#How to Generate Credit Report from Credit Karma

Explore tagged Tumblr posts

Text

How to Generate Credit Report from Credit Karma

In today’s fast-paced world, financial stability and creditworthiness have become crucial for individuals and businesses alike. A credit report is a vital tool that provides a comprehensive overview of an individual’s credit history and financial behavior. One of the most popular platforms for generating credit reports is Credit Karma. In this article, we will guide you through the process of how…

View On WordPress

#Credit Karma Report#free credit report#Generate Credit Report from Credit Karma#How do I download full credit report from Credit Karma?#How to Generate Credit Karma Report#How to Generate Credit Report from Credit Karma#How to generate credit report from credit karma online

0 notes

Text

Incorrect Quotes from the smiling critters X persona AU I am working on...Mostly cause I am bored.

~~~~~~

Kickin: I can finally drive! Wahoo!

Dogday: Kickin, sweetie, I'm so sorry. Don't feel bad. Alot of people don't pass their test the first time.

Kickin: I passed.

Dogday: You will get the next ti-What? You did? Really? Wow. Really?

Bubba: Hey Kickin, too bad, but I mean, maybe if you studied-

Kickin: I passed.

Bubba: You are going to be driving? Great. (Pulls Dogday aside) Are we sure this is a great idea?!

Crafty, bringing a handmade gift: I made this to cheer you up.

Kickin: I passed.

Crafty: I will save it for your report card.

~~~~~~

Bubba: I will have you know ma'am, that I studied under Mr. Karma. He threatens to murder to me everyday.

Karma: (Holding a bat in the corner)

Bubba: Like that.

~~~~~~

Bobby, winking: So what does a girl have to do to get a drink around here?

Dogday: You ask the guy behind the counter then exchange money?

3 Days Later

Dogday, fixing uniform:...WAIT A SECOND-

~~~~~~

Hoppy: How long have you been standing there!?

Kickin: Don't try it. You know the concept of time confuses me.

~~~~~~

Catnap: We need a way to get inside...Oh! Bubba, give me your credit card!

Bubba: Just try not to bend it.

Catnap: Thanks! (Pockets the card) Kickin, bust down the door!

Kickin: (Shoulder barges the door down)

~~~~~~

Bubba: Were you flirting with me!?

Picky:...Have been for the past year, but thanks for noticing.

~~~~~~

Bubba: Or, as they say in the theater, "Fracture a Femur."

Catnap: What?

Bubba: The actual saying is "Break a Leg," but I improved it!

Catnap: I hate both of those equally.

~~~~~~

Catnap: Wh-what is this!?

Bobby: Something your father clearly never gave you. A hug.

~~~~~~

Kickin: I am a Tank player, so I am always north!

Bubba: And I am Dragoon player, so I am always on the floor!

Catnap: And I am Catnap, nice to meet you.

~~~~~~

Dogday:...I am very bad at this am I?

Hoppy: Yeah...Bunzo is never going to find out where are dating.

Dogday: OH THAT'S WHAT WE ARE DOING!?

~~~~~~

Kickin: People always shoot down my ideas and I’m sick of it. Two sentences in and everyone’s always shouting “what the fuck? that’s illegal!” and “you can’t do that!”. Like, c'mon, let me talk!

~~~~~~

Dogday, referring to Catnap: My favorite person in the world, and my wife!

Bobby:...My whole life.

~~~~~~

Crafty: You stalked a man.

Kickin: No, a boy! He's a young boy! And WE stalked him as partners.

~~~~~~

Hoppy, referring to the boys: Let's find that idiot, that psycho, that douchebag and Kickin.

~~~~~~

Bubba: You know what your problem is?

Dogday: I have more then one?

~~~~~~

*Catnap and Crafty texting*

Catnap: Come downstairs and talk to me please. I'm lonely.

Crafty: Isn't Hoppy there?

Catnap: Yes but I like you more.

~~~~~~

Hoppy: I have very high standards, you know.

Picky: I can make spaghetti.

Hoppy: Oh no! You're meeting all my standards!

~~~~~~

Picky, holding a phone: You guys can't connect without these. You use emoticons instead of emotions. Y'all an unfeeling generation of Zombies!

Dogday and Catnap, putting their heads together: (Starting growling and pretending to eat each other's brains)

Picky: Stop eating him.

~~~~~~

Crafty: Excuse me sir, may I give a different perspective?

Bubba: Of course Crafty save me. Did I go too far?

Crafty: Always sir.

~~~~~~

Shadow Catnap, coming in with a starbucks in hand: Good evening everyone. I would ask what did I miss, but I probably know more then all of you combined.

~~~~~~

Catnap: Did you take out Bubba as I requested?

Picky: Bubba has been taken out, yes.

Catnap: You have my grat-

Picky: It was a great restaurant.

Picky: We had a romantic candlelit dinner.

Picky: Bubba proposed afterwards- we’re filing the wedding papers.

#poppy playtime#smiling critters#au#persona#smiling critters arg#crossover#smiling critters poppy playtime#incorrect quotes#smiling sona

33 notes

·

View notes

Text

Is it hard to get an Amex Gold business card?

The Amex Gold Business Card stands out as a premier option for business owners who want a combination of rewards and flexibility. Known for its robust rewards system and extensive travel benefits, this card offers both business utility and personal perks. However, it also comes with specific prerequisites and a detailed application process.

What is the Amex Gold Business Card?

The Amex Gold Business Card, issued by American Express, is tailored for business owners seeking to optimize rewards and manage their finances effectively. Unlike personal credit cards, it focuses on business expenses and provides a sophisticated rewards program alongside travel and purchase protections. This makes it an invaluable tool for modern entrepreneurs.

For more details on the Amex Gold Business Card, visit the American Express website.

Features and Benefits of the Amex Gold Business Card

The Amex Gold Business Card is distinguished by its comprehensive range of benefits:

Generous Rewards Program

Travel and Purchase Protections

For an in-depth review of these benefits, check out NerdWallet's review.

Eligibility Requirements for the Amex Gold Business Card

To be eligible for the Amex Gold Business Card, applicants must meet several criteria:

Assessing Your Creditworthiness and Financial Stability

Evaluating your creditworthiness is crucial before applying. American Express reviews both personal and business credit reports to assess financial reliability. A strong credit score (generally above 700), a healthy debt-to-income ratio, and a history of timely payments are essential.

For more information on how creditworthiness impacts your application, refer to Experian's guide.

Income and Business Size Requirements

Learn more about income and business size requirements from Forbes.

Impact of Personal Credit Score on Application

Your personal credit score is a significant factor. Although the card is intended for business use, American Express considers personal credit history to determine overall creditworthiness. A high personal credit score can improve the chances of approval and enhance credit limits and terms.

For insights on how personal credit scores affect your application, see Credit Karma.

Application Process for the Amex Gold Business Card

The application process involves several steps:

Step-by-Step Guide to Applying

Common Pitfalls to Avoid During the Application

For additional tips on avoiding application pitfalls, see The Points Guy.

Alternative Business Cards to Consider

While the Amex Gold Business Card offers many advantages, exploring other options can be beneficial. Alternative business cards may offer competitive rewards programs, lower fees, or specialized benefits.

Comparing the Amex Gold with Other Business Credit Cards

When comparing alternatives, consider:

Evaluating the Pros and Cons of Different Options

Each business credit card has its strengths and limitations. The Amex Gold excels in rewards for dining and travel but may come with higher fees. Conversely, other cards might offer lower fees or different rewards categories. Weighing these factors will help you choose the card that best suits your business needs.

For a comparison of business credit cards, visit GuideRichess.

#amex business gold card#american express business gold card#amex business credit card#amex business gold#amex business gold card review#amex gold card#amex business gold card benefits#american express gold card#business credit cards#american express business card#american express business gold card review#best amex business card#american express business gold#amex business platinum card#amex gold business card#best business credit cards#amex gold card review

1 note

·

View note

Text

How to really get a 800+ credit score in the next 5 days

youtube

Understanding Credit: Insights from a Credit Specialist

As a Credit Specialist, I'm often asked about the intricacies of credit and the differences between what banks know and what consumers understand. Here are some key insights to keep in mind:

Banker vs. Consumer Knowledge

Banker's Knowledge: Many bankers may not have a deep understanding of the credit underwriting process or their own products.

Consumer's Knowledge: Consumers often have a better grasp of credit-related information than their bankers.

Achieving an 800 Credit Score

Time Required: Contrary to popular belief, it is possible to achieve an 800 credit score within 30-45 days, depending on your credit file.

Key Factors: The two biggest keys to an 800 credit score are maintaining low utilization (under 10%) and having a loan on your credit file.

Credit Karma Scores: Vantage scores, such as those provided by Credit Karma, can vary significantly (up to 80 points) from your actual FICO score, which is used by most lenders.

Loan Approval with an 800 Credit Score

Debt-to-Income Ratio: Even with an 800 credit score, if your debt-to-income ratio is above 50-55%, you may still be denied for loans, especially personal loans.

Alternative Lenders: For those with high credit scores but high debt-to-income ratios, considering alternative lenders may be a better option.

Authorized Users and Credit Rebuilding

Authorized User Limits: When adding authorized users to your credit, it's generally recommended to limit the number to one or two, rather than loading up on multiple authorized users.

FICO 8 vs. FICO 9: Institutions using FICO 8, such as Chase and American Express, may not calculate authorized user information, while FICO 9 institutions, like Navy Federal, do consider it.

Remember, credit is a complex topic, and understanding the nuances can make a significant difference in your financial success. If you have any questions about business credit funding, personal credit funding, or removing negative items from your credit report, feel free to schedule a consultation.

YouTube Source: https://www.youtube.com/watch?v=fKqG9SmZmV4 YouTube Channel: https://www.youtube.com/channel/UCwTiSgSSNPiNANoB2cREAAg Related Content: https://www.pinterest.com/pin/792000284501344230/ https://www.linkedin.com/feed/update/urn:li:share:7198957970909458433

0 notes

Text

Kelsea Palm was feeling out of sorts as the presidential election was approaching. So, she did what many Americans do when they’re feeling anxious: She went shopping.

The Wheaton College senior and her friend hit shops in Massachusetts the weekend before Election Day, and while Palm prides herself on shopping responsibly, she wound up impulse-buying a purse to ease her stress.

“It was a new thing that made us feel like we had some sort of control over our lives. We can vote, but what else can we do? We can get a bag that’ll make us happy,” she told CNN.

Palm is among the increasing number of consumers who cope with feelings of anxiety by “doom spending.”

Doom spending, or the practice of spending money to soothe fears about broader issues like politics or the economy, shows up everywhere from YouTube and TikTok videos to Reddit to personal finance discussions and data in surveys.

Gen Z and millennial consumers are also more likely to say it is better to treat themselves now rather than hold off for a future “that feels like it could change at any moment,” according to an Axios Vibes survey in June conducted by The Harris Poll.

While this kind of catharsis might work to temporarily allay worries, experts say doom spending poses a danger to consumers’ long-term financial health.

“We’re not always rational when it comes to our emotions, when it comes to our money,” said Courtney Alev, consumer financial advocate at Credit Karma. “It’s really easy to bury our heads in the sand and look for those quick dopamine hits when we’re feeling anxious or stressed.”

Why are we doom spending?

Alev says a third of Americans across all generations have a hard time rationalizing saving money due to feelings of uncertainty about current and future affairs, and a persistent sense of economic pessimism is partly to blame.

The economy President-elect Donald Trump is set to inherit is strong on paper, with a low unemployment rate and a projected economic growth rate better than other G7 economies.

Inflation has largely been tamed, too. But a lower rate of inflation doesn’t mean everyone is feeling its effects – and it doesn’t mean prices have come down. Only 37% of Americans said they approved of the economy, according to a CNN poll published in February.

Frustration surrounding the economy also played a major role in Trump’s victory as voters repeatedly cited it as their top issue, with 54% saying they trusted Trump to handle it better than his opponent Vice President Kamala Harris, according to a Gallup survey published in October.

Grocery costs and housing prices — two cornerstones of most consumers’ budgets — also continue to remain high, which translate into a less-than-rosy perception of economy.

Customers shop in the deli meat aisle of a grocery store on October 17 in Miami, Florida. Joe Raedle/Getty Images

That financial gloom is powering doom spending and, in turn, driving up credit card debt. An August survey by Bankrate showed that half of American cardholders carry credit card debt from month-to-month, spurred on by sky-high interest rates before the Federal Reserve cut rates in September and again this week.

And, in the third quarter this year, credit card delinquencies surpassed pre-pandemic levels for the first time, according to a report from the Federal Reserve Bank of Philadelphia.

Beyond the economy, experts say that internet habits play a significant role in driving doom spending, especially for younger consumers.

More than half of Americans say they feel like they are constantly receiving bad news online, and it’s affecting how they spend their money, Bankrate data shows.

“What you’re following and the messages that you are receiving online can make you feel worse, increase your anxiety, and make things feel more dire than they are,” said Aja Evans, a financial therapist and author of “Feel Good Finance.”

She says “information overload” from online media paired with influencer culture and product advertisements can make consumers feel more tempted to open their wallets.

“When you’re in the midst of scrolling, you might think: ‘You know what? Things are just really bad. I’m going to feel better if I purchase,’” Evans said.

How does the election factor in?

While the results of the election have already been decided, news about it hasn’t stopped.

“We expect a lot of young Americans to spend much of this next week online, scrolling social media, as they continue to digest election-focused content. Doing so could lead to even more charged feelings and drive further spending,” Alev said.

Former President Donald Trump speaks at an election night watch party Wednesday, November 6, 2024, in West Palm Beach, Florida. Jeff Roberson/AP

Republican economic sentiment rose and Democratic economic sentiment fell when Trump first took office in 2017 and subsequently flipped during the Biden administration.

But Alev says that she anticipates a pop in spending whether Americans feel positively or negatively about the outcome of the election.

“Those who are upset with the results may spend to make themselves feel better, and those happy with the results may spend because it feels like a reward,” she said.

How do you curb doom spending?

Evans says the first step is self-awareness. Understanding your beliefs surrounding money and where they stem from can help you be more conscious of how you react to certain events and how they affect your spending habits.

What do you think?Join 421 others in the comments

View Comments

She also emphasized the importance of unplugging and taking a step back from a pervasive internet culture.

“You literally need to go outside sometimes. Be in nature and just remind yourself that there is a world beyond the screen,” she said.

From there, she says that consumers can take steps to prevent destructive financial behaviors by engaging in other coping strategies to take their minds off their worries.

That might be as simple as going for a walk or calling a friend, or it might be something more active, like signing up for a class.

“If you can afford to spend, go ahead. But if you find yourself consistently putting yourself over your budget or feeling uncomfortable, then that’s the time to shift your behavior,” she said. “Recognize that you can get that dopamine hit from somewhere outside spending.”

CNN - doomspending after the election

28 notes

·

View notes

Text

Finance Apps: 10 Must-Haves for Your Smartphone

In our tech-driven era, managing finances effectively has never been more accessible. With just a touch, swipe, or tap, users can view, handle, and optimize their finances on the go. For those wanting to manage their money better or those just starting to explore the world of finance, here’s a deep dive into ten essential finance apps you should consider having on your smartphone.

1. Introduction to Finance Apps

From budgeting and investing to credit monitoring and expense tracking, finance apps encompass a wide range of tools designed to simplify and enhance money management. Not only do these apps offer convenience, but they also empower users with insights and tools previously available only to finance professionals.

2. Mint: Holistic Financial Overview

Overview: Mint is a widely recognized budgeting app that aggregates all your financial accounts in one place.

Features: Automatic categorization of expenses, budget setting, credit score tracking, and monthly bill reminders.

Why It's Essential: With its user-friendly interface, Mint provides a clear picture of your financial health and offers tailored tips to save money.

3. YNAB (You Need a Budget): Proactive Budgeting

Overview: YNAB is more than just a budget tracker; it's a philosophy.

Features: Customizable budget categories, debt paydown tools, goal tracking, and reports that break down spending patterns.

Why It's Essential: YNAB encourages users to "give every dollar a job," promoting proactive financial planning and discouraging mindless spending.

4. Acorns: Investing with Spare Change

Overview: Acorns is designed for beginner investors, turning spare change into investment opportunities.

Features: Automatic round-ups from daily purchases to invest, diversified portfolios, and educational content on investing basics.

Why It's Essential: Acorns removes the intimidation from investing, allowing users to grow their wealth incrementally.

5. Credit Karma: Credit Monitoring and More

Overview: Credit Karma offers free credit score updates and insights to improve it.

Features: Credit score updates from two major bureaus, credit monitoring alerts, and tailored financial product recommendations.

Why It's Essential: Monitoring credit can detect potential fraud and provides insights to enhance creditworthiness.

6. Robinhood: Stock Trading Simplified

Overview: Robinhood provides a commission-free trading platform for stocks, ETFs, and cryptocurrencies.

Features: Streamlined trading interface, extended trading hours, and a premium option for margin trading.

Why It's Essential: Ideal for those venturing into stock trading, Robinhood offers an uncomplicated platform without traditional trading fees.

7. Expensify: Expense Reports Made Easy

Overview: Expensify is a must-have for professionals and business owners needing to track and report expenses.

Features: Receipt scanning, auto-matching with bank transactions, mileage tracking, and automatic expense report generation.

Why It's Essential: Expensify streamlines the cumbersome process of expense reporting, saving time and ensuring accuracy.

8. PocketGuard: Spend Within Your Means

Overview: PocketGuard helps users make informed spending decisions based on their available 'pocket' money.

Features: Links to bank accounts to calculate "in my pocket" money, bill negotiation assistance, and subscription optimizer.

Why It's Essential: By showing how much money you truly have left after bills, savings, and essentials, PocketGuard prevents overspending.

9. Personal Capital: Wealth Management at Your Fingertips

Overview: Beyond budgeting, Personal Capital offers tools for investments and retirement planning.

Features: Net worth calculator, portfolio breakdown, retirement planner, and fee analyzer.

Why It's Essential: Personal Capital caters to individuals looking for a comprehensive financial management tool with a focus on long-term planning.

10. Splitwise: Effortless Expense Sharing

Overview: Splitwise is perfect for those who often share expenses with friends or roommates.

Features: Bill splitting, IOU tracking, and PayPal/Venmo integration for easy repayments.

Why It's Essential: Say goodbye to complicated calculations when sharing bills. Splitwise ensures everyone pays their fair share without the fuss.

11. Honeydue: Couples’ Finances, Uncomplicated

Overview: Honeydue helps couples manage shared finances transparently.

Features: Joint account monitoring, bill reminders, and monthly spending limits.

Why It's Essential: Honeydue fosters financial communication and trust between partners, promoting shared financial goals.

12. Conclusion: Navigating the Financial World with Ease

With technology at our fingertips, managing finances has never been more straightforward. From daily expenses to long-term investments, there's an app to help navigate every financial challenge. By leveraging these tools, individuals can gain control, clarity, and confidence in their financial journeys. As always, while apps provide tools and insights, individual research and perhaps consultation with financial professionals can ensure well-informed decisions. Happy budgeting, investing, and saving!

0 notes

Link

Part homage, all farce, the AWFULLY CHEERFUL ENGINE! is an irreverent, affectionate parody of pop-culture tropes and a love-letter to 80s roleplaying games in a new, modern comic-book sized format! It’s a wacky roleplaying game of action comedy!

Hardcover collector's omnibus, softcover rules and adventures, blank ID cards, monster cards, hero role cards, VTT tokens

Are you a fan of the Ghostbusters RPG from the 1980s? Danger Mouse or Teenage Mutant Ninja Turtles? Bill & Ted or Rick & Morty? Back to the Future, Indiana Jones, Dracula, or sci-fi adventures on the final frontier? Do you enjoy chortling at TV tropes or chuckling at pop-culture parodies? Then the Awfully Cheerful Engine! is here for you!

ACE! is brought to you by Russ 'Morrus' Morrissey (EN World, WOIN, Judge Dredd & The Worlds of 2000 AD), Dave Chapman (Doctor Who, Star Trek Adventures), and Marc Langworthy (Hellboy, Judge Dredd & The Worlds of 2000 AD). With a foreword by Sandy Petersen, co-author of the Ghostbusters RPG!

ACE! is designed for everybody! From talking animals to pulp heroes to eldritch horrors, kids and adults alike will find adventures to love with the Awfully Cheerful Engine!

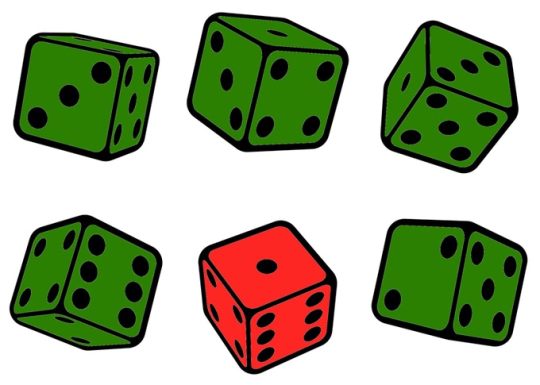

This tabletop roleplaying game, which we’re calling ACE! with an exclamation point, is one of fast, cinematic, action comedy. To play you need a handful of six-sided dice, a pen, and some paper. Each player plays one Hero, except for one player who takes the role of the Director.

Think of ACE! as an irreverent, fun-packed movie. You might play as ghost hunters in New York City, a band of plucky galactic guardians, vampire slayers, or soldiers of fortune in the Los Angeles underground. Heck, you might even be cartoon animals. Good grief!

This is a multi-dimensional, time-hopping, genre-mashing, pan-galactic portal into any type of adventure you can imagine! Want to play in a fantasy world full of elves and orcs? Crew a starship as it explores the galaxy? Hunt vampires in Victorian London? Play as animal detectives, robot cowboys, wizards, ninjas, or time traveling bounty hunters?

The only limit is your imagination, and the requirement that you have fun.

This Kickstarter is for the full five-book set.

What? Five books, you say? Fear not -- they're pretty small books! They include the core rules, and four hilarious genre-hopping adventures. Each book is about 30 pages long. Except for one which is longer, but we wrote 'BUMPER SIZE ISSUE' on the front of that, so it's OK. If you’ve ever held a comic-book in your hand, the Awfully Cheerful Engine! will feel very familiar!

The core rulebook is just 30 pages in a bright, colorful comic-book sized format. We even gave it an issue number, like a comic-book! After that, each 'issue' is a standalone adventure, designed for one-shots or short campaigns with new characters each time. One week you might be fighting ghosts on the streets of Manhattan, and the next you might be exploring the frontiers of space in your trusty starship!

You don't have to play them all, or in order. The standalone format means you can fit them in whenever and however you feel like it. GM can't make your regular game? Go bust some ghosts instead! Pickup game at a convention? Investigate the strange goings-on in a small American town in the 1980s. Running a livestream? Board a starship and fight the Kulkan Empire! Play one of them, some of them, or all of them! It's up to you!

Are they comics? Or are they RPGs? (They're RPGs)

ACE #1: Introducing the Awfully Cheerful Engine! With a foreword by Ghostbusters RPG author Sandy Petersen, this book tells you the rules, how to create your Heroes, and gives you a bunch of Extras (NPCs & monsters) to use. By Russ Morrissey.

ACE #2: Spirits of Manhattan. Strap on your Anti-Plasm Particle Thrower, grab your Electromagnetic Field Detector, and jump into your Ghostmobile. New York City needs your help! By Dave Chapman and Russ Morrissey.

ACE #3: Montana Drones & The Raiders of the Cutty Sark. At the request of Army Intelligence, Montana Drones and her team travel the globe in search of lost or hidden artefacts, often exploring dangerous sites and racing against hostile enemy agents to keep the objects of their quests from falling into the wrong hands. Striking locations, exciting chases, dangerous enemies and monotonous classroom lectures await! By Marc Langworthy.

ACE #4: Strange Science. Welcome to Wilden Falls, your average American town in the heart of the country. Surrounded by trees, nature, and there’s a wonderful waterfall that brings the tourists. It’s a quaint little town. Until weird things start happening at the local research facility, people go missing, and there’s a sudden influx of fitness nuts in the town. That’s before we get to the time travel, bodysnatching, and portals to other dimensions. Maybe ‘strange’ isn’t strong enough a word for it! By Dave Chapman.

ACE #5: Beam Me Up! These are the voyages of the starship FSS Brazen. Its continuing mission: to recklessly go where plenty of people have probably been before… and hope a major interstellar incident isn’t sparked in the process. In this highly illogical adventure for the ACE! roleplaying game, you’ll explore frontiers you never thought you had. By Marc Langworthy.

We give you four adventures to start with, and we have plans for more, but there's also a free compatibility license so anybody can write and publish material powered by the Awfully Cheerful Engine!

Hardy Hobbit. Teenage Samurai. Cheerful Stuntman. Clumsy Vampire. Squeamish Ghost. Who knew you could say so much in just two words? The possibilities are endless.

It’s not just Awfully Cheerful! It’s fast and fun, too!

You won’t get bogged down in endless rules and character sheets that look like tax forms. Your ACE! ID Card contains everything you need to know, and it’s only about the size of a credit card! But don’t try to spend it. It’s not a real credit card. Honestly, we tried, and it didn't end well.

You can download blank ID cards from our website. Don’t worry, there’s a printer-friendly black-and-white version too!

Making your Hero takes about five minutes. And that includes a coffee break.

You can choose from an array of talking animals, alien and fantasy species, and occupations from a bunch of genres. Play a cat, a crow, or a turtle. An alien, an elf, a robot, or a vampire. A knight, a pirate, or a wizard. An astronaut, a burglar, a reporter, or a spy. The core book has dozens of Roles to get you started with, and each adventure book introduces more!

Even better, you can already use our online character builder and make a character in about 30 seconds! It's so quick! Give it a try! And if you felt like sharing your Hero on Twitter with the hashtag #awfullycheerful and a link to this page, well, we'd be most awfully grateful!

Build your Hero online!

Alternatively, each adventure comes with its own selection of pre-generated characters. If you don't want to make your own characters, you can simply use those - perfect for one-shots or new players!

Download the pre-gens for all four adventures from the official website!

In A.C.E! each Hero (that's you!) has a Role. Your Role gives you a special ability only you can use. Here's a quick look at some of the Roles you can play!

Talking animals like Ape, Cat, Crow, Dog, Kangaroo, and Turtle.

Species like Alien, Dwarf, Elf, Ghost, Goblin, Golem, Hobbit, Monster, Ogre, Robot, Vampire, and Werewolf.

Fantasy roles like Alchemist, Assassin, Barbarian, Cleric, Druid, Knight, Ninja, Outlaw, Pirate, Ranger, Samurai, Slayer, and Wizard.

Occupations like Actor, Archeologist, Astronaut, Athlete, Bounty Hunter, Boxer, Burglar, Chef, Con Artist, Cowboy, Detective, Doctor, Engineer, Gambler, Gangster, Hacker, Hermit, Inventor, Musician, Pilot, Priest, Professor, Reporter, Scientist, Smuggler, Soldier, Spy, Student, and Stuntman.

Even a couple of superheroes like Speedster and Vigilante!

Yep, you can play a Ghost. You don’t take damage unless its from a holy source or some special sci-fi ecto-gadget. But you also can’t pick things up. So there’s that.

Each of the adventures adds some more Roles (or recommends some old ones)!

Spirits of Manhattan adds Ghost, Demonologist, Doctor, Engineer, Exorcist, Inventor, Priest, Professor, Scientist, and Student.

Raiders of the Cutty Sark adds Botanist, Double-Agent, Socialite, and Witch.

Strange Science adds Brain, Cheerleader, Outsider, Protector, Radio Presenter, and Tycoon.

Beam Me Up adds Captain, Chief Engineer, Comms, Hologram, Gunner, Counsellor, and Pilot.

ACE! is a pretty fast, light game. If you played 1986's Ghostbusters RPG, you'll see the influence immediately.

Stats! The AWFULLY CHEERFUL ENGINE! is a d6 dice pool system*. You have four Stats -- Smarts, Moves, Style, and Brawn. If you have a Moves score of 3, you roll three six-sided dice when you try to jump a motorcycle over a ravine. If you roll high enough, you succeed. It's pretty simple!

Focuses! For each Stat you also have a Focus. For Smarts it might be a science, or chess, or history. For Style it might be bluffing, singing, or fashion, and for Brawn it might be brawling or swimming. You can choose from plenty of focuses. Foci. Focuses. Whatever. Anyway, if the thing you're trying to do relates to a Focus, you get to roll an extra two dice.

Trait! You choose a trait, like Angry or Cheerful or Rebellious or Despondent. This, combined with your Role, makes you a Gullible Vampire, a Brave Turtle, or a Squeamish Scientist.

Karma! Finally, you have a bunch of Karma points. These can be spent for extra dice or to absorb damage from attacks, and they're recovered by using your trait.

*Fun fact -- did you know that 1986's Ghostbusters RPG, by Sandy Petersen, Lynn Willis and Greg Stafford, was the first ever dice pool RPG? Also Sandy Petersen has written an awesome foreword for the AWFULLY CHEERFUL ENGINE!

What, I hear you ask, is a CALAMITY DIE?

The Calamity Die is how you find out that your friends really aren't your friends. You see, when you make a roll, one of those dice is a different color, and is called the Calamity Die. And if your roll fails, and also the Calamity Die rolls a 1, your so-called 'friends' decide what happens to you. It won't kill you or anything, but...

Well, we'll leave that thought with you.

Nooooo! And it was all going so well!

Kickstarter campaign ends: Fri, June 18 2021 10:00 PM BST

Website: [Awfully Cheerful Engine] [EN Publishing] [facebook] [twitter]

36 notes

·

View notes

Text

Annual Jedi Council Holiday Party

The Jedi Council held an annual holiday party, attendance was strongly encouraged. The younglings had their own holiday party that Master Jocasta Nu chaperoned. Padawans could attend the Council party with their Masters. Dress code was enforced, Masters and Knights being required to wear dress robes. Padawans weren’t required to wear their Jedi attire, but they had to dress nicely.

This year the Council decided to extend the invitation to the clone officers they served alongside. They also extended one to the Senate, since they all needed to come together during the holiday season. Political discussions were off limits however. The Senate had its own party scheduled, but some had confirmed their attendance.

The Jedi Temple had converted a training room into the party room, streamers were hung with the Force and a large table stretched down the middle of the room. Master Yoda supervised the preparations, the table should seat more than enough people.

“Very excited for this gathering I am.” He commented to Master Mundi, who nodded in agreement.

“It’s been a long while since we’ve all come together.” He said pensively. The party was due to begin shortly. As if on cue, Master Kenobi and young Skywalker walked into the training-room-turned-party-room.

“Oh ho ho, nice work Master Yoda!” Anakin exclaimed, looking around in appreciation.

“I agree! Very nice.” Obiwan added.

Ahsoka came in next, wearing a knee-length maroon dress. She was followed by Marshal Commander Cody and Captain Rex. Both officers were dressed in their dress uniforms, black suits with their ranks pinned in their particular battalion colors. Cody and Rex looked a bit uncomfortable, Yoda sensing the unease coming from them. He had a feeling that once more officers arrived, they’d ease up.

Within 20 minutes, the room was buzzing with Jedi, Padawans, Senators, and clone officers. They had each formed their little groups, with the occasional mingler. Yoda needed more interaction between the groups. He looked at the clone officers, Commander Doom was using Captain Keeli to demonstrate how one of his young troopers took down a droid. A couple of the lady Senators giggled when Marshall Commander Cody looked over at them.

The Senators had gathered together near the end of the table. Senator Chuchi however had wandered over to the clone officers, Commander Fox making room for her next to him. She and him spent a lot of time together Master Yoda had observed. At least that’s what it seemed like to Yoda, who had always noticed them interact in some fashion when he stopped by the Senate building. Senator Amidala and Senator Organa had also decided to RSVP. They seemed to be in deep conversation about something. Yoda hobbled over to the pair.

“Not talking politics I hope.” Yoda giggled.

“Oh no Master Yoda, I was just asking Bail if he could get me the name of his electrician. There is a light in my apartment that keeps shorting out.” Padmè explained.

“Oh I can fix that!” Anakin piped up.

“You’re too kind Anakin, but I couldn’t ask you to do that. Besides, I want to give Bail’s friend some business.” She replied with a smile.

Finally they were seated at the table, Yoda had made sure to mix everyone up so that groups aren’t together. The purpose of this holiday gathering was to meet each other. He had Obiwan seated next to Commander Fox and Senator Chuchi (Yoda felt they’d appreciate that), Master Windu was placed next to Senator Bail and Commander Doom. Yoda had seated Senator Amidala next to himself and Master Mundi and so on.

“Commander, I hope your troopers are enjoying themselves tonight.” Senator Bail commented to Doom.

“I turned them loose on Coruscant with Rex’s boys so I’m hoping no one gets arrested.” Doom replied.

“Unlike last year.” Fox snickered. “Poor Thire has never recovered.” He added. Him and Doom laughing.

Yoda loved to hear the clones laugh, it was a sound they rarely got to make.

“10 credits it’s Jesse and Boost!” Commander Ponds joined in.

“Wolffe would kill Boost if he got arrested again.” Master Windu chuckled.

“I’m surprised Wolffe hasn’t already killed him.” Bail said, Wolffe rolling his eyes.

“Unfortunately he’s useful.” The Commander with the cybernetic eye muttered as he chewed his food.

The pleasant conversation continued, Master Yoda choosing to listen rather than join in. Master Windu and Wolffe got into a debate on which Twi’lek restaurant was more authentic. Rex and Senator Bail went head to head with seeing who can toss the most grapes up and catch them in their mouths. It was a tight race until Chuchi wordlessly tossed a grape at Fox who cleanly caught it in his mouth and continued his chat with Master Mundi about the Cerean people. This was how the Great Grape Toss began.

Rex, Fox, and Bail stood up and went to one side of room. Chuchi, Anakin, and Doom went and stood a couple feet away from their respective partners: Anakin and Rex, Chuchi and Fox, Bail and Doom. Yoda smirked and watched the bonding. This is what he wanted. The contest began, the space between partners was lengthened each time one caught a grape. Doom was better at it than Rex had thought. Fox and Chuchi were like a well-oiled machine. Anakin playfully caught a grape that was meant for Chuchi and promptly choked on it. Worried, people gathered around him but he shooed them away, comming Kix. The comm unit beeped its pattern until it was suddenly cut off, Kix’s away message playing. The medic had sent his General to voicemail. Doom shook his head and heimliched Anakin.

“That’s Karma Master Skywalker.” Chuchi chided, Fox nodded. Anakin shrugged. In the end, Doom and Bail took the win.

The dinner was finished and a variety of desserts was brought out, Ahsoka immediately calling one of the slices of cake with a large piece of Jogan fruit. Plo made sure it got to her by floating it to her plate. The young Togruta bounced excitedly in her seat. Fox’s comm unit suddenly beeped and he excused himself from the table, walking a couple feet away.

“What is it Thire?”

“It’s them sir!”

“Who?”

“Jesse and Boil!”

Commander Cody pretended not to hear that as he bit into a piece of fruit tart.

“What are they doing?”

“Well Jesse kept asking me irritating questions and...ok well now I’m pretty sure Boil just mooned me!” Fox smirked and Cody’s shoulders slumped slightly. Everyone could hear Thire’s irritated voice.

“Oh kriff Jesse!”

“That’s what your mom said last night!!” Came Jesse’s faded reply, Anakin almost choked on his cake as he laughed.

“What?! That doesn’t...we don’t even have a mom you moron!!” Thire yelled back. Fox cut off the comm and rejoined the table.

“He can handle it.” He replied cooly.

The gathering continued, chatter and laughter filling the room. Hours passed and drinks were had. Yoda observed smiles on faces that often wore frowns, laugher from mouths that yelled orders to press forward. He watched Ahsoka and Wolffe bond over arm wrestling, Bail being the moderator. Both participants had jokingly declared Plo too biased to moderate. Doom urged his brother on while Chuchi pretended to wipe sweat from Ahsoka‘s brow. They ended calling a tie, with plans for a rematch later.

Eventually the party had to end, none really wanting to leave. But Rex and Cody had to go get Jesse and Boil from Thire’s patrol speeder. Wolffe and Doom had to check to make sure reports were all submitted. Bail, Padmè, and Chuchi had meetings the next morning and needed sleep. Yoda thanked them all for coming, the group making plans to make this an annual gathering. Little did they know that next year wouldn’t be the same.

#star wars#the clone wars#star wars the clone wars#anakin skywalker#ahsoka tano#captain rex#obiwan kenobi#obiwan#anakin#master yoda#mace windu#ki adi mundi#commander ponds#commander cody#commander doom#commander fox#commander thire#captain keeli#bail organa#padme amidala#senator chuchi#fox x riyo#riyo chuchi#clone trooper boil#arc trooper jesse#clone trooper jesse#jedi council#star wars fanfic#clone wars fic#annual Jedi council holiday party

164 notes

·

View notes

Text

Our Free Credit Monitoring - Experian Ideas

Look to see if your lender is listed. If you are a company partner and wish to share FICO Ratings with your customers, contact us.

In order to enhance and preserve your financial health, we advise checking your credit rating more than only once a year. According to a research study by Discover, 76% of individuals who examined their credit report at least seven times a year said their score improved. By checking your credit rating regularly, you will stay mindful of the numerous accounts open in your name and stay alert to any prospective scams or identity theft.

Nevertheless, your credit report is not the like your credit rating. Your credit rating is a 3 digit number from 300850 and is what many people describe when discussing "excellent" or "bad credit. The most extensively used credit score is the FICO rating, which is used by 90% of loan providers, however there are other designs likewise utilized - check credit score.

How to check your credit report regularlyWhen it comes to your credit history, it pays to remain alert. We recommend inspecting your credit report frequently in order to remain on top of any potential informs and changes. The following are a few methods you can examine your credit report beyond your as soon as a year, complimentary report.

The Best Guide To Discover Credit Scorecard Review: Is It Worth Signing Up?

If you simply require to understand the precise score that your loan provider will probably be using, you'll require to secure your wallet and pay a little. Please note that Self Lending institution credit monitoring service uses Experian Vantage Score 3. 0 which is not the like a FICO score.

It is necessary to note, however, that these totally free reports indicate a basic range for your credit history and are not main scores. However, they are normally close. This isn't a guaranteed location to inspect your credit report, however increasingly more credit card and loan business are starting to publish credit rating on the regular monthly statement.

Some non-profit credit counselors or HUD-approved housing counselors may be able to give you a credit rating free of charge. If you receive these services, it deserves it to ask if they can provide you with a rating. Register for free and begin monitoring your credit now. Self Lending institution's credit monitoring tool makes use of the Experian Vantage Score 3.

Self Loan provider will permit you to keep an eye on and check your credit history. Furthermore, Self Lender will regularly send out notifications of any changes in your credit report. In addition, if you do have an unfavorable report such as a late payment affecting your credit score, it will not impact it permanently. Late payments will usually vanish after two years.

Rumored Buzz on Best Apps For Your Free Credit Score - Us News

That means even if your rating is lower than you desire now, with a little time and some excellent practices, it can improve.

youtube

So, I have actually been trying to watch on my credit rating, and have been utilizing Credit Karma as a basic guide. Just recently I registered and started utilizing Discover's monitoring tool as well. My rating on Discover is about 100 points greater than on Credit Karma. I understand CK uses Vantage 3 scoring, but I'm not exactly sure what Discover uses.

Your credit history might be the finest tool you never knew you had. An excellent one can conserve you loads on things like loans, charge card, insurance coverage and more.

Access to your credit history can assist you monitor your general monetary health, which is particularly crucial when you're considering a big purchase, applying for a charge card or taking out a loan. You may understand that Discover uses open door to your FICO Rating. However it's not the only service provider to lure cardholders with this perk.

Monitoring Your Credit Reports - Credit Card Insider - Truths

The Discover Credit https://sc-blog-production.elasticbeanstalk.com/2011/03/03/public-record-information-and-credit-reports-whats-there/ Scorecard breaks down elements of your credit history in an easy-to-scan dashboard - best identity theft protection reddit. Together with your FICO Rating, you'll see your total accounts open, the length of your credit https://sc-blog-production.elasticbeanstalk.com/2011/03/29/what-is-a-trade-line/ history, your credit usage and any missed out on payments or questions. The very best part? You do not need to be a Discover cardholder to qualify.

Examining your Discover Credit Scorecard won't impact your credit, and your score is updated monthly. You'll also get insight and suggestions to enhance your credit based upon your individual scorecard. To access your Discover Credit Scorecard for totally free: 1. Go to Discover's site. Under All Products, click. 2. Struck.

Enter your complete name, e-mail address, date of birth, house address and Social Security number. Click. 4. Review Discover's terms. If you grant its terms, click. You need to instantly see your Discover Credit Scorecard. For future access, log in to your online Discover account. In 2014, the Consumer Financial Security Bureau (CFPB) asked for credit card companies to start allowing open door to consumer credit scores.

1 note

·

View note

Text

Jaguar Lease Ny

Gmc Lease Deals Long Island

Table of ContentsLand Rover Lease Deals NySubaru Lease Deals Long IslandPorsche Leasing Prices

5 S $26,990 Premium Luxury $39,365 350 $47,025 SV $21,710 300 $39,692 S P250 $39,900 40 Premium $39,895 RED Sport 400 $56,775 2. 0T SE $35,995 S CC $43,990 $25,045 $35,060 $23,375 GT-Line $21,455 500 $78,055 SE $24,595 350 F Sport $60,680 Base $27,655 Essential $47,125 $26,925 SE $25,845 LX $25,110 228i xDrive Gran Coupe $40,195 EX $35,910 45 Premium $45,745 Cooper S $34,750 S $21,410 228i xDrive Gran Coupe $40,745 S Hardtop 2 Door $31,750 LE $23,114 2.

0T S line Premium $37,495 LT $36,275 EX $28,780 Premium 25t $47,800 GT-Line $34,125 S $26,245 P250 S $56,300 45 Premium $46,945 350e 4MATIC $53,395 Base $20,895 $116,895 $39,225 sDrive30i $52,695 Autograph $55,225 250 $37,145 IVT $19,925 Innovation $38,885 LX $21,755,, and are the very best method to see the most affordable automobile costs in your location - volvo lease ny.

This must be the initial step you take when negotiating your car price (acura tlx lease rates). Follow this up with my checklist to make certain you eject every last little cost savings. - Gregg Fidan Gregg Fidan is the creator of RealCarTips. After being ripped off on his very first automobile purchase, he committed several years to determining the finest ways to avoid scams and negotiate the best cars and truck offers (volvo lease ny).

November 12, 2020 November 5, 2020 October 29, 2020 October 22, 2020 October 15, 2020 October 8, 2020 October 1, 2020 September 24, 2020 September 17, 2020 September 10, 2020 September 3, 2020.

Yes, makers are using a variety of absolutely no down lease offers today. And sometimes you can work out absolutely no down for other models if you have good credit. Many popular producers like Honda, Hyundai, and Nissan regularly use lease handle no deposit required. Manufacturers regularly release deals monthly that have zero or extremely low due at signing quantities. volvo lease ny.

Audi Lease Deals Long Island

Learn more about how to work out a lease (volvo lease ny). One of the primary advantages of leasing is the low up-front costs, web page however bear in mind that a zero down lease will raise your regular monthly payment given that you are not pre-paying a few of the lease responsibility. The due at signing amount usually includes the first month's payment, down payment, acquisition fee, and any state taxes.

Bmw Long Island

Range Rover Lease Ny

Discover how absolutely no down leases work. With some exceptions, the typical minimum credit report to lease a vehicle is 620. Nevertheless, unless your credit report is over 680, you will not qualify for the very best lease deals. A minimum of this is real when all renting agreement requirements have actually been satisfied. Remember that a deposit (a. k.a. a security deposit) is not the exact same thing as a deposit. Deposits are not refundable however security deposits usually are. Also note that some leases need non-refundable deposits.

While it is possible, it is challenging to lease a lorry if you have a poor credit ranking and no cash for a deposit (volvo lease ny). Many zero-down lease offers require a healthy credit ranking. bmw long island. But do not stress, there are lots of options readily available for automobile buyers with less-than-stellar credit report.

Cadillac Lease Deals Ny

In general, credit score lower than 619 is categorized as "subprime". While this kind of credit won't generally be immediately decreased, a 619 or lower credit rating suggests you will generally need to pay a higher rate of interest and/or deposit (volvo lease ny). There are a great deal of actions you can take to improve your credit rating like look for too numerous loans, employment history, and constant on-time payments.

It must, however, be an authorized car dealership for the car manufacturer. It's probably obvious, but you can't turn a rented car into any other brand of car dealership. You can, however, turn your rented MINI into any authorized MINI dealership across the country. Again, assuming all your lease agreement obligations have actually been fulfilled. volvo lease ny.

Obviously, specifics will vary within specific lease agreements, but most leases will cover normal wear-and-tear service and maintenance needs for your leased lorry. These consist of fluid and filter modifications, regular tune-ups, and regularly set up maintenance normally doesn't cost anything out of pocket. If you have more questions about car leasing or our existing offers, then contact us today.

Editorial Note: Credit Karma gets payment from third-party advertisers, but that does not impact our editors' viewpoints. Our marketing partners don't evaluate, approve or back our editorial content. It's precise to the very best of our understanding when published. Schedule of products, functions and discount rates may vary by state or area - volvo lease ny. Read our Editorial Standards for more information about our group.

Honda Lease Deals Long Island

It's pretty simple, actually - mitsubishi outlander lease deals. The deals for financial items you see on our platform originated from companies who pay us. The cash we make assists us give you access to totally free credit scores and reports and helps us develop our other terrific tools and educational products. Payment might factor into how and where items appear on our platform (and in what order).

youtube

That's why we offer features like your Approval Chances and cost savings estimates (volvo lease ny). Obviously, the deals on our platform don't represent all financial items out there, however our goal is to show you as lots of terrific alternatives as we can. toyota lease deals long island. Prospective advantages of leasing a car Possible advantages of purchasing a vehicle Lower down payment Lower monthly payments available Repairs usually covered by warranty No selling involved Possible option of new cars and truck every few years Ultimate ownership Modify vehicle without worry of breaking agreement No mileage limits Sell cars and truck any time after it's settled If you're looking for the most cost-efficient option over the long term, buying a used automobile and keeping it for a couple of years after you have actually paid it off is frequently the very best option.

Infiniti Lease Deals Long Island

The fact is there's no one-size-fits-all alternative when it concerns the olden concern of lease or purchase. Still, determining some essential elements connected to cost and your personal choices can assist you choose what's right for you. Let's look at some of the important aspects you need to consider before talking with a dealership.

1 note

·

View note

Text

Growlikemustardseed

make money online On the off chance that you're new to the expert offshoot promoting Internet business play area, at that point you're no uncertainty considering what member showcasing is about. In most straightforward terms, it is showcasing and advancing some other organization's items/administrations on the Internet. You, the genius offshoot advertiser, advance through whatever means is accessible to you (your ezine, blog, email, web based promoting, and so forth.), which at that point sends traffic and clients to another organization's site, who at that point accomplishes all the work - create, sell and bolster the genuine items as well as administrations; close the deal; process the requests, take installments and make conveyance; and so on - for the paying client. You, as the advertiser and wellspring of that business, are then paid a commission for your work. That is it!

affiliate marketing

The entire business course of action is basically income sharing. The organization that gives the item or administration being sold is by and large called the partner dealer, and he shares the income they create with you, the member advertiser, for sending business their way. Much of the time, the associate advertiser scrounges up that business through different types of genuine promoting strategies on a wide assortment of online roads and stages.

Note that by and large, the member vendor doesn't pay anything for the "showcasing" and advancement until a deal has really happened. Along these lines, the vendor can limit both hazard and uses. Hypothetically, the partner would then be able to be remunerated all the more abundantly for taking on that advertising danger and use. Be that as it may, since the member advertiser doesn't have to take on the hazard, venture and consumption of creating and supporting an item/administration and managing a deal, the relationship is a lot of considered a success win course of action, with each gathering concentrating with respect to the business they are acceptable at and keen on.

Following, Calculating and Paying Affiliate Income

How the offshoot advertiser basically gets paid for his work relies completely upon the member dealer. In essentially all cases, the course of action is entirely overseen through a computerized framework, with the vendor utilizing Internet server-based programming that gives a member advertiser a one of a kind connection code or ID which the advertiser should then use to distinguish all the traffic and clients he sends to the trader. This is actually the main way the shipper can appropriately recognize, credit and remunerate the correct offshoot for any business created.

At times, an offshoot dealer utilizes the assets of an a lot bigger member arrange administration, (for example, Commission Junction, LinkShare, and so on.) to regulate its partner program. Some different traders, then again, decide to run their own in-house offshoot framework, keeping their program autonomous from everyone else's. In for all intents and purposes all cases, be that as it may, the nuts and bolts of how a member program tracks and figures subsidiary commissions follow what is sketched out above.

The dealer for the most part indicates the monetary terms previously (payroll interval, least installment edges, when cash is paid and how, and so forth.), regardless of whether it utilizes the administrations of an outsider assistance or runs its own associate program in-house. How an associate is at last paid will rely upon these foreordained points of interest, and they can run the range from being paid online through administrations like Paypal, having reserves wired legitimately to an offshoot's financial balance, to having a physical check printed and sent straightforwardly to the subsidiary.

In spite of the fact that there is clearly a degree of trust in the shipper engaged with this game plan, it works on the grounds that not exclusively is it to the member trader's advantage to keep up a decent working relationship with its offshoots so as to develop its business and guarantee its proceeded with progress, the network of expert partner advertisers is genuinely very close with broad correspondences channels that rapidly reports any obscurity and negative professional interactions. On head of that, partner programs that sudden spike in demand for outsider system administrations offer an additional layer of insurance and trust to the subsidiary, with the systems guaranteeing that all exchanges are appropriately followed, determined and redressed. This is one explanation that numerous expert associate advertisers regularly receive an approach that they will just work with partner programs that are directed through these outsider offshoot arrange administrations.

Member Program Selection

You, as the expert member advertiser, are allowed to pick whatever offshoot program you wish to join and market. As it were, you basically pick which items and additionally benefits you'll be advancing (through your blog, site, ezine, ads, and so forth.). It's anything but a light choice, since your pay is a lot of influenced by how well you coordinate your all out "offer" to your "crowd" or "market." That, in any case, is basically your activity and is a piece of what you as the expert subsidiary advertiser is remunerated lavishly for.

make money online

Much of the time, what subsidiary projects you do pick is generally dictated by your prior business sectors and crowds, For instance, in the event that you previously run a planting blog, at that point clearly the projects you would search out would cultivate related or ones that you've decided would bear some significance with the crowd segment your planting website draws in.

In the event that you are moving toward this offshoot showcasing business as an unadulterated advertiser, notwithstanding, where the choice on the most proficient method to advertise an item or administration would be exceptionally reliant on what it is you really select to advance, how you select a member program can be founded on a wide range of components.

Some expert member advertisers, for instance, pick programs dependent on commission size (high payouts per deal) or market size. These are business choices you need to make, once more, some portion of what you're getting paid for. Here are a few proposals for novices, in any case, that may assist you with beginning.

Pick items/administrations you are by and by keen on. On the off chance that you are keen on planting or golf, for instance, at that point center around items/benefits explicitly for those business sectors. Its plain straightforward truth is that it is a lot harder to advance an item or administration that you truly couldn't think less about.

Pick items/benefits that don't humiliate you and that you are happy with having your loved ones partner with you. For instance, despite the fact that it's very rewarding, some expert partner advertisers can't advance dating destinations and administrations for reasons of shame and inconvenience.

Pick items/administrations you are as of now acquainted with and completely comprehend. Regardless of whether you are not too inspired by autos or travel, for example, you may definitely know all that anyone could need about the items and administrations in those specific markets that you can really sell in those market specialties.

Select member programs that furnish you with the best deals support. This lone comes up from earlier examination, obviously, yet it's something you should do in any case. The business support alluded to here are things like preparing, publicizing material and assets, broad item data, and so on. Clearly, the more apparatuses they offer you to sell with, the better your odds.

Keep in mind: Being an expert partner advertiser implies that you are ready to go. Your business. Your prosperity is eventually controlled by your choices and activities. Good karma.

Mir Apacible is an expert partner advertiser and a marketing specialist for growlikemustardseed, the How to Make Money Writing blog, at

http://growlikemustardseed.com/

1 note

·

View note

Text

Do-It-Yourself Credit Repair: Fix Bad Credit On Your Own In 6 Easy Steps

Don't fall for scams promising easy, overnight credit repair. If you want to fix your poor credit, you can (and should) do it yourself. Follow these six simple steps to do-it-yourself credit repair.If you’ve had an overdue student loan, years of high credit card balances, collections accounts, or even a foreclosure, unfortunately, you probably have below-average or bad credit.

With poor credit, you may not be able to get approved for new credit products like credit cards. Although you may still be able to take out an auto loan or a mortgage, you’ll pay a much higher interest rate because of your low credit score. Compared to a borrower with good credit, someone with poor credit can pay $50,000 more in interest on a mortgage. Over an entire lifetime, you could end up

paying over $200,000 more in unnecessary interest

just because of bad credit.

The good news is—as you should know if you’ve read Money Under 30 for a while—that you can repair your credit score all on your own. It just requires a little bit of know-how and a good bit of patience. Here are six steps towards building better credit.

What’s Ahead:

6. Don’t apply for new credit

1. Figure out where you stand

Before you begin do-it-yourself credit repair, you’ll want to get copies of your full credit reports from all three bureaus (Experian, TransUnion, and Equifax).

You can get your reports truly free, once a year, at www.annualcreditreport.com or by calling 1-877-322-8228. Other websites may claim to offer free reports, but the Federal Trade Commission (FTC) warns that these offers are often deceptive.

You can also try free credit score tracking apps Credit Karma or Credit Sesame to get a sense of where you stand.

Credit scores range from 300 to 850. A score of between 700 and 740, depending on the scoring method used, is considered “good credit” and usually enough to qualify you for the best credit cards and lowest mortgage rates.

Related: How Credit Works: Understanding Your Report And Score

2. If you find errors, dispute them

The next step in credit repair is to dispute incorrect information on your credit report.

Errors aren’t common, but they happen. Of course, sometimes bad credit is just your fault. You shouldn’t try to argue accurate information, but if you do see errors–even small ones—it’s worth cleaning them up. Here’s how:

Once you have the copy of your full credit report in hand, check your identity information (Social Security number, spelling of your name and address), and credit history.

Review the list of credit cards, outstanding debts, and major purchases. If you see any mistakes or questionable items, make a copy of the report and highlight the error.

Next, gather any information that you have to back you up, such as bank account statements, and make copies of these as well. This is important! The credit bureaus won’t do anything without proof.

Write a letter to the specific credit reporting agency that shows the falsehood, whether it is Experian, Equifax, or TransUnion. Explain the mistake and include a copy of the highlighted report along with your documentation. Although certain bureaus now let you submit disputes online, it’s not a bad idea to send this letter by certified mail, and keep a copy for yourself. The reporting agency has 30 days from the receipt of your letter to respond. The Federal Trade Commission provides advice on contacting the credit bureaus about discrepancies. Here are the contact numbers and web sites for the three credit bureaus:

Experian: 1-888-397-3742 – www.experian.com

TransUnion: 1-800-916-8800 – www.transunion.com

Equifax: 800-685-1111 – www.equifax.com

3. Stop the bleeding

Once you deal with any errors on your credit report, it’s time to ensure you’re not still spending more than you can afford each month.

Why is this so important? It’s because are only three simple things to do to repair bad credit:

Pay all of your bills on time

Pay down debt (especially credit card debt)

Avoid applying for credit

But before you can do these things, you need to make sure you’re not spending more than you earn—you need a budget.

To start, review your tax returns for the past two years to get a sense of how much money you actually take home in a year.

Subtract your regular monthly expenses (rent or mortgage, car payments, and home, car and health insurance) from your current income.

Next, estimate your monthly spending habits for other expenses such as gas, groceries and entertainment. Create a limit, based on your income, of what you can spend in each of the different categories of expenses. For example, if you tend to spend $400 a month on groceries, try to stick to $300 a month on groceries by making changes like buying generic brands, using coupons, and resisting impulse purchases.

4. Pay all bills on time going forward

If you want to fix bad credit, you need to start paying all of your monthly bills on time, period!

If you’re behind on any bill, get caught up as soon as you can. On-time payments are the single most important factor to your credit score. Simply put, your credit won’t improve until you can consistently pay every bill on time.

One downside of this is that you don’t get credit for basic bills like your monthly phone and utilities. Experian Boost can help with that. The free service links your bank account to Experian to monitor your monthly payments. On average, customers have enjoyed a 13-point FICO score increase using this service.

5. Pay down credit card balances

Take charge of your credit cards by paying down their balances.

If you have any outstanding balances, make room in your budget to pay down these debts bit by bit, every month until they are gone.

Know your credit limits and make every effort to stay well under the maximum when charging items.

That’s because credit bureaus analyze your debt load as a ratio. If you charge $500 on a card which has a $1,500 limit, you’ve used 33 percent, which is better for your credit score than charging the same amount on a card which has a $1,000 limit (50 percent), both of which are better than being maxed out (100 percent).

Related: Big Fat Guide to Getting Out of Debt

Pay these credit cards down, but don’t cancel them. The total amount of available credit affects your score, even if you owe nothing.

6. Don’t apply for new credit

Finally, resist the temptation to open a new credit card, even when a store offers a discount on your purchase for doing so.

Each time you apply for credit is listed on your credit report as a “hard inquiry” and if you have too many within two years, your credit score will suffer. In general, a consumer with good credit can apply for credit a few times each year before it begins to affect their credit score. If you’re already starting with below-average credit, however, these inquiries may have more of an impact on your score and delay your ultimate goal of watching your credit score climb.

When the dust settles, consider a unique way to build your credit like Self Lender. Self Lender offers four different types of loans, each which you pay down monthly. At the end of the term, Self Lender sends you back the initial term of the loan, minus interest and a small application fee. Each month you make a payment, they’ll report to good behavior to the credit bureaus and you’re credit score and profile will likely improve. The initial application may drop your credit score, but if you make all payments (to yourself) on-time, it should increase.

Experian Boost™ is another way for people with a poor or limited credit history to get ahead. Many times, these people will have a positive, consistent record of paying utilities on time, but those payments aren’t being included in their credit profile. Experian Boost™ allows people to include this payment history to their credit score. Best of all – it’s completely free.

Disclaimer – Results may vary. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost™.

Summary

Start by looking at your credit reports to get a sense of where you stand.

If you see any errors, dispute them with the credit bureaus. Then, focus on paying down any credit card debt while making every bill payment on time. In the meantime, do not apply for new credit. Basically, in order to repair your credit, you will need to limit your use of credit.

It may take months or even a couple of years for your credit score to improve, but if you plan on buying a new home, or taking on any other big debt, it’s well worth it.

1 note

·

View note

Text

Vedanta: The Science of Spirituality

Vedanta is just one of the world's oldest and most extensive spiritual philosophies. It is based upon the Vedas, or sacred bibles of India as well as underlies the principles of Yoga, Ayurveda, and also Hinduism. Words "Vedanta" has 2 parts, Veda, which means knowledge, and anta, which suggests completion or goal of.

Therefore Vedanta indicates the end of all knowledge as well as where it wraps up. This expertise was "cognized" or viewed by sages as well as seers in higher states of consciousness, none of whom take credit score for the information. It is infinite, global understanding that every person has a right to as well as is not something that you think in, check out, or simply understand intellectually, however something that you experience.

Vedanta is also known as the Science of Spirituality. It's not an idea system, an ideological background, conviction, or a religious beliefs, It is an approach for discovering the nature of reality. Several may discover this definition to be contradictory or perhaps unreasonable in that scientific research as well as spirituality seem to be mutually exclusive terms that can't exist side-by-side together. However, when you consider Vedanta via the lens of the modern-day clinical version, the reasons for this interpretation come to be clear.

The Scientific Method

For hundreds, if not thousands, of years the scientific technique has been one of the most efficient and reliable ways we have for understanding the world in which we live. All science complies with these particular steps when discovering the visible universe:

Observe some element or habits of the universe.

Collect info and also make an educated forecast of what is occurring, called a hypothesis.

Test the theory with an experiment.

Record the outcomes of the experiment which will certainly either assistance or disprove the hypothesis.

Draw verdicts, release your searchings for, and also ask your peers (fellow researchers) to validate and also examine your theory by repeating your experiment.

If the results of your peers concur with your findings, then the theory or concept is taken into consideration to be scientifically legitimate. If they can not duplicate your results, the theory is taken into consideration suspicious and also not a precise description of exactly how the universe behaves. When this takes place, the scientist heads back to the drawing board to establish if there was a flaw in the experiment or possibly the theory itself. If essential, a brand-new theory may be developed and succeeding testing happens up until an agreement is reached by the bigger scientific community. This uncolored and self-correcting procedure of theory testing goes to the heart of all kinds of all clinical endeavor.

Now, allow's see just how Vedanta straightens itself with these steps.

Vedanta as well as Action 1: Observations

First, Vedanta makes the adhering to observation: There appears to be a much deeper reality beyond the material world and what the five detects report back to you. The inner globe of ideas, feelings, as well as assumptions really feel as if they are in some way attached to the outer world of objects, time, space, cause, and effect.

Vedanta and Step 2: Hypothesis

Second, Vedanta assumes that the splitting up you really feel from the remainder of the globe is an impression and also that there is in fact only one fact of pure consciousness, and also your real nature is that of entirety with the countless capacity for all that exists, for all that was, and also for all that will certainly be. This one fact is timeless, was never birthed, and also will never pass away. Vedanta likewise identifies that your experience of the globe comes to you in one of 4 means: a sensation, an idea, an action, or a feeling of being.

Vedanta and Step 3: Experiment

Third, to examine the theory of one truth, Vedanta provides the speculative procedure for which you can verify this theory. It mentions that based on the four kinds of experiences you can have, there are four corresponding methods of uncovering the true nature of reality and yourself. These methods are understood as Yogas, or paths back to union. They are:

Bhakti Yoga - the path of sensation. This is the yoga exercise of love in a human partnership or love for God, the connection of the human spirit to the universal spirit in all its aspects.

Gyana Yoga - the course of reasoning. This is the yoga exercise of intellectual understanding and scientific research, making use of the intelligence to go past the intellect.

Karma Yoga - the path of action. The yoga exercise of selfless solution, or service without add-on to the result or need for vanity gratification.

Raja Yoga - the path of being. The yoga exercise of meditation as well as all its allied disciplines.

In essence, Vedanta says: Here are the courses to self-realization as well as knowledge, each of which is suitable to the nature of the private hunter. Pick the course that is best matched to your personality and run the experiment.

Vedanta and Step 4: Results

Fourth, while complying with the course of one of the 4 yogas, you can do the following:

Measure the effects of your technique, analyzing your subjective experience, recording the adjustments in your mind, body, perceptions, understandings, intuitions, and also innovative insights.

Take note of modifications in your awareness and seek hints that the gap between the inner globe and also external world is expanding smaller.

Accumulate proof of the evolution of your spirit in minutes of lightheartedness, joy, and also bliss along with the simplicity in which your wishes are being fulfilled.

Record experiences that suggest the change of the personal self into the universal self.

Notice any type of indicators that factor to progress via the seven states of awareness as explained by Vedanta.

Vedanta and Step 5: Conclusion

Lastly, having carried out the experiment, you have the ability to conclude whether or not the theory of one truth stands. If you have actually experienced it directly and also have actually collected the evidence to sustain your findings, after that you will understand it to be true. You can publish or share your searchings for with your peers of fellow candidates in the form of creating or educating that details your experience and urges others to check the theory as well.

If, however, your experiment stops working to generate results, if it stops working to verify the existence of the one reality Vedanta describes, then you are under no obligation to think it and it ought to be thrown out. Nothing should be taken on idea or faith. A viewpoint needs to only be approved if it has actually been tested and also confirmed via straight experience.

A comparable reminder is echoed in the Buddha's words when he stated: