#Gst Accounting Software

Explore tagged Tumblr posts

Text

Top 5 Benefits of GST Accounting Software for Small Businesses

Since GST was introduced back in India in 2010, businesses — especially the small ones — have had a tough time managing tax filings and invoice compliance. That said, it's safe to say that a GST accounting software has become an absolute necessity. It saves time and ensures that your business stays GST-compliant without any fuss or worry.

Here are the top 5 benefits of GST-compliant software like Tririd Biz Accounting Software:

1. 🧾 GST Calculations on Autopilot

A lot of manual effort goes into calculating CGST, SGST, or IGST for every transaction. Manual computation is a lengthy process and laden with chances of errors. Most GST compliant software practically automates everything — applying the correct rates of tax depending on the product and customer location.

2. 📥 Prepare GST-compliant Invoices

Create professional invoices with Tririd Biz, which are directed by all GST norms, like:

HSN/SAC codes

Tax breakdowns

GSTIN display

This gives an assurance that, during audits, there will not be any legal or compliance issues.

3. 📊 The GST Reports You Want Just a Click Away from Your GST Software

When it is time to file the GSTR-1 or the GSTR-3B, hire a CA merely to collate your data? Exportable reports in the software allow you to upload directly or send them to your accountant.

4. 📈 Returns Are Filed with Ease

Returns are filed effortlessly and promptly, as and when sales and purchase activities happen. There will never be a missed deadline again, and overdue fines will be a thing of the past.

5. 📉 Acquaintance with Business Intelligence

GST accounting software does tax management with a few other added bonuses:

Best-selling products

High-paying customers

Monthly overview of profit or loss

These dimensions enable faster and smarter business decisions.

✅ Sum Up:

Having the right accounting software for GST is no longer negotiable but absolutely necessary for any unfolding business today. If you are looking for simple tax management with smart billing-only one tool, then we suggest Tririd Biz Accounting Software.

👉 Call Now for a Free Demo and Feel the Power of Easy Accounting!

Call us @ +91 8980010210

Visit Our Website: https://tririd.com/tririd-biz-gst-billing-accounting-software

#GST accounting software#GST billing software for small business#Best accounting software in India#Invoice and GST software#TRIRID Biz Accounting Software

0 notes

Text

🚨 Special All India Drive Against Fake GST Registrations 🚨

The Indian government has launched a nationwide crackdown on fake GST registrations. It's crucial to ensure your compliance to avoid hefty penalties. 💼💰 🔍 Why This Matters: - Protect your business from legal consequences. - Ensure your GST registration is valid and up-to-date. - Stay ahead of the curve with proper documentation and filings. 📍 For more information and support, visit the AJMS Global office in Jaipur. Our experts are here to guide you through the process and ensure full compliance. Don't take any risks—get the right advice today!

📞 Contact Us: https://wa.link/8zz9db

Landline: 0141-4812238 - Mobile: +91-7303587271

#tax managed services#gst services#gst compliances#gst registration#india gst#gst filing 2024#accounting services#company registration#investing#gst accounting software

0 notes

Text

Go GST Bill - The Ultimate Solution for Efficient GST Invoicing and Accounting

Managing the financial aspects of your business can often be a complex and time-consuming task, especially when it comes to GST compliance and invoicing. Enter Go GST Bill, your go-to partner for simplifying the intricacies of GST billing and accounting. Our intuitive platform offers robust features designed to streamline your invoicing process, ensure GST compliance, provide a seamless purchase order format, and offer a user-friendly GST invoice format.

When it comes to efficient invoicing and GST compliance, Go GST Bill excels as a comprehensive GST billing software. Our platform is equipped with all the tools you need to create professional invoices that meet GST requirements seamlessly. With just a few clicks, you can generate accurate GST bills and streamline your invoicing process, saving you time and effort in managing your financial transactions.

Transform Your Accounting Practices with Go GST Bill's Free Tools for Invoicing and GST Billing

For businesses seeking a reliable GST accounting software that not only simplifies accounting tasks but also ensures compliance with tax regulations, Go GST Bill is the ideal choice. Our platform is designed to help you keep track of your finances, manage expenses, and generate insightful reports to make informed business decisions. With Go GST Bill, you can take the complexity out of accounting and focus on growing your business.

One of the key features of Go GST Bill is its user-friendly purchase order format, which empowers you to create detailed and professional purchase orders effortlessly. Whether you're ordering supplies, managing inventory, or processing vendor transactions, our template makes the procurement process smooth and efficient, enabling you to stay organized and in control of your purchases.

Additionally, our platform offers a streamlined GST invoice format that simplifies the invoicing process while ensuring compliance with GST regulations. By using our GST invoice template, you can create customized invoices that reflect your brand identity, include all necessary tax details, and meet the standards set by the tax authorities.

0 notes

Text

#Tally ERP-9#GST accounting software#Tally GST module#GST compliance#Tally ERP-9 features#GST invoicing#Tally GST integration#Tally GST implementation#Tally ERP-9 for GST returns#GST billing in Tally

0 notes

Text

Unlocking Efficiency with Link ID Assignment feature in RealBooks

In the dynamic world of business, keeping track of your financial data is essential. But with countless transactions occurring daily, maintaining accuracy and organization can feel like a constant struggle. Fortunately, RealBooks offers a powerful solution: the link ID assignment feature.

What is Link ID Assignment?

Link IDs are unique identifiers assigned to individual transactions. They act like labels, enabling categorization and tracking across different transactions and reports. Think of them as serial numbers for your transactions, offering a distinct reference point.

How Link IDs Simplify Your Life

1. Enhanced Tracking and Analysis: Say goodbye to sifting through endless data. Link IDs allow you to effortlessly track specific transactions across various ledgers and reports. This means you can identify trends, patterns, and anomalies with ease, gaining valuable insights into your financial health.

2. Error-Free Organization: Tired of duplicate entries and inconsistencies? Link IDs eliminate the confusion by ensuring each transaction has a unique identity. This promotes accuracy and organization in your financial records, boosting your confidence in data-driven decisions.

3. Effortless Exception Management: Not all transactions fit neatly into predefined categories. Link IDs come to the rescue by allowing you to assign them to a dedicated "exception" category. This keeps your main ledgers clean while still providing easy access to these transactions for analysis.

How to Leverage Link IDs in RealBooks:

To Use Link Transaction Feature first enable the feature from RealBooks Configuration option.

Go to Settings => Configuration => Accounts => General => Link Transaction

Click the Toggle button to enable the Link Transaction Feature.

Next, Enable Link id feature in Ledger

For ledger new Creation enable the toggle button available in right hand side of the screen.

For existing ledgers go to edit and enable it.

That’s it now just record entries and assign link ids in transaction page.

Take Control of Your Data

Whether you're a small business owner or a large organization, the link ID assignment feature in RealBooks empowers you to take control of your financial data. With increased accuracy, organization, and reporting capabilities, you gain the insights needed to make informed decisions and drive your business forward.

So, unleash the power of link IDs today and experience the difference in your financial management journey!

#accounting#online accounting software#accounting software#gst accounting software in india#accounting software india#cloud accounting software#gst accounting software#best accounting software for gst#cloud accounting#multi branch accounting software

0 notes

Text

GimBooks: Your E-Way Bill Companion

Let GimBooks be your trusted companion for E-Way bill generation. Create E-Way bills effortlessly in just 60 seconds from any invoice, ensuring compliance and smooth transportation. Our versatile GST billing software streamlines billing processes, covering quotations, purchase bills, payment receipts, and credit notes. Simplify e-invoicing through the GST portal with GimBooks. Stay informed about your business with real-time reports, and optimize your inventory management effortlessly. Integrated banking makes vendor payments and collections a breeze. Choose GimBooks as your E-Way bill companion for streamlined invoicing.

#gst billing software#gst accounting software#e invoicing software#generate eway bill#e invoice in gst portal

0 notes

Text

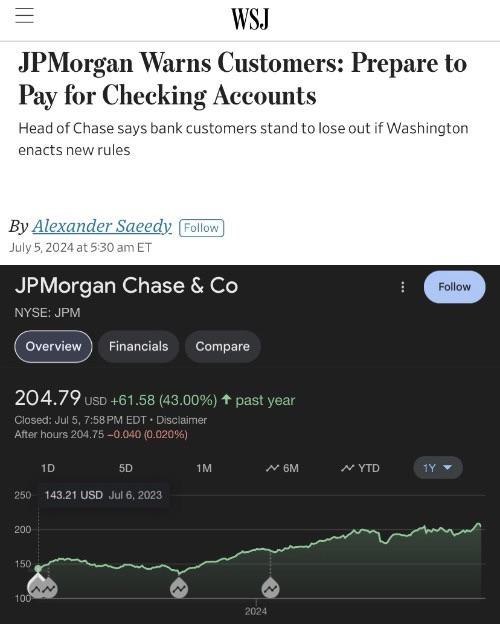

THINK OF THE SHAREHOLDERS.

#THINK OF THE SHAREHOLDERS.#shareholders#eat the rich#eat the fucking rich#jpmorgan#class war#chase bank#exploitation#exploitative#gst registration#gstfiling#gst accounting software for retail#gstreturns#gst#property taxes#us taxes#death and taxes#filing taxes#taxes#tax#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government

3 notes

·

View notes

Text

Common Mistakes to Avoid When Managing GST Ledgers in Tally

Goods and Services Tax (GST) is a comprehensive indirect tax levy on the manufacture, sale, and consumption of most goods and services in Bharat. It was introduced on July 1, 2017, to subsume multiple indirect taxes, such as excise duty, value-added tax (VAT), service tax, and central sales tax (CST). GST ledgers in Tally are used to record all GST transactions, such as sales, purchases, and expenses. It is important to avoid mistakes in GST ledgers, as this can lead to penalties from the GST authorities.

#accounting automation software#GST Ledgers#GST#tally on cloud#automated bank statement processing#e invoice in tally#tally solutions

2 notes

·

View notes

Text

The Future of Billing: Cloud-Based Solutions for Small Businesses

In today’s fast-paced digital economy, small businesses are under increasing pressure to streamline operations, reduce costs, and stay competitive. One key area where innovation is transforming the way businesses operate is billing. Traditional invoicing methods—often reliant on spreadsheets, paper, and manual data entry—are quickly becoming outdated. In their place, Cloud-Based Billing Solutions are emerging as the future of efficient, scalable, and reliable financial management.

Why Traditional Billing Systems Are No Longer Enough

Traditional billing systems are not only time-consuming but also prone to human error. Manual processes often lead to missed invoices, delayed payments, and accounting discrepancies. For small businesses, which may not have dedicated accounting departments, these issues can directly impact cash flow and overall business health.

Moreover, legacy billing software often requires costly infrastructure, regular maintenance, and is difficult to scale as the business grows. As more businesses embrace remote work and digital platforms, the need for flexible, accessible billing systems has become more urgent than ever.

The Rise of Cloud-Based Billing

Cloud-based billing solutions offer a modern alternative that addresses many of the shortcomings of traditional systems. Here’s how:

1. Accessibility and Mobility

Cloud billing platforms are accessible from any device with an internet connection. Whether you're on-site, at home, or traveling, you can create, send, and manage invoices on the go. This level of flexibility is especially valuable for entrepreneurs and small business owners who wear many hats.

2. Automation and Efficiency

Automation is one of the biggest advantages of cloud-based billing. These platforms can automatically generate recurring invoices, send payment reminders, apply taxes, and even reconcile transactions with minimal human intervention. This reduces administrative workload and minimizes errors.

3. Cost-Effective

Cloud billing systems typically operate on a subscription model, eliminating the need for large upfront investments in hardware or software. Small businesses can choose plans that suit their budget and scale up or down as needed.

4. Data Security and Backup

Reputable cloud billing providers invest heavily in data security. Features like encryption, regular backups, and multi-factor authentication ensure that your financial data is protected against breaches and data loss—something not always guaranteed with traditional systems.

5. Real-Time Analytics and Reporting

Modern billing platforms come with integrated analytics dashboards. Business owners can track cash flow, monitor overdue invoices, and analyze customer payment behavior in real time. These insights support better decision-making and strategic planning.

Key Features to Look For

When choosing a cloud-based billing solution, small businesses should consider features such as:

Customizable invoicing templates

Multi-currency and multi-language support

Integration with accounting software (e.g., QuickBooks, Xero)

Mobile app availability

Customer portals for invoice viewing and payments

Automated tax calculations and compliance features

Preparing for the Future

Adopting cloud-based billing is not just a trend—it’s a strategic move toward digital transformation. As technologies like AI, machine learning, and blockchain continue to evolve, we can expect billing systems to become even more intelligent, predictive, and secure.

Small businesses that make the shift today will not only enjoy immediate efficiency gains but will also be better positioned for long-term growth and adaptability in an increasingly digital marketplace.

Conclusion

The future of billing is undoubtedly cloud-based. For small businesses, these solutions offer a powerful combination of convenience, cost savings, and operational efficiency. By embracing Cloud Billing Technologies, entrepreneurs can spend less time on administrative tasks and more time focusing on what truly matters—growing their business.

0 notes

Text

VAS (Virtual Accounting Service) for Petrol Pumps – Powered by Petrosoft

Petrosoft introduces VAS (Virtual Accounting Service), a simple and smart way to manage petrol pump accounts. This software is specially made for petrol pumps and fuel stations to handle daily transactions, credit bills, sales, stock, and GST reports in one place.

With VAS, you can record daily fuel sales, manage customer payments, and check profit reports without needing expert knowledge. It helps avoid manual errors and saves a lot of time. Whether you sell petrol, diesel, or oil, every entry is safe, fast, and accurate in the system.

Petrosoft’s VAS gives you full control of your accounts. You can view all your reports anytime and even manage multiple fuel stations from one screen. The software is easy to use and works smoothly for both beginners and experienced staff.

#Virtual Accounting Service#Petrol Pump Accounting#VAS Software#Fuel Station Management#Petrosoft#Accounting Software for Fuel Stations#GST Reports Petrol Pump#Credit Billing Software#Petrosoft VAS#Easy Accounting Software

0 notes

Text

Want to Rule Busy Software?

Busy Accounting Software has become one of the most powerful tools for managing business accounts, GST compliance, billing, and inventory—all in one integrated platform. If you’re planning to build a career in modern business accounting, gaining expertise in Busy software is a must-have skill that sets you apart in today’s job market.

This professional course is designed to equip learners with a deep understanding of Busy’s core functionalities, ranging from company creation and ledger setup to GST-enabled invoicing and return filing. You’ll learn how to manage financial transactions, handle multiple accounts, and prepare accurate reports that simplify decision-making for businesses.

📚 Learn Busy Accounting Software : Attitude Academy

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#e accoune#busy accounting software course.#Learn Busy accounting#Busy GST Accounting#software accounting

1 note

·

View note

Text

Revolutionizing Business Billing for Indian MSMEs: Meet Karosauda

Running a small business in India comes with its fair share of challenges from managing inventory and creating GST-compliant invoices to tracking payments and generating reports. Most MSME owners juggle multiple apps or, worse, still rely on manual registers and Excel.

That’s where Karosauda steps in.

Karosauda is a smart billing and accounting software made in India, for India. It's tailored specifically for MSMEs, traders, shopkeepers, service providers, and small manufacturers who want to simplify their day-to-day operations without needing an accounting degree.

From professional invoices to inventory tracking, multi-user support, and real-time GST reporting, Karosauda packs all essential features into a single, easy-to-use mobile and desktop platform.

Best of all? You don’t need to be a tech expert. If you can use a smartphone, you can use Karosauda.

With affordable pricing, cloud backup, and 40+ detailed reports, it’s the digital backbone every small business needs today.

✅ Fast ✅ Reliable ✅ Made for Bharat 🇮🇳

0 notes

Text

Understanding HSN/SAC Codes for Indian Businesses

For any business working in the Goods and Services Tax regime in India, understanding HSN codes and SAC codes or applying them correctly is not merely a matter of fulfilling a legal requirement-it is an important aspect of ensuring bills are correctly prepared, that the right amount of tax is calculated, and GST has been properly complied with.

At first glance, these codes can appear complicated, but that is far from the truth-just like everything is based on common sense—these codes were developed with the intention that they provide uniformity and clarity in respect of classification of goods and services. Any other form of misclassification may have various consequences like levy of wrong tax, imposition of penalties, and reconciliation problems.

Tririd Biz, your trusted accounting and billing software in India, believes that GST compliance can be a little less challenging if it is clear upfront. This comprehensive guide will clarify HSN and SAC codes, show why these matters are of significance to your business, and even walk you through how our software makes managing HSN and SAC codes quite simple.

What are HSN Codes and SAC Codes?

Briefly:

HSN Code (Harmonized System of Nomenclature): These are internationally accepted classification codes for goods. The codes were evolved by the World Customs Organisation (WCO) to classify traded goods the world over systematically. In India, these codes are used in GST to assess the rate of tax applicable to different products.

Structure: While HSN codes remain international only till 6-digits, India in reality uses an HSN code of 2, 4, 6, or 8 digits depending on the turnover of the business. The more digits the code has, the finer the classification.

SAC Code (Service Accounting Code): In the same manner HSN is structured for goods, SAC codes are used to classify services. These codes are restricted to India and were developed by the Central Board of Indirect Taxes & Customs (CBIC) for service tax purposes, which were subsequently taken over by GST.

Structure: The SAC code is of 6 digits only; the initial two digits are '99' for services, and the next four digits specify the exact nature of service.

Why are HSN/SAC Codes Necessary for GST Compliance in India?

The primary reasons HSN/SAC codes are mandatory under GST are:

Uniform Classification: They ensure that goods and services are classified uniformly across India, preventing ambiguity and disputes regarding tax rates.

Tax Rate Determination: Every HSN/SAC code is linked to a specific GST rate. Using the correct code ensures you charge and pay the right amount of tax.

Invoice Generation: It is mandatory to mention the HSN/SAC code on GST-compliant invoices, especially for B2B transactions, if your turnover exceeds certain limits.

GST Return Filing: HSN/SAC-wise summary of outward supplies (sales) is required in GSTR-1, providing granular detail to the tax authorities.

Data Analysis & Policy Making: The government uses these codes to analyze trade data, understand consumption patterns, and formulate economic policies.

How Many Digits of HSN/SAC Code Do You Need to Use?

The number of digits you need to declare depends on your business's aggregate annual turnover in the preceding financial year:

For Goods (HSN):

Turnover up to ₹5 Crore: 4-digit HSN code (mandatory for B2B invoices)

Turnover exceeding ₹5 Crore: 6-digit HSN code (mandatory for all invoices)

Exports & Imports: 8-digit HSN code is generally required.

For Services (SAC):

All Turnovers: 6-digit SAC code is generally required.

(Always refer to the latest notifications from the GST portal for the most accurate and up-to-date requirements, as these thresholds can be revised.)

How to Find Your HSN/SAC Codes

Finding the right HSN/SAC code relevant to your goods or services is extremely important. Some good ways include:

GST Portal: The GST portal at times has search methods or links to official HSN/SAC code lists.

CBIC Website: Lists of HSN codes for goods and SAC codes for services are available on the Central Board of Indirect Taxes & Customs (CBIC) website.

Industry Associations: Your industry association might have compiled lists or issued guidelines for your particular industry.

Tax Consultants: A professional tax consultant will assist in determining the correct codes for your particular offerings.

Through Your Accounting Software: A good smart GST accounting software like Tririd Biz will take away a lot of these worries.

Common Mistakes to Avoid with HSN/SAC Codes

Using Wrong Codes: It is the commonest mistake, and these wrong codes can lead to wrong tax calculations, penalties, and problems for the customers in claiming ITC.

Not Updating Codes: As products or services change, or as GST rules change, always ensure your codes are up to date.

Ignoring Compulsory Requirements: Not mentioning the HSN/SAC code in the invoice, when it is required to do so, or putting in lesser digits than required, with respect to the turnover.

Confusing Goods with Services: Remember to use the HSN for goods and SAC for services.

Lack of Documentation: Failure to maintain documentation explaining the basis for assigning a certain HSN/SAC code, especially in the case of complex items.

How Tririd Biz Accounting & Billing Software Simplifies HSN/SAC Management

Managing HSN/SAC codes manually for every product and service can be tedious and error-prone, especially for businesses with diverse offerings. Tririd Biz is designed to take this burden off your shoulders:

Product/Service Master Data: Easily store and manage your products and services, each tagged with its correct HSN/SAC code and corresponding GST rate, within our software.

Automated Tax Calculation: When you create an invoice in Tririd Biz, the software automatically picks up the HSN/SAC code and applies the correct GST rate based on your master data. This minimizes manual errors.

Invoice Printing: Your GST-compliant invoices generated by Tririd Biz will automatically include the required HSN/SAC codes, ensuring you meet legal requirements.

GSTR-1 Summary: Tririd Biz helps in generating HSN/SAC-wise summaries for your GSTR-1, streamlining your return filing process.

Seamless Data Management: Update codes centrally, and the changes reflect across all relevant transactions, ensuring consistency.

By leveraging Tririd Biz, you can focus on growing your business, knowing that your GST billing and accounting are accurate and compliant with the latest HSN/SAC regulations.

Ensure Compliance, Embrace Simplicity

Understanding HSN/SAC codes is a fundamental aspect of GST compliance for Indian businesses. By dedicating time to correctly classify your goods and services and utilizing smart tools like Tririd Biz, you can ensure accuracy, avoid penalties, and simplify your entire GST filing process.

Ready to streamline your GST compliance with intelligent HSN/SAC management?

Get a Free Demo of Tririd Biz Today! Learn More About Tririd Biz GST Software Explore Tririd Biz Features

Call us @ +91 8980010210

Visit Our Website: https://tririd.com/tririd-biz-gst-billing-accounting-software

#Tririd Biz Accounting Software#HSN SAC codes India#GST codes for goods and services#Understanding HSN code#What is SAC code in GST#GST invoice HSN SAC

0 notes

Text

Beyond Troubleshooting: RealBooks Support – Your Co-Pilot in Financial Excellence

In the dynamic world of business, accounting plays a crucial role in ensuring financial stability and growth. RealBooks, a leading provider of online accounting software in India, understands this importance and has built a robust support system to assist its users every step of the way.

The Human Touch

RealBooks knows that every problem you have is different, so we give you personalized attention. Our support team is made up of experts who are ready to help you with whatever you need. Whether you're a small business owner or a big company, our goal is to make sure you have the support you need when you need it.

Operating Hours

Our support service operates during standard business hours, ensuring that you have access to assistance when most needed. We believe in quality over quantity, focusing on delivering impactful solutions during the times you're actively engaged with your accounting processes.

How It Works

Reaching out for support is a breeze. Simply dial our helpline during operating hours, and you'll be connected with a knowledgeable support representative. Alternatively, if you prefer written communication, you can also reach us via email. Our team is ready to assist with everything from software navigation to troubleshooting.

Beyond Troubleshooting

RealBooks support goes beyond just resolving issues. We view each interaction as an opportunity to empower our users. Whether you need clarification on a feature, want guidance on best practices, or seek advice on optimizing your accounting processes, our team is here to help.

Continuous Improvement

Your feedback matters. We constantly strive to enhance our support services based on user experiences and evolving needs. By listening to your suggestions and concerns, we ensure that our support system grows and adapts alongside your business.

Instant Responses for Seamless Resolution

RealBooks understands that time is of the essence in business, and delays in resolving accounting issues can have significant consequences. That's why we prioritizes instant responses to customer inquiries. Whether you reach out through phone, email, or chat, you can expect a quick and helpful response from RealBooks' support team.

Having a strong support system is like having a compass for any business, regardless of its size or stage. RealBooks is here to help you navigate the ups and downs of your financial journey. We're committed to providing you with the support you need during our regular business hours. While we might not be available around the clock, our focus on excellence during operating hours ensures that you receive the support you deserve.

Remember, at RealBooks, success is not just a destination; it's a journey we navigate together.

#accounting#online accounting software#accounting software#gst accounting software in india#accounting software india#cloud accounting software#gst accounting software#best accounting software for gst#cloud accounting#multi branch accounting software#freeaccountingsoftware#freeaccountingsoftwareinindia

0 notes

Text

Simplify GST Invoicing with GimBooks

GimBooks makes GST compliance a breeze. Easily create professional GST invoices and send payment links to clients. Our GST software streamlines your billing process, allowing you to generate quotations, manage purchase bills, issue payment receipts, and handle credit notes effortlessly. Create E-Way bills in just 60 seconds directly from any invoice. Stay on top of your business with real-time reports and never worry about stock levels with our inventory management features. Enjoy smooth financial transactions with integrated banking. GimBooks is your comprehensive solution for all things GST.

0 notes