#INVESTMNET

Explore tagged Tumblr posts

Text

What you need to Start a Pure Veg Grace Thali Franchise

* Passion to Start Business * 250+ Sq.ft. Space * 5 Lakh+ Investment * 2 cooks and 2 helpers * Water & Electricity

1 note

·

View note

Text

youtube

When Anuj Kawar began his career as an intern at Motilal Oswal, he was earning just ₹5,000 a month. Despite the humble start, he stayed focused on his dream—to work at top global finance firms like Morgan Stanley, KPMG, and JPMorgan Chase. His interest in finance was strong, and his team lead noticed it. That’s when he was encouraged to enrol in the Certified Investment Banking Operations Professional (CIBOP) Program at Imarticus Learning, known as the best investment banking course for practical skills and career outcomes.

At Imarticus Learning, Anuj gained solid domain knowledge, hands-on training, and key soft skills that helped him grow professionally and personally. The program gave him everything he needed to chase his dream with confidence. Today, Anuj is an Associate Consultant at Morgan Stanley in Mumbai—one of the companies he once dreamed of working for. His journey from earning ₹5,000 a month as an intern to becoming a part of a global investment banking firm proves how the right support and guidance can change lives.

At Imarticus Learning, we’re proud to be part of Anuj’s inspiring journey—and many others like his.

#investment banking course#CIBOP#best investmnet banking course#imarticus investment banking#Youtube

0 notes

Link

Investing, to grow wealth, whether it's to bring in additional income, or to save for retirement comes with a variety of risks. Since real estate is a tangible asset, which almost always tends to rise in value, real estate investing may allow you to safely pursue relatively low-risk investment while still gaining substantial income and/or capital appreciation.

2 notes

·

View notes

Text

Which is the better 2023 investment? Plots or villas?

Purchasing undeveloped land is no longer a difficult undertaking. There are rural properties available all around the country. Farmlands, plots, and real estate properties are generally inexpensive, especially if you purchase them intelligently from a reputable source. But is buying undeveloped land advantageous if you intend to sell it or build a house on it later? Do you think investing in raw land is a good idea? Today, we’ll dispel some common misconceptions and talk about some exciting advantages of land ownership.

Without a question, one of the most lucrative and reliable types of investing is real estate. Real estate investments aren’t limited to residential properties, despite the fact that they have practically become identified with them. Here are the Five Folded reasons why investing in plots should be your first choice if you’re thinking about buying real estate.

The flexibility scope and imagination scale: The architect’s design for the villa is frequently the only option available to consumers when buying a villa. There are a limited number of alterations that they can make to the building, and they are not allowed to change the home’s design in any way. On a plot, however, you can create the home of your dreams because it is a blank canvas. Your home can be designed entirely from scratch, with your preferences for materials and crucial features added. Being able to customize your home so that it reflects your personality and lifestyle is crucial because a home lasts a lifetime.

Zero maintenance and zero hassles: You don’t have to worry about regular maintenance and repairs as a landowner. Landowners rarely have to worry about things like leaking roofs, painting, HVAC (Heating, ventilation, and air conditioning), or regular costs associated with other real estate. You can hold the property as an asset permanently because there are almost no upkeep expenditures and often very low taxes.

Finite resources and infinite opportunities: The fact that land is a limited resource is one of the main benefits of investing in it. There will continue to be new residential high-rise development, but there is a finite amount of land that can be purchased. Owners can be confident that their venture will increase significantly in value as a result of the fact that there will always be a market for it. You have absolute authority to use vacant land however you see fit if you own it. The land could be developed for farming or turned into a storage facility. In addition, you can use your land to build a house, create a rental property, or develop it for outdoor recreation. There are always other possibilities for vacant land, even if you purchase it with the intention of holding onto it and selling it for more money. The size of the property will determine whether you can build a solar energy farm, a campground, a golf course, or harvest timber there. The fact that you retain ownership of your property is the best aspect of owning land.

Difference between purchase and possession: People who invest in a residence that is being built must wait until it is completely developed before taking possession. The final handover may take a year or possibly longer, depending on the state of construction that the project is in. A plot of land basically eliminates the likelihood of a delay. Owners can almost immediately take control of their new plot because the land doesn’t require any building. It is simple to purchase each property with your own money and avoid coming to grips with banks and financing firms at all costs.

Long-term investments and secure retirements: You can buy land without actually investing much if you have a detailed plan and specific goals. Costs are low after you own the property. After retirement, property owners might make money by renting or leasing their property. There are other advantages to owning land as well. Over time, a piece of land might develop into an asset that generates money. Land usually continues to appreciate and needs little to no care. The most secure approach to making a respectable amount of money each month is to invest in land. Retirees can continue to lead a desirable lifestyle and generate larger earnings. Purchasing undeveloped land is a great way to invest and increase your capital. The next crucial step after purchasing a piece of property is to make improvements to it for certain uses. The quickest way to profit from your acreage is to split it up and sell the individual parcels for a profit. Therefore, having land is advantageous for retirees. To protect your investment and make prudent land purchases, you must grasp some things.

Land ownership can provide you with all you need, whether you seek financial stability, desire to multiply your wealth, wish to earn additional income, or want to invest in real estate. Since you don’t have to worry about theft or damage, you can keep it for generations and let it appreciate. Landowners have numerous chances to profit from their property and are not subject to theft or depreciation. Overall, it’s a finite resource that you can use to invest money in order to increase your wealth.

0 notes

Text

The covid-19 pandemic has unleashed a once-in-a-lifetime crisis on the world economy although real estate is not a stock market or payday loans, it's a long-run investment. To find the property that fits into your plans, get a loan for it or buy it and get registered. Buy open plots in Suvarnabhoomi infra developers Pvt Ltd Suvarnabhoomi Infra Developers Pvt Ltd. తరతరాలకు చెరగని చిరునామా. For More details:- http://www.suvarnabhoomiinfra.com

#suvarnabhoomiinfra#infra#pandemic#unleashed#crisis#fund#economy#stockmarket#longRun#investmnet#property#plans#jio prepaid plans#realestate#plots#land#residentialplots#commercialplots#openplots#toprealestatecompanyinhyderabad

0 notes

Text

5 checks to ensure you make smart investments

This goes back to 2007, markets are going crazy, everyone is making smart investments and my friend Sonika is opening the doors of this fascinating world to me. She introduced me to the world of yahoo groups and the money control groups.

People with nicknames discussing trades, ideas, concepts and in just killing it. People with 100x returns on stocks

It left me hooked with just one look.

In a weeks time, I had my broking account opened and I went all in. I moved fast, I listened, I copied tried to grasp all. I thought I was crushing it

Then out of nothing 2008 happened. The rooms were becoming much quieter, hushed. I was getting scared with each loss. And yet there were few of these nicknames which were wholly relaxed and going on as usual. For them, the game never stopped; in fact, they were upping the ante. All of them got supernormal returns over the next 3-4.

Awestruck, I slowly started getting acquainted with them. Over the next few years, I began to notice that all of them had a pattern of playing this game. Understanding this pattern This would eventually help me start reinvesting in 2011, and since then I have compounded money at > 25% CAGR.

The Big Pattern

There was one common and distinct pattern that consistently stood out among many others. No matter the investing style, this pattern stood above all. That pattern was: Don’t commit big mistakes. I started to look, deeply on this pattern. Slowly clarity emerged that there was a process, a method, checklist in this pattern

That process ensured that they made smart investments consistently. It ensured that they were always sane when markets were going crazy.

Below I try to share some of the processes. Think of it as a game with each checkpoint leads to the next one and the only way to progress in-game is to cross each checkpoint in sequence.

Check Point 1:

Are you ready to be an investor?

See where you fit in the grid

The effort would mean reading books, reports, charts, journals to learn continuously. Time would expect if you can put in at least put in 1-2 hours daily Irrespective of your style technical or long term or momentum you need a high combination of above to succeed If you are not in the top right then, you are not ready to go ahead

Check Point 2:

To cross this rubicon answer this question. Is your aim from investment to get maximum gains?

If the answer is yes, you will get hurt. Your Northstar is not maximizing gains but maximizing gains per unit of risk. Joel Greenblatt says “My largest positions are the ones where I don’t think I’m going to lose money.” Any stock can go to zero, but some have a higher probability of hitting that. These have one or two significant risks live leverage or a single customer. Knowing this requires you to put in both effort and time.

Check Point 3:

You are skilled, ergo you make money

Enter Michael Mauboussin, who says skill is not the only reason for success. Most activities that we think are skill-based have luck involved. Think if you can deliberately mess up any activity no matter what happens. If not, then you know there is luck involved. Let’s take a case

You find a crap stock and are ready to lose money deliberately by buying it. A perfect case of skill doing magic The next day an MNC decides to buy them! What just happened! Luck in play. The smartest guys know about this role of chance because they position themselves for this by always surviving. Any game of chance is all about survival

Check 4:

Do you quickly learn from your mistakes?

This is a story about Gary Kasparov, which he told in his book. He would make a wrong move say pawn to E4 in a situation. Most of us would say this is a quick lesson. In a case like this don’t move the pawn to E4. “What were the mental routines that occurred before I made that decision? Don’t do them again”. This is how Gary Kasparov thinks. Doesn’t try to learn quickly but try to learn correctly. Smart Investments require you to acknowledge

Check 5:

Are you happy being a smart investor?

Are you happy after doing well? You earn 150000, but someone makes 160000, and you are like damn!!. Money from investments is straightforward but holding that money and being happy about is the real financial plan. If you don’t, then there is a high chance you would get seduced in doing something which increases your risk.

Do also read basis the above how you should think about planning goals.

0 notes

Link

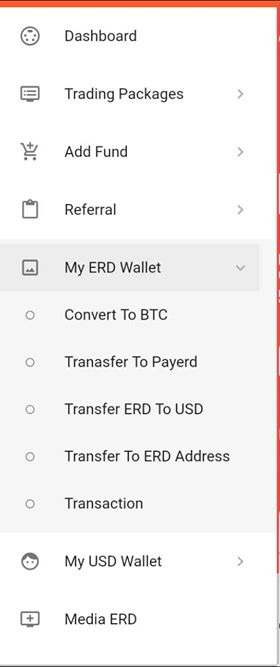

🌐 Crypto Fastest Legit Growing Eldorado Token Earn Bitcoin And Money 🌐

Eeldorado Token (ERDToken). It’s a new Block-chain based ERC-20 token made for payments and trading

Eldorado token or ERD token is a decentralized and open-source cross-platform cryptocurrency. Designed to facilitate the exchange of information between blockchains and non-blockchain networks. A highly secure network, featuring quantum resistant signature technology.

Eldorado Token Eldorado Private limited Company is Started in UK in Corporated. Active Your Account 25$ Dollar And Get Get 0.6% ERD Token Daily For One Year #Direct Referral Income 15$ dollar And You Can Convert Your #ERD Tokens To BTC Or USD..

* Bank transfers (Any Country)

💰 Packages 💰

1 Level opens - 25 $

3 Level opens - 100$

10 Level opens - 250$

16 Level opens -750$

25 Level opens - 3000$

No Holiday

Level 1 - 3% Level 2 - 2% Level 3 - 1% Level 4 to 10 - 0.5% Level 11 to 16 - 0.25% Level 17 to 25 - 0.20%

🏦 Withdrawal Minimum 15 $ Daily Any Time 🏦

Use This Token In All Types Of Daily Services PayerdApp

* Flights Tickets ✈ * Buss Booking 🚌 * Mobile Recharge 📱 * Pay Current bills 🧾 * Gift voucher 🎁 * Gas bill ( Etc ) ⛽ Use this token in all types of daily services 😍

Recharge success! by ERD TOKEN 🥳

Convert success! ERD TO BTC 😍

Convert success! ERD TO USD 😍

Withdraw success! Bank Account !🏦 Register here.! https://geteldorado.com/eld/#/register?id=6384374 If You Are Intrested You Can Visit Here EldoradoToken Thank you.

0 notes

Text

RAKESH JHUNJHUNWALA PORTFOLIO INVESTMENT TIPS STRATEGY

0 notes

Text

All you wanted to know about Corporate Finance

What is Corporate Finance?

· Business involves decisions which have financial consequences and any decision that involves the use of money is said to be a corporate finance decision.

· Corporate finance is one of the most important part of the finance domain as whether the organization is big or small they raise and deploy capital in order to survive and grow.

·There are various roles that corporate finance plays, which are very interesting and challenging, one of the main roles is that of being a Finance adviser.

·This can comprise helping to manage investments or even suggesting a mergers and acquisitions strategy.

Corporate Finance Principles

·Investment Principle: This principle revolves around the simple concept that businesses have resources which need to be allocated in the most efficient way.

·Financing Principle: The job here for the corporate financier is to make sure that the business has right amount of capital and the right mix of debt, equity and other financial instruments.

· Dividend Principle: So the basic discussion here is that if the excess cash should be left in the business or given away to the investors/owners.

Understanding the concepts

Capital budgeting Capital budgeting is the process of planning expenditures on assets (fixed assets) whose cash flows are expected to extend beyond one year. Managers study projects and decide which ones to include in the capital budget. -The “capital” refers to long-term assets. -The “budget” is a plan which details projected cash inflows and outflows during future period

The value of money

If you have a dollar today, you can earn interest on it and have more that a dollar next year. For example, $100 of today’s money invested for one year and earning 8% interest will be worth $108 after one year.

Cost of capital

· Capital is an essential factor of production, and has a cost. The suppliers of capital require a return on their money.

· The cost of capital is significant for a firm to calculate, as this is the rate of return that must be used when evaluating capital projects.

· The return from the project must be superior than the cost of the project in order for it to be acceptable.

Working capital management

· Working capital management involves the relationship between a firm’s short-term assets and its short-term liabilities.

· The goal of working capital management is to ensure that a firm is able to continue its operations and that it has adequate ability to satisfy both maturing short-term debt and upcoming operational expenses.

· The management of working capital encompasses managing inventories, accounts receivable and payable and cash.

Corporate Finance Career Overview

· Corporate finance professionals are accountable to manage the money of the organization i.e. to know from where to source it, deciding how to spend it to get the maximum returns at the lowest possible risk.

· They seek to find ways to ensure flow of capital, increasing the profitability and decreasing the expenses.

· They have to monitor the other departments on their expenditure and if the company is in a position to take the risk of additional expenditure.

· They explore the best ways to help company expand whether it is through acquisition or investing internally.

#Mina Mar Group#MMG#Miro Zecevic#corporate#corporate finance#company#capital#investing#financing#investmnet

0 notes

Photo

Hit the bullseye with your investment. MAN Investments provides opportunities in Bills discounting, Invoice finance, Channel finance and Inter corporate deposits with higher returns and shorter maturity. Connect with us to achieve the desired returns on your investments. #investment #investing #investors#supplychainfinance #intercorporatedeposits#corporatefinance #invoicefinance #funding #money#india #highreturns #maninvestments

#investmnet#billsdiscounting billsofexchange invoicediscounting invoicefinancehundi hundidiscounting hundifinancing workingcapitalfinance workingcapital

0 notes

Photo

if u want to buy in noida best place best price

visit www.propertycafe.in

0 notes

Link

Fincart consultants offers financial solution over phone; records the conversation and shares the audio-link of recorded conversation. All communications are over email & documented. It allows you the flexibility to talk to our consultants, anytime from anywhere during working hours. These consultants not only help you plan but also help you invest and navigate the investments to help reach and often exceed your financial goals.

#financial Planners#investment#investment planners#finance#financial planners in delhi#investment planners in delhi#financial Planners in noida#investment planners in noida#Mutual funds#financial planning#financial goals#online investnment planners#online investment planners in delhi#online investmnet planners in noida

2 notes

·

View notes

Text

#SCO Plot in Gurgaon#Real estate#commercial property#best investmnet#commercial property noida#commerciaal property gurgaon#gurgaon#noida#india

0 notes

Text

Investment Firm Orange County - Making the Right Investment Choices for You

An investment firm is a company that helps people invest their money. They do this by buying and selling stocks, bonds, and other investments on behalf of their clients. Investment firms can also offer advice on what investments to make and when to sell them.

When you work with an investment firm, you are essentially entrusting them with your money. It is important to do your research before choosing an investment firm, and to ask lots of questions. You should find out what fees they charge, what type of investments they offer, and how they make their recommendations.

It is also important to be aware of the risks associated with investing. No investment is guaranteed to make money, and there is always the possibility that you could lose your entire investment. That's why it's important to have a solid financial plan in place, and to only invest money that you can afford to lose.

If you're looking for help managing your investments, Investment firm Orange County may be the right choice for you. Just be sure to do your homework first so you can find the best firm for your needs.

What an investment firm can do for you

When it comes to investing, there are a lot of options available to you. But if you're looking for a reliable and trustworthy investment firm to help you get the most out of your money, then you should definitely consider working with one of the top firms in the industry.

At a top investment firm, you can expect to receive world-class service and advice that is tailored specifically to your needs and goals. And, because these firms have access to the latest information and resources, they can help you make sound investment decisions that could potentially lead to higher returns down the road.

Here are six reasons why working with a top investment firm can be extremely beneficial for you:

1) Expertise and Advice: One of the biggest benefits of working with an investment firm is that you have access to the firm's team of experts. These professionals have years of experience in the industry and can help you make informed decisions about where to invest your money. They can also provide guidance on how to reach your financial goals in a timely manner.

2) Diversification: A good investment firm will also help you diversify your portfolio by investing in a variety of different asset types. This can help reduce your overall risk level and protect your investments against unforeseen market fluctuations.

3) Access to Information: Investment firms have access to a wealth of information that can help them make well-informed investment decisions. They also stay up-to-date on all the latest market news and trends, so you can be confident that you're getting advice from knowledgeable professionals.

4) Professional Guidance: Along with providing expert advice, investment firms also offer guidance on how to manage your portfolio over time. This can be especially helpful if you're new to investing or don't have a lot of experience in the market.

5) Comprehensive Services: Many top investment firms offer a wide range of services, such as retirement planning, insurance products, and estate planning. This means that you can work with one firm for all your financial needs, which can save time and money in the long run.

6) Personalised Service: Finally, one of the best things about working with an investment firm is that you get personalised service based on your specific needs and goals. The professionals at the firm will take the time to understand what's important to you and create a plan that is tailored specifically for you.

0 notes

Text

Mutual Funds में निवेश पिछले 10 साल में 5 गुना बढ़ा, म्यूचुअल फंड इंडस्ट्री 38.45 लाख करोड़ रुपए के पार

Mutual Funds में निवेश पिछले 10 साल में 5 गुना बढ़ा, म्यूचुअल फंड इंडस्ट्री 38.45 लाख करोड़ रुपए के पार

Mutual Funds Investment: देश में निवेश का ट्रेंड तेजी से बदल रहा है. बैंक की कम ब्याज दर की वजह से लोग दूसरे निवेश विकल्पों की तरफ तेजी से शिफ्ट हो रहे हैं. इनमें म्यूचुअल फंड और शेयर बाजार सबसे पसंदीदा क्षेत्र बन कर उभरा है. खास तौर से म्यूचुल फंड में इंवेस्टमेंट तेजी से बढ़ा है और बढ़ रहा है. पिछले 10 साल में Mutual Funds में Investment पांच गुना बढ़ गया है. हर साल तेजी से नए एसपीआई (SIP) खुल…

View On WordPress

#how to make money#investmnet tips#mutual funds#mutual funds investment#saving#Share market#sip#एसआईपी#पैसा कैसे बनाएं#म्यूुचुअल फंड#शेयर बाजार

0 notes

Text

Last Minute Tax Saving Investments – Section 80C

Last Minute Tax Saving Investments – Section 80C

Detailed Analysis of Tax Saving Investment As the Financial Year 2021 is about to end and as we all know that 31st March is the last date for Tax-Saving Investments under section 80C, Investors rush for such investments which help them save taxes. For investors looking out for such last-minute Tax Saving Investments Option, let’s take a look at different investment options. Introduction From…

View On WordPress

#benefits of ELSS#ELSS#ELSS vs ULIPs#Employees Provident Fund#last minute tax saving investment#National Pension scheme#National Saving Certificates#NPS#PPF#Public Provident Fund#section 80c#Senior Citizen Saving Scheme#sukanya samriddhi yojana#tax#tax saving#tax saving investment fixed diposit#tax saving investmnet#ULIPs#voluntary provident fund#What are tax saving investment options#Where to invest to save taxes

0 notes