is a decentralized digital ledger that records transactions across multiple computers in a way that ensures the security and transparency of data. In healthcare, blockchain can be used to manage patient records, track pharmaceuticals, ensure the integrity of clinical trials, and streamline administrative processes. The immutable nature of blockchain helps in preventing data breaches, ensuring data accuracy, and enhancing patient privacy.

According to BIS Research, the Global Blockchain in Healthcare Market was estimated to grow to a value of $5.61 billion by 2025, and still the market is showing a steep growth till 2030 witnessing a double-digit CAGR growth rate throughout the forecast period.

Key Market Dynamics

Several factors are driving the growth of the global blockchain in healthcare market:

Data Security and Privacy:

Need for robust data security and privacy solutions.

Healthcare data breaches are a growing concern.

Blockchain's secure, immutable nature protects sensitive patient information.

Interoperability and Data Sharing:

Facilitates seamless data sharing between healthcare providers and systems.

Overcomes current interoperability issues.

Leads to better patient outcomes by providing a comprehensive view of health history.

Supply Chain Transparency:

Tracks the entire lifecycle of drugs in the pharmaceutical industry.

Ensures the authenticity of medications.

Helps combat counterfeit drugs.

Efficient Administrative Processes:

Streamlines various administrative processes, such as billing and claims management.

Reduces fraud and administrative costs.

Support from Regulatory Bodies:

Increasing support from regulatory bodies and governments.

Initiatives by FDA and EMA to explore blockchain for drug traceability and clinical trials boost market growth.

Request for an updated Research Report on Global Blockchain in Healthcare Market Research.

Global Blockchain in Healthcare Industry Segmentation

Segmentation by Application:

Data Exchange and Interoperability

Supply Chain Management

Claims Adjudication and Billing Management

Clinical Trials and Research

Others

Segmentation by End-User:

Healthcare Providers

Pharmaceutical Companies

Payers

Others

Segmentation by Region:

North America

Europe

Asia-Pacific

Latin America and Middle East & Africa

Future Market Prospects

The future of the global blockchain in healthcare market looks promising, with several trends likely to shape its trajectory:

Integration with AI and IoT: The integration of blockchain with artificial intelligence (AI) and the Internet of Things (IoT) will enhance data analytics, predictive healthcare, and real-time monitoring.

Expansion of Use Cases: New use cases for blockchain in digital healthcare will emerge, including patient-centered care models, personalized medicine, and enhanced telemedicine services.

Focus on Patient-Centric Solutions: Blockchain will enable more patient-centric healthcare solutions, empowering patients with greater control over their health data and enhancing patient engagement.

Development of Regulatory Frameworks: The establishment of clear regulatory frameworks and industry standards will facilitate the widespread adoption of blockchain in healthcare.

Conclusion

The Global Blockchain in Healthcare Industry is poised for significant growth, driven by the need for enhanced data security, interoperability, supply chain transparency, and efficient administrative processes. By addressing challenges related to regulatory compliance, implementation costs, standardization, and scalability, and leveraging opportunities in technological advancements, investments, partnerships, and government initiatives, the potential of blockchain in healthcare can be fully realized. This technology promises to revolutionize healthcare delivery, enhancing efficiency, transparency, and patient outcomes, and setting new standards for the future of digital health.

#Blockchain in Healthcare Market#Blockchain in Healthcare Industry#Blockchain in Healthcare Market Report#Blockchain in Healthcare Market Research#Blockchain in Healthcare Market Forecast#Blockchain in Healthcare Market Analysis#Blockchain in Healthcare Market Growth#BIS Research#Healthcare

2 notes

·

View notes

Text

Core Banking Software: Industry Dynamics, Major Companies Analysis and Forecast- 2030

Core Banking Software Industry Overview

The global core banking software market size was valued at USD 10.89 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030. The market growth can be attributed to the rising incorporation of technology to provide core banking operations and services. Digitized operations have enhanced banking service quality and reduced turnover times. Technological advancements have also enabled financial institutions to adapt to changing customer needs, a prominent example being the provision of omnichannel banking access.

Gather more insights about the market drivers, restrains and growth of the Core Banking Software Market

In addition to providing customers the ability to manage accounts remotely through online banking and mobile channels, core banking software has multiple other benefits. Core banking software solutions connect multiple branches to a centralized system making them interconnected and allowing for efficient search and comparison of data. Banks can leverage core banking software to analyze data and improve internal processes. Moreover, through transaction monitoring and screening, core banking solutions help detect and prevent money laundering.

The pace of technological innovation and adoption has gathered tremendous pace across sectors. Integrating the latest technologies, such as generative artificial intelligence in banking and financial activities, can help firms differentiate from the competition and gain a competitive edge. According to a study conducted by Accenture in March 2023, covering over 49,000 customers, 67% mentioned using branch services for very specific and complex problems that require physical presence. Moreover, the survey estimates that banks can boost revenue by up to 20% through better engagement with primary customers.

Core banking digitization can make banking transactions more effective. A unified system enables seamless access to customer information and reduces the need for redundant data entry, resulting in faster and more accurate transactions. Additionally, core banking systems support real-time processing, enable instant account and transaction updates, and faster payments and fund transfers. Furthermore, core banking software improves overall security features and fraud detection mechanisms, ensuring the safety of transactions and protecting customers from potential risks.

However, the complex nature of banking operations may pose some challenges. Several financial institutions are in the early phases of transitioning from legacy systems to digital solutions for better banking. However, the transition is bringing about privacy concerns associated with making the shift which plagues the growth of the market. However, core banking solution providers are innovating and providing customized solutions to meet the needs of banks and financial institutions.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

• The global public relations tools market size was valued at USD 6.35 billion in 2023 and is expected to grow at a CAGR of 10.9% from 2024 to 2030. Public relations (PR) tools are used to connect with public organizations or institutions to build a positive connection between the organization and customers.

• The global AI in chemicals market size was estimated at USD 943.0 million in 2023 and is projected to grow at a CAGR of 27.8% from 2024 to 2030. The market is experiencing significant growth as the industry increasingly adopts advanced technologies to enhance efficiency and innovation.

Core Banking Software Market Segmentation

Grand View Research has segmented the global core banking software market based on solution, service, deployment, end-use, and region.

Core Banking Software Solution Outlook (Revenue, USD Million, 2017 - 2030)

• Deposits

• Loans

• Enterprise Customer Solutions

• Others

Core Banking Software Service Outlook (Revenue, USD Million, 2017 - 2030)

• Professional Service

• Managed Service

Core Banking Software Deployment Outlook (Revenue, USD Million, 2017 - 2030)

• Cloud

• On-premise

Core Banking Software End-use Outlook (Revenue, USD Million, 2017 - 2030)

• Banks

• Financial Institutions

• Others

Core Banking Software Regional Outlook (Revenue, USD Million, 2017 - 2030)

• North America

o US

o Canada

• Europe

o Germany

o U.K.

o France

• Asia Pacific

o China

o India

o Japan

o Australia

o South Korea

• Latin America

o Brazil

o Mexico

• Middle East & Africa

o Kingdom of Saudi Arabia (KSA)

o UAE

o South Africa

Order a free sample PDF of the Core Banking Software Market Intelligence Study, published by Grand View Research.

Key Companies profiled:

• Capgemini

• Finastra

• FIS

• Fiserv, Inc.

• HCL Technologies Limited

• Infosys Limited

• Jack Henry & Associates, Inc.

• Oracle Corporation

• Temenos Group

• Unisys

0 notes

Text

How Technology is Revolutionizing Fund Support Solutions

Fund support solutions often include investor onboarding, managing shareholder relations, conducting financial audits, integrating digital commerce, market research, creating multimarket funds, and managing debt conversion. As the banking, financial services, and insurance (BFSI) sector rapidly expands, stakeholders are increasingly adopting the latest fintech innovations to optimize these processes. This post explores how technology is revolutionizing fund support solutions.

Understanding the Scope of Fund Support Solutions

Risk analysis and developing effective portfolio strategies require in-depth market research, company profiling, and rigorous due diligence. Consequently, the demand for fintech that facilitates automation is growing globally. Numerous fund support solutions have also emerged to simplify fund admissions, automate investment research, and provide comprehensive feasibility reports.

To scale operations effectively, global bankers, financial advisors, and auditors must explore technological integrations while maintaining consistent accounting practices, round-the-clock fund management, and high data quality. Moreover, technologies that track evolving policies on taxation, sustainability disclosures, and wealth management are essential for minimizing compliance risks.

How Technology is Revolutionizing Fund Support Solutions

1| Forecasting Fund Performance

Predictive analytics uses historical data combined with machine learning (ML) to predict a fund's future performance. These predictive tools help in risk assessments, enabling portfolio managers to make balanced investment decisions. As a result, financial professionals can enhance their screening and profiling processes, leading to more accurate reporting.

Prescriptive analytics, an advanced stage of predictive technology, uses artificial intelligence (AI) to recommend risk management and portfolio diversification strategies. However, implementing such technologies requires robust fund data solutions, as high-quality datasets are critical for generating accurate AI recommendations.

2| Real-Time Data Streaming and Edge Computing

Real-time data streaming and edge computing technologies capture data near its source as soon as an event occurs, providing immediate insights to relevant devices for fund support solutions. This approach enables access to higher-quality datasets, as edge computing can filter data based on relevance or other criteria before dissemination.

While related to the Internet of Things (IoT), these applications focus on tracking market trends, company activities, media coverage, and risk exposure. Enhanced decentralized processing capabilities also reduce the workload on central servers for financial advisory firms.

Furthermore, companies need to collaborate with auditors, safety inspectors, and compliance assessors who may require instantaneous data delivery through custom streaming platforms. Real-time access to a company’s operations, accurate accounting, and legal compliance bolsters investor confidence. However, while implementing this technology in public companies is straightforward, it can be more challenging for private enterprises.

3| Blockchain and Smart Contracts

Technologies like blockchain and smart contracts create secure, unchangeable databases that record transactions, ownership, contracts, and partnerships. Blockchain technology can reduce transaction times by minimizing the need for extensive cross-verification, which typically delays high-value transactions through traditional banks.

This shift promises a faster transition to transparent financial management. At the same time, blockchain can streamline fund operations and investment support, benefiting all BFSI stakeholders. By promptly reflecting fund changes, blockchain and smart contracts support informed wealth management decisions.

Conclusion

Regardless of the specific role within the financial sector—whether it’s investment research or sustainability auditing—modern technology enhances record-keeping, data sharing, and risk assessment, contributing to more effective fund support solutions.

For example, Deloitte has demonstrated the benefits of integrating blockchain technology with private equity operations and tax evaluations, highlighting how limited partners (LPs) can gain from tokenized share ownership.

Similar initiatives are gaining traction among regulators and private companies worldwide, pointing toward a promising future for fintech applications.

1 note

·

View note

Text

Whitepaper dispels fears of AI-induced job losses

New Post has been published on https://thedigitalinsider.com/whitepaper-dispels-fears-of-ai-induced-job-losses/

Whitepaper dispels fears of AI-induced job losses

.pp-multiple-authors-boxes-wrapper display:none;

img width:100%;

Fears that AI will lead to mass job losses are unfounded, according to a new whitepaper. The report, released by British AI software firm Automated Analytics, found that none of its 5,000 clients across the UK and US reported laying off staff as a result of AI implementation.

The whitepaper, titled “Unlocking Data, Unlocking People: Harnessing the Power of AI to Transform Your Business,” launched today at Scale Space White City in London’s White City Innovation District. It argues that AI can actually be a catalyst for growth, rather than a threat to jobs.

Despite evidence to the contrary, the study also reveals a lingering fear of AI among UK business leaders.

A YouGov survey commissioned by Automated Analytics found that over half of senior decision-makers still believe AI will eliminate more jobs than it creates. Only 17% believe AI will create more jobs than it eliminates.

This hesitancy, the report warns, could have serious consequences for the UK economy. As US firms increasingly embrace AI, British businesses risk being left behind. Mark Taylor, CEO of Automated Analytics, argues that the UK needs to shift its focus from regulation to innovation in order to remain competitive.

“AI is not about replacing jobs; it’s about enhancing productivity and creating new opportunities,” says Taylor. “Our whitepaper provides concrete examples of how AI can drive growth, efficiency, and competitiveness. The UK cannot afford to lag behind in this critical area.”

The whitepaper highlights several case studies demonstrating the positive impact of AI on businesses:

British Gas’ Dyno-Rod: AI helped to halve the number of service calls by improving understanding of customer journeys, providing franchise operations with 100% visibility.

Pizza Hut (US): Restaurant Management Group, the fourth-largest US franchisee, used AI to reduce recruitment costs by $1 million and increase hires by 42%.

Fourth (UK): The hospitality recruitment firm saw a 220% increase in candidate flow and a drastic reduction in cost-per-application within 30 days of implementing its AI-driven TalentTrack software.

Taylor also expressed concern over the cultural differences between the US and UK in embracing new technologies.

“The US is leading the charge in AI adoption, while the UK remains overly focused on regulation. This whitepaper demonstrates that many fears surrounding AI are unfounded and that it can play a crucial role in driving the UK’s economic growth.”

The whitepaper serves as a call to action for UK businesses to embrace AI as a vital tool for driving innovation and competitiveness in the global market. While it’s clear that businesses must adopt AI responsibly, the whitepaper should help to dispel fears of mass job losses.

A copy of the whitepaper can be found here (registration required.)

(Photo by Ruthson Zimmerman)

See also: UK signs AI safety treaty to protect human rights and democracy

Want to learn more about AI and big data from industry leaders? Check out AI & Big Data Expo taking place in Amsterdam, California, and London. The comprehensive event is co-located with other leading events including Intelligent Automation Conference, BlockX, Digital Transformation Week, and Cyber Security & Cloud Expo.

Explore other upcoming enterprise technology events and webinars powered by TechForge here.

Tags: adoption, ai, artificial intelligence, careers, enterprise, ethics, jobs, regulation, report, research, Society, study, whitepaper

#000#adoption#ai#ai & big data expo#AI adoption#ai safety#amp#Analytics#applications#Articles#artificial#Artificial Intelligence#automation#Big Data#Business#california#Careers#catalyst#CEO#Cloud#comprehensive#concrete#conference#cyber#cyber security#data#decision-makers#Democracy#Digital Transformation#driving

0 notes

Text

Competitive Landscape in the Custom Software Development Sector

Network Slicing Market Overview:

Network slicing is a network architecture technique that enables the creation of multiple virtual networks within a single physical network infrastructure. Each "slice" operates as an independent network with its own set of resources, tailored to meet specific requirements for different services or applications. This approach enhances efficiency by allowing operators to optimize network resources for varying use cases, such as IoT, enhanced mobile broadband, or ultra-reliable low-latency communications. Network slicing supports greater flexibility, scalability, and customization, making it a key component in the evolution of 5G and beyond.

Network Slicing Market Trends:

The network slicing market is experiencing rapid growth driven by the expansion of 5G networks and the increasing demand for customized, high-performance connectivity solutions. Key trends include the adoption of network slicing for diverse applications such as IoT, smart cities, and autonomous vehicles, which require distinct network characteristics. Additionally, advancements in virtualization and cloud-native technologies are facilitating more efficient and flexible network slicing implementations. The integration of artificial intelligence and machine learning for dynamic slice management is also gaining traction, enhancing the ability to optimize network performance and resource allocation in real-time.

[PDF Brochure] Request for Sample Report:

Network Slicing Market Segmentation:

Custom Software Development Solution Outlook

Web-based Solutions

Mobile App

Enterprise Software

Custom Software Development Deployment Outlook

Cloud

On-premise

Custom Software Development Enterprise Size Outlook

Large Enterprises

Small & Medium Enterprises (SMEs)

Custom Software Development End Use Outlook

BFSI

Government

Healthcare

IT & Telecom

Manufacturing

Retail

Key Companies Profiled Source:

Brainvire Infotech Inc., Capgemini, Iflexion, Infopulse, Infosys Ltd., Magora, MentorMate Inc., Tata Consultancy Services Limited, Trigent Software, Inc., and TRooTech Business Solutions

Custom Software Development Enterprise Regional Outlook:

The custom software development enterprise landscape is increasingly characterized by regional diversification, driven by technological advancements and shifting market demands. In North America and Europe, the focus is on leveraging cutting-edge technologies like AI and cloud computing to build sophisticated, scalable solutions. Meanwhile, in regions such as Asia-Pacific and Latin America, there's a growing emphasis on cost-effective solutions and rapid development cycles to cater to dynamic business environments. Overall, the industry is evolving towards a more globalized approach, where local expertise and regional trends play a crucial role in shaping customized software solutions.

Future Outlook

The future of custom software development is poised for rapid transformation, driven by advancements in artificial intelligence, machine learning, and automation. As businesses increasingly seek tailored solutions to address complex needs, the demand for agile development practices and integrated technologies will grow. The rise of edge computing and IoT will further propel innovation, enabling real-time data processing and enhanced user experiences. Additionally, cybersecurity and data privacy concerns will become more central, influencing how software is developed and deployed. Overall, the industry will likely see a greater emphasis on personalization, efficiency, and secure, scalable solutions.

Browse In-depth Market Research Report:

0 notes

Text

Open Banking Market is Predicted to Grow At More Than 22% CAGR till 2032

Open Banking Market size is estimated to be valued at USD 130.2 Bn till 2032. The rising integration with digital currency platforms to enable seamless transactions between fiat currencies and cryptocurrencies will influence the industry growth. The implementation of robust security measures, such as encryption, multi-factor authentication, and real-time monitoring, has grown critical for protecting sensitive financial data in open banking. Of late, leading financial institutions and fintech firms are exploring subscription-based models for open banking services to offer premium features and value-added services through tiered pricing plans.

Request for Sample Copy report @ https://www.gminsights.com/request-sample/detail/6210

Open banking market share from the digital currencies financial services segment is expected to exponentially expand between 2024 and 2032. By directly linking digital wallets to their banking systems, open banking streamlines the acceptance of digital currency payments by merchants. This integration lowers the hurdles for businesses eager to embrace cryptocurrencies. Furthermore, it enables connections with global financial institutions, simplifying cross-border transactions and allowing users to effortlessly send and receive payments in various currencies worldwide.

The on-premise deployment model segment is expected to account for considerable share of the open banking industry by 2032. Financial institutions using on-premise open banking solutions can fully control sensitive customer data. As concerns about data breaches and cyberattacks grow, numerous banks are opting to manage data in-house instead of depending on third-party cloud services. On-premise deployments further allow banks to customize their open banking infrastructure as per their specific needs. This flexibility is particularly important for large financial institutions with complex IT environments that require bespoke solutions.

Request for customization this report @ https://www.gminsights.com/roc/6210

Asia Pacific open banking industry size is anticipated to reach a significant share by 2032. This is propelled by the surge in cross-border open banking services, particularly in areas, such as remittances and international payments. Countries like India, Indonesia, and Vietnam are witnessing a swift expansion of open banking. With a vast unbanked populace and a strong mobile presence, these nations present lucrative prospects for open banking solutions. The proliferation of digital payments in China and India will also influence regional market growth.

Partial chapters of report table of contents (TOC):

Chapter 1 Methodology & Scope

1.1 Market scope & definition

1.2 Research design

1.2.1 Research approach

1.2.2 Data collection methods

1.3 Base estimates & calculations

1.3.1 Base year calculation

1.3.2 Key trends for market estimation

1.4 Forecast model

1.5 Primary research and validation

1.5.1 Primary sources

1.5.2 Data mining sources

Chapter 2 Executive Summary

2.1 Industry 3600 synopsis, 2021 - 2032

Chapter 3 Industry Insights

3.1 Industry ecosystem analysis

3.2 Supplier landscape

3.2.1 API platforms and gateway providers

3.2.2 Security solutions providers

3.2.3 RegTech providers

3.2.4 End user

3.3 Profit margin analysis

3.4 Technology & innovation landscape

3.5 Patent analysis

3.6 Key news & initiatives

3.7 Regulatory landscape

3.8 Impact forces

3.8.1 Growth drivers

3.8.1.1 Increase in adoption of digital banking for convenience and accessibility

3.8.1.2 Technological advancements in big data analytics, artificial intelligence (AI), and APIs

3.8.1.3 Government initiatives and regulatory support to enhance financial transparency

3.8.1.4 Consumer demand for personalized services

3.8.2 Industry pitfalls & challenges

3.8.2.1 Security and privacy concerns

3.8.2.2 Lack of consumer trust and adoption

3.9 Growth potential analysis

3.10 Porter’s analysis

3.11 PESTEL analysis

About Global Market Insights:

Global Market Insights, Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact us:

Aashit Tiwari

Corporate Sales, USA

Global Market Insights Inc.

Toll Free: +1-888-689-0688

USA: +1-302-846-7766

Europe: +44-742-759-8484

APAC: +65-3129-7718

Email: [email protected]

0 notes

Text

Global Online Banking Market: Industry Research Report

The digital banking market has experienced significant growth over the past decade, driven by rapid technological advancements and changing consumer behaviors. As traditional banking methods become increasingly outdated, digital banking has emerged as a dominant force in the financial industry, reshaping the way consumers interact with their financial institutions. This blog delves into the digital banking market's size, share, growth, trends, key players, challenges, and offers a conclusive outlook on its future.

Market Size, Share, and Growth

As of 2023, the global digital banking market was valued at approximately USD 13.9 billion. The market is projected to grow at a compound annual growth rate (CAGR) of 15.2% from 2024 to 2030, reaching an estimated value of USD 35.5 billion by the end of the forecast period. This impressive growth is fueled by the increasing adoption of smartphones, the widespread availability of high-speed internet, and the growing demand for convenient, efficient, and secure banking solutions.

North America currently holds the largest market share, accounting for around 35% of the global digital banking market. The region's dominance can be attributed to its early adoption of digital technologies, a robust financial infrastructure, and high consumer trust in digital financial services. Europe follows closely, with a significant market share driven by regulatory support, particularly the PSD2 directive, which has encouraged the development of innovative digital banking solutions.

The Asia-Pacific region is expected to witness the highest growth rate during the forecast period. Countries like China, India, and Southeast Asian nations are leading this growth due to their large unbanked populations, increasing internet penetration, and a rapidly growing middle class. These factors, combined with government initiatives to promote financial inclusion, are creating a fertile ground for digital banking solutions.

Market Trends

Several key trends are shaping the digital banking market, each contributing to its rapid evolution:

Mobile Banking Dominance: The proliferation of smartphones and mobile internet has made mobile banking the most popular form of digital banking. Consumers prefer the convenience of managing their finances on the go, leading to a surge in mobile banking app downloads and usage. Banks are responding by enhancing their mobile app offerings with features like AI-driven financial advice, real-time notifications, and biometric security.

Artificial Intelligence and Machine Learning: AI and ML are revolutionizing digital banking by enabling personalized customer experiences, predictive analytics, and automated customer support. Banks are leveraging these technologies to offer tailored financial products, detect fraudulent activities, and streamline operations.

Open Banking: Open banking, driven by regulatory initiatives like the PSD2 in Europe, is fostering innovation in the digital banking space. By allowing third-party developers to access banking data (with customer consent), open banking is enabling the creation of new financial products and services that enhance customer choice and competition in the market.

Blockchain and Cryptocurrencies: Blockchain technology and cryptocurrencies are gradually making their way into the digital banking landscape. While still in the early stages of adoption, these technologies promise to enhance security, transparency, and efficiency in banking transactions. Some digital banks are already offering cryptocurrency wallets and trading services, catering to the growing demand for digital assets.

Neobanks and Challenger Banks: Neobanks, or digital-only banks, are rapidly gaining popularity, particularly among younger, tech-savvy consumers. These banks operate without physical branches, offering a fully digital banking experience with lower fees and innovative features. The rise of neobanks is challenging traditional banks to innovate and improve their digital offerings to stay competitive.

Key Market Players

The digital banking market is highly competitive, with a mix of traditional banks, neobanks, and fintech companies vying for market share. Some of the key players in the market include:

JPMorgan Chase & Co.: As one of the largest banks in the United States, JPMorgan Chase has made significant investments in digital banking. The bank’s digital platform, Chase Mobile, is among the most popular mobile banking apps, with over 54 million active users. JPMorgan Chase holds a substantial market share, particularly in North America, where it leads in digital banking innovation.

Bank of America: Another major player in the digital banking space, Bank of America’s mobile app, Erica, leverages AI to provide personalized financial guidance and customer support. The bank has a strong presence in the U.S. market, with nearly 40 million active digital banking users.

BBVA: Spanish multinational bank BBVA is a pioneer in digital banking, particularly in Europe and Latin America. The bank’s digital transformation strategy has positioned it as a leader in mobile banking and open banking initiatives. BBVA’s digital user base has grown significantly, with over 70% of its customers using digital channels.

Revolut: A leading neobank based in the UK, Revolut has rapidly expanded its user base, surpassing 30 million customers globally. Revolut offers a wide range of digital financial services, including currency exchange, cryptocurrency trading, and budgeting tools. The neobank’s innovative approach and competitive pricing have made it a formidable competitor in the digital banking market.

Chime: One of the most prominent neobanks in the United States, Chime has attracted over 15 million customers with its fee-free banking model and user-friendly mobile app. Chime’s success has prompted traditional banks to re-evaluate their digital offerings to retain their customer base.

Market Challenges

Despite the rapid growth and numerous opportunities in the digital banking market, several challenges persist:

Regulatory Compliance: The digital banking industry is subject to stringent regulatory requirements, which vary by region. Compliance with these regulations, such as data protection laws and anti-money laundering (AML) policies, can be complex and costly for digital banks. Moreover, as digital banking expands, regulators are likely to impose even stricter controls to protect consumers and ensure financial stability.

Cybersecurity Risks: As digital banking transactions increase, so do the risks associated with cyberattacks. Digital banks are prime targets for hackers, who seek to exploit vulnerabilities in online systems. Ensuring robust cybersecurity measures is crucial for maintaining customer trust and safeguarding sensitive financial information.

Customer Trust and Adoption: While digital banking is growing rapidly, some customers remain hesitant to fully embrace digital-only banking services due to concerns about security and the lack of a physical branch. Building and maintaining customer trust is essential for the continued growth of the digital banking market.

Competition from Traditional Banks: Traditional banks are not sitting idly by as digital banks encroach on their market share. Many have launched their own digital banking services or acquired fintech companies to enhance their digital offerings. This intensifying competition could make it challenging for new entrants to gain a foothold in the market.

Technology Integration: Integrating advanced technologies like AI, blockchain, and open banking APIs into existing banking systems can be complex and costly. Digital banks must continually invest in technology to stay competitive, which may strain their financial resources, especially for smaller players.

Conclusion The digital banking market is on a trajectory of robust growth, driven by technological advancements, changing consumer preferences, and a dynamic competitive landscape. With a projected market size of USD 35.5 billion by 2030, the industry offers significant opportunities for innovation and expansion. However, navigating the challenges of regulatory compliance, cybersecurity, customer trust, and intense competition will be crucial for digital banks aiming to maintain and grow their market share.

#Digital banking market#Digital Banking Industry#Online Banking Market#Online Banking Market size#online banking analysis#internet banking market

0 notes

Text

Unlocking Industry Insights: How BIS Research Market Reports Drive Strategic Decisions

In today’s rapidly evolving business landscape, making informed decisions is crucial for staying ahead of the competition. This is where market research reports play a vital role. They offer businesses valuable insights into industry trends, emerging technologies, competitive landscapes, and future growth opportunities.

Why Are Market Research Reports Important?

Market Research Reports are essential for businesses, investors, and industry stakeholders. They provide detailed data and analysis about specific markets, helping companies to make data-driven decisions. From identifying market size and growth potential to analyzing consumer behavior and technological advancements, these reports offer a comprehensive understanding of the market dynamics.

With the increasing complexity of global industries, businesses need reliable and timely industry research reports to understand the competitive landscape, anticipate future challenges, and identify emerging opportunities. BIS Research specializes in delivering these insights across various sectors.

BIS Research: A Trusted Provider of Market Research Reports

High-quality market research on deep technologies that could significantly disrupt the market in the coming years is offered by BIS Research. When it comes to performing market viability analyses for innovations that are still in the early phases of development, BIS Research excels.

Our unique selling point is that we provide market estimates based on secondary research data that are subsequently confirmed by primary research with input from key industry players and other stakeholders.

Precision medicine, medical devices, diagnostics, life sciences, artificial intelligence (AI), machine learning (ML), Internet of Things (IoT), big data analysis, blockchain technology, 3D printing, advanced materials and chemicals, agriculture and FoodTech, mobility, robotics and UAVs, aerospace and defense, and other related fields are the only areas in which we at BIS Research concentrate.

Key features of BIS Research’s market research reports are:

Comprehensive Market Analysis: BIS Research reports offer in-depth analysis of market trends, competitive landscapes, growth opportunities, and supply chain dynamics, enabling strategic decision-making.

Industry-Specific Research Reports: Specialized reports provide tailored insights for specific industries such as healthcare, automotive, and advanced materials, catering to diverse market verticals.

Focus on Emerging Technologies: BIS Research emphasizes emerging technologies like AI, robotics, and biotechnology, showcasing their impact on various industries and future market developments.

Actionable Business Insights: The reports provide actionable insights, helping companies apply research findings to strategies, whether for market expansion, innovation, or operational improvements.

Global Market Coverage: With a global scope, BIS Research’s reports highlight international trends and opportunities, guiding businesses in expanding globally and navigating foreign markets.

Industries Covered by BIS Research

BIS Research covers a broad spectrum of industries, offering industry research reports tailored to the unique needs of each sector.

Advanced Materials and Chemicals

Aerospace

Agriculture

Automotive

Defence & Security

Digital Technologies

Electronics & Semiconductors

Energy & Power

FoodTech

Healthcare

Robotics & Automation

Benefits of Using BIS Research’s Market Research Reports

Informed Decision-Making: With detailed data and actionable insights, BIS Research’s reports empower businesses to make informed decisions, minimizing risks and maximizing growth potential.

Competitive Advantage: Understanding the competitive landscape is key to staying ahead. BIS Research’s industry research reports provide comprehensive competitor analysis, helping companies position themselves effectively in the market.

Identifying Emerging Opportunities: Staying updated on emerging technologies and market trends is crucial for growth. BIS Research helps companies identify new business opportunities and stay ahead of disruptive innovations.

Strategic Planning: Whether expanding into new markets or launching new products, BIS Research’s reports assist in strategic planning by providing reliable data on market size, demand, and growth forecasts.

Conclusion

In today’s competitive business environment, access to reliable and accurate market research reports is essential. BIS Research, with its industry-leading insights and expertise, is a trusted partner for businesses looking to gain a competitive edge. By focusing on emerging technologies and disruptive innovations, BIS Research provides businesses with the tools they need to succeed in the ever-evolving marketplace.

If you're looking for comprehensive insights into your industry, BIS Research’s industry research reports are your go-to solution. Contact BIS Research today to explore their extensive catalog of reports and take the next step in your business growth journey.

1 note

·

View note

Text

Smart Home Market: key Vendors, Trends, Analysis, Segmentation, Forecast to 2023-2030

Smart Home Industry Overview

The global smart home market size was valued at USD 79.16 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 27.07% from 2023 to 2030. Smart home products are available in the form of cameras, smart lights, streaming devices, dishwashers, and more. Growing trend of integrating Artificial Intelligence (AI) in smart home products for smart features is expected to increase product demand. Moreover, high penetration rate of smartphones and the internet globally is driving the demand for connected smart home products. Digital assistance integrated with AI is offering users a hands-free and more user-friendly deployment of smart devices, significantly impacting the buyers’ preferences.

Gather more insights about the market drivers, restrains and growth of the Smart Home Market

Growing use of virtual assistants, such as Siri, Google Assistant, and Alexa, enables users to use voice commands for task automation. The emerging features of these digital assistants, such as Bluetooth speakers and hands-free channel surfing, among others are driving the demand for smart home devices. For instance, in October 2022, Google updated its assistant to support voice-input message typing along with emoji support for convenience in messaging for users. Rapid adoption of modern technologies, such as Internet of Things (IoT), blockchain, smart voice recognition, and AI, is significantly impacting the market growth.

For instance, smart voice recognition technology enables smart home products with a mic to recognize users’ voices and give them personalized responses. Similarly, an increased adoption rate of IoT in developing and developed regions has also contributed to the growth of this market. The capability of technologies to allow connectivity between devices has helped in generating demand for smart home market. The COVID-19 pandemic shut down industries and affected the manufacturing of smart home devices. However, due to stringent lockdowns around the world, people were forced to stay at home.

As a result, people turned towards entertainment in the form of TV shows and movies, which caused a surge in demand for smart TVs and entertainment centres. In addition, there was a rise in the trend for smart homes as they offered automation in tasks following social distancing regulations. Although supply chain disruptions were present, the pandemic and its impacts also revealed significant shortcomings in the digital device and internet infrastructure sectors. As supplies decreased and production lagged, there were not enough semiconductors available to support smart products. This impacted the companies that manufacture smart home products.

Key Companies profiled:

• LG Electronics, Inc.

• Siemens AG

• Amazon.com, Inc.

• Google Nest (Google LLC)

• Samsung Electronics Co. Ltd.

• Schneider Electric SE

• Legrand S.A.

• Robert Bosch GmbH

• Assa Abloy AB

• Sony Group Corporation

• ABB, Ltd.

• Philips Lighting B.V.

• Honeywell International, Inc.

Browse through Grand View Research's Category Next Generation Technologies Industry Research Reports.

• The global target drone market size was estimated at USD 5.18 billion in 2023 and is expected to expand at a CAGR of 9.3% from 2024 to 2030. The increasing military and defense expenditures worldwide is boosting the demand for target drones. Governments and defense organizations are investing heavily in advanced technologies to enhance their military capabilities.

• The global enterprise information archiving market size was estimated at USD 7.58 billion in 2023 and is anticipated to grow at a CAGR of 14.1% from 2024 to 2030. The enterprise information archiving (EIA) market is primarily driven by the increasing volume of digital data, stringent regulatory compliance requirements, and the need for improved data management and security.

Smart Home Market Segmentation

Grand View Research has segmented the global smart home market on the basis of products, protocols, application, and region:

Smart Home Products Outlook (Revenue, USD Million, 2018 - 2030)

• Security & Access Controls

o Security Cameras

o Video Door Phones

o Smart Locks

o Remote Monitoring Software & Services

o Others

• Lighting Control

o Smart Lights

o Relays & Switches

o Occupancy Sensors

o Dimmers

o Other Products

• Entertainment Devices

o Smart Displays/TV

o Streaming Devices

o Sound Bars & Speakers

• HVAC

o Smart Thermostats

o Sensors

o Smart Vents

o Others

• Smart Kitchen Appliances

o Refrigerators

o Dish Washers

o Cooktops

o Microwave/Ovens

• Home Appliances

o Smart Washing Machines

o Smart Water Heaters

o Smart Vacuum Cleaners

• Smart Furniture

• Home Healthcare

• Other Devices

Smart Home Protocols Outlook (Revenue, USD Million, 2018 - 2030)

• Wireless Protocols

o ZigBee

o Wi-Fi

o Bluetooth

o Z Wave

o Others

• Wired Protocols

• Hybrid

Smart Home Application Outlook (Revenue, USD Million, 2018 - 2030)

• New Construction

• Retrofit

Smart Home Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o US

o Canada

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Benelux

o Nordic Countries

o Russia

• Asia Pacific

o China

o India

o Japan

o South Korea

o Australia

o Indonesia

o Thailand

• Latin America

o Brazil

o Mexico

o Argentina

• Middle East & Africa

o Saudi Arabia

o UAE

o Egypt

o South Africa

o Nigeria

Order a free sample PDF of the Smart Home Market Intelligence Study, published by Grand View Research.

Recent Developments

• In January 2023, Schneider Electric acquired AVEVA plc to use AVEVA plc’s advanced software capabilities to introduce modern automation solutions for residential, commercial, and building complexes. The acquisition is expected to grow Schneider Electric’s home automation offering.

• In April 2022, ABB Ltd. launched a collaboration with Samsung Electronics Co., Ltd. to expand its home automation portfolio. The collaboration will make it easier for new customers to reduce costs and create a positive impact on the environment.

• In September 2022, Lutron Electronics Co., Inc. launched its Diva Smart Dimmer and Claro Smart Switch for smart lighting automation in homes which also has a wireless option.

0 notes

Text

"Smart Cars Need Smart Sensors: The Evolution of Automotive Technology"

Market Overview and Report Coverage

The automotive sensor market for Original Equipment Manufacturers (OEM) is experiencing significant growth due to the increasing demand for advanced vehicle safety systems, emission controls, and enhanced driving experiences. Automotive sensors are critical components that monitor and control various aspects of a vehicle's performance, including engine functions, safety features, and environmental impact. The rise of electric vehicles (EVs), autonomous driving technologies, and stringent emission regulations are key factors driving the expansion of this market.

According to Infinium Global Research, the global automotive sensor market for OEMs is expected to witness robust growth from 2023 to 2030. The ongoing advancements in sensor technology, including miniaturization, improved accuracy, and integration with artificial intelligence, are further accelerating the adoption of automotive sensors in modern vehicles. Additionally, the increasing focus on connected cars and the integration of Internet of Things (IoT) technologies is propelling market growth.

Market Segmentation

By Type:

Pressure Sensors: These sensors are used to monitor various pressure levels in the vehicle, including tire pressure, fuel pressure, and oil pressure. The demand for pressure sensors is growing due to their critical role in ensuring vehicle safety and performance.

Temperature Sensors: Temperature sensors monitor engine temperature, exhaust gas temperature, and other critical temperatures within the vehicle. They are essential for optimizing engine performance and reducing emissions.

Position Sensors: Position sensors include throttle position sensors, camshaft position sensors, and crankshaft position sensors. These sensors provide vital data for engine control and are crucial for the smooth operation of the vehicle.

Oxygen Sensors: Oxygen sensors play a key role in controlling the air-fuel mixture in the engine, optimizing fuel efficiency, and reducing emissions. The increasing emphasis on emission control standards is driving the demand for these sensors.

Speed Sensors: Speed sensors are used to monitor the speed of the vehicle's wheels, transmission, and engine. They are critical components for anti-lock braking systems (ABS), traction control systems, and electronic stability control systems.

Other Sensors: This category includes various other sensors, such as rain sensors, light sensors, and occupancy sensors, which enhance the comfort, convenience, and safety of the vehicle.

By Application:

Powertrain: Automotive sensors in the powertrain are essential for monitoring and controlling the engine, transmission, and exhaust systems. They help improve fuel efficiency, reduce emissions, and enhance overall vehicle performance.

Safety and Security: Sensors used in safety and security applications include those for airbags, seat belts, collision detection, and lane departure warning systems. The growing emphasis on vehicle safety standards is driving the demand for these sensors.

Body Electronics: Sensors in body electronics are used for climate control, lighting, infotainment systems, and other convenience features. The increasing consumer demand for enhanced in-car experiences is boosting the adoption of these sensors.

Chassis: Sensors in the chassis are used for braking systems, suspension control, and steering systems. They play a crucial role in ensuring vehicle stability and handling, especially in advanced driver-assistance systems (ADAS).

Telematics and Infotainment: Sensors in telematics and infotainment systems enable connected car features, such as GPS navigation, vehicle tracking, and entertainment systems. The growing trend towards connected and autonomous vehicles is driving the adoption of these sensors.

Sample pages of Report: https://www.infiniumglobalresearch.com/form/1059?name=Sample

Regional Analysis:

North America: The North American market, led by the United States, is expected to maintain a strong position in the global automotive sensor market. The region’s focus on innovation, safety standards, and the development of autonomous vehicles is driving market growth.

Europe: Europe is a mature market for automotive sensors, with countries like Germany, France, and the UK leading the adoption of advanced sensor technologies. The region's stringent emission regulations and focus on automotive safety are key growth drivers.

Asia-Pacific: The Asia-Pacific region is anticipated to experience the fastest growth, driven by the rapid expansion of the automotive industry in countries like China, Japan, and India. The increasing demand for electric vehicles and the growing focus on vehicle safety are contributing to market growth.

Latin America and Middle East & Africa: These regions are also expected to witness significant growth, fueled by rising automotive production, increasing disposable incomes, and a growing focus on vehicle safety and emission standards.

Emerging Trends in the Automotive Sensor Market (OEM)

Several key trends are shaping the future of the automotive sensor market. The integration of sensors with artificial intelligence and machine learning is enabling predictive maintenance and enhancing the capabilities of advanced driver-assistance systems (ADAS). The shift towards electric and autonomous vehicles is driving the development of new sensor technologies, including LiDAR, radar, and ultrasonic sensors. Additionally, the increasing demand for connected cars is leading to the integration of IoT technologies, enabling real-time data collection and analysis for improved vehicle performance and safety.

Major Market Players

Bosch: A global leader in automotive sensor technology, Bosch offers a wide range of sensors for various applications, including powertrain, safety, and ADAS. The company’s strong focus on innovation and quality has helped it maintain a leading position in the market.

Continental AG: Continental is another key player in the automotive sensor market, known for its advanced sensor solutions for safety, powertrain, and body electronics. The company is heavily invested in developing sensors for autonomous and electric vehicles.

Denso Corporation: Denso, a leading automotive supplier, provides a variety of sensors used in powertrain, safety, and body electronics applications. The company’s commitment to developing environmentally friendly and energy-efficient technologies is driving its growth in the market.

Sensata Technologies: Sensata specializes in developing sensors for safety, powertrain, and chassis applications. The company’s focus on reliability and performance has made it a preferred choice for OEMs around the world.

Aptiv PLC: Aptiv is known for its advanced automotive sensors and systems, particularly in the areas of safety and connectivity. The company is at the forefront of developing sensor technologies for connected and autonomous vehicles.

Report Overview : https://www.infiniumglobalresearch.com/market-reports/global-automotive-sensor-market-oem

0 notes

Text

Interactive Kiosk Market, 2030: Growth Share and Future Trends

The global interactive kiosk market size was valued at USD 28.45 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 7.1% from 2022 to 2030.

Due to the high development in payment and security technologies, the market has witnessed rapid growth over the past few years. Many of the self-service kiosk manufacturers will continue to extract these technologies’ maximum potential and are expected to include them as an indispensable component of their product offering. Interactive kiosks help prevent long queues at public places, such as inquiry counters at railway stations, banks, and malls and check-in counters at airports. At places, such as hospitals and government offices, they help reduce the paperwork associated with visitor data collection and enhance visitors’ experiences.

Gather more insights about the market drivers, restrains and growth of the Interactive Kiosk Market

An increase in product adoption in the BFSI and retail segments is expected to be a major growth driver for the market. Some of the major manufacturers are already working on developing and integrating Artificial Intelligence (AI)-based technology in interactive kiosks. For instance, ViaTouch Media has introduced AI-based kiosks, which enable shoppers to examine the products before making a purchase. As products are removed from the retailer’s shelf, a video screen above displays product information to the customer. The growing problems due to the outbreak of COVID-19 have increased the adoption of self-checkout kiosks to avoid human interaction. As self-checkout kiosks ensure social distancing in stores, they pave the way for a little human interaction.

Looking forward to driving the adoption of and advantages offered by interactive kiosks to customers, the vendors operating in the market have launched various advanced solutions and technologies in response to the COVID-19 pandemic. The COVID-19 pandemic has doubled the R&D spending and innovation by the vendors. For instance, kiosk systems with temperature sensors, Personal Protective Equipment (PPE)-dispensing kiosks, smart kiosks that collect swab samples for COVID-19 tests, and mobile testing kiosks are some of the latest solutions launched by the vendors operating in the market. The vendors are expected to continue focusing on product innovation and development to gain a significant share in the years to come.

Interactive Kiosk Market Segmentation

Grand View Research has segmented the global interactive kiosk market report on the basis of component, type, end use, and region:

Component Outlook (Revenue, USD Million, 2017 - 2030)

• Hardware

o Display

o Printer

o Others

• Software

o Windows

o Android

o Linux

o Others (iOS, Others)

• Service

o Integration & Deployment

o Managed Services

Type Outlook (Revenue, USD Million, 2017 - 2030)

• Automated Teller Machines (ATMs)

• Retail Self-Checkout Kiosks

• Self-Service Kiosks

• Vending Kiosks

End Use Outlook (Revenue, USD Million, 2017 - 2030)

• BFSI

• Retail

• Food & Beverage

• Healthcare

• Government

• Travel & Tourism

• Others

Regional Outlook (Revenue, USD Million, 2017 - 2030)

• North America

o U.S.

o Canada

• Europe

o U.K.

o Germany

o France

• Asia Pacific

o China

o India

o Japan

o Singapore

o Thailand

o Indonesia

o Malaysia

o Vietnam

o Australia

• Latin America

o Brazil

• Middle East & Africa (MEA)

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

• The global hybrid printing technologies market size was estimated at USD 4.59 billion in 2023 and is projected to grow at a CAGR of 12.3% from 2024 to 2030.

• The global 4D printing market size was estimated at USD 156.8 million in 2023 and is anticipated to grow at a CAGR of 35.8% from 2024 to 2030.

Key Companies & Market Share Insights

The market is characterized by the presence of a few players accounting for significant industry share. New product launches and technology partnerships are some of the major strategies adopted by key companies to strengthen their market position. Key industry players are also heavily investing in research & development projects and focusing on establishing production infrastructure to develop and offer differentiated and cost-effective self-service solutions. The Meridian, Advanced Kiosk, and Kiosk Information System have a strong market presence due to the availability of a strong R&D department and production facilities. The companies mainly focus on product innovation and effective distribution through a strong network of partners in multiple countries, such as the U.S., Germany, India, and Brazil. Some of the key players in the global interactive kiosk market include:

• NCR Corp.

• Diebold Nixdorf AG

• ZEBRA Technologies Corp.

• Advanced Kiosks

• Embross Group

• GRGBanking

• IER SAS

Order a free sample PDF of the Interactive Kiosk Market Intelligence Study, published by Grand View Research.

#Interactive Kiosk Market#Interactive Kiosk Industry#Interactive Kiosk Market size#Interactive Kiosk Market share#Interactive Kiosk Market analysis

0 notes

Text

Data Center Racks Market Overview: Extensive Evaluation of Market Size, Share, and Growth Opportunities

The global data center rack market size is expected to reach USD 7.57 billion by 2030, exhibiting a CAGR of 9.1% from 2024 to 2030, according to a new study by Grand View Research, Inc. The market is driven by several key factors, reflecting the increasing demand for efficient and scalable data storage solutions. Technological advancements, such as high-density servers and advanced cooling technologies, propel market growth by optimizing space and energy efficiency within data centers.

Additionally, stringent data security and compliance regulations are prompting enterprises to invest in robust data center infrastructure to ensure data integrity and security. The ongoing digital transformation across various sectors and the increasing penetration of artificial intelligence and big data analytics further underscores the critical need for scalable and resilient data center rack solutions, thereby driving market expansion.

High-density racks are increasingly preferred for their ability to maximize computational power within limited space, while modular designs offer flexibility for future expansion. Advanced cooling technologies, such as liquid and in-row cooling systems, are critical for managing the heat generated by dense configurations, enhancing both performance and energy efficiency. The push for sustainable data centers has led to adoption of energy-efficient designs and renewable energy integration.

Enhanced physical security features and compliance with industry standards ensure data protection and regulatory adherence. The rise of edge computing and micro data centers also necessitates compact, robust, and deployable racks and enclosures. Integrating intelligent management and remote monitoring capabilities further optimizes data center operations. Customizable and aesthetically pleasing designs are also becoming important as data centers integrate more closely with business environments.

For More Details or Sample Copy please visit link @: Data Center Rack Market Report

Data Center Rack Market Report Highlights

The cabinet rack type segment is expected to register a CAGR of around 9.7% from 2024 to 2030. The trend toward modular and scalable data center designs encourages using cabinet racks that can be easily reconfigured and expanded to meet evolving business needs. These racks also support improved cable management and power distribution, contributing to data centers' overall operational efficiency and maintainability. Additionally, integrating advanced cooling technologies within cabinet racks addresses the thermal management challenges of high-density deployments, ensuring operational efficiency and reliability.

The above 42 U segment is expected to grow at a CAGR of 10.1% from 2024 to 2030. The trend towards hyper-scale and edge data centers accentuates the demand for larger racks, as they facilitate the deployment of extensive IT infrastructure in a compact footprint. Consequently, the preference for 45U and 48U racks reflects the broader industry shift towards scalable, efficient, and space-saving data center solutions.

The 19-inch segment is expected to grow at a CAGR of 8.9% from 2024 to 2030. The 19-inch rack width is preferred for its space efficiency, allowing data centers to maximize their available floor space while accommodating high equipment density. This efficiency is crucial as data centers aim to optimize their real estate and minimize operational costs. Additionally, the prevalence of the 19-inch standard has led to a mature market with a wide selection of accessories, such as cable management solutions, cooling options, and security features, enhancing the overall functionality and reliability of the data center infrastructure.

The healthcare segment is expected to grow at the highest CAGR from 2024 to 2030. Stringent regulatory requirements for data protection and patient privacy necessitate sophisticated data center solutions that can ensure compliance and safeguard sensitive information. As healthcare providers strive for enhanced interoperability and seamless data exchange across various platforms, the demand for robust and scalable data center infrastructure continues to rise, propelling the market forward.

Asia Pacific is expected to grow at the highest CAGR of 9.9% from 2024 to 2030. The Asia Pacific region is witnessing rapid market growth due to the increasing digital transformation across various industries, particularly in emerging economies. The region's expanding internet user base, coupled with the rising adoption of cloud services and big data analytics, is fueling the demand for data center infrastructure.

Data Center Rack Market Segmentation

Grand View Research has segmented the global data center rack market report based on rack, height, width, vertical, and region.

Gain deeper insights on the market and receive your free copy with TOC now @: Data Center Rack Market Report

#DataCenterRacks#DataCenterInfrastructure#ServerRacks#ITInfrastructure#DataCenterSolutions#RackMarketTrends#NetworkRacks#ServerManagement#DataCenterEquipment#DataCenterCooling#DataCenterDesign#RackServers#CloudInfrastructure#DataStorageSolutions#ITHardwareMarket#DataCenterOptimization#TechIndustryTrends#DataCenterGrowth#RackDeployment#DataCenterExpansion

0 notes

Text

Multi-Factor Authentication (MFA): Strengthening Digital Security

Multi-Factor Authentication (MFA) is a security framework designed to enhance the protection of digital systems by requiring multiple forms of verification before granting access. Unlike traditional single-factor authentication, which relies solely on a password, MFA combines two or more verification methods, such as something the user knows (password), something the user has (smartphone or hardware token), and something the user is (biometric data). This layered approach significantly reduces the risk of unauthorized access and enhances overall security. MFA is increasingly adopted across various sectors, including finance, healthcare, and enterprise environments, to protect sensitive information and mitigate the risks associated with cyber threats.

The Multi-Factor Authentication Market, valued at USD 16.00 billion in 2023, is projected to reach USD 54.12 billion by 2032, with a CAGR of 14.5% from 2024 to 2032.

Future Scope:

The future of MFA will be shaped by advancements in authentication technologies and the evolving landscape of cyber threats. As digital environments become more complex, MFA solutions will need to evolve to provide even stronger protection. Future developments will likely focus on integrating advanced biometric technologies, such as facial recognition and voice authentication, to improve user experience and security. Additionally, the integration of MFA with emerging technologies like blockchain and artificial intelligence (AI) will enhance its adaptability and resilience against sophisticated attacks. The rise of remote work and cloud-based applications will further drive the demand for flexible and scalable MFA solutions.

Key Points:

MFA enhances security by requiring multiple forms of verification for access.

Combines factors such as passwords, mobile devices, and biometric data.

Future developments will focus on advanced biometrics, AI integration, and scalability.

Trends:

Key trends in the MFA market include the increasing use of biometric authentication methods for improved security and user convenience. The integration of MFA with AI and machine learning technologies is enabling more adaptive and context-aware solutions. There is also a growing emphasis on user experience, with MFA systems being designed to be seamless and less intrusive. Additionally, the rise of remote work and cloud computing is driving the need for more flexible and scalable MFA solutions that can accommodate diverse and distributed user environments.

Application:

MFA is widely applied across various industries to enhance security. In financial services, MFA protects online banking and transaction systems. Healthcare organizations use MFA to secure patient records and comply with regulations. Government agencies and enterprises implement MFA to safeguard critical infrastructure and sensitive data. Consumer applications, such as email and social media, also utilize MFA to prevent unauthorized access and enhance account security.

Conclusion:

Multi-Factor Authentication (MFA) remains a critical component of modern cybersecurity strategies, offering robust protection against unauthorized access and data breaches. As technology evolves, MFA will continue to play an essential role in safeguarding digital assets. Innovations in authentication technologies and the growing adoption of MFA across various sectors will ensure its effectiveness in addressing the challenges of the digital age.

Browse More Details: https://www.snsinsider.com/reports/multi-factor-authentication-market-3838

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Akash Anand — Head of Business Development & Strategy

Email: [email protected]

Phone: +1–415–230–0044 (US) | +91–7798602273 (IND)

1 note

·

View note

Text

Transforming Financial Services in the Digital Age with Artificial Intelligence

In the dynamic land of finance, lately investment banking has come to the forefront of technological innovation — now integrating Artificial Intelligence (AI). This blog intends to explain how AI is reshaping traditional practices, driving operational efficiency, and redefining client engagement in the dynamic world of financial services.

The Road of AI in Investment Banking

AI has totally transformed investment banking by giving it proper algorithms and analysis tools that help in making rightful decisions and allow optimization workflows. AI technologies span from predictive analytics to algorithmic trading, giving data-driven insights and strategic advantages that will serve in the competitive environment.

Advantages of AI in Investment Banking

1. Advanced Data Analytics: AI-powered analytics help investment banks delve into unlimited datasets in order to unearth market trends and pinpoint investment opportunities with accuracy and speed. Analytical capabilities enhance the accuracy of decision-making and give some proactive views, so far as strategies for portfolio management are concerned.

2. Automation of Routine Task: It cuts much of the manual work associated with taking on these tasks — drudges such as data entry, compliance checks, and trade execution. This significantly reduces operational costs and enhances efficiency by bankers focusing on strategic initiatives and relationships with clients.

3. Personalized Client Experience: AI-driven customer interaction through the analysis of behavior data and offering investment recommendations that would be suitable for personal need-based financial goals and risk profile. Such personalization would only aid in establishing deeper client relationships and further build long-term loyalty.

4. Risk Management and Compliance: Risk models injected with AI are measuring the market risks and tracking portfolio performance while exploring the inconsistencies in real time. This way, it is facilitating the proactive implementing strategies of risk mitigation to ensure regulatory compliance, safeguarding the client’s assets and strengthening the trust on any banking institution there is.

Applications of AI in Modern Investment Banking

Quantitative Analysis: Applying pertinacious AI algorithms toward quantitative research, statistical modeling, and predictive forecasting to optimize investment strategies, ensuring that superior risk-adjusted returns are obtained. Trading and Execution: Applying AI-powered algorithms in trading and smart order distribution and management for liquidity to maximize trading efficiencies and seize opportunities in the market.

Compliance and Regulatory Reporting Harness AI in transaction monitoring, fraud detection and regulatory reporting for adherence to global compliance standards and to mitigate legal risks.

Future Trends and Innovations

AI will fuel constant innovation in investment banking:

Explainable AI — Leverage AI to take the best decisions and have explanations for building up confidence amid investors and regulatory bodies.

Big Data: AI can be used for the collection and analysis of unstructured data sources, social media trends, and alternative data sets that help garner deeper insights into the markets and aid in making appropriate investment decisions.

Cyber security and data privacy — Leverage AI for cyber security policies and protection protocols around data to protect highly sensitive customer information in the rapidly digitalizing world of finance, although challenging it remains to reduce cyber security threats. Ethical Considerations and Building Trust

Second, investment banks must deal with ethical concerns related to the AI technologies they have adopted, especially the issues surrounding data privacy, algorithmic bias, and responsible AI deployment. Thus, ethical standards and transparency in AI applications breed trust and uplift governance practices within the corporation while ensuring that the firm uses its AI responsibly to drive business outcomes.

Conclusion

AI is a transformational force within investment banking, enabling banking and financial institutions to innovate, become operationally efficient, and be agile in a highly competitive environment globally by delivering highly individualized client experiences. Armed with AI technologies, investment banks can deal with the complexities of risks and ride through strategic opportunities with confidence and agility in shaping the future of financial services in the digital age.

#AI in investment banking#Photon Insights#AI in Finance#Financial research#AI in Financial Research#Automated diligence#Investment Banking#Document Insights

0 notes